funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Meditation app unicorn Calm wants you to doze off to the dulcet tones of actor Matthew McConaughey’s southern drawl or writer Stephen Fry’s English accent. Calm’s Sleep Stories feature that launched last year is a hit, with more than 150 million listens from its 2 million paid subscribers and 50 million downloads. While lots of people want to meditate, they need to sleep. The seven-year-old app has finally found its must-have feature that makes it a habit rather than an aspiration.

Keen to capitalize on solving the insomnia problems plaguing people around the world, Lightspeed tells TechCrunch it has just invested $27 million into a Series B extension round in Calm alongside some celebrity angels at a $1 billion valuation. The cash will help the $70 per year subscription app further expand from guided meditations into more self-help masterclasses, stretching routines, relaxing music, breathing exercises, stories for children and celebrity readings that lull you to sleep.

The funding adds to Calm’s $88 million Series B led by TPG that was announced in February that was also at a $1 billion valuation, bringing the full B round to $115 million and Calm’s total funding to about $141 million. Lightspeed partner Nicole Quinn confirms the fund started talks with Calm around the same time as TPG, but took longer to finish due diligence, which is why the valuation didn’t grow despite Calm’s progress since February.

“Nicole and Lightspeed are valuable partners as we continue to double down on entertainment through our content,” Calm’s head of communications Alexia Marchetti tells me. The startup plans to announce more celebrity content tie-ins later this summer.

Broadening its appeal is critical for Calm amidst a crowded meditation app market that includes Headspace, Simple Habit and Insight Timer, plus newer entrants like Peloton’s mindfulness sessions and Journey’s live group classes. It’s become easy to find guided meditations online for free, so Calm needs to become a holistic mental wellness hub.

While it risks diluting its message by doing so much, Calm’s plethora of services could make it a gateway to more of your personal health spend, including therapy, meditation retreats and health merchandise from airy clothing to yoga mats. But subscription fees alone are powering a big business. Calm quadrupled revenue in 2018 to reach $150 million in ARR and hit profitability.

Calm is poised to keep up its rapid revenue growth. After the launch of Sleep Stories, “it was incredible to see the engagement spike up and also the retention,” says Quinn. Users can choose from having McConaughey describe the wonders of the cosmos, John McEnroe walk them through the rules of tennis, fairy tales like The Little Mermaid and more.

Quinn tells me “Sleep Stories is now a huge percentage of the business, and also the length of time people spend on the app has gone up dramatically.” She tells me that so many startups are “trying to invent a problem where there isn’t one.” But difficulty snoozing is so widespread and detrimental that users are eager to pay for an app instead of a sleeping pill. Having the Interstellar actor talk about the universe until I pass out sounds alright, alright, alright.

Powered by WPeMatico

Artificial intelligence has become an increasingly important component of how a lot of technology works; now it’s also being applied to how technologists themselves work. Today, one of the startups building such a tool has raised some capital, Tara.ai, a platform that uses machine learning to help an organization get engineering projects done — from identifying and predicting the work that will need to be tackled, to sourcing talent to execute that, and then monitoring the project of that project — has raised a Series A of $10 million to continue building out its platform.

The funding for the company cofounded by Iba Masood (she is the CEO) and Syed Ahmed comes from an interesting group of investors that point to Tara’s origins, as well as how it sees its product developing over time.

The round was led by Aspect Ventures (the female-led firm that puts a notable but not exclusive emphasis on female-founded startups) with participation also from Slack, by way of its Slack Fund. Previous investors Y Combinator and Moment Ventures also participated in the round. (Y Combinator provides an avenue to companies from its cohorts to help them source their Series A rounds, and Tara.ai went through this process.)

Tara.ai was originally founded as Gradberry out of Y Combinator, with its initial focus on using an AI platform for organizations to evaluate and help source engineering talent: Tara.ai was originally that name of its AI engine.

(The origin of how Masood and Ahmed identified this problem was through their own direct experience: both were grads (she in finance, he in engineering) from the American University of Sharjah in the U.A.E. that had problems getting hired because no one had ever heard of their university. Even so, they had won an MIT-affiliated startup competition in Morocco and relocated to Boston. The idea with Gradberry was to cut through the big names and focus just on what people could do.)

Masood and Syed (who eventually got married) eventually realised that using that engine to evaluate the wider challenges of executing engineering projects came as a natural progression once the team started digging into the challenges and identifying what actually needed to be solved.

A study that McKinsey (where Masood once worked) conducted across some 5,000 projects found that $66 billion dollars were identified as “lost” due to projects running past the expected completion time, lack of adequate talent and just overall poor planning.

“We realised that recruiting was actually the final decision you make, not the first, and we wanted to be involved earlier in the decision-making process,” Masood said in an interview. “We saw a much bigger opportunity looking not at the people, but the whole project.”

In action, that means that Tara.ai is used not just to scope out the nature of the problem that needed to be solved, or the goal that an organization wanted to achieve; it is also used to suggest which frameworks will need to be used to execute on that goal, and then suggest a timeline to follow.

Then, it starts to evaluate a company’s own staff expertise, along with that from other recruiting platforms, to figure out which people to source from within the company. Eventually, that will also be complemented with sourcing information from outside the organization — either contractors or new hires.

Masood noted that a large proportion of users in the tech world today use Jira and platforms like it to manage projects. While there are some tools in Jira to help plan out projects better, Tara is proposing its platform as a kind of virtual project manager, or an assistant to an existing project manager, to conceive of the whole project, not just help with the admin of getting it done.

Notably, right now she says that some 75% of Tara.ai’s users — customers include Cisco, Orange Silicon Valley and Mower Digital — are “not technical,” meaning they themselves do not ship or use code. “This helps them understand what could be considered and the dependencies that can be expected out of a project,” she notes.

Lauren Kolodny, the partner at Aspect who led the investment, said that one of the things that stood out for her, in fact, with Tara.ai, was precisely how it could be applied exactly in those kinds of scenarios.

Today, tech is such a fundamental part of how a lot of businesses operate, but that doesn’t mean that every business is natively a technology one (think here of food and beverage companies as an example, or government agencies). In those cases, these companies would have traditionally had to turn to outside consultants to identify opportunities, and then build and potentially long-term operate whatever the solutions become. Now there is an opportunity to rethink how technology is used in these kinds of organizations.

“Projects have been hacked together from multiple systems, not really built in combination,” Kolodny said of how much development happens at these traditional businesses. “We are really excited about the machine learning scoping and mapping of internal and external talent, which is looking to be particularly important as traditional enterprises are required to get level with newer businesses, and the amount of talent they need to execute on these projects becomes challenging.”

Tara.ai’s next steps will involve essentially taking the building blocks of what you can think of as a very powerful talent and engineering project search engine, and making it more powerful. That will include integrating databases of external consultants and figuring out how best to have these in tandem with internal teams while keeping them working well together. And soon to come also will be bug prediction: how to identify these before they arise in a project. The company is releasing an updated AI engine to coincide with the funding.

The Slack investment is also a notable nod to what direction Tara.ai will take. Masood said that Slack was one of three “big tech” companies interested in investing in this round, and she and Syed chose Slack because from what they could see of its existing and target customers, many were already using it and some have already started requesting closer collaboration so that events in one could come up as updates in the other.

“Our largest customers are heavy Slack users and they are already having conversations in Slack related to projects in Tara.ai,” she said. “We are tackling the scoping element and now seeing how to link up even command line interfaces between the two.”

She noted that this does not rule out closer integrations with communications and other platforms that people use on a daily basis to get their work done: the idea is to become a tool to work better overall.

Powered by WPeMatico

Startups depend on the angel lifecycle. A few flush post-exit individuals put the first cash into a fresh venture. With some skill and plenty of luck, the early team grows the company into a big success. It sells or goes public and those team members earn a fortune. They then pay it forward by investing in the next generation of startups.

If they hoard their spoils they starve the early-stage ecosystem or leave founders stuck with dumb money from non-strategic financiers. If they redistribute their winnings, they can influence startup culture by deciding what, and more importantly, who gets funding.

But how does a co-founder or VP learn to be a mini-VC? That’s the goal of First Round Capital’s Angel Track, a free three-month workshop series in San Francisco and New York for learning how to source, vet, close, and support angel investments.

A scene from Angel Track’s first cohort

Every two weeks, an expert on some part of the investing process like finding deals or interviewing founders talks to the class, does Q&A, and then leaves the group to openly discuss what they learned and how to use it. Angel Track sessions have been tought by some of the smartest people in the valley like growth master Elad Gil, #ANGELS founding partner and former Twitter VP of corp dev Jessica Verrilli, and Precursor Ventures managing partner Charles Hudson.

Hundreds of startup execs apply for the 15 spots on each coast. After two classes in SF and one in NYC, today First Round unveiled its recently-graduated third cohort from programs in both cities. Those include Lucy Zhang who sold Facebook her chat startup Beluga that became the foundation of Messenger, and Mented Cosmetics co-founder and CEO KJ Miller. By the end of the program they’re taking joint pitch meetings from startups, showing each other the best questions to ask.

As with Y Combinator, it’s as much about the fellowship between new investors as the education. “It’s both a community and a masterclass” says First Round general partner Hayley Barna who oversees the NYC Angel Track. “It’s about bringing a talented group of emerging angels together to build a productive cohort of collaborators.”

She says diversity and inclusion is a big goal of the program, and it features 50% women and 20% underrepresented minorities. Being rich is not a pre-requisite. Barna declares “We’re not pulling in the bankers and the traders doing angel investing as a side-hustle.”

LOS ANGELES, CA – MARCH 29: Confetti falls as Lyft CEO Logan Green (C) rings the Nasdaq opening bell celebrating the company’s initial public offering (IPO) on March 29, 2019 in Los Angeles, California. The ride hailing app company’s shares were initially priced at $72. (Photo by Mario Tama/Getty Images)

After a slew of big 2019 IPOs from Uber, Lyft, Pinterest, Slack, and Zoom, there are plenty of newly-minted potential angels for First Round to teach. The venture firm benefits by building a cadre of co-investors or alternative backers for deals it vets, and through added visibility into the next top fundraises. Unlike some VC scout programs, there’s no formal obligation to send opportunities to First Round or pledge funding alongside it. That keeps it appealing to future investors that innovation hubs need to keep the circle of life flowing.

“A lot of angel investors that got their start in the mid-to late 2000s, they’re almost all fund managers now. They went from angels or super angels to venture investors” First Round partner Brett Berson tells me. “There haven’t been a lot of people who’ve come in and filled that gap”, which could stunt the ecosystem’s growth. Graduates ramp up their angel investing while often staying in their operating roles, though some like former Pinterest head of culture Cat Lee who became a partner at Maveron turn investing into their day job.

First Round VP Ben Cmejla who helped launch the program explains that “Some people are doing it for the financial return. Some people want access to new ideas and are curious. Some people have a specific type of community they want to support with their investments.”

Becoming a successful angel means a lot more than evaluating term sheets. Just like how ideas are a dime a dozen and it’s about who can execute, fundraises are frequent but getting into the right ones takes hard work. First Round focuses on many of the soft skills required to win. Participants receive mentorship on how to:

How to approach the delicate power balance of meetings with entrepreneurs can be especially tricky, so I spoke at length with First Round’s Phin Barnes about the session he teaches on founder interviews. I wanted to get a taste for what it’d be like in the classroom, despite First Round declining to let me attend the real thing. Turns out having a journalist in the room can disrupt a safe learning environment for budding angels.

First Round partner Phin Barnes

“Investing is a sell-side product” Barnes stresses. “Capital is a commodity, especially in this market. What you’re saying with a term sheet is that you think the founder’s equity is worth more than your dollars.” That means investors have to close the value gap with sweat.

Barnes gives me what he calls the ‘chocolate soufflé or brownies’ scenario. “The danger of being a smart, talented executive or entrepreneur is that when a founder talks to you about sugar and flour and butter, you start imagining a molten lava soufflé cake you’d build with the ingredients. You invest, and then the founder comes back with a tray of brownies. ‘That’s not what I thought I invested in!’”

The mistake comes in envisioning what you’d do rather than really listening to the founder — the one who’s cooking. Instead of trying to hijack the roadmap or being disappointed by the direction, angels need to help make those brownies as tasty as possible. That means entering into interviews with an open mind.

“You should be positively inclined to invest and have some critical questions. If you don’t think you should invest, you shouldn’t have the meeting in the first place” Barnes explains. “You want to hold that perspective loosely and as new information comes to light, you want to check ‘Am I still interested?’ By the end you want to know what you don’t know, and the open questions you need to answer to validate your hypothesis.”

The four main areas of evaluation are:

The market — Why does this category of product need to exist? What would the world look like if they dominate the category? Can they clearly explain to a five-year old the problem they’re trying to solve? What’s their contrarian thinking? And what motivation will keep them persevering to address the problem despite setbacks and opportunity cost?

The product — Is addressing this specific customer problem unique and defensible? It’s less about if the product is good or bad, or should the button be red or blue. It’s more about how the founder took the inputs and made the decision and how they process information. Have them walk you through the go-to-market plan and see how they shift between high-level strategy and ground-level tactics.

The team — Do they have on-paper talent like PhDs or experience? Can they iterate quickly? You have to weed out victims and look for people who are learners that evolve when faced with adversity. Do your homework on who they are before so you can dig deeper into how they tick. Ask how they show trust in their team and how they get their team to trust them. Have them tell you about the most important thing that happened at the company in the last week to understand their priorities and emotional connection to the process.

The relationship with the founder — Investors need to ask what the best way to work with them is, and what founders are looking for in support from an investor. Do they want a hands-off investor who only chimes in when summoned, or do they expect frequent co-building sessions? Do they need more help accessing a bigger network for hiring and partnerships, or industry-specific expertise to navigate complex decisions?

“We have two roles. We interview and then we coach” Barnes says, providing tips for both. “The very best questions are open-ended. They start with a how/what/why and end with a question mark. Double-barreled questions are terrible. Ask them what would you do, and stop. Get comfortable with silence. They’ll usually fill the silence with something off-script that reveals a deeper truth.” Only once has a founder asked Barnes ‘are you ok?’ in response to his inquisitive stare.

Being able to summarize what you’ve learned lets you quickly cross-check your assumptions with the founder and get helpful corrections. That helps you figure out what questions you still need to ask and keep a diligent list of what you’ll need to research after.

When it comes to giving an answer on whether you’ll invest, “Second best to a quick yes is a quick no with a strong point of view and information for the entrepreneur. The worst is ghosting people. 90% of people operate that way but that’s not the way to do it” Barnes emphasizes. “If you walk out without a yes, no, or what to learn more about in specific detail, you’ve failed as an investor and wasted the time of the entrepreneur.”

“It was like the perfect mix of your favorite college seminar and a super practical apprenticeship” says Ariana Poursartip, the VP of product for fintech startup Petal who was in the first NYC Angel Track class. “I came away with a better sense of my personal investing approach, and a community of fellow angel investors who I’ll continue to learn from for years.”‘

Fostering better educated angels is crucial for enabling founders. “Dumb money” from investors without expertise in a relevant space, connections they’ll leverage to help, or an understanding of what startups need can be dangerous. It can lead founders to raise more but inefficient capital and make slower progress that puts them at risk of a future down-round that can trigger a startup death spiral.

First Round’s Angel Track cohort 3

First Round is far from the only one trying to fill the angel gap. “Initiatives like Spearhead, YC’s Startup Investor School, and scout programs help lower the barrier to entry for many people who will be terrific and helpful investors for startups” says Cmejla. Sequoia, General Catalyst, Village Global and more run their own scout networks. There are some questionable programs out there too, though, like Venture University which charges from $4,000 to $65,000 for its programs that require students to source deals in exchange for a hazy profit-sharing agreement.

Cmejla insists “It isn’t about providing the capital, a short crash course, or a path to becoming a full-time VC, but about building a durable community that members can lean on and lean into as they level up.” Instead, First Round scores a way to connect founders it funds with relevant angels from its classes. That incentivizes the firm to teach savvy etiquette. Barna warns “You want to be thorough, but if you’re putting in a small check, you can’t ask founders to jump through too many hoops . . . and spend five hours just to get that dinky paycheck.”

Cmejla insists “It isn’t about providing the capital, a short crash course, or a path to becoming a full-time VC, but about building a durable community that members can lean on and lean into as they level up.” Instead, First Round scores a way to connect founders it funds with relevant angels from its classes. That incentivizes the firm to teach savvy etiquette. Barna warns “You want to be thorough, but if you’re putting in a small check, you can’t ask founders to jump through too many hoops . . . and spend five hours just to get that dinky paycheck.”

Past Angel Track participants like Poursartip and Instacart VP of growth Bengaly Kaba tell me they wish the program got them spending more time together both during and after the class, which could spur deeper alliances. “Currently the program ends and there is no formal programming to keep the alumni cohorts engaged and connected” Kaba notes. Many already back startups brought to the class by their peers. Still, Square Cash app product lead Ayo Omojola wanted a stronger structure like perhaps a syndicate so cohort-mates could do more investing together.

What they all cited was the massive value of learning to codify what they’re looking for and what they bring to the table. Kaba highlighted how he enjoyed “Hearing how Elad Gil, [Floodgate co-founding partner] Ann Muira-Ko, Charles Hudson and other guest speakers defined their investment theses around macro trends, industry specific insights, and founder traits.”

When the lock-ups expire on recent IPOs and employees start getting liquidity, “you’re going to see a whole new generation of investors get going over the next couple of years” says Berson.

Not every company spawns the same quality of investor, though. Companies like Uber that empower less-senior team members as the ride sharing company does with regional general managers tend to develop talent with the self-direction and conviction to be great angels. Looking back, you similarly see more angels and founders emerging from more decentralized Google than top-down Apple.

As software eats the world, unicorns proliferate, and the proceeds of tech’s winning streak are spread wide, more and more people will be ready to write angel checks. “It will most likely materially accelerate over the next 12-24 months” Berson concludes. Those without the skills could squander what they’ve earned. Angels who know what makes them special and can evaluate startups without getting swept up in the hype will crown the queens of tomorrow.

Powered by WPeMatico

In the early 2000s, journalists popularized the term “PayPal mafia” to describe the PayPal founders and employees who left to start their own wildly successful tech companies, including Peter Thiel, Reid Hoffman, and Elon Musk. Drawing from that idea, this article seeks to cover the formation and flow of talent within the crypto landscape today.

I’m fascinated by the concept of tech mafias, popularized by Paypal in the early 00s.

Early signs of crypto mafias:

Coinbase

@0xProject @dydxprotocol

Ethereum/ConsenSys@Cardano @polkadotnetwork @metamask_io

MIT@EnigmaMPC @Algorand Unit-e

IC3Avalanche

Others?

— Ash Egan (@AshAEgan) April 3, 2019

The crypto world is in a constant state of flux, with new startups entrants joining the industry every single day. These new startups have the potential either to be superstars within a portfolio company or to start the next Coinbase. Additionally, there are already impressive spin-outs from some of the more established crypto companies.

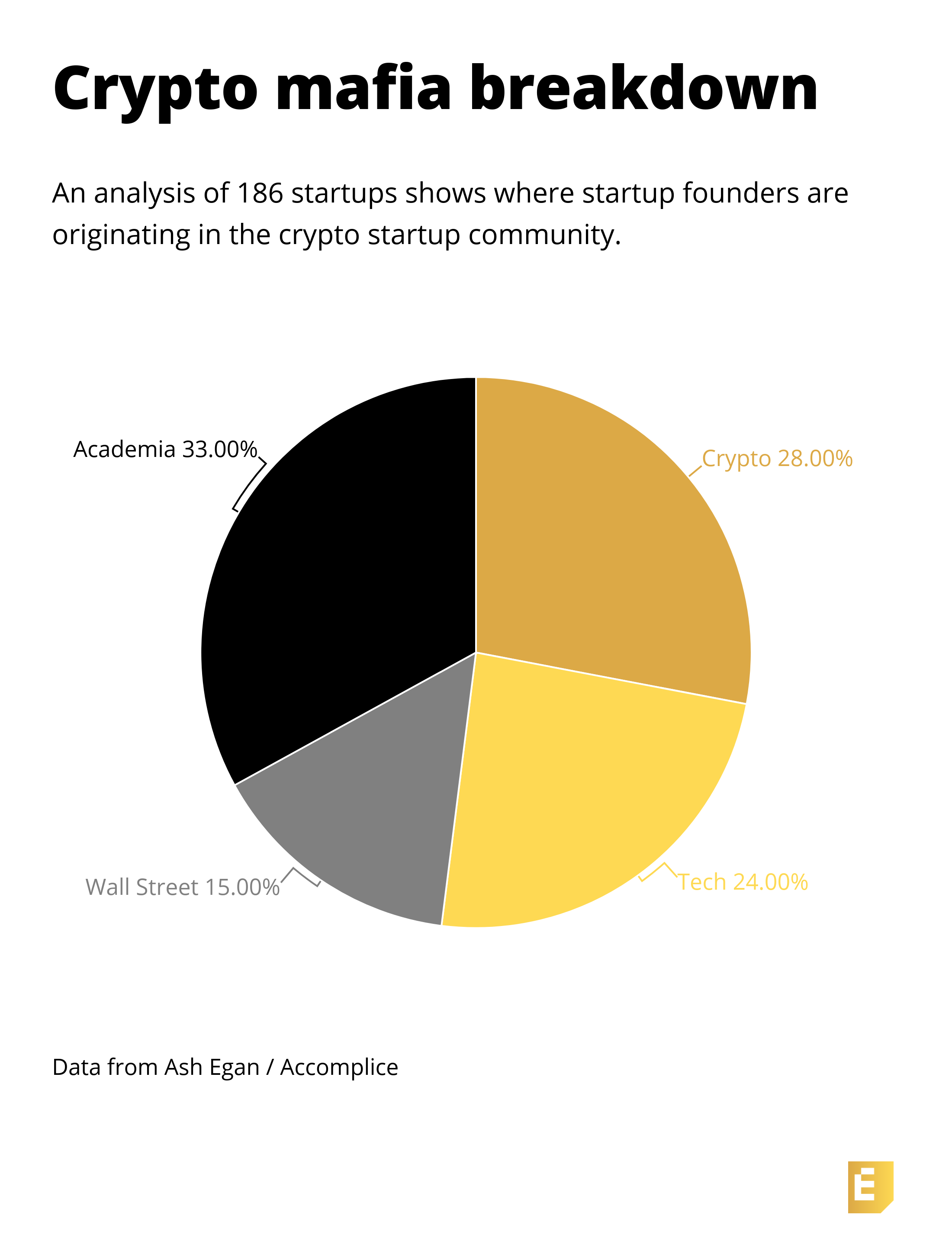

For ease of framing, I’ve separated these early-forming mafias into four categories: Crypto, Tech, Wall Street, and Academia. Since 2009, there have been 186 spinout companies originating from those four categories (33% from Academia, 28% from Crypto, 24% from Tech, and 15% from Wall Street).

Obvious but important disclaimer: this article does not intend to promote organized crime within crypto.

Powered by WPeMatico

Rohan Silva is obsessed with social mobility and why certain groups are so under-represented in the technology industry.

He co-founded Second Home, a coworking space looking to bring together disparate civic-minded, cultural, creative and commercial entrepreneurs at sites in Lisbon, London and (now) Los Angeles, and he has spent years examining how gender, race and class impact access to technology as a now-reformed politician. Throughout that work though, one area that he says he overlooked was accessibility and entrepreneurship focused on people with disabilities.

“At Second Home, we pride ourselves on having a diverse community. I can count on one hand the number of founders with disabilities we have in our community, so there is definitely something going profoundly wrong,” Silva says.

Enlisting the help of the European venture capital fund Atomico, Silva has set up a micro-investment fund of £100,000 to tackle the problem.

“It’s a large amount compared to what I have and a small amount compared to most venture capital funds,” he explains. “The much bigger prize here is the ability to fund technologies that have the opportunities to improve the lives of people with disabilities.”

Silva isn’t alone. Organizations like Not Impossible Labs, a Los Angeles-based company, and startups like OrCam Technologies, eSight, B-Temia, Kinova Robotics, Open Bionics, Voiceitt and Whill are harnessing technology to bring solutions to people with disabilities across the world.

Powered by WPeMatico

For many years, the boom and bust of China’s tech landscape have centered around consumer-facing products. As this space gets filled by Baidu, Alibaba, Tencent, and more recently Didi Chuxing, Meituan Dianping, and ByteDance, entrepreneurs and investors are shifting attention to business applications.

One startup making waves in China’s enterprise software market is four-year-old Laiye, which just raised a $35 million Series B round led by cross-border venture capital firm Cathay Innovation. Existing backers Wu Capital, a family fund, and Lightspeed China Partners, whose founding partner James Mi has been investing in every round of Laiye since Pre-A, also participated in this Series B.

The deal came on the heels of Laiye’s merger with Chinese company Awesome Technology, a team that’s spent the last 18 years developing Robotic Process Automation, a term for technology that lets organizations offload repetitive tasks like customer service onto machines. With this marriage, Laiye officially launched its RPA product UiBot to compete in the nascent and fast-growing market for streamlining workflow.

“There was a wave of B2C [business-to-consumer] in China, and now we believe enterprise software is about to grow rapidly,” Denis Barrier, co-founder and chief executive officer of Cathay Innovation, told TechCrunch over a phone interview.

Since launching in January, UiBot has collected some 300,000 downloads and 6,000 registered enterprise users. Its clients include major names such as Nike, Walmart, Wyeth, China Mobile, Ctrip and more.

Guanchun Wang, chairman and CEO of Laiye, believes there are synergies between AI-enabled chatbots and RPA solutions, as the combination allows business clients “to build bots with both brains and hands so as to significantly improve operational efficiency and reduce labor costs,” he said.

When it comes to market size, Barrier believes RPA in China will be a new area of growth. For one, Chinese enterprises, with a shorter history than those found in developed economies, are less hampered by legacy systems, which makes it “faster and easier to set up new corporate software,” the investor observed. There’s also a lot more data being produced in China given the population of organizations, which could give Chinese RPA a competitive advantage.

“You need data to train the machine. The more data you have, the better your algorithms become provided you also have the right data scientists as in China,” Barrier added.

However, the investor warned that the exact timing of RPA adoption by people and customers is always not certain, even though the product is ready.

Laiye said it will use the proceeds to recruit talents for research and development as well as sales of its RPA products. The startup will also work on growing its AI capabilities beyond natural language processing, deep learning, and reinforcement learning, in addition to accelerating commercialization of its robotic solutions across industries.

Powered by WPeMatico

AUrate, a startup selling gold jewelry directly to consumers, announced today that it has raised $13 million in Series A funding.

The company’s co-founders Bouchra Ezzahraoui and Sophie Kahn said that AUrate’s prices range from $50 to $3,000, but they’re really aiming for what Ezzahraoui called “this new market sweet spot” of $300 to $500. And while that’s not exactly cheap, she said customers are getting a piece of fine jewelry made from real gold, which would normally be priced at $1,200 or more.

The jewelry is produced by local partners in New York City, and the gold comes from sustainable sources. Kahn also said while fine jewelry has traditionally been created “by men for women,” she designs AUrate’s pieces, and she’s “always looking for a balance between bold and feminine, which represents our women.”

In addition to selling jewelry online, AUrate also operates two brick-and-mortar stores in New York, with a third under construction in Washington, D.C. And it introduced something called Curate, where the company will send up to five recommended pieces to customers, which they can try at home with no commitment.

Founded in 2015, AUrate says its online revenue has been growing consistently by 400 percent every year, while its brick-and-mortar retail business has been doubling. Also noteworthy: 40 percent of its customers return for additional purchases, and 90 percent of customers are women.

The new funding was led by Michael Platt’s Bluecrest Capital, with participation from Point King Capital, Arab Angel Fund and Drake Management.

Powered by WPeMatico

Skubana, a startup promising to help e-commerce business manage what can be a dizzying array of logistical challenges, is announcing that it has raised $5.4 million in Series A funding.

The round was led by Defy Partners, with participation from Advancit Capital and FJ Labs. Early Skubana backer Brian Lee — who co-founded The Honest Company, ShoeDazzle and LegalZoom, and is also involved as a Defy Sage — is joining Skubana’s board of directors.

“When I first launched Shoedazzle and The Honest Company, one of our primary challenges was understanding how our products performed across channels,” Lee said in a statement. “Skubana solves a core problem that thousands of brands face and no other competitor solves well.”

CEO Chad Rubin said these were issues he faced when he started his own e-commerce business, Crucial Vacuum, a decade ago. In fact, Rubin’s co-founder and CTO DJ Kunovac (who was working at McKesson health IT) recalled visiting Rubin’s warehouse and saying, “What you’re experiencing right now is effectively where healthcare was a decade or two ago.”

The problem, Kunovac argued, is that there was separate software and systems for every part of the process. What was needed was a “horizontal platform of commerce.”

So with Skubana, Rubin and Kunovac have built a software platform that handles shipping, inventory management, restocking and more. The main thing Skubana doesn’t handle is the creating the actual online storefront and shopping cart. Instead, it’s built to take care of everything that a business needs to do once those orders start coming in.

As Rubin put it, “If Shopify is a city, then we’re everything underneath the ground.”

By bringing all the data together from various sales channels and applying and machine learning, the company says it can improve profitability and reduce issues like selling more product that you have in the inventory. There’s also an app store to integrate Skubana with other systems.

“We’re completely replacing these siloed, fragmented pieces of software,” Rubin said.

Brands already using the software include Bird Rides, Valvoline, and Deathwish Coffee. Kunovac noted that Skubana isn’t “entry-level software” — when brands sign up to use it, they’ve usually a growing a commerce business, which is when “the laws of physics have started to take over.” In other words: “They come to us from pain.”

With the new funding, Skubana says it will double its size in the next 18 months, build a number of new products and continue to invest in its app store ecosystem.

Powered by WPeMatico

Two months ago, we reported that Carbon was set to raise up to $300 million, bringing the 3D printing company’s valuation up to a lofty $2.5 billion. The real numbers released this week by the company aren’t quite so lofty, but are impressive nonetheless. The Series E fetched $260 million, putting its valuation at closer to $2.4 billion.

The latest round follows a $200 million Series D that arrived in late-2017, bringing the company’s total raise to $680 million. What exactly is the bay area-based startup planning to do with that massive sum, in the wake of high profile manufacturing partnerships with companies like Adidas and Riddell?

CEO/co-founder Joseph M. DeSimone and recent addition CMO Dara Treseder (most recently of GE Ventures) stopped by our offices to discuss what the latest round means for the Bay Area-based company.

Asked for a timeline around when Carbon might exit, DeSimon offered a non-committal answer. “As we grow our business, we haven’t made announcements for our IPO or anything like that yet,” he told TechCrunch. But the revenue business is growing nicely. So we’re in pretty good shape.”

It’s hard to say precisely what goals the company is hoping to attain before going public, but at the very least, Carbon presents a good indicator that the 3D printing industry is back on the uptick — in some circles, at least.

Powered by WPeMatico

Meme creators have never gotten their fair share. Remixed and reshared across the web, their jokes prop up social networks like Instagram and Twitter that pay back none of their ad revenue to artists and comedians. But 300 million monthly user meme and storytelling app Imgur wants to pioneer a way to pay creators per second that people view their content.

Today Imgur announces that it’s raised a $20 million venture equity round from Coil, a micropayment tool for creators that Imgur has agreed to build into its service. Imgur will eventually launch a premium membership with exclusive features and content reserved for Coil subscribers.

Users pay Coil a fixed monthly fee, install its browser extension, the Interledger protocol is used to route assets around, and then Coil pays creators dollars or XRP tokens per second that the subscriber spends consuming their content at a rate of 36 cents per hour. Imgur and Coil will earn a cut too, diversifying the meme network’s revenue beyond ads.

“Imgur began in 2009 as a gift to the internet. Over the last 10 years we’ve built one of the largest, most positive online communities, based on our core value to ‘give more than we take’” says Alan Schaaf, founder and CEO of Imgur. The startup bootstrapped for its first five years before raising a $40 million Series A from Andreessen Horowitz and Reddit. It’s grown into the premier place to browse ‘meme dumps’ of 50+ funny images and GIFs, as well as art, science, and inspirational tales. With the same unpersonalized homepage for everyone, it’s fostered a positive community unified by esoteric inside jokes.

While the new round brings in fewer dollars, Schaaf explains that Imgur raised at a valuation that’s “higher than last time. Our investors are happy with the valuation. This is a really exciting strategic partnership.” Coil founder and CEO Stefan Thomas who was formerly the CTO of cryptocurrency company Ripple Labs will join Imgur’s board. Coil received the money it’s investing in Imgur from Ripple Labs’ Xpring Initiative, which aims to fund proliferation of the Ripple XRP ecosystem, though Imgur received US dollars in the funding deal.

Thomas tells me that “There’s no built in business model” as part of the web. Publishers and platforms “either make money with ads or with subscriptions. The problem is that only works when you have huge scale” that can bring along societal problems as we’ve seen with Facebook. Coil will “hopefully offer a third potential business model for the internet and offer a way for creators to get paid.”

Founded last year, Coil’s $5 per month subscription is now in open beta, and it provides extensions for Chrome and Firefox as it tries to get baked into browsers natively. Unlike Patreon where you pick a few creators and choose how much to pay each every month, Coil lets you browse content from as many creators as you want and it pays them appropriately. Sites like Imgur can code in tags to their pages that tell Coil’s Web Monetization API who to send money to.

The challenge for Imgur will be avoiding the cannibalization of its existing content to the detriment of its non-paying users who’ve always known it to be free. “We’re in the business of making the internet better. We do not plan on taking anything away for the community” Schaaf insists. That means it will have to recruit new creators and add bonus features that are reserved for Coil subscribers without making the rest of its 300 million users feel deprived.

It’s surprising thT meme culture hasn’t spawned more dedicated apps. Decade-old Imgur precedes the explosion in popularity of bite-sized internet content. But rather than just host memes like Instagram, Imgur has built its own meme creation tools. If Imgur and Coil can prove users are willing to pay for quick hits of entertainment and creators can be fairly compensated, they could inspire more apps to help content makers turn their passion into a profession…or at least a nice side hustle.

Powered by WPeMatico