Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Facebook will only build its own Calibra cryptocurrency wallet into Messenger and WhatsApp, and will refuse to embed competing wallets, the head of Calibra David Marcus told the Senate Banking Committee today. While some, like Senator Brown, blustered that “Facebook is dangerous!,” others surfaced poignant questions about Libra’s risks.

Calibra will be interoperable, so users can send money back and forth with other wallets, and Marcus committed to data portability so users can switch entirely to a competitor. But solely embedding Facebook’s own wallet into its leading messaging apps could give the company a sizable advantage over banks, PayPal, Coinbase or any other potential wallet developer.

Other highlights from the “Examining Facebook’s Proposed Digital Currency and Data Privacy Considerations” hearing included Marcus saying:

But Marcus also didn’t clearly answer some critical questions about Libra and Calibra, and may be asked again when he testifies before the House Financial Services Committee tomorrow.

Chairman Crapo asked if Facebook would collect data about transactions made with Calibra that are made on Facebook, such as when users buy products from businesses they discover through Facebook. Marcus instead merely noted that Facebook would still let users pay with credit cards and other mediums as well as Calibra. That means that even though Facebook might not know how much money is in someone’s Calibra wallet or their other transactions, it might know how much they paid and for what if that transaction happens over their social networks.

Senator Tillis asked how much Facebook has invested in the formation of Libra. TechCrunch has also asked specifically how much Facebook has invested in the Libra Investment Token that will earn it a share of interest earned from the fiat currencies in the Libra Reserve. Marcus said Facebook and Calibra hadn’t determined exactly how much it would invest in the project. Marcus also didn’t clearly answer Senator Toomey’s question of why the Libra Association is considered a not-for-profit organization if it will pay out interest to members.

Senator Menendez asked if the Libra Association would freeze the assets if terrorist organizations were identified. Marcus said that Calibra and other custodial wallets that actually hold users’ Libra could do that, and that regulated off-ramps could block them from converting Libra into fiat. But this answer underscores that there may be no way for the Libra Association to stop transfers between terrorists’ non-custodial wallets, especially if local governments where those terrorists operate don’t step in.

Perhaps the most worrying moment of the hearing was when Senator Sinema brought up TechCrunch’s article citing that “The real risk of Libra is crooked developers.” There I wrote that Facebook’s VP of product Kevin Weil told me that “There are no plans for the Libra Association to take a role in actively vetting [developers],” which I believe leaves the door open to a crypto Cambridge Analytica situation where shady developers steal users money, not just their data.

Senator Sinema asked if an Arizonan was scammed out of their Libra by a Pakistani developer via a Thai exchange and a Spanish wallet, would that U.S. citizen be entitled to protection to recuperate their lost funds. Marcus responded that U.S. citizens would likely use American Libra wallets that are subject to protections and that the Libra Association will work to educate users on how to avoid scams. But Sinema stressed that if Libra is designed to assist the poor who are often less educated, they could be especially vulnerable to scammers.

Here @SenatorSinema cites my article warning that we need protection from Facebook Libra’s unvetted developers https://t.co/gYeYIQVFLj pic.twitter.com/QSqVDztpCU

— Josh Constine (@JoshConstine) July 16, 2019

Overall, the hearing was surprisingly coherent. Many Senators showed strong base knowledge of how Libra worked and asked the right questions. Marcus was generally forthcoming, beyond the topics of how much Facebook has invested in the Libra project and what data it will glean from transactions atop its social network.

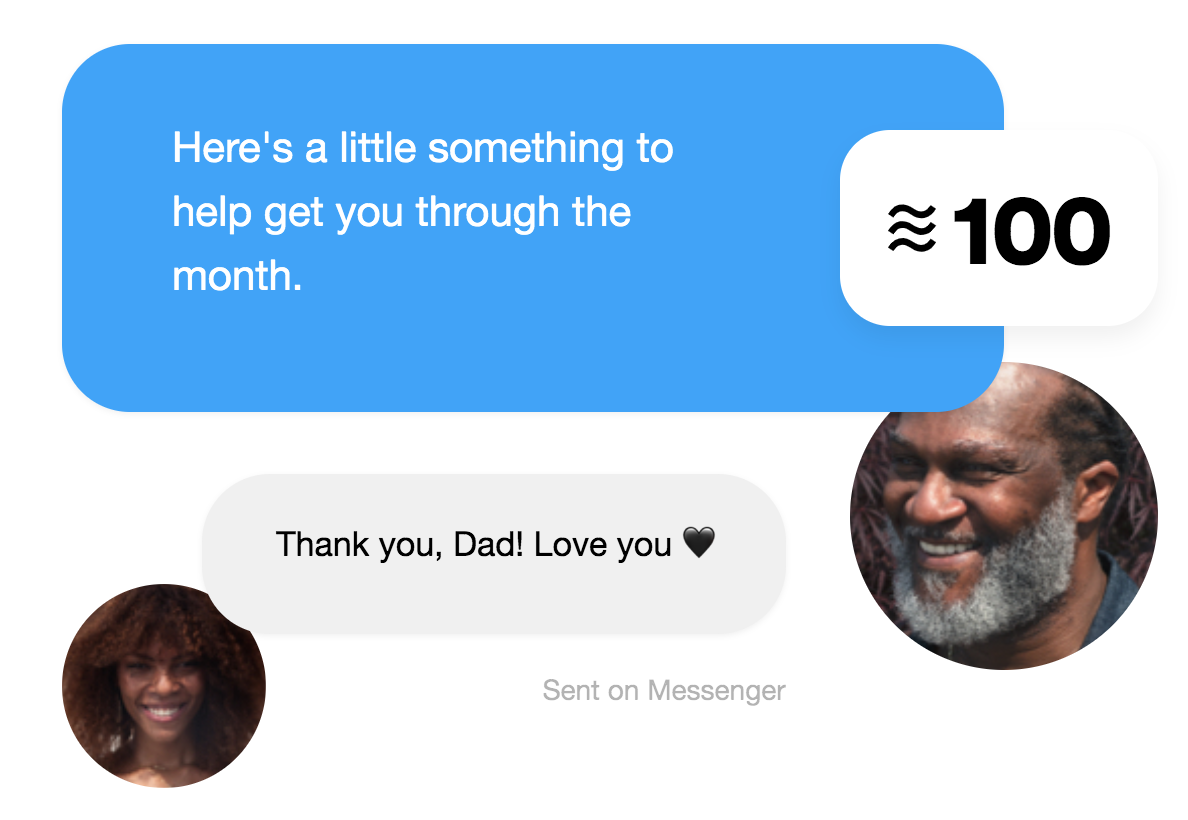

Some of the top concerns, such as terrorist money laundering, encompass the entire cryptocurrency ecosystem and can’t be solved even by strong rules around Libra. Little regard was given to how Libra could improve remittance or cut transaction fees that see corporations profit off families and small businesses.

Still, if Libra actually becomes popular and evolves as an open ecosystem full of unvetted developers, the currency could be used to facilitate scams. Precisely because of the lack of trust in Facebook that many Senators harped on, consumers could go seeking Libra wallet alternatives to the company that might push them into the hands of evildoers. The Libra Association may need to shift the balance further toward safety and away from cryptocurrency’s prevailing philosophies from openness. Otherwise, the frontiers of this Wild West could prove dangerous, even if its civilized regions are well-regulated.

Powered by WPeMatico

Quirk, a YC-backed company, is looking to bring cognitive behavioral therapy (CBT) to more people suffering from anxiety or depression.

CBT aims to lessen or stop harmful behavior by changing the way people think, stopping them from falling into established patterns of negatively distorting their reality to justify or account for unhelpful habits.

“CBT has 40 years of research behind it,” says CEO and founder Evan Conrad. “I’ve had severe panic attacks my whole life and saw different therapists who tried what I now know is CBT. I assumed it was a pseudo science. It wasn’t until 10 months ago that I re-discovered CBT on my own and learned about its efficacy. It’s the gold standard.”

The app helps users practice one of the most common exercises in CBT: the triple-column technique.

Here’s how it works:

Users jump into the app whenever they have anxiety or a depressive thought to record it. They then identify any distortions that apply to that thought, such as Catastrophizing, Magnification of the Negative, Fortune Telling or Over-Generalization, among others. From there, the user can challenge the thought with reasons why that thought might have been illogical to begin with. Finally, the user replaces the thought with something more reasonable.

For example, if I was worried about not getting a response to a text, I might believe (irrationally) that it has something to do with how that person feels about me, rather than the more obvious explanation: they’re just busy.

The hope of CBT is that identifying thought distortions and manually replacing them with beliefs grounded in reality retrains the brain to experience the world in a realistic way and relieves patients from their depression and/or anxiety.

Conrad says that he went from having two anxiety attacks a week to two every six months.

The problem that Quirk is trying to solve is two-fold. First, people may not know the benefits or the empirical data supporting CBT. Second, the process of manually recording this on pen and paper can be more tedious and feel less private out in a public space.

Quirk’s attempt to solve these problems is to make CBT accessible to more people and to make the process of doing CBT slightly more private.

We asked Conrad about the potential negative affects of practicing CBT without the oversight of a mental health professional.

“As for self-administered CBT, we’ve run this by a number of therapists and all of them have said it’s generally a net-benefit,” Conrad said via email. “What would be harmful is if someone with a severe condition decided that they should use Quirk instead of seeing a therapist. But in practice we’ve seen the opposite effect. People who would have otherwise done nothing about their condition use Quirk as a ‘first step’ towards therapy or will use Quirk when they would otherwise have no option (either because there isn’t a treatment in their country/area or because they can’t afford it).”

Dr. Daniel J. Fridberg, a practicing CBT psychologist from the University of Chicago, says that the triple-column technique is a great CBT exercise, but that it’s just part of the whole package of Cognitive Behavioral Therapy. He also said that the only way to know if a product like this can do harm is through a study, but that CBT itself is an evidence-based psychotherapy and has been proven effective.

“CBT is an effective, time-limited, reasonably cost-effective psychotherapy for things like depression, anxiety, substance abuse, etc,” said Dr. Fridberg. “The problem is that finding a good CBT therapist who delivers evidence-based treatment isn’t always easy in smaller communities where there isn’t easy access to a research hub. In some respects, an app that is packaged in an attractive way gets people’s attention and promotes CBT as effective is a good thing.”

Dr. Fridberg also stated that anyone suffering from an issue that’s disrupting their day-to-day functioning should seek professional help.

Conrad says that he hopes Quirk can be a jumping off point for folks suffering from anxiety and depression, with the app suggesting that those suffering seek professional help in conjunction with using the app. He also shared that Quirk hopes to be able to connect users to professionals in their area as soon as they have the scale to do so.

Quirk costs $4/month for users.

Powered by WPeMatico

Users of Amazon’s voice assistant will soon be able to talk to Alexa in Hindi. Amazon announced today that it has added a Hindi voice model to its Alexa Skills Kit for developers. Alexa developers can also update their existing published skills in India for Hindi.

Amazon first revealed last month during its re: MARS machine learning and artificial intelligence conference that it would add fluent Hindi to Alexa. Before, Alexa was only able to understand a few Hinglish (a portmanteau of Hindi and English) commands. Rohit Prasad, vice president and head scientist for Alexa, told Indian news agency IANS that adding Hindi to Alexa posed a “contextual, cultural as well as content-related challenge” because of the wide variety of dialects, accents and slang used in India.

Along with English, Hindi is one of India’s official languages (Google Voice Assistant also offers Hindi support). According to Citi Research, Amazon holds about a 30% market share, about the same as its main competitor, Walmart-backed Flipkart.

Powered by WPeMatico

The head of Facebook’s blockchain subsidiary Calibra David Marcus has released his prepared testimony before Congress for tomorrow and Wednesday, explaining that the Libra Association will be regulated by the Swiss government because that’s where it’s headquartered. Meanwhile, he says the Libra Association and Facebook’s Calibra wallet intend to comply will all U.S. tax, anti-money laundering and anti-fraud laws.

“The Libra Association expects that it will be licensed, regulated, and subject to supervisory oversight. Because the Association is headquartered in Geneva, it will be supervised by the Swiss Financial Markets Supervisory Authority (FINMA),” Marcus writes. “We have had preliminary discussions with FINMA and expect to engage with them on an appropriate regulatory framework for the Libra Association. The Association also intends to register with FinCEN [The U.S. Treasury Department’s Financial Crimes Enforcement Network] as a money services business.”

Marcus will be defending Libra before the Senate Banking Committee on July 16th and the House Financial Services Committees on July 17th. The House subcomittee’s Rep. Maxine Waters has already issued a letter to Facebook and the Libra Association requesting that it halt development and plans to launch Libra in early 2020 “until regulators and Congress have an opportunity to examine these issues and take action.”

The big question is whether Congress is savvy enough to understand Libra to the extent that it can coherently regulate it. Facebook CEO Mark Zuckerberg’s testimonies before Congress last year were rife with lawmakers dispensing clueless or off-topic questions.

Sen. Orin Hatch infamously demanded to know “how do you sustain a business model in which users don’t pay for your service?,” to which Zuckerberg smirked, “Senator, we run ads.” If that concept trips up Congress, it’s hard to imagine it grasping a semi-decentralized stablecoin cryptocurrency that took us 4,000 words to properly explain, and a six-minute video just to summarize.

Attempting to assuage a core concern that Libra is trying to replace the dollar or meddle in financial policy, Marcus writes that “The Libra Association, which will manage the Reserve, has no intention of competing with any sovereign currencies or entering the monetary policy arena. It will work with the Federal Reserve and other central banks to make sure Libra does not compete with sovereign currencies or interfere with monetary policy. Monetary policy is properly the province of central banks.”

Marcus’ testimony comes days after President Donald Trump tweeted Friday to condemn Libra, claiming that “Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity. Similarly, Facebook Libra’s ‘virtual currency’ will have little standing or dependability. If Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National and International.”

TechCrunch asked Facebook for a response Friday, which it declined to provide. However, a Facebook spokesperson noted that the Libra Association won’t interact with consumers or operate as a bank, and that Libra is meant to be a complement to the existing financial system.

Regarding how Libra will comply with U.S. anti-money laundering (AML) and know-your-customer (KYC) laws, Marcus explains that “The Libra Association is similarly committed to supporting efforts by regulators, central banks, and lawmakers to ensure that Libra contributes to the fight against money laundering, terrorism financing, and more,” Marcus explains. “The Libra Association will also maintain policies and procedures with respect to AML and the Bank Secrecy Act, combating the financing of terrorism, and other national security-related laws, with which its members will be required to comply if they choose to provide financial services on the Libra network.”

He argues that “Libra should improve detection and enforcement, not set them back,” because cash transactions are frequently used by criminals to avoid law enforcement. “A network that helps move more paper cash transactions—where many illicit activities happen—to a digital network that features regulated on- and off-ramps with proper know-your-customer (KYC) practices, combined with the ability for law enforcement and regulators to conduct their own analysis of on-chain activity, will present an opportunity to increase the efficacy of financial crimes monitoring and enforcement.”

As for Facebook itself, Marcus writes that “The Calibra wallet will comply with FinCEN’s rules for its AML/CFT program and the rules set by the Office of Foreign Assets Control (OFAC) . . . Similarly, Calibra will comply with the Bank Secrecy Act and will incorporate KYC and AML/CFT methodologies used around the world.”

These answers might help to calm finance legal eagles, but I expect much of the questioning from Congress will deal with the far more subjective matter of whether Facebook can be trusted after a decade of broken privacy promises, data leaks and fake news scandals like Cambridge Analytica.

That’s why I don’t expect the following statement from Marcus about how Facebook has transformed the state of communication will play well with lawmakers that are angry about how those changes impacted society. “We have done a lot to democratize free, unlimited communications for billions of people. We want to help do the same for digital currency and financial services, but with one key difference: We will relinquish control over the network and currency we have helped create.” Congress may interpret “democratize” as “screw up,” and not want to see the same happen to money.

Facebook and Calibra may have positive intentions to assist the unbanked who are indeed swindled by banks and money transfer services that levy huge fees against poorer families. But Facebook isn’t acting out of pure altruism here, as it stands to earn money from Libra in three big ways that aren’t mentioned in Marcus’ testimony:

The real-world stakes are much higher here than in photo sharing, and warrant properly regulatory scrutiny. No matter how much Facebook tries to distance itself from ownership of Libra, it started, incubated and continues to lead the project. If Congress is already convinced “big is bad,” and Libra could make Facebook bigger, that may make it difficult to separate their perceptions of Facebook and Libra in order to assess the currency on its merits and risks.

Below you can read Marcus’ full testimony:

For full details on how Libra works, read our feature story on everything you need to know:

Powered by WPeMatico

Navigation app Waze is making getting to where you’re going even easier — or at least more transparent. A new feature rolling out today will show you any tolls along your route, including the actual amount you’re going to pay, across both the U.S. and Canada.

This is above and beyond what you’ll get in most navigation apps, where you might get a visual or text indicator that there is a toll on one of the roads in your path (and you can opt to avoid them if possible) but you won’t know what you’re actually paying. With Waze, you’ll get the amount — sourced from its community of user-drivers, rather than direct from the official toll road operators — but Waze’s crowd-sourced navigation data often has a leg up on the official source in other cases.

Waze will show you the toll prices up front, too, before the navigation actually gets under way, which is great, because that’s when you actually have the opportunity to do something about it, whether it’s scrounging seat-cushion change or just choosing to drive a different way.

This will be rolling out beginning today, so keep an eye out if you’re trying to get somewhere in the U.S. or Canada.

Powered by WPeMatico

Could Roblox create a new entertainment and communication category, something it calls “human co-experience”?

When it was a small startup, few observers would have believed in that future. But after 15 years — as told in the origin story of our Roblox EC-1 — the company has accumulated 90 million users and a new $150 million venture funding war chest. It has captured the imagination of America’s youth, and become a startup darling in the entertainment space.

But what, exactly, is human co-experience? Well, it can’t be described precisely — because it’s still an emerging category. “It’s almost like that fable where the nine blind men are touching and describing an elephant.

Everyone has a slightly different view,” says co-founder and CEO Dave Baszucki. In Roblox’s view, co-experience means immersive environments where users play, explore, talk, hang out, and create an identity that’s as thoroughly fleshed out (if not as fleshy) as their offline, real life.

But the next decade at Roblox will also be its most challenging time yet, as it seeks to expand from 90 million users to, potentially, a billion or more. To do so, it needs to pull off two coups.

First, it needs to expand the age range of its players beyond its current tween and teen audience. Second, it must win the international market. Accomplishing both of these will be a puzzle with many moving parts.

One thing Roblox has done very well is appeal to kids within a certain age range. The company says that a majority of all 9-to-12-year-old children in the United States are on its platform.

Within that youthful segment, Roblox has arguably already created the human co-experience category. Many games are more cooperative than competitive, or have goals that are unclear or don’t seem to matter much. One of Roblox’s most popular games, for instance, is MeepCity, where players can run around and chat in virtual environments like a high school without necessarily interacting with the game mechanics at all.

What else separates these environments from what you can see today on, say, the App Store or Steam? A few characteristics seem common.

For one, the environments look rough. One Robloxian put the company’s relaxed attitude toward looks as “not over-indexing on visual fidelity.”

Roblox games also ignore the design principles now espoused by nearly every game company. Tutorials are infrequent, user interfaces are unpolished, and one gets the sense that KPIs like retention and engagement are not being carefully measured.

That’s similar to how games on platforms like Facebook and the App Store started out, so it seems reasonable to say Roblox is just in a similarly early stage. It is — but it’s also competing directly with mobile games that are more rigorously designed. Over half of its players are on smartphones, where they could have chosen a free game that looks more polished, like Fortnite or Clash of Clans.

The more accurate explanation of why Roblox draws big player numbers is that there’s a gap in the kids entertainment market. So far, only Roblox fills that gap, despite its various shortcomings.

“The amount of unstructured, undirected play has been declining for decades. [Kids] have much more homework, and structured activities like theater after school.

One of the big unmet needs we solve is to give kids a place to have imagination,” explains Craig Donato, Roblox’s chief business officer. “If you play the experiences on our platform, you’re not playing to win. You go into these worlds with people you know and share an experience.”

Games like The Sims tried to do the same, but eventually faded in the children’s demo. Roblox’s trick has been continued growth: it provides kids with an endless array of games that unlock their imagination. But just like we don’t expect adults to have fun with Barbie dolls, it’s unlikely most adults would enjoy Roblox games.

Of course, it would be easy to point at Roblox and laugh off its ambitions to win over people of all ages. That laughter would also be short-sighted.

As David Sze, the Greylock Partners investor who led Roblox’s most recent round, pointed out: “When we invested in Facebook there was a huge amount of pushback that nobody would use it outside college.” Companies that have won over one demographic have a good chance of winning others.

Roblox has also proven its ability to evolve. At one time, the platform’s players were 90 percent male. Now, that’s down to about 60 percent. Roblox now has far more girls playing than the typical game platform.

Powered by WPeMatico

Facebook provided TechCrunch with new information on how its cryptocurrency will stay legal amidst allegations from President Trump that Libra could facilitate “unlawful behavior.” Facebook and Libra Association executives tell me they expect Libra will incur sales tax and capital gains taxes. They confirmed that Facebook is also in talks with local convenience stores and money exchanges to ensure anti-laundering checks are applied when people cash-in or cash-out Libra for traditional currency, and to let you use a QR code to buy or sell Libra in person.

A Facebook spokesperson said the company wouldn’t respond directly to Trump’s tweets, but noted that the Libra association won’t interact with consumers or operate as a bank, and that Libra is meant to be a complement to the existing financial system.

Trump had tweeted that “Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity. Similarly, Facebook Libra’s ‘virtual currency’ will have little standing or dependability. If Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National and International.”

For a primer on how Libra works, watch our explainer video below or read our deep dive into everything you need to know:

In a wide-reaching series of interviews this week, the Libra Association’s head of policy Dante Disparte, Facebook’s head economist for blockchain Christian Catalini and Facebook’s blockchain project subsidiary Calibra’s VP of product Kevin Weil answered questions about regulation of Libra. Here’s what we’ve learned (their answers were trimmed for clarity but not edited):

Calibra’s Kevin Weil: We believe that creating a financial ecosystem that has significantly broader access where all it takes is a phone and lower transaction fees across the board is good for people. And we want to bring it to as many people around the world as we can. But as a custodial wallet we are regulated and will be compliant and we will only operate in markets where we’re allowed.

We want that to be as many markets as possible. That’s why we announced well in advance of actually launching a product — because we’ve been engaging with regulators. We’re continuing to engage with regulators and we can help them understand the effort that we’re taking to make sure that people are safe and also the value that accrues to the people in their countries when there’s broader access to financial services with lower transaction fees across the board.

TechCrunch: But what if you’re banned in the U.S.?

Weil: I’m hesitant to give a blanket answer. But in general, we believe that Libra is positive for people and we want to launch as broadly as possible. The world where the U.S. does that I think would probably cause other regulatory regimes to also be concerned about it. I think that’s very much a bridge that we’ll cross when we get there. But so far we’re having frank, open and honest discussions with regulators. Obviously, that continues next week with David’s testimony. And I hope it doesn’t come to that, because I think that Libra can do a lot of good for a lot of people.

TechCrunch’s Analysis: The U.S. House subcommittee has already submitted a letter to Facebook requesting that it cease development of Libra and Calibra until regulators can better examine it and take action. It sounds like Facebook believes a U.S. ban on Libra/Calibra would cause a domino effect in other top markets, and therefore make it tough to rationalize still launching. That puts even more pressure on the outcome of July 16th and 17th’s congressional hearings on Libra with the head of Facebook’s head of Calibra, David Marcus.

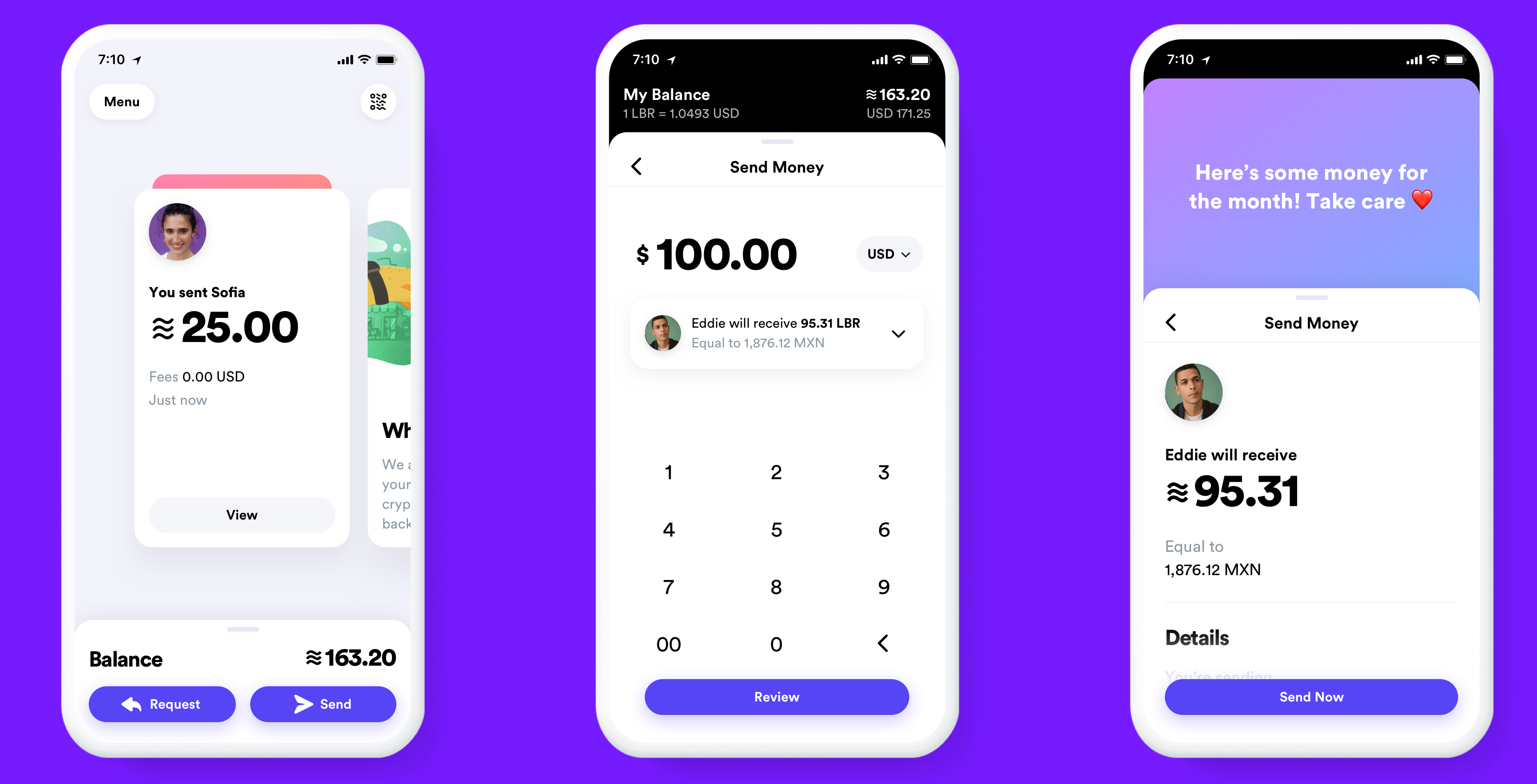

We already know that Facebook’s own Libra wallet called Calibra will be baked into Messenger and WhatsApp plus have its own standalone app. There, those with connected bank accounts and government ID that go through a Know Your Customer (KYC) anti-fraud/laundering check will be able to buy and sell Libra. But a big goal of Libra is to bring the unbanked into the modern financial system. How does that work?

Weil: Because Libra is an open ecosystem, any money exchange business or entrepreneur can begin supporting cash-in/cash-out without needing any permission from anyone associated with the Libra Association or member of the Libra Association. They can just do it. Today in a lot of emerging markets [there’s a service for matching you with someone to exchange cryptocurrency for cash or vice-versa called] LocalBitcoins.com and I think you’ll see that with Libra too.

Second, we can augment that by by working with local exchanges, convenience stores and other cash-in/cash-out providers to make it easy from within Calibra. You could imagine an experience in the Calibra app or within Messenger or WhatsApp, where if you want to cash in or cash out, you’ll pop up a map that highlights physical locations around that allow you to do it. You select one that’s nearby, you select an amount, and you get a QR code that you can take to them and complete the transaction.

I’d imagine that most of these businesses that we work with will support Libra more broadly, so even if we get these deals started it will benefit the whole ecosystem and every Libra wallet, not just Calibra.

TechCrunch: Have you struck relationships with any convenience store operators or money exchangers like Western Union or MoneyGram, or Walgreens, CVS or 7-Eleven? Are you in talks with them yet?

Weil: I probably shouldn’t comment on any specific deals but we’re in conversation with a lot of the folks you might think, because ultimately being able to move between Libra and your local currency is critical to driving adoption and utility in the early days . . . If you’re banked there are easier ways to do that. If you’re not banked and you’re in cash — those are the people we really want to serve with Libra — we’re working very hard to make that process easy for people.

TechCrunch’s analysis: This approach will let Calibra largely avoid the complicated and potentially error-prone process of KYCing people in person or handing out cash by offloading the responsibility and liability to other parties.

Weil: There are very important populations that don’t have an ID. People in a refugee camp may not, as an example, and we want Libra to serve them. So this is one example of many of why it’s important that Calibra isn’t the only option for people who want to participate in the Libra ecosystem . . . Others of these will be run by local providers and they have programs to meet customers face-to-face and other ways to serve people and even KYC them that we may not . . . We’re not going be the only wallet, we don’t want to be the only wallet.

This is one of the reasons NGOs have been members of the Libra association from the start, because we want to encourage the monetization of identity processes both through working with governments issuing credentials for more people and also making use of new types of information for identity and authentication. We hope this process will hep the last mile problem.

In the case of a non-custodial wallet, the user isn’t trusting anyone. The way the regulations have worked and this is evolving as we speak. The on-ramps and off-ramps to the crypto world are regulated and they have direct customer relationships and it’s their responsibility to KYC people. In our case we’ll be a custodial wallet and we’ll KYC people. There are a number of wallets in the Bitcoin or Ethereum ecosystem — non-custodial wallets that don’t have a direct relationships with the users. . . They have to get that Bitcoin somehow. Usually they’re going through an exchange where usually as part of the process they’re KYC’d.

In a lot of emerging markets you have LocalBitcoins.com where you can find a representative or agent who will meet you in person and exchange cash for bitcoin in whatever market you have to be in. And I believe that they just started making sure that they KYC everyone, but they’re doing it in person. And they have more flexibility in how they do it than you might otherwise. I think there are lots of ways that this will happen and the fact that Libra is an open ecosystem will enable people to be entrepreneurial about it.

There are lots an lots of people who are underserved by today’s financial ecosystem who have government ID. So even with requiring everyone go through a KYC process, we’ll be able to serve many, many people who are not well-served by today’s financial ecosystem. We want to find ways to support people who can’t KYC and the important part is that Calibra will fully interoperate with any other wallet, including ones that people in local markets are using because it’s a better fit for their needs.

TechCrunch: Through that interoperability, if someone with a non-custodial wallet receives Libra and then sends it a Calibra wallet user, does that mean you Libra coming into Calibra from users who weren’t KYC’d and could be laundering money?

Weil: So it’s part of the regulatory situation that’s evolving as we speak. There’s something called the Travel Rule . . . If there’s a transfer above a certain value you have to make sure that you understand both who the sender is, which you do if they’re using a custodial wallet, and who the receiver is. These are evolving regulations, but it’s something that obviously we’re going to make sure that we implement as regulations solidify.

TechCrunch’s Analysis: Calibra appears to be inviting regulation that it can strictly abide by rather than trying to guess at what the best approach is. But given it’s unclear when concrete rules will be established for transfers between non-custodial wallets and custodial wallets, or for in-person cashing, Facebook and Calibra may need to establish their own strong protocols. Otherwise they could be guilty of permitting the “unlawful behavior” Trump describes.

Dante Disparte of Libra: Taxing of digital assets is something that’s being designed at the local level and at the jurisdiction level. Our view of the world is that like with any form of money or any form of payment or banking, the onus in terms of compliance with tax is with the individual user and consumer, and the same would hold true broadly here.

We expect that the many, many wallets and financial services providers building solutions on the Libra blockchain would begin to provide tools that make it much easier than it is today [to calculate and file taxes] for digital assets and cryptocurrencies more generally . . . There’s plenty of time between now and Libra hitting the market to begin defining this more strictly at the jurisdictional level among providers.

TechCrunch’s Analysis: Again, here Facebook, Calibra and the Libra Association are hoping to avoid shouldering all the responsibility for taxes. Their position is that just as you have to take the initiative of paying your taxes whether or not you use a Visa card or your bank’s checks to transact, it’s on you to pay your Libra taxes.

TechCrunch: Do you think in the United States that it’s reasonable for the government to ask that Libra transactions be taxed?

Disparte: Tax treatments of digital assets broadly hasn’t been entirely clarified in most places around the world. And we hope that this is something that this project and the ecosystem around it helps to clarify.

Tax authorities will see a benefit from Libra at the consumption level and at the household level, while some cryptocurrencies have avoided taxes until the point they tried to cash out. But the nature of it and the lack of speculation and its design we think should give it a light tax treatment the way you would find with traditional currencies.

Christian Catalini of Facebook: Cryptocurrencies are taxed right now every time you have a sale on the differences in gains and losses. Because Libra is designed to be a medium of exchange, those gains and losses are likely to be very tiny relative to your local currency . . . Sales tax would likely be implemented the exact same way on Libra as it is today when you pay with a credit card.

At launch giving current regulations, the Calibra wallet will have to track every purchase and sale of Libra for a U.S. user and those differences will have to be reported on tax day. You can think of the losses, albeit they may be very small gains and losses relative to USD, as similar to the what people do today when they have a Coinbase account with Bitcoin.

The sales tax I think could be implemented in the exact same way as it today with any other sort of digital payment, it would be no different. If you’re buying goods or services with Libra you’ll be paying sales tax the same way as if you used a different form of payment. Like today when you see a percentage, that is the sales tax on your total.

Disparte: Maybe the best way to frame how taxes work all over the world is that it’s not up to Libra, Calibra, Facebook or any company to make that determination. It’s up to regulators and authorities.

TechCrunch: Does Calibra already have plans in place for how to handle sales tax?

Weil: That’s also a pretty rapidly evolving part of the regulatory ecosystem right now. It’s really an ongoing discussion. We will do whatever the regulation says we need to do.

TechCrunch’s Analysis: Here we have the firmest answers of our interviews. Facebook, Calibra and the Libra Association believe the proper approach to taxes is that Libra transactions carry a country’s traditional sales tax, and that Libra you hold in your wallet will have to pay taxes based on the Libra stablecoin’s value (that’s pegged to a basket of international currencies) relative to the U.S. dollar.

If the Libra Association recommends all wallets and transactions follow these rules and Calibra builds in protocols to handle these taxes simply, at least the government can’t argue Libra is a method of dodging taxes and everyone paying their fair share.

Powered by WPeMatico

There are successful companies that grow fast and garner tons of press. Then there’s Roblox, a company which took at least a decade to hit its stride and has, relative to its current level of success, barely gotten any recognition or attention.

Why has Roblox’s story gone mostly untold? One reason is that it emerged from a whole generation of gaming portals and platforms. Some, like King.com, got lucky or pivoted their business. Others by and large failed.

Once companies like Facebook, Apple and Google got to the gaming scene, it just looked like a bad idea to try to build your own platform — and thus not worth talking about. Added to that, founder and CEO Dave Baszucki seems uninterested in press.

But overall, the problem has been that Roblox just seemed like an insignificant story for many, many years. The company had millions of users, sure. So did any number of popular games. In its early days, Roblox even looked like Minecraft, a game that was released long after Roblox went live, but that grew much, much faster.

Yet here we are today: Roblox now claims that half of all American children aged 9-12 are on its platform. It has jumped to 90 million monthly unique users and is poised to go international, potentially multiplying that number. And it’s unique. Essentially all other distribution services offering games through a portal have eventually fizzled, aside from some distant cousins like Steam.

This is the story of how Roblox not only survived, but built a thriving platform.

(Photo by Steve Jennings/Getty Images for TechCrunch)

Before Roblox, there was Knowledge Revolution, a company that made teaching software. While designed to allow students to simulate physics experiments, perhaps predictably, they also treated it like a game.

“The fun seemed to be in building your own experiment,” says Baszucki. “When people were playing it and we went into schools and labs, they were all making car crashes and buildings fall down, making really funny stuff.” Provided with a sandbox, kids didn’t just make dry experiments about mass or velocity — they made games, or experiences they could show off to friends for a laugh.

Knowledge Revolution was founded in 1989, by Dave Baszucki and his brother Greg (who didn’t later co-found Roblox, but is now on its board). Nearly a decade later, it was acquired for $20 million by MSC Software, which made professional simulation tools. Dave continued there for another four years before leaving to become an angel investor.

Baszucki put money into Friendster, a company that pre-dated Facebook and MySpace in the social networking category. That investment seeded another piece of the idea for Roblox. Taken together, the legacy of Knowledge Revolution and Friendster were the two key components undergirding Roblox: a physics sandbox with strong creation tools, and a social graph.

Baszucki himself is a third piece of the puzzle. Part of an older set of entrepreneurs, which might be called the Steve Jobs generation, Baszucki’s archetype seems closer to Mr. Rogers than Jobs himself: unfailingly polite and enthusiastic, never claiming superior insight, and preferring to pass credit for his accomplishments on to others. In conversation, he shows interests both central and tangential to Roblox, like virtual environments, games, education, digital identity and the future of tech. Somewhere in this heady mix, the idea of Roblox came about.

Powered by WPeMatico

A marketplace dominated by Slack and Microsoft Teams, along with a host of other smaller workplace communication apps, might seem to leave little room for a new entrant, but Swit wants to prove that wrong. The app combines messaging with a roster of productivity tools, like task management, calendars and Gantt charts, to give teams “freedom from integrations.” Originally founded in Seoul and now based in the San Francisco Bay Area, Swit announced today that it has raised a $6 million seed round led by Korea Investment Partners, with participation from Hyundai Venture Investment Corporation and Mirae Asset Venture Investment.

Along with an investment from Kakao Ventures last year, this brings Swit’s total seed funding to about $7 million. Swit’s desktop and mobile apps were released in March and since then more than 450 companies have adopted it, with 40,000 individual registered users. The startup was launched last year by CEO Josh Lee and Max Lim, who previously co-founded auction.co.kr, a Korean e-commerce site acquired by eBay in 2001.

While Slack, which recently went public, has become so synonymous with the space that “Slack me” is now part of workplace parlance at many companies, Lee says Swit isn’t playing catch-up. Instead, he believes Swit benefits from “last mover advantage,” solving the shortfalls of other workplace messaging, collaboration and productivity apps by integrating many of their functions into one hub.

“We know the market is heavily saturated with great unicorns, but many companies need multiple collaboration apps and there is nothing that seamlessly combines them, so users don’t have to go back and forth between two platforms,” Lee tells TechCrunch. Many employees rely on Slack or Microsoft Teams to chat with one another, on top of several project management apps, like Asana, Jira, Monday and Confluence, and email to communicate with people at other companies (Lee points to a M.io report that found most businesses use at least two messaging apps and four to seven collaboration tools).

Lee says he used Slack for more than five years and during that time, his teammates added integrations from Asana, Monday, GSuite and Office365, but were unsatisfied with how they worked.

“All we could do with the integrations was receive mostly text-based notifications and there were also too many overlapping features,” he says. “We realized that working with multiple environments reduced team productivity and increased communication overhead.” In very large organizations, teams or departments sometimes use different messaging and collaboration apps, creating yet more friction.

Swit’s goal is to cover all those needs in one app. It comes with integrated Kanban task management, calendars and Gantt charts, and at the end of this year about 20 to 30 bots and apps will be available in its marketplace. Swit’s pricing tier currently has free and standard tiers, with a premium tier for enterprise customers planned for fall. The premium version will have full integration with Office365 and GSuite, allowing users to drag-and-drop emails into panels or convert them into trackable tasks.

While being a late-mover gives Swit certain advantages, it also means it must convince users to switch from their current apps, which is always a challenge when it comes to attracting enterprise clients. But Lee is optimistic. After seeing a demo, he says 91% of potential users registered on Swit, with more than 75% continuing to use it every day. Many of them used Asana or Monday before, but switched to Swit because they wanted to more easily communicate with teammates while planning tasks. Some are also gradually transitioning over from Slack to Swit for all their messaging (Swit recently released a Slack migration tool that enables teams to move over channels, workspaces and attachments. Migration tools for Asana, Trello and Jira are also planned).

In addition to “freedom from integrations,” Lee says Swit’s competitive advantages include being developed from the start for small businesses as well as large enterprises that still frequently rely on email to communicate across different departments or locations. Another differentiator is that all of Swit’s functions work on both desktop and mobile, which not all integrations in other collaboration apps can.

“That means if people integrate multiple apps into a desktop app or web browser, they might not be able to use them on mobile. So if they are looking for data, they have to search app by app, channel by channel, product by product, so data and information is scattered everywhere, hair on fire,” Lee says. “We provide one centralized command center for team collaboration without losing context and that is one of our biggest sources of customer satisfaction.”

Powered by WPeMatico

Nintendo’s latest mobile game is now available for iOS devices, a day before its official target launch date. The game is based on the Nintendo game created in 1990 for the NES and Game Boy, and re-released/re-made a bunch of times over the years for various Nintendo consoles.

Dr. Mario World, the iOS game available now, is, like its predecessors, a matching puzzle game in which you as Dr. Mario (or maybe you’re just a colleague of Dr. Mario? It’s somewhat unclear) cure “viruses” by matching pill colors to the little jerks. This version has a number of additional gameplay features compared to the first, which was pretty Tetris-like in play. It also focuses on drag-and-drop mechanics, instead of manipulating pills like Tetris blocks as they fall.

For instance, you have other doctors from the rich Mario fictional world to call upon for help, including Dr. Peach and Dr. Bowser, as well as assistants, including Goomba, Koopa Troopa and others who apparently never either attained or aspired to professional medical doctor status. These have different skills that can make virus busting easier, and Nintendo plans to update the game with fresh doctors and assistants regularly.

Multiplayer is also part of Dr. Mario World, and you can go head-to-head or work together. Predictably, if you’ve followed Nintendo’s foray into mobile titles, this one is free-to-play, with in-game purchases for unlocking more play time and unlacing additional characters and upgrades.

Powered by WPeMatico