funding

Auto Added by WPeMatico

Auto Added by WPeMatico

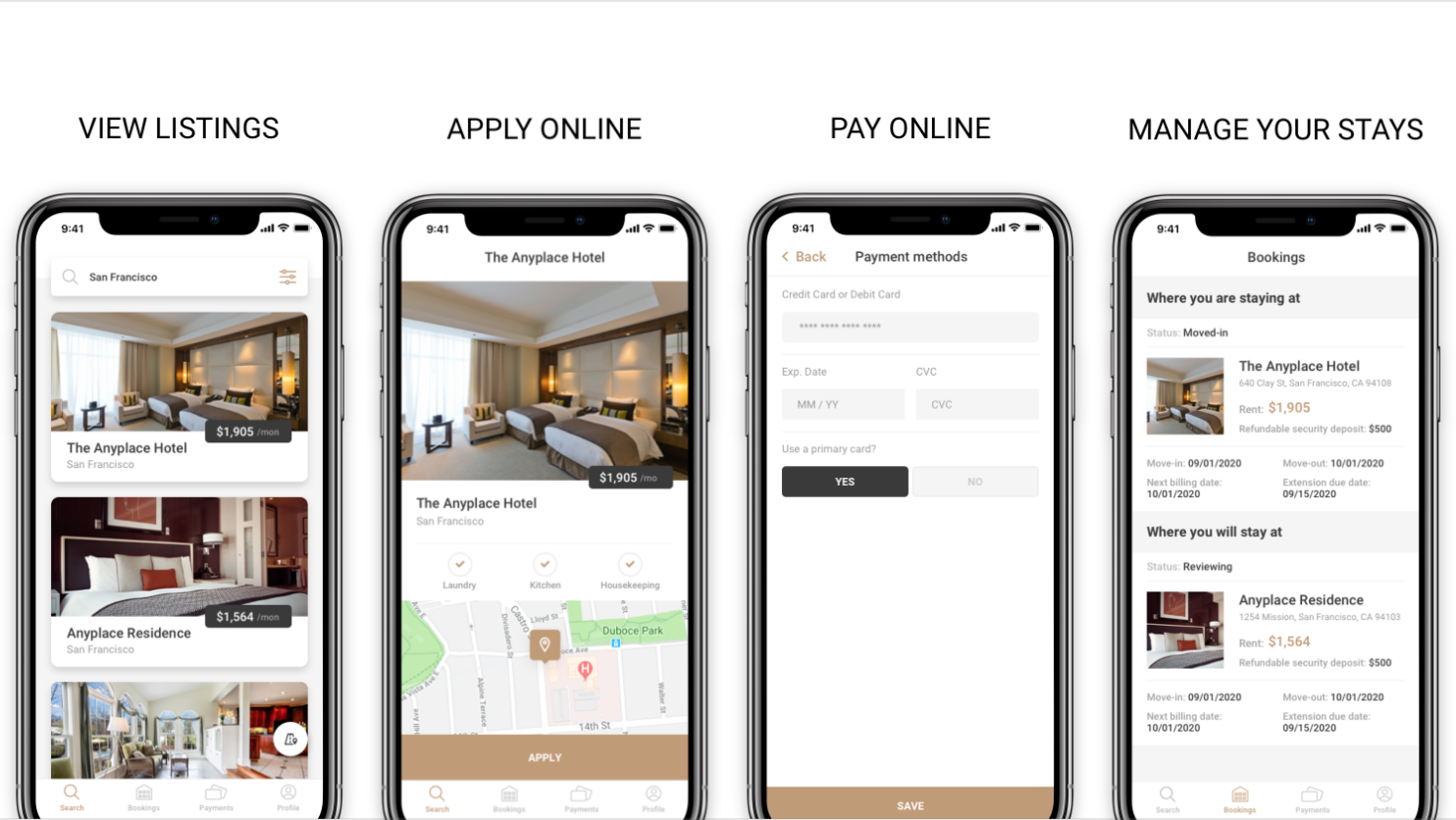

Anyplace, a startup offering furnished rooms and apartments to anyone who’s not interested in signing a long-term lease, is announcing that it has raised $2.5 million in seed funding.

CEO Satoru Steve Naito said he co-founded the company to meet his own needs as a “digital nomad” who likes to move from city to city every few months.

“I wanted this product for myself: I hate to commit to a long-term contract, and I want utilities and wifi taken care of when I secure a room,” Naito said.

For him, that meant moving into a hotel, where he said the rooms are “easy-to-book and fully furnished.” And while Naito’s far from the first person to call a hotel room home (I did it myself for a summer journalism internship back in 2006), with Anyplace, he’s created an online marketplace where you can rent hotel rooms and other furnished housing on a month-to-month basis.

Naito said Anyplace normally negotiates a 30% to 50% discount with the hotels. (Checking the Anyplace website this morning, it looks like monthly prices in New York range from $1,331 to $4,157.) Those hotels then get a new source of monthly revenue, which may be particularly important as they try to compete with services like Airbnb.

And while the pitch might sound similar to a serviced apartment or a co-living space, Naito noted that Anyplace functions purely as an online marketplace, without operating any properties of its own. So it actually partners with apartments and co-living companies to bring them more renters.

Anyplace handles the booking and payment process, in return for collecting a 10 percent commission. It also reduces the risk for the hotel or property owner by performing basic background checks, and Naito also plans to introduce insurance that will cover eviction costs for up to $10,000.

And there are new features for renters in the works, including a “nomad loyalty program” that rewards frequent customers with things like airplane ticket discounts, and an online community to help you find friends when you’re in a new city.

“We don’t want to become boring housing rental marketplace,” Naito said. “We are not a housing business, we are a freedom business.”

When Naito and I met to discuss the funding, he estimated that there were around 100 people currently staying in Anyplace properties. He also said the service generated $1.3 million in bookings last year.

He acknowledged that while digital nomadism sounds appealing, it’s “a very niche and small group,” so Anyplace is also designed to serve anyone in need of temporary housing, whether they’re relocating for a new job, taking an extended business trip or moving somewhere for an internship.

The startup’s seed funding comes from Jason Calacanis, FundersClub, UpHonest Capital, East Ventures, Keisuke Honda, Kenji Kasahara Bora Uygun and Global Brain.

Powered by WPeMatico

Fluree, a North Carolina startup that wants to bring the immutability of blockchain to the database, announced a $4.7 million seed round today led by 4490 Ventures with participation from Revolution’s Rise of the Rest Seed Fund.

As CEO and co-founder Brian Platz explains, the database combines blockchain and graph database technologies to offer a new way of thinking about storing and querying data. “The real benefits it provides is immense integrity around the data, so you can prove it has never been tampered with, who put it in there, etc., something you can’t do with current databases or other data management technologies.”

He added, “It has the ability to make the data immensely collaborative by allowing multiple parties to actually interact with it and improve security, and it really allows you, especially with how we’ve organized our database, to get better leverage out of the data.”

If you’re thinking such a database would be slow because of the nature of decentralized data, Platz says that it really depends how you choose to tune your blockchain. He sees blockchain technology on a spectrum with choices and tradeoffs between speed and decentralization.

“If you want 100% decentralization, something like Bitcoin, it’s going to be slow. You can’t have your cake and eat it too. If you need to, you can decrease the amount of centralization. So there’s a spectrum there, and we focus on giving people the knob to adjust that based on what they’re trying to do,” Platz explained.

Fluree has a free community edition and a paid enterprise version with some increased controls. The company currently has 17 employees based in Winston Salem, North Carolina, a number it will expand in the coming year with new funding.

Powered by WPeMatico

Chinese tech giant Alibaba is doubling down on India’s burgeoning video market, looking to fight back local rival ByteDance, Google and Disney to gain its foothold in the nation. The company said today that it is pumping $100 million into Vmate, a three-year-old social video app owned by subsidiary UC Web.

Vmate was launched as a video streaming and short-video-sharing app in 2016. But in the years since, it has added features such as video downloads and 3-dimensional face emojis to expand its use cases. It has amassed 30 million users globally, and will use the capital to scale its business in India, the company told TechCrunch. Alibaba Group did not respond to TechCrunch’s questions about its ownership of the app.

The move comes as Alibaba revives its attempts to take on the growing social video apps market, something on which it has missed out completely in China. Vmate could potentially help it fill the gap in India. Many of the features Vmate offers are similar to those offered by ByteDance’s TikTok, which currently has more than 120 million active users in India. ByteDance, with a valuation of about $75 billion, has grown its business without taking money from either Alibaba or Tencent, the latter of which has launched its own TikTok-like apps with limited success.

Alibaba remains one of the biggest global investors in India’s e-commerce and food-tech markets. It has heavily invested in Paytm, BigBasket, Zomato and Snapdeal. It was also supposedly planning to launch a video streaming service in India last year — a rumor that was fueled after it acquired a majority stake in TicketNew, a Chennai-based online ticketing service.

UC Web, a subsidiary of Alibaba Group, also counts India as one of its biggest markets. The browser maker has attempted to become a super app in India in recent years by including news and videos. In the last two years, it has been in talks with several bloggers and small publishers to host their articles directly on its platform, many people involved in the project told TechCrunch.

UC Web’s eponymous browser rose to stardom in the days of feature phones, but has since lost the lion’s share to Google Chrome as smartphones become more ubiquitous. Chrome ships as the default browser on most Android smartphones.

The major investment by Alibaba Group also serves as a testament to the growing popularity of video apps in India. Once cautious about each megabyte they spent on the internet, thrifty Indians have become heavy video consumers online as mobile data gets significantly cheaper in the country. Video apps are increasingly climbing up the charts on Google Play Store.

In an event for marketers late last year, YouTube said that India was the only nation where it had more unique users than its parent company Google. The video juggernaut had about 250 million active users in India at the end of 2017. The service, used by more than 2 billion users worldwide, has not revealed its India-specific user base since.

T-Series, the largest record label in India, became the first YouTube channel this week to claim more than 100 million subscribers. What’s even more noteworthy is that T-Series took 10 years to get to its first 10 million subscribers. The additional 90 million subscribers signed up to its channel in the last two years. Also fighting for users’ attention is Hotstar, which is owned by Disney. Earlier this month, it set a new global record for most simultaneous views on a live-streaming event.

Powered by WPeMatico

Entering into the world of Anthemis is a bit like stepping into the frame of a Wes Anderson film. Eclectic, offbeat people situated in colorful interiors? Check. A muse in the form of a renowned British-Venezuelan economist? Check. A design-forward media platform to provoke deep thought? Check. An annual summer retreat ensconced in the French Alps? Bien sûr.

Sitting atop this most unusual fintech(ish) VC is its ponytailed founder and chairman Sean Park, whose difficult-to-place accent and Philosophy professor aura belie his extensive fixed income capital markets experience. He’s joined by founder and CEO Amy Nauiokas, who in addition to being one of Fintech’s most prominent female investors also owns a high-minded film and television production company.

When Arman Tabatabai and I recently sat down with Park and Nauiokas in their New York office, the firm’s leaders were in an upbeat mood, having blown past the temporary perception-setback associated with the abrupt resignation last year of Anthemis’ former CEO Nadeem Shaikh (for more on this, read TechCrunch writer Steve O’Hear’s coverage of the situation).

And as the conversation below demonstrates, Park and Nauiokas are well poised to bring the quirk into everything they touch, which these days runs the gamut from backing companies involved in sustainable finance, advancing their home-grown media platform and preparing a soon-to-be-announced initiative elevating female entrepreneurs.

Gregg Schoenberg: With the two of you now at the helm, how does Anthemis present itself today?

Sean Park: I’ll step back and say that when Amy and I were working at big financial institutions in the noughties, we saw that the industry was going to change and that existing business models were running into their natural diminishing returns.

We tried to bring some new ideas to the organizations we were working in, but we each had epiphany moments when we realized that big organizations weren’t built to do disruptive transformation — for bad reasons, but also good reasons, too.

GS: Let’s fast forward to today, where you have several strong Fintech VCs out there. But unlike others, Anthemis puts weirdness at the heart of its model.

Yes, you’ve backed some big names like Betterment and eToro, but you’ve done other things that are farther afield. What’s the underlying thesis that supports that?

Amy Nauiokas: Whatever we do at Anthemis has to be a non-zero-sum game. It has to be for good, not for evil. So that means that we aren’t looking in any place where you see predatory opportunities to make money.

Powered by WPeMatico

The Valley’s rocky history with cleantech investing has been well-documented.

Startups focused on non-emitting-generation resources were once lauded as the next big cash cow, but the sector’s hype quickly got away from reality.

Complex underlying science, severe capital intensity, slow-moving customers and high-cost business models outside the comfort zones of typical venture capital ultimately caused a swath of venture-backed companies and investors in the cleantech boom to fall flat.

Yet, decarbonization and sustainability are issues that only seem to grow more dire and more galvanizing for founders and investors by the day, and more company builders are searching for new ways to promote environmental resilience.

While funding for cleantech startups can be hard to find nowadays, over time we’ve seen cleantech startups shift down the stack away from hardware-focused generation plays toward vertical-focused downstream software.

A far cry from past waves of venture-backed energy startups, the downstream cleantech companies offered more familiar technology with more familiar business models, geared toward more recognizable verticals and end users. Now, investors from less traditional cleantech backgrounds are coming out of the woodwork to take a swing at the energy space.

An emerging group of non-traditional investors getting involved in the clean energy space are those traditionally focused on fintech, such as New York and Europe-based venture firm Anthemis — a financial services-focused team that recently sat down with our fintech contributor Gregg Schoenberg and I (check out the full meat of the conversation on Extra Crunch).

The tie between cleantech startups and fintech investors may seem tenuous at first thought. However, financial services have long played a significant role in the energy sector and is now becoming a more common end customer for energy startups focused on operations, management and analytics platforms, thus creating real opportunity for fintech investors to offer differentiated value.

Though the conversation around energy resources and decarbonization often focuses on politics, a significant portion of decisions made in the energy generation business is driven by pure economics — is it cheaper to run X resource relative to resources Y and Z at a given point in time? Based on bid prices for request for proposals (RFPs) in a specific market and the cost-competitiveness of certain resources, will a developer be able to hit their targeted rate of return if they build, buy or operate a certain type of generation asset?

Alternative generation sources like wind, solid oxide fuel cells or large-scale or even rooftop solar have reached more competitive cost levels — in many parts of the U.S., wind and solar are in fact often the cheapest form of generation for power providers to run.

Thus as renewable resources have grown more cost competitive, more infrastructure developers and other new entrants have been emptying their wallets to buy up or build renewable assets like large-scale solar or wind farms, with the American Council on Renewable Energy even forecasting cumulative private investment in renewable energy possibly reaching up to $1 trillion in the U.S. by 2030.

A major and swelling set of renewable energy sources are now led by financial types looking for tools and platforms to better understand the operating and financial performance of their assets, in order to better maximize their return profile in an increasingly competitive marketplace.

Therefore, fintech-focused venture firms with financial service pedigrees, like Anthemis, now find themselves in pole position when it comes to understanding cleantech startup customers, how they make purchase decisions, and what they’re looking for in a product.

In certain cases, fintech firms can even offer significant insight into shaping the efficacy of a product offering. For example, Anthemis portfolio company kWh Analytics provides a risk management and analytics platform for solar investors and operators that helps break down production, financial analysis and portfolio performance.

For platforms like kWh analytics, fintech-focused firms can better understand the value proposition offered and help platforms understand how their technology can mechanically influence rates of return or otherwise.

The financial service customers for clean energy-related platforms extends past just private equity firms. Platforms have been and are being built around energy trading, renewable energy financing (think financing for rooftop solar) or the surrounding insurance market for assets.

When speaking with several of Anthemis’ cleantech portfolio companies, founders emphasized the value of having a fintech investor on board that not only knows the customer in these cases, but that also has a deep understanding of the broader financial ecosystem that surrounds energy assets.

Founders and firms seem to be realizing that various arms of financial services are playing growing roles when it comes to the development and access to clean energy resources.

By offering platforms and surrounding infrastructure that can improve the ease of operations for the growing number of finance-driven operators or can improve the actual financial performance of energy resources, companies can influence the fight for environmental sustainability by accelerating the development and adoption of cleaner resources.

Ultimately, a massive number of energy decisions are made by financial services firms and fintech firms may often know the customers and products of downstream cleantech startups more than most. And while the financial services sector has often been labeled as dirty by some, the vital role it can play in the future of sustainable energy offers the industry a real chance to clean up its image.

Powered by WPeMatico

Brex, the fintech business that’s taken the startup world by storm with its sought after corporate card tailored for entrepreneurs, is raising millions in Series D funding less than a year after it launched, TechCrunch has learned.

Bloomberg reports Brex is raising at a $2 billion valuation, though sources tell TechCrunch the company is still in negotiations with both new and existing investors. Brex didn’t immediately respond to requests for comment.

Kleiner Perkins is leading the round via former general partner Mood Rowghani, who left the storied venture capital fund last year to form Bond alongside Mary Meeker and Noah Knauf. As we’ve previously reported, the Bond crew is still in the process of deploying capital from Kleiner’s billion-dollar Digital Growth Fund III, the pool of capital they were responsible for before leaving the firm.

Bond, which recently closed on $1.25 billion for its debut effort and made its first investment, is not participating in the round for Brex, sources confirm to TechCrunch. Bond declined to comment.

Brex, a graduate of Y Combinator’s winter 2017 cohort, has raised $182 million in VC funding, reaching a valuation of $1.1 billion in October 2018 three months after launching its corporate card for startups and less than a year after completing YC’s accelerator program.

Most recently, Brex attracted a $125 million Series C investment led by Greenoaks Capital, DST Global and IVP. The startup is also backed by PayPal founders Peter Thiel and Max Levchin, and VC firms such as Ribbit Capital, Oneway Ventures and Mindset Ventures, according to PitchBook.

The company’s pace of growth is unheard of, even in Silicon Valley where inflated valuations and outsized rounds are the norm. Why? Brex has tapped into a market dominated by legacy players in dire need of technological innovation and, of course, startup founders always need access to credit. That, coupled with the fact that it’s capitalized on YC’s network of hundreds of startup founders — i.e. Brex customers — has accelerated its path to a multi-billion-dollar price tag.

Brex doesn’t require any kind of personal guarantee or security deposit from its customers, allowing founders near-instant access to credit. More importantly, it gives entrepreneurs a credit limit that’s as much as 10 times higher than what they would receive elsewhere.

Investors may also be enticed by the fact the company doesn’t use third-party legacy technology, boasting a software platform that is built from scratch. On top of that, Brex simplifies a lot of the frustrating parts of the corporate expense process by providing companies with a consolidated look at their spending.

“We have a very similar effect of what Stripe had in the beginning, but much faster because Silicon Valley companies are very good at spending money but making money is harder,” Brex co-founder and chief executive officer Henrique Dubugras told me late last year.

Stripe, for context, was founded in 2010. Not until 2014 did the company raise its unicorn round, landing a valuation of $1.75 billion with an $80 million financing. Today, Stripe has raised a total of roughly $1 billion at a valuation north of $20 billion.

Dubugras and Brex co-founder Pedro Franceschi, 23-year-old entrepreneurs, relocated from Brazil to Stanford in the fall of 2016 to attend the university. They dropped out upon getting accepted into YC, which they applied to with a big dreams for a virtual reality startup called Beyond. Beyond quickly became Brex, a name in which Dubugras recently told TechCrunch was chosen because it was one of few four-letter word domains available.

Brex’s funding history

March 2017: Brex graduates Y Combinator

April 2017: $6.5M Series A | $25M valuation

April 2018: $50M Series B | $220M valuation

October 2018: $125M Series C | $1.1B valuation

May 2019: undisclosed Series D | ~$2B valuation

In April, Brex secured a $100 million debt financing from Barclays Investment Bank. At the time, Dubugras told TechCrunch the business would not seek out venture investment in the near future, though he did comment that the debt capital would allow for a significant premium when Brex did indeed decide to raise capital again.

In 2019, Brex has taken steps several steps toward maturation.Recently, it launched a rewards program for customers and closed its first notable acquisition of a blockchain startup called Elph. Shortly after, Brex released its second product, a credit card made specifically for ecommerce companies.

Its upcoming infusion of capital will likely be used to develop payment services tailored to Fortune 500 business, which Dubugras has said is part of Brex’s long term plan to disrupt the entire financial technology space.

Powered by WPeMatico

Let’s go beyond the high-level fundraising advice that fills VC blogs. If you have a compelling business and have educated yourself on crafting a pitch deck and getting warm intros to VCs, there are still specific questions about the strategy to follow for your fundraise.

How can you make your round “hot” and trigger a fear of missing out (FOMO) among investors? How can you fundraise faster to reduce the distraction it has on running your business?

“You’re trying to make a market for your equity. In order to make a market you need multiple people lining up at the same time.”

Unsurprisingly, I’ve noticed that experienced founders tend to be more systematic in the tactics they employ to raise capital. So I asked several who have raised tens (or hundreds) of millions in VC funding to share specific strategies for raising money on their terms. Here’s their advice.

(The three high-profile CEOs who agreed to share their specific playbooks requested anonymity so VCs don’t know which is theirs. I’ve nicknamed them Founder A, Founder B, and Founder C.)

Have additional fundraising tactics to share? Email me at eric.peckham@techcrunch.com.

“You’re trying to make a market for your equity. In order to make a market, you need multiple people lining up at the same time.”

That advice from Atrium CEO Justin Kan (a co-founder of companies like Twitch and former partner at Y Combinator) was reiterated by all the entrepreneurs I interviewed. Fundraising should be a sprint, not a marathon, otherwise the loss of momentum will make it more difficult.

Powered by WPeMatico

Logz.io announced a $52 million Series D investment today. The round was led by General Catalyst.

Other investors participating in the round included OpenView Ventures, 83North, Giza Venture Capital, Vintage Investment Partners, Greenspring Associates and Next47. Today’s investment brings the total raised to nearly $100 million, according to Crunchbase data.

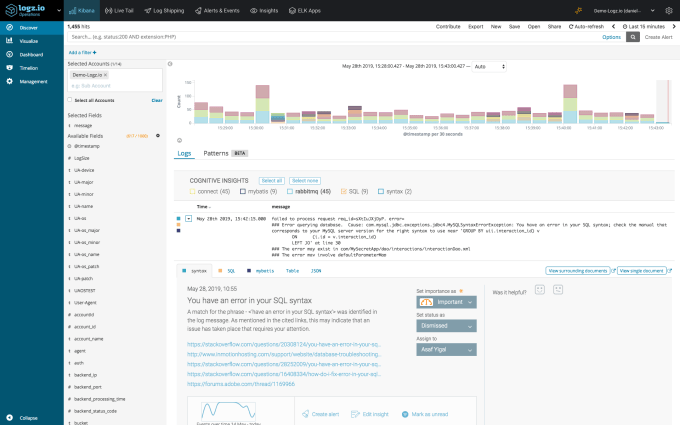

Logz.io is a company built on top of the open-source tools Elasticsearch, Logstash and Kibana (collectively known by the acronym ELK) and Grafana. It’s taking those tools in a typical open-source business approach, packaging them up and offering them as a service. This approach enables large organizations to take advantage of these tools without having to deal with the raw open-source projects.

The company’s solutions intelligently scan logs looking for anomalies. When it finds them, it surfaces the problem and informs IT or security, depending on the scenario, using a tool like PagerDuty. This area of the market has been dominated in recent years by vendors like Splunk and Sumo Logic, but company founder and CEO Tomer Levy saw a chance to disrupt that space by packaging a set of open-source logging tools that were rapidly increasing in popularity. They believed they could build on that growing popularity, while solving a pain point the founders had actually experienced in previous positions, which is always a good starting point for a startup idea.

Screenshot: Logz.io

“We saw that the majority of the market is actually using open source. So we said, we want to solve this problem, a problem we have faced in the past and didn’t have a solution. What we’re going to do is we’re going to provide you with an easy-to-use cloud service that is offering an open-source compatible solution,” Levy explained. In other words, they wanted to build on that open-source idea, but offer it in a form that was easier to consume.

Larry Bohn, who is leading the investment for General Catalyst, says that his firm liked the idea of a company building on top of open source because it provides a built-in community of developers to drive the startup’s growth — and it appears to be working. “The numbers here were staggering in terms of how quickly people were adopting this and how quickly it was growing. It was very clear to us that the company was enjoying great success without much of a commercial orientation,” Bohn explained.

In fact, Logz.io already has 700 customers, including large names like Schneider Electric, The Economist and British Airways. The company has 175 employees today, but Levy says they expect to grow that by 250 by the end of this year, as they use this money to accelerate their overall growth.

Powered by WPeMatico

Equalum, an Israeli startup that helps companies gather data from a variety of enterprise sources, announced an $18 million Series B investment today.

The round was led by Planven Investments . Other participants included United Ventures and prior investors Innovation Endeavors and GE Ventures, along with a group of unnamed individuals. Today’s haul brings the total raised to $25 million, according to data provided by the company.

Equalum CEO and founder Nir Livneh says his company essentially acts as the data pipes to feed artificial intelligence, machine and more traditional business intelligence requirements. “Equalum is a real-time data ingestion platform. The idea of the platform is to be able to [gather] data coming from a bunch of enterprise system sources and be able to centralize that data and send it in real-time into analytic environments and feed those analytic environments,” Livneh explained.

He sees the money from this round as a way to continue to expand the original vision he had for the company. His approach in many ways is a classic Series B play. “I think the original thesis was validated. We have proven that we can go into Fortune 100 companies and get our solution adopted quickly,” he said. The next step is to expand beyond the original set of several dozen large customers and accelerate growth.

The company was founded in 2015 in Tel Aviv, Israel. It still maintains its R&D arm there today, with sales, marketing and management in Silicon Valley. Interestingly, its first customer was GE, which was also an early investor via GE Ventures.

Livneh says that he sees lots of room to grow in this market, which he says is still dominated by legacy vendors. He believes he can swoop in and replace aging offerings by providing a more modern and streamlined approach to data collection. Time will tell if he is right.

Powered by WPeMatico

Away from the limelight of urban cities, where an increasingly growing number of firms are fighting for a piece of India’s digital payments market, a South Korean startup’s app is quietly helping millions of Indians pay digitally and enjoy many financial services for the first time.

The app, called True Balance, began its life as a tool to help users easily find their mobile balance, or topping up pre-pay mobile credit. But in its four-year journey, its ambition has significantly grown beyond that. Today, it serves as a digital wallet app that helps users pay their mobile and electricity bills, and it also lets users pay later.

One thing that has not changed for the parent company of True Balance, BalanceHero, which employs less than 200 people, is its consumer focus. It is strictly catering to people in tier-two and tier-three markets — often dubbed as India 2 and India 3 — who have relatively limited access to the internet, and lower financial power. And it remains operational just in India.

Even as India is already the second largest internet market with more than 500 million users, more than half of its population remains offline. In recent years, the nation has become a battleground for Silicon Valley giants and Chinese firms that are increasingly trying to win existing users and bring the rest of the population online.

And like many other companies, BalanceHero’s bet on India is beginning to pay off. The startup told TechCrunch today that it has clocked $100 million in GMV sales and has amassed about 60 million registered users. Yongsung Yoo, a spokesperson for the startup, added that BalanceHero, which has raised $42 million to date, is also nearing profitability.

The South Korean firm’s playbook is different from many other players that are racing to claim a slice of India’s burgeoning digital payments market. True Balance competes with the likes of Paytm, MobiKwik, Google, Amazon and Walmart-owned Flipkart, though its competitors are still largely catering to the urban parts of India.

In the last two years, many firms have begun to explore smaller cities and towns, but their services are still too out-of-the-world for local residents. Raising awareness about digital services is a big challenge in such markets, Yoo said, so the startup is relying on existing users to help others make their first transactions and in paying bills.

Yoo said the startup rewards these “digital agents” with cash back and other benefits. For these digital agents, many of whom do not have a day job, True Balance has emerged as a side project to make extra money.

Later this year, Yoo said the startup, which recently also added support for UPI in its service, will open an e-commerce store on its app and also offer insurance to users. To accelerate its growth and expansion, True Balance is in the final stages of raising between $50 million to $70 million in a new round that it expects to close in July this year, Yoo said.

Powered by WPeMatico