funding

Auto Added by WPeMatico

Auto Added by WPeMatico

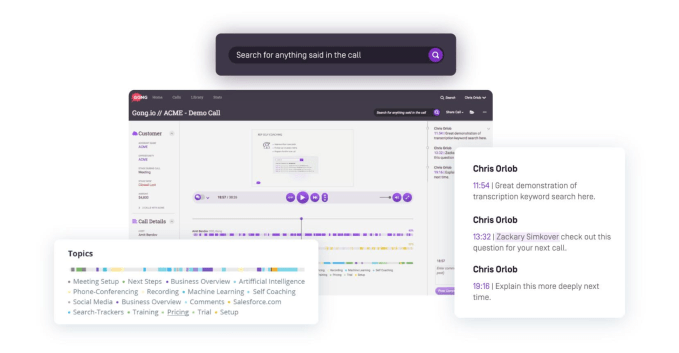

With traditional CRM tools, sales people add basic details about the companies to the database, then a few notes about their interactions. AI has helped automate some of that, but Gong.io wants to take it even further using voice recognition to capture every word of every interaction. Today, it got a $40 million Series B investment.

The round was led by Battery Ventures, with existing investors Norwest Venture Partners, Shlomo Kramer, Wing Venture Capital, NextWorld Capital and Cisco Investments also participating. Battery general partner Dharmesh Thakker will join the startup’s board under the terms of the deal. Today’s investment brings the total raised so far to $68 million, according to the company.

Indeed, $40 million is a hefty Series B, but investors see a tool that has the potential to have a material impact on sales, or at least give management a deeper understanding of why a deal succeeded or failed using artificial intelligence, specifically natural language processing.

Company co-founder and CEO Amit Bendov says the solution starts by monitoring all customer-facing conversation and giving feedback in a fully automated fashion. “Our solution uses AI to extract important bits out of the conversation to provide insights to customer-facing people about how they can get better at what they do, while providing insights to management about how staff is performing,” he explained. It takes it one step further by offering strategic input like how your competitors are trending or how are customers responding to your products.

Screenshot: Gong.io

Bendov says he started the company because he has had this experience at previous startups where he wants to know more about why he lost a sale, but there was no insight from looking at the data in the CRM database. “CRM could tell you what customers you have, how many sales you’re making, who is achieving quota or not, but never give me the information to rationalize and improve operations,” he said.

The company currently has 350 customers, a number that has more than tripled since the end of 2017 when it had 100. He says it’s not only that it’s adding new customers, existing ones are expanding, and he says that there is almost zero churn.

Today, Gong has 120 employees, with headquarters in San Francisco and a 55-person R&D team in Israel. Bendov expects the number of employees to double over the next year with the new influx of money to keep up with the customer growth.

Powered by WPeMatico

Amazon’s formidable presence in the world of retail stems partly from the fact that it’s just not a commerce giant, it’s also a tech company — building solutions and platforms in-house that make its processes, from figuring out what to sell, to how much to have on hand and how best to distribute it, more efficient and smarter than those of its competition. Now, one of the startups that is building retail technology to help those that are not Amazon compete better with it, has raised a significant round of funding to meet that challenge.

Relex — a company out of Finland that focuses on retail planning solutions by helping both brick-and-mortar as well as e-commerce companies make better forecasts of how products will sell using AI and machine learning, and in turn giving those retailers guidance on how and what should be stocked for purchasing — is today announcing that it has raised $200 million from TCV. The VC giant — which has backed iconic companies like Facebook, Airbnb, Netflix, Spotify and Splunk — last week announced a new $3 billion fund, and this is the first investment out of it that is being made public.

Relex is not disclosing its valuation, but from what I understand it’s a minority stake, which would put it at between $400 million and $500 million. The company has been around for a few years but has largely been very capital-efficient, raising only between $20 million and $30 million before this from Summit Partners, with much of that sum still in the bank.

That lack of song and dance around VC funding also helped keep the company relatively under the radar, even while it has quietly grown to work with customers like supermarkets Albertsons in the U.S., Morrisons in the U.K. and a host of others. Business today is mostly in North America and Europe, with the U.S. growing the fastest, CEO Mikko Kärkkäinen — who co-founded the company with Johanna Småros and Michael Falck — said in an interview.

While the company has already been growing at a steady clip — Kärkkäinen said sales have been expanding by 50 percent each year for a while now — the plan now will be to accelerate that.

Relex competes with management systems from SAP, JDA and Oracle, but Kärkkäinen said that these are largely “legacy” solutions, in that they do not take advantage of advances in areas like machine learning and cloud computing — both of which form the core of what Relex uses — to crunch more data more intelligently.

“Most retailers are not tech companies, and Relex is a clear leader among a lot of legacy players,” said TCV general partner John Doran, who led the deal.

Significantly, that’s an approach that the elephant in the room pioneered and has used to great effect, becoming one of the biggest companies in the world.

“Amazon has driven quite a lot of change in the industry,” Kärkkäinen said (he’s very typically Finnish and understated). “But we like to see ourselves as an antidote to Amazon.”

Brick-and-mortar stores are an obvious target for a company like Relex, given that shelf space and real estate are costs that these kinds of retailers have to grapple with more than online sellers. But in fact Kärkkäinen said that e-commerce companies (given that’s also where Amazon primarily operates too) have been an equal target and customer base. “For these, we might be the only solution they have purchased that has not been developed in-house.”

The funding will be used in two ways. First, to give the company’s sales a boost, especially in the U.S., where business is growing the fastest at the moment. And second, to develop more services on its current platform.

For example, the focus up to now has been on-demand forecasting, Kärkkäinen said, and how that effects prices and supply, but it would like to expand its coverage also to labor optimisation alongside that; in other words, how best to staff a business according to forecasts and demands.

Of course, while Amazon is the big competition for all retailers, they potentially also exist as a partner. The company regularly productizes its own in-house services, and it will be interesting to see how and if that translates to Amazon emerging as a competitor to Relex down the line.

Powered by WPeMatico

Rovio’s efforts to diversify beyond its Angry Birds franchise is getting a little investment boost today. The company announced that Japan’s NTT Docomo is taking a stake in Hatch, a Rovio subsidiary that describes itself as the “Netflix of gaming,” providing subscribers with a rotating mix of freemium games from a mix of publishers, with the option of paying a single monthly fee for a wider mix.

Docomo and Rovio are not discussing the size or value of the stake, but a spokesperson for Rovio told TechCrunch that prior to this deal, Hatch was 80 percent owned by Rovio and 20 percent by Hatch personnel. He didn’t specify who had sold shares to Docomo in this latest transaction.

The deal will cover not just investment to expand the Hatch platform and number of games on offer — currently the selection numbers more than 100 — but to bring Hatch specifically to the Japanese market.

This will include, starting next week (February 13), a soft launch of Hatch on Android devices in the country, as well as prominent placement of Hatch on Docomo’s Android TV service, sweetening the deal with three-month free trials of the Premium tier.

The Android TV offering is a key OTT play for Docomo. Known primarily as one of the country’s biggest mobile carriers (and, historically, a trailblazer in mobile services, setting the pace for how much was building in the world of mobile content globally in the earliest days of mobile phones), like other network service providers, Docomo has been hit hard by the huge wave of services that bypass carriers and strike billing deals directly with consumers.

Hatch will be one more feather in Docomo’s cap to try to lure more people to its service, which can be subscribed to and paid for by way of Docomo’s “d Account,” an iTunes-style platform that people can use regardless of which network carrier they contract with.

Like Netflix, Amazon and other OTT video streaming plays, the concept behind Hatch is to offer a mix of games from various publishers, as well as developing its own selection of games in-house that it hopes will be popular enough to help differentiate the service from the rest of the field.

That is critical, because Hatch and Rovio are not the only ones vying for the title of “Netflix for gaming.” Other formidable hopefuls include Amazon, Microsoft, Apple, Google and perhaps maybe even Netflix itself.

The current selection of games on Hatch include Monument Valley, Space Invaders Infinity Gene and Hitman GO, with a new game called Arkanoid Rising — “a bold new reimagining of the arcade classic produced in association with Japanese gaming legends TAITO” — coming in the spring, which will be “the first Hatch Original exclusive to the platform.”

Down the line, there also will be collaborations to develop esports events and more titles, Rovio said.

The move is a natural one for Hatch, given gaming culture and how strong it is in Japan.

“Japan is the world’s third largest games market and where the video games industry as we know it was born. In this extremely competitive market we couldn’t be happier to work with a partner like Docomo to help take our vision of cloud gaming mainstream,” says Juhani Honkala, Hatch founder and CEO, in a statement. “Docomo’s leading contributions to 5G technology and infrastructure and commitment to amazing new 5G-enabled services make the company an ideal strategic partner in Japan, and we look forward to a long and fruitful collaboration.”

“We are excited to work together with Hatch, a great example of the new type of consumer services, which can bring out its potential towards the 5G era,” added Takanori Ashikawa, director, Consumer Business Department of Docomo, in a separate statement. “Hatch’s vision for cloud gaming changes the way people play and discover games, and our shared goal to enrich the everyday lives of our customers makes Hatch an excellent strategic partner for the long term.”

Since its lacklustre public debut in September 2017, Rovio has been facing a lot of growth challenges, in part because of strong competition in the gaming industry and the company’s over-reliance on a nearly 10-year-old franchise amid a bigger industry shift to new tastes in games — marked by the rise of streamed, multiplayer titles like Fortnite.

But while overall profits have continued to decline at the company, sales of some titles have actually grown, with Angry Birds 2 — now almost three years old — surprisingly seeing a surge of growth in 2018.

In that context, a different focus by way of Hatch, with a little financial help from NTT Docomo, could be the bet that helps catapult Rovio to a new level of the gaming playing field.

Powered by WPeMatico

Reddit is raising $150 million to $300 million to keep the front page of the internet running, multiple sources tell TechCrunch. The forthcoming Series D round is said to be led by Chinese tech giant Tencent at a $2.7 billion pre-money valuation. Depending on how much follow-on cash Reddit drums up from Silicon Valley investors and beyond, its post-money valuation could reach an epic $3 billion.

As more people seek esoteric community and off-kilter entertainment online, Reddit continues to grow its link-sharing forums. Indeed, 330 million monthly active users now frequent its 150,000 Subreddits. That warrants the boost to its valuation, which previously reached $1.8 billion when it raised $200 million in July 2017. As of then, Reddit’s majority stake was still held by publisher Conde Nast, which bought in back in 2006 just a year after the site launched. Reddit had raised $250 million previously, so the new round will push it to $400 million to $550 million in total funding.

It should have been clear that Reddit was on the prowl after a month of pitching its growth to the press and beating its own drum. In December Reddit announced it had reached 1.4 billion video views per month, up a staggering 40 percent from just two months earlier after first launching a native video player in August 2017. And it made a big deal out of starting to sell cost-per-click ads in addition to promoted posts, cost per impression and video ads. A 22 percent increase in engagement and 30 percent rise in total view in 2018 pushed it past $100 million in revenue for the year, CNBC reported.

The exact details of the Series D could fluctuate before it’s formally announced, and Reddit and Tencent declined to comment. But supporting and moderating all that content isn’t cheap. The company had 350 employees just under a year ago, and is headquartered in pricey San Francisco — though in one of its cheaper but troubled neighborhoods. Until Reddit’s newer ad products rev up, it’s still relying on venture capital.

Tencent’s money will give Reddit time to hit its stride. It’s said to be kicking in the first $150 million of the round. The Chinese conglomerate owns all-in-one messaging app WeChat and is the biggest gaming company in the world thanks to ownership of League of Legends and stakes in Clash of Clans-maker Supercell and Fortnite developer Epic. But China’s crackdown on gaming addiction has been rough for Tencent’s valuation and Chinese competitor ByteDance’s news reader app Toutiao has grown enormous. Both of those facts make investing in American newsboard Reddit a savvy diversification, even if Reddit isn’t accessible in China.

Reddit could seek to fill out its round with up to $150 million in additional cash from previous investors like Sequoia, Andreessen Horowitz, Y Combinator or YC’s president Sam Altman. They could see potential in one of the web’s most unique and internet-native content communities. Reddit is where the real world is hashed out and laughed about by a tech-savvy audience that often produces memes that cross over into mainstream culture. And with all those amateur curators toiling away for internet points, casual users are flocking in for an edgier look at what will be the center of attention tomorrow.

Reddit has recently avoided much of the backlash hitting fellow social site Facebook, despite having to remove 1,000 Russian trolls pushing political propaganda. But in the past, the anonymous site has had plenty of problems with racist, misogynistic and homophobic content. In 2015 it finally implemented quarantines and shut down some of the most offensive Subreddits. But harassment by users contributed to the departure of CEO Ellen Pao, who was replaced by Steve Huffman, Reddit’s co-founder. Huffman went on to abuse that power, secretly editing some user comments on Reddit to frame them for insulting the heads of their own Subreddits. He escaped the debacle with a slap on the wrist and an apology, claiming “I spent my formative years as a young troll on the Internet.”

Investors will have to hope Huffman has the composure to lead Reddit as it inevitably encounters more scrutiny as its valuation scales up. Its policy choice about what constitutes hate speech and harassment, its own company culture and its influence on public opinion will all come under the microscope. Reddit has the potential to give a voice to great ideas at a time when flashy visuals rule the web. And as local journalism wanes, the site’s breed of vigilante web sleuths could be more in demand, for better or worse. But that all hinges on Reddit defining clear, consistent, empathetic policy that will help it surf atop the sewage swirling around the internet.

Powered by WPeMatico

Little Spoon, a startup producing modular packages of nutritional, direct-to-consumer baby food, has raised a $7 million round of funding lead by Vaultier7.

The subscription-based service delivers meals — a fixed $3 apiece — to customers’ doorsteps. To date, Little Spoon said it has delivered 1 million meals. Other investors in the round include Kairos, Chobani’s executive vice president of sales Kyle O’Brien, Tinder founders Sean Rad and Justin Mateen, Interplay Ventures, the San Francisco 49ers and SoGal Ventures.

Among the business’s co-founders are Michelle Muller, chief executive officer Ben Lewis, chief product officer Angela Vranich and chief marketing officer Lisa Barnett, a former partner at Dorm Room Fund and Sherpa Foundry. The four launched the company a little over a year ago out of New York. Today, the site offers a rotating menu of 50 different recipes and 80 different ingredients.

“Our success is a testament to what we are seeing more broadly in the parenting space,” Barnett told TechCrunch. “There are a lot of demands for brands from this generation of parents.”

As an investor privy to rising trends within the technology and entrepreneurship space, Barnett became interested in the growing parenting tech sector.

“There has definitely been an eruption in the space,” she said. “I think there’s going to be the next big brand in this parenting space and I think that is what Little Spoon can be and is working toward becoming.”

Little Spoon members are given a personalized meal plan when they register with the service. The startup’s packaging is 100 percent recyclable, spoon included, which they say is a “developmentally advantageous form factor that promotes improved motor skills and mindful eating habits.”

The startup plans to use the capital to expand its line of baby meals.

And if you’re wondering why the 49ers invested in a baby food startup… “The 49ers were looking to partner with startups that drive innovation in and access to healthier lifestyles,” Lewis told TechCrunch. “They look for companies making it easier for the average American to live a healthier life, and we found a shared passion in our vision to make quality nutrition accessible to children everywhere.”

Powered by WPeMatico

Signal Sciences, an LA-based firm that helps customers secure their web applications, announced a $35 million Series C investment today.

Lead Edge Capital led the round (which seems appropriate, given its name). CRV, Index Ventures, Harrison Metal and OATV also participated. Today’s investment brings the total raised to around $62 million, according to the company.

The company helps protect web applications like online banking, shopping carts, email or any application you access online. It acts as a protection layer or firewall around the application, Andrew Peterson, CEO and company co-founder told TechCrunch.

“We protect people’s websites or mobile sites. We have software that actually fits in line between the internet and traffic coming into those web applications and all of the data that are behind it,” Petersen explained. It sounds simple enough, but given the onslaught of breaches we have seen across the internet, it’s obviously a difficult problem to solve.

Signal Sciences looks at behavior and tries to determine if it’s malicious. “We combine attack information with behavior about what that attacker is doing.” He says this gives customers a real understanding of the behavior of the attacker and what they’re trying to do against their site, instead of trying to randomly trying to determine if each suspicious activity is an attack or not.

Petersen won’t identify a specific number of customers. He feels it’s a misleading metric because some of his large enterprise customers have multiple business units running almost as independent entities and it doesn’t necessarily reflect the size of the business. He will say that Signal Sciences is protecting more than 10,000 applications involving 1 trillion requests every month from companies like Adobe, Under Armour and WeWork.

The company is up to 150 employees, a number Petersen says has been doubling every year. That trend is expected to continue with this new influx of money. The company wants to get the word out to more customers and help people understand there is a way to attack this problem.

“We started this company to build an innovative technology. We want to continue to drive the bar up for what customers should be expecting from their web protection in the future,” Petersen said.

Powered by WPeMatico

Single-use plastics are the scourge of the environment, which is why many lawmakers are working to eliminate them.

Today, a new brand is launching to try to eliminate single-use plastic in the area of personal care. With $4 million in seed funding led by Lerer Hippeau (with participation from Red Sea Ventures, BoxGroup, SV Angel, Great Oaks, SoulCycle co-founder Elizabeth Cutler, and CPO of Adobe, Scott Belsky, among others), By Humankind offers deodorant, shampoo and mouthwash.

But unlike your typical personal care products, the By Humankind portfolio products are rethought from the ground up to eliminate single-use plastic and be kind to the environment.

For example, the mouthwash doesn’t come in a big plastic container, but rather in tablet form. Users can drop a tablet into a small cup of water and the mouthwash, which is alcohol-free, dissolves into a liquid. With the shampoo, the By Humankind team decided to eliminate the plastic bottle by simply taking a page out of the old soap bar playbook, creating a shampoo bar.

Meanwhile, the By Humankind deodorant comes in a refillable plastic roller, with paper-pod refills (which the company calls KindFills).

The company says that its products eliminate single-use plastic by 90 percent when compared to other products in their respective categories. Moreover, By Humankind has designed its shipping packages with biodegradable, bamboo fiber-based materials.

“Keeping our packaging footprint to a minimum is an extension of our mission, which is enabling our customers to reduce their single-use plastic waste, while not sacrificing quality or convenience,” said co-founder and CEO Brian Bushell.

Bushell came from Baked By Melissa, where he was co-founder and CEO. A couple of years after leaving the company, Bushell went on a trip with his girlfriend to Southeast Asia. On a scuba excursion, he noticed a large amount of plastic trash in the ocean, which took him by surprise as he believed to be in one of the few untouched, idyllic parts of the planet.

“We went to the hotel into the bathroom and looked at the stuff we brought on the trip and realized that we were part of the problem,” said Bushell. “That’s when the idea was hatched to build a personal care brand that not only cared about ingredients but about the containers they come in.”

But Bushell knew that the mission would only be successful if the products performed well. That’s why the company spent time and resources creating high-performance formulas for its products, such as the By Humankind deodorant, which the company says kills odor-causing bacteria 40 percent faster than other leading natural deodorants.

According to By Humankind, customers that switch from their current products to all three By Humankind products, with normal usage, will save five pounds of single-use plastic over the course of a year.

Powered by WPeMatico

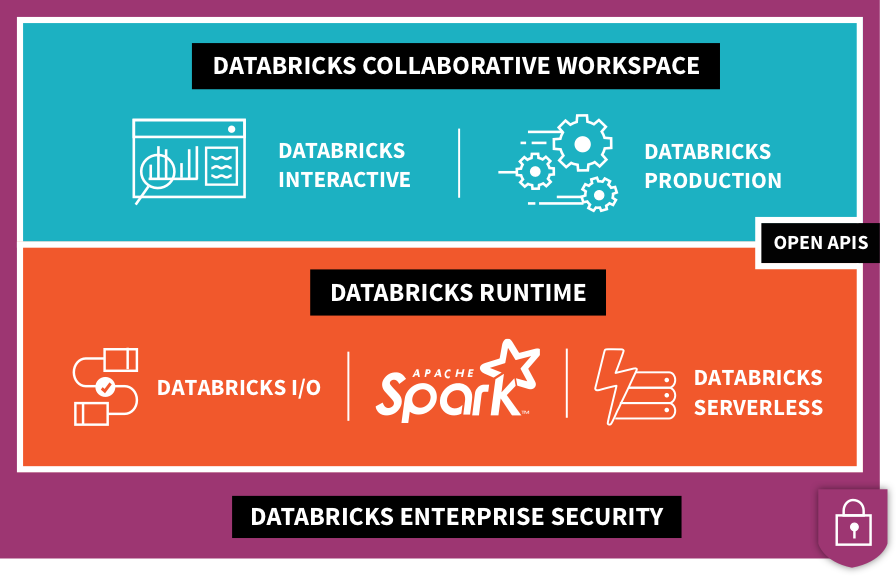

Databricks, the company founded by the original team behind the Apache Spark big data analytics engine, today announced that it has raised a $250 million Series E round led by Andreessen Horowitz. Coatue Management, Green Bay Ventures, Microsoft and NEA, also participated in this round, which brings the company’s total funding to $498.5 million. Microsoft’s involvement here is probably a bit of a surprise, but it’s worth noting that it also worked with Databricks on the launch of Azure Databricks as a first-party service on the platform, something that’s still a rarity in the Azure cloud.

As Databricks also today announced, its annual recurring revenue now exceeds $100 million. The company didn’t share whether it’s cash flow-positive at this point, but Databricks CEO and co-founder Ali Ghodsi shared that the company’s valuation is now $2.75 billion.

Current customers, which the company says number around 2,000, include the likes of Nielsen, Hotels.com, Overstock, Bechtel, Shell and HP.

While Databricks is obviously known for its contributions to Apache Spark, the company itself monetizes that work by offering its Unified Analytics platform on top of it. This platform allows enterprises to build their data pipelines across data storage systems and prepare data sets for data scientists and engineers. To do this, Databricks offers shared notebooks and tools for building, managing and monitoring data pipelines, and then uses that data to build machine learning models, for example. Indeed, training and deploying these models is one of the company’s focus areas these days, which makes sense, given that this is one of the main use cases for big data, after all.

On top of that, Databricks also offers a fully managed service for hosting all of these tools.

“Databricks is the clear winner in the big data platform race,” said Ben Horowitz, co-founder and general partner at Andreessen Horowitz, in today’s announcement. “In addition, they have created a new category atop their world-beating Apache Spark platform called Unified Analytics that is growing even faster. As a result, we are thrilled to invest in this round.”

Ghodsi told me that Horowitz was also instrumental in getting the company to re-focus on growth. The company was already growing fast, of course, but Horowitz asked him why Databricks wasn’t growing faster. Unsurprisingly, given that it’s an enterprise company, that means aggressively hiring a larger sales force — and that’s costly. Hence the company’s need to raise at this point.

As Ghodsi told me, one of the areas the company wants to focus on is the Asia Pacific region, where overall cloud usage is growing fast. The other area the company is focusing on is support for more verticals like mass media and entertainment, federal agencies and fintech firms, which also comes with its own cost, given that the experts there don’t come cheap.

Ghodsi likes to call this “boring AI,” since it’s not as exciting as self-driving cars. In his view, though, the enterprise companies that don’t start using machine learning now will inevitably be left behind in the long run. “If you don’t get there, there’ll be no place for you in the next 20 years,” he said.

Engineering, of course, will also get a chunk of this new funding, with an emphasis on relatively new products like MLFlow and Delta, two tools Databricks recently developed and that make it easier to manage the life cycle of machine learning models and build the necessary data pipelines to feed them.

Powered by WPeMatico

Solar installations are becoming a no-brainer for anyone with a roof in much of the country. But getting an estimate on how much it would cost and how much juice it would generate can be complicated and time-consuming. Aurora Solar has made an automated process for doing this, and attracted $20 million in funding as a result.

A big part of the uncertainty anyone has about getting solar installed is the upfront cost and return on investment. An on-site visit may cost hundreds, or thousands for a commercial property, or that cost may be rolled up into the overall charge. But why send someone out when all the data you need can be acquired in bulk from the air?

Aurora uses lidar data for this — but not the kind of lidar where you have to fly a drone with the instrument over the house. That would hardly be less expensive and time-consuming than a normal visit. Instead they use lidar collected by small aircraft making low-altitude passes over the city.

The resulting data (you can see it above) produces detailed 3D models of the terrain and all the buildings on it; the exact size and slope of a roof can be determined with high precision. It’s actually similar in a way to how archaeologists used it to map out an ancient Mayan metropolis.

There are some programs and services out there that do virtual site visits, but many just estimate your roof area and orientation by looking at satellite imagery. That’s good for a basic estimate, but Aurora uses multiple sources of data to create a detailed 3D map of your roof, and it’s proud of its results.

“From the get-go, we have been very ambitious about the way we address the problem, probably since we faced the same issues our clients face ourselves,” said co-founder Christopher Hopper in an email to TechCrunch. That would have been in 2012, when he and co-founder Samuel Adeyemo experienced significant friction with a solar install in East Africa. The installation itself was a snap, they found, but the planning and design of the system took months.

“Aurora pioneered the concept of ‘remote site visits,’ which enables solar installers to precisely calculate how many solar panels fit on a property, and how much energy they produce without traveling to the site,” Hopper said. “We have a large dataset of LIDAR data pre-loaded in the application that’s accessible to our users. We estimate that that covers about 2/3 of the US population.”

This and other data lets Aurora create a detailed CAD model of the building in just a few minutes, and generate a basic plan for solar cell placement as well that accounts for slope, exposure, and any shade-producing obstacles like chimneys or trees nearby. (Shade reports are usually done in person, and are necessary to receive certain rebates.)

From there users can go straight into the sales and financing process, even including line diagrams for the electrical system you’ll be building. And theoretically it could all take less than an hour, which is probably how much time you’d spend on the phone trying to get a local solar installer to come out.

The A round was led by Energize Ventures, whose managing director Amy Francetic will be joining the board, with S28 and seed investor Pear also contributing.

Once nice thing about companies relying on data and automation: they scale well. So Aurora won’t need to buy a thousand new trucks to get its next few thousand customers — it needs to hire engineers, sales and support people, which is exactly what it plans to do.

“We expect to expand all of the functions in our organization,” said Hopper. “We are particularly excited about all of the things we can do on the product side and in customer success. And finally, this funding means that we are here to stay. For companies [i.e. Aurora’s clients] that rely on a software provider for their day-to-day operations this is an important factor.”

Adeyemo notes in the press release announcing the funding that “the solar professional” is the “fastest growing occupation in the U.S.” Hopefully making things easier for the customer will keep it that way for a while.

Disclosure: Former TechCruncher Rahul Nihalani now works for Aurora. Rahul’s great, but this does not affect our coverage.

Powered by WPeMatico

Robotics process automation (RPA) is as hot as any enterprise technology at the moment, as companies look for ways to marry their legacy systems with a more modern flavor of automation. Catalytic, a startup from the Midwest, is putting its own flavor on RPA, aiming at more unstructured data. Today it was rewarded with a $30 million Series B investment.

The investment was led by Intel Capital, with participation from Redline Capital and existing investors NEA, Boldstart and Hyde Park Angel. Today’s round brings the total raised to almost $42 million, according to the company.

RPA helps automate highly mundane processes. Sean Chou, Catalytic co-founder and CEO, says there are a couple of ways his company’s solution diverts from his competition, which includes companies like Blue Prism, Automation Anywhere and UIPath.

For starters, Chou says, his company’s solution concentrates on unstructured data, like pulling information from documents or emails using a variety of techniques, depending on requirements. It could be old-fashioned scanning and OCR or more modern natural language process (NLP) to “read” the document, depending on requirements.

It is designed like all RPA tools to take humans out of the loop when it comes to the most mundane business processes, but, as Chou says, his company wants human employees in the loop whenever needed, whether that’s exception processing or tasks that are simply too challenging to program at the moment.

The company launched in 2015 using money Chou had earned from the sale of his previous company, Fieldglass, which he had sold the previous year to SAP for more than $1 billion dollars. Fieldglass helped with outsourcing, and as Chou developed that company, he saw a growing problem around automating certain tedious business processes, especially when they touched legacy systems inside an organization. He raised $3.1 million in seed money from Boldstart Ventures in NYC in 2016 and began building out the product in earnest.

Today, Catalytic has a dozen customers, including Bosch, the German manufacturing conglomerate. It employs 60 people in its Chicago headquarters. While its investors come from the coasts, Catalytic is building a company in the heart of the Midwest, a part of the country that has often been left out of the startup economy.

With $30 million, Catalytic can begin expanding the number of employees, including helping service its large customers, building out it partner network with other software companies and systems integrators and bringing in more engineering talent to continue building out the product.

The product is offered on a subscription basis as a cloud service.

Powered by WPeMatico