funding

Auto Added by WPeMatico

Auto Added by WPeMatico

In just a few years, Niantic has evolved from internal side project into an independent industry trailblazer. Having reached tremendous scale in such a short period of time, Niantic acts as a poignant crash course for founders and company builders. As our EC-1 deep-dive into the company shows, lessons from the team’s experience building the Niantic’s product offering remain just as fresh as painful flashbacks to the problems encountered along the way.

As we did for our Patreon EC-1, we’ve poured through every analysis we could find on Niantic and have compiled a supplemental list of resources and readings that are particularly useful for getting up to speed on the company.

Reading time for this article is about 9.5 minutes. It is part of the Extra Crunch EC-1 on Niantic. Feature illustration by Bryce Durbin / TechCrunch.

Google-Incubated Niantic, Maker of Ingress, Stepping Out on Its Own | August 2015 | In August of 2015, Niantic announced that it would spin out from Google and become an independent company. As discussed in WSJ’s coverage of the news, Niantic looked at the spin out as a way to accelerate growth and collaborate with the broader entertainment ecosystem.

Powered by WPeMatico

Artificial intelligence applied to information security can engender images of a benevolent Skynet, sagely analyzing more data than imaginable and making decisions at lightspeed, saving organizations from devastating attacks. In such a world, humans are barely needed to run security programs, their jobs largely automated out of existence, relegating them to a role as the button-pusher on particularly critical changes proposed by the otherwise omnipotent AI.

Such a vision is still in the realm of science fiction. AI in information security is more like an eager, callow puppy attempting to learn new tricks – minus the disappointment written on their faces when they consistently fail. No one’s job is in danger of being replaced by security AI; if anything, a larger staff is required to ensure security AI stays firmly leashed.

Arguably, AI’s highest use case currently is to add futuristic sheen to traditional security tools, rebranding timeworn approaches as trailblazing sorcery that will revolutionize enterprise cybersecurity as we know it. The current hype cycle for AI appears to be the roaring, ferocious crest at the end of a decade that began with bubbly excitement around the promise of “big data” in information security.

But what lies beneath the marketing gloss and quixotic lust for an AI revolution in security? How did AL ascend to supplant the lustrous zest around machine learning (“ML”) that dominated headlines in recent years? Where is there true potential to enrich information security strategy for the better – and where is it simply an entrancing distraction from more useful goals? And, naturally, how will attackers plot to circumvent security AI to continue their nefarious schemes?

The year AI debuted as the “It Girl” in information security was 2017. The year prior, MIT completed their study showing “human-in-the-loop” AI out-performed AI and humans individually in attack detection. Likewise, DARPA conducted the Cyber Grand Challenge, a battle testing AI systems’ offensive and defensive capabilities. Until this point, security AI was imprisoned in the contrived halls of academia and government. Yet, the history of two vendors exhibits how enthusiasm surrounding security AI was driven more by growth marketing than user needs.

Powered by WPeMatico

OverActive Media, the company that owns the Splyce esports org and the Overwatch League’s Toronto Defiant team, have announced that The Weeknd (real name: Abel Tesfaye) has invested in the company.

In the world of esports, OAM is a big organization — the Toronto-based company, which launched in 2017, has teams in the League of Legends European Championship, Overwatch League, Call of Duty World League, Rocket League, Starcraft and Smite. OAM is one of only five esports orgs in the world with permanent slots both in League of Legends and the Overwatch League.

If you have no idea what I’m talking about, here’s a look at one of the Toronto Defiant’s recent Overwatch League games.

The terms of the investment were not disclosed, but it would appear that The Weeknd will be contributing to some marketing efforts and building brand awareness around Splyce and the Toronto Defiant.

“Abel’s standing in the music industry will provide our Toronto Defiant and Splyce brands the opportunity to reach more fans and engage new audiences,” said OAM CEO and president Chris Overholt.

The release also mentions that Toronto Defiant fans will see “unique joint efforts” with The Weeknd throughout the 2019 Overwatch League seasons.

Here’s what The Weeknd had to say, via the release:

As a big esports fan, I am really excited to be involved in this project. I am looking forward to collaborating with OverActive Media in unique and innovative ways.

The Weeknd is not the first musical artist to invest in an esports org. Drake and Scooter Braun invested in esports company 100 Thieves in October of 2018.

Powered by WPeMatico

CleverTap, an India-based startup that lets companies track and improve engagement with users across the web, has pulled in $26 million in new funding thanks to a round led by Sequoia India.

Existing investor Accel and new backer Tiger Global also took part in the deal, which values CleverTap at $150-$160 million, the startup disclosed. The deal takes CleverTap to around $40 million from investors to date.

Founded in 2015 and based in Mumbai, CleverTap competes with a range of customer experience services, including Oracle Cloud. Its service covers a range of touchpoints with consumers, including email, in-app activity, push notifications, Facebook, WhatsApp (for business) and Viber. Its service helps companies map out how their users are engaging across those vectors, and develop “re-engagement” programs to help reactive dormant users or increase engagement among others.

The company says its SDK is installed in more than 8,000 apps and its customers include Southeast Asia-based startups Go-Jek and Zilingo, Hotstar in India and U.S.-based Fandango . With a considerable customer base in Asia, CleverTap puts a particular focus on mobile because many of these markets are all about personal devices.

“Asia is mobile-first and massively growing,” CleverTap CEO and co-founder Sunil Thomas told TechCrunch in an interview. “A lot of engagement in this [part of the] world is timely… we were sort of born physically on the east side of the world, so we got to scale with all these diverse set of devices.”

That stands to benefit CleverTap as it seeks to grow market share outside of Asia, and in markets like the U.S. and Europe where mobile is — right now — just one part of the marketing and customer engagement process. The company believes that engagement by mobile has a long way to develop there.

“Engagement [in the West] is still email-heavy and not really timely,” Thomas said. “Whereas the East thinks of it as ‘Hey, let’s be proactive… instead of a user coming in to hunt for information, can I provide it when I think he or she will need it?’ ”

Of course, mobile push and in-app notifications can be easily abused.

Most people will know of an app on their phone that falls into that category. So, how does a company know what is too much or what isn’t enough?

“As long as you use push or in-app as an extension of your brand, then I think it’s extremely useful,” explained Thomas. “After all, this is a really competitive world; it isn’t just your app out there — if you can make your brand count when this person isn’t in your app, that’ll help you.”

More broadly, Thomas argued that CleverTap brings data to the table which, ultimately, “changes the whole context in real time.” So a customer can really look holistically at their online presence and figure out what is working, and with which users. In real terms, when used to acquire new users online, he said he believes that CleverTap typically doubles registration conversions and triples the buying rate.

“The cost of acquisition to first purchase is what we really effect,” said Thomas. “It’s that moment you get a new person into your house.”

CleverTap has an office in Sunnyvale and it has just landed in Singapore. Now it plans to add a location in Indonesia before the end of the year. Those expansions are centered around business development, with some customer support, since tech and other teams are in India. Already, according to Thomas, the company is looking to grow in Europe while it is weighing the potential to enter Latin America in a move that could include a local partnership.

The CleverTap CEO is also considering raising more money toward the end of the year, when he believes that the company can push its valuation as high as $400 million.

“That’s very doable based on revenue growth,” he said. “We think that the revenue will demand that valuation.”

Powered by WPeMatico

How much does transportation cost you?

In most cities, bus or subway fare might set you back $3 or so. A tank of gas, maybe $30 or $40 depending on your car. An hour of street parking? Sometimes it’s free, sometimes it’s a few bucks. And you can usually snag an economy seat on a round-trip U.S. domestic flight for less than $300.

These numbers probably ring true for most people. There’s just one problem: Everything you know about the cost of transportation is wrong.

Despite a massive infusion of venture capital into the transportation sector over the past few years, mobility startups are starting to learn what every transportation business has known for generations: transportation profits are elusive, and the system is mainly held together by subsidies. Will this be the first generation of transportation businesses to escape history?

Powered by WPeMatico

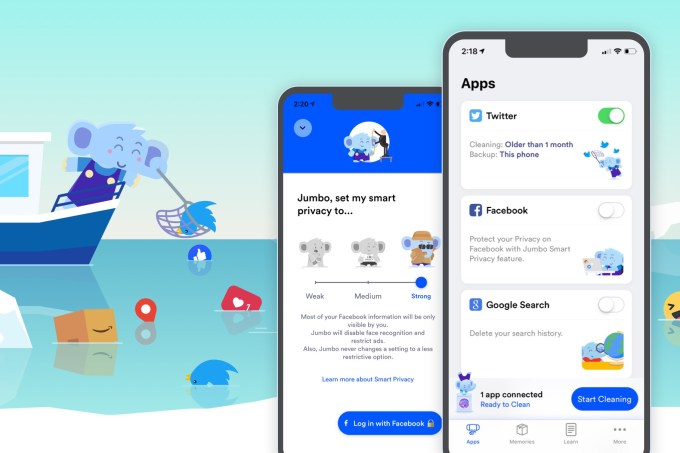

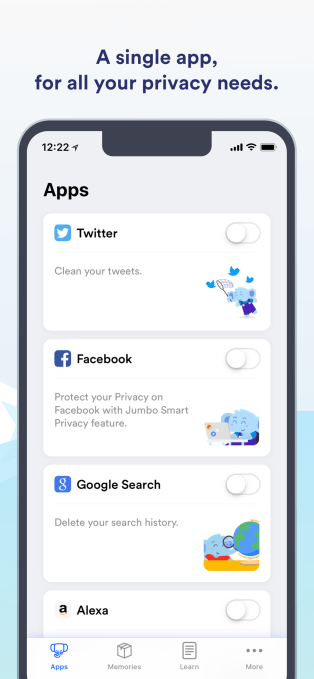

Jumbo could be a nightmare for the tech giants, but a savior for the victims of their shady privacy practices.

Jumbo saves you hours as well as embarrassment by automatically adjusting 30 Facebook privacy settings to give you more protection, and by deleting your old tweets after saving them to your phone. It can even erase your Google Search and Amazon Alexa history, with clean-up features for Instagram and Tinder in the works.

The startup emerges from stealth today to launch its Jumbo privacy assistant app on iPhone (Android coming soon). What could take a ton of time and research to do manually can be properly handled by Jumbo with a few taps.

The question is whether tech’s biggest companies will allow Jumbo to operate, or squash its access. Facebook, Twitter and the rest really should have built features like Jumbo’s themselves or made them easier to use, since they could boost people’s confidence and perception that might increase usage of their apps. But since their business models often rely on gathering and exploiting as much of your data as possible, and squeezing engagement from more widely visible content, the giants are incentivized to find excuses to block Jumbo.

The question is whether tech’s biggest companies will allow Jumbo to operate, or squash its access. Facebook, Twitter and the rest really should have built features like Jumbo’s themselves or made them easier to use, since they could boost people’s confidence and perception that might increase usage of their apps. But since their business models often rely on gathering and exploiting as much of your data as possible, and squeezing engagement from more widely visible content, the giants are incentivized to find excuses to block Jumbo.

“Privacy is something that people want, but at the same time it just takes too much time for you and me to act on it,” explains Jumbo founder Pierre Valade, who formerly built beloved high-design calendar app Sunrise that he sold to Microsoft in 2015. “So you’re left with two options: you can leave Facebook, or do nothing.”

Jumbo makes it easy enough for even the lazy to protect themselves. “I’ve used Jumbo to clean my full Twitter, and my personal feeling is: I feel lighter. On Facebook, Jumbo changed my privacy settings, and I feel safer.” Inspired by the Cambridge Analytica scandal, he believes the platforms have lost the right to steward so much of our data.

Valade’s Sunrise pedigree and plan to follow Dropbox’s bottom-up freemium strategy by launching premium subscription and enterprise features has already attracted investors to Jumbo. It’s raised a $3.5 million seed round led by Thrive Capital’s Josh Miller and Nextview Ventures’ Rob Go, who “both believe that privacy is a fundamental human right,” Valade notes. Miller sold his link-sharing app Branch to Facebook in 2014, so his investment shows those with inside knowledge see a need for Jumbo. Valade’s six-person team in New York will use the money to develop new features and try to start a privacy moment.

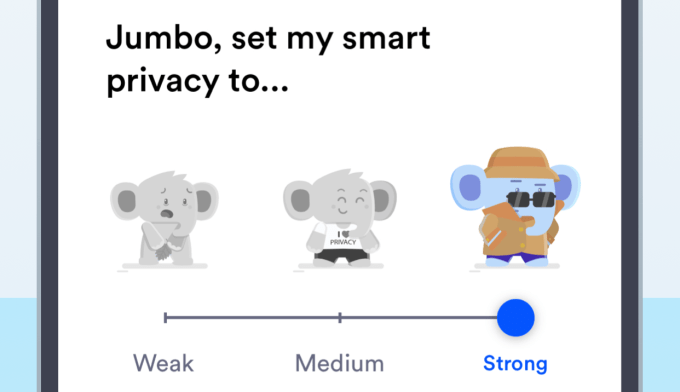

First let’s look at Jumbo’s Facebook settings fixes. The app asks that you punch in your username and password through a mini-browser open to Facebook instead of using the traditional Facebook Connect feature. That immediately might get Jumbo blocked, and we’ve asked Facebook if it will be allowed. Then Jumbo can adjust your privacy settings to Weak, Medium, or Strong controls, though it never makes any privacy settings looser if you’ve already tightened them.

Valade details that since there are no APIs for changing Facebook settings, Jumbo will “act as ‘you’ on Facebook’s website and tap on the buttons, as a script, to make the changes you asked Jumbo to do for you.” He says he hopes Facebook makes an API for this, though it’s more likely to see his script as against policies.

.

For example, Jumbo can change who can look you up using your phone number to Strong – Friends only, Medium – Friends of friends, or Weak – Jumbo doesn’t change the setting. Sometimes it takes a stronger stance. For the ability to show you ads based on contact info that advertisers have uploaded, both the Strong and Medium settings hide all ads of this type, while Weak keeps the setting as is.

The full list of what Jumbo can adjust includes Who can see your future posts?, Who can see the people?, Pages and lists you follow, Who can see your friends list?, Who can see your sexual preference?, Do you want Facebook to be able to recognize you in photos and videos?, Who can post on your timeline?, and Review tags people add to your posts the tags appear on Facebook? The full list can be found here.

For Twitter, you can choose if you want to remove all tweets ever, or that are older than a day, week, month (recommended), or three months. Jumbo never sees the data, as everything is processed locally on your phone. Before deleting the tweets, it archives them to a Memories tab of its app. Unfortunately, there’s currently no way to export the tweets from there, but Jumbo is building Dropbox and iCloud connectivity soon, which will work retroactively to download your tweets. Twitter’s API limits mean it can only erase 3,200 tweets of yours every few days, so prolific tweeters may require several rounds.

Its other integrations are more straightforward. On Google, it deletes your search history. For Alexa, it deletes the voice recordings stored by Amazon. Next it wants to build a way to clean out your old Instagram photos and videos, and your old Tinder matches and chat threads.

Across the board, Jumbo is designed to never see any of your data. “There isn’t a server-side component that we own that processes your data in the cloud,” Valade says. Instead, everything is processed locally on your phone. That means, in theory, you don’t have to trust Jumbo with your data, just to properly alter what’s out there. The startup plans to open source some of its stack to prove it isn’t spying on you.

While there are other apps that can clean your tweets, nothing else is designed to be a full-fledged privacy assistant. Perhaps it’s a bit of idealism to think these tech giants will permit Jumbo to run as intended. Valade says he hopes if there’s enough user support, the privacy backlash would be too big if the tech giants blocked Jumbo. “If the social network blocks us, we will disable the integration in Jumbo until we can find a solution to make them work again.”

But even if it does get nixed by the platforms, Jumbo will have started a crucial conversation about how privacy should be handled offline. We’ve left control over privacy defaults to companies that earn money when we’re less protected. Now it’s time for that control to shift to the hands of the user.

Powered by WPeMatico

Mobile shopping startup Dote is announcing $12 million in new funding, as well as a new feature called Shopping Party.

Founder and CEO Lauren Farleigh said her initial goal was to create “a truly native mobile experience” that made it “easy to check out across a lot of different stores.”

Over time, recommendations from social media influencers have become a big part of the app. With Shopping Party, they’re taking center stage — the feature allows them to share live video while browsing different products on Dote and chatting with fans.

Farleigh said the idea came from a trip she took with Dote influencers to Fiji last fall. She described watching them shop and talk together at the airport, and in what she said was an “ah-ha moment,” she realized that there’s an experience that was “lost when we stopped going to the mall with our friends.”

She added that influencers embraced the idea, with some telling her, “We love going live on Instagram [but] it’s challenging because there’s no shared experience for us to have that meaningful interaction over. It usually turns into the same Q&A over and over again.”

Dote CEO Lauren Farleigh

Shopping Party offers one solution to that issue, because you’re actually browsing and talking about specific products in the Dote app. Apparently this was a real technical challenge — Shopping Party is leveraging Apple’s ReplayKit 2 framework to deliver two live streams (one from the phone camera, one from the Dote app) while also incorporating live chats.

Farleigh, who previously worked as a product manager at mobile gaming company Pocket Gems, also compared this to game streaming on Twitch, except for shopping.

To kick things off, Dote plans to host two Shopping Parties every hour from 6am to 10am Pacific time for the next two weeks. (The company says the average Shopping Party lasts about 15 minutes.) There also will be Shopping Parties sponsored by specific brands.

As for the funding, it was led by Goodwater Capital, with participation from Lightspeed Venture Partners and Harrison Metal. Dote has now raised a total of $23 million.

“[Dote’s] customer-centric shopping platform uniquely blends innovative technologies such as live-streaming with relevant and fun social features, setting the standard for how all major brands and retailers will connect with Gen Z,” said Goodwater Managing Partner Eric Kim in a statement. “We’re thrilled to partner with them to accelerate this transformation.”

Powered by WPeMatico

Klaviyo, a Boston-based email marketing firm founded in 2012, went about building its email marketing business the old-fashioned way. First it built a profitable company, then it went looking for funding to accelerate the growth. Today, it announced a massive $150 million Series B with the entire sum coming from Summit Partners.

The company had raised just $8.5 million before today’s announcement. Co-founder Andrew Bialecki wrote in a blog post announcing the funding that they decided to bootstrap for the first several years because they felt it was the right way to build a business — that, and they had no idea how to raise money.

“We came from families that started small businesses from scratch and ran them for decades. They may not have been huge, but they were real, lasting businesses. We wanted to try to build something like that. The second reason is much less idealistic. We had no idea how to raise money,” he wrote in the blog post.

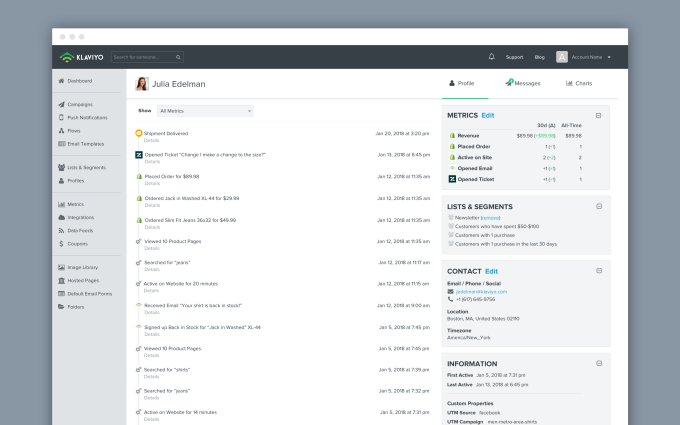

What is the company doing to warrant such a huge investment? It has created an email marketing platform, which in and of itself is not that special, but what the company has done that it feels is different is build a platform where the data lives with the messaging. This enables them to build highly customized messages quickly.

Screenshot: Klaviyo

Bialecki says there are two problems with email marketing tools today. The first is they aren’t really very smart. Most companies are still sending the same message to everyone, regardless of whether they are a new customer or a repeat one. Secondly, while they are probably measuring things like open rates and click-through rates, most platforms aren’t measuring the most important metric of all, and that’s revenue generated as a result of the email campaign.

To be fair, many companies are building highly customized email marketing campaigns based on analytics. In fact, he admits that many people ask if this isn’t a solved problem. Clearly, there are many companies selling email marketing solutions, but he says his company’s approach is different. “Our point of view is that there’s a ton of noise about this, a lot of marketing about marketing companies saying they solve these problems, but they don’t actually,” he said.

He believes the reason for that is simple. “They just don’t store all the customer data themselves. They delegate that job to data warehouses, customer data platforms or some other [platforms]. Then they try to connect them up and it’s a really bad experience.”

He said having all the data stored on the company’s platform lets their users respond much more quickly to changing situations and to deliver email that’s more personalized and in context of the user’s actual experience.

Michael Medici, a managing director at Summit Partners, who is joining the company board as part of this investment, says the company is a combination of product vision and technical expertise. “Klaviyo continues to change the playing field in commerce, allowing companies of all sizes to harness the power of data-driven customer engagement activity to grow sales – and the results are impressive,” he said in a statement.

The company is growing in leaps and bounds. It currently has 12,000 customers. To put that into perspective, it had just 1,000 at the end of 2016 and 5,000 at the end of 2017.

The company certainly understands that marketing is just one channel, but the goal up until now was to concentrate on email marketing, and get that right. Moving forward with the big investment, the company can accelerate growth and expand the platform into other areas like mobile and websites.

“We think the big change coming is to own all of those channels. Right now, businesses are forced to choose between going through some intermediary like Google or Facebook for ads, or selling on a marketplace like Amazon. If you’re a consumer business, we think you can go directly to customers,” he said.

He adds, “Our mentality is that we’re going to be a self-sustaining business, and we want to be here for decades.” With this kind of money, it certainly has the runway to be around for the foreseeable future.

Powered by WPeMatico

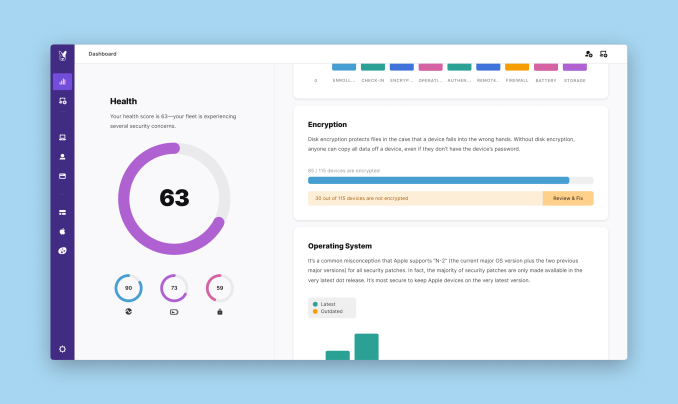

Fleetsmith launched in 2016 with a mission to manage Apple devices in the cloud. It simplified an IT activity that had previously been complex, with help from Apple’s Device Enrollment Program. Over the last year, the startup has beefed up its offering considerably, and today it announced a $30 million Series B round led by Menlo Ventures.

Tiger Global Management, Upfront Ventures and Harrison Metal also participated. Under the terms of the deal, Naomi Pilosof Ionita, a partner at Menlo, will join the company board. Her colleague Matt Murphy will become a board observer. With today’s announcement, the startup has now raised more than $40 million, according to data supplied by the company.

Company co-founder and CEO Zack Blum says the original mission was about solving a pain point he and his co-founders were feeling around finding a modern approach to managing Apple devices. “From a customer perspective, they can ship devices directly to their employees. The employee unwraps it, connects to Wi-Fi and the device is enrolled automatically in Fleetsmith,” Blum explained.

He says that this automated approach, combined with the product’s security and intelligence capabilities, means that IT doesn’t have to worry about devices being registered and up-to-date, regardless of where an employee happens to be in the world.

It has moved from solving that problem for SMBs to having a broader mission for companies of all sizes, especially those with distributed work forces, which can benefit from enrolling in this automated fashion from anywhere. Once enrolled, companies can push security updates to all of the company’s employees and force updates if desired (or at least send strong reminders to avoid updating in the middle of a client meeting).

Over the last year, the company developed a dashboard for IT to monitor all of the devices under its management, including providing an overall health score with any potential problems it has found. For example, there may be a number of MacBook Pros without disk encryption enabled.

The dashboard ties into the identity management component of Office 365 and G Suite. IT can import the employee directory into the dashboard from either tool, and employees can sign into Fleetsmith with either set of credentials, providing a quick way to manage all employees in an organization.

Screenshot: Fleetsmith

Fleetsmith has also set up a partner program with Managed Service Providers (MSPs) to expand its reach further. MSPs manage IT for SMBs, and building a relationship with these types of companies can help it expand much more quickly.

The approach seems to be working, as the company has 30 employees and 1,500 customers. With the new cash in pocket, it intends to hire more people and continue building out the product’s capabilities, while expanding beyond the U.S. to markets overseas.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Kirsten Korosec and Kate Clark led a deep-dive discussion into Lyft’s IPO and the outlook for the business going forward.

After skyrocketing nearly 10% on its first day hitting the public markets, Lyft stock has faded back down towards its IPO price as some investors grow more concerned over the company’s path to profitability (or lack thereof) and the long-term fundamentals of the business. But Lyft’s public listing is bigger than just the latest in increasingly common unicorn IPOs. As the first public “transportation-as-a-service” company, Lyft offers the first inside glimpse into the business model and its economics, and its development may ultimately act as the canary in the coal mine for the future of transportation.

“Lyft, hasn’t just survived, they’ve grown. 18.6 million people took at least one ride in the last quarter of 2018. That’s up from 16.6 million in late-2016. That illustrates the growth that the company has had. They’ve also said that they have 39% share of the ride-sharing market in the US. That’s up from 22% in 2016.

To me, the big question is let’s say they had Uber’s share, which is 66%, would they be able to make a profit? Is that the determination? And I’m not convinced that it is, which is why all these other aspects of the transportation-as-a-service business model [micromobility, AVs, etc.] are going to be really important.”

Image via Getty Images / Mario Tama

Kirsten and Kate dive deeper into what the market response to Lyft means for Uber and the timeline for its impending IPO. The two also elaborate on their skepticism of ride-hailing economics and debate which innovative transportation model will ultimately drive the path to profitability for Lyft, Uber and others.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Danny Crichton: Good afternoon and good morning everyone this is Danny Crichton, executive editor of Extra Crunch. Thanks so much for joining us today with TechCrunch reporters Kate and Kirsten.

I’ll start with a quick introduction for our two writers today. We have Kate Clark, our venture capital reporter. Kate has been with us for a while now covering everything in the startup and venture world. She’s also one of the hosts of TechCrunch’s podcast Equity and also writes our Startups Weekly newsletter.

Our other writer today is Kirsten, our intrepid automotive writer covering all things Elon Musk, Tesla, and everything else in the autonomous vehicle space. Kirsten has also been with us for quite some time and also writes a newsletter that she just introduced in the last couple of weeks, around transportation. So with that, I’m going to hand off the conversation to the two of them now.

Kirsten Korosec: Thanks so much Danny. This is Kirsten Korosec here. The newsletter is in a bit of a soft launch but it is being published Fridays and we hope to have an email subscription coming sometime in the future, so just keep an eye out for that.

I should also mention I too have a podcast centered around autonomous vehicles and future transportation called The Autonocast that comes out weekly. Thanks so much for joining the call and just a reminder, we want participation. So at about the halfway point, we’ll turn and open up the line and answer questions. Let’s get started.

Before we dig into all the hot takes out there, I think it’s worth providing a primer of sorts — a general timeline of events. We all probably know Lyft of course and most of us think of 2012 as the launch date when it came to San Francisco, but really Lyft was build out of the service of Zimride. Which is the ride-sharing company that John Zimmer and Logan Green founded in 2007.

A lot of attention has been placed on Lyft in 2018 with what happened in the past year, in the run-up to the IPO. But I think it is worth noting the intense activity and growth that happened between 2014 and 2016. These are critically important years for Lyft, just a frenzy of activity in a period where the company gained ground, investors, and partners.

To showcase the amount of activity that was happening; Lyft had two separate funding rounds, one for $530 million another for $150 million, just two months apart in 2015. You might also recall in early-2016 its partnership with GM and the automakers’ $500 million dollar investment as part of the Series F $1 billion dollar fundraising effort.

That was really interesting because GM’s president at the time Dan Ammann took a seat on the board, which he has since vacated. As Lyft and GM started realizing that they were competitors. Now, Dan is the CEO of GM Cruise which is the self-driving unit of GM.

2017 and 2018 were also big years, as Lyft launched their first international market in Toronto. They made big moves on the autonomous vehicle front, which we’ll talk about today, and in micromobility. Their scooter business launched in Denver in 2018. They bought Motivate, which is the oldest and largest electric bike share company in North America. Then, we finally get to the end of 2018, and this is when Lyft confidentially files a statement with the FDC and we’re off with the races to the IPO.

The last two months or three months is when Lyft unveiled its prospectus, met with investors, priced its IPO and made its public debut. So Kate what are the nuts and bolts of the IPO and what’s happening right now?

Kate Clark: Hi everybody this is Kate. So I’m just going to mention really quickly the timeline these last couple of months in the run-up to Lyft’s highly historical IPO. So going back to December, that’s when Lyft initially filed confidentially to go public. We later find out that they are going public on the NASDAQ when they eventually unveiled their S1 in early March.

This is after Lyft had raised $5 billion in debt and equity funding at a $15 billion dollar valuation, so there are a lot of people paying attention to what was the first ever rideshare IPO. So then in early-March, we’re able to get a closer look at Lyft’s S1, which tells us that the company has $911 million in losses in 2018 and revenues of $2.2 billion. So after calculating and pulling together some data, a lot of people were quick to find out that that means Lyft has some of the largest losses ever for any IPO. But also has some of the largest revenues ever for any pre-IPO company, just following Google and Facebook in that category.

So this is a really interesting IPO for a lot of people given these sky-high losses but also these huge, huge revenues. The next we see Lyft price their IPO between $62 and $68 dollars a share. Some people were quick to say that that was maybe a little underpriced, given that this was a highly anticipated IPO with a ton of demand. So on the second day of Lyft’s roadshow, the process, they say that their IPO is oversubscribed. So demand is apparently huge, their oversubscribed, so they decide we’re going to increase the price of our shares.

Image via GettyImages / maybefalse

So Lyft then says they gonna charge a max of $72 per share and then on the day of their IPO they charge $72 per share, the next day opening at $87 per share. So we see a huge IPO pop that I don’t think was particularly surprising given that they already spoke of this demand, and we had already known that there was a lot of demand on Wall Street. Not just for Lyft but just for unicorn IPO’s of this stature, given that there are so few of these. So Lyft began trading hitting $87 per share though, if you’ve been following the news that’s not were Lyft is today.

Kirsten: Yeah so I was just about to ask — Kate give me the latest numbers, you know a lot of focus is on that opening day but things haven’t exactly sustained. So what’s happened in the past few days?

Kate: Yeah it’s really tough to manage expectations after an IPO. I mean, I think there has been a lot of criticism towards Lyft now and I think it’s trading below its initial share price. So as I mentioned Lyft opened at $87 per share, it priced at $72, but almost immediately they began trading below that $72 price per share. So they closed Tuesday trading at $68.96 per share. Still boasting a market cap larger than $19 billion. So they’re still significantly valued at more than they were as a private company at $15 billion but it doesn’t look good to be trading below a price per share so quickly.

However, it actually did hit its IPO price for just a minute today, so maybe let’s give it a few more hours and see where it closes. It’s possible that it will sort of jump towards that $72, but it’s still trading quite significantly below that $87.

Kirsten: With IPOs like this, and especially such a high profile one, there’s going to be a ton of attention on share price and on volatility. And so I’m wondering, in your view, what did this first week, or first few days of volatility say to you? What does it say about Lyft’s future and, well certainly, its present?

Kate: Yeah. I mean, it’s hard to say. I think a lot of people were questioning if Wall Street was going to be interested in a company like Lyft that’s extremely unprofitable at this time and has years left before it will reach profitability, if indeed it ever reaches profitability.

So at this point you got to wonder, do some of these investors that did buy Lyft right off the bat, were they really long on Lyft? Because it does look like a lot of those investors have already sold their stock and perhaps weren’t as invested in Lyft’s long-term profitability plan, which involves a lot of very iffy things, like the future of autonomous vehicles, which we’ll talk about later in this call. And there’s a lot of uncertainty there.

But with that said, it’s not uncommon for a stock to experience volatility right off the bat, and you can’t assume the future of that stock price just because of some early volatility.

And we gathered some examples of IPOs where there was some early volatility that did not determine the long term future. So Carvana, for example, which is an online used car dealer in the automotive space, and it did experience volatility at first, with the stock sliding in the first few months but ultimately trended upward.

Kate: So Carvana opened at $13.50 a share, falling below its IPO price, so it didn’t even have the IPO pop. And then in 2018, it hit an all-time high of $65 per share. Today, it’s trading around $58 per share, so that’s ultimately a positive story to be told there.

And then another example on the other side of things is Snap, which actually took four months to dip beneath its 2017 IPO price, and we all know Snap has definitely not been a success story and it’s trading well below its offer price. But then finally, Facebook, for example, dropped below its IPO price on its second day of trading and then actually had a rough first year on the stock market before the stock ultimately took off and became a very obvious success.

Kirsten: So, Kate, I’m wondering why you think that there was that initial run up on that first day. Was it excitement? Was there something material that was pushing the price up? What was the cause?

Kate: I think there was a lot of excitement and demand around this IPO because it was very much one-of-a-kind, and there were a lot of investors that it seemed were really long on the possibility of Lyft becoming this hugely profitable company. And I think a lot of that was because in the S1, although you did see these really, really big losses — quite major, just ridiculously huge losses — you did see that they were shrinking over time and that there was definitely a path in which Lyft could take where it would reach profitability, say, in the next five years.

And I think Wall Street was really paying attention to that, and they were not paying attention to some of the other metrics. Now, they’ve taken off their rose-colored glasses and they’re looking at Lyft as a public company, and it’s just a little bit different now that it’s actually completed its debut.

Kirsten: Well, so, I mean, I like to view IPOs often times, and especially in Lyft’s case, as a measure of an investors’ faith in the company’s growth prospects, because this is a company that while it does have quite a bit of revenue, it has significant losses and it’s really planning not just for the present day but for the future. It’s been called a disruptive business for a reason, and it is certainly very forward-looking. So I’m wondering if you think it was a good strategy for Lyft. They wanted to open it up to “the everyman” when they actually went to market. They did a different approach, and do you think this might have had an effect? I mean, it’s very on-brand for them to do this, but I’m wondering if you thought that means that some of the investors aren’t as disciplined.

Kate: Do you mean with the fact they were providing bonuses to their employees and drivers to actually participate in the IPO as well?

Kirsten: Absolutely. That’s actually a really good point that maybe you can elaborate on. Lyft did a little bit of a more open approach for its IPO. Typically IPOs can be closed off to only large, institutional investors. So did this set them up perhaps to have more volatility?

Kate: Yeah, Lyft provided some of their drivers up to, I think, $10,000 to, in theory, actually buy stock in the IPO. Do I think that had a high impact? I don’t know. I think there’s not enough comparison, not enough data to really make a decision or to make a hot take on whether that really was part of the volatility. I think just given the uncertain nature of Lyft’s future and their big losses, I think their volatility was pretty inevitable, and I think people paying attention to this are probably not particularly surprised by how the stock has fared in these first couple days.

And I do want to add there’s this six-month lock-up period for the venture capital funds that own Lyft and as well as their employees, so I think we’re not sure what’s going to happen when that lock-up period ends and those holders can just sell their stock right then or how that will impact the stock price, as well.

Image via TechCrunch/MRD

Kirsten: So something to keep an eye on. It reminds me a lot of a company I write a lot about, which is Tesla, and I’ve been covering them for years. And it’s one of the most volatile stocks, and their investors, they certainly have large, institutional investors, but the number of fanboys that they have with smaller investors, either prop up the share price sometimes or add to that volatility, and I’m kind of really curious to see if that happens with Lyft. If you go to a shareholder meeting at Tesla, for example, it’s filled with people who are passionate about the brand and its CEO, Elon Musk.

And Lyft and possibly Uber, if they end up finally going through with their IPO, you can see that potentially happening because people feel very strongly about the brand and also the service it provides. So I’m curious to see how this all sort of shakes out. And I tend to take the view that I invest personally in mutual funds and things like that. I don’t invest in any of these companies, but the long, patient view tends to be the better one, and trying to catch a falling knife, as investors have told me, is never really a good idea.

So I’m curious to see if investors sort of grow up and learn with Lyft, if they’ll become disciplined and just sort of wait it out and see them play out the growth prospects for the company in the long term. So, we’ve been talking about Lyft and I can’t not talk about Uber as a result. I’m wondering what you think this might mean for Uber. The big story initially was let’s beat Uber to IPO and I’m wondering what this means then. Is this indicative of what Uber is going to experience?

Kate: I think that question is really at the top of everyone’s mind right now, including my own. I will say that I still do think it was highly beneficial for Lyft to get out first. Because imagine if and when Uber does too experience volatility, which it probably will, if it were to have gone first, I think that would have frightened Lyft a lot more than Lyft’s volatility may or may not be frightening Uber. So, with that said, I think I’m of two minds right now with my thoughts on how this impacts Uber’s IPO. I think that if Lyft stock continues to be volatile and perhaps even falls lower than it already has. I do think that there is a chance Uber may ultimately decide to push its IPO back.

I think that for a few reasons, namely being that Uber is not in a huge rush to go public. They do have the ability to wait. They have filed to go public. So it’s likely to happen quite soon, but it may not happen in April as they are reportedly planning to do.

On the other hand, Lyft went public at like a $24 or $25 billion dollar market cap. Whereas Uber is going to debut at maybe a $120 billion dollar initial market cap. So these IPOs, although they are both ride hail IPOs and they are very similar companies in a lot of ways, they’re also very different and Uber is operating on an entirely different scale though it still is unprofitable. And has some of the same issues that, investors are probably noting about Lyft.

I think it’s either going to be that it’s maybe that they do decide to push it back or maybe that Uber is like, well we’re five times larger, six times larger. We have much larger statistics to show to investors. There’s just a chance it could go either way. I wish I had a better, more concrete answer, but I just don’t think we know yet.

Kirsten: Well I’m okay with not taking hot takes just a few days into this IPO. I think this is a good time to open it up to questions. While we wait for a question, I will do one quick follow up with you Kate. What do you think this means for Uber? Will it delay its IPO?

Kate: Right now, no, I don’t think they’re going to. But it’s like I said, it’s tough to say given that it’s only been a few days of Lyfts IPO. But no, I think you’ve got to imagine that they are ready to discuss the possibilities of Lyfts IPO and already planned ahead if there was volatility. They maybe already assumed that would happen, given that that’s not uncommon. So right now I’m going to say no, I don’t think they’re going to delay, but it’s certainly still a possibility.

Kirsten: Okay, great. I think another really interesting piece for Uber was their acquisition of Careem. This is a deal that was made right before their IPO, so it was shifting attention away from Lyft, just for a moment.

Why did Uber do this? Is this not a signal that they’re delaying their IPO? Is this just prepping for it? What are you hearing on it? I’m wondering if this might have just been a strategy to show the world investors, specifically potential shareholders, what the road ahead is going to look like. Or is it some other reason — Is it to justify their really big losses?

Image via Careem / Facebook

Kate: I think it’s the latter two things you said. Just to give some background Uber is paying about $3.1 billion to acquire Careem, which is a Middle Eastern ride-hailing company. So basically just the Uber of the Middle East. Uber does have a history of acquiring, smaller competitors like this in different markets where it’s not active, just as a way for Uber to quickly grow essentially.

So I do think it’s a big deal to make just before going public. So I guess we don’t know if they necessarily will go public in April, but I think it was a move to present to public market investors as a prep for an IPO, to show “we just acquired this company, here’s more evidence of future growth”. Like you mentioned, it’s definitely a justification of those huge losses that we know Uber has.

Kirsten: Thanks for that. Questions?

Caller Question: Hi there, so when we talk about looking ahead and moving towards profitability — what role, if any, do you think the acquisition of a scooter or other mobility companies will have for companies like Lyft and Uber?

Kirsten: That’s a great question. I think it’s going to be a huge piece of both of their businesses. A lot of people describe this as the first ride-hailing IPO. We need to stop calling this a ride-hailing company. These are transportation-as-a-service companies and they’re making money. But generating revenue as opposed to making profit is a totally different thing. When you start talking about ridesharing, it’s a tough business. With those it’s an asset-light business, right? They don’t own the cars and then they technically don’t employ these drivers.

But at the same time, as of 2016 only something like 1% of people in the US were using rideshare. So you see this opportunity, but they’re not pushing forward. There is a ton of car ownership still that’s happening. Yes, sharing has absolutely increased, but 17 million new cars were sold in the US last year. So scooters, bike share and other businesses are going to be key to their paths to profitability because ride-sharing alone is just difficult to make a profit. It’s not difficult to generate revenue. It’s difficult to make a profit on.

And I’m wondering, talking about that road to profitability, I do think it’s worth noting how much they have grown. Lyft, hasn’t just survived, they’ve grown. 18.6 million people took at least one ride in the last quarter of 2018. That’s up from 16.6 million in late 2016, that illustrates the growth that the company has had.

They’ve also said that they have 39% share of the ride-sharing market in the US. That’s up from 22% in 2016. To me, the big question is let’s say they had Uber’s share, which is 66%, would they be able to make a profit? Is that the determination? And I’m not convinced that it is, which is why all these other aspects of the transportation-as-a-service business model are going to be really important.

Kate: I think what you pointed out is important, about Lyft and Uber both becoming transportation businesses, not ride-hailing companies and I think their long-term visions involve scooters, bikes, autonomous vehicles, all sorts of different models of transportation beyond just car sharing.

Kirsten: I hate to be wishy-washy here and say, I don’t know, but I do really think that it’s going to come down to a variety of items all coming together. It’s just not going to be enough for Lyft to scale up its ride-hailing business. And I should point out that Uber should be treated in some ways the same way, but there are some distinct differences. But it’s important for us to think of Lyft as a transportation-as-a-service business. I mean they say in their prospectus that transportation is a massive market opportunity. The hard part of course is turning that into a profit. There might be opportunity there.

So there’s this asset-light business that they have right now, which is the ride-hailing, but then they are making acquisitions in the micromobility space and that is going to become more capital intensive. And that’s going to force them to change their business. And then there’s the autonomous vehicle piece. And then finally, I actually think that one of the pieces of their S1 that has really not received much attention at all is what they’re pursuing in terms of public transportation. And they have said that they, and Uber, intend on being a piece of the public transit ecosystem.

Now that doesn’t mean that they’re going to necessarily be operating buses, but there are people that I’ve talked to in the industry who actually feel like, in Uber’s case, they want to control every mode of transportation. For Lyft, I see them seeing more of the opportunity financially with the data piece and becoming more of a platform and becoming that one-stop shop where you use an app to figure out if you want to use the scooter or a bike, or ride-hailing or buy that ticket for the L in Chicago or the Bart System.

So I really think that the public transit piece often gets ignored and cities are having so much more control now and weighing in. We see this in New York City with congestion pricing. It’s going to force Lyft and Uber to take advantage of these opportunities and use their platform in a way that perhaps accelerates faster than they had intended.

Kate: I’m very interested in the public transportation element, but I’m also very skeptical of the scooters and bikes in the future for Lyft, I think, given the unit economics, I certainly wouldn’t rely on them to be Lyft’s path to profitability. I think autonomous vehicles are a much more interesting path towards profitability. So a lot of companies, Uber, Lyft, Waymo and more are focusing on autonomous vehicles and their development, whether that be with hardware or software. How does Lyft’s strategy with autonomous vehicles differentiate from some of their competitors or does it does differentiate?

Kirsten: It does differentiate, and the funny thing is, is that so you don’t see micromobility necessarily as the oath to profitability and are interested in AVs and I write about AVs, but I see that AVs as a harder path to profitability in a way because of the nuts and bolts that it takes to develop them.

So just to weigh in really quickly on the micromobility piece and then I’ll move on to AVs; To show the opportunity but also the volatility in a real-world example for micromobility, I was in Austin for South by Southwest, I think you were there too, and you probably saw scooters everywhere, right? 18 months ago there were no scooters or bike share in the city. Then bike share came first.

Image via Flickr / Austin Transportation / https://www.flickr.com/photos/austinmobility/41536051644/in/album-72157669223418248/

And I was talking to that mayor of Austin and one of the folks from Spin, which is a Ford owned business, and they told me something that was really remarkable that I hadn’t thought about, which was that scooters were disrupting the bike share business. So bikes share came in and then scooters came in and all of a sudden they’re pulling bikes off the streets because no one was using them or were not using them at the same level as scooters.

Lyft is going to go through these same exact growing pains and people are figuring out what works. And as you mentioned, the unit economics are an issue, the wear and tear on the scooters alone is driving up costs and driving down revenues certainly, but pretty much making it very difficult to make a profit on it.

But that’s a near term business, right? So it’s at least generating revenue right now. On the other hand, you have this other piece, which is the AV piece. Lyft is doing some really interesting things on the AV piece — they kind of have a two-prong approach.

So they basically created a ton of partnerships to use their platform. So this started a couple of years ago and companies like Aptiv, drive.ai, even Waymo and nuTtonomy, which Aptiv just recently bought about a year ago and GM, and Lyft basically allows developers to use their platform and connect to their autonomous vehicle and offer these rides.

And the best example of this, if you’ve been to CES or if you have been to Las Vegas I should say more specifically, is this partnership that Lyft has with Aptiv — and Aptiv as a tier one supplier, they used to be called Delphi, they spun out, they bought nuTonomy, and they’re Aptiv now. And this is taking Aptiv automated BMW, which are on the Lyft network. If you hail a ride, you might be asked if you want a self-driving car, or “are you okay with a self-driving car?” And they have a safety driver, no humans have been pulled away from it yet. But they provided about 35,000 rides since I want to say January 2018.

Then they’re also doing Level 5, a dedicated self-driving vehicle division that launched in 2017. And here they’re basically creating an open self-driving system or open SDS. On top of that, they have partnered with Magna, an auto parts producer, to develop these self-driving systems that can be manufactured at scale.

And so you just see a rush of partnerships and sort of dual approaches and all of that costs a lot of money. And I can’t emphasize the amount of money that it costs or will cost to develop these systems and deploy them commercially. And I hear from other companies figures like $5 billion to get self-driving vehicles. So developing the full stack, doing fleet management, maintenance, all of that — that’s a lot of money. And, I’m not sure where Lyft, will get that capital, will they get it from the open market or will they have to go and ask for more capital.

Kate: So when do you think then that Lyft will be able to commercialize autonomous vehicles?

Kirsten: The timeline? So depending on who you talk to, you can hear from any of these developers between five years and 30 years. I think it’s important to talk about language and how we talk about autonomous vehicles. So to be clear, there is currently not a single commercial autonomous vehicle deployment where a human being or safety driver has been pulled away from the wheel. It just doesn’t exist.

There are plenty of pilots and Waymo is probably considered the leader in that list, though it is a bit of a confusing one for me because they have so many partnerships and they’ve become competitors to some of those partnerships. The analogy I use is “Survivor,” the reality show. Everyone wants to make these alliances so they don’t get voted off the island.

And now we’re at that point where autonomous vehicle development has entered what we call the trough of disillusionment, which is heads down, “let’s get away from the hype, let’s do the hard work.” And I think we’re going to see a lot of those partnerships and headwinds really come up in the next year, 18 months. So to put a target date on Lyft, it’s really going to depend on which one of those partnerships really play out and are real. I think the one with Aptiv seems the most real to me based on what I know the company is doing and I can see them doing a lot more pilots in the next 18 months.

Does that mean commercial deployment without a human safety driver behind the wheel? I’m not sure I can see a lot more these pilots with a human safety driver expanding beyond Las Vegas. I see pilots happening absolutely in the next year to 18 months. The issue is going to be when is that human safety driver going to be pulled out and with which partner.

Kate: So should we open it up to questions again?

Caller Question: Hi, I was just wondering how we should think about the regulatory risks that might exist as these companies expand to new cities, new markets, or even the public transport use case you mentioned. Thanks.

Kirsten: The regulatory piece is an interesting one. Let’s talk about ride-hailing first. We’ve already seen the regulatory environment, in cities, push back against companies like Uber and Lyft. I think the congestion pricing model that just launched in New York City is going to be one to watch and could be something that will put pressure on, on businesses like Lyft.

Kate: I agree and just to speak, quickly on the scooters; I think the narrative around scooters has been pretty dominated by how cities have forced them out or cities push these strict regulatory barriers on them. And I think that’s still playing out very much. There are even some scooter providers that have had to pull out of cities that they worked very hard to get into in the first place. So I think that has slowed down some of the growth there. And given that Lyft has micromobility as such a key part of their road to profitability, I think that’s partially why I am a little bit skeptical of how that’s gonna play out.

Kirsten: One thing we’ve found, and something to consider for Uber as well, in the future, if any of these AV developers end up, filing for IPOs on their own — there’s been chit chat about Waymo someday doing that or GM cruise someday— the implications for all of these companies and their relationship with cities should not be ignored or undervalued.

And I think you see a bit of that playing out with the present day track we have, which is the ride-hailing scooters and bike share cities and transit agencies or the DOT of different counties finding that they are in a more powerful position than they’ve ever been before. And they are exerting that power.

And so you will see instances like Los Angeles where they have put forth a mandatory data sharing component if you want to operate in their city. This raises some privacy concerns by the way, but it also adds another cost to a company or certainly forces them to look at their business a little bit differently.

Then you start talking about AVs and where are they will operate, how they will operate, where are they will park, what type of vehicle will be allowed in the urban center. In places like Europe, there are strict emissions rules, so that’s going to go to an AV or hybrid profile. And it’s important to think about what that regulatory framework might be and acknowledge the fact that it’s really a mishmash.

There are voluntary guidelines on the federal level right now, but there were no mandates. And so it’s really left up to the cities, counties and states to decide how an AV might be deployed. It’s going to mean probably more lobbyists in DC working with federal folks to ensure that their business doesn’t get hamstrung as a result as well as more of a presence in those cities and states and counties.

But Kate, I’m wondering what is your view from a startup perspective? Do you think of Lyft as a startup anymore are they acting like a startup or are they acting like a company that could handle all of these different complicated, various challenges? I mean, we’ve got pricing pressure, regulatory pressure or you’ve got AV development, opportunities with scooters and all this other stuff. So are they acting like a company that is able to handle this?

Image via Getty Images / Jeff Swensen

Kate: That’s an interesting question. I mean, they’re definitely not a startup anymore by, by anybody’s definition. You maybe could have still used that word, if they were still private, but even then, I know many people would yell at you for using that term for a company worth $15 billion. But now it’s a public company. It’s not a startup. I don’t think they’re acting like a startup, no. I think that they are mature in the way that they’re handling all of these different, so-called paths to profitability.

But we need to wait and see. Let’s see how this year goes, let’s see how they handle all the criticism that they’re going to undoubtedly take from Wall Street or from everyone who’s either interested in buying or just taking a seat and watching how the stock favors and then we’ll know what kind of lessons they took from all those years as a private company. Then we can decide if their behavior is really that of a mature public company.

Kirsten: I do want to make one point that I think is an interesting one on Lyft’s strategy versus Uber is in terms of AVs. Let’s all put a big asterisk that says no, AVs are still a ways out. It is important to note the Lyft and Uber’s strategies for AVs are wildly different and Uber does not take this dual approach. Uber is throwing a ton of capital towards developing their own, self-driving stack and also they’ve done, some acquisitions as well.

They’ve also had quite a bit of trouble. Last year Uber had the first self-driving vehicle fatality that happened in Tempe, Arizona, which looked like it was going to derail their self-driving unit, but it did not. They’re back, testing in a very limited way, but Lyft’s is all about what they call the democratization of autonomous vehicles.

And we can look at that as marketing speech, but I do think that it’s important to look at those words because it shows what their business model is. Their business model is partnerships, alliances, opening up the platform and casting the widest net possible. What I’m very interested to find out is which approach will end up being the winner. It’s going to be a very long game. It’s not going to be anything that’s going to be determined in the next year. I think what Lyft’s proven is that when they look like they’re down and out, they come back.

We’ll see what the better approach is. Do you do everything in-house and launch your own robo-taxi service? Or take capital partners on or do the Lyft approach, with multiple partners? Are partnerships actually too complicated? As someone who covers the startup world, do you have a thought on which one might work or not?

Kate: I have no idea which will work better and I’m sort of excited to see where this all goes, especially as Uber and Lyft are now going to be public.

That’s a good spot to end the call on.

Kirsten: Thanks so much for joining. Thanks again for being Extra Crunch subscribers, we really appreciate it. Bye everyone.

Powered by WPeMatico