funding

Auto Added by WPeMatico

Auto Added by WPeMatico

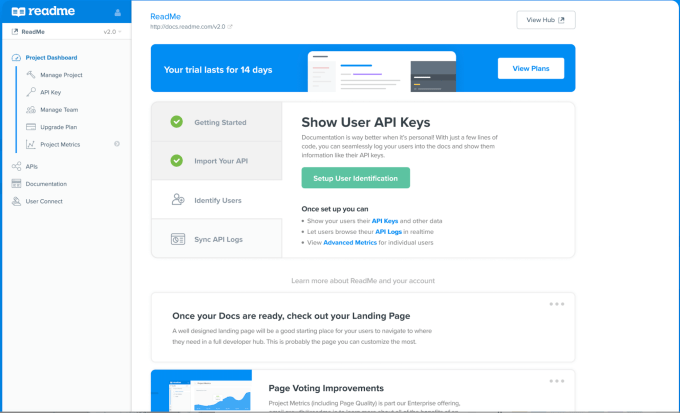

Software APIs help different tools communicate with one another, let developers access essential services without having to code it themselves and are critical components for driving a platform-driven strategy. Yet they require solid documentation to help make the best use of them. ReadMe, a startup that helps companies customize their API documentation, announced a $9 million Series A today led by Accel with help from Y Combinator. The company was part of the Y Combinator Winter 2015 cohort.

Prior to today’s funding announcement, the company had taken just a $1.2 million seed round in 2014. Today, it reports 3,000 paying customers and that it has been profitable for the last several years, an unusual position for a startup. In spite of this success, co-founder and CEO Gregory Koberger said as the company has taken on larger customers, they have more sophisticated requirements, and that prompted them to take this round of funding.

In addition, it has expanded the platform to use a company’s API logs to help create more dynamic documentation and improve customer support kinds of scenarios. But by taking on data from other companies, it needs to make sure the data is secure, and today’s funding will help in that regard.

“We’re going to still build the company traditionally by hiring more engineers, more support people, more designers, the obvious stuff, but the main impetus for doing this was that we started working with bigger companies with more secure data. So a lot of the money is going to help make sure that we handle that right,” Koberger explained.

Image: ReadMe

He says this ability to make use of the API logs has opened up all kinds of possibilities for the company, as the data provides a valuable window into how people use the APIs. “It’s amazing how much you get by just actually seeing what the server sees. When people are having problems with an API, they can debug it themselves because they can actually see the problems, the support team can see it as well,” Koberger said.

Accel’s Dan Levine, whose firm is leading the investment, believes that having good documentation is the difference between making and breaking an API. “APIs don’t just create technical integration, they create ecosystems around core services and underpin corporate partnerships that generate billions of dollars. ReadMe is as much a strategy as it is a service for businesses. Providing clean, interactive, data-driven API documentation to make developers love working with you can be the difference between 100 partnerships or 1,000 partnerships,” Levine said.

ReadMe was founded in 2014. It has 22 employees in their San Francisco office, a number that should increase with today’s funding.

Powered by WPeMatico

PlaceIQ is announcing a strategic investment from Experian.

CEO Duncan McCall said the investment is part of a growth round that PlaceIQ raised after divesting itself of its advertising business (which is being taken over by Zeta Global). He declined to disclose the size of the round, or of the Experian investment.

“It’s a multi-year, strategic partnership, where we will work together to license data [to Experian], and they also proactively become an investor in the company,” McCall said, adding that this “coincided nicely with us divesting of our media business and raising a modest growth round.”

While Experian is best-known for credit reporting, this partnership involves its marketing services business. Under the deal, the Experian Marketing Services will incorporate PlaceIQ’s LandMark location data product into its broader suite of data and measurement tools.

“With the mindset that consumers need to be at the heart of every marketing strategy, brands and agencies need to find ways to reach them and deliver more relevant messages,” said Experian’s president of marketing services Kevin Dean in a statement.” We believe quality data and advanced technology underpin that entire approach, and our collaboration and investment with PlaceIQ reinforce our commitment to helping brands meet that expectation.”

Asked about the direction of PlaceIQ’s business going forward, McCall explained that the company started with a focus on selling location data, and now, it’s gone back to “being a data-only company again.”

“Of course, we would have preferred to have focused on just one business model all these years, but life’s not that simple,” he said.

In his telling, PlaceIQ had to expand into the ad sales business because the infrastructure didn’t exist at the time to incorporate that data into the ad-buying process. Now that the infrastructure is there, PlaceIQ can focus once more on selling location data, which can then be used for targeting on a broad range of ad-buying platforms.

According to Crunchbase, PlaceIQ previously raised a total of $52 million in funding.

Powered by WPeMatico

Many Silicon Valley companies and fintech startups in India today share a common mission: They all want to bring their financial services to the next billion users. Dozens of fintech startups that we have spoken to in recent months have told us that they all want to address much of India, one of the last great growth markets globally, in the next few years.

So you can imagine our excitement when we learned there is at least one startup that is going after just a few million users in the immediate future. We’re talking about CRED, a nine-month-old, Bangalore-based startup that is building solutions to incentivize credit card users in India to become more responsible with money and thereby improve their credit score.

CRED has raised $120 million in a Series B financing round, Kunal Shah, founder and CEO of the startup, told TechCrunch on Monday. He declined to share more information. The startup, which has raised about $145 million to date, is now valued between $430 million to $450 million, a person familiar with the matter told TechCrunch.

According to a regulatory filing, existing investors Sequoia Capital, Ribbit Capital and DST Global’s Gemini Investments led the round, with participation from Tiger Global, Hillhouse Capital, General Catalyst, Greenoaks Capital and Dragoneer.

Hundreds of millions of Indians today don’t have a credit score because they have never taken a loan from a recognized entity nor owned a credit card. According to the government’s official figures, fewer than 50 million credit cards are in circulation in India currently, with industry reports suggesting that the actual number of unique credit card holders is about half of that.

“Nobody taught us about how to use money,” Shah told TechCrunch in a recent interview. “This has created a huge trust gap in India. If you look at developed markets, systematic trust is very high between all the entities. Members don’t have to rely on third-parties. In India, even if you wanted to rent a flat, you look for brokers, for instance.”

You can build that trust when you know how someone handles their money, and how they have handled it in recent history. “Our aim is to create a big membership community with high credit worthiness, therefore open up more opportunities for them,” Shah explained.

Shah is not going after the masses. He wants to focus on just the credit card users for now, and if he could win the trust of just half of those plastic card holders in India, he would consider it a success.

“Instead of chasing the mythological mass customers who are currently useful only on paper if you wanted to boast about your daily active user or monthly active user metric, our goal is to serve the existing users,” he said.

On CRED, users are offered a range of features, including the ability to better track their spending, get reminders and check their credit score, but more importantly, access to a range of lofty offers such as membership to a gym at a discounted price, access to good restaurants at low prices and subscription to various services at little to no charge. Users can access these features by earning points, which they can secure every time they pay their credit card bills on time.

Varun Krishnan, editor of technology news site FoneArena, told TechCrunch that he has found CRED useful in getting reminders to pay his bills and likes that he can pay them through a range of payment options, including UPI apps and debit cards. “I have several cards and it is hard to track amounts and due dates of payment for each one. They send all these alerts on WhatsApp, which is a blessing,” he said.

These are the reasons that attracted many people like Krishnan to join CRED. That, and some incentive to pay his bills — though he hopes that CRED expands the range of offers it currently provides to customers.

That wish may soon come true. In the coming months, CRED will enable these highly sought-after customers to access some financial services from banks in a single-click. Additionally, it is also exploring expansion to some international markets, the aforementioned source said.

CRED does not charge users any money for joining its platform, nor for availing any of the features it offers. But it is generating revenue from some of the partners that are supplying offers on the app.

It’s not a surprise that Shah, an industry veteran known for speaking the uncomfortable truths at conferences, has won the trust of so many investors already. He built one of the biggest payment apps in India, Freecharge, and sold it to e-commerce giant Snapdeal for a whopping $400 million in one of the increasingly rare exits that India’s fintech market has seen to date.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Bedding startup Boll & Branch raises $100M

The company sells sustainably sourced sheets, pillows, mattresses and towels. Until now, it had only raised $12 million in outside capital.

This new funding comes from L Catterton. CEO Scott Tannen compared Boll & Branch to the firm’s previous investments The Honest Company and Peloton — companies that “have become the winner in the startup competition” and are ready to “really become household names.”

2. Nvidia and VMware team up to make GPU virtualization easier

Nvidia today announced that it has been working with VMware to bring its virtual GPU technology to VMware’s vSphere and VMware Cloud on AWS.

Founded by three Tsinghua University graduates in 2011, Megvii is among China’s leading AI startups, with its peers (and rivals) including SenseTime and Yitu. Its clients include Alibaba, Ant Financial, Lenovo, China Mobile and Chinese government entities.

4. Watch the first look at ‘Star Wars: The Rise of Skywalker’ from Disney’s big fan event

This video goes really heavy on the nostalgia.

5. Experimental US Air Force space plane breaks previous record for orbital spaceflight

The Boeing-built X-37B space plane commissioned and operated by the U.S. Air Force has now broken its own record for time spent in space. Its latest mission has lasted 719 days as of today.

6. Is Knotel poised to turn WeWork from a Unicorn into an Icarus?

Knotel has reversed the WeWork “co-working” model. Instead of “WeWork” branding everywhere, Knotel simply leases buildings, takes a small office for its staff and then kits out the space in a way where a company can just move straight in and call it their own. (Extra Crunch membership required.)

7. This week’s TechCrunch podcasts

John Vrionis of Unusual Ventures joins Equity to talk about why he thinks “stage-agnostic” investing doesn’t make any sense. And on Original Content, we review the Netflix movie “The Red Sea Diving Resort.”

Powered by WPeMatico

Boll & Branch, which sells sustainably sourced sheets, pillows, mattresses and towels, is announcing that it has raised $100 million in a strategic investment from L Catterton’s Flagship Buyout Fund.

This looks like a big change from the company’s previous approach to funding. It was self-funded for its first two years (resulting in what CEO Scott Tannen described as “a lot of maxed out credit cards and five mortgages on my house”), and even when it started looking at venture capital, it only raised a total of $12 million from a single institutional backer, Silas Capital.

In fact, when Recode wrote about Boll & Branch’s Series B last year, it described the startup as one “that wants to raise as little venture capital as possible.”

Tannen said that when he founded the company with his wife Missy, they wanted to “build a sustainable business from the ground up,” and that wasn’t just about the products — they didn’t want to build a company that was “ultimately designed from day one to be sold.”

As a result, he said, Boll & Branch has been profitable for the past four years and is now bringing in “nine-figure revenue.” He compared it to other L Catterton investments like The Honest Company and Peloton, companies that “have become the winner in the startup competition” and are ready to “really become household names.”

In a statement, L Catterton’s Nik Thukral described Boll & Branch as “one of the most beloved bedding brands” and said it “capitalizes on several compelling trends including the emergence of authentic, pure, and chemical free products that can be traced back to their origin, as well as consumers’ heightened focus on healthy living.”

The company’s next steps include expanding internationally — Tannen said that while the company doesn’t currently sell outside the United States, “It’s hard to imagine a country or market in the world that doesn’t make sense for Boll & Branch.”

It will also continue expanding the product lineup. Tannen hinted at “really interesting product introductions” coming in the next few months. They might not be the most obvious additions to the lineup, but he said these decisions come from asking, “What does the home goods brand of the future look like?”

He added, “That’s what we’re trying to be, versus trying to look in the shopping mall and just creating a new version of something [that already exists].”

Powered by WPeMatico

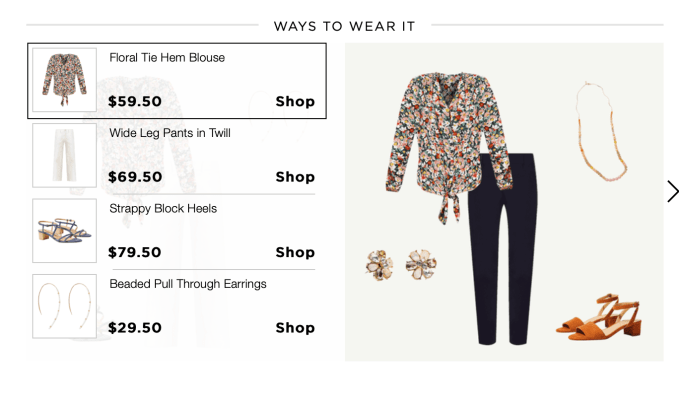

Stylitics, a startup powering outfit-based shopping recommendations for online retailers, is announcing that it has raised $15 million in Series B funding.

The company was initially known for ClosetSpace, a mobile app that provided consumers with outfit recommendations and inspiration.

While the app is still live, Stylitics’ focus has shifted to its retailer tools — for example, when you look at this blouse on the LOFT website or this shirt on the Banana Republic site, Stylitics is powering the “Ways to Wear It” and “Wear It With” widgets recommending other products that you could purchase to complete the outfit.

The company said it’s drawing on brand merchandising guidelines, engagement and purchase data from the retailer, broader trend data and stylists’ expertise to create these recommendations, which are updated as products sell out.

In an email, founder and CEO Rohan Deuskar (pictured above) added that Stylitics is able to provide useful recommendations from the start, without requiring time to train with a retailer’s data.

“We have billions of data points from powering outfitting on dozens of sites for more than four years, so we have a very good idea on Day One what an excellent and high performing outfit should look like for each product for a new customer,” Deuskar said.

Stylitics says it has driven $300 million for its retail partners — a group grown in the past year to include Ann Taylor, Calvin Klein, Chico’s, Gap, Kohl’s, Macy’s, Under Armour and White House Black Market.

The startup has now raised a total of $21 million. The new round was led by PeakSpan Capital, with participation from Trestle LP. PeakSpan co-founder Phil Dur is joining the Stylitics board.

“With the rapid growth of digital commerce, retailers are scrambling to keep pace with the consumer demand for more visually exciting and compelling shopping experiences,” Dur said in a statement.

The startup said it will use the money to grow its sales and marketing team while developing new types of shoppable content and in-store experiences.

Powered by WPeMatico

FreshToHome, a Bangalore-based e-commerce startup that sells fresh vegetable, fish, chicken and other kinds of meat, has raised $20 million in a new financing round as it looks to expand its footprint in the nation.

The Series B round for the startup was led by Iron Pillar, with Joe Hirao, the founder of Japan’s ZIGExn, also participating. The startup, which closed its $11 million Series A financing round three months ago, has raised $33 million to date.

FreshToHome sells “100 percent” pure and fresh vegetables and meat in Bangalore, Mumbai and Pune — the latter two of which it recently entered. It says it does not add any preservatives or other chemicals to prolong the life of the produce. (Typical meat sold by a retail store is riddled with chemicals and could be months old.)

Unlike most other marketplaces, FreshToHome has built its own supply chain network, which gives it better control over quality and delivery of the food items. It uses trains and planes to move inventory, and has become one of the biggest clients of several local airlines.

The startup sources vegetables and fish directly from 1,500 fishermen and farmers across the nation. It uses an app to negotiate with farmers and fishermen.

It continues to expand its control over all aspects of its business. “Today a large part of our poultry comes from institutional farmers. Now we are going a step ahead and processing the chicken at the slaughtering level ourselves,” Shan Kadavil, CEO of FreshToHome, told TechCrunch in an interview.

FreshToHome is able to deliver the perishables on the same day and as soon as up to two hours, Kadavil said.

The startup also began operations in UAE recently and has opened physical stores in Bangalore and Chennai.

FreshToHome has amassed 650,000 customers — up from 400,000 in late May — in 10 cities in India, and recently started to sell milk in Bangalore, another market segment that remains largely unstructured in the nation. Every day it receives 14,000 orders, and processes 20 tons of fresh food.

It recently crossed $30 million in annualized direct to consumer sales, which makes it the largest e-commerce platform serving this category. It is seeing 30% month-to-month growth, said Kadavil, who has previously managed tech support for Support, and India operations for gaming firm Zynga.

And that growth has helped the startup attract some attention. Several major players in the nation, including Amazon India that recently expanded to include perishable category and Flipkart, have held talks with FreshToHome to acquire some stake in the startup, a person familiar with the matter told TechCrunch.

And there is a big opportunity in the space. The cold-chain market of India is estimated to grow to $37 billion in next five years.

In addition to directly procuring its supplies from farmers and fishermen, FreshToHome also serves as a micro-VC, giving them access to some money upfront and resources to produce more from their farms. It also gives them an assurance that it will buy back their produce.

Kadavil founded FreshToHome with Mathew Joseph, a veteran in the industry who has dealt with fish export for more than 30 years. Joseph started India’s first e-commerce venture in fish and meat, called SeaToHome, in 2012.

FreshToHome will use the fresh capital to expand its network of contract farmers, and add 200 to 300 tons of additional produce each month.

In a prepared statement, Anand Prasanna, managing partner of Iron Pillar, for which it is the first investment in food-tech space, said, “FreshToHome’s brand proposition has been to provide 100% fresh food with 0% chemicals — not an easy thing to achieve in India at a large scale. By smartly using big data and machine learning, they have created a sustainable supply chain, which offers a fair price to consumers, fishermen and farmers, for their premium produce… We love companies that solve such hard issues in large market segments in India through unique tech enabled moats!”

Powered by WPeMatico

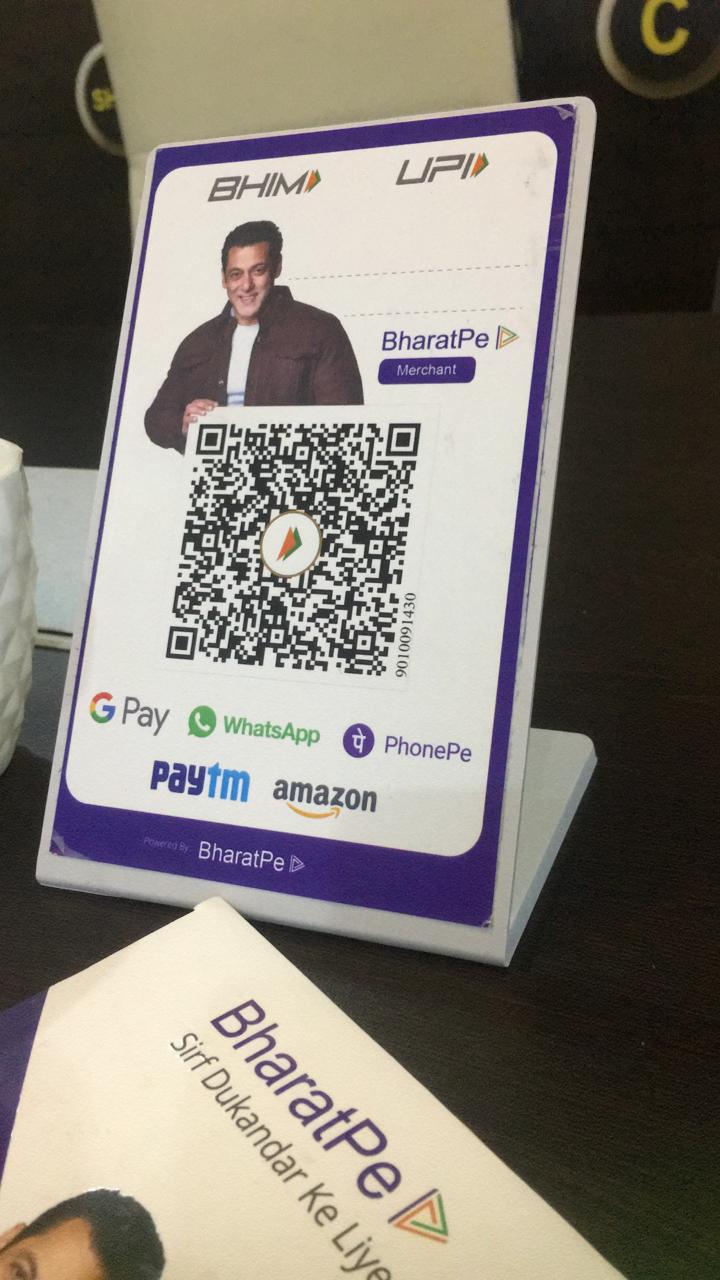

BharatPe, a New Delhi-based firm that is enabling hundreds of thousands of merchants to start accepting digital payments for the first time, and is also giving them access to working capital, has raised $50 million as it looks to scale its business in the nation.

The Series B round for the one-year-old startup was led by San Francisco-headquartered VC firm Ribbit Capital and London-based Steadview Capital, both of which have previously invested in a number of financial services in India.

Existing investors Sequoia Capital, Beenext Capital and Insight Partners also participated in the round, pushing BharatPe’s all-time raise to $65 million. The new round valued the startup at $225 million, Ashneer Grover, co-founder and CEO of BharatPe, told TechCrunch in an interview.

Google and Amazon, both of which offer payment services in India, were also in advanced stages of talks to fund BharatPe’s Series B financing round, but the startup’s founding team was not keen on diluting their stakes, especially in the wake of BharatPe’s recent growth, a person familiar with the matter told TechCrunch.

BharatPe operates an eponymous service to help offline merchants accept digital payments. Even as India has already emerged as the second largest internet market, with more than 500 million users, much of the country remains offline. Among those outside of the reach of the internet are merchants running small businesses, such as roadside tea stalls.

To make these merchants comfortable in accepting digital payments, BharatPe relies on QR codes built as part of government-backed UPI payments infrastructure. “We get them to put up a QR code in their shops, and any customer that uses a UPI-powered payments app — which is now supported by nearly every payments app in India — can pay these shop owners digitally,” said Grover.

Through BharatPe, these merchants also get access to a simplified dashboard on their phones to track the customers who owe them money and get periodic reminders.

BharatPe has amassed more than 1.5 million merchants on its platform. It processes more than 21 million transactions a month, worth more than $83 million, Grover said.

BharatPe also allows merchants to secure short-term loans. New merchants can secure about $500 for a period of three months from BharatPe. As merchants spend more time on BharatPe, the firm increases the amount to about $2,000.

The lending business is crucial to BharatPe. Payment apps make little to no money through making transactions on their platforms. Those processing UPI payments can not even charge a small commission to merchants. “There is no money to be made in doing payments in India,” Grover said. So you charge small interest on loans.

Access to working capital is a major challenge in developed markets such as India. According to a World Bank report, more than 2 billion people globally do not have access to working capital.

Grover said BharatPe aims to use the fund to add about 3.5 million merchants in the next 12 months. The firm has more than 2,000 sales people who are adding 400,000 new merchants to BharatPe each month, he said.

The rest of the money will go into financing the loans on the platform and building new solutions. Later today, BharatPe will launch a new service to connect suppliers and merchants through BharatPe so that their accounts are in sync.

Powered by WPeMatico

The day of reckoning for the “flexible office space as a startup” is coming, and it’s coming up fast. WeWork’s IPO filing has fired the starting gun on the race to become the game-changer both in the future of property and real estate but also the future of how we live and work. As Churchill once said, “we shape our buildings and afterwards our buildings shape us.”

Until recently, WeWork was the ruler by which other flexible-space startups were measured, but questions are now being asked if it deserves its valuation. The profitable IWG plc, formerly Regus, has been a business providing serviced offices, virtual offices, meeting rooms and the rest, for years, and yet WeWork is valued by 10 times more.

That’s not to mention how it exposes landlords to $40 billion in rent commitments, something which a few of them are starting to feel rather nervous about.

Some analysts even say WeWork’s IPO is a “masterpiece of obfuscation.”

Powered by WPeMatico

As the technologies that were once considered science fiction become the purview of science, the venture capital firms that were once investing at the industry’s fringes are now finding themselves at the heart of the technology industry.

Investing in the commercialization of technologies like genetic engineering, quantum computing, digital avatars, augmented reality, new human-computer interfaces, machine learning, autonomous vehicles, robots, and space travel that were once considered “frontier” investments are now front-and-center priorities for many venture capital firms and the limited partners that back them.

Earlier this month, Lux Capital raised $1.1 billion across two funds that invest in just these kinds of companies. “[Limited partners] are now more interested in frontier tech than ever before,” said Bilal Zuberi, a partner with the firm.

Lux Capital just closed on a whopping $1 billion in capital, doubling the amount of money it manages

He sees a few factors encouraging limited partners (the investors who provide financing for venture capital funds) to invest in the firms that are financing companies developing technologies that were once considered outside of the mainstream.

Powered by WPeMatico