funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Embrace, an LA-based startup that offers a mobile-first application performance management platform, today announced that it has raised a $4.5 million funding round led by Pritzker Group Venture Capital. This brings the company’s total funding to $7 million. New investors Greycroft, Miramar Ventures and Vy Captial also participated in this round, as did previous investors Eniac Ventures, The Chernin Group, Techstars Ventures, Tikhon Bernstam of Parse and others.

Current Embrace customers include the likes of Home Depot, Headspace, OkCupid, Boxed, Thrive Market and TuneIn. These companies use the service to get a better view of how their apps perform on their users’ devices.

As Embrace CEO and co-founder Eric Futoran, who also co-founded entertainment company Scopely, argues, too many similar services mostly focus on crashes, yet those only constitute a small number of the actual user experience issues in most apps. “To a large extent, crashes are solved,” he told me. “The crash percentages are often 99.8 percent crash-free and yet users are still complaining.”

That’s because there are plenty of other issues beyond code exceptions, which many tools focus on almost exclusively, that can force an app to close (think memory issues or the OS shutting down the app because it uses too many CPU cycles). “To users, that looks like a crash. Your app closed. But in no way, that’s a crash from a technical perspective,” Futoran noted.

Raising this new round, Futoran told me, was pretty easy. Indeed, Pritzker approached the company. “It was not fundraising,” he said. “They sat us down and said, ‘we want to fund you guys,’ which I find pretty unusual. So I’ve been calling it a pre-emptive round.” He also noted that having Pritzker involved should help open up the mid-west market for Embrace, which is mostly focusing on enterprise customers (though Futoran’s definition of “enterprise” includes the likes of digital-first companies like Headspace).

“We saw many organizations trust Embrace’s seamless and innovative optimization platform to quickly identify and resolve any user-impacting issues within their apps, and we’re optimistic about the future of the company in this growing market,” said Gabe Greenbaum, an LA-based partner for Pritzker Group Venture Capital. “We look forward to this next stage in the company’s growth journey and are honored to partner with Eric and Fredric to help them achieve their vision.”

The company plans to use the new funding to increase its go-to-market capabilities, and grow its team to build out its technology.

Powered by WPeMatico

The RealReal, an online retailer for authenticated luxury consignment, has authorized the sale of up to $70 million in new shares, per a Delaware stock authorization filing discovered by the Prime Unicorn Index. If the company raises the entire amount, it would reach a valuation of $1.06 billion, cementing its status as the newest e-commerce unicorn.

The filing doesn’t guarantee The RealReal will sell the full amount of authorized shares. The company declined to comment on its fundraising plans.

The RealReal is led by founder and chief executive officer Julie Wainwright (pictured), the former CEO of Pets.com, a company now synonymous with the dot-com bust. It has raised quite a bit of capital to date — a total of $288 million from venture capital and private equity backers, including Great Hill Partners, Sandbridge Capital, PWP Growth Equity, Industry Ventures, Greycroft Partners and Canaan Partners. Most recently, The RealReal closed a Series G financing of $115 million in July 2018 that valued the business at $745 million, per PitchBook.

The RealReal has recently expanded its brick-and-mortar footprint and added additional e-commerce fulfillment centers as demand increased for its supply of second-hand luxury items. Founded in 2011, the company operates eight luxury consignment offices, where customers can receive free valuations of their luxury items. The RealReal is headquartered in San Francisco.

In a conversation with TechCrunch in 2017, Wainwright confirmed the company’s intent to go public at some point. With this upcoming round, The RealReal would be well placed for a 2020 initial public offering.

“That’s the goal,” Wainwright said during the interview. “We really aren’t in the mood to sell the business, we’re in the mood to go public at some point in the future.”

The RealReal competes with fellow second-hand e-tailers ThredUp and Poshmark . The latter is gearing up for a fall IPO, according to The Wall Street Journal. The online marketplace has tapped Morgan Stanley and Goldman Sachs to lead its offering after closing in on $150 million in revenue in 2018. ThredUp, another major player in the fashion retail market, hasn’t raised capital since 2015, but did begin opening physical stores in 2017 as part of its greater effort to compete with fellow venture-backed second-hand e-tailers.

The RealReal would also be the latest in a series of high-profile female-founded companies to gain unicorn status. Glossier tripled its valuation to $1.2 billion with a $100 million round earlier this year, followed by Rent the Runway, which attracted a $125 million investment at a $1 billion valuation, to name a few.

Powered by WPeMatico

Warehouse automation is all the rage in robotics these days. No surprise then, that another emerging player just got a healthy slice of venture funding. Massachusetts-based Locus Robotics this week announced that it has secured a $26 million Series C. The round, led by Zebra Ventures and Scale Venture Partners, brings the startup’s total funding to around $66 million.

The five-year-old company produces robotic shelving designed to transfer bins inside of warehouses. Founder Bruce E. Welty was onstage at our robotics event back in 2017 demonstrating the technology.

It’s a similar principle to many other players in the space, including Amazon’s Kiva and Bay Area-based Fetch. And like those companies, Locus has garnered interest from some big players — most notably delivery giant, DHL.

The robotics automation space has heated up quite a bit in 2019. Colorado-based Canvas, which makes autonomous warehouse delivery carts, was acquired by Amazon last week. Even Boston Dynamics is looking at the category as a way forward for its own impressive technologies, putting its robot Handle to work in a fulfillment center.

“We have seen a massive uptick in demand for the flexible automation incorporated into Locus’s multi-bot solution, which is uniquely suited to address these challenges,” CEO Rick Faulk says in a release tied to the news. “Not only is our solution proven to dramatically improve productivity and drive down costs, but it is also a source of scalable labor that can be adapted to meet the demands of numerous product and customer profiles. This new funding will enable us to scale to meet growing demand for our revolutionary solution worldwide.”

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Brian Heater and Lucas Matney shared their key takeaways from our Robotics + AI Sessions event at UC Berkeley last week.

The event was filled with panels, demos and intimate discussions with key robotics and deep learning founders, executives and technologists. Brian and Lucas discuss which companies excited them most, as well as which verticals have the most exciting growth prospects in the robotics world.

“This is the second [robotics event] in a row that was done at Berkeley where people really know the events; they respect it, they trust it and we’re able to get really, I would say far and away the top names in robotics. It was honestly a room full of all-stars.

I think our Disrupt events are definitely skewed towards investors and entrepreneurs that may be fresh off getting some seed or Series A cash so they can drop some money on a big-ticket item. But here it’s cool because there are so many students. robotics founders and a lot of wide-eyed people wandering from the student union grabbing a pass and coming in. So it’s a cool different level of energy that I think we’re used to.

And I’ll say that this is the key way in which we’ve been able to recruit some of the really big people like why we keep getting Boston Dynamics back to the event, who generally are very secretive.”

Brian and Lucas dive deeper into how several of the major robotics companies and technologies have evolved over time, and also dig into the key patterns and best practices seen in successful robotics startups.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

Mfine, an India-based startup aiming to broaden access to doctors and healthcare by using the internet, has pulled in a $17.2 million Series B funding round for growth.

The company is led by four co-founders from Myntra, the fashion commerce startup acquired by Flipkart in 2014. They include CEO Prasad Kompalli and Ashutosh Lawania who started the business in 2017 and were later joined by Ajit Narayanan and Arjun Choudhary, Myntra’s former CTO and head of growth, respectively.

The round is led by Japan’s SBI Investment with participation from sibling fund SBI Ven Capital and another Japanese investor, Beenext. Existing Mfine backers Stellaris Venture Partners and Prime Venture Partners also returned to follow-on. Mfine has now raised nearly $23 million to date.

“In India, at a macro-level, good doctors are far and few and distributed very unevenly,” Kompalli said in an interview with TechCrunch. “We asked ‘Can we build a platform that is a very large hospital on the cloud?,’ that’s the fundamental premise.”

There’s already plenty of money in Indian healthtech platforms — Practo, for one, has raised more than $180 million from investors like Tencent — but Mfine differentiates itself with a focus on partnerships with hospitals and clinics, while others have offered more daily health communities that include remote sessions with doctors and healthcare professionals who are recruited independently of their day job.

“We are entering a different phase of what is called healthtech… the problems that are going to be solved will be much deeper in nature,” Kompalli said in an interview with TechCrunch.

Mfine makes its money as a digital extension of its healthcare partners, essentially. That means it takes a cut of spending from consumers. The company claims to work with more than 500 doctors from 100 “top” hospitals, while there’s a big focus on tech. In particular, it says that an AI-powered “virtual doctor” can help in areas that include summarising diagnostic reports, narrowing down symptoms, providing care advice and helping with preventative care. There are also other services, including medicine delivery from partner pharmacies.

To date, Mfine said that its platform has helped with more than 100,000 consultations across 800 towns in India during the last 15 months. It claims it is seeing around 20,000 consultations per month. Beyond helping increase the utilization of GPs — Mfine claims it can boost their productivity 3 to 4X — the service can also help hospitals and centers increase their revenue, a precious commodity for many.

Going forward, Kompalli said the company is increasing its efforts with corporate companies, where it can help cover employee healthcare needs, and developing its insurance-style subscription service. Over the coming few years, that channel should account for around half of all revenue, he added.

A more immediate goal is to expand its offline work beyond Hyderabad and Bangalore, the two cities where it currently operates.

“This round is a real endorsement from global investors that the model is working,” he added.

Powered by WPeMatico

Series B rounds used to be about establishing a product-market fit, but for some startups the whole process seems to be accelerating. Harness, the startup founded by AppDynamics co-founder and CEO Jyoti Bansal is one of those companies that is putting the pedal the metal with his second startup, taking his learnings and a $60 million round to build the company much more quickly.

Harness already has an eye-popping half billion dollar valuation. It’s not terribly often I hear valuations in a Series B discussion. More typically CEOs want to talk growth rates, but Bansal volunteered the information, excited by the startup’s rapid development.

The round was led by IVP, GV (formerly Google Ventures) and ServiceNow Ventures. Existing investors Big Labs, Menlo Ventures and Unusual Ventures also participated. Today’s investment brings the total raised to $80 million, according to Crunchbase data.

Bansal obviously made a fair bit of money when he sold AppDynamics to Cisco in 2017 for $3.7 billion and he could have rested after his great success. Instead he turned his attention almost immediately to a new challenge, helping companies move to a new continuous delivery model more rapidly by offering Continuous Delivery as a Service.

As companies move to containers and the cloud, they face challenges implementing new software delivery models. As is often the case, large web scale companies like Facebook, Google and Netflix have the resources to deliver these kinds of solutions quickly, but it’s much more difficult for most other companies.

Bansal saw an opportunity here to package continuous delivery approaches as a service. “Our approach in the market is Continuous Delivery as a Service, and instead of you trying to engineer this, you get this platform that can solve this problem and bring you the best tooling that a Google or Facebook or Netflix would have,” Basal explained.

The approach has gained traction quickly. The company has grown from 25 employees at launch in 2017 to 100 today. It boasts 50 enterprise customers including Home Depot, Santander Bank and McAfee.

He says that the continuous delivery piece could just be a starting point, and the money from the round will be plowed back into engineering efforts to expand the platform and solve other problems DevOps teams face with a modern software delivery approach.

Bansal admits that it’s unusual to have this kind of traction this early, and he says that his growth is much faster than it was at AppDynamics at the same stage, but he believes the opportunity here is huge as companies look for more efficient ways to deliver software. “I’m a little bit surprised. I thought this was a big problem when I started, but it’s an even bigger problem than I thought and how much pain was out there and how ready the market was to look at a very different way of solving this problem,” he said.

Powered by WPeMatico

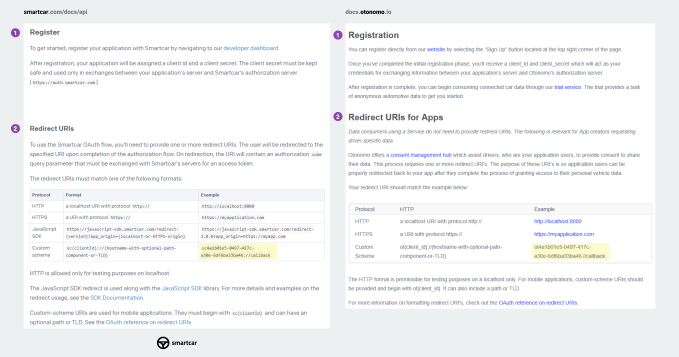

Ruthless copying is common in tech. Just ask Snapchat. However, it’s typically more conceptual than literal. But car API startup Smartcar claims that its competitor Otonomo copy-and-pasted Smartcar’s API documentation, allegedly plagiarizing it extensively to the point of including the original’s typos and randomly generated strings of code. It’s published a series of side-by-side screenshots detailing the supposed theft of its intellectual property.

Smartcar CEO Sahas Katta says “We do have evidence of several of their employees systemically using our product with behavior indicating they wanted to copy our product in both form and function.” Now a spokesperson for the startup tells me “We’ve filed a cease-and-desist letter, delivered to Otonomo this morning, that contains documented aspects of different breaches and violations.”

The accusations are troubling given Otonomo is not some inconsequential upstart. The Israel-based company has raised over $50 million since its founding in 2015, and its investors include auto parts giant Aptiv (formerly Delphi) and prestigious VC firm Bessemer Ventures Partners. Otonomo CMO Lisa Joy provided this statement in response to the allegations, noting it will investigate but is confident it acted with integrity:

Otonomo prides itself on providing a completely unique offering backed by our own intellectual property and patents. We take Smartcar’s questions seriously and are conducting an investigation, but we remain confident that our rigorous standards of integrity remain uncompromised. If our investigation reveals any issues, we will immediately take the necessary steps to address them.

Both startups are trying to build an API layer that connects data from cars with app developers so they can build products that can locate, unlock, or harness data from vehicles. The 20-person Mountain View-based Smartcar has raised $12 million from Andreessen Horowitz and NEA. A major deciding factor in who’ll win this market is which platform offers the best documentation that makes it easiest for developers to integrate the APIs.

“A few days ago, we came across Otonomo’s publicly available API documentation. As we read through it, we quickly realized that something was off. It looked familiar. Oddly familiar. That’s because we wrote it” Smartcar explains in its blog post. “We didn’t just find a few vague similarities to Smartcar’s documentation. Otonomo’s docs are a systematically written rip-off of ours – from the overall structure, right down to code samples and even typos.”

The screenshot above comparing API documentation from Smartcar on the left and Otonomo on the right appears to show Otonomo used nearly identical formatting and the exact same randomly generated sample identifier (highlighted) as Smartcar. Further examples flag seemingly identical code strings and snippets.

Smartcar founder and CEO Sahas Katta

Otonomo has pulled down their docs.otonomo.io documentation website, but TechCrunch has reviewed an Archive.org Wayback Machine showing this Otonomo site as of April 5, 2019 featured sections that are identical to the documentation Smartcar published in August 2018. That includes Smartcar’s typo “it will returned here”, and its randomly generated sample code placeholder “”4a1b01e5-0497-417c-a30e-6df6ba33ba46” which both appear in the Wayback Machine copy of Otonomo’s docs. The typo was fixed in this version of Otonomo’s docs that’s still publicly available, but that code string remains.

“It would be a one in a quintillion chance of them happening to land on the same randomly generated string” Smartcar’s Katta tells TechCrunch.

Yet curiously, Otonomo’s CMO told TechCrunch that “The materials that [Smartcar] put on their post are all publicly accessible documentation, It’s all public domain content.” But that’s not true, Katta argues, given the definition of ‘public domain’ is content belonging to the public that’s uncopyrightable. “I would sure hope not, considering . . . we have proper copyright notices at the bottom. Our product is our intellectual property. Just like Twilio’s API documentation or Stripe’s, it is published and publicly available — and it is proprietary.”

Otonomo’s Lisa Joy noted that her startup is currently fundraising for its Series C, which reportedly already includes $10 million from South Korean energy and telecom holdings giant SK. “We’re in the middle of raising a round right now. That round is not done” she told me. But if Otonomo gets a reputation for allegedly copying its API docs, that could hurt its standing with developers and potentially endanger that funding round.

Powered by WPeMatico

Africa has made its global IPO debut. Pan-African e-commerce company Jumia—a $1 billion-valued company—began trading live on the NYSE last week.

The stock offering made Jumia the first upstart operating in Africa to list on a major global exchange.

This raises expectations for unicorns and IPOs to create the continent’s first wave of startup moguls. But unlike other markets, big public listings and nine-figure valuations could remain rare in Africa.

The rise of venture arms and startup acquisitions will factor more prominently than IPOs in creating Africa’s early startup successes.

I’ll break down why. First, a quick briefer.

Not everyone may be aware, but yes, Africa has a booming tech scene. When measured by monetary values, it’s minuscule by Shenzen or Silicon Valley standards.

Powered by WPeMatico

Five years after Dropbox acquired their startup Zulip, Waseem Daher, Jeff Arnold and Jessica McKellar have gained traction for their third business together: Pilot.

Pilot helps startups and small businesses manage their back office. Chief executive officer Daher admits it may seem a little boring, but the market opportunity is undeniably huge. To tackle the market, Pilot is today announcing a $40 million Series B led by Index Ventures with participation from Stripe, the online payment processing system.

The round values Pilot, which has raised about $60 million to date, at $355 million.

“It’s a massive industry that has sucked in the past,” Daher told TechCrunch. “People want a really high-quality solution to the bookkeeping problem. The market really wants this to exist and we’ve assembled a world-class team that’s capable of knocking this out of the park.”

San Francisco-based Pilot launched in 2017, more than a decade after the three founders met in MIT’s student computing group. It’s not surprising they’ve garnered attention from venture capitalists, given that their first two companies resulted in notable acquisitions.

Pilot has taken on a massively overlooked but strategic segment — bookkeeping,” Index’s Mark Goldberg told TechCrunch via email. “While dry on the surface, the opportunity is enormous given that an estimated $60 billion is spent on bookkeeping and accounting in the U.S. alone. It’s a service industry that can finally be automated with technology and this is the perfect team to take this on — third-time founders with a perfect combo of financial acumen and engineering.”

The trio of founders’ first project, Linux upgrade software called Ksplice, sold to Oracle in 2011. Their next business, Zulip, exited to Dropbox before it even had the chance to publicly launch.

It was actually upon building Ksplice that Daher and team realized their dire need for tech-enabled bookkeeping solutions.

“We built something internally like this as a byproduct of just running [Ksplice],” Daher explained. “When Oracle was acquiring our company, we met with their finance people and we described this system to them and they were blown away.”

It took a few years for the team to refocus their efforts on streamlining back-office processes for startups, opting to build business chat software in Zulip first.

Pilot’s software integrates with other financial services products to bring the bookkeeping process into the 21st century. Its platform, for example, works seamlessly on top of QuickBooks so customers aren’t wasting precious time updating and managing the accounting application.

“It’s better than the slow, painful process of doing it yourself and it’s better than hiring a third-party bookkeeper,” Daher said. “If you care at all about having the work be high-quality, you have to have software do it. People aren’t good at these mechanical, repetitive, formula-driven tasks.”

Currently, Pilot handles bookkeeping for more than $100 million per month in financial transactions but hopes to use the infusion of venture funding to accelerate customer adoption. The company also plans to launch a tax prep offering that they say will make the tax prep experience “easy and seamless.”

“It’s our first foray into Pilot’s larger mission, which is taking care of running your companies entire back office so you can focus on your business,” Daher said.

As for whether the team will sell to another big acquirer, it’s unlikely.

“The opportunity for Pilot is so large and so substantive, I think it would be a mistake for this to be anything other than a large and enduring public company,” Daher said. “This is the company that we’re going to do this with.”

Powered by WPeMatico

Over the past half a decade, the tidal wave of niche brands delivering new kinds of products to consumers and doing so online has changed the retail and CPG landscapes forever.

This shift has in some way caused a shakeout in traditional retail, with once-popular retailers announcing store closures (JCPenney, Sears) or even liquidation (Payless, Toys R Us) and has sent fashion houses and CPG brands on a soul-searching journey. The changing demographics and desires of shoppers have also fueled the decline of traditional brands and their distribution mechanisms.

This bleak scenario of incumbent consumer brands is in stark contrast to the rapid emergence of a host of digitally-native Direct to Consumer (D2C) brands. A few D2C brands have been successful enough to become unicorns! Retailers like Walmart, Nordstrom, and Target have quickly adapted to the D2C era.

Walmart has made a string of acquisitions beginning with Jet.com and Bonobos. Nordstrom has broadened its assortment to include D2C brands, Target has partnered with Harry’s, Quip, and Flamingo – all of which have rolled out their products in Target’s stores across the country. Target has also invested in Casper, which is the latest D2C brand to become a Unicorn.

Venture capital firms have invested over four billion dollars in D2C brands since 2012, with 2018 alone accounting for over a billion. With investment comes pressure to scale and deliver profits. And this pressure is bringing the focus on some pertinent questions – How are these D2C brands going to evolve and how could they sustain as businesses?

Like always, the pioneering companies find their path and we then derive the playbooks out of them. From PipeCandy’s analysis of several D2C brands, we see the following approaches taken by D2C brands.

We discuss the market size and capital availability factors that influence the paths and the outcomes.

Many of these D2C brands that have experienced early success owe their rise largely to an authentic relationship with consumers that is built on the promise of one product. In many ways, focusing on one product line and a small set of SKUs makes total business sense.

Design, Production, Marketing & Customer Support complexities can stay manageable with such deliberate narrowing down of focus.

In some categories, you could stay focused on one product line for a long time and build a successful company.

Powered by WPeMatico