Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Indonesia’s logistics industry is very fragmented, with several large providers operating alongside thousands of smaller companies. This means shippers often have to work with a variety of carriers, driving up costs and making supply chains harder to manage. Logisly, a Jakarta-based startup that describes itself as a “B2B tech-enabled logistics platform,” announced today it has raised $6 million in Series A funding to help streamline logistics in Indonesia. The round was led by Monk’s Hill Ventures.

This brings the total Logisly has raised since it was founded last year to $7 million. Its platform digitizes the process of ordering, managing and tracking trucks. First, it verifies carriers before adding them to Logisly’s platform. Then it connects clients to trucking providers, using an algorithm to aggregate supply and demand. This means companies that need to ship goods can find trucks more quickly, while carriers can reduce the number of unused space on their trucks.

Co-founder and chief executive officer Roolin Njotosetiadi told TechCrunch that about “40% of trucks are utilized in Indonesia, and the rest are either sitting idle or coming back from their hauls empty handed. All of these result in high logistics costs and late deliveries.”

He added that Logisly is “laser focused on having the largest trucking network in Indonesia, providing 100% availability of cost-efficient and reliable trucks.”

Logisly now works with more than 1,000 businesses in Indonesia in sectors like e-commerce, fast-moving consumer goods (FCG), chemicals and construction. This number includes 300 corporate shippers. Logisly’s Series A will be used on growing its network of shippers and transporters (which currently covers 40,000 trucks) and on product development.

The startup’s clients include some of the largest corporate shippers in Indonesia, including Unilever, Haier, Grab, Maersk and JD.ID, the Indonesian subsidiary of JD.com, one of China’s largest e-commerce companies.

Other venture capital-backed startups that are focused on Indonesia’s logistics industry include Shipper, which focuses on e-commerce; logistics platform Waresix; and Kargo.

Powered by WPeMatico

Started as a side project by its founders, Warren is now helping regional cloud infrastructure service providers compete against Amazon, Microsoft, IBM, Google and other tech giants. Based in Tallinn, Estonia, Warren’s self-service distributed cloud platform is gaining traction in Southeast Asia, one of the world’s fastest-growing cloud service markets, and Europe. It recently closed a $1.4 million seed round led by Passion Capital, with plans to expand in South America, where it recently launched in Brazil.

Warren’s seed funding also included participation from Lemonade Stand and angel investors like former Nokia vice president Paul Melin and Marek Kiisa, co-founder of funds Superangel and NordicNinja.

The leading global cloud providers are aggressively expanding their international businesses by growing their marketing teams and data centers around the world (for example, over the past few months, Microsoft has launched a new data center region in Austria, expanded in Brazil and announced it will build a new region in Taiwan as it competes against Amazon Web Services).

But demand for customized service and control over data still prompt many companies, especially smaller ones, to pick local cloud infrastructure providers instead, Warren co-founder and chief executive officer Tarmo Tael told TechCrunch.

“Local providers pay more attention to personal sales and support, in local language, to all clients in general, and more importantly, take the time to focus on SME clients to provide flexibility and address their custom needs,” he said. “Whereas global providers give a personal touch maybe only to a few big clients in the enterprise sectors.” Many local providers also offer lower prices and give a large amount of bandwidth for free, attracting SMEs.

He added that “the data sovereignty aspect that plays an important role in choosing their cloud platform for many of the clients.”

In 2015, Tael and co-founder Henry Vaaderpass began working on the project that eventually became Warren while running a development agency for e-commerce sites. From the beginning, the two wanted to develop a product of their own and tested several ideas out, but weren’t really excited by any of them, he said. At the same time, the agency’s e-commerce clients were running into challenges as their businesses grew.

Tael and Vaaderpass’s clients tended to pick local cloud infrastructure providers because of lower costs and more personalized support. But setting up new e-commerce projects with scalable infrastructure was costly because many local cloud infrastructure providers use different platforms.

“So we started looking for tools to use for managing our e-commerce projects better and more efficiently,” Tael said. “As we didn’t find what we were looking for, we saw this as an opportunity to build our own.”

After creating their first prototype, Tael and Vaaderpass realized that it could be used by other development teams, and decided to seek angel funding from investors, like Kiisa, who have experience working with cloud data centers or infrastructure providers.

Southeast Asia, one of the world’s fastest-growing cloud markets, is an important part of Warren’s business. Warren will continue to expand in Southeast Asia, while focusing on other developing regions with large domestic markets, like South America (starting with Brazil). Tael said the startup is also in discussion with potential partners in other markets, including Russia, Turkey and China.

Warren’s current clients include Estonian cloud provider Pilw.io and Indonesian cloud provider IdCloudHost. Tael said working with Warren means its customers spend less time dealing with technical issues related to infrastructure software, so their teams, including developers, can instead focus on supporting clients and managing other services they sell.

The company’s goal is to give local cloud infrastructure providers the ability to meet increasing demand, and eventually expand internationally, with tools to handle more installations and end users. These include features like automated maintenance and DevOps processes that streamline feature testing and handling different platforms.

Ultimately, Warren wants to connect providers in a network that end users can access through a single API and user interface. It also envisions the network as a community where Warren’s clients can share resources and, eventually, have a marketplace for their apps and services.

In terms of competition, Tael said local cloud infrastructure providers often turn to OpenStack, Virtuozzo, Stratoscale or Mirantis. The advantage these companies currently have over Warren is a wider network, but Warren is busy building out its own. The company will be able to connect several locations to one provider by the first quarter of 2021. After that, Tael said, it will “gradually connect providers to each other, upgrading our user management and billing services to handle all that complexity.”

Powered by WPeMatico

At its five-year anniversary gala graced by celebrities, esports stars and orchestras, Tencent’s mobile game Honor of Kings said it has crossed 100 million daily active users. The title has not only broken user records but generated other unprecedented accomplishments along the way.

For one, it consistently ranks among the top-grossing mobile games worldwide, jostling with PUBG Mobile made by another Tencent studio Lightspeed & Quantum — gaming has long been the cash cow for Tencent, better known for its WeChat messenger. The brain behind Honor of Kings is TiMi Studios, which ramped up hiring in the U.S. this year to further global expansion.

The game is credited for popularizing the multiplayer online battle arena (MOBA) category in China using clever designs like short sessions, friendly controls, esports integration, and social networking leverage, as games analyst Daniel Ahmad pointed out. The title has an unusually high female player base — around 50% — for a genre dominated by males.

TiMi focused on creating a MOBA that was tailored to the expectations of mobile players. Which included shorter session lengths, touch friendly controls and automated systems.

The game is great for beginners to the MOBA genre, but still requires skill to master. Broad appeal. pic.twitter.com/mSqMOKBEIc

— Daniel Ahmad (@ZhugeEX) November 1, 2020

Though not always seen as an original creator, Tencent pioneers monetization models for mobile games and can be Western studios’ sought-after partner. To name one, it helped develop the mobile version of Activision’s Call of Duty, which surpassed 250 million downloads in June.

Controversy has also arisen amid Honor of Kings’ fervor. A state newspaper chastised it for hooking young users and misrepresenting historical events. Tencent has since tightened age verification checks for players, now standard practice in China’s gaming industry.

TiMi unveiled its milestone at a time when Riot Games is testing a mobile version of League of Legends, widely seen as the desktop blockbuster that had inspired Honor of Kings in the first place. The overseas edition of Honor of Kings, called Arena of Valor, has had limited success outside Asia. It now comes the time for Riot, fully acquired by Tencent in 2015, to test its own interpretation, Wild Rift. TiMi told TechCrunch that it’s not involved in the development process of Riot’s new mobile title.

As part of the announcement, TiMi also revealed that it’s capitalizing on Honor of Kings for IP derivative works, including two new games in unspecified new genres, an anime, and a TV series.

“There is still plenty of room to further grow and develop the Honor of Kings IP in China,” Li Min, the game’s director and general manager of TiMi Studios, told TechCrunch. “I want to see it take on a life of its own and continue to resonate with and thrive among players for generations to come.”

“One of our great successes has been capturing historic moments, which were otherwise mostly irrelevant to young people today, and fuse them with modern aesthetics to bring them to life in Honor of Kings,” he added.

The story was updated on November 2, 2020 with comments from TiMi Studios.

Powered by WPeMatico

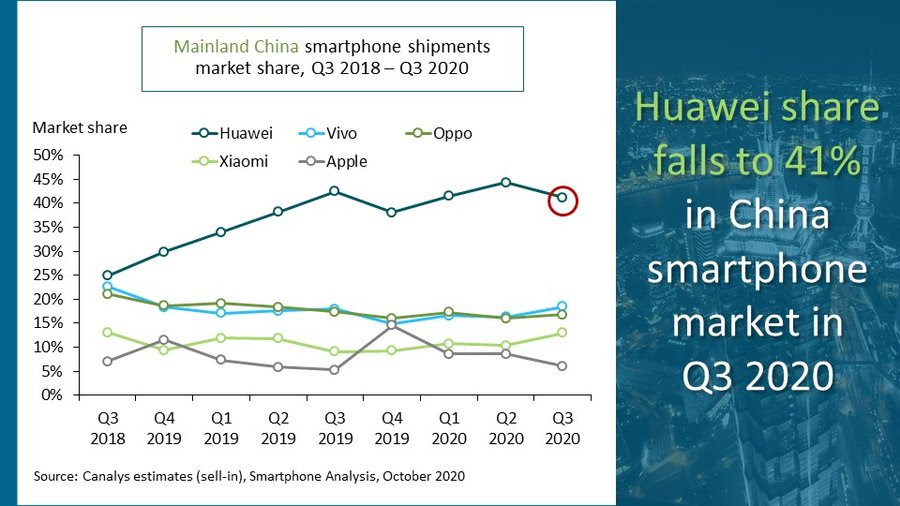

China was the first major global smartphone market to rebound from the early days of the COVID-19 pandemic. Stringent lockdown measures were able to help the country recover from the virus relatively quickly during the first wave, as sales started to return well ahead of other areas.

In Q3, however, things have begun to decline again. New numbers from Canalys point to an 8% drop between quarters — and a 15% drop year-over-year. The firm chalks much of the slowdown to longtime market leader Huawei’s ongoing issues with the U.S. government. The problems had a kind of cascading effect that served to impact the number two companies, Vivo and Oppo.

Image Credits: Canalys

“Huawei was forced to restrict its smartphone shipments following the August 17 US sanctions which caused a void in channels in Q3 that its peers were not equipped to fill. Huawei is facing its most serious challenge since taking the lead in 2016,” analyst Mo Jia said in a release. “If the position of the US administration does not change, Huawei will attempt to pivot its business strategy, to focus on building the [Harmony] OS and software ecosystem, as the Chinese government is eager to nurture home-grown alternatives to global platforms.”

Huawei dropped 18% in Mainland China, year-over-year. Vivo and Oppo posted similar declines at 13% and 18%, respectively. Xiaomi was able to make up ground at third place, gaining 19% y-o-y per the figures. Apple, meanwhile, remained relatively steady, in spite of the delated launch of the iPhone 12. Huawei’s continued struggles could provide a vacuum for the competition to fill.

Analyst Nicole Peng notes that the arrival of the 5G handset put the U.S. company in a strong position, looking forward: “iPhone 12 series will be a game changer for Apple in Mainland China. As most smartphones in China are now 5G-capable, Apple is closing a critical gap, and pent-up demand for its new 5G-enabled family will be strong.”

Powered by WPeMatico

PUBG Mobile, the sleeper hit mobile game, will terminate all service and access for users in India on October 30, two months after New Delhi banned the game in the world’s second largest internet market over cybersecurity concerns.

India on September 2 banned PUBG Mobile Nordic Map: Livik and PUBG Mobile Lite, along with more than 100 apps with links to China. The ban came after India banned TikTok and dozens of other popular Chinese apps in late June.

These apps were “prejudicial to sovereignty and integrity of India, defence of India, security of state and public order,” the country’s IT Ministry said on both the instances.

But unlike other affected apps that became unavailable within days — if not hours — PUBG Mobile apps remained accessible in the country for users who already had them installed on their phones, tablets and PCs. In fact, according to one popular mobile insight firm, PUBG Mobile had retained more than 90% of its monthly active users in the country, a mobile-first market where 99% of smartphones run Android, in the weeks following New Delhi’s order.

(Following the ban, Google and Apple pulled PUBG Mobile apps from their app stores in India. But soon enough, guides on how to work around the ban and obtain and install the apps became popular on several forums.)

PUBG Mobile had about 50 million monthly active users in India, tens of millions of users ahead of Call of Duty: Mobile and Fortnite and any other mobile game in the country.

“PUBG Mobile kickstarted an entire ecosystem — from esports organisations to teams and even a cottage industry of streamers that made the most of its spectator sport-friendly gameplay,” said Rishi Alwani, a long-time analyst of Indian gaming market and publisher of news outlet The Mako Reactor.

“Granted Tencent did a lot of the heavy lifting in building it out, but the game’s quality itself was heads and shoulders above what most Indians were used to on smartphones. And that’s a reason many kept coming back, some eventually monetising as well,” he added.

South Korea-headquartered PUBG Mobile attempted to assuage New Delhi’s concern by cutting ties with Tencent, the game’s publishing and distribution partner in India.

On Thursday, PUBG Mobile said, “protecting user data has always been a top priority and we have always complied with applicable data protection laws and regulations in India. All users’ gameplay information is processed in a transparent manner as disclosed in our privacy policy.”

“We deeply regret this outcome, and sincerely thank you for your support and love for PUBG Mobile in India,” it added.

Powered by WPeMatico

Despite e-commerce firms Amazon and Walmart and others pouring billions of dollars into India, offline retail still commands more than 95% of all sales in the world’s second largest internet market.

The giants have acknowledged the strong hold neighborhood stores (mom and pop shops) have in the country, and in recent quarters scrambled for ways to work with them. Mukesh Ambani, India’s richest man, has made the dynamics more interesting in the past year as he works to help these neighborhood stores sell online.

But the market opportunity is still too large, and there are many aspects of the old retail business that could use some tech. That’s the bet WareIQ, a Bangalore-headquartered, Y Combinator-backed startup is making. And it has just raised a $1.65 million seed financing round from YC, FundersClub, Pioneer Fund, Soma Capital, Emles Venture Advisors and founders of Flexport.

The one-year-old startup operates a platform to leverage the warehouses across the country. It has built a management system for these warehouses, most of which largely engage in offline business-to-business commerce and have had little to no prior e-commerce exposure.

“We connect these warehouses across India to our platform and utilize their infrastructure for e-commerce order processing,” said Harsh Vaidya, co-founder and chief executive of WareIQ, in an interview with TechCrunch. The company offers this as a service to retail businesses.

Who are these businesses? Third-party sellers (some of whom sell to Amazon and Flipkart and use WareIQ to speed up their delivery), e-commerce firms, social commerce platforms, as well as neighborhood stores and social media influencers.

Any online store, for instance, can send its products to WareIQ, which has integrations with several popular e-commerce platforms and marketplaces. It works with courier partners to move items from one warehouse to another to offer the fastest delivery, explained Vaidya.

The infrastructure stitched together by WareIQ also enables an online seller to set up their own store and engage with customers directly, thereby saving fees they would have paid to Amazon and other established e-commerce players.

“The sellers were not able do this on their own before because it required them to talk directly to warehousing companies that maintain their own rigid contracts, and high-security deposits, and they still needed to work with multiple technology providers to complete the tech-stack,” he said. WareIQ also offers these sellers last-mile delivery, cash collection and fraud detection among several other services.

“In a way, we are building an open-source Amazon fulfilment service, where any seller can send their goods to any of our warehouses and we fulfil their Amazon orders, Myntra orders, Flipkart orders or their own website orders. We also comply with the standard of these individual marketplaces, so our sellers get a Prime tag on Amazon,” he said.

WareIQ is free for anyone to sign up with any charge and it takes a cut by the volume of orders it processes. The startup today works with more than 40 fulfilment centres and plans to deploy the fresh capital to expand its network to tier 2 and tier 3 cities, he said. It’s also hiring for a number of tech roles.

Powered by WPeMatico

Following the news that China’s esport giant VSPN (Versus Programming Network) has raised close to $100 million in a Series B funding round led by Tencent Holdings, TechCrunch interviewed founder and CEO Dino Ying via email about his strategy for the company.

Founded in 2016 and headquartered in Shanghai, VSPN was one of the early pioneers in esports tournament organization and content creation out of Asia. It has since expanded into other businesses, including offline venue operation.

VSPN began hosting the first large-scale esport event with offline audiences in August, although tournaments now operate under strict COVID-19 prevention measures.

TechCrunch: VSPN has a large content production ecosystem surrounding its esports activity. Can you expand on the detail behind your stated short-form video strategy? Will this involve TikTok?

Ying: VSPN intends to use our world-class video production capabilities and industry insights to create different forms of content. We will give our existing fans and a wider audience a new and vivid esports experience. Kuaishou, as our investors and a strategic partner, will support in all ways as a media platform to help our content reach more users. Short-form video is an important part of our future strategy and we look forward to working with platforms all over the world in this regard.

TC: What is VSPN’s share of the esports market?

Ying: There is no official estimation of the size of the esports market, but VSPN is by far the largest esports organization in China, with over 1,000+ employees and covering every major esports tournament you’ve ever heard of. By many measures, we are the largest esports organization in the world and will continue to expand.

TC: Why do you think Shanghai has become a center for esports?

Ying: As the biggest and perhaps most international city in China, it has a vibrant and increasingly sophisticated economy. Tech innovation and new industries are actively encouraged to grow here.

The Shanghai government has implemented supportive measures and policies to encourage the growth of esports both domestically and internationally. Thanks to these measures Shanghai has become an international hub for the biggest and best tournaments in the world.

VSPN events have returned, despite COVID-19. Image via VSPN

TC: How important is research into esports for VSPN and why?

Ying: It is vital for VSPN. As an esports total solutions provider aiming to build a sustainable global esports ecosystem, data and R&D allows us to give our fans a richer experience. The research center will allow us to continually improve as a company and develop the industry.

TC: You are the co-founder and chairman and CEO by title. What is the role of co-founder Ethan Teng?

Ying: Ethan Teng is co-founder and president of VSPN. Ethan as one of the most important partners of VSPN, with his dedicated esports industry experience, he plays a vital role in leading and managing the company’s strategic goal setting and day to day management.

TC: What is the nature of the strategic relationship with Tencent?

Ying: VSPN is a key partner of Tencent in the esports industry. With Tencent’s support, VSPN has built a leading position in esports tournament content production. Since the emergence of esports in China, our deep-rooted industry expertise has helped further develop the esports ecosystem to grow and mature. Alongside Tencent we will continue to generate new opportunities within the industry.

TC: What made you choose these partners and why? What was the strategic thinking behind these decisions?

Ying: Together with Kuaishou, VSPN aims to establish an esports short-form video ecosystem to diversify existing content, and to build the connections between top quality creators and channels. With an extensive portfolio in the consumer and TMT sectors, both Tiantu Capital and SIG will utilize their industry insights and expertise to aid VSPN’s strategic development. With our investors, we will empower esports to be the new sports for the next generation.

TC: In addition to the core esports tournament and content production business, VSPN has branded esports venues. How important are these other businesses — like the venues — to the core offering of VSPN? What sort of growth do you expect in the next few years?

Ying: Regardless of business lines, VSPN’s core mission is to provide the best esports experiences for our fans. And these experiences include not just online viewing experiences, but also offline ones where fans physically attend. We see our offline business as a natural way to extend our services to our fans; it is an important supplement to our overall offerings. We expect to grow it per our fans’ and partner’s demands.

TC: Mobile esports, especially the KPL and PUBG MOBILE (or Peacekeeper Elite in China), have attracted more and more female audiences. What is the future of esports among women / girls?

Ying: Mobile gaming has really helped extend esports’ reach to female participants and audiences. Rightfully so, we see a future of esports where female participants take a more prominent role than they have done. Not just onstage as athletes, but also off stage as fans and more importantly backstage as top quality producers and decision-makers in the industry. The impact of having more female fans, athletes and professionals is exciting and will be hugely beneficial to the wider industry.

TC: What is the future of esports in augmented reality?

Ying: We think esports in its full form will look and feel a lot different from what we’ve seen so far in sports and entertainment. The possibility of integrating real-world gaming and virtual competitions is fascinating. VSPN is only beginning to test the boundaries of new technologies such as AR, VR. The emergence of these technologies will help us create fresher experiences, and the possibilities are endless.

VSPN headquarters. Image via VSPN

TC: Please tell us more about your personal history.

Ying: Firstly, thank you for having me — it is a real pleasure to speak to TechCrunch and be able to announce our fundraise to the world. I have been working in the gaming and esports industry all my life and I’m excited about the future. With the team at VSPN we are proud to be pioneers in the esports industry.

I live between Beijing and Shanghai, but I spend a lot of my time travelling to other Chinese cities like Xi’an, Chengdu, Guangzhou and Shenzhen where we have esports arenas and business interests. Usually I travel internationally to some of our overseas operations and competitions, so I look forward to that when travel becomes easier.

I am a fan of traditional sports too and an avid football fan. I follow some of the European leagues — whenever I can, I go to matches to enjoy the atmosphere; I went to Stamford Bridge early this year and loved it, but seeing the AC versus Inter Derby live is hard to beat…

TC: Why did you get into this business and how?

Ying: Mostly because I am a HUGE gaming fan! I’ve been playing computer games since I was a teenager and enjoy playing all types. Earlier this year I played COD Warzone as soon as it came out and often play PUBG Mobile; I’m extremely lucky to be in an industry which I’ve loved since I was very young. It’s a great way to connect with friends and I am proud to have worked in game development and publishing for my whole career. Five years ago, esports seemed like the obvious next step because of the competitive element. We saw the beginnings of a trend and founded VSPN with a world-class team to make that potential a reality.

VSPN is very proud to be leading the world in a relatively new industry. We think esports will continue to grow exponentially and will be an incredibly important part of the entertainment industry in years to come. To lead a Chinese company with a global future is really exciting.

TC: What motivates you as a businessman?

Ying: Bringing new forms of entertainment to millions of people around the world and building a global business.

TC: Who inspires you most in the business world?

There are so many fantastic businessmen in China who are doing some really innovative things at the moment. For example, the live-streaming industry has become enormous in 2020 due to the pandemic and has offered entrepreneurs a new way to sell products and engage with new audiences.

If I had to name one it would be Mark Ren (COO at Tencent Holdings) — he is an exceptional businessman. The way he has helped create sustainable ecosystems in the entertainment space and captured trends is something every businessman should aspire to. This is something VSPN works hard at and we are very proud to be such close partners of Tencent.

TC: What is your opinion of Silicon Valley?

Ying: It’s an amazing place and has shown the world how technology can improve lives all over the world. For many years it has led the world as a centre for creativity and innovation and continues to be an inspiration to entrepreneurs around the world. In China, we have lots of Silicon Valleys!

TC: Is there anything else you’d like to say to TechCrunch readers?

Ying: This has been a challenging year for many businesses and the esports industry has had to adapt, but I think the world has seen how big esports is and how it can bring communities and cultures together. As the industry grows there will bigger and bigger online and offline tournaments across the world, especially with 5G and mobile gaming becoming even more popular. We look forward to being at the forefront of esports for competitors all over the world and hopefully some of your readers will enjoy watching our original content and tournaments.

Finally, with celebrities and big brands seeing live streaming and casual gaming as a new way to engage with a wider audience, the future for VSPN is very, very bright.

Powered by WPeMatico

Further confirmation that the esports market is booming amid the pandemic comes today with the news that esports “total solutions provider” VSPN (Versus Programming Network) has raised what it describes as “close to” $100 million in a Series B funding round, led by Tencent Holdings . Other investors that participated in the round include Tiantu Capital, SIG (Susquehanna International Group), and Kuaishou. The funding round will go toward improving esports products and its ecosystem in China and across Asia.

Founded in 2016 and headquartered in Shanghai, VSPN was one of the early pioneers in esports tournament organization and content creation out of Asia. It has since expanded into other businesses, including offline venue operation.

In a statement, Dino Ying, CEO of VSPN (see also our exclusive interview) said: “We are delighted to announce this latest round of funding. Thanks to policies supporting Shanghai as the global center for esports, and with Beijing, Chengdu, and Xi’an expressing confidence in the development of esports, VSPN has grown rapidly in recent years. After this funding round, we look forward to building an esports research institute, an esports culture park, and further expanding globally. VSPN has a long-term vision and is dedicated to the sustainable development of the global esports ecosystem.”

Dino Ying, VSPN CEO. Image via VSPN

Mars Hou, general manager of Tencent Esports, commented: “VSPN’s long-term company vision and leading position in esports production are vital for Tencent to optimize the layout of the esports industry’s development.”

We had a hint that Tencent might invest in VSPN when, in March this year, Mark Ren, COO of Tencent Holdings, made a public statement that Tencent would provide more high-quality esports competitions in conjunction with tournament organizers like VSPN.

As we observed in August, Tencent, already the world’s biggest games publisher, said that it would consolidate Douyu and Huya, the previously competing live-streaming sites focused on video games.

In other words, Tencent’s investment into VSPN shows it is once again doubling-down on the esports market.

This Series B funding round comes four years after VSPN’s 2016 Series A funding round, which was led by Focus Media Network, joined by China Jianteng Sports Industry Fund, Guangdian Capital and Averest Capital.

Now, VSPN has become the principal tournament organizer and broadcaster for PUBG MOBILE international competitions, and China’s top competitions for Honor of Kings, PUBG, Peacekeeper Elite, CrossFire, FIFA, QQ Speed and Clash Royale. This will tally-up 12,000 hours of original content. The company has partnered with more than 70% of China’s esports tournaments.

In March, another huge esports player, ESL, joined forces with Tencent to become a part of the PUBG Mobile esports circuit for 2020.

In addition to its core esports tournament and content production business, VSPN has branded esports venues in Chengdu, Xi’an and Shanghai. In May, VSPN launched its first overseas venue, V. SPACE in Seoul, South Korea.

And even offline events are coming back. VSPN hosted the first large-scale esport event with offline audiences in August this year. And the LOL S10 event will open 6,000 tickets. However, all tournaments will operate under strict COVID-19 prevention measures and approval processes by the Chinese government, and not all esports events are allowing offline audiences.

VSPN said it will continue to focus on building an esports short-form video ecosystem, improving the quality of esports content creation, and reaching more users via different channels. VSPN currently houses more than 1,000 employees in five business divisions.

Powered by WPeMatico

Earlier this year, the founders of event analytics platform Hubilo pivoted to become a virtual events platform to survive the impact of COVID-19. Today, the startup announced it has raised a $4.5 million seed round, led by Lightspeed, and says it expects to exceed $10 million bookings run rate and host more than one million attendees over the next few months.

The round also included angel investors Freshworks CEO Girish Mathrubootham; former LinkedIn India CEO Nishant Rao; Slideshare co-founder Jonathan Boutelle; and Helpshift CEO Abinash Tripathy.

Hubilo’s clients have included the United Nations, Roche, Fortune, GITEX, IPI Singapore, Tech In Asia, Infocomm Asia and Clarion Events. The startup is headquartered in San Francisco, but about 12% of its sales are currently from Southeast Asia, and it plans to further scale in the region. It will also focus on markets in the United States, Europe, the Middle East and Africa.

Vaibhav Jain, Hubilo’s founder and CEO, told TechCrunch that many of its customers before the pandemic were enterprises and governments that used its platform to help organize large events. Those were also the first to stop hosting in-person events.

In February, “we knew that most, if not all, physical events were getting postponed or cancelled globally. To counter the drop in demand for offline events, we agreed to extend the contracts by six more months at no cost,” Jain said. “However, this was not enough to retain our clients and most of them either cancelled the contracts or put the contract on hold indefinitely.”

As a result, Hubilo’s revenue dropped to zero in February. With about 30 employees and reserves for only three months, Jain said the company had to choose between shutting down or finding an alternative model. Hubilo’s team created an MVP (minimum viable product) virtual event platform in less than a month and started by convincing a client to use it for free. That first virtual event was hosted in March and “since then, we’ve never looked back,” said Jain.

This means Hubilo is now competing with other virtual event platforms, like Cvent and Hopin (which was used to host TechCrunch Disrupt). Jain said his company differentiates by giving organizers more chances to rebrand their virtual spaces; focusing on sponsorship opportunities that include contests, event feeds and virtual lounges to increase attendee engagement; and providing data analytic features that include integration with Salesforce, Marketo and HubSpot.

With so many events going virtual that “Zoom fatigue” and “webinar fatigue” have now become catchphrases, event organizers have to not only convince people to buy tickets, but also keep them engaged during an event.

Hubilo “gamifies” the experience of attending a virtual event with features like its Leaderboard. This enables organizers to assign points for things like watching a session, visiting a virtual booth or messaging someone. Then they can give prizes to the attendees with the most points. Jain said the Leaderboard is Hubilo’s most used feature.

Powered by WPeMatico

The long-anticipated IPO of Alibaba-affiliated Chinese fintech giant Ant Group could raise tens of billions of dollars in a dual-listing on both the Shanghai and Hong Kong exchanges.

Shares for the company formerly known as Ant Financial are expected to price at around HK$80, or roughly 68 to 69 Chinese Yuan. The company is selling around 134 million shares in the Hong Kong portion of its debut, worth around $17.25 billion American dollars at HK$80 apiece.

Given that the share sale is expected to raise a similar amount of money from its Shanghai listing, the company’s IPO could raise as much as $34.5 billion. That tally would make the debut the largest in history, besting the recent Aramco IPO that raised around $29.4 billion.

Alibaba owns a 33% stake in Ant Group. At its currently expected share price, Ant Group would be worth as much as $310 billion, according to The New York Times, or $313 billion per CNBC.

Ant Group’s huge IPO fits its own epic scale. As TechCrunch reported in July, Ant had around 1.3 billion annual active users in March of this year, a number that could have risen in recent quarters. Ant’s Alipay competes with Tencent’s WeChat Pay in the huge and lucrative Chinese market.

The Ant Group IPO could be viewed as a moment in which the United States stock markets showed weakness. When Alibaba went public back in 2014, it did so via the New York Stock Exchange. The Chinese tech giant later dual-listed on the Hong Kong exchange. To see Ant Group dual-list on the Hong Kong and Shanghai indices without a float in New York shows what is possible outside of the United States when it comes to capital financing.

Fintech startups have broadly seen their fortunes rise during 2020 as the global pandemic changed consumer behavior and moved more commerce and payments into the digital realm. And IPOs have generally performed strongly as well, meaning that Ant Group could find a few tailwinds for its equity when it begins to trade.

Ant has not been content to stick to its knitting, keeping itself busy by investing in other startups. The company took a small stake in installment-payment service Klarna earlier this year, for example.

At a valuation of more than $310 billion, Ant Group would be worth about as much as JPMorgan Chase, the most valuable American bank today. It would also best U.S.-based digital payments leader PayPal, which is currently valued at $236 billion, as well as Square, which is valued at $77 billion.

Powered by WPeMatico