funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Orai, a startup building communication coaching tools, is announcing that it has raised $2.3 million in seed funding.

CEO Danish Dhamani said that he co-founded the company with Paritosh Gupta and Aasim Sani to address a need in his own life — the fact that he was “held back personally and professionally” by lackluster “communications skills and public speaking skills.”

Dhamani said he attended Toastmasters International meetings hoping to improve those skills, where he came to a surprising conclusion — that he could build an algorithm to analyze your speaking abilities and give tips on how to improve.

To be clear, Orai isn’t necessarily trying to replace groups like Toastmasters, or individual speaking coaches. However, Dhamani said the “status quo” involves a “one-to-one” approach, where a human coach gives feedback to one person. Orai, on the other hand, can coach “entire IT teams, entire student bodies.”

“I am a big advocate of personalized, one-on-one coaching as well,” he said. “Orai is not replacing that, it’s enhancing that if used together.”

The startup has created iOS and Android smartphone apps to demonstrate the technology, which offer focused lessons and then assess your progress by analyzing recordings of your voice. (I did the initial assessment, and although I was praised for not using any “filler words,” I was told that I need to slow down — something I hear a lot.)

The real business model involves selling the tools to businesses, which can then assign Orai lessons to salespeople or other teams, create their own lessons and track everyone’s progress.

Attendees of TechCrunch’s Disrupt SF hackathon may recognize the team, which presented a body language analyzer in 2017 called Vocalytics. So you can probably guess that Dhamani’s plans go beyond audio.

The funding was led by Comcast Ventures — Orai was one of the startups at Comcast’s LIFT Labs Accelerator in Philadelphia. (Currently accepting applications for its second class!) In addition to announcing the funding, Orai has signed up famed speaking coach Nancy Duarte as an advisor.

Powered by WPeMatico

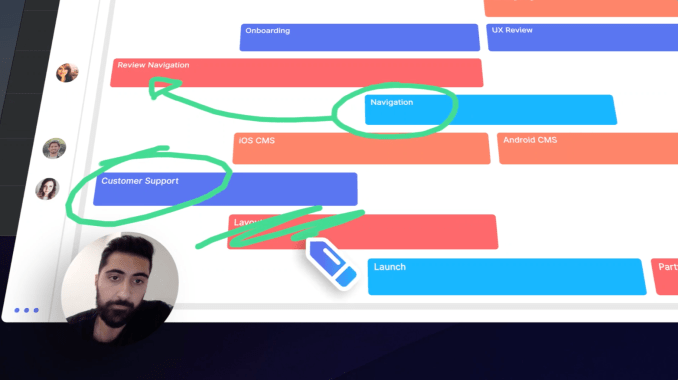

If a picture is worth a thousand words, how many emails can you replace with a video? As offices fragment into remote teams, work becomes more visual and social media makes us more comfortable on camera, it’s time for collaboration to go beyond text. That’s the idea behind Loom, a fast-rising startup that equips enterprises with instant video messaging tools. In a click, you can film yourself or narrate a screenshare to get an idea across in a more vivid, personal way. Instead of scheduling a video call, employees can asynchronously discuss projects or give “stand-up” updates without massive disruptions to their workflow.

In the 2.5 years since launch, Loom has signed up 1.1 million users from 18,000 companies. And that was just as a Chrome extension. Today Loom launches its PC and Mac apps that give it a dedicated presence in your digital work space. Whether you’re communicating across the room or across the globe, “Loom is the next best thing to being there,” co-founder Shahed Khan tells me.

Now Loom is ready to spin up bigger sales and product teams thanks to an $11 million Series A led by Kleiner Perkins . The firm’s partner Ilya Fushman, formally Dropbox’s head of product and corporate development, will join Loom’s board. He’ll shepherd Loom through today’s launch of its $10 per month per user Pro version that offers HD recording, calls-to-action at the end of videos, clip editing, live annotation drawings and analytics to see who actually watched like they’re supposed to.

“We’re ditching the suits and ties and bringing our whole selves to work. We’re emailing and messaging like never before, but though we may be more connected, we’re further apart,” Khan tells me. “We want to make it very easy to bring the humanity back in.”

Loom co-founder Shahed Khan

But back in 2016, Loom was just trying to survive. Khan had worked at Upfront Ventures after a stint as a product designer at website builder Weebly. He and two close friends, Joe Thomas and Vinay Hiremath, started Opentest to let app makers get usability feedback from experts via video. But after six months and going through the NFX accelerator, they were running out of bootstrapped money. That’s when they realized it was the video messaging that could be a business as teams sought to keep in touch with members working from home or remotely.

Together they launched Loom in mid-2016, raising a pre-seed and seed round amounting to $4 million. Part of its secret sauce is that Loom immediately starts uploading bytes of your video while you’re still recording so it’s ready to send the moment you’re finished. That makes sharing your face, voice and screen feel as seamless as firing off a Slack message, but with more emotion and nuance.

“Sales teams use it to close more deals by sending personalized messages to leads. Marketing teams use Loom to walk through internal presentations and social posts. Product teams use Loom to capture bugs, stand ups, etc.,” Khan explains.

Loom has grown to a 16-person team that will expand thanks to the new $11 million Series A from Kleiner, Slack, Cue founder Daniel Gross and actor Jared Leto that brings it to $15 million in funding. They predict the new desktop apps that open Loom to a larger market will see it spread from team to team for both internal collaboration and external discussions from focus groups to customer service.

Loom will have to hope that after becoming popular at a company, managers will pay for the Pro version that shows exactly how long each viewer watched. That could clue them in that they need to be more concise, or that someone is cutting corners on training and cooperation. It’s also a great way to onboard new employees. “Just watch this collection of videos and let us know what you don’t understand.” At $10 per month though, the same cost as Google’s entire GSuite, Loom could be priced too high.

Next Loom will have to figure out a mobile strategy — something that’s surprisingly absent. Khan imagines users being able to record quick clips from their phones to relay updates from travel and client meetings. Loom also plans to build out voice transcription to add automatic subtitles to videos and even divide clips into thematic sections you can fast-forward between. Loom will have to stay ahead of competitors like Vidyard’s GoVideo and Wistia’s Soapbox that have cropped up since its launch. But Khan says Loom looms largest in the space thanks to customers at Uber, Dropbox, Airbnb, Red Bull and 1,100 employees at HubSpot.

“The overall space of collaboration tools is becoming deeper than just email + docs,” says Fushman, citing Slack, Zoom, Dropbox Paper, Coda, Notion, Intercom, Productboard and Figma. To get things done the fastest, businesses are cobbling together B2B software so they can skip building it in-house and focus on their own product.

No piece of enterprise software has to solve everything. But Loom is dependent on apps like Slack, Google Docs, Convo and Asana. Because it lacks a social or identity layer, you’ll need to send the links to your videos through another service. Loom should really build its own video messaging system into its desktop app. But at least Slack is an investor, and Khan says “they’re trying to be the hub of text-based communication,” and the soon-to-be-public unicorn tells him anything it does in video will focus on real-time interaction.

Still, the biggest threat to Loom is apathy. People already feel overwhelmed with Slack and email, and if recording videos comes off as more of a chore than an efficiency, workers will stick to text. And without the skimability of an email, you can imagine a big queue of videos piling up that staffers don’t want to watch. But Khan thinks the ubiquity of Instagram Stories is making it seem natural to jump on camera briefly. And the advantage is that you don’t need a bunch of time-wasting pleasantries to ensure no one misinterprets your message as sarcastic or pissed off.

Khan concludes, “We believe instantly sharable video can foster more authentic communication between people at work, and convey complex scenarios and ideas with empathy.”

Powered by WPeMatico

Redis Labs, a startup that offers commercial services around the Redis in-memory data store (and which counts Redis creator and lead developer Salvatore Sanfilippo among its employees), today announced that it has raised a $60 million Series E funding round led by private equity firm Francisco Partners.

The firm didn’t participate in any of Redis Labs’ previous rounds, but existing investors Goldman Sachs Private Capital Investing, Bain Capital Ventures, Viola Ventures and Dell Technologies Capital all participated in this round.

In total, Redis Labs has now raised $146 million and the company plans to use the new funding to accelerate its go-to-market strategy and continue to invest in the Redis community and product development.

Current Redis Labs users include the likes of American Express, Staples, Microsoft, Mastercard and Atlassian . In total, the company now has more than 8,500 customers. Because it’s pretty flexible, these customers use the service as a database, cache and message broker, depending on their needs. The company’s flagship product is Redis Enterprise, which extends the open-source Redis platform with additional tools and services for enterprises. The company offers managed cloud services, which give businesses the choice between hosting on public clouds like AWS, GCP and Azure, as well as their private clouds, in addition to traditional software downloads and licenses for self-managed installs.

Redis Labs CEO Ofer Bengal told me the company’s isn’t cash positive yet. He also noted that the company didn’t need to raise this round but that he decided to do so in order to accelerate growth. “In this competitive environment, you have to spend a lot and push hard on product development,” he said.

It’s worth noting that he stressed that Francisco Partners has a reputation for taking companies forward and the logical next step for Redis Labs would be an IPO. “We think that we have a very unique opportunity to build a very large company that deserves an IPO,” he said.

Part of this new competitive environment also involves competitors that use other companies’ open-source projects to build their own products without contributing back. Redis Labs was one of the first of a number of open-source companies that decided to offer its newest releases under a new license that still allows developers to modify the code but that forces competitors that want to essentially resell it to buy a commercial license. Ofer specifically notes AWS in this context. It’s worth noting that this isn’t about the Redis database itself but about the additional modules that Redis Labs built. Redis Enterprise itself is closed-source.

“When we came out with this new license, there were many different views,” he acknowledged. “Some people condemned that. But after the initial noise calmed down — and especially after some other companies came out with a similar concept — the community now understands that the original concept of open source has to be fixed because it isn’t suitable anymore to the modern era where cloud companies use their monopoly power to adopt any successful open source project without contributing anything to it.”

Powered by WPeMatico

3DEN is building spaces for what it calls the “in-between moments” of your day.

The name (pronounced “Eden”) comes from the idea of the “third place” — a space that’s neither home nor work. Founder and CEO Ben Silver told me the goal is to create a space that people can use if, say, they’ve got 45 minutes to fill between meetings, or if they’ve just gotten off a red-eye flight and need somewhere to freshen up.

Coffee shops, co-working spaces, gyms or hotels might serve some of those functions, but Silver said 3DEN is “aggregating many different services” and bringing them together into “a very reliable space.” He suggested that the closest analogue might be a members-only clubhouse — except that instead of charging a steep membership fee, 3DEN requires no commitment, with pricing starting at $6 for each 30 minutes of your visit.

Earlier this week, I dropped by the site of the first 3DEN, located in the shopping area of New York City’s Hudson Yards development. The space is still being built, but I saw booths for phone calls, private showers and even swings for relaxing.

Silver said there will be a meditation space and Casper nap pods, too. He emphasized the nature-inspired design, with plenty of trees and plants, as well as the space’s “acoustic zoning,” with some areas designated for socializing and others designed to be quieter and more restful.

So if you want to catch up on some work, make some calls or even host a meeting (you can invite and pay for up to two guests), you can do that. If you just want to chill out and relax, you can do that, too.

Silver said that while the space will be staffed with a few hosts, technology will be key to the experience, with most transactions being handled via smartphone app. If you’re interested in visiting an 3DEN space, you check-in via the app (which will tell you the current crowd level, and put you on the waiting list if the space is at capacity); you can also reserve a shower and make purchases.

3DEN’s core services will be included in that $6-per-half-hour price, but Silver said there will be a retail element as well, with visitors able to buy products in categories like food and health/beauty. He also said he’s exploring additional pricing models (such as corporate memberships) for regular guests, but he emphasized the importance of “no commitments” pricing that makes the space accessible to a wide swath of visitors.

The seed round was led by b8ta and Graphene Ventures, with participation from Colle Capital Partners, The Stable, JTRE, InVision CEO Clark Valberg, Target’s former Chief Strategy and Innovation Officer Casey Carl and Firebase founder Andrew Lee.

The first 3DEN location has a planned opening of March 15, and Silver said the company is also negotiating for four additional locations across New York City.

Powered by WPeMatico

If you’re a video creator in 2019, you’re probably thinking about a long list of publishing destinations: YouTube, of course, but also Facebook, Instagram, Twitter, Snapchat and more.

StayTuned Digital is a new startup trying to help video creators and publishers push their content to multiple platforms. The company, which bills itself as “content’s best friend,” is officially unveiling its product today and announcing that it’s raised $2.5 million in funding.

StayTuned was founded by CEO Serge Kassardjian (previously the global head of media app business development for Google Play) and Randy Jimenez (previously CTO at SinglePlatform). Kassardjian told me he saw the need for a product like this during his time at Google, when he would talk to content creators becoming “overwhelmed” by the fragmentation across all the different devices and platforms available to them.

“What’s happened is every single one of the platforms is releasing new formats, new ways to optimize, it’s constantly changing every couple of months,” Kassardjian said.

So with StayTuned, publishers shouldn’t have to worry about all that. Kassardjian said the product does three big things: optimizes the video so it looks good and can perform well on each platform, pushes the video to each platform and then measures the results, which feeds back into the optimization.

Kassardjian acknowledged that getting into the media business, even as a technology provider, might seem like a bad idea right now, but he said, “There’s a misconception that what’s happening in the world is that media and content is dead, but there’s more media and content than ever before.”

Nor does Kassardjian believe that publishers can stop relying on Facebook and other platforms. Sure, they may want to drive more traffic to their own properties or launch their own subscription services, but unless they’re Netflix-sized, they can’t ignore the big platforms entirely.

“We provide ubiquity to where the audience is,” he said.

And when he talks about video publishers, he isn’t just thinking about traditional media companies (although he’s looking to work with them too). He also said StayTuned could work with newer digital companies, e-commerce retailers and other brands that are creating content — and eventually, small businesses.

As for the funding, it was led by Bowery Capital, with participation from CourtsideVC, Quaker Health, Social Leverage, Liquid 2 Ventures, The Fund, Hive Ventures, Grape Arbor and a number of angel investors. StayTuned is also part of the current GCT Startup-in-Residence program.

Powered by WPeMatico

Peltarion, a Swedish startup founded by former execs from companies like Spotify, Skype, King, TrueCaller and Google, today announced that it has raised a $20 million Series A funding round led by Euclidean Capital, the family office for hedge fund billionaire James Simons. Previous investors FAM and EQT Ventures also participated, and this round brings the company’s total funding to $35 million.

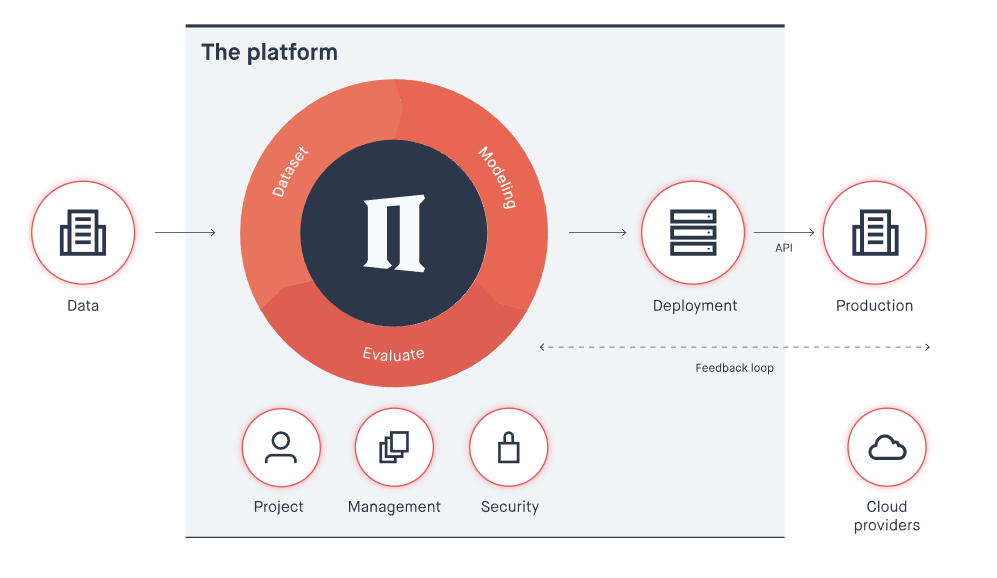

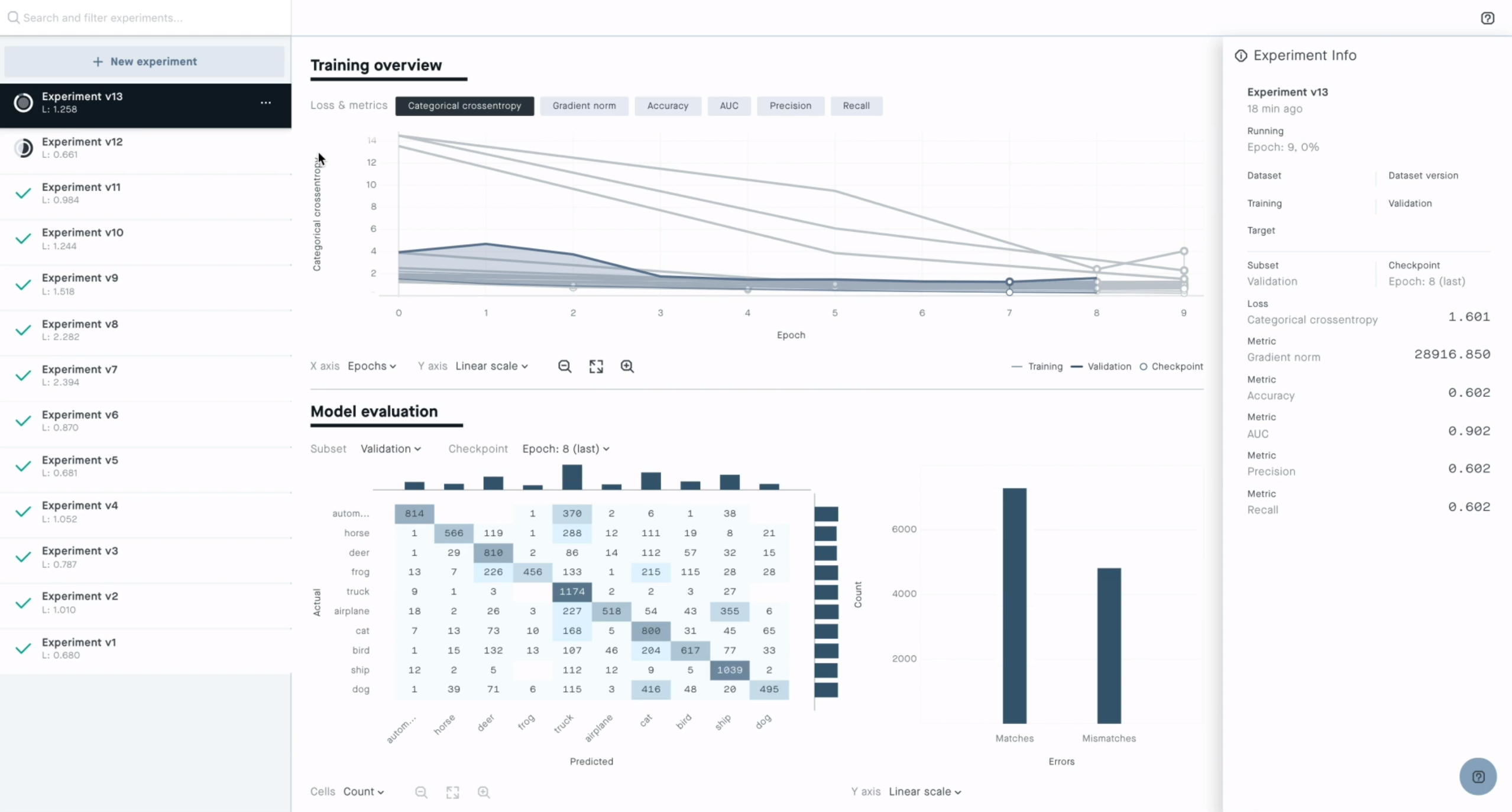

There is obviously no dearth of AI platforms these days. Peltarion focus on what it calls “operational AI.” The service offers an end-to-end platform that lets you do everything from pre-processing your data to building models and putting them into production. All of this runs in the cloud and developers get access to a graphical user interface for building and testing their models. All of this, the company stresses, ensures that Peltarion’s users don’t have to deal with any of the low-level hardware or software and can instead focus on building their models.

“The speed at which AI systems can be built and deployed on the operational platform is orders of magnitude faster compared to the industry standard tools such as TensorFlow and require far fewer people and decreases the level of technical expertise needed,” Luka Crnkovic-Friis, of Peltarion’s CEO and co-founder, tells me. “All this results in more organizations being able to operationalize AI and focusing on solving problems and creating change.”

In a world where businesses have a plethora of choices, though, why use Peltarion over more established players? “Almost all of our clients are worried about lock-in to any single cloud provider,” Crnkovic-Friis said. “They tend to be fine using storage and compute as they are relatively similar across all the providers and moving to another cloud provider is possible. Equally, they are very wary of the higher-level services that AWS, GCP, Azure, and others provide as it means a complete lock-in.”

Peltarion, of course, argues that its platform doesn’t lock in its users and that other platforms take far more AI expertise to produce commercially viable AI services. The company rightly notes that, outside of the tech giants, most companies still struggle with how to use AI at scale. “They are stuck on the starting blocks, held back by two primary barriers to progress: immature patchwork technology and skills shortage,” said Crnkovic-Friis.

The company will use the new funding to expand its development team and its teams working with its community and partners. It’ll also use the new funding for growth initiatives in the U.S. and other markets.

Powered by WPeMatico

It’s well understood that many network breaches begin with phishing emails designed to trick users into giving hackers their credentials. They don’t even have to work to find a vulnerability, they can just waltz in the front door. Elevate Security, a San Francisco startup, wants to change that by helping employees understand phishing attacks better using behavioral techniques. Today, the company announced an $8 million Series A round to build on this idea.

The investment was led by Defy Partners. Existing investor Costanoa Ventures also participated. Today’s round brings the total raised to $10 million, according to the company.

What has the company created to warrant this investment? “We have a solution that motivates, measures and rewards employees to change their security habits, while at the same time giving security teams unprecedented visibility into the security habits and actions of their employees,” co-founder Masha Sedova told TechCrunch.

Specifically, the company has built a Security Behavior platform. “Our platform pulls in data sets that allow employees or security teams to see where the strengths and weaknesses of their organization lie, and then apply a suite of solutions that are rooted in behavioral science that helps them change behavior,” she explained.

Sedova and co-founder Robert Fly started working on this problem when both were part of the Salesforce security team. They began working with the idea of gamifying security to teach employees and customers how to be more security aware.

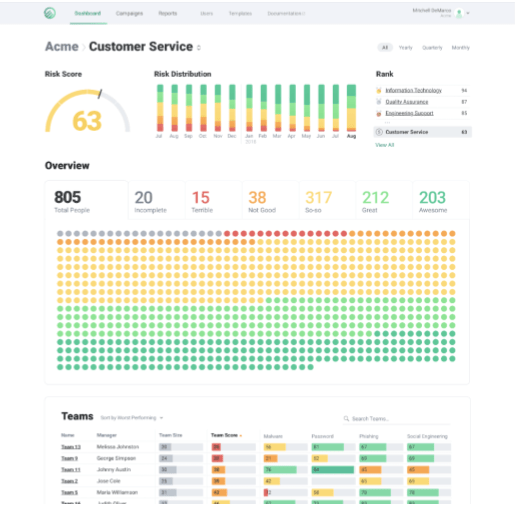

Elevate Security dashboard

When Fly’s team at Salesforce dug into the root of security problems, it found that it was often simply human error. He said it wasn’t malicious on the employee’s part, but they had jobs to do, and expected the security team to handle these issues. He realized that shifting employees to become more security aware was as much a behavioral psychology problem as a technology one and the roots of Elevate began to take shape.

The first product they built on top of the platform is called Hacker’s Mind, a tool designed to help employees understand how hackers think and operate.

The company launched in 2017 and currently has 15 employees, half of which are women. It also boasts an entirely female board of directors, and the startup plans to continue this trend as it staffs up with the new funding. Its headquarters are in San Francisco, but it just opened an engineering office in Montreal. Current customers include AutoDesk, Exxon and Illumio.

Powered by WPeMatico

Last week TechCrunch reported that Reddit was raising $150 million from Chinese tech giant Tencent and up to $150 million more in a Series D that would value the company at $2.7 billion pre-money or $3 billion post-money. After no-commenting on our scoop, today Reddit confirmed it has raised $300 million at $3 billion post-money, with $150 million from Tencent.

The deal makes for an odd pairing between one of the architects of China’s Great Firewall of censorship and one of America’s most lawless free-speech forums. Some Redditors are already protesting the funding by trying to post content that would rile Chinese’s internet watchdogs, like imagery from Tiananmen Square and Winnie the Pooh memes mocking Chinese President Xi Jinping’s appearance.

The round brings the Conde Nast-majority owned Reddit to $550 million in total funding. Beyond Tencent, the rest of the round came from previous investors potentially including Andreessen Horowitz, Sequoia and Fidelity. Apparently frustrated that we had disrupted its PR plan, Reddit today handed confirmation of the round to CNBC, which re-reported our scoop without citation. While CNBC reported in June 2018 that Reddit would top $100 million in revenue, a reliable source tells us Reddit only brought in $85 million in 2018 revenue.

Reddit’s CEO Steve Huffman has had his own problems with attribution after the exec was caught editing users’ comments to mislead viewers into thinking they were insulting their Subreddit’s moderators. Huffman managed to get off with just an apology and vow not to do it again, though he seemed to laugh off and excuse the abuse of power by saying “I spent my formative years as a young troll on the Internet.”

Reddit will have to compete for ad dollars with the Google-Facebook duopoly despite having less information about its users, who are often anonymous. Reddit sees 330 million users per month across its Subreddit forums for discussing everything from news and entertainment to niche types of pornography, conspiracy theories and other highly brand-unsafe content. Meanwhile, users may be concerned that Reddit’s policy views could be tightened as it cosies up to Tencent.

Reddit has struggled with staff departures and user revolts over the years as it tries to balance freedom of expression with civility. The hope is the cash could help it pay for experienced leaders and more moderation staff to maintain that balance. But without proper oversight, the cash could simply scale up Reddit and its problems along with it.

Powered by WPeMatico

We know by now that modern website attacks are typically automated, as armies of bots knock on doors until they inevitably find vulnerabilities and take advantage. PerimeterX, a San Francisco, startup wants to protect sites from these automated assaults. Today, it announced a $43 million Series C.

The round was led by Scale Venture Partners . New investor Adams Street Partners joined existing investors Canaan Partners, Vertex Ventures and Data Collective in the round. Ariel Tseitlin, a partner at Scale, will be joining the company’s board under the terms of the deal. Today’s investment brings the total raised to more than $77 million, according to Crunchbase data.

Omri Iluz, co-founder and CEO at PerimeterX, says bots have become the preferred way of hackers to attack websites and mobile apps, and his company has developed a way to defend against that kind of approach. It uses an approach called behavioral fingerprinting to blunt these automated attacks.

“Once we gain visibility into the behavior of the user, we are able to discern between normal behavior and an anomalous behavior that looks like it’s coming from an automated tool,” he said. The solution looks at attributes like mouse movements and swipes. It also analyzes the hardware to understand the graphics driver and audio driver of whatever device the bot is purporting to be.

To achieve this kind of identification requires massive amounts of data, and PerimeterX uses machine learning to help understand normal behavior and shut down anomalous behavior in an automated fashion.

The company was founded in 2014 and currently has 140 employees. Ariel Tseitlin from Scale Venture Partners, whose firm is leading the round, says as companies reach this level of maturity, the Series C money tends to go into sales and marketing to push the revenue pedal and scale the company.

“While there is a lot of opportunity in R&D, generally at this stage most of the dollars are going for sales and marketing, so hiring more salespeople, hiring more marketers more sales ops. That’s where a big part of the expansion comes from, and that tends to be pretty closely correlated to revenue growth, and pretty closely correlated to just greater growth in general,” Tseitlin explained

We wrote about Signal Sciences’ funding last week, a company that also works to protect web apps using a firewall approach. Iluz says the two companies often work together with the same customers, rather than competing, because they attack the problem differently.

Powered by WPeMatico

Did anyone else listen to season one of StartUp, Alex Blumberg’s OG Gimlet podcast? I did, and I felt like a proud mom this week reading stories of the major, first-of-its-kind Spotify acquisition of his podcast production company, Gimlet. Spotify also bought Anchor, a podcast monetization platform, signaling a new era for the podcasting industry.

On top of that, Himalaya, a free podcast app I’d never heard of until this week, raised a whopping $100 million in venture capital funding to “establish itself as a new force in the podcast distribution space,” per Variety.

The podcasting business definitely took center stage, but Lime and Bird made headlines, as usual, a new unicorn emerged in the mental health space and Instacart, it turns out, has been screwing its independent contractors.

As mentioned, Spotify, or shall we say Spodify, gobbled up Gimlet and Anchor. More on that here and a full analysis of the deal here. Key takeaway: it’s the dawn of podcasting; expect a whole lot more venture investment and M&A activity in the next few years.

This week’s biggest “yikes” moment was when reports emerged that Instacart was offsetting its wages with tips from customers. An independent contractor has filed a class-action lawsuit against the food delivery business, claiming it “intentionally and maliciously misappropriated gratuities in order to pay plaintiff’s wages even though Instacart maintained that 100 percent of customer tips went directly to shoppers.” TechCrunch’s Megan Rose Dickey has the full story here, as well as Instacart CEO’s apology here.

Slack confidentially filed to go public this week, its first public step toward either an IPO or a direct listing. If it chooses the latter, like Spotify did in 2018, it won’t issue any new shares. Instead, it will sell existing shares held by insiders, employees and investors, a move that will allow it to bypass a roadshow and some of Wall Street’s exorbitant IPO fees. Postmates confidentially filed, too. The 8-year-old company has tapped JPMorgan Chase and Bank of America to lead its upcoming float.

Reddit CEO Steve Huffman delivers remarks on “Redesigning Reddit” during the third day of Web Summit in Altice Arena on November 08, 2017 in Lisbon, Portugal. (Horacio Villalobos-Corbis/Contributor)

It was particularly tough to decide which deal was the most notable this week… But the winner is Reddit, the online platform for chit-chatting about niche topics — r/ProgMetal if you’re Crunchbase editor Alex Wilhelm . The company is raising up to $300 million at a $3 billion valuation, according to TechCrunch’s Josh Constine. Reddit has been around since 2005 and has raised a total of $250 million in equity funding. The forthcoming Series D round is said to be led by Chinese tech giant Tencent at a $2.7 billion pre-money valuation.

Runner up for deal of the week is Calm, the app that helps users reduce anxiety, sleep better and feel happier. The startup brought in an $88 million Series B at a $1 billion valuation. With 40 million downloads worldwide and more than one million paying subscribers, the company says it quadrupled revenue in 2018 from $20 million to $80 million and is now profitable — not a word you hear every day in Silicon Valley.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

I listened to the Bird CEO’s chat with Upfront Ventures’ Mark Suster last week and wrote down some key takeaways, including the challenges of seasonality and safety in the scooter business. I also wrote about an investigation by Consumer Reports that found electric scooters to be the cause of more than 1,500 accidents in the U.S. I’m also required to mention that e-scooter unicorn Lime finally closed its highly anticipated round at a $2.4 billion valuation. The news came just a few days after the company beefed up its executive team with a CTO and CMO hire.

Databricks raises $250M at a $2.75B valuation for its analytics platform

Retail technology platform Relex raises $200M from TCV

Raisin raises $114M for its pan-European marketplace for savings and investment products

Self-driving truck startup Ike raises $52M

Signal Sciences secures $35M to protect web apps

Ritual raises $25M for its subscription-based women’s daily vitamin

Little Spoon gets $7M for its organic baby food delivery service

By Humankind picks up $4M to rid your morning routine of single-use plastic

We don’t spend a ton of time talking about the growing, venture-funded, tech-enabled logistics sector, but one startup in the space garnered significant attention this week. Turvo poached three key Uber Freight employees, including two of the unit’s co-founders. What’s that mean for Uber Freight? Well, probably not a ton… Based on my conversation with Turvo’s newest employees, Uber Freight is a rocket ship waiting to take off.

Who knew that investing in female-focused brands could turn a profit for investors? Just kidding, I knew that and this week I have even more proof! This is L., a direct-to-consumer, subscription-based retailer of pads, tampons and condoms made with organic materials sold to P&G for $100 million. The company, founded by Talia Frenkel, launched out of Y Combinator in August 2015. According to PitchBook, it was backed by Halogen Ventures, 500 Startups, Fusion Fund and a few others.

Speaking of ladies getting stuff done, Bessemer Venture Partners promoted Talia Goldberg to partner this week, making the 28-year-old one of the youngest investing partners at the Silicon Valley venture fund. Plus, Palo Alto’s Eclipse Ventures, hot off the heels of a $500 million fundraise, added two general partners: former Flex CEO Mike McNamara and former Global Foundries CEO Sanjay Jha.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase editor-in-chief Alex Wilhelm and I chat about the expanding podcast industry, Reddit’s big round and scooter accidents.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico