computing

Auto Added by WPeMatico

Auto Added by WPeMatico

If you develop software for a large enterprise company, chances are you’ve heard of Tricentis. If you don’t develop software for a large enterprise company, chances are you haven’t. The software testing company with a focus on modern cloud and enterprise applications was founded in Austria in 2007 and grew from a small consulting firm to a major player in this field, with customers like Allianz, BMW, Starbucks, Deutsche Bank, Toyota and UBS. In 2017, the company raised a $165 million Series B round led by Insight Venture Partners.

Today, Tricentis announced that it has acquired Neotys, a popular performance testing service with a focus on modern enterprise applications and a tests-as-code philosophy. The two companies did not disclose the price of the acquisition. France-based Neotys launched in 2005 and raised about €3 million before the acquisition. Today, it has about 600 customers for its NeoLoad platform. These include BNP Paribas, Dell, Lufthansa, McKesson and TechCrunch’s own corporate parent, Verizon.

As Tricentis CEO Sandeep Johri noted, testing tools were traditionally script-based, which also meant they were very fragile whenever an application changed. Early on, Tricentis introduced a low-code tool that made the automation process both easier and resilient. Now, as even traditional enterprises move to DevOps and release code at a faster speed than ever before, testing is becoming both more important and harder for these companies to implement.

“You have to have automation and you cannot have it be fragile, where it breaks, because then you spend as much time fixing the automation as you do testing the software,” Johri said. “Our core differentiator was the fact that we were a low-code, model-based automation engine. That’s what allowed us to go from $6 million in recurring revenue eight years ago to $200 million this year.”

Tricentis, he added, wants to be the testing platform of choice for large enterprises. “We want to make sure we do everything that a customer would need, from a testing perspective, end to end. Automation, test management, test data, test case design,” he said.

The acquisition of Neotys allows the company to expand this portfolio by adding load and performance testing as well. It’s one thing to do the standard kind of functional testing that Tricentis already did before launching an update, but once an application goes into production, load and performance testing becomes critical as well.

“Before you put it into production — or before you deploy it — you need to make sure that your application not only works as you expect it, you need to make sure that it can handle the workload and that it has acceptable performance,” Johri noted. “That’s where load and performance testing comes in and that’s why we acquired Neotys. We have some capability there, but that was primarily focused on the developers. But we needed something that would allow us to do end-to-end performance testing and load testing.”

The two companies already had an existing partnership and had integrated their tools before the acquisition — and many of its customers were already using both tools, too.

“We are looking forward to joining Tricentis, the industry leader in continuous testing,” said Thibaud Bussière, president and co-founder at Neotys. “Today’s Agile and DevOps teams are looking for ways to be more strategic and eliminate manual tasks and implement automated solutions to work more efficiently and effectively. As part of Tricentis, we’ll be able to eliminate laborious testing tasks to allow teams to focus on high-value analysis and performance engineering.”

NeoLoad will continue to exist as a stand-alone product, but users will likely see deeper integrations with Tricentis’ existing tools over time, include Tricentis Analytics, for example.

Johri tells me that he considers Tricentis one of the “best kept secrets in Silicon Valley” because the company not only started out in Europe (even though its headquarters is now in Silicon Valley) but also because it hasn’t raised a lot of venture rounds over the years. But that’s very much in line with Johri’s philosophy of building a company.

“A lot of Silicon Valley tends to pay attention only when you raise money,” he told me. “I actually think every time you raise money, you’re diluting yourself and everybody else. So if you can succeed without raising too much money, that’s the best thing. We feel pretty good that we have been very capital efficient and now we’re recognized as a leader in the category — which is a huge category with $30 billion spend in the category. So we’re feeling pretty good about it.”

Powered by WPeMatico

Data centers and bitcoin mining operations are becoming huge energy hogs, and the explosive growth of both risks undoing a lot of the progress that’s been made to reduce global greenhouse gas emissions. It’s one of the major criticisms of cryptocurrency operations and something that many in the industry are trying to address.

Enter LiquidStack, a company that’s spinning out from the cryptocurrency hardware technology developer Bitfury Group with a $10 million investment.

The company, which was formerly known as Allied Control Limited, restructured as a commercial operating company headquartered in the Netherlands with commercial operations in the U.S. and research and development in Hong Kong, according to a statement.

It was first acquired by Bitfury in 2015 after building a two-phase immersion cooling 500kW data center in Hong Kong, that purportedly cut energy consumption by 95% versus traditional air cooling technologies. Later, the companies jointly deployed 160 megawatts of two-phase immersion-cooled data centers.

“Bitfury has been innovating across multiple industries and sees major growth opportunities with LiquidStack’s game-changing cooling solutions for compute-intensive applications and infrastructure,” said Valery Vavilov, CEO of Bitfury. “I believe LiquidStack’s leadership team, together with our customers and strategic support from Wiwynn, will rapidly accelerate the global adoption and deployment of two-phase immersion cooling.”

The $10 million in funding came from the Taiwanese conglomerate Wiwynn, a data center and infrastructure developer with revenues of $6.3 billion last year.

“Wiwynn continues to invest in advanced cooling solutions to address the challenges of fast-growing power consumption and density for cloud computing, AI, and HPC,” said Emily Hong, chief executive of Wiwynn, in a statement.

In a statement, LiquidStack said its technology could enable at least 21 times more heat rejection per IT rack compared to air cooling — all without the need for water. The company said its cooling method results in a 41% reduction in energy used for cooling and a 60% reduction in data center space.

“Bitfury has always been focused on leading by example and is a technology driven company from the top of the organization, to its grass roots,” said Joe Capes, co-founder and chief executive of LiquidStack, in a statement. “Launching LiquidStack with new funding enables us to focus on our strengths and capabilities, accelerating the development of liquid cooling technology, products and services to help solve real thermal and sustainability challenges driven by the adoption of cloud services, AI, edge and high-performance computing.”

Powered by WPeMatico

The explosion in productivity software amid a broader remote work boom has been one of the pandemic’s clearest tech impacts. But learning to use a dozen new programs while having to decipher which data is hosted where can sometimes seem to have an adverse effect on worker productivity. It’s all time that users can take for granted, even when carrying out common tasks like navigating to the calendar to view more info to click a link to open the browser to redirect to the native app to open a Zoom call.

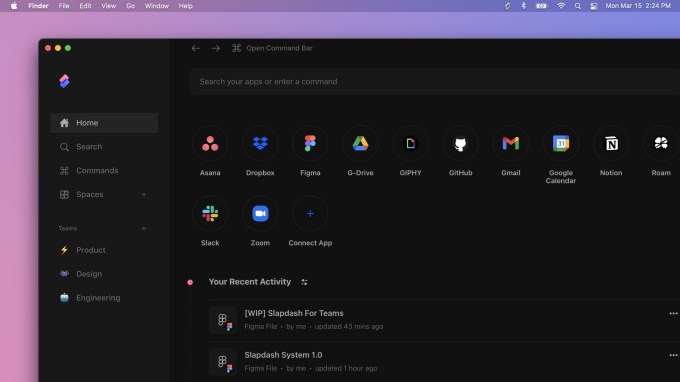

Slapdash is aiming to carve a new niche out for itself among workplace software tools, pushing a desire for peak performance to the forefront with a product that shaves seconds off each instance where a user needs to find data hosted in a cloud app or carry out an action. While most of the integration-heavy software suites to emerge during the remote work boom have focused on promoting visibility or re-skinning workflows across the tangled weave of SaaS apps, Slapdash founder Ivan Kanevski hopes that the company’s efforts to engineer a quicker path to information will push tech workers to integrate another tool into their workflow.

The team tells TechCrunch that they’ve raised $3.7 million in seed funding from investors that include S28 Capital, Quiet Capital, Quarry Ventures, UP2398 and Twenty Two Ventures. Angels participating in the round include co-founders at companies like Patreon, Docker and Zynga.

Image Credits: Slapdash

Kanevski says the team sought to emulate the success of popular apps like Superhuman, which have pushed low-latency command line interface navigation while emulating some of the sleek internal tools used at companies like Facebook, where he spent nearly six years as a software engineer.

Slapdash’s command line widget can be pulled up anywhere, once installed, with a quick keyboard shortcut. From there, users can search through a laundry list of indexable apps including Slack, Zoom, Jira and about 20 others. Beyond command line access, users can create folders of files and actions inside the full desktop app or create their own keyboard shortcuts to quickly hammer out a task. The app is available on Mac, Windows, Linux and the web.

“We’re not trying to displace the applications that you connect to Slapdash,” he says. “You won’t see us, for example, building document editing, you won’t see us building project management, just because our sort of philosophy is that we’re a neutral platform.”

The company offers a free tier for users indexing up to five apps and creating 10 commands and spaces; any more than that and you level up into a $12 per month paid plan. Things look more customized for enterprise-wide pricing. As the team hopes to make the tool essential to startups, Kanevski sees the app’s hefty utility for individual users as a clear asset in scaling up.

“If you anticipate rolling this out to larger organizations, you would want the people that are using the software to have a blast with it,” he says. “We have quite a lot of confidence that even at this sort of individual atomic level, we built something pretty joyful and helpful.”

Powered by WPeMatico

Amazon is apparently pleased with how its Amazon Care pilot in Seattle has gone, since it announced this morning that it will be expanding the offering across the U.S. this summer, and opening it up to companies of all sizes, in addition to its own employees. The Amazon Care model combines on-demand and in-person care, and is meant as a solution from the search giant to address shortfalls in current offerings for employer-sponsored healthcare.

In a blog post announcing the expansion, Amazon touted the speed of access to care made possible for its employees and their families via the remote, chat and video-based features of Amazon Care. These are facilitated via a dedicated Amazon Care app, which provides direct, live chats via a nurse or doctor. Issues that then require in-person care are then handled via a house call, so a medical professional is actually sent to your home to take care of things like administering blood tests or doing a chest exam, and prescriptions are delivered to your door as well.

The expansion is being handled differently across both in-person and remote variants of care; remote services will be available starting this summer to Amazon’s own employees, as well as other companies that sign on as customers, starting this summer. The in-person side will be rolling out more slowly, starting with availability in Washington, D.C., Baltimore, and “other cities in the coming months” according to the company.

As of today, Amazon Care is expanding in its home state of Washington to begin serving other companies. The idea is that others will sign on to make Amazon Care part of an overall benefits package for employees. Amazon is touting as a major strength of the service the speed advantages of testing services, including results delivery, for things including COVID-19.

The Amazon Care model has a surprisingly Amazon twist, too — when using the in-person care option, the app will provide an updated ETA for when to expect your physician or medical technician, which is eerily similar to how its primary app treats package delivery.

While the Amazon Care pilot in Washington only launched a year-and-a-half ago, the company has had its collective mind set on upending the corporate healthcare industry for some time now. It announced a partnership with Berkshire Hathaway and JPMorgan back at the beginning of 2018 to form a joint venture specifically to address the gaps they saw in the private corporate healthcare provider market.

That deep pocketed all-star team ended up officially disbanding at the outset of this year, after having done a whole lot of not very much in the three years in between. One of the stated reasons that Amazon and its partners gave for unpartnering was that each had made a lot of progress on its own in addressing the problems it had faced anyway. While Berkshire Hathaway and JPMorgan’s work in that regard might be less obvious, Amazon was clearly referring to Amazon Care.

It’s not unusual for large tech companies with lots of cash on the balance sheet and a need to attract and retain top-flight talent to spin up their own healthcare benefits for their workforces. Apple and Google both have their own on-campus wellness centers staffed by medical professionals, for instance. But Amazon’s ambitions have clearly exceeded those of its peers, and it looks intent on making a business line out of the work it did to improve its own employee care services — a strategy that isn’t too dissimilar from what happened with AWS, by the way.

Powered by WPeMatico

Squarespace has raised $300 million in a round of funding that values the company at a staggering $10 billion valuation.

New backers include Dragoneer, Tiger Global, D1 Capital Partners, Fidelity Management & Research Company, funds and accounts advised by T. Rowe Price Associates, Inc. and Spruce House. Existing backers Accel and General Atlantic also participated.

Squarespace founder & CEO Anthony Casalena said the fresh capital will advance the company’s growth initiatives and help it scale its product suite.

The move comes less than two months after the company filed confidentiality to go public via a direct listing or initial public offering.

Squarespace, which has helped millions create their own websites, was founded in 2003 and bootstrapped until a $38.5 million Series A in 2010 that was co-led by Accel and Index Ventures.

The online website creation and hosting service — which has now expanded into e-commerce by hosting online stores — then raised another $40 million round in 2014. But it is perhaps best known for its epic 2017-era $200 million secondary round that General Atlantic financed. That round was raised at a $1.5 billion pre-money valuation. That means it has effectively upped its valuation by more than five times in just over three years.

At that time, TechCrunch reported that Squarespace was a profitable company, with revenues increasing 50% in the prior year, to about $300 million. Execs are declining to comment on the company’s latest funding round beyond a post on its website.

New York City-based Squarespace has over 1,200 employees spread across its headquarters and offices in Dublin, Ireland; Portland, Oregon; and Los Angeles, California.

Powered by WPeMatico

Noogata, a startup that offers a no-code AI solution for enterprises, today announced that it has raised a $12 million seed round led by Team8, with participation from Skylake Capital. The company, which was founded in 2019 and counts Colgate and PepsiCo among its customers, currently focuses on e-commerce, retail and financial services, but it notes that it will use the new funding to power its product development and expand into new industries.

The company’s platform offers a collection of what are essentially pre-built AI building blocks that enterprises can then connect to third-party tools like their data warehouse, Salesforce, Stripe and other data sources. An e-commerce retailer could use this to optimize its pricing, for example, thanks to recommendations from the Noogata platform, while a brick-and-mortar retailer could use it to plan which assortment to allocate to a given location.

“We believe data teams are at the epicenter of digital transformation and that to drive impact, they need to be able to unlock the value of data. They need access to relevant, continuous and explainable insights and predictions that are reliable and up-to-date,” said Noogata co-founder and CEO Assaf Egozi. “Noogata unlocks the value of data by providing contextual, business-focused blocks that integrate seamlessly into enterprise data environments to generate actionable insights, predictions and recommendations. This empowers users to go far beyond traditional business intelligence by leveraging AI in their self-serve analytics as well as in their data solutions.”

We’ve obviously seen a plethora of startups in this space lately. The proliferation of data — and the advent of data warehousing — means that most businesses now have the fuel to create machine learning-based predictions. What’s often lacking, though, is the talent. There’s still a shortage of data scientists and developers who can build these models from scratch, so it’s no surprise that we’re seeing more startups that are creating no-code/low-code services in this space. The well-funded Abacus.ai, for example, targets about the same market as Noogata.

“Noogata is perfectly positioned to address the significant market need for a best-in-class, no-code data analytics platform to drive decision-making,” writes Team8 managing partner Yuval Shachar. “The innovative platform replaces the need for internal build, which is complex and costly, or the use of out-of-the-box vendor solutions which are limited. The company’s ability to unlock the value of data through AI is a game-changer. Add to that a stellar founding team, and there is no doubt in my mind that Noogata will be enormously successful.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico

Google Cloud today announced the launch of a new support option for its Premium Support customers that run mission-critical services on its platform. The new service, imaginatively dubbed Mission Critical Services (MCS), brings Google’s own experience with Site Reliability Engineering to its customers. This is not Google completely taking over the management of these services, though. Instead, the company describes it as a “consultative offering in which we partner with you on a journey toward readiness.”

Initially, Google will work with its customers to improve — or develop — the architecture of their apps and help them instrument the right monitoring systems and controls, as well as help them set and raise their service-level objectives (a key feature in the Site Reliability Engineering philosophy).

Later, Google will also provide ongoing check-ins with its engineers and walk customers through tune-ups architecture reviews. “Our highest tier of engineers will have deep familiarity with your workloads, allowing us to monitor, prevent, and mitigate impacts quickly, delivering the fastest response in the industry. For example, if you have any issues–24-hours-a-day, seven-days-a-week–we’ll spin up a live war room with our experts within five minutes,” Google Cloud’s VP for Customer Experience, John Jester, explains in today’s announcement.

This new offering is another example of how Google Cloud is trying to differentiate itself from the rest of the large cloud providers. Its emphasis today is on providing the high-touch service experiences that were long missing from its platform, with a clear emphasis on the needs of large enterprise customers. That’s what Thomas Kurian promised to do when he became the organization’s CEO and he’s clearly following through.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20 percent off tickets right here.

Powered by WPeMatico

Aqua Security, a Boston- and Tel Aviv-based security startup that focuses squarely on securing cloud-native services, today announced that it has raised a $135 million Series E funding round at a $1 billion valuation. The round was led by ION Crossover Partners. Existing investors M12 Ventures, Lightspeed Venture Partners, Insight Partners, TLV Partners, Greenspring Associates and Acrew Capital also participated. In total, Aqua Security has now raised $265 million since it was founded in 2015.

The company was one of the earliest to focus on securing container deployments. And while many of its competitors were acquired over the years, Aqua remains independent and is now likely on a path to an IPO. When it launched, the industry focus was still very much on Docker and Docker containers. To the detriment of Docker, that quickly shifted to Kubernetes, which is now the de facto standard. But enterprises are also now looking at serverless and other new technologies on top of this new stack.

“Enterprises that five years ago were experimenting with different types of technologies are now facing a completely different technology stack, a completely different ecosystem and a completely new set of security requirements,” Aqua CEO Dror Davidoff told me. And with these new security requirements came a plethora of startups, all focusing on specific parts of the stack.

What set Aqua apart, Dror argues, is that it managed to 1) become the best solution for container security and 2) realized that to succeed in the long run, it had to become a platform that would secure the entire cloud-native environment. About two years ago, the company made this switch from a product to a platform, as Davidoff describes it.

“There was a spree of acquisitions by CheckPoint and Palo Alto [Networks] and Trend [Micro],” Davidoff said. “They all started to acquire pieces and tried to build a more complete offering. The big advantage for Aqua was that we had everything natively built on one platform. […] Five years later, everyone is talking about cloud-native security. No one says ‘container security’ or ‘serverless security’ anymore. And Aqua is practically the broadest cloud-native security [platform].”

One interesting aspect of Aqua’s strategy is that it continues to bet on open source, too. Trivy, its open-source vulnerability scanner, is the default scanner for GitLab’s Harbor Registry and the CNCF’s Artifact Hub, for example.

“We are probably the best security open-source player there is because not only do we secure from vulnerable open source, we are also very active in the open-source community,” Davidoff said (with maybe a bit of hyperbole). “We provide tools to the community that are open source. To keep evolving, we have a whole open-source team. It’s part of the philosophy here that we want to be part of the community and it really helps us to understand it better and provide the right tools.”

In 2020, Aqua, which mostly focuses on mid-size and larger companies, doubled the number of paying customers and it now has more than half a dozen customers with an ARR of over $1 million each.

Davidoff tells me the company wasn’t actively looking for new funding. Its last funding round came together only a year ago, after all. But the team decided that it wanted to be able to double down on its current strategy and raise sooner than originally planned. ION had been interested in working with Aqua for a while, Davidoff told me, and while the company received other offers, the team decided to go ahead with ION as the lead investor (with all of Aqua’s existing investors also participating in this round).

“We want to grow from a product perspective, we want to grow from a go-to-market [perspective] and expand our geographical coverage — and we also want to be a little more acquisitive. That’s another direction we’re looking at because now we have the platform that allows us to do that. […] I feel we can take the company to great heights. That’s the plan. The market opportunity allows us to dream big.”

Powered by WPeMatico

People are not only shopping digitally more than ever, they’re also shopping using their mobile phones more than ever.

And for mobile-first companies like Snapcommerce, this is good news.

Snapcommerce, formerly known as SnapTravel, has raised $85 million in what the company is describing as a “Pre-IPO” growth round to help further its mission of “changing the way people shop on their phones.”

The Toronto, Ontario-based startup has built out an AI-driven, vertical-agnostic platform that uses messaging in an effort to personalize the mobile shopping experience and “deliver the best promotional prices.” While it was initially focused on the travel industry, the company is now branching out into other consumer verticals — hence its name change.

Inovia Capital and Lion Capital co-led the new growth round, which included participation from Acrew DCF, Thayer Ventures and Full In Partners, as well as existing backers Telstra Ventures and Bee Partners. The financing brings Snapcommerce’s total raised since its 2016 inception to over $100 million. Its last raise — a $7.2 million round from Telstra and NBA star Steph Curry — took place in 2019.

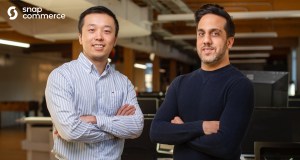

The startup was founded by tech entrepreneurs Hussein Fazal, whose prior company AdParlor grew to $100+ million in revenue, then sold to AdKnowledge back in 2011; and Henry Shi, who previously built uMentioned and worked at Google, where he helped launch YouTube Music Insights, according to previous TechCrunch reporting.

Snapcommerce co-founders Henry Shi and Hussein Fazal. Image courtesy of Snapcommerce

Snapcommerce launched its first, travel-focused product in 2017. It works by using chatbots to interact with customers via messaging apps such as SMS, Facebook and WhatsApp. But the company also has human agents ready to help if people need more assistance, in the past essentially serving as on-demand travel agents.

Its service is not just for hotels and flights, but also to help people book restaurants and activities too.

“Our focus has been on building that personal relationship,” Fazal said. “Many people end up coming back to us when they travel again.” In fact, over 40% of its sales in 2020 came from repeat customers.

Over the years, the company claims to have helped more than 10 million users globally save over $75 million. It expects to cross over $1 billion in total mobile sales this year.

And now it’s ready to branch out into helping consumers save money on goods.

“When shopping, it’s hard to find the right product and even if you do, it’s hard to find a good deal,” he said. “On a desktop, there’s ways around it. But on mobile, it’s virtually impossible.”

The company turned the corner to profitability three months into the pandemic in 2020, seeing a 60% spike in sales in the second half of the year compared to H2 2019, according to CEO Fazal.

It then decided to re-invest its profits to continue growing the business.

“The profitability during the pandemic gave us confidence that we could turn to profitability whenever we needed to and gave us control of our own destiny, which enabled this fundraise,” Fazal told TechCrunch. “The third quarter of 2020 ended up being our greatest quarter ever.”

The COVID-19 pandemic, naturally, only accelerated its growth as more consumers turned to mobile.

“We believe the next wave of power purchasers will be via mobile,” Fazal said. “Some of the new generation don’t even have desktops or laptops, and they spend all their time on their mobile phone and messaging. So we’re able to be at the forefront.”

Snapcommerce has an IPO in its sights, although no specific timeline. The company did not reveal its current valuation or hard revenue figures. The company makes money by either marking up prices provided by a merchant or charging the merchant a commission.

Chris Arsenault, partner at Inovia and Snapcommerce lead investor, said his firm “tripled up” on its investment in the startup after witnessing its success in the travel space.

“Other companies out there only care about the transaction, and force consumers to look through several services to see if they got the best price, all the while telling them ‘there’s only two seats left,’ ” he told TechCrunch. “We believe that consumers aren’t going to accept that type of pressure-selling in the future. And Snapcommerce’s ability to build trust with its customers and service providers has attracted us to them as they are defining what the future of commerce is going to be like.”

Ultimately, the company plans to use its fresh capital to continue to scale with the goal of streamlining the entire mobile search, purchase and fulfillment process and make finding “the right item at the right price as easy as sending a message to a trusted friend.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Sometimes the smallest innovations can have the biggest impacts on the world’s efforts to stop global climate change. Arguably, one of the biggest contributors in the fight against climate change to date has been the switch to the humble LED light, which has slashed hundreds of millions of tons of carbon dioxide emissions simply by reducing energy consumption in buildings.

And now firms backed by Robert Downey Jr. and Bill Gates are joining investors like Amazon and iPod inventor Tony Fadell to pour money into a company called Turntide Technologies that believes it has the next great innovation in the world’s efforts to slow global climate change — a better electric motor.

It’s not as flashy as an arc reactor, but like light bulbs, motors are a ubiquitous and wholly unglamorous technology that have been operating basically the same way since the nineteenth century. And, like the light bulb, they’re due for an upgrade.

“Turntide’s technology and approach to restoring our planet will directly reduce energy consumption,” said Steve Levin, the co-founder (along with Downey Jr. ) of FootPrint Coalition.

The operation of buildings is responsible for 40% of CO2 emissions worldwide, Turntide noted in a statement. And, according to the U.S. Department of Energy (DOE), one-third of energy used in commercial buildings is wasted. Smart building technology adds an intelligent layer to eliminate this waste and inefficiency by automatically controlling lighting, air conditioning, heating, ventilation and other essential systems and Turntide’s electric motors can add additional savings.

That’s why investors have put over $100 million into Turntide in just the last six months.

PARIS, FRANCE – JUNE 16: Tony Fadell, inventor of the iPod and founder and former CEO of Nest, attends a conference during Viva Technology at Parc des Expositions Porte de Versailles on June 16, 2017 in Paris, France. Viva Technology is a fair that brings together, for the second year, major groups and startups around all the themes of innovation. (Photo by Christophe Morin/IP3/Getty Images)

The company, led by chief executive and chairman Ryan Morris, is commercializing technology that was developed initially at the Illinois Institute of Technology.

Turntide’s basic innovation is a software-controlled motor, or switch reluctance motor, that uses precise pulses of energy instead of a constant flow of electricity. “In a conventional motor you are continuously driving current into the motor whatever speed you want to run it at,” Morris said. “We’re pulsing in precise amounts of current just at the times when you need the torque… It’s software-defined hardware.”

The technology spent 11 years under development, in part because the computing power didn’t exist to make the system work, according to Morris.

Morris was initially part of an investment firm called Meson Capital that acquired the technology back in 2013, and it was another four years of development before the motors were actually able to function in pilots, he said. The company spent the last three years developing the commercialization strategy and proving the value in its initial market — retrofitting the heating ventilation and cooling systems in buildings that are the main factor in the built environment’s 28% contribution to carbon dioxide emissions that are leading to global climate change.

“Our mission is to replace all of the motors in the world,” Morris said.

He estimates that the technology is applicable to 95% of where electric motors are used today, but the initial focus will be on smart buildings because it’s the easiest place to start and can have some of the largest immediate impact on energy usage.

“The carbon impact of what we’re doing is pretty massive,” Morris told me last year. “The average energy reduction [in buildings] has been a 64% reduction. If we can replace all the motors in buildings in the U.S. that’s the carbon equivalent of adding over 300 million tons of carbon sequestration per year.”

That’s why Downey Jr.’s Footprint Coalition, and Bill Gates’ Breakthrough Energy Ventures and the real estate and construction-focused venture firm Fifth Wall Ventures have joined the Amazon Climate Fund, Tony Fadell’s Future Shape, BMW’s iVentures fund and a host of other investors in backing the company.

The company has raised roughly $180 million in financing, including the disclosure today of an $80 million investment round, which closed in October.

Buildings are clearly the current focus for Turntide, which only yesterday announced the acquisition of a small Santa Barbara, California-based building management software developer called Riptide IO. But there’s also an application in another massive industry — electric vehicles.

“Two years from now we will definitely be in electric vehicles,” Morris said.

“Our technology has huge advantages for the electric vehicle industry. There’s no rare earth minerals. Every EV uses rare earth minerals to get better performance of their electric motors,” he continued. “They’re expensive, destructive to mine and China controls 95% of the global supply chain for them. We do not use any exotic materials, rare earth minerals or magnets… We’re replacing that with very advanced software and computation. It’s the first time Moore’s law applies to the motor.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included in each for audience questions and discussion.

Powered by WPeMatico