DN Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

Copenhagen-based process automation platform Leapwork has snagged Denmark’s largest-ever Series B funding round, announcing a $62 million raise co-led by KKR and Salesforce Ventures, with existing investors DN Capital and Headline also participating.

Also today it’s disclosing that its post-money valuation now stands at $312 million.

The “no-code” 2015-founded startup last raised back in 2019, when it snagged a $10 million Series A. The business was bootstrapped through earlier years — with the founders putting in their own money, garnered from prior successful exits. Their follow-on bet on no-code already looks to have paid off in spades: Since launching the platform in 2017, Leapwork has seen its customer base more than double year on year and it now has a roster of 300+ customers around the world paying it to speed up their routine business processes.

Software testing is a particular focus for the tools, which Leapwork pitches at enterprises’ quality assurance and test teams.

It claims that by using its no-code tech — a label for the trend which refers to software that’s designed to be accessible to non-technical staff, greatly increasing its utility and applicability — businesses can achieve a 10x faster time to market, 97% productivity gains and a 90% reduction in application errors. So the wider pitch is that it can support enterprises to achieve faster digital transformations with only their existing mix of in-house skills.

Customers include the likes of PayPal, Mercedes-Benz and BNP Paribas.

Leapwork’s own business, meanwhile, has grown to a team of 170 people — working across nine offices throughout Europe, North America and Asia.

The Series B funding will be used to accelerate its global expansion, with the startup telling us it plans to expand the size of its local teams in key markets and open a series of tech hubs to support further product development.

Expanding in North America is a big priority now, with Leapwork noting it recently opened a New York office — where it plans to “significantly” increase headcount.

“In terms of our global presence, we want to ensure we are as close to our customers as possible, by continuing to build up local teams and expertise across each of our key markets, especially Europe and North America,” CEO and co-founder Christian Brink Frederiksen tells TechCrunch. “For example, we will build up more expertise and plan to really scale up the size of the team based out of our New York office over the next 12 months.

“Equally we have opened new offices across Europe, so we want to ensure our teams have the scope to work closely with customers. We also plan to invest heavily in the product and the technology that underpins it. For example, we’ll be doubling the size of our tech hubs in Copenhagen and India over the next 12 months.”

Product development set to be accelerated with the chunky Series B will focus on enhancements and functionality aimed at “breaking down the language barrier between humans and computers,” as Brink Frederiksen puts it

“Europe and the U.S. are our two main markets. Half of our customers are U.S. companies,” he also tells us, adding: “We are extremely popular among enterprise customers, especially those with complex compliance setups — 40% of our customers come from enterprises banking, insurance and financial services.

“Having said that, because our solution is no-code, it is heavily used across industries, including healthcare and life sciences, logistics and transportation, retail, manufacturing and more.”

Asked about competitors — given that the no-code space has become a seething hotbed of activity over a number of years — Leapwork’s initial response is coy, trying the line that its business is a “truly special snowflake.” (“We truly believe we are the only solution that allows non-technical everyday business users to automate repetitive computer processes, without needing to understand how to code. Our no-code, visual language is what really sets us apart,” is how Brink Frederiksen actually phrases that.)

But on being pressed Leapwork names a raft of what it calls “legacy players” — such as Tricentis, Smartbear, Ranorex, MicroFocus, Eggplant Software, Mabl and Selenium — as (also) having “great products,” while continuing to claim they “speak to a different audience than we do.”

Certainly Leapwork’s Series B raise speaks loudly of how much value investors are seeing here.

Commenting in a statement, Patrick Devine, director at KKR, said:

Test automation has historically been very challenging at scale, and it has become a growing pain point as the pace of software development continues to accelerate. Leapwork’s primary mission since its founding has been to solve this problem, and it has impressively done so with its powerful no-code automation platform.

“The team at Leapwork has done a fantastic job building a best-in-class corporate culture which has allowed them to continuously innovate, execute and push the boundaries of their automation platform,” added Stephen Shanley, managing director at KKR, in another statement.

In a third supporting statement, Nowi Kallen, principal at Salesforce Ventures, added:

Leapwork has tapped into a significant market opportunity with its no-code test automation software. With Christian and Claus [Rosenkrantz Topholt] at the helm and increased acceleration to digital adoption, we look forward to seeing Leapwork grow in the coming years and a successful partnership.

The proof of the no-code “pudding” is in adoption and usage — getting non-developers to take to and stick with a new way of interfacing with and manipulating information. And so far, for Leapwork, the signs are looking good.

Powered by WPeMatico

Aforza, developing cloud and mobile apps for consumer goods companies, announced a $22 million Series A round led by DN Capital.

The London-based company’s technology is built on the Salesforce and Google Cloud platforms so that consumer goods companies can digitally transform product distribution and customer engagement to combat issues like unprofitable promotions and declining market share, Aforza co-founder and CEO Dominic Dinardo told TechCrunch. Using artificial intelligence, the company recommends products and can predict the order a retailer can make with promotions and pricing based on factors like locations.

The global market for consumer packaged goods apps is forecasted to reach $15 billion by 2024. However, the industry is still using outdated platforms that, in some cases, lead to a loss of 5% of sales when goods are out of stock, Dinardo said.

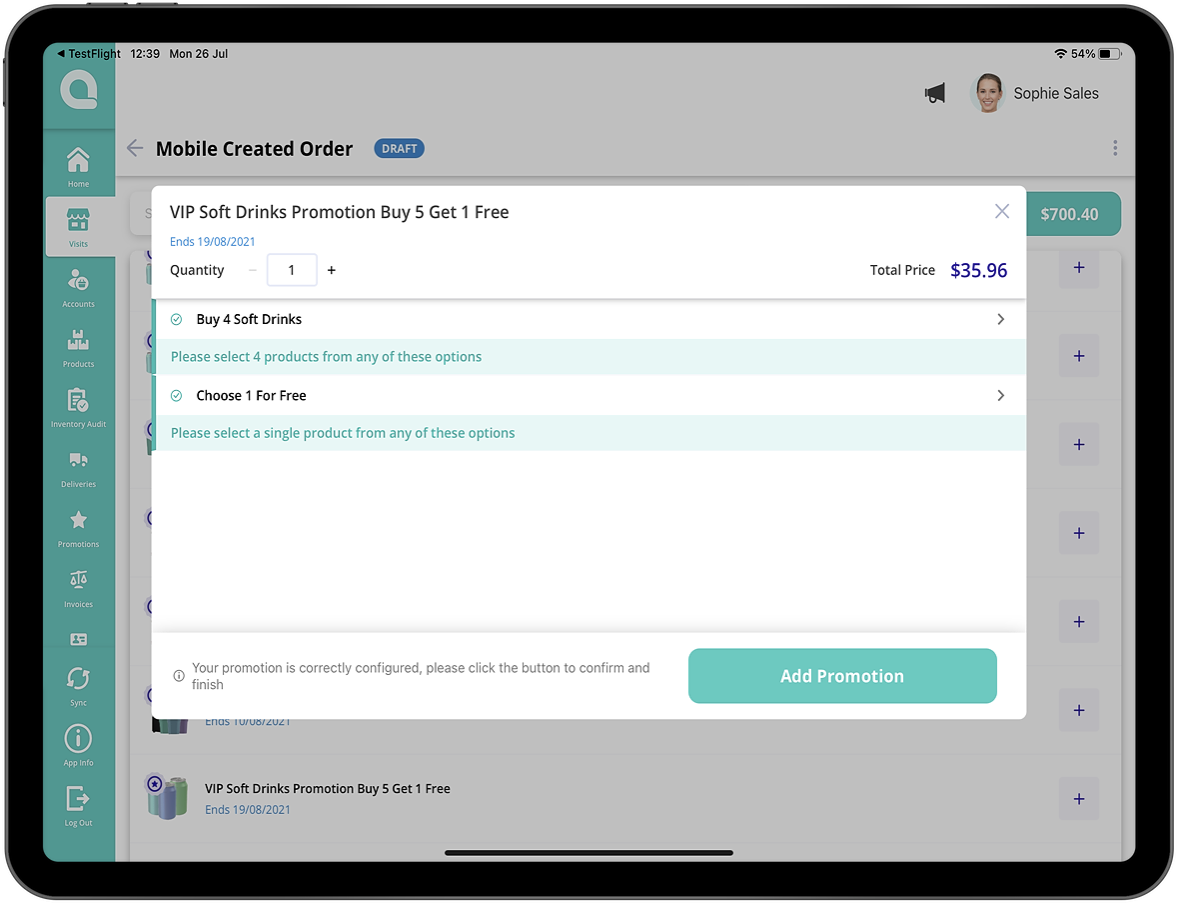

Aforza’s trade promotion designer mobile image. Image Credits: Aforza

Dinardo and his co-founders, Ed Butterworth and Nick Eales, started the company in 2019. All veterans of Salesforce, they saw how underserved the consumer goods industry was in terms of moving to digital.

Aforza is Dinardo’s first time leading a company. However, from his time at Salesforce he feels he got an education like going to “Marc Benioff’s School of SaaS.” The company raised an undisclosed seed round in 2019 from Bonfire Ventures, Daher Capital, DN Capital, Next47 and Salesforce Ventures.

Then the pandemic happened, which had many of the investors leaning in, which was validation of what Aforza was doing, Dinardo said.

“Even before the pandemic, the consumer goods industry was challenged with new market entrants and horrible legacy systems, but then the pandemic turned off pathways to customers,” he added. “Our mission is to improve the lives of consumers by bringing forth more sustainable products and packaging, but also helping companies be more agile and handle changes as the biggest change is happening.”

Joining DN Capital in the round were Bonfire Ventures, Daher Capital and Next47.

Brett Queener, partner at Bonfire Ventures, said he helped incubate Aforza with Dinardo and Eales, something his firm doesn’t typically do, but saw a unique opportunity to get in on the ground floor.

Also working at Salesforce, he saw the consumer goods industry as a major industry with a compelling reason to make a technology shift as customers began expecting instant availability and there were tons of emerging startups coming into the direct-to-consumer space.

Those startups don’t have a year or two to pull together the kind of technology it took to scale. With Aforza, they can build a product that works both online and off on any device, Queener said. And rather than planning promotions on a quarterly basis, companies can make changes to their promotional spend in real time.

“It is time for Aforza to tell the world about its technology, time to build out its footprint in the U.S. and in Europe, invest more in R&D and execute the Salesforce playbook,” he said. “That is what this round is about.”

Dinardo intends on using the new funding to continue R&D and to double its employee headcount over the next six months as it establishes its new U.S. headquarters in the Northeast. It is already working with customers in 20 countries.

As to growth, Dinardo said he is using his past experiences at startups like Veeva and Vlocity, which was acquired by Salesforce in 2020, as benchmarks for Aforza’s success.

“We have the money and the expertise — now we need to take a moment to breathe, hire people with the passion to do this and invest in new product tiers, digital assets and even payments,” he said.

Powered by WPeMatico

Weezy — an on-demand supermarket that delivers groceries in as fast as 15 minutes — has raised $20 million in a Series A funding led by New York-based venture capital fund Left Lane Capital. Also participating were U.K.-based fund DN Capital, earlier investors Heartcore Capital and angel investors, notably Chris Muhr, the Groupon founder.

Although the company hasn’t made mention of a later U.S. launch, the presence of U.S. investors would tend to suggest that. Weezy is reminiscent of Kozmo, the on-demand groceries business from the dot-com boom of the late ’90s. However, it differs from Postmates in that it doesn’t do pickups.

The cash injection will be used to expand its grocery delivery service across London and the broader UK, and open two fulfillment centers across London. Some 40 more U.K. sites are planned by the end of 2021 and it plans to add 50 new employees in the next four months.

Launched in July 2020, Weezy uses its own delivery people on pedal cycles or electric mopeds to deliver goods in less than 15 minutes on average. As well as working with wholesalers, it also sources groceries from independent bakers, butchers and markets.

It has pushed at an open door during the pandemic. In Q2 2020, half a million new shoppers joined the grocery delivery sector, which is now worth £14.3 billion in the U.K., according to research.

Kristof Van Beveren, co-founder and CEO of Weezy, said in a statement: “People are no longer happy to wait around for deliveries, and there is strong demand for a more efficient service.”

Weezy’s co-founders are Kristof Van Beveren and Alec Dent. Van Beveren is formerly from the consumer goods world at Procter & Gamble and McKinsey & Company, while Dent headed up operations at U.K. startup Drover and business development at BlaBlaCar.

Harley Miller, managing partner, Left Lane Capital, commented: “Weezy’s founding team have the right balance of drive, experience and temperament to lead in e-commerce innovation and convenience within the UK grocery market and beyond.”

Nenad Marovac, founder and managing partner, DN Capital, said: “Even before the pandemic, interest in online grocery shopping was on the rise. The first time I ordered from Weezy, my delivery arrived in seven minutes and I was hooked.”

Powered by WPeMatico

Last year all-in-one digital sales platform GetAccept raised a $7 million Series A funding round. The platform, which wraps in video, live chat, proposal design, document tracking and e-signatures, has now raised $20 million in Series B funding, led by Bessemer Venture Partners, as the company expands its platform aimed at SMBs. The funding comes as the pandemic means SMBs have largely shifted to remote, and so has their digital sales process.

Last year the funding was led by DN Capital, with participation from BootstrapLabs, Y Combinator and a number of Spotify’s early investors. This round brings GetAccept’s total financing raised to $30 million. GetAccept competes with several separate tools, including well-financed solutions like DocSend, PandaDoc, Showpad, Highspot, DocuSign and Adobe Sign.

Founded in 2015 by Swedish entrepreneurs and Y Combinator alumni Samir Smajic, Mathias Thulin, Jonas Blanck and Carl Carell, GetAccept has expanded from 30 to now 100+ employees over the last 18 months, with offices across the U.S. and EU countries.

Smajic said: “We believe in the power of relationships and want to bring personalized and engaging interactions back to the online sales process. We saw this digital sales shift and change in behavior back in 2015, which is why we founded GetAccept in the first place. The COVID-19 pandemic has accelerated and forced B2B buyers and sellers to go digital, which has placed digital sales models high up on the company agendas. We aim to be the online place where every B2B business happens, in a personal way.”

Alex Ferrara, partner at Bessemer Venture Partners commented: “Bessemer Venture Partners is thrilled to back the ambitious GetAccept team and their vision to empower millions of SMBs to streamline and digitize their end-to-end sales processes. They have built a world-class product, prepared for business transactions that continue to shift permanently online at a rapid pace. We look forward to partnering with GetAccept on the journey ahead.”

Powered by WPeMatico

Venture capital investment exploded across a number of geographies in 2019 despite the constant threat of an economic downturn.

San Francisco, of course, remains the startup epicenter of the world, shutting out all other geographies when it comes to capital invested. Still, other regions continue to grow, raking in more capital this year than ever.

In Utah, a new hotbed for startups, companies like Weave, Divvy and MX Technology raised a collective $370 million from private market investors. In the Northeast, New York City experienced record-breaking deal volume with median deal sizes climbing steadily. Boston is closing out the decade with at least 10 deals larger than $100 million announced this year alone. And in the lovely Pacific Northwest, home to tech heavyweights Amazon and Microsoft, Seattle is experiencing an uptick in VC interest in what could be a sign the town is finally reaching its full potential.

Seattle startups raised a total of $3.5 billion in VC funding across roughly 375 deals this year, according to data collected by PitchBook. That’s up from $3 billion in 2018 across 346 deals and a meager $1.7 billion in 2017 across 348 deals. Much of Seattle’s recent growth can be attributed to a few fast-growing businesses.

Convoy, the digital freight network that connects truckers with shippers, closed a $400 million round last month bringing its valuation to $2.75 billion. The deal was remarkable for a number of reasons. Firstly, it was the largest venture round for a Seattle-based company in a decade, PitchBook claims. And it pushed Convoy to the top of the list of the most valuable companies in the city, surpassing OfferUp, which raised a sizable Series D in 2018 at a $1.4 billion valuation.

Convoy has managed to attract a slew of high-profile investors, including Amazon’s Jeff Bezos, Salesforce CEO Marc Benioff and even U2’s Bono and the Edge. Since it was founded in 2015, the business has raised a total of more than $668 million.

Remitly, another Seattle-headquartered business, has helped bolster Seattle’s startup ecosystem. The fintech company focused on international money transfer raised a $135 million Series E led by Generation Investment Management, and $85 million in debt from Barclays, Bridge Bank, Goldman Sachs and Silicon Valley Bank earlier this year. Owl Rock Capital, Princeville Global, Prudential Financial, Schroder & Co Bank AG and Top Tier Capital Partners, and previous investors DN Capital, Naspers’ PayU and Stripes Group also participated in the equity round, which valued Remitly at nearly $1 billion.

Up-and-coming startups, including co-working space provider The Riveter, real estate business Modus and same-day delivery service Dolly, have recently attracted investment too.

A number of other factors have contributed to Seattle’s long-awaited rise in venture activity. Top-performing companies like Stripe, Airbnb and Dropbox have established engineering offices in Seattle, as has Uber, Twitter, Facebook, Disney and many others. This, of course, has attracted copious engineers, a key ingredient to building a successful tech hub. Plus, the pipeline of engineers provided by the nearby University of Washington (shout-out to my alma mater) means there’s no shortage of brainiacs.

There’s long been plenty of smart people in Seattle, mostly working at Microsoft and Amazon, however. The issue has been a shortage of entrepreneurs, or those willing to exit a well-paying gig in favor of a risky venture. Fortunately for Seattle venture capitalists, new efforts have been made to entice corporate workers to the startup universe. Pioneer Square Labs, which I profiled earlier this year, is a prime example of this movement. On a mission to champion Seattle’s unique entrepreneurial DNA, Pioneer Square Labs cropped up in 2015 to create, launch and fund technology companies headquartered in the Pacific Northwest.

Boundless CEO Xiao Wang at TechCrunch Disrupt 2017

Operating under the startup studio model, PSL’s team of former founders and venture capitalists, including Rover and Mighty AI founder Greg Gottesman, collaborate to craft and incubate startup ideas, then recruit a founding CEO from their network of entrepreneurs to lead the business. Seattle is home to two of the most valuable businesses in the world, but it has not created as many founders as anticipated. PSL hopes that by removing some of the risk, it can encourage prospective founders, like Boundless CEO Xiao Wang, a former senior product manager at Amazon, to build.

“The studio model lends itself really well to people who are 99% there, thinking ‘damn, I want to start a company,’ ” PSL co-founder Ben Gilbert said in March. “These are people that are incredible entrepreneurs but if not for the studio as a catalyst, they may not have [left].”

Boundless is one of several successful PSL spin-outs. The business, which helps families navigate the convoluted green card process, raised a $7.8 million Series A led by Foundry Group earlier this year, with participation from existing investors Trilogy Equity Partners, PSL, Two Sigma Ventures and Founders’ Co-Op.

Years-old institutional funds like Seattle’s Madrona Venture Group have done their part to bolster the Seattle startup community too. Madrona raised a $100 million Acceleration Fund earlier this year, and although it plans to look beyond its backyard for its newest deals, the firm continues to be one of the largest supporters of Pacific Northwest upstarts. Founded in 1995, Madrona’s portfolio includes Amazon, Mighty AI, UiPath, Branch and more.

Voyager Capital, another Seattle-based VC, also raised another $100 million this year to invest in the PNW. Maveron, a venture capital fund co-founded by Starbucks mastermind Howard Schultz, closed on another $180 million to invest in early-stage consumer startups in May. And new efforts like Flying Fish Partners have been busy deploying capital to promising local companies.

There’s a lot more to say about all this. Like the growing role of deep-pocketed angel investors in Seattle have in expanding the startup ecosystem, or the non-local investors, like Silicon Valley’s best, who’ve funneled cash into Seattle’s talent. In short, Seattle deal activity is finally climbing thanks to top talent, new accelerator models and several refueled venture funds. Now we wait to see how the Seattle startup community leverages this growth period and what startups emerge on top.

Powered by WPeMatico

Cubyn, the Paris-based logistics startup that lets e-merchants outsource fulfillment and delivery logistics, has raised €12 million in new funding. The round is led by DN Capital, with participation from Partech Ventures, 360 Capital Partners, BNP Paribas Développement and the French investment bank BPI France.

The injection of capital is timed with the launch of “Cubyn Fulfillment,” as the company moves beyond pickup and delivery only. The new service is described as a fully integrated “first mile” solution that covers the entire fulfillment process, including keeping stock in Cubyn’s warehouses. It claims to be offered at a 30% lower price point than competitors.

“We want to make affordable world-class logistics accessible to every single e-merchant, whatever their size,” Cubyn co-founder and CEO Adrien Fernandez Baca tells TechCrunch. “Our typical customer is an e-merchant who sells across sales channels (marketplaces their own website). Size can go from 500 to 50,000 orders shipped per month.”

Launched in 2015, Cubyn says that in four years it has made more than 2 million shipments. It also reckons that because its tech is “built from the ground up,” the startup is well positioned to tackle fulfillment more efficiently than legacy players.

“Most direct competitors are the traditional third-party logistics players who missed the e-commerce revolution and lack technology intelligence,” says Baca. “We are 30% cheaper, with simpler multi-channel integrations and higher delivery quality. Less direct competitors are the fulfillment offer of marketplaces. They do offer a good logistics experience at a good price, but only for orders going through their marketplace.”

This, he argues, means there is a big gap in the market for a solution geared at multi-channel e-merchants. “We are marketplace agnostic and offer a seamless and high-quality multi-channel logistics,” adds the Cubyn CEO.

Specifically, the way the new Cubyn Fulfillment product works is as follows: An e-merchant signs up to Cubyn and plugs in their various sales channels, such as Amazon, Rakuten, eBay, Shopify etc. They then send Cubyn an appropriate amount of inventory to fulfill future orders, which is stored temporarily in a Cubyn warehouse. When an order is placed, Cubyn automatically packs the order and ships via the most suitable carrier to optimise for transit time and cost.

“Our customers pay based on the number of parcels they ship,” explains Baca. “Logistics is a game of volume and thanks to technology we can manage volumes that couldn’t be managed by historical players. This allow us to offer… cheaper prices and still have great margins.”

Powered by WPeMatico