FirstMark Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

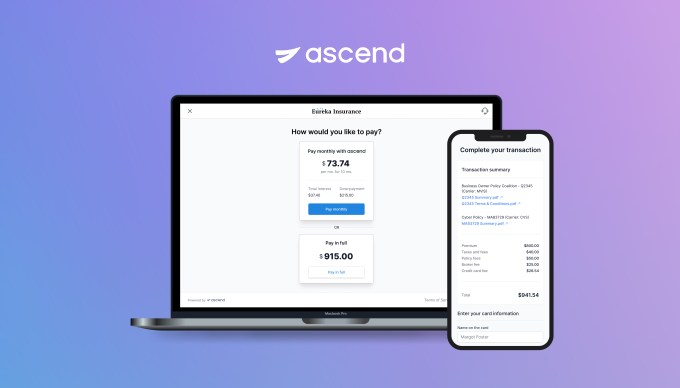

Ascend on Wednesday announced a $5.5 million seed round to further its insurance payments platform that combines financing, collections and payables.

First Round Capital led the round and was joined by Susa Ventures, FirstMark Capital, Box Group and a group of angel investors, including Coalition CEO Joshua Motta, Newfront Insurance executives Spike Lipkin and Gordon Wintrob, Vouch Insurance CEO Sam Hodges, Layr Insurance CEO Phillip Naples, Anzen Insurance CEO Max Bruner, Counterpart Insurance CEO Tanner Hackett, former Bunker Insurance CEO Chad Nitschke, SageSure executive Paul VanderMarck, Instacart co-founders Max Mullen and Brandon Leonardo and Houseparty co-founder Ben Rubin.

This is the first funding for the company that is live in 20 states. It developed payments APIs to automate end-to-end insurance payments and to offer a buy now, pay later financing option for distribution of commissions and carrier payables, something co-founder and co-CEO Andrew Wynn, said was rather unique to commercial insurance.

Wynn started the company in January 2021 with his co-founder Praveen Chekuri after working together at Instacart. They originally started Sheltr, which connected customers with trained maintenance professionals and was acquired by Hippo in 2019. While working with insurance companies they recognized how fast the insurance industry was modernizing, yet insurance sellers still struggled with customer experiences due to outdated payments processes. They started Ascend to solve that payments pain point.

The insurance industry is largely still operating on pen-and-paper — some 600 million paper checks are processed each year, Wynn said. He referred to insurance as a “spaghetti web of money movement” where payments can take up to 100 days to get to the insurance carrier from the customer as it makes its way through intermediaries. In addition, one of the only ways insurance companies can make a profit is by taking those hundreds of millions of dollars in payments and investing it.

Home and auto insurance can be broken up into payments, but the commercial side is not as customer friendly, Wynn said. Insurance is often paid in one lump sum annually, though, paying tens of thousands of dollars in one payment is not something every business customer can manage. Ascend is offering point-of-sale financing to enable insurance brokers to break up those commercial payments into monthly installments.

“Insurance carriers continue to focus on annual payments because they don’t have a choice,” he added. “They want all of their money up front so they can invest it. Our platform not only reduces the friction with payments by enabling customers to pay how they want to pay, but also helps carriers sell more insurance.”

Ascend app

Startups like Ascend aiming to disrupt the insurance industry are also attracting venture capital, with recent examples including Vouch and Marshmallow, which raised close to $100 million, while Insurify raised $100 million.

Wynn sees other companies doing verticalized payment software for other industries, like healthcare insurance, which he says is a “good sign for where the market is going.” This is where Wynn believes Ascend is competing, though some incumbents are offering premium financing, but not in the digital way Ascend is.

He intends to deploy the new funds into product development, go-to-market initiatives and new hires for its locations in New York and Palo Alto. He said the raise attracted a group of angel investors in the industry, who were looking for a product like this to help them sell more insurance versus building it from scratch.

Having only been around eight months, it is a bit early for Ascend to have some growth to discuss, but Wynn said the company signed its first customer in July and six more in the past month. The customers are big digital insurance brokerages and represent, together, $2.5 billion in premiums. He also expects to get licensed to operate as a full payment in processors in all states so the company can be in all 50 states by the end of the year.

The ultimate goal of the company is not to replace brokers, but to offer them the technology to be more efficient with their operations, Wynn said.

“Brokers are here to stay,” he added. “What will happen is that brokers who are tech-enabled will be able to serve customers nationally and run their business, collect payments, finance premiums and reduce backend operation friction.”

Bill Trenchard, partner at First Round Capital, met Wynn while he was still with Sheltr. He believes insurtech and fintech are following a similar story arc where disruptive companies are going to market with lower friction and better products and, being digital-first, are able to meet customers where they are.

By moving digital payments over to insurance, Ascend and others will lead the market, which is so big that there will be many opportunities for companies to be successful. The global commercial insurance market was valued at $692.33 billion in 2020, and expected to top $1 trillion by 2028.

Like other firms, First Round looks for team, product and market when it evaluates a potential investment and Trenchard said Ascend checked off those boxes. Not only did he like how quickly the team was moving to create momentum around themselves in terms of securing early pilots with customers, but also getting well known digital-first companies on board.

“The magic is in how to automate the underwriting, how to create a data moat and be a first mover — if you can do all three, that is great,” Trenchard said. “Instant approvals and using data to do a better job than others is a key advantage and is going to change how insurance is bought and sold.”

Powered by WPeMatico

As AI improves, the possibilities of what we can do with the technology grow exponentially (for better or worse). Synthesia, an AI video generation platform, is looking to make video content creation as simple and efficient as possible, and FirstMark is taking a bet on it making the world better, and not worse.

The company has just announced the close of a $12.5 million Series A funding round led by FirstMark Capital, with participation from angels Christian Bach (CEO, Netlify) and Michael Buckley (VP Communications, Twilio), as well as existing investors LDV Capital, MMC Ventures, Seedcamp, Mark Cuban, Taavet Hinrikus, Martin Varsavsky and TinyVC.

Though Synthesia’s technology could be applied to dozens of use cases, the startup is focused initially on educational content for organizations and enterprises. Think training videos and company- or department-wide video updates.

Here’s how it works: Users can choose from a library of existing actors (who get paid per video in which they appear) or upload their own video to create an avatar. To use their own voice and avatar, Synthesia walks them through instructions on what type of video and audio they should send in.

Users can then type in a script, add other components like text, images, shapes, etc. and ultimately generate the video without any video creation or editing skills whatsoever. It’s also super easy to update or edit the video without having to do any traditional video editing.

The startup is well aware of how this platform could be used nefariously, and has built in multiple layers of security and authentication to ensure that users are aware of how their avatar is being used in videos, with the ability to check the script or the video before it’s generated or published.

Not only can this platform be used for the dozen or so training and educational videos that a company deploys each year, but it can be used in more creative ways. The general principle is that video content is more compelling and engaging than text or other content. So imagine, say, that the weekly emails that come from your manager or CEO with updates on the business came in the form of video. With Synthesia, it’s super easy and low-cost to create that video quickly.

Synthesia has an entry-level plan, which costs $30 per month per seat and offers 10 minutes of video per month. The startup also has an enterprise-level plan that starts at $500 per month and comes with more video minutes and extra functionality.

The company plans to use the funding to fuel customer growth and product development.

Beyond the enterprise video platform, Synthesia is also working on an API that would allow organizations to hook the Synthesia tech into their own systems and distribute that video. Co-founder and CEO Victor Riparbelli showed an example where users could choose a stock and plug in a phone number that would automatically create a video with a daily stock price update and distribute that video to the specified phone number.

The enterprise product, called STUDIO, launched into public beta in the summer of 2020 and has since amassed more than 1000 companies as users.

Powered by WPeMatico

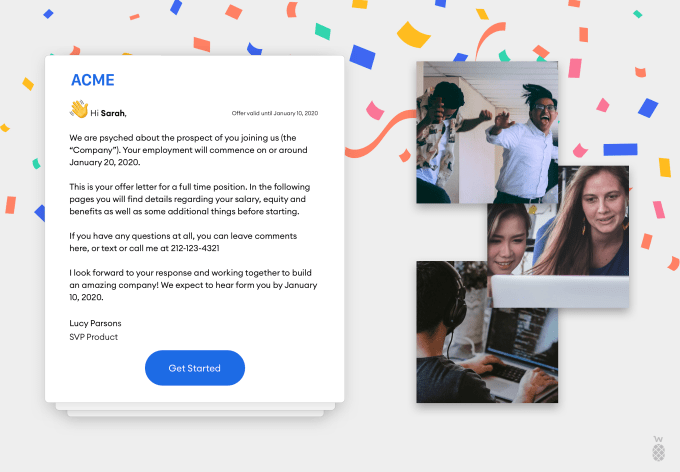

Welcome, the HR software that helps organizations make and close offers to new candidates, announced the close of a $6 million seed round today, led by FirstMark Capital. Participating investors include Ludlow Ventures, Nat Turner and Zach Weinberg, and Keenan Rice and Ben Porterfield (which were existing investors), as well as a wide array of angels.

TechCrunch last covered Welcome in August, when it announced a $1.4 million funding round. That the startup was able to raise more as quickly as it has is testament to how hot the early-stage venture capital market is today, and likely an endorsement of Welcome’s economic profile and recent growth.

Past the new capital, Welcome is also launching a new product today called Total Rewards, which helps not just new candidates but also existing employees get a complete, easy-to-understand picture of their compensation, across salary, benefits, equity, etc.

But let’s back up.

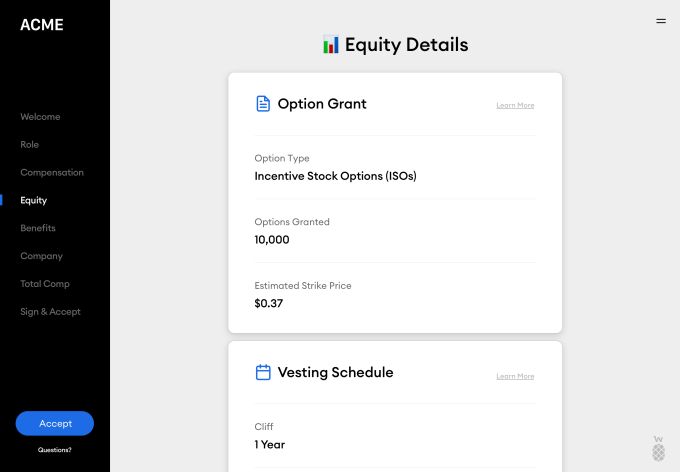

Welcome was founded in 2019 by Nick Gavronsky and Rick Pereira, with a mission to help organizations close offers on candidates by providing a much clearer picture of compensation, particularly around equity. Co-founder and CEO Nick Gavronsky explained that many candidates don’t truly understand the value of the equity they’re offered, or how it works.

“A lot of recruiting teams aren’t well-equipped to use it as a selling tool and explain it effectively and showcase the value to candidates to help them think about their ownership at the company,” he added.

Image Credits: Welcome

Welcome allows companies to organize their compensation offers based on level and position, and deliver that information digitally to candidates in a way that makes sense.

The startup integrates with a variety of other software providers, including Slack, Lever, Greenhouse, ADP and Justworks to name a few, simplifying onboarding for Welcome clients and bringing a broad array of information into one place.

Offers sent through Welcome show a description of the role, equity details, total compensation and even include a welcome note and video. This is in stark contrast to the black and white legal PDF often sent to candidates.

Image Credits: Welcome

The next phase for the company comes in the form of the launch of Total Rewards, which is meant to help retain existing employees, helping them understand their compensation value and their potential at the company.

“Painting a better picture becomes a pre-retention tool,” said Gavronsky. “An employee will sometimes leave thousands of dollars on the table because they don’t understand what they’re walking away from. A lot of times companies will wait until that person is going to resign. Let me now bring up all the things that are great about our company and talk through your stock options. But the decision’s already made. So we wanted something that we can kind of put in with performance reviews.”

Welcome also has plans to offer a third product pillar in the form of real-time accurate industry-wide compensation data, helping companies understand where they fit into the larger ecosystem with regards to compensation.

Thus far, Welcome has 40 companies on the platform, including Uncork and Betterment, with hundreds on the waitlist, according to the co-founders. The company plans to use the funding to build out the team and the product.

Powered by WPeMatico

Here.fm, a new web-based communication platform founded by Jesse Boyes and Seth Harris, has today announced the close of a $2.9 million seed round from FirstMark with participation by Y Combinator and a group of angel investors.

Here is all about giving people the chance to create personal, shareable and flexible video chat rooms. Boyes and Harris, like the rest of us, moved to Zoom to collaborate when the pandemic hit and felt that there were several shortcomings.

Harris explained that it felt very impersonal and formal to switch into presentation mode with his co-founder and buddy, and that notes and other content in those meetings disappeared when the meeting ended, “like a wormhole.”

They set out to add more layers to virtual communication.

“There are four main components to communication,” said Harris. “What you’re saying, where you are, what you’re doing and how you move. Everything we use today almost exclusively focuses on what you say, and very little on what you do. Zoom is a phone call with pictures.”

Here, in contrast, is a fully customizable room with video chat built on top of it, giving users the ability to decorate their room with virtual items, gifs, backgrounds, notes, pictures, etc. And, of course, these users can also customize their own video chat window and those of others, arranging them in the room in the size and shape that they prefer.

As with any other video chat software, users can also share their screen.

Image Credits: Here.fm

Harris and Boyes aren’t ready to commit to a certain business model or even use case, but would rather prefer to see how users approach the platform. Some have built out product war rooms, while others have set up their own virtual Blue Bottle shop to have coffee with each other. Others have set up Pilates classes that look and feel more like an actual Pilates studio than a Zoom call would.

That’s not to say they haven’t started thinking about revenue at all. There is potential here to offer payments processing for folks hosting classes or paid events, and there are also options to paywall persistence of the room and the items inside it, or even to charge for premium virtual objects or goods.

Here launched two months ago and thousands of rooms have been created since, with the average user session being 41 minutes.

Competition in this space is heating up. Mmhmm offers similar tools to customize the video chat room, but focuses more on presenting than hanging out. Macro is a tool that sits on top of a Zoom call to help ensure meetings are productive and efficient. And then there are the dozens (if not more) of startups that sprung to action at the onset of the pandemic to build out the next-generation of video chat.

But Boyes and Harris don’t see competition as the greatest challenge to the company.

“Here is a product problem, it is not an execution problem,” said Harris. “It is about generating a very strong emotional response in our users when they come in.”

Image Credits: Here.fm

Powered by WPeMatico

In three years Zachariah Reitano’s startup, Ro, has managed to hit a reported $1.5 billion valuation for its transformation from a company focused on treating erectile dysfunction to a telemedicine service for a range of elective and urgent care-focused treatments.

Through Rory for women’s health, Roman for men’s health and Zero for smoking cessation, Reitano and fellow co-founders Saman Rahmanian, and Rob Schutz, built a company that now treats 20 conditions, including sexual health, weight loss, dermatology, allergies and more, according to a statement from the company.

Image Credit: Zero

Ro also has a new pharmacy business, Ro Pharmacy, which is an online cash pay pharmacy offering more than 500 generic medications for just $5 per month per drug. And the company is getting into the weight loss business through a partnership with the private equity-backed healthcare company, Gelesis.

Ro’s also becoming a gateway into patient acquisition for primary care providers through Ribbon Health, and a test-case for the use of Pfizer’s Greenstone service, which provides certification that a generic drug is validated by one of the major pharmaceuticals.

The company’s $1.5 billion valuation is courtesy of a new $200 million investment from existing investors led by General Catalyst and including FirstMark Capital, Torch, SignalFire, TQ Ventures, Initialized Capital, 3L and BoxGroup. New first-time investor The Chernin Group also participated. In all, Ro has raised $376 million since it launched in 2017.

“This new investment will further our mission to become every patient’s first call. We’ll continue to invest in our vertically-integrated healthcare ecosystem, from our Collaborative Care Center to our national pharmacy operating system. This is just the beginning of Ro’s patient-centered healthcare platform.”

It’s all part of the company’s mission to provide a point of entry into the healthcare system independent of insurance qualifications.

“Telehealth companies like Ro are using technology to address long-standing healthcare disparities that have been exacerbated by COVID-19,” said Dr. Joycelyn Elders, MD, Ro Medical Advisor and Former U.S. Surgeon General. “By empowering providers to leverage their skills as efficiently and effectively as possible, Ro delivers affordable, high-quality care regardless of a patient’s location, insurance status, or physical access to physicians and pharmacies.”

Ro’s new financing is one of several forays by tech investors into reshaping the healthcare system at a time when patient care has been severely disrupted by attempts to mitigate the spread of COVID-19.

Digital medicine is assuming a central position in the healthcare world, with most consultations now occurring online. Reimbursement schemes for telemedicine have changed dramatically and investors see an opportunity to capitalize on these changes by aggressively backing the expansion plans of companies looking to bring digital healthcare directly to consumers.

That’s one of the reasons why Ro’s major competitor, Hims, is reported to be seeking access to public markets through its sale to a special purpose acquisition company for roughly $1 billion, according to Reuters.

Powered by WPeMatico

Crisp, a demand forecasting platform for the food industry, has today announced the close of a $12 million Series A funding round led by FirstMark Capital, with participation from Spring Capital and Swell Partners.

Crisp launched out of beta in January of this year with a product that aimed to give food suppliers and distributors a clearer picture of customer demand at retailers. Before Crisp, these organizations usually had several data scientists compiling data from various sources into an unintelligible spreadsheet, making it difficult to see general demand outlooks, and nearly impossible to spot anomalies.

Not only does this lead to losses in revenue, but it also contributes to a terrible amount of food waste.

Crisp looks to solve this by giving these suppliers and distributors a visualization of their data instantly and in real time. The company has built integrations with a large number of ERP software, ingesting historical data from food brands and combining them with a wide range of other signals around demand drivers, such as seasonality, holidays, price sensitivity, past marketing campaigns, changes in the competitive landscape and weather that might affect the sale or shipment of ingredients or the product itself.

The end goal is to consolidate data across the industry, from brands to distributors to grocery stores, so that each individual link in the food chain can do a better job of matching their supply with their demand on an individual basis.

Since launching out of beta, Crisp has expanded beyond food brands and suppliers into retail and distributor space. The company has also expanded beyond produce and dairy into verticals like beverages, bakery, CPG, flowers, meat and poultry. The startup says its seen an 80% increase in the number of customers using the platform since January.

Obviously, the coronavirus pandemic brings its own unique challenges and opportunities to Crisp’s business. On the one hand, grocery store shopping is booming and the supply chain behind it is certainly in need of better data science and demand forecasting as user behavior shifts rapidly. On the other hand, user behavior is shifting rapidly.

With state by state, and sometimes county by county, lockdowns and shifts in the restrictions imposed on small businesses, Crisp has had to manually track what’s going on around the country in order to provide clear insights to its customers.

“This period we’re in has increased that willingness to share data and increased collaboration between everybody in the supply chain,” said founder and CEO Are Traasdahl. “We’ve seen a big shift there. Earlier, everyone assumed that everyone else was able to deliver, but now this ability to have a full, top-down visibility across a whole depth of companies, not just the companies next to you in your trading relationships, but being able to unify data and have more insights from multiple steps away from yourself, and get that data in real time been accelerated.”

Crisp currently has 33 employees (with plans to hire on the back of the funding), which is 33% women and 15% people of color. Half of Crisp’s management team are women.

Powered by WPeMatico

In this pandemic world, in-person meetings are a thing of the past. Most meetings these days are done via video conference, and no company has capitalized on the shift quite like Zoom.

Macro, a new FirstMark-backed company, is looking to capitalize on the capitalization. To Capitalism!

Sorry. Let’s get back on track. Macro is a native app that employs the Zoom SDK to add depth and analysis to your daily work meetings.

There are two modes. The first is essentially focused on collaboration, which turns the usual Zoom meeting into a light overlay, where folks are shown in small, circular bubbles at the top of the screen. This mode is to be used when folks are working on the same project, such as a wireframe or a collaborative document. The UI is meant to kind of fade into the background, allowing users to click on taps or objects behind other attendees’ bubbles.

The other mode is an Arena or Stadium mode, which is meant for hands-on meetings and presentations. It has two distinct features. The first is an Airtime feature, which shows how much different participants have ‘had the floor’ for the past five minutes, thirty minutes, or in total during the meeting. The second is a text-input system on the right side of the UI that lets people enter Questions, Takeaways, Action Items and Insights from the call.

Macro automatically adds that text to a Google Doc, and formats it into something instantly shareable.

There is no extra hassle involved in getting Macro up and running. When a user installs Macro on their computer, they’re instantly loaded into Macro each time they click a Zoom link, whether it’s in an email, a calendar invite, or in Slack.

Macro cofounders Ankith Harathi and John Keck explained to TechCrunch that this isn’t your usual enterprise play. The product is free to use and, with the Google Doc export, is still useful even as a single-player product. The Google Doc is auto-formatted with Macro messaging, explaining that it was compiled by the company with a link to the product.

In other words, Harathi and Keck want to see individuals within organizations get Macro for themselves and let the product grow organically within an organization, rather than trying to sell to large teams right off the bat.

“A lot of collaborative productivity SaaS applications need your whole team to switch over to get any value out of them,” said Harathi. “That’s a pretty big barrier, especially since so many new products are coming out and teams are constantly switching and that creates a lot of noise. So our plan was to ensure one person can use this and get value out of it, and nobody else is affected. They get the better interface and other team members will want to switch over without any requirement to do so.”

This is possible in large part to the cost of the Zoom SDK, which is $0. The heavy lifting of audio and video is handled by Zoom, as is the high compute cost. This means that Macro can offer its product for free at a relatively low cost to the company as it tries to grow.

Of course, there is some risk involved with building on an existing platform. Namely, one Zoom platform change could wreak havoc on Macro’s product or model. However, the team has plans to expand beyond Zoom to other video conferencing platforms like Google, BlueJeans, WebEx, etc. Roelof Botha told TechCrunch back in May that businesses built on other platforms have a much greater chance of success when there is platform across that sector, as there certainly is here.

And there seems to be some competition for Macro in particular — for one, Microsoft Teams just added some new features to its video conferencing UI to relieve brain fatigue and Hello is looking to offer app-free video chat via browser.

Macro is also looking to add additional functionality to the platform, such as the ability to integrate an agenda into the meeting and break up the accompanying Google doc by agenda item.

The company has raised a total of $4.8 million since launch, including a new $4.3 million seed round from FirstMark Capital, General Catalyst and Underscore VC. Other investors include NextView Ventures, Jason Warner (CTO GitHub), Julie Zhuo (former VP Design Facebook), Harry Stebbings (Founder/Host of 20minVC), Adam Nash (Dropbox, Wealthfront, LinkedIn), Clark Valberg (CEO Invision), among others.

Macro has more than 25,000 users and has been a part of 50,000 meetings to date.

Powered by WPeMatico

Bonusly, a platform that involves the entire organization in recognizing employees and rewarding them, closed on a $9 million Series A financing round led by Access Venture Partners. Next Frontier Capital, Operator Partners and existing investor FirstMark Capital also participated in the round.

Bonusly launched in 2013 when co-founder and CEO Raphael Crawford-Marks saw the opportunity to reinvent the way employers and colleagues recognize and reward their employees/coworkers.

“I knew that, in order to be successful, companies would be shifting their approach to employee experience and I thought software could enable that shift,” said Crawford-Marks. “Bonusly was this elegant idea of empowering employees to give each other timely, frequent and meaningful recognition that would not only benefit employees because they would feel recognized but also surface previously hidden information to the entire company about who was working with whom and on what and what strengths they were bringing to the workplace.”

Most employers use year-end bonuses and performance reviews to motivate workers, with some employers providing some physical rewards.

Bonusly thinks recognition should happen year-round. The platform works with the employers on their overall budget for recognition and rewards, and breaks that down into “points” that are allotted to all employees at the organization.

These employees can give out points to other co-workers, whether they’re direct reports or managers or peers, at any time throughout the year. Those points translate to a monetary value that can be redeemed by the employee at any time, whether it’s through PayPal as a cash reward or with one of Bonusly’s vendor partners, including Amazon, Tango Card and Cadooz. Bonusly also partners with nonprofit organizations to let employees redeem their points via charitable donation.

In fact, Crawford-Marks noted that Bonusly users just crossed the $500,000 mark for total donations, and have donated more than $100,000 to the WHO in six weeks.

Bonusly integrates with several collaboration platforms, including Gmail and Slack, to give users the flexibility to give points in whatever venue they choose. Bonusly also has a feed, not unlike social media sites like Twitter, that shows in real time employees who have received recognition.

The company has also built in some technical features to help with usability. For example, Bonusly understands the social organization of a company, surfacing the most relevant folks in the point feed based on who employees have given or received points to/from in the past. In a company with tens of thousands of employees, this keeps Bonusly relevant.

Bonusly has also incorporated tools for employers, including an auto-scale button for employers with workers in multiple jurisdictions or companies. The button allows employers to scale up or down the point allotments in different geographies based on cost of living.

There are also privacy controls on Bonusly that allow high-level employees and leadership to give each other recognition for projects that may not be widely known about at the company yet, like say for an acquisition that was completed.

Bonusly says that peer-to-peer recognition is more powerful than manager-only recognition, saying it’s nearly 36% more likely to have better financial outcomes.

The company also cites research that says that a happy workforce raises business productivity by more than 30%.

Bonusly competes with Kazoo and Motivocity, and Crawford-Marks says that the biggest differentiation factor is participation.

“We set a very high bar for how we measure participation and engagement in the platform,” he said. “You’ll see other companies claiming really high participation rates, but typically if you dig into that they’re talking about getting recognition every six months or every year or just logging in, rather than giving recognition every single month, month over month.”

He noted that 75% of employees on average give recognition in the first month of deployment with an organization, and that number gradually increases over time. By the two-year mark, 80% of employees are giving recognition every month.

Bonusly has raised a total of nearly $14 million in funding since inception.

Powered by WPeMatico

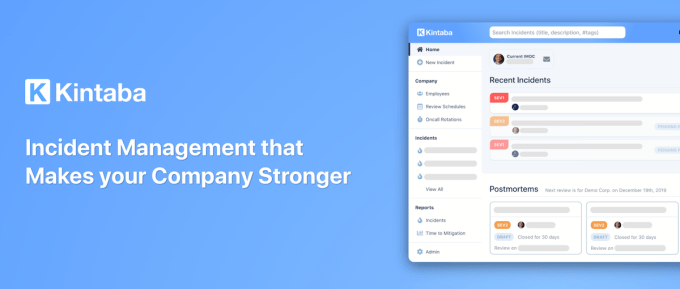

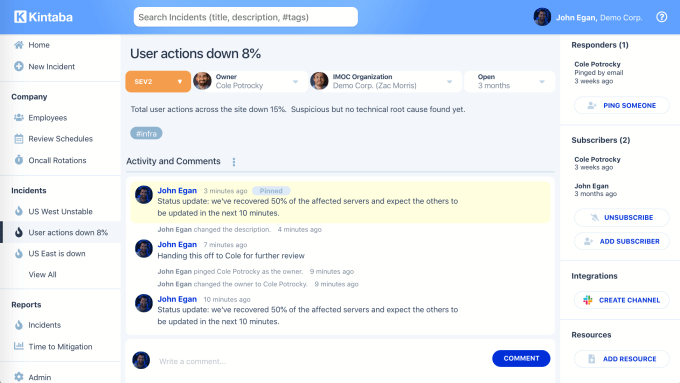

“It’s an open secret that every company is on fire,” says Kintaba co-founder John Egan. “At any given moment something is going horribly wrong in a way that it has never gone wrong before.” Code failure downtimes, server outages and hack attacks plague engineering teams. Yet the tools for waking up the right employees, assembling a team to fix the problem and doing a post-mortem to assess how to prevent it from happening again can be as chaotic as the crisis itself.

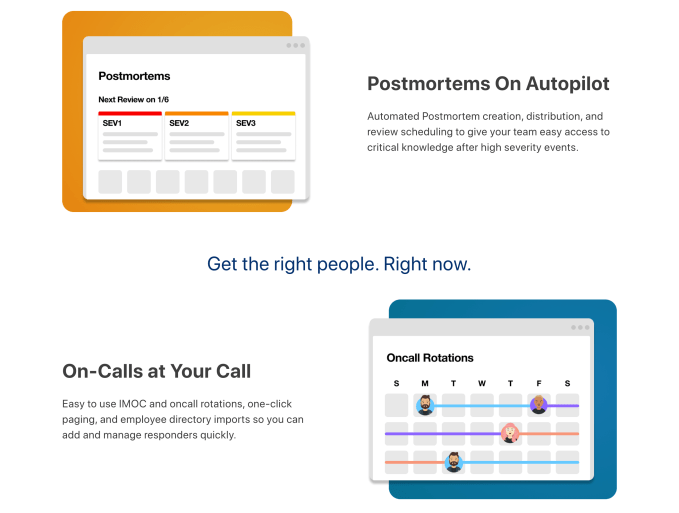

Text messages, Slack channels, task managers and Google Docs aren’t sufficient for actually learning from mistakes. Alerting systems like PagerDuty focus on the rapid response, but not the educational process in the aftermath. Finally, there’s a more holistic solution to incident response with today’s launch of Kintaba.

The Kintaba team experienced these pains firsthand while working at Facebook after Egan and Zac Morris’ Y Combinator-backed data transfer startup Caffeinated Mind was acqui-hired in 2012. Years later, when they tried to build a blockchain startup and the whole stack was constantly in flames, they longed for a better incident alert tool. So they built one themselves and named it after the Japanese art of Kintsugi, where gold is used to fill in cracked pottery, “which teaches us to embrace the imperfect and to value the repaired,” Egan says.

With today’s launch, Kintaba offers a clear dashboard where everyone in the company can see what major problems have cropped up, plus who’s responding and how. Kintaba’s live activity log and collaboration space for responders let them debate and analyze their mitigation moves. It integrates with Slack, and lets team members subscribe to different levels of alerts or search through issues with categorized hashtags.

“The ability to turn catastrophes into opportunities is one of the biggest differentiating factors between successful and unsuccessful teams and companies,” says Egan. That’s why Kintaba doesn’t stop when your outage does.

Kintaba Founders (from left): John Egan, Zac Morris and Cole Potrocky

As the fire gets contained, Kintaba provides a rich text editor connected to its dashboard for quickly constructing a post-mortem of what went wrong, why, what fixes were tried, what worked and how to safeguard systems for the future. Its automated scheduling assistant helps teams plan meetings to internalize the post-mortem.

Kintaba’s well-pedigreed team and their approach to an unsexy but critical software-as-a-service attracted $2.25 million in funding led by New York’s FirstMark Capital.

“All these features add up to Kintaba taking away all the annoying administrative overhead and organization that comes with running a successful modern incident management practice,” says Egan, “so you can focus on fixing the big issues and learning from the experience.”

Egan, Morris and Cole Potrocky met while working at Facebook, which is known for spawning other enterprise productivity startups based on its top-notch internal tools. Facebook co-founder Dustin Moskovitz built a task management system to reduce how many meetings he had to hold, then left to turn that into Asana, which filed to go public this week.

The trio had been working on internal communication and engineering tools as well as the procedures for employing them. “We saw firsthand working at companies like Facebook how powerful those practices can be and wanted to make them easier for anyone to implement without having to stitch a bunch of tools together,” Egan tells me. He stuck around to co-found Facebook’s enterprise collaboration suite Workplace while Potrocky built engineering architecture there and Morris became a mobile security lead at Uber.

Like many blockchain projects, Kintaba’s predecessor, crypto collectibles wallet Vault, proved an engineering nightmare without clear product market fit. So the team ditched it and pivoted to build out the internal alerting tool they’d been tinkering with. That origin story sounds a lot like Slack’s, which began as a gaming company that pivoted to turn its internal chat tool into a business.

So what’s the difference between Kintaba and just using Slack and email or a monitoring tool like PagerDuty, Splunk’s VictorOps or Atlassian’s OpsGenie? Here’s how Egan breaks a site downtime situation handled with Kintaba:

You’re on call and your pager is blowing up because all your servers have stopped serving data. You’re overwhelmed and the root cause could be any of the multitude of systems sending you alerts. With Kintaba, you aren’t left to fend for yourself. You declare an incident with high severity and the system creates a collaborative space that automatically adds an experienced IMOC (incident manager on call) along with other relevant on calls. Kintaba also posts in a company-wide incident Slack channel. Now you can work together to solve the problem right inside the incident’s collaborative space or in Slack while simultaneously keeping stakeholders updated by directing them to the Kintaba incident page instead of sending out update emails. Interested parties can get quick info from the stickied comments and #tags. Once the incident is resolved, Kintaba helps you write a postmortem of what went wrong, how it was fixed, and what will be done to prevent it from happening. Kintaba then automatically distributes the postmortem and sets up an incident review on your calendar.

Essentially, instead of having one employee panicking about what to do until the team struggles to coordinate across a bunch of fragmented messaging threads, a smoother incident reporting process and all the discussion happens in Kintaba. And if there’s a security breach that a non-engineer notices, they can launch a Kintaba alert and assemble the legal and PR team to help, too.

Alternatively, Egan describes the downtime fiascoes he’d experience without Kintaba like this:

The on call has to start waking up their management chain to try and figure out who needs to be involved. The team maybe throws a Slack channel together but since there’s no common high severity incident management system and so many teams are affected by the downtime, other teams are also throwing slack channels together, email threads are happening all over the place, and multiple groups of people are trying to solve the problem at once. Engineers begin stepping all over each other and sales teams start emailing managers demanding to know what’s happening. Once the problem is solved, no one thinks to write up a postmortem and even if they do it only gets distributed to a few people and isn’t saved outside that email chain. Managers blame each other and point fingers at people instead of taking a level headed approach to reviewing the process that led to the failure. In short: panic, thrash, and poor communication.

While monitoring-apps like PagerDuty can do a good job of indicating there’s a problem, they’re weaker at the collaborative resolution and post-mortem process, and designed just for engineers rather than everyone, like Kintaba. Egan says, “It’s kind of like comparing the difference between the warning lights on a piece of machinery and the big red emergency button on a factory floor. We’re the big red button . . . That also means you don’t have to rip out PagerDuty to use Kintaba,” since it can be the trigger that starts the Kintaba flow.

Still, Kintaba will have to prove that it’s so much better than a shared Google Doc, an adequate replacement for monitoring solutions or a necessary add-on that companies should pay $12 per user per month. PagerDuty’s deeper technical focus helped it go public a year ago, though it has fallen about 60% since to a market cap of $1.75 billion. Still, customers like Dropbox, Zoom and Vodafone rely on its SMS incident alerts, while Kintaba’s integration with Slack might not be enough to rouse coders from their slumber when something catches fire.

Still, Kintaba will have to prove that it’s so much better than a shared Google Doc, an adequate replacement for monitoring solutions or a necessary add-on that companies should pay $12 per user per month. PagerDuty’s deeper technical focus helped it go public a year ago, though it has fallen about 60% since to a market cap of $1.75 billion. Still, customers like Dropbox, Zoom and Vodafone rely on its SMS incident alerts, while Kintaba’s integration with Slack might not be enough to rouse coders from their slumber when something catches fire.

If Kintaba can succeed in incident resolution with today’s launch, the four-person team sees adjacent markets in task prioritization, knowledge sharing, observability and team collaboration, though those would pit it against some massive rivals. If it can’t, perhaps Slack or Microsoft Teams could be suitable soft landings for Kintaba, bringing more structured systems for dealing with major screw-ups to their communication platforms.

When asked why he wanted to build a legacy atop software that might seem a bit boring on the surface, Egan concluded that, “Companies using Kintaba should be learning faster than their competitors . . . Everyone deserves to work within a culture that grows stronger through failure.”

Powered by WPeMatico

The food industry may be the biggest industry in the world, but it’s also one of the least efficient. BCG says 1.6 billions tons of food, worth $1.2 trillion, is wasted in food every year, and those numbers are only expected to go up.

A number of players have stepped up to try to solve their own portion of the problem, and one such solution is Crisp. The company, which received $14 million in Series A funding last year led by FirstMark Capital, is today going live with its platform (which has been in beta).

Crisp aims to solve the global food waste problem via demand forecasts. Founder and CEO Are Traasdahl, a serial founder, believes that a lack of communication and data flow between the many players in the supply chain is a main cause for all this waste, a great deal of which happens long before the food reaches the consumer.

Right now, forecasting demand is nowhere close to a perfect science for many of these players. From food brands to distributors to grocery stores, the problem is usually solved by looking at a spreadsheet from last year’s sales to try to determine the signals that played into this or that SKU’s sales performance.

And then there was Crisp.

Integrated with almost any ERP software a company might have, Crisp ingests historical data from these food brands and combines that data with signals around other demand drivers, such as seasonality, holidays, price sensitivity and other pricing information, marketing campaigns, competitive landscape, weather that might affect the sale or shipment of certain produce or other ingredients.

Using these data points, and historical sales data, Crisp believes it can give a much more accurate picture of demand over the next day, week, month or year.

But Crisp isn’t just for food brands, such as Nounós Creamery, a Crisp customer that says its reduced scrapped inventory by 80% since switching to the platform. Crisp serves almost every player in the food supply chain, from retailers to distributors to brands to brokers.

And the more customers it gets, the better it is at predicting demand on a very specific level. For instance, the demand forecasting Crisp offers for a particular grocery store, based on external data, will obviously get much better once that grocery store is a customer on the platform.

Traasdahl was initially concerned that his customers would be reluctant to hand over this type of sensitive sales data, and also that players within the industry might be anxious to hand over such data to a platform that’s aggregating everyone’s data, including their competitors’. Turns out, the food industry has more of a “better together” mentality.

“Other industries are not as dependent on each other,” said Traasdahl. “If I am a creamery and need to buy blueberries for my yogurt, I may have five different vendors for those blueberries. And if they don’t get delivered on the right day, Costco will yell at me for being late with the yogurt. Everyone in the supply chain is somewhat dependent on each other.”

For that reason, it’s been easier than expected to attract clients to the platform. The prospect of a collaborative demand forecast platform, which is pulling signals from across the entire industry, is going to be more accurate than siloed demand forecasts produced by a single vendor or brand.

During the beta program, which launched in October, Crisp brought on more than 30 companies to the platform, including Gilbert’s Craft Sausages, SunFed Perfect Produce, Nounós Creamery, Hofseth, REMA and Superior Farms.

Powered by WPeMatico