Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Here’s what we know for sure: Apple’s holding a big event on its campus at 10AM PT on September 10.

Here’s what we almost certainly know for sure: The iPhone 11 will launch with a new camera configuration. There will be probably be three different models.

From there, things get a bit more complicated.

There’s some speculation around whether the company will continue to offer the budget-minded iPhone R as an alternative to the flagship devices. Some rumors thus far have suggested that this year’s models will present a kind of paradigm shift for the line. Rather than introducing an iPhone 11R, the cheaper model could become the base level iPhone 11, with two pricier models taking up the Pro moniker, with a Pro and Pro Max model distinguishing the different screen sizes.

The shift would make some sense from the standpoint of the broader smartphone market. Pricing is one of the key reasons smartphone adoption has slowed considerably. Premium devices like the iPhone and Samsung’s S series routinely top $1,000. If Apple can reposition the price point, that could go a ways toward justifying a faster upgrade cycle.

One of the key distinguishing factors between the iPhone 11 and the Pro models is likely to be the camera. The base model will retain the XS’s two-camera setup, while the Pros will move to a three-camera array in a square configuration. The third lens will bring an additional wide angle to the device, similar to a number of Android handsets.

Using on-board AI and software, the cameras are said to create a composite image that can correct certain shooting errors, offer higher-resolution shots and get better images in low light. The video software on the Pro models is said to be significantly improved, as well, letting users correct color balances and apply effects on-device. The front-facing camera, meanwhile, is said to have a wider field of view, which should help face unlock work from more angles, including while lying down on a table — one of the biggest complaints with the current Face ID configuration.

The device build is largely expected to stay the same, including the top notch, which has remained unchanged since the introduction of the iPhone X. Some have suggested that the invitation hints at additional colors for the handset, which would be in keeping with other entry-level devices, like the iPhone R. The Lightning port, for better and worse, is expected to remain, in spite of the addition of USB-C on the iPad Pro.

Jeff Williams, chief operating officer of Apple Inc., speaks during an event at the Steve Jobs Theater in Cupertino, California, U.S., on Wednesday, Sept. 12, 2018. Apple will kick off a blitz of new products this week, ending a year of minor updates and setting the technology giant up for a potentially strong holiday quarter. Photographer: David Paul Morris/Bloomberg via Getty Images

A couple of rumors have been floating around hinting at the arrival of a new Apple Watch. The Series 4 device is reportedly getting a new (likely very pricey) Titanium version. The line is also set to finally add some solid sleep tracking into the mix.

The event may well see some new MacBooks, the first to include new switch mechanisms for the keyboard. That will hopefully alleviate longstanding complaints against several generations of keyboard switches.

Expect some firm dates on the software and content front, as well, including availability for the public launch of MacOS Catalina, iPadOS and iOS 13. There’s a pretty good chance that the company will also firm up launch dates for long-awaited content plays like Apple TV+ and Arcade.

All (or some) of this and more (or less) will be revealed on Tuesday September 10. TechCrunch will, as always, be on hand, bringing it to you live.

Powered by WPeMatico

An eight-month-old startup in India that wants to improve the user experience of credit card holders in the nation has received the backing of at least two major investors.

Pune-based FPL Technologies said Thursday it has raised $4.5 million from Matrix Partners India, Sequoia Capital India and others in its maiden financing round.

In an interview with TechCrunch earlier this week, Anurag Sinha, co-founder and CEO of FPL Technologies, said the startup aims to build a full-stack solution to reimagine how people in India get their first credit card and engage with it.

Even as hundreds of millions of people in India today are securing loans from organized financial lenders, most of them are unable to get a credit card. Fewer than 25 million people in the country today have a credit card, according to industry estimates. And even those who have a credit card are not exactly pleased with the experience.

Vibhav, Anurag, Rupesh, co-founders of FPL Technologies, pose for a picture

Much of the blame goes to banks and other credit card issuing firms that are largely relying on archaic technology to operate their plastic card business.

Sinha, an industry veteran, said through his startup he aims to address a wide range of pain points of credit card holders, such as in-person meeting or telephonic interaction with bank representatives for getting a credit card, having to talk to someone to get basic support and not being able to mask the card’s identity when shopping online.

The startup, which employs about 20 people, aims to build the mobile credit card service in the next couple of months, but in the meantime, it is offering an app called OneScore to help users check their credit score and learn how to improve it. Sinha said OneScore, unlike most of its rivals, doesn’t sell the data of customers to third-party agencies.

The app was launched two months ago and has already amassed more than 100,000 users, Sinha said. These users would get the first dibs on the startup’s mobile credit card, he said.

In a statement, Shailesh Lakhani, managing director of Sequoia Capital India, said, “When they presented a plan to modernize credit cards in India it immediately resonated with the Sequoia India team. It’s a delight to partner with them as they work on developing more flexible, affordable and easier to use financial products for Indian consumers.”

In recent months, a handful of startups in India have started to explore ways to expand the reach of credit cards in the nation and incentivize users to become more responsible with how they engage with it. Bangalore-based SlicePay offers a payment card with a pre-approved credit line for students, gig-workers, freelancers and startup employees. CRED, a startup by industry veteran Kunal Shah, recently raised $120 million to motivate users to improve their financial behavior.

Powered by WPeMatico

Flipkart, the largest e-commerce platform in India, said Tuesday it has concluded the roll-out of a range of features to its shopping app in what is its biggest update in recent years.

Chief among these new features is access to Flipkart in Hindi language. Prior to the revamp of the app, Flipkart was available only in English, a language spoken by 10% of India’s 1.3 billion population.

Flipkart says it is hoping that the new features, which includes a video streaming service, would help it reach the next 200 million users in India.

The major bet on Hindi, a language spoken by more than 500 million people in India, illustrates a growing push from local and international companies operating in the country as they adapt their services and business models to go beyond the urban cities.

And that’s where much of the opportunity, which countless startups and companies have trumpeted to investors to successfully raise hundreds of millions of dollars in debt and venture capital in recent years, lies in the nation.

Powered by WPeMatico

While investors are already writing big checks for meditation startups, Elevate Labs founder and CEO Jesse Pickard said that none of the existing meditation apps can replace the experience of working with a human coach.

“This experience where you have somebody that meets with you is wildly better than any digital product that’s out there,” Pickard said. “The problem is, it’s not affordable to 99% of the planet.”

So Elevate Labs is launching a new mobile app today called Balance, which is designed to replicate the experience of working with a live meditation coach.

“Even with meditation increasingly getting into the mainstream, it’s a fairly difficult practice to adhere to,” Pickard said. “We take away a lot of that indecision and present you with a path that is unique to you … People live all sorts of different lives: Some people care about stress, some people care about sleep, some people care about focus. But when you and I go into any of the other major apps, we’re getting the exact same recording.”

With Balance, on the other hand, you’re not just browsing through a library of prerecorded content. Instead, the app starts out by asking you about your goals, your meditation experience and more. You’ll then get a set of introductory meditations that may look familiar, but Pickard said that each meditation is actually “a combination of dozens and dozens of clips woven together that’s personalized to you.”

For example, I told the app that I already had experience with meditation, and that my top goal was to stay focused. As a result, my first meditation skipped most of the introductory explanations, and the main exercise was designed to help me focus on the sound of my breath.

Pickard said the app will continue to ask you questions about your experience over time, which in turn will lead to more personalization. The meditations are narrated by coach Leah Santa Cruz, who’s also involved in writing the content, and there are other meditation experts on the Balance team.

The app’s initial 10-day course is free. After that, to get access to additional meditations, you’ll need to pay $11.99 per month, $49.99 per year or $199.99 for a lifetime subscription. In addition to the meditations, Balance also includes a guided activity designed to help people sleep.

On top of launching a new app, Elevate Labs is also announcing that it has raised a $7.1 million Series B led by Keesing Media Group, with participation from Oakhouse Partners.

Under its old name MindSnacks, the company built language-learning games before shifting focus to Elevate, a “brain training” app that has supposedly been downloaded 25 million times and won Apple’s App of the Year Award in 2014. Pickard (who, thanks to the magic of Craigslist, was my roommate for about a year when I was first starting at TechCrunch) said that unlike most of the other apps that are marketed as improving your mind, Elevate focuses on trainable skills like reading, writing and math — rather than, say, improving your memory.

“We’ve been extremely careful about [not] venturing into untrainable skills — things like improving your attention span, those activities are not as provenly teachable,” he said.

It’s been a while since the company has raised outside funding — seven years since MindSnacks announced a Series A from Sequoia. Pickard said the company actually raised another bridge round in 2015, then “buckled down for a number of years and really just had to build a business that actually was sustainable.”

Apparently that’s paid off — he said Elevate Labs was cash-flow positive last year. With a total of $17.1 million in funding, the plan now is to continue supporting and growing Elevate while also launching Balance and building a whole line of related apps.

“We think there’s a really huge brand to be built around mental fitness,” Pickard said.

Powered by WPeMatico

Depop started as a simple app to post photos of clothes and offer them for sale. But it has become a cultural phenomenon with millions of users, a vibrant community and even some superusers making a living from the platform. That’s why I’m excited to announce that Depop CEO Maria Raga is joining us at TechCrunch Disrupt Berlin.

Many have tried to merge a social app with a shopping experience, but few have succeeded. Depop is one of them. If you’re an Instagram user, the app looks familiar with its outline icons. But instead of following brands and sometimes buying new items, Depop is all about vintage items, rare sneakers and things you simply can’t find on a regular social network.

Depop users can follow other users, discover items from their favorite brand, get personalized recommendations and, of course, buy and sell items. It’s a social experience that works particularly well on mobile and makes shopping more personal.

Selling something on Depop is as easy as posting photos on a social app. You enter a description, a location, a brand and a price and you’re good to go. After that, other users can buy stuff directly from the app. You can then ship your items and get your money on your PayPal account.

And it’s been a massive success. There are currently more than 13 million users — the vast majority of them are under the age of 26. The company has handled more than $500 million of gross merchandise value since its launch.

Interestingly, some superusers thrived on the platform. Those users are talented when it comes to spotting and acquiring limited-edition clothes, sneaker drops and other valuable items. They sell them on Depop, with some of them generating as much as $100,000 of revenue per year.

Under Maria Raga, Depop has raised more than $100 million. Earlier this summer, the company announced a $62 million funding round led by General Atlantic. It’s clear that Depop is now thriving as both a social app and a marketplace. And I can’t wait to hear how Maria Raga did it.

Buy your ticket to Disrupt Berlin to listen to this discussion — and many others. The conference will take place December 11-12.

In addition to panels and fireside chats, like this one, new startups will participate in the Startup Battlefield to compete for the highly coveted Battlefield Cup.

Maria Raga is the CEO of Depop. Since being promoted to the position in 2016 from VP of Operations, she has presided over every element of the business from finance and engineering to marketing and product. An open and collaborative CEO, Maria is dedicated to her team, which has grown to 150+ employees in 5 offices worldwide in the last three years alone. Perhaps most importantly, since she took over as CEO, she has raised close to $100M in funding, which has helped to grow and nurture the community on Depop – now 13 million users.

Prior to Depop, Maria held successively roles at Groupon and Privalia. Having graduated from Insead MBA, Maria joined Bain & Company as a consultant.

Born in Valencia, Spain, Maria now resides in London with her husband and 2 children. In her spare time, Maria enjoys connecting with Depop’s entrepreneurial Gen-Z constituency and promoting women in the workplace

Powered by WPeMatico

Zhihu may not be as well known outside of China as WeChat or ByteDance’s Douyin, but over the past eight years, it has cultivated a reputation for being one of the country’s most trustworthy social media platforms. Originally launched as a question-and-answer site similar to Quora, Zhihu has grown to be a central hub for professional knowledge, allowing users to interact with experts and companies in a wide range of industries.

Headquartered in Beijing, Zhihu recently raised a $434 million Series F, its biggest round since 2011. The funding also brought Zhihu two important new partners: video and live-streaming app Beijing Kuaishou, which led the round, and Baidu, owner of China’s largest search engine (other participants in the round included Tencent and CapitalToday).

Launched in 2011, Zhihu (the name means “do you know”) is most frequently compared to Quora and Yahoo Answers. While it resembled those Q&A platforms at first, it has grown in scope. Now it would be more accurate to say that the platform is like a combination of Quora, LinkedIn and Medium’s subscription program.

For example, Zhihu has an invitation-only blogging platform for verified experts and since launching official accounts, it has become a channel for companies and organizations to communicate with users. A representative for Zhihu told TechCrunch that the platform had 220 million users and 30,000 official accounts as of January 2019 (for context, there are currently about 800 million Internet users in China), who have posted a total of 130 million answers so far.

The company’s growth will be closely watched since Zhihu is reportedly preparing for an initial public offering. Last November, the company hired its first chief financial officer, Sun Wei, heightening speculation. A representative for the company told TechCrunch the position was created because of Zhihu’s business development needs and that there is currently no timeline for a public listing.

At the same time, the company has also dealt with reports that its growth has slowed.

Powered by WPeMatico

Indian mobile payments firm MobiKwik has reached a milestone very few of its local rivals can even contemplate: not burning money. The 10-year-old Gurgaon-headquartered firm said Tuesday it is now generating a profit excluding interest, taxes, depreciation and amortization.

“We have been in an ecosystem where we have seen a lot of high-growth and several regulatory changes in the payments domain. But what we realized was that payments alone is likely not going to be a very profitable business,” Bipin Singh, co-founder and CEO of MobiKwik, told TechCrunch in an interview.

To get to the path of profitability, MobiKwik has made a number of significant changes to its business in recent years. It stopped participating in the race to aggressively acquire users and fighting with heavily backed firms such as Paytm, which has raised more than $2 billion to date.

Paytm remains unprofitable and an analysis of its financial performance shows that this is not going to change anytime soon. Google, which also offers a payments service in India, has no shortage of cash, either. MobiKwik has raised about $118 million to date from Sequoia Capital, American Express and Cisco Investments, among others.

Upasana Taku, co-founder and COO of MobiKwik, said the company has taken inspiration from Kotak and ICICI banks, both of which have about 15 million to 20 million customers — a fraction of many digital payment apps — but are profitable. MobiKwik, which employs 400 people, has 110 million users, she said.

In the last two and a half years, MobiKwik has cut down on cashbacks it bandies out to users — a practice followed by every company offering a payments solution in India — and focused on building financial services on top of its wallet app to retain customers and find additional sources of revenue.

The company continues to focus on its mobile wallet and payments processing businesses that account for about 75% of its revenue, but its growing suite of financial services, such as providing credits and insurance to customers, is already bringing the rest of the revenue, she said.

That’s not surprising, as India remains alarmingly under served. Fewer than 50 million credit cards are in circulation in the nation currently, and for people with limited income, getting a loan of any size remains a major challenge.

“Even the population that has access to smartphones and cheap internet data can’t get a credit card in India. We found it a good match for the growth of our payments app. We started serving these users who have the discipline to repay money and have certain kind of income,” the couple said, who are now also donning the role of angel investors.

MobiKwik works with banks and other lenders to finance loans between Rs 5,000 ($69) to Rs 100,000 ($1,380). In the 18 months since it started offering this, MobiKwik has provided 800,000 loans and disbursed $100 million.

In late 2018, the company launched “sachet-sized” insurance plans to provide protection from cyber fraud, fire, accident and hospitalization. These sachets start at as little as Rs 20 (28 cents) and thousands of users buy these everyday. Similarly, it also allows users to buy mutual funds for as little as $1.30.

MobiKwik expects its revenue to hit $69 million in the financial year that ends in March next year, up from $28 million a year earlier. The company, which expects to turn fully profitable by fiscal year 2021, plans to go public in four to five years, Taku said.

MobiKwik competes with a number of players, many of which are increasingly adding financial services, such as loans, to their platforms. Since these digital platforms are able to process loans without the need of salespeople and support staff, it becomes feasible for banks to chase customers with weak financial power.

India’s overall retail credit demand is expected to grow 60% to $771 billion over the next four years, according to the Digital Lenders Association of India.

Powered by WPeMatico

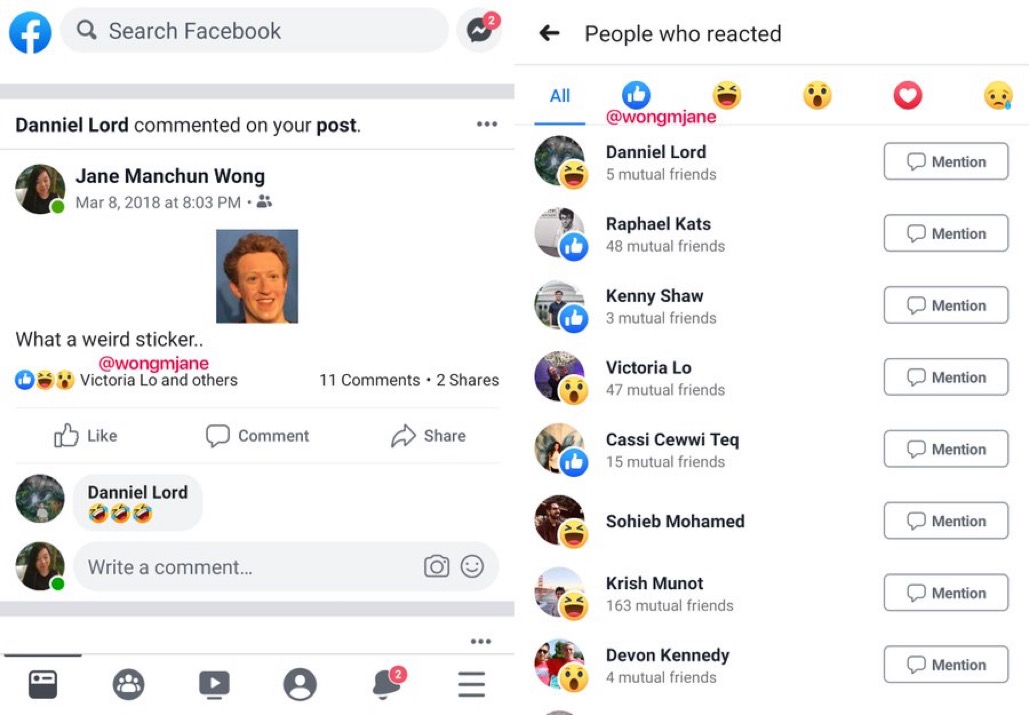

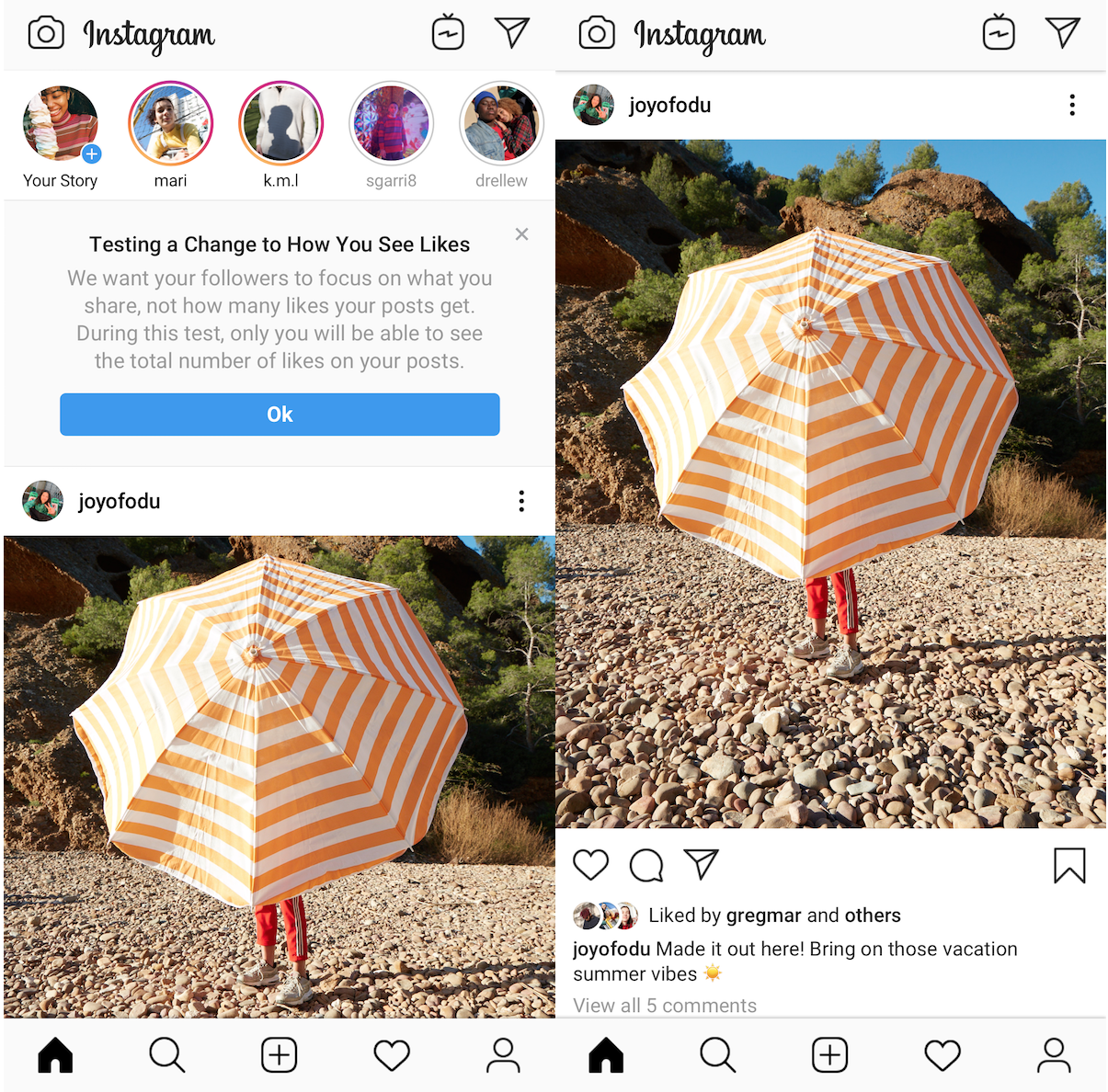

Facebook could soon start hiding the Like counter on News Feed posts to protect users’ from envy and dissuade them from self-censorship. Instagram is already testing this in 7 countries including Canada and Brazil, showing a post’s audience just a few names of mutual friends who’ve Liked it instead of the total number. The idea is to prevent users from destructively comparing themselves to others and possibly feeling inadequate if their posts don’t get as many Likes. It could also stop users from deleting posts they think aren’t getting enough Likes or not sharing in the first place.

Facebook prototypes hiding like counts [via Jane Manchun Wong]

Reverse engineering master Jane Manchun Wong spotted Facebook prototyping the hidden Like counts in its Android app. When we asked Facebook, the company confirmed to TechCrunch that it’s considering testing removal of Like counts. However it’s not live for users yet. Facebook declined to share results from the Instagram Like hiding tests, its exact motives, or any schedule for starting testing. If it does decide to go ahead with a test, Facebook would likely do so gradually and pull back if it significantly hurts usage or ad revenue.

Still, the prototype might indicate positive results from hiding Like tallies in Instagram, which we first reported in April after it was spotted by Wong there as well. After beginning testing in Canada later that month. Instagram added Brazil, Australia, New Zealand, Italy, Ireland, and Japan to the test in July. There, a post’s author can still see the Like total, but everyone else can’t. The expansion of that Instagram test and Facebook potentially trying it in its own app signals that it might have positive or negligible impacts on sharing while aiding mental health, or at least be worth a slight drop in engagement.

Instagram is already testing hiding Like counts and Facebook may soon do the same.

Facebook has gradually been relegated to the place for sharing showy life events like marriages or new jobs while Instagram and Snapchat take over for day-to-day sharing. The problem is that people have so many fewer of those big moments, and the large Like counts they attract can make other users self-conscious of their of own lives and content. That’s all problematic for Facebook’s ad views. Facebook wants to avoid scenarios such as “Look how many Likes they get. My life is lame in comparison” or “why even share if it’s not going to get as many Likes as her post and people will think I’m unpopular”.

Removing Like counts could put less pressure on users and encourage them to share more freely and frequently, as I wrote in 2017. It could also obscure Facebook’s own potential decline in popularity as users switch to other apps. Posts not getting as many Likes as they used to could hasten the exodus.

Come see my interview with Snapchat CEO Evan Spiegel at TechCrunch Disrupt SF (Oct 2nd-4th — tickets here) to learn more about how social networks are adapting to growing mental health concerns.

Powered by WPeMatico

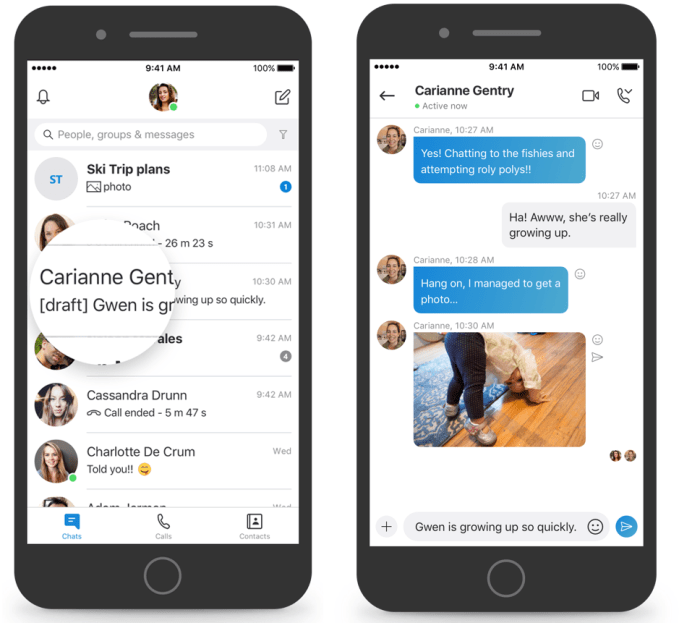

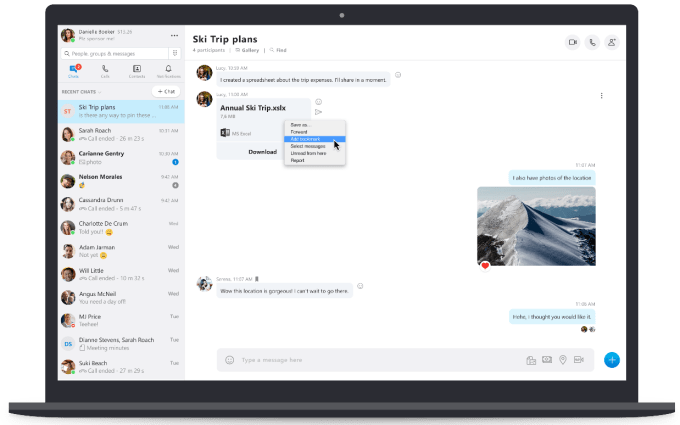

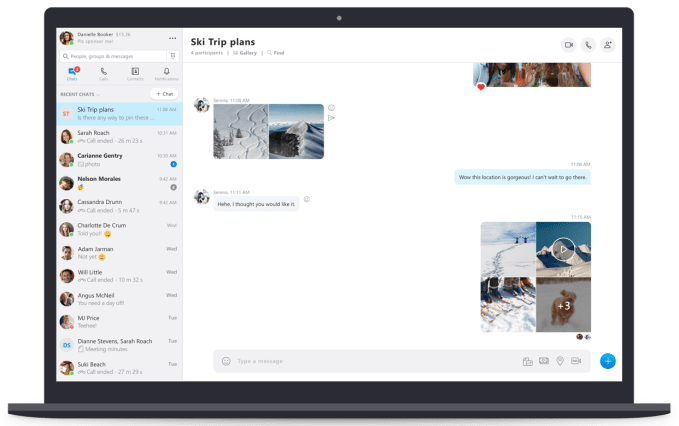

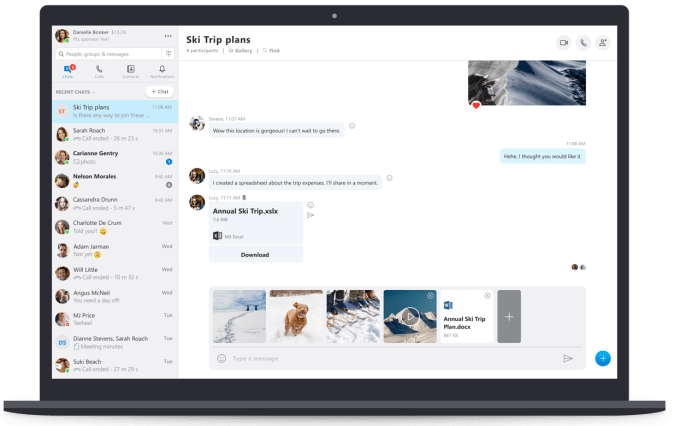

Skype is best known for being a video calling app and, to some extent, that’s because its messaging feature set has been a bit underdeveloped. Today, the company is working to change that image with a series of improvements to Skype’s chatting features aimed at further differentiating it from rival apps.

One of the most useful of the new features is support for Message Drafts.

Similar to email, any message you type up in Skype but don’t yet send is saved within the conversation with a “draft” tag attached. That way you can return to the message to finish it and send it later.

It’s a feature that would be great to see other messaging clients adopt, as well, given how much of modern business and personal communication takes place outside of email.

People have wanted the ability to draft and schedule iMessage texts for years — so much so that clever developers invented app-based workarounds to meet consumers’ needs. Some people even type up their texts in Notepad, waiting for the right time to send them.

In another email-inspired addition, Skype is also introducing the ability to bookmark important messages. To access this option, you just have to long-press a message (on mobile) or right-click (on desktop), then tap or click “Add Bookmark.” This will add the message to your Bookmarks screen for easy retrieval.

You’ll also now be able to preview photos, videos and files before you send them through messages — a worthwhile improvement, but one that’s more about playing catch-up to other communication apps than being particularly innovative.

And if you’re sharing a bunch of photos or videos all at once, Skype will now organize them neatly. Instead of overwhelming recipients with a large set of photos, the photos are grouped in a way that’s more common to what you’d see on social media. That is, only a few are displayed while the rest hide behind a “+” button you have to click in order to see more.

Unrelated to the messaging improvements, Skype also rolled out split window support for all versions of Windows, Mac and Linux. (Windows 10 support was already available.)

As one of the older messaging apps still in use, Skype is no longer the largest or most popular, claiming only 300 million monthly active users compared to WhatsApp’s 1.5 billion, for example.

However, it’s good to see its team getting back to solving real consumer pain points rather than trying to clone Snapchat as it mistakenly tried to do not too long ago. (Thankfully, those changes were rolled back.) What Skype’s remaining users appreciate is the app’s ease-of-use and its productivity focus, and these changes are focused on that direction.

Outside of the expanded access to split view, noted above, all the other new features are rolling out across all Skype platforms, the company says.

Powered by WPeMatico

Spotify this morning announced a new way for you to share music with friends (or fans, if you’re an artist) — by way of a new Facebook Stories integration that includes 15-second song previews. Viewers can also optionally tap on the “Play on Spotify” button in the Story to be redirected to the Spotify app to hear more.

The feature is designed largely with artists and their teams in mind, as it gives them another way to promote their new music across Facebook’s social network. Musicians and their managers often today use the Spotify app’s sharing feature to post their content across social media, including to Instagram, Twitter, WhatsApp, and elsewhere.

Last year, Spotify introduced a way to share music to Instagram Stories, including their albums, tracks, and playlists, as part of Facebook’s announcement that it was opening up sharing to Facebook and Instagram Stories from other, third-party apps.

At the time, the company said an integration with Facebook Stories was coming soon.

Since its launch on Instagram, the sharing feature has been mutually beneficial for both Spotify and Instagram alike, as it made users’ Stories more engaging while also sending traffic back to the Spotify app for further music discovery.

Add some music to your story

Audio sharing to Facebook Stories is now available. pic.twitter.com/HSBgmxYd8G— Spotify (@Spotify) August 30, 2019

There’s likely not as much demand for sharing to Facebook Stories, however.

In order to share the 15-second clips to Facebook Stories, you’ll tap the “Share” button from the Spotify app and choose Facebook as the destination.

Side note: We’re not seeing the option to share to News Feed as the picture Spotify published shows (see above. Instead, tapping “Facebook” launches you right into the Story interface, as shown in the tweet above.

You can then customize your Story as you would normally using the Story editing tools and post it to your profile. Viewers will get to hear the 15-second song clip, and can then tap to go to Spotify to hear more.

Spotify had offered Facebook Story sharing in the past, but the access was later pulled.

Hi there! We’re afraid the “Share to Facebook Stories” feature is no longer supported on Spotify. Give us a shout if you have other questions /MT

— SpotifyCares (@SpotifyCares) January 30, 2019

These song previews only work when you’re sharing a single track to Stories. If you choose to share other content, like albums, playlists, or an artist profile page, viewers can click into that content, but won’t hear any preview, Spotify says.

Powered by WPeMatico