computing

Auto Added by WPeMatico

Auto Added by WPeMatico

At its (virtual) Build conference today, Microsoft launched a number of new features, tools and services for developers who want to integrate their services with Teams, the company’s Slack competitor. It’s no secret that Microsoft basically looks at Teams, which now has about 145 million daily active users, as the new hub for employees to get work done, so it’s no surprise that it wants third-party developers to bring their services right to Teams as well. And to do so, it’s now offering a set of new tools that will make this easier and enable developers to build new user experiences in Teams.

There’s a lot going on here, but maybe the most important news is the launch of the enhanced Microsoft Teams Toolkit for Visual Studio and Visual Studio Code.

“This essentially enables developers to build apps easier and faster — and to build very powerful apps tapping into the rich Microsoft stack,” Microsoft group program manager Archana Saseetharan explained. “With the updated toolkit […], we enable flexibility for developers. We want to meet developers where they are.”

The toolkit offers support for tools and frameworks like React, SharePoint and .NET. Some of the updates the team enabled with this release are integration with Aure Functions, the SharePoint Framework integration and a single-line integration with the Microsoft Graph. Microsoft is also making it easier for developers to integrate an authorization workflow into their Teams apps. “Login is the first kind of experience of any user with an app — and most of the drop-offs happen there,” Saseetharan said. “So [single-sign on] is something we completely are pushing hard on.”

The team also launched a new Developer Portal for Microsoft Teams that makes it easier for developers to register and configure their apps from a single tool. ISVs will also be able to use the new portal to offer their apps for in-Teams purchases.

Other new Teams features for developers include ways for developers to build real-time multi-user experiences like whiteboards and project boards, for example, as well as a new meeting event API to build meeting-related workflows for when a meeting starts and ends, for example, as well as new features for the Teams Together mode that will let developers design their own Together experiences.

There are a few other new features here as well, but what it all comes down to is that Microsoft wants developers to consider Teams as a viable platform for their services — and with 145 million daily active users, that’s potentially a lucrative way for software firms to get their services in front of a new audience.

“Teams is enabling a new class of apps called collaborative apps,” said Karan Nigam, Microsoft’s director of product marketing for Teams. “We are uniquely positioned to bring the richness to the collaboration space — a ton of innovation to the extensibility side to make apps richer, making it easier with the toolkit update, and then have a single-stop shop with the developer portal where the entire lifecycle can be managed. Ultimately, for a developer, they don’t have to go to multiple places, it’s one single flow from the business perspective for them as well.”

Powered by WPeMatico

As decentralized currencies have taken off in recent months, there’s been renewed attention around DAOs, or Decentralized Autonomous Organizations, as a means of bringing together groups of investors who can deploy capital as a unit while voting collectively on those investments. In the spirit of blockchain, they aim to bring greater transparency to investment decision-making.

A number of high-profile DAOs have launched in recent months as the fervor for crypto mania increased. Komorebi Collective, launching today, is a new organization founded by women in the blockchain space that will be making investments exclusively in “exceptional female and nonbinary crypto founders,” founding member Manasi Vora tells TechCrunch.

The group is comprised of a number of core team members largely assembled from the crypto nonprofit she256 and the organization Women in Blockchain, including Vora, Eva Wu, Kristie Huang, Medha Kothari and Kinjal Shah, who will collectively do most of the heavy lifting behind finding and presenting investments to the group. Other hand-selected members who committed a minimum of $5,000 USD will likely have a lighter commitment.

Each investment will be voted on by all the collective’s key signers, some 36 in total, the majority of whom are female.

“DAOs level the hierarchy of a venture fund by ensuring everyone is going to have a seat at the table,” says Shah, who is also an investor at crypto VC firm Blockchain Capital. “We are very careful in approaching the backers that are really mission-aligned.”

Other members of the DAO include firms like Kleiner Perkins, Mechanism Capital, Dragonfly Capital, IDEO CoLab Ventures and Stacks Accelerator alongside a number of individuals and founders who work at firms like Twitter, Coinbase, Skynet Labs, Celo Labs and Gitcoin.

The organization itself is built on the Syndicate Protocol, a project that shares some of Komorebi Collective’s backers.

The group hopes the structure of their organization will be able to take a mission-driven approach that improves diversity in the crypto space while proving the sustainability of the DAO model. Despite an explosion in startup investments in the past year, women-led startups received just 2.3% of venture dollars invested in 2020, a study in HBR found.

“There’s so much more room to grow when it comes to female founders getting funding and I want to be part of the solution,” Shah tells TechCrunch.

Powered by WPeMatico

At Google I/O today Google Cloud announced Vertex AI, a new managed machine learning platform that is meant to make it easier for developers to deploy and maintain their AI models. It’s a bit of an odd announcement at I/O, which tends to focus on mobile and web developers and doesn’t traditionally feature a lot of Google Cloud news, but the fact that Google decided to announce Vertex today goes to show how important it thinks this new service is for a wide range of developers.

The launch of Vertex is the result of quite a bit of introspection by the Google Cloud team. “Machine learning in the enterprise is in crisis, in my view,” Craig Wiley, the director of product management for Google Cloud’s AI Platform, told me. “As someone who has worked in that space for a number of years, if you look at the Harvard Business Review or analyst reviews, or what have you — every single one of them comes out saying that the vast majority of companies are either investing or are interested in investing in machine learning and are not getting value from it. That has to change. It has to change.”

Wiley, who was also the general manager of AWS’s SageMaker AI service from 2016 to 2018 before coming to Google in 2019, noted that Google and others who were able to make machine learning work for themselves saw how it can have a transformational impact, but he also noted that the way the big clouds started offering these services was by launching dozens of services, “many of which were dead ends,” according to him (including some of Google’s own). “Ultimately, our goal with Vertex is to reduce the time to ROI for these enterprises, to make sure that they can not just build a model but get real value from the models they’re building.”

Vertex then is meant to be a very flexible platform that allows developers and data scientist across skill levels to quickly train models. Google says it takes about 80% fewer lines of code to train a model versus some of its competitors, for example, and then help them manage the entire lifecycle of these models.

The service is also integrated with Vizier, Google’s AI optimizer that can automatically tune hyperparameters in machine learning models. This greatly reduces the time it takes to tune a model and allows engineers to run more experiments and do so faster.

Vertex also offers a “Feature Store” that helps its users serve, share and reuse the machine learning features and Vertex Experiments to help them accelerate the deployment of their models into producing with faster model selection.

Deployment is backed by a continuous monitoring service and Vertex Pipelines, a rebrand of Google Cloud’s AI Platform Pipelines that helps teams manage the workflows involved in preparing and analyzing data for the models, train them, evaluate them and deploy them to production.

To give a wide variety of developers the right entry points, the service provides three interfaces: a drag-and-drop tool, notebooks for advanced users and — and this may be a bit of a surprise — BigQuery ML, Google’s tool for using standard SQL queries to create and execute machine learning models in its BigQuery data warehouse.

“We had two guiding lights while building Vertex AI: get data scientists and engineers out of the orchestration weeds, and create an industry-wide shift that would make everyone get serious about moving AI out of pilot purgatory and into full-scale production,” said Andrew Moore, vice president and general manager of Cloud AI and Industry Solutions at Google Cloud. “We are very proud of what we came up with in this platform, as it enables serious deployments for a new generation of AI that will empower data scientists and engineers to do fulfilling and creative work.”

Powered by WPeMatico

Merge, a startup that helps its users build customer-facing integrations with third-party tools, today announced that it has raised a $4.5 million seed round led by NEA. Additional angel investors include former MuleSoft CEO Greg Schott, Cloudflare CEO Matthew Prince, Expanse co-founders Tim Junio and Matt Kraning, and Jumpstart CEO Ben Herman.

Launched in 2020, the core focus of Merge is to give B2B companies a unified API to access data from what is currently about 40 HR, payroll, recruiting and accounting platforms, with plans for expanding to additional areas soon. But Merge co-founders Shensi Ding and Gil Feig, who have been lifelong friends and previously worked at companies like Expanse and Jumpstart, stress that the service isn’t aiming to replace workflow tools Workato or Zapier.

“What we built is more similar to Plaid than MuleSoft or other things,” Feig said. “We built a unified API, so we’re fully embedded in a customer’s product and they build one integration with us and can automatically offer all these integrations to their customers. On top of that, we offer what we call integrations management, which is a suite of tools to automatically detect issues where the customer would have to get involved — automatically detect that stuff and handle it without ever having to involve engineering again.”

When Merge’s systems detect issues with an integration, maybe because a data schema in an API response has changed without notice (which happens with some regularity), Merge’s engineers can fix that within minutes, in part because the teams also built an internal no-code tool for building and managing these integrations.

As Ding also noted, B2B buyers today also simply expect their tools to feature integrations with the service they use. “Companies, when they purchase a vendor, they expect that vendor to have integrations with all the other vendors that they own,” she said. “They don’t want to have to purchase a vendor and then purchase a workflow product and then connect those products.”

And while Merge’s focus right now is squarely on a few verticals, the plan is to expand this to far more areas shortly, likely starting with CRM. “Salesforce has a pretty large market share, so we thought that it wasn’t going to be as interesting of a market,” Ding said. “But it turns out that their API is so complex that customers would still prefer to integrate with us instead if we simplify it for them.”

Ding and Feig tell me the company, which came out of stealth about two months ago, already has about 100 organizations on its platform, varying from seed-stage companies to publicly listed enterprises. The team credits its focus on security and reliability (and its SOC II compliance) with being able to bring on some of these larger companies despite being a seed-stage company itself.

To monetize the service, Merge offers a free tier (up to 10,000 API requests per month) and charges $0.01 per API request for additional usage. Unsurprisingly, the company also offers customized enterprise plans for its larger customers.

“The time and expense associated with building and maintaining myriad API integrations is a pain point we hear about consistently from our portfolio companies across all industries,” said NEA managing general partner Scott Sandell, who will join the company’s board. “Merge is tackling this ubiquitous problem head-on via their easy-to-use, unified API platform. Their platform has broad applicability and is a massive upgrade for any software company that needs to build, manage, and maintain multiple API integrations.”

Powered by WPeMatico

Panaseer, which takes a data science approach to cybersecurity, has raised $26.5 million in a Series B funding led by AllegisCyber Capital. Existing investors, including Evolution Equity Partners, Notion Capital, AlbionVC, Cisco Investments and Paladin Capital Group, as well as new investor National Grid Partners, also participated. Panaseer has now raised $43 million to date.

Panaseer’s special sauce and sales pitch amount to what it calls “Continuous Controls Monitoring” (CCM). In plainer English that means correlating a great deal of data from all available security tools to check assets, control gaps, you name it.

As a result, the company says it can identify zero-day and other exposures faster, or exposure to, say, FireEye or SolarWinds vulnerabilities.

Jonathan Gill, CEO, Panaseer said: “Most enterprises have the tools and capability to theoretically prevent a breach from occurring. However, one of the key reasons that breaches occur is that there is no technology to monitor and react to failed controls. CCM continuously validates and measures levels of protection and provides notifications of failures. Ultimately, CCM enables these failures to be fixed before they become security incidents.”

Speaking to me on a call he added: “The investment, allows us to scale our organization to meet those demands of customers with a team of people to implement the platform and help them get tremendous value and to evolve the product. To add more and more capability to that technology to support more and more use cases. So they’re the two main directions, and there’s a market we think of tens of thousands of organizations of a certain size, who are regulated or they have assets worth protecting and a level of complexity that makes it difficult to solve the problem themselves. And our Advisory Board and the customers I’ve spoken with think maybe there are barely 20 companies in the world who can solve this problem. And everybody else gets stuck on the fact that it’s a really difficult data science problem to solve. So we want to scale that and take that to more organizations.”

And why did they pick these investors: “I think we picked them and they picked us, we’ve been on that journey together. It takes months to find the best combination. The dollars are all the same when it comes to investors, but I think they can help improve as an organization and grow just like the existing investors do. They give us access and reach into parts of the market and help make us better as organizations as well.”

Bob Ackerman, founder and managing director of AllegisCyber Capital, and co-founder of DataTribe said: “The emergence of Continuous Controls Monitoring as a new cybersecurity category demonstrates a ‘coming of age’ for cybersecurity. Cyber is the existential threat to the global digital economy. All levels of the enterprise, from the CISO, to Chief Risk Officer, to the Board of Directors are demanding comprehensive visibility, transparency and hard metrics to assess cyber situational awareness.”

Powered by WPeMatico

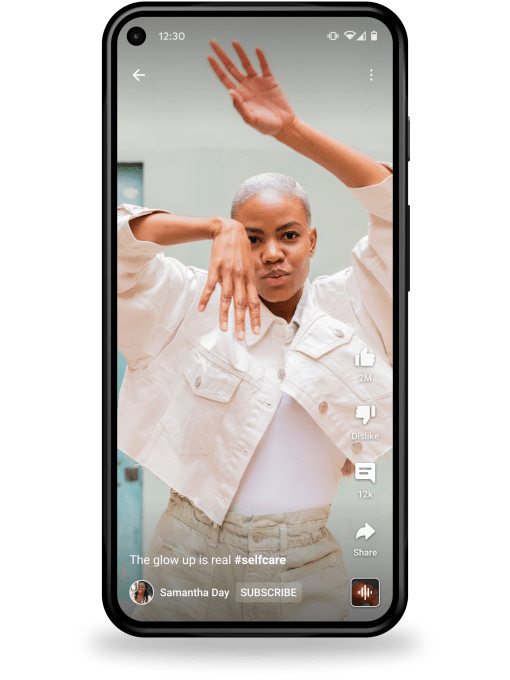

YouTube is giving its TikTok competitor, YouTube Shorts, an injection of cash to help it better compete with rivals. The company today introduced the YouTube Shorts Fund, a $100 million fund that will pay YouTube Shorts creators for their most viewed and most engaging content over the course of 2021 and 2022. Creators can’t apply for the fund to help with content production, however. Instead, YouTube will reach out to creators each month whose videos exceeded certain milestones to reward them for their contributions.

The company expects to dole out money to “thousands” of creators every month, it says. And these creators don’t need to be in the YouTube Partner Program to qualify — anyone is eligible to receive rewards by creating original content for YouTube Shorts.

YouTube declined to share more specific details about the fund’s operations at this time, including how creators will be vetted or what specific thresholds for receiving payments YouTube has in mind. It also wouldn’t offer details as to whether YouTube creators could receive multiple payments in the same pay period if they had several videos that would qualify, or any other details.

And while the company stressed that only “original” content would gain rewards, it didn’t clarify how it will go about checking to ensure the content isn’t already uploaded on another platform, like Reels, Snapchat or TikTok.

Image Credits: YouTube

Instead, YouTube said that more details about the payments and qualifications would be available closer to the fund’s launch, which is expected sometime in the next few months. It pointed out also that it has paid out over $30 billion to creators, artists and media companies over the last three years, and it expects the new fund will help it to build a long-term monetization model for Shorts on YouTube going forward.

YouTube isn’t the only platform to take on the threat of TikTok by throwing cash at the problem.

Snapchat has been paying $1 million per day to creators for their top-performing videos on Spotlight, its own TikTok clone, minting several millionaires in the process. Facebook-owned Instagram, meanwhile, made lucrative offers to top TikTok stars to use its new service, Reels, The WSJ reported last year.

Despite the size of these efforts, TikTok’s own Creator Fund remains a competitive force. It announced its fund would grow to over $1 billion in the U.S. in the next three years and would be more than double that on a global basis. This March, it also added another requirement to receiving the fund’s payments, including having at least 100K authentic views in the last 30 days — a signal that it’s setting the bar even higher, given its current success.

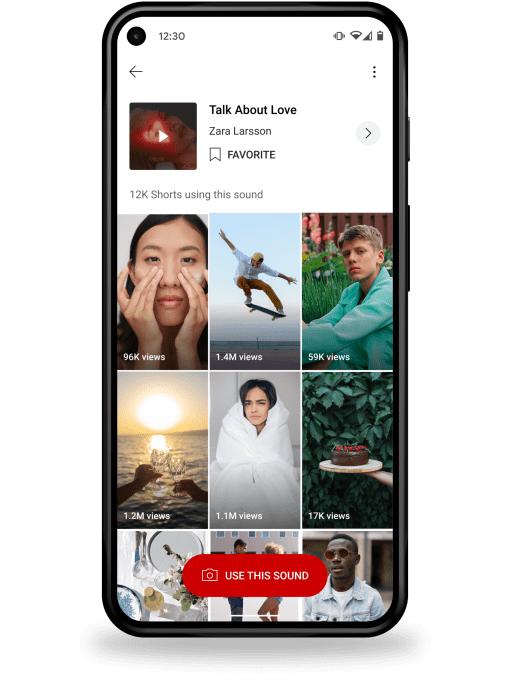

Alongside the debut of YouTube’s Shorts Fund, the company also noted it’s expanding its Shorts player feature across more places on YouTube to help viewers discover this short-form video content, will begin testing ads for Shorts and will be rolling out the new “remix audio” feature to all Shorts creators.

Image Credits: YouTube

This somewhat controversial feature allows Shorts creators to sample sounds from other YouTube videos for use in their Shorts, instead of only using song clips or original audio. Some YouTube creators were surprised to find the feature was opt-out by default — meaning their content could be used on YouTube Shorts unless they took the time to turn this setting off or removed their video from YouTube.

Since its launch, YouTube has also rolled out other features to Shorts, including support for captions, the ability to record up to 60 seconds with the Shorts camera, the ability to add clips from your phone’s gallery to your recordings made with the Shorts camera and the ability use basic filters to color correct videos. YouTube says more effects will arrive in the future.

But even as YouTube tries to catch up with TikTok on feature sets, TikTok has been expanding its own effects lineup and becoming more YouTube-like by supporting longer videos. Some TikTok creators, for example, have recently been given the ability to record videos three minutes in length, instead of just 60 seconds.

YouTube says the new fund will roll out in the coming months and it will listen to the feedback from the creator community to develop a long-term program designed for YouTube Shorts.

Powered by WPeMatico

Remote work is no longer a new topic, as much of the world has now been doing it for a year or more because of the COVID-19 pandemic.

Companies — big and small — have had to react in myriad ways. Many of the initial challenges have focused on workflow, productivity and the like. But one aspect of the whole remote work shift that is not getting as much attention is the culture angle.

A 100% remote startup that was tackling the issue way before COVID-19 was even around is now seeing a big surge in demand for its offering that aims to help companies address the “people” challenge of remote work. It started its life with the name Icebreaker to reflect the aim of “breaking the ice” with people with whom you work.

“We designed the initial version of our product as a way to connect people who’d never met, kind of virtual speed dating,” says co-founder and CEO Perry Rosenstein. “But we realized that people were using it for far more than that.”

So over time, its offering has evolved to include a bigger goal of helping people get together beyond an initial encounter –– hence its new name: Gatheround.

“For remote companies, a big challenge or problem that is now bordering on a crisis is how to build connection, trust and empathy between people that aren’t sharing a physical space,” says co-founder and COO Lisa Conn. “There’s no five-minute conversations after meetings, no shared meals, no cafeterias — this is where connection organically builds.”

Organizations should be concerned, Gatheround maintains, that as we move more remote, that work will become more transactional and people will become more isolated. They can’t ignore that humans are largely social creatures, Conn said.

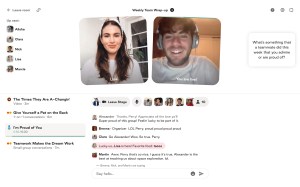

The startup aims to bring people together online through real-time events such as a range of chats, videos and one-on-one and group conversations. The startup also provides templates to facilitate cultural rituals and learning & development (L&D) activities, such as all-hands meetings and workshops on diversity, equity and inclusion.

Gatheround’s video conversations aim to be a refreshing complement to Slack conversations, which despite serving the function of communication, still don’t bring users face-to-face.

Image Credits: Gatheround

Since its inception, Gatheround has quietly built up an impressive customer base, including 28 Fortune 500s, 11 of the 15 biggest U.S. tech companies, 26 of the top 30 universities and more than 700 educational institutions. Specifically, those users include Asana, Coinbase, Fiverr, Westfield and DigitalOcean. Universities, academic centers and nonprofits, including Georgetown’s Institute of Politics and Public Service and Chan Zuckerberg Initiative, are also customers. To date, Gatheround has had about 260,000 users hold 570,000 conversations on its SaaS-based, video platform.

All its growth so far has been organic, mostly referrals and word of mouth. Now, armed with $3.5 million in seed funding that builds upon a previous $500,000 raised, Gatheround is ready to aggressively go to market and build upon the momentum it’s seeing.

Venture firms Homebrew and Bloomberg Beta co-led the company’s latest raise, which included participation from angel investors such as Stripe COO Claire Hughes Johnson, Meetup co-founder Scott Heiferman, Li Jin and Lenny Rachitsky.

Co-founders Rosenstein, Conn and Alexander McCormmach describe themselves as “experienced community builders,” having previously worked on President Obama’s campaigns as well as at companies like Facebook, Change.org and Hustle.

The trio emphasize that Gatheround is also very different from Zoom and video conferencing apps in that its platform gives people prompts and organized ways to get to know and learn about each other as well as the flexibility to customize events.

“We’re fundamentally a connection platform, here to help organizations connect their people via real-time events that are not just really fun, but meaningful,” Conn said.

Homebrew Partner Hunter Walk says his firm was attracted to the company’s founder-market fit.

“They’re a really interesting combination of founders with all this experience community building on the political activism side, combined with really great product, design and operational skills,” he told TechCrunch. “It was kind of unique that they didn’t come out of an enterprise product background or pure social background.”

He was also drawn to the personalized nature of Gatheround’s platform, considering that it has become clear over the past year that the software powering the future of work “needs emotional intelligence.”

“Many companies in 2020 have focused on making remote work more productive. But what people desire more than ever is a way to deeply and meaningfully connect with their colleagues,” Walk said. “Gatheround does that better than any platform out there. I’ve never seen people come together virtually like they do on Gatheround, asking questions, sharing stories and learning as a group.”

James Cham, partner at Bloomberg Beta, agrees with Walk that the founding team’s knowledge of behavioral psychology, group dynamics and community building gives them an edge.

“More than anything, though, they care about helping the world unite and feel connected, and have spent their entire careers building organizations to make that happen,” he said in a written statement. “So it was a no-brainer to back Gatheround, and I can’t wait to see the impact they have on society.”

The 14-person team will likely expand with the new capital, which will also go toward helping adding more functionality and details to the Gatheround product.

“Even before the pandemic, remote work was accelerating faster than other forms of work,” Conn said. “Now that’s intensified even more.”

Gatheround is not the only company attempting to tackle this space. Ireland-based Workvivo last year raised $16 million and earlier this year, Microsoft launched Viva, its new “employee experience platform.”

Powered by WPeMatico

DigitalOcean has emailed customers warning of a data breach involving customers’ billing data, TechCrunch has learned.

The cloud infrastructure giant told customers in an email on Wednesday, obtained by TechCrunch, that it has “confirmed an unauthorized exposure of details associated with the billing profile on your DigitalOcean account.” The company said the person “gained access to some of your billing account details through a flaw that has been fixed” over a two-week window between April 9 and April 22.

The email said customer billing names and addresses were accessed, as well as the last four digits of the payment card, its expiry date and the name of the card-issuing bank. The company said that customers’ DigitalOcean accounts were “not accessed,” and passwords and account tokens were “not involved” in this breach.

“To be extra careful, we have implemented additional security monitoring on your account. We are expanding our security measures to reduce the likelihood of this kind of flaw occuring [sic] in the future,” the email said.

DigitalOcean said it fixed the flaw and notified data protection authorities, but it’s not clear what the apparent flaw was that put customer billing information at risk.

In a statement, DigitalOcean’s security chief Tyler Healy said 1% of billing profiles were affected by the breach, but declined to address our specific questions, including how the vulnerability was discovered and which authorities have been informed.

Companies with customers in Europe are subject to GDPR and can face fines of up to 4% of their global annual revenue.

Last year, the cloud company raised $100 million in new debt, followed by another $50 million round, months after laying off dozens of staff amid concerns about the company’s financial health. In March, the company went public, raising about $775 million in its initial public offering.

Powered by WPeMatico

Arm today announced the launch of two new platforms, Arm Neoverse V1 and Neoverse N2, as well as a new mesh interconnect for them. As you can tell from the name, V1 is a completely new product and maybe the best example yet of Arm’s ambitions in the data center, high-performance computing and machine learning space. N2 is Arm’s next-generation general compute platform that is meant to span use cases from hyperscale clouds to SmartNICs and running edge workloads. It’s also the first design based on the company’s new Armv9 architecture.

Not too long ago, high-performance computing was dominated by a small number of players, but the Arm ecosystem has scored its fair share of wins here recently, with supercomputers in South Korea, India and France betting on it. The promise of V1 is that it will vastly outperform the older N1 platform, with a 2x gain in floating-point performance, for example, and a 4x gain in machine learning performance.

“The V1 is about how much performance can we bring — and that was the goal,” Chris Bergey, SVP and GM of Arm’s Infrastructure Line of Business, told me. He also noted that the V1 is Arm’s widest architecture yet. He noted that while V1 wasn’t specifically built for the HPC market, it was definitely a target market. And while the current Neoverse V1 platform isn’t based on the new Armv9 architecture yet, the next generation will be.

N2, on the other hand, is all about getting the most performance per watt, Bergey stressed. “This is really about staying in that same performance-per-watt-type envelope that we have within N1 but bringing more performance,” he said. In Arm’s testing, NGINX saw a 1.3x performance increase versus the previous generation, for example.

In many ways, today’s release is also a chance for Arm to highlight its recent customer wins. AWS Graviton2 is obviously doing quite well, but Oracle is also betting on Ampere’s Arm-based Altra CPUs for its cloud infrastructure.

“We believe Arm is going to be everywhere — from edge to the cloud. We are seeing N1-based processors deliver consistent performance, scalability and security that customers want from Cloud infrastructure,” said Bev Crair, senior VP, Oracle Cloud Infrastructure Compute. “Partnering with Ampere Computing and leading ISVs, Oracle is making Arm server-side development a first-class, easy and cost-effective solution.”

Meanwhile, Alibaba Cloud and Tencent are both investing in Arm-based hardware for their cloud services as well, while Marvell will use the Neoverse V2 architecture for its OCTEON networking solutions.

Powered by WPeMatico

The two founders of Crusoe Energy think they may have a solution to two of the largest problems facing the planet today — the increasing energy footprint of the tech industry and the greenhouse gas emissions associated with the natural gas industry.

Crusoe, which uses excess natural gas from energy operations to power data centers and cryptocurrency mining operations, has just raised $128 million in new financing from some of the top names in the venture capital industry to build out its operations — and the timing couldn’t be better.

Methane emissions are emerging as a new area of focus for researchers and policymakers focused on reducing greenhouse gas emissions and keeping global warming within the 1.5 degree target set under the Paris Agreement. And those emissions are just what Crusoe Energy is capturing to power its data centers and bitcoin mining operations.

The reason why addressing methane emissions is so critical in the short term is because these greenhouse gases trap more heat than their carbon dioxide counterparts and also dissipate more quickly. So dramatic reductions in methane emissions can do more in the short term to alleviate the global warming pressures that human industry is putting on the environment.

And the biggest source of methane emissions is the oil and gas industry. In the U.S. alone roughly 1.4 billion cubic feet of natural gas is flared daily, said Chase Lochmiller, a co-founder of Crusoe Energy. About two-thirds of that is flared in Texas, with another 500 million cubic feet flared in North Dakota, where Crusoe has focused its operations to date.

For Lochmiller, a former quant trader at some of the top American financial services institutions, and Cully Cavness, a third generation oil and gas scion, the ability to capture natural gas and harness it for computing operations is a natural combination of the two men’s interests in financial engineering and environmental preservation.

NEW TOWN, ND – AUGUST 13: View of three oil wells and flaring of natural gas on The Fort Berthold Indian Reservation near New Town, ND on August 13, 2014. About 100 million dollars’ worth of natural gas burns off per month because a pipeline system isn’t in place yet to capture and safely transport it. The Three Affiliated Tribes on Fort Berthold represent Mandan, Hidatsa and Arikara Nations. It’s also at the epicenter of the fracking and oil boom that has brought oil royalties to a large number of Native Americans living there. (Photo by Linda Davidson / The Washington Post via Getty Images)

The two Denver natives met in prep-school and remained friends. When Lochmiller left for MIT and Cavness headed off to Middlebury they didn’t know that they’d eventually be launching a business together. But through Lochmiller’s exposure to large-scale computing and the financial services industry, and Cavness’ assumption of the family business, they came to the conclusion that there had to be a better way to address the massive waste associated with natural gas.

Conversation around Crusoe Energy began in 2018 when Lochmiller and Cavness went climbing in the Rockies to talk about Lochmiller’s trip to Mt. Everest.

When the two men started building their business, the initial focus was on finding an environmentally friendly way to deal with the energy footprint of bitcoin mining operations. It was this pitch that brought the company to the attention of investors at Polychain, the investment firm started by Olaf Carlson-Wee (and Lochmiller’s former employer), and investors like Bain Capital Ventures and new investor Valor Equity Partners.

(This was also the pitch that Lochmiller made to me to cover the company’s seed round. At the time I was skeptical of the company’s premise and was worried that the business would just be another way to prolong the use of hydrocarbons while propping up a cryptocurrency that had limited actual utility beyond a speculative hedge against governmental collapse. I was wrong on at least one of those assessments.)

“Regarding questions about sustainability, Crusoe has a clear standard of only pursuing projects that are net reducers of emissions. Generally the wells that Crusoe works with are already flaring and would continue to do so in the absence of Crusoe’s solution. The company has turned down numerous projects where they would be a buyer of low-cost gas from a traditional pipeline because they explicitly do not want to be net adders of demand and emissions,” wrote a spokesman for Valor Equity in an email. “In addition, mining is increasingly moving to renewables and Crusoe’s approach to stranded energy can enable better economics for stranded or marginalized renewables, ultimately bringing more renewables into the mix. Mining can provide an interruptible base load demand that can be cut back when grid demand increases, so overall the effect to incentivize the addition of more renewable energy sources to the grid.”

Other investors have since piled on, including: Lowercarbon Capital, DRW Ventures, Founders Fund, Coinbase Ventures, KCK Group, Upper90, Winklevoss Capital, Zigg Capital and Tesla co-founder JB Straubel.

The company now operates 40 modular data centers powered by otherwise wasted and flared natural gas throughout North Dakota, Montana, Wyoming and Colorado. Next year that number should expand to 100 units as Crusoe enters new markets such as Texas and New Mexico. Since launching in 2018, Crusoe has emerged as a scalable solution to reduce flaring through energy intensive computing, such as bitcoin mining, graphical rendering, artificial intelligence model training and even protein folding simulations for COVID-19 therapeutic research.

Crusoe boasts 99.9% combustion efficiency for its methane, and is also bringing additional benefits in the form of new networking buildout at its data center and mining sites. Eventually, this networking capacity could lead to increased connectivity for rural communities surrounding the Crusoe sites.

Currently, 80% of the company’s operations are being used for bitcoin mining, but there’s increasing demand for use in data center operations, and some universities, including Lochmiller’s alma mater of MIT, are looking at the company’s offerings for their own computing needs.

“That’s very much in an incubated phase right now,” said Lochmiller. “A private alpha where we have a few test customers… we’ll make that available for public use later this year.”

Crusoe Energy Systems should have the lowest data center operating costs in the world, according to Lochmiller and while the company will spend money to support the infrastructure buildout necessary to get the data to customers, those costs are negligible when compared to energy consumption, Lochmiller said.

The same holds true for bitcoin mining, where the company can offer an alternative to coal-powered mining operations in China and the construction of new renewable capacity that wouldn’t be used to service the grid. As cryptocurrencies look for a way to blunt criticism about the energy usage involved in their creation and distribution, Crusoe becomes an elegant solution.

Institutional and regulatory tailwinds are also propelling the company forward. Recently New Mexico passed new laws limiting flaring and venting to no more than 2% of an operator’s production by April of next year, and North Dakota is pushing for incentives to support on-site flare capture systems while Wyoming signed a law creating incentives for flare gas reduction applied to bitcoin mining. The world’s largest financial services firms are also taking a stand against flare gas with BlackRock calling for an end to routine flaring by 2025.

“Where we view our power consumption, we draw a very clear line in our project evaluation stage where we’re reducing emissions for an oil and gas projects,” Lochmiller said.

Powered by WPeMatico