funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Social networking platform for neighbors Nextdoor today announced it has secured additional funding to close out its $170 million growth round. The new financing includes the $123 million Nextdoor raised in May from new investor Riverwood Capital along with existing investors Benchmark, Tiger Global Management and Kleiner Perkins. The additional funding announced today comes from tech investment firm, Bond.

As a result of the new investment, Mary Meeker from will join Nextdoor’s board.

As of the May 2019 round, Nextdoor was valued at $2.1 billion for its neighborhood-level networking platform, which today generates revenue from sponsored posts and its real estate vertical for local agents. The company had said it was on track to double its revenue in 2019.

We understand the valuation remains at $2.1 billion, even with the additional funding.

Since its 2010 founding, the Nextdoor platform has grown to more than 247,000 neighborhoods across 10 countries. Its international growth potential appears to be of interest to Meeker, as does the verification process Nextdoor uses to ensure its users actually live in the neighborhoods they join.

This is not how Facebook’s Groups product works, where verification is left up to individual Group admins. That results in neighborhood groups filled with people who are just looking to research the area, those who used to live there but have since moved, businesses looking to advertise to locals, people who live nearby but don’t have a neighborhood group of their own and various other non-neighbors.

“Nextdoor has proven itself as the leader in local connectivity. Nextdoor is built on trust — verifying each members’ name, address and neighborhood — which creates the transparency and accountability that is core to building communities,” Meeker said. “Nextdoor is connecting people to the information and services that matter most, and I am excited to work with this impressive team to help expand Nextdoor’s local utility as well as it’s growing global footprint,” she added.

In recent months, Nextdoor has also grown its team, with new hires Antonio Silveira as its head of engineering; Tatyana Mamut, head of product; Bryan Power, head of people; and Craig Lisowski, head of data, information systems and trust.

“We could not be more thrilled to welcome Bond to our family of investors. Mary Meeker has been a strong supporter of Nextdoor for many years and is deeply knowledgeable about consumer technology,” stated Sarah Friar, CEO of Nextdoor, in a statement. “At Nextdoor, we believe that change starts with each of us opening our front doors and building deeper connections with the people nearest to us: our neighbors. We’re thrilled and honored to partner with all of our forward-looking investors to catalyze neighbors’ ability to connect with relevant local conversations, organizations, and businesses, engage in real-world interactions, and unlock the global power of local.”

Powered by WPeMatico

The three founders of York IE have a vision about how to change the way early stage startups get funding. They have experience shattering norms, having built a successful startup, Dyn, in Manchester, New Hampshire, which is not exactly a hot-bed of startup activity.

The founders want to take that same spirit and apply it to investing, while maintaining its headquarters in New Hampshire (and Boston). In fact, the three founders — Kyle York, Joe Raczka and Adam Coughlin — were early Dyn employees and helped built it to $30 million in ARR before taking a dime in venture funding. They went onto raise $100 million before being acquired by Oracle in 2016. They believe they can apply the lessons that they learned to other early stage startups.

“We think, especially in B2B and SaaS, there is a way to build a scalable, effective and efficient business without chasing massive fund raises, diluting your company, bringing on traditional venture investors and chasing those kind of on-paper vanity metrics,” company CEO and co-founder Kyle York told TechCrunch.

For the past five years, while working at Oracle after the acquisition, the founders have been testing their theories while advising startups and acting as angel investors. They believed it was time to take all of those learnings and apply it to their own firm.

“I started thinking about how to transition out of Oracle, and what I wanted to do from a career perspective and we wanted to build a modern investment firm less focused on how to deploy as much capital as possible for the limited partners, and more on working with the entrepreneurs to help coach them on a path to success,” York said.

The company still wants to act as investors, and to make money along the way, but they want to help build more solid, grounded companies. York says that they want the founders truly understand that they are selling a part of their company in exchange for those dollars, and that it makes sense to have a strong foundation before taking on money.

York wants to change this culture of fund raising for fund raising’s sake. He acknowledges that some companies with deep tech or deep infrastructure require that kind of substantial up-front investment to get off the ground, but SaaS companies are supposed to be able to take advantage of modern technology to build companies more easily, and he wants to see them build solid companies first and foremost.

“The goal shouldn’t be to raise more capital. The goal should be to build a healthy, successful, scalable company,” he said.

To put their money where their mouth is, the new firm will not take management fees. “We are investing like a normal investor and coming through with an equity position, but we are betting on the future. In essence, if the startup wins, then we win.”

Powered by WPeMatico

A growing number of IT breaches has led to security becoming a critical and central aspect of how computing systems are run and maintained. Today, a startup that focuses on one specific area — developing security tools aimed at developers and the work they do — has closed a major funding round that underscores the growth of that area.

Snyk — a London and Boston-based company that got its start identifying and developing security solutions for developers working on open-source code — is today announcing that it has raised $70 million, funding that it will be using to continue expanding its capabilities and overall business. For example, the company has more recently expanded to building security solutions to help developers identify and fix vulnerabilities around containers, an increasingly standard unit of software used to package up and run code across different computing environments.

Open source — Snyk works as an integration into existing developer workflows, compatible with the likes of GitHub, Bitbucket and GitLab, as well as CI/CD pipelines — was an easy target to hit. It’s used in 95% of all enterprises, with up to 77% of open-source components liable to have vulnerabilities, by Snyk’s estimates. Containers are a different issue.

“The security concerns around containers are almost more about ownership than technology,” Guy Podjarny, the president who co-founded the company with Assaf Hefetz and Danny Grander, explained in an interview. “They are in a twilight zone between infrastructure and code. They look like virtual machines and suffer many of same concerns such as being unpatched or having permissions that are too permissive.”

While containers are present in fewer than 30% of computing environments today, their growth is on the rise, according to Gartner, which forecasts that by 2022, more than 75% of global organizations will run containerized applications. Snyk estimates that a full 44% of Docker image scans (Docker being one of the major container vendors) have known vulnerabilities.

This latest round is being led by Accel with participation from existing investors GV and Boldstart Ventures. These three, along with a fourth investor (Heavybit) also put $22 million into the company as recently as September 2018. That round was made at a valuation of $100 million, and from what we understand from a source close to the startup, it’s now in the “range” of $500 million.

“Accel has a long history in the security market and we believe Snyk is bringing a truly unique, developer-first approach to security in the enterprise,” said Matt Weigand of Accel said in a statement. “The strength of Snyk’s customer base, rapidly growing free user community, leadership team and innovative product development prove the company is ready for this next exciting phase of growth and execution.”

Indeed, the company has hit some big milestones in the last year that could explain that hike. It now has some 300,000 developers using it around the globe, with its customer base growing some 200% this year and including the likes of Google, Microsoft, Salesforce and ASOS (side note: you know that if developers at developer-centric places themselves working at the vanguard of computing, like Google and Microsoft, are using your product, that is a good sign). Notably, that has largely come by word of mouth — inbound interest.

The company in July of this year took on a new CEO, Peter McKay, who replaced Podjarny. McKay was the company’s first investor and has a track record in helping to grow large enterprise security businesses, a sign of the trajectory that Snyk is hoping to follow.

“Today, every business, from manufacturing to retail and finance, is becoming a software business,” said McKay. “There is an immediate and fast growing need for software security solutions that scale at the same pace as software development. This investment helps us continue to bring Snyk’s product-led and developer-focused solutions to more companies across the globe, helping them stay secure as they embrace digital innovation – without slowing down.”

Powered by WPeMatico

Glance, a subsidiary of Indian mobile ad business firm InMobi, said today it has raised $45 million as it prepares to scale its business outside of India and bulk up its product offerings.

The unnamed maiden financing round for Glance was funded by Mithril Capital, a growth-stage investment firm co-founded by Silicon Valley investors Peter Thiel and Ajay Royan.

In an interview with TechCrunch, Naveen Tewari, founder and CEO of InMobi Group, said the current round has not closed and could bag another $30 million to $55 million in the next two months.

Glance operates an eponymous service that shows media content in local languages on the lock screen of Android-powered smartphones. InMobi has partnered with a number of top smartphone vendors, including Xiaomi, Samsung and Gionee, to integrate Glance into their respective operating systems.

Glance, which was launched in September last year and supports English, Hindi, Tamil and Telugu, has amassed 50 million monthly active users in India, its primary market. Users are spending an average of 22 minutes with Glance each day, he said.

“All the new smartphone models launched by Samsung, Xiaomi and a handful of other vendors have launched with Glance on them,” Tewari said.

In a statement, Mithril Capital’s Royan said, “We share Glance’s global vision of breaking through the constraints of application architectures and linguistic markets to deliver rich, frictionless, and engaging experiences across a myriad of cultures and languages.” As part of the financing round, he is joining Glance’s board.

Glance does not show traditional ads, something it intends to never change, but shows a certain kind of content to drive engagement for brands.

In the months to come, Glance plans to expand the platform and bring short-form videos (Glance TV), and mini games (Glance Games) to the lock screen. It is also working on a feature dubbed Glance Nearby that will enable brands to court users in their vicinity, and Glance Shopping to explore ways to build commerce around content.

As of today, InMobi Group is not monetizing Glance platform, but plans to explore ways to make money from it early next year, Tewari said.

The 12-year-old firm said it plans to expand footprints of Glance outside of India. The company plans to take Glance to some Southeast Asian markets like Malaysia, Indonesia and Thailand. InMobi’s Tewari said Glance has already started to find users in these markets.

InMobi Group, which had raised $320 million prior to today’s financing round, has been profitable for several years, but the company decided to raise outside funding to accelerate Glance’s growth, Tewari said.

The firm, which has three subsidiaries, including its marquee marketing cloud division, plans to go public in the next few years. But instead of taking the entire group public, Tewari said the firm is thinking of publicly listing each division as they mature. The marketing cloud division, which brings in the vast majority of revenue for the firm, will go public first, he said.

“The IPO plans remain, and we will evaluate them as we go along. The reality, however, is that the market is so big and there is so much room that we can continue to be private for a few more years,” he said.

Powered by WPeMatico

Fully autonomous cars may (or may not) be just around the corner, but in the meantime, a startup that’s building in-car apps to help human drivers pass the time when behind the wheel has raised a round of funding.

Drivetime — which makes voice-based trivia quizzes, games and interactive stories that people can play while driving — has raised $11 million in funding led by Makers Fund (a prolific investor in gaming startups), with participation from Amazon (via the Alexa Fund) and Google (via its Assistant investment program).

The startup today has eight “channels” on its platform consisting of games and stories that you can access either within a limited free-to-play tier or via a paid subscription ($9.99 a month or $99.99 a year). The plan is to use the funding to continue expanding that catalog, as well as investing in deeper integrations with its new big-name strategic investors, who themselves have longstanding and deep interests in bringing more voice services and content to the in-car experience.

Co-founder and CEO Niko Vuori told TechCrunch that his ultimate ambition is for Drivetime to become “the Sirius XM of interactive content” for cars, with hundreds of different channels of content.

In keeping with those plans, along with the funding, Drivetime is today announcing a key content deal.

It has teamed up with the long-running, popular game show Jeopardy to build a trivia channel for the platform, which lets drivers test their own skills and also play against other drivers and people they know. The Jeopardy channel will source content from the TV show’s trove of IP and come with another familiar detail: it will be narrated by Alex Trebek, with a new quiz getting published every weekday for premium users.

That social element of the Jeopardy game is not a coincidence. The San Francisco-based startup is founded by Zynga alums, with Vuori and his co-founders Justin Cooper and Cory Johnson also working together at another startup called Rocket Games since leaving the social games giant and exiting that to gaming giant Penn National for up to $170 million. That track record goes some way to explaining the strong list of investors in the new startup.

“Social and interactive formats are the next frontier in audio entertainment,” said Makers Fund founding partner Jay Chi, in a statement. “Niko, Justin Cooper and Cory Johnson, with a decade-long history of working together and a proven track record in building new platforms, is the best team to bring this idea to life.”

“Gaming and entertainment are among customers’ favorite use cases for Alexa, and we think those categories will only grow in popularity as Alexa is integrated into more vehicles,” said Paul Bernard, director of the Alexa Fund at Amazon, in a separate statement. “Drivetime stands out for its focus on voice-first games in the car, and we’re excited to work with them to broaden the Alexa Auto experience and help customers make the most of their time behind the wheel.”

In addition to the three investors in this latest round, prior to this Drivetime had raised about $4 million from backers that include Felicis Ventures, Fuel Capital, Webb Investment Network (Maynard Webb’s fund) and Access Ventures.

Vuori declined to say how many installs or active users the app has today — although from the looks of it on AppAnnie, it’s seeing decent if not blockbuster success on iOS and Android so far.

Instead, the company prefers to focus on another stat, its addressable market, which it says is 110 million drivers in North America alone.

Meanwhile, adding a Jeopardy channel is building on what has worked best so far. The most popular category at the moment is trivia, with Tunetime (a “name that tune” game) coming in second and storytelling a third.

Drivetime’s premise is an interesting one. Drivers are a captive audience, but one that has up to now had a relatively limited amount of entertainment created for it, focusing mainly on music and spoken word.

However, the rise of voice-based interfaces and interactivity using natural language — spurred by the rise of personal assistant apps and in-home hubs like Amazon’s Echo — have opened a new opportunity, developing interactive, voice-based content for drivers to engage with more proactively.

You might think that this sounds like a recipe for a car accident. Won’t a driver get too distracted trying to remember the fourth president of the United States, or who was known as the father of the Constitution? (Hint: It’s the same guy.)

Vuori claims it’s actually the reverse: Having an interactive game that requires the driver to speak out loud can focus him or her and keep the driver more alert.

“We are double-dipping in safety,” he said. “On the one hand, we embody the safety aspects of Alertness Maintaining Tasks (AMTs). But we also act as a preventative, meaning that while players engage with Drivetime, they are not engaging with anything else.”

While the content today may serve as a way of keeping drivers from doing things they shouldn’t be doing while in a car, there is another obvious opportunity that might come as drivers become less necessary and will need other things to occupy themselves.

Longer term, the Jeopardy deal could usher in other channels based on popular game shows. Sony Pictures Television Games, which owns the rights to it, also owns Wheel of Fortune and Who Wants to Be a Millionaire.

“We are thrilled to work with Sony Pictures Television Games to bring Jeopardy, the greatest game show on the planet, to an underserved audience that desperately needs interactive entertainment the most – the 110 million commuters in North America driving to and from work by themselves every day,” said Vuori said in a statement.

Interestingly, despite the growth of “skills” for Alexa or apps for Google Home and other home hubs, and the overall popularity of these as a way of interacting with apps and sourcing information, Vuori says that he hasn’t seen any competition emerge yet from other app developers to build voice-based entertainment for drivers in the way that Drivetime has.

That gives the company ample opportunity to continue picking up new users — and more deals with publishers and content companies looking for more mileage (sorry) for their legacy IP and new business.

“Drivetime is one of the early pioneers in creating safe, stimulating entertainment for drivers in the car,” Ilya Gelfenbeyn, founding lead of the Google Assistant Investments Program, noted in a statement. “More and more people are using their voice to stay productive on the road, asking the Google Assistant on Android and iOS phones to help send text messages, make calls and access entertainment hands free. We share Drivetime’s vision, and look forward to working with their team to make the daily commute more enjoyable.”

Powered by WPeMatico

It turns out GDPR was just the tip of the privacy iceberg. With California’s privacy law coming on line January 1st and dozens more in various stages of development, it’s clear that governments are taking privacy seriously, which means companies have to as well. New York startup BigID, which has been developing a privacy platform for the last several years, finds itself in a good position to help. Today, the company announced a $50 million Series C.

The round was led by Bessemer Venture Partners with help from SAP.io Fund, Comcast Ventures, Boldstart Ventures, Scale Venture Partners and ClearSky. New investor Salesforce Ventures also participated. Today’s investment brings the total raised to more than $96 million, according to Crunchbase.

In addition to the funding, the company is also announcing the formation of a platform of sorts, which will offer a set of privacy services for customers. It includes data discovery, classification and correlation. “We’ve separated the product into some constituent parts. While it’s still sold as a broad-based solution, it’s much more of a platform now in the sense that there’s a core set of capabilities that we heard over and over that customers want,” CEO and co-founder Dimitri Sirota told TechCrunch.

He says that these capabilities really enable customers to see connections in the data across a set of disparate data sources. “There are a lot of products that do the request part, but there’s nobody that’s able to look across your entire data landscape, the hundreds of petabytes, and pick out the data in Salesforce, Workday, AWS, mainframe, and all these places you could have data on [an individual], and show how it’s all tied together,” Sirota explained.

It’s interesting to see the mix of strategic investors and traditional venture capitalists that are investing in the company. The strategics in particular see the privacy landscape as well as anyone, and Sirota says it’s a case of privacy mattering more than ever and his company providing the means to navigate the changing landscape. “Consumers care about privacy, which means legislators care about it, which ultimately means companies have to care about it,” he said. He added, “Strategics, whether they are companies that collect personal data or those that sell to those companies, therefore have an interest in BigID .”

The company has been growing fast and raising money quickly to help it scale to meet demand. Starting in January 2018, it raised $14 million. Just six months later, it raised another $30 million and you can tack on today’s $50 million. Sirota says having money in the bank and seeing these investments helps give enterprise customers confidence that the company is in this for the long haul.

Sirota wouldn’t give an exact valuation, only saying that while the company is not a unicorn, the valuation was a “robust number.” He says the plan now it to keep expanding the platform, and there will be announcements coming soon around partnerships, customers and new capabilities.

Sirota will be appearing at TechCrunch Sessions: Enterprise on September 5th at 11 am on the panel “Cracking the Code: From Startup to Scaleup in Enterprise Software.”

Powered by WPeMatico

An eight-month-old startup in India that wants to improve the user experience of credit card holders in the nation has received the backing of at least two major investors.

Pune-based FPL Technologies said Thursday it has raised $4.5 million from Matrix Partners India, Sequoia Capital India and others in its maiden financing round.

In an interview with TechCrunch earlier this week, Anurag Sinha, co-founder and CEO of FPL Technologies, said the startup aims to build a full-stack solution to reimagine how people in India get their first credit card and engage with it.

Even as hundreds of millions of people in India today are securing loans from organized financial lenders, most of them are unable to get a credit card. Fewer than 25 million people in the country today have a credit card, according to industry estimates. And even those who have a credit card are not exactly pleased with the experience.

Vibhav, Anurag, Rupesh, co-founders of FPL Technologies, pose for a picture

Much of the blame goes to banks and other credit card issuing firms that are largely relying on archaic technology to operate their plastic card business.

Sinha, an industry veteran, said through his startup he aims to address a wide range of pain points of credit card holders, such as in-person meeting or telephonic interaction with bank representatives for getting a credit card, having to talk to someone to get basic support and not being able to mask the card’s identity when shopping online.

The startup, which employs about 20 people, aims to build the mobile credit card service in the next couple of months, but in the meantime, it is offering an app called OneScore to help users check their credit score and learn how to improve it. Sinha said OneScore, unlike most of its rivals, doesn’t sell the data of customers to third-party agencies.

The app was launched two months ago and has already amassed more than 100,000 users, Sinha said. These users would get the first dibs on the startup’s mobile credit card, he said.

In a statement, Shailesh Lakhani, managing director of Sequoia Capital India, said, “When they presented a plan to modernize credit cards in India it immediately resonated with the Sequoia India team. It’s a delight to partner with them as they work on developing more flexible, affordable and easier to use financial products for Indian consumers.”

In recent months, a handful of startups in India have started to explore ways to expand the reach of credit cards in the nation and incentivize users to become more responsible with how they engage with it. Bangalore-based SlicePay offers a payment card with a pre-approved credit line for students, gig-workers, freelancers and startup employees. CRED, a startup by industry veteran Kunal Shah, recently raised $120 million to motivate users to improve their financial behavior.

Powered by WPeMatico

While investors are already writing big checks for meditation startups, Elevate Labs founder and CEO Jesse Pickard said that none of the existing meditation apps can replace the experience of working with a human coach.

“This experience where you have somebody that meets with you is wildly better than any digital product that’s out there,” Pickard said. “The problem is, it’s not affordable to 99% of the planet.”

So Elevate Labs is launching a new mobile app today called Balance, which is designed to replicate the experience of working with a live meditation coach.

“Even with meditation increasingly getting into the mainstream, it’s a fairly difficult practice to adhere to,” Pickard said. “We take away a lot of that indecision and present you with a path that is unique to you … People live all sorts of different lives: Some people care about stress, some people care about sleep, some people care about focus. But when you and I go into any of the other major apps, we’re getting the exact same recording.”

With Balance, on the other hand, you’re not just browsing through a library of prerecorded content. Instead, the app starts out by asking you about your goals, your meditation experience and more. You’ll then get a set of introductory meditations that may look familiar, but Pickard said that each meditation is actually “a combination of dozens and dozens of clips woven together that’s personalized to you.”

For example, I told the app that I already had experience with meditation, and that my top goal was to stay focused. As a result, my first meditation skipped most of the introductory explanations, and the main exercise was designed to help me focus on the sound of my breath.

Pickard said the app will continue to ask you questions about your experience over time, which in turn will lead to more personalization. The meditations are narrated by coach Leah Santa Cruz, who’s also involved in writing the content, and there are other meditation experts on the Balance team.

The app’s initial 10-day course is free. After that, to get access to additional meditations, you’ll need to pay $11.99 per month, $49.99 per year or $199.99 for a lifetime subscription. In addition to the meditations, Balance also includes a guided activity designed to help people sleep.

On top of launching a new app, Elevate Labs is also announcing that it has raised a $7.1 million Series B led by Keesing Media Group, with participation from Oakhouse Partners.

Under its old name MindSnacks, the company built language-learning games before shifting focus to Elevate, a “brain training” app that has supposedly been downloaded 25 million times and won Apple’s App of the Year Award in 2014. Pickard (who, thanks to the magic of Craigslist, was my roommate for about a year when I was first starting at TechCrunch) said that unlike most of the other apps that are marketed as improving your mind, Elevate focuses on trainable skills like reading, writing and math — rather than, say, improving your memory.

“We’ve been extremely careful about [not] venturing into untrainable skills — things like improving your attention span, those activities are not as provenly teachable,” he said.

It’s been a while since the company has raised outside funding — seven years since MindSnacks announced a Series A from Sequoia. Pickard said the company actually raised another bridge round in 2015, then “buckled down for a number of years and really just had to build a business that actually was sustainable.”

Apparently that’s paid off — he said Elevate Labs was cash-flow positive last year. With a total of $17.1 million in funding, the plan now is to continue supporting and growing Elevate while also launching Balance and building a whole line of related apps.

“We think there’s a really huge brand to be built around mental fitness,” Pickard said.

Powered by WPeMatico

By now, the venture world is wary of blood testing startups offering health data from just a few drops of blood. However, Baze, a Swiss-based personal nutrition startup providing blood tests you can do in the convenience of your own home, collects just a smidgen of your sanguine fluid through an MIT manufactured device, which, according to the company, is in accordance with FDA regulations.

The idea is to find out (via your blood sample) which vitamins you’re missing out on and are keeping you from living your best life. That seems to resonate with folks who don’t want to go into the doctor’s office and separately head to their nearest lab for testing.

Most health professionals would agree it’s important to know if you are getting the right amount of nutrition — Vitamin D deficiency is a worldwide epidemic affecting calcium absorption, hormone regulation, energy levels and muscle weakness. An estimated 74% of the U.S. population does not get the required daily levels of Vitamin D.

“There are definitely widespread deficiencies across the population,” Baze CEO and founder Philipp Schulte tells TechCrunch. “[With the blood test] we see that we can actually close those gaps for the first time ever in the supplement industry.”

While we don’t know exactly how many people have tried out Baze just yet, Schulte says the company has seen 40% month-over-month new subscriber growth.

That has garnered the attention of supplement company Nature’s Way, which has partnered with the company and just added $6 million to the coffers to help Baze ramp up marketing efforts in the U.S.

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze-contracted lab.

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze-contracted lab.

I will say it is certainly more convenient to just pop on a little device myself — although it might be tricky if you’re at all squeamish, as you’ll see a little bubble where the blood is being sucked from your arm. For anyone who hesitates, it might be easier to just head to a lab and have another human do this for you.

The price is also nice, compared to going to a Quest Diagnostics or LabCorp, which can vary depending on which vitamins you need to test for individually. With Baze it’s just $100 a pop, plus any additional supplements you might want to buy via monthly subscription after you get your results. The first month of supplements is free with your kit.

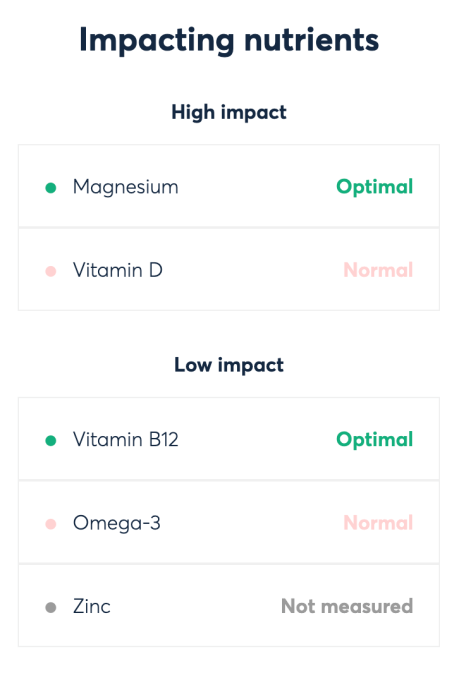

Baze’s website will show your results within about 12 days (though Schulte tells TechCrunch the company is working on getting your results faster). It does so with a score and then displays a range of various vitamins tested.

I was told that, overall, I was getting the nutrients I require with a score of 74 out of 100. But I’m already pretty good at taking high-quality vitamins. The only thing that really stuck out was my zinc levels, which I was told was way off the charts high after running the test through twice. Though I suspect, as I am not displaying any symptoms of zinc poisoning, this was likely the result of not wiping off my zinc-based sunscreen well enough before the test began.

For those interested in conducting their own at-home test and not afraid to prick themselves in the arm with something that looks like you might have it on hand in the kitchen, you can do so by heading over to Baze and signing up.

Powered by WPeMatico

If you think about the traditional hotel business, there hasn’t been a ton of innovation. You mostly still stand in a line to check in, and sometimes even to check out. You let the staff know about your desire for privacy with a sign on the door. Mews believes it’s time to rethink how hotels work in a more modern digital context, especially on the administrative side, and today it announced a $33 million Series B led by Battery Ventures.

When Mews founder Richard Valtr started his own hotel in Prague in 2012, he wanted to change how hotels have operated traditionally. “I really wanted to change the way that hotel systems are built to make sure that it’s more about the experience that the guest is actually having, rather than facilitating the kind of processes that hotels have built over the last hundred years,” Valtr told TechCrunch.

He said most of the innovation in this space has been in the B2C area, using Airbnb as a prime example. He wants to bring that kind of change to the way hotels operate. “That’s essentially what Mews is trying to do. [We want to shift the focus to] the fundamental things about why we love to travel and why people actually love to stay in hotels, experience hotels, and be cared for by professional staff. We are trying to do that in a way that that actually delivers a really meaningful experience and personalized experience to that one particular customer,” he explained.

For starters, Mews is a cloud-based system that automates a lot of the manual tasks, like room assignments that hotel staff at many hotels often still have to handle as part of their jobs. Valtr believes by freeing the staff from these kinds of tedious activities, it enables them to concentrate more on the guests.

It also offers ways for guests and hotels to customize their stays to get the best experience possible. Valtr says this approach brings a new level of flexibility that allows hotels to create new revenue opportunities, while letting guests choose the kind of stay they want.

From a guest perspective, they could by-pass the check-in process altogether, sharing all of their registration details ahead of time and getting a pass code sent to their phone to get into the room. The system integrates with third-party hotel booking sites like Booking.com and Expedia, as well as other services, through its open hospitality API, which offers lots of opportunities for properties to partner with local businesses.

The company is currently operating at 1,000 properties across 47 countries, but it lacks a presence in the U.S. and wants to use this round to open an office in NYC and expand into this market. “We really want to attack the U.S. market because that’s essentially where most of the decision makers for all of the major chains are. And we’re not going to change the industry if we don’t actually change the thinking of the biggest brands,” Valtr said.

Today, the company has 270 employees spread across 10 offices around the world. Headquarters are in Prague and London, but the company is in the process of opening that NYC office, and the number of employees will expand when that happens.

Powered by WPeMatico