Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Xiaomi, the Chinese smartphone maker tipped for a public listing this year, has made a unique pledge: if it makes too much money, it’ll give a chunk of its profits back to its customers.

Yes, that’s right.

The company said today it will forever limit to just five percent the net profit margins after tax for smartphones, smart home devices and other hardware. If it makes more money than planned over a calendar year, it plans to “distribute the excess amount by reasonable means to its users.”

Today our CEO Lei Jun announced a promise to all our fans…#Xiaomi will forever limit the net profit margin after tax for our entire hardware sales (including smartphones, IoT and lifestyle products) to a maximum of 5%.

Do you like the sound of that? pic.twitter.com/ZbEjaVeBLf

— Mi (@xiaomi) April 25, 2018

It’s hard to know exactly what “reasonable means” Xiaomi is referring to, but here are some thoughts.

Spoiler number one alert !! — Most companies in mobile make a scant profit, if any at all, on hardware.

Firms like LG and Samsung rely on component divisions and other consumer brands to record the bulk of the revenue that makes them profitable. More broadly, the competitive market means there’s not much money to claim in selling phones. Apple is estimated to account for a whopping 87 percent of all smartphone profits despite just 18 percent market share.

Xiaomi Mi Mix 2 was widely lauded when it launched last year

Spoiler number two alert !! — Selling hardware with a low net profit has always been a component of Xiaomi’s strategy.

Indeed, former head of international Hugo Barra previously said it didn’t make money on hardware sales. That approach may have changed, but Xiaomi had never put a figure on its take-home margin before.

This pledge aligns itself neatly with the company’s core focus of providing cutting-edge tech, or as close to, at affordable prices. Much has been said over the years of the bang-for-buck of its $150 Redmi range, while countless comparisons of its higher-end Mi phones — which typically sell for $150-$300 — and flagship products from Apple and Samsung have graced the internet.

Xiaomi has said from the get-go that smartphones are just one part of its wider ecosystem — which includes Xiaomi-branded smart home and “lifestyle” devices from third-parties, and, crucially, services that link all the hardware together. Those include services such as online video, e-commerce, financial products and other digital services.

“From the beginning, we embarked on a relentless pursuit of innovation, quality, design, user experience and efficiency advances, to provide the best technology products and services at accessible prices. We hope that our products and services will help our users to achieve a better life,” CEO and co-founder Lei Jun said in the money statement that accompanies today’s announcement.

Xiaomi is widely tipped to go public this year in an IPO that could value its business as high as $100 billion, according to Bloomberg. Chinese media recently claimed that the company is planning a dual-IPO that would see it list both in Hong Kong and on Mainland China, as our sister site Technode explained.

Such a double-headed IPO would be unique but, as Xiaomi showed today, it has no intention of sticking to so-called convention.

Powered by WPeMatico

Gaming hardware maker Razer, which went public in a big IPO in Hong Kong last year, is doubling down on payments after it announced a deal to acquire MOL, a company that offers online and offline payments in Southeast Asia.

Razer made an initial $20 million investment in MOL last June to supercharge its zGold virtual credit program for gamers by allowing them to buy using MOL’s online service or its offline, over-the-counter network of retailers that includes 7-Eleven. Now Razer aims to gobble up MOL in full by acquiring the remaining 65 percent, which will allow it to grow its alternative revenue streams by pushing fully into payment services by merging MOL’s virtual payment platform with zGold.

It’s worth noting that the deal is an intention to buy MOL. It’ll be subject to review from shareholders, but Razer said it has already secured support from major shareholders. The transaction gives MOL, which delisted from the Nasdaq in 2016 following a bumpy two-year spell, the same $100 million valuation it held for the initial Razer investment.

The acquisition will boost Razer’s recently announced online games store, which rivals services like Steam, but first and foremost it is focused on growing the firm’s share of online sales in Southeast Asia’s growing e-commerce and payment space. To that end, Razer recently launched a store on Lazada, the Alibaba-owned e-commerce service in Southeast Asia, something that Apple did earlier this year.

“We are already the No. 1 gaming brand in the U.S., Europe and China, but Southeast Asia is still nascent and a very small part of our business,” Razer CEO and co-founder Min-Liang Tan told TechCrunch in an interview. “We see this [deal with MOL] as stuff we can do immediately.”

Tan said that, in particular, working with MOL saw revenue grow “dramatically” while MOL itself surpassed $1.1 billion in GMV across its payment network last year.

“This is the perfect opportunity for us to not just be a minority shareholder, but to combine the business and continue scaling from here,” he added, reiterating that he believes the deal gives Razer the world’s largest virtual credit system for gamers based on user registrations. “That’s a huge opportunity for us.”

Away from its core business, the push will also help Razer in Singapore where it has applied to develop a unified e-payment system that would be used across the country, which is the Razer CEO home nation.

Tan said he has kept an ongoing dialogue with regulators, adding that he believes this deal “makes it clear that we don’t just have the scale, we also have the right technology.”

Beyond the Singapore opportunity, where Razer is a new entrant and thus considered an outsider for the license, Tan said the focus is on enabling cash-less payments right across Southeast Asia.

The blockchain has been widely touted as a building block that can help develop financial inclusion platforms in emerging markets, but for now Razer isn’t talking about whether it will hop on that wagon.

“We are excited about blockchain and the technology it brings, but we don’t have anything to comment on at this juncture,” Tan said.

The Razer chief was more vocal on the company’s wider goal, which he said is to develop “an entire ecosystem for our games partners.” The goal is to offset Razer’s impressive hardware sales business by constructing services that span game payments, game distribution and analytics on gamers and their behavior.

That optimism isn’t shared right now by investors in Hong Kong, however, which lured Razer as part of a push to attract more tech listings. Despite a surge when it when public in November, the stock traded at an all-time low of HK$2.44 today, down from its initial list price of HK$3.88.

Tan said he is focused on growing the business and its services regardless, but he did admit there’s a need for “the Hong Kong investment public to be more educated on tech companies.”

Powered by WPeMatico

Startups are a gamble, but it’s possible to better understand why some thrive and many more die by looking at the ecosystems in which they operate. Such is the mission of eight-year-old Startup Genome, composed of a group of researchers and entrepreneurs who, every year, interview thousands of founders and investors around the world to get a better handle on what’s changing in the regions where they operate, and what remains stubbornly the same.

The larger objective is to figure out how to help more startups succeed, and the outfit — which this year surveyed 10,000 founders with the help of partners like Crunchbase and Dealroom — produced some data that should perhaps concern those in the U.S. To wit, China looks positioned to overtake U.S. dominance when it comes to numerous tech sectors. Consider: In 2014, just 14 percent of so-called unicorns were based in China. Between the start of last year through today, that percentage has shot up to 35 percent, while in the U.S., the number of homegrown unicorns has fallen from 61 percent to 41 percent of the overall global number.

You could argue that investors are simply assigning China-based startups overly lofty valuations, as happened here in the U.S., and we partly believe that to be true. But China is also clearly “in it to win it,” based on a look at patents, with four times as many AI-related applications and three times as many crypto- and blockchain-related patents registered in China last year. With so much of the tech industry now focused on deep tech, it’s worth noting. In fact, though we loathed the January Financial Times column penned by famed VC Michael Moritz, who suggested U.S. companies follow China’s lead, his underlying call to arms was probably, gulp, prescient in its own way.

What else should startups know? According to Startup Genome’s findings, in addition to the rise of AI, blockchain and robotics manufacturing, there are clearly declining sub sectors, too, including, least surprisingly, adtech, which has seen a roughly 35 percent drop in funding over the last five years. No doubt that ties directly to the growing dominance of Facebook and Google, which accounted for 73 percent of all U.S. digital advertising last year, according to the equity research firm Pivotal.

That doesn’t mean adtech startups are cooked, notes the study’s authors. Rather, declining sub-sectors are often “mature” but can be revived by new technologies. In this case, while funding for adtech has dropped, virtual reality and augmented reality could well inject some new growth into the industry at some point. Maybe.

Either way, to us, the most interesting facets of this report — and it really is worth poring over — are the connections it’s able to make by talking with so many people around the world. It addresses, for example, how Stockholm, a relatively small startup ecosystem, is able to produce sizable startups at a meaningful rate, versus Chicago, whose ecosystem is ostensibly three times bigger. (The answer: Stockholm’s startup founders are apparently better connected to the world’s top seven ecosystems.)

Also quite interesting is the report’s findings about women founders, who build more relationships with regional founders and are more locally connected than their male counterparts — except with investors. That’s bad news for both women founders and investors, as local connectedness is associated with better startup performance.

To read the report in full, click over here. You have to fork over your email address, but with 240 pages filled with fascinating nuggets and other useful information, you’ll likely find it well worth it.

Powered by WPeMatico

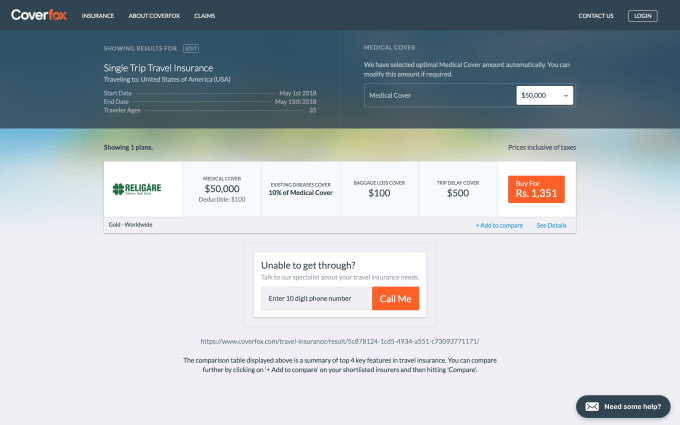

Coverfox, one of a handful of companies aiming to digitize insurance in India, has landed fresh funding via a $22 million Series C round that will be used to push into more rural parts of the country.

The investment is led by IFC, a sister organization of World Bank, and U.S. insurance firm Transamerica, with participation from existing investors SAIF Partners, Accel and Catamaran Ventures, the fund from Infosys co-founder Narayana Murthy. The company confirmed the round was actually closed in two phases, which explains why media reports around the Transamerica investment surfaced last June.

Based in Mumbai, Coverfox is a digital platform that aggregates insurance options. Currently, it works with 35 partners to offer some 150-plus packages that span health, car, bike, life and travel insurance policies in India.

Today’s announcement takes Coverfox, which was founded in 2013, to $39 million raised from investors.

Many of those same Coverfox backers have also funded digital insurance firm Acko, which was started by Coverfox co-founder Varun Dua last year. Acko and Dua made headlines when, nearly a year ago, the startup announced a $30 million seed investment round that came in before a product had even hit the market.

Acko got its license from the Insurance Regulatory & Development Authority of India (IRDAI) in September to go into business, and it again attracted headlines for its relationship with Amazon. The e-commerce firm was said to be in talks to invest (no deal has been announced) while Dua himself said the company was planning to develop products for the e-commerce giant, and potentially others of that scale too.

To date, though, Coverfox isn’t working with Acko, according to its CEO Premanshu Singh.

“We don’t work with Acko at all, and we don’t plan to work for next three to six months at least,” he said in an interview with TechCrunch, explaining that the company is going after larger insurance providers initially.

He also dismissed the potential for consolidation between the two despite the common investor base.

“Both entities are very different, with separate teams and different office locations. We can’t visualize anything strategic coming up,” Singh added.

Coverfox itself said it has seen “impressive momentum and scale” lately, which Singh clarified as four-fold revenue growth over the past year, although he declined to give specific figures. The company plans to double down on growth and use the new money to expand into India’s tier-two and tier-three cities, where it said that insurance coverage is 35 percent lower than in urban areas, while coverage among women is lower still at 40 percent below that of men.

The company also plans to put additional capital behind its Coverdrive app for Android, which is designed to equip insurance sales staff, who previously worked almost entirely offline, with digital-first materials to help grow their business using the Coverfox platform.

Coverdrive is a smart addition because it helps the company tackle the long tail of rural India without initial investment upfront. Instead, insurers use its service to boost their own business, thereby growing Coverfox sales at the same time.

Singh said Coverdrive accounts for around one-quarter of Coverfox sales. But that isn’t its only focus in tier-two and tier-three markets, where the company will roll out its own staff and focus on listing related policies.

Citing the growth of mobile data usage in rural India and a growth in digital as internet banking chips away at the bank assurance model used by most insurance brands, Singh said that rural India is better positioned for expansion than in previous years.

Coverfox isn’t yet looking at overseas options despite Singh explaining that there has been a considerable volume of inbound requests.

“It’s going to happen for sure [but] we haven’t decided where to go first,” he said.

Likewise, the model isn’t decided on either. Beyond a straight-up expansion, Coverfox could move into new markets via partnership or franchise.

Powered by WPeMatico

LG is making efforts to improve the user experience on its devices after it opened a “Software Upgrade Center” in its native Korea.

The new lab will be focused on “providing customers worldwide with faster, timelier, smartphone operating system and software updates,” the company explained in a brief statement.

The idea is to help get the latest versions of Android out to more users at a faster pace than it does right now.

That’s a genuine problem for Android OEM who are tasked with bringing the latest flavor of Android to devices that already in the market. Issues they have to deal with include different chipsets, Android customization and carriers.

The issue has been pretty problematic for LG. Android Oreo, for example, announced by Google last September only began rolling out to the first handful of LG devices last month.

The Korean firm said that one of the first priorities for this new center is to get Oreo out to Korea-based owners of the LG G6 — last year’s flagship phone — before the end of this month. After that, it will look to expand the rollout to G6 owners in other parts of the world.

Beyond Android updates, the center will also focus on stability update to make sure that the newest features work on devices without compromising performance.

This move is one of the first major strategies from new LG Mobile CEO Hwang Jeong-hwan, who took the top job last year. He came directly from the company’s R&D division, which suggests that he identified the update issue as a fairly urgent one to address.

His bigger challenge is to stop LG’s mobile division bleeding capital. LG Electronics itself is forecasting record Q1 financial results later this month, but its smartphone unit is likely to post yet another loss that drags the parent down.

We’ll find out more when LG’s next flagship is unveiled next month.

Powered by WPeMatico

Who are you? That’s both an existential question, and also a very practical administrative concern. Today, identity is often exchanged through the use of government ID cards and official paperwork, but what happens when someone loses that paperwork or it is destroyed? Or, as is often the case in many countries around the world, a citizen never received the paperwork to begin with?

Element wants to completely change the way banks, hospitals, and other service providers work with their customers by providing a platform for decentralized biometric identity. The company’s software runs on any mobile device, and using the device’s camera, it can identify a user’s face, palm, and fingerprints to create a verified match. Users have options on which modality they want to use.

Biometric identification is a tough machine learning application, so it shouldn’t be surprising that Element, which was formed in 2012, was co-founded by Adam Perold, a Stanford-educated product designer, and Yann LeCun, a famed machine learning researcher. LeCun was the progenitor of convolution neural nets, which today form one of the foundational theories for deep learning AI. He is now chief science advisor for the company, having taken a role as Director of AI Research at Facebook in New York while continuing his professorship at NYU.

Element is announcing a $12 million Series A round, led by PTB Ventures and GDP Ventures, with David Fields of PTB and On Lee of GDP joining the company’s board of directors. Earlier investors of the company included Pandu Sjahrir, Scott Belsky, Box Group, and Recruit Strategic Partners.

While technologies like Apple’s Touch ID and Face ID systems have popularized biometric identity, neither of these were around when Element got started. The early years of the company were devoted to solving critical technical challenges. Wireless connectivity can be limited in many developing countries, which meant that identities had to be local to the device in order to be useful. That also meant that the platform couldn’t be a cloud infrastructure solution, since identity information had to be processed on the device.

Furthermore, given the quality of hardware available, data had to be extremely compressed to be useful, and the machine learning algorithms couldn’t use too much compute power since a low-powered Android device wouldn’t be able to execute an identity match quickly enough to provide a good user experience.

That’s where LeCun’s deep expertise in neural nets, and particularly in areas like optical character recognition, came in handy. The Element team managed to reduce the amount of data required to store the identity of a single person down to about two kilobytes, according to the company.

The next challenge the company faced in building out its platform was security. Identity data, particularly biometrics, is a major security challenge, but it was exacerbated by the fact that devices would often be shared between users. A single device at a bank, for instance, might service thousands of users, all of which need independent, secured data. The company said that these security challenges have been designed into the core of the system.

Ultimately, the company’s platform lives as an SDK behind the mobile apps of its partners. It provides not only the identity layer itself, but also a secure data infrastructure that allows records such as bank accounts and medical files to be connected to the underlying identity.

Element is targeting the developing world, and Perold tole me he spends more than half of his time traveling to Southeast Asia and Africa building partnerships and doing research on how the company’s technology can improve critical social services. Among the company’s signed partnerships is Telekom Indonesia, which as the service provider for 180 million subscribers, is one of the key connections between people and their identity in that fast-growing economy.

Another partnership formed by the company is with the Global Good Fund, a joint venture between Bill Gates and Intellectual Ventures. That project works to create better biometric identities for newborns and infants, which is critical for health outcomes. The company is working with icddr,b and the Angkor Hospital for Children in Cambodia to build out the program.

In addition to the lead investors, the company received strategic venture capital investments from Bank BCA (via Central Capital Ventura), Bank BRI, Telkom Indonesia (via MDI Ventures), and Maloekoe Ventures.

Correction: The Global Good Fund is a joint venture with Bill Gates, not the Gates Foundation.

Powered by WPeMatico

Rumors of a new ASIC mining rig from Bitmain have driven Ethereum prices well below their one-week high of $585. An ASIC – or Application-specific integrated circuit – in the cryptocurrency world is a chip that designers create for the specific purpose of mining a single currency. Early Bitcoin ASICs, for example, drove adoption up and then, in some eyes, centralized Bitcoin mining in a few hands, thereby thwarting the decentralized ethos of die-hard cryptocurrency fans.

According to a CNBC report, analyst Christopher Rolland visited China where he unearthed rumors of a new ASIC chip dedicated to Ethereum mining.

“During our travels through Asia last week, we confirmed that Bitmain has already developed an ASIC [application-specific integrated circuit] for mining Ethereum, and is readying the supply chain for shipments in 2Q18,” analyst Christopher Rolland wrote in a note to clients Monday. “While Bitmain is likely to be the largest ASIC vendor (currently 70-80% of Bitcoin mining ASICs) and the first to market with this product, we have learned of at least three other companies working on Ethereum ASICs, all at various stages of development.”

Historically users have mined Ethereum using GPUs which, in turn, led to the unavailability of GPUs for gaming and graphics. However, an ASIC would change the mining equation entirely, resulting in a certain amount of centralization as big players – including Bitmain – created higher barrier to entry for casual miners.

“Ethereum is of the most profitable coins available for GPU mining,” said Mikhail Avady, founder of TryMining.com. “It’s going to affect a lot of the market. Without understanding the hash power of these Bitmain machines we can’t tell if it will make GPUs obsolete or not.”

“It can be seen as an attack on the network. It’s a centralization problem,” he said.

Avady points out that there is a constant debate among cryptocurrency aficionados regarding ASICs and their effect on the market. Some are expecting a move to more mineable coins including Monero and ZCash.

“What would be bad is if there was only one Ethereum ASIC manufacturer,” he said. “But with Samsung and a couple other players getting into the game it won’t be bad for long.”

There is also concern over ICO launches and actual utility of Ethereum-based smart contract tokens. “The price of ETH is becoming consolidated as people become more realistic about blockchain technology,” said Sky Guo, CEO of Cypherium. “People are looking for higher quality blockchain projects. I believe a rebound in ETH’s price will come soon as panic surrounding regulations begins to fade.”

Powered by WPeMatico

The U.S. maneuvers against China’s tech giants continue today with an official announcement from FCC Chairman Ajit Pai that the agency may soon ban purchasing anything from companies that “pose a national security threat.” Huawei, ZTE and other major tech manufacturers aren’t named specifically, but it’s clear what is meant.

Pai lists the risk of backdoored routers, switches and other telecoms equipment as the primary threat; Huawei and ZTE have been accused of doing this for years, though hard evidence has been scarce.

The proposal would prohibit any money from the FCC’s $8.5 billion Universal Service Fund, used for all kinds of projects and grants, to be spent on companies beholden to “hostile governments.” Pai mentioned the two Chinese giants in a previous letter describing the proposed plan.

Both companies in question have strenuously denied the charges; perhaps most publicly by Richard Yu, CEO of the company’s consumer business group, at CES this year.

But warnings from U.S. intelligence services have been ongoing since 2012, and Congress is considering banning Huawei equipment from use by government entities, saying the company “is effectively an arm of the Chinese government.”

Strong ties between these major companies and the Chinese government are hard to deny, of course, given China’s particularly hands-on methods in this sort of thing. Ironically, however, it seems that our spy agencies are so sure about this in great part because they themselves have pushed for and occasionally accomplished the same compromises of network infrastructure. If they’ve done it, they can be sure their Chinese rivals have.

The specifics of the rule are unknown, but even a relatively lax ban would likely be a big hit to Huawei and ZTE, which so far have failed to make a dent in the U.S. phone market but still manufacture all kinds of other telecommunications gear making up our infrastructure.

The draft of the new rule will be published tomorrow; the other commissioners have it now and are no doubt reading and forming their own opinions on how to improve it. The vote is set for April 17.

Powered by WPeMatico

Smartphone and VR headset maker HTC has published its consolidated results for Q4 2017 — and it makes for grim reading.

The topline figures are:

HTC says this latest quarterly loss was due to “market competition, product mix, pricing, and recognized inventory write-downs”. So pretty much a full house of operational and business problems.

The one bright spot for HTC’s business is a deal worth $1.1BN, in which Google acquired a chunk of HTC’s hardware business — which was completed at the end of January.

That one-off cash injection is not reflected in the Q4 results but will rather give some passing uplift to HTC’s Q1 2018 results.

HTC says it will be using the Google windfall for “greater investment in emerging technologies”, writing that they will be “vital across all of our businesses and present significant long-term growth opportunities”.

There’s no doubt that any business revival would require hefty investment. But exactly what long-term growth opportunities HTC believes it can capture is questionable, given how fiercely competitive the smartphone market continues to be (with Chinese OEMs making what running there is in a shrinking global market); and how the VR market — which HTC bet big on in 2015, with Vive and Valve, to try to diversify beyond mobile — has hardly turned out to be the next major computing paradigm. Not yet anyway.

So the emphasis really is on the “long-term” earning potential of VR — say five or even ten years hence.

HTC flags the launch of its VIVE Focus standalone VR system in China — which it last week said it would also be bringing to the UK and other global markets later this year — and the launch of a VIVE Pro premium PC VR system in January, which it was showing off at CES, as examples of focused product innovation in the VR space.

Following a strategic business review aimed at optimizing its teams and processes — both for smartphones and VR — it also says it now has “a series of measures in place to enable stronger execution”, and is touting fresh innovations coming across its markets this year.

But HTC is going to need a whole lot more than squeezable gimmicks and shiny finishes to lift out of these doldrums.

Powered by WPeMatico

Chinese smartphone giant Xiaomi could make its debut in the U.S. as soon as this year, according to its CEO. Lei Jun, the serial entrepreneur who leads the phone maker, told The Wall Street Journal that the company — which is being linked with an IPO this year — plans to finally begin selling phones Stateside within the next twelve months. “We’ve always been… Read More

Chinese smartphone giant Xiaomi could make its debut in the U.S. as soon as this year, according to its CEO. Lei Jun, the serial entrepreneur who leads the phone maker, told The Wall Street Journal that the company — which is being linked with an IPO this year — plans to finally begin selling phones Stateside within the next twelve months. “We’ve always been… Read More

Powered by WPeMatico