funding

Auto Added by WPeMatico

Auto Added by WPeMatico

In emergency situations, minutes can mean the difference between life and death. Paladin Drones, a company launching out of Y Combinator, wants to use technology to minimize the amount of time between a 911 call and a response through autonomous drones.

The company today announced the close of a $1.3 million seed round with participation from Khosla Ventures and Paul Buchheit.

Paladin’s software allows a drone — right now the software works with DJI drones — to deploy to the location of an incident and let first responders scope out the area beforehand. For example, a Paladin Drone might be deployed to the site of the fire, where it will arrive before first responders in an attempt to map out any dangers and locate hot spots of the fire inside the building.

The hope is to do as much data gathering and analysis as possible before any first responder gets on site. This allows them to jump straight into the process of saving lives and preventing further damage as soon as they arrive, as opposed to taking the time to map out the situation.

According to Paladin, one of the big issues in emergency situations is lack of information. Usually, the only information that first responders have when they get on site is what was gleaned from a 911 call. Because people placing 911 calls are usually in a state of panic, that information can be unreliable.

In fact, that’s how Paladin came to be. Co-founder and CEO Divyaditya Shrivastava had a conversation with firefighters after his friend’s house had burned down while the family was on vacation. The 911 call was placed by a neighbor walking by. The firefighters told Shrivastava that they originally didn’t have the right location of the emergency due to an unreliable 911 call.

“They said that this actually happens about 70% of the time because whenever there is an emergency, generally, the person calling 911 is panicking and can only give so much information,” he said. “That’s when I realized this is a huge problem. These are firefighters trying to save lives and they don’t have good information.”

As a recreational drone pilot, Shrivastava realized there was an opportunity to give firefighters and other first responders a real-time view of the scene to close the information gap. And so Paladin was born.

Shrivastava and his co-founder Trevor Pennypacker recently graduated out of Y Combinator and are running a pilot program with Memorial Village police department just outside of Houston, Texas.

The Paladin Drone technology offers clear benefits to first responders — the average response time for an emergency ranges from 8 to 15 minutes, whereas a Paladin-powered drone can get there in 30 to 90 seconds. That said, there are looming concerns about the invasiveness of this type of surveillance technology.

But Paladin has thought ahead. Not only does the company plan to work with local, state and federal government to ensure that its platform is compliant, but it has also built software to ensure that Paladin Drones record the sky when they’re en route to an emergency, only panning down to the ground when they’re on site.

Powered by WPeMatico

Shan Kadavil, who spent early days of his career managing tech support firm Support and then heading India operations of gaming firm Zynga, says he had a calling of sorts when his son was born. Kadavil realized that much of the meat that sells in India is not exactly healthy. The perishables are loaded with chemicals to superficially extend their life by six months, if not more. He wanted to do something better.

Fast forward four years, Kadavil said today that FreshToHome, his new e-commerce startup that delivers “100 percent” pure and fresh fish, chicken, and other kinds of meat, has raised $11 million in Series A funding. The startup has raised $13 million to date.

The round was led by CE Ventures, with participation from Das Capital, Kortschak Investments, TTCER Partners, Al-Nasser Holdings, M&S Partners and other Asia and Valley based Investors. Some of the backers of FreshToHome include Rajan Anandan, the former head of Google Southeast Asia, David Krane, CEO of GV, and Mark Pincus, chairman of Zynga.

FreshToHome has already courted 400,000 customers across four cities — Bengaluru, NCR (Delhi, Gurgaon, Noida, Faridabad, Ghaziabad & Greater Noida), Chennai and Kerala (Kochi, Trivandrum, Calicut & Trichur) — in India. On the backend, the startup does business with 1,500 fishermen across 125 coasts.

In an interview with TechCrunch, Kadavil said the startup is trying to “Uber-ize farmers and fishmen in India. We are giving them an app — around which we have a US patent — for commodity exchange. What farmers and fishermen do is they bid with us (as mandated by local laws) electronically using the app.” By dealing directly with the source, the startup is eliminating as many as half a dozen middlemen to cut costs.

The startup has built its own supply chain network. “We have got a 1,000 people, 100 trucks, and 40 collection points.” The startup, which also uses trains and planes to move inventory, has become one of the biggest clients of airlines Indigo and SpiceJet, he added. Kadavil claimed that FreshToHome is also the largest e-commerce platform for meat with $1.73 million in GMV sales each month.

If this all sounds well strategized, it is because of the people who are running the show. Kadavil founded the FreshToHome with Mathew Joseph, a veteran in the industry who has dealt with fish export for more than 30 years. Joseph started India’s first e-commerce venture in fish and meat called SeaToHome in 2012.

FreshToHome has also emerged as a micro-VC to farmers where it is doing cooperative farming. In such model, FreshToHome guides farmers to use the latest technologies to produce certain kind of fish. As of today, the startup is seeing 60,000 kg (132,227 pound) of production in cooperative farming through its marketplace and over 400,000 kg (881,849 pound) of total products sold per month.

FreshToHome will use the fresh capital to expand its supply chain network, connect with as many as 8,500 new farmers, and start delivering vegetables. It already delivers vegetables in Bengaluru. Kadavil said the startup will also expand to two more cities — Mumbai and Pune.

FreshToHome will compete with a handful of startups, including Licious, which has raised more than $35 million to date, ZappFresh, and BigBasket, which just earlier this month raised $150 million. The cold-chain market of India is estimated to grow to $37 billion in next five years.

In a prepared statement, Tushar Singhvi, Director of CE Ventures said, “The Meat and Seafood segment in India is pegged to be a 50 billion dollar market, but we have to keep in mind that it’s a highly fragmented industry. FreshToHome.com is not only trying to streamline the industry, they’re also using technology to revolutionize the way the industry functions by disintermediating the supply chain, eliminating the middleman and working directly with the fishermen and farmers in a market place model, to make fresh and chemical free food accessible to the masses at large.”

Powered by WPeMatico

Venture capitalists aren’t supposed to make their portfolio companies battle to the death. There’s a long-standing but unofficial rule that investors shouldn’t fund multiple competitors in the same space. Conflicts of interest could arise, information about one startup’s strategy could be improperly shared with the other, and the companies could become suspicious of advice provided by their investors. That leads to problems down the line for VCs, as founders may avoid them if they fear the firm might fund their rival down the line.

SoftBank shatters that norm with its juggernaut $100 billion Vision Fund plus its Innovation Fund. The investor hasn’t been shy about funding multiple sides of the same fight.

The problem is that SoftBank’s power distorts the market dynamics. Startups might take exploitative deals from the firm under the threat that they’ll be outspent whoever is willing to take the term sheet. That can hurt employees, especially ones joining later, who might have a reduced chance for a meaningful exit. SoftBank could advocate for mergers, acquisitions, or product differentiation that boost its odds of reaping a fortune at the expense of the startups’ potential.

Powered by WPeMatico

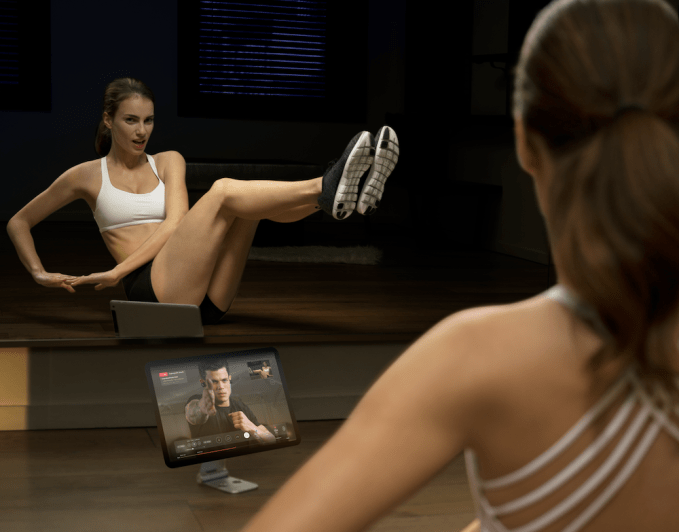

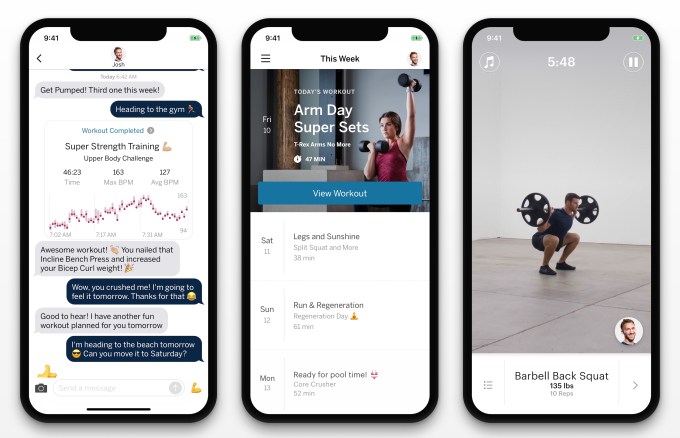

Livekick, a startup that gives customers access to one-on-one personal training and yoga from their home (or hotel room, or elsewhere), is announcing that it has raised $3 million in seed funding.

The company was founded by entrepreneur Yarden Tadmor and fitness expert Shayna Schmidt. Tadmor said that with all his travel for work, his fitness routine “really eroded,” so he contacted Schmidt and asked her to train him remotely — they’d connect via FaceTime, he’d mount his phone at the gym and she’d supervise his workout.

“We trained this way for a while, and then we realized: Hey, this is something that other people can really benefit from,” Tadmor said.

So with Livekick, users can sign up for one, two or three live, 30-minute sessions with a remote trainer, who they’ll connect with via the Livekick iOS app or website. (After a two-week trial, pricing starts at $32 per week.) The workouts will be tailored to the space and equipment that you have access to, and the trainers will also assign other workouts for the rest of the week.

Tadmor and Schmidt contrasted this approach with companies like Peloton and Mirror, which are bringing new exercise equipment and classes into the home, but which don’t offer one-on-one interaction with a trainer. Tadmor said this individualized approach is not just better-tailored to each user’s needs, but also more effective at keeping them motivated. And Schmidt said the live interaction also ensures that people are doing their workouts correctly and safely.

As for the trainers, Schmidt said this gives them a new way to find clients, particularly during their off-hours.

“For trainers, the hours that users are never booked are usually noon to 4pm — they never get a client because people are at work, obviously,” she said. “So we can give trainers in London those hours because for a user in New York, that’s morning. We can really fill their schedules [and] help them make some more income.”

Beyond consumer subscriptions, Livekick also offers a corporate program called Livekick for Work. And just to be clear, the service isn’t just for frequent travelers, as Tadmor noted: “If you live in New York, you have access to a lot of fitness options, but most people don’t. You’ve got to do a lot of commuting to get to a studio with great trainers, and so part of what we’re trying to bring is really let you do that from the comfort of your home.”

And while we recently covered the launch of a similar service called Future, Livekick actually launched in September, and Tadmor said the average retention rate has been over six months.

The round was led by Firstime VC, with participation from Rhodium and Draper Frontier.

“With its leading technology and ethos to make exercise accessible and affordable, we believe Livekick has the capacity to improve the lives and health of millions,” said Firstime’s Nir Tarlovsky in a statement.

Powered by WPeMatico

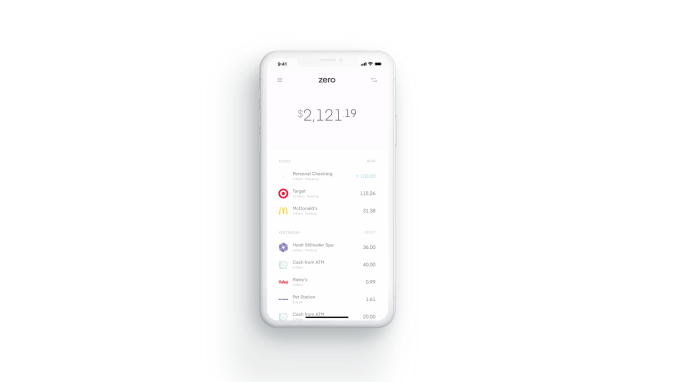

Just ahead of the launch of the Apple Card, a startup that has its own take on modernizing the credit card industry, Zero, is announcing the close of its $20 million Series A. The new round of funding was led by New Enterprise Associates (NEA), and brings Zero’s total raised to date to $35 million, including both equity and debt funding.

Other investors in the round include SignalFire, Eniac Ventures, Nyca Partners and some unnamed school endowments. Zero had previously announced an $8.5 million raise in fall 2017, led by Eniac, and had raised $7 million in venture debt from Silicon Valley Bank.

Zero has a clever idea that targets millennials’ hesitance to sign up for credit cards.

Today, only 33% of millennials have a major credit card, a Bankrate survey found — largely because they’re wary of falling into the vicious debt cycle. Instead, this younger demographic often only carries a debit card. But that also means they’re missing out on credit card benefits — like points, rewards and cash back.

Zero’s idea is to offer a rewards credit card that works like debit.

The Zerocard itself is a World Mastercard, so it earns credit card cash back. But unlike a traditional credit card, it’s combined with an FDIC-backed checking account called Zero Checking. That means Zerocard and Zero Checking work together in the app, allowing cardholders to see one net number they can spend from.

That way, they won’t make the mistake of accidentally going over budget, as is often the case with traditional credit cards, which then benefit from charging interest on the unpaid balance.

Zero co-founder and CEO Bryce Galen says he had always liked optimizing his personal finances, but didn’t see the value in overspending to chase rewards.

“People spend 10 to 15% more on average just because they’re putting it on a credit card, and not seeing where they stand all the time,” he says. “Spending 10 to 15% more to chase 1 to 2% in rewards doesn’t make sense.”

Plus, he adds, “half of all credit card points are never even redeemed.”

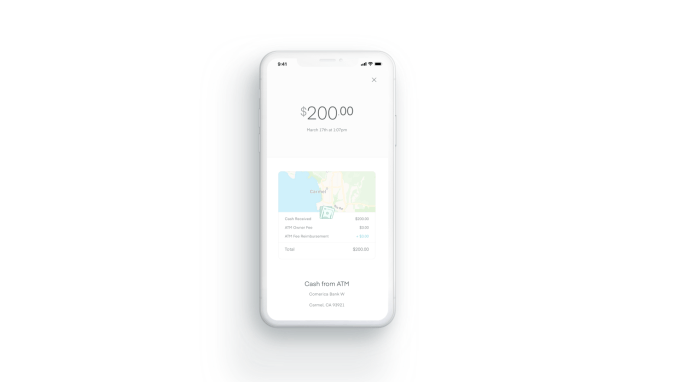

With Zerocard, the company does away with other credit card annoyances as well.

Zerocard doesn’t charge annual fees like many traditional credit cards do. And Zero Checking doesn’t add any additional ATM fees beyond what the ATM owner charges. It also does away with foreign transaction fees, minimum balance fees and overdraft fees — like many of today’s challenger banks.

Meanwhile, the Zero app is built with an eye toward what makes apps great.

Galen, who led product development for Zynga’s “Words with Friends” has experience in this department, while co-founder and COO Joel Washington previously co-founded car sales marketplace Shift. The executive team, combined, has backgrounds that include time at Affirm, Apple, Capital One, Dropbox, Google, Postmates, Silicon Valley Bank, Upgrade and Wells Fargo.

Overall, Zero’s design feels clean and simple, compared to the cluttered and dated apps from traditional banks. It has smart features, too, like a detailed transaction view that shows the vendor’s logo and location on a map to make it easier to recognize purchases.

“Zero creates an innovative debit-style experience, with an elegant design, and truly compelling rewards. It’s a fabulous banking experience,” said Hans Morris, managing partner of Nyca Partners and former president of Visa, Inc., in a statement. “Few people understand how complex it is to launch either a credit card or a checking account program, and I believe Zero is the first U.S. startup to launch both,” he said.

Zero launched in November 2018, but only to a small number of customers. Though officially open for business, it was functioning more like a public beta — though it didn’t call it that at the time. Meanwhile, its waitlist continued to grow.

Today, there are still 204,000 people waiting to be allowed in — something that Galen says is now going to happen.

“We haven’t launched to everyone on the waitlist yet, but we expect to within the next few weeks,” he says.

Another interesting twist on traditional credit cards is Zero’s path to card upgrades: it encourages but also rewards customers for telling their friends. By doing so, customers gain access to better-looking cards and higher cash-back percentages.

Zero customers start with a “Quartz” card offering 1% back on purchases. When a friend they refer joins, they receive a higher-level card called “Graphite” that offers 1.5% back. Two friends earns you the “Magnesium” card with 2% back and four friends gets you the “Carbon” card with 3% back. The Carbon card is also solid metal, capitalizing on the millennial trend of wanting their cards to look cool. And metal cards are in particular demand.

To receive the full cash-back rates, customers have to pay their balances in full by the due date, Zero says.

The company has partnered with Salt Lake City-based WebBank to issue the card, and deposits are held at Memphis-based Evolve Bank & Trust, an FDIC member. Zero makes money primarily on interchange and interest on deposits.

While some users may leave balances on the card that generate interest, Zero isn’t focused on that aspect of the business for revenue generation.

“Most companies in fintech today are launching undifferentiated debit cards as a feature or extension to their product for an additional engagement and monetization stream,” says Rick Yang, partner at NEA, as to why he invested.

“Zero is completely focused on their card programs and building a differentiated solution that actually provides a value proposition that resonates with consumers. We’ve also been fascinated by the growth of debit outpacing credit, and we think that our solution gives consumers the best of both worlds,” he adds.

Zero is currently iOS-only, but is working on an Android version that is expected to be ready in August.

Powered by WPeMatico

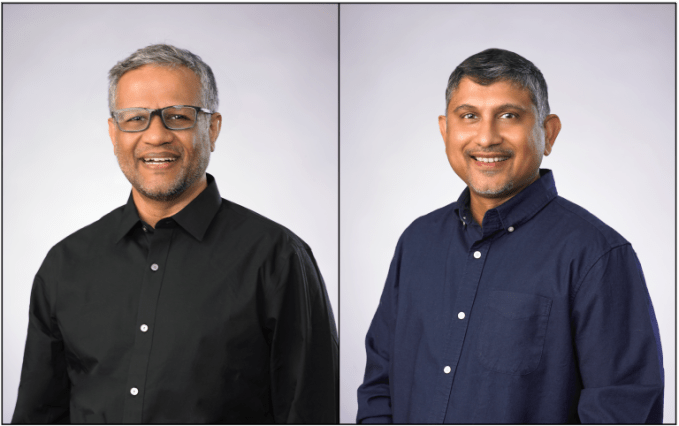

PlanetScale’s founders invented the technology called Vitess that scaled YouTube. Now they’re selling it to any enterprise that wants their data both secure and consistently accessible. And thanks to its ability to re-shard databases while they’re operating, it can solve businesses’ troubles with GDPR, which demands they store some data in the same locality as the user to whom it belongs.

The potential to be a computing backbone that both competes with and complements Amazon’s AWS has now attracted a mammoth $22 million Series A for PlanetScale. Led by Andreessen Horowitz and joined by the firm’s Cultural Leadership Fund, head of the US Digital Service Matt Cutts, plus existing investor SignalFire, the round is a tall step up from the startup’s $3 million seed it raised a year ago. Andreessen general partner Peter Levine will join the PlanetScale board, bringing his enterprise launch expertise.

PlanetScale co-founders (from left): Jitendra Vaidya and Sugu Sougoumarane

“What we’re discovering is that people we thought were at one point competitors, like AWS and hosted relational databases — we’re discovering they may be our partners instead since we’re seeing a reasonable demand for our services in front of AWS’ hosted databases,” says CEO Jitendra Vaidya. “We are growing quite well.” Competing database startups were raising big rounds, so PlanetScale connected with Andreessen in search of more firepower.

Vitess is a horizontal scaling sharding middleware engineered for MySQ that was built to run on “Borg” the predecessor to Kubernetes at Google. It lets businesses segment their database to boost memory efficiency without sacrificing reliable access speeds. PlanetScale sells Vitess in four ways: hosting on its database-as-a-service, licensing of the tech that can be run on-premises for clients or through another cloud provider, professional training for using Vitess and on-demand support for users of the open-source version of Vitess. PlanetScale now has 18 customers paying for licenses and services, and plans to release its own multi-cloud hosting to a general audience soon.

With data becoming so valuable and security concerns rising, many companies want cross-data center durability so one failure doesn’t break their app or delete information. But often the trade-off is unevenness in how long data takes to access. “If you take 100 queries, 99 might return results in 10 milliseconds, but one will take 10 seconds. That unpredictability is not something that apps can live with,” Vaidya tells me. PlanetScale’s Vitess gives enterprises the protection of redundancy but consistent speeds. It also allows businesses to continually update their replication logs so they’re only seconds behind what’s in production rather than doing periodic exports that can make it tough to track transactions and other data in real-time.

Now equipped with a ton of cash for a 20-person team, PlanetScale plans to double its staff by adding more sales, marketing and support. “We don’t have any concerns about the engineering side of things, but we need to figure out a go-to-market strategy for enterprises,” Vaidya explains. “As we’re both technical co-founders, about half of our funding is going towards hiring those functions [outside of engineering], and making that part of our organization work well and get results.”

But while a $22 million round from Andreessen Horowitz would be exciting for almost any startup, the funding for PlanetScale could assist the whole startup ecosystem. GDPR was designed to reign in tech giants. In reality, it applied compliance costs to all companies — yet the rich giants have more money to pay for those efforts. For a smaller startup, figuring out how to obey GDPR’s data localization mandate could be a huge engineering detour they can hardly afford. PlanetScale offers them not only databases but compliance-as-a-service too. It shards their data to where it has to be, and the startup can focus on their actual product.

Powered by WPeMatico

The only way to beat laziness is with guilt, so that’s what Future sells. It assigns you an actual human trainer who builds personalized workout plans and messages you throughout the day to make sure you’re doing them. It even gives you an Apple Watch to track your activity and ensure you’re not lying. Future actually got me to the gym where my coach kicked my ass remotely with a 30-minute lifting routine I’d never have stuck to by myself.

The catch? It’s probably the most expensive app you’ve ever seen, charging $150 per month.

Future officially launches today. Luckily it comes with a one-month money-back guarantee that CEO Rishi Mandal says has only been redeemed once. It’s produced some stunning stats from its beta tests: 95% of users stuck with it for three months, and 85% kept training for six months. That’s unheard of in fitness tech.

Future’s welcome kit includes a water bottle and Apple Watch

The remarkable retention and Future’s potential to become a gateway for your exercise and nutrition spending have roped in some big-name investors. Today it’s announcing an $8.5 million Series A led by Kleiner Perkins with partner Mamoon Hamid joining the board, building on its $3 million seed. Other backers include Instagram co-founder Mike Krieger, Khosla Ventures, Founders Fund and Caffeinated Capital. Athletes are betting on Future’s promise of democratizing the personal training they get, including Golden State Warrior Sean Livingston, and NFL stars Ndamukong Suh and Kelvin Beachum.

“Future manages to be both deeply personalized (and personable!) while being super convenient,” says Krieger of one of his first investments since leaving Instagram. Future’s Mandal built his old startup Sosh while sitting next to Krieger at incubator Dogpatch Labs, where Instagram was getting its start. “The always-available nature of it means travel or a shifting schedule is no longer an excuse to not work out.”

Throughout the onboarding, Future flexes the money you spend to offer what feels like a luxury app experience.

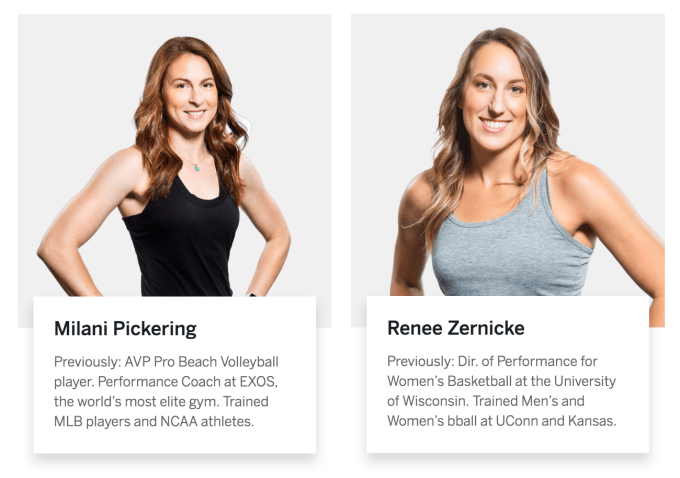

Upon signup, you’ll answer some questions about your goals like slimming down or beefing up, and pick from a few expert trainers matched to your needs. You’ll do a 15-minute video chat with your trainer to get friendly, describe your schedule and hammer out details of your workout plan. After you get your welcome kit with some swag and an Apple Watch, your trainer delivers your week’s worth of personalized daily routines that come with video instructions for each exercise. The Future app provides audio cues (and optional music) to guide you through the workouts while your trainer chimes in with personalized pointers and motivation via pre-recorded voice clips.

Future’s app guides you through workouts with instructional video clips and audio cues

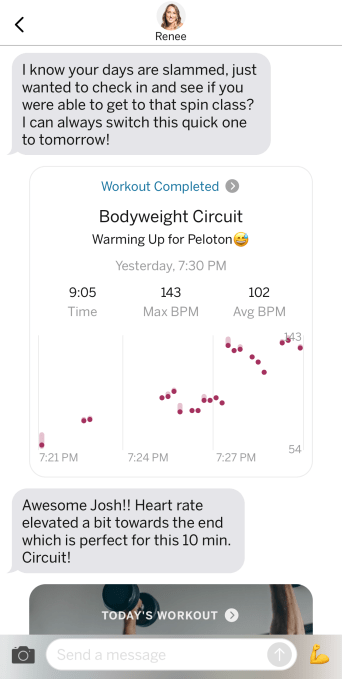

But what’s unique about Future is that your trainer proactively checks in with you throughout your day to make sure you’re actually going to the gym or doing those pushups. Because you don’t switch between trainers with each workout like some apps, and because they have your activity and heart-rate data from the Apple Watch, they can spot patterns of procrastination or flaking out. You’re prompted to give feedback after each sweat session that the trainer uses to tweak your plan. That personalization and prodding go a long way to making sure Future always fits your day and actually stays part of it.

For example, I wanted to burn a few pounds without burning too much time by adding a gym day or two plus some warmup strength training before my home Peloton rides. My trainer Renee Zernicke, a former University of Wisconsin director of Sports Performance for basketball, designed a 30-minute weight-lifting circuit and some 10-minute bodyweight exercise plans for me. When I messaged her that I was doing a more intense spin class today, she remixed my warmup exercises to avoid legs so I wouldn’t be tired during my ride. So far she’s always responded within a few minutes, and been cheerful yet forceful. “I know your days are slammed, just wanted to check in and see if you were able to get to that spin class?” she messaged me at 6:30pm. That’s something even most in-person trainers don’t do.

Future matches you with several trainer options

I found most of the workout instructions easy to understand, and the audio cues make it easy to do routines without constantly staring at your phone. But the one thing you really lose with a text message trainer instead of an in-person coach is warnings when you’re doing something wrong. Bad posture or jerky motions could get you injured. It’s all a lot smoother if you know your way around a gym. Future could do more to gauge your familiarity with proper form for riskier exercises, and then either teach you or steer you away from them. I hope I’m so sore today because I’m getting built, not getting hurt.

My trainer Renee encouraging me to get to the gym

Future was inspired by some scary facts. “Seventy percent of Americans are obese and overweight,” Mandal tells me. “We spend $3.5 trillion per year on healthcare, yet we have pretty mediocre outcomes.” Mandal had gone through Stanford, worked at NASA and been at Slide when it was acquired by Google. After selling his local experience app Sosh to Postmates, he became an entrepreneur-in-residence at Khosla Ventures, which does many medtech investments. There, Mandal realized health is largely determined by how you eat, sleep, deal with stress, take your medicine and exercise.

Thanks to smart watches, that last one had become the easiest to measure while remaining the toughest to do right on your own. Mandal set out to learn what the fittest people, professional athletes, do for exercise. They all said they relied on personal trainers to make all the workout plans and force them to do them. Home gyms or apps full of pre-made exercises weren’t enough. They needed someone to keep them accountable.

The trouble is that’s pretty expensive one-on-one. So Mandal teamed up with Justin Santamaria, a 10-year Apple veteran from the first iOS team who’d been working on iMessage and FaceTime. Together they designed Future in 2017 to make personal trainers cheap enough to be more accessible while retaining the personal connection that keeps trainees on track.

If you won’t shell out $150 per month to be nagged, there are plenty of apps like Sweat that let you choose between guided workouts. Hell, if you’ve got that much will power you could get any gym membership or just go running. But the closest thing to Future, called Fit.net, folded. AI trainers like Freeletics can’t make you feel guilty or inspired the same way. Lose It and MyFitnessPal can get fellow trainees to badger you, but Mandal found people don’t obey peers like a respected trainer.

The constant communication and sense of trust users develop with their coaches could give Future potential beyond subscription fitness. The app becomes a hub for your healthy behavior. Future already offers an in-app Shop where it recommends workout clothes, headphones and water bottles. It’s easy to imagine it partnering with fitness equipment makers, health food lines or other brands to score a cut of referred sales. “We become your most important relationship regarding your health. You only talk to your doctor two times to three times per year,” says Mandal. But you might tell your trainer you’re looking for ways to eat healthier or sleep better. “Over time, that’s the opportunity.”

Still, the biggest hurdle is convincing people to pay more than 10X their Netflix fee for a personal trainer they don’t see in person. Compared to the $1 apps we’re used to, Future can induce sticker shock. But compared to unused gym memberships, pricey private coaching and potential health problems, Future could look affordable if well-to-do professionals squint right. Humans are sluggish. Most healthy habits lapse. But Future is building the closest thing to “press button, pay money, get fitter” — which in the end looks like getting someone to enthusiastically shame/support us from afar.

Powered by WPeMatico

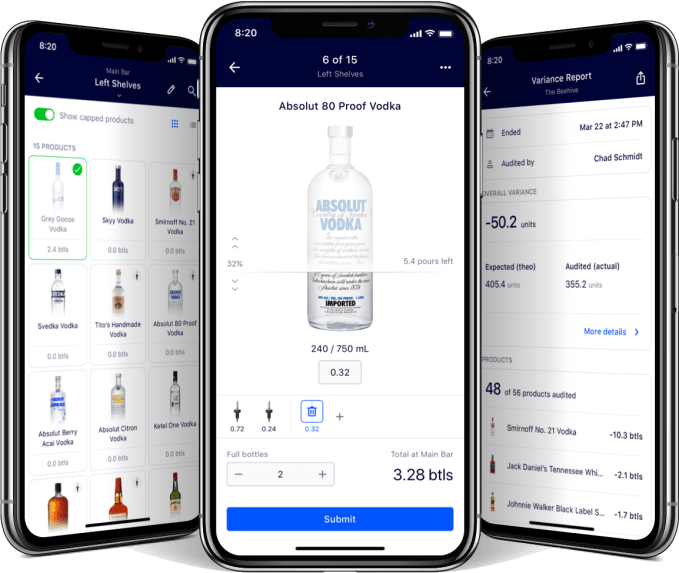

Bars lose 20% of their alcohol to overpours and “free” drinks for friends. That amounts to $50 billion per year in booze that mysteriously disappears, making life tough for every pub and restaurant. Nectar wants to solve that mystery with its ultrasound depth-sensing bottle caps that measure how much liquid is left in a bottle by measuring how long it takes a sonar pulse to bounce back. And now it’s bringing real-time pour tracking to beer with its gyroscopic taps. The result is that bar managers can determine who’s pouring too much or giving away drink, which promotions are working and when to reorder bottles without keeping too much stock on hand — and avoid wasting hours weighing or eyeballing the liquor level of their inventory.

Nectar’s solution to alcohol shrinkage has now attracted a $10 million Series A led by DragonCapital.vc and joined by former Campari chairman Gerry Ruvo, who will join the board. “Not a lot of technology has come to the bottle,” Nectar CEO Aayush Phumbhra says of ill-equipped bars and restaurants. “Liquor is their highest margin and highest cost item. If you don’t manage it efficiently, you go out of business.” Other solutions can look ugly to customers, forcibly restrict bartenders or take time and money to install and maintain. In contrast, Phumbhra tells me, “I care about solving deep problems by building a solution that doesn’t change behavior.”

Investors were eager to back the CEO, since he previously co-founded text book rental giant Chegg — another startup disrupting an aged market with tech. “I come from a pretty entrepreneurial family. No one in my family has ever worked for anyone else before,” Phumbhra says with a laugh. He saw an opportunity in the stunning revelation that the half-trillion-dollar on-premises alcohol business was plagued by missing booze and inconsistent ways to track it.

Typically at the end of a week or month, a bar manager will have staff painstakingly look at each bottle, try to guess what percent remains and mark it on a clipboard to be loaded into a spreadsheet later. While a little quicker, that’s very subjective and inaccurate. More advanced systems see every bottled weighed to see exactly how much is left. If they’re lucky, the scale connects to a computer, but they still have to punch in what brand of booze they’re sizing up. But the process can take many hours, which amounts to costly labor and infrequent data. None of these methods eliminate the manual measurement process or give real-time pour info.

Typically at the end of a week or month, a bar manager will have staff painstakingly look at each bottle, try to guess what percent remains and mark it on a clipboard to be loaded into a spreadsheet later. While a little quicker, that’s very subjective and inaccurate. More advanced systems see every bottled weighed to see exactly how much is left. If they’re lucky, the scale connects to a computer, but they still have to punch in what brand of booze they’re sizing up. But the process can take many hours, which amounts to costly labor and infrequent data. None of these methods eliminate the manual measurement process or give real-time pour info.

So with $6 million in funding, Nectar launched in 2017 with its sonar bottle caps that look and operate like old-school pourers. When bars order them, they come pre-synced and labeled for certain bottle shapes like Patron or Jack Daniels. Their Bluetooth devices stay charged for a year and connect wirelessly to a base hub in the bar. With each pour, the sonar pulse determines how much is in the bottle and subtracts it from the previous measurement to record how much was doled out. And the startup’s new gyroscopic beer system is calibrated to deduce pour volume from the angle and time the tap is depressed without the need for a sensor to be installed (and repaired) inside the beer hose.

Bar managers can keep any eye on everything throughout the night with desktop, iOS and Android apps. They could instantly tell if a martini special is working based on how much gin across brands is being poured, ask bartenders to slow their pours if they’re creeping upwards in volume or give the green light to strong pours on weeknights to reward regular customers. “Some bars encourage overpours to get people to keep coming back,” says local San Francisco celebrity bartender Broke-Ass Stuart, who tells me pre-measured pourers can save owners money but cost servers tips.

Nectar now sells self-serve subscriptions to its hardware and software, with a 20-cap package costing $99 per month billed annually with free yearly replacements. It’s also got a free two-tap trial package, or a $399 per month enterprise subscription for 100 taps. Nectar is designed to complement bar point of sale systems. And if a bar just wants the software, Nectar just launched its PrecisionAudit app, where staff tap the current liquid level on a photo of each different bottle for more accurate eyeballing. It’s giving a discount rate of $29.99 per month on the first 1,000 orders.

After 2 million pours measured, the business is growing 200% quarter-over-quarter as bowling alley chains and stadiums sign up for pilots. The potential to change the booze business seduced investors like Tinder co-founders Sean Rad and Justin Mateen, Palantir co-founder Joe Lonsdale and the founding family of the Modelo beer company. Next, Nectar is trying to invent a system for wine. That’s trickier, as its taps would need to be able to suck the air out of the bottles each night.

The big challenge will be convincing bars to change after tracking inventory the same way for decades. No one wants to deal with technical difficulties in a jam-packed bar. That’s partly why Nectar’s subscription doesn’t force owners to buy its hardware up front.

If Nectar can nail not only the tech but the bartender experience, it could pave a smoother path to hospitality entrepreneurship. Alcohol shrinkage is one factor leading to the rapid demise of many bars and restaurants. Plus, it could liberate bartenders from measuring bottles into the wee hours. As Phumbhra noted, “They’re coming in on weekends and working late. We want them to spend that time with their families and on customer service.”

Powered by WPeMatico

While Android and iOS have locked up the market for smartphone operating systems, a feature phone platform that has the distinction of being the world’s third biggest mobile OS is announcing a hefty round of funding to continue its expansion. KaiOS, which makes the OS that powers devices like Nokia’s feature phones and Jio’s devices out of India, has raised $50 million from Cathay Innovation (which led the round) and previous investors Google and TCL Holdings.

The funding takes the total raised by KaiOS — which has now shipped 100 million devices across 100 countries — to $72 million. It comes less than a year after Google invested $22 million in the business — a strategic round that also marked KaiOS beginning the process of creating native integrations of different Google services like Maps and (more recently) Assistant into the platform.

KaiOS is not disclosing its valuation, but Sebastien Codeville, its CEO, confirmed it is “definitely up.” (PitchBook put it at a very modest $43.75 million last year on the back of Google’s earlier round.)

We actually knew a little about this round back in February, at MWC in Barcelona, when KaiOS announced new handset partners and a raft of new features. A spokesperson for KaiOS told TechCrunch the delay in closing the deal and making it public was due to a need to coordinate with different stakeholders.

As it turned out, KaiOS’s timing for this announcement turned out to be pretty interesting. The big news this week in mobile is what kind of an impact Huawei will face in the wake of a U.S. regulation barring it from doing business in the U.S. One development in that story has been just how serious Huawei is about building its own operating system to replace Google’s Android and its related services.

This is big news because while Huawei is currently the world’s second-biggest mobile phone maker, we haven’t seen any platform gain reasonable mobile phone traction against the hegemony of iOS and Android outside of China — including the failure of Firefox OS, which retreated from the market only to reemerge, phoenix-like, as KaiOS two years ago — in part because of the extensive ecosystems that have coalesced around these two.

But while all eyes are on smartphones, KaiOS’s funding and general growth represents an interesting alternative for markets, carriers and consumers that might be in the market for what KaiOS refers to as “smart feature phones.”

Today, the company counts companies like Reliance Jio, Google, Facebook, Twitter, Orange, MTN and Qualcomm among its partners, and it’s been building an interesting, two-pronged strategy for targeting people both in developed and developing markets.

As Codeville describes it, in emerging markets (which are KaiOS’s primary target), its devices are being purchased by first-time phone users, or those that have had very basic, non-data mobile phones and are upgrading without the big step and expense of smartphones. “We are bringing people to internet usage with a device they are familiar with,” he said of the form factor. “Other key characteristics are a long battery life, a keyboard and a more resistant touch panel.”

The developed market, he added, was an interesting opportunity because of the amount of professionals and others who want pared-down devices for weekend use to unplug from their daily grind.

Many had left feature phones for dead with the growth in popularity of devices like the iPhone, app stores and, of course, apps themselves. But research from Counterpoint found that feature phones still accounted for almost 25% of all handset shipments in Q3 of last year, working out to a $28 billion market opportunity in the years ahead. Today there are some 1.5 billion feature phone users, an interesting number to consider as smartphone sales continue to feel the crunch.

Powered by WPeMatico

Tired of noisy music venues where you can hardly see the stage? SoFar Sounds puts on concerts in people’s living rooms where fans pay $15 to $30 to sit silently on the floor and truly listen. Nearly 1 million guests have attended SoFar’s more than 20,000 gigs. Having attended a half dozen of the shows, I can say they’re blissful…unless you’re a musician to pay a living. In some cases, SoFar pays just $100 per band for a 25 minute set, which can work out to just $8 per musician per hour or less. Hosts get nothing, and SoFar keeps the rest, which can range from $1100 to $1600 or more per gig — many times what each performer takes home. The argument was that bands got exposure, and it was a tiny startup far from profitability.

Today, SoFar Sounds announced it’s raised a $25 million round led by Battery Ventures and Union Square Ventures, building on the previous $6 million it’d scored from Octopus Ventures and Virgin Group. The goal is expansion — to become the de facto way emerging artists play outside of traditional venues. The 10-year-old startup was born in London out of frustration with pub-goers talking over the bands. Now it’s throwing 600 shows per month across 430 cities around the world, and over 40 of the 25,000 artists who’ve played its gigs have gone on to be nominated for or win Grammys. The startup has enriched culture by offering an alternative to late night, dark and dirty club shows that don’t appeal to hard-working professionals or older listeners.

But it’s also entrenching a long-standing problem: the underpayment of musicians. With streaming replacing higher priced CDs, musicians depend on live performances to earn a living. SoFar is now institutionalizing that they should be paid less than what gas and dinner costs a band. And if SoFar suck in attendees that might otherwise attend normal venues or independently organized house shows, it could make it tougher for artists to get paid enough there too. That doesn’t seem fair given how small SoFar’s overhead is.

By comparison, SoFar makes Uber look downright generous. A source who’s worked with SoFar tells me the company keeps a lean team of full-time employees who focus on reserving venues, booking artists, and promotion. All the volunteers who actually put on the shows aren’t paid, and neither are the venue hosts, though at least SoFar pays for insurance. The startup has previously declined to pay first-time SoFar performers, instead providing them a “high-quality” video recording of their gig. When it does pay $100 per act, that often amounts to a tiny shred of the total ticket sales.

“SoFar, however, seems to be just fine with leaving out the most integral part: paying the musicians” writes musician Joshua McClain. “This is where they willingly step onto the same stage as companies like Uber or Lyft — savvy middle-men tech start-ups, with powerful marketing muscle, not-so-delicately wedging themselves in-between the customer and merchant (audience and musician in this case). In this model, everything but the service-provider is put first: growth, profitability, share-holders, marketers, convenience, and audience members — all at the cost of the hardworking people that actually provide the service.” He’s urged people to #BoycottSoFarSounds

A deeply reported KQED expose by Emma Silvers found many bands were disappointed with the payouts, and didn’t even know SoFar was a for-profit company. “I think they talk a lot about supporting local artists, but what they’re actually doing is perpetuating the idea that it’s okay for musicians to get paid shit,” Oakland singer-songwriter Madeline Kenney told KQED.

SoFar CEO Jim Lucchese, who previously ran Spotify’s Creator division after selling it his music data startup The Echo Nest and has played SoFar shows himself, declares that “$100 buck for a showcase slot is definitely fair” but admits that “I don’t think playing a SoFar right now is the right move for every type of artist.” He stresses that some SoFar shows, especially in international markets, are pay-what-you-want and artists keep “the majority of the money”. The rare sponsored shows with outside corporate funding like one for the Bohemian Rhapsody film premier can see artists earn up to $1500, but these are a tiny fraction of SoFar’s concerts.

Otherwise, Lucchese says “the ability to convert fans is one of the most magical things about SoFar” referencing how artists rely on asking attendees to buy their merchandise or tickets for their full-shows and follow them on social media to earn money. He claims that if you pull out what SoFar pays for venue insurance, performing rights organizations, and its full-time labor, “a little over half the take goes to the artists.” Unfortunately that makes it sound like SoFar’s few costs of operation are the musicians’ concern. As McClain wrote, “First off, your profitability isn’t my problem.”

Now that it has ample funding, I hope to see SoFar double down on paying artists a fair rate for their time and expenses. Luckily, Lucchese says that’s part of the plan for the funding. Beyond building tools to help local teams organize more shows to meet rampant demand, he says “Am I satisfied that this is the only revenue we make artists right now? Abslutely not. We want to invest more on the artist side.” That includes better ways for bands to connect with attendees and turn them into monetizable fans. Even just a better followup email with Instagram handles and upcoming tour dates could help.

We don’t expect most craftspeople to work for “exposure”. Interjecting a middleman like SoFar shouldn’t change that. The company has a chance to increase live music listening worldwide. But it must treat artists as partners, not just some raw material they can burn through even if there’s always another act desperate for attention. Otherwise musicians and the empathetic fans who follow them might leave SoFar’s living rooms empty.

Powered by WPeMatico