Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Instagram dodges child safety laws. By not asking users their age upon signup, it can feign ignorance about how old they are. That way, it can’t be held liable for $40,000 per violation of the Child Online Privacy Protection Act. The law bans online services from collecting personally identifiable information about kids under 13 without parental consent. Yet Instagram is surely stockpiling that sensitive info about underage users, shrouded by the excuse that it doesn’t know who’s who.

But here, ignorance isn’t bliss. It’s dangerous. User growth at all costs is no longer acceptable.

It’s time for Instagram to step up and assume responsibility for protecting children, even if that means excluding them. Instagram needs to ask users’ age at sign up, work to verify they volunteer their accurate birthdate by all practical means, and enforce COPPA by removing users it knows are under 13. If it wants to allow tweens on its app, it needs to build a safe, dedicated experience where the app doesn’t suck in COPPA-restricted personal info.

Instagram is woefully behind its peers. Both Snapchat and TikTok require you to enter your age as soon as you start the sign up process. This should really be the minimum regulatory standard, and lawmakers should close the loophole allowing services to skirt compliance by not asking. If users register for an account, they should be required to enter an age of 13 or older.

Instagram’s parent company Facebook has been asking for birthdate during account registration since its earliest days. Sure, it adds one extra step to sign up, and impedes its growth numbers by discouraging kids to get hooked early on the social network. But it also benefits Facebook’s business by letting it accurately age-target ads.

Most importantly, at least Facebook is making a baseline effort to keep out underage users. Of course, as kids do when they want something, some are going to lie about their age and say they’re old enough. Ideally, Facebook would go further and try to verify the accuracy of a user’s age using other available data, and Instagram should too.

Both Facebook and Instagram currently have moderators lock the accounts of any users they stumble across that they suspect are under 13. Users must upload government-issued proof of age to regain control. That policy only went into effect last year after UK’s Channel 4 reported a Facebook moderator was told to ignore seemingly underage users unless they explicitly declared they were too young or were reported for being under 13. An extreme approach would be to require this for all signups, though that might be expensive, slow, significantly hurt signup rates, and annoy of-age users.

Instagram is currently on the other end of the spectrum. Doing nothing around age-gating seems recklessly negligent. When asked for comment about how why it doesn’t ask users’ ages, how it stops underage users from joining, and if it’s in violation of COPPA, Instagram declined to comment. The fact that Instagram claims to not know users’ ages seems to be in direct contradiction to it offering marketers custom ad targeting by age such as reaching just those that are 13.

Luckily, this could all change soon.

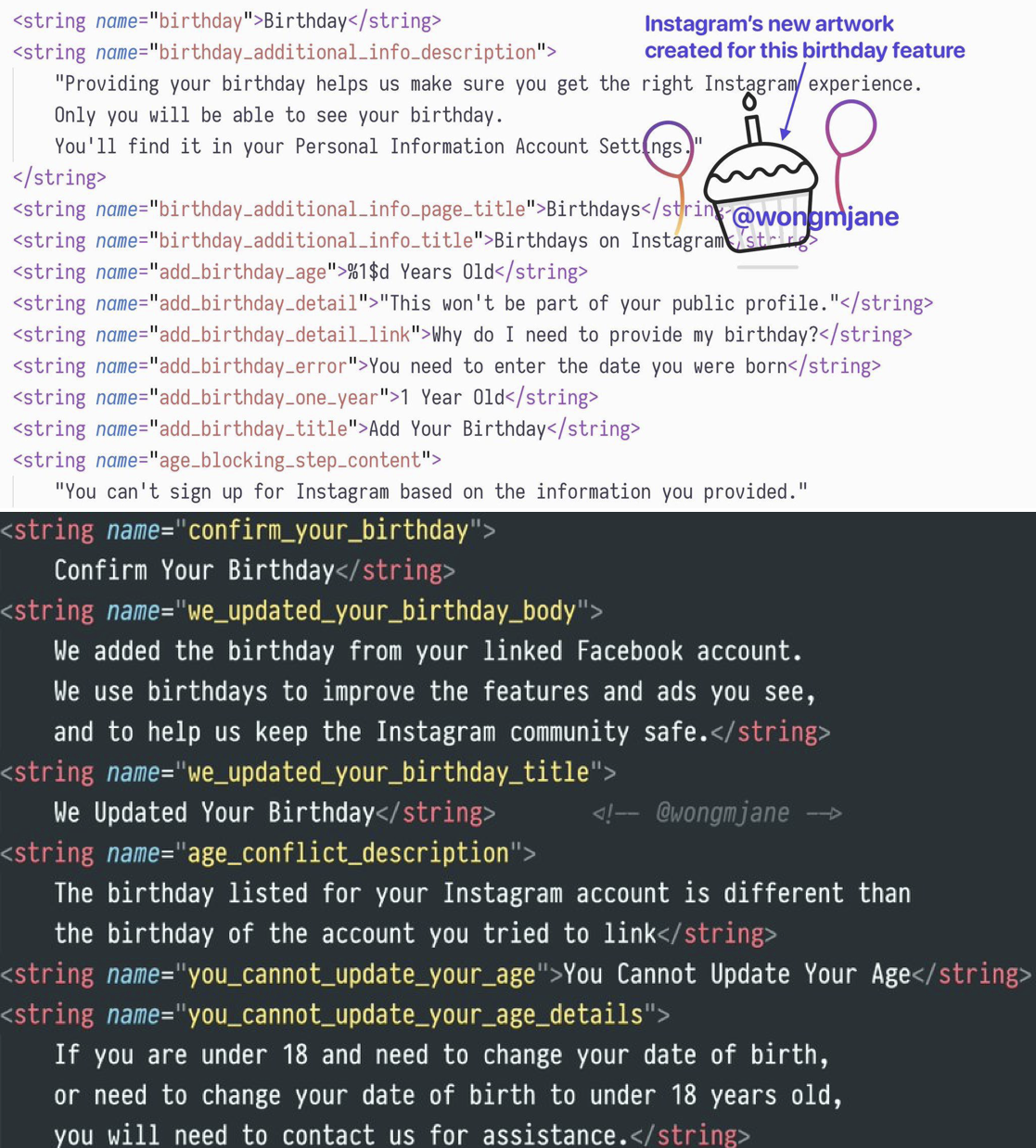

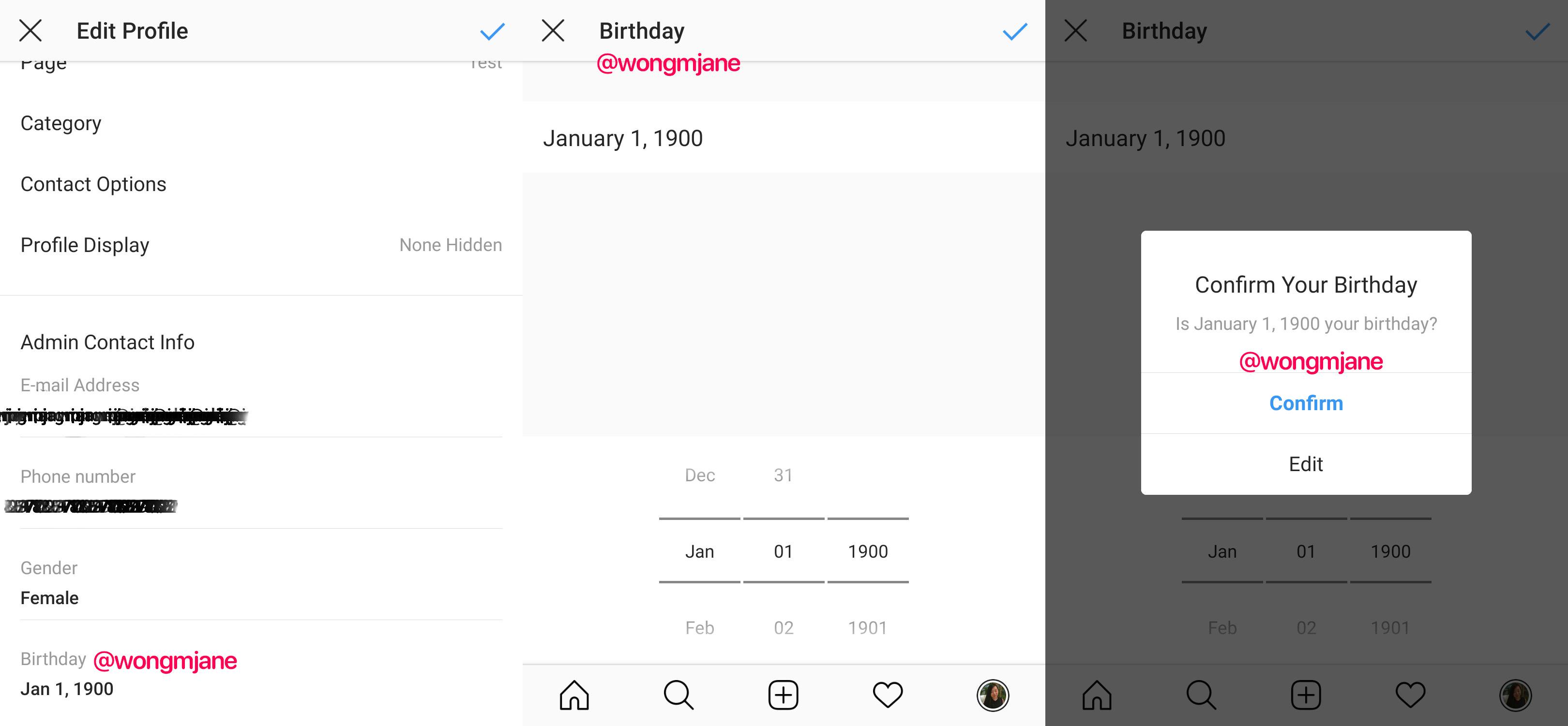

Mobile researcher and frequent TechCrunch tipster Jane Manchun Wong has spotted Instagram code inside its Android app that shows it’s prototyping an age-gating feature that rejects users under 13. It’s also tinkering with requiring your Instagram and Facebook birthdates to match. Instagram gave me a “no comment” when I asked about if these features would officially roll out to everyone.

Code in the app explains that “Providing your birthday helps us make sure you get the right Instagram experience. Only you will be able to see your birthday.” Beyond just deciding who to let in, Instagram could use this info to make sure users under 18 aren’t messaging with adult strangers, that users under 21 aren’t seeing ads for alcohol brands, and that potentially explicit content isn’t shown to minors.

Instagram’s inability to do any of this clashes with it and Facebook’s big talk this year about its commitment to safety. Instagram has worked to improve its approach to bullying, drug sales, self-harm, and election interference, yet there’s been not a word about age gating.

Meanwhile, underage users promote themselves on pages for hashtags like #12YearOld where it’s easy to find users who declare they’re that age right in their profile bio. It took me about 5 minutes to find creepy “You’re cute” comments from older men on seemingly underage girls’ photos. Clearly Instagram hasn’t been trying very hard to stop them from playing with the app.

I brought up the same unsettling situations on Musically, now known as TikTok, to its CEO Alex Zhu on stage at TechCrunch Disrupt in 2016. I grilled Zhu about letting 10-year-olds flaunt their bodies on his app. He tried to claim parents run all of these kids’ accounts, and got frustrated as we dug deeper into Musically’s failures here.

Thankfully, TikTok was eventually fined $5.7 million this year for violating COPPA and forced to change its ways. As part of its response, TikTok started showing an age gate to both new and existing users, removed all videos of users under 13, and restricted those users to a special TikTok Kids experience where they can’t post videos, comment, or provide any COPPA-restricted personal info.

If even a Chinese app social media app that Facebook CEO has warned threatens free speech with censorship is doing a better job protecting kids than Instagram, something’s gotta give. Instagram could follow suit, building a special section of its apps just for kids where they’re quarantined from conversing with older users that might prey on them.

Perhaps Facebook and Instagram’s hands-off approach stems from the fact that CEO Mark Zuckerberg doesn’t think the ban on under-13-year-olds should exist. Back in 2011, he said “That will be a fight we take on at some point . . . My philosophy is that for education you need to start at a really, really young age.” He’s put that into practice with Messenger Kids which lets 6 to 12-year-olds chat with their friends if parents approve.

The Facebook family of apps’ ad-driven business model and earnings depend on constant user growth that could be inhibited by stringent age gating. It surely doesn’t want to admit to parents it’s let kids slide into Instagram, that advertisers were paying to reach children too young to buy anything, and to Wall Street that it might not have 2.8 billion legal users across its apps as it claims.

But given Facebook and Instagram’s privacy scandals, addictive qualities, and impact on democracy, it seems like proper age-gating should be a priority as well as the subject of more regulatory scrutiny and public concern. Society has woken up to the harms of social media, yet Instagram erects no guards to keep kids from experiencing those ills for themselves. Until it makes an honest effort to stop kids from joining, the rest of Instagram’s safety initiatives ring hollow.

Powered by WPeMatico

Instagram is hiding Like counts to make people feel better. But what if you’re curious, competitive or just petty? Now you can re-embrace the popularity contest by installing the Socialinsider Chrome extension that reveals Instagram Like and comment counts. “The Return of the Likes” extension overlays the numbers of Likes and comments on the top-right corner of posts on Instagram’s website. If you don’t want Instagram’s overprotective helicopter parenting, now you can download the extension here to put an end to it.

Obviously, it’s not as useful as showing Like counts right in the Instagram mobile app. You probably aren’t going to switch to browsing Insta just on the web, but if you see a post you want to know the Like count of, you can easily send yourself the permalink and open it on a computer.

Instagram is currently testing hiding Like counts with a percentage of users in every country worldwide. It started the experiment in Canada in April before adding six more countries in July and then the U.S. last month. Facebook launched a similar hidden likes experiment in Australia in September.

TechCrunch tested Return of the Likes and verified that it works. It comes from social media analytics company Socialinsider, which offers software for measuring engagement and benchmarking performance against competitors. The company insists that “No data is sent to Socialinsider servers.” We asked Instagram if the Chrome extension was in compliance with the app’s rules, and will update if we hear back.

As social media evolves, the emerging trend is for platforms to step in to protect users. In many cases, it’s warranted. Like counts can hurt people’s well-being by leading them into envy spirals comparing themselves against peers, or coercing them to self-censor to avoid an embarrassingly low Like count. Still, the question remains whether users deserve control over their own experience. Should we be able to opt back in to seeing Like counts, the way we have controls over block lists of offensive words?

After the platforms step up to ensure safety, we’ll have to decide when we want to step in and demand to see what’s been covered up.

Additional reporting by Lucas Matney

Powered by WPeMatico

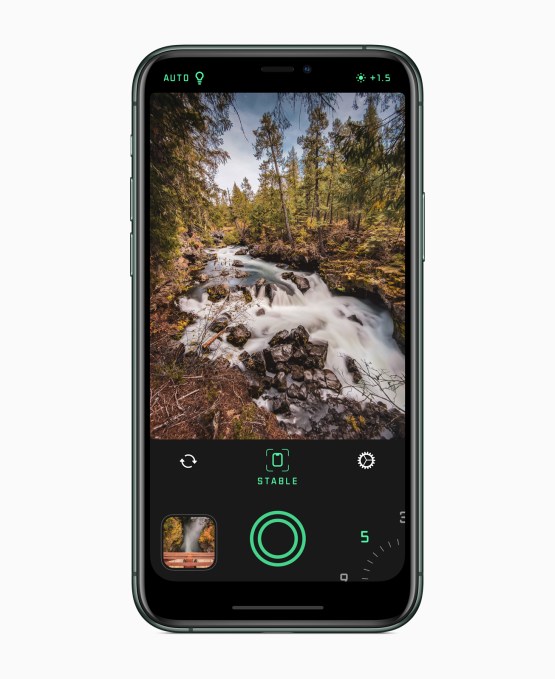

Continuing their annual tradition, Apple and Google have released their list of the best apps and games of 2019. Apple, for the first time, held a real-world event to celebrate its winners, where it crowned AI-powered camera app Spectre Camera as its best iPhone app of the year and Sky: Children of the Light as its best game. Google, meanwhile, dubbed video messaging app Ablo as its app winner and Call of Duty: Mobile as its best game.

Apple’s event held in New York put its winning developers in front of media in order to demonstrate their apps and games. The event was less formal than the Apple Design Awards held at the company’s worldwide developer conference each year, and instead focused on private presentations to press.

Apple said its winners this year sit “at the nexus of digital and pop culture,” but its list really better highlights what Apple thinks are the key selling features for its devices. For example, with Spectre Camera by Lux Optics, it’s about the iPhone’s ability to serve as your main camera even for complicated tasks like long-exposure photos.

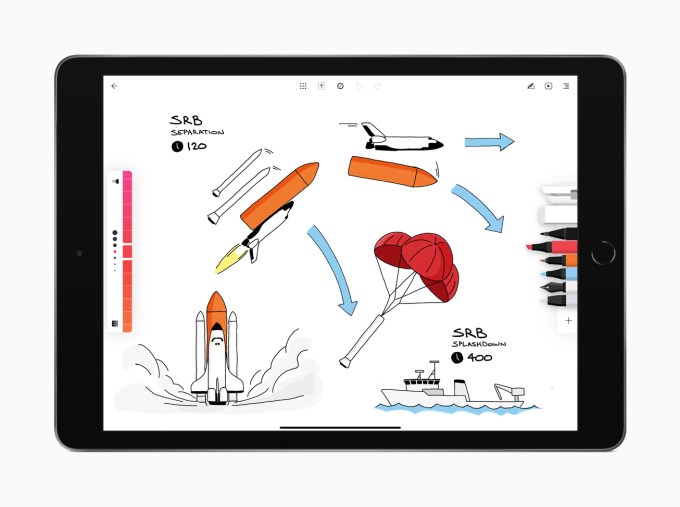

The iPad app of the year was Flow by Moleskin, an app that already won a 2019 Design Award. In this case, the digital notebook app shows off a top iPad use case of being a device aimed at creative professionals. Users can take advantage of its digital graphite pencils and chisel-tipped markers to draw and sketch as they could in real life.

The Mac app of the year, Affinity Publisher by Serif Labs, allows users to design and publish books, magazines, brochures, posters and more — a task that best lends itself to a larger device with a full-sized keyboard.

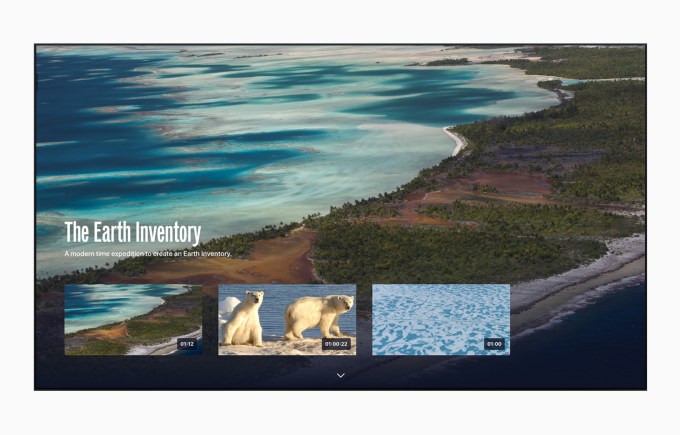

Finally, the Apple TV app of the year, The Explorers by The Explorers Network, showcases something that works best on your TV’s larger, high-def screen. The app’s community of photographers and videographers are working together to create a visual inventory of the natural world, which you can enjoy on your big screen.

Apple’s iPhone Game of the Year, Sky: Children of the Light by thatgamecompany (makers of Journey, the 2013 Game of the Year), iPad Game of the Year Hyper Light Drifter by Abylight S.L. and Mac Game of the Year GRIS by Nomada Studio, are all the sort of beautifully designed games that Apple prefers to showcase.

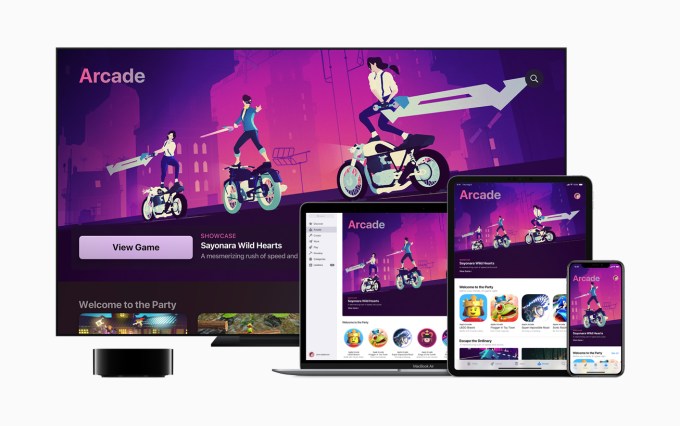

Today’s gaming market has become over-filled with free-to-play titles due to the sort of supported business models that work on the App Store. That’s something Apple Arcade is an attempt to correct, in fact. Apple winners show that even free games can be works of art.

Sky: Children...is a free to play social adventure with in-app purchases, but is also beautiful and creative. Similarly, adventure game Hyper Light was already a visual arts award winner at the Independent Games Festival. And GRIS has been described as one of the most gorgeous games.

The Apple TV Game of the Year, Wonder Boy: The Dragon’s Trap by DotEmu, was developed by LizardCube with the cooperation of series creator Ryuichi Nishizawa to bring an ’80s cult classic back to life. That’s part of one of Apple’s larger App Store gaming trends — a year of “blockbusters reimagined.”

Apple also gave mention of other launches in this space, like Mario Kart Tour, Dr. Mario World, Minecraft Earth, Pokémon Masters, Assassin’s Creed Rebellion, Gears POP!, The Elder Scrolls: Blades, Alien: Blackout and Google’s Game of the Year, Call of Duty: Mobile.

And in what could be the start of a new tradition, Apple also anointed an Apple Arcade Game of the Year with the gorgeous, fast-paced and music-filled Sayonara Wild Hearts developed by Simogo and published by Annapurna Interactive.

Apple’s year-end list also highlighted App Store non-gaming trend of “Storytelling,” which featured a variety of apps to tell stories, including visually, as well as through audio and text. Noted apps here were Anchor, Canva, Unfold, Steller, Spark Camera, Over and Wattpad.

Google doesn’t go all-out as Apple does for its “Best of 2019” picks.

Instead, it simply featured best app Ablo and best game Call of Duty: Mobile as its editorial picks, then leaves the rest to a User’s Choice. Voters selected the same game, but gave the Best App award to a video editor, Glitch Video Effects.

Google’s full list also includes Google Play’s best e-books, audiobooks, TV shows and movies, which you can see here.

Powered by WPeMatico

Singapore-headquartered FinAccel has secured $90 million in one of the largest funding rounds for a fintech startup in Southeast Asia as it looks to further grow its credit lending app Kredivo and build more financial services.

The financing round, dubbed Series C, for the three-and-a-half-year-old startup was jointly led by Asia Growth Fund — a joint venture between Mirae Asset and Naver — and Square Peg.

Singtel Innov8, TMI (Telkomsel Indonesia), Cathay Innovation, Kejora-InterVest, Mirae Asset Securities, Reinventure and DST Partners participated in the “oversubscribed” financing round, the startup said.

FinAccel said it has raised more than $200 million in debt and equity this year itself. It has raised $140 million in equity to date.

FinAccel operates credit lending app Kredivo in Indonesia, where it has amassed more than a million customers and is growing by a whopping 300% each year, Akshay Garg, chief executive of FinAccel, told TechCrunch in an interview.

The app enables customers to secure credit between $100 and $2,200. If a customer pays it back in full in a month, FinAccel does not charge them any fee. Otherwise, the service levies an interest rate of 2.95%, he explained.

Kredivo’s payments option is also integrated with a number of e-commerce firms, including Lazada and Shoppe, and food delivery startups in Indonesia, so users can quickly access the credit to purchase things and pay the app later.

Credit lending apps are increasingly gaining popularity across the globe, but especially in Southeast Asian markets, where the penetration of credit cards remains low — hence, there are very few people with a traditional credit score. This has created an opportunity for startups to look at other metrics to determine who should get a loan.

FinAccel’s team poses for a picture

Garg said Kredivo looks at a range of data points, including the kind of smartphone model a customer is using, and the apps they have installed on it. “Basically what we’re doing is almost like creating a user profile about the user using a combination of different data signals that come from the existing credit bureaus, the telcos, the e-commerce accounts, the bank accounts and the users themselves,” he said.

“All of that creates a 360-degree overview of the customer that helps us determine the risk factors and decide whether to issue the credit,” he added. As of today, Kredivo is only approving about one-third of the applications it receives.

Jikwang Chung, managing director of Mirae Asset Capital, the strategic investment arm of Mirae Asset, said in a statement that FinAccel is one of the leading companies in Southeast Asia that is able to “combine a strong technology DNA with top-tier risk management and a bold vision of financial inclusion.”

FinAccel, which works with banks to finance the credit to customers, has evaluated more than 3 million applications to date and disbursed nearly 30 million loans. Garg said the startup is now working to develop more financial services, such as low-interest education and healthcare loans.

In the next three to four years, it aims to grow to 10 million users and expand to other Southeast Asian markets such as the Philippines, Thailand, and Vietnam.

A handful of other startups also operate in this space in Indonesia. C88, which also offers credit to customers, last year raised $28 million in a financing round led by Experian.

Powered by WPeMatico

Meet Pixpay, a French startup that wants to replace cash when you’re handing out pocket money to your kids. Anybody who is older than 10 years old can create a Pixpay account, get a debit card and manage pocket money.

Challenger banks are nothing new, but they’re still mostly targeted towards adults. If you want to create an N26 or Revolut account, you need to be at least 18 years old. You can create a Lydia account if you’re at least 14 years old with parental consent.

Pixpay, like Kard, wants to fill that gap and offer modern payment methods to teens so that you can ditch cash altogether. Parents and kids both download the Pixpay app to interact with the service.

A few days after creating an account, your child receives a Mastercard. It offers the same features that you’d expect from a challenger bank — you can customize the PIN code, lock it and unlock it, receive a notification with each transaction and restrict some features, such as limits, ATM withdrawals, online payments and payments abroad. Pixpay also lets you generate virtual cards for online payments.

In addition to some spending analytics, users can create projects and set money aside to buy an expensive thing after months of savings. Parents can also define an interest rate on a vault account to teach children how to save money. In the future, Pixpay wants to let teens collect money after a babysitting job for instance.

As for parents, they can send money instantly from the Pixpay app. You can top up your Pixpay account with your favorite debit card and send money on a regular basis (€4 per week for instance) or for one-off payment (here’s €15 for your movie ticket and fast food).

Parents can see an overview of multiple accounts in case you have multiple children using Pixpay. Eventually, the startup wants to let multiple parents manage the account of their child, which could be useful for separated couples.

Pixpay costs €2.99 per month per card. Payments and ATM withdrawals in the Eurozone are free. Transactions in foreign currencies cost 2% in foreign exchange and ATM withdrawals outside of the Eurozone cost €2.

The startup has raised $3.4 million (€3.1 million) from Global Founders Capital. The company partners with Treezor, a banking-as-a-service platform that lets you generate cards and e-wallet accounts using an API.

Powered by WPeMatico

Fintech startup Revolut is adding a key feature for users who want to replace their traditional bank account altogether. You can now pay with GBP direct debits. Revolut already added EUR direct debits last year.

While most people use cards to pay for goods and services in the U.K., some businesses require you to pay with direct debit. It can be a utility bill, a gym membership or a phone contract for instance.

Compared to card transactions, direct debits pull money directly from your account and transfer it to the recipient’s account. It doesn’t go through Mastercard or Visa. Some businesses love direct debits because it’s usually cheaper than card processing fees. Direct debits also don’t have an expiry date, unlike cards.

Customers from the European Economic Area can now share their GBP account details for direct debits in the U.K. Direct debits are protected against some fraud and payment errors by the U.K. Direct Debit Guarantee.

Revolut has partnered with Modulr for this feature as it uses Modulr’s API. Business customers will also be able to take advantage of direct debits. You can now pay suppliers with your account details, which could be convenient for large sums of money for instance.

Powered by WPeMatico

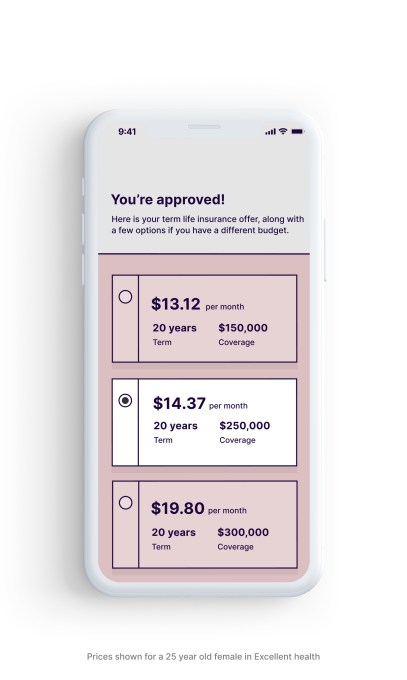

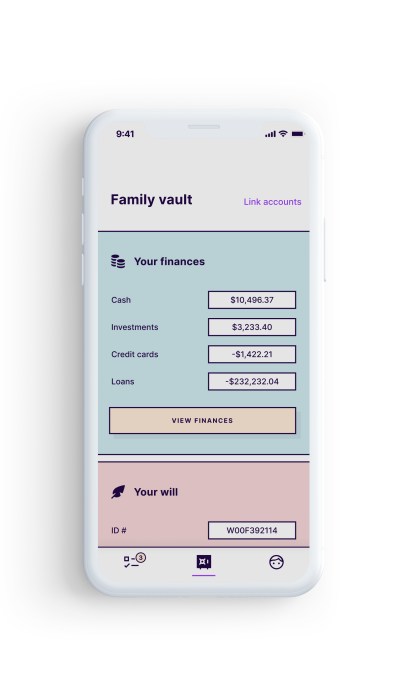

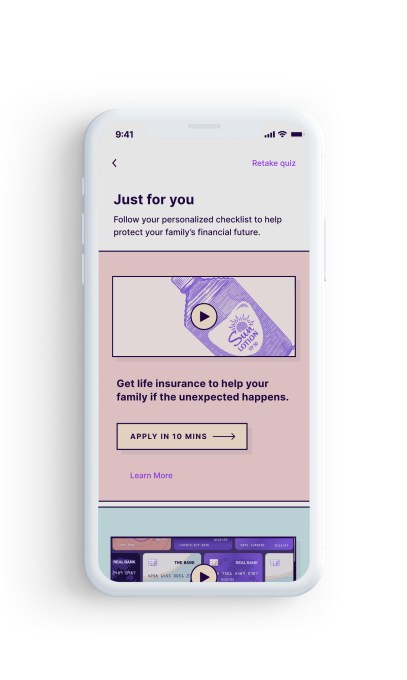

A new app called Fabric aims to make it simpler for parents to plan for their family’s long-term financial well-being. The goal is to offer parents a one-stop-shop that includes the ability to ability for term life insurance from their phone, create a free will in about five minutes, and collaborate with a spouse or partner to organize key financial accounts or other important documents. In addition, parents are able to coordinate with beneficiaries, children’s guardians, attorneys, financial advisors, and others right from the app.

Fabric was originally founded in 2015 by Adam Erlebacher, previously the COO at online bank Simple, and Steven Surgnier, previously the Director of Data at Simple. The company last year raised a $10 million Series A led by Bessemer Venture Partners, after having sold life insurance coverage to thousands of families.

Since launch, Fabric has expanded beyond life insurance to offer other services, like easy will creation and the addition of tools that help families organize their financial and legal information in one place. The idea, the company explained at the time, was to offer today’s busy parents a better alternative to meetings with agents to discuss complicated life insurance products. Instead, the company offers a simple, 10-minute life insurance application and the option to connect with a licensed team if they need additional help, as well as a similarly simplified will creation workflow.

As with the founders’ earlier company, Simple, which offered a better front-end to banking while actual bank accounts were held elsewhere, Fabric’s life insurance policies are issued by “A” rated insurer, Vantis Life, not Fabric itself.

However, until now, Fabric’s suite of services were only available on the web. They’re now offered in an app for added convenience. The app is initially available on iOS with an Android version in the works.

“Money can be especially stressful when you’re trying to build a family and a career,” said Fabric co-founder and CEO Adam Erlebacher. “In one survey by Everyday Health, 52% of respondents said financial issues regularly stress them out, and people between the ages of 38 to 53 were the most stressed out financially. Parents want to have more control over their families’ long-term financial well-being and today’s dusty old products and tools are failing them,” he added.

Using the Fabric app, parents can take advantage of any of its offerings, including the option to apply for life insurance from the phone and get immediate approval. The app also makes it possible to share the policy information with beneficiaries, so it doesn’t get lost.

Another feature lets you create your will for free, and share that information with key people as well, including the witnesses you need to coordinate with in order to finalize the will, for example. And a spouse can choose to mirror your will, which speeds up the process of creating a second one with the same set of choices.

Fabric also helps to address an issue that often only comes up after it’s too late or in other emergency situations — organizing both parents’ finances in a single place. Many working adults today have not just a bank account, but also have investment accounts, 401Ks, IRAs, and credit cards, or a combination of those. But their partner may not know where to find this information or where the accounts are held.

The app, which we put through its paces (but didn’t purchase life insurance through), is very easy to use. It starts off with a short quiz to get a handle on your financial picture. It then delivers you to a personalized homescreen with a checklist of suggestions of what to do next. Naturally, this includes the life insurance application, as this is where Fabric’s revenue lies. And if you’re lacking a will and have other fiances to organize, these are featured, too.

The online forms are easy to fill out, despite the smartphone’s reduced screen space compared with a web browser, and Fabric has taken the time to get the small touches right — like when you enter a phone number, the numeric keypad appears, for example, or the integration of address lookup so you can just tap on the match and have the rest autofill. It also saves your work in progress, so you can finish later in case you get interrupted — as parents often do. And it explains terms, like “executor,” so you know what sort of rights you’re assigning.

Given its focus, Fabric protects user information with bank-grade security, including 256-bit encryption, two-factor authentication, automatic lockouts, biometrics, and other adaptive security features.

Fabric isn’t alone in helping parents and others financially plan wills and more from their iPhone. Other apps exist in this space, including will planning apps from Tomorrow, LegalZoom, Qwill, and others. Plus many insurers offer a mobile experience. Fabric is unique because it puts wills, insurance, and other tools into a single destination, without complicating the user interface.

Fabric’s app is a free download on the App Store.

Powered by WPeMatico

You’ve probably heard murmurs about Google’s forthcoming Ambient Mode for Android . The company first announced this feature, which essentially turns an Android device into a smart display while it’s charging, in September. Now, in a Twitter post, Google confirmed that it will launch soon, starting with a number of select devices that run Android 8.0 or later.

At the time, Google said Ambient Mode was coming to the Lenovo Smart Tab M8 HD and Smart Tab tablets, as well as the Nokia 7.2 and 6.2 phones. According to the Verge, it’ll also come to Sony, Nokia, Transsion and Xiaomi phones, though Google’s own Pixels aren’t on the company’s list yet.

While your

charges, Ambient Mode comes to life. Hear how it delivers a proactive Google Assistant experience to your #Android phone. pic.twitter.com/67rrgTTxqO

— Android (@Android) November 25, 2019

“The ultimate goal for proactive Assistant is to help you get things done faster, anticipate your needs and accomplish your tasks as quickly and as easily as possible,” said Google Assistant product manager Arvind Chandrababu in the announcement. “It’s fundamentally about moving from an app-based way of doing things to an intent-based way of doing things. Right now, users can do most things with their smartphones, but it requires quite a bit of mental bandwidth to figure out, hey, I need to accomplish this task, so let me backtrack and figure out all the steps that I need to do in order to get there.”

Those are pretty lofty goals. In practice, what this means, for now, is that you will be able to set an alarm with just a few taps from the ambient screen, see your upcoming appointments, turn off your connected lights and see a slideshow of your images in the background. I don’t think that any of those tasks really consumed a lot of mental bandwidth in the first place, but Google says it has more proactive experiences planned for the future.

Powered by WPeMatico

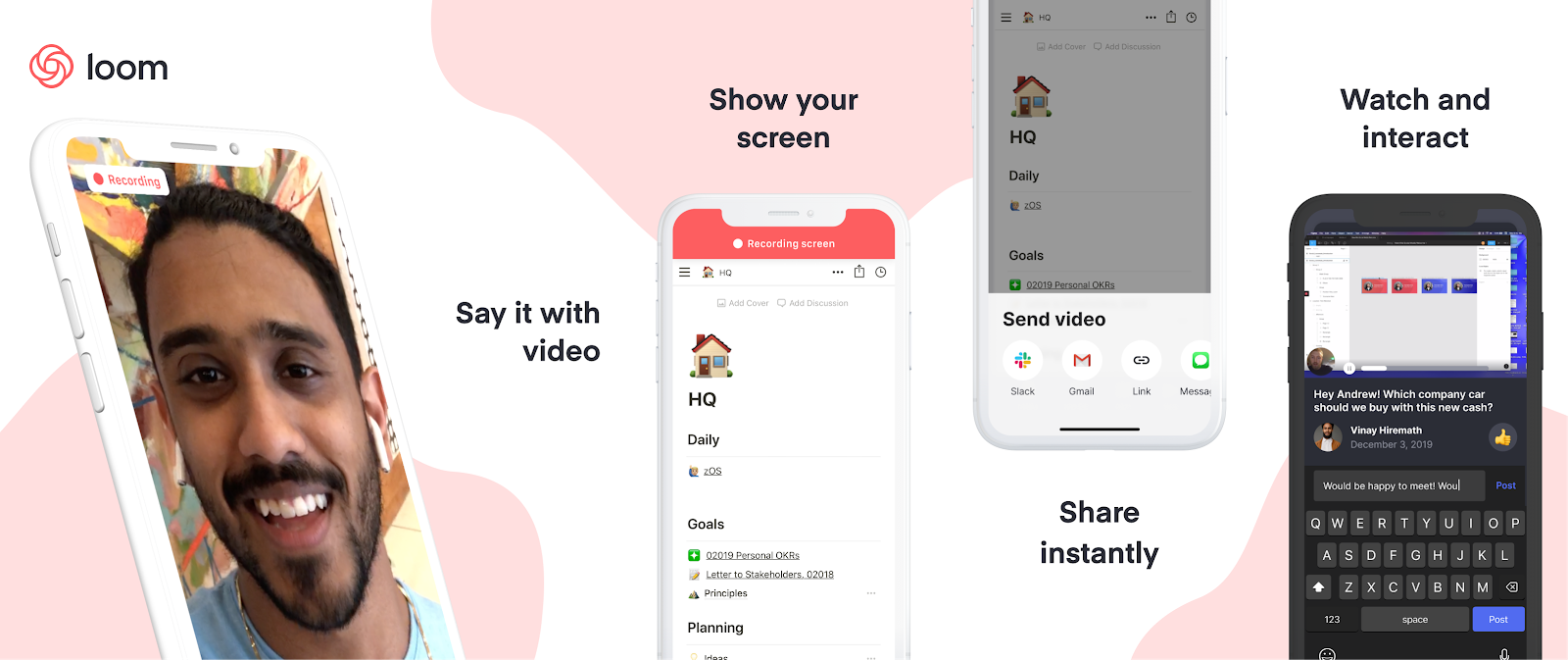

Why are we all trapped in enterprise chat apps if we talk 6X faster than we type, and our brain processes visual info 60,000X faster than text? Thanks to Instagram, we’re not as camera-shy anymore. And everyone’s trying to remain in flow instead of being distracted by multi-tasking.

That’s why now is the time for Loom. It’s an enterprise collaboration video messaging service that lets you send quick clips of yourself so you can get your point across and get back to work. Talk through a problem, explain your solution, or narrate a screenshare. Some engineering hocus pocus sees videos start uploading before you finish recording so you can share instantly viewable links as soon as you’re done.

Loom video messaging on mobile

“What we felt was that more visual communication could be translated into the workplace and deliver disproportionate value” co-founder and CEO Joe Thomas tells me. He actually conducted our whole interview over Loom, responding to emailed questions with video clips.

Launched in 2016, Loom is finally hitting its growth spurt. It’s up from 1.1 million users and 18,000 companies in February to 1.8 million people at 50,000 businesses sharing 15 million minutes of Loom videos per month. Remote workers are especially keen on Loom since it gives them face-to-face time with colleagues without the annoyance of scheduling synchronous video calls. “80% of our professional power users had primarily said that they were communicating with people that they didn’t share office space with” Thomas notes.

A smart product, swift traction, and a shot at riding the consumerization of enterprise trend has secured Loom a $30 million Series B. The round that’s being announced later today was led by prestigious SAAS investor Sequoia and joined by Kleiner Perkins, Figma CEO Dylan Field, Front CEO Mathilde Collin, and Instagram co-founders Kevin Systrom and Mike Krieger.

“At Instagram, one of the biggest things we did was focus on extreme performance and extreme ease of use and that meant optimizing every screen, doing really creative things about when we started uploading, optimizing everything from video codec to networking” Krieger says. “Since then I feel like some products have managed to try to capture some of that but few as much as Loom did. When I first used Loom I turned to Kevin who was my Instagram co-founder and said, ‘oh my god, how did they do that? This feels impossibly fast.’”

Systrom concurs about the similarities, saying “I’m most excited because I see how they’re tackling the problem of visual communication in the same way that we tried to tackle that at Instagram.” Loom is looking to double-down there, potentially adding the ability to Like and follow videos from your favorite productivity gurus or sharpest co-workers.

Loom is also prepping some of its most requested features. The startup is launching an iOS app next month with Android coming the first half of 2020, improving its video editor with blurring for hiding your bad hair day and stitching to connect multiple takes. New branding options will help external sales pitches and presentations look right. What I’m most excited for is transcription, which is also slated for the first half of next year through a partnership with another provider, so you can skim or search a Loom. Sometimes even watching at 2X speed is too slow.

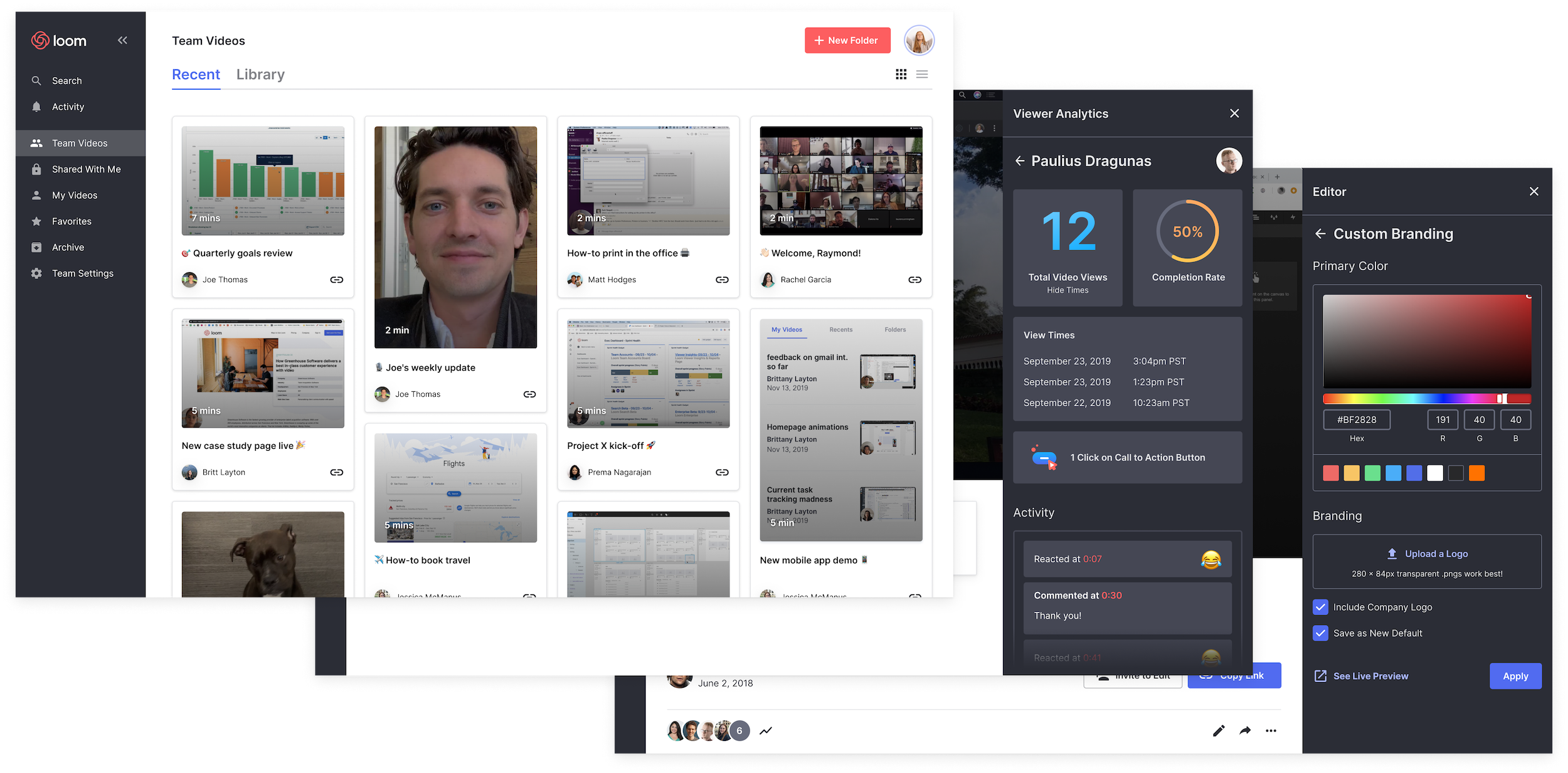

But the point of raising a massive $30 million Series B just a year after Loom’s $11 million Kleiner-led Series A is to nail the enterprise product and sales process. To date, Loom has focused on a bottom-up distribution strategy similar to Dropbox. It tries to get so many individual employees to use Loom that it becomes a team’s default collaboration software. Now it needs to grow up so it can offer the security and permissions features IT managers demand. Loom for teams is rolling out in beta access this year before officially launching in early 2020.

Loom’s bid to become essential to the enterprise, though, is its team video library. This will let employees organize their Looms into folders of a knowledge base so they can explain something once on camera, and everyone else can watch whenever they need to learn that skill. No more redundant one-off messages begging for a team’s best employees to stop and re-teach something. The Loom dashboard offers analytics on who’s actually watching your videos. And integration directly into popular enterprise software suites will let recipients watch without stopping what they’re doing.

To build out these features Loom has already grown to a headcount of 45, though co-founder Shahed Khan is stepping back from company. For new leadership, it’s hired away former head of web growth at Dropbox Nicole Obst, head of design for Slack Joshua Goldenberg, and VP of commercial product strategy for Intercom Matt Hodges.

Still, the elephants in the room remain Slack and Microsoft Teams. Right now, they’re mainly focused on text messaging with some additional screensharing and video chat integrations. They’re not building Loom-style asynchronous video messaging…yet. “We want to be clear about the fact that we don’t think we’re in competition with Slack or Microsoft Teams at all. We are a complementary tool to chat” Thomas insists. But given the similar productivity and communication ethos, those incumbents could certainly opt to compete. Slack already has 12 million daily users it could provide with video tools.

Loom co-founder and CEO Joe Thomas

Hodges, Loom’s head of marketing, tells me “I agree Slack and Microsoft could choose to get into this territory, but what’s the opportunity cost for them in doing so? It’s the classic build vs. buy vs. integrate argument.” Slack bought screensharing tool Screenhero, but partners with Zoom and Google for video chat. Loom will focus on being easily integratable so it can plug into would-be competitors. And Hodges notes that “Delivering asynchronous video recording and sharing at scale is non-trivial. Loom holds a patent on its streaming, transcoding, and storage technology, which has proven to provide a competitive advantage to this day.”

The tea leaves point to video invading more and more of our communication, so I expect rival startups and features to Loom will crop up. Vidyard and Wistia’s Soapbox are already pushing into the space. As long as it has the head start, Loom needs to move as fast as it can. “It’s really hard to maintain focus to deliver on the core product experience that we set out to deliver versus spreading ourselves too thin. And this is absolutely critical” Thomas tells me.

One thing that could set Loom apart? A commitment to financial fundamentals. “When you grow really fast, you can sometimes lose sight of what is the core reason for a business entity to exist, which is to become profitable. . . Even in a really bold market where cash can be cheap, we’re trying to keep profitability at the top of our minds.”

Powered by WPeMatico

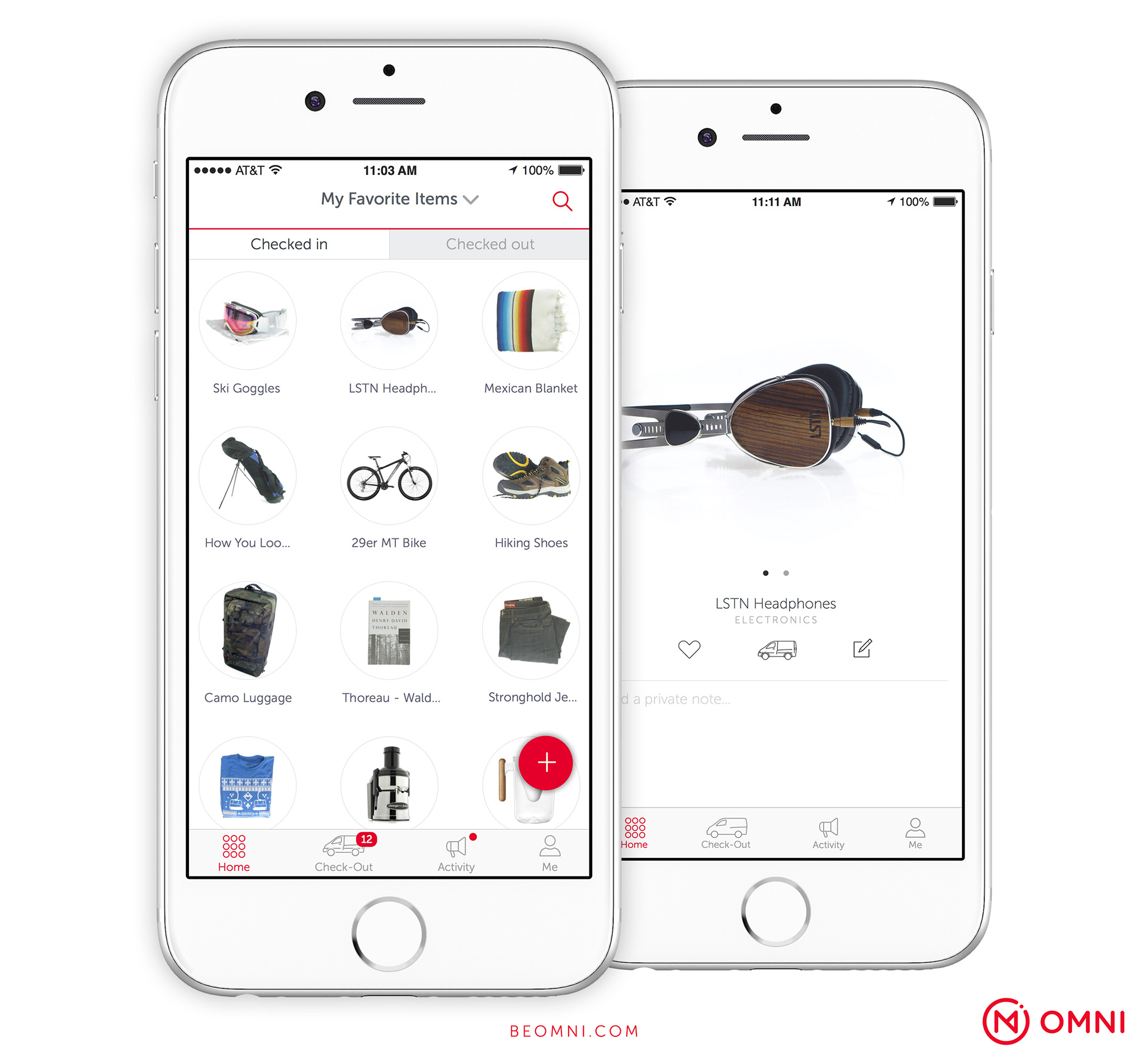

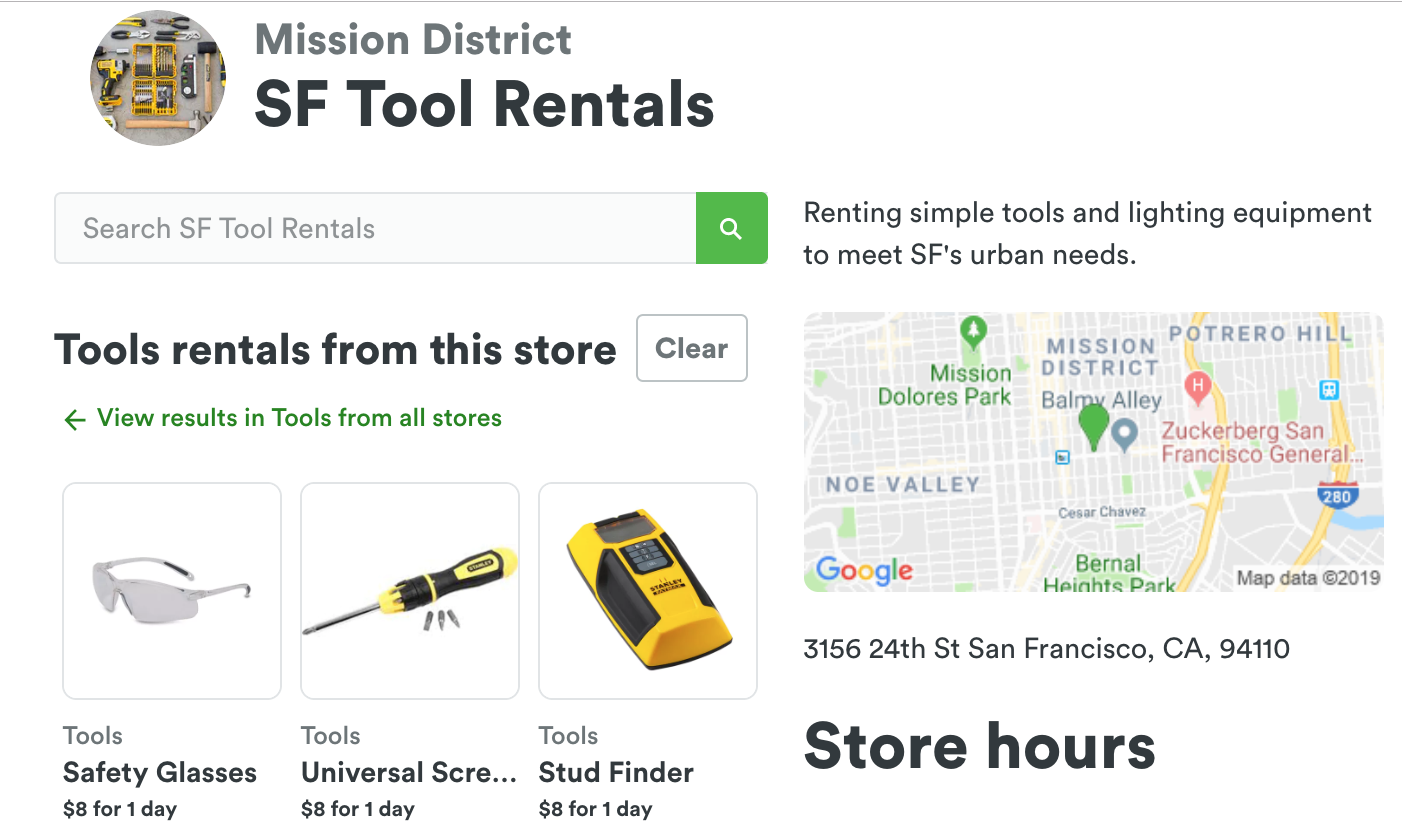

$35 million-funded Omni is packing up and shutting down after struggling to make the economics of equipment rentals and physical on-demand storage work out. It’s another victim of a venture capital-subsidized business offering a convenient service at an unsustainable price.

The startup fought for a second wind after selling off its physical storage operations to competitor Clutter in May. Then sources tell me it tried to build a whitelabel software platform for letting brick-and-mortar merchants rent stuff like drills or tents as well as sell them so Omni could get out of hands-on logistics. But now the whole company is folding, with Coinbase hiring roughly 10 of Omni’s engineers.

“They realized that the core business was just challenging as architected” a source close to Omni tells TechCrunch. “The service was really great for the consumer but when they looked at what it would take to scale, that would be difficult and expensive.” Another source says Omni’s peak headcount was around 70.

The news follows TechCrunch’s report in October that Omni had laid off operations teams members and was in talks to sell its engineering team to Coinbase. Omni had internally discussed informing its retail rental partners ahead of time that it would be shutting down. Meanwhile, it frantically worked to stop team members from contacting the press about the startup’s internal troubles.

“We’ll be winding down operations at Omni and closing the platform by the end of this year. We are proud of what we built and incredibl y thankful for everyone who supported our vision over the past five and a half years” an Omni spokesperson says. Omni CEO Tom McLeod did not respond to multiple requests for comment. Oddly, Omni was still allowing renters to pay for items as of this morning, though it’s already shut down its blog and hasn’t made a public announcement about its shut down.

“Coinbase has reached an agreement with Omni to hire members of its engineering team. We’re always looking for top-tier engineering talent and look forward to welcoming these new team members to Coinbase” a Coinbase spokesperson tells us. The team was looking for more highly skilled engineers they could efficiently hire as a group, though it’s too early to say what they’ll be working on.

Omni originaly launched in 2015, offering to send a van to your house to pick up and index any of your possession, drive them to a nearby warehouse, store them, and bring them back to you whenever you needed for just a few dollars per month. It seemed too good to be true and ended up being just that.

Eventually Omni pivoted towards letting you rent out what you were storing so you and it could earn some extra cash in 2017. Sensing a better business model there, it sold its storage business to Softbank-funded Clutter and moved to helping retail stores run rental programs. But that simply required too big of a shift in behavior for merchants and users, while also relying on slim margins.

One major question is whether investors will get any cash back. Omni raised $25 million from cryptocurrency company Ripple in early 2018. Major investors include Flybridge, Highland, Allen & Company, and Founders Fund, plus a slew of angels.

The implosion of Omni comes as investors are re-examining business fundamentals of startups in the wake of Uber’s valuation getting cut in half in the public markets and the chaos at WeWork ahead of its planned IPO. VCs and their LPs want growth, but not at the cost of burning endless sums of money to subsidize prices just to lure customers to a platform.

It’s one thing if the value of the service is so high that people will stick with a startup as prices rise to sustainable levels, as many have with ride hailing. But for Omni, ballooning storage prices pissed off users as on-demand became less afforable than a traditional storage unit. Rentals were a hassle, especially considering users had to pick-up and return items themselves when they could just buy the items and get instant delivery from Amazon.

Startups that need a ton of cash for operations and marketing but don’t have a clear path to ultra-high lifetime value they can earn from customers may find their streams of capital running dry.

Powered by WPeMatico