FirstMark Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

Loop Returns, the startup that helps brands handle returns from online purchases, has today announced the close of a $10 million Series A funding round led by FirstMark Capital. Lerer Hippeau and Ridge Ventures also participated in the round.

Loop started when Jonathan Poma, a co-founder and COO and president, was working at an agency and consulting with a big Shopify brand on how to improve their system for returns and exchanges. After partnering with longtime friend Corbett Morgan, Loop Returns was born.

Loop sits on top of Shopify to handle all of a brand’s returns. It first asks the customer if they’d like a different size in the item they bought, quickly managing an exchange. It then asks if the customer would prefer to exchange for a new item altogether, depositing the credit in that person’s account in real time so they can shop for something new immediately.

If an exchange isn’t in the cards, Loop will ask the customer if they’d prefer credit with this brand over a straight-up refund.

The goal, according to Poma and Morgan, is to turn the point of return into a moment where brands can create a life-loyal customer when handled quickly and properly.

The more we shop online, the more brands extend themselves financially, and returns are a big part of that. Returns account for 20 to 30% of e-commerce sales, which can become a terrible financial burden on a growing direct-to-consumer brand. And what’s more, the cost of acquiring those users in the first place also goes down the drain.

Loop Returns hopes to keep that customer in the fold by giving them post-purchase options that are more sticky and more lucrative for the brand than a refund.

The company thinks of it as Connection Infrastructure. Most brands already have a customer acquisition architecture, and Shopify and Amazon are ahead when it comes to the infrastructure around customer convenience. But the ties that bind customers to brands haven’t been optimized for the many D2C brands out there looking to make an impact.

“The big problem we’re trying to solve long term is connection infrastructure,” said Morgan. “Why does this brand matter? Why does it mean something to me? Why does the product matter? We want to enforce more mindfulness and meaning into buying.”

Of course, a more mindful shopper doesn’t yield as many returns. Poma and Morgan admit that the goal of their software is to minimize returns, the very reason for the software’s existence. After all, return volume is one of a handful of variables that help Loop Returns determine what it will charge its brand clients.

But the team is thinking about other layers of the connection infrastructure, with plans to launch a product in 2020 that also focuses on the connection point after purchase. Poma and Morgan believe, with an almost religious reverence, that the brands themselves will help lead shoppers and infrastructure providers to a better, more connected shopping experience.

“Brands are the torch bearers,” said Poma. “They will lead us to a more enlightened era of how we think about buying. Empowerment of the brand will lead us to a better consumerism.”

The co-founders stayed mum on any specific plans for the 2020 product, but did say they will use the funding to expand operations and further build out its current and future products.

Of course, Loop is playing in a crowded space. Not only are there other players thinking about post-purchase connection, but Shopify has itself built out tools to help with exchanges and returns, and even acquired Return Magic, a similar service, in the summer of 2018.

That said, Loop Returns believes there is a long way to go as it builds the “connection infrastructure,” and that one clear path forward is actual personalization. With data from returns and exchanges, Loop Returns is relatively well-positioned to take on personalization in a meaningful way.

For now, Loop Returns has more than 200 customers and has handled more than 2 million returns, working with brands like Brooklinen, Allbirds, PuraVida and more.

Powered by WPeMatico

When Crossbeam CEO and co-founder Bob Moore was working at previous startups, he noticed a problem around sharing information with potential partners. In fact, it was so acute he decided to create a startup to solve that problem, and today, Crossbeam announced a $12.5 million Series A round led by FirstMark Capital, with participation from existing investors Uncork Capital and Slack Fund.

Moore says that in his previous jobs, he was encountering issues with getting partners integrated and answering basic questions like how many customers do we have in common or are my sales reps currently selling to any of the same people that your sales reps are selling to, and so forth.

“We eventually realized the reason these questions were hard to answer was that you can’t draw a Venn diagram of all the data unless you have all of the data in both of the circles,” Moore told TechCrunch. In other words, each company has only half of the picture, what they already know, and it’s hard to make data-driven decisions without more information.

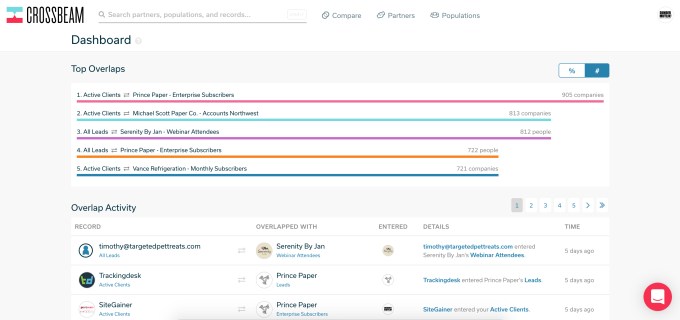

Crossbeam Summary Dashboard (Screenshot: Crossbeam)

He added that there is danger in the age of GDPR and the upcoming California Consumer Privacy Act (CCPA) in oversharing of data, but at the other extreme is not sharing at all. Moore said he created Crossbeam to deal with this. “It seemed like the solution would be to build something that could almost function as an escrow service for data, which could sit between companies that are partnering with each other, and allow them to combine their data sets and identify that when certain conditions are met — like an overlapping need, or an overlapping customer — to take very specific precise actions as a result of that overlap,” Moore explained.

The product works by sharing data from tools like Salesforce, HubSpot or even a .csv file and comparing that data inside of Crossbeam. Partners can see the overlap and where it makes sense for them to work together. Sometimes that may involve customer names, but other times it may be common sales reps across accounts. He says that many companies start with highly trusted partners to get comfortable with the product before branching out.

The company, which was founded in July 2018, has 15 employees and is based in Philadelphia. It previously received a $3.3 million seed round at the end of 2018.

Powered by WPeMatico

Gaming continues to grow in popularity, with esports revenue growing 23% from last year to top $1 billion in 2019.

But the metrics by which talent is evaluated in gaming, and the methods by which gamers can train to better hone their craft, are varied and at times non-existent. That’s where Statespace, and specifically the company’s gaming arm Klutch, come into play.

In 2017, Statespace launched out of stealth with their first product, Aim Lab. Aim Lab is meant to mimic the physical rules of a game to give gamers a practice space where they can improve their skills. Moreover, Aim Lab identifies weaknesses in a player’s gameplay — one person might struggle with their visual acuity in the top-left quadrant of the screen, while another might have trouble spotting or aiming at targets on the bottom-right side of the screen — and allows gamers to focus in on their weaknesses to get better.

Today, the company has announced a $2.5 million seed funding round led by FirstMark Capital, with participation from Expa, Lux Capital and WndrCo. This brings the company’s total funding to $4 million.

Alongside growing Aim Lab, which is on track to soon reach 1 million users, one of the company’s main goals is to create a standardized metric by which gamers’ skills can be measured. In football, college athletes and NFL coaches have the Scouting Combine to make decisions around recruiting. This doesn’t necessarily take into account stats like yardage or touchdowns, but rather the raw skills of a player, such as 40-yard sprint speed.

In fact, Statespace has partnered with the Pro Football Hall of Fame for “The Cognitive Combine,” becoming the official integrative medicine program cognitive assessment partner of the organization. Statespace wants to create a similar “combine” for gaming.

The hope is that the company can offer this metric to publishers, colleges and esports orgs, giving them the ability to not only evaluate talent, but to better serve casual users through improved matchmaking and cheat detection.

“We want to go a level beyond your kill:death ratio,” said co-founder and CEO Dr. Wayne Mackey. Those metrics greatly depend on factors like who you’re playing with. You won’t always be matched against players who are on an even keel with you. So we want to look at fundamental skills like hand-eye coordination, visual acuity, spatial processing skills and working memory capacity.”

Klutch has partnered with the National Championship Series as the official FPS training partner for 2019. NCS has majors for both CS:Go and Overwatch, two of the biggest competitive FPS games in the world. The company is also partnering with top Twitch streamers and Masterclass to create The Academy.

Academy users will be able to get advanced tutorials from streamers like KingGeorge (Rainbox Six Siege), SypherPK (Fortnite), Valkia (Overwatch), Drift0r (CoD) and Launders (CS:GO).

Obviously, gaming is a major part of Statespace’s business model. But the skeleton of the technology has a number of different applications, particularly in medicine. Statespace is currently in the research phase of rolling out an Aim Lab product that is specifically focused on helping people who have had strokes recover and rehabilitate.

Statespace wants to use the funding to build out the team and expand the Klutch Aim Lab platform beyond Steam to mobile and eventually console, with Xbox prioritized over PlayStation, as well as launching the Academy.

Powered by WPeMatico

Text IQ, a machine learning system that parses and understands sensitive corporate data, has raised $12.6 million in Series A funding led by FirstMark Capital, with participation from Sierra Ventures.

Text IQ started as co-founder Apoorv Agarwal’s Columbia thesis project titled “Social Network Extraction From Text.” The algorithm he built was able to read a novel, like Jane Austen’s “Emma,” for example, and understand the social hierarchy and interactions between characters.

This people-centric approach to parsing unstructured data eventually became the kernel of Text IQ, which helps corporations find what they’re looking for in a sea of unstructured, and highly sensitive, data.

The platform started as a tool used by corporate legal teams. Lawyers often have to manually look through troves of documents and conversations (text messages, emails, Slack, etc.) to find specific evidence or information. Even using search, these teams spend loads of time and resources looking through the search results, which usually aren’t as accurate as they should be.

“The status quo for this is to use search terms and hire hundreds of humans, if not thousands, to look for things that match their search terms,” said Agarwal. “It’s super expensive, and it can take months to go through millions of documents. And it’s still risky, because they could be missing sensitive information. Compared to the status quo, Text IQ is not only cheaper and faster but, most interestingly, it’s much more accurate.”

Following success with legal teams, Text IQ expanded into HR/compliance, giving companies the ability to retrieve sensitive information about internal compliance issues without a manual search. Because Text IQ understands who a person is relative to the rest of the organization, and learns that organization’s “language,” it can more thoroughly extract what’s relevant to the inquiry from all that unstructured data in Slack, email, etc.

More recently, in the wake of GDPR, Text IQ has expanded its product suite to work in the privacy realm. When a company is asked by a customer to get access to all their data, or to be forgotten, the process can take an enormous amount of resources. Even then, bits of data might fall through the cracks.

For example, if a customer emailed Customer Service years ago, that might not come up in the company’s manual search efforts to find all of that customer’s data. But because Text IQ understands this unstructured data with a person-centric approach, that email wouldn’t slip by its system, according to Agarwal.

Given the sensitivity of the data, Text IQ functions behind a corporation’s firewall, meaning that Text IQ simply provides the software to parse the data rather than taking on any liability for the data itself. In other words, the technology comes to the data, and not the other way around.

Text IQ operates on a tiered subscription model, and offers the product for a fraction of the value they provide in savings when clients switch over from a manual search. The company declined to share any further details on pricing.

Former Apple and Oracle General Counsel Dan Cooperman, former Verizon General Counsel Randal Milch, former Baxter International Global General Counsel Marla Persky and former Nationwide Insurance Chief Legal and Governance Officer Patricia Hatler are on the advisory board for Text IQ.

The company has plans to go on a hiring spree following the new funding, looking to fill positions in R&D, engineering, product development, finance and sales. Co-founder and COO Omar Haroun added that the company achieved profitability in its first quarter entering the market and has been profitable for eight consecutive quarters.

Powered by WPeMatico

TechCrunch’s Connie Loizos published some interesting stats on seed and Series A financings this week, courtesy of data collected by Wing Venture Capital. In short, seed is the new Series A and Series A is the new Series B. Sure, we’ve been saying that for a while, but Wing has some clean data to back up those claims.

Years ago, a Series A round was roughly $5 million and a startup at that stage wasn’t expected to be generating revenue just yet, something typically expected upon raising a Series B. Now, those rounds have swelled to $15 million, according to deal data from the top 21 VC firms. And VCs are expecting the startups to be making money off their customers.

“Again, for the old gangsters of the industry, that’s a big shift from 2010, when just 15 percent of seed-stage companies that raised Series A rounds were already making some money,” Connie writes.

As for seed, in 2018, the average startup raised a total of $5.6 million prior to raising a Series A, up from $1.3 million in 2010.

Now on to IPO updates, then a closer look at all the companies raising big rounds. Want more TechCrunch newsletters? Sign up here. Contact me at kate.clark@techcrunch.com or @KateClarkTweets.

![]()

Slack: The workplace communication software provider dropped its S-1 on Friday ahead of a direct listing. That’s when companies sell existing shares directly to the market, allowing them to skip the roadshow and minimize the astronomical fees typically associated with an initial public offering. Here’s the TLDR on financials: Slack reported revenues of $400.6 million in the fiscal year ending January 31, 2019, on losses of $138.9 million. That’s compared to a loss of $140.1 million on revenue of $220.5 million for the year before. Slack’s losses are shrinking (slowly), while its revenues expand (quickly). It’s not profitable yet, but is that surprising?

Zoom was the Slack we thought Slack was all along.

— alex (PVD) (@alex) April 26, 2019

Uber: The ride-hail giant is fast approaching its IPO, expected as soon as next week. On Friday, the company established an IPO price range of $44 to $50 per share to raise between $7.9 billion and $9 billion at a valuation of approximately $84 billion, significantly lower than the $100 billion previously reported estimations. The most likely outcome is Uber will price above range and all the latest estimates will be way off course. Best to sit back and see how Uber plays it. Oh, and PayPal said it would make a $500 million investment in the company in a private placement, as part of an extension of the partnership between the two.

There are a lot of fascinating companies raising colossal rounds, so I thought I’d dive a bit deeper than I normally do. Bear with me.

Carbon: The poster child for 3D printing has authorized the sale of $300 million in Series E shares, according to a Delaware stock filing uncovered by PitchBook. If Carbon raises the full amount, it could reach a valuation of $2.5 billion. Using its proprietary Digital Light Synthesis technology, the business has brought 3D-printing technology to manufacturing, building high-tech sports equipment, a line of custom sneakers for Adidas and more. It was valued at $1.7 billion by venture capitalists with a $200 million Series D in 2018.

Canoo: The electric vehicle startup formerly known as Evelozcity is on the hunt for $200 million in new capital. Backed by a clutch of private individuals and family offices from China, Germany and Taiwan, the company is hoping to line up the new capital from some more recognizable names as it finalizes supply deals with vendors, according to reporting from TechCrunch’s Jonathan Shieber. The company intends to make its vehicles available through a subscription-based model and currently has 400 employees. Canoo was founded in 2017 after Stefan Krause, a former executive at BMW and Deutsche Bank, and another former BMW executive, Ulrich Kranz, exited Faraday Future amid that company’s struggles.

Starry: The Boston-based wireless broadband internet startup has authorized the sale of Series D shares worth up to $125 million, according to a Delaware stock filing. If Starry closes the full authorized raise it will hold a post-money valuation of $870 million. A spokesperson for the company confirmed it had already raised new capital, but disputed the numbers. The company has already raised more than $160 million from investors, including FirstMark Capital and IAC. The company most recently closed a $100 million Series C this past July.

Selina & Sonder: The Airbnb competitor Sonder is in the process of closing a financing worth roughly $200 million at a $1 billion valuation, reports The Wall Street Journal. Investors including Greylock Partners, Spark Capital and Structure Capital are likely to participate. Sonder is four years old but didn’t emerge from stealth until 2018. The startup, which turns homes into hotels, quickly attracted more than $100 million in venture funding. Meanwhile, another hospitality business called Selina has raised $100 million at an $850 million valuation. The company, backed by Access Industries, Grupo Wiese and Colony Latam Partners, builds living/co-working/activity spaces across the world for digital nomads.

Fresh funds: Mary Meeker has made history with the close of her new fund, Bond Capital, the largest VC fund founded and led by a female investor to date. Bond has $1.25 billion in committed capital. If you remember, Meeker ditched Kleiner Perkins last fall and brought the firm’s entire growth team with her. Kleiner said it was a peaceful split that would allow the firm to focus more on its early-stage efforts, leaving the growth investing to Bond. Fortune, however, reported this week that a power struggle of sorts between Meeker and Mamoon Hamid, who joined recently to reenergize the early-stage side of things, was a larger cause of her exit.

Plus, SOSV, a multi-stage venture firm that was founded as the personal investment vehicle of entrepreneur Sean O’Sullivan after his company went public in 1994, has raised $218 million for its third fund. The vehicle has a $250 million target that SOSV expects to meet. Already, the fund is substantially larger than the firm’s previous vehicle, which closed with $150 million.

A grocery delivery startup crumbles: Honestbee, the online grocery delivery service in Asia, is nearly out of money and trying to offload its business. Despite looking impressive from the outside, the company is currently in crisis mode due to a cash crunch — there’s a lot happening right now. TechCrunch’s Jon Russell dives in deep here.

Extra Crunch: “When it comes to working with journalists, so many people are, frankly, idiots. I have seen reporters yank stories because founders are assholes, play unfairly, or have PR firms that use ridiculous pressure tactics when they have already committed to a story.” Sign up for Extra Crunch for a full list of PR don’ts. Here are some other EC pieces to hit the wire this week:

Equity: If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about Kleiner Perkins, Chinese IPOs and Slack & Uber’s upcoming exits.

Powered by WPeMatico

Pinterest priced shares of its stock, “PINS,” above its anticipated range on Wednesday evening, CNBC reports. The company will sell 75 million shares of Class A common stock at $19 apiece in an offering that will attract $1.4 billion in new capital for the visual search engine.

The NYSE-listed business had planned to sell its shares at between $15 to $17 and didn’t increase the size of its planned offering prior to Wednesday’s pricing.

Valued at $12.3 billion in 2017, the initial public offering gives Pinterest a fully diluted market cap of $12.6 billion.

The IPO has been a long time coming for the nearly 10-year-old company led by co-founder and chief executive officer Ben Silbermann . Given Wall Street’s lackluster demand for ride-hailing company Lyft, another consumer technology stock that recently made its Nasdaq debut, it’s unclear just how well Pinterest will perform in the days, weeks, months and years to come. Pinterest is unprofitable like its fellow unicorns Lyft and Uber, but its financials, disclosed in its IPO prospectus, illustrate a clear path to profitability. As for Lyft and Uber, Wall Street analysts, among others, still question whether either of the businesses will ever achieve profitability.

Eric Kim of consumer tech investment firm Goodwater Capital says despite the fact that Pinterest and Lyft are very different companies, Lyft’s falling stock has undoubtedly impacted Pinterest’s offering.

“They are so close together, it’s hard for those not to influence one another,” Kim told TechCrunch. “It’s a much different category, but they are still both consumer tech and they will both be trading at a double-digital revenue multiple.

The San Francisco-based company posted revenue of $755.9 million in the year ending December 31, 2018 — 16 times less than its latest decacorn valuation — on losses of $62.9 million. That’s up from $472.8 million in revenue in 2017 on losses of $130 million.

The stock offering represents a big liquidity event for a handful of investors. Pinterest had raised a modest $1.47 billion in equity funding from Bessemer Venture Partners, which holds a 13.1 percent pre-IPO stake, FirstMark Capital (9.8 percent), Andreessen Horowitz (9.6 percent), Fidelity Investments (7.1 percent) and Valiant Capital Partners (6 percent). Bessemer’s stake is worth upwards of $1 billion. FirstMark and a16z’s shares will be worth more than $700 million each.

Zoom — another tech company going public on Thursday that, unlike its peers, is actually profitable — priced its shares on Wednesday too after increasing the price range of its IPO earlier this week. The price values Zoom at roughly $9 billion, nearly surpassing Pinterest, an impressive feat considering Zoom was last valued at $1 billion in 2017 around when Pinterest’s Series H valued it at a whopping $12.3 billion.

Profitability, as it turns out, may mean more to Wall Street than Silicon Valley thinks.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

What a Friday. This afternoon (mere hours after we released our regularly scheduled episode no less!), both Pinterest and Zoom dropped their public S-1 filings. So we rolled up our proverbial sleeves and ran through the numbers. If you want to follow along, the Pinterest S-1 is here, and the Zoom document is here.

Got it? Great. Pinterest’s long-awaited IPO filing paints a picture of a company cutting its losses while expanding its revenue. That’s the correct direction for both its top and bottom lines.

As Kate points out, it’s not in the same league as Lyft when it comes to scale, but it’s still quite large.

More than big enough to go public, whether it’s big enough to meet, let alone surpass its final private valuation ($12.3 billion) isn’t clear yet. Peeking through the numbers, Pinterest has been improving margins and accelerating growth, a surprisingly winsome brace of metrics for the decacorn.

Pinterest has raised a boatload of venture capital, about $1.5 billion since it was founded in 2010. Its IPO filing lists both early and late-stage investors, like Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity and Valiant Capital Partners as key stakeholders. Interestingly, it doesn’t state the percent ownership of each of these entities, which isn’t something we’ve ever seen before.

Next, Zoom’s S-1 filing was more dark horse entrance than Katy Perry album drop, but the firm has a history of rapid growth (over 100 percent, yearly) and more recently, profit. Yes, the enterprise-facing video conferencing unicorn actually makes money!

In 2019, the year in which the market is bated on Uber’s debut, profit almost feels out of place. We know Zoom’s CEO Eric Yuan, which helps. As Kate explains, this isn’t his first time as a founder. Nor is it his first major success. Yuan sold his last company, WebEx, for $3.2 billion to Cisco years ago then vowed never to sell Zoom (he wasn’t thrilled with how that WebEx acquisition turned out).

Should we have been that surprised to see a VC-backed tech company post a profit — no. But that tells you a little something about this bubble we live in, doesn’t it?

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

According to Parsley Health, the average adult spends 19 minutes with their physician every year. Seventy percent of the time, these short visits result in the prescription of a medication.

“According to the CDC, 70% of diseases in our country are chronic and lifestyle-driven,” said Parsley Health founder and CEO Dr. Robin Berzin. “And yet instead of addressing the root causes of health problems, medicine’s toolkit is limited to prescriptions and procedures, driving up costs while the average person gets sicker. The answer isn’t just another pill.”

Parsley Health, an annual membership service ($150/month), reimagines what medicine can be. The company focuses on the cause of an illness rather than simply throwing Band-Aids at the problem. But in order to do this, your doctor needs far more than 19 minutes of your time each year.

Today, Parsley announced the close of a $10 million Series A funding led by FirstMark Capital, with participation from Amplo, Trail Mix Ventures, Combine and The Chernin Group. Individual investors such as Dr. Mark Hyman, M.D., director of the Cleveland Clinic Center for Functional Medicine; Nat Turner, CEO of Flatiron Health; Neil Parikh, co-founder of Casper; and Dave Gilboa, co-founder of Warby Parker, also invested in the round.

As part of the financing, FirstMark Capital partner Catherine Ulrich will join the board.

Here’s how Parsley works:

When a user first signs up online, they enter in a wide range of data about themselves, from family health history to past procedures to symptoms and lifestyle. The user then schedules their first visit with their new doctor, which will last for 75 minutes, during which time the doctor will exhaustively go through that information to download a full picture of that patient’s health.

After that visit, the user has full transparency into their medical data and the doctor’s notes. The patient also leaves with a health plan, including lifestyle nutritional advice, and access to their own health coach. Parsley also writes prescriptions, when necessary, and refers patients to top-of-the-line specialists, if needed.

Membership includes five annual visits with their doctors (which rounds out to about four hours), as well as five sessions with their certified health coach. These coaches help patients stay on their health plan, whether it’s advice on physical exercise or getting better sleep or finding take-out places and menu items near their office to eat healthier meals.

Throughout a patient’s membership, they have full access to their medical data and doctor’s notes online, as well as unlimited direct messaging with their doctor. At Parsley, there is always a doctor on call to answer questions about semi-urgent issues like a UTI or a sinus infection.

All of Parsley’s doctors and health coaches are full-time employees at Parsley, and Dr. Berzin told TechCrunch that the company sees a lot of inbound from doctors who want to spend more time with patients and help solve the root of their problems.

Parsley also trains their doctors in functional medicine, which uses a systems-biology approach to better resolve and manage modern chronic disease, as part of Parsley’s clinical fellowship, where they are trained in evaluating thousands of biomarkers to diagnose and treat diseases at their origin.

Parsley is not the first in the space. Forward and One Medical also look to change the way that healthcare is provided in this country, while NextHealth Technologies is focused on supplemental treatments like IV treatments and cryo.

“When I tell people about Parsley, they say ‘wow! That’s what medicine should be’,” said Dr. Berzin. “People are really searching for something better than feeling like they’re paying more and more for healthcare while getting less and less. People are excited to invest in their health and wellness and to have a team that’s working to care for them.”

Parsley has clinics in San Francisco, New York and Los Angeles.

Editor’s Note: An earlier version of this article incorrectly stated that Parsley Health costs $150/year.

Powered by WPeMatico

SelfMade brings professional photo editing to your phone — yes, literally. The startup, which is announcing that it has raised $11 million in funding, was founded by CEO Brian Schechter and CTO Zach Lloyd. Schechter was previously co-founder at IAC-acquired dating startup HowAboutWe, and he points to HowAboutWe as the starting point for his interest in photo editing. After all, he… Read More

SelfMade brings professional photo editing to your phone — yes, literally. The startup, which is announcing that it has raised $11 million in funding, was founded by CEO Brian Schechter and CTO Zach Lloyd. Schechter was previously co-founder at IAC-acquired dating startup HowAboutWe, and he points to HowAboutWe as the starting point for his interest in photo editing. After all, he… Read More

Powered by WPeMatico

FirstMark Capital is one of the most successful early-stage VCs in NYC. With investments in Airbnb, Frame.io, Shopify, Pinterest, InVision, and Brooklinen, among many others, the firm is now looking to grow its internal roster. Today, FirstMark Capital is announcing the addition of a new partner, Catherine Ulrich. Ulrich started out at Harvard, where she was the Coxswain for the men’s… Read More

FirstMark Capital is one of the most successful early-stage VCs in NYC. With investments in Airbnb, Frame.io, Shopify, Pinterest, InVision, and Brooklinen, among many others, the firm is now looking to grow its internal roster. Today, FirstMark Capital is announcing the addition of a new partner, Catherine Ulrich. Ulrich started out at Harvard, where she was the Coxswain for the men’s… Read More

Powered by WPeMatico