funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Generation Investment Management, the firm co-founded by environmentalist and former Vice President Al Gore, was built on the premise of backing sustainable startups. Now, as the idea of sustainability starts to gain wider traction, the firm is doubling down on the concept.

Today, Generation is announcing that it has closed a $1 billion Sustainable Solutions Fund for growth investments. As the name implies, it plans to put the $1 billion to work backing later-stage startups that work on sustainability in at least one of three areas — environmental solutions; healthcare; and financial inclusion, including the future of work — and are creating financially sustainable businesses out of that focus.

Typical investments will range from $50 million to $150 million, and there have already been two made out of the fund before it closed, both indicative of the kinds of investments Generation plans to be making.

Andela — the startup that pairs companies needing engineering talent to work on projects with developers based out of Africa — in January announced a $100 million round. Also that month, Sophia Genetics — the company that applies AI to DNA sequencing to help formulate more accurate medical treatments — raised $77 million led by the firm.

Other companies that Generation has backed include Asana, DocuSign, gogoro, CiBO, M-Kopa, Ocado, Optoro and Seventh Generation.

This is Generation’s third growth fund and the largest raised by the firm to date, which itself is a sign of the swing we’ve seen in the tech world.

In general, founders, workers and investors all remain relentlessly focused on growing new ideas. But along with that there has been a rising conscientiousness of the massive role that tech plays in shaping the world, and so some are now trying to make more of an effort to use that for more meaningful outcomes.

“You are seeing how sustainability is attracting high-performing entrepreneurs,” said Lilly Wollman, partner and co-head of the Growth Equity platform, in an interview. “They care about the mission, and that is also driving financial performance.”

“We believe that we are at the early stages of a technology-led sustainability revolution,” said Al Gore, chairman and co-founder, in a statement, “which has the scale of the industrial revolution, and the pace of the digital revolution.”

In the case of Generation, it’s also an indication that the firm — which has $22 billion under management today — is providing impressive enough returns on its mission to drive more interest from LPs to grow the commitment to back it.

“There is a recognition of this momentum,” added Lila Preston, a partner who is the growth platform’s co-head, “of the 15 years the firm has already spent on this concept and the work it’s put into it. We see this as a movement, but one with a road map based on research and understanding.”

It’s also notable to me that the two people leading the growth team are women. Wollman noted that 60% of the Generation team is female, with the employee base spanning eight nationalities. “The firm believes more diversity leads to better outcomes,” she said.

Consumers are also playing a big role. Of all the good, bad and ugly that has been wrought by the rise of social media, one of the positives has been how social platforms have been used to raise awareness of issues such as climate change and inclusion. We may be getting into more online fights with our distant cousins (and closer friends and relatives), and sometimes issues like trying to curtail emissions gasses seems like an insurmountable challenge. But some will also use what they read about and watch online as inspiration to try to make a change.

“One of the things that is so interesting in this moment is that we are at an inflection point,” said Wollman. “Sustainability is winning on economics alone. You see sustainable products and solutions that are both efficacious and cheap. People are buying electric vehicles not just because they are green, but because they are starting to become cheap enough, and provide better performance.”

That’s bringing in a new wave of investors to the mix, and it’s interesting to see how some more conventional investors are even starting to take a bigger step into making mission-driven investment decisions. (Just yesterday, in the U.K., Balderton co-led a large round for Wagestream, a startup aimed at helping promote financial inclusion by creating a way to easily and cheaply draw down money from monthly paychecks. Generation hinted that it too might be making an investment in a startup working in a similar area in the weeks to come.)

“It helps to have a set of co-investors to ask questions related not only to ‘what are your growth metrics’ but ‘how does what you are doing affect the wider world,’ ” said Preston. “We are finding an increase of sophistication, which we think is positive recognition. Given the context of our shift, whether it’s a new economic model or climate change, we are going to need masses of capital to drive sustainable solutions and re-frame what is successful.”

Powered by WPeMatico

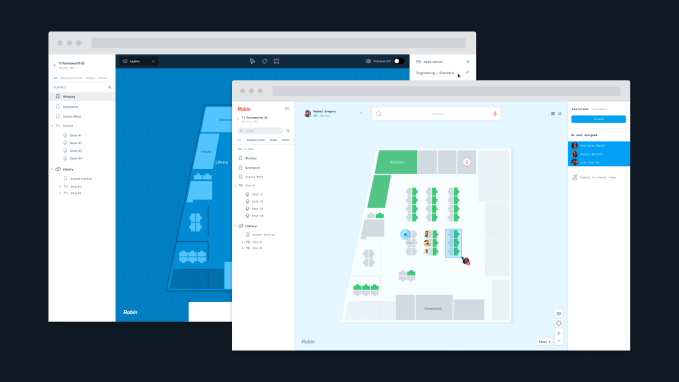

Robin Powered, a startup looking to help offices run better, has today announced the close of a $20 million Series B funding. The round was led by Tola Capital, with existing investors Accomplice and FirstMark participating in the round, along with a new strategic Allegion Ventures.

Robin started as part of an agency called One Mighty Roar, where Robin Powered co-founder Sam Dunn and his two co-founders built out RFID and beacon tech for clients’ live events. In 2014, they spun out the tech as Robin and tweaked the focus on the modern office.

The office stands to be one of the least efficient pieces of any business. As a company grows, or even if it doesn’t, it’s particularly difficult to understand the “inventory” of the office and how it is used by workers throughout the day.

“Before, if I asked you what you needed out of your next office, you might go around and survey employees or hire an architecture firm,” said Dunn. “I heard a story where a manager sent around an intern every Thursday at 3pm to talk to employees about the office, and that was one of two pieces of information handed over to the architecture firm. At the end of the day, it’s hard to know if there’s a shortage of meeting rooms, or teleconference-enabled rooms, or collaborative workspaces.”

That’s where Robin comes in. Robin hooks into Google Calendar and Outlook to help employees get a sense of what meeting rooms and activity spaces are available in the office, complete with tablet signage out front. Meetings are the starting point for Robin, but the company can also offer tools for seating charts and office maps, as well as insights. The company wants to offer insights about how the space in this or that office is being used — what they lack and what they have too much of.

Robin charges its clients per room ($300) and per desk ($24 – $60). The hope is to build out the same technological backbone for clients’ offices as WeWork provides alongside its physical space, giving every business the opportunity to optimize one of their biggest investments: the office itself.

Robin has raised a total of $30 million.

Powered by WPeMatico

Getting your work wages on a monthly (not weekly nor biweekly) basis has become a more widespread trend as the price of running payrolls has gone up, and organizations’ cashflow has gone down. That 30-day shift may be a boost to employers, but not employees, who may need access to those wages more immediately and find it a challenge to stretch out their income month to month.

Now, a startup based out of London has raised a large round of funding for service that’s aiming to plug that gap. Wagestream — which works with employers to let employees draw down a percentage of their income in the month for a small, flat fee — today said that it has closed a Series A round of £40 million ($51 million).

The funding is coming in the form of equity and debt, with Balderton and Northzone leading on the equity side, which makes up £15 million of the raise, and savings bank Shawbrook investing £25 million on the debt side to finance employee draw-downs. Other investors in the round include QED, the Rowntree Foundation, the London Co-investment Fund (LCIF) and Village Global, a social venture firm backed by Bill Gates and Jeff Bezos, among others.

The company is not disclosing its valuation, but this brings the total raised to just under £45 million, and “the valuation is definitely higher now,” according to CEO and co-founder Peter Briffett.

The list of investors is proving to be a useful one for Wagestream as it grows. I asked if Bezos’ company, Amazon, was working with Wagestream. Briffett confirmed it is not a customer currently, “but we are talking to them.” It does, however, have a number of other customers already signed up, including pest removal service Rentokil PLC, Camden Town Brewery, the Slug & Lettuce pub chain and Carluccio’s chain of eateries, along with the NHS and Hackney Council — covering some 120,000 workers in all.

Amazon is an indicative example of one of the big opportunities for the company, which today is active in the U.K. but aiming to expand across Europe and the rest of the world.

While it is one of the biggest employers in the tech world, where it might typically pay out six-figure salaries in senior management, operational and technical roles, it’s also building out its business by being one of the biggest employers of hourly workers in its warehouses, wider logistics operations and similar areas. It’s employees like these who might be considered the first wave of employees that Wagestream is initially targeting, some of whom may be earning just enough or slightly more than enough to get by (at best), and face being victims of what Briffett referred to as the “payday poverty cycle.”

Getting paid monthly accounts for some 85% of all paychecks in the U.K. today, and the proportion is similar in Europe and also getting increasingly common in the U.S., Briffett — who has also worked at Microsoft, LivingSocial (when it was still backed by Amazon, and where he started the U.K. operation and ran it as the CEO for years) and YPlan (acquired by Time Out) — said in an interview. You might ask: Why don’t the workers just budget better? But it doesn’t always work out that way, especially the longer the gap is between paychecks, and if you, for example, have an unexpected expense to cover.

Because of that ubiquity, and the acuteness of the problem (if you’ve ever earned just about enough, or been a child in a family whose parents did, you may understand the predicament quite well), Wagestream is not the first time we’ve seen a financial services startup emerge to target that demographic.

Some other attempts have been scandalously disastrous, however: recall “Payday Loan” provider Wonga, backed by an illustrious set of investors but ultimately accused of, and hit hard by regulators and the public for, preying on people who were in need of funds with loans that were not transparent enough in their terms and led the borrowers into deep debt.

Wonga itself paid a big price for its practices, and the company is now bankrupt (and apparently still unable to replay creditors, as of the last report in March).

It was the disaster of Wonga — and an article in the WSJ about alternatives to payday loans — that Briffett said got him thinking about the possibilities and building Wagestream. (Ironic note: if you use PitchBook as I do, Wonga is listed among Wagestream’s backers, which Briffett assures me is an error.)

Wagestream positions itself as a “social impact” startup for targeting a very real problem that impacts financial inclusion for a proportion of the population, and it says this represents one of the highest rounds ever for a startup in the U.K. aimed at social impact.

“We fell in love with the strong product-market fit of Wagestream. We very rarely hear such universal positive feedback from all who have tried a product,” said Rob Moffat, a partner at Balderton, in a statement. “Companies used to take an active role in supporting the financial health of their users but this has slowly been eroded, to the extent where employees paid at the end of the month are effectively subsidising their employer for 29 days a month. Wagestream starts to restore the right balance.”

Wagestream operates by striking deals with employers to offer its services to its workers, who download an app and link up Wagestream with their salary and banking details. Businesses are able to set limits for what percentage of their wages employees can draw down each month, and how often the service can be used. Typically the limit is around 40% of a monthly wage, Briffett said.

Employees then can get the money instantly by paying a fee of £1.75 per withdrawal. “We are funding all of the withdrawals up front,” Briffett said. “We are the first company to marry workforce management and financial data.”

Down the road, the plan will be to expand to Europe as well as to the U.S., where there are already some other services that are trying to tackle the same problem, such as Instant Financial and DailyPay. There are also a number of areas the company could move into, such as working with companies that employ contract workers, and providing additional financial services to workers already using the app to draw down funds.

More expansion, Briffett said, will inevitably also mean more funding, particularly on the debt side.

For now, the emergence of Wagestream is an encouraging sign of how VCs are not just interested in tapping their coffers to bet on tech companies that they think will be hits. They also want to hunt for those whose returns may well be strong, but ultimately are made stronger by the longer-term effect they might have on the wider landscape of consumers, how they interface with fintech, and continue their own progress in the world.

Powered by WPeMatico

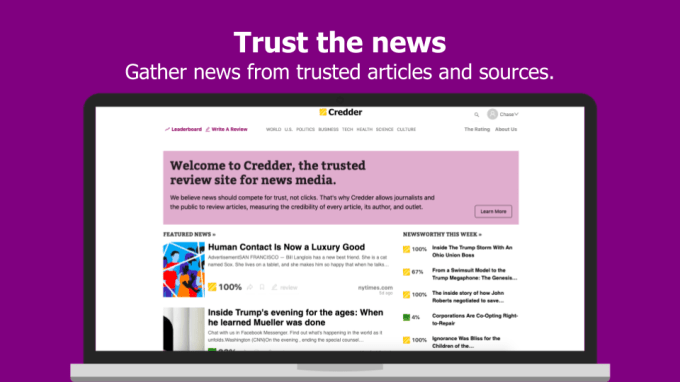

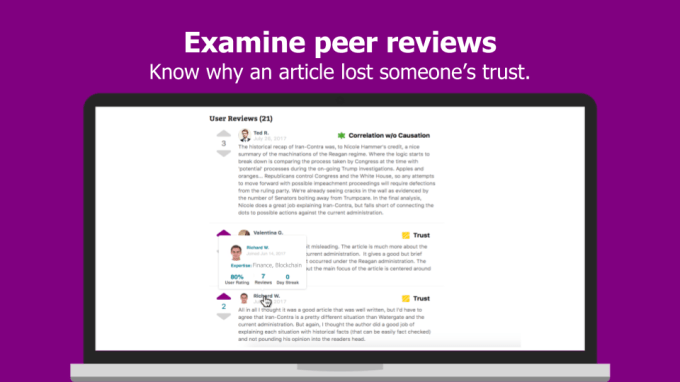

In an age of online misinformation and clickbait, how do you know whether a publication is trustworthy?

Startup Credder is trying to solve this problem with reviews from both journalists and regular readers. These reviews are then aggregated into an overall credibility score (or rather, scores, since the journalist and reader ratings are calculated separately). So when you encounter an article from a new publication, you can check their scores on Credder to get a sense of how credible they are.

Co-founder and CEO Chase Palmieri compared the site to movie review aggregator Rotten Tomatoes. It makes sense, then, that he’s enlisted former Rotten Tomatoes CEO Patrick Lee to his advisory board, along with journalist Gabriel Snyder and former Xobni CEO Jeff Bonforte.

Palmieri plans to open Credder to the general public later this month, and he’s already raised $750,000 in funding from Founder Institute CEO Adeo Ressi, Ira Ehrenpreis, the law firm Orrick, Herrington & Sutcliffe, Steve Bennet and others.

Palmieri told me he started working full-time on the project back in 2016, with the goal of “giving news consumers a way to productively hold the news producers accountable,” and to “realign the financial incentives of online media, so it’s not just rewarding clicks and traffic metrics.” In other words, he wanted to create a landscape where publishing empty clickbait or heavily slanted propaganda might have actual consequences.

If Credder gets much traction, it will likely attract its share of trolls — it’s easy to imagine that the same kind of person who leaves a negative review of “Captain Marvel” without seeing the movie (this is a real issue that Rotten Tomatoes has had to face), would be just as happy to smear The New York Times or CNN as “fake news.” And even if a reviewer is offering honest, good-faith feedback, the review might be less influenced by the quality of a publication’s journalism and more by their personal baggage or political leanings.

Palmieri acknowledged the risk and pointed to several ways Credder is trying to mitigate it. For one thing, users can’t just write an overall review of The New York Times or The Wall Street Journal or TechCrunch. Instead, they’re reviewing specific articles, so hopefully they’re engaging with the substance and specifics of the story, rather than just venting their preexisting feelings. The scores assigned to publications and to journalists are only generated when there are enough article ratings to create an aggregated score.

In addition, Palmieri said the reviewers “are also being held accountable,” because users can upvote or downvote their comments. That affects how the reviews get weighted in the overall score, and in turn generates a rating for the reviewers.

“It will take time for the weight of your reviews to be meaningful, and there will be a visible track record,” he said.

While I appreciated Palmieri’s vision, I was also skeptical that a credibility score can actually influence readers’ opinions — maybe it will matter when you encounter a new publication, but everyone already has set ideas about who they trust and don’t trust.

When I brought this up, Palmieri replied, “What we see in today’s media landscape is the left-wing media attacks the right-wing media, and vice versa. We never get a sense of what our fellow news consumers feel. What’s more likely to change your perspective and make you question yourself? It’s going to a rating page [for] an article, pointing out a specific problem in that article.”

To be clear, Credder isn’t hosting articles itself, simply crawling the web and creating rating pages for articles, publications and writers. As for making money, Palmieri said he’s considered both a tipping system and an ad system where publications can pay to promote their stories.

TechCrunch readers can check it out early by visiting the Credder website and using the promo code “TCNEWS”.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Kate Clark sat down with Eric Yuan, the founder and CEO of video communications startup Zoom, to go behind the curtain on the company’s recent IPO process and its path to the public markets.

Since hitting the trading desks just a few weeks ago, Zoom stock is up over 30%. But the Zoom’s path to becoming a Silicon Valley and Wall Street darling was anything but easy. Eric tells Kate how the company’s early focus on profitability, which is now helping drive the stock’s strong performance out of the gate, actually made it difficult to get VC money early on, and the company’s consistent focus on user experience led to organic growth across different customer bases.

Eric: I experienced the year 2000 dot com crash and the 2008 financial crisis, and it almost wiped out the company. I only got seed money from my friends, and also one or two VCs like AME Cloud Ventures and Qualcomm Ventures.

nd all other institutional VCs had no interest to invest in us. I was very paranoid and always thought “wow, we are not going to survive next week because we cannot raise the capital. And on the way, I thought we have to look into our own destiny. We wanted to be cash flow positive. We wanted to be profitable.

nd so by doing that, people thought I wasn’t as wise, because we’d probably be sacrificing growth, right? And a lot of other companies, they did very well and were not profitable because they focused on growth. And in the future they could be very, very profitable.

Eric and Kate also dive deeper into Zoom’s founding and Eric’s initial decision to leave WebEx to work on a better video communication solution. Eric also offers his take on what the future of video conferencing may look like in the next five to 10 years and gives advice to founders looking to build the next great company.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Kate Clark: Well thanks for joining us Eric.

Eric Yuan: No problem, no problem.

Kate: Super excited to chat about Zoom’s historic IPO. Before we jump into questions, I’m just going to review some of the key events leading up to the IPO, just to give some context to any of the listeners on the call.

Powered by WPeMatico

Health at Scale, a startup with founders who have both medical and engineering expertise, wants to bring machine learning to bear on healthcare treatment options to produce outcomes with better results and less aftercare. Today the company announced a $16 million Series A. Optum, which is part of the UnitedHealth Group, was the sole investor.

Today, when people look at treatment options, they may look at a particular surgeon or hospital, or simply what the insurance company will cover, but they typically lack the data to make truly informed decisions. This is true across every part of the healthcare system, particularly in the U.S. The company believes using machine learning, it can produce better results.

“We are a machine learning shop, and we focus on what I would describe as precision delivery. So in other words, we look at this question of how do we match patients to the right treatments, by the right providers, at the right time,” Zeeshan Syed, Health at Scale CEO told TechCrunch.

The founders see the current system as fundamentally flawed, and while they see their customers as insurance companies, hospital systems and self-insured employers, they say the tools they are putting into the system should help everyone in the loop get a better outcome.

The idea is to make treatment decisions more data-driven. While they aren’t sharing their data sources, they say they have information, from patients with a given condition, to doctors who treat that condition, to facilities where the treatment happens. By looking at a patient’s individual treatment needs and medical history, they believe they can do a better job of matching that person to the best doctor and hospital for the job. They say this will result in the fewest post-operative treatment requirements, whether that involves trips to the emergency room or time in a skilled nursing facility, all of which would end up adding significant additional cost.

If you’re thinking this is strictly about cost savings for these large institutions, Mohammed Saeed, who is the company’s chief medical officer and has an MD from Harvard and a PhD in electrical engineering from MIT, insists that isn’t the case. “From our perspective, it’s a win-win situation since we provide the best recommendations that have the patient interest at heart, but from a payer or provider perspective, when you have lower complication rates you have better outcomes and you lower your total cost of care long term,” he said.

The company says the solution is being used by large hospital systems and insurer customers, although it couldn’t share any. The founders also said it has studied the outcomes after using its software and the machine learning models have produced better outcomes, although it couldn’t provide the data to back that up at that point at this time.

The company was founded in 2015 and currently has 11 employees. It plans to use today’s funding to build out sales and marketing to bring the solution to a wider customer set.

Powered by WPeMatico

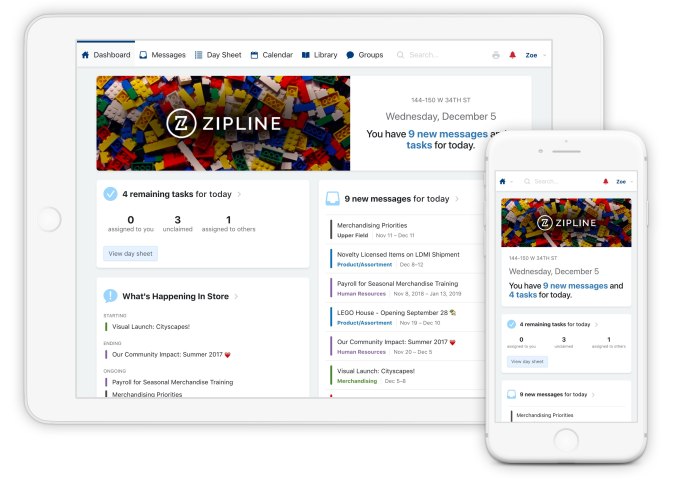

Retail Zipline, a startup aiming to improve communication between retail stores and corporate decision makers, announced today that it has raised $9.6 million in Series A funding.

CEO Melissa Wong previously worked in corporate communications for Old Navy, where she said she saw “such a disconnect between what was decided in headquarters and what was decided in stores.” For example, management might decide on a big marketing push to sell any remaining Mother’s Day-related items after the holiday has passed, but then “the stores wouldn’t do it.”

“The stores would say there were too many messages, they didn’t see the memo, they didn’t know it was a priority,” Wong said.

So she founded Retail Zipline with CTO Jeremy Baker, with the goal of building better communication tools for retailers. Baker said that while they looked at existing chat and task management software for inspiration, those tools were “mostly built for people sitting at a desk all day,” rather than workers who are “on the floor, dealing with customers.”

Retail Zipline’s features include messaging and task management — plus a centralized library of documents and multimedia and a survey tool to track results and feedback from stores.

To illustrate how the software is actually being used, Baker outlined a scenario where an athletic shoe company is launching “a huge initiative,” with a big-name athlete signed on to promote the latest pair of shoes.

“In a traditional environment, someone might FedEx over a package to [the store], someone might send an email down, ‘Hey, look for a package on this day,’ someone else from the marketing team might say, ‘Hey guys, we’re doing a shoe launch,’ ” he said. “All of this in these disparate systems, where people have to piece together the story. It’s kind of like a murder mystery.”

Baker said that Retail Zipline, on the other hand, provides a single place to find all the needed materials and tasks “tied together with a bow, instead of a store manager spending 10-plus hours in the back room trying to piece this thing together, or even worse not seeing it.”

The company’s customers include Casper, LEGO and Lush Cosmetics. Wong said Retail Zipline works “with anyone that has a retail location” — ranging from Gap, Inc. with thousands of stores, to Toms Shoes with 10.

The funding was led by Emergence, with Santi Subotovsky and Kara Egan from Emergence both joining the startup’s board of directors. Serena Williams’ new firm Serena Ventures also participated.

“As someone with an incredibly active life, I understand the need to be dynamic, and capable of quickly adapting to shifting priorities, but I’m also aware of the stress a fast-paced work environment can impose,” Williams said in a statement. “Retail Zipline is tackling this issue head-on in retail – a notoriously stressful industry – by pioneering products that help store associates get organized, communicate efficiently, and deliver amazing customer experiences.”

Powered by WPeMatico

MultiVu, a Tel Aviv-based startup that is developing a new 3D imaging solution that only relies on a single sensor and some deep learning smarts, today announced that it has raised a $7 million seed round. The round was led by crowdfunding platform OurCrowd, Cardumen Capital and Hong Kong’s Junson Capital.

Tel Aviv University’s TAU Technology Innovation Momentum Fund supported some of the earlier development of MultiVu’s core technology, which came out of Prof. David Mendlovic’s lab at the university. Mendlovic previously co-founded smartphone camera startup Corephotonics, which was recently acquired by Samsung.

The promise of MultiVu’s sensor is that it can offer 3D imaging with a single-lens camera instead of the usual two-sensor setup. This single sensor can extract depth and color data in a single shot.

This makes for a more compact setup and, by extension, a more affordable solution as it requires fewer components. All of this is powered by the company’s patented light field technology.

Currently, the team is focusing on using the sensor for face authentication in phones and other small devices. That’s obviously a growing market, but there are also plenty of other applications for small 3D sensors, ranging from other security use cases to sensors for self-driving cars.

“The technology, which passed the proof-of-concept stage, will bring 3D Face Authentication and affordable 3D imaging to the mobile, automotive, industrial and medical markets,” MultiVu CEO Doron Nevo said. “We are excited to be given the opportunity to commercialize this technology.”

Right now, though, the team is mostly focusing on bringing its sensor to market. The company will use the new funding for that, as well as new marketing and business development activities.

“We are pleased to invest in the future of 3D sensor technologies and believe that MultiVu will penetrate markets, which until now could not take advantage of costly 3D imaging solutions,” said OurCrowd Senior Investment Partner Eli Nir. “We are proud to be investing in a third company founded by Prof. David Mendlovic (who just recently sold CorePhotonics to Samsung), managed by CEO Doron Nevo – a serial entrepreneur with proven successes and a superb team they have gathered around them.”

Powered by WPeMatico

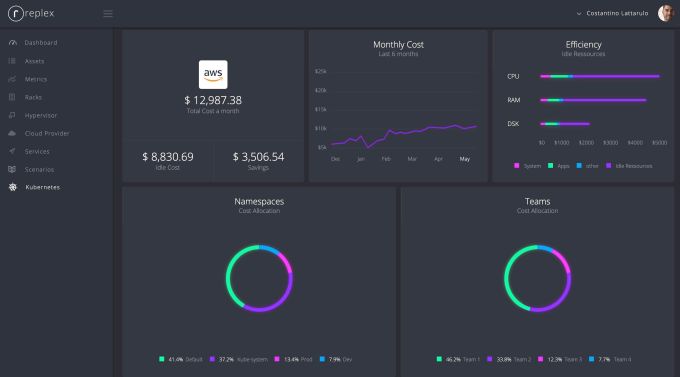

Replex wants to help track cloud spending, but with a cloud native twist, and today it announced a $2.45 million seed round. The company previous raised $1.68 million in 2017 for a total of $4.15 million so far.

As companies shift to a cloud native environment, and move ever more quickly, it is increasingly important to get visibility into how development and operations teams are using resources in the cloud. Replex is designed to give more visibility into spending and to help optimize the container environment in the most economical way.

Company CEO and co-founder Patrick Kirchhoff says the product is about controlling spending in a cloud native context. “The Replex platform enables operators, finance and IT managers to see who spends what. We allow them then to right-size clusters, pods and container sizes for optimal results, and they are able to control the cost, manage chargebacks and find [optimal] capacity,” he explained.

Replex cloud spending control panel. Screenshot: Replex

While there are variety of similar cloud cost control startups out there, Kirchoff says his company has been purpose built for cloud native environments and that is a key differentiating factor. “We see that the way organizations work has completely changed because with the move to cloud native infrastructure, teams within the business lines are now able to provision infrastructure on their own. Central IT departments still need to control costs and govern these resources, but they don’t have the tools to do that anymore because the existing tools are built on architectures for traditional infrastructure, and not for the cloud native approach,” he said.

Kirchoff says that developers tend to over provision just to be on the safe side, but using data from Replex, customers can figure out the optimal amount to provision for a particular workload, work with development teams, and that can save money in the long run.

Investors across the two rounds include Entrepreneurs Investment Fund, eValue, EnBW New Ventures, High-Tech Gruenderfonds (HTGF) and Technologiegruenderfonds Sachsen (TGFS). The company is currently participating in the Alchemist Accelerator . The latest round closed in December. The previous one in May 2017.

Powered by WPeMatico

OpenFin, the company looking to provide the operating system for the financial services industry, has raised $17 million in funding through a Series C round led by Wells Fargo, with participation from Barclays and existing investors including Bain Capital Ventures, J.P. Morgan and Pivot Investment Partners. Previous investors in OpenFin also include DRW Venture Capital, Euclid Opportunities and NYCA Partners.

Likening itself to “the OS of finance,” OpenFin seeks to be the operating layer on which applications used by financial services companies are built and launched, akin to iOS or Android for your smartphone.

OpenFin’s operating system provides three key solutions which, while present on your mobile phone, has previously been absent in the financial services industry: easier deployment of apps to end users, fast security assurances for applications and interoperability.

Traders, analysts and other financial service employees often find themselves using several separate platforms simultaneously, as they try to source information and quickly execute multiple transactions. Yet historically, the desktop applications used by financial services firms — like trading platforms, data solutions or risk analytics — haven’t communicated with one another, with functions performed in one application not recognized or reflected in external applications.

“On my phone, I can be in my calendar app and tap an address, which opens up Google Maps. From Google Maps, maybe I book an Uber . From Uber, I’ll share my real-time location on messages with my friends. That’s four different apps working together on my phone,” OpenFin CEO and co-founder Mazy Dar explained to TechCrunch. That cross-functionality has long been missing in financial services.

As a result, employees can find themselves losing precious time — which in the world of financial services can often mean losing money — as they juggle multiple screens and perform repetitive processes across different applications.

Additionally, major banks, institutional investors and other financial firms have traditionally deployed natively installed applications in lengthy processes that can often take months, going through long vendor packaging and security reviews that ultimately don’t prevent the software from actually accessing the local system.

OpenFin CEO and co-founder Mazy Dar (Image via OpenFin)

As former analysts and traders at major financial institutions, Dar and his co-founder Chuck Doerr (now president & COO of OpenFin) recognized these major pain points and decided to build a common platform that would enable cross-functionality and instant deployment. And since apps on OpenFin are unable to access local file systems, banks can better ensure security and avoid prolonged yet ineffective security review processes.

And the value proposition offered by OpenFin seems to be quite compelling. OpenFin boasts an impressive roster of customers using its platform, including more than 1,500 major financial firms, almost 40 leading vendors and 15 of the world’s 20 largest banks.

More than 1,000 applications have been built on the OS, with OpenFin now deployed on more than 200,000 desktops — a noteworthy milestone given that the ever-popular Bloomberg Terminal, which is ubiquitously used across financial institutions and investment firms, is deployed on roughly 300,000 desktops.

Since raising their Series B in February 2017, OpenFin’s deployments have more than doubled. The company’s headcount has also doubled and its European presence has tripled. Earlier this year, OpenFin also launched it’s OpenFin Cloud Services platform, which allows financial firms to launch their own private local app stores for employees and customers without writing a single line of code.

To date, OpenFin has raised a total of $40 million in venture funding and plans to use the capital from its latest round for additional hiring and to expand its footprint onto more desktops around the world. In the long run, OpenFin hopes to become the vital operating infrastructure upon which all developers of financial applications are innovating.

“Apple and Google’s mobile operating systems and app stores have enabled more than a million apps that have fundamentally changed how we live,” said Dar. “OpenFin OS and our new app store services enable the next generation of desktop apps that are transforming how we work in financial services.”

Powered by WPeMatico