funding

Auto Added by WPeMatico

Auto Added by WPeMatico

MyGate, a Bangalore-based startup that offers security management and convenience service for guard-gated premises, said today it has bagged more than $50 million in a new financing round as it looks to expand its footprint in the nation.

Chinese internet giant Tencent, Tiger Global, JS Capital and existing investor Prime Venture Partners funded the three-year-old startup’s $56 million Series B financing round. The new round pushes MyGate’s total fundraise to $67.5 million.

MyGate offers an eponymous mobile app that allows home residents to approve entries and exits, communicate with their neighbors, log attendance and pay society maintenance bills and daily help workers.

The startup says it is operational in 11 cities in India and has amassed over 1.2 million home customers. Its customer base is increasing by 20% each month, it claimed. The service is handling 60,000 requests each minute and clocking over 45 million check-in requests each month.

The idea of MyGate came after its co-founder and CEO, Vijay Arisetty, left the Indian armed force. In an interview with TechCrunch, he said his family was appalled to learn about the poor state of security across societies in India.

“This was also when e-commerce companies and food delivery firms were beginning to gain strong foothold in the nation. This meant that many people were entering a gated community each day,” he said.

MyGate has inked partnerships with many e-commerce players to create a system to offer a silent and secure delivery experience for its users. The startup also trains guards to understand the system.

According to industry estimates, more than 4.5 million people in India today live in gated communities, and that figure is growing by 13% each year. The private security industry in the country is a $15 billion market.

Arisetty says he believes the startup could significantly accelerate its growth as its solution understands the price-sensitive market. Using MyGate costs an apartment about Rs 20 (28 cents) per month. Even at that price, the startup says it is making a profit. “Today, we are seeing more demand than we can handle,” he said.

That’s where the new funding would come into play for the startup, which today employs about 700 people.

The startup plans to use the fresh capital to expand its technology infrastructure, its marketing and operations teams and build new features. The startup aims to reach 15 million homes in 40 Indian cities in the next 18 months.

In a statement, Sanjay Swamy, managing partner at Prime Venture Partners, said, “It’s been great to see a fledgling startup execute consistently and holistically, and grow into a category-creating market-leader.”

Powered by WPeMatico

In our oceans the scale of disasters is measured in millions, billions, and trillions, while solutions amount to single digits: individuals or institutions working to impact a chosen issue with approaches often both brilliant and quixotic. Putting such individuals in close contact with both whales and billionaires is the strange alchemy being attempted by the Sustainable Ocean Alliance’s Accelerator at Sea.

I and a few other reporters were invited to observe said program, a five-day excursion in Alaska that put recent college graduates, aspiring entrepreneurs, legends of the sea, and soft-spoken financial titans on the same footing: spotting whales from Zodiacs in the morning, learning from one another in the afternoon, and drinking whiskey good and bad under the Northern lights in the pre-dawn dark.

The boat — no, not that big one, or that other big one… yes, that one.

In that time I got to know the dozen or so companies in the accelerator, the second batch from the SOA but the first to experience this oddly effective enterprise. And I also gathered from conversations among the group the many challenges facing conservation-focused startups.

(By way of disclosure, I should say that I was among four press offered a spot on the chartered boat; Those invited, from penniless students to deep-pocketed investors, could join provided they got themselves to Juneau for embarkation.)

The picture painted by just about everyone was one of impending doom from a multiplicity of interlinked trends, and as many different approaches to averting or mitigating that doom as people discussing it.

In Silicon Valley one grows so used to seeing enormous sums of money expended on things barely categorizable as irritations, let alone serious problems, that it is a bit bewildering to be presented with the opposite: existential problems being addressed on shoestring budgets by founders actually passionate about their domain.

Throughout the trip, the discussions had at almost every occasion, be it looking for bear prints in a tidal flat or visiting a local salmon hatchery, were about the imminent collapse of natural ecosystems and the far-reaching consequences thereof.

Overfishing, rising water temperatures, deforestation, pollution, strip mining, microplastics — everywhere we looked is a man-made threat that has been allowed to go too far. Not a single industry or species is unaffected.

It’s enough to make you want to throw your hands up and go home, which is in fact what some have advised. But the people on this boat are not them. They were selected for their dedication to conservation and ingenuity in pursuing solutions.

Of course, there’s no “solution” to the million of tons of plastic and oil in the oceans poisoning fish and creating enormous dead zones. There’s no “solution” to climate change. No one expects or promises a miracle cure for nature’s centuries of abuse at human hands.

But there are mitigations, choices we can make and technologies we can opt for where a small change can propagate meaningfully and, if not undo the damage we’ve done, reduce it going forward and make people aware of the difference they can make.

The trip came right at the beginning of the accelerator, a choice that meant they were only getting started in the program and in fact had never met one another. It also meant in many cases their pitches and business models were less than polished. This is for the most part an early-stage program, and early in the program at that.

That said, the companies may be young but the ideas and technologies are sound. I expect to follow up with many as they perfect their hardware, raise money, and complete pilot projects, but I think it’s important to highlight each one of them, if only briefly. The accelerator’s demo day is actually today, and I wish I could attend to see how the companies and founders have evolved.

Some accelerators are so big and so general-purpose that it was refreshing to have a manageable number of companies all clustered around interlinked issues and united by a common concern. If young entrepreneurs trying to change the world isn’t TechCrunch business, I don’t know what is.

The problems may be multifarious, but I managed to group the startups under two general umbrellas: waste reduction and aquatic intelligence.

But before that I want to mention one that doesn’t fit into either category and for other reasons deserves a shout out.

Coral Vita is working on a special method of fast-tracking coral growth and simultaneously selecting for organisms resistant to bleaching and other threats. The founder, Gator Halpern, impressed the importance of the coral systems on us over the trip, as did filmmaker Jeff Orlowski, who directed the harrowing documentaries Chasing Ice and Chasing Coral. (He gave a workshop on storytelling — important when you’re pitching a film or a startup.)

Gator is using a special method to grow corals at 50 times normal rates and hopefully resuscitate reefs around the world, which is awesome, but I wanted to put Coral Vita first because of a horribly apropos coincidence: Hurricane Dorian, the latest in a historically long unbroken line of storms, struck his home and lab in the Bahamas while we were at sea.

It was literally battering the islands while he was supposed to pitch investors, and he used his time instead to ask us to help the victims of the storm. That’s heart. And it serves as a reminder that these are not armchair solutions to invented problems.

If you can spare a buck, you can support Coral Vita and victims of Dorian in the Bahamas here.

The other companies were addressing problems equally as destructive, if not quite so immediately so.

Humans produce a lot of waste, and a lot of that waste ends up in the ocean, either as whole plastic bags scooping up fish, microplastics poisoning them, or heavier trash cluttering the sea floor. These startups focused on reducing humanity’s deleterious effects on ocean ecosystems.

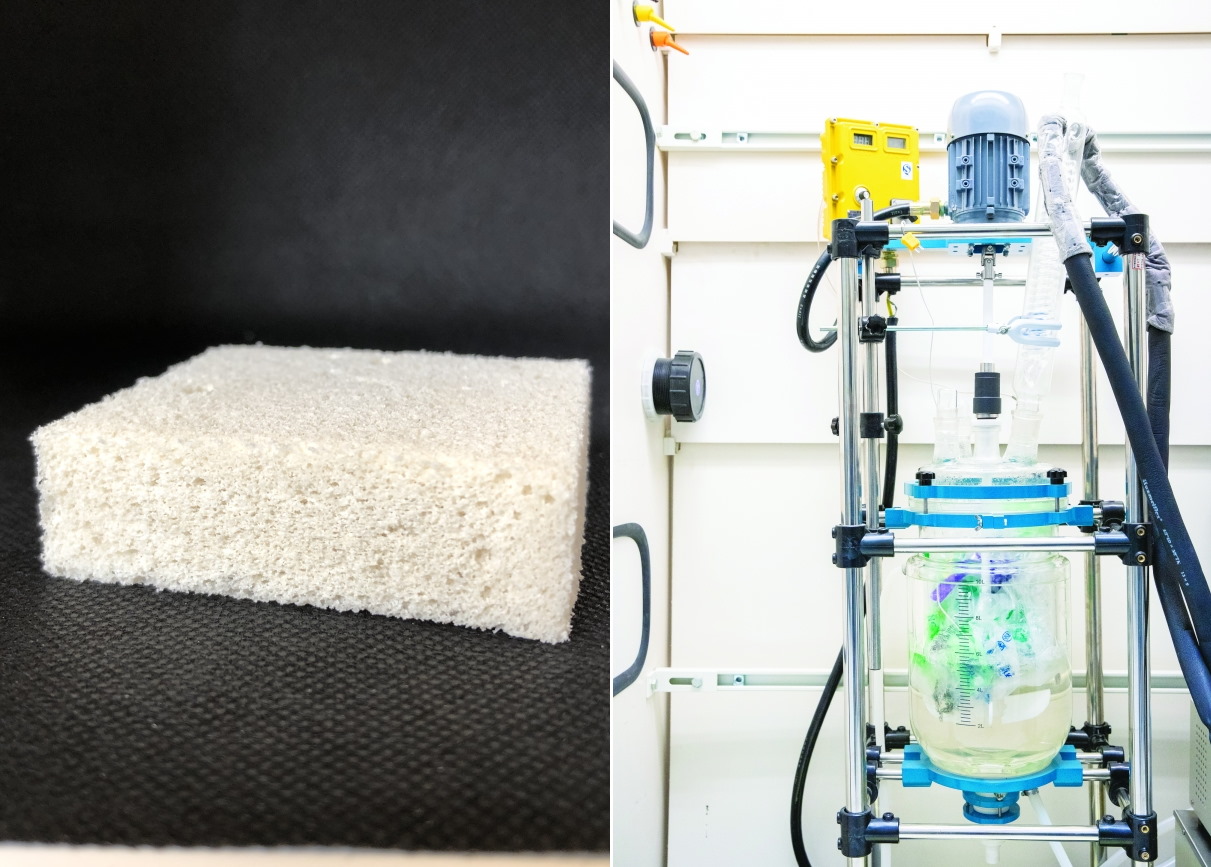

Cruz Foam is looking to replace one of my least favorite substances, Styrofoam, which I see broken up and mixed in with beach soil and sand all the time. The company has created a process that uses an incredibly abundant and strong material called chitin to create a lightweight, biodegradable packing foam. Chitin is what a lot of invertebrates use to form their shells and exoskeletons, and there’s tons of it out there — but the company has been careful to find ethical sourcing for the volume it need.

Cruz Foam’s chitin-based product, left, and Biocellection’s plastic reduction process.

Biocellection is coming from the other direction, having created a process to break down polyethylenes (i.e. plastics) into smaller molecules that are useful in existing chemical processes. It’s actually upcycling waste plastic rather than repurposing it as a lower grade product.

Loliware was in SOA’s first batch, and creates single-use straws out of kelp material — a timely endeavor, as evidenced by the $6M round A they just pulled in, and backlog of millions of units ordered. Their challenge now is not finding a market but supplying it.

Dispatch Goods and Muuse are taking complementary approaches to reducing single-use items for take-out. Dispatch follows a model in use elsewhere in the world where durable containers are used rather than disposable ones for delivery items, then picked up, washed, and reused. Kind of obvious when you think about it, which is it’s common in other places.

Muuse (formerly Revolv) takes a more tech-centric approach, partnering with coffee shops to issue reusable cups rather than disposable ones. You can keep the cup if you want, or drop it off at a smart collection point and get a refund; RFID tags keep track of the items. Founder Forrest Carroll talked about early successes with this model on semi-closed environments like airports and college campuses.

Repurpose is aiming to create a way to go “plastic neutral” the way people try to go “carbon neutral.” Companies and individuals can sponsor individual landfills where their plastics go, subsidizing the direct removal and handling costs of a given quantity of trash.

Finless Foods hopes to indirectly reduce the huge amount of cost and waste created by fishing (“sustainable” really isn’t) by creating lab-grown tuna tissue that’s indistinguishable from the real thing. It’s a work in progress, but they’ve got a ton of money so you can probably count on it.

The technology used in the maritime and fishing industries tends toward the “sturdy legacy” type rather than “cutting edge.” That’s changing as costs drop and the benefits of things like autonomous vehicles and IoT become evident.

Ellipsis represents perhaps the most advanced, yet direct, application of the latest tech. The company uses camera-equipped drones using computer vision to inspect rivers and bodies of water for plastics, helping cleanup and response crews characterize and prioritize them. This kind of low-level data is largely missing from cleanup efforts, which gave rise to the name, which refers to both the peripatetic founder Ellie and the symbol indicating missing or omitted information

Ellipsis uses computer vision to find plastic waste in water systems.

For larger-scale inspection, autonomous boats like Saildrone are an increasingly valuable tool — but they cost hundreds of thousands of dollars and have their own limitations.

EcoDrone is a lower-cost, smaller, customizable autonomous sailboat that costs more like $2,500. Plenty of missions would prefer to deploy a fleet of smaller, cheaper boats than put all their hopes into one vessel.

Sea Proven is going the other direction, with a much larger autonomous ship: 20 meters long with a full ton of payload space. That opens up entirely new mission profiles that use sophisticated, large-scale equipment and require long-term presence at sea. The company has two ships now embarking on a mission to track whales in the Mediterranean.

Nets and traps are notoriously dumb, producing a huge amount of “bycatch,” animals caught up in them that aren’t what the fishing vessel was aiming (or licensed) to collect. Smart Catch equips these huge nets with a camera that tracks and characterizes the fish that enter, allowing the owner to watch and monitor them remotely and respond if necessary.

Meanwhile “dumb” traps can still be smarter in other ways. Stationary traps in stormy seas are often lost, dragged along the sea bed to an unknown location, there to sit attracting hapless crab and fish until they fall apart centuries from now. Blue Ocean Gear makes GPS-equipped buoys that can be tracked easily, reducing the risk of losing expensive fishing kit and line, and preventing “ghost fishing.”

Connectivity at sea can be problematic, with satellite often the only real option. Sure, Starlink and others are on their way, but why wait? A system of interconnected floating hubs from ONet could serve as hotspots for ships carrying valuable and voluminous data that would otherwise need to be processed at sea or uploaded at great cost.

And integrating all that data with other datasets like those provided by universities, ports, municipalities, NGOs… good luck getting it all in one place. But that’s the goal of SINAY, which is assembling a huge ocean-centric meta-database where users can cross-reference without having to sort or process it locally. Clouds come from oceans, right? So why shouldn’t the ocean be in the cloud?

The idea of commencing this accelerator program with a trip to southeast Alaska is a fanciful one, no doubt. But an influx of support for the accelerator’s parent organization, the Sustainable Ocean Alliance, made it possible. The SOA raised millions from the mysterious Pine and not-so-mysterious Benioffs, but it also made a deep impression on the founder of Lindblad Expeditions, Sven Lindblad, who offered not just to host the event but to attend and speak at it.

He joined several other experts and interesting people in doing so: Former head of Google X Tom Chi, Value Act’s Jeff Ubben, Gigi Brisson and her Ocean Elders, including Captain (ret.) Don Walsh, the first man to reach the bottom of the Challenger Depths in the Marianas Trench. He’s hilarious, by the way.

I met SOA founder Daniela Fernandez at a TechCrunch event a few years ago when all this was just one of many twinkles in her twinkly eyes, and it’s been rewarding to watch her grow a community around these issues, which have passionate supporters around the globe if you’re willing to look for them and validate their purpose. It’s not a surprise to me at all that she has collected such an impressive group.

The boat, departing from Juneau, made a number of stops at local places of interest, where we would meet locals in the fishing industry, whale researchers, and others, or hear about the local economy ecology from one of the boat’s designated naturalists. In between these expeditions we did team-building exercises, honed pitches, and heard talks from the people mentioned above on hiring practices, investment trends, history.

These people weren’t just plucked from from the void — they are all part of the extended community that the SOA and Fernandez have built over the last few years. The organization was built with the idea of putting young, motivated people together with older, more experienced ones, and that’s just what was happening.

In a way it was what you might expect out of an accelerator program: Connecting startups with industry veterans and investors (of which there were several present) and getting them the advice and exposure they need. There was a pitch competition — the “Otter Sanctuary” (you had to be there).

But there was something very different about doing it this way — on a boat, I mean. In Alaska. With bears, whales, and the northern lights present at every turn.

“For the first time ever, we brought together a community of ocean entrepreneurs from all around the world and allowed them to become fully immersed in the environment that they have been working so hard to protect,” said Craig Dudenhoffer, who runs the accelerator program. “It was amazing to see the entrepreneurs establishing lifelong relationships with each other and with members of the SOA community. It might seem counter-intuitive for a technology entrepreneur, but sometimes you have to disconnect from technology in order to reconnect with your mission.”

In a normal startup accelerator, and in fact for the remainder of this one, aspiring entrepreneurs are living on their own somewhere, coming into a shared office space, attending office hours, meeting VCs in their offices or at demo days. That’s just fine, and indeed what many a startup needs — a peer group, a focal point in space and time, goals and advice.

On the boat, however, these things were present, but secondary to the experience of, say, standing next to someone under the aurora. I’m aware of how that sounds — “it was an experience, man!” — but there’s something fundamentally different about it.

In an office in the Bay Area, there is an established power structure and hierarchy. Schedules are adjusted around meetings, priorities are split, time and attention are devoted in formal 15-minute increments. On the boat there was no hierarchy, or rather the artificial one to which we would cleave in the city was flattened by the scale of what we were learning and experiencing.

You’d be in a zodiac or pressed against the railing with your binoculars, talking about whales and the threat of microplastics with whoever’s next to you in a normal fashion, only to find out they’re a billionaire who you’d never be able to meet directly with at all, let alone on equal terms.

Sitting at breakfast one day the guy next to me started talking about hydrogen-powered trucking — I figured I’d indulge this harmless idealist. In fact it was Jeff Ubben and Value Act was investing millions in an ecosystem they fully expect to take over the west coast. This sort of encounter was happening constantly as people engaged naturally, acting outside the established hierarchies and power structures.

Part of that was the gravity of the issues the startups were facing, and which we were reminded of repeatedly by the impending hurricane, the hatchery warning of salmon apocalypse, the visibly collapsing ecosystems, and perhaps most poignantly by the changes seen personally by Don and Sven, who were been on the seas professionally long before I was even born.

On the last night of the trip, I shared a glass of wine with Sven to talk about why he was supporting this endeavor, which was undoubtedly expensive and certainly unusual.

“From a business perspective, I depend on the ocean — but there’s a personal connection as well. I’m constantly looking for ways to protect what we depend on,” he began. “We have a fund that generates a couple million dollars a year, and we find different people that we believe in — that have an idea, a passion, intelligence. You meet someone like Daniela, you want to go to bat for them.”

“When you’re 21 or whatever, you have all these idealistic thoughts about making a difference in the world. They need support in a variety of ways — advice, finance, mentorship, all these things are part of the puzzle,” he said. “What SOA has done is recognize people that have a good idea. Left to their own devices most of them would probably fail. But we can provide some support, and it’s like with salmon eggs – maybe instead of one in a million surviving, maybe two, or five survive, you know?”

“Tech is a valuable tool, but it has to serve to support an idea. It isn’t the idea. Eliminating plastics and bycatch, making data more useful, putting sonar sensors on robotic boats, all very interesting. We need solutions, actions, ideas, as fast as we can, to accelerate the change in behavior as fast as we can.”

His earnest replies soon became emotional, however, as his core concern for the ocean and planet in general took over.

“We’re fucked,” he said simply. “We are literally destroying the next generation’s future. I’ve been with colleagues and we’ve wept over glasses of wine over what we’re doing.”

“I have two personalities,” he explained. “And most of my friends, associates, scientists have these dual personalities, too. One is when they look in the mirror and talk to themselves — that tends to be more pessimistic. But the other is the external personality, where being pessimistic is not helpful.”

“Something like this really activates that optimism,” he said. “At the end of the day young people have to grab their future, because we sure haven’t done a great job of it. They have to get out there, they have to vote, they have to take control. Because if the system really starts to collapse… I don’t think anyone even begins to understand the magnitude of it. It’s unfathomable.”

The Accelerator at Sea program was a fascinating experience and I’m glad to have taken part. I feel sure it was valuable for the startups as well, and not just because of the $25,000 they were each spontaneously awarded from the investors on board, who in closing remarks emphasized how important it is that startups like these and the people behind them are supported by gatekeepers like venture firms and press.

The combination of good times in nature, stimulating experts and talks, and a group of highly motivated young entrepreneurs was a powerful mixture, and unfortunately one that is difficult to describe even in 3,000 words. But I’m glad it exists and I look forward to following the progress of these companies and the people behind them. You can keep up with the SOA at its website.

Powered by WPeMatico

If you’re an avid TechCrunch reader, someone who loves to absorb endless startup profiles and pore through fundraising stories, you might think raising venture capital is easy. In reality, it’s very, very difficult and not the best source of capital for most businesses.

For startups hoping to scale far and wide as fast as possible, VC may be the right fit. To shed light on the process of raising equity capital from venture capital firms and provide some exclusive tips and tricks for Extra Crunch subscribers, we sat down with three experts on the subject. Below are the top pieces of advice from Charles Hudson, founder and managing partner of Precursor Ventures, Redpoint Ventures general partner Annie Kadavy, and DocSend founder Russ Heddleston. The following has been lightly edited for length and clarity.

Charles Hudson: I think venture capital, it’s really a specialty type of capital. It’s really for companies that have the aspiration to grow really quickly, to build really large businesses … If you’re not a company that needs to grow quickly, venture capital might not be the right source of capital for you. There has to be a really big prize at the end of the journey.

Russ Heddleston: If you’re thinking about whether or not to raise, there are a couple of reasons that I will often advise people to raise early. One is if they’re really stressing about buying a whiteboard for their office, or like some something of relatively small cost. If you think it could be a big company, and you’re stressing about small things, raise money and buy the whiteboard, hire the additional person and get back to what you should be doing, which is running your business and growing it quickly.

The other thing is if you ask the question, ‘is there a competitor I don’t know about?’ If you heard tomorrow, that competitor just raised $2 million, or $5 million or $10 million, how nervous would that make you? For some businesses, you’re like, I don’t really care, it’s a services industry, it’s not a winner take all market. And other times, you’re like, oh, I’d be really nervous. So if either those apply, that’s a good reason to make a compelling case to someone like Charles.

The number one thing you can do to get a VC’s attention is make [your pitch] really simple. Precursor Ventures’ Charles Hudson

Annie Kadavy: I’d be hard-pressed to think of an example where a founder is not paying themselves, the question, though, is how much? You’re paying yourself enough so that the basic costs of life and running your business are not giving you anxiety, because as an early stage investor one of our primary roles is to try and keep the baseline stress as low as it can be, because it’s really hard to go build a company.

If a founder is coming in at the Series A and they say I’m going to go pay myself $300,000, we might be like, well, that doesn’t really feel right, shouldn’t you want to put some of that money into the company? The ranges I’ve seen are anything from $60,000 up to probably $120,000 at the Series A, or maybe $150,000. Then, as the company grows and as the balance sheet grows and it’s de-risked, your salary as an executive at the company will scale with that.

Powered by WPeMatico

Toggle, a Brooklyn-based robotics startup, announced today that it scored $3 million in seed funding. The early-stage round was led by Point72 Ventures’ AI Group, with participation from Mark Cuban and VC Twenty Seven Ventures. The series follows a 2018 pre-seed round of $570,000 from its Urban-X accelerator, Urban Us, Accelerate NY / Empire State Development and Perl Street Capital.

The 15-person startup creates robotics that fabricate and assemble rebar. It’s designed to work in tandem with existing robotics and steel fabrication technologies, while speeding up the process up to 5 times, by the company’s count.

Toggle has already begun a soft launch “for a wide range of projects in New York City and the surrounding area,” according to the company. It expects to ramp up toward commercial production over the course of the next year and a half. CEO Daniel Blank tells TechCrunch that the seed round will be used toward R&D and growing the Toggle team.

“This funding will be used to further develop our technology — both the hardware and software — around assembly and fabrication automation, as well as grow the engineering team that supports this development,” Blank tells TechCrunch. “The funding also provides us with a strong foundation for our manufacturing operation which is already supplying services and materials to customers in New York City and the surrounding region.”

Powered by WPeMatico

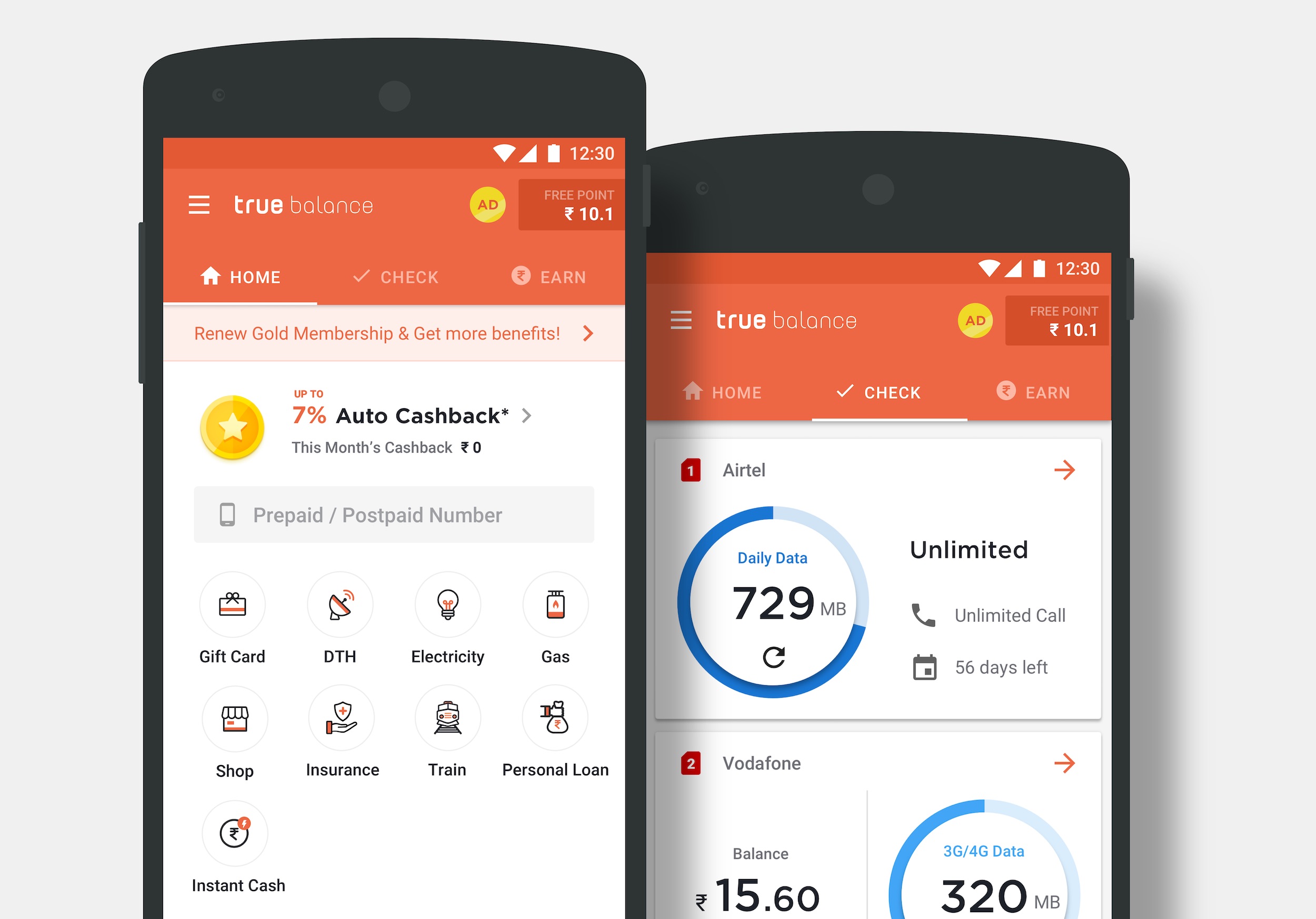

South Korean startup True Balance, which operates an eponymous financial services app aimed at tens of millions of users in small cities and towns in India, has closed a new financing round as it looks to court more first-time users in the world’s second largest internet market.

True Balance said on Tuesday that it has raised $23 million in its Series C financing round from seven Korean investors — NH Investment & Securities, IBK Capital, D3 Jubilee Partners, SB Partners, Shinhan Capital and existing partners IMM Investment and HB Investment.

TechCrunch reported earlier this year that True Balance — which has raised $65 million to date, including the $38 million that it closed in its previous financing round — was looking to raise as much as $70 million in its Series C round.

True Balance began its life as a tool to help users easily find their mobile balance, or top up pre-pay mobile credit. But in its four-year journey, its ambition has significantly grown beyond that. Today, it serves as a digital wallet app that helps users pay their mobile and electricity bills, and offer credit to customers so that they can pay later for their digital purchases.

The startup says it has amassed more than 60 million registered users in India, most of whom live in small cities and towns — or dubbed India 2 and India 3. Most of these users are coming online for the first time and True Balance says it has an army of local agents — who get certain incentives — to help first-time internet users understand the benefit of online transactions and start using the app.

True Balance says it clocks more than 300,000 digital transactions on its app each day. The startup, which recently introduced e-commerce shopping services on its app to sell products like smartphones, has clocked $100 million in GMV sales in the country to date.

Charlie Lee, founder of True Balance, said the startup will use the fresh capital to bulk up the offerings on the app. Some of the features that True Balance intends to add before the end of this fiscal year include the ability to purchase bus and train tickets, digital gold and book cooking gas cylinders.

True Balance will also expand its lending and e-commerce services, Lee said. Its lending feature was used 1 million times in three months when it was introduced earlier this year. “We aim to strengthen our data and alternative credit scoring strategy to provide better financial services to our target — the next billion Indian users. Our goal is to reach 100 million digital touch points and become one of the top fintech companies in India by 2022,” he added in a statement.

Even as more than 600 million users in India are online today, just about as many remain offline. In recent years, many major companies in India have started to customize their services to appeal to users in India 2 and India 3 — who also have limited financial power.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Connie Loizos hopped on the line with prominent investor, entrepreneur, thought leader, and Techstars co-founder Brad Feld to chat about the latest edition of his book “Venture Deals,” his advice to founders and investors, and his take on hot-button issues of the day.

In their conversation, Brad and Connie discuss the need to know information when it comes to preparing for, structuring and executing venture deals, and how that information has changed over the past several decades. Feld walks through the major topics that have been added in the latest edition of the book, such as how to handle venture debt, along with tactical attributes that aren’t currently in the book, such as secondary market trading.

Brad also shares his take on the most effective fundraising tactics for founders, and which common pieces of advice might be overblown.

Brad Feld: “I think the approach to the amount of money that you’re raising is both nuanced and evolves based on what financing round you’re at. So if you’re in an early round, some of the characteristics are different than if you’re in a later round. But I think the general truism… that I like to use when people say, ‘Well, how much money should I raise?’

I start with two variables and you the entrepreneur get to define those two variables. The two variables are: the amount of money you raise and what getting to the next level means. The amount of money you should raise is the amount of money that you need to get your business to the next level. There are lots of different ways to define what next level is and by forcing yourself internally to define next level and then define what you need in terms of capital to get to that next level… when you’re raising that first round of financing or even the second or third round of financing, it helps you size rationally what you need versus reactively to whatever the market characteristics are.

I actually encourage entrepreneurs to raise the least amount of money they need to get to the next level, or at least that’s the number that they go out to market with. Not a range, not a big number because you’re trying to drive some kind of valuation characteristic off a big number, but the amount of money that you actually think you need to get to the next level. Then if you can be oversubscribed, that’s an awesome situation.”

Feld and Connie dive deeper into current issues in the startup and venture landscape, including Brad’s take on the impact of the SoftBank Vision Fund, what went down internally and externally at both WeWork and Uber, as well as how boards, executives and founders can manage cult of personality and static company cultures.

For access to the full transcription and the call audio — and for the opportunity to participate in future conference calls — become a member of Extra Crunch. Learn more and try it for free.

Connie Loizos: I think the last time I saw you in person was out here in San Francisco at an event I was hosting and that was maybe two years ago?

Brad Feld: Yup, that’s right. That was at the Autodesk Lab if I remember correctly.

Loizos: Yes. It’s good to hear your voice, and thank you for joining us on this call. We have a lot of readers who are big fans of yours that are on the line and are eager to learn about your book “Venture Deals” and your broader thoughts about the current state of the market. That said — and I know you only have so much time — let’s dive first into the book. So Wiley, your publisher has just put out the fourth edition of this book “Venture Deals,” and it’s really easy to appreciate why. I was looking through it and it’s so incredibly instructive how venture deals come together and possible pitfalls to avoid. And given there are always new entrepreneurs emerging, it continues to be highly relevant.

How do you go about updating a book like this, given that some things change and some things stay the same?

Powered by WPeMatico

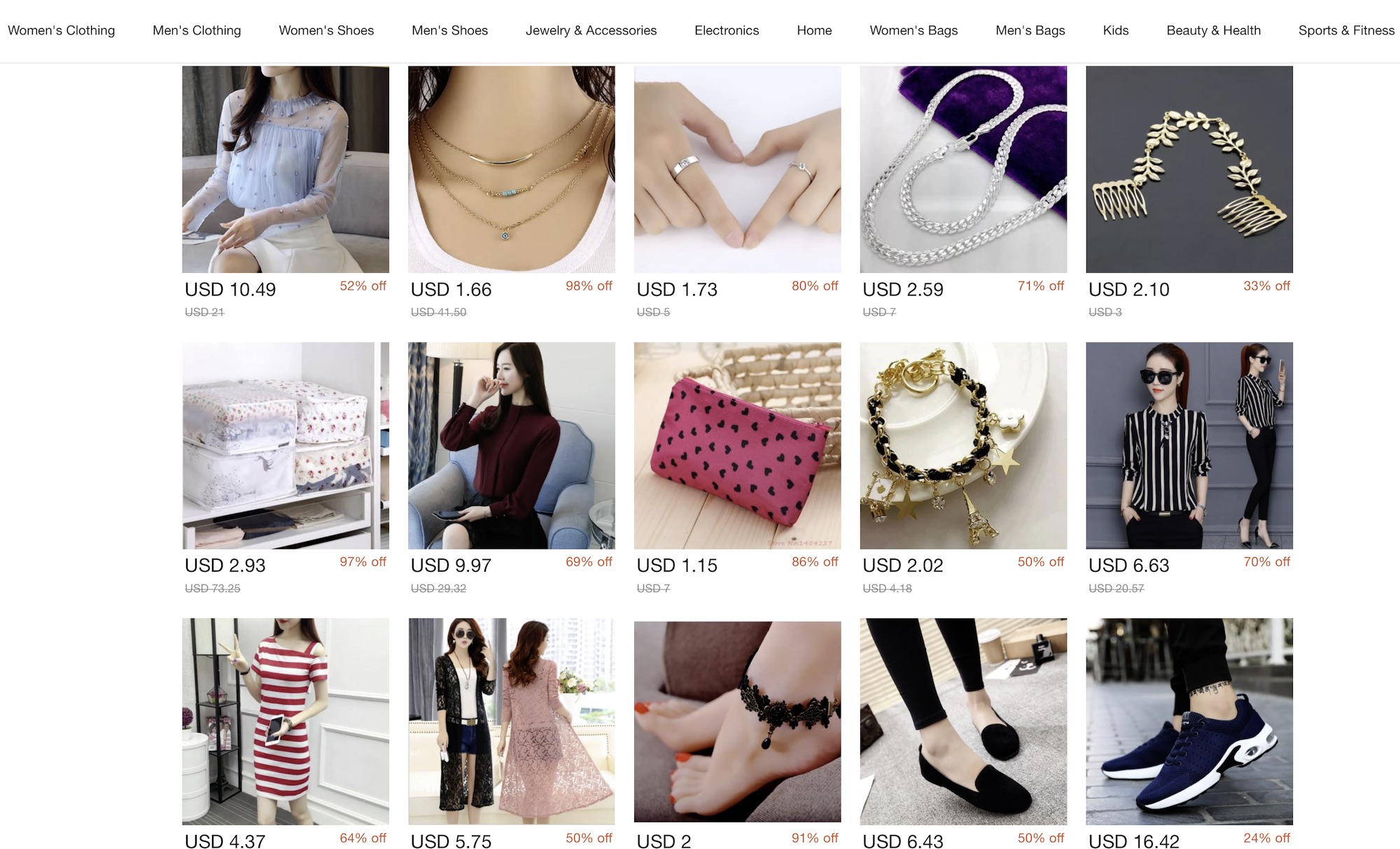

Club Factory, a Chinese e-commerce platform that sells fashion and beauty items and electronics accessories, has raised $100 million in a new financing round as it looks to expand its footprint in India.

The new financing round — Series D — was led by Qiming Venture Partners, Bertelsmann, IDG Capital “and other Fortune 500 companies from the U.S. and Asia,” the five-year-old Hangzhou-headquartered startup said. Club Factory, which raised $100 million in its previous financing round early last year, has raised about $220 million to date.

Club Factory has amassed more than 70 million users on its platform, of which about 40 million live in India. The startup cited figures from app analytics firm App Annie to claim that Club Factory is now the third-largest e-commerce platform in India, surpassing once a market-leader Snapdeal.

Club Factory does not charge local sellers any commission fee, incentivizing them to cut down the cost of their items and expand offerings. The number of sellers on its platform in India has grown by 10X in the last six months, the startup claimed. Club Factory, which has about 5,000 sellers in India, plans to double that figure by year-end, it said.

A screenshot of Club Factory’s homepage

“At the same time, we have also pioneered to strengthen the ‘store-within-platform’ concept in India’s e-commerce industry, allowing direct contact between buyers and sellers through our application,” said Vincent Lou, co-founder and chief executive of Club Factory, in a statement.

He added, “We have changed the status of the Indian e-commerce industry that monopolized information of buyers and sellers, allowing SMEs to own their customers and run their business better. All this, combined with our strategy to reduce the transaction costs of buyers and sellers and allow more local players to enter the ecosystem, has worked very well for us in India.”

The startup said in the coming months it will also bulk up more items on its platform and introduce new product categories.

Powered by WPeMatico

Clari uses AI to help companies find key information like the customers most likely to convert, the state of orders in the sales process or the next big sources of revenue. As its revenue management system continues to flourish, the company announced a $60 million Series D investment today.

Sapphire Ventures led the round with help from newcomer Madrona Venture Group and existing investors Sequoia Capital, Bain Capital Ventures and Tenaya Capital. Today’s investment brings the total raised to $135 million, according to the company.

The valuation, which CEO and co-founder Andy Byrne pegged at around a half a billion, appears to be a hefty raise from what the company was likely valued at in 2018 after its $35 million Series C. As TechCrunch’s Ingrid Lunden wrote at the time:

For some context, Clari, according to Pitchbook, had a relatively modest post-money valuation of $83.5 million in its last round in 2014, so my guess is that it’s now comfortably into hundred-million territory, once you add in this latest $35 million.

Byrne says the company wasn’t even really looking for a new round, but when investors came knocking, he couldn’t refuse. “On the fundraise side, what’s really interesting is how this whole thing went down. We weren’t out looking, but we had a massive amount of interest from a lot of firms. We decided to engage, and we got it done in less than three weeks, which the board was kind of blown away by,” Byrne told TechCrunch.

What’s motivating these companies to invest is that Clari is helping to define this revenue operations category, and has attracted companies like Okta, Zoom and Qualtrics as customers. What they are providing is this AI-fueled way to see where the best sales opportunities are to drive revenue, and that’s what every company is looking for. At the same time, Byrne says that he’s moving companies away from a spreadsheet-driven record keeping system, enabling them to see all of the data in one place.

“Clari is allowing a rep to really understand where they should spend time, automating a lot of things for them to close deals faster, while giving managers new insights they’ve never had before to allow them to drive more revenue. And then we’re getting them out of ‘Excel hell.’ They’re no longer in these spreadsheets. They’re in Clari, and have more predictability in their forecasting,” he said.

Clari was founded in 2012 and is headquartered in Sunnyvale, Calif. It has more than 300 customers and just passed the 200 employee mark, a number that should increase as the company uses this money to begin to accelerate growth and expand the product’s capabilities.

Powered by WPeMatico

The reMarkable tablet is a strange device in this era of ultra-smart gadgets: A black and white screen meant for reading, writing, and sketching — and nothing more. Yet the company has sold 100,000 of the devices and now has attracted $15 million in series A funding from Spark Capital.

It’s an unusual trajectory for a hardware startup exploring a nearly unoccupied market, but CEO Magnus Wanberg is confident that’s because this category of device is destined to grow in response to increasingly invasive tech. Sometimes an anti-technology trend is the tech opportunity of a lifetime.

I reviewed the reMarkable last year and compared it with its only real competition, the Sony Digital Paper Tablet. It was launched not on Kickstarter or Indiegogo but with its own independent crowdfunding campaign — and considering we’ve seen devices like this attempt such a thing and either let down or rip off their backers, that alone was a significant risk.

The device has been a runaway success, though, selling over 100,000 units — and attracting investment in the process. When I talked with Wanberg and co-founder Gerst about their new A round, the conversation was so interesting that I decided to publish it in full (or at least slightly edited).

How did they get here? What would they have done differently? Is the threat of the “smart” world really a thing? Why fight tech with more tech?

Devin: So you guys raised some money, that’s great! But it’s been a while since we talked. I think it’s important to hear about the progress of unique companies that are doing interesting things. So first can you tell me a little about what the company’s been busy with?

Magnus: Well, we’ve created this wonderful product, the reMarkable paper tablet. We’ve been very focused on that effort, based on a love for paper and a love for technology, to see if we can find some ways to join these two together to help people think better. That’s sort of the the whole ethos of the company.

So for the last six years, we’ve just been grinding away… you know, we’re a small player up against the big guys on this. So we’ve been sort of fighting guerrilla warfare trying to trying to establish ourselves.

And we were successful, fortunately, when we did our pre-order campaign, because as we found out, we weren’t the only ones who who love this notion of thinking better with the paper tablet, seeing paper as a powerful tool for thinking and for creating.

Powered by WPeMatico

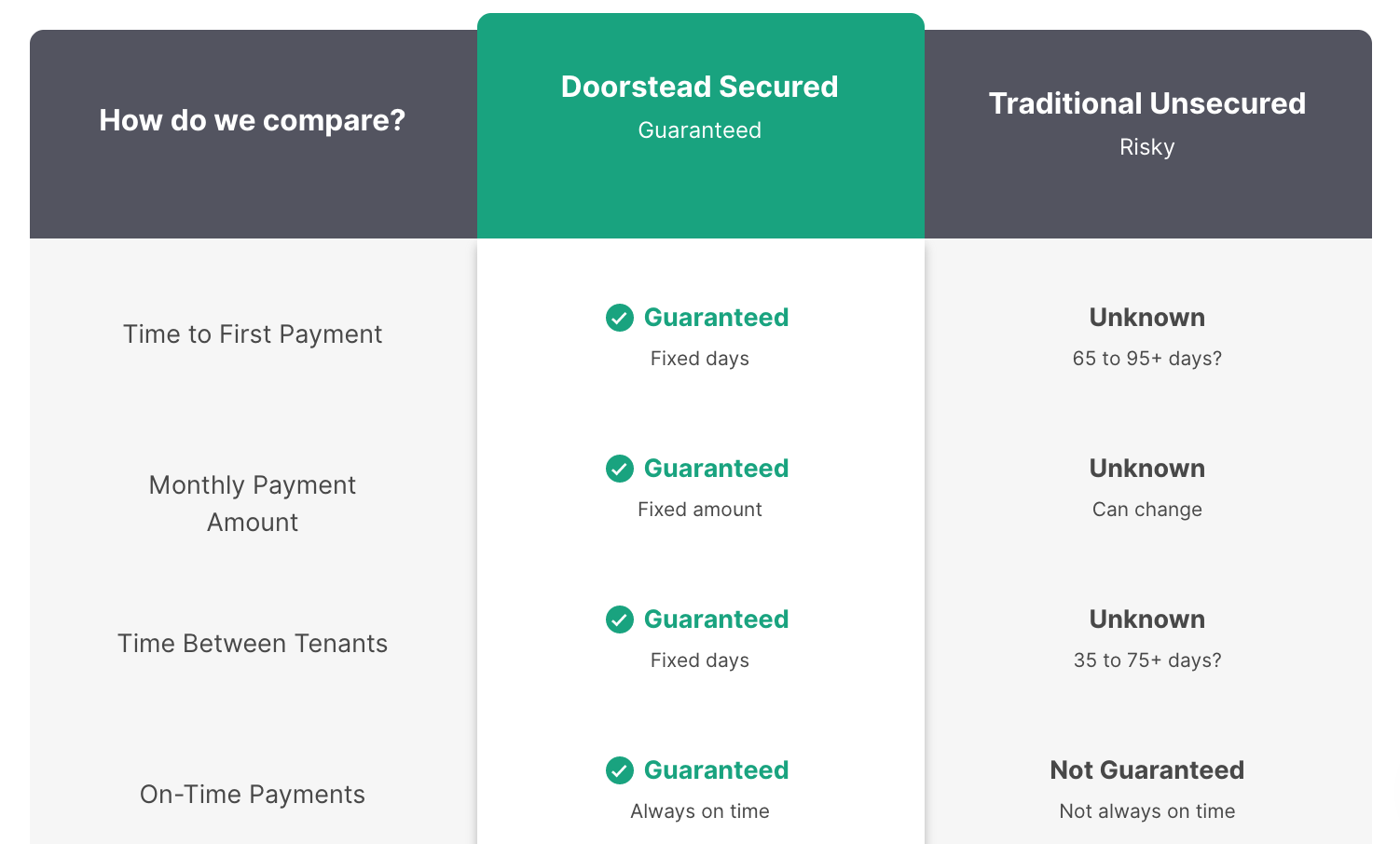

Missing out on a month’s rent because you can’t find a tenant is a huge loss. Searching for someone to fill a home takes work, while property managers are incentivized to price your place too high, leading to costly vacancies.

But new startup Doorstead wants to take on the risk and the work for you. It acts as a property manager for single-family homes, but guarantees you rent at a specific rate starting in a certain number of days, even if it can’t fill the house or apartment. It also handles all the algorithmic pricing, advertising, tenant interviews, repairs, maintenance, leases and online payments in exchange for 8% of rent. Owners just sit back and receive the money, making it much easier to profit off of distant real estate. The startup claims to earn users 3% to 9% more than other property management models.

Doorstead’s approach to the hot sector of “iRenting” has attracted a $3.3 million seed round co-led by M13 and Silicon Valley Data Capital, and joined by Venture Reality Fund and SOMA Capital. They’re betting on co-founders Jennifer Bronzo, whose parents ran a construction and property management firm, and Ryan Waliany, who worked in product at Uber after his recipe platform Kitchenbowl was acqui-hired.

Doorstead co-founders (from left): Jennifer Bronzo and Ryan Waliany

“I grew up going to job sites and learning about construction,” Bronzo says. “In the recent decade, my family purchased a lot of properties in the Bay and they needed help filling capacity. I saw so many opportunities in property management because of how antiquated the industry is.” Doorstead is now operating in five cities around the San Francisco Bay Area.

As consumers grow accustomed to zero-friction services, that approach is branching into bigger and bigger sectors like the trillions paid for long-term rentals. Waliany, Doorstead’s CEO, tells me, “We’re in the process of Uber’izing each step of the property management life cycle.” The startup is hoping to become the OpenDoor of rentals.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

From there, the startup does approved maintenance and cleaning as necessary, and then methodically lists the home on all the top rental platforms. It handles open house walk-throughs and runs background checks on potential tenants to find who will most reliably pay rent. Doorstead prepares a lease and gets it signed by a tenant, but even if it doesn’t, owners still get their guaranteed payments. Rent is collected online, and if a move-out or eviction is necessary, Doorstead takes care of the transition to finding a new tenant.

There’s plenty of margin for Doorstead to earn if it can consistently fill homes faster. Most property managers charge at least 50% of the first month’s rent, but instead, Doorstead keeps all the rent of any extra days if it fills the spot before the guaranteed due date. From there, it charges 8% of monthly rent with no tenant placement fee, which is close to or under the common 10% fee on single-family home property management. And if it manages to secure a higher rate from tenants than its guarantee, it gives 70% to the owner.

Doorstead claims to be less risky than alternatives

“Property management incumbents have a 43-day vacancy average which leads to $86 billion in economic waste in the U.S. alone,” Waliany tells TechCrunch. “This means that landlords could earn the same money and lower rents by 12% for tenants with an efficient market.”

With Doorstead, even if the owner lives far away, the turn-key service lets them efficiently rent their home. That’s not only important to them, but to overcrowded cities like San Francisco that often see apartments left vacant by overseas owners because they’re too much effort to rent out. To date, Doorstead’s algorithm has allowed it to recoup 100% of its guarantees and it’s shooting to stay above 90%, while maintaining its NPS of 80.

But if the startup is working that well, it’s only a matter of time until incumbents try to barge in.

“It would be a no brainer for Airbnb to enter this market and Zillow to open this,” Waliany admits, given their existing pricing algorithms and popularity as rental destinations. But Bronzo says “the biggest barrier is the operations piece that an Airbnb and Zillow haven’t stepped into.” It would be a big departure from their lean software-based marketplaces. Other property management startups like Mynd, OneRent and BelongHome only offer guaranteed rent once tenants are found, absolving themselves of most of the risk. They’d have to take on a more precarious business model.

What about Zeus, Sonder and Lyric, which offer property management of homes they then use for corporate housing or as boutique hotels? “An owner of ours considered Zeus versus Doorstead and went with Doorstead because: 1) our offer was ~12% higher, and 2) they didn’t want the wear-and-tear that comes with having people move in and out of the property every few days or few months,” Waliany explains. “Sonder and Lyric have 300 move-in and move-outs over a six-year period. Doorstead has ~4 move ins/outs and that results in significantly less wear-and-tear and a much easier operations to manage. Not only that, the long-term rental market is 42x larger and has 12x more addressable revenue.” Doorstead will have to build a brand and product moat to defend against inevitable direct competition.

As iRenting is still a fresh concept, Waliany warns that “with any new business model, there will inevitably be ‘unknown unknowns’ that we cannot predict, black swan events and things that we might only be able to learn through calculated bets.” Luckily, because it doesn’t hold the leases for very long, and home rentals typically increase in an economic downturn, Doorstead’s liability is manageable in the event of a recession or other crisis.

“There are three large trillion-dollar industries — food, transportation and housing. At Doorstead, we have an opportunity to completely redefine the housing value chain by creating a new class of property management that eliminates unnecessary vacancies. In the end, this redefinition of the value chain allows ourselves to become the Blackstone of the future,” Waliany concludes. “It seems like we’re giving everyone free money.” That will prove either the startup’s downfall or a powerful growth tactic.

Powered by WPeMatico