funding

Auto Added by WPeMatico

Auto Added by WPeMatico

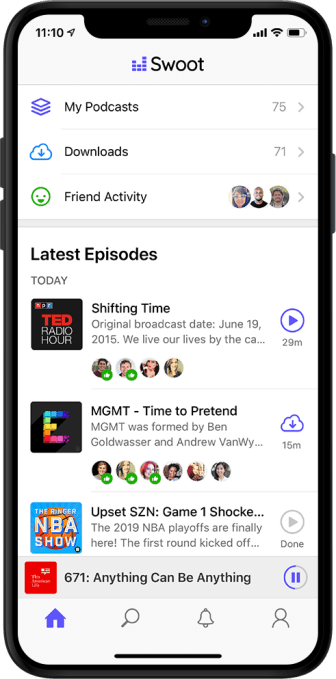

Pete Curley and Garret Heaton, who previously co-founded team chat app HipChat and sold it to Atlassian, are officially launching their new product, Swoot, today. The app makes it easy for users to recommend podcasts and see what their friends are listening to.

This might seem like a big leap from selling enterprise software — and indeed, Curley said the company was initially focused on creating another set of team collaboration tools.

What they realized, however, was that HipChat is “actually a consumer product that the company just happens to pay for, because the employees demand it” — and he said they weren’t terribly interested in trying to build a business around a more traditional “top-down sales process.”

Meanwhile, Curley said he’d injured his back while lowering one of his children into a crib, which meant that for months, his only form of exercise was walking. He recalled walking around for hours each day and, for the first time, keeping himself entertained by listening to podcasts.

“I was actually way behind the times,” he said. “I didn’t know this, that everyone else was listening to them … This is like the dark web of content.”

The startup has already raised a $3 million seed funding round led by True Ventures .

“Pete and Garret both have incredible product and entrepreneurial experience, plus they have built successful businesses together in the past,” said True Ventures co-founder Jon Callaghan in a statement. “Their focus of solving the disjointed podcast listening experience through Swoot’s elegant design fills a clear gap in media discovery.”

Discovery — namely, finding new podcasts beyond the handful that you already subscribe to — is one of the biggest issues in podcasting right now. It’s something a number of companies are trying to solve, but in Curley’s view, the key is to make the listening experience more social.

He noted that social sharing features are getting added to “literally everything,” including your bathroom scale, except “the one thing that I actually wanted it for.”

Curley also contrasted the podcast listening experience with YouTube: “We don’t realize how big [podcasting] is because there is no social thing where you see that Gangnam Style has 8 billion views, and you realize that the entire world is watching. There’s no view count, no anything that tells you what’s popular.”

So he’s trying to provide that view with Swoot. Instead of focusing on overall listen counts (which might not be that impressive in a new app), Swoot gives you two main ways to track what’s popular among your friends.

There’s a feed that shows you everything that your friends are listening to or recommending, plus a list of episodes that are currently trending, with little icons showing you the friends who have listened to at least 20 percent of an episode.

Curley said the team has been beta testing the app by simply releasing it on the App Store and telling friends about it, then letting it spread by word of mouth until it was in the hands of around 1,000 users. During that test, it found that 25 percent of the podcasts that users listened to were coming from friends.

Curley also noted that this approach is “episode-centric” rather than “show-centric.” In other words, it’s not just helping you find the next podcast that you want to subscribe to and listen to for years — it also helps surface the specific episode that everyone’s listening to right now.

“In the 700,000 shows that exist, if you’re the 690,000 worst-ranked show, but you have one great episode that should be able to go viral, that’s basically impossible to do right now, because audio is crazy hard to share,” Curley said.

In the course of our conversation, I brought up my experience with Spotify — I like knowing what’s popular, but when a friend recently mentioned specific songs that they could see I’d been listening to on the service, I was a bit creeped out.

“It’s funny, I actually thought, how ironic that Spotify is getting into podcasting now [through the acquisitions of Gimlet and Anchor],” Curley replied. “They actually had this correct mechanism applied to the wrong thing. Music is a deeply personal thing.”

Which isn’t to say that podcast listening isn’t personal, but there’s more of an opportunity to discover overlapping interests, say the fact that you and your friends all listen to true crime podcasts.

Curley also said that the app is deliberately designed to ensure that “the service does not get worse because a ton of people follow you” — so they see what you are listening to, but they can’t comment on it or tell you that you’re an idiot for listening.

At the same time, he also said the team will be adding a mode to only share podcasts you actively recommend, rather than posting everything you listen to.

As for making money, Curley suggested that he’s interested in exploring a variety of possibilities, whether that’s integrating with other subscription or tipping services, or in creating ad opportunities around promoting podcasts.

“My actual answer is, there are a bunch of people trying to monetize right now, but I don’t think there’s a platform even close to mature enough to even try to monetize podcasting yet, other than podcasters doing their own advertising,” he said. “I think the endgame, where the real money is made in podcasting, actually hasn’t been come up with yet.”

Powered by WPeMatico

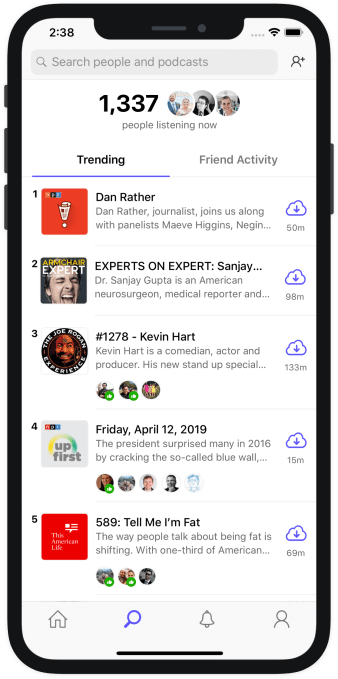

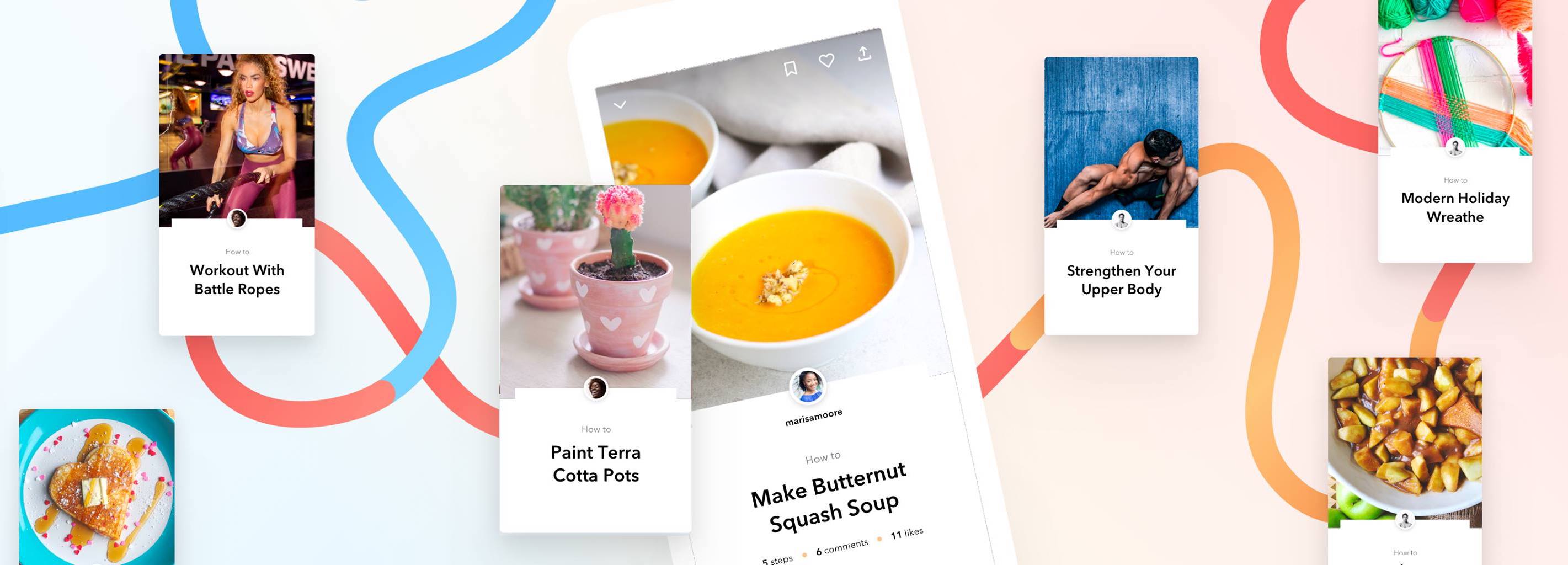

Sick of pausing and rewinding YouTube tutorials to replay that tricky part? Jumprope is a new instructional social network offering a powerful how-to video slideshow creation tool. Jumprope helps people make step-by-step guides to cooking, beauty, crafts, parenting and more using voice-overed looping GIFs for each phase. And creators can export their whole lesson for sharing on Instagram, YouTube or wherever.

Jumprope officially launches its iOS app today with plenty of how-tos for making chocolate chip bars, Easter eggs, flower boxes or fierce eyebrows. “By switching from free-form linear video to something much more structured, we can make it much easier for people to share their knowledge and hacks,” says Jumprope co-founder and CEO Jake Poses.

The rise of Snapchat Stories and Pinterest have made people comfortable jumping on camera and showing off their niche interests. By building a new medium, Jumprope could become the home for rapid-fire learning. And because viewers will have tons of purchase intent for the makeup, art supplies or equipment they’ll need to follow along, Jumprope could make serious cash off ads or affiliate commerce.

The opportunity to bring instruction manuals into the mobile video era has attracted a $4.5 million seed round led by Lightspeed Venture Partners and joined by strategic angels like Adobe Chief Product Officer Scott Belsky and Thumbtack co-founders Marco Zappacosta and Jonathan Swanson. People are already devouring casual education content on HGTV and the Food Network, but Jumprope democratizes its creation.

Jumprope co-founders (from left): CTO Travis Johnson and CEO Jake Poses

The idea came from a deeply personal place for Poses. “My brother has pretty severe learning differences, and so growing up with him gave me this appreciation for figuring out how to break things down and explain them to people,” Poses reveals. “I think that attached me to this problem of ‘how do you organize information so it’s simple and easy to understand?’ Lots and lots of people have this information trapped in their heads because there isn’t a way to easily share that.”

Poses was formerly the VP of Product at Thumbtack where he helped grow the company from 8 to 500 people and a $1.25 billion valuation. He teamed up with AppNexus’ VP of engineering Travis Johnson, who’d been leading a 50-person team of coders. “The product takes people who have knowledge and passion but not the skill to make video [and gives them] guard rails that make it easy to communicate,” Poses explains.

Disrupting incumbents like YouTube’s grip on viewers might take years, but Jumprope sees its guide creation and export tool as a way to infiltrate and steal their users. That strategy mirrors how TikTok’s watermarked exports colonized the web.

Jumprope lays out everything you’ll need to upload, including a cover image, introduction video, supplies list and all your steps. For each, you’ll record a video that you can then enhance with voice-over, increased speed, music and filters.

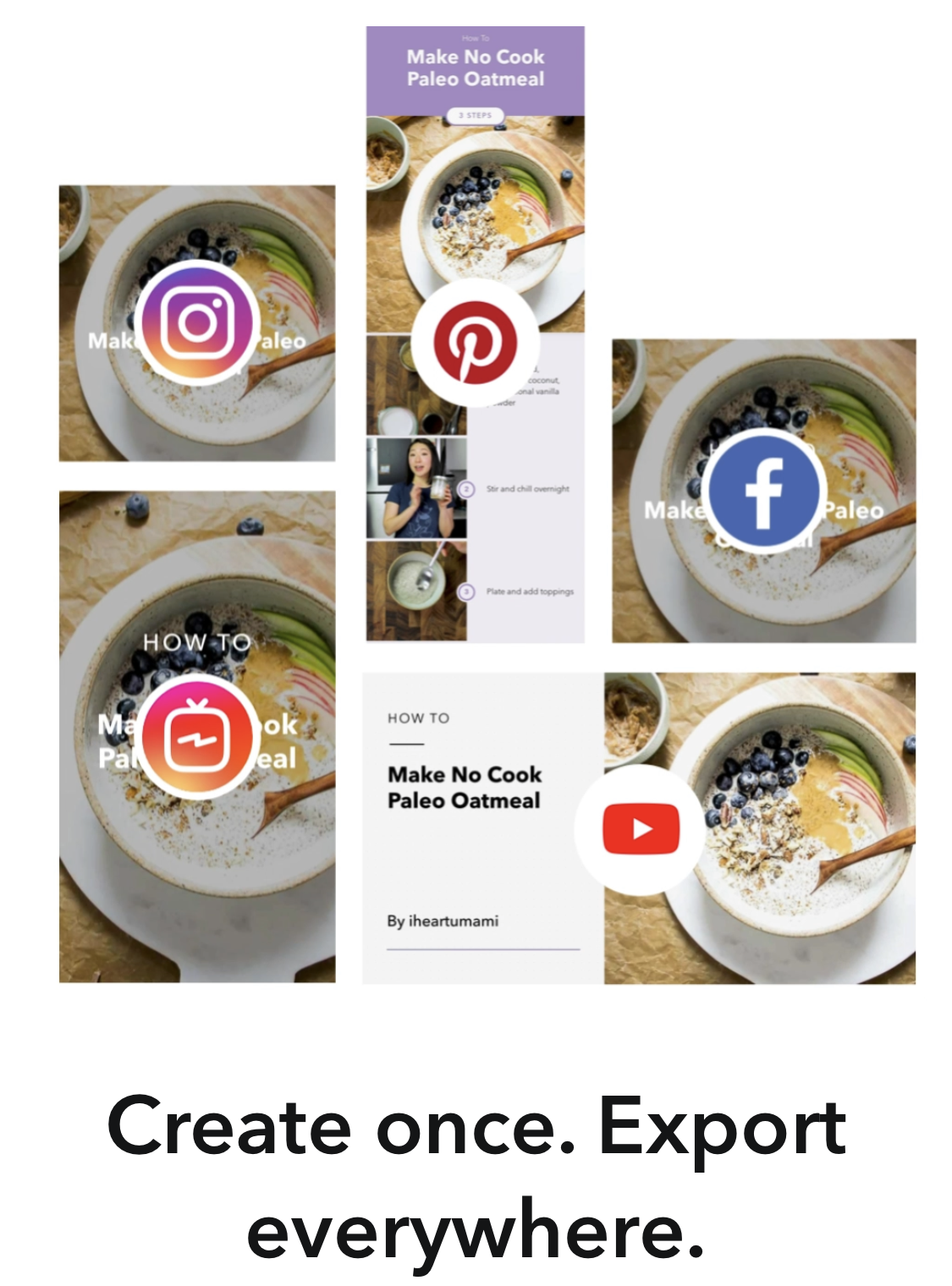

Creators are free to suggest their own products or enter affiliate links to monetize their videos. Once it has enough viewers, Jumprope plans to introduce advertising, but it could also add tipping, subscriptions, paid how-tos or brand sponsorship options down the line. Creators can export their lessons with five different border themes and seven different aspect ratios for posting to Instagram’s feed, IGTV, Snapchat Stories, YouTube or embedding on their blog.

Creators are free to suggest their own products or enter affiliate links to monetize their videos. Once it has enough viewers, Jumprope plans to introduce advertising, but it could also add tipping, subscriptions, paid how-tos or brand sponsorship options down the line. Creators can export their lessons with five different border themes and seven different aspect ratios for posting to Instagram’s feed, IGTV, Snapchat Stories, YouTube or embedding on their blog.

“Like with Stories, you basically tap through at your own pace,” Poses says of the viewing experience. Jumprope offers some rudimentary discovery through categories, themed collections or what’s new and popular. The startup has done extensive legwork to sign up featured creators in all its top categories. That means Jumprope’s catalog is already extensive, with food guides ranging from cinnabuns to pot roasts to how to perfectly chop an onion.

“You’re not constantly dealing with the frustration of cooking something and trying to start and stop the video with greasy hands. And if you don’t want all the details, you can tap through it much faster” than trying to skim a YouTube video or blog post, Poses tells me. Next the company wants to build a commenting feature where you can leave notes, substitution suggestions and more on each step of a guide.

Poses claims there’s no one building a direct competitor to its mobile video how-to editor. But he admits it will be an uphill climb to displace viewership on Instagram and YouTube. One challenge facing Jumprope is that most people aren’t hunting down how-to videos every day. The app will have to work to remind users it exists and that they shouldn’t just go with the lazy default of letting Google recommend the videos it hosts.

The internet has gathered communities around every conceivable interest. But greater access to creation and consumption necessitates better tools for production and curation. As we move from a material to an experiential culture, people crave skills that will help them forge memories and contribute to the world around them. Jumprope makes it a lot less work to leap into the life of a guru.

You can watch my first Jumprope here or below to learn how to tie up headphones without knots:

Powered by WPeMatico

Five years ago, Dynamic Yield was courting an investment from The New York Times as it looked to shift how publishers paywalled their content. Last month, Chicago-based fast food king McDonald’s bought the Israeli company for $300 million, a source told TechCrunch, with the purpose of rethinking how people order drive-thru chicken nuggets.

The pivot from courting the grey lady to the golden arches isn’t as drastic as it sounds. In a lot of ways, it’s the result of the company learning to say “no” to certain customers. At least, that’s what Bessemer’s Adam Fisher tells us.

The Exit is a new series at TechCrunch. It’s an exit interview of sorts with a VC who was in the right place at the right time but made the right call on an investment that paid off.

Fisher

Fisher was Dynamic Yield founder Liad Agmon’s first call when he started looking for funds from institutional investors. Bessemer bankrolled the bulk of a $1.7 million funding round which valued the startup at $5 million pre-money back in 2013. The firm ended up putting about $15 million into Dynamic Yield, which raised ~$85 million in total from backers including Marker Capital, Union Tech Ventures, Baidu and The New York Times.

Fisher and I chatted at length about the company’s challenging rise and how Israel’s tech scene is still being underestimated. Fisher has 11 years at Bessemer under his belt and 14 exits including Wix, Intucell, Ravello and Leaba.

The interview has been edited for length and clarity.

Lucas Matney: So, right off the bat, how exactly did this tool initially built for publishers end up becoming something that McDonalds wanted?

Adam Fisher: I mean, the story of Dynamic Yield is unique. Liad, the founder and CEO, he was an entrepreneur in residence in our Herzliya office back in 2011. I’d identified him earlier from his previous company, and I just said, ‘Well, that’s the kind of guy I’d love to work with.’ I didn’t like his previous company, but there was something about his charisma, his technology background, his youth, which I just felt like “Wow, he’s going to do something interesting.” And so when he sold his previous company, coincidentally to another Chicago based company called Sears, I invited him and I think he found it very flattering, so he joined us as an EIR.

And really only at the very end of his residence did he come up with this idea that would become Dynamic Yield. He came about it very much focused on the problem he saw with publishers being outwitted by ad buyers. He felt like all the big publishers really didn’t understand their digital businesses, didn’t understand their users, didn’t understand how performance ad buying was working, and he began to build a product that could dynamically optimize a publisher’s website to maximize revenue, hence the yield … the dynamic yield.

But very quickly, we told him, ‘That’s interesting, but we’re not sure how big that market is. And, you know it’s not always great to sell to those kind of weak customers. Sometimes they’re weak for a reason.’

Powered by WPeMatico

Airbase is a startup with a plan to change the way you think about accounting around spending. Instead of multiple workflows, it wants to create a simpler one involving, well, Airbase. It’s a bold move for any startup to take on something as entrenched as financials, but it’s giving it a shot, and today the company launched with a $7 million Series A investment.

First Round Capital was lead investor. Maynard Webb, Village Global, BoxGroup and Quiet Capital also participated. The deal closed at the end of November last year. This is the first external funding for the company, which company founder and CEO Thejo Kote had bootstrapped previously with $300,000 of his own money.

“At a high level, Airbase is the first all-in-one spend management system. It replaces a number of different systems that companies use to manage how they spend money,” Kote told TechCrunch.

He knows of what he speaks. Prior to starting this company, Kote co-founded Automatic, a startup that he sold to SiriusXM for more than $100 million in 2017. As a founder, he saw just how difficult it was to track the vast variety of spending inside a company, from supplies to subscriptions to food and drink.

“Think about the hundreds of things that companies spend money on, and the way in which the management of that happens is a pretty broken process today,” he said. For starters, it usually involves some sort of approval request in a tool like Slack, Jira or Google forms.

Once approved, the person requesting the expense will put that on a company credit card, then have to submit expense reports at the end of each month using a tool like Expensify. If you purchase from a vendor, then that involves an invoice and that has to be processed and paid. Finally it would need to be reconciled and accounted for in accounting software. Each step of this process ends up being time-consuming and costly for an organization.

Kote’s idea was to take this process and streamline it by removing the friction, which he saw as being related to the disparate systems in place to get the work done. He believed by creating a single workflow on a unified, single platform he could create a smoother system for everyone involved.

He is putting that single system between the bank and the accounting system, including a virtual Airbase Visa card that can take the place of physical cards if desired. Request for spending happens inside Airbase instead of an external tool. When the virtual card gets charged, bookkeeping and reconciliation gets handled in Airbase and pushed to your accounting package of choice.

Airbase workflow. Diagram: Airbase

This could be a difficult proposition for companies with existing systems in place, but could be attractive to startups and small companies whose accounting systems have not yet hardened. Perhaps that’s why most of Airbase’s customers are startups or SMBs with between 50 and 1000 employees, such as Gusto, Netlify and Segment.

Bill Trenchard, general partner at lead investor First Round Capital, says he has seen very little innovation in this space and that’s what drew him to Airbase. “Airbase has taken a bold step forward to create an entirely new paradigm. It delivers a real solution to the biggest problems finance teams face as their companies grow,” Trenchard said in a statement.

The company was founded in 2017 and has 22 employees. It has a sales office in San Francisco, but other employees are spread across four countries.

Powered by WPeMatico

This week’s banishment of host Scott Rogowsky was merely a symptom of the ongoing struggle to decide who will lead HQ Trivia. According to multiple sources, over half of the startup’s staff signed an internal petition to depose CEO Rus Yusupov who they saw as mismanaging the company. But Yusupov then fired three core supporters of the mutiny, leading to a downward spiral of morale that mirrors HQ’s plummeting App Store rank.

TechCrunch spoke to multiple sources familiar with HQ Trivia’s internal troubles to piece together how the live video mobile game went from blockbuster to nearly bust. Two sources said HQ recently only had around $6 million in the bank but was burning over $1 million per month, meaning its runway could be dwindling. But its early investors are reluctant to hand Yusupov any more cash. “

Employees petitioned to remove HQ Trivia’s CEO Rus Yusupov

HQ reimagined gaming and mobile entertainment with the launch of its 12-question trivia game in August 2017 where players all competed live in twice-daily shows with anyone who got all the answers right split a cash jackpot. The games felt urgent since you could only participate at designated times, fun to play against friends or strangers, and winning carried a significance no single-player or non-stop online game could match.

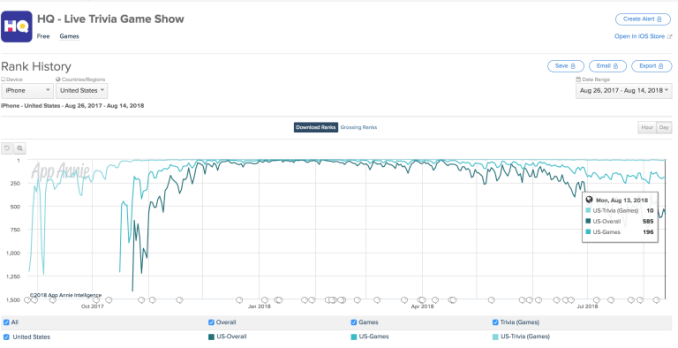

When TechCrunch wrote the first coverage of HQ Trivia in October 2017, it had just 3500 concurrent players. But by January it had climbed to the #3 game and #6 overall app in the App Store, and grown to 2.38 million players by March. Quickly, copycats from China and Facebook entered the market. But they all lacked HQ’s secret weapon — its plucky host comedian Scott Rogowsky. Affectionately awarded nicknames like Quiz Daddy, Quiz Khalifa, Host Malone, and Trap Trebek from the “HQties” who played daily, he was the de facto face of the startup.

Yet HQ had some shaky foundations. Co-founder Colin Kroll, who’d also started Vine with Yusupov and sold it to Twitter, had been fired from Twitter after 18 months for being a bad manager, Recode reported. He’d also picked up a reputation of being creepy around female employees, as well as Vine stars, TechCrunch has learned. Rapid growth and an investigation by early HQ investor Jeremy Liew that found no egregious misconduct by Kroll paved the way for a $15 million investment. The round was led by Founders Fund’s Cyan Bannister, and it valued HQ at over $100 million.

Yusupov failed to translate that cash into sustained growth and product innovation. His public behavior had already raised flags. He yelled at a Daily Beast reporter after the outlet’s Taylor Lorenz interviewed Rogowsky without Yusupov’s approval, threatening to fire the host. “You’re putting Scott’s job in jeopardy. Is that what you want? . . . Please read me your story word for word,” Yusupov said. When he learned Rogowsky had expressed his preference for salad restaurant chain Sweetgreen, Yusupov shouted “He cannot say that! We do not have a brand deal with Sweetgreen! Under no circumstances can he say that.” The next day, Yusupov falsely claimed he’d never threatened Rogowsky’s job.

With HQ’s bank account full, sources say Yusupov was extremely slow to make decisions, allowing HQ to stagnate. The novelty of playing trivia for money via phone has begun to wear off, and people increasingly ignored HQ’s push notifications to join its next game. But beyond bringing in some guest hosts and the option to buy a second chance after a wrong answer, HQ ceased to evolve. HQ fell to the #196 game on iOS and the #585 overall app as concurrent players waned.

That’s when things started to get a bit Game Of Thrones.

Liew pushed for HQ to swap Kroll into the CEO spot in September 2018 while moving Yusupov to Chief Creative Officer, which was confirmed despite an HR complaint against Kroll for aggressive management. However, three sources tell TechCrunch that Yusupov pushed that HQ employee to file the complaint against Kroll. As the WSJ reported after Kroll’s death, that employee later left the startup because they felt that they’d been exploited. “There was definitely what felt like manipulation there, and that’s also why that employee resigned from the company.” one source said. Another source said that staffer “believed Rus used their unhappiness about work to use them as a pawn in his CEO war and not because Rus actually cared about resolving things.”

Cyan of Founders Fund stepped down from HQ’s board after the decision to swap out Yusupov due to her firm’s reputation of keeping founders in control, Recode’s Kurt Wagner reported. Sources say that despite Kroll’s reputation, the staff believed in him. “Colin loved HQ and was dedicated to all the employees more than Rus. Rus cares about Rus. Colin cared about the content” a source tells me.

Three sources say that in a desperate ploy to retain power and prevent Kroll’s rise, Yusupov suggested Rogowsky, a comedian with no tech or management experience, be made CEO of HQ Trivia. He even suggested the company film a reality show about Rogowsky taking over. That idea was quickly shot down as preposterous.

“It was a very personal desperation tactic not to have Colin be CEO. It was not a professionally thought-out idea” a source tells me, though another said it was always hard to tell if Yusupov’s crazy ideas were jokes. Both Yusupov and HQ Trivia declined to respond to multiple requests for comment, but we’ll update if we hear back.

HQ Trivia co-founder Colin Kroll passed away in December

Then tragedy struck in December. Kroll, then CEO, was found dead in his apartment from a drug overdose. Employees were distraught over what would happen next. “Colin’s plan was to ship fast, and get new things out there” a source says, noting that Kroll had pushed for the release of HQ’s first new game type HQ Words modeled after Wheel Of Fortune. “He wasn’t perfect but in the time he was in charge, the ship started to turn, but when Rus took over again it was like the 9 months where we did nothing.”

By February 2019, HQ’s staff was fed up. Two sources confirm that 20 of the roughly 35 employees signed a letter asking the board to remove Yusupov and establish a new CEO. With HQ’s download rate continuing to sink, they feared he’d run the startup into the ground. One source suggested Yusupov might rather have seen the whole startup come crashing down with the blame placed on the product than have it come to light that he played a large hand in the fall. The tone of the letter, which was never formally delivered but sources believe the board knew of, wasn’t accusatory but a plea for transparency about the company’s future and the staff’s job security.

At a hastily convened all-hands meeting in late February, HQ investor Liew told the company his fund Lightspeed would support a search for a new CEO to replace Yusupov, and provide that new CEO with funding for 18 more months of runway. Liew told the staff he would step down from the board once that CEO was found, but the search continues and so Liew remains on HQ’s board.

“Mostly everyone was on Jeremy’s side as no one wanted to work under Rus. Jeremy wasn’t trying to screw him over the way Rus would screw other people over. He just wanted to do what was right, getting behind what everyone wanted” a source said of Liew.

Instead, HQ’s board moved forward with instituting a new executive decision-making committee composed of Yusupov, HQ’s head of production Nick Gallo, and VP of engineering Ben Sheats. Yusupov would remain interim CEO, and he continued to cling to power and there’s been little transparency about the CEO replacement process. Until a new CEO is found, HQ must subsist on its existing funds. The staff is “always worried about running out of runway” and are given vague answers when they ask leadership about how much money is left.

On March 1st, the committee emerged from a meeting and fired three employees who had spearheaded the petition and been vocal about Yusupov’s failings.

One who wasn’t fired was Rogowsky, despite sources saying at one point he’d tried to organize the staff to go on strike. Other employees had been cautious about standing up to Yusupov. “Everyone was terrified of retaliation. Their fears have totally been validated” a source explains. Engineers and other staffers with strong employment prospects began to drain out of the company. Those left were just trying to hold onto their jobs. Without inspiring leadership or a strategy to reverse user shrinkage, recruiting replacements would prove difficult.

Yusupov remains on the board, along with Tinder CEO Elie Seidman who Yusupov appointed to his additional common seat. Liew retains his seat until the new CEO is found and given that seat. And Kroll’s seat appears to have gone to Lightspeed partner Merci Victoria Grace. Lightspeed and Cyan of Founders Fund declined to respond to requests for comment.

Tensions at HQ and a desire to diversify his prospects led Rogowsky to pick up a side gig hosting baseball talk show ChangeUp on the DAZN network, TMZ reported this week. He’d hoped to continue hosting HQ during its big weekend contests. But tensions with Yusupov and the CEO’s desire for the host to remain exclusively at HQ led negotiations to sour causing Rogowsky to leave the startup entirely. TechCrunch was first to report that he’s been replaced by former HQ guest host Matt Richards, who Yusupov bluntly told me Friday had polled higher than Rogowsky in a SurveyMonkey survey of HQ’s top players.

In tweets, Rogowsky revealed that that “Sadly, it won’t be possible for me to continue hosting HQ concurrently as I had hoped” noting, “I wasn’t given the courtesy of a farewell show.” Finding a way to preserve Rogowsky’s ties to HQ likely would have been best for the startup. TechCrunch had raised the concern a year ago that unless Rogowsky was properly locked in with an adequate equity vesting schedule at HQ, he could leave. Or worse, he could be poached by Facebook, Snapchat, or YouTube to host an HQ competitor.

“Rus is a visionary but not a good leader. He is extremely manipulative in an unproductive way. He’s a dude who just cares a lot about his reputation” a source noted. “A lot of the negative sentiment amongst staff is the belief that he cares more about his reputation than the company itself.”

HQ’s next attempt to revive growth appears to be HQ Editor’s Picks, is described as “a new live show on your phone where our host shows funny viral videos and you decide on who gets paid.” Finally it seems willing to embrace the potential of interactive live video entertainment outside of trivia and puzzles. HQ Editor’s Picks will face an uphill battle, since HQ dropped out of the top 1500 iOS apps last month, according to App Annie. Sensor Tower estimates that HQ saw just 8 percent as many downloads in March 2019 as March 2018.

After the loss of its spirit animal Rogowsky, the employees’ chosen leader Kroll, the supervision of veteran investor Cyan, and its product momentum, tough questions are what remain for HQ Trivia. The company’s struggles have paralyzed its progress towards finding a new viral mechanic or game format that attracts users. While HQ Words is fun, it’s too similar to its trivia competition to change the startup’s trajectory. And all of the in-fighting could scare off any talent hoping to turn HQ around. Unfortunately, securing an extra life for the game will take a more than a $3.99 in-app purchase.

Powered by WPeMatico

Hundreds of billions of dollars in venture capital went into tech startups last year, topping off huge growth this decade. Here at DocSend, we’re seeing the downstream effects in our data: investors who receive DocSend links are reviewing more pitch decks than ever, as more people build companies and try to get a slice of the funding opportunities.

So it stands to reason that making your pitch deck stand out is critical to raising a round. But how do you do that in such a competitive landscape?

After analyzing both successful and failed fundraising pitch decks, we’ve learned that storytelling matters and this hasn’t changed over the last few years. This makes intuitive sense — who doesn’t love a good story?

But does telling a story help founders raise capital successfully? And more importantly, do you fail to fundraise if you don’t tell a story? In this post, I’m going to share some hard evidence.

It follows up on my post over on TechCrunch, looking at three big mistakes we see in failed pitch decks.

Before we start diving into the data, here’s why we know: our document sharing and tracking platform is used every day by thousands of startups to share their decks securely with investors, with visits to pitch decks shared via DocSend having grown 4x from 2017 to 2018. Controlling for DocSend’s growth, we estimate that investors are viewing 35% more decks in 2018 than they did in 2017.

In total, over 100,000 users have shared over 2.2 million links through DocSend since we launched in 2014, and these documents have received over 220 million views; while we’ve grown quickly among sales, business development and customer success teams, startup pitch decks have continued to be a popular use-case. We’ve also been analyzing the pitch data in a collaboration with Harvard Business School since 2015, so we’re experienced at analyzing and interpreting this data.

The old adage “you only get one chance to make a first impression” is true when it comes to pitch decks, and in fact that was the case for our company’s own fundraising process. When I pitched DocSend for our seed round, I knew what we were up against — why will this be a big business? And, why won’t Google build this? Our product was still in private beta, and we had no revenue. However, we had an MVP and those who were using our product, including our potential investors, found the product to be very useful.

Powered by WPeMatico

Fundraising has always been something of a black box. High-flying companies make it seem like a breeze, but most entrepreneurs lose sleep over it. My first startup was called Pursuit.com and although we successfully raised a seed round, it was incredibly tough (we were eventually aqui-hired by Facebook). DocSend is my second startup, and it has taught me a lot about the process — not only because of our own fundraising, but because the product itself reveals big pitching trends in a unique way.

Since 2014, over 100,000 users have shared over 2.2 million links through our document tracking and sharing platform, and these documents have received over 220 million views. Thousands of founders share their funding decks with prospective investors every day, in addition to our product’s other uses for sales, business development and customer success. To get insights about all this activity, we have a long-running partnership with Harvard Business School, where we’ve been analyzing the anonymized fundraising data of startups attempting to raise a Seed or an A round.

We shared our early learnings in a TechCrunch article in 2015, Lessons from a study of perfect pitch decks. In this post, I’ll update our findings based on the last four years of data (and a lot of user growth on our side).

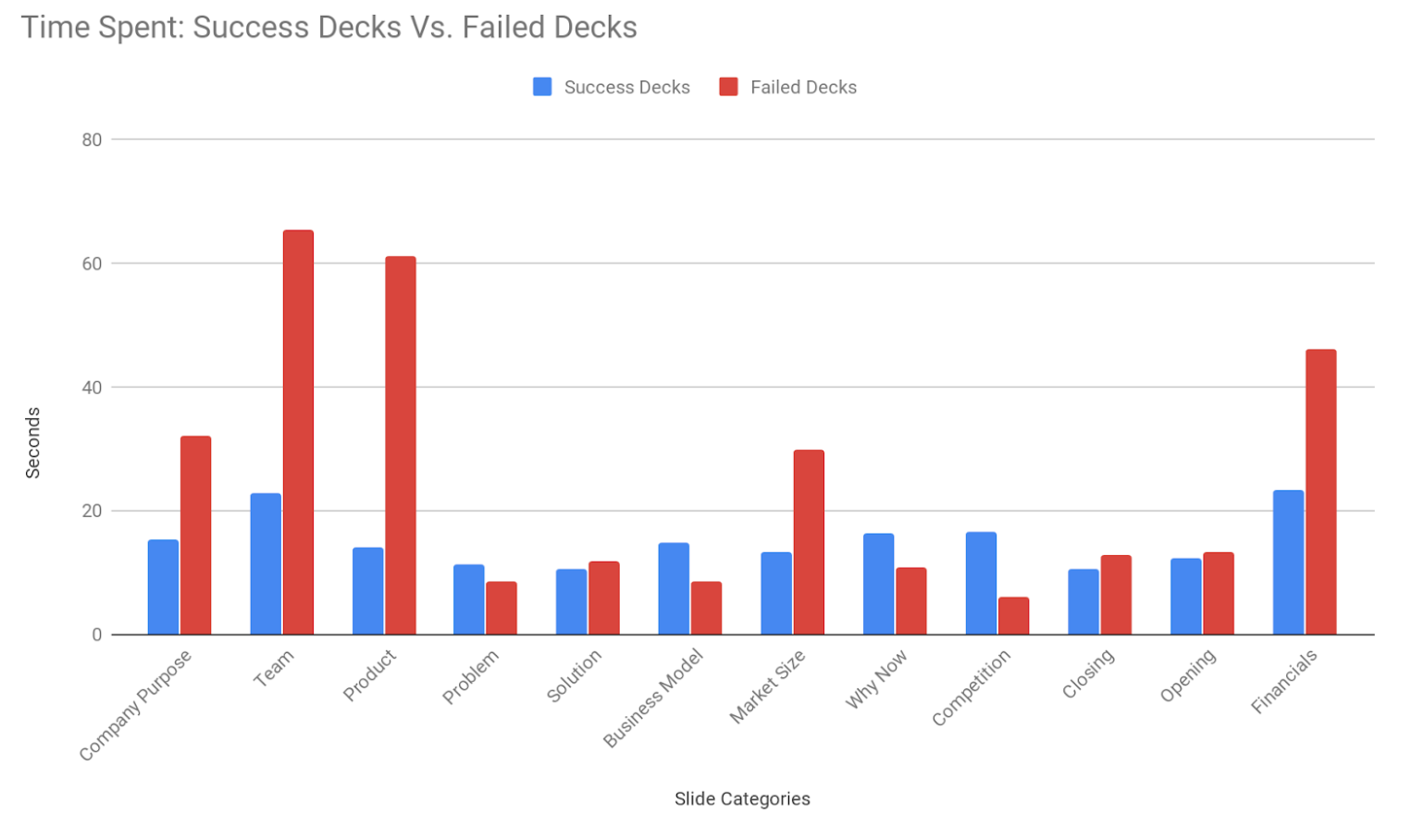

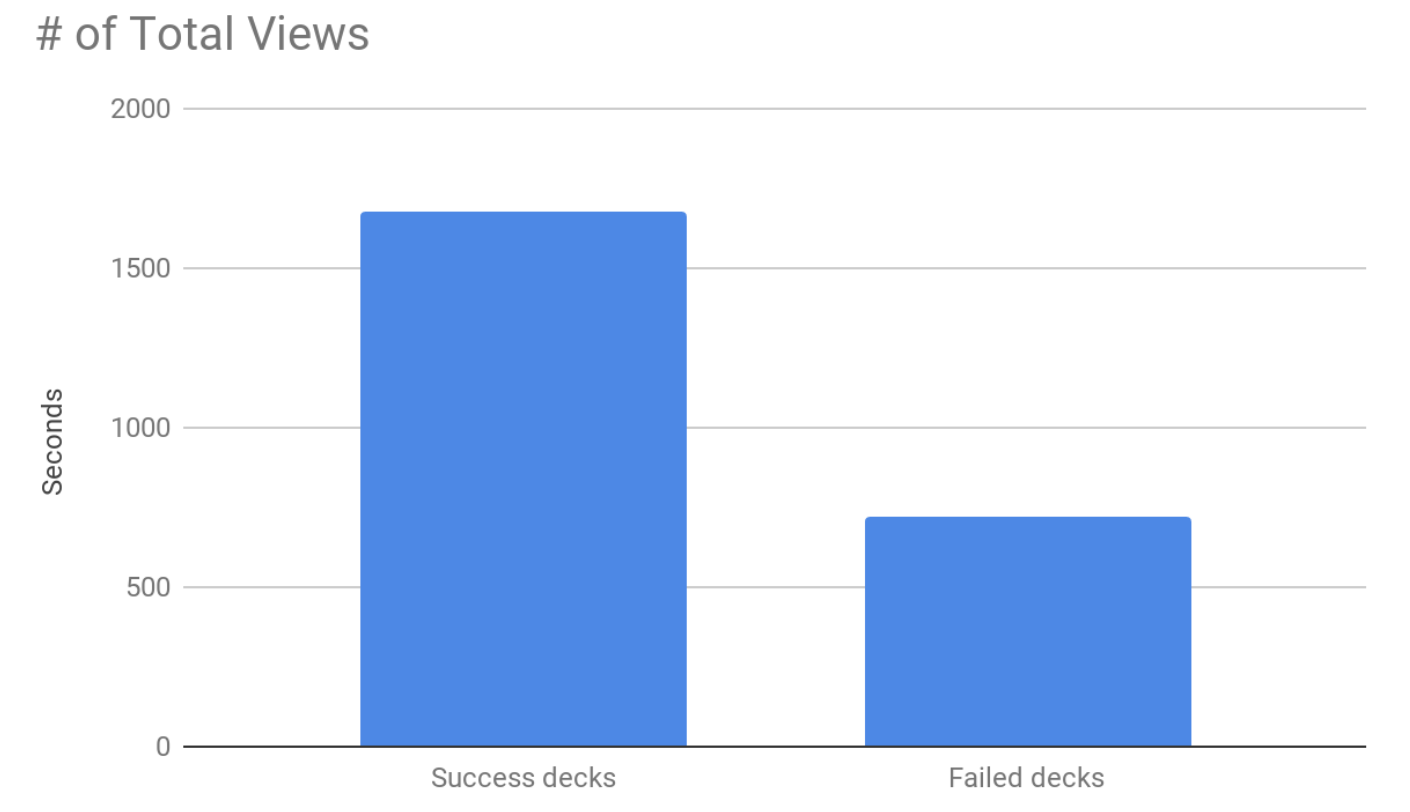

So what differentiates a winning seed round pitch deck from those that fail to raise capital? While both successful and failed pitch decks are about the same length, an average of 18 pages, how the content is structured is vastly different. And while investors spend the same amount of time on both, 3.7 minutes on average, where they spend time tells us a lot about what successful pitches and failed pitches have in common. Below, I detail three mistakes that you want to avoid.

If you want to check out more details on what you should do in your deck, read my follow-up article “Data tells us that investors love a good story“ over on Extra Crunch.

It’s very tempting, especially for technical founders, to start pitch decks with how incredible their product is, how much time they’ve spent building it, their unique tech stack, and how convinced they are that they have just the right MVP for launch. But guess what?

You might think that’s a good thing. More time on my product slides, right? No. Data tells us that they are probably digging into the details trying to map your product‘s value to the current market needs and they are not coming away with a clear connection between the two.

Your target investors are also not your target customer. Showing screenshots and product details are just confusing for them. What are they looking at? Why does this matter? Most products are capable of being built; the question they are trying to answer is why is this product going to create a big business?

Image via DocSend

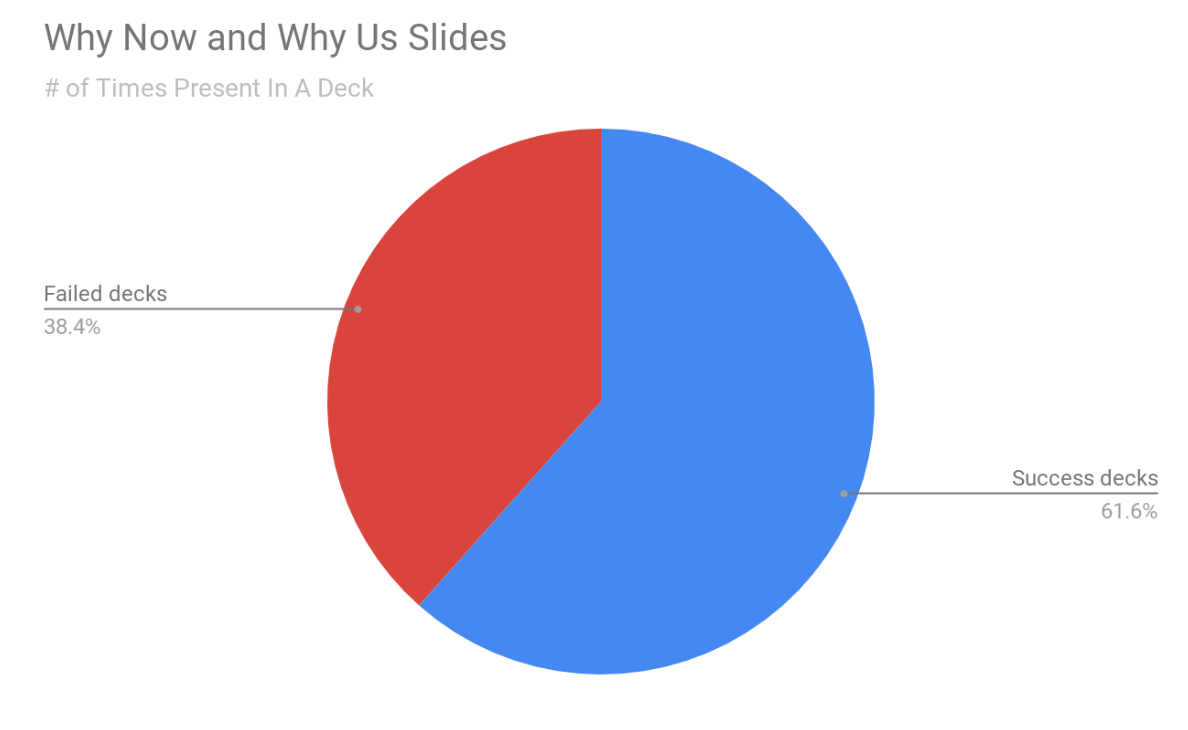

By now Simon Sinek has beaten this one into our collective brains with his start with the why Ted Talk and yet what we see in our data is that in failed decks, the “why now” and “why you” question has been left to the end. Successful pitches start with their company purpose, followed by why this team, and why the timing is right for this particular product.

In successful decks, investors spend 27 seconds on an average on “why now” and “why you” slides but in failed decks, they spend 62 seconds on these slides. We read this as investors are spending more time researching your team and your capabilities than they do with successful pitch decks. More time spent on these pages means that investors are not as convinced about this venture as the entrepreneur would like them to be. Entrepreneurs should focus on making their “why” slides part of a seamless narrative that leaves the investors wondering why this isn’t already a huge business.

Image via DocSend

Everyone loves a good story and investors are no exception to this rule. All successful pitch decks tell a compelling story and follow a similar narrative thread. They start with the company purpose, the big problem they are trying to solve, why now is the right time, and why they are the right team to solve it. Failed pitch decks start with the product, followed by business model, and competitive landscape. Successful decks cover these too but they invariably follow a narrative that makes intuitive sense while in failed decks there is no compelling narrative.

Successful decks also get more repeat visits, they are visited 2.3 times more than failed decks and are forwarded along more often than failed pitch decks.

Image via DocSend

In the early days, entrepreneurs spend most of their time conceiving and building their minimum viable product (MVP). Naturally, they feel compelled to pitch this to investors. Although unintuitive, data suggests that you should restrain yourself from talking about your product before you have painted a narrative about the business opportunity: why now and why you. Once investors are convinced of those key points, by all means, go through all the product details and roadmaps. Just don’t lead with your product.

This is the first of a series of articles about fundraising. My followup article now available on Extra Crunch reveals what our data shows you should do with your deck. In future installments, I’ll be sharing more about the difference between Seed, Series A, and Series B rounds as well as how fundraising challenges change as your company grows. For the next post, I’ll be writing about why some pitch decks raise way more money than others. In the meantime, have questions about the best way to raise money? Check out our blog or reach out to us on Twitter at: @rheddleston or @docsend.

Powered by WPeMatico

The SoftBank Vision Fund has been screaming from the venture headlines the last few months, driven by eye-popping rounds (and valuations!) into some of the most notable startups around the world. Yet, SoftBank isn’t the only player rapidly buying up the cap tables of top startups. Indeed, another firm, more than a century old, has been fighting for that late-stage equity crown.

… Who the what?

When our fintech contributor Gregg Schoenberg interviewed Charles Plowden, the firm’s joint senior partner, about the firm’s prodigious investing, we realized that we have never gone in-depth on one of the most influential investors in Silicon Valley. So here goes.

Baillie Gifford is a 110-year-old asset management firm based out of Edinburgh, Scotland, and has long had a penchant for pre-IPO tech companies. The firm was an early investor into some of the world’s most valuable private and public tech companies, boasting a roster of portfolio companies that includes unicorns from nearly all generations in modern tech, including everything from Amazon, Google and Salesforce to Tesla, Airbnb, Spotify, newly public Lyft, Palantir and even SpaceX.

Baillie Gifford’s reach stretches way beyond the 280/101 corridor. The firm has an extensive history of investing across geographies, with one of its first and most successful investments coming from an early entry into Chinese e-commerce titan Alibaba. More recently, Baillie Gifford even held a stake in recently IPO’d Chinese electric autonomous vehicle manufacturer NIO, and one the firm’s largest current holdings is South African internet conglomerate Naspers — which itself is an active investor and developer of emerging market tech infrastructure.

The firm’s low profile belies its aggressive capital deployment strategy. According to data from PitchBook, Baillie Gifford was involved in roughly 20 deals in 2018 and was involved as a lead or participant in transactions worth over $21 billion in aggregate total deal size — beating out behemoth Tiger Global, which tallied roughly $13.25 billion on the same metric.

The firm has about $2 billion focused on private companies, so while it is aggressive in getting into later-stage rounds, it is not nearly operating at the scale of say the Vision Fund or Tiger Global. While the asset manager primarily focuses on public-equity investing, the firm has participated in investment rounds as early as Series A, according to PitchBook and Crunchbase data.

Overall, the firm manages $221 billion in assets under management as of January 2019.

As one of the earliest asset managers to invest in pre-IPO tech companies, Baillie Gifford has sourced investments through its longstanding reputation as an investor. The firm first began really diving into private tech investing in the wake of the dot-com bubble. The firm doubled down on the tech sector at a time when few others were investing and sifted through the blood bath to find cheap entryways into companies that are now amongst the world’s largest.

Today, however, the landscape is undoubtedly much different. Tech companies now make up four of the top five largest companies in the world by market cap, and seven out of the top 10. Now, everyone wants a piece of the pie and there seem to be more checks being thrown at founders than most can even fit in their wallets.

With more capital at their fingertips than ever before, founders are opting to keep their startups private for longer in order to avoid the stress of having to deal with short-term public market investors who are more often than not looking for the first opportunity to cash out. So why, amongst so much choice, do companies continue to partner with Baillie Gifford?

Plowden has some insights on that front in our interview, but the summary is that Baillie Gifford just sees itself as a partner. Unlike its peers and most investment managers, Baillie Gifford has no outside shareholder owners to report to. As a partnership, wholly owned and run by just 44 partners, the firm doesn’t face the organizational constraints that beset most firms that manage billions and billions in assets.

The result? In short, Baillie Gifford has quietly been making a killing, and probably drinking some good Scotch along the way, as well.

Powered by WPeMatico

“It is our contention that the investment industry may be experiencing a peak of its own, in this case the point of the maximum rate at which it extracts value from its clients’ assets. Let’s call it Peak Gravy.” That’s a recent quote from Tom Coutts, who is one of a few dozen partners at Baillie Gifford (See Arman Tabatabai’s profile here). It’s also typical of the provocative sentiments offered by this band of fund managers who are based in Edinburgh, but scour the world looking for opportunities.

In an effort to distinguish its world view, the firm has introduced the somewhat eyebrow-raising tagline, “We’re actual investors.” For many US technology observers, though, Baillie Gifford is known for its investments in unicorns. But as Extra Crunch’s executive editor Danny Crichton and I found out in a recent conversation with Charles Plowden (one of two senior partners and the overseer of the firm’s investment departments), there’s a lot more to the story and motivations behind this unique 110-year-old partnership that’s still going strong.

Powered by WPeMatico

Armis is helping companies protect IoT devices on the network without using an agent, and it’s apparently a problem that is resonating with the market, as the startup reports 700 percent growth in the last year. That caught the attention of investors, who awarded them a $65 million Series C investment to help keep accelerating that growth.

Sequoia Capital led the round with help from new investors Insight Venture Partners and Intermountain Ventures. Returning investors Bain Capital Ventures, Red Dot Capital Partners and Tenaya Capital also participated. Today’s investment brings the total raised to $112 million, according to the company.

The company is solving a hard problem around device management on a network. If you have devices where you cannot apply an agent to track them, how do you manage them? Nadir Izrael, company co-founder and CTO, says you have to do it very carefully because even scanning for ports could be too much for older devices and they could shut down. Instead, he says that Armis takes a passive approach to security, watching and learning and understanding what normal device behavior looks like — a kind of behavioral fingerprinting.

“We observe what devices do on the network. We look at their behavior, and we figure out from that everything we need to know,” Izrael told TechCrunch. He adds, “Armis in a nutshell is a giant device behavior crowdsourcing engine. Basically, every client of Armis is constantly learning how devices behave. And those statistical models, those machine learning models, they get merged into master models.”

Whatever they are doing, they seem to have hit upon a security pain point. They announced a $30 million Series B almost exactly a year ago, and they went back for more because they were growing quickly and needed the capital to hire people to keep up.

That kind of growth is a challenge for any startup. The company expects to double its 125-person work force before the end of the year, but the company is working to put systems in place to incorporate those new people and service all of those new customers.

The company plans to hire more people in sales and marketing, of course, but they will concentrate on customer support and building out partnership programs to get some help from systems integrators, ISVs and MSPs, who can do some of the customer hand-holding for them.

Powered by WPeMatico