funding

Auto Added by WPeMatico

Auto Added by WPeMatico

GoTenna is best known for its outdoors-oriented consumer products that let you text and share locations between smartphones off the grid. But the company has found that government work — military, fire, rescue — is the real market, and is pursuing it with a vengeance on the strength of a $24 million funding round.

“We’ve been busy!” said Daniela Perdomo, founder and CEO of the company, in an interview. “We have a good problem, which is a technology that can be so foundationally enabling for so many use cases.”

GoTenna’s core tech is mesh networking over radio frequencies normally used for walkie-talkies: long range but low bandwidth. Yet if all you need to send are GPS coordinates or a short message, it’s perfectly sufficient and works great where mobile and satellite connections are impractical. Just turn on the device, smaller than a deck of cards, and you can chat over miles in the middle of nowhere with your climbing partners or back-country ski pals.

In the last couple of years the company has shifted its priorities from consumer tech — the GoTenna and Mesh series of gadgets — to filling the needs of public-sector clients that have been asking for something like this for years.

Firefighters, military operations, local law enforcement, search and rescue — many were using bulky, over-engineered, expensive solutions that haven’t changed much in decades. GoTenna works with nearly any smartphone and instantly creates a mesh network that can span miles, making it perfect for off-grid communications.

Perdomo said this was actually more or less the plan from the beginning.

“It was in my first-ever pitch deck when we raised our seed in 2013, there was this blue-sky vision of how the technology would be used,” she told me. “But it was simpler to launch an MVP to consumers. We always felt that product was going to bring in the public sector. And that’s exactly what happened — when we launched our first-generation product, I think within 24 hours we had a variety of different public sector customers reach out to us.”

“We now have some federal agencies that have been customers through every generation of the product. We sill have our consumer product, and people love it, but it’s a small part of our business compared to the public sector,” she said.

An example of how the interface might look in use. It can relay the locations of other GoTenna devices at intervals, helping teams keep in touch automatically.

While disaster response crews could of course just buy a couple dozen of the regular GoTenna products, they were quick to ask for “pro” versions with features prized by advanced users and military customers.

Longer range, more programmable wireless parameters, compatibility with various legacy systems — the Pro and new ProX versions of the GoTenna system hit a lot of sweet spots. As Perdomo told me when the Pro first came out, legacy systems are powerful in some ways but can also be horribly expensive, incompatible with foreign wireless systems or even have legal restrictions on where they can be used.

For a cash-strapped NGO that goes around doing global aid, a $100-$500 gadget that turns an ordinary phone into a versatile mesh node is potentially game-changing. (You can also use them to temporarily replace destroyed communications infrastructure.)

But deep-pocketed federal agencies and military branches are also shelling out for the devices, and increasingly for the software support contracts that go with them. GoTenna’s Aspen Grove is a proprietary mesh network protocol that they’ve engineered to be faster and more robust than anything else out there. I’d exert a little skepticism here normally, but from what I’ve seen, the systems GoTenna is replacing or augmenting aren’t exactly competitive.

In fact, GoTenna’s next major hardware project is to create a mesh networking board that can be integrated right into existing hardware, simplifying the systems and baking its protocols in even deeper.

“We have a long list of companies that want to integrate our tech into vehicles, aircraft, anything you can think of,” Perdomo said. “So you can put one of these babies on a UAV and let ‘er rip! Our record range, point to point from a UAV, is 69 miles.”

Meanwhile the company is also releasing a broader open-source mesh platform called Lot 49 that’s meant to be capable of supporting a global messaging infrastructure without relying on any wireless providers. That could be a big deal for Internet of Things-type devices as well.

Meanwhile the company is also releasing a broader open-source mesh platform called Lot 49 that’s meant to be capable of supporting a global messaging infrastructure without relying on any wireless providers. That could be a big deal for Internet of Things-type devices as well.

Interestingly, Perdomo doesn’t feel threatened by the new and rather scary kid on the block: communications satellite constellations like Starlink and OneWeb. If the idea is that GoTenna lets you communicate where the grid doesn’t reach, what happens when the grid is global?

“No matter how many satellites you put up, repeaters you put up, cables you lay down, you always have that last mile. You need resiliency, access, and I believe neutrality as well,” she said. And indeed you’re not going to take a Starlink ground station with you on a covert operation or into an active wildfire. And having an existing, ongoing business agreement with a satellite communications provider may not even be desirable in the first place.

“There’s a reason why certain incumbents in the tactical radio space as well as carriers are partnering with us,” Perdomo pointed out — and indeed Comcast Ventures is a new face among the investors. “We’re creating a new layer in the communications stack, mesh networks with a focus on bursty data. I think of us as perfectly complementary to every other communications company.”

“There’s a reason why certain incumbents in the tactical radio space as well as carriers are partnering with us,” Perdomo pointed out — and indeed Comcast Ventures is a new face among the investors. “We’re creating a new layer in the communications stack, mesh networks with a focus on bursty data. I think of us as perfectly complementary to every other communications company.”

As for that funding, it will go toward easing the rapid growth the company is experiencing, finishing the pro and embedded options, hiring up and expanding operations to support their growing services business. The $24 million round was led by Founders Fund, with participation from Comcast Ventures and existing investors Union Square Ventures, Collaborative Fund, Walden VC, MentorTech and Bloomberg Beta.

“We’ve been in R&D for a really long time,” Perdomo said. “It’s exciting now to also be becoming a business. All of the most impressive mainstream telecommunications technologies we use today, things like the internet or GPS, they hit it out of the park with the public sector first. If you can win there, in life or death situations, you know you can win everywhere else as well.”

Powered by WPeMatico

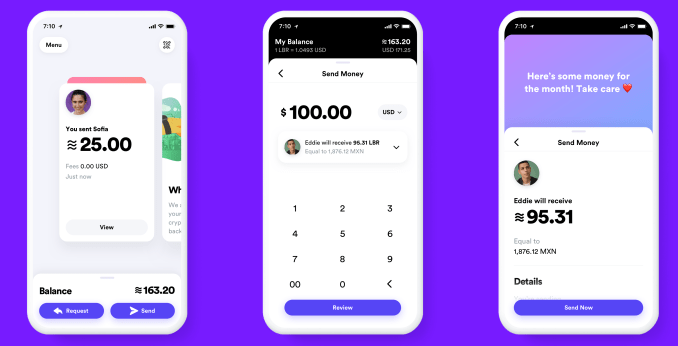

Facebook has finally revealed the details of its cryptocurrency, Libra, which will let you buy things or send money to people with nearly zero fees. You’ll pseudonymously buy or cash out your Libra online or at local exchange points like grocery stores, and spend it using interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger and its own app. Today Facebook released its white paper explaining Libra and its testnet for working out the kinks of its blockchain system before a public launch in the first half of 2020.

Facebook won’t fully control Libra, but instead get just a single vote in its governance like other founding members of the Libra Association, including Visa, Uber and Andreessen Horowitz, which have invested at least $10 million each into the project’s operations. The association will promote the open-sourced Libra Blockchain and developer platform with its own Move programming language, plus sign up businesses to accept Libra for payment and even give customers discounts or rewards.

Facebook is launching a subsidiary company also called Calibra that handles its crypto dealings and protects users’ privacy by never mingling your Libra payments with your Facebook data so it can’t be used for ad targeting. Your real identity won’t be tied to your publicly visible transactions. But Facebook/Calibra and other founding members of the Libra Association will earn interest on the money users cash in that is held in reserve to keep the value of Libra stable.

Facebook’s audacious bid to create a global digital currency that promotes financial inclusion for the unbanked actually has more privacy and decentralization built in than many expected. Instead of trying to dominate Libra’s future or squeeze tons of cash out of it immediately, Facebook is instead playing the long-game by pulling payments into its online domain. Facebook’s VP of blockchain, David Marcus, explained the company’s motive and the tie-in with its core revenue source during a briefing at San Francisco’s historic Mint building. “If more commerce happens, then more small businesses will sell more on and off platform, and they’ll want to buy more ads on the platform so it will be good for our ads business.”

In cryptocurrencies, Facebook saw both a threat and an opportunity. They held the promise of disrupting how things are bought and sold by eliminating transaction fees common with credit cards. That comes dangerously close to Facebook’s ad business that influences what is bought and sold. If a competitor like Google or an upstart built a popular coin and could monitor the transactions, they’d learn what people buy and could muscle in on the billions spent on Facebook marketing. Meanwhile, the 1.7 billion people who lack a bank account might choose whoever offers them a financial services alternative as their online identity provider too. That’s another thing Facebook wants to be.

Yet existing cryptocurrencies like Bitcoin and Ethereum weren’t properly engineered to scale to be a medium of exchange. Their unanchored price was susceptible to huge and unpredictable swings, making it tough for merchants to accept as payment. And cryptocurrencies miss out on much of their potential beyond speculation unless there are enough places that will take them instead of dollars, and the experience of buying and spending them is easy enough for a mainstream audience. But with Facebook’s relationship with 7 million advertisers and 90 million small businesses plus its user experience prowess, it was well-poised to tackle this juggernaut of a problem.

Now Facebook wants to make Libra the evolution of PayPal . It’s hoping Libra will become simpler to set up, more ubiquitous as a payment method, more efficient with fewer fees, more accessible to the unbanked, more flexible thanks to developers and more long-lasting through decentralization.

“Success will mean that a person working abroad has a fast and simple way to send money to family back home, and a college student can pay their rent as easily as they can buy a coffee,” Facebook writes in its Libra documentation. That would be a big improvement on today, when you’re stuck paying rent in insecure checks while exploitative remittance services charge an average of 7% to send money abroad, taking $50 billion from users annually. Libra could also power tiny microtransactions worth just a few cents that are infeasible with credit card fees attached, or replace your pre-paid transit pass.

…Or it could be globally ignored by consumers who see it as too much hassle for too little reward, or too unfamiliar and limited in use to pull them into the modern financial landscape. Facebook has built a reputation for over-engineered, underused products. It will need all the help it can get if wants to replace what’s already in our pockets.

By now you know the basics of Libra. Cash in a local currency, get Libra, spend them like dollars without big transaction fees or your real name attached, cash them out whenever you want. Feel free to stop reading and share this article if that’s all you care about. But the underlying technology, the association that governs it, the wallets you’ll use and the way payments work all have a huge amount of fascinating detail to them. Facebook has released more than 100 pages of documentation on Libra and Calibra, and we’ve pulled out the most important facts. Let’s dive in.

Facebook knew people wouldn’t trust it to wholly steer the cryptocurrency they use, and it also wanted help to spur adoption. So the social network recruited the founding members of the Libra Association, a not-for-profit which oversees the development of the token, the reserve of real-world assets that gives it value and the governance rules of the blockchain. “If we were controlling it, very few people would want to jump on and make it theirs,” says Marcus.

Each founding member paid a minimum of $10 million to join and optionally become a validator node operator (more on that later), gain one vote in the Libra Association council and be entitled to a share (proportionate to their investment) of the dividends from interest earned on the Libra reserve into which users pay fiat currency to receive Libra.

The 28 soon-to-be founding members of the association and their industries, previously reported by The Block’s Frank Chaparro, include:

Facebook says it hopes to reach 100 founding members before the official Libra launch and it’s open to anyone that meets the requirements, including direct competitors like Google or Twitter. The Libra Association is based in Geneva, Switzerland and will meet biannually. The country was chosen for its neutral status and strong support for financial innovation including blockchain technology.

To join the association, members must have a half rack of server space, a 100Mbps or above dedicated internet connection, a full-time site reliability engineer and enterprise-grade security. Businesses must hit two of three thresholds of a $1 billion USD market value or $500 million in customer balances, reach 20 million people a year and/or be recognized as a top 100 industry leader by a group like Interbrand Global or the S&P.

Crypto-focused investors must have more than $1 billion in assets under management, while Blockchain businesses must have been in business for a year, have enterprise-grade security and privacy and custody or staking greater than $100 million in assets. And only up to one-third of founding members can by crypto-related businesses or individually invited exceptions. Facebook also accepts research organizations like universities, and nonprofits fulfilling three of four qualities, including working on financial inclusion for more than five years, multi-national reach to lots of users, a top 100 designation by Charity Navigator or something like it and/or $50 million in budget.

The Libra Association will be responsible for recruiting more founding members to act as validator nodes for the blockchain, fundraising to jump-start the ecosystem, designing incentive programs to reward early adopters and doling out social impact grants. A council with a representative from each member will help choose the association’s managing director, who will appoint an executive team and elect a board of five to 19 top representatives.

Each member, including Facebook/Calibra, will only get up to one vote or 1% of the total vote (whichever is larger) in the Libra Association council. This provides a level of decentralization that protects against Facebook or any other player hijacking Libra for its own gain. By avoiding sole ownership and dominion over Libra, Facebook could avoid extra scrutiny from regulators who are already investigating it for a sea of privacy abuses as well as potentially anti-competitive behavior. In an attempt to preempt criticism from lawmakers, the Libra Association writes, “We welcome public inquiry and accountability. We are committed to a dialogue with regulators and policymakers. We share policymakers’ interest in the ongoing stability of national currencies.”

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal line unicode character ≋ like the dollar is represented by $. The value of a Libra is meant to stay largely stable, so it’s a good medium of exchange, as merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major price fluctuations in any one foreign currency so that the value of a Libra stays consistent.

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal line unicode character ≋ like the dollar is represented by $. The value of a Libra is meant to stay largely stable, so it’s a good medium of exchange, as merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major price fluctuations in any one foreign currency so that the value of a Libra stays consistent.

The name Libra comes from the word for a Roman unit of weight measure. It’s trying to invoke a sense of financial freedom by playing on the French stem “Lib,” meaning free.

The Libra Association is still hammering out the exact start value for the Libra, but it’s meant to be somewhere close to the value of a dollar, euro or pound so it’s easy to conceptualize. That way, a gallon of milk in the U.S. might cost 3 to 4 Libra, similar but not exactly the same as with dollars.

The idea is that you’ll cash in some money and keep a balance of Libra that you can spend at accepting merchants and online services. You’ll be able to trade in your local currency for Libra and vice versa through certain wallet apps, including Facebook’s Calibra, third-party wallet apps and local resellers like convenience or grocery stores where people already go to top-up their mobile data plan.

Each time someone cashes in a dollar or their respective local currency, that money goes into the Libra Reserve and an equivalent value of Libra is minted and doled out to that person. If someone cashes out from the Libra Association, the Libra they give back are destroyed/burned and they receive the equivalent value in their local currency back. That means there’s always 100% of the value of the Libra in circulation, collateralized with real-world assets in the Libra Reserve. It never runs fractional. And unliked “pegged” stable coins that are tied to a single currency like the USD, Libra maintains its own value — though that should cash out to roughly the same amount of a given currency over time.

When Libra Association members join and pay their $10 million minimum, they receive Libra Investment Tokens. Their share of the total tokens translates into the proportion of the dividend they earn off of interest on assets in the reserve. Those dividends are only paid out after Libra Association uses interest to pay for operating expenses, investments in the ecosystem, engineering research and grants to nonprofits and other organizations. This interest is part of what attracted the Libra Association’s members. If Libra becomes popular and many people carry a large balance of the currency, the reserve will grow huge and earn significant interest.

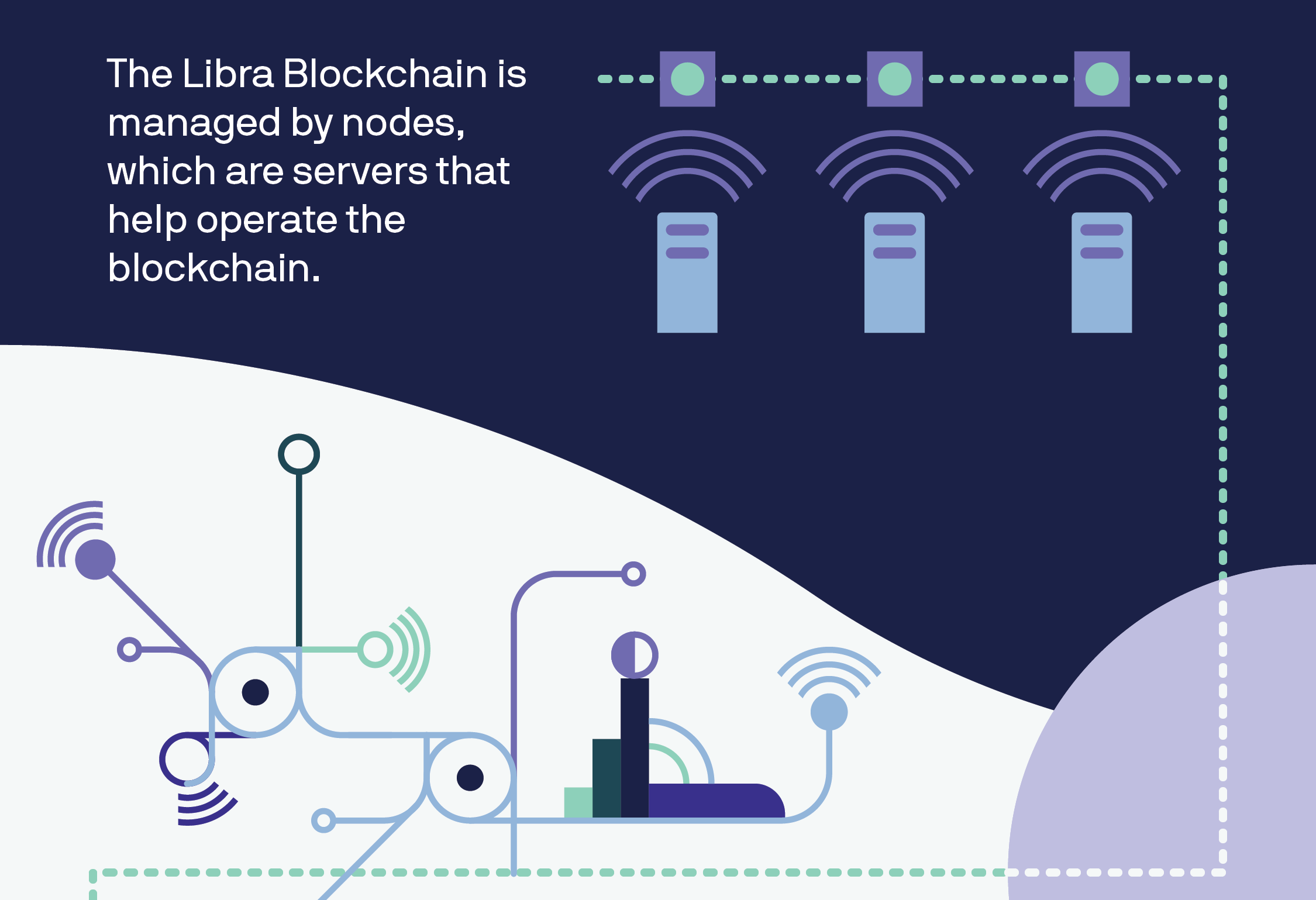

Every Libra payment is permanently written into the Libra Blockchain — a cryptographically authenticated database that acts as a public online ledger designed to handle 1,000 transactions per second. That would be much faster than Bitcoin’s 7 transactions per second or Ethereum’s 15. The blockchain is operated and constantly verified by founding members of the Libra Association, which each invested $10 million or more for a say in the cryptocurrency’s governance and the ability to operate a validator node.

When a transaction is submitted, each of the nodes runs a calculation based on the existing ledger of all transactions. Thanks to a Byzantine Fault Tolerance system, just two-thirds of the nodes must come to consensus that the transaction is legitimate for it to be executed and written to the blockchain. A structure of Merkle Trees in the code makes it simple to recognize changes made to the Libra Blockchain. With 5KB transactions, 1,000 verifications per second on commodity CPUs and up to 4 billion accounts, the Libra Blockchain should be able to operate at 1,000 transactions per second if nodes use at least 40Mbps connections and 16TB SSD hard drives.

Transactions on Libra cannot be reversed. If an attack compromises over one-third of the validator nodes causing a fork in the blockchain, the Libra Association says it will temporarily halt transactions, figure out the extent of the damage and recommend software updates to resolve the fork.

Transactions aren’t entirely free. They incur a tiny fraction of a cent fee to pay for “gas” that covers the cost of processing the transfer of funds similar to with Ethereum. This fee will be negligible to most consumers, but when they add up, the gas charges will deter bad actors from creating millions of transactions to power spam and denial-of-service attacks. “We’ve purposely tried not to innovate massively on the blockchain itself because we want it to be scalable and secure,” says Marcus of piggybacking on the best elements of existing cryptocurrencies.

Currently, the Libra Blockchain is what’s known as “permissioned,” where only entities that fulfill certain requirements are admitted to a special in-group that defines consensus and controls governance of the blockchain. The problem is this structure is more vulnerable to attacks and censorship because it’s not truly decentralized. But during Facebook’s research, it couldn’t find a reliable permissionless structure that could securely scale to the number of transactions Libra will need to handle. Adding more nodes slows things down, and no one has proven a way to avoid that without compromising security.

That’s why the Libra Association’s goal is to move to a permissionless system based on proof-of-stake that will protect against attacks by distributing control, encourage competition and lower the barrier to entry. It wants to have at least 20% of votes in the Libra Association council coming from node operators based on their total Libra holdings instead of their status as a founding member. That plan should help appease blockchain purists who won’t be satisfied until Libra is completely decentralized.

The Libra Blockchain is open source with an Apache 2.0 license, and any developer can build apps that work with it using the Move coding language. The blockchain’s prototype launches its testnet today, so it’s effectively in developer beta mode until it officially launches in the first half of 2020. The Libra Association is working with HackerOne to launch a bug bounty system later this year that will pay security researchers for safely identifying flaws and glitches. In the meantime, the Libra Association is implementing the Libra Core using the Rust programming language because it’s designed to prevent security vulnerabilities, and the Move language isn’t fully ready yet.

Move was created to make it easier to write blockchain code that follows an author’s intent without introducing bugs. It’s called Move because its primary function is to move Libra coins from one account to another, and never let those assets be accidentally duplicated. The core transaction code looks like: LibraAccount.pay_from_sender(recipient_address, amount) procedure.

Eventually, Move developers will be able to create smart contracts for programmatic interactions with the Libra Blockchain. Until Move is ready, developers can create modules and transaction scripts for Libra using Move IR, which is high-level enough to be human-readable but low-level enough to be translatable into real Move bytecode that’s written to the blockchain.

The Libra ecosystem and the Move language will be completely open to use and build, which presents a sizable risk. Crooked developers could prey on crypto novices, claiming their app works just the same as legitimate ones, and that it’s safe because it uses Libra. But if consumers get ripped off by these scammers, the anger will surely bubble up to Facebook. Yet still, Calibra’s head of product tells me, “There are no plans for the Libra Association to take a role in actively vetting [developers],” Calibra’s head of product Kevin Weil tells me.

Even though it’s tried to distance itself sufficiently via its subsidiary Libra and the association, many people will probably always think of Libra as Facebook’s cryptocurrency and blame it for their woes.

Read our full story on the dangers of Libra’s unvetted developer platform

The Libra Association wants to encourage more developers and merchants to work with its cryptocurrency. That’s why it plans to issue incentives, possibly Libra coins, to validator node operators who can get people signed up for and using Libra. Wallets that pull users through the Know Your Customer anti-fraud and money laundering process or that keep users sufficiently active for over a year will be rewarded. For each transaction they process, merchants will also receive a percentage of the transaction back.

Businesses that earn these incentives can keep them, or pass some or all of them along to users in the form of free Libra tokens or discounts on their purchases. This could create competition between wallets to see which can pass on the most rewards to their customers, and thereby attract the most users. You could imagine eBay or Spotify giving you a discount for paying in Libra, while wallet developers might offer you free tokens if you complete 100 transactions within a year.

“One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems – especially for those in financially underserved markets,” Spotify’s Chief Premium Business Officer Alex Norström writes. “In joining the Libra Association, there is an opportunity to better reach Spotify’s total addressable market, eliminate friction and enable payments in mass scale.”

This savvy incentive system should massively help ratchet up Libra’s user count without dictating how businesses balance their margins versus growth. Facebook also has another plan to grow its developer ecosystem. By offering venture capital firms like Andreessen Horowitz and Union Square Ventures a portion of the reserve interest, they’re motivating to fund startups building Libra infrastructure.

So how do you actually own and spend Libra? Through Libra wallets like Facebook’s own Calibra and others that will be built by third-parties, potentially including Libra Association members like PayPal. The idea is to make sending money to a friend or paying for something as easy as sending a Facebook Message. You won’t be able to make or receive any real payments until the official launch next year, though, but you can sign up for early access when it’s ready here.

None of the Libra Association members agreed to provide details on what exactly they’ll build on the blockchain, but we can take Facebook’s Calibra wallet as an example of the basic experience. Calibra will launch alongside the Libra currency on iOS and Android within Facebook Messenger, WhatsApp and a standalone app. When users first sign up, they’ll be taken through a Know Your Customer anti-fraud process where they’ll have to provide a government-issued photo ID and other verification info. They’ll need to conduct due diligence on customers and report suspicious activity to the authorities.

From there you’ll be able to cash in to Libra, pick a friend or merchant, set an amount to send them and add a description and send them Libra. You’ll also be able to request Libra, and Calibra will offer an expedited way of paying merchants by scanning your or their QR code. Eventually it wants to offer in-store payments and integrations with point-of-sale systems like Square.

The Libra Association’s e-commerce members seem particularly excited about how the token could eliminate transaction fees and speed up checkout. “We believe blockchain will benefit the luxury industry by improving IP protection, transparency in the product life cycle and — as in the case of Libra — enable global frictionless e-commerce,” says FarFetch CEO Jose Neves.

Facebook CEO Mark Zuckerberg explained some of the philosophy behind Libra and Calibra in a post today. “It’s decentralized — meaning it’s run by many different organizations instead of just one, making the system fairer overall. It’s available to anyone with an internet connection and has low fees and costs. And it’s secured by cryptography which helps keep your money safe. This is an important part of our vision for a privacy-focused social platform — where you can interact in all the ways you’d want privately, from messaging to secure payments.”

By default, Facebook won’t import your contacts or any of your profile information, but may ask if you wish to do so. It also won’t share any of your transaction data back to Facebook, so it won’t be used to target you with ads, rank your News Feed, or otherwise earn Facebook money directly. Data will only be shared in specific instances in anonymized ways for research or adoption measurement, for hunting down fraudsters or due to a request from law enforcement. And you don’t even need a Facebook or WhatsApp account to sign up for Calibra or to use Libra.

“We realize people don’t want their social data and financial data commingled,” says Marcus, who’s now head of Calibra. “The reality is we’ll have plenty of wallets that will compete with us and many of them will not be in social, and if we want to successfully win people’s trust, we have to make sure the data will be separated.”

In case you are hacked, scammed or lose access to your account, Calibra will refund you for lost coins when possible through 24/7 chat support because it’s a custodial wallet. You also won’t have to remember any long, complex crypto passwords you could forget and get locked out from your money, as Calibra manages all your keys for you. Given Calibra will likely become the default wallet for many Libra users, this extra protection and smoother user experience is essential.

For now, Calibra won’t make money. But Calibra’s head of product Kevin Weil tells me that if it reaches scale, Facebook could launch other financial tools through Calibra that it could monetize, such as investing or lending. “In time, we hope to offer additional services for people and businesses, such as paying bills with the push of a button, buying a cup of coffee with the scan of a code or riding your local public transit without needing to carry cash or a metro pass,” the Calibra team writes. That makes it start to sound a lot like China’s everything app WeChat.

Facebook got one thing right for sure: Today’s money doesn’t work for everyone. Those of us living comfortably in developed nations likely don’t see the hardships that befall migrant workers or the unbanked abroad. Preyed on by greedy payday lenders and high-fee remittance services, targeted by muggers and left out of traditional financial services, the poor get poorer. Libra has the potential to get more money from working parents back to their families and help people retain credit even if they’re robbed of their physical possessions. That would do more to accomplish Facebook’s mission of making the world feel smaller than all the News Feed Likes combined.

If Facebook succeeds and legions of people cash in money for Libra, it and the other founding members of the Libra Association could earn big dividends on the interest. And if suddenly it becomes super quick to buy things through Facebook using Libra, businesses will boost their ad spend there. But if Libra gets hacked or proves unreliable, it could cost lots of people around the world money while souring them on cryptocurrencies. And by offering an open Libra platform, shady developers could build apps that snatch not just people’s personal info like Cambridge Analytica, but their hard-earned digital cash.

Facebook just tried to reinvent money. Next year, we’ll see if the Libra Association can pull it off. It took me 4,000 words to explain Libra, but at least now you can make up your own mind about whether to be scared of Facebook crypto.

Powered by WPeMatico

Bounce, a Bangalore-based startup that offers thousands of electric scooters for rent in India, has raised $72 million to accelerate its bid to impact how people navigate India’s traffic-clogged urban areas.

The Series C funding round for the five-year-old startup was led by B Capital — the VC firm founded by Facebook co-founder Eduardo Saverin — and Falcon Edge Capital. Chiratae Ventures, Maverick Ventures, Omidyar Network India, Qualcomm Ventures and existing investors Sequoia Capital India and Accel Partners India also participated in the round.

This new money means that the startup has raised $92 million to date. The current round valued it at more than $200 million, a person familiar with the matter said.

Bounce, formerly known as Metro Bikes, operates in Bangalore. Its app allows users to pick up a scooter and, when their ride is finished, drop it off at any parking spot. It charges customers based on the time and model of electric scooter they choose. An hour-long ride could cost as little as Rs 15 (21 cents). The startup claims it has already clocked two million rides.

Vivekananda Hallekere, co-founder and CEO of Bounce, told TechCrunch in an interview that the startup plans to use the fresh capital to add more than 50,000 electric scooters to its fleet by the end of the year, up from its current mix of 5,000 electric and gasoline scooters. Additionally, Bounce, which employs about 200 people, plans to enter more cities in India and invest in growing its tech infrastructure and head count.

“We have about 10 metro and non-metro cities in mind. Starting next quarter, we will start to expand in those cities,” he said. The startup also aims to service one million rides in the next year.

Hallekere said Bounce, which currently offers IoT hardware and design for the scooters, is also working on building its own form factor for scooters.

The rise of Bounce comes as it bets that shared two-wheeler vehicles — already a common mode of transportation in the nation — will play an important role in the future of ridesharing, with electric vehicles replacing petrol ones.

This bet has gained more momentum in recent years. Startups such as Yulu, which partnered with Uber earlier this year to conduct a trial in Bangalore; Vogo, which raised money from Uber rival Ola; and Ather Energy have expanded their businesses and gained the backing of major investors.

Their adoption, though still in their nascent stages, is increasingly proving that for millions of people, rides from Uber and Ola are just too expensive for their wallets. Besides, in jam-packed traffic in Bangalore and Delhi and other cities in India, two wheels are more efficient than four.

Powered by WPeMatico

Almost every organization, regardless of size, is inundated with meetings, so much so it’s often hard to find dedicated time to do actual work. Clockwise wants to change that by bringing machine learning to the calendar to help employees free up time. Today, it announced an $11 million Series A investment, and made the product, which had been in beta, generally available.

The round was co-led led by Greylock and Accel . Other investors included Slack Fund, Michael Ovitz, Ellen Levy, George Hu, Soraya Darabi, SV Angel and Jay Simons. The company has raised a total of $13 million.

Matt Martin, CEO and co-founder at Clockwise, says the company’s mission is to help employees make time for what matters, and they are doing that by applying machine learning to the calendar to free up blocks of time to concentrate on work. Calendars have tended to be pretty static, and this provides a way to bring a level of intelligence to automatically shift meetings to a better time when it makes sense.

After you download Clockwise you can set parameters for which meetings can be moved and which are set in stone, and other preferences. As Martin wrote in a blog post announcing the new tool, this gives employees “uninterrupted blocks of time to focus, think and innovate.” For now, it’s available for G Suite users.

Gif: Clockwise

You may think this is a one-trick pony that will be hard to scale, but Martin says in the past few months, Clockwise has recovered thousands of hours, and as they gain more data, the tool will get even more intelligent about meeting shifting.

Certainly his investors see the potential. John Lilly, who is leading the investment at Greylock, believes Clockwise is filling a huge unfilled need inside organizations. “Clockwise is focused on helping individuals and teams retake ownership of their time. This is not an easy feat — building the Clockwise product requires a sophisticated understanding of machine learning, user interaction and systems design breakthrough,” Lilly said.

Clockwise founders were part of the team at RelateIQ, a company Salesforce bought for $390 million in 2014. Since leaving RelateIQ they decided to put that experience to work on making the calendar more efficient.

Powered by WPeMatico

Three years ago, I met with a founder who had raised a massive seed round at a valuation that was at least five times the market rate. I asked what firm made the investment.

She said it was not a traditional venture firm, but rather a strategic investor that not only had no ties to her space but also had no prior investment experience. The strategic investor, she said, was looking to “get their hands dirty” and “get in on the ground floor.”

Over the next 2 years, I kept a close eye on the founder. Although she had enough capital to pivot her business focus multiple times, she seemed to be at odds, serving the needs of her strategic investor and her customer base.

Ultimately, when the business needed more capital to survive, the strategic investor didn’t agree with the founder’s focus, opted not to prop it up, and the business had to shut down.

Sadly, this is not an uncommon story as examples abound of strategic investors influencing startup direction and management decisions to the point of harm for the startup. Corporate strategics, not to be confused with dedicated funds focused on financial returns like a traditional venture investor like Google Ventures, often care less about return on investment, and more about a startup’s focus, and sector specificity. If corporate imperatives change, the strategic may cease to be the right partner or could push the startup in a challenging direction.

And yet, fortunately, as the disruptive power of technology is being unleashed on nearly every major industry, strategic investors are now getting smarter, both in terms of how they invest and how they partner with entrepreneurs.

From making strong acquisitive plays (i.e. GM’s purchase of Cruise Automation or Toyota’s early-stage investment in Uber) to building dedicated funds, to executing commercial agreements in tandem with capital investment, strategics are getting savvier, and by extension, becoming better partners. In some instances, they may be the best partner.

Negotiating a term sheet with a strategic investor necessitates a different set of considerations. Namely: the preference for a strategic to facilitate commercial milestones for the startup, a cautious approach to avoid the “over-valuation” trap, an acute focus on information rights, and the limitation of non-compete provisions.

Powered by WPeMatico

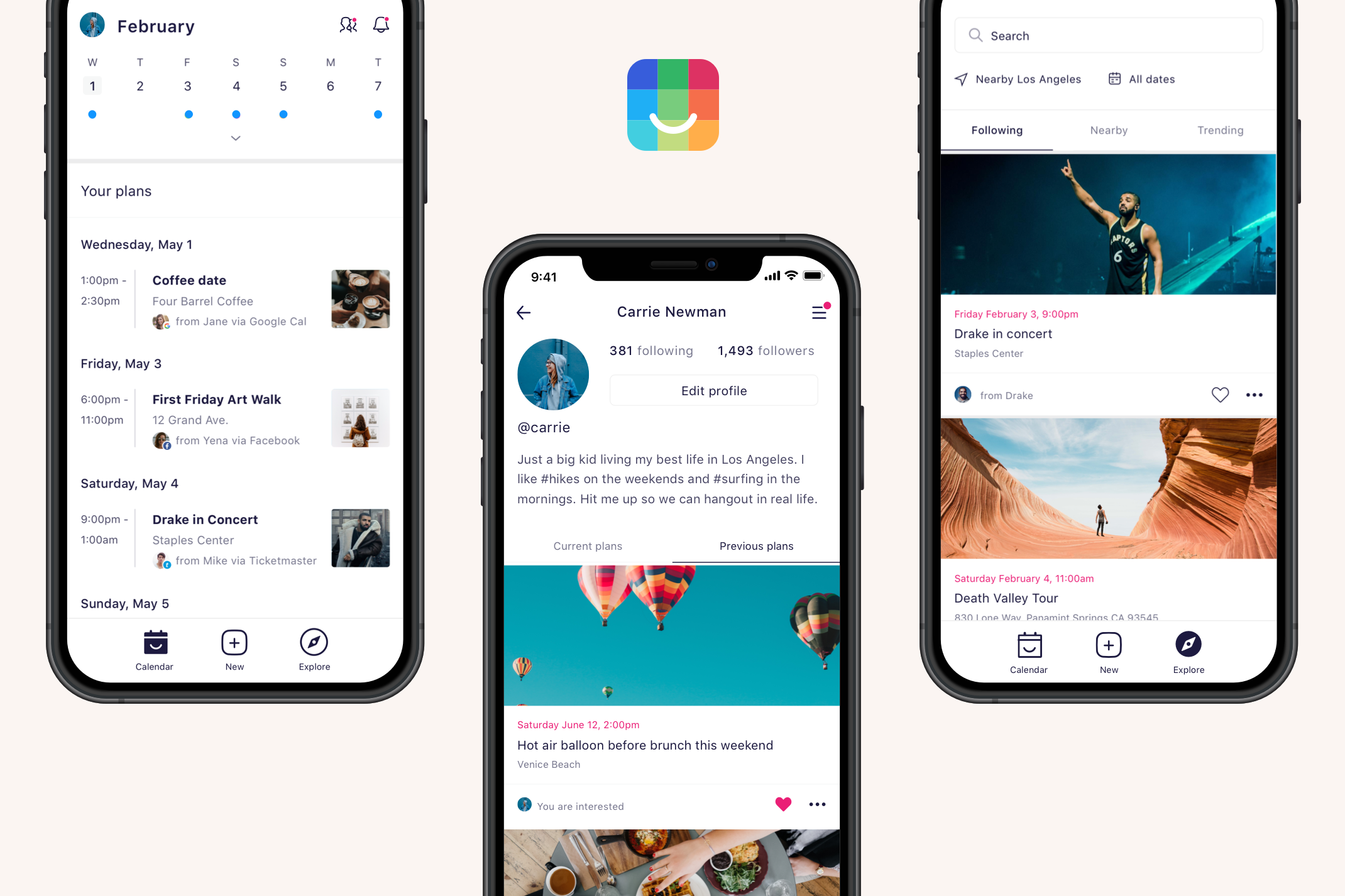

Why is there no app where you can follow party animals, concert snobs or conference butterflies for their curated suggestions of events? That’s the next phase of social calendar app IRL that’s launching today on iOS to help you make and discuss plans with friends or discover nearby happenings to fill out your schedule.

The calendar, a historically dorky utility, seems like a strange way to start the next big social network. Many people, especially teens, either don’t use apps like Google Calendar, keep them professional or merely input plans made elsewhere. But by baking in an Explore tab of event recommendations and the option to follow curators, headliners and venues, IRL could make calendars communal like Instagram did to cameras.

“There’s Twitter for ‘follow my updates,’ there’s SoundCloud for ‘follow my music,’ but there’s no ‘follow my events’ ” IRL CEO Abe Shafi tells me of his plan to turbocharge his calendar app. “They’re arguably the best product that’s been built for organizing what you’re doing, but no one has Superhuman’d or Slack’d the calendar. Let’s build a super f*cking dope calendar!” he says with unbridled excitement. He’ll need that passion to persevere as IRL tries to steal a major use case from SMS, messaging apps and Facebook .

Finding a new opportunity for a social network has attracted a new $8 million Series A funding round for IRL led by Goodwater Capital and joined by Founders Fund and Kleiner Perkins. That builds on its $3 million seed from Founders Fund and Floodgate, whose partner Mike Maples is joining IRL’s board. The startup has also pulled in some entertainment and event CEOs as strategic investors, including Warner Bros. president Greg Silverman, Lionsgate Films president Joe Drake and ClassPass CEO Fritz Lanman to help it recruit calendar influencers users can follow.

In Shafi, investors found a consummate extrovert who can empathize with event-goers. He dropped out of Berkeley to build out his recruitment software startup getTalent before selling it to HR platform Dice, where he became VP of product. He started to become disillusioned by tech’s impact on society and almost left the industry before some time at Burning Man rekindled his fever for events.

IRL CEO Abe Shafi

Shafi teamed up with PayPal’s first board member Scott Banister and early social network founder Greg Tseng. Shafi’s first attempt Gather pissed off a ton of people with spammy invites in 2017. By 2018, he’d restarted as IRL, with a focus on building a minimalist calendar where it was easy to create events and invite friends. Evite and Facebook Events were too heavy for making less formal get-togethers with close friends. He wisely chose to geofence his app and launch state by state to maximize density so people would have more pals to plan with.

IRL is now in 14 states, with a modest 1.3 million monthly active users and 175,000 dailies, plus 3 million people on the waitlist. “Fifty percent of all teens in Texas have downloaded IRL. I wanted to focus on the central states, not Silicon Valley,” Shafi explains. Users log in with a phone number or Google, two-way sync their Google Calendar if they have one, and can then manage their existing schedule and create mini-events. The stickiest feature is the ability to group chat with everyone invited so you can hammer out plans. Even users without the app can chime in via text or email. And unlike Facebook, where your mom or boss are liable to see your RSVPs, your calendar and what you’re doing on IRL is always private unless you explicitly share it.

The problem is that most of this could be handled with SMS and a more popular calendar. That’s why IRL is doubling-down on event discovery through influencers, which you can’t do anywhere else at scale. With the new version of the app launching today, you’ll be recommended performers, locations and curators to follow. You’ll see their suggestions in the Explore tab that also includes sub-tabs of Nearby and Trending happenings. There’s also a college-specific feed for users that auth in with their school email address. Curators and event companies like TechCrunch can get their own IRL.com/… URL people can follow more easily than some janky list of events of gallery of flyers on their website. Since pretty much every promoter wants more attendees, IRL’s had little resistance to it indexing all the events from Meetup.com and whatever it can find.

IRL is concentrating on growth for now, but Shafi believes all the intent data about what people want to do could be valuable for directing people to certain restaurants, bars, theaters or festivals, though he vows that “we’re never going to sell your data to advertisers.” For now, IRL is earning money from affiliate fees when people buy tickets or make reservations. Event affiliate margins are infamously slim, but Shafi says IRL can bargain for higher fees as it gains sway over more people’s calendars.

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Yet the biggest challenge will be rearranging how people organize their lives. A lot of us are too scatterbrained, lazy or instinctive to make all our plans days or weeks ahead of time and put them on a calendar. The beauty of mobile is that we can communicate on the fly to meet up. “Solving for spontaneity isn’t our focus so far,” Shafi admits. But that’s how so much of our social lives come together.

My biggest problem isn’t finding events to fill my calendar, but knowing which friends are free now to hang out and attend one with me. There are plenty of calendar, event discovery and offline hangout apps. IRL will have to prove they deserve to be united. At least Shafi says it’s a problem worth trying to solve. “I know for a fact that the product of a calendar will outlive me.” He just wants to make it more social first.

Powered by WPeMatico

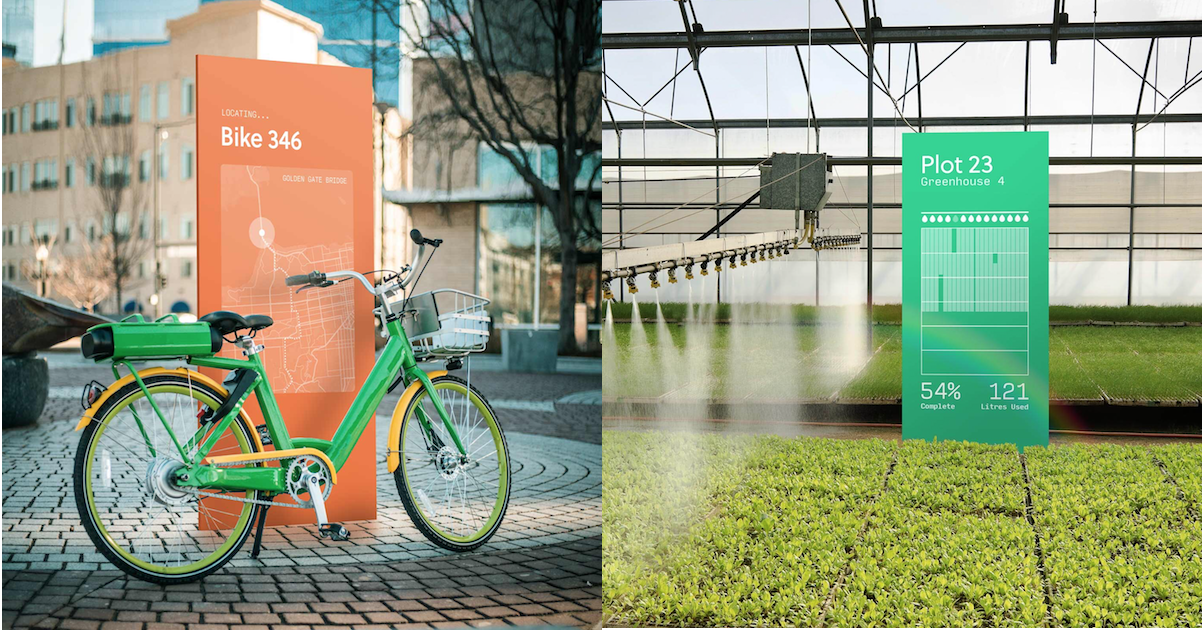

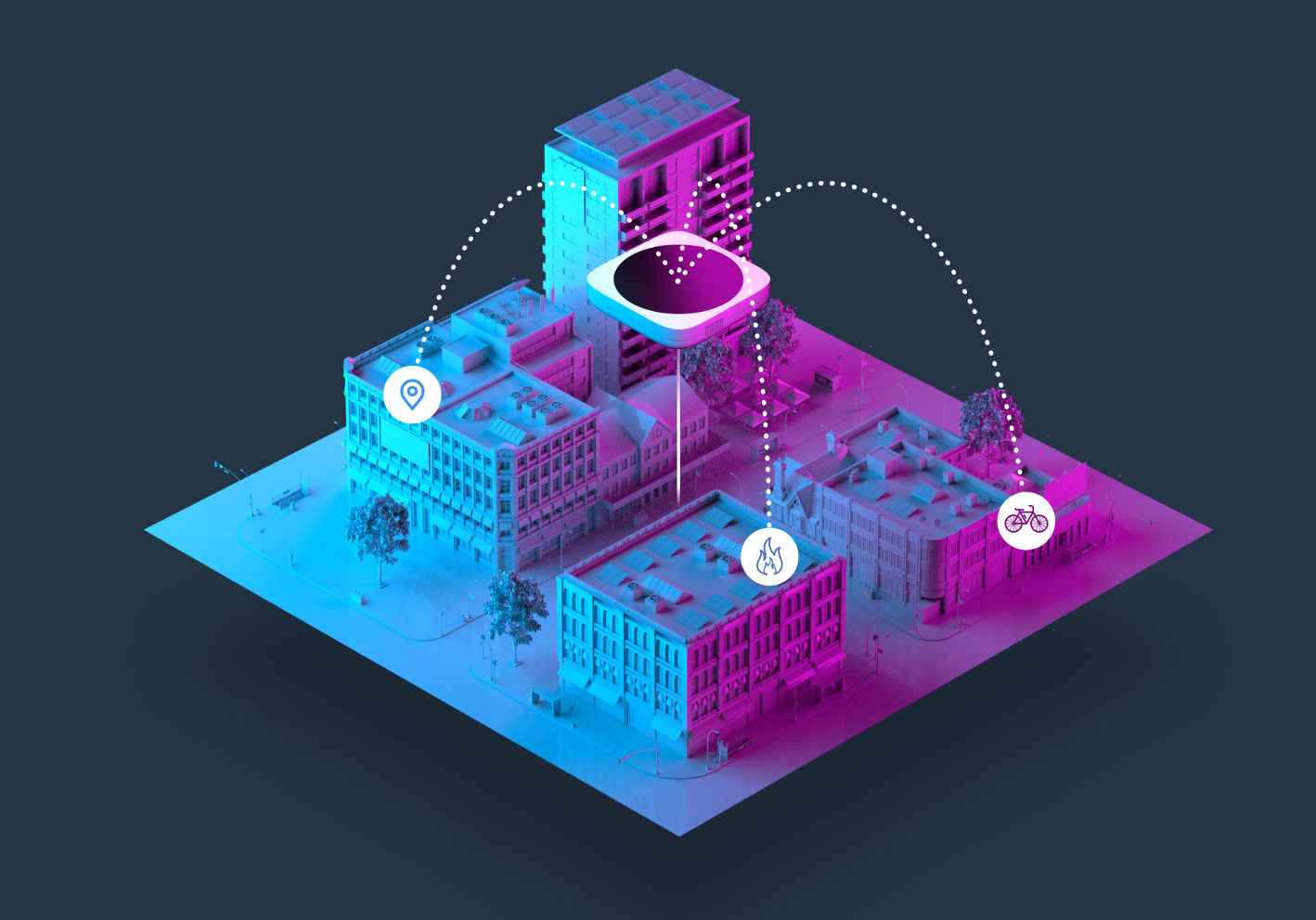

With 200X the range of Wi-Fi at 1/1000th of the cost of a cellular modem, Helium’s “LongFi” wireless network debuts today. Its transmitters can help track stolen scooters, find missing dogs via IoT collars and collect data from infrastructure sensors. The catch is that Helium’s tiny, extremely low-power, low-data transmission chips rely on connecting to P2P Helium Hotspots people can now buy for $495. Operating those hotspots earns owners a cryptocurrency token Helium promises will be valuable in the future…

The potential of a new wireless standard has allowed Helium to raise $51 million over the past few years from GV, Khosla Ventures and Marc Benioff, including a new $15 million Series C round co-led by Union Square Ventures and Multicoin Capital. That’s in part because one of Helium’s co-founders is Napster inventor Shawn Fanning. Investors are betting that he can change the tech world again, this time with a wireless protocol that like Wi-Fi and Bluetooth before it could unlock unique business opportunities.

Helium already has some big partners lined up, including Lime, which will test it for tracking its lost and stolen scooters and bikes when they’re brought indoors, obscuring other connectivity, or their battery is pulled, out deactivating GPS. “It’s an ultra low-cost version of a LoJack” Helium CEO Amir Haleem says.

InvisiLeash will partner with it to build more trackable pet collars. Agulus will pull data from irrigation valves and pumps for its agriculture tech business. Nestle will track when it’s time to refill water in its ReadyRefresh coolers at offices, and Stay Alfred will use it to track occupancy status and air quality in buildings. Haleem also imagines the tech being useful for tracking wildfires or radiation.

Haleem met Fanning playing video games in the 2000s. They teamed up with Fanning and Sproutling baby monitor (sold to Mattel) founder Chris Bruce in 2013 to start work on Helium. They foresaw a version of Tile’s trackers that could function anywhere while replacing expensive cell connections for devices that don’t need high bandwith. Helium’s 5 kilobit per second connections will compete with SigFox, another lower-power IoT protocol, though Haleem claims its more centralized infrastructure costs are prohibitive. It’s also facing off against Nodle, which piggybacks on devices’ Bluetooth hardware. Lucky for Helium, on-demand rental bikes and scooters that are perfect for its network have reached mainstream popularity just as Helium launches six years after its start.

Helium says it already pre-sold 80% of its Helium Hotspots for its first market in Austin, Texas. People connect them to their Wi-Fi and put it in their window so the devices can pull in data from Helium’s IoT sensors over its open-source LongFi protocol. The hotspots then encrypt and send the data to the company’s cloud that clients can plug into to track and collect info from their devices. The Helium Hotspots only require as much energy as a 12-watt LED light bulb to run, but that $495 price tag is steep. The lack of a concrete return on investment could deter later adopters from buying the expensive device.

Only 150-200 hotspots are necessary to blanket a city in connectivity, Haleem tells me. But because they need to be distributed across the landscape, so a client can’t just fill their warehouse with the hotspots, and the upfront price is expensive for individuals, Helium might need to sign up some retail chains as partners for deployment. As Haleem admits, “The hard part is the education.” Making hotspot buyers understand the potential (and risks) while demonstrating the opportunities for clients will require a ton of outreach and slick marketing.

Without enough Helium Hotspots, the Helium network won’t function. That means this startup will have to simultaneously win at telecom technology, enterprise sales and cryptocurrency for the network to pan out. As if one of those wasn’t hard enough.

Powered by WPeMatico

Adjust is announcing that it has raised $227 million in new funding.

The company, founded in Berlin back in 2012, has created a variety of ad measurement and anti-fraud tools — CEO Christian Henschel said the goal is to “make marketing simpler, smarter and safer.” Adjust says it’s now being used in more than 25,000 mobile apps for customers like NBCUniversal, Zynga, Robinhood, Pinterest and Procter & Gamble.

It’s been nearly four years since the company raised its previous round of $15 million. Henschel (pictured above with his co-founder and CTO Paul Müller) told me the company was already profitable back then, and it’s continued to be profitable while growing revenue by an average of 80 percent every year. So it raised more money (a lot more), he said, “because we saw the opportunity … to grow our business even further.”

Henschel pointed to three broad areas where Adjust is planning to invest and grow. First, there’s combating fraud, where he said the company was “very early,” first launching its mobile fraud prevention suite in 2016. It expanded its offerings earlier this year with the acquisition of Unbotify.

Second, he said Adjust will continue to invest in automation and aggregation — an area where it made another recent acquisition, namely the data aggregation company Acquired.io.

“We’re giving our customers the ability to get rid of the repetitive and boring tasks and really focus them back on thigns that human beings are very good at — that is creativity,” Henschel said.

Lastly, the company (which already has 350 employees in 15 offices worldwide) will continue to invest in customer service and geographic expansion, particularly in Asia.

Speaking of acquisitions, Adjust says it’s also partnered with Japanese marketing agency Adways and acquired Adways’ attribution tool PartyTrack. So naturally, you might assume that this new capital means even more deals are in the works, but Henschel said, “Acquisitions are always tough — it’s hard to find the right companies, and even harder to integrate them.”

In other words, he’s open to acquiring more companies, but he said, “We don’t have any plans right now.”

This new round brings Adjust’s total funding to $250 million. It was led by Eurazeo Growth, Highland Europe, Morgan Stanley Alternative Investment Partners and Sofina.

“Adjust reached profitability just three years after its creation, and has seen extraordinary growth since then,” said Eurazeo Growth’s Yann du Rusquec in a statement. “The company is ideally positioned to further expand its product and footprint throughout 2019 and beyond, cementing its position as one of the most successful global tech champions to come out of Europe.”

Powered by WPeMatico

As grocery shopping moves online, one piece of the puzzle hasn’t been directly addressed: fresh fruits and vegetables. That also happens to be a category in which there is a ton of food waste, with a good deal of fruits and veggies never making it out of the grocery store to begin with.

Misfits Market has raised $16.5 million in Series A to handle just that.

Greenoaks Capital led the round, but Misfits isn’t disclosing other participants in the financing. Other Greenoaks Capital investments include Deliveroo, OYO, Clover Health, Brex and Discord.

Misfits Market offers a subscription box of “ugly” fruits and veggies, the ones with blemishes or odd shapes that make a grocery shopper think twice before checking out, each week.

Misfits sources these fruits and veggies straight from farms. This means that the extra time spent shipping them to a grocery store, and then sitting on shelves, is eliminated from the equation with Misfits.

The company currently operates in all zip codes in Pennsylvania, New York, New Jersey, Connecticut, Delaware, Massachusetts, Vermont, New Hampshire, Rhode Island, Maine and Ohio, with plans to expand into Washington, D.C., Maryland, Virginia, West Virginia, North Carolina, South Carolina, Georgia and Florida.

Currently, Misfits Market offers two different box options. The smaller box, called The Mischief, includes 10 to 12 pounds of fruits and veggies each week for $23.75 à la carte, or less than $20 as a weekly subscription. The Madness, Misfits’ bigger box, includes 18 to 20 pounds of fresh fruits and veggies for $42.50 as a one-time purchase, or for $34 as a subscription.

Users can pause their weekly subscription or cancel at any time.

CEO and founder Abhi Ramesh said the idea for Misfits Market started when he visited a farm a few years ago. The farmer was collecting apples that he said weren’t of the grade he could sell to grocery stores or farmers’ markets, and that they’d either be given away to neighbors or thrown away.

“That was my sort of romanticized light bulb moment,” said Ramesh.

He was fascinated and started interviewing farmers in the north east and asking them how much of their produce ended up going to waste because it wasn’t pretty enough for grocery stores. The answer was consistently between 20% and 40%.

Ramesh says there is an opportunity down the line to expand beyond fruits and veggies, but that for now the company is laser-focused on that category.

Since launching in 2018, Misfits has sent out 5 million pounds of produce that would have gone to waste otherwise.

Powered by WPeMatico

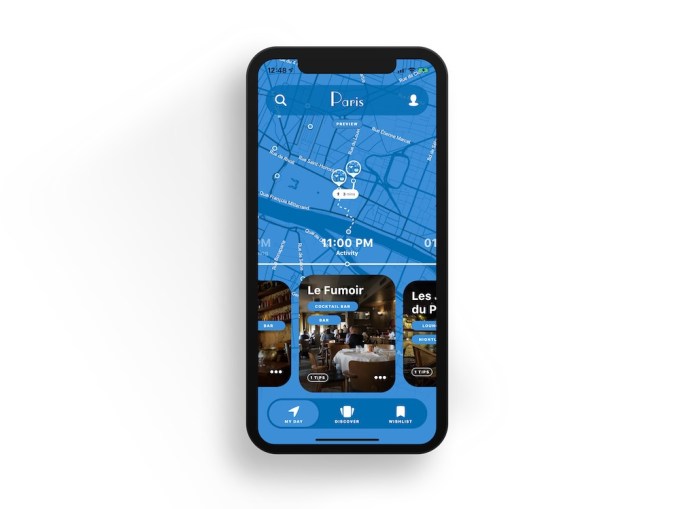

Welcome is a new app that CEO Matthew Rosenberg said is designed for a more spontaneous approach to traveling.

“What we’re going after is these millennials [and] Gen Z travelers who feel comfortable going in the moment,” Rosenberg told me. “Eighty-five percent of people aren’t even looking at activities before they arrive.”

So instead of asking travelers to create their own itineraries by browsing through a list of recommendations and reviews, Welcome builds the itinerary for them. When you’re planning to visit a destination, or when you’ve arrived and you’re wondering what to do, you can open Welcome and browse through a list of potential locations and activities, indicating which ones interest you. You also can browse recommendations from local experts, or ask for tips from your friends.

Welcome then uses your responses to create a schedule for you, consisting both of places you’ve explicitly said you want to visit and of things that would probably be of interest. The itineraries are also based on location, with different travel options like taking an Uber or Lyft, mass transit or walking.

Most intriguingly, the itineraries adjust in real time — if one of the items on the list doesn’t interest you, you can swipe to skip it, and Welcome will automatically fill in the gap with new activities. Or if you find a great spot where you want want to spend the whole afternoon, the app will once again adjust. Rosenberg said it’s even pulling in weather data, so “if we were going to send you to a park in the afternoon, and at lunch it starts raining, we can replace it with a museum.”

He acknowledged that this approach might be less suited for travelers who like to plan everything in advance — but even then, he noted, “The truth is, for all the planning that happens, most people’s plans tend to fall apart in the moment. Something always changes, some alley you want to go down, some boat you want to take, some sort of adventure that if you didn’t take it, you’d regret. That’s what we’ve really tried to embrace.”

Rosenberg added that the app could eventually introduce new ways for users to more explicitly filter the results based on their preferences — say, if they’re particularly interested in theater or museums, or if they’re on a tight budget.

Welcome says it already offers recommendations in more than 250 cities worldwide.

It’s a free app, and Rosenberg said the focus is on growth, not monetization. While he plans to make money by driving purchases and transactions, he said Welcome will never be advertising-driven. “Everything we show you is authentic. No one’s paying us to send you to some mediocre restaurant.”

The startup was founded by Rosenberg (who previously founded video app Cameo) and Peter Gerard, and has raised $1.2 million in seed funding led by 3 Rodeo.

“What we use today in travel is rooted in this old-school style of thinking,” Rosenberg said. “What I mean by that is, most travel sites put a bunch of pins on a map, but it’s still up to you to look around and figure out what to do. I don’t think anyone’s really thought: How can we take advantage not only of the mobile device, but really the data that’s out there right now … No one’s really built tools for our generation.”

Powered by WPeMatico