funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Next Insurance, a three-year-old U.S.-based firm that sells insurance products to small businesses, has become the latest unicorn in the nation after bagging $250 million in a new financing round, the startup said today.

Germany-based Munich Re, one of the world’s largest reinsurers, alone funded Next Insurance’s Series C round, the two said in a statement. The new financing round valued the three-year-old startup, which has raised $381 million to date, at more than $1 billion, the startup said.

Guy Goldstein, co-founder and chief executive of Next Insurance, said the startup will use the fresh capital to build new products and expand its customer initiatives. Next Insurance offers a wide-range of insurance coverage to more than 1,000 unique types of business. It has amassed over 70,000 customers in the U.S., the only market where it currently operates.

Next Insurance aims to become a one-stop insurance shop for micro and small business insurance needs. Its insurance plans and products are designed to cater to the business sectors that are often overlooked by more general insurers.

The startup offers a number of insurance products, including general liability, which covers a number of accidents at work, including property damage and physical injury; professional liability, which covers business owners from accusations of professional mistakes; and commercial auto, which pays for damage caused by or to your business vehicle.

As TechCrunch’s Steve O’Hear explained earlier, small business owners often rely on price comparison websites to figure out what kind of coverage they need and where to buy it, though that means the plans they get don’t always cover all their needs. The other option is to use a broker, but that also adds another middle person.

In a statement, Joachim Wenning, chairman of the Board of Management at Munich Re, said the new investment will help Munich Re expand its footprint in the U.S.’s insurance market of small and medium-sized commercial customers.

“Next Insurance will benefit from our expertise in primary insurance and reinsurance. This investment emphasizes Munich Re’s commitment to be the leading provider of digital insurance solutions,” added Wenning.

Next Insurance, of course, isn’t the only player attempting to address the insurance needs of small and micro-sized businesses. It competes with a handful of startups, including Lemonade, which raised $300 million in April this year, and Root Insurance, which sells car insurance and raised $100 million last year.

Powered by WPeMatico

Fyle, a Bangalore-headquartered startup that operates an expense management platform, has extended its previous financing round to add $4.5 million of new investment as it looks to court more clients in overseas markets.

The additional $4.5 million tranche of investment was led by U.S.-based hedge fund Steadview Capital, the startup said. Tiger Global, Freshworks and Pravega Ventures also participated in the round. The new tranche of investment, dubbed Series A1, means that the three-and-a-half-year-old startup has raised $8.7 million as part of its Series A financing round, and $10.5 million to date.

The SaaS startup offers an expense management platform that makes it easier for employees of a firm to report their business expenses. The eponymous service supports a range of popular email providers, including G Suite and Office 365, and uses a proprietary technology to scan and fetch details from emails, Yash Madhusudhan, co-founder and CEO of Fyle, demonstrated to TechCrunch last week.

A user, for instance, could open a flight ticket email and click on Fyle’s Chrome extension to fetch all details and report the expense in a single click in real-time. As part of today’s announcement, Madhusudhan unveiled an integration with WhatsApp . Users will now be able to take pictures of their tickets and other things and forward it to Fyle, which will quickly scan and report expense filings for them.

These integrations come in handy to users. “Eighty percent to ninety percent of a user’s spending patterns land on their email and messaging clients. And traditionally it has been a pain point for them to get done with their expense filings. So we built a platform that looks at the challenges faced by them. At the same time, our platform understands frauds and works with a company’s compliances and policies to ensure that the filings are legitimate,” he said.

“Every company today could make use of an intelligent expense platform like Fyle. Major giants already subscribe to ERP services that offer similar capabilities as part of their offerings. But as a company or startup grows beyond 50 to 100 people, it becomes tedious to manage expense filings,” he added.

Fyle maintains a web application and a mobile app, and users are free to use them. But the rationale behind introducing integrations with popular services is to make it easier than ever for them to report filings. The startup retains its algorithms each month to improve their scanning abilities. “The idea is to extend expense filing to a service that people already use,” he said.

Until late last year, Fyle was serving customers in India. Earlier this year, it began searching for clients outside the nation. “Our philosophy was if we are able to sell in India remotely and get people to use the product without any training, we should be able to replicate this in any part of the world,” he said.

And that bet has worked. Fyle has amassed more than 300 clients, more than 250 of which are from outside of India. Today, the startup says it has customers in 17 nations, including the U.S. and the U.K. Furthermore, Fyle’s revenue has grown by five times in the last five months, said Madhusudhan, without disclosing the exact figures.

To accelerate its momentum, the startup is today also launching an enterprise version of Fyle that will serve the needs of major companies. The enterprise version supports a range of additional security features, such as IP restriction and a single sign-in option.

Fyle will use the new capital to develop more product solutions and integrations and expand its footprint in international markets, Madhusudhan said. The startup, which just recently set up its sales and marketing team, will also expand the headcount, he said.

Moving forward, Madhusudhan said the startup would also explore tie-ups with ERP providers and other ways to extend the reach of Fyle.

In a statement, Ravi Mehta, MD at Steadview Capital, said, “intelligent and automated systems will empower businesses to be more efficient in the coming decade. We are excited to partner with Fyle to transform one of the core business processes of expense management through intelligence and automation.”

Powered by WPeMatico

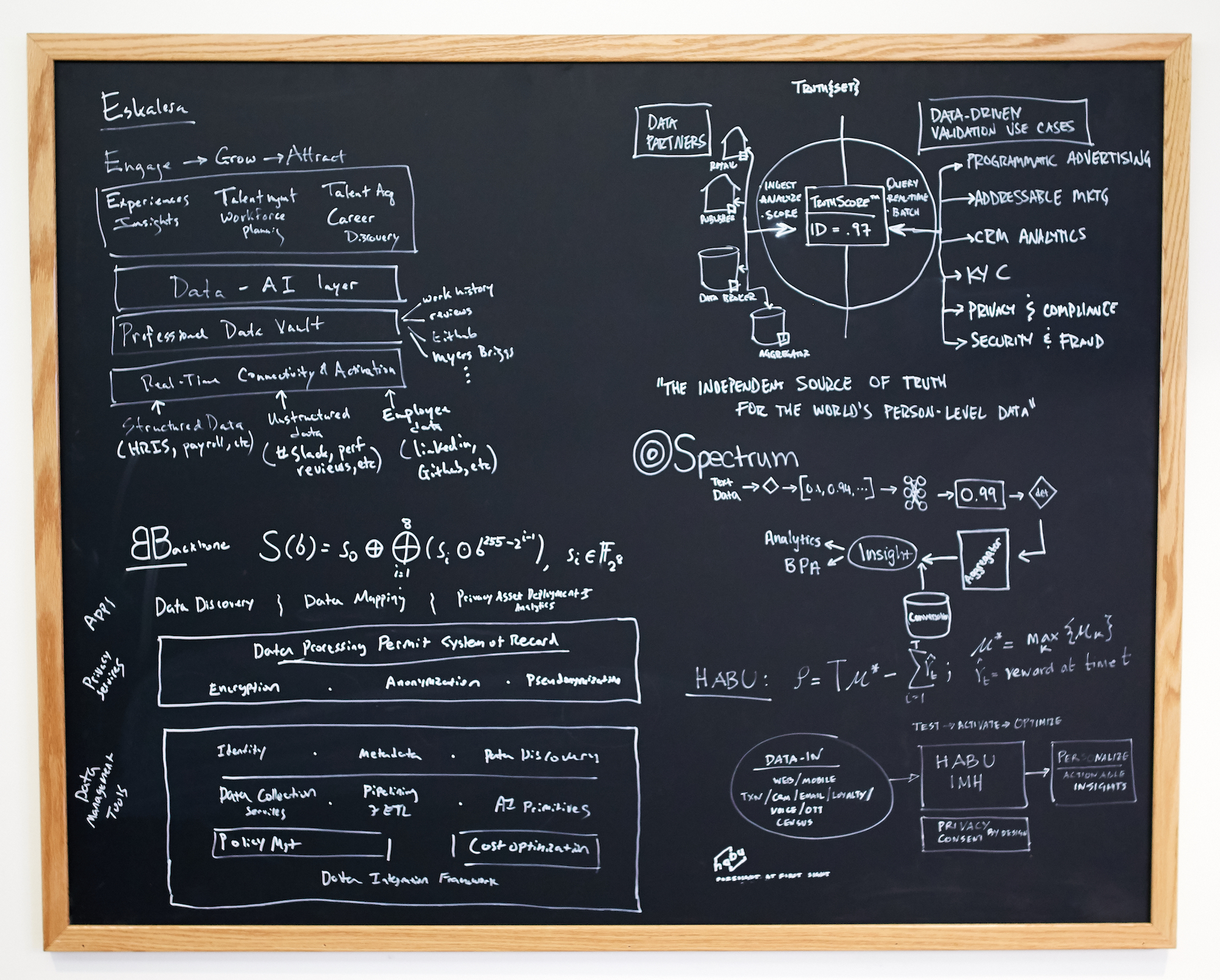

Think Jack Dorsey’s jobs are tough? Well, Tom Chavez is running six startups. He thinks building businesses can be boiled down to science, so today he’s unveiling his laboratory for founding, funding and operating companies. He and his team have already proven they can do it themselves after selling their startups Rapt to Microsoft and Krux to Salesforce for a combined $1.2 billion. Now they’ve raised a $65 million fund for “super{set}”, an enterprise startup studio with a half-dozen companies currently in motion.

The idea is that {super}set either conceptualizes a company or brings in founders whose dream they can make a reality. The studio provides early funding and expertise while the startup works from their shared space in San Francisco, plus future ones in New York and Boston. The secret sauce is the “super{set} Code,” an execution playbook plus technological tools and building blocks that guide the strategy and eliminate redundant work. “Our belief is that we can make the companies 10x faster and increase capital efficiency by 5X,” says Chavez of his partnership with {super}set co-founders Vivek Vaidya, who acts as CTO, and Jae Lim who manages the fund.

The {super}set team (from left): Tom Chavez, Jae Lim, Jen Elena and Vivek Vaidya

Perhaps the question isn’t whether the portfolio startups can scale, but if the humans behind them can without breaking. It’s stressful running a single company, let alone six. Even with the order of operations nailed down, each encounters unique challenges and no plan is one-size-fits-all. But after delivering 17.5X returns to their past investors, Chavez et al. have proven their power to repeatedly recognize what enterprises need and build admittedly boring but bountiful products in customer data management, and advertising yield.

The studio’s playbooks cover business plan formation, pitch strategies, go to market, revenue, machine learning, management principles, HR processes, sales methods, pipeline measurement, product sequencing, finance, legal and more. There’s also shared engineering code it provides, so each startup doesn’t have to reinvent the wheel. “I don’t think you can systemize it but I do think you can accelerate and de-risk the path,” Chavez explains.

{super}set Code

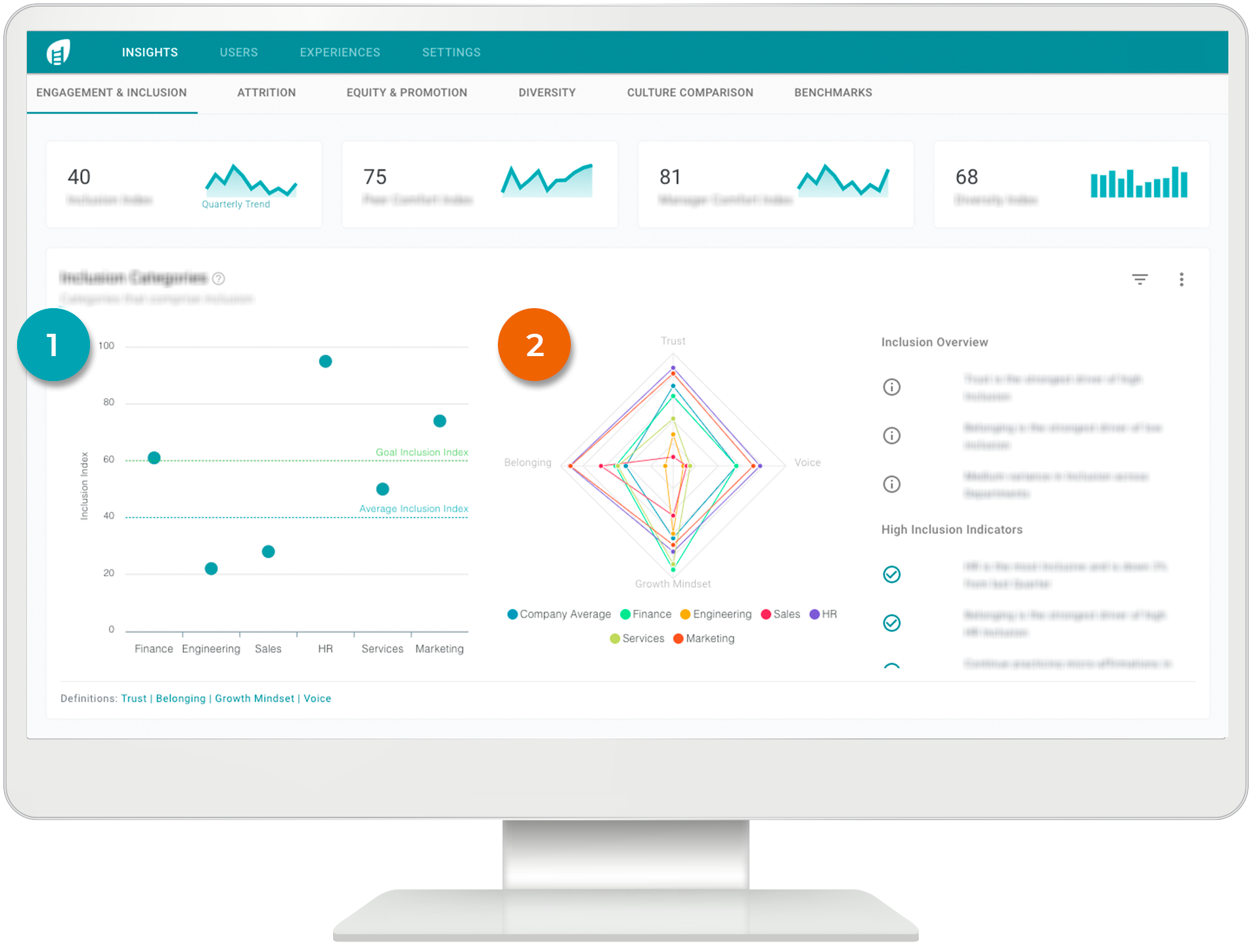

Today, the first {super}set company is coming out of stealth. Eskalera helps enterprises retain top talent by tracking diversity and inclusion stats of employees to engage them with career growth and community programs. Chavez is the CEO, but plans to install a new one shortly so he can focus more time on founding more startups. There are 55 employees across the first six companies, with two already generating revenue and most ready to emerge in the next nine months.

The funding for Eskalera and other {super}set companies comes with unique terms. Because Chavez and the team aren’t just board members you hear from once a quarter but “shoulder to shoulder with the entrepreneurs” as he repeats several times in our interview, the startups pay more equity for the cash.

The hope is having seasoned leadership aboard is worth it. “We’re product people first and foremost,” Chavez tells me. “What are you going to build? Who’s going to buy it? Why? What’s the technical moat? We’re not people doing jazz hands.” The {super}set team has plenty of skin in the game, though, given Chavez himself put in a big chunk of the $65 million, and the fund sticks to a standard management fee.

Eskalera

To supercharge the companies, {super}set brings in expert staffers in artificial intelligence, data science and more, who then align with the most relevant companies in the portfolio. They get equity grants to incentivize them to work hard on the startups’ behalf. “The worry I have about these larger funds is that they have an incentive disconnect where they work for the fees” Chavez says. His fund hopes to win through follow-on funding of its winners.

{super}set co-founder Tom Chavez

If portfolio companies hit hard times, Chavez says {super}set will stick with them. “My first company had multiple layoffs and a major pivot. We had an enterperenur that walked away. They lost conviction, but we brought that company to an $180 million exit after people said there was no effing way and that felt really good,” Chavez says of staying the course. “The good entrepreneurs have that demonic energy.” But if everyone involved agrees a project isn’t working, they’ll shutter it. “It comes back to opportunity cost of people’s time.”

Chavez has respect for studios taking different approaches, like Atomic in consumer startups, Science in e-commerce and Pioneer Square Labs, which maintains a larger fund staff. “What excites me is moving entrepreneurship a step forward. Why couldn’t we franchise this in other cities?” He hopes {super}set can attract top talent that “just want to work on cool shit” rather than getting sucked into a single company.

Can {super}set keep all the plates spinning and really lower their risk? “If we’re wrong there will be a giant orange plume streak across the sky. The early returns are promising but we have to prove it,” Chavez says. But after accruing plenty of wealth for himself, he says the thrill that keeps him in the startup game is seeing life-changing outcomes for his teams. “I have spreadsheets showing the wealth generated by employees of companies I’ve built and nothing makes me happier than seeing them pay for tuitions, property, or retiring.”

Powered by WPeMatico

Books on tape were the lifeblood of self-help. But e-learning startups like Khan Academy and Coursera demanded our eyes, not just our ears. Then came podcasts that make knowledge accessible, yet rarely focus on you retaining and applying what they teach.

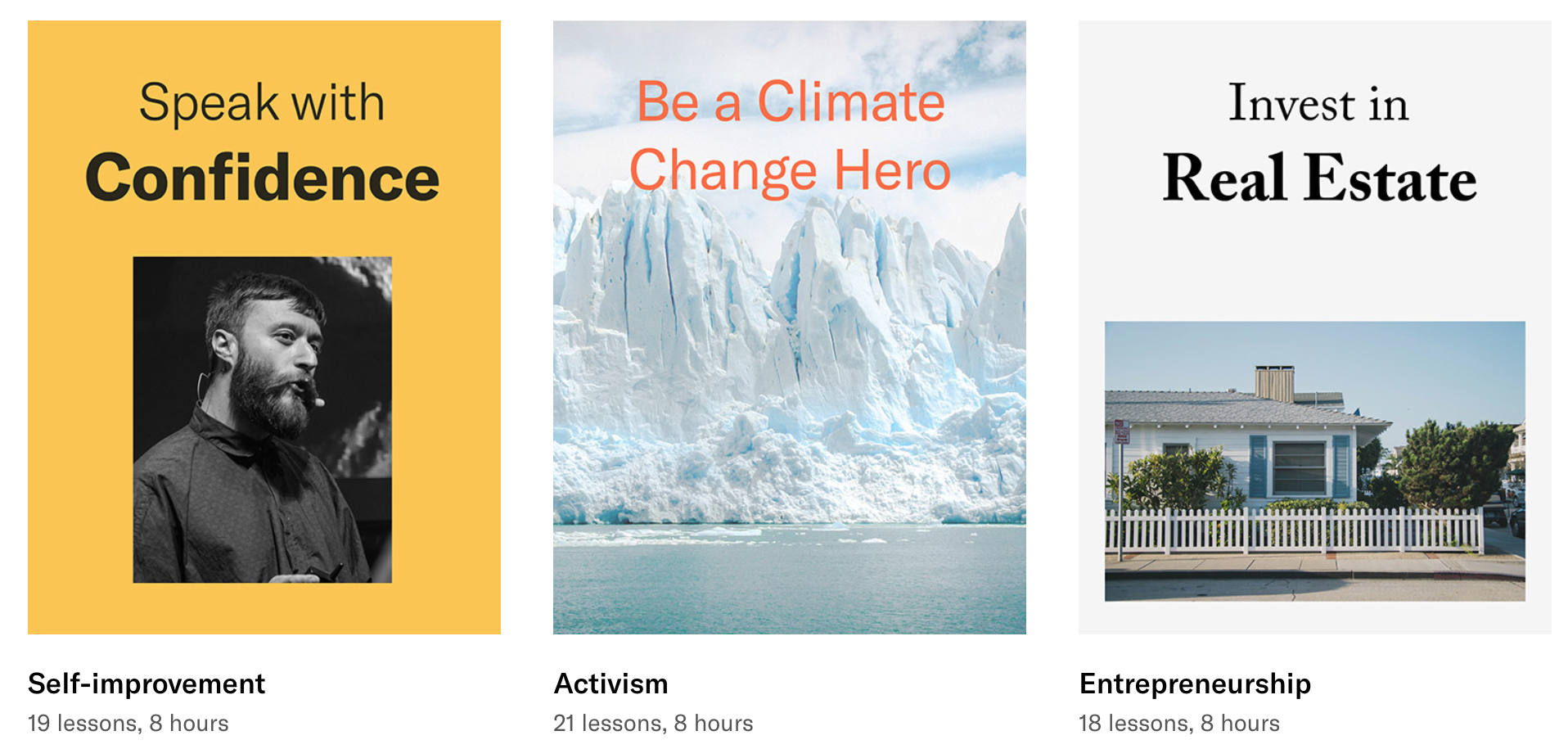

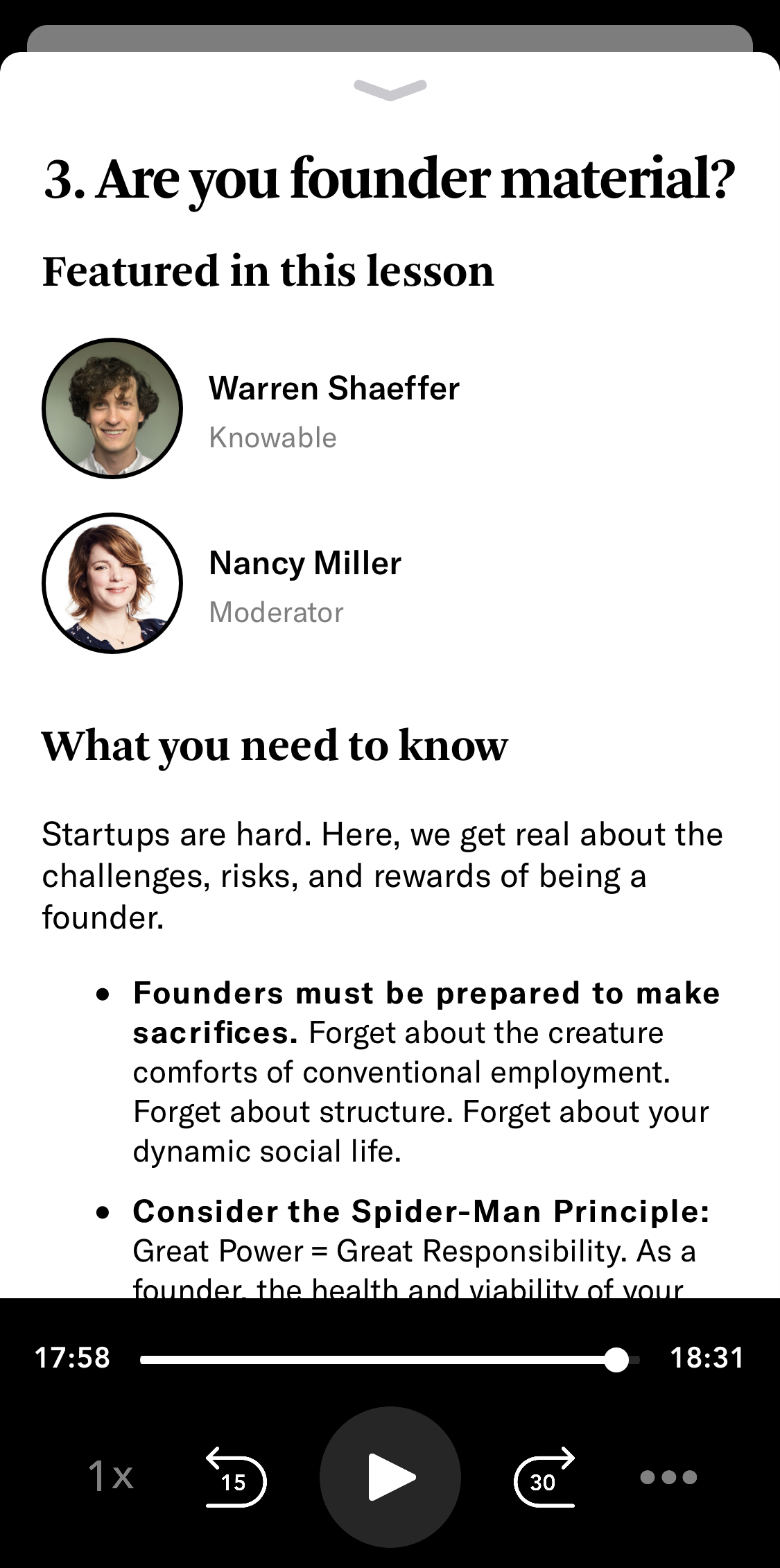

Today, a new startup called Knowable is launching to provide gaze-free audio education at $100 per eight-hour course on topics like how to launch a startup or how to sleep better. The idea is that by layering chapter summaries and eventually interactive activities atop premium, long-form, ad-free lessons, it can become the trusted name in learning anywhere. With always-in Bluetooth earbuds and smart speakers becoming ubiquitous, we can imbibe content in smaller chunks in new environments. Knowable wants to fill that time with self-improvement.

The big question is whether Knowable can differentiate its content from free alternatives and build a moat against copycats through savvy voice-responsive learning exercises so you don’t forget everything.

To evolve beyond the podcast, Knowable has raised a $3.75 million seed round led by Andreessen Horowitz’s partner Connie Chan, and joined by Upfront, First Round and Initialized. “The market is ready for a company like Knowable. Their timing is right and their team possesses the rare combination of product expertise and creative media experience necessary to win. That’s why I’m not just hosting Knowable’s first course, Launch a Startup, we’re also one of the earliest investors in the company,” says Initialized’s Alexis Ohanian.

There’s certainly a market opportunity, as 32% of Americans listen to podcasts monthly, up from 26% in 2018, with 74% of those citing the desire to learn. Half of Americans have listened to an audio book. The e-learning market is $190 billion today, but projected to grow to $300 billion as bloated and expensive higher education succumbs to cheaper and more focused options.

But to score consistent revenue, Knowable must build up its library and execute on plans to offer a subscription service with access to updates on prior lessons. A major challenge will be bundling classes on the right topics that don’t exhaust users so they keep listening and paying.

“My first-generation immigrant parents came here without college degrees. Great teachers let me move up the socioeconomic ladder pretty quickly,” says Knowable co-founder Warren Shaeffer. “The genesis of the idea came from our shared interest in education and the value of great teachers.”

Shaeffer and his co-founder Alex Benzer have already been through the struggles of startup life together. After meeting at MuckerLab in LA and splitting from their respective co-founders, in 2007 they created SocialEngine, a community website builder that sold to Room 214. Next they built up a video platform for independent creators called Vidme that raised $9 million but never became sustainable before selling to Giphy in 2018.

Shaeffer and his co-founder Alex Benzer have already been through the struggles of startup life together. After meeting at MuckerLab in LA and splitting from their respective co-founders, in 2007 they created SocialEngine, a community website builder that sold to Room 214. Next they built up a video platform for independent creators called Vidme that raised $9 million but never became sustainable before selling to Giphy in 2018.

The pair had glimpsed how great content could rope in an audience, but felt like the true potential of the podcast hadn’t been explored. Why did they have to be produced on the cheap, distributed on generic platforms and supported by ads? Knowable emerged as a way to create luxury audio, delivered through a purpose-built app and paid for with direct sales or subscriptions. Instead of recording unscripted discussions as episodes, they mapped out course curriculum and filled them with structured advice from experts.

I’m a few hours into the Ohanian-hosted Launch a Startup. It’s certainly a lot more efficient than trying to learn the basics just through storytelling from podcasts like Reid Hoffman’s Masters of Scale or NPR’s How I Built This. One chapter breaks down the top ways startups die and the traits you’ll need to persevere. From optimism and resilience operating in unstructured environments to a refusal to make excuses why you can’t succeed, Ohanian cooly recaps the learnings at the end of the chapter. Open the app and you’ll get a written summary plus suggested blog posts and books for diving deeper. An accompanying 95-page PDF workbook collects all the key learnings for rapid review later.

The topic is huge, though, and Knowable is at its best when it’s distilling knowledge into neatly packaged lists and frameworks. The course’s weakest moments are when it feels most like a podcast, with somewhat meandering conversations with random founders discussing how they dealt with problems. Meanwhile, it currently lacks some basic tools like in-app notetaking and sharing, or as wide a range of playback speeds and rewind options as you’ll get on Audible. “We don’t think of ourselves as a podcast company,” Shaeffer says, but that’s still who he’s competing against.

— Alexis Ohanian Sr.

(@alexisohanian) May 28, 2019

What’s also missing is any true interactivity. The downside of audio learning is that if you’re not paying full attention, it’s easy to zone out. Knowable needs to develop voice and touch-controlled exercises to help users apply and retain the lessons. There are plans to launch learning communities where students can confer about the classes, akin to Y Combinator’s “Bookface” forum.

However, Shaeffer says that “we’re on a mission to make education more accessible and quizzes might be an impediment to that,” which leaves questions about what the learning activities will look like, even though they’re crucial to users coughing up $100 per class. It’s easy to imagine Spotify/Anchor, Gimlet Media or other major podcast players developing their own interactive features and classes if Knowable doesn’t get there first.

The startup’s bid for virality is the ability to give a friend a code to take the class with you. Knowable is also hoping big-name experts and quality driven by a team cobbled together from NPR, The Washington Post, William Morris Endeavor, Masterclass and Vice will set it apart. They’ve got a lot of work ahead to grow beyond the six courses currently available on topics like climate change activism and real estate, especially because there’s a 100% money-back guarantee if classes fall short.

For the moment, Knowable feels a bit late with its homework. It has the potential and demand to reinvent audio learning but currently sounds too similar to what’s already everywhere. I was hoping for a Bandersnatch for education that made a broadcast experience feel more like a game.

But the opportunity will only continue to grow as we spend more of our lives in earshot of AirPods and Echoes. With a broad enough library and clever editing, one day you might tell Knowable “teach me something about venture capital in eight minutes” as you walk to the coffee shop. That’s going to have a much better impact on your life than just scrolling through another feed.

Powered by WPeMatico

Even as tens of millions of Indians have come online for the first time in recent years, most businesses in the nation remain offline. They continue to rely on long notebooks to keep a log of their financial transactions. A nine-month old startup which is digitizing the bookkeeping and allowing merchants to accept online payments just raised a significant amount of capital.

Khatabook, a Bangalore-based startup, said on Tuesday it has raised $25 million in a new financing round. The Series A round for the startup was funded by GGV Capital, Partners of DST Global, RTP Ventures, Sequoia India, Tencent, and Y Combinator. A clutch of high-profile angel investors including Amrish Rau, Anand Chandrasekharan, Deep Nishar, Gokul Rajaram, Jitendra Gupta, Kunal Bahl, and Kunal Shah also participated in the round. The startup has raised $29 million to date.

Khatabook operates an eponymous Android app that allows small and medium businesses to keep a log of their financial transactions and accept payments online. The app, which was launched on Google Play Store in December last year, has amassed 5 million merchants from more than 3,000 cities, towns, and villages in India, Ravish Naresh, cofounder and CEO of Khatabook told TechCrunch in an interview this week.

The app, which remains free of charge, was used to process transactions worth more than $3 billion in August, said Naresh. Most merchants in developing markets are not online currently. They continue to rely on logging their financial transactions — credit, for instance — on notebooks. As you can imagine, this methodology is not structured.

Even has Reliance Jio, a telecom operator launched by India’s richest man Mukesh Ambani, upended the Indian market and brought tens of millions of Indians online for the first time in last three years, most businesses in the country are still carrying out their operations without the use of any technology, said Naresh. “Could we build an app that makes it very easy for merchants to digitize their bookkeeping?” he said.

“As soon as we launched the app, we instantly started to go viral,” he said. For several months now, the startup is seeing 20% growth each month, he said. In six months, the app has helped businesses recover $5 billion in previously unpaid credits, Naresh claimed. Without any marketing, the app has also gained a significant number of users in Nepal, Pakistan, and Bangladesh, said Naresh.

“At Khatabook, we have taken early but significant steps towards leveraging this trend to digitize India’s shopkeepers. For most of our merchants, we are the first business software they’ve used in their entire life. And we will continue to build more India-first innovations to further enable the growth of what is still a largely untapped sector,” he said.

In a statement, Hans Tung, Managing Partner of GGV Capital, said, “as a global investor, we seek out founders who understand the local market and respond to growth opportunities with speed and agility – we certainly see this with the Khatabook team.”

Naresh, a cofounder of property startup Housing, said the startup will use the capital to build new features to serve merchants. In next 12 months, Khatabook will aim to add 25 million businesses, he said.

A growing number of startups in India are attempting to help businesses. OkCredit, which raised $67 million last month, serves 5 million merchants. IndiaMART, a 23-year-old B2B firm that went public this year, led a round in a startup called Vyapar last month that is addressing similar problems.

Powered by WPeMatico

…And see other pitchdecks get the teardown treatment from top early-stage investors Charles Hudson (Precursor Ventures), Anu Duggal (Female Founders Fund) and Russ Heddleston (CEO of DocSend). If you’re attending Disrupt, you’ll get an email with instructions on how you can submit your deck and if you are selected, you can get feedback directly from them in a workshop setting.

If we use your deck, we’ll also provide you a free ticket to any TechCrunch event of your choosing next year.

This is part of a new project to make Disrupt even more focused on founders. We’re already offering the Extra Crunch stage, where you’ll get lots of time to ask questions yourselves in addition to hearing their interviews. For this additional project, we’re setting up workshops with experts on our Q&A stage where they’ll be going over the actual founder problems.

These folks have seen everything, so they will have a gut sense for how generalized advice can be applied to your specific team and market — the nuance that can compellingly explain your strengths and weaknesses. Hudson and Duggal have written some of the first checks for some of the most interesting startups today. The Athletic, Clearbanc, Incredible Health, Sudo and Pico are names you may recognize from the Precursor portfolio; Tala, BentoBox, Thrive Global and WayUp are a few of the many on Female Founder Fund’s list.

Heddleston, meanwhile, is a repeat founder who now has some of the best insight into trends in funding through his current company, DocSend . As you may have read on TechCrunch already, the company provides document management for a large portion of startup founders out there, allowing them to share anonymized data with DocSend about how investors are reading their pitch decks. He’ll provide a data-driven founder perspective.

Attendees will be notified via email on how to submit their pitch deck. If you want to submit your deck for review, get your pass to the event here and we’ll send out an email with instructions on how to submit your deck.

Please note: The workshop is open to conference attendees and is officially on the record. Other investors and members of the media may be in the workshop and see what you have in your deck, so plan accordingly.

Powered by WPeMatico

StrongSalt, then known as OverNest, appeared at the TechCrunch Disrupt NYC Battlefield in 2016, and announced a product for searching encrypted code, which remains unusual to this day. Today, the company announced a $3 million seed round led by Valley Capital Partners.

StrongSalt founder and CEO Ed Yu says encryption remains a difficult proposition, and that when you look at the majority of breaches, encryption wasn’t used. He said that his company wants to simplify adding encryption to applications, and came up with a new service to let developers add encryption in the form of an API. “We decided to come up with what we call an API platform. It’s like infrastructure that allows you to integrate our solution into any existing or any new applications,” he said.

The company’s original idea was to create a product to search encrypted code, but Yu says the tech has much more utility as an API that’s applicable across applications, and that’s why they decided to package it as a service. It’s not unlike Twilio for communications or Stripe for payments, except in this case you can build in searchable encryption.

The searchable part is actually a pretty big deal because, as Yu points out, when you encrypt data it is no longer searchable. “If you encrypt all your data, you cannot search within it, and if you cannot search within it, you cannot find the data you’re looking for, and obviously you can’t really use the data. So we actually solved that problem,” he said.

Developers can add searchable encryption as part of their applications. For customers already using a commercial product, the company’s API actually integrates with popular services, enabling customers to encrypt the data stored there, while keeping it searchable.

“We will offer a storage API on top of Box, AWS S3, Google Cloud, Azure — depending on what the customer has or wants. If the customer already has AWS S3 storage, for example, then when they use our API, and after encrypting the data, it will be stored in their AWS repository,” Yu explained.

For those companies that don’t have a storage service, the company is offering one. What’s more, they are using the blockchain to provide a mechanism for sharing, auditing and managing encrypted data. “We also use the blockchain for sharing data by recording the authorization by the sender, so the receiver can retrieve the information needed to reconstruct the keys in order to retrieve the data. This simplifies key management in the case of sharing and ensures auditability and revocability of the sharing by the sender,” Yu said.

If you’re wondering how the company has been surviving since 2016, while only getting its seed round today, it had a couple of small seed rounds prior to this, and a contract with the U.S. Department of Defense, which replaced the need for substantial earlier funding.

“The DOD was looking for a solution to have secure communication between computers, and they needed to have a way to securely store data, and so we were providing a solution for them,” he said. In fact, this work was what led them to build the commercial API platform they are offering today.

The company, which was founded in 2015, currently has 12 employees spread across the globe.

Powered by WPeMatico

The climate crisis continues to be just that… a crisis. And it’s spurring people across the country (and globe) to take action, particularly when it comes to their own lifestyle.

Lauren Singer is one such person. After studying Environmental Science and Politics at NYU, she started a blog called Trash Is For Tossers to make a zero-waste lifestyle more accessible and comprehensible to everyone. But there’s still an issue. Even with a steep rise in sustainable CPG products, these brands rarely have the scale to compete with traditional CPG products in price, and lack the distribution to be accessible to everyone.

That’s where Package Free comes into play. Today, Package Free is announcing that it has raised its very first capital since launch in 2017, with a fresh $4.5 million in seed funding led by Primary Ventures. Scooter Braun’s TQ Ventures, Day One Ventures, Ryan Engel of Peleton, Brooke Wall of The Wall Group, and Casper founder Neil Parikh also participated in the round, alongside others.

Package Free started as a little pop-up shop for sustainable CPG brands to show off their wares in a brick-and-mortar environment. The brands themselves paid between $1000 and $3000 to participate, and were given 100 percent of the profit from the pop-up.

By the end of month one, says Singer, every brand had been paid back for their investment. By the end of month three, Package Free had become the primary revenue driver for those brands. At that point, they switched over to a traditional retail model to generate revenue to launch an ecommerce site.

Today, Package Free is a full-fledged reseller. The pop-up shop now has a permanent status in the trendy neighborhood of Williamsburg in Brooklyn, NY, with its own warehouse in Greenpoint. The company buys their inventory wholesale and enforces incredibly strict guidelines for the vendors they work with, not least of which is a no-exceptions no-plastic policy.

Brands that sell through Package Free not only have to use all natural ingredients and be plastic-free, but must also ship to the Package Free warehouse without using any plastic. The company actually charges vendors a percentage of the shipment if the shipment arrives with plastic, and increases that percentage on the second infraction. Three strikes, and that vendor is out for good.

“We know it’s completely possible to do these things without plastic, it’s just not the norm now,” said Singer. “So we’re trying to change the foundational benchmarks of what it means to package sustainably. I truly believe that the burden of waste should never fall on the consumer. It should fall on the manufacturer first, and then the reseller.”

Once products are at the warehouse, Package Free reuses the dunnage (packaging materials) that the original shipment came with, meaning the company never uses ‘virgin dunnage’. The boxes that Package Free ships to consumers are 100 percent recycled, and shipping labels are also 100 percent recyclable. In fact, every Package Free box is printed with the words “I’m not trash” with further facts about trash.

With the funding, Package Free wants to expand to creating its own sustainable CPG products, first tackling the ‘white space’ of products that aren’t currently available via vendor partners. Singer declined to share any more details around what Package Free’s first products might be.

Package Free is also looking to hire, with a specific focus on the marketing vertical as the company has yet to do any formal marketing or paid marketing up until this point.

The ultimate goal is to put sustainable CPG on the same playing field as traditional CPG products simply by way of economies of scale. Price is the primary obstacle between everyday consumers and accessible sustainable products, and Singer’s goal is to scale up the sustainable CPG category as a whole to the point where it can reasonably compete with the Unilevers and P&Gs of the world.

Powered by WPeMatico

An Indian SaaS startup, which is increasingly courting clients from outside of the country, just raised a significant amount of capital to expand its business.

Hyderabad-based Darwinbox, which operates a cloud-based human resource management platform, said on Thursday it has raised $15 million in a new financing round. The Series B round — which moves the firm’s total raise to $19.7 million — was led by Sequoia India and saw participation from existing investors Lightspeed India Partners, Endiya Partners, and 3one4 Capital.

More than 200 firms including giants such as adtech firm InMobi, fintech startup Paytm, drink conglomerate Bisleri, automobile maker Mahindra, Kotak group, and delivery firms Swiggy and Milkbasket use Darwinbox’s HR platform to serve half a million of their employees in 50 nations, Rohit Chennamaneni, cofounder of Darwinbox, told TechCrunch in an interview.

The startup, which competes with giants such as SAP and Oracle, said its platform enables high level of configurability, ease of use, and understands the needs of modern employees. “The employees today who have grown accustomed to using consumer-focused services such as Uber and Amazon are left disappointed in their experience with their own firm’s HR offerings,” said Gowthami Kanumuru, VP Marketing at Darwinbox, in an interview.

Darwinbox’s HR platform offers a range of features including the ability for firms to offer their employees insurance and early salary as loans. Its platform also features social networks for employees within a company to connect and talk, as well as an AI assistant that allows them to apply for a leave or set up meetings with quick voice commands from their phone.

“The AI system is not just looking for certain keywords. If an employee tells the system he or she is not feeling well today, it automatically applies a leave for them,” she said.

Darwinbox’s platform is built to handle onboarding new employees, keeping a tab on their performance, monitor attrition rate, and maintain an ongoing feedback loop. Or as Kanumuru puts it, the entire “hiring to retiring” cycle.

One of Darwinbox’s clients is L&T, which is tasked with setting up subway in many Indian cities. L&T is using geo-fencing feature of Darwin to log the attendance of employees. “They are not using biometric punch machine that is typically used by other firms. Instead, they just require their 1,200 employees to check-in from the workplace using their phones,” said Kanumuru.

Additionally, Darwinbox is largely focusing on serving companies based in Asia as it believes Western companies’ solutions are not a great fit for people here, said Kanumuru. The startup began courting clients in Southeast Asian markets last year.

“Our growth is a huge validation for our vision,” she said. “Within six months of operations, we had the delivery giant Delhivery with over 23,000 employees use our platform.”

In a statement to TechCrunch, Dev Khare, a partner at Lightspeed Venture, said, “there is a new trend of SaaS companies targeting the India/SE Asia markets. This trend is gathering steam and is disproving the conventional wisdom that Asia-focused SaaS companies cannot get to be big companies. We firmly believe that Asia-focused SaaS companies can get to large impact value and become large and profitable. Darwinbox is one of these companies.”

Darwinbox’s Chennamaneni said the startup will use the fresh capital to expand its footprints in Indonesia, Malaysia, Thailand, and other Southeast Asian markets. Darwinbox will also expand its product offerings to address more of employees’ needs. The startup is also looking to make its platform enable tasks such as booking of flights and hotels.

Chennamaneni, an alum of Google and McKinsey, said Darwinbox aims to double the number of clients it has in the next six to nine months.

Powered by WPeMatico

Nearly everything about Netdata, makers of an open-source monitoring tool, defies standard thinking about startups. Consider that the founder is a polished, experienced 50-year-old executive who started his company several years ago when he became frustrated by what he was seeing in the monitoring tools space. Like any good founder, he decided to build his own, and today the company announced a $17 million Series A led by Bain Capital.

Marathon Ventures also participated in the round. The company received a $3.7 million seed round earlier this year, which was led by Marathon.

Costa Tsaousis, the company’s founder and CEO, was working as an executive for a company in Greece in 2014 when he decided he had had enough of the monitoring tools he was seeing. “At that time, I decided to do something about it myself — actually, I was pissed off by the industry. So I started writing a tool at night and on weekends to simplify monitoring significantly, and also provide a lot more insights,” Tsaousis told TechCrunch.

Mind you, he was a 45-year-old executive who hadn’t done much coding in years, but he was determined, as any startup founder tends to be, and he took two years to create his monitoring tool. As he tells it, he released it to open source in 2016 and it just took off. “In 2016, I released this project to the public, and it went viral, I wrote a single Reddit post, and immediately started building a huge community. It grew up about 10,000 GitHub stars in a matter of a week,” he said. Even today, he says that it gets a half million downloads every single day, and hundreds of people are contributing to the open-source version of the product, relieving him of the burden of supporting the product himself.

Panos Papadopoulos, who led the investment at Marathon, says Tsaousis is not your typical early-stage startup founder. “He is not following many norms. He is 50 years old, and he was a C-level executive. His presentation and the depth of his thinking, and even his core materials, are unlike anything else have seen in an early-stage startup,” he said.

What he created was an open-source monitoring tool, one that he says simplifies monitoring significantly, and also provides a lot more insights, offering hundreds of metrics as soon as you install it. He says it is also much faster, providing those insights every second, and it’s distributed, meaning Netdata doesn’t actually collect the data, just provides insights on it wherever it lives.

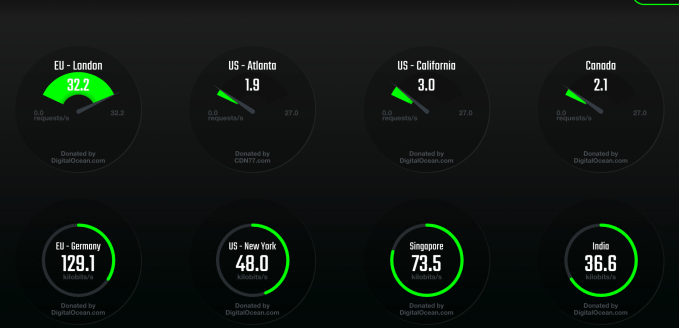

Live dashboard on the Netdata website

Today, the company has 24 employees and Tsaousis has set up shop in San Francisco. In addition, to the open-source version of the product, there is a SaaS version, which also has what he calls a “massively free plan.” He says the open-source monitoring agent is “a gift to the world.” The SaaS tool is about democratizing monitoring and the pay version is even different from most monitoring tools, charging by the seat instead of by the amount of infrastructure you are monitoring.

Tsaousis wants no less than to lead the monitoring space eventually, and believes that the free tiers will lead the way. “I think Netdata can change the way people perceive and understand monitoring, but in order to do this, I think that offering free services in a massive way is essential. Otherwise, it will not work. So my aim is to lead monitoring. This may sound arrogant, and Netdata is not there yet, but I think it can be,” he said.

Powered by WPeMatico