Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Uber will acquire Cornershop, a grocery delivery startup that began life serving the Latin American market and recently shifted to offer service in Toronto, its first North American city. Uber announced on Friday that it expects its acquisition of a majority ownership stake in Cornershop in early 2020, once it receives all the necessary regulatory sign-offs.

Cornershop was founded in 2015 by Oskar Hjertonsson, Daniel Undurraga and Juan Pablo Cuevas; it’s headquartered in Chile. The company will continue to operate under that leadership in its current form for now, Uber says, and will report to a board that counts Uber leadership in the majority of its overall makeup.

Over the course of four rounds of funding, Cornershop raised $31.7 million from investors including Accel, Jackson Square Ventures and others. The on-demand grocery company was supposed to be acquired by Walmart in a deal valued at $225 million announced in September, but that deal ultimately fell apart in June when Mexican anti-trust regulators blocked it from going through.

Meanwhile, Walmart has continued to work with Cornershop, expanding its service offerings in Toronto with the startup as recently as yesterday. Uber has previously experimented with grocery delivery, including in partnership with Walmart, and Uber CEO Dara Khosrowshahi has said that grocery delivery is a natural place for the company to expand its business, given the success of Uber Eats. It’ll face competition from entrenched players, including Instacart and Postmates, but Uber Eats also faced competition from much more established players at its genesis, too.

The deal is still subject to regulatory approval, as mentioned, and that’s exactly where the planned Walmart acquisition stumbled, so it’s worth keeping a close eye on this one. Still, Uber’s not making any secret of its intentions with the grocery category, so that looks likely to take shape one way or another.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

Less than a day after Apple was criticized by Chinese state media for allowing HKmap in the App Store, the crowdsourced map app said it had been delisted.

This is Apple’s second reversal on the issue, which it explained with a statement claiming it learned that the app “has been used in ways that endanger law enforcement and residents in Hong Kong.”

2. Grammarly raises $90M at over $1B+ valuation for its AI-based grammar and writing tools

Grammarly provides a toolkit used today by 20 million people to correct their written grammar, suggest better ways to write things and moderate their tone depending on who will be doing the reading.

3. Okta wants to make every user a security ally

Okta is giving end users information about suspicious activity involving their login, while letting them share information with the company’s security apparatus.

4. Waymo to customers: ‘Completely driverless Waymo cars are on the way’

Waymo’s existing programs all use a human safety driver behind the wheel. Now the Alphabet-owned company is getting ready for completely driverless rides.

5. Calm and Room made a $4,000 branded ‘meditation booth’

From the looks of it, the Calm Booth by Room is little more than a standard Room booth, with frosted glass, softer lighting and “a soothing misty forest interior.” But it’s a pretty smart partnership between two white-hot startups.

6. Creators of modern rechargeable batteries share Nobel prize

The prize this year honors M. Stanley Whittingham, John Goodenough and Akira Yoshino, all of whom contributed to the development of what is today the most common form of portable power.

7. Silicon Valley’s competing philosophies on tech ethics with The New Yorker’s Andrew Marantz

Marantz has in recent years trained his attention on the tech world and its contribution to social unrest in the United States and beyond. And he has just published a new book, “Antisocial: Online Extremists, Techno-Utopians, and the Hijacking of the American Conversation.” (Extra Crunch membership required.)

Powered by WPeMatico

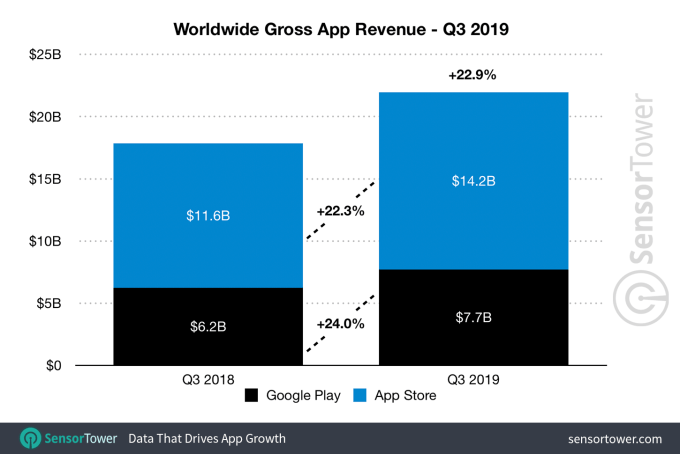

Global app revenue continues to climb, thanks to the growth in mobile gaming and the subscription economy. In the third quarter of 2019, consumer revenue grew 22.9% year-over-year from $17.9 billion to reach an estimated $21.9 billion across both the App Store and Google Play worldwide, according to new data from Sensor Tower.

Notably, the App Store continues to account for the large majority of this revenue, the report found, making up 65% of total spending compared with just 35% on Google Play.

App Store users spent $14.2 billion, up 22.3% from the $11.6 billion they spent in Q3 2018. Google Play generated $7.7 billion in revenue, up 24% from the $6.2 billion spent in the year-ago quarter.

Sensor Tower’s revenue estimates are a bit lower than those provided by App Annie’s recent report, which said the quarter saw $23 billion in consumer spending, not ~$22 billion.

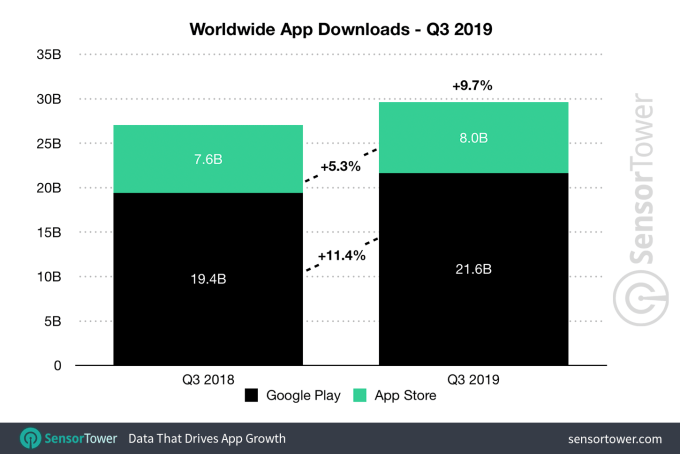

App Annie also estimated nearly 31 billion downloads in Q3, while Sensor Tower claimed 29.6 billion.

In both cases, Google Play is still said to be the main source for downloads, with nearly three times more first-time installs than the App Store. In Q3, the total number of downloads was up 9.7% year-over-year to 29.6 billion, said Sensor Tower, with Google Play accounting for 21.6 billion of those.

Despite the overall growth, one big app market — China — saw a slight decline, Sensor Tower found. Its installs dropped 6% year-over-year to 2.2 billion in the quarter. But its revenue grew by 26.9% to $4.1 billion, up from $3.2 billion the year prior. This could be attributed to the nine-month game license freeze in China which, though now lifted, had slowed momentum.

Sensor Tower’s charts don’t include third-party app stores, so it’s not a full picture of the Chinese app market, it’s worth noting.

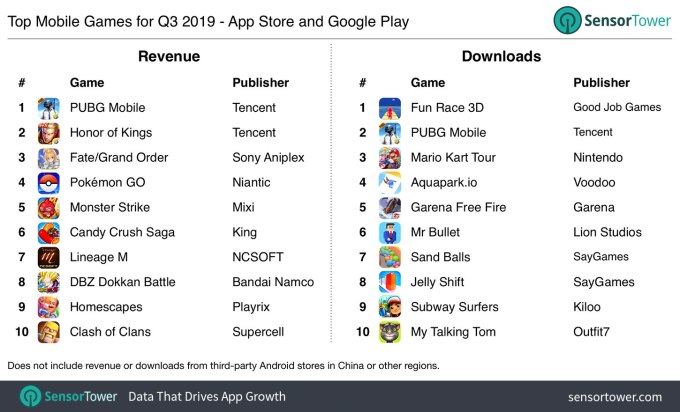

The top money-making (non-game) app in the quarter was again Tinder, which generated $233 million in consumer spending, up 7% over the prior quarter. Netflix was No. 2 and YouTube clocked in at No. 3, at $164 million in Q3.

App Annie has a slightly different ranking. It has Tinder and Netflix leading the top-grossing charts, but puts IQIYI ahead of YouTube. This could be because App Annie has a bigger window into the Chinese app market.

In terms of downloads, TikTok is continuing to disrupt Facebook-owned apps’ dominance over the top of the charts. In Sensor Tower’s rankings, WhatsApp was No. 1 and Messenger was No. 3, but Facebook and Instagram dropped to No. 4 and No. 5, respectively. And TikTok reached No. 2.

This isn’t the first time TikTok has passed Facebook, Sensor Tower said — it did so back in Q4 2018 and in Q1 2019, before dropping to No. 4 again last quarter. But with 177 million downloads in Q3, it’s inching its way up to the top.

App Annie, on the other hand, sees TikTok having just a bit more of climb, sticking it at No. 3 in the quarter, behind Messenger and Facebook. It also called out some Q3 break-out hits, like the return of FaceApp’s popularity (No. 9 in downloads) and the growing subscription revenue of Google One (No. 7 in non-game revenue). Sensor Tower put FaceApp at No. 6 instead, but agreed on Google One.

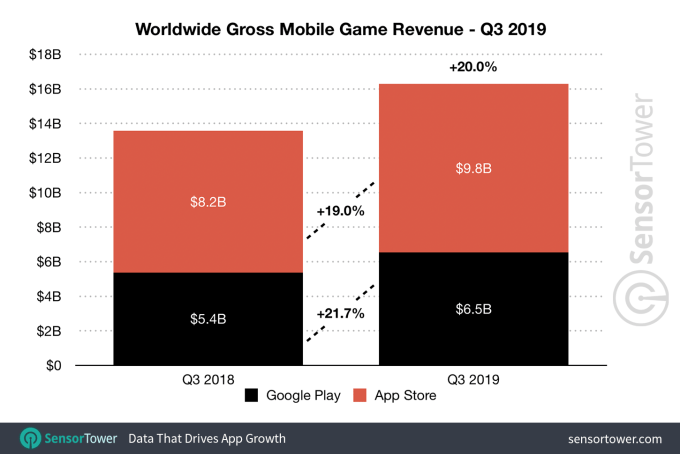

Mobile gaming continues to generate most of the cash, and did so again in Q3 with $16.3 billion in mobile game gross revenue — or 74% of the total in-app spending, the new report said. The App Store accounted for $9.8 billion of that figure, with Google Play users spending $6.5 billion.

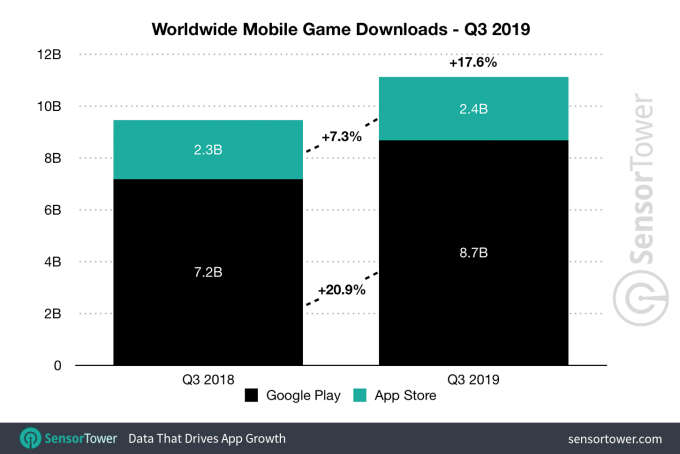

Game downloads across both Google Play and the App Store increased by 17.6% in Q3 from 9.5 billion last year to 11.1 billion.

The top three games in the quarter by downloads were Fun Race 3D (123 million downloads), PUBG Mobile (94 million) and newcomer Mario Kart Tour, which hit 86 million downloads despite only launching in late September.

PUBG Mobile was the top-grossing game with $496 million in revenue, up 652% over last year. The No. 2 title, Tencent’s Honor of Kings, and No. 3 Aniplex’s Fate/Grand Order generated $377 million and $354 million, respectively.

Image credits: Sensor Tower

Correction: App Annie estimated nearly 31 billion downloads in Q3, not 23 billion as first written. We corrected this. Apologies for the error.

Powered by WPeMatico

Instagram has finally turned Throwback Thursday into an official feature. It’s part of the new Instagram “Create” mode that launches today in Stories, bringing the app beyond the camera. Create makes Instagram a more omni-purpose social network with the flexibility to adapt to a broader range of content formats.

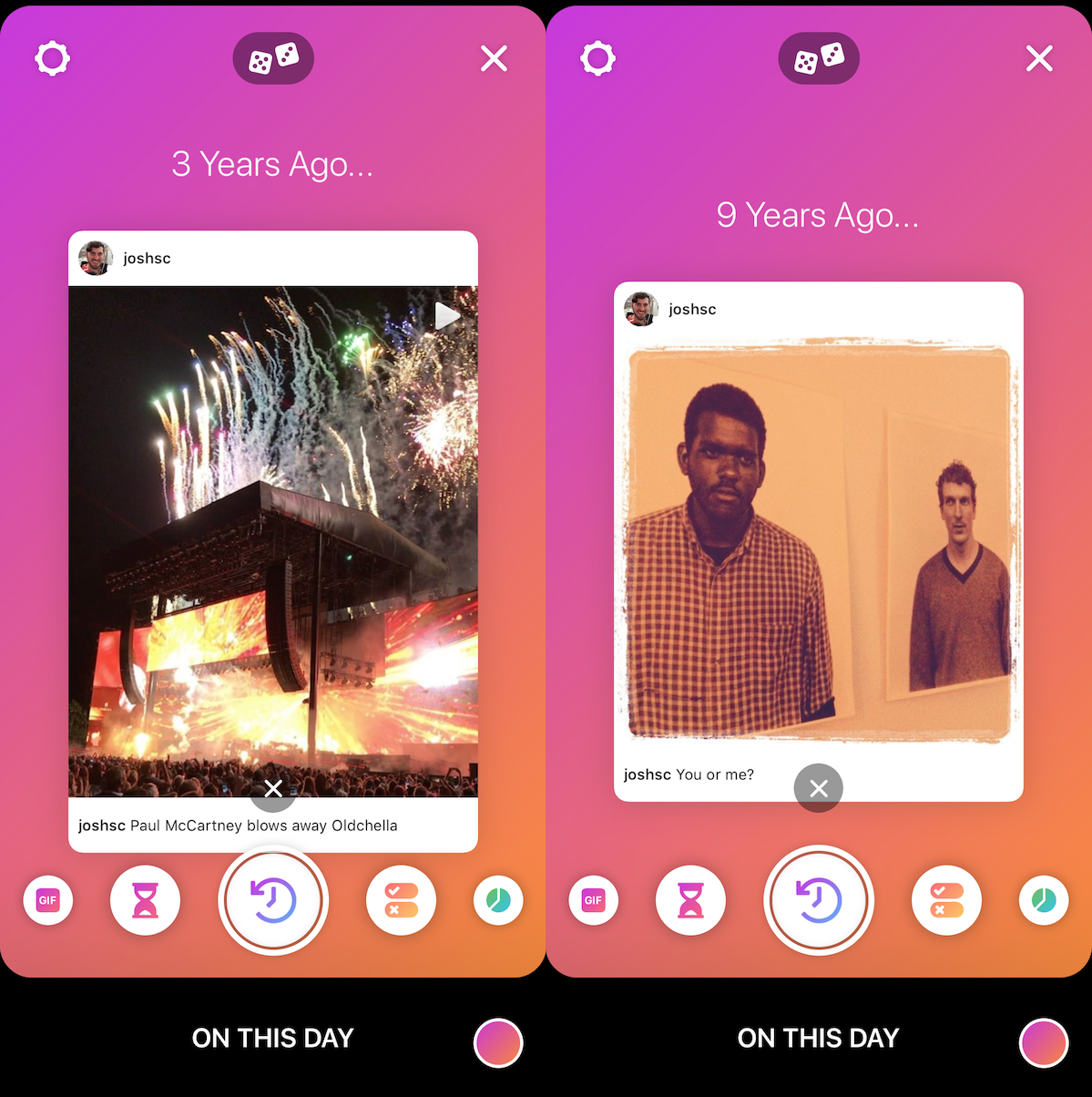

For now, the highlight of Create is the “On This Day” option that shows a random feed post you shared on the same calendar date in the past. Tap the dice button to view a different On This Day post, and once you find one you prefer, you can share it to Stories as an embedded post people can open.

The launch could make it easy for users to convert their old impermanent content into fresh ephemeral content. That could be especially helpful because not everyone does something Stories-worthy every day. And given how many #TBT throwbacks get shared already, there’s clearly demand for sharing nostalgia with new commentary.

When asked about Create mode, an Instagram spokesperson told me, “this new mode helps you combine interactive stickers, drawings and text without needing a photo or video to share . . . On This Day suggests memories and lets you share them via Direct and Stories.” It’d sure be nice if embedded On This Day video posts played inside of Stories, but for now you have to tap to open them on their own page.

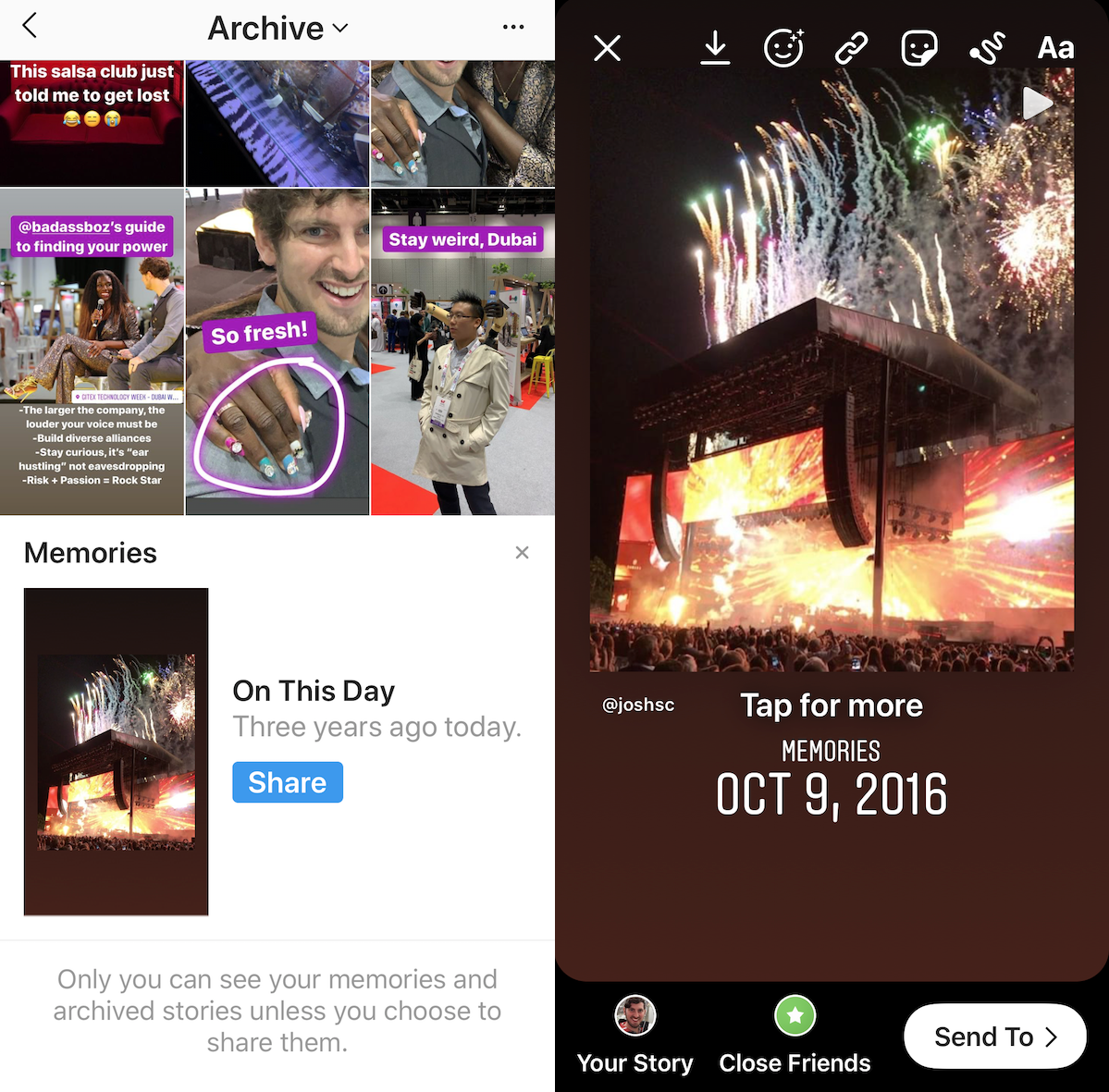

Instagram actually launched a different way to share throwbacks, called “Memories,” early this year. But most users didn’t know about it because it was tucked in the Profile -> Three-Line ‘Hamburger’ Sidebar -> Archive option used to for Highlighting or Restoring expired Stories or post you’d hidden.

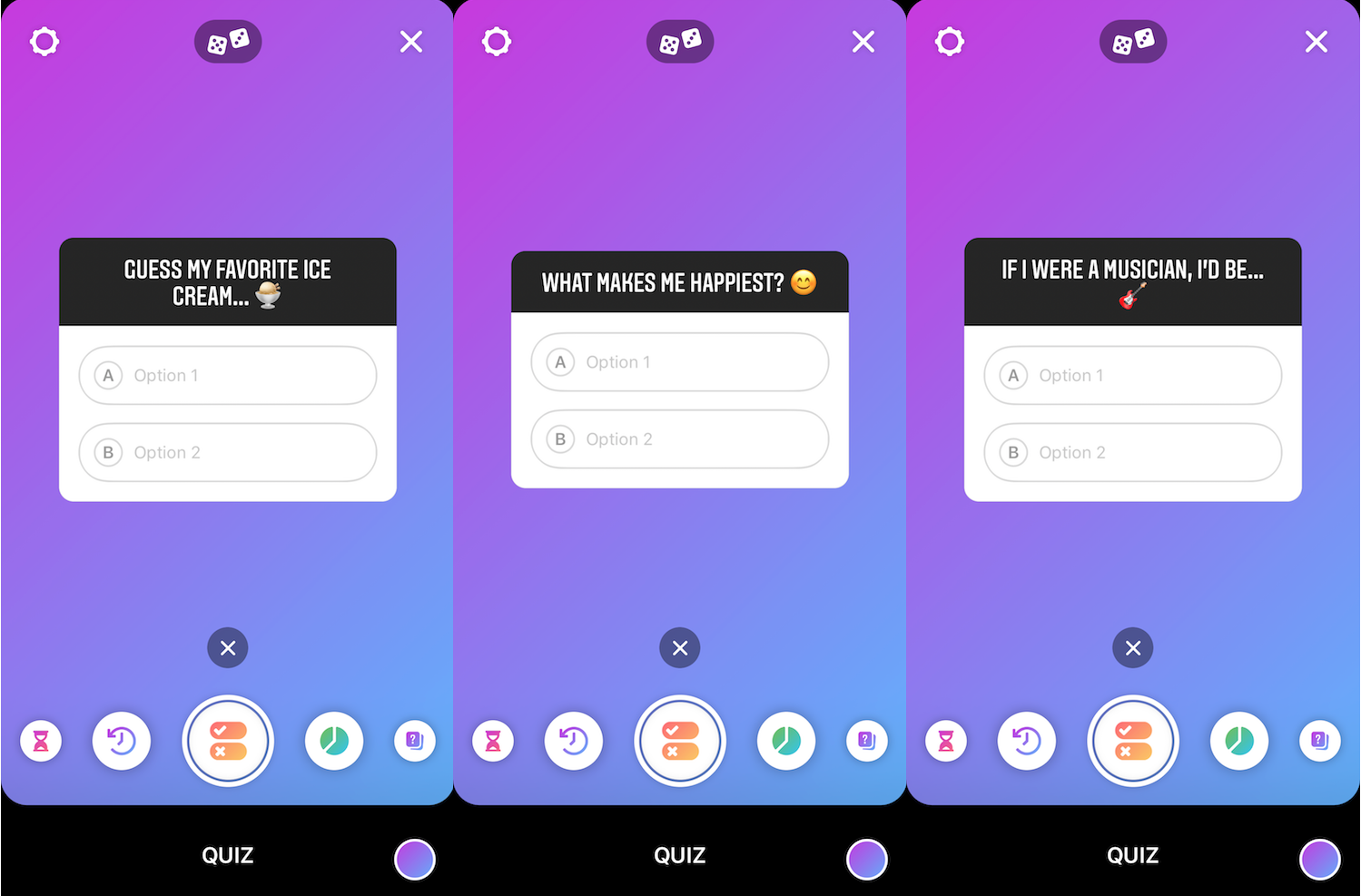

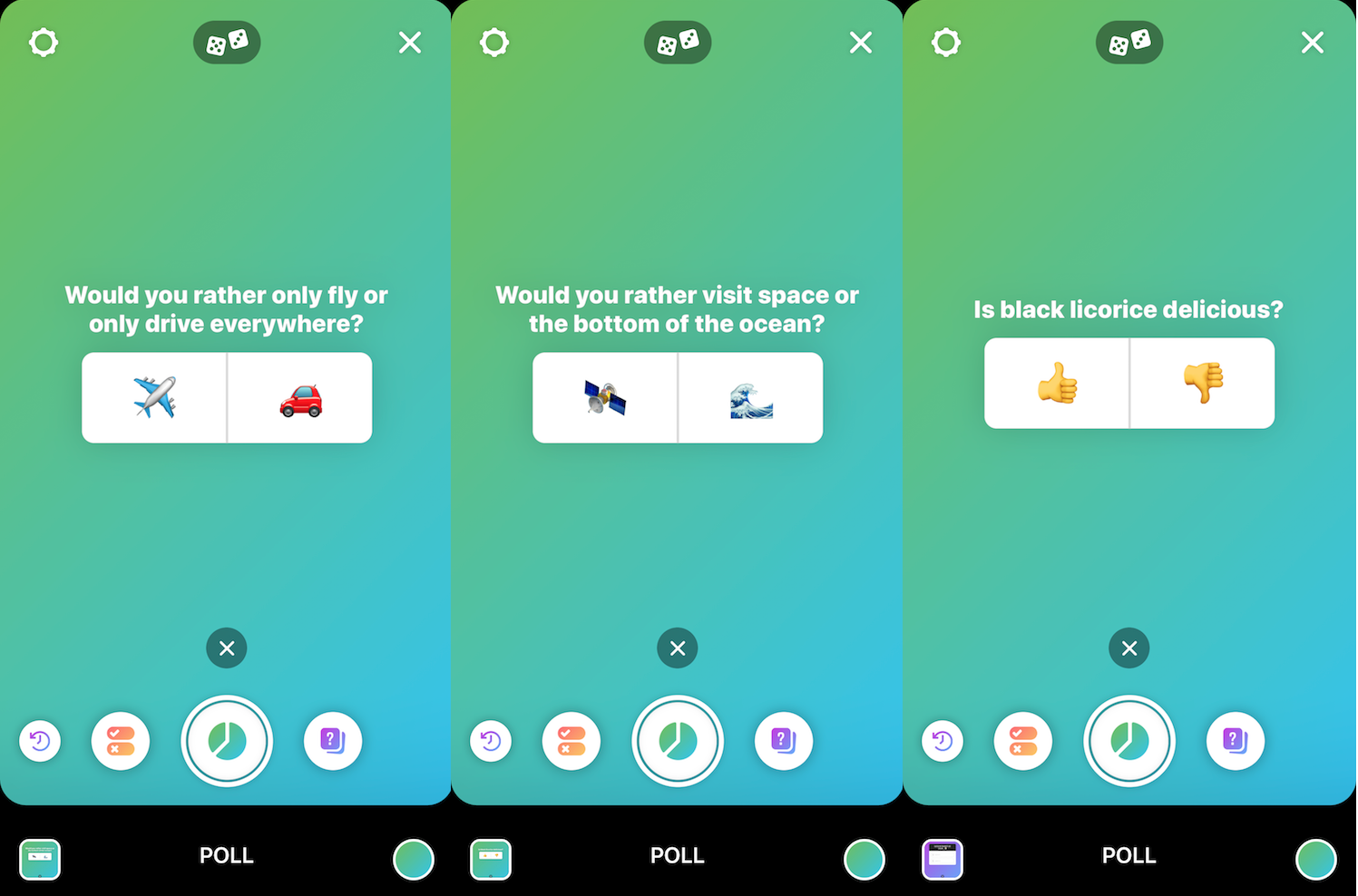

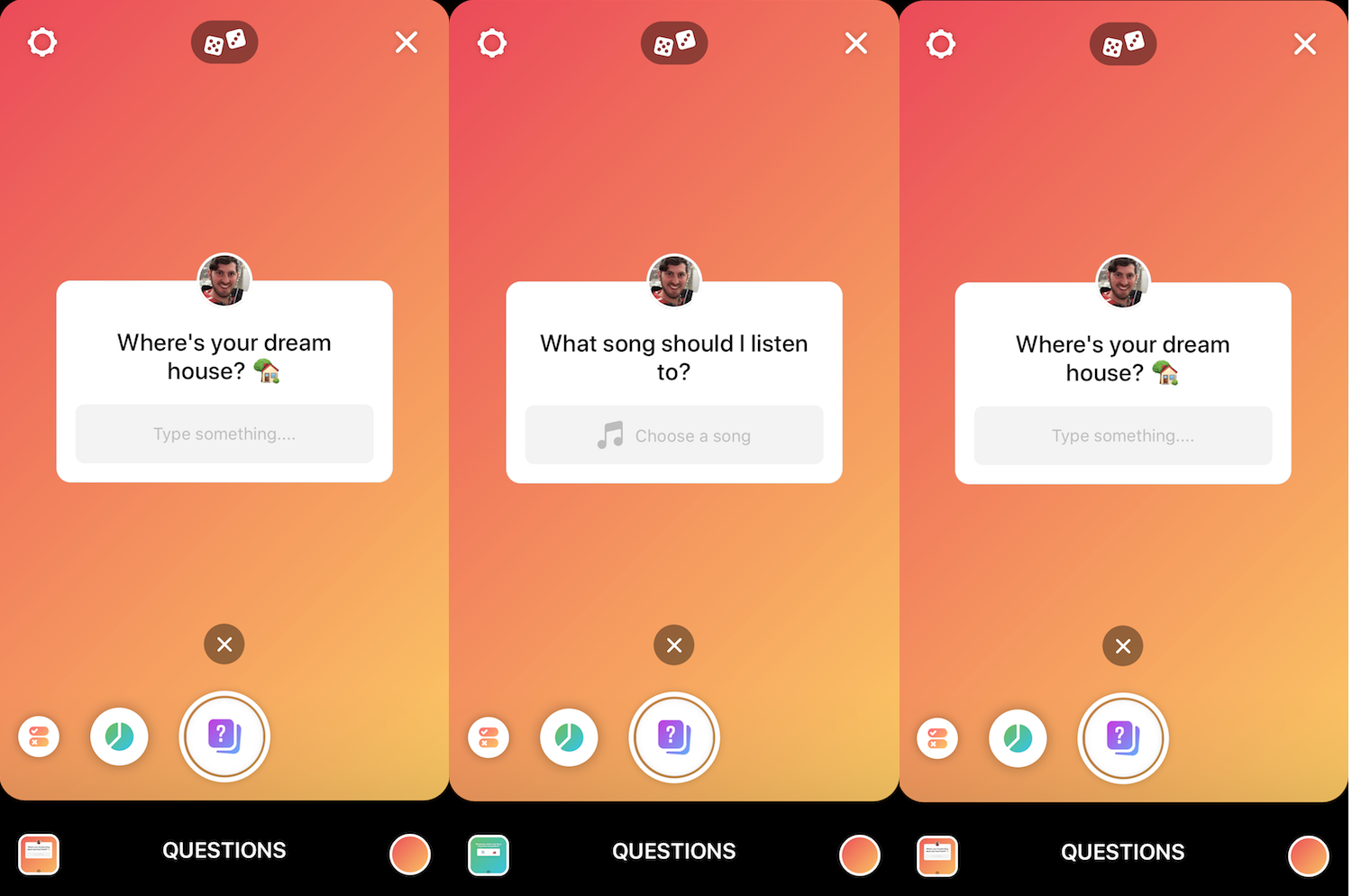

Now On This Day is much more accessible as part of the new Create Mode inside the Stories composer, which replaces Type mode with more options for sharing without your camera than just posting text. You can access it by swiping right at the bottom of the screen from the Stories camera, instead of left to other options like Boomerang. Create lets you use features otherwise added as Stickers atop photos and videos, but on their own with new suggestions of what to share:

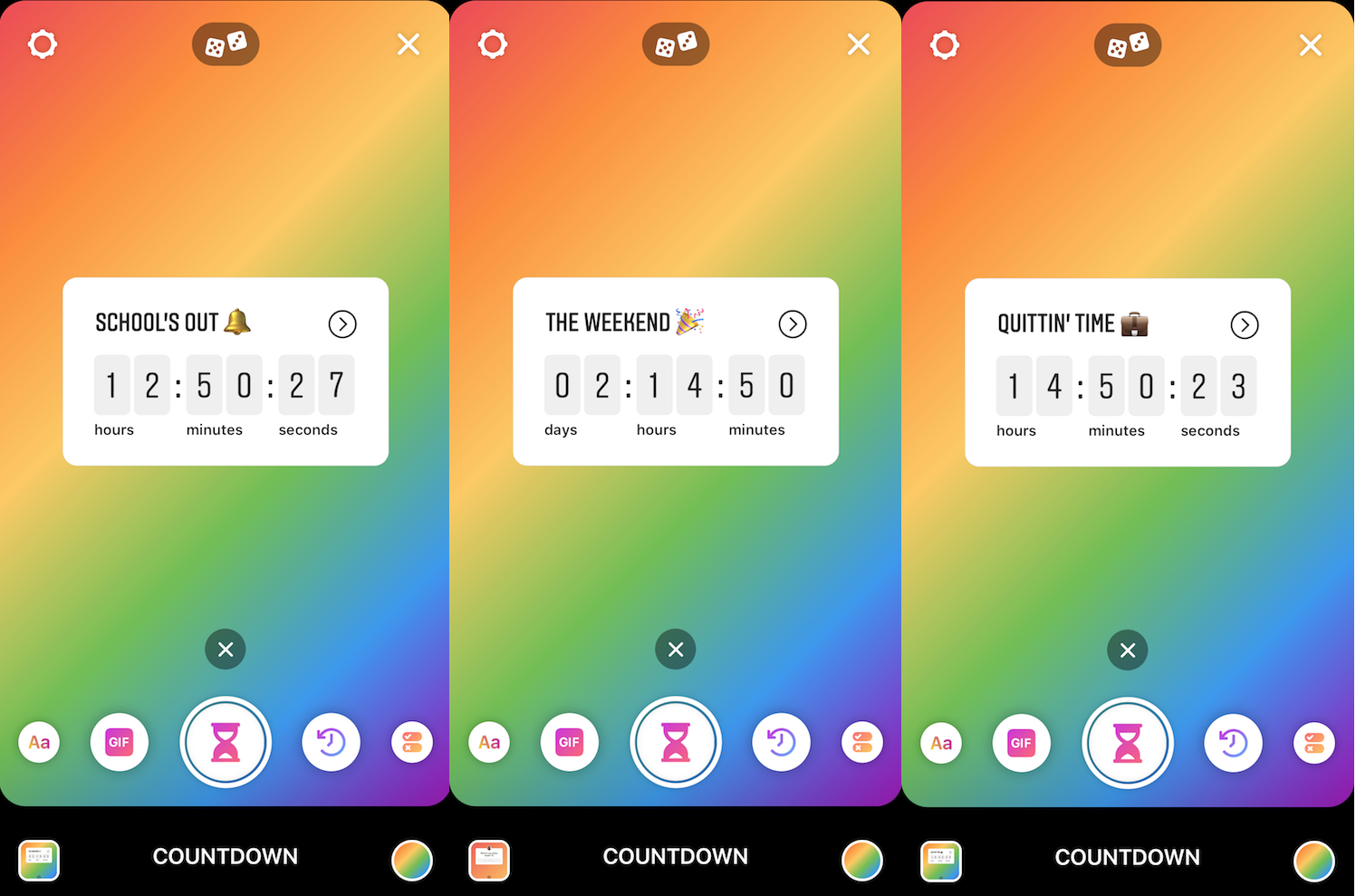

-Countdown timer with suggestions for “The Weekend,” “Quittin’ Time,” and “School’s Out”

-Quiz with suggestions including “What’s my biggest fear?” and “Only one of these is true” (The Quiz sticker already had suggestions)

-Poll with suggestions including “Sweet or savory?” and “Better first date: dinner or movie?”

-Question with suggestions including “If you had 3 wishes…” and “Any hidden talents?”

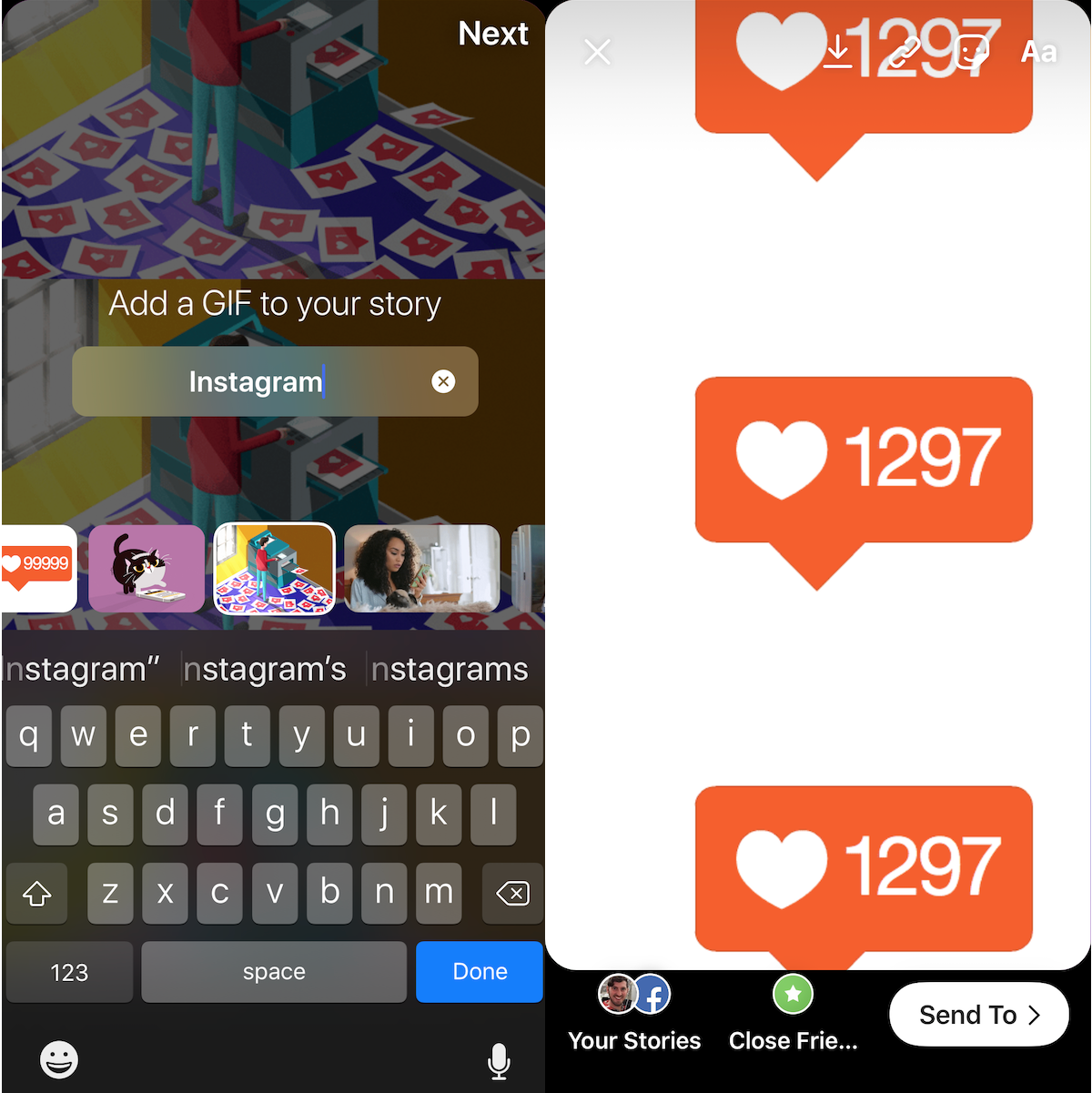

Instagram is also offering a new version of its Giphy -powered GIFs feature inside Create. It lets you search for a GIF and see it tiled three times vertically as the background of your Create post, rather than laid on top.

Through all these features, Create lets people generate new things to share even if they’re laying in bed or stuck somewhere. As Instagram grows internationally to more users with lower-quality phones, and replaces Facebook for many people, the ability to share text and other stuff without having to use their camera could increase people’s posting. Between the Camera shutter modes and room for more sharing styles in Create, Instagram can encompass most any content.

As of today, Instagram is about more than photos and videos. It’s stepping up as a multi-faceted social app just as Facebook’s battered brand becomes desperate to turn Instagram into its reputation and business lifeboat.

Powered by WPeMatico

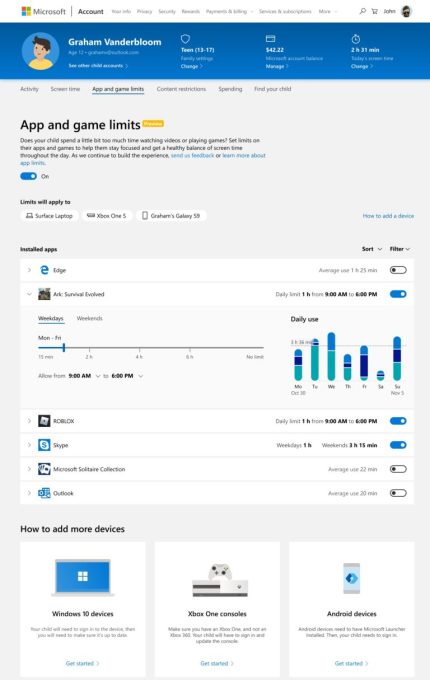

Microsoft is following Apple and Google’s lead with today’s launch of per-app and per-game time limits in its parental control software. Already, the company allows parents to limit screen time across Windows 10, Xbox One and Android via the Microsoft Launcher. However, it hadn’t yet allowed parents to limit the amount of time a child could spend in a specific app or game, as its competitors do.

Instead, its existing controls allowed parents only to dole out a set amount of hours of screen time. Parents could choose to either leave the time up to the kids to manage, or limit it at the device level — like, only allowing one hour of Xbox time but permitting more screen time on the PC, for example.

However, the current trend in screen time management is not to approach all screen time as unproductive and unhealthy. Instead, it’s about configuring limits on the more addictive apps and games that eat up increasing amounts of children’s time, while permitting educational tools to have fewer limits.

For older kids and teens, social media apps like TikTok or Instagram could be the culprit, while younger kids may just be spending too much time “hanging out” in virtual worlds like Roblox and Fortnite. Problems on this front have gotten pretty bad. Mobile games are under fire for using gambling tactics like loot boxes to engage children. And Fortnite is now the subject of a lawsuit that claims that, in part, the game’s addictive nature is due to its use slot machine-like mechanics and variable reward systems, which manipulate children’s brains.

Without being able to limit these apps directly, kids may end up using all of their allotted screen time on just the one app or game they’re obsessed with at the moment.

Apple had already allowed per-app time limits with the launch of its screen time controls in iOS 12. And Google more recently updated its own Family Link software, now preinstalled on new Android devices, to include a similar feature.

With today’s update, Microsoft is now on board, too.

The new app and game limits parents set will apply across Windows 10, Xbox and Android devices running Microsoft Launcher. In other words, kids can’t get more game time just by switching devices.

The controls also allow parents to offer more screen time on certain days — like weekends, for instance — than others.

To use this feature, parents will need to create a family group and make Microsoft accounts for all the kids.

Once enabled, kids will get a warning about their screen time 15 minutes before the limit is reached, and then again at five minutes. Because kids will often beg for a few more minutes, Microsoft made it easy for parents to grant or deny more time via email or via a Microsoft Launcher notification on their own Android phone.

The per-app time limits are launching today in preview within Microsoft’s existing family settings.

“Ultimately, our goal is for the app and game limits feature to provide flexible and customizable tools to meet each family’s unique needs,” the company explains in an announcement. “You as parents know what’s best for your children — no technology can ever replace that — but we’re hoping these tools can help you to strike the right balance,” it says.

Powered by WPeMatico

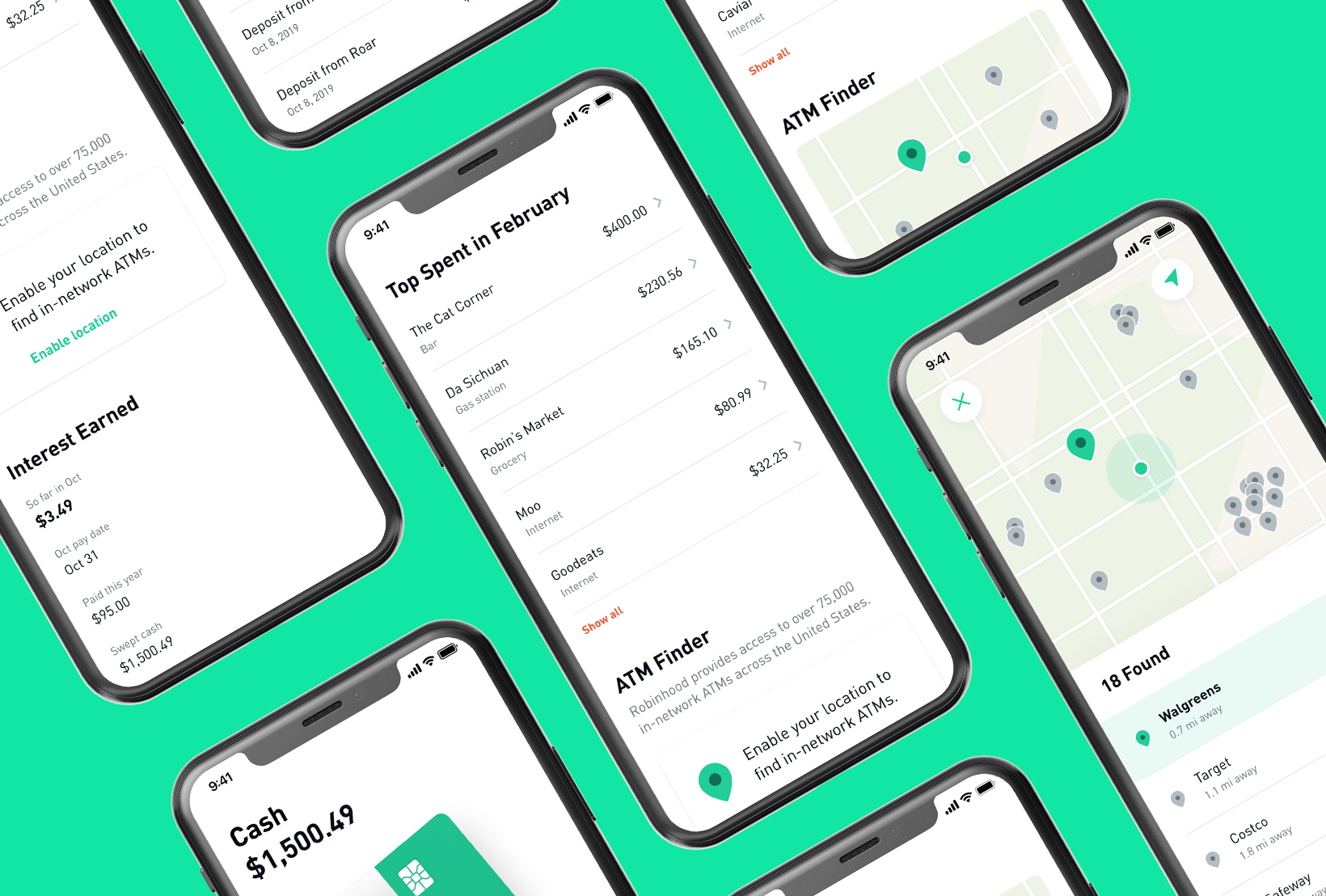

This time it actually has insurance. Zero-fee stock-trading app Robinhood is launching Cash Management, a new feature that earns users 2.05% APY interest on uninvested money in their account with the ability to spend it through a special Mastercard debit card. The waitlist opens today in the U.S. with the first users to be admitted soon. “If you have $5,000 in your account while you’re thinking about what to invest in, you’d have an extra $105 at the end of the year” thanks to Robinhood Cash Management’s interest, co-CEO Baiju Bhatt tells me.

The $7.6 billion-valuation startup first attempted something similar in December with Robinhood Checking, promising a stunningly tall 3% interest rate. But the product turned into a PR disaster when the Securities Investor Protection Corporation that was supposed to insure users’ funds declared Robinhood ineligible, with its CEO noting it had never agreed to cover checking accounts. That led Robinhood to shelve the feature, scrub its site of any mention of Checking and apologize.

Robinhood Cash Management’s debit cards, featuring the same design from the scrapped Checking launch

Now despite Bhatt claiming “Cash Management is a brand new program built from the ground up,” it will offer the same debit card design and network of 75,000 ATMs. It’s even using an identical promo image for its half-translucent green, black, white and American flag debit card designs. But each user’s funds will be covered by the Federal Deposit Insurance Corporation up to $1.25 million. To get around the $250,000 FDIC limit per bank, Robinhood is partnering with six banks that it will spread a user’s cash across as necessary to bundle up to that sum. Robinhood earns money by taking a chunk of the interchange fees from transactions on its debit card run in partnership with Sutton Bank, and from a fee paid by the six banks cash gets swept into.

To help it avoid further regulatory missteps, Robinhood yesterday added former SEC commissioner Dan Gallagher as its first independent board member. He joins the startup’s recently hired COO, CFO, chief compliance officer, VP of Risk & Compliance and VP of Legal & Regulatory to bring more supervision to Robinhood.

Robinhood co-founders and co-CEOs (from left): Baiju Bhatt and Vlad Tenev

The opt-in feature prevents users from missing out on earning interest if they keep money in their Robinhood account, and makes funds from stock sales quickly accessible via the debit card for spending or withdrawal. That convenience could give Robinhood an edge as its loses one if its key differentiators. Last week, its top incumbent competitors Charles Schwab, E*Trade and AmeriTrade all dropped their $4.95 to $6.95 fees on stock trades to match Robinhood’s free offering. That makes Cash Management and Robinhood Crypto even more critical to its continued growth. That’s necessary to justify the $7.6 billion valuation from its recent $323 million Series E raise led by DST Global that brings it to $860 million in total funding.

“We decided the best thing to do is giving people the peace of mind that their money is held at these banks, while trying to pay back the very best interest rates,” Bhatt tells me. [Disclosure: I know Robinhood’s co-founders from college.]

With Cash Management, once users deposit cash into the Robinhood accounts and opt into the program, they’re eligible to earn interest. Any balance on their account, including returns from sales of securities or cryptocurrencies, is swept into the FDIC-insured partner banks via Promontory’s debit suite system. Those banks include Wells Fargo, HSBC, Goldman Sachs, Citibank, U.S. Bank and Bank of Baroda. If one of those banks folds, the FDIC will make customers whole for up to $250,000, equaling $1.25 million across all six working with Robinhood. Users are able to opt out of specific banks.

There the cash earns a variable annual percentage yield (APY) that may fluctuate based on market factors like the Fed fund’s rate. Currently Robinhood offers a 2.05% APY, but refused to compare it to competitors. However, it ranks relatively high amongst popular banking options like these, according to Bankrate, especially given it has no minimum balance:

Robinhood Cash Management will also compete directly with Wealthfront Cash that launched in February and now offers 2.07% APY interest, but lacks a debit card or ATMs. Betterment Checking & Savings does provide a Visa debit card, but its current APY is 1.79%.

Cash Management users can select from the four debit card styles that are accepted anywhere that takes Mastercard, plus 75,000 ATMs. It also works with Apple Pay, Google Pay and Samsung Pay. There are no foreign transaction fees, maintenance fees or account minimum.

A variety of new Cash Management features are being added to the Robinhood app. You can get notifications and emails for all your transactions, and lock the card from your phone if you suspect fraud. You also can opt for location protection, which alerts you if your card is used too far away from your phone. An in-app ATM finder shows users where they can get cash without a fee.

“Partially we want this to be a good business but we also want this to be a big part of customer’s lives,” says Robinhood VP of product Josh Elman. Instead of nickel and diming Cash Management users, the startup monetizes by charging its partners. But the bigger strategy is to get more users on Robinhood in hopes some will subscribe to Robinhood Gold. There users pay a variable monthly fee depending on how much they want to borrow from the startup to trade on margin.

Robinhood co-CEO Baiju Bhatt speaks with TechCrunch’s Josh Constine at Disrupt SF 2018

“I think the main takeaway over the last year has been that since last December, our company has been very committed to building an organization that has a really strong culture [of compliance]” Bhatt concludes. “We’ve grown the leadership team over the last year with experience from risk and finance backgrounds. We think that’s reflected pretty clearly in how Robinhood operates and the diligence that went into building this new program.”

No longer a scrappy startup, the budding fintech giant must now grapple with much greater regulatory scrutiny. With more than 6 million users, the SEC won’t stand for it putting people’s finances in in jeopardy.

Powered by WPeMatico

In a long-awaited move, Spotify announced this morning its iOS 13 app would now offer Siri support and its streaming music service would also become available on Apple TV. That means you can now request your favorite music or podcasts using Siri voice commands, by preferencing the command with “Hey Siri, play…,” followed by the audio you want and concluding the command with “on Spotify.”

The Siri support had been spotted earlier while in beta testing, but the company hadn’t confirmed when it would be publicly available.

According to Spotify, the Siri support will also work over Apple AirPods, on CarPlay and via AirPlay on Apple HomePod.

In addition, the Spotify iOS app update will include support for iPhone’s new data-saver mode, which aids when bandwidth is an issue.

Spotify is also today launching on Apple TV, joining other Spotify apps for TV platforms, including Roku, Android TV, Samsung Tizen and Amazon Fire TV.

The app updates are still rolling out, so you may need to wait to take advantage of the Apple TV support and other new features.

The lack of Siri support for Spotify was not the streaming music service’s fault — it wasn’t until iOS 13 that such support even became an option. With the new mobile operating system launched in September, Apple finally opened up its SiriKit framework to third-party apps, allowing end-users to better control their apps using voice commands. That includes audio playback on music services like Spotify, as well as the ability to like and dislike tracks, skip or go to the next song and get track information.

Pandora, Google Maps and Waze were among the first to adopt Siri integration when it became available in iOS 13 — a clear indication that some of Apple’s chief rivals have been ready and willing to launch Siri support as soon as it was possible.

Though the integration with Siri will be useful for end-users and beneficial to Spotify’s business, it may also weaken the streaming company’s antitrust claims against Apple.

Spotify has long stated that Apple engages in anti-competitive business practices when it comes to its app platform, which is designed to favor its own apps and services, like Apple Music, it says. Among its chief complaints was the inability of third-party apps to work with Siri, which gave Apple’s own apps a favored position. Spotify also strongly believes the 30% revenue share required by the App Store hampers its growth potential.

The streamer filed an antitrust complaint against Apple in the European Union in March. And now, U.S. lawmakers have reached out to Spotify to request information as a part of an antitrust probe here in the states, reports claim.

Despite its new ability to integrate with Siri in iOS 13, Spotify could argue that it’s still not enough. Users will have to say “on Spotify” to take advantage of the new functionality, instead of being able to set their default music app to Spotify, which would be easier. It could also point out that the support is only available to iOS 13 devices, not the entire iOS market.

Along with the Apple-related news, Spotify today also announced support for Google Nest Home Max, Sonos Move, Sonos One SL, Samsung Galaxy Fold, and preinstallation on Michael Kors Access, Diesel and Emporio Armani Wear OS smartwatches.

Powered by WPeMatico

Next Insurance, a three-year-old U.S.-based firm that sells insurance products to small businesses, has become the latest unicorn in the nation after bagging $250 million in a new financing round, the startup said today.

Germany-based Munich Re, one of the world’s largest reinsurers, alone funded Next Insurance’s Series C round, the two said in a statement. The new financing round valued the three-year-old startup, which has raised $381 million to date, at more than $1 billion, the startup said.

Guy Goldstein, co-founder and chief executive of Next Insurance, said the startup will use the fresh capital to build new products and expand its customer initiatives. Next Insurance offers a wide-range of insurance coverage to more than 1,000 unique types of business. It has amassed over 70,000 customers in the U.S., the only market where it currently operates.

Next Insurance aims to become a one-stop insurance shop for micro and small business insurance needs. Its insurance plans and products are designed to cater to the business sectors that are often overlooked by more general insurers.

The startup offers a number of insurance products, including general liability, which covers a number of accidents at work, including property damage and physical injury; professional liability, which covers business owners from accusations of professional mistakes; and commercial auto, which pays for damage caused by or to your business vehicle.

As TechCrunch’s Steve O’Hear explained earlier, small business owners often rely on price comparison websites to figure out what kind of coverage they need and where to buy it, though that means the plans they get don’t always cover all their needs. The other option is to use a broker, but that also adds another middle person.

In a statement, Joachim Wenning, chairman of the Board of Management at Munich Re, said the new investment will help Munich Re expand its footprint in the U.S.’s insurance market of small and medium-sized commercial customers.

“Next Insurance will benefit from our expertise in primary insurance and reinsurance. This investment emphasizes Munich Re’s commitment to be the leading provider of digital insurance solutions,” added Wenning.

Next Insurance, of course, isn’t the only player attempting to address the insurance needs of small and micro-sized businesses. It competes with a handful of startups, including Lemonade, which raised $300 million in April this year, and Root Insurance, which sells car insurance and raised $100 million last year.

Powered by WPeMatico

In what we understand was a “technical issue”, the Amazon Prime Video app disappeared from the Apple App Store, making it unavailable for new downloads or updates to users both on iOS and Apple TV. Twitter users began to tweet to Amazon for help about the problem on Friday morning, to which Amazon’s support channels have yet to reply.

[Update: we’ve learned the issue is technical in nature, but we have no further information as to the details of the problem. The app should be back shortly.]

[Update 2: Amazon has now offered a comment on the disappearance.

“Earlier today, there was a technical glitch that impacted the Prime Video app on iOS and tvOS devices,” an Amazon spokesperson said. “The issue has been resolved, and the Prime Video app is now once again available in the App Store.”

Earlier post continues below:

The app’s disappearance was earlier reported by AppleInsider, iMore and others.

The most likely reason for the app’s removal is a technical one — an issue with the update could have caused it to be temporarily pulled, perhaps.

What’s not likely is that Amazon Prime Video is gone for good.

The company just released an X-Ray upgrade to the app across platforms, including iOS, allowing users to get more information about what they’re streaming, including Amazon’s run of Thursday Night Football games.

Nor is it likely that Apple has for some reason booted out Prime Video, given the anti-competitive nature of such a move (Apple TV+ is soon to launch), at a time when the tech giants are under increased regulatory scrutiny.

Not just you – https://t.co/DTgGRZwsUc

— Jared DiPane (@jareddipane) October 4, 2019

Was ist da los? Amazon Prime Video wurde aus dem App Store entfernt? pic.twitter.com/w6urAq7X70

— Pino (@madphone) October 4, 2019

The amazon prime video app is gone from the App Store?

@PrimeVideo pic.twitter.com/wtiyIBCI3u

— Adrian (@emoflipsan) October 4, 2019

@PrimeVideo is it just me or is the Amazon Prime Video app gone from the Apple App Store??

— Gary Schafer (@GaryLSchafer) October 4, 2019

Does the Amazon Prime Video app not exist on the App Store anymore?

— Swapnanil Dhol (@SwapnanilDhol) October 4, 2019

Whaaat!!! Amazon Prime Video App removed pic.twitter.com/ayxtrGAHuz

— Jesús Cruz (@jesusmisanador) October 4, 2019

Amazon video is no longer in App Store @amazon @PrimeVideo pic.twitter.com/JuY3s9Ygs0

— Ahmad Najim Noori (@Ah_najeem_noori) October 4, 2019

The issue isn’t only impacting users in the U.S., nor is it limited to iPhone, as Apple TV is also affected.

According to data from app store intelligence firm Sensor Tower, the app was removed today in all regions except Australia, Guatemala, Hong Kong, Hungary, Israel, India, Kenya, Kuwait, Lithuania, Luxembourg, Madagascar and Saudi Arabia.

Amazon has not responded publicly to users asking for help.

TechCrunch has also reached out to Amazon for comment and will update when we hear back.

Powered by WPeMatico

StrattyX is a trading interface that lets you set up sophisticated “if-this-then-that” rules and execute orders on the stock market. The startup is participating in the Startup Battlefield at TechCrunch Disrupt SF.

There are plenty of brokers that let you buy and sell shares using a mobile app and a web interface. But if you want to access more sophisticated tools and automate strategies, there’s not much you can do.

StrattyX wants to open up automated trading software to anyone, from non-professional traders who have some savings to professional day traders. The startup focuses on this specific part of the process.

It doesn’t try to reinvent the wheel and it doesn’t want to become an online stock broker. Instead, the company integrates with existing brokers, such as Robinhood, TD Ameritrade and many others as long as they support trading via an API. It acts as an interface and executes orders on your behalf.

You can create rules based on multiple different factors. In addition to traditional stop-loss and stop-limit orders, you can say that you want to buy or sell shares if something happens on Twitter, in the news or on the stock market.

Here are a few examples of rules you can create:

Interestingly, StrattyX will provide a marketplace of strategies. If a star investor starts using StrattyX to define a set of automated rules, other users could follow the same strategy.

StrattyX then wants to go one step further by giving you the tools to train a model using machine learning and user-generated data sets. You could imagine a feature that lets you upload a .csv file with price history and different types of data points, such as SEC filings, earnings, etc.

The company is also working on a feature that would show you news headlines that you’d rate with a Tinder-style swipe gesture — swipe right if you think it’s good news, swipe left if you think it’s bad news.

StrattyX is launching its mobile app today. It’s a sort of minimum viable product for now — some features are still in beta. The company is also working on a desktop version that would be useful for professional traders in particular.

StrattyX initially costs $5 per month per user, with more expensive plans for bigger teams and whether you execute a lot of orders through the product. The startup is looking to raise a seed round in the coming months.

Powered by WPeMatico