funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Customer experience management platform Medallia has filed to raise up to $70 million in Series F funding, according to regulatory documents obtained by the Prime Unicorn Index. The new shares were priced at $15 apiece, valuing the nearly two-decades-old business at $2.4 billion.

Medallia confirmed the funding. A previous version of this report pinpointed Medallia’s valuation at $1.7 billion.

Medallia is expected to finally transition to the public markets in 2019, a year chock-full of high-profile unicorn IPOs. The downsized round, which is less than half of its Series E funding, will likely be Medallia’s final infusion of private investment.

San Mateo-headquartered Medallia, led by newly appointed chief executive officer Leslie Stretch, operates a platform meant to help businesses better provide for their customers. Its core product, the Medallia Experience Cloud, provides employees real-time data on customers collected from online review sites and social media. The service leverages that data to provide insights and tools to improve customer experiences.

Leslie Stretch, president and CEO of Medallia (PRNewsfoto/Medallia)

According to PitchBook, Medallia boasts a particularly clean cap table, especially for a roughly 18-year-old business. It’s backed by four venture capital firms: Sequoia Capital, Saints Capital, TriplePoint Venture Growth and Grotmol Solutions, the latter which invested a small amount of capital in 2010. Medallia has raised a total of $268 million in equity funding, including a $150 million round in 2015 that valued the company at $1.25 billion.

Prior to hiring Stretch to lead the company to IPO, Medallia co-founder Borge Hald ran the company as CEO since its 2001 launch. Hald is now executive chairman and chief strategy officer.

Powered by WPeMatico

The future of healthcare isn’t entirely digital. For encounters as intimate as the client-therapist dynamic, a face-to-face relationship is still key.

For those able to afford tech-enabled therapy services, Two Chairs, a San Francisco-headquartered mental healthcare business, may be of interest. The startup believes in the power of in-person therapy, as opposed to the new variety of affordable digital tools meant to replace or coexist with therapy services. Today, the company is announcing a $7 million Maveron-led Series A financing to open additional brick-and-mortar clinics and build out its client-therapist matching app, which leverages technology to pair its customers with a therapist best-tailored to their needs.

The company currently operates four clinics in the Bay Area, where patients can access individual or group therapy. Each of those clinics was built with modern, young professionals in mind using “thoughtful design” to create “non-judgmental spaces.”

A Two Chairs clinic, which emphasizes “non-judgmental” design

The app and clinic interior design are the key differences between Two Chairs and a neighborhood private practice, it says. As far as pricing, at $180 an hour, a session doesn’t differ terribly from a typical session at a Bay Area private practice. The startup currently employs 30 therapists, who also are available over video chat should a client be sick or traveling, with a customer base of “several thousand.”

Two Chairs was founded in 2017 by former Palantir employee Alex Katz (pictured). In a conversation with TechCrunch, Katz admitted procuring real estate for Two Chairs’ brick-and-mortar clinics has been an expensive and difficult endeavor. It’s no wonder venture capitalists tend to favor IT startups devoid of the overhead costs associated with firms in the real estate business. Katz is hoping the latest investment, which brings Two Chairs’ total raised to $8 million, will help the business quickly sign additional leases outside of the most expensive city in the U.S.

The cash will also be used to advance Two Chairs’ matching app. The app surveys potential clients on their history, preferences and goals, then uses a library of data to match the client with the most suitable therapist in its roster and to create a customized treatment plan. Katz says they’ve provided clients with an accurate match 95 percent of the time.

“We know that the client-therapist relationship is the best predictor of an outcome with care and while it sounds intuitive, matching is not a concept that has existed in the mental health field historically,” Katz told TechCrunch.

Two Chairs is one of several mental health startups to capture the attention of venture capitalists lately. Basis, which helps people cope with anxiety and depression through guided conversations via chat and video, emerged from stealth in 2018 with a $3.75 million investment led by Bedrock. Wisdo, a community-focused app that connects people seeking help with those who can offer help, brought in an $11 million investment in December and emotional well-being app Aura raised $2.7 million from Cowboy Ventures in October.

Those three businesses have one thing in common: they are digital-first endeavors looking to innovate on top of a broken mental healthcare model. Two Chairs’ plan to build additional therapy clinics, however, doesn’t feel particularly inventive. Opening a chain of therapy offices, rather, sounds like a hard-to-scale, expensive business idea.

As for the uptick in capital for mental health tech, Katz is satisfied Silicon Valley has finally acknowledged the problem: “I think Silicon Valley venture has had a preference for models that don’t involve brick-and-mortar and minimize the use of people; they prefer software businesses,” he said. “The reason we are taking this approach is we know from the research that really well-matched in-person therapy is really effective. Still, at a high level, it’s exciting. There are a lot of people thinking in innovative ways of how we can provide improved mental healthcare.”

Goldcrest Capital also participated in Two Chairs’ Series A.

Powered by WPeMatico

Ceros allows marketers to create animated, interactive content — but don’t call it a content marketing company.

“We think content is just a dry, bland, over-leveraged, oversaturated space,” said founder and CEO Simon Berg. “The goal is not to hack the system, the goal is to make a great experience for your customers.”

That’s why he describes Ceros as a platform for creating experiences. The company is focused on powering beautiful, well-designed graphics and web pages, instead of blog posts or white papers that mostly exist to snare search traffic.

Ceros is announcing today that it has raised $14 million in Series C funding.

Ceros previously raised $19.5 million in funding, according to Crunchbase. The new round was led by Greenspring Associates, with participation from Grotech Ventures, CNF Investments, Sigma Prime Ventures, StarVest Partners, Greycroft and Silicon Valley Bank.

“Ceros is well known for empowering marketers to think creatively, but we have also come to know Ceros as a highly capital efficient business, which is a refreshing change in the burn-rate happy world of digital,” said Greenspring’s John Avirett, general partner, in a statement. “We’re confident that this investment will catalyze Ceros’ continued growth while enabling their team to opportunistically pursue acquisitions that enhance the core product and further penetration of key markets.”

For examples of the difference between Ceros “experiences” and run-of-the-mill content marketing, check out Ceros/Inspire, where some of the most-viewed projects include a comic book-style blockchain explainer from Ozy and a “friend versus pro” created to promote H&R Block.

“What we’ve continued to work on over the last seven years is to comply with laws of physics that are laws of internet, whilst giving as much creative freedom as possible,” Berg said. “We want to put the creative and the design piece first.”

The company says it’s now working with more than 400 customers, including well-known brands like United Airlines and Red Bull, as well as publishers including Condé Nast and Vice, plus sports teams like the Baltimore Ravens and Detroit Lions.

“Both in terms of the revenues that we’ve reached and the clients that we’ve worked with … you never really ‘arrive,’ but I feel like we’ve reached a critical milestone,” Berg said.

Powered by WPeMatico

Ridesharing isn’t just for transporting teenagers and adults anymore. Zūm, a ridesharing startup for kids, just raised a $40 million Series C round led by BMW i Ventures with participation from Spark Capital and Sequoia Capital. This brings the company’s total funding to $70 million.

Zūm is a mobile app that enables parents to schedule rides for their kids from fully vetted drivers. It also partners with school districts to support their transportation needs. To date, the company has partnered with 150 school districts across the country and transported more than 500,000 students.

“Zūm has proven itself as a force to be reckoned with in a market that has a lot of untapped opportunity,” BMW i Ventures managing partner Ulrich Quay said in a statement. “Its leadership is strong not only because of their drive to help working families, but because they themselves have families and understand the need for better child transportation, today. We’re proud to be supporting Zūm and look forward to seeing its momentum as it continues driving funds back into schools.”

The plan with the funding is to support the increase of partnerships with schools throughout the nation. Additionally, Zūm plans to use the funding to further develop its one-stop platform technology for schools. This platform features route optimization, vehicle and quality tracking and real-time vehicle dashboards for schools.

“I’m honored to gain the support of our incredible investors who believe in what Zūm does, and our mission to build the world’s largest and safest transportation service for students,” Zūm founder and CEO Ritu Narayan (pictured above) said in a press release. “It is beyond exciting to have investors who have supported transportation, tech and marketplace startups across the globe, and to know they see in Zūm what I’ve seen since the beginning—ineffective, inefficient school transportation is a massive issue and we need to build a better future for our children.”

Zūm, however, is not the only startup tackling transportation for kids. HopSkipDrive, a rideshare service that picks up your kids, similarly partners with school districts for school bus alternatives. In 2017, HopSkipDrive raised a $7.4 million round to bring its total funding to $21.5 million. There’s also Kango, a more Uber-like service for kids. However, you may recall Shuddle’s shutdown of its Uber-like service for kids in 2016. Shuddle had raised $12.2 million prior to shutting down. Perhaps partnering with schools and school districts is the way to go in this kid ride-hailing business.

Powered by WPeMatico

The rapid rise of Slack has ushered in a new wave of apps, all aiming to solve one challenge: creating a user-friendly platform where coworkers can have productive conversations. Many of these are based around real-time notifications and “instant” messaging, but today a new startup called Threads coming out of stealth to address the other side of the coin: a platform for asynchronous communication that is less time-sensitive, and creating coherent narratives out of those conversations.

Armed with $10.5 million in funding led by Sequoia, the company is launching a beta of its service today.

Rousseau Kazi, the startup’s CEO who co-founded threads with Jon McCord, Mark Rich and Suman Venkataswamy, cut his social teeth working for six years at Facebook (with a resulting number of patents to his name around the mechanics of social networking), says that the mission of Threads is to become more inclusive when it comes to online conversations.

“After a certain number of people get involved in an online discussion, conversations just break and messaging becomes chaotic,” he said. (McCord and Rich are also Facebook engineering alums, while Venkataswamy is a Bright Roll alum.)

And if you have ever used Twitter, or even been in a popular channel in Slack, you will understand what he is talking about. When too many people begin to talk, the conversation gets very noisy and it can mean losing the “thread” of what is being discussed, and seeing conversation lurch from one topic to another, often losing track of important information in the process.

There is an argument to be made for whether a platform that was built for real-time information is capable of handling a difference kind of cadence. Twitter, as it happens, is trying to figure that out right now. Slack, meanwhile, has itself introduced threaded comments to try to address this too — although the practical application of its own threading feature is not actually very user friendly.

Threads’ answer is to view its purpose as addressing the benefit of “asynchronous” conversation.

To start, those who want to start threads first register as organizations on the platform. Then, those who are working on a project or in a specific team creates a “space” for themselves within that org. You can then start threads within those spaces. And when a problem has been solved or the conversation has come to a conclusion, the last comment gets marked as the conclusion.

The idea is that topics and conversations that can stretch out over hours, days or even longer, around specific topics. Threads doeesn’t want to be the place you go for red alerts or urgent requests, but where you go when you have thoughts about a work-related subject and how to tackle it.

These resulting threads, when completed or when in progress, can in turn be looked at as straight conversations, or as annotated narratives.

For now, it’s up to users themselves to annotate what might be important to highlight for readers, although when I asked him, Kazi told me he would like to incorporate over time more features that might use natural language processing to summarize and pull out what might be worth following up or looking at if you only want to skim read a longer conversation. Ditto the ability to search threads. Right now it’s all based around keywords but you can imagine a time when more sophisticated and nuanced searches to surface conversations relevant to what you might be looking for.

Indeed, in this initial launch, the focus is all about what you want to say on Threads itself — not lots of bells and whistles, and not trying to compete against the likes of Slack, or Workplace (Facebook’s effort in this space), or Yammer or Teams from Microsoft, or any of the others in the messaging mix.

There are no integrations of other programs to bring data into Threads from other places, but there is a Slack integration in the other direction: you can create an alert there so that you know when someone has updated a Thread.

“We don’t view ourselves as a competitor to Slack,” Kazi said. “Slack is great for transactional conversation but for asynchronous chats, we thought there was a need for this in the market. We wanted something to address that.”

It may not be a stated competitor, but Threads actually has something in common with Slack: the latter launched with the purpose of enabling a certain kind of conversation between co-workers in a way that was easier to consume and engage with than email.

You could argue that Threads has the same intention: email chains, especially those with multiple parties, can also be hard to follow and are in any case often very messy to look at: something that the conversations in Threads also attempt to clear up.

But email is not the only kind of conversation medium that Threads thinks it can replace.

“With in-person meetings there is a constant tension between keeping the room small for efficiency and including more people for transparency,” said Sequoia partner Mike Vernal in a statement. “When we first started chatting with the team about what is now Threads, we saw an opportunity to get rid of this false dichotomy by making decision-making both more efficient and more inclusive. We’re thrilled to be partnering with Threads to make work more inclusive.” Others in the round include Eventbrite CEO Julia Hartz, GV’s Jessica Verrilli, Minted CEO Mariam Naficy, and TaskRabbit CEO Stacy Brown-Philpot.

The startup was actually formed in 2017, and for months now it has been running a closed, private version of the service to test it out with a small amount of users. So far, the company sizes have ranged between 5 and 60 employees, Kazi tells me.

“By using Threads as our primary communications platform, we’ve seen incredible progress streamlining our operations,” said one of the testers, Perfect Keto & Equip Foods Founder and CEO, Anthony Gustin. “Internal meetings have reduced by at least 80 percent, we’ve seen an increase in participation in discussion and speed of decision making, and noticed an adherence and reinforcement of company culture that we thought was impossible before. Our employees are feeling more ownership and autonomy, with less work and time that needs to be spent — something we didn’t even know was possible before Threads.”

Kazi said that the intention is ultimately to target companies of any size, although it will be worth watching what features it will have to introduce to help handle the noise, and continue to provide coherent discussions, when and if they do start to tackle that end of the market.

Powered by WPeMatico

Sapling, a three-year-old, San Francisco-based company whose employee management and onboarding software is being adopted by a small but growing number of mid-size companies with far-flung workforces, is announcing today that it has raised $4 million in funding from Gradient Ventures, which is Google’s AI fund, and Tuesday Capital, formerly known as CrunchFund.

It quietly secured the funding several months ago and has been using it to ramp up to the 50 people it currently employs.

The company’s founding team is the kind that investors like to see, meaning that in many ways, their previous work experiences led them to start Sapling .

Co-founder and CEO Bart Macdonald has spent his entire career in HR, working most recently in Melbourne, Australia, as a regional director for the global coding school General Assembly, where he hired and managed a 10-person marketing, sales and operations team.

Meanwhile, co-founder Andy Crebar (born in the same Sydney hospital as Macdonald, a day later) also knows the plight of individuals trying to seamlessly onboard new hires, having worked most recently on business development initiatives at a fintech startup called Credible Labs, where adding headcount was, as at many companies, a point of frustration.

“I liked that Bart and Andy had lived through their own experiences dealing with crappy HR software in previous positions and thus really understood how customers view the problem,” says Tuesday Capital co-founder Pat Gallagher. “The fact that neither are technical would have been an issue if we were investing pre product, but by the time we invested, they had proven they could build software that their customers loved.”

In fact, says Gallagher, his team was drawn to Sapling specifically because a handful of the firm’s portfolio companies has been using its onboarding software and “really raving about it. It’s hard to find HR software that people really like, so that was a big positive for us and helped cut through the noise of the space that they operate in.”

So what’s so special about Sapling? Mostly, it seems, its approach brings together the tools and software that HR execs are already using, including ADP for payroll, or G Suite for productivity, and Lever for recruiting, integrations that also employ a heavy dose of AI to anticipate the behaviors of employees, making it easier for managers to recruit, aid, manage and support current and future staffers.

As Macdonald explains it on the simplest level, Sapling not only provisions software for them but it connects their tools “so they don’t have to open 10 tabs. All they have to do is run their workflow inside of Sapling so that, for example, an employee can ask for time off in Slack,” and that request will automatically be reflected in the employer’s payroll and benefits systems (once approved).

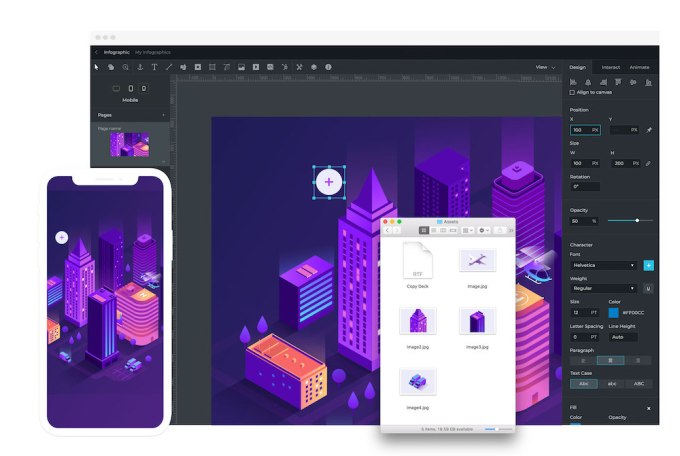

Sapling currently works with companies with anywhere from 100 to 1,500 employees, including InVision, an eight-year-old commercial platform used by design teams to create digital products for mobile and desktop that is currently investing its Series F round. InVision, which has a large distributed workforce, says Sapling has saved the company 1,000 hours by speeding up communications and making employee engagement far more seamless.

What comes next for Sapling remains to be seen. It’s in an awfully crowded category, with no shortage of all-in-one HR solutions attracting venture capital. In the meantime, with low unemployment creating headaches for many outfits looking to keep its talent, Sapling is smartly positioning itself as an important tool in specifically helping companies with geographically distributed teams to retain and engage employees. Customers like InVision, along with Digital Ocean, KPMG and Kayak, say it’s working, too.

Above, left to right: founders Bart Macdonald and Andy Crebar, courtesy of Sapling.

Powered by WPeMatico

A new wave of female-led businesses wants to help women get off.

Dipsea, an app-based platform for short-form erotic audio stories, is the latest to grab funding from venture capital investors. The female-founded, San Francisco-headquartered startup, which officially launched in December, has raised $5.5 million in a round led by Bedrock Capital and Thrive Capital. The funding comes amid a notable explosion in interest and investment in audio content consumption and creation, as well as an uptick in AirPod sales, easily removable wireless earbuds that encourage listeners to enjoy snackable audio like Dipsea’s erotica.

In addition to Dipsea’s seed financing, podcasting platform WaitWhat secured a $4.3 million round this month. Days earlier, Himalaya nabbed $100 million to scale its podcast distribution tool and a pair of podcast startups, Gimlet and Anchor, sold to Spotify in a nine-figure deal.

Meanwhile, as the audio content space booms, more attention is being paid to female entrepreneurs eyeing venture capital. Enter Dipsea, whose founders say the business captures the zeitgeist of female empowerment.

Dipsea’s subscription-based app, available for $8.99 per month or $48 per year, offers short audio stories meant to turn women on. The app’s library, which is poised to expand with the new cash, includes narrative sexy stories and non-narrative guided audio pieces. The stories are designed to be listened to at any time, with the company’s examples including solo in bed, while getting ready for a date or to help turn off boss brain on the way home from work. The subscription business model made me wince at first, but auditory erotica doesn’t exactly lend itself to an advertising business model, after all, and once I listened to a few of Dipsea’s short stories, I understood that the service is something many women would pay for.

Since the onset of internet porn, there’s been a gaping hole in content crafted specifically for women. Most women use “mental framing” to get turned on, meaning they imagine scenarios, often with detailed story-lines and characters to stimulate themselves, per a study by OMGYes and The Kinsey Institute. Dipsea’s sensorial audio storytelling sets the mood and sparks the listener’s imagination.

“Audio is amazing because it’s imaginative; it requires you to paint a picture in your brain that’s very stimulating and it’s super intimate and very personal,” Dipsea co-founder and chief executive officer Gina Gutierrez told TechCrunch.

The brand and design strategist started Dipsea alongside chief technical officer Faye Keegan, a former product manager at Neighborly. Gutierrez said she came up with the idea while meditating with Headspace, a wellness app.

The founders have prioritized diversity of perspective, working with freelance writers of different backgrounds on various episodes, as well as consensuality, ensuring a form of verbal consent is worked into storylines. They recently hired their first staff writer.

“To me the future of entertainment is sensory,” Gutierrez said. “This felt like it could be a medium for women that hadn’t been harnessed or attempted before.”

Powered by WPeMatico

There has been a wave of fintech startups emerging that make different kinds of investing more accessible to a wider pool of people, and today one of them has raised a substantial round of money to help fill out its mission.

YieldStreet — which provides a platform for making alternative investments in areas like real estate, marine/shipping, legal finance, commercial loans and other opportunities that in the past were only open to institutional investors — is today announcing that it has raised $62 million in a Series B round of funding.

Co-founder and CEO Milind Mehere said in an interview that the money will be used to build a fundamental expansion of the platform so that any interested party can invest.

With a view to improving everyone’s financial lot in life, the name of the game is capitalism, and more specifically democratising the opportunity to invest, making it possible for more people beyond the often-cloistered and clubby environment of the investment world.

“In order for consumers to move to financial security and financial independence, they should be given access to the same products institutions have,” said Mehere. “This is about creating the most wealth out of people’s money, irrespective of their net worth.”

The round was led by Edison Partners, with participation from Greenspring Associates, Raine Ventures and a large multi-billion-dollar NY family office. YieldStreet’s valuation is not being disclosed with this round. Prior to this, the company raised around $116 million, with $100 million of that in debt, according to PitchBook.

To date, YieldStreet has seen more than $600 million invested on its platform from more than 100,000 members, with an expected 12 percent IRR and more than $300 million in principal and interest payments made to its investors. Up to now a person had to be an accredited investor to benefit from this. That was already a progression on those investments being restricted only to institutions, but it is still a relatively small pool of users. In the U.S., where YieldStreet operates, being an accredited investor has a specific set of criteria that includes individuals having a net worth of at least $1 million and income of $200,000 or more.

The plan is now to use the funding to expand the funnel by creating new vehicles for investing that will not require people to be accredited to get involved. This will build on groundwork the company has already laid with YieldStreet Wallet, a savings account that provides 2.2 percent interest, which is open to everyone.

The idea will be to offer non-accredited investors investment vehicles, created by YieldStreet, where they will be able to access multiple products, Mehere said. “We are working through the legal and regulatory aspects now.” He added that the company is also looking at ways of tapping into retirement and IRA accounts for these users as well.

The Jobs Act in the U.S., and the wider growth of people shifting all of their financial services online, has created a landscape of startups that are liberalising how capital moves. Many of these are specifically freeing up the arcane and rarified world of investment. They include companies like Robinhood, which has built a platform for trading public stocks. In the area of private investment — that is, investing in businesses and opportunities that are not publicly traded — we have seen PeerStreet, which is offers a service similar to YieldStreet but focusing on real estate. In the U.K., you also have startups like LendInvest, which lets property buyers bypass traditional mortgages by letting others put up the funding for those purchases.

“The ability for individual, accredited and non-accredited, investors to access products that previously were only available to institutional investors is a key part of fintech’s promise to leverage technology to create access and reduce fees on these types of investments. In addition, lower fees can be passed on to investors to allow them to achieve a higher return,” said Chris Sugden, managing partner, Edison Partners, in an email. (Sugden will also be joining the startup’s board with this investment.)

What’s interesting is that the sheer number of fintech startups, even if you only focus in on those centered around investing, will inevitably lead to some M&A down the line, and that is an area that YieldStreet will also be exploring ahead.

Powered by WPeMatico

WaitWhat, the digital content production engine behind LinkedIn co-founder Reid Hoffman’s Masters of Scale podcast, has secured a $4.3 million Series A investment led by Cue Ball Capital and Burda Principal Investments.

Launched in January 2017, WaitWhat will use the cash to create additional media properties across a variety of mediums, including podcasts.

Investors are gravitating toward podcast startups as consumer interest in original audio content skyrockets. Podcasting, though an infantile industry that hit just $314 million in revenue in 2017, is maturing, raking in venture capital rounds large and small and recording its first notable M&A transaction with Spotify’s acquisition of Gimlet and Anchor earlier this month. The music streaming giant shelled out a total of $340 million for the podcast production platform and the provider of a suite of podcast creation, distribution and monetization tools, respectively. It plans to spend an additional $500 million on audio storytelling platforms as part of a larger plan to become the Netflix of audio.

WaitWhat, for its part, dubs itself the “media invention company.” Founded by June Cohen and Deron Triff, a pair of former TED executives responsible for expanding the nonprofit’s digital media business, WaitWhat is today launching Should This Exist, a new podcast hosted by Flickr founder and tech investor Caterina Fake. Fake will interview entrepreneurs about the human side and the impact of technology in the show created in partnership with Quartz.

“People don’t just transact with content; they want to feel connected to it through a sense of wonder, awe, curiosity, and mastery,” Cohen said in a statement. “These are contagious emotions, and research shows they stimulate sharing. Where many media companies aim for volume — putting out lots of content with a short shelf life — we’re building a completely distinctive portfolio of premium properties that are continually increasing in value, inspiring deep audience engagement, and creating opportunities for format expansion.”

Other investors in the round include Reid Hoffman, MIT Media Lab director Joi Ito and Liminal Ventures. WaitWhat previously raised a $1.5 million round from Victress Capital, Human Ventures and Able Partners, all of which have joined the A round.

Powered by WPeMatico

Delivery company DoorDash is announcing that it has raised $400 million in Series F financing.

Earlier this month, The Wall Street Journal reported that the company was looking to raise $500 million at a valuation of $6 billion or more. In fact, DoorDash now says the funding came at a $7.1 billion valuation.

The round was led by Temasek and Dragoneer Investment Group, with participation from previous investors SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia Capital and Y Combinator.

DoorDash has been raising money at an impressive rate, with a $535 million round last March followed by a $250 million round (valuing the company at $4 billion) in August.

Co-founder and CEO Tony Xu told me the round is “a reflection of superior performance over the past year.” Apparently, the company is currently seeing 325 percent growth, year-over-year, and it points to recent data from Second Measure showing that the service has overtaken Uber Eats in U.S. market share for online food delivery — DoorDash now comes in second to Grubhub.

“I think the numbers speak for themselves,” Xu said. “If you just run the math on DoorDash’s course and speed, we’re on track to be number one.”

Tony Xu of DoorDash

He attributed the company’s growth to three factors: its geographic reach (3,300 cities in the United States and Canada), its selection of partners (not just restaurants — Walmart is using DoorDash for grocery deliveries) and DoorDash Drive, which allows businesses to use the DoorDash network to make their own deliveries.

He added that DoorDash has been “growing in a disciplined way, turning markets towards profitability.”

The funding, Xu said, will allow the company to continue investing in Drive, in its DashPass subscription service (where you pay $9.99 per month for free deliveries on orders of $15 or more from select restaurants) and in more hiring. And while DoorDash is currently available in all 50 states, Xu said there’s still plenty of room to cover additional territory in the U.S. and especially Canada.

“To me, this round … really changes the position of the company, not only as we march towards market leadership, but as we go beyond restaurants and become the last mile for commerce,” he said.

Not all of DoorDash’s recent news has been good. Along with Instacart, the company has been under scrutiny for subsidizing its driver payments with customer tips.

When asked about the criticism, Xu said the current compensation system was tested “not in a quarter, not in a month, but tested for months” before being implemented in 2017, and since then, there’s been a “significant increase” in retention among “dashers,” along with improved dasher satisfaction and on-time deliveries.

“When it comes to this pay model that has been in the press, the most important thing, I would say, is looking again at the facts and results,” he said.

Powered by WPeMatico