funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As we wrote last week in How Salesforce paved the way for the SaaS platform approach, the ability to build extensions, applications and even whole companies on top of the Salesforce platform set the stage and the bar for every SaaS company since. Vlocity certainly recognized that. Targeting five verticals, it built industry-specific CRM solutions on the Salesforce platform, and today announced a $60 million Series C round on a fat unicorn $1 billion valuation.

The round was led by Sutter Hill Ventures and Salesforce Ventures. New investors Bessemer Venture Partners and existing strategic investors Accenture and New York Life also participated. The company has now raised $163 million.

Company co-founder and CEO David Schmaier, whose extensive career includes stints with Siebel Systems and Oracle, says he and his co-founders (three of whom helped launch Veeva) wanted to take the idea of Veeva, which is a life sciences-focused company built on top of Salesforce, and extend that idea across five verticals instead of just one. Those five verticals include communications and media, insurance and financial services, health, energy and utilities and government and nonprofits.

The idea he said was to build a company with a market that was 10x the size of life sciences. “What we’re doing now is building five Veevas at once. If you could buy a product already tailored to the needs of your industry, why wouldn’t you do that?,” Schmaier said.

The theory seems to be working. He says that the company, which was founded in 2014, has already reached $100 million in revenue and expects to double that by the end of this year. Then of course, there is the unicorn valuation. While perhaps not as rare as it once was, reaching the $1 billion level is still a significant milestone for a startup.

In the Salesforce platform story, co-founder and CTO Parker Harris addressed the need for solutions like the ones from Veeva and Vlocity. “…Harris said they couldn’t build one Salesforce for healthcare and another for insurance and a third one for finance. We knew that wouldn’t scale, and so the platform [eventually] just evolved out of this really close relationship with our customers and the needs they had.” In other words, Salesforce made the platform flexible enough for companies like these to fill in the blanks.

“Vlocity is a perfect example of the incredible innovation occurring in the Salesforce ecosystem and how we are working together to provide customers in all industries the technologies they need to attract and serve customers in smarter ways,” Jujhar Singh, EVP and GM for Salesforce Industries said in a statement.

It’s also telling that of the three strategic investors in this round — New York Life, Accenture and Salesforce Ventures — Salesforce is the biggest investor, according to Schmaier.

The company has 150 customers, including investor New York Life, Verizon (which owns this publication), Cigna and the City of New York. It already has 700 employees in 20 countries. With this additional investment, you can expect those numbers to increase.

“What this Series C round allows us to do is to really put the gas on investing in product development, because verticals are all about going deep,” Schmaier said.

Powered by WPeMatico

Heathcare kiosks, a home-cooked food marketplace, and a way for startups to earn interest on their funding topped our list of high-potential companies from Y Combinator’s Winter 2019 Demo Day 2. 88 startups launched on stage at the lauded accelerator, though some of the best skipped the stage as they’d already raised tons of money.

Be sure to check out our write-ups of all 85 startups from day 1 plus our top picks, as well as the full set from day 2. But now, after asking investors and conferring with the TechCrunch team, here are our 9 favorites from day 2.

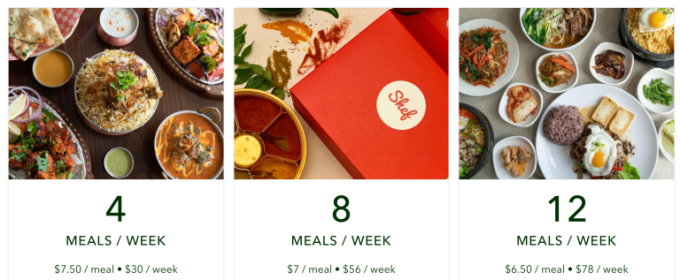

Two months ago, California passed the first law in the country legalizing the sale of home cooked food. Shef creates a marketplace where home chefs can find nearby customers. Shef’s meals cost around $6.50 compared to $20 per meal for traditional food delivery, and the startup takes a 22 percent cut of every transaction. It’s been growing 50 percent week over week thanks to deals with large property management companies that offer the marketplace as a perk to their residents. Shef wants to be the Airbnb of home cooked food.

Why we picked Shef: Deregulation creates gold rush opportunities and Shef was quick to seize this one, getting started just days after the law passed. Food delivery is a massive megatrend but high costs make it unaffordable or a luxury for many. If a parent is already cooking meals for their whole family, it takes minimal effort to produce a few extra portions to sell to the neighbors at accessible rates.

This startup automates the collection process of unpaid construction invoices. Construction companies are often forced to pay for their own jobs when customers are late on payments. According to Handle, there are $104 billion in unpaid construction invoices every year. Handle launched six weeks ago and is currently collecting $22,800 in monthly revenue. The founders previously launched an Andreessen Horowitz-backed company called Tenfold.

Why we picked Handle: Construction might seem like an unsexy vertical, but it’s massive and rife with inefficiencies this startup tackles. Handle helps contractors demand payments, instantly file liens that ensure they’re compensated for work or materials, or exchange unpaid invoices for cash. Even modest fees could add up quickly given how much money moves through the industry. And there are surely secondary business models to explore using all the data Handle collects on the construction market.

This pediatric telemedicine company provides medical care instantly to families. Blueberry provides constant contact, the ability to talk to a pediatrician 24/7 and at-home testing kits for a total of $15 per month. They’ve just completed a paid consumer pilot and say they were able to resolve 84 percent of issues without in-person care. They’ve partnered with insurance providers to reduce ER visits.

Why we picked Blueberry: Questionable emergency room visits are a nightmare for parents, a huge source of unnecessary costs, and a drain on resources for needy patients. Parents already spend so much time and money trying to keep their kids safe that this is a no-brainer subscription. And the urgent and emotional pull of pediatrics is a smart wedge into telemedicine for all demographics.

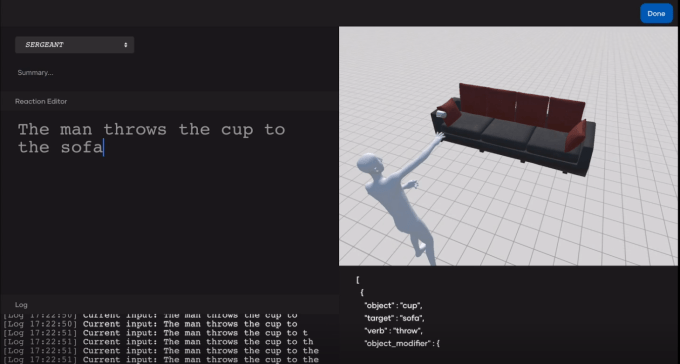

Led by a team of YC alums behind Raven, an AI startup acquired by Baidu in 2017, rct studio is a creative studio for immersive and interactive film. The platform provides a real time “text to render “engine (so the text “A man sits on a sofa” would generate 3D imagery of a man sitting on a sofa) that supports mainstream 3D engines like Unity and Unreal, as well as a creative tool for film professionals to craft immersive and open-ended entertainment experiences called Morpheus Engine.

Why we picked rct studio: Netflix’s Bandersnatch was just the start of mainstream interactive film. With strong technology, an innovative application, and proven talent, rct could become a critical tool for creating this kind of media. And even if the tech falls short of producing polished media, it could be used for storyboards and mockups.

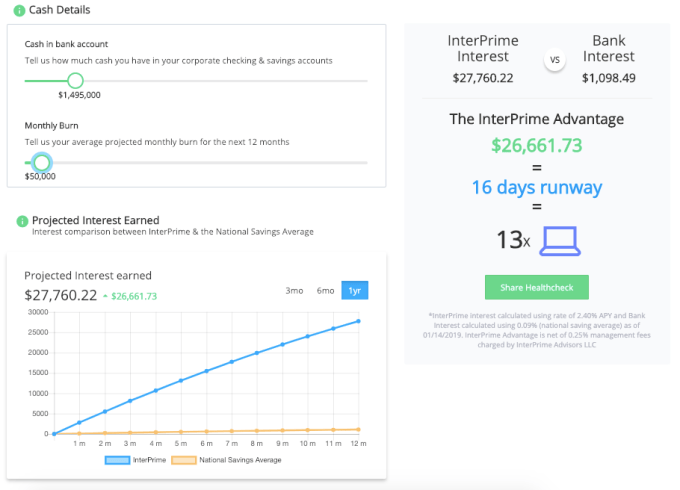

Provides “Apple level” treasury services to startups. Startups are raising a lot of money with no way to manage it, says Interprime. They want to help these businesses by managing these big investments by helping them earn interest on their funding while retaining liquidity. They take a .25 percent advisory fee for all the investment they oversee. So far, they have $10 million in investment capital they are servicing.

Why we picked Interprime: The explosion of early stage startup funding evidenced by Y Combinator itself has created new banking opportunities. Silicon Valley Bank is ripe for competition and Interprime’s focus on startups could unlock new financial services. With Interprime’s YC affiliation, it has access to tons of potential customers.

Nabis

NabisNabis is tackling the cannabis shipping and logistics business, working with suppliers to ship out goods to retailers reliably. It’s illegal for FedEx to ship weed so Nabis has swooped in and is helping ship and connect while taking cuts of the proceeds, a price the suppliers are willing to pay due to their 98 percent on-time shipping record.

Why we picked Nabis: Quirky regulation creates efficiency gaps in the marijuana business where incumbents can’t participate since they’re not allowed to handle the flower. As more states legalize and cannabis finds its way into more products, moving goods from farm to processor to retailer could spawn a big market for Nabis with a legal moat. It’s already working with many top marijuana brands, and could sell them additional services around business intelligence and distribution.

This startup measures weather damage for insurance companies. WeatherCheck has secured $4.7 million in annual bookings in the five months since it launched to help insurance carriers reduce their overall claims expense. To use the service, insurers upload data about their properties. WeatherCheck then monitors the weather and sends notifications to insurance companies, if, for example, a property has been damaged by hail.

Why we picked WeatherCheck: Extreme weather is only getting worse due to climate change. With 10.7 million US properties impacted by hail damage in 2017, WeatherCheck has found a smart initial market from which to expand. It’s easy to imagine the startup working on flood, earthquake, tornado, and wildfire claims too. Insurance is a fierce market, and old-school providers could get a leg up with WeatherCheck’s tech.

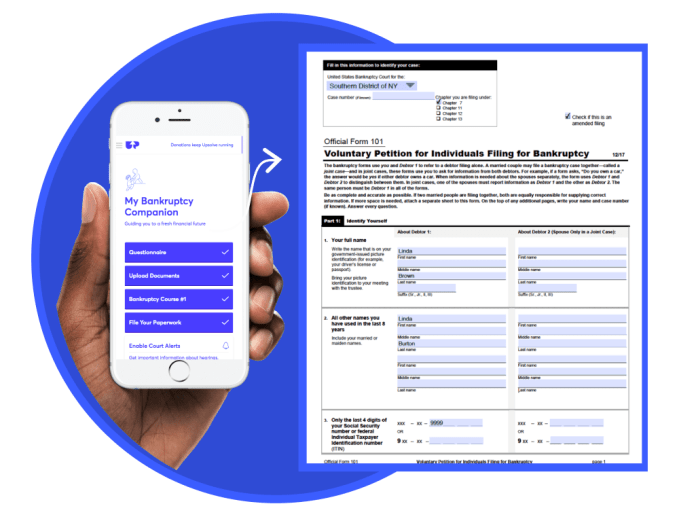

Upsolve wants to help low-income individuals file for bankruptcy more easily. The non-profit service gets referral fees from pointing non low-income families to bankruptcy lawyers and is able to offer the service for free. The company says that medical bills, layoffs and predatory loans can leave low-income families in dire situations and that in the last 6 months, their non-profit has alleviated customers from $24 million in debt.

Why we picked Upsolve: Financial hardship is rampant. With the potential for another recession and automation threatening jobs, many families could be at risk for bankruptcy. But the process is so stigmatized that some people avoid it at all costs. Upsolve could democratize access to this financial strategy while inserting itself into a lucrative transaction type.

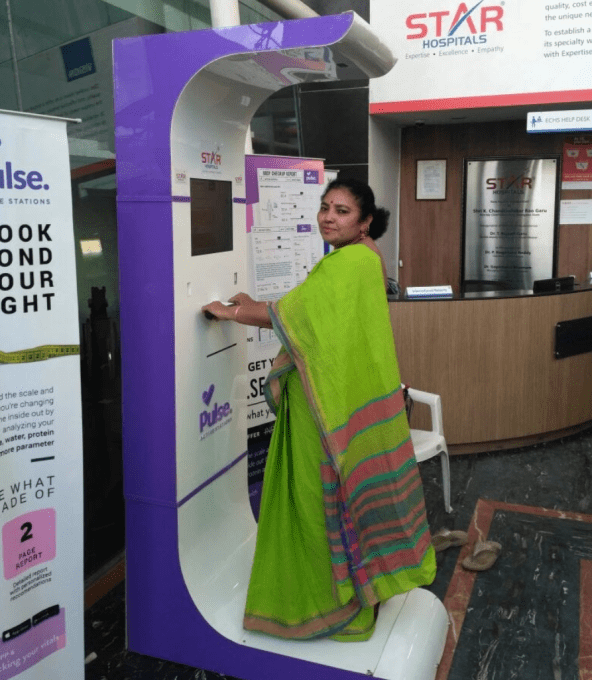

This startup makes health kiosks for India, meant to be installed in train stations. Co-founder Joginder Tanikella says that there are 600,000 preventable deaths in India as many in the region don’t get regular doctor checkups. “But everyone takes trains,” he says. Their in-station kiosk measures 21 health parameters. The company made $28,000 in revenue last month. Charging $1 per test, Tanikella says each machine pays for itself within 3 months. In the future, the kiosks will allow them to sell insurance and refer users to doctors.

Why we picked Pulse: Telemedicine can’t do everything, but plenty of people around the world can’t make it in to a full-fledged doctor’s office. Pulse creates a mid-point where hardware sensors can measure body fat, blood pressure, pulse, and bone strength to improve accuracy for diagnosing diabetes, osteoarthritis, cardiac problems, and more. Pulse’s companion app could spark additional revenue streams, and there’s clearly a much bigger market for this than just India.

-Allo, a marketplace where parents can exchange babysitting and errand-running

-Shiok, a lab-grown shrimp substitute

-WithFriends, a subscription platform for small retail businesses

—

More Y Combinator coverage from TechCrunch:

Additional reporting by Kate Clark, Lucas Matney, and Greg Kumparak

Powered by WPeMatico

Hundreds gathered this week at San Francisco’s Pier 48 to see the more than 200 companies in Y Combinator’s Winter 2019 cohort present their two-minute pitches. The audience of venture capitalists, who collectively manage hundreds of billions of dollars, noted their favorites. The very best investors, however, had already had their pick of the litter.

What many don’t realize about the Demo Day tradition is that pitching isn’t a requirement; in fact, some YC graduates skip out on their stage opportunity altogether. Why? Because they’ve already raised capital or are in the final stages of closing a deal.

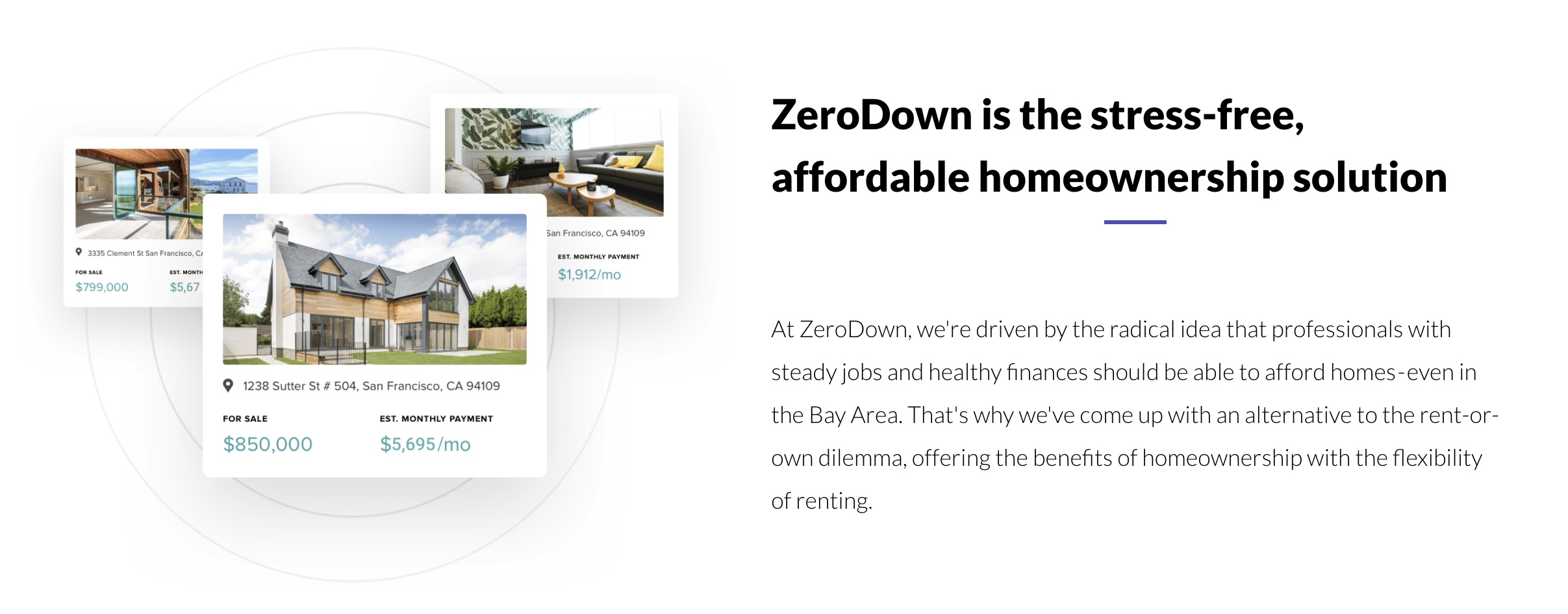

ZeroDown, Overview.AI and Catch are among the startups in YC’s W19 batch that forwent Demo Day this week, having already pocketed venture capital. ZeroDown, a financing solution for real estate purchases in the Bay Area, raised a round upwards of $10 million at a $75 million valuation, sources tell TechCrunch. ZeroDown hasn’t responded to requests for comment, nor has its rumored lead investor: Goodwater Capital.

Without requiring a down payment, ZeroDown purchases homes outright for customers and helps them work toward ownership with monthly payments determined by their income. The business was founded by Zenefits co-founder and former chief technology officer Laks Srini, former Zenefits chief operating officer Abhijeet Dwivedi and Hari Viswanathan, a former Zenefits staff engineer.

The founders’ experience building Zenefits, despite its shortcomings, helped ZeroDown garner significant buzz ahead of Demo Day. Sources tell TechCrunch the startup had actually raised a small seed round ahead of YC from former YC president Sam Altman, who recently stepped down from the role to focus on OpenAI, an AI research organization. Altman is said to have encouraged ZeroDown to complete the respected Silicon Valley accelerator program, which, if nothing else, grants its companies a priceless network with which no other incubator or accelerator can compete.

Overview .AI’s founders’ resumes are impressive, too. Russell Nibbelink and Christopher Van Dyke were previously engineers at Salesforce and Tesla, respectively. An industrial automation startup, Overview is developing a smart camera capable of learning a machine’s routine to detect deviations, crashes or anomalies. TechCrunch hasn’t been able to get in touch with Overview’s team or pinpoint the size of its seed round, though sources confirm it skipped Demo Day because of a deal.

Catch, for its part, closed a $5.1 million seed round co-led by Khosla Ventures, NYCA Partners and Steve Jang prior to Demo Day. Instead of pitching their health insurance platform at the big event, Catch published a blog post announcing its first feature, The Catch Health Explorer.

“This is only the first glimpse of what we’re building this year,” Catch wrote in the blog post. “In a few months, we’ll be bringing end-to-end health insurance enrollment for individual plans into Catch to provide the best health insurance enrollment experience in the country.”

TechCrunch has more details on the healthtech startup’s funding, which included participation from Kleiner Perkins, the Urban Innovation Fund and the Graduate Fund.

Four more startups, Truora, Middesk, Glide and FlockJay had deals in the final stages when they walked onto the Demo Day stage, deciding to make their pitches rather than skip the big finale. Sources tell TechCrunch that renowned venture capital firm Accel invested in both Truora and Middesk, among other YC W19 graduates. Truora offers fast, reliable and affordable background checks for the Latin America market, while Middesk does due diligence for businesses to help them conduct risk and compliance assessments on customers.

Finally, Glide, which allows users to quickly and easily create well-designed mobile apps from Google Sheets pages, landed support from First Round Capital, and FlockJay, the operator an online sales academy that teaches job seekers from underrepresented backgrounds the skills and training they need to pursue a career in tech sales, secured investment from Lightspeed Venture Partners, according to sources familiar with the deal.

Raising ahead of Demo Day isn’t a new phenomenon. Companies, thanks to the invaluable YC network, increase their chances at raising, as well as their valuation, the moment they enroll in the accelerator. They can begin chatting with VCs when they see fit, and they’re encouraged to mingle with YC alumni, a process that can result in pre-Demo Day acquisitions.

This year, Elph, a blockchain infrastructure startup, was bought by Brex, a buzzworthy fintech unicorn that itself graduated from YC only two years ago. The deal closed just one week before Demo Day. Brex’s head of engineering, Cosmin Nicolaescu, tells TechCrunch the Elph five-person team — including co-founders Ritik Malhotra and Tanooj Luthra, who previously founded the Box-acquired startup Steem — were being eyed by several larger companies as Brex negotiated the deal.

“For me, it was important to get them before batch day because that opens the floodgates,” Nicolaescu told TechCrunch. “The reason why I really liked them is they are very entrepreneurial, which aligns with what we want to do. Each of our products is really like its own business.”

Of course, Brex offers a credit card for startups and has no plans to dabble with blockchain or cryptocurrency. The Elph team, rather, will bring their infrastructure security know-how to Brex, helping the $1.1 billion company build its next product, a credit card for large enterprises. Brex declined to disclose the terms of its acquisition.

Y Combinator partners Michael Seibel and Dalton Caldwell, and moderator Josh Constine, speak onstage during TechCrunch Disrupt SF 2018. (Photo by Kimberly White/Getty Images)

Ultimately, it’s up to startups to determine the cost at which they’ll give up equity. YC companies raise capital under the SAFE model, or a simple agreement for future equity, a form of fundraising invented by YC. Basically, an investor makes a cash investment in a YC startup, then receives company stock at a later date, typically upon a Series A or post-seed deal. YC made the switch from investing in startups on a pre-money safe basis to a post-money safe in 2018 to make cap table math easier for founders.

Michael Seibel, the chief executive officer of YC, says the accelerator works with each startup to develop a personalized fundraising plan. The businesses that raise at valuations north of $10 million, he explained, do so because of high demand.

“Each company decides on the amount of money they want to raise, the valuation they want to raise at, and when they want to start fundraising,” Seibel told TechCrunch via email. “YC is only an advisor and does not dictate how our companies operate. The vast majority of companies complete fundraising in the 1 to 2 months after Demo Day. According to our data, there is little correlation between the companies who are most in demand on Demo Day and ones who go on to become extremely successful. Our advice to founders is not to over optimize the fundraising process.”

Though Seibel says the majority raise in the months following Demo Day, it seems the very best investors know to be proactive about reviewing and investing in the batch before the big event.

Khosla Ventures, like other top VC firms, meets with YC companies as early as possible, partner Kristina Simmons tells TechCrunch, even scheduling interviews with companies in the period between when a startup is accepted to YC to before they actually begin the program. Another Khosla partner, Evan Moore, echoed Seibel’s statement, claiming there isn’t a correlation between the future unicorns and those that raise capital ahead of Demo Day. Moore is a co-founder of DoorDash, a YC graduate now worth $7.1 billion. DoorDash closed its first round of capital in the weeks following Demo Day.

“I think a lot of the activity before demo day is driven by investor FOMO,” Moore wrote in an email to TechCrunch. “I’ve had investors ask me how to get into a company without even knowing what the company does! I mostly see this as a side effect of a good thing: YC has helped tip the scale toward founders by creating an environment where investors compete. This dynamic isn’t what many investors are used to, so every batch some complain about valuations and how easy the founders have it, but making it easier for ambitious entrepreneurs to get funding and pursue their vision is a good thing for the economy.”

This year, given the number of recent changes at YC — namely the size of its latest batch — there was added pressure on the accelerator to showcase its best group yet. And while some did tell TechCrunch they were especially impressed with the lineup, others indeed expressed frustration with valuations.

Many YC startups are fundraising at valuations at or higher than $10 million. For context, that’s actually perfectly in line with the median seed-stage valuation in 2018. According to PitchBook, U.S. startups raised seed rounds at a median post-valuation of $10 million last year; so far this year, companies are raising seed rounds at a slightly higher post-valuation of $11 million. With that said, many of the startups in YC’s cohorts are not as mature as the average seed-stage company. Per PitchBook, a company can be several years of age before it secures its seed round.

I did not talk to a single company in this batch raising under $10M post (admittedly I only was able to speak with a fraction of the 205).

— Peter Rojas (@peterrojas) March 20, 2019

Nonetheless, pricey deals can come as a disappointment to the seed investors who find themselves at YC every year but because their reputations aren’t as lofty as say, Accel, aren’t able to book pre-Demo Day meetings with YC’s top of class.

The question is who is Y Combinator serving? And the answer is founders, not investors. YC is under no obligation to serve up deals of a certain valuation nor is it responsible for which investors gain access to its best companies at what time. After all, startups are raking in larger and larger rounds, earlier in their lifespans; shouldn’t YC, a microcosm for the Silicon Valley startup ecosystem, advise their startups to charge the best investors the going rate?

Powered by WPeMatico

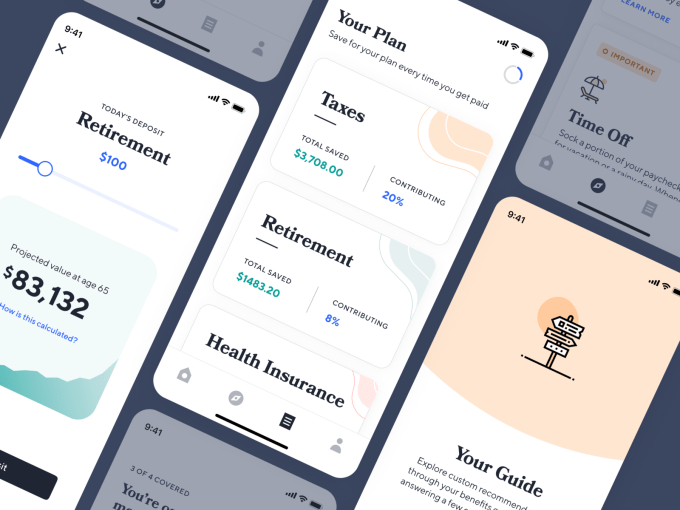

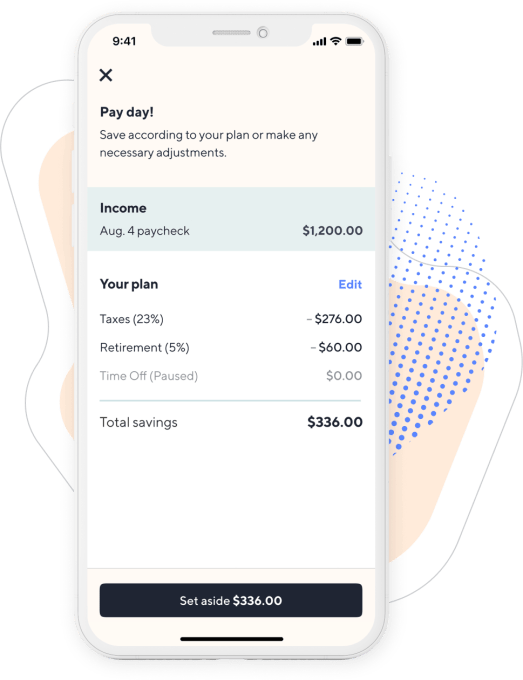

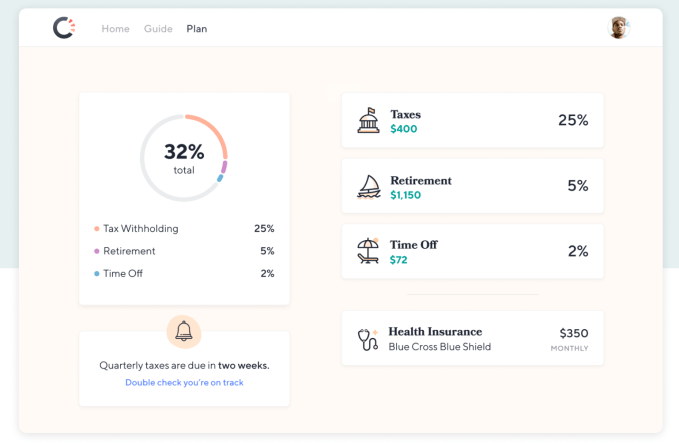

One of the hottest Y Combinator startups just raised a big seed round to clean up the mess created by Uber, Postmates and the gig economy. Catch sells health insurance, retirement savings plans and tax withholding directly to freelancers, contractors, or anyone uncovered. By building and curating simplified benefits services, Catch can offer a safety net for the future of work.

“In order to stay competitive as a society, we need to address inequality and volatility. We think Catch is the first step to offering alternatives to the mandate that benefits can only come from an employer or the government,” writes Catch co-founder and COO Kristen Tyrrell. Her co-founder and CEO Andrew Ambrosino, a former Kleiner Perkins design fellow, stumbled onto the problem as he struggled to juggle all the paperwork and programs companies typically hire an HR manager to handle. “Setting up a benefits plan was a pain. You had to become an expert in the space, and even once you were, executing and getting the stuff you needed was pretty difficult.” Catch does all this annoying but essential work for you.

Now Catch is getting its first press after piloting its product with tens of thousands of users. TechCrunch caught wind of its highly competitive seed round closing, and Catch confirms it has raised $5.1 million at a $20.5 million post-money valuation co-led by Khosla Ventures, Kindred Ventures, and NYCA Partners. This follow-up to its $1 million pre-seed will fuel its expansion into full heath insurance enrollment, life insurance and more. Catch is part of a growing trend that sees the best Y Combinator startup fully funded before Demo Day even arrives.

“Benefits, as a system built and provided by employers, created the mid-century middle class. In the post-war economic boom, companies offering benefits in the form of health insurance and pensions enabled familial stability that led to expansive growth and prosperity,” recalls Tyrrell, who was formerly the director of product at student debt repayment benefits startup FutureFuel.io. “Emboldened by private-sector growth (and apparent self-sufficiency), the 1970s and 80s saw a massive shift in financial risk management from the government to employers. The public safety net contracted in favor of privatized solutions. As technological advances progressed, employers and employees continued to redefine what work looked like. The bureaucratic and inflexible benefits system was unable to keep up. The private safety net crumbled.”

That problem has ballooned in recent years with the advent of the on-demand economy, where millions become Uber drivers, Instacart shoppers, DoorDash deliverers and TaskRabbits. Meanwhile, the destigmatization of remote work and digital nomadism has turned more people into permanent freelancers and contractors, or full-time employees without benefits. “A new class of worker emerged: one with volatile, complex income streams and limited access to second-order financial products like automated savings, individual retirement plans, and independent health insurance. We entered the new millennium with rot under the surface of new opportunity from the proliferation of the internet,” Tyrrell declares. “The last 15 years are borrowed time for the unconventional proletariat. It is time to come to terms and design a safety net that is personal, portable, modern and flexible. That’s why we built Catch.”

Catch co-founders Andrew Ambrosino and Kristen Tyrrell

Currently Catch offers the following services, each with their own way of earning the startup revenue:

These and the rest of Catch’s services are curated through its Guide. You answer a few questions about which benefits you have and need, connect your bank account, choose which programs you want and get push notifications whenever Catch needs your decisions or approvals. It’s designed to minimize busy work so if you have a child, you can add them to all your programs with a click instead of slogging through reconfiguring them all one at a time. That simplicity has ignited explosive growth for Catch, with the balances it holds for tax withholding, time off and retirement balances up 300 percent in each of the last three months.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

If any of this sounds boring, that’s kind of the point. Instead of sorting through this mind-numbing stuff unassisted, Catch holds your hand. Its benefits Guide is available on the web today and it’s beta testing iOS and Android apps that will launch soon. Catch is focused on direct-to-consumer sales because “We’ve seen too many startups waste time on channels/partnerships before they know people truly want their product and get lost along the way,” Tyrrell writes. Eventually it wants to set up integrations directly into where users get paid.

Catch’s biggest competition is people haphazardly managing benefits with Excel spreadsheets and a mishmash of healthcare.gov and solutions for specific programs. Twenty-one percent of Americans have saved $0 for retirement, which you could see as either a challenge to scaling Catch or a massive greenfield opportunity. Track.tax, one of its direct competitors, charges a subscription price that has driven users to Catch. And automated advisors like Betterment and Wealthfront accounts don’t work so well for gig workers with lots of income volatility.

So do the founders think the gig economy, with its suppression of benefits, helps or hinders our species? “We believe the story is complex, but overall, the existing state of the gig economy is hurting society. Without better systems to provide support for freelance/contract workers, we are making people more precarious and less likely to succeed financially.”

When I ask what keeps the founders up at night, Tyrrell admits “The safety net is not built for individuals. It’s built to be distributed through HR departments and employers. We are very worried that the products we offer aren’t on equal footing with group/company products.” For example, there’s a $6,000/year IRA limit for individuals while the corporate equivalent 401k limit is $19,000, and health insurance is much cheaper for groups than individuals.

To surmount those humps, Catch assembled a huge list of angel investors who’ve built a range of financial services, including NerdWallet founder Jake Gibson, Earnest founders Louis Beryl and Ben Hutchinson, ANDCO (acquired by Fiverr) founder Leif Abraham, Totem founder Neal Khosla, Commuter Club founder Petko Plachkov, Playable (acquired by Stripe) founder Tad Milbourn and Synapse founder Bruno Faviero. It also brought on a wide range of venture funds to open doors for it. Those include Urban Innovation Fund, Kleiner Perkins, Y Combinator, Tempo Ventures, Prehype, Loup Ventures, Indicator Ventures, Ground Up Ventures and Graduate Fund.

Hopefully the fact that there are three lead investors and so many more in the round won’t mean that none feel truly accountable to oversee the company. With 80 million Americans lacking employer-sponsored benefits and 27 million without health insurance and median job tenure down to 2.8 years for people ages 25 to 34 leading to more gaps between jobs, our workforce is vulnerable. Catch can’t operate like a traditional software startup with leniency for screw-ups. If it can move cautiously and fix things, it could earn labor’s trust and become a fundamental piece of the welfare stack.

Powered by WPeMatico

Thirstie announced today that it has raised $7 million in Series A funding, and that it’s partnering with Drinkworks to power the e-commerce experience for the cocktail-making machine created by Keurig and Anheuser-Busch.

Co-founder and CEO Devaraj Southworth suggested that this is emblematic of the company’s current direction — rather than building a consumer app for alcohol delivery (which is what Thirstie focused on initially), the company now works with alcohol brands like Dom Perignon, Clos19 and Maker’s Mark to create e-commerce and delivery experiences.

Southworth said this is appealing to brands because “there’s a whole new generation of digital-first, mobile-first consumers and there’s an opportunity to increase revenue.” More important, he said, is “the data opportunity — the data belongs to our brand partners, the data doesn’t belong to a marketplace.”

And while Thirstie is now focused on building an enterprise business, it’s still taking advantage of the network of alcohol retailers that the company created for its consumer app.

Southworth explained said that while Thirstie allows you to order a bottle directly from the Dom Perignon website, it’s actually routing orders “through the network,” so they’re fulfilled by licensed retailers. This means alcohol brands can build a direct relationship with consumers while remaining compliant with the three-tier alcohol distribution system.

And from the Thirstie perspective, this also means building a substantial business without having to invest millions of dollars into marketing a consumer app.

Currently, Thirstie said it supports on-demand delivery in more than 30 cities, and can also ship to any location where shipping alcohol is legal.

Looking ahead, Southworth plans to continue developing Thirstie’s data technology — not just creating dashboards where brands can view their own customer data, but also doing more to aggregate that data to give brands an anonymized, industry-wide view.

“Down the road, there are some very interesting products we can build that can — if the brands are interested — be shared,” he said. “It will be more of a shared marketplace, so all of the brands are going to benefit.”

Thirstie has now raised a total of $12 million, with the new funding coming from Queens Court Capital.

“While some companies have taken capital from industry players to rapidly accelerate the growth of their business, Thirstie realized this could create bias if done too early,” said former Citibank CEO Joe Plumeri (who invested through Queens Court) in a statement. “We admire that Thirstie decided it was more important to scale at a pace that is manageable and allows them to remain independent, and we’re excited to help them achieve their goals.”

Powered by WPeMatico

We’ve decided to step back from the breaking news for a minute to conduct a review of seed and early-stage funding trends over the last decade for U.S.-based companies.

I’m fairly certain we can all agree that the environment for startups has changed dramatically in the past 10 years, specifically in two major ways:

What we’ve also seen are recent concerns raised about the decline in seed stage funding by Mark Suster, a partner at UpFront Ventures, as there has not been commensurate growth in early stage funding (Series A and B), to meet this growth in seed-financed companies. This is often expressed as the Series A crunch.

So with venture funding at an all-time high, along with increased growth in supergiant rounds, now seems like an appropriate time to conduct this kind of review.

First, let’s set the stage for our analysis and explain where our data comes from with a few quick facts:

Now, let’s take a look at the trends.

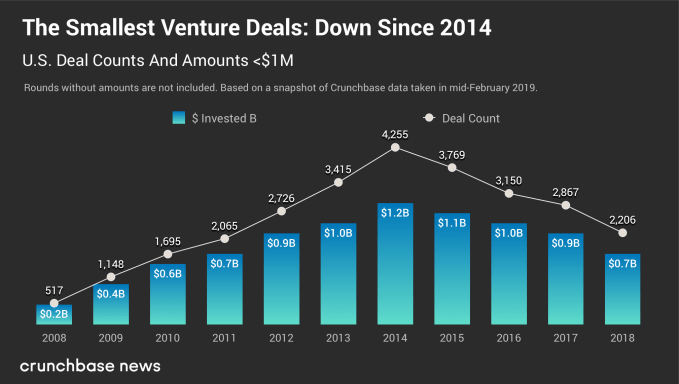

Since 2014 we have seen mostly double-digit declines in less than $1 million rounds each year – a strong pivot from 2008-2014 when we saw double-digit growth.

In 2018 seed funding counts and amounts below $1 million were down from 2015 at 41 and 35 percent respectively. Given that data at this stage can be added long after the round took place, we assess there could be a 20 percentage-point relative increase in 2018 compared to 2017.

If we factor this in, 2018 seed funding counts and amounts below $1 million are down from 2015 at 30 and 23 percent respectively. In other words, seed below $1 million are closer to 2012 and 2017 levels.

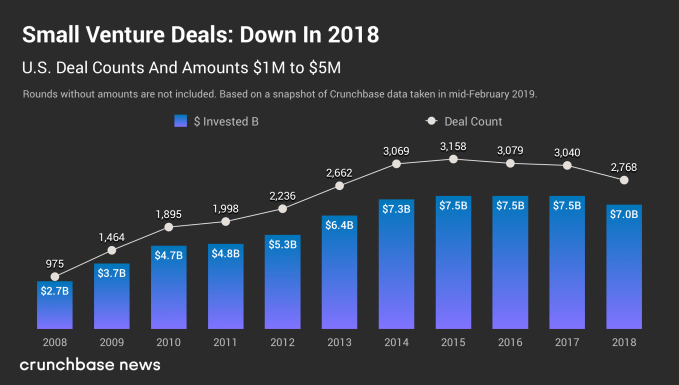

Round from $1 million to $5 million also experienced growth from 2008 through 2015, more than threefold for counts and close to threefold for amounts. Upward growth stalled from 2015. However, we do not see a substantial downward trend in the last three years. Dollars invested are stable at $7.5 billion from 2015 through 2017. Counts and amounts are down in 2018 from the 2015 height by 12 percent for deal count and 6 percent for amounts.

At Crunchbase we are always cautious about reporting downward trends for the most recent year or quarter, as data does flow in after the close of the most recent time period. If the trend is over a greater time period, that is a stronger signal for change in the market. Based on data continuing to be added after the end of a year for the previous year, we assess around 10 percentage point increase relative to 2017. This would make 2018 roughly equivalent to 2017 on rounds and slightly up on amounts.

Why is seed flattening? Seed investors report putting more dollars into fewer deals. Or as they raise more substantial subsequent funds, they are putting more dollars into the same number of transactions. Seed funds need to get enough equity for a meaningful stake, should a startup survive to raise subsequent rounds. Seed funds are investing in fewer startups for more equity.

UpFront Ventures’ Suster (referenced earlier) also talks about larger venture firms becoming less active in seed, as investing at the seed stage can limit their ability down the road to invest in competitive startups who emerge as growing contenders in a specific sector. The growth of more substantial funds in venture allows firms to see deals mature before investing, perhaps paying more to get the equity they want, and allowing startups not growing as quickly to fail or get acquired.

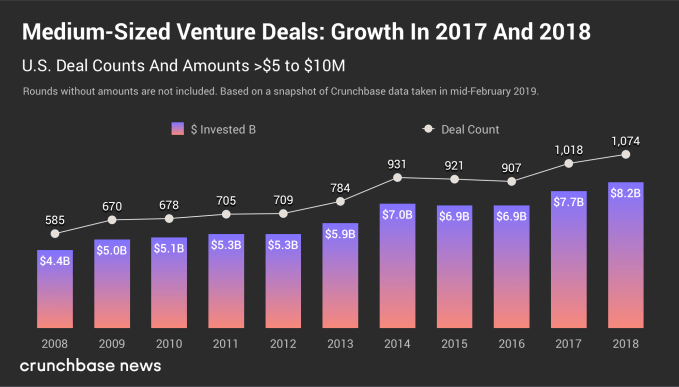

As Fred Wilson from Union Square Ventures notes, “In the first five years of this decade, we saw the seed portion of the market explode. In the last five years of this decade we saw the growth portion of the market explode. But over those last ten years, the middle part, the traditional venture capital market, has not changed much.”

For the middle, Series A and B rounds (which used to be the first institutional money in), the market for $5 million to $10 million rounds has almost doubled, but it has taken from 2008 to 2018. In that same period, growth has been slower than round below $5 million. Growth has continued past 2015. Since 2015, rounds are down slightly for one year, and then continue to grow in 2017 and 2018. Counts are up from 2015 by 17 percent and dollars by 18 percent.

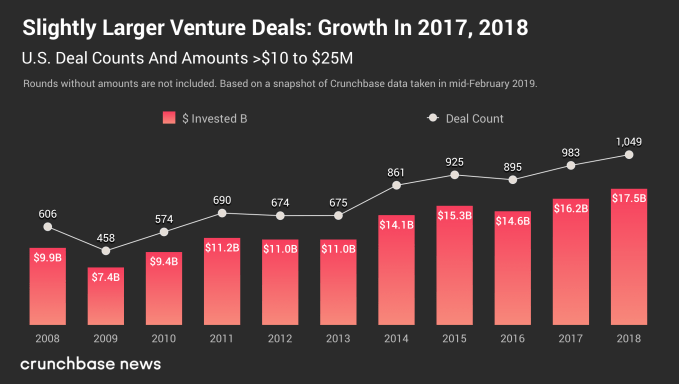

Rounds of $10 million to $25 million have grown over 11 years by 73 percentage points for counts, and 78 percentage points for amounts. This is a slower pace than $5 million to $10 million rounds, but continuing to edge up year over year.

Seed is its own class that is here to stay. Indeed pre-seed, seed and seed extension all seem to have specific dynamics. Of the 600-plus active seed funds who have raised a fund below $100 million, close to half have raised more than one fund. In the last three years in the U.S. we have not seen a slowing of seed funds raised for $100 million and below.

When we take into account the data lag, dollars for below $5 million is projected to be $8.5 billion, close to the height in 2015 of $8.6 billion. Deal counts are down from the height by a fifth, which does mean less seed-funded startups in the U.S. Provided that capital allocation is greater than $5 million continues to grow, less seed funded startups will die before raising a Series A. More companies have a chance to succeed, which is good for seed funds, and ultimately for the whole ecosystem.

Powered by WPeMatico

I spent the week at SXSW, Austin’s really, really huge technology, music, comedy and film festival. It’s my first year making the trek down here for the event, which I did to interview sextech entrepreneur Lora DiCarlo founder Lora Haddock, whose robotics innovation reward was infamously revoked at this year’s CES.

“I brush my teeth and I masturbate. It’s all normal,” she said, addressing the stigma surrounding female-focused pleasure tech. Haddock, during our chat, also announced the first-ever government grant for a sextech startup, a $99,637 funding for Lora DiCarlo from the state of Oregon. Lora DiCarlo plans to release its first product, the Osé, this fall.

Here’s what happened while I was wondering confused around Austin.

Uber dominated the news cycle this week; here’s the TL;DR. The ride-hailing company is probably, most likely going to unveil its S-1 next month and it’s tying up some loose ends ahead of its big IPO. Uber wants to raise roughly $1 billion at a valuation of between $5 billion and $10 billion for its autonomous vehicles unit — yes, the same one that was burning through $20 million per month. Waymo, similarly, is looking to raise outside capital for the first time for its AV efforts.

Top TPG dealmaker caught in college admissions scandal

Bill McGlashan, who built his career as a top investor at the private equity firm TPG, was fired (or maybe quit?) says the firm after he was caught up in what the Justice Department said is the largest college admissions scandal it has ever prosecuted. Even worse, McGlashan lead TPG’s social impact strategy under the Rise Fund brand, making the charges particularly damning.

HotelTonight and Slack stakeholder Accel raised $2.525 billion, sources confirm to TechCrunch; $525 million for its fourteenth early-stage fund, $1.5 billion for its fifth growth fund and $500 million for its second Leaders Fund, or a dedicated pool of capital meant to help the firm strengthen its positions on particularly competitive bets. Plus, 137 Ventures announced its fourth fund with $210 million in committed capital. The firm provides liquidity to founders and early employees of “sustainable, fast-growing, private companies.” In essence, 137 Ventures buys shares directly from employees at unicorn tech companies, like Palantir, Flexport and Airbnb.

Last week, we reported Y Combinator president Sam Altman would be stepping down to focus on OpenAI. TechCrunch’s Connie Loizos questions whether he had a positive or negative influence on the accelerator during his presidency. Altman was part of the first YC startup class in 2005 and began working part-time as a YC partner in 2011. He was ultimately made the head of the organization five years ago.

Brian O’Malley’s HotelTonight win

Forerunner Ventures general partner Brian O’Malley went long on HotelTonight and it paid off. For your weekend reading, we thought you might enjoy an oral history from O’Malley about how he stumbled upon HotelTonight and remained connected to the company across its nine-year history.

In an announcement that shocked VC Twitter, Tiger Global announced that Lee Fixel, whom Bill Gurley once said is one of the smartest investors on the scene, is leaving the firm at the end of June. Scott Shleifer and Chase Coleman will continue as co-managers of the portfolios Fixel has overseen, with Shleifer taking over as its head. “Lee has been a driving force behind the expansion of Tiger Global’s private equity investing activities in the United States and India, and he has distinguished himself as a world-class investor across multiple sectors and stages,” the firm stated. And on the hiring front, Canvas Ventures is expanding its team of three general partners to four with the hiring of Mike Ghaffary, a former general partner at Social Capital.

Subscribers to TechCrunch’s premium content can learn which types of startups are most often profitable.

YC demo days are coming up quick. The TechCrunch staff has been meeting with YC startups and documenting their journey through the startup accelerator. I spoke to YourChoice Therapeutics, a startup developing unisex, non-hormonal birth control, and Bottomless, which operates a direct-to-consumer coffee delivery service. TechCrunch’s Lucas Matney wrote about Jetpack Aviation, a YC startup, and its $380,000 flying motorcycle, and Adventurous, an augmented reality scavenger hunt crafted for families. TechCrunch’s Megan Rose Dickey spoke to Ysplit, which wants to make it so you never have to owe anyone money ever again.

This week on Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines, Crunchbase News’ editor-in-chief Alex Wilhelm and TechCrunch’s Connie Loizos discuss Uber’s IPO and Stash’s big round. Listen here.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Cookie-cutter corporate housing turns people into worker drones. When an employee needs to move to a new city for a few months, they’re either stuck in bland, giant apartment complexes or Airbnbs meant for shorter stays. But Zeus lets any homeowner get paid to host white-collar transient labor. Through its managed ownership model, Zeus takes on all the furnishing, upkeep, and risk of filling the home while its landlords sit back earning cash.

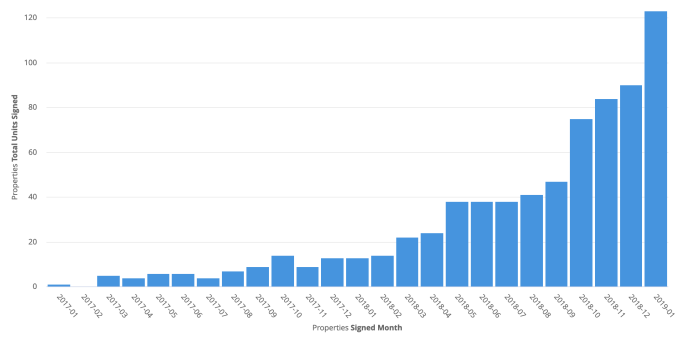

Zeus has quietly risen to a $45 million revenue run rate from renting out 900 homes in 23 cities. That’s up 5X in a year thanks to Zeus’ 150 employees. With a 90 percent occupancy rate, it’s proven employers and their talent want more unique, trustworthy, well-equipped multi-month residences that actually make them feel at home.

Now while Airbnb is distracted with its upcoming IPO, Zeus has raised $24 million to steal the corporate housing market. That includes a previous $2.5 million seed round from Bowery, the new $11.5 million Series A led by Initialized Capital whose partner Garry Tan has joined Zeus’ board, and $10 million in debt to pay fixed costs like furniture. The plan is to roll up more homes, build better landlord portal software, and hammer out partnerships or in-house divisions for cleaning and furnishing.

“In the first decade out of school people used to have two jobs. Now it’s four jobs and it’s trending to five” says Zeus co-founder and CEO Kulveer Taggar. “We think in 10 years, these people won’t be buying furniture.” He imagines they’ll pay a premium for hand-holding in housing, which judging by the explosion in popularity of zero-friction on-demand services, seems like an accurate assessment of our lazy future. Meanwhile, Zeus aims to be “the quantum leap improvement in the experience of trying to rent out your home” where you just punch in your address plus some details and you’re cashing checks 10 days later.

“When I sold my first startup, I bought a home for my mom in Vancouver” Taggar recalls. It was payback for when she let him remortgage her old house while he was in college to buy a condo in Mumbai he’d rent out to earn money. “Despite not having much growing up, my mom was a travel agent and we got to travel a lot” which Taggar says inspired his goal to live nomadically in homes around the world. Zeus could let other live that dream.

Zeus co-founder and CEO Kulveer Taggar

After Oxford and working as an analyst at Deutsche Bank, Taggar built student marketplace Boso before moving to the United States. There, he co-founded auction tool Auctomatic with his cousin Harjeet Taggar and future Stripe co-founder Patrick Collison, went through Y Combinator, and sold it to Live Current Media for $5 million just 10 months later. That gave him the runway to gift a home to his mom and start tinkering on new ideas.

With Y Combinator’s backing again, Taggar started NFC-triggered task launcher Tagstand, which pivoted into app settings configurer Agent, which pivoted into automatic location sharing app Status. But when his co-founder Joe Wong had to move an hour south from San Francisco to Palo Alto, Taggar was dumbfounded by how distracting the process was. Listing and securing a new tenant was difficult, as was finding a medium-term rental without having to deal with exhorbitant prices or sketchy Cragislist. Having seen his former co-founder go on to great success with Stripe’s dead-simple payments integration, Taggar wanted to combine that vision with OpenDoor’s easy home sales to making renting or renting out a place instantaneous. That spawned Zeus.

To become a Zeus landlord, you just type in your address, how many bedrooms and bathrooms, and some aesthetic specs, and you get a monthly price quote for what you’ll be paid. Zeus comes in and does a 250-point quality assessment, collects floor plans, furnishes the property, and handles cleaning and maintenance. It works with partners like Helix mattresses, Parachute sheets, and Simple Human trash cans to get bulk rates. “We raised debt because we had these fixed investments into furniture. It’s not as dilutive as selling pure equity” Taggar explains.

Zeus quickly finds a tenant thanks to listings in Airbnb and relationships with employers like Darktrace and ZS Associates with lots of employees moving around. After passing background checks, tenants get digital lock codes and access to 24/7 support in case something doesn’t look right. The goal is to get someone sleeping there in just 10 days. “Traditional corporate housing is $10,000 a month in SF in the summer or at extended stay hotels. Airbnb isn’t well suited [for multi-month stays]. ” Taggar claims. “We’re about half the price of traditional corporate housing for a better product and a better experience.”

Zeus signs minimum two-year leases with landlords and tries to extend them to five years when possible. It gets one free month of rent as is standard for property managers, but doesn’t charge an additional rate. For example, Zeus might lease your home for $4,000 per month but gets the first month free, and rent it out for $5,000 so it earns $60,000 but pays you $44,000. That’s a tidy margin if Zeus can get homes filled fast and hold down its upkeep costs.

“Zeus has been instrumental for my company to start the process of re-location to the Bay Area and to host our visiting employees from abroad now that we are settled” writes Zeus client Meitre’s Luis Caviglia. “I particularly like the ‘hard truths’ featured in every property, and the support we have received when issues arose during our stays.”

There’s no shortage of competitors chasing this $18 billion market in the US alone. There are the old-school corporations and chains like Oakwood and Barbary Coast that typically rent out apartments from vast, generic complexes at steep rates. Stays over 30 days made up 15 percent of Airbnb’s business last year, but the platform wasn’t designed for peace-of-mind around long-term stays. There are pure marketplaces like UrbanDoor that don’t always take care of everything for the landlord or provide consistent tenant experiences. And then there are direct competitors like $130 million-funded Sonder, $66 million-funded Domio, recently GV-backed 2nd Address, and European entants like MagicStay, AtHomeHotel, and Homelike.

Zeus’ property unit growth

There’s plenty of pie, though. With 330,000 housing units in SF alone, Zeus has plenty of room to grow. The rise of remote work means companies whose employee typically didn’t relocate may now need to bring in distant workers for a multi-month sprint. A recession could make companies more expense-cautious, leading them to rethink putting up staffers in hotels for months on end. Regulatory red tape and taxes could scare landlords away from short-term rentals and towards coprorate housing. And the need to expand into new businesses could tempt the big vacation rental platforms like Airbnb to make acquisitions in the space — or try to crush Zeus.

Winners will be determined in part by who has the widest and cheapest selection of properties, but also by which makes people most comfortable in a new city. That’s why Taggar is taking a cue from WeWork by trying to arrange more community events for its tenants. Often in need of friends, Zeus could become a favorite by helping people feel part of a neighborhood rather than a faceless inmate in a massive apartment block or hotel. That gives Zeus network effect if it can develop density in top markets.

Taggar says the biggest challenge is that “I feels like I’m running five startups at once. Pricing, supply chain, customer service, B2B. We’ve decided to make everything custom — our own property manager software, our own internal CRM. We think these advantages compound, but I could be wrong and they could be wasted effort.”

The benefits of Zeus‘ success would go beyond the founder’s bank account. “I’ve had friends in New York get great opportuntiies in San Francisco but not take them because of the friction of moving” Taggar says. Routing talent where it belongs could get more things built. And easy housing might make people more apt to live abroad temporarily. Taggar concludes, “I think it’s a great way to build empathy.”

Powered by WPeMatico

ProdPerfect, a Boston-based startup focused on automating QA testing for web apps, has announced the close of a $2.6 million Seed round co-led by Eniac Ventures and Fika Ventures, with participation from Entrepreneurs Roundtable Accelerator.

ProdPerfect started when co-founder and CEO Dan Widing was VP of engineering at WeSpire, where he saw firsthand the pain points associated with web application QA testing. Whereas there were all kinds of product analytics tools for product engineers, the same data wasn’t there for the engineers building QA tests that are meant to replicate user behavior.

He imagined a platform that would use live data around real user behavior to formulate these QA tests. That’s how ProdPerfect was born. The platform sees user behavior, builds and delivers test scripts to the engineering team.

The service continues to build on what it knows about a product, and can then simulate new tests when new features are added based on aggregated flows of common user behavior. This data doesn’t track any information about the user, but rather anonymizes them and watches how they move through the web app. The hope is that ProdPerfect gives engineers the opportunity to keep building the product instead of spreading their resources across building a QA testing suite.

The new funding will go toward expanding the sales team and further building out the product. For now, ProdPerfect simply offers functional testing, which uses a single virtual user to test whether a product breaks or not. But president and co-founder Erik Fogg sees an opportunity to build more integrated testing, including performance, security and localization testing.

Fogg says the company is growing 40 percent month over month in booked revenue.

The company says it can deploy within two weeks of installing a data tracker, and provide more than 70 percent coverage of all user interactions with 95 percent+ test stability.

“The greatest challenge is going to be finding people who share our company’s core values and are of high enough talent, ambition and autonomy in part because our hiring road map is so steep,” said Fogg. “Growing pains catch up with businesses as a team expands quickly and we have to make sure that we’re picky and that we reinforce the values we have.”

Powered by WPeMatico

Deep learning involves a highly iterative process where data scientists build models and test them on GPU-powered systems until they get something they can work with. It can be expensive and time-consuming, often taking weeks to fashion the right model. New startup Determined AI wants to change that by making the process faster, cheaper and more efficient. It emerged from stealth today with $11 million in Series A funding.

The round was led by GV (formerly Google Ventures) with help from Amplify Partners, Haystack and SV Angel. The company also announced an earlier $2.6 million seed round from 2017, for a total $13.6 million raised to date.

Evan Sparks, co-founder and CEO at Determined AI, says that up until now, only the largest companies like Facebook, Google, Apple and Microsoft could set up the infrastructure and systems to produce sophisticated AI like self-driving cars and voice recognition technologies. “Our view is that a big reason why [these big companies] can do that is that they all have internal software infrastructure that enables their teams of machine learning engineers and data scientists to be effective and produce applications quickly,” Sparks told TechCrunch.

Determined’s idea is to create software to handle everything from managing cluster compute resources to automating workflows, thereby putting some of that big-company technology within reach of any organization. “What we exist to do is to build that software for everyone else,” he said. The target market is Fortune 500 and Global 2000 companies.

The company’s solution is based on research conducted over the last several years at AmpLab at the University of California, Berkeley (which is probably best known for developing Apache Spark). It used the knowledge generated in the lab to build sophisticated solutions that help make better use of a customer’s GPU resources.

“We are offering kind of a base layer that is scheduling and resource sharing for these highly expensive resources, and then on top of that we’ve layered some services around workflow automation.” Sparks said the team has generated state of the art results that are somewhere between five and 50 times faster than the results from tools that are available to most companies today.

For now, the startup is trying to help customers move away from generic kinds of solutions currently available to more customized approaches, using Determined AI tools to help speed up the AI production process. The money from today’s round should help fuel growth, add engineers and continue building the solution.

Powered by WPeMatico