Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Ridesharing and transportation platform Didi Chuxing announced today that it has formed a joint venture with BP, the British gas, oil and energy company, to build electric-vehicle charging infrastructure in China. The charging stations will be available to Didi and non-Didi drivers.

The news of Didi and BP’s joint venture comes one week after Didi announced that it had received funding totaling $600 million from Toyota Motor Corporation. As part of that deal, Didi and Toyota Motor set up a joint venture with GAC Toyota Motor to provide vehicle-related services to Didi drivers.

BP’s first charging site in Guangzhou has already been connected to XAS (Xiaoju Automobile Solutions), which Didi spun out in April 2018 to put all its vehicle-related services into one platform.

XAS is part of Didi Chuxing’s evolution from a ridesharing company to a mobility services platform, with its services available to other car, transportation and logistics companies. In June, Didi also opened its ridesharing platform to other companies, enabling its users to request rides from third-party providers in a bid to better compete with apps like Meituan Dianping and AutoNavi, which aggregate several ride-hailing services on their platforms.

Didi says it now offers ridesharing, vehicle rental and delivery services to 550 million users and covers 1,000 cities through partnerships with Grab, Lyft, Ola, 99 and Bolt (Taxify). The company also claims to be the world’s largest electric vehicle operator with more than 600,000 EVs on its platform.

It also has partnerships with automakers and other car-related companies, like Toyota, FAW, Dongfeng, GAC, Volkswagen and Renault-Nissan-Mitsubishi, to collaborate on a platform that uses new energy and AI-based and mobility technologies.

In a press statement, Tufan Erginbilgic, the CEO of BP’s Downstream business, said “As the world’s largest EV market, China offers extraordinary opportunities to develop innovative new businesses at scale and we see this as the perfect partnership for such a fast-evolving environment. The lessons we learn here will help us further expand BP’s advanced mobility business worldwide, helping drive the energy transition and develop solutions for a low carbon world.”

Powered by WPeMatico

Aspire, a Singapore-based startup that helps SMEs secure working capital, has raised $32.5 million in a new financing round to expand its presence in several Southeast Asian markets.

The Series A round for the one-and-a-half-year-old startup was funded by MassMutual Ventures Southeast Asia. Arc Labs and existing investors Y Combinator — Aspire graduated from YC last year — Hummingbird and Picus Capital also participated in the round. Aspire has raised about $41.5 million to date.

Aspire operates a neo-banking-like platform to help small and medium-sized enterprises (SMEs) quickly and easily secure working capital of up to about $70,000. AspireAccount, the startup’s flagship product, provides merchants and startups with instant credit limit for daily business expenses, as well as a business-to-business acceptance and other tools to help them manage their cash flow.

Co-founder and CEO Andrea Baronchelli tells TechCrunch that about 1,000 business accounts are opened each month on Aspire and that the company plans to continue focusing on Southeast Asia, where he says there are about 78 million small businesses, leaving plenty of room to scale (applications can be made through Aspire’s mobile app and are reviewed using a proprietary risk assessment engine before getting final approval from a human). Aspire claims it has seen 30% month-over-month growth since it was founded in January 2018 and expects to open more than 100,000 business accounts by next year.

Baronchelli, who served as a CMO for Alibaba’s Lazada platform for four years, says Aspire launched to close the gap left by the traditional banking industry’s focus on consumer services or businesses that make more than $10 million in revenue a year. As a result, smaller businesses in Southeast Asia, including online vendors and startups, often lack access to credit lines, accounts and other financial services tailored to their needs.

Aspire currently operates in Thailand, Indonesia, Singapore and Vietnam. The startup said it will use the fresh capital to scale its footprints in those markets. Additionally, Aspire is building a scalable marketplace banking infrastructure that will use third-party financial service providers to “create a unique digital banking experience for its SME customers.”

Baronchelli adds that “the bank of the future will probably be a marketplace,” so Aspire’s goal is to provide a place where SMEs can not only open accounts and credit cards, but also pick from different services like point of sale systems. It is currently in talks with potential partners. The startup is also working on a business credit card that will be linked to each business account by as early as this year.

Southeast Asia’s digital economy is slated to grow more than six-fold to reach more than $200 billion per year, according to a report co-authored by Google. But for many emerging startups and businesses, getting financial services from a bank and securing working capital have become major pain points.

A growing number of startups are beginning to address these SMEs’ needs. In India, for instance, NiYo Bank and Open have amassed millions of businesses through their neo-banking platforms. Both of these startups have raised tens of millions of dollars in recent months. Drip Capital, which helps businesses in developing markets secure working capital, raised $25 million last week.

Powered by WPeMatico

The media has largely bought into Huawei’s “strong” half-year results today, but there’s a major catch in the report: the company’s quarter-by-quarter smartphone growth was zero.

The telecom equipment and smartphone giant announced on Tuesday that its revenue grew 23.2% to reach 401.3 billion yuan ($58.31 million) in the first half of 2019 despite all the trade restrictions the U.S. slapped on it. Huawei’s smartphone shipments recorded 118 million units in H1, up 24% year-over-year.

What about quarterly growth? Huawei didn’t say, but some quick math can uncover what it’s hiding. The company clocked a strong 39% in revenue growth in the first quarter, implying that its overall H1 momentum was dragged down by Q2 performance.

Huawei said its H1 revenue is up 23.2% year-on-year — but when you consider that Q1 revenue rose by 39%, Q2 must have been a real struggle…https://t.co/dFQo4gxEVbhttps://t.co/HABAQ6fmfK

— Jon Russell (@jonrussell) July 30, 2019

The firm shipped 59 million smartphones in the first quarter, which means the figure was also 59 million units in the second quarter. As tech journalist Alex Barredo pointed out in a tweet, Huawei’s Q2 smartphone shipments were historically stronger than Q1.

Huawei smartphones Q2 sales were traditionally much more stronger than on Q1 (32.5% more on average).

This year after Trump’s veto it is 0%. That’s quite the effect pic.twitter.com/x3dQlOePDA

— Alex B

(@somospostpc) July 30, 2019

And although Huawei sold more handset units in China during Q2 (37.3 million) than Q1 (29.9 million) according to data from market research firm Canalys, the domestic increase was apparently not large enough to offset the decline in international markets. Indeed, Huawei’s founder and chief executive Ren Zhengfei himself predicted in June that the company’s overseas smartphone shipments would drop as much as 40%.

The causes are multi-layered, as the Chinese tech firm has been forced to extract a raft of core technologies developed by its American partners. Google stopped providing to Huawei certain portions of Android services, such as software updates, in compliance with U.S. trade rules. Chip designer ARM also severed business ties with Huawei. To mitigate the effect of trade bans, Huawei said it’s developing its own operating system (although it later claimed the OS is primarily for industrial use) and core chips, but these backup promises may take some time to materialize.

Consumer products are just one slice of the behemoth’s business. Huawei’s enterprise segment is under attack, too, as small-town U.S. carriers look to cut ties with Huawei. The Trump administration has also been lobbying its western allies to stop purchasing Huawei’s 5G networking equipment.

In other words, being on the U.S.’s entity list — a ban that prevents American companies from doing business with Huawei — is putting a real squeeze on the Chinese firm. Washington has given Huawei a reprieve that allows American entities to resume buying from and selling to Huawei, but the damage has been done. Ren said last month that all told, the U.S. ban would cost his company a staggering $30 billion loss in revenue.

Huawei chairman Liang Hua (pictured above) acknowledged the firm faces “difficulties ahead” but said the company is “fully confident in what the future holds,” he said today in a statement. “We will continue investing as planned – including a total of CNY120 billion in R&D this year. We’ll get through these challenges, and we’re confident that Huawei will enter a new stage of growth after the worst of this is behind us.”

Powered by WPeMatico

WhatsApp has amassed more than 400 million users in India, the instant messaging app confirmed today, reaffirming its gigantic reach in its biggest market.

Amitabh Kant, CEO of highly influential local think-tank NITI Aayog, revealed the new stat at a press conference held by WhatsApp in New Delhi on Thursday. A WhatsApp spokesperson confirmed that the platform indeed had more than 400 million monthly active users in the country.

The remarkable revelation comes more than two years after WhatsApp said it had hit 200 million users in India. WhatsApp — or Facebook — did not share any India-specific users count in the period in between.

The public disclosure today should help Facebook reaffirm its dominance in India, where it appears to be used by nearly every smartphone user. According to research firm Counterpoint, India has about 450 million smartphone users. (Some other research firms peg the number to be lower.)

It’s worth pointing out that WhatsApp also supports KaiOS — a mobile operating system for feature phones. Millions of KaiOS-powered JioPhone handsets have shipped in India. Additionally, there are about 500 million internet users, according to several industry estimates.

As WhatsApp becomes ubiquitous in the nation, the service is increasingly mutating to serve additional needs. Businesses such as social-commerce app Meesho have been built on top of WhatsApp. Facebook backed Meesho recently in what was its first investment of this kind in an Indian startup. Then, of course, WhatsApp has also come under hot water for its role in the spread of false information in the nation.

As ByteDance and others aggressively expand their businesses in India, Facebook’s perceived dominance in the country has come under attack in recent months. ByteDance’s TikTok, which has amassed 120 million users in India, has been heralded by many as the top competitor of Facebook.

A WhatsApp spokesperson also told TechCrunch that India remains WhatsApp’s biggest market. In 2017, Facebook said its marquee service had about 250 million users in India — a figure it has not updated in the years since.

WhatsApp, which has about 1.5 billion monthly active users worldwide, does not really have any major competitor in India. The closest to a competitor it has in the country is Messenger, another platform owned by Facebook, and Hike, which millions of users check everyday. Times Internet — an internet conglomerate in India that runs several news outlets, entertainment services and more — claims to reach 450 million users in the country each month.

At the aforementioned press conference, WhatsApp global chief Will Cathcart said WhatsApp also plans to roll out WhatsApp Pay, its payment service, to all its users toward the end of the year — something TechCrunch reported earlier.

Its arrival in India’s burgeoning payments space could create serious tension for Google Pay, Flipkart’s PhonePe and Paytm. For Facebook, WhatsApp Pay’s success is even more crucial as the company currently has no plans to bring cryptocurrency wallet Calibra to the country, it told TechCrunch on the sidelines of the Libra and Calibra unveil.

In a series of announcements this week, WhatsApp also unveiled a tie-up with NITI Aayog to promote women’s entrepreneurship. “By launching ‘gateway to a billion opportunities’ and our digital skills training program, we hope to shine a light on the amazing work already happening and build the next generation of entrepreneurs and change makers,” said Cathcart.

At a conference in Mumbai on Wednesday, Cathcart announced a partnership with the Indian School of Public Policy — India’s first program in the theory and practice of public policy, product design and management — to bring a series of privacy design workshops to future policy makers. These workshops will explore “the importance and practice of privacy-centric design to help technology make a positive impact on society,” the Facebook-owned platform said.

Powered by WPeMatico

Salesforce, the 20-year-old leader in customer relationship management (CRM) tools, is making a foray into Asia by working with one of the country’s largest tech firms, Alibaba.

Alibaba will be the exclusive provider of Salesforce to enterprise customers in mainland China, Hong Kong, Macau and Taiwan, and Salesforce will become the exclusive enterprise CRM software suite sold by Alibaba, the companies announced on Thursday.

The Chinese internet has for years been dominated by consumer-facing services such as Tencent’s WeChat messenger and Alibaba’s Taobao marketplace, but enterprise software is starting to garner strong interest from businesses and investors. Workflow automation startup Laiye, for example, recently closed a $35 million funding round led by Cathay Innovation, a growth-stage fund that believes “enterprise software is about to grow rapidly” in China.

The partners have something to gain from each other. Alibaba does not have a Salesforce equivalent serving the raft of small-and-medium businesses selling through its e-commerce marketplaces or using its cloud computing services, so the alliance with the American cloud behemoth will fill that gap.

On the other hand, Salesforce will gain sales avenues in China through Alibaba, whose cloud infrastructure and data platform will help the American firm “offer localized solutions and better serve its multinational customers,” said Ken Shen, vice president of Alibaba Cloud Intelligence, in a statement.

“More and more of our multinational customers are asking us to support them wherever they do business around the world. That’s why today Salesforce announced a strategic partnership with Alibaba,” said Salesforce in a statement.

Overall, only about 10% of Salesforce revenues in the three months ended April 30 originated from Asia, compared to 20% from Europe and 70% from the Americas.

Besides gaining client acquisition channels, the tie-up also enables Salesforce to store its China-based data at Alibaba Cloud. China requires all overseas companies to work with a domestic firm in processing and storing data sourced from Chinese users.

“The partnership ensures that customers of Salesforce that have operations in the Greater China area will have exclusive access to a locally-hosted version of Salesforce from Alibaba Cloud, who understands local business, culture and regulations,” an Alibaba spokesperson told TechCrunch.

Cloud has been an important growth vertical at Alibaba and nabbing a heavyweight ally will only strengthen its foothold as China’s biggest cloud service provider. Salesforce made some headway in Asia last December when it set up a $100 million fund to invest in Japanese enterprise startups and the latest partnership with Alibaba will see the San Francisco-based firm actually go after customers in Asia.

Powered by WPeMatico

At a conference in New Delhi early last year, Netflix CEO Reed Hastings was confronted with a question that his company has been asked many times over the years. Would he consider lowering the subscription cost in India?

It’s a tactic that most Silicon Valley companies have adapted to in the country over the years. Uber rides aren’t as costly in India as they are elsewhere. Spotify and Apple Music cost less than $2 per month to users in the country. YouTube Premium as well as subscriptions to U.S. news outlets such as WSJ and New York Times are also priced significantly lower compared to the prices they charge in their home turf.

Hastings had also come prepared: He acknowledged that the entertainment viewing industry in India is very different from other parts of the world. To be sure, much of the pay-TV in India is supported by ads and the access fee remains too low ($5). But that was not going to change how Netflix likes to roll, he said.

“We want to be sensitive to great stories and to fund those great stories by investing in local content,” he said. “So yes, our strategy is to build up the local content — and of course we have got the global content — and try to uplevel the industry,” he said, identifying movie-goers who spend about Rs 500 ($7.25) or more on tickets each month as Netflix’s potential customers.

Indian commuters walking below a poster of “Sacred Games”, an original show produced by Netflix (Image: INDRANIL MUKHERJEE/AFP/Getty Images)

Less than a year and a half later, Netflix has had a change of heart. The company today rolled out a lower-priced subscription plan in India, a first for the company. The monthly plan, which restricts usage of the service to mobile devices only, is priced at Rs 199 ($2.8) — a third of the least expensive plan in the U.S.

At a press conference in New Delhi today, Netflix executives said that the lower-priced subscription tier is aimed at expanding the reach of its service in the country. “We want to really broaden the audience for Netflix, want to make it more accessible, and we knew just how mobile-centric India has been,” said Ajay Arora, Director of Product Innovation at Netflix.

The move comes at a time when Netflix has raised its subscription prices in the U.S. by up to 18% and in the UK by up to 20%.

Netflix’s strategy shift in India illustrates a bigger challenge that Silicon Valley companies have been facing in the country for years. If you want to succeed in the country, either make most of your revenue from ads, or heavily subsidize your costs.

But whether finding users in India is a success is also debatable.

Powered by WPeMatico

After months of anticipation, Nintendo Switch is ready to shed more light on its China launch. The Japanese console giant and Tencent are “working diligently” to bring the Switch to the world’s largest market for video games, the partners announced on Weibo (the Twitter equivalent in China) today.

The pair did not specify a date when the portable gaming system will officially launch, as the government approval process can take months. But there are signs that things are moving forward. For example, Tencent has been given the green light to run a trial version of the New Super Mario Mario Bros. U Deluxe and a few other blockbuster titles in China.

On August 2, the partners will jointly host a press conference for Switch — no product launch yet — in Shanghai, Tencent confirmed to TechCrunch. It appears to be a strategic move that coincides with the country’s largest gaming expo China Joy beginning on the same day in the city.

Tencent and Nintendo are hosting a media event on August 2nd 2019 in Shanghai for Nintendo Switch.

Steven Ma, Senior Vice President of Tencent and Satoru Shibata, executive at Nintendo, will attend.

Should be more details of Switch launch in China. pic.twitter.com/MULC7jMSqg

— Daniel Ahmad (@ZhugeEX) July 24, 2019

Sales of Nintendo Switch in China, made possible through a distribution deal with Tencent, will likely add fuel to Nintendo’s slowing growth. It can also potentially diversify Tencent’s gaming revenues, which took a hit last year as Beijing tightened controls over online entertainment.

Switch faces an uphill battle as consoles, including Sony PS4 and Microsoft Xbox, have for years struggled to catch on in China. The reasons are multifaceted. China had banned consoles until 2014 to protect minors from harmful content. The devices are also much less affordable than mobile games, making it difficult as a form of social interaction in the mobile-first nation.

Powered by WPeMatico

Netflix has a new plan to win users in India: make the entry point to its service incredibly cheap. The streaming giant today introduced a low-priced mobile tier in the country that costs Rs 199 ($2.8) per month in a bid to take on Disney, Amazon and dozens of other aggressively priced competitors in the country.

The new subscription tier from Netflix restricts the usage of the service to one mobile device — and permits only one concurrent stream — and offers the standard definition viewing (~480p). Users also can opt to have the new plan on their tablets, but again, several features such as the ability to cast (or mirror) the content to a TV are restricted.

Netflix began testing a lower-priced subscription plan in India and some other Asian markets late last year. (During the test, Netflix charged users about $3.6 per month.) At a press conference in New Delhi, company officials said today that there is currently no plan to expand this offering to other regions. During the trial period, Netflix was also testing a weekly subscription plan; that too, is no longer being pursued, officials said.

The announcement comes days after Netflix reported that it added 2.7 million new subscribers in the quarter that ended in June this year, far fewer than the 5.1 million figure it had projected earlier this year. Jessica Lee, VP of Communications at Netflix, said the company’s recent performance in other markets did not influence its move in India.

During its earnings report, Netflix said last week that it planned to introduce a mobile-only subscription offering in India by Q3 this year. But the company has moved to make the new offering already live in the country. Previous subscription tiers that start at Rs 499 ($7.2) and go up to Rs 799 ($11.5) will continue to be offered in the country.

Mobile devices are increasingly driving media consumption in India, said Ajay Arora, director of Product Innovation at Netflix. The streaming service’s users in India have shown far richer appetite for consuming content on mobile devices than users in any other nation, he said.

India has turned into an intense battleground for video streaming services in recent years. Netflix today competes with more than three-dozen local and international players in the country. Hotstar, owned by Disney, currently leads the market with over 300 million users. The ad-supported service offers about 80% of its catalog at no cost to users. Its yearly plan, which includes titles from HBO and Showtime, is priced at Rs 999 ($14.5). Amazon Prime Video is similarly priced in India.

Indians spend 30% of their smartphone time and over 70% of their mobile data on entertainment services, a recent industry report estimated.

A cheaper plan could significantly help Netflix grow its user base in the country, analysts say. “Netflix had a good early start, but growth has been slow in the last six months given the mass Indian consumer market remains value-conscious,” Mihir Shah, vice president of research firm Media Partners Asia, told TechCrunch.

“At 200 rupees, Netflix could address a sizable target market in India. One could draw parallels from the Indian multiplex industry, which caters to 100 million consumers spending an average $4 per movie,” he added.

Netflix is estimated to have less than two million subscribers in India. However, despite its relatively smaller user base, it was the top video streaming app in the country by revenue last year, according to research firm App Annie. Research firm IHS Markit estimates that the service could scale to 4 million subscribers in the country by year-end.

At a conference last year, Netflix CEO Reed Hastings said that India could contribute as many as 100 million users to the platform in the coming years.

Netflix CEO “expects to see 100m” subscribers in India. A reminder, only ~80m Indians (top 10%) make more than $3000/yr. Even for them a $90 annual Netflix sub is well over a week’s wages. And they can get local content for basically free. So no, not 100m https://t.co/323RHe6hmS

— Stanley Pignal (@spignal) February 23, 2018

Some analysts say Netflix also needs to focus on its content catalog to make it more appealing to Indians. Hotstar has grown its business largely on top of live streaming of high-profile cricket matches. Netflix, which has produced over two-dozen titles in India to date, currently has very few titles that focus on sports.

“Netflix will need to strike the right balance of ensuring a steady supply of original local content,” Shah said.

Powered by WPeMatico

Since the launch of its first electric scooter in 2015, Gogoro co-founder and CEO Horace Luke has frequently been asked when the startup is going to expand beyond Taiwan. In its home country, Gogoro’s two-wheel vehicles, with their distinctive swappable battery system, are now the top-selling electric scooters.

But Luke says the company has always seen itself as a platform company, with the ultimate goal of providing a turnkey solution for energy-efficient vehicles. Now with the launch of GoShare*, its new vehicle-sharing platform, and partnerships with manufacturers such as Yamaha, Gogoro is ready to go global.

Founded by Luke, HTC’s former chief innovation officer, and chief technology officer Matt Taylor in 2011, Gogoro develops most of its technology in-house, including scooter motors, telematics units, backend servers and software. GoShare’s pilot program will launch next month in Taoyuan City, where Gogoro’s research and development center is located, with the goal of expanding with partners into cities around the world over the next year, starting in Europe, Australia and Southeast Asia.

“Gogoro has always been out with a thesis that we will be a platform enabler,” Luke told Extra Crunch during an interview in the company’s Taipei City headquarters. “Now you’ve seen the transformation of the company. Doing something this big, like what Gogoro is doing, takes time.”

Since the release of Gogoro’s first Smartscooter in 2015, the company says it has become the best-selling brand of electric two-wheel vehicles in Taiwan, holding a 17 percent share of the country’s vehicle market, including gas vehicles.

Last year, the company began licensing its technology to manufacturers Yamaha, Aeon and PGO to produce scooters that run on Gogoro’s batteries and charging infrastructure. It also has a partnership with Coup, the European electric-scooter sharing startup that plans to increase its fleet to more than 5,000 scooters on the streets of Paris, Berlin, Madrid and Tübingen this year, and is seeking similar deals with other vehicle-sharing services, as well as local governments that want to reduce traffic and pollution (the GoShare pilot program is being launched in collaboration with Taoyuan City’s government).

GoShare’s platform is meant to be a “very robust and cost-effective, very worry-free solution for municipalities and entrepreneurs,” Luke says. Parts of the system can be licensed separately or packaged as a turnkey solution that can be deployed in as little as two weeks.

The company describes GoShare as a “mobility solution.” When asked if this means the platform can be used for other electric vehicles, including cars, Luke says “just think of us as batteries and a motor.”

“It’s just like computers and processing ram,” he adds. “It can be any form factor. It just happens to be that the two-wheel form factor is the one we’re working on and focusing on at the moment.”

Powered by WPeMatico

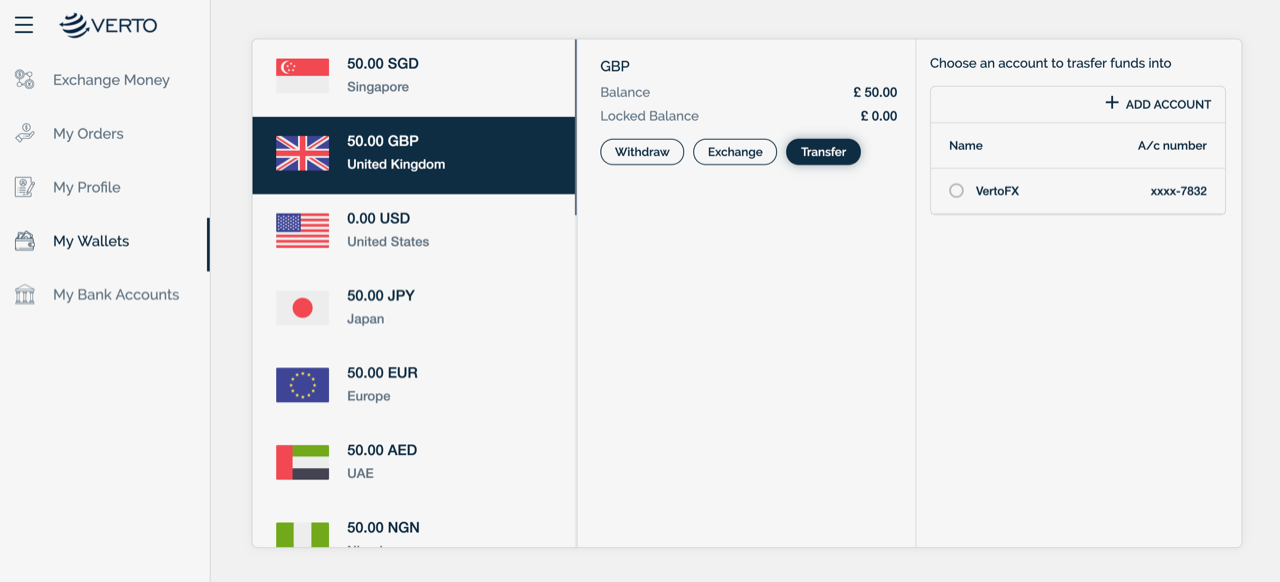

VertoFX, an Africa and emerging markets-focused currency trading and payment startup, has raised a $2.1 million seed round, led by Accelerated Digital Ventures.

The London-based company, with a subsidiary in Lagos, Nigeria, has created a platform that allows businesses and banks to exchange and make payments in exotic foreign currencies that don’t often convert or trade conveniently across businesses or banks.

For example, South Africa’s Rand is Africa’s most convertible and traded currency — with lower spreads and transaction costs — while currencies of countries such as Ethiopia or Egypt may be difficult or expensive to trade or transact B2B payments.

“That’s the reason we are utilizing technology to create a marketplace model and price discovery to create liquidity for these currencies,” VertoFX founder Ola Oyetayo told TechCrunch.

There are around 40 global currencies that are considered exotic or illiquid, most of them in frontier markets in Asia, Africa and the Middle-East, according to Oyetayo.

And there’s a revenue opportunity to creating a convenient online marketplace for trading and payments in these currencies.

And there’s a revenue opportunity to creating a convenient online marketplace for trading and payments in these currencies.

“Our research says there’s about $400 billion being done by small and medium-scale businesses in Africa alone in transactional volume on an annual basis. If we take 1% of that as a commission or transaction fee, that’s a $4 billion addressable market, just in the continent,” said Oyetayo.

VertoFX was founded in 2017 by Oyetayo and Anthony Oduwole — both ex-global bankers born in Nigeria. The company was part of Y Combinator’s 2019 winter cohort and processed around $7 million in transaction volume last month, according to Oyetayo.

VertoFX was founded in 2017 by Oyetayo and Anthony Oduwole — both ex-global bankers born in Nigeria. The company was part of Y Combinator’s 2019 winter cohort and processed around $7 million in transaction volume last month, according to Oyetayo.

VertoFX is registered as a payment services provider with the U.K.’s Financial Conduct Authority. Current clients include several undisclosed banks and San Francisco-based payment venture Flutterwave.

VertoFX doesn’t release revenue figures, but confirmed it earns a commission, or spread, on each transaction processed on its platform. There are currently 19 currencies on the platform and the ability to settle in 120 countries, including China and the U.S.

VertoFX is also moving into offering market research — toward potential subscription services — on the currencies it trades, according to Oyetayo.

The startup will use the round for platform development, expanding the currencies and gaining licenses in new countries. “We’ll also use the round for hiring, primarily in compliance and regulator type roles,” said Oyetayo. VertoFX already has a developer team in India and is looking at local developer talent for its Africa offices.

ADV’s Ryan Proctor confirmed the VC firm’s lead on the investment round, which also included participation from YC and several local angel investors in Africa, Oyetayo told TechCrunch.

On the possibility of becoming acquired by a big bank, VertoFX isn’t so interested, according to Oyetayo.

“We both come from big banks and if we’d wanted to go down that route we’d have developed this more as a software as a service platform,” he said.

“We’re playing the long game here, and I don’t think acquisition is the end game,” he said.

Powered by WPeMatico