funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Many software vulnerabilities are already known, and vendors have even issued patches, but the problem is there are so many patches that it’s often difficult for companies to keep up. Vulcan Cyber wants to help by bringing a level of automation to the patching operation, and in the process reduce exposure to known risks.

Today, it announced a $10 million Series A round from Ten Eleven Ventures and YL Ventures .

In a typical scenario, security researchers find vulnerabilities, the vendors disclose them and patch them. From there it’s up to individual companies to take care of downloading and installing the patch, but Vulcan Cyber co-founder and CEO Yaniv Bar-Dayan says the number of patches has been growing at a furious pace with 6000 patches in 2016, 16,000 in 2017 and 18,000 last year. And that growth trajectory is continuing this year, he says.

Vulcan’s ultimate mission is to help companies remediate security vulnerabilities from their infrastructure. They do this by bringing a level of automation to the process, recognizing that humans can’t keep up with these numbers. “We automate the process of prioritization and deployment to remediate more vulnerabilities faster,” Bar-Dayan explained. What’s more, he said that Vulcan does this without risking business operations, while reducing risk and costs.

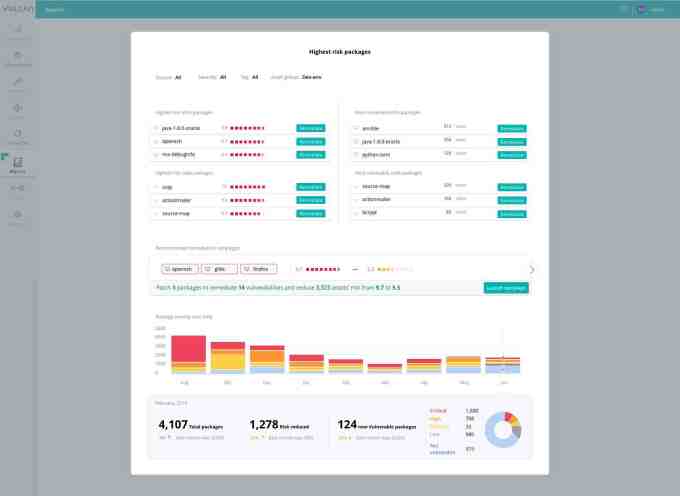

Vulcan Cyber risk prioritization view. Screenshot: Vulcan Cyber

The company raised a $4 million seed round last year, bringing the total raised to $14 million so far. As TechCrunch’s Frederic Lardinois pointed out while writing about that seed round, it’s able to achieve this level of automation, while working with the tools developers and security teams typically work with anyway.

“Vulcan Cyber plays nicely with all of the major cloud platforms, as well as tools like Puppet, Chef and Ansible, as well as GitHub and Bitbucket. It also integrates with a number of major security testing tools and vulnerability scanners, including Black Duck, Nessus, Fortify, Tripwire, Checkmarx, Rapid7 and Veracode,” Lardinois wrote.

The company was founded last year and has 25 employees. It plans to continue building its engineering team in Israel with the money from this round, as well as opening an office in San Francisco for sales, marketing and customer success.

Powered by WPeMatico

Big money continues to flow in India’s growing education market. Bangalore-based Unacademy, which operates an online learning platform to help millions prepare for competitive exams in India, has raised $50 million to further scale its reach.

The Series D financing round was led by Steadview Capital, Sequoia India, Nexus Venture Partners and Blume Ventures, with Unacademy’s own co-founders Gaurav Munjal and Roman Saini also participating in it. The new round means the startup has raised close to $90 million to date.

The four-year-old startup is aimed at students who are preparing for competitive exams to get into a college and those who are pursuing graduation-level courses. Unacademy allows students to watch live classes from educators and later engage in sessions to review topics in more detail. It has 10,000 registered educators and 13 million learners — up from 3 million a year ago.

The startup said it will use the new fund to expand the number of educators it has on the platform, and also add more exam courses, Unacademy CEO Munjal told TechCrunch. It will also improve its product and expand the team.

Unacademy began its journey as a YouTube channel, but has since expanded to its own app where it offers some courses for free and others through a recently launched subscription business. The subscription service — called Unacademy Plus Subscription — has 50,000 users.

Unacademy also maintains an archive of all the classes, giving students the option to reference older lectures at any time through the app. The startup says YouTube is still its largest distribution channel. Overall, the platform sees more than 100 million monthly views across the platforms.

“We are seeing unprecedented growth and engagement from learners in smaller towns and cities, and are also very humbled to see that top-quality educators are choosing Unacademy as their primary platform to reach out to students. In the last few months, we have taken bigger strides toward achieving this mission. We have more than 400 top educators from across the country taking live classes every day on Unacademy Plus. This is available to every student, irrespective of their location,” said Munjal.

Unacademy competes with unicorn Byju’s, which is widely believed to be the largest edtech startup in the world with its valuation nearing $4 billion. Byju’s, which has more than 2.4 million paid subscribers (and over 30 million users), offers courses for students in kindergarten to year 12, in addition to those preparing for competitive under graduation level courses.

India has the largest population in the world in the age bracket of 5 to 24 years. The education space in the nation is estimated to grow to $35 billion in the next six years.

In recent months, Unacademy has grown more aggressive with marketing. Last year it tied up with web-production house The Viral Fever to fund a show called “Kota Factory,” which revolves around the lives of students who are preparing to go to an engineering college. In the midst of it, Unacademy also offered low-cost, discounted subscription plans to attract users to its subscription platform.

Unacademy has presence in Indonesia as well, where as of last year, it had about 30 educators. The startup did not offer an update on how its international ambitions are holding up. A representative of Unacademy told TechCrunch recently that the platform does not rely on ads for monetization.

Powered by WPeMatico

David’s Bridal once owned 50% of the $36 billion wedding gown market before it filed for bankruptcy last year. Brides were growing sick of the lack of styles and sizes plus high prices at expensive brick & mortar shops. The industry was destined for disruption by software that would replace overhead costs and inflexibility with direct-to-consumer personalization.

That’s why I profiled a new custom wedding dress startup back in 2016 called Anomalie despite little funding or traction. The rise of Instagram meant every bride wanted to look unique on a budget, not pay $5000 for a cookie-cutter $200 dress that happened to be white. Anomalie was willing to embrace software to offer 4 billion design permutations and break the markup cartel by selling gowns starting at $1000.

2.5 years later, Anomalie has begun to prove that cheaper doesn’t have to look cheap and custom doesn’t have to cause a headache. 13% of US brides, 275,000 out of 2.1 million, created an Anomalie account in the last year. With David’s Bridal looking shaky and wedding dresses being a seven-times larger market than bedding and mattresses, investors eagerly proposed to Anomalie. Today the startup announces a $13.6 million Series A led by consumer product VC Goodwater Capital .

“I don’t think I’ll ever get tired of working with brides. Other companies would kill for this costumer. She’s so obsessed with every detail of her wedding dress. it’s just a perfect environment to collect data” says Anomalie co-founder and CEO Leslie Voorhees. “Long lead time, high margin, this industry that’s completely f*cked up — it’s the perfect place to start this mass customization engine beginning with the wedding dress” she tells me, hinting at the startup’s potential to customize other clothing too.

Anomalie is also flexing its tech muscle today with the launch of its new dress sketch visualizer. Choose between a few options on shape, cut, color, pattern, and fabric, and you’ll see an algorithmic sketch of your dream dress appear instantly. Anomalie then pairs you with a squad of its designers to finalize the details, ship swatches, and get you your gown with a 100% refund policy if it’s not right.

The startup’s nest egg will go towards hiring more engineers plus bringing more of production in-house to offer additional features like this. But Voorhees insists that “I don’t think we’ll ever completely automate away the stylists. Customer don’t care about AI or machine learning, but they want to trust us to pull the ideas out of their heads.”

Anomalie co-founder and CEO Leslie Voorhees

Anomalie was woven out of Voorhees’ frustrations picking her own wedding dress. She’d been managing factories and supply chains in Asia for Nike and Apple, and it made no sense why slapping “bridal” on a dress could make it up to ten-times more expensive.

Her investigation uncovered that most brands were outsourcing their manufacturing, so she did an end-run, contacted factories directly, and got her dress made custom for a fraction of the price. So many of her pals demanded help doing the same that the Harvard Business School grad soft-launched Anomalie with her husband Calley Means [Disclosure: who I know from college] in the summer of 2016.

The startup’s gowns now average $1,400. Growth has been swift since weddings are so photographed and shared, with Anomalie reaching an outstanding net promoter score of 91. A friend of mine recently bought her dess through the company and it looked stunning and one-of-a-kind without breaking the bank. And since they’re custom, Anomalie makes inclusivity and advantage by offering larger sizes absent elsewhere

Meanwhile, Anomalie’s incumbent competitors have struggled. Gap and J.Crew abandoned the wedding dress business in the last few years. David’s Bridal emerged from bankruptcy with its 300 retail stores still operating, but it’s slipped to 30 percent US market share. It’s now owned by lenders including Oaktree Capital Group, which is a bad omen given that firm was responsible for driving Toys”R”Us into liquidation instead of keeping it open. No other players have a sizable foot or well-known brand besides super high-end designer Vera Wang.

Anomalie capitalized on David’s troubles by poaching its head of bridal production Angela Ng, who now leads the startup’s Hong Kong team and relieves Voorhees of constant trips to China. It also hired former Sephora VP of digital Marcy Zelmar and former TrueCar VP of engineering Aaron Tavistock. Their goal is to sell more dresses to get Anomalie more data, more factory modularization, and more control over its manufacturing.

Anomalie’s dress visualizer turns a few style selections into a sketch of your potential gown

The new funding round that builds on its $4.5 million seed round was joined by Signia, SoGal Ventures, Lerer Hippeau’s BN Capital Fund, and Fin’s Sam Lessin also includes strategic angels like former Stitch Fix CTO Jeff Barrett and ThirdLove underwear CEO Heidi Zak. At Anomalie’s San Francisco headquarters, mannequins sporting design prototypes stand beside software teams optimizing the new dress visualizer. And when I say the dresses are custom, I mean they can get about as weird as you want. Anomalie is finishing up a dress with lyrics from the couple’s favorite song embroidered in a secret language from their favorite TV show…and it still looks beautiful.

“One of the coolest things about Anomalie is that they’re not just using digital as a distribution strategy, but to also deliver a differentiated product experience” says Goodwater partner Eric Kim. “Anomalie’s sketch-builder is a great expression of this emphasis on product and customer centricity.” Wedding dresses have been largely ignored by startups despite the market being bigger than luggage ($34 billion), or shaving ($21 billion), oral care ($10 billion) and hair loss ($4 billion) combined.

The challenge is that unlike those products, bridal gowns are “a zero failure game. This is like airplane engines and heart rate monitors” Voorhees stresses. Anomalie must maintain perfect quality, times, and customer experience to avoid ruining someone’s big day. “Never messing up a dress or losing a dress — we take this really, really seriously.” She knows a few viral disasters could sink the ship. It also has to stay ahead of fresh entrants like COUTURME, a new Y Combinator startup making custom evening gowns as well as wedding dresses.

Anomalie’s SF headquarters. Photo by Summer Wilson

Anomalie sees global demand for a better experience, and thinks it can apply its data set to wedding dresses for more cultures as well as additional types of clothing. “We are building up a large repository of female measurements and creating tech plus operational processes around ‘mass customization’ that can be applied to other garments” Voorhees reveals. “Our aspirations are around bringing more body inclusivity + customization to women’s fashion, not just bridal.”

And while Anomalie could always find a retail partner to get more exposure, it’s tough for brick & mortar brands to operate online without cannibalizing their sales. “We think the women’s closet of the future contains staples from Stitch Fix, rotating dresses from Rent the Runway, and signature custom garments from Anomalie.”

The Anomalie just needs to educate brides that they can actually have the dress of their dreams, and now it wants to inspire that dream on-site too. Full of ambition and verve, Voorhees concludes, “What’s Pinterest valued at when it’s basically a wedding dress search engine?”

Powered by WPeMatico

Tundra, a new zero-commission wholesale marketplace, has today announced the close of $12 million in Series A funding. The round was led by Redpoint’s Annie Kadavy, with participation from investors such as Initialized Capital, Peterson Ventures, FJ Labs, Switch Ventures and Background Capital.

Tundra was founded by married couple Arnold and Katie Engel who previously ran a global supply chain company called Vox Supply Chain. In that world, they quickly realized just how much inefficiency is built into the wholesale market, from disorganized trade shows to transaction fees from the incumbents to a business that’s largely done on phone with pen and paper.

That’s where Tundra comes in.

Tundra allows suppliers to list their products on the platform, which is built to look and feel like a B2C marketplace. Buyers can come on the platform and shop for products, complete with ratings and reviews, supplier performance metrics, and free shipping with easy tracking.

“The wholesale market is set up to benefit big businesses, with other platforms and distributors charging anywhere from 5 percent to 30 percent commission,” said Engel. “That can be particularly pronounced for small businesses.”

“The wholesale market is set up to benefit big businesses, with other platforms and distributors charging anywhere from 5 percent to 30 percent commission,” said Engel. “That can be particularly pronounced for small businesses.”

Plus, it can be perilous for small players to depend on big platforms like Amazon. Just a few weeks ago, there were rumors that Amazon would focus its attention on big brands like P&G and purge smaller suppliers from the platforms. Amazon denied the rumors, saying it evaluates suppliers on an individual basis.

For Tundra, the hope is to eliminate both the time-consuming and tedious process of negotiating deals at trade shows as well as the cost of simply buying and selling wholesale products online. And, importantly, Tundra has a zero-fee model, which means that buyers and suppliers can operate on the platform without spending a penny if they so choose.

Of course, the company has to generate revenue in some way, which is why Tundra offers premium options at checkout, such as faster shipping, order insurance, and additional custom clearance and logistics services for international orders.

Having spent a year serving as Head of Strategic Operations growing Uber Freight, Redpoint Managing Director Annie Kadavy saw first-hand just how gargantuan the wholesale market is. During a phone interview, she reminded me that almost every item within view at any given moment was shipped on a truck and purchased at a wholesale price before it was purchased by a consumer in a store.

“Tundra’s greatest challenge ahead is execution, because the market opportunity here is very obvious,” said Kadavy. “It’s a huge business that is currently transacted by fax, phone call and pen and paper, so the opportunity is very clear.”

There is clearly movement in the space. Just last month, Shopify acquired Handshake to handle B2B e-commerce directly for customers. That followed its acquisition of dropshipping platform Oberlo in 2017, signaling the fact that existing platforms realize the opportunity of wholesale e-commerce, as well.

And a recent report stated that B2B e-commerce passed the $1 trillion mark for the first time in 2018.

The opportunity is there, as is the competition, but Tundra comes to the table armed with fresh capital.

Powered by WPeMatico

Sales teams have long turned to tech solutions to help improve how they source leads, develop relationships and close deals. Now, one of the startups that helps out at a key point in that trajectory is announcing a round of growth funding to help fuel its own rapid growth. Showpad, a sales enablement platform that lets salespeople source and organise relevant content and other collateral that they use in their deals, has raised a Series D of $70 million.

The funding, which brings the total raised by Showpad to $160 million, is coming in the form of debt and equity. The equity part is co-led by Dawn Capital and Insight Partners, with existing investors Hummingbird Ventures, and Korelya Capital also participating. Silicon Valley Bank is providing debt financing. This is one of the first big investments out of Dawn’s Opportunities Fund that we wrote about last week.

The company is not disclosing its valuation but Pieterjan Bouten, the CEO who co-founded the company with Louis Jonckheere (currently CPO) and Peter Minne (CTO), confirmed that it has doubled since last year, and is seven times the valuation it had when it raised a $50 million Series C in 2016. The company is growing 90% year-on-year at the moment in terms of revenues.

And as a point of reference, another sales enablement player, Seismic, last December raised a Series E of $100 million at a $1 billion valuation.

Founded in Ghent, Belgium, Showpad today operates across two main headquarters, its original European base and Chicago. The latter was the homebase of LearnCore, a company that Showpad acquired last year that focuses on sales coaching and training. This became a strategic acquisition to expand Showpad’s primary product, a platform that acts as a kind of content management system for sales collateral. (Today, while Chicago is where Showpad builds its go-to market efforts and professional services, Ghent focuses on engineering and product, he said.) As it happens, Chicago is also the headquarters of Seismic.

As Bouten described in an interview, Showpad is part of what he considers to be the fourth pillar of the technology marketing stack: storage (the cloud services where you keep all your data), CRM, marketing automation and sales enablement, where Showpad sits.

While the first three are key to helping to manage a salesperson’s activities and work, the fourth is a crucial one for helping to make sure a salesperson can do his or her job more effectively.

Traditionally a lot of the content that salespeople used — presentations, white papers, other materials — to help make their cases and close their deals would be managed offline and directly by individual salespeople. Showpad has taken some of that process and made it digital, which means that now teams of salespeople can more effectively share materials amongst each other; and interestingly the material and its link to successful sales becomes part of how Showpad “learns” what works and what doesn’t.

That, in turn, helps build Showpad’s own artificial intelligence algorithms, to help suggest the best materials for a particular sales effort either to someone else in that team, or to other salespeople using the platform.

“To date there has been enormous innovation in automating the marketing and sales workflow. However, in the end, sales comes down to one person selling to another,” said Norman Fiore, General Partner at Dawn Capital and member of the Showpad Board, in a statement. “Historically, this has been an offline process that has been wildly inconsistent and opaque. Showpad’s suite of products succeeds in bringing this process online for the first time with data-rich feedback loops on the effectiveness of teams, managers, salespeople and even individual pieces of sales content.”

This is a crowded area of the market with a number of standalone companies building sales enablement solutions, but also other companies within the sales stack also adding on enablement as a value-added service.

For now, though, Bouten notes that these are more strategic partners than competitors. For example, Salesforce and Microsoft are partners, and, he adds, “We integrate with Salesloft to make sure sure emails that are sent out are using the right content. We become the single source of truth but also are being used for outreach.”

Today, the company has around 1,200 enterprise customers, including Johnson & Johnson, GE Healthcare, Bridgestone, Honeywell, and Merck. The plan going forward will be to continue building out the services that it offers around its sales enablement software, alongside the core product itself.

“You can equip sales people with the best content, but if they are not trained and coached in the right way, it goes nowhere,” Bouten said.

Powered by WPeMatico

Welcome back to this week’s transcribed edition of Equity.

This week, TechCrunch’s Danny Crichton filled in for co-host Alex Wilhelm – who was out in preparation for his wedding this weekend – joining Kate to cover the big news of the week.

Kate and Danny dive straight into Slack’s IPO and the implications of its direct listing strategy, before shifting gears to discuss the launch of Facebook’s new ‘Libra’ cryptocurrency and the VCs backing the initiative.

The duo then took a look at Lime’s latest fundraising efforts and the potential headwinds facing scooter companies with an appetite for capital. Lastly, Kate and Danny talk about underappreciated tensions for founders, including getting pushed out of their own companies and handling their own salaries.

Crichton: Talking about founders and compensation, our correspondent, Ron Miller, talked to a bunch of VCs to ask how are founders paying themselves today? Obviously, the cost of living in the Bay Area, in New York and other startup hubs has increased dramatically. So VCs have had to become acutely aware of their founders’ financial means.

One of the things that really came out of this survey though, from my perspective, was just how high the numbers are. We surveyed small number. We put it out in the interviews. It came out to post-Series A people are starting to get paid around 200K. But the numbers, even a couple of years ago, I seem to recall was like $120 was the magic number around the Series A, $90K if you had a serious seed fund and like $60 to $80 if you are just getting started.

But the numbers that we saw out of this were significantly higher. I think that shows a lot about how the cost of living has just continued to creep up in San Francisco and in New York.

Clark: Yeah. I think the point is made in the story. If you live in San Francisco and you’re paying a mortgage and you have kids, of course, you need to make six figures really to get by, which is just an unfortunate reality. I can’t say I was surprised by how those salaries looked. Seeing $125K for a founder, if anything, I thought was maybe a little low.

But it reminded me of, nearly a year ago at this point, when I wrote something on how much VCs are paid. I had written it based off data that was provided to me from a consulting firm. People were just up in arms at what I had written because, and I understand looking back, I think it grouped VCs together as VCs who work at really big funds who are getting the 2% carry out of a multi-billion dollar fund and who are paid a lot more.

And there are of course VCs who run seed funds or any kind of fund. There are many different sizes of VC funds. Some VCs actually don’t have a salary at all and are up against the same challenges, if not even more difficult challenges, of a startup founder.

Want more Extra Crunch? Need to read this entire transcript? Then become a member. You can learn more and try it for free.

Kate Clark: Hello, and welcome back to Equity, TechCrunch’s venture capital-focused podcast. My co-host, Alex, is getting married this weekend so he’s not with us today, unfortunately. But we’ve got TechCrunch editor, Danny Crichton on the line. Danny, how are you?

Powered by WPeMatico

Welcome to this week’s transcribed edition of This is Your Life in Silicon Valley. We’re running an experiment for Extra Crunch members that puts This is Your Life in Silicon Valley in words – so you can read from wherever you are.

This is your Life in Silicon Valley was originally started by Sunil Rajaraman and Jascha Kaykas-Wolff in 2018. Rajaraman is a serial entrepreneur and writer (Co-Founded Scripted.com, and is currently an EIR at Foundation Capital), Kaykas-Wolff is the current CMO at Mozilla and ran marketing at BitTorrent. Rajaraman and Kaykas-Wolff started the podcast after a series of blog posts that Sunil wrote for The Bold Italic went viral.

The goal of the podcast is to cover issues at the intersection of technology and culture – sharing a different perspective of life in the Bay Area. Their guests include entrepreneurs like Sam Lessin, journalists like Kara Swisher and Mike Isaac, politicians like Mayor Libby Schaaf and local business owners like David White of Flour + Water.

This week’s edition of This is Your Life in Silicon Valley features Lisa Fetterman – the Founder/CEO of Nomiku (a Y Combinator alum). Lisa talks extensively about why Silicon Valley does not care about female founders, and proposes a solution to the problem.

If you are interested in diving deep into the diversity problem in technology, this episode is for you.

For access to the full transcription, become a member of Extra Crunch. Learn more and try it for free.

Rajaraman: Welcome to season three of This is Your Life in Silicon Valley. A podcast about the Bay Area, technology and culture. I’m your host Sunil Rajaraman and I’m joined by my co-host Jascha Kaykas-Wolff.

Kaykas-Wolff: So, now I got a straw poll for you. Are you ready?

Rajaraman: I’m ready.

Powered by WPeMatico

Pretty much everything about making a self-driving car is difficult, but among the most difficult parts is making sure the vehicles know what pedestrians are doing — and what they’re about to do. Humanising Autonomy specializes in this, and hopes to become a ubiquitous part of people-focused computer vision systems worldwide.

The company has raised a $5.3 million seed round from an international group of investors on the strength of its AI system, which it claims outperforms humans and works on images from practically any camera you might find in a car these days.

HA’s tech is a set of machine learning modules trained to identify different pedestrian behaviors — is this person about to step into the street? Are they paying attention? Have they made eye contact with the driver? Are they on the phone? Things like that.

The company credits the robustness of its models to two main things. First, the variety of its data sources.

“Since day one we collected data from any type of source — CCTV cameras, dash cams of all resolutions, but also autonomous vehicle sensors,” said co-founder and CEO Maya Pindeus. “We’ve also built data partnerships and collaborated with different institutions, so we’ve been able to build a robust data set across different cities with different camera types, different resolutions and so on. That’s really benefited the system, so it works in nighttime, rainy Michigan situations, etc.”

Notably their models rely only on RGB data, forgoing any depth information that might come from lidar, another common sensor type. But Pindeus said that type of data isn’t by any means incompatible, it just isn’t as plentiful or relevant as real-world, visual-light footage.

In particular, HA was careful to acquire and analyze footage of accidents, because these are especially informative cases of failure of AVs or human drivers to read pedestrian intentions, or vice versa.

The second advantage Pindeus claimed is the modular nature of the models the company has created. There isn’t one single “what is that pedestrian doing” model, but a set of them that can be individually selected and tuned according to the autonomous agent’s or hardware’s needs.

“For instance, if you want to know if someone is distracted as they’re crossing the street. There’s a lot of things that we do as humans to tell if someone is distracted,” she said. “We have all these different modules that kind of come together to predict whether someone’s distracted, at risk, etc. This allows us to tune it to different environments, for instance London and Tokyo — people behave differently in different environments.”

“For instance, if you want to know if someone is distracted as they’re crossing the street. There’s a lot of things that we do as humans to tell if someone is distracted,” she said. “We have all these different modules that kind of come together to predict whether someone’s distracted, at risk, etc. This allows us to tune it to different environments, for instance London and Tokyo — people behave differently in different environments.”

“The other thing is processing requirements; Autonomous vehicles have a very strong GPU requirement,” she continued. “But because we build in these modules, we can adapt it to different processing requirements. Our software will run on a standard GPU when we integrate with level 4 or 5 vehicles, but then we work with aftermarket, retrofitting applications that don’t have as much power available, but the models still work with that. So we can also work across levels of automation.”

The idea is that it makes little sense to aim only for the top levels of autonomy when really there are almost no such cars on the road, and mass deployment may not happen for years. In the meantime, however, there are plenty of opportunities in the sensing stack for a system that can simply tell the driver that there’s a danger behind the car, or activate automatic emergency braking a second earlier than existing systems.

While there are lots of papers published about detecting pedestrian behavior or predicting what a person in an image is going to do, there are few companies working specifically on that task. A full-stack sensing company focusing on lidar and RGB cameras needs to complete dozens or hundreds of tasks, depending on how you define them: object characterizations and tracking, watching for signs, monitoring nearby and distant cars and so on. It may be simpler for them and for manufacturers to license HA’s functioning and highly specific solution rather than build their own or rely on more generalized object tracking.

“There are also opportunities adjacent to autonomous vehicles,” pointed out Pindeus. Warehouses and manufacturing facilities use robots and other autonomous machines that would work better if they knew what workers around them were doing. Here the modular nature of the HA system works in its favor again — retraining only the parts that need to be retrained is a smaller task than building a new system from scratch.

Currently the company is working with mobility providers in Europe, the U.S. and Japan, including Daimler Mercedes Benz and Airbus. It’s got a few case studies in the works to show how its system can help in a variety of situations, from warning vehicles and pedestrians about each other at popular pedestrian crossings to improving path planning by autonomous vehicles on the road. The system can also look over reams of past footage and produce risk assessments of an area or time of day given the number and behaviors of pedestrians there.

The $5 million seed round, led by Anthemis, with Japan’s Global Brain, Germany’s Amplifier and SV’s Synapse Partners, will mostly be dedicated to commercializing the product, Pindeus said.

“The tech is ready, now it’s about getting it into as many stacks as possible, and strengthening those tier 1 relationships,” she said.

Obviously it’s a rich field to enter, but still quite a new one. The tech may be ready to deploy, but the industry won’t stand still, so you can be sure that Humanising Autonomy will move with it.

Powered by WPeMatico

Text IQ, a machine learning system that parses and understands sensitive corporate data, has raised $12.6 million in Series A funding led by FirstMark Capital, with participation from Sierra Ventures.

Text IQ started as co-founder Apoorv Agarwal’s Columbia thesis project titled “Social Network Extraction From Text.” The algorithm he built was able to read a novel, like Jane Austen’s “Emma,” for example, and understand the social hierarchy and interactions between characters.

This people-centric approach to parsing unstructured data eventually became the kernel of Text IQ, which helps corporations find what they’re looking for in a sea of unstructured, and highly sensitive, data.

The platform started as a tool used by corporate legal teams. Lawyers often have to manually look through troves of documents and conversations (text messages, emails, Slack, etc.) to find specific evidence or information. Even using search, these teams spend loads of time and resources looking through the search results, which usually aren’t as accurate as they should be.

“The status quo for this is to use search terms and hire hundreds of humans, if not thousands, to look for things that match their search terms,” said Agarwal. “It’s super expensive, and it can take months to go through millions of documents. And it’s still risky, because they could be missing sensitive information. Compared to the status quo, Text IQ is not only cheaper and faster but, most interestingly, it’s much more accurate.”

Following success with legal teams, Text IQ expanded into HR/compliance, giving companies the ability to retrieve sensitive information about internal compliance issues without a manual search. Because Text IQ understands who a person is relative to the rest of the organization, and learns that organization’s “language,” it can more thoroughly extract what’s relevant to the inquiry from all that unstructured data in Slack, email, etc.

More recently, in the wake of GDPR, Text IQ has expanded its product suite to work in the privacy realm. When a company is asked by a customer to get access to all their data, or to be forgotten, the process can take an enormous amount of resources. Even then, bits of data might fall through the cracks.

For example, if a customer emailed Customer Service years ago, that might not come up in the company’s manual search efforts to find all of that customer’s data. But because Text IQ understands this unstructured data with a person-centric approach, that email wouldn’t slip by its system, according to Agarwal.

Given the sensitivity of the data, Text IQ functions behind a corporation’s firewall, meaning that Text IQ simply provides the software to parse the data rather than taking on any liability for the data itself. In other words, the technology comes to the data, and not the other way around.

Text IQ operates on a tiered subscription model, and offers the product for a fraction of the value they provide in savings when clients switch over from a manual search. The company declined to share any further details on pricing.

Former Apple and Oracle General Counsel Dan Cooperman, former Verizon General Counsel Randal Milch, former Baxter International Global General Counsel Marla Persky and former Nationwide Insurance Chief Legal and Governance Officer Patricia Hatler are on the advisory board for Text IQ.

The company has plans to go on a hiring spree following the new funding, looking to fill positions in R&D, engineering, product development, finance and sales. Co-founder and COO Omar Haroun added that the company achieved profitability in its first quarter entering the market and has been profitable for eight consecutive quarters.

Powered by WPeMatico

Postman, a five-year-old startup that is attempting to simplify development, tests and management of APIs through its platform, has raised $50 million in a new round to scale its business.

The Series B for the startup, which began its journey in India, was led by CRV and included participation from existing investor Nexus Venture Partners . The startup, with offices in India and San Francisco, closed its Series A financing round four years ago and has raised $58 million to date.

Postman offers a development environment which a developer or a firm could use to build, publish, document, design, monitor, test and debug their APIs. Postman, like some other startups such as RapidAPI, also maintains a marketplace to offer APIs for quick integration with other popular services.

The startup was co-founded by Abhinav Asthana, a former intern at Yahoo . Asthana was frustrated with how APIs were an afterthought for many developers, as they usually got around to building them in the eleventh hour. Additionally, developers were relying on their own workflows and there was no organized platform that could be used by many, he explained in an interview with TechCrunch.

Even big software firms have not looked into this space yet, and many have instead become a customer of Postman. “We are solving a fundamental problem for the technology landscape. Big companies tend to be slower as they have many other things on their plate,” said Asthana.

Five years later, Postman has grown significantly. More than 7 million users and 300,000 companies, including Microsoft, Twitter, Best Buy, AMC Theaters, PayPal, Shopify, BigCommerce and DocuSign today use Postman’s platform.

The modern software development relies heavily on APIs as more businesses begin to talk with one another. According to research firm Gartner, more than 65% of global infrastructure service providers’ revenue will be generated through services enabled by APIs by 2023, up from 15% in 2018.

Asthana said Postman intends to use the fresh capital to scale its startup, products and grow its team. “We are scaling rapidly across all dimensions. There are many use cases that we still want to address over the coming months. We will also experiment with sales and invest in improving user experience,” he added.

Postman offers some of its services in limited capacity for free to users. For the rest, it charges between $8 to $18 per user to its customers. That’s how the company generates revenue. Asthana declined to share the financial performance of the startup, but said its customer base was “growing phenomenally.”

Postman said CRV general partner Devdutt Yellurkar has joined its board of directors.

Powered by WPeMatico