funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Critical cyber attacks on both businesses and individuals have been grabbing headlines at an alarming rate. Cybersecurity has moved from a background risk for enterprises to a critical day-to-day threat to business operations, forcing executive teams to pour time and hundreds of billions in capital into monitoring and prevention efforts.

Yet even as investment in security ticks up, the frequency and cost of cybercrime to businesses continues to rapidly accelerate, with the World Economic Forum estimating the economic loss due to cybercrime could reach $3 trillion by 2020.

More companies are now turning to cyber insurance as a means of mitigating financial exposure. However, for traditional insurers, cybersecurity remains a relatively nascent and unfamiliar issue, requiring risk-assessment data points and methodologies largely different from those seen in traditional insurance products. As a result, businesses often struggle to get the scale of cybersecurity coverage they require.

Arceo.ai is hoping to expand the size and scope of the cyber insurance market for both insurers and companies, by providing insurers with effective real-time data, analytics and context, necessary for safely and efficiently underwrite cyber risk.

This morning, Arceo took a major step in achieving that goal, announcing the company has raised a $37 million round of funding led by Lightspeed Venture Partners and Founders Fund with participation from CRV and UL Ventures.

Using an expansive set of global sources across a customer’s digital footprint, Arceo.AI collects internal, external and macro cyber risk data which it uses to evaluate a company’s security and cyber risk management behavior. By automating the data collection process and connecting it with insurer underwriting processes, Arceo is able to keep its data and policy assessments up to date in real-time and enable faster, more efficient quotes.

Using an expansive set of global sources across a customer’s digital footprint, Arceo.AI collects internal, external and macro cyber risk data which it uses to evaluate a company’s security and cyber risk management behavior. By automating the data collection process and connecting it with insurer underwriting processes, Arceo is able to keep its data and policy assessments up to date in real-time and enable faster, more efficient quotes.

A vital component of Arceo’s platform is its analytics offering. Using patented data science and cyber risk models, Arceo generates analytics-driven insights for insurance carriers, brokers and end-insured customers. For end-insured customers, Arceo helps companies understand whether they’re using the best mitigation strategies by providing policy recommendations and industry benchmarking to help contextualize day-to-day cyber behavior and hygiene. For underwriters, Arceo can provide specific insurance recommendations based on particular policy coverages.

Ultimately, Arceo looks to provide both insurers and the insured with actionable answers to key questions such as how one assesses cyber risk, how one determines what risks can be mitigated with technology alone, how one knows which systems are best and whether those systems are being used appropriately.

In an interview with TechCrunch, Arceo Chairman Raj Shah explained that the company’s background expertise, proprietary data systems, and deep pedigree in both the security and insurance truly differentiate Arceo from competing solutions. For starters, both Shah and Arceo co-founder and CEO Vishaal Hariprasad have spent close to the entirety of their careers in national security and cybersecurity. Hariprasad started his career in the Airforce’s first cohort of cyber warfare officers, before teaming up with Shah to start Morta Security in 2012, a security startup the two sold to Palo Alto networks in just roughly two years.

After selling the company, Shah and Hariprasad remained in the security world before realizing that there was a natural intersection between security and insurance, and a real opportunity for risk transfer solutions.

“Having studied the market, we saw that people are spending more and more dollars on cybersecurity products… There are hundreds of thousands of new vendors every year… Spend is going up, but we don’t feel any safer!” Shah told TechCrunch.

“That’s when we said ‘Hey, we need to move beyond just thinking about technology points and products, and think about holistic cyber risk management.’ And this is where insurance has historically done a great job. Putting a price on behavior and making people think and letting them take risks… From life and death and health to buyers and property and casualty. And so cyber is that next class risk… So that’s really why we started the business. We wanted to provide a real way to manage the cyber stress that they’re facing and that will impact every single one of our digital lives.”

Since the company’s founding, Raj and Vishaal have been joined by a deep network of cyber and insurance experts. Today, Arceo also announced that Hemant Shah, founder and former CEO of catastrophe risk modeling company RMS has joined Arceo’s Board of Directors. Additionally, earlier this month, the company announced that Mario Vitale, the former CEO of publically-traded insurance companies Willis Towers Watson and Zurich Insurance Group, would be joining the Arceo team as the company’s President.

The company noted that participation from high-profile industry vets like Hemant and Mario not only further advance Arceo’s competitive advantage but also acts as another major validation of the company’s future and work to date.

According to Arceo Chairman Raj Shah, after years of investing in R&D, the latest funds will be used towards expansion efforts and scaling Arceo to the broader ecosystem of insurance and brokers. Longer-term, the company hopes to offer the most complete combined cybersecurity and risk transfer solution to insurers and the insured, easing the stress around cyber threats for both enterprises and individuals and ultimately improving broader cyber resiliency.

If you’d like to hear more from Arceo’s Raj Shah, Raj will also be joining us this year on the Extra Crunch stage at TechCrunch Disrupt SF, where he’ll discuss how founders and companies should think about potential US government investment. Grab tickets here and we hope to see you there!

Powered by WPeMatico

Few organizations have the complex data and analytics problems that challenge the defense and intelligence communities every single day. Whether it is managing petabytes of text, audio, or video data, finding extraordinarily small patterns in the noise, or processing multilingual analytics, the agencies at the heart of America’s national security system confront cutting-edge problems every day.

Despite the desire for better tools though, intelligence analysts are often stymied to procure up-to-date software due to the byzantine rules that drive Pentagon and intelligence procurement.

That’s why a former intelligence official and former intelligence investor are looking to build a new platform that connects the best minds in artificial intelligence, machine learning, and natural language processing and bundling it together into a service purchasable by these government agencies.

Through Palo Alto-based Vannevar, co-founders Brett Granberg and Nini Moorhead are hoping to launch their first product, which is focused on bringing NLP technologies like feature detection to international counterterrorism missions.

Co-founders Nimi Moorhead and Brett Granberg of Vannevar Labs. Photo via Vannevar Labs.

The company is named for Vannevar Bush, who is often credited with inventing an early form of the computer, putting together the Manhattan Project which led to the atom bomb, and for writing a seminal essay that sort of predicted the internet decades before its inception.

The two chose this particular product as an entrée because of their past experiences. Before beginning Vannevar, Granberg spent two years at In-Q-Tel, the non-profit VC firm that works deeply with the intelligence community to supply agencies with the best in startup technology. He also was an advisor at Lilt, a real-time deep learning translation product that spun out of Chris Manning’s famed Stanford NLP research lab.

Meanwhile, Moorhead spent seven years working as a counterterrorism officer within the intelligence community, working to disrupt terrorist networks.

The two met while they overlapped at Stanford GSB and realized they had seen similar problems that they both wanted to solve. While in business school, “top of mind for me was some of the technological challenges that I encountered as an end user [and] analyst in the intelligence community,” Moorhead said. “We immediately connected and shared a lot of experiences in common in terms of seeing gaps between the really hard domain problems that I’d been working on in my career as an analyst and some of the technology that was available to me,” she said. The two actually met the first day of school.

Their approach is to take proven techniques and attempt to translate them into government use cases. “We’re not sort of inventing new math to solve these problems, we’re more taking cutting-edge approaches and just applying them to specific use cases,” Granberg said.

While the project is early, the team raised a $4.5 million seed venture capital funding from fellow GSB alum Katherine Boyle of General Catalyst and Costanoa Ventures. Boyle has made a big push into defense and highly-regulated industries as part of her investment practice, where she previously funded Anduril, the company started by Oculus founder Palmer Luckey that has attempted to apply ML technology to security issues such as battlefield awareness and border control (and gotten into some controversy along the way as well).

She is particularly excited about new ways for startups to secure government contracts at a speed faster than the sun burning out. Talking to me about the potential in this industry, she said:

We’ve been spending a lot of time with companies that are going after what’s known as Other Transaction Authorities, which are a new type of contracting vehicle that was developed in 2015 by former Secretary of Defense Ash Carter, to help tech companies work very quickly with the Department of Defense and with the intelligence community. So what historically might have taken 18 months to get a contract now takes 30 to 60 days for critical pieces of technology

Boyle explained that Vannevar fits directly into her thesis for the future of government procurement. “Our view is that the companies that do best in the space are people who have worked in government or understand how to sell to governments,” she said. She noted that the company is very early, and her investment was primarily focused on the team.

I asked about recent controversies that have hit companies like Google, which saw a revolt by some employees over its involvement with a defense program called Project Maven, which attempted to use machine learning technology and apply that to the battlefield, so that, for instance, drones could increase their effectiveness during strikes.

Granberg said that “we think that the people that defend our country should have access to the best tools and technologies to do their job. We know these people, we used to work with them, and we want to help them.”

He understands the concerns of critics though, and says that Vannevar intends to work with the government to ensure ethics remains core to its product. “We believe it’s our responsibility to sort of shape that technology and help the government think about putting in place policies that … prevent the misuse from happening.”

Boyle agreed. “One of the things that we’ve noticed is that if you’re very transparent and upfront about the types of products you’re going to be building in the beginning, it’s not a recruitment problem, it’s not an ethics problem.” Unlike Google, which had a six-figure large workforce with many employees who don’t want to touch defense-related code, the hope for Granberg and Moorhead is that a company like Vannevar can build a coalition of the willing, as it were, and maybe solve some serious security problems as well.

Powered by WPeMatico

There are two sides to starting a new business. On one side, entrepreneurs need creativity, imagination — a dream, essentially — to find, build, and market a new product to users and consumers. But on the other side, they have to deal with the regulatory state and all the minutia that comes with running any business in the 21st century.

That includes such delightful topics as choosing a particular model for incorporation, ensuring that a business has the right licenses to operate, and tracking all the legal changes happening in 50 state legislatures every year. It can be inordinately complicated (and expensive!) to ensure that your business is ready and legal.

That’s where ZenBusiness comes in. The Austin-based startup wants to empower entrepreneurs to build businesses large and small by dramatically simplifying the processes required to launch a business and then grow it.

When I last chatted with the company 18 months ago, they had just raised a $4.5 million seed round and had launched its platform. Today, it’s announcing that it has raised a new $15 million series A round led by return backer Greycroft, along with returning investors Lerer Hippeau and Revolution’s Rise of the Rest fund, alongside new investors Rosecliff Venture Partners, Interlock Partners and Recruit Strategic Partners.

The company launched with a product that was essentially an automated registered agent for new entrepreneurs. Under state incorporation laws, companies must designate a so-called “registered agent” to receive official notices from regulatory agencies, and so ZenBusiness chose this strategic point for entry into the market.

When I last chatted with CEO Russ Buhrdorf, he described rolling up this market as one of the key initial targets for the company:

ZenBusiness is the brainchild of Ross Buhrdorf, who joined vacation rental marketplace HomeAway five months after its inception as founding CTO, and stayed for a decade until its acquisition by Expedia in 2015 for $3.9 billion. Buhrdorf intended to take a year off, but “didn’t quite make it a year” he told me.

He explained to me that HomeAway in many ways followed a rollup playbook, “raising $400 million and acquired 26 companies.” Bringing that rollup lens while exploring new spaces, he ran into the corporate legal services market, which offers help to companies to keep them in compliance with the law. Buhrdorf liked what he saw. “It’s different in all 50 states, highly-regulated, which is great for technology, it is overpriced, and they underserve their customers.” He says the space is “completely ripe for disruption.”

Since that time, the company has expanded its product to help entrepreneurs get beyond merely incorporating to actually building out their business by recommending services like banking, lending, tax preparation, website building, and more. The hope is to provide a “worry-free” guarantee to entrepreneurs so that they can get those early critical logistics out of the way and back to actually operating and growing their business.

“Small businesses come through this funnel, they don’t necessarily know exactly what to do. So we curate that solution, and then we provide them with the basics for them to get up and running and to be successful,” Buhrdorf said.

He explained that the company has built out some tools itself such as a simple webpage creator, but in the long run, he hopes to partner with other providers who integrate into the ZenBusiness platform. For instance, ZenBusiness has partnered with Xero as the company’s main accounting provider, while also backstopping that offering with accountants working at ZenBusiness. The idea is that the automated tooling plus a little human touch can help most owners handle the day-to-day challenges of running a business.

The ZenBusiness team in 2018. Photo via ZenBusiness.

Buhrdorf is particularly focused on keeping the product very self-service and automated to allow it to focus on these smaller customers. “Many of the companies that you cover that are in the enterprise space, who provide solutions for medium-sized businesses, they have to charge, they have to have sales forces, it’s very competitive there,” Buhrdorf said. “What we’re after is the segment that’s underserved, it’s the long tail of the small business segment.”

ZenBusiness has expanded its services, and it is hoping to use the fresh infusion of capital to invest in building out community features that will allow small business owners to swap tips with each other and help one another grow their businesses (presumably with some guidance from ZenBusiness community managers and experts).

The company is now 40 employees predominantly in Austin with a small office in Peru. Since we last checked in, the company has transitioned to become a public benefit corporation, which Buhrdorf said was an attempt to better align the company’s charter with its mission orientation to help small business entrepreneurs.

Update: The funding total was changed from $10m to $15m. Sorry about that.

Powered by WPeMatico

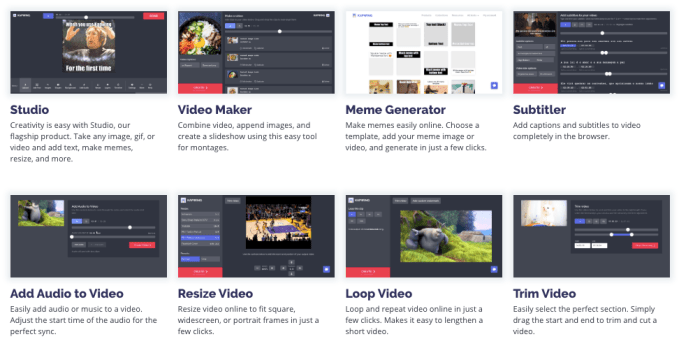

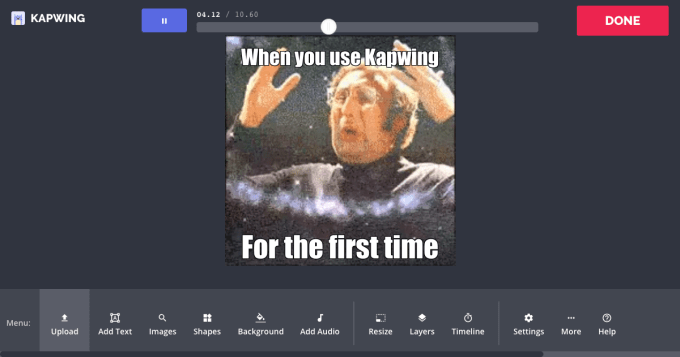

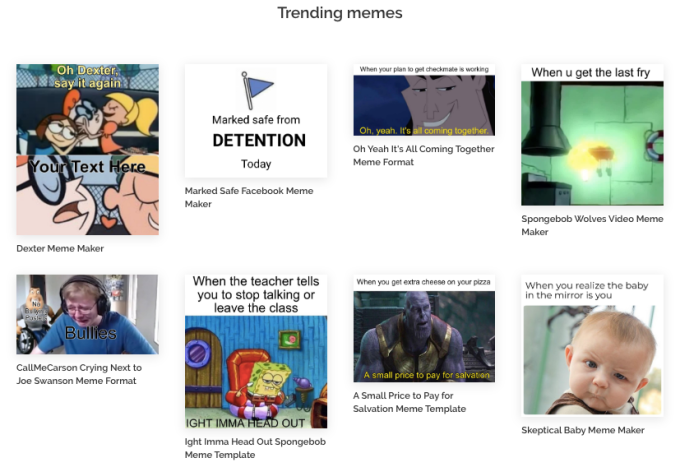

Kapwing is a laymen’s Adobe Creative Suite built for what people actually do on the internet: make memes and remix media. Need to resize a video? Add text or subtitles to a video? Trim or crop or loop or frame or rotate or soundtrack or… then you need Kapwing. The free web and mobile tool is built for everyone, not just designers. No software download or tutorials to slog through. Just efficient creativity.

In a year since coming out of stealth with 100,000 users, Kapwing has grown 10X, to more than 1 million. Now it going pro, building out its $20/month collaboration tools for social media managers and scrappy teams. But it won’t forget its roots with teens, so it has dropped its pay-$6-to-remove-watermarks tier while keeping its core features free.

Eager to capitalize on the meme and mobile content business, CRV has just led an $11 million Series A round for Kapwing. It’s joined by follow-on cash from Village Global, Sinai and Shasta Ventures, plus new investors Jane VC, Harry Stebbings, Vector and the Xoogler Syndicate. CRV partners “the venture twins” Justine and Olivia Moore actually met Kapwing co-founder and CEO Julia Enthoven while they all worked at The Stanford Daily newspaper in 2012.

Need to edit a meme or video? Kapwing has all the resizing, GIF, & subtitle tools you need https://t.co/FXDjShlUTq pic.twitter.com/1fEHxGoboz

— Josh Constine (@JoshConstine) September 24, 2019

“As a team, we love memes. We talk about internet fads almost every day at lunch and pay close attention to digital media trends,” says Enthoven, who started the company with fellow Googler Eric Lu. “One of our cultural tenets is to respect the importance of design, art and culture in the world, and another one is to not take ourselves too seriously.” But it is taking on serious clients.

As Kapwing’s toolset has grown, it has seen paying customers coming from Amazon, Sony, Netflix and Spotify. Now only 13% of what’s made with it are traditional text-plus-media memes. “Kapwing will always be designed for creators first: the students, artists, influencers, entrepreneurs, etc. who define and spread culture,” says Enthoven. “But we make money from the creative professionals, marketers, media teams and office workers who need to create content for work.”

That’s why in addition to plenty of templates for employing the latest trending memes, Kapwing now helps Pro subscribers with permanent hosting, saving throughout the creation process and re-editing after export. Eventually it plans to sell enterprise licenses to let whole companies use Kapwing.

Copycats are trying to chip away at its business, but Kapwing will use its new funding to keep up a breakneck pace of development. Pronounced “Ka-Pwing,” like a bullet ricochet, it’s trying to stay ahead of Imgflip, ILoveIMG, Imgur’s on-site tool and more robust apps like Canva.

If you’ve ever been stuck with a landscape video that won’t fit in an Instagram Story, a bunch of clips you want to stitch together or the need to subtitle something for accessibility, you’ll know the frustration of lacking a purpose-built tool. And if you’re on mobile, there are even fewer options. Unlike some software suites you have to install on a desktop, Kapwing works right from a browser.

” ‘Memes’ is such a broad category of media nowadays. It could refer to a compilation like the political singalong videos, animations like Shooting Star memes or a change in music like the AOC Dancing memes,” Enthoven explains. “Although they used to be edgy, memes have become more mainstream . . . Memes popularized new types of multimedia formats and made raw, authentic footage more acceptable on social media.”

As communication continues to shift from text to visual media, design can’t only be the domain of designers. Kapwing empowers anyone to storytell and entertain, whether out of whimsy or professional necessity. If big-name creative software from Adobe or Apple don’t simplify and offer easy paths through common use cases, they’ll see themselves usurped by the tools of the people.

Powered by WPeMatico

Engage:BDR announced today that it has raised $23.25 million in new funding.

CEO Ted Dhanik told me that this includes both debt and equity funding, and will be used to grow the company’s NetZero payments program.

NetZero is designed to address the ongoing issue of long delays faced by publishers before they get paid by advertisers. Dhanik said “the terms are getting worse and worse,” with publishers being asked to wait 30, 60, 90 or even 120 days after they invoice their advertising partners before payment.

Other companies like FastPay have tried to fill in the gap, but Dhanik said these loans can have interest rates as high as 25%. So the team at Engage:BDR (which is publicly traded on the Australian Securities Exchange) asked itself: “Hey, what if we could just pay publishers the exact same day that they invoice us?”

Rather than making money by charging interest, Dhanik said his company is trying to drive more publishers to its programmatic advertising platform.

“We just want the business — the incremental revenue,” he said.

Engage:BDR says web, mobile and connected TV publishers in North America, Australia and Europe are eligible to participate in the NetZero program, though they’ll need to be approved by the company first.

“If you think about NetZero, you might think: Hey, if there’s fraud, it’s pretty dangerous you don’t have the ability to clawback [the payment],” Dhanik said. But apparently Engage:BDR has “a lot of technology in place to qualify them pretty quickly, within the first few days.”

Powered by WPeMatico

Automattic, the company behind WordPress.com, WooCommerce, Longreads, Simplenote and soon Tumblr, is now worth $3 billion. But its founder and CEO Matt Mullenweg has a bigger goal. He wants to make the web better, more open and diverse.

With the rise of social networks and closed platforms, Automattic’s mission statement has never sounded so important. Automattic doesn’t want to be the hot new startup. It wants to build a strong foundation to empower content creators for decades to come.

In an interview this week, Matt Mullenweg discussed why he raised $300 million from Salesforce Ventures, what he thinks of the current state of the web and how Automattic has a shot at building the open-source operating system of the web. The interview was edited for clarity and brevity.

(Photo Credit: Christopher Michel / Flickr under a CC BY 2.0 license)

Romain Dillet: Tell me more about how much money you’ve raised, who you’ve raised from.

Powered by WPeMatico

Of the 1.3 billion people who live in India, more than 100 million of whom are using digital payment apps each day, only about 20 million today invest in mutual funds and stocks. An Indian startup that is betting on changing that figure by courting millennials has just received a big backing.

Groww, a Bangalore-based startup, said today it has raised $21.4 million in a Series B financing round that was led by U.S.-based VC firm Ribbit Capital. Existing investors Sequoia India and Y Combinator also participated in the round, said the two-year-old startup that has raised about $29 million to date.

Groww allows users to invest in mutual funds, including systematic investment planning (SIP) and equity-linked savings. The app, which maintains a very simplified user interface to make it easier for its largely millennial customer base to comprehend the investment world, offers every fund that is currently available in India.

Lalit Keshre, co-founder and CEO of Groww, told TechCrunch in an interview earlier this week that the market of mutual funds is increasingly widening in India and the startup is hoping to accelerate its growth with the fresh capital. Other than that, he plans to double Groww’s headcount to 200 in the coming months.

Groww has amassed about 2.5 million registered users, two-thirds of whom are first-time investors, Keshre said. Groww is currently free to use and does not charge any commission on transactions. The startup eventually plans to offer a paid service as it looks to monetize its user base, but Keshre declined to share a timeline on how soon that would happen.

Groww will also soon begin to offer the ability to purchase stocks from its eponymous app, said Keshre, a former executive at Flipkart who co-founded Groww with three other Flipkart colleagues (Harsh Jain, Neeraj Singh and Ishan Bansal).

In a statement, Micky Malka, founder of Ribbit Capital, said, “We backed the Groww team because we believe in their mission. They have built the most trusted product in this space and are on the path to create a category-defining product.”

Ribbit Capital has made a number of investments in India in recent months. Last month, it invested in Cred, a startup that is trying to improve the financial behavior of credit card holders, and BharatPe, a payments solution for businesses.

In recent years, a number of startups such as INDWealth and Cube Wealth have emerged in India to offer wealth management platforms to the country’s growing internet population. Many established financial firms such as Paytm have also expanded their offerings to include investments in mutual funds.

Ashish Agarwal, a principal partner at Sequoia Capital India, said, “Investment products such as mutual funds and stocks were traditionally sold offline through financial advisors, who were mis-incentivized to sell high-commission products. Groww is taking a refreshing approach with a zero-commission mobile first model, enabling investors to make their own investment choices through a slick and easy user interface.”

Powered by WPeMatico

As expectations from seed investors intensify, a new stage of investment has established itself earlier in the venture-backed company life cycle.

Known as “pre-seed” investing, one of the first legitimate outfits to double down on the stage has refueled, closing its second fund on $77 million.

Afore Capital’s sophomore fund is likely the largest pool of venture capital yet to focus exclusively on pre-seed companies, or pre-product businesses seeking their first bout of institutional capital. In many cases, a pre-seed startup may even be “pre-idea,” yet to fully incorporate. While some funds are happy to invest that early, Afore seeks slightly more mature companies.

Afore invests between $500,000 and $1 million in nascent startups. As it kicks off its second fund, founding partners Anamitra Banerji and Gaurav Jain tell TechCrunch they plan to lead all of their investments.

We have the opportunity to build a firm that defines a category. – Afore founding partner Anamitra Banerji

Standouts in Afore’s existing portfolio include the no-fee credit card company Petal — which has raised roughly $50 million to date — mobile executive coaching business BetterUp, childcare information platform Winnie and Modern Health, a B2B mental wellness platform.

Afore portfolio companies have raised more than $360 million in follow-on funding, with an aggregate market cap of $1.5 billion, Jain, the founding product manager at Android Nexus and former principal at Founder Collective, tells TechCrunch. “These are high-quality teams with high-quality projects and ideas.”

Jain and Banerji — a founding product manager at Twitter and former partner at Foundation Capital — began raising capital for Afore’s $47 million debut fund in 2016. Since then, the landscape for seed investing has shifted. Early-stage investors have begun funneling larger sums of capital to standout teams at the seed, while billion-dollar venture capital funds set aside capital for serial entrepreneurs working on their next big idea. As a result, deal sizes have swelled and deal count has shrunk simultaneously.

“Pre-seed has replaced seed in the venture ecosystem,” Banerji tells TechCrunch. “We saw this early as a result of both of us having been at funds. We knew that this was going to be a massive category just like seed was before it. Now we think it’s clearly here to stay and we have the opportunity to build a firm that defines a category.”

Since launching the firm, the pair explain they’ve noticed more and more founders explicitly stating that they are in the market for a pre-seed round, a statement you wouldn’t have heard as recently as two years ago.

This is a result of Afore’s efforts to legitimize the stage through investments and programming, including its annual Pre-Seed Summit. Though Afore is certainly not the only VC fund focused on the earliest stage of startup investing — other firms deploying capital at the stage include Hustle Fund, which closed an $11.8 million debut fund last year, plus the $20 million immigrant-focused pre-seed fund Unshackled Ventures and the predominant seed and pre-seed stage firm Precursor Ventures, which announced a $31 million second fund earlier this year.

In the past year alone, more than $200 million has been dedicated to the pre-seed stage, with at least nine new funds launching to nurture early-stage startups.

More and more firms are setting up shop at the pre-seed stage as competition at the seed stage reaches new heights. As we’ve previously reported, monster funds are becoming increasingly active at the seed stage, muscling seed funds out of top deals with less dilutive offers. While the pre-seed stage, for the most part, remains protected from competition at the later stage, these firms still have to compete.

“Nobody wants to lose sight of a deal, so they are willing to toss small amounts of capital very early behind interesting founders,” Jain said. “But frankly, we aren’t sure if it’s good for a company to raise that much capital that early in their life cycle.”

Working with a fund that isn’t passionate about what you are building or familiar with the plights of the stage of your business is terrible for founders, adds Jain. Pairing with a focused fund like Afore, on the other hand, allows for “incentive alignment.”

Afore invests across all industries, preferring to back startups in categories “before they are categories.”

“What we are looking for is deep authenticity and passion around the product they are building,” says Banerji. “Ideas on their own aren’t enough. Founder resumes on their own aren’t enough. While we do care about all of those aspects, we get crazy about their clarity of thought in the short term.”

“We don’t take the point of view of ‘here is some money, it’s OK to lose it,’ ” he adds. “For us to invest, the founder must be all in. And we generally don’t invest in celebrity founders; we are going after the underdog founder.”

Powered by WPeMatico

Julo, a peer-to-peer lending platform in Indonesia, said on Wednesday it has extended its $5 million Series A raise to $15 million as it looks to scale its business in the key Southeast Asian market.

The $10 million Series A2 round for the Jakarta-headquartered startup was led by Quona Capital, with Skystar, East Ventures, Provident, Gobi Partners and Convergence participating. The two-year-old startup, which has raised about $16 million to date, is now closing the round, Adrianus Hitijahubessy, co-founder and CEO of Julo, told TechCrunch in an interview.

Through its eponymous Android app, Julo provides loans of about $300 to users at aggressively competitive rate of 3-5% per month — one of its key differentiating factors. Julo has managed to keep its interest rate low because its credit scoring system is more efficient than those of its rivals, claimed Hitijahubessy, who has amassed more than a decade of experience in credit scoring systems using alternative data from his previous stints.

“There are lots of players in this market. Not just Indonesia, but globally. But it comes down to who actually knows what they are doing. The bar is becoming higher and it is increasingly becoming difficult for digital lending companies to just launch an app and charge a high interest rate,” he said.

Julo works with banks and individuals to finance loans to customers. It says it has disbursed about $50 million to date.

Hitijahubessy said Julo will use the fresh capital to expand the team and enhance its credit score system. The startup intends to focus on growing its business in Indonesia itself.

In a statement, Ganesh Rengaswamy, co-founder and partner of Quona Capital, said, “a significant majority of JULO’s loans are used for productive purposes that can enhance the economic well-being of families and small businesses — driving financial inclusion in Indonesia, which is a cornerstone of Quona’s focus.”

Digital lending is becoming an increasingly crowded space in South Asian markets. In India, for instance, a growing number of digital mobile wallets, including Paytm and MobiKwik, have recently started to offer credits to customers.

Powered by WPeMatico

PlayVS, the platform that allows high school students to compete on varsity esports teams through their school, has today announced the close of a $50 million Series C led by existing investor NEA. Battery Ventures, Dick Costolo and Adam Bain of 01 Advisors, Sapphire Sport, Michael Zeisser, Dennis Phelps of IVP and co-founder of CAA Michael Ovitz participated.

This brings the startup’s total funding to $96 million, the vast majority of which was raised in the last 13 months.

PlayVS launched in April of 2018 under founder and CEO Delane Parnell, who believes that the opportunity of esports is fundamentally broken without high school leagues. Through an exclusive partnership with the NFHS (the NCAA of high schools), PlayVS allows schools across the country to create esports teams and participate in leagues with their neighboring schools, just like any other varsity sport.

PlayVS also partners with the game publishers, which allows the platform to pull stats directly from the PlayVS website and track players’ performance across every game.

The startup charges either the player, parent/guardian or school $64 per player to participate in “Seasons,” PlayVS’s first product. It was launched in October of 2018 in five states and expanded to eight states this spring.

Since launch, 13,000 schools have joined the waitlist to get a varsity esports team through PlayVS, which represents 68% of the country. PlayVS says that just over 14,000 high schools in the United States have a football program, marking the idea of varsity esports as a relatively popular one.

With the upcoming fall Season for 2019, all 50 states will have access to the PlayVS platform, with 15 states competing for an actual State Championship in partnership with their state association. These states include Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Georgia, Hawaii, Kentucky, Massachusetts, Mississippi, Rhode Island, Virginia and Washington D.C.

States that have not gotten an endorsement from their state association will still compete regionally for a PlayVS championship. PlayVS supports League of Legends, Rocket League and SMITE, with plans to support other games in the future.

Not only does PlayVS offer high school students the chance to play organized esports, but it also gives colleges and esports orgs a recruitment tool to scope and scoop young talent.

But what about that funding? Well, Parnell says that the new round gives the company a war chest to not only hire aggressively — the company has gone from 18 to 41 employees in the last year — but also to consider mergers and acquisitions as a means of growth.

Perhaps most importantly, the company will use the funding to explore products outside of high school, with eyes squarely focused on the collegiate market. With esports still in its infancy, there is a huge opportunity to provide the infrastructure of these leagues early on, and PlayVS is looking to capture that.

Powered by WPeMatico