funding

Auto Added by WPeMatico

Auto Added by WPeMatico

There are successful companies that grow fast and garner tons of press. Then there’s Roblox, a company which took at least a decade to hit its stride and has, relative to its current level of success, barely gotten any recognition or attention.

Why has Roblox’s story gone mostly untold? One reason is that it emerged from a whole generation of gaming portals and platforms. Some, like King.com, got lucky or pivoted their business. Others by and large failed.

Once companies like Facebook, Apple and Google got to the gaming scene, it just looked like a bad idea to try to build your own platform — and thus not worth talking about. Added to that, founder and CEO Dave Baszucki seems uninterested in press.

But overall, the problem has been that Roblox just seemed like an insignificant story for many, many years. The company had millions of users, sure. So did any number of popular games. In its early days, Roblox even looked like Minecraft, a game that was released long after Roblox went live, but that grew much, much faster.

Yet here we are today: Roblox now claims that half of all American children aged 9-12 are on its platform. It has jumped to 90 million monthly unique users and is poised to go international, potentially multiplying that number. And it’s unique. Essentially all other distribution services offering games through a portal have eventually fizzled, aside from some distant cousins like Steam.

This is the story of how Roblox not only survived, but built a thriving platform.

(Photo by Steve Jennings/Getty Images for TechCrunch)

Before Roblox, there was Knowledge Revolution, a company that made teaching software. While designed to allow students to simulate physics experiments, perhaps predictably, they also treated it like a game.

“The fun seemed to be in building your own experiment,” says Baszucki. “When people were playing it and we went into schools and labs, they were all making car crashes and buildings fall down, making really funny stuff.” Provided with a sandbox, kids didn’t just make dry experiments about mass or velocity — they made games, or experiences they could show off to friends for a laugh.

Knowledge Revolution was founded in 1989, by Dave Baszucki and his brother Greg (who didn’t later co-found Roblox, but is now on its board). Nearly a decade later, it was acquired for $20 million by MSC Software, which made professional simulation tools. Dave continued there for another four years before leaving to become an angel investor.

Baszucki put money into Friendster, a company that pre-dated Facebook and MySpace in the social networking category. That investment seeded another piece of the idea for Roblox. Taken together, the legacy of Knowledge Revolution and Friendster were the two key components undergirding Roblox: a physics sandbox with strong creation tools, and a social graph.

Baszucki himself is a third piece of the puzzle. Part of an older set of entrepreneurs, which might be called the Steve Jobs generation, Baszucki’s archetype seems closer to Mr. Rogers than Jobs himself: unfailingly polite and enthusiastic, never claiming superior insight, and preferring to pass credit for his accomplishments on to others. In conversation, he shows interests both central and tangential to Roblox, like virtual environments, games, education, digital identity and the future of tech. Somewhere in this heady mix, the idea of Roblox came about.

Powered by WPeMatico

Maker Faire and Maker Media are getting a second chance after suddenly going bankrupt, but they’ll return in a weakened capacity. Sadly, their flagship crafting festivals remain in jeopardy, and it’s unclear how long the reformed company can survive.

Maker Media suddenly laid off all 22 employees and shut down last month, as first reported by TechCrunch. Now its founder and CEO Dale Dougherty tells me he’s bought back the brands, domains, and content from creditors and rehired 15 of 22 laid off staffers with his own money. Next week, he’ll announce the relaunch of the company with the new name “Make Community“.

Read our story about how Maker Faire fell apart

The company is already working on a new issue of Make Magazine and the online archives of its do-it-yourself project guides will remain available. I hopes to keep publishing books. And it will continue to license the Maker Faire name to event organizers who’ve thrown over 200 of the festivals full of science-art and workshops in 40 countries. But Dougherty doesn’t have the funding to commit to producing the company-owned flagship Bay Area and New York Maker Faires any more.

“We’ve succeeded in just getting the transition to happen and getting Community set up” Dougherty tells me. But sounding shaky, he asks “Can I devise a better model to do what we’ve been doing the past 15 years? I don’t know if I have the answer yet.” Print publishing proved tougher and tougher recently. Combined with declining corporate sponsorships of the main events, Maker Media was losing too much money to stay afloat last time.

“On June 3rd, we basically stopped doing business. And, you know, the bank froze our accounts” Dougherty said at a meetup he held in Oakland to take feedback on his plan, according a recording made by attendee Brian Benchoff. Grasping for a way to make the numbers work, he told the small crowd gathered “I’d be happy if someone wanted to take this off my hands.”

Maker Faire [Image via Maker Faire Instagram]

For now, Dougherty is financing the revival himself “with the goal that we can get back up to speed as a business, and start generating revenue and a magazine again. This is where the community support needs to come in because I can’t fund it for very long.”

Maker Faire founder and Make Community CEO Dale Dougherty

The immediate plan is to announce a new membership model next week at Make.co where hobbyists and craft-lovers can pay a monthly or annual fee to become patrons of Make Community. Dougherty was cagey about what they’ll get in return beyond a sense of keeping alive the organization that’s held the maker community together since 2005. He does hope to get the next Make Magazine issue out by the end of summer or early fall, and existing subscribers should get it in the mail.

The company is still determining whether to move forward as a non-profit or co-op instead of as a venture-backed for-profit as before. “The one thing i don’t like about non-profit is that you end up working for the source you got the money from. You dance to their tune to get their funding” he told the meetup.

Last time, he burned through $10 million in venture funding from Obvious Ventures, Raine Ventures, and Floodgate. That could make VCs weary of putting more cash into a questionable business model. But if enough of the 80,000 remaining Make Magazine subscribers, 1 million YouTube followers, and millions who’ve attended Maker Faire events step up, pehaps the company can find surer footing.

“I hope this is actually an opportunity not just to revive what we do but maybe take it to a new level” Dougherty tells me. After all, plenty of today’s budding inventors and engineers grew up reading Make Magazine and being awestruck by the massive animatronic creations featured at its festivals.

Audibly peturbed, the founder exclaimed at his community meetup “It frustrates the heck out of me thinking that I’m the one backing up Maker Faire when there’s all these billionaires in the valley.”

Powered by WPeMatico

Car shoppers now have several new options to avoid long-term debt and commitments. Automakers and startups alike are increasingly offering services that give buyers new opportunities and greater flexibility around owning and using vehicles.

In the first part of this feature, we explored the different startups attempting to change car buying. But not everyone wants to buy a car. After all, a vehicle traditionally loses its value at a dramatic rate.

Some startups are attempting to reinvent car ownership rather than car buying.

My favorite car blog Jalopnik said it best: “Cars Sales Could Be Heading Straight Into the Toilet.” Citing a Bloomberg report, the site explains automakers may have had the worst first half for new-vehicle retail sales since 2013. Car sales are tanking, but people still need cars.

Companies like Fair are offering new types of leases combining a traditional auto financing option with modern conveniences. Even car makers are looking at different ways to move vehicles from dealer lots.

Fair was founded in 2016 by an all-star team made up of automotive, retail and banking executives including Scott Painter, former founder and CEO of TrueCar.

Powered by WPeMatico

Growing D2C brands face an interesting challenge. While they’ve eliminated much of the hassle of a physical storefront, they must still deal with all the complications involved in managing inventory and manufacturing and shipping a physical product to suppliers.

Anvyl, with a fresh $9.3 million in Series A funding, is looking to jump in and make a difference for those brands. The company, co-founded by chief executive Rodney Manzo, is today announcing the raise, led by Redpoint Ventures, with participation from existing investors First Round Capital and Company Ventures. Angel investors Kevin Ryan (MongoDB and DoubleClick), Ben Kaufman (Quirky and Camp) and Dan Rose (Facebook) also participated in the round.

Manzo hails from Apple, where with $300 million in spend to manage logistics and supply chain he was still operating in an Excel spreadsheet. He then went to Harry’s, where he shaved $10 million in cash burn in his first month. He says himself that sourcing, procurement and logistics are in his DNA.

Which brings us to Anvyl. Anvyl looks at every step in the logistics process, from manufacture to arrival at the supplier, and visualizes that migration in an easy-to-understand UI.

The difference between Anvyl and other supply chain logistics companies, such as Flexport, is that Anvyl goes all the way to the very beginning of the supply chain: the factories. The company partners with factories to set up cameras and sensors that let brands see their product actually being built.

“When I was at Apple, I traveled for two years at least once a month to China and Japan just to oversee production,” said Manzo. “To oversee production, you essentially have to be boots on the ground and eyes in the factory. None of our brands have traveled to a factory.”

On the other end of the supply chain, Anvyl lets brands manage suppliers, find new suppliers, submit RFQs, see cost breakdowns and accept quotes.

The company also looks at each step in between, including trucks, trains, boats and planes so that brands can see, in real time, their products go from being manufactured to delivery.

Anvyl charges brands a monthly fee using a typical SaaS model. On the other end, Anvyl takes a “tiny percentage” of goods being produced within the Anvyl marketplace. The company declined to share actual numbers around pricing.

This latest round brings Anvyl’s total funding to $11.8 million. The company plans to use the funding toward hiring in engineering and marketing, and grow its consumer goods customer base.

Powered by WPeMatico

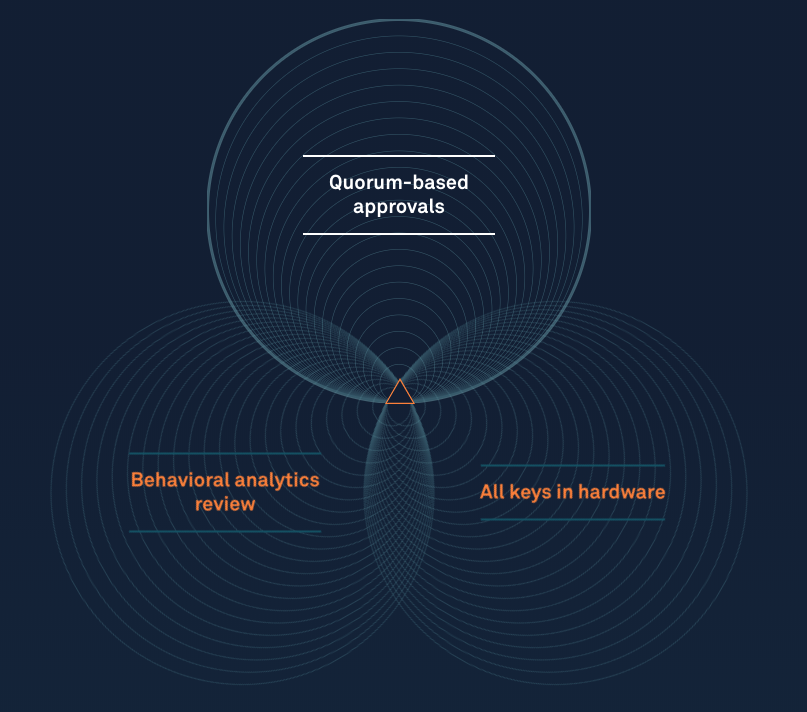

Visa and Andreessen Horowitz are betting even bigger on cryptocurrency, funding a big round for fellow Facebook Libra Association member Anchorage’s omnimetric blockchain security system. Instead of using passwords that can be stolen, Anchorage requires cryptocurrency withdrawals to be approved by a client’s other employees. Then the company uses both human and AI review of biometrics and more to validate transactions before they’re executed, while offering end-to-end insurance coverage.

This new-age approach to cryptocurrency protection has attracted a $40 million Series B for Anchorage, led by Blockchain Capital and joined by Visa and Andreessen Horowitz. The round adds to Anchorage’s $17 million Series A that Andreessen led just six months ago, demonstrating extraordinary momentum for the security startup.

“As a custodian, our work is focused on building financial plumbing that other companies depend on for their operations to run smoothly. In this regard we have always looked at Visa as a model,” Anchorage co-founder and president Diogo Mónica tells me.

“Visa was ‘fintech’ before the term existed, and has always been on the vanguard of financial infrastructure. Visa’s investment in Anchorage is helpful not only to our company but to our industry, as a validation of the entire ecosystem and a recognition that crypto will play a key role in the future of global finance.”

Cold-storage, where assets are held in computers not connected to the internet, has become a popular method of securing Bitcoin, Ether and other tokens. But the problem is that this can prevent owners from participating in governance of certain cryptocurrency where votes are based on their holdings, or earning dividends. Anchorage tells me it’s purposefully designed to permit this kind of participation, helping clients to get the most out of their assets like capturing returns from staking and inflation, or joining in on-chain governance.

As three of the 28 founding members of the Libra Association that will govern the new Facebook-incubated cryptocurrency, Anchorage, Visa and Andreessen Horowitz will be responsible for ensuring the stablecoin stays secure. While Facebook is building its own custodial wallet called Calibra for users, other Association members and companies hoping to dive into the ecosystem will need ways to protect their Libra stockpiles.

“Libra is exactly the kind of asset that Anchorage was created to hold,” Mónica wrote the day Libra was revealed. “Our custody solution enables online participation with offline assets, so that asset-holders don’t face a trade-off between security and usability.” The company believes that custodians shouldn’t dictate which coins their clients hold, so it’s working to support all types of digital assets. Anchorage tells me that will include support for securing Libra in the future.

You’ve probably already used technology secured by Anchorage’s founders, who engineered Docker’s containers that are used by Microsoft, and Square’s first encrypted card reader. Mónica was at Square when he met his future Anchorage co-founder Nathan McCauley, who’d been working on anti-reverse-engineering tech for the U.S. military. When a company that had lost the password to a $1 million cryptocurrency account asked for their help with security, they recognized the need for a more idiot-proof take on asset protection.

“Anchorage applies the best of modern security engineering for a more advanced approach: we generate and store private keys in secure hardware so they are never exposed at any point in their life cycle, and we eliminate human operations that expose assets to risk,” Mónica says. The startup competes with other crypto custody firms like Bitgo, Ledger, Coinbase and Gemini.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Anchorage ditches usernames, passwords, email addresses and phone numbers completely. That way a hacker can’t just dump your coins into their account by stealing your private key or SIM-porting your number to their phone. Instead, clients whitelist devices held by their employees, who use the Anchorage app to submit transactions. You’d propose selling $10 million worth of Bitcoin or transferring it to someone else as payment, and a minimum of two-thirds of your designated co-workers would need to concur to form a quorum that approves the transfer.

But first, Anchorage’s artificial intelligence and human staff would check for any suspicious signals that might indicate a hack in progress. It uses behavioral analysis (do you act like a real human and similar to how you have before), biometric signals (do you look like you) and network signals (is your device what and where it should be) to confirm the transaction is legitimate. The same process goes down if you try to add a new whitelisted device or change who has permission to do what.

The challenge will be scaling security to an ever-broadening range of digital assets, each with their own blockchain quirks and complex smart contracts. Even if Anchorage keeps coins safely in custody, those variables could expose assets to risk while in transit. Now with deeper pockets and the Visa vote of confidence, Anchorage could solve those problems as clients line up.

While most blockchain attention has focused on the cryptocurrencies themselves and the exchanges where you can buy and sell them, a second order of critical infrastructure startups is emerging. Companies like Anchorage could make Bitcoin, Ether, Libra and more not just objects of speculation or the domain of experts, but safely functioning elements of the new world economy.

Powered by WPeMatico

NiYO Solutions, a Bangalore-based “neo-bank” that helps salaried employees and blue-collar workers access company benefits and other financial services, has raised $35 million in a new funding round to expand its business in the nation and explore international markets for some of its products.

The four-year-old startup, which serves small and medium businesses and other salaried employees across India, raised its Series B from Horizons Ventures, Tencent and existing investor JS Capital. It has raised $49.2 million to date, with its $13.2 million Series A closing in January last year.

NiYO Solutions serves as a “neo-bank” that relies on traditional financial institutions (Yes Bank and DCB banks, in its case) and offers to customers additional features such as lending and insurance. Blue-collared employees in India (and many other markets) continue to struggle in availing crucial financial services from banks that typically reserve them for the privileged segment. With its payroll solution and other products, NiYO is trying to drive financial inclusion in the country, it said.

The startup also offers a global travel card with no mark-up fee. More than 50,000 users have already signed up for the travel card — and NiYO intends to scale that figure to 500,000 by April next year. In an interview with TechCrunch, Vinay Bagri, co-founder and CEO of NiYO, said the startup is exploring bringing the travel card to other markets — though he did not share any names.

He said the startup will also use the fresh capital to build new product offerings and in expansion of its distribution and marketing efforts. It also wants to grow its customer base from about 1 million currently to 5 million in the next three years. Bagri said NiYO is looking to acquire other startups that are a good fit for its vision.

Neo banks are increasingly becoming popular across the globe as traditional banks show little interest in addressing the needs of niche customer bases. Tide and N26 are showing remarkable growth in European markets, while Azlo in the U.S. and Tyro Payments and Volt Bank in Australia are also among the top players.

In developing regions such as India, too, this tried and tested idea is increasingly being replicated. Open, another Bangalore-based neo-bank, helps businesses automate their finances. It raised $30 million last month.

Powered by WPeMatico

Waresix, one of a handful of startups aiming to modernize logistics in Indonesia — the world’s fourth most populous country — has pulled in $14.5 million to grow its 18-month-old business.

This new investment, Waresix’s Series A, is led by EV Growth — the growth-stage fund co-run by East Ventures — with participation from SMDV — the investment arm of Indonesia corporation Sinar Mas — and Singapore’s Jungle Ventures . The startup previously raised $1.6 million last year from East Ventures, SMDV and Monk’s Hill Ventures. It closed a seed round in early 2018.

Waresix is aiming to digitize logistics, the business of moving goods from A to B, which it believes is worth a total of $240 billion in Indonesia.

A large part of that is down to the country’s geography. The archipelago officially has more than 17,000 islands, but there are five main ones. That necessitates a lot of challenges for logistics, which are said to account for 25-30% of GDP — a figure that is typically below 5% in Western markets — while Indonesia barely scraped the top 50 rankings in World Bank’s Logistics Performance Index.

But, as Southeast Asia’s largest economy and the key market for digital growth in the region, that makes this an attractive problem to solve… or, rather, attractive industry to modernize.

Like others in its space worldwide — which include Chinese unicorn Manbang and BlackBuck in India — Waresix is focused on optimizing logistics by making the process more transparent for clients and more efficient for haulage companies and truckers. That includes removing the chain of “middle man” brokers, who add costs and reduce transparency, and provide a one-stop solution for transportation by land or sea, as well as cold storage and general cargo handling.

As of today, Waresix claims a fleet of more than 20,000 trucks and over 200 warehouse partners across Indonesia. The company said it plans to use this new capital to expand that coverage further. In particular, that’ll include additional land transport options and additional warehouse capacity in tier-two cities and more remote areas. That’s a push that founders Andree Susanto (CEO) and Edwin Wibowo (CFO) — who met at UC Berkeley in the U.S. — believe fits with Indonesia’s own $400 billion commitment to improve national infrastructure and transport.

Waresix trucks

It is also consistent with East Ventures, the long-standing early-stage VC, which has backed a pack of young companies aiming to inject internet smarts into traditional industries in Indonesia. Some of that portfolio includes Warung Pintar, which develops smart street vendor kiosks, Kedai Sayur, which is digitizing street vendors, and Fore Coffee, which draws inspiration from China’s digital-first brand Luckin Coffee, which recently listed in the U.S.

Now with EV Growth, which reached a final close of $200 million thanks to LPs that include SoftBank, East Ventures has the firepower to write larger checks that go beyond seed and pre-Series A deals, as it has done with Waresix.

But the company is far from alone in going after the logistics opportunity in Indonesia. Its rivals include Kargo, which was started by a former Uber Asia exec and is backed by Uber co-founder Travis Kalanick’s 10100 fund among others, and Ritase.

Ritase, which claims to be profitable, closed an $8.5 million Series A this week. It said it has 7,500 trucks and, on the client side, some 500 SMEs and a smattering of well-known global brands. Kargo has kept its metrics quiet, but it is a later arrival on the scene. The startup only came out of stealth in March of this year when it announced a $7.6 million funding round.

Powered by WPeMatico

Upfront Ventures, a Los Angeles-based venture capital firm, has filed paperwork with the U.S. Securities and Exchange Commission to raise its third growth-stage investment fund.

Though the firm typically invests at the seed and Series A, capital from Upfront Growth III will be used for follow-on or late-stage deals.

The firm, known for its investments in Bird, Goat, Ring, ThredUP and Parachute, plans to raise $250 million for the effort. Mark Suster and Yves Sisteron, listed on the filing, lead the firm as managing partners. Upfront’s investor line-up also includes partners Kobie Fuller, Greg Bettinelli, Kara Nortman and Kevin Zhang.

One of the oldest VCs rooted in LA, Upfront previously closed on $400 million for its sixth flagship early-stage fund in 2017.

LA is on pace for a banner year of VC investment, attracting $33 billion across more than 1,000 deals already in 2019, according to PitchBook. Last year, companies headquartered in LA raised more than $60 billion.

Powered by WPeMatico

The new era of tech-enabled banks is coming, even in regulation-heavy Japan. Kyash, a fintech company with visions on becoming Japan’s first challenger bank, said today it has raised $14 million to continue its expansion.

To be clear, Kyash isn’t a bank. Yet. But it is currently applying for a host of licenses in Japan that could allow it to offer banking-style features, including checking accounts, ATM withdrawals and money remittance. Right now, it is a payment app that offers a connected Visa card in the style of Monzo, N26, Revolut (which has a Japan license) and others of that ilk.

The startup was founded in 2015 by Shinichi Takatori, a former banker and management consultant who saw the potential to merge tech and finance.

“I really noticed that information and communication has become ubiquitous but money itself hasn’t changed for a long time,” Takatori told TechCrunch in an interview.

The company took some time — two years — before it released a consumer product, but it quickly tied up with Visa to offer a prepaid debit card that connects to the Kyash app. That provides benefits like instant payment notifications, clear balance and lower fees for overseas spending, while costs are borne by merchants rather than users. They might seem elementary today, but they are still not standard among Japan’s traditional banks, Takatori explained.

The company declined to share its user numbers, but Takatori said this new round of funding — Kyash’s Series B — is a validation of the progress it has made.

The $14 million investment is co-led by Goodwater Capital, a U.S. investor that has backed fintech startups like Monzo, Stash and Toss in Korea, and Mitsubishi UFJ Capital, the investment arm of Japan’s largest bank.

Mitsubishi’s involvement means that Kyash counts Japan’s three largest banks as investors, with SMBC and Mizuho having previously put money into the company. Others that took part in this Series B include Toppan Printing, JAFCO and Shinsei Corporate Investment Limited.

So many banks on the cap table might seem like a strange thing for a disruptor — let alone the banks, which tend to behave territorially — but Takatori believes that there’s the potential for cooperation, not to mention that it will help the startup with its licensing efforts. Already, he revealed, Mitsubishi plans to integrate its card with the Kyash app to provide its customers with the best of both worlds.

“We’re not here to win over existing banks, but instead inform [them of] how money should work in next decade,” explained Takatori. “So why not collaborate in some way.”

Kyash has a tie-up with Visa that allows it to offer its customers a connected debit card and also provide issuing services to other fintech startups

There’s also the fact that, even with a license, Kyash and others are unlikely to be able to offer full banking services. That means they will have to serve as complementary offerings to the industry, which would likely mean that cooperation is good — essential — for both sides.

But, beyond the consumer play, a notable piece of Kyash’s business that has investors excited is its B2B payment business.

The company developed its own payment processing system to reduce costs, which is one reason it took time to launch. Thanks to a tie-up with Visa, it offers both issuing and processing of prepaid Visa cards to fintech companies in Japan that want to go down the payment route.

That’s increasingly popular, given the government push to make the country a “cashless society” ahead of the 2020 Olympic Games next year. It also could appeal to crypto companies in Japan, which offers the world’s most robust licensing, that want to follow the example of the Coinbase card in Europe or startups like Crypto.com and TenX, which offer similar prepaid cards.

Takatori said Kyash is “in discussions” with crypto companies, but that it has not made a decision on how to proceed yet. The company is also eyeing potential overseas expansions, although that is some way down the line.

“We have open eyes for globalization, it’s just a matter of when,” he told TechCrunch. “We still have a far way to go [in Japan, but] maybe after the Olympics.”

More pressingly, he sees the company looking to raise a “pretty quick” Series C round to give it acceleration into next year. That’s likely to go to more expansion and user acquisition as the licenses the startup has applied for are unlikely to be granted this year.

Powered by WPeMatico

Even as much of the world is digitizing its governance, in small towns and villages of India, data about its citizens is still being largely logged on long and thick notebooks. Have they received the subsidized cooking gas cylinders? How frequent are the power cuts in the village? If these data points exist at all, they are probably stored in big paperbacks stacked in a corner of some agency’s office.

Five years ago, two young entrepreneurs — Prukalpa Sankar and Varun Banka — set out to modernize this system. They founded SocialCops, a startup that builds tools that make it easier for government officials — and anyone else — to quickly conduct surveys and maintain digital records that could be accessed from anywhere.

The Indian government was so impressed with SocialCops’ offering that it partnered with the startup on National Data Platform, a project to connect and bring more transparency within many of the state-run initiatives; and Ujjwala Yojana, a project to deliver subsidized cooking gas cylinders to poor women across the nation.

“This is a crucial step towards good governance through which we will be able to monitor everything centrally,” India’s Prime Minister Narendra Modi said of National Data Platform. “It will enable us to effectively monitor every village of the country.”

Two years ago, the duo wondered if the internal tools that they built for their own teams to manage their projects could help data teams around the world? The early results are in: Atlan, a startup they founded using learnings from SocialCops, has secured more than 200 customers from over 50 nations and has raised $2.5 million in pre-Series A funding led by Waterbridge Ventures, an early stage venture fund.

The startup, which employs about 80 people, has also received backing from Ratan Tata, Chairman Emeritus of conglomerate Tata Sons, Rajan Anandan, the former head of Google Southeast Asia, and 500 Startups. On Tuesday, Singapore-headquartered Atlan moved out of stealth mode.

The premise of Atlan’s products is simple. It’s built on the assumption that the way most people in enterprises deal with data is inefficient and broken, Sankar and Banka told TechCrunch in an interview. Typically, there is no central system to keep track of all these data points that often live in their own silos. This often results in people spending days to figure out what their compliance policy is, for instance.

“Atlan wants to democratize data inside organizations,” said Sankar.

Teams within a typical company currently use a number of different tools to gather and manage data. Atlan has built products — dubbed Discovery, Grid, and Workflows — to create a collaboration layer, bringing together diverse data (from internal and external sources), tools and people to one interface.

“We are reimagining every human interaction with data. For instance, code has a profile on GitHub—what would a “profile” of data look like? What if you could share data as easily as a Google Sheets link, without worrying about the size or format? Or what would a data versioning and approval workflow look like? What if data scientists could acquire external data within minutes, instead of the months it takes right now?” said Banka.

The startup has also built a product called Collect that allows an organization to quickly deploy apps to collect granular data. These apps can collect data even when there is no internet connection. All of these data points, too, then find their way to the interface.

Atlan intends to use the capital it has raised on product development and sign more customers. It has already won some big names including Unilever, Milkbasket, Barbeque Nation, WPP and GroupM, Mahindra Group and InMobi in India, Chuan Lim Construction in Singapore, ServeHaiti in Haiti, Swansea University in the UK, the Ministry of Environment in Costa Rica, and Varun Beverages in Zambia.

In a prepared statement, Manish Kheterpal, Managing Partner at WaterBridge Ventures, said, “companies are struggling to overcome the friction that arises when diverse individuals need to collaborate, leading to project failure. The IPOs of companies like Slack and Zoom are proof that we live in the era of consumerization of the enterprise. With its sharp focus on data democratization, Atlan is well-positioned to reimagine the future of how data teams work.”

As for SocialCops, Sankar said it will live on as a data science community and pursue its signature “social good” mission.

Powered by WPeMatico