Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

“We were in the back washing blenders so they could keep taking Snackpass orders,” recalls co-founder and CEO Kevin Tan. The team from order-ahead food startup Snackpass was willing to get their hands dirty to keep up with demand at one of their first restaurant partners, Tropical Smoothie Cafe on the Yale University campus.

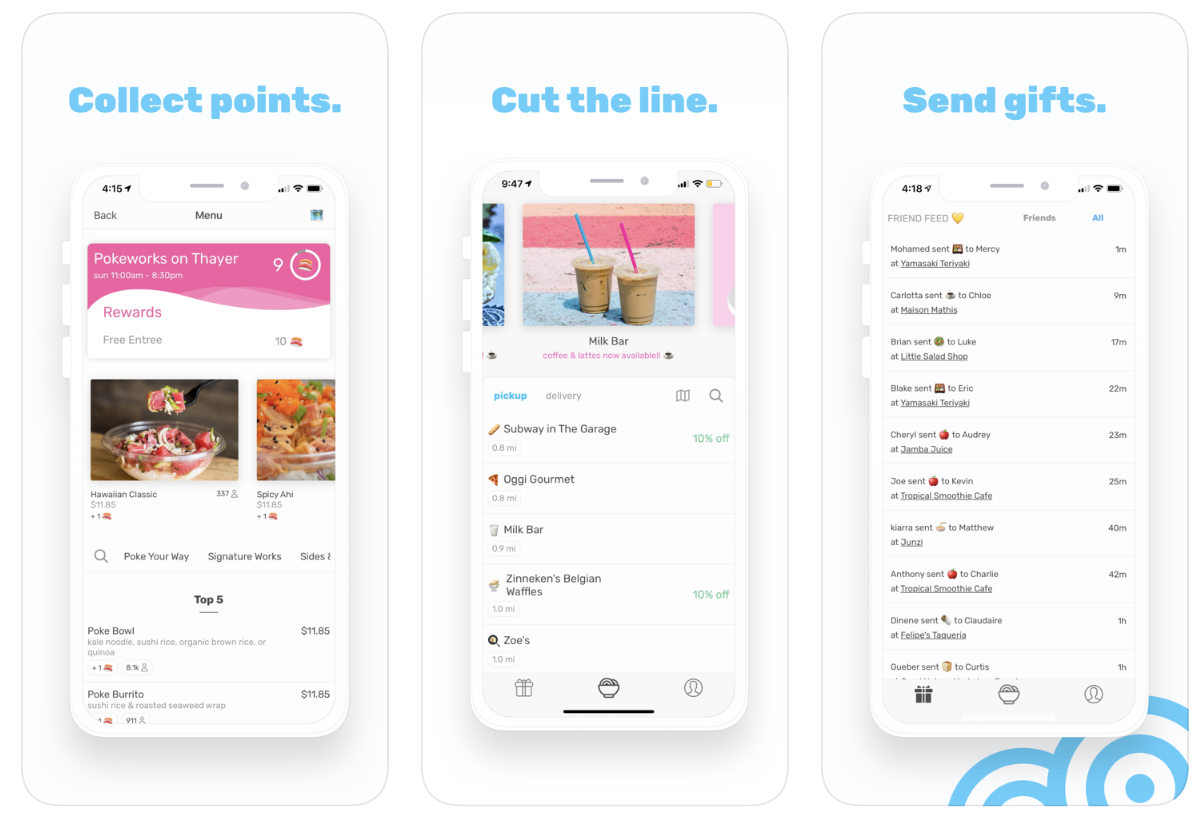

Why were people so eager to pay for takeout through Snackpass? Because it lets them earn loyalty points to redeem for free food — both for themselves and as gifts for their friends. Sending people Snackpass rewards became a new way to flirt or show gratitude at Yale. And through the Venmo-esque Snackpass social feed, users could keep up with a fresh form of gossip while discovering restaurants.

“Anywhere someone is standing in line to order something, we can solve that with Snackpass,” says Tan. “Consumer spending will be social in the future.”

That future is already taking hold. Two years after launch, Snackpass is on 11 college campuses across the U.S., often boasting a 75% penetration rate amongst students within six months. It takes a cut of every order and keeps margins high because users pick up the food themselves rather than waiting for delivery. While other food ordering startups battle to offer discounts as marauding users deal-hop between apps, Snackpass keeps users coming back through its loyalty program.

Its momentum, retention and opportunity to expand from colleges to dense cities has now won Snackpass a $21 million Series A led by Andreessen Horowitz partner Andrew Chen. The round was joined by other heavy hitters, like Y Combinator, General Catalyst, Inspired Capital and First Round, plus angels, including musician Nas, NFL star Larry Fitzgerald and legendary talent agent Michael Ovitz. Building on Snackpass’ $2.7 million seed, the cash will go toward hiring up with the goal of reaching 100 campuses in two years.

Its momentum, retention and opportunity to expand from colleges to dense cities has now won Snackpass a $21 million Series A led by Andreessen Horowitz partner Andrew Chen. The round was joined by other heavy hitters, like Y Combinator, General Catalyst, Inspired Capital and First Round, plus angels, including musician Nas, NFL star Larry Fitzgerald and legendary talent agent Michael Ovitz. Building on Snackpass’ $2.7 million seed, the cash will go toward hiring up with the goal of reaching 100 campuses in two years.

“Takeout is an important market because it’s huge — also in the hundreds of billions — and fragmented,” writes Chen. “The opportunity complements the food delivery market in a big way: For the average restaurant, there are 6 takeout orders for every delivery order!”

Like many of the best startup ideas, Snackpass was born out of the founders’ own needs at Yale. Slow and expensive food delivery services didn’t make sense for smaller orders like a coffee, ice cream or a pepperoni slice on campuses small enough for customers to walk or bike to the restaurant. Tan says, “I was dabbling in several side projects, including helping a friend who managed a local pizza shop build a website to help better reach the local student community.” He realized how tough it was for restaurants around colleges to retain and reward customers, especially as regulars graduated.

Tan joined up with neuroscience student and Thiel Fellow Jamie Marshall, who became Snackpass’ COO. “I had grown up calling in every order,” Marshall tells me. “Waiting in line didn’t make sense for me. I used every order-ahead platform and thought this was the future.” Jonathan Cameron, a serial entrepreneur who’d built his own order-ahead app called Happy Hour, rounded out the founding team.

Snackpass founders (from left): Jamie Marshall and Kevin Tan

Snackpass offers users a list of nearby restaurants from which they can order ahead, with special tags for ones offering deals. Menu items include counts of how many people have ordered them and how many rewards points you’ll earn buying them. You pay in the app, skip the line at the restaurant and grab your order from the counter. Each restaurant can configure their own rewards system with how much items earn and cost, such as giving you a free coffee for every 10 you buy.

Users can then spend their points to get themselves free menu items, or send a virtual Snackpass gift card to any of their phone contacts or people they find via search. This gives Snackpass a way to grow virally that most food apps lack. Thankfully, you can block people on Snackpass if they get creepy showering you with gifts.

Each purchase and gift on Snackpass shows up in its social feed unless you make it private. “That’s become its own language. People use it to flirt with each other, or bond and connect with someone new,” Tan tells me. “There’s some drama or intrigue there seeing who’s sending gifts to who. People even look at the feed in the way they look at someone’s Instagram to see what’s going on with them.”

Snackpass has also done some integration work specifically for the college market that sets it apart from other order-ahead and delivery services. It can sync with students’ campus meal plans so they can spend them through the app. And student groups from clubs to fraternities can pre-load and replenish accounts for their members. Snackpass works with the same organizations to launch on new campuses. “We host parties, sponsor tailgates and make it feel like a student-led effort so it grows organically across campus communities,” Tan explains. “These efforts, combined with the social feed which would give anyone FOMO if they’re not in the app.”

With all the competition in the space, restaurants can be inundated with apps to manage, some of which just exacerbate spikes in demand that overwhelm kitchens. “There is certainly a risk that local restaurants will start to get platform fatigue, finding that using some apps will take too big of a bite out of their margins,” says Tan. That’s why Snackpass built features that let restaurants batch orders and control how many come in at a certain time so dine-in patients and non-app users aren’t stuck with unreasonable delays.

With all the competition in the space, restaurants can be inundated with apps to manage, some of which just exacerbate spikes in demand that overwhelm kitchens. “There is certainly a risk that local restaurants will start to get platform fatigue, finding that using some apps will take too big of a bite out of their margins,” says Tan. That’s why Snackpass built features that let restaurants batch orders and control how many come in at a certain time so dine-in patients and non-app users aren’t stuck with unreasonable delays.

Snackpass has recruited talent from Uber Eats and an advisor from Yelp’s executive team to help it navigate the tricky SMB sales process. One ace up its sleeve is that it can offer to send push notifications to announce recently signed partners or specials they’re launching, driving the new customers restaurants are desperate for. Tan says his startup is considering if it could charge for this kind of promotion down the line. Most customers who walk into restaurants are effectively in incognito mode, but Snackpass provides its partners with analytics to help them improve their own businesses.

“At the surface level there is a lot of competition in this space,” Tan admits. “The social aspect of the app has been the key differentiator for us. Other companies have been focused on creating the fastest, cheapest, most efficient delivery service, but it’s really hard to make those margins work and consumers are trained to shop around on different apps to get the best deal or fastest delivery time . . . Eating food is supposed to be fun and social, and our generation grew up online and in social networks. We’re combining the social aspect of eating with the utility of order ahead, which has helped us build loyalty and enable retention amongst our users.”

It will still be a battle to overtake long-running competitors like Allset, Level Up and Ritual, plus incumbents that offer takeout pickup like Uber and Grubhub. Logistics is a cut-throat business, and plenty of startups have already failed in the restaurant loyalty space.

Having Andreessen Horowitz’s support could give Snackpass some extra firepower. “A16z has better support and services for their portfolio companies than any other VC we’ve come across and they’ve delivered,” Tan tells me. “We knew that Andrew Chen understands growth and marketplaces from his blog and his Twitter.” That’s critical in a crowded space where such a precise balance of customer acquisition and lifetime value is necessary.

Snapchat, TikTok and Fortnite have all tapped into the youth market with a lighthearted nature that keeps users coming back until they develop network effect. Snackpass is managing to do the same, not with a messaging app or game, but a commerce platform. “We play up creativity, silliness and delight in areas where most companies focus on utility and convenience,” Tan concludes. “We built Snackpass for ourselves and our friends. We’ve carried on this philosophy: if something makes us laugh, we put it in the app.”

Powered by WPeMatico

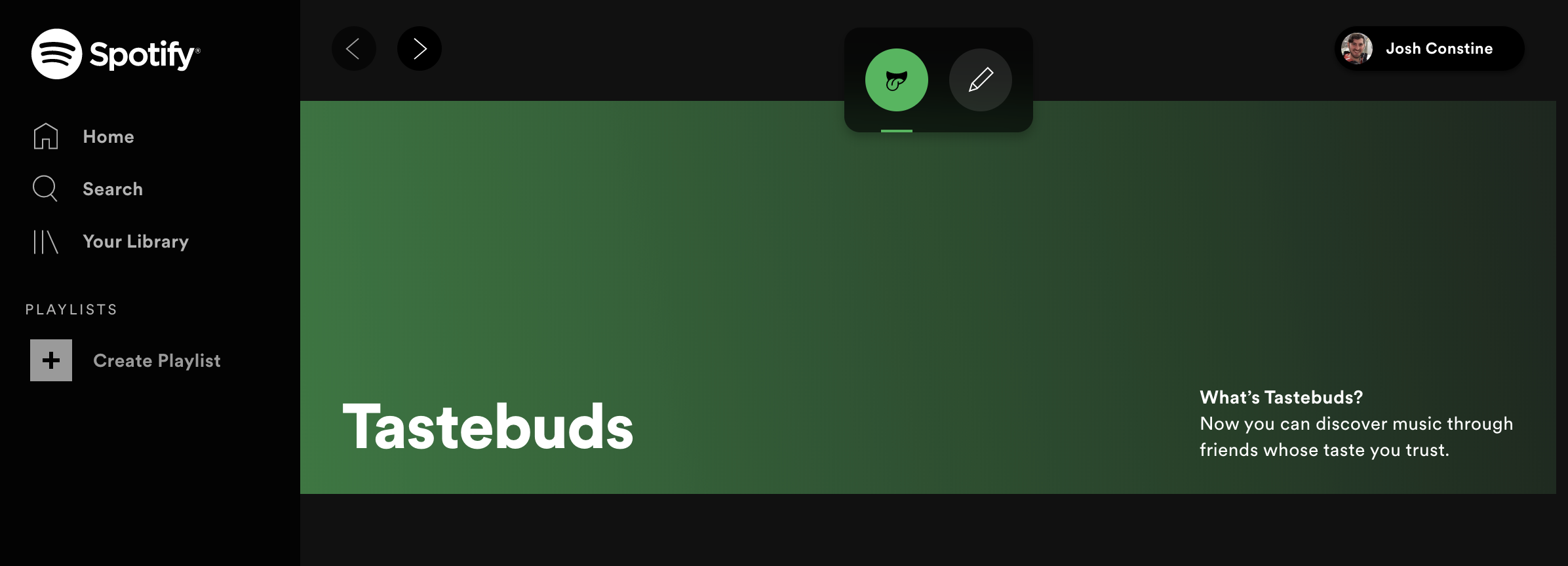

Spotify is prototyping a new way to see what friends have been listening to, called “Tastebuds.” Despite how discovering music is inherently social, Spotify has no features for directly interacting with friends within its mobile app after axing its own inbox in 2017 and keeping its Friend Activity ticker restricted to desktop.

It seemed like Spotify was purposefully restricting social features to force users to rely on the company’s own playlists and discovery surfaces. This gave Spotify the power to play king-maker, massively influencing which artists got featured and rose to stardom. This in turn gave it leverage in its combative negotiations with record labels, which worried their artists might get left off playlists if they don’t play nice with Spotify in terms of sustainable royalty rates and access to exclusives.

That strategy seems to have paid off with Spotify improving its licensing deals and becoming a critical promotional partner for the labels, paving the way to its IPO. Spotify’s shares sit around $152, up from its direct listing price of $132, though down from its first-day pop that saw it rise to $165. More comfortable in its position, now Spotify seems ready to relinquish more control of discovery and enable users to be better inspired by what friends are playing.

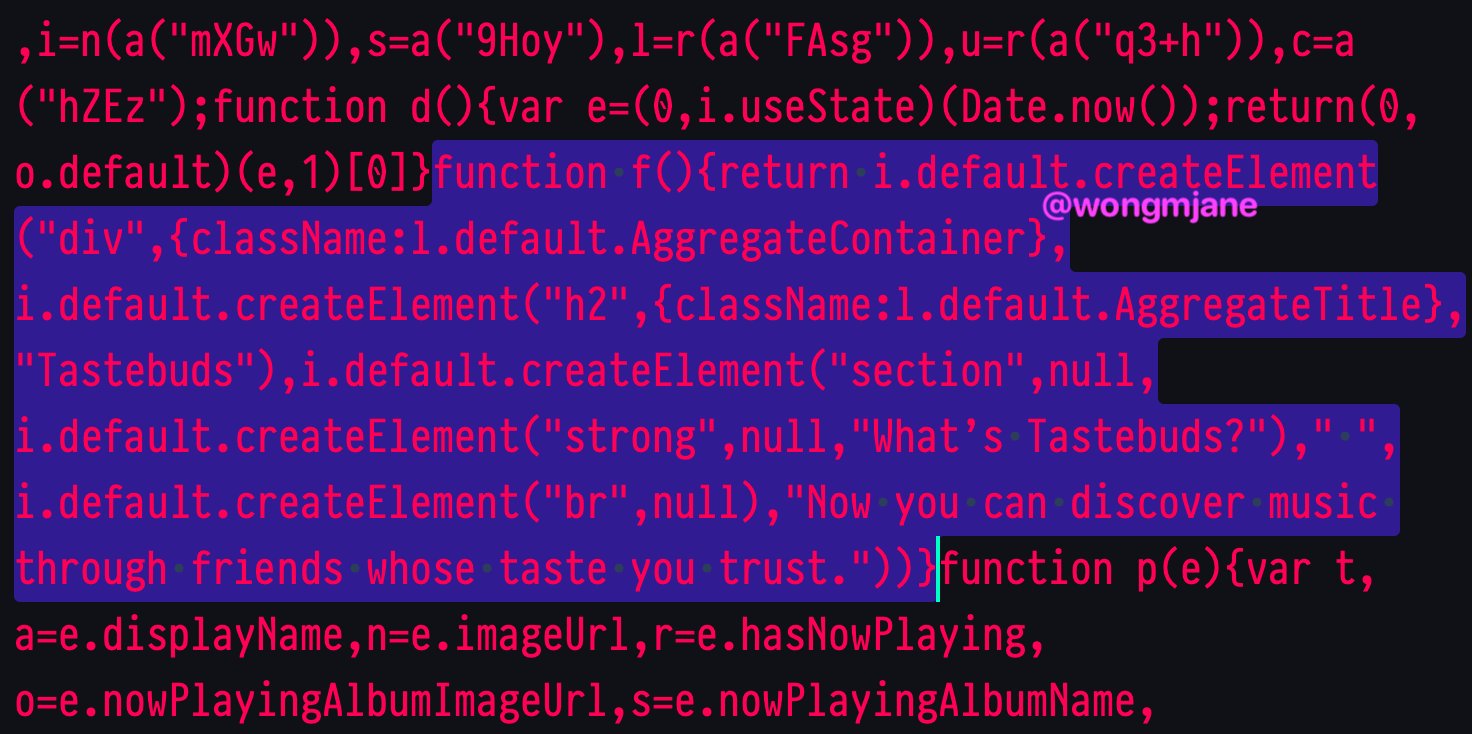

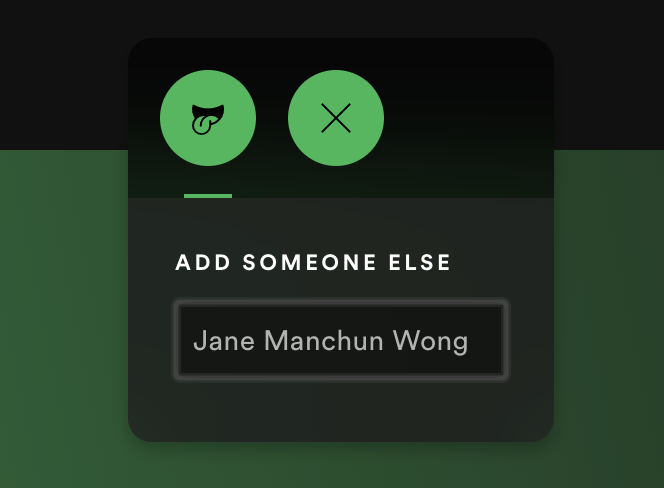

Spotify Tastebuds code via Jane Manchun Wong

Tastebuds is designed to let users explore the music taste profiles of their friends. Tastebuds lives as a navigation option alongside your Library and Home/Browse sections. Anyone can access a non-functioning landing page for the feature at https://open.spotify.com/tastebuds. The feature explains itself, with text noting “What’s Tastebuds? Now you can discover music through friends whose taste you trust.”

The prototype feature was discovered in the web version of Spotify by reverse engineering sorceress and frequent TechCrunch tipster Jane Manchun Wong, who gave us some more details on how it works. Users tap the pen icon to “search the people you follow.” From there they can view information about what users have been playing most and easily listen along or add songs to their own library.

Without Tastebuds, there are only a few buried ways to interact socially on Spotify. You can message friends a piece of music through buttons for SMS, Facebook Messenger and more, or post songs to your Instagram or Snapchat Story. Spotify used to have an in-app inbox for trading songs, but removed it in favor of shuttling users to more popular messaging apps. On the desktop app, but not mobile or web, you can view a Friend Activity ticker of songs your Facebook friends are currently listening to. Or you can search for specific users and follow them or view playlists they’ve made public, though Spotify doesn’t promote user search much.

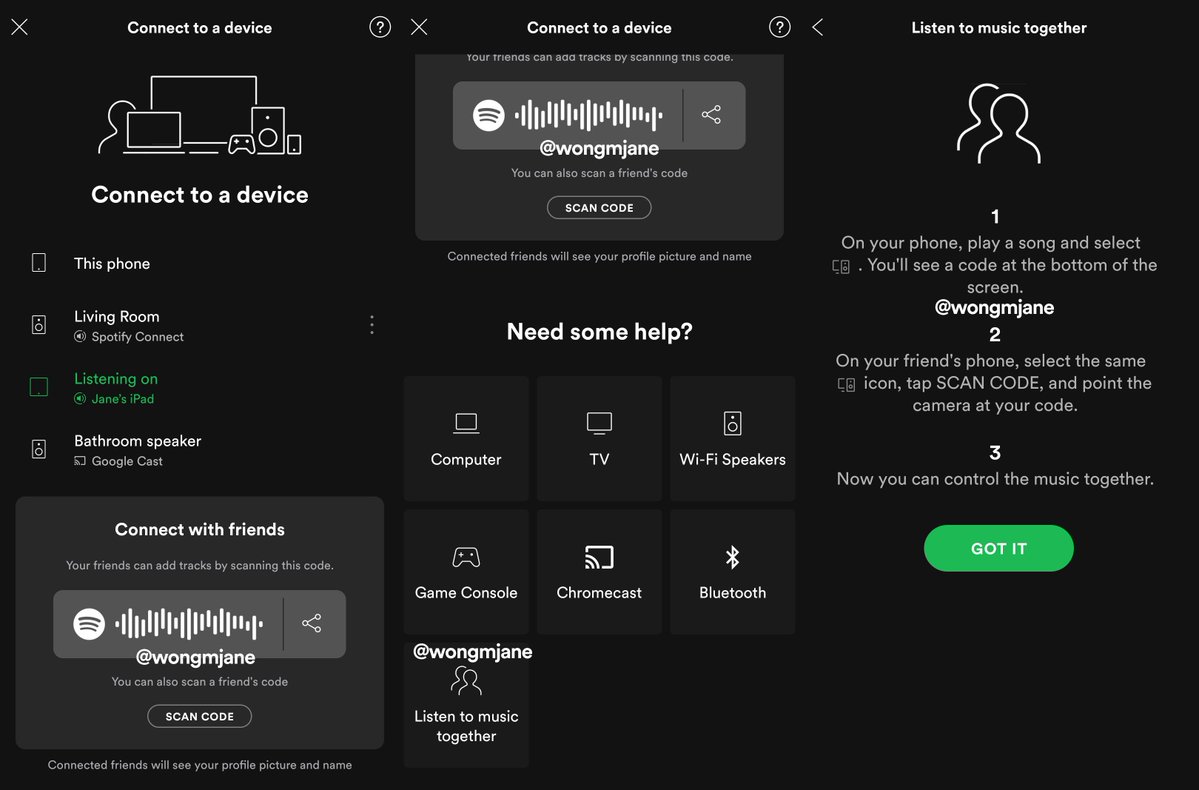

Spotify has a few other social features it has experimented with but never launched. Those include a Friends Weekly playlist spotted last year by The Verge’s Dani Deahl. Then this May, we reported Wong had spotted a shared-queue Social Listening feature that let you and friends play songs simultaneously while apart. Back in 2014, I wrote that Spotify should move beyond blog-esque browsing to create a “PlayFeed” playlist that would dynamically update with algorithmic recommendations, new releases from your top artists and friends’ top listens. It has since launched Discovery Weekly and Release Radar, and Tastebuds could finally bring in that final social piece.

Spotify’s simultaneous social listening prototype

The result is that you can only see either a myopic snapshot of friends’ current songs, the few and often outdated playlists they manually made public or you message them songs elsewhere. There was no great way to get a holistic view of what a friend has been jamming to lately, or their music preferences overall.

We’ve reached out to Spotify seeking more information about how Tastebuds works, how privacy functions around who can see what and if and when the feature might launch. We’re also interested to see if Spotify has any deal in place with a music dating startup called Tastebuds.fm which launched way back in 2010 to help people connect and flirt through song sharing. [Update: A Spotify spokesperson confirms that “We’re always testing new products and experiences, but have no further news to share at this time.” They also said this is not related to the Tastebuds.fm startup.]

Social is a huge but under-tapped opportunity for Spotify. Not only could social recommendations get users listening to Spotify for longer, thereby hearing more ads or becoming less likely to cancel their subscription, it also helps Spotify lock in users with a social graph they can’t find elsewhere. While competitors like Apple Music or YouTube might offer similar music catalogs, users won’t stray from Spotify if they become addicted to social discovery through Tastebuds.

Powered by WPeMatico

HungerBox, an Indian food tech startup that has courted 10 of the 11 largest companies in the country to use its services, today announced it has raised $12 million from Paytm and others as it looks to sign clients in Southeast Asia.

The three-year-old startup’s new financing round, a Series C, was funded by a consortium of Indian and international investors, including payments firm Paytm and NPTK, an Asian VC fund that invests in emerging firms. Existing investors Sabre Partners and Neoplux also participated in the round, which pushes the Bangalore-based startup’s to-date raise to $16.5 million.

HungerBox offers management services to companies and institutions to improve and run their in-house cafeterias and canteens. HungerBox also enables its clients to connect with food partners through an app and get real-time updates of their order.

The startup, which also provides these firms with a point-of-sale machine, helps them get better insight into the quality of food being catered to their employees, and enables scheduled delivery and tracking of orders to address the long queues, said Sandipan Mitra, co-founder and chief executive of HungerBox, in an interview with TechCrunch.

“We all talk about the food delivery to consumers, but not many are looking to improve the quality of food and how it is being catered to tens of millions of employees in the country each day,” he said. “It’s a challenge that has not been addressed well.”

It turns out, when a startup finally looked into the space, many quickly jumped to appreciate it. HungerBox has amassed more than 126 large businesses and institutions — with more than 100,000 workforce each, across 18 Indian cities, said Mitra. Food delivery startups Swiggy and Zomato have started to explore this space, too, in recent quarters.

HungerBox is processing 560,000 orders each day, a figure that is growing 10% every month, claimed Mitra. The startup’s solutions are today employed at more than 535 cafeterias for its clients that work in IT / technology, retail, healthcare, aviation, education, financial services and manufacturing, he said. He declined to reveal the name of the clients, citing confidential agreements.

Annual food sales on the HungerBox platform have exceeded $100 million, he said.

The startup, which employs 1,500 people, will use the fresh capital to fuel its expansion in 10 additional Indian cities and to markets in Southeast Asia, said Mitra.

In a statement, Madhur Deora, president of Paytm, said HungerBox has enabled Paytm to add new use cases for the company’s payments business and digitization of offline transactions.

“HungerBox is the market leader in the institutional food tech space and we will partner closely with them and bring the benefits of Paytm’s ecosystem to HungerBox,” he said.

Powered by WPeMatico

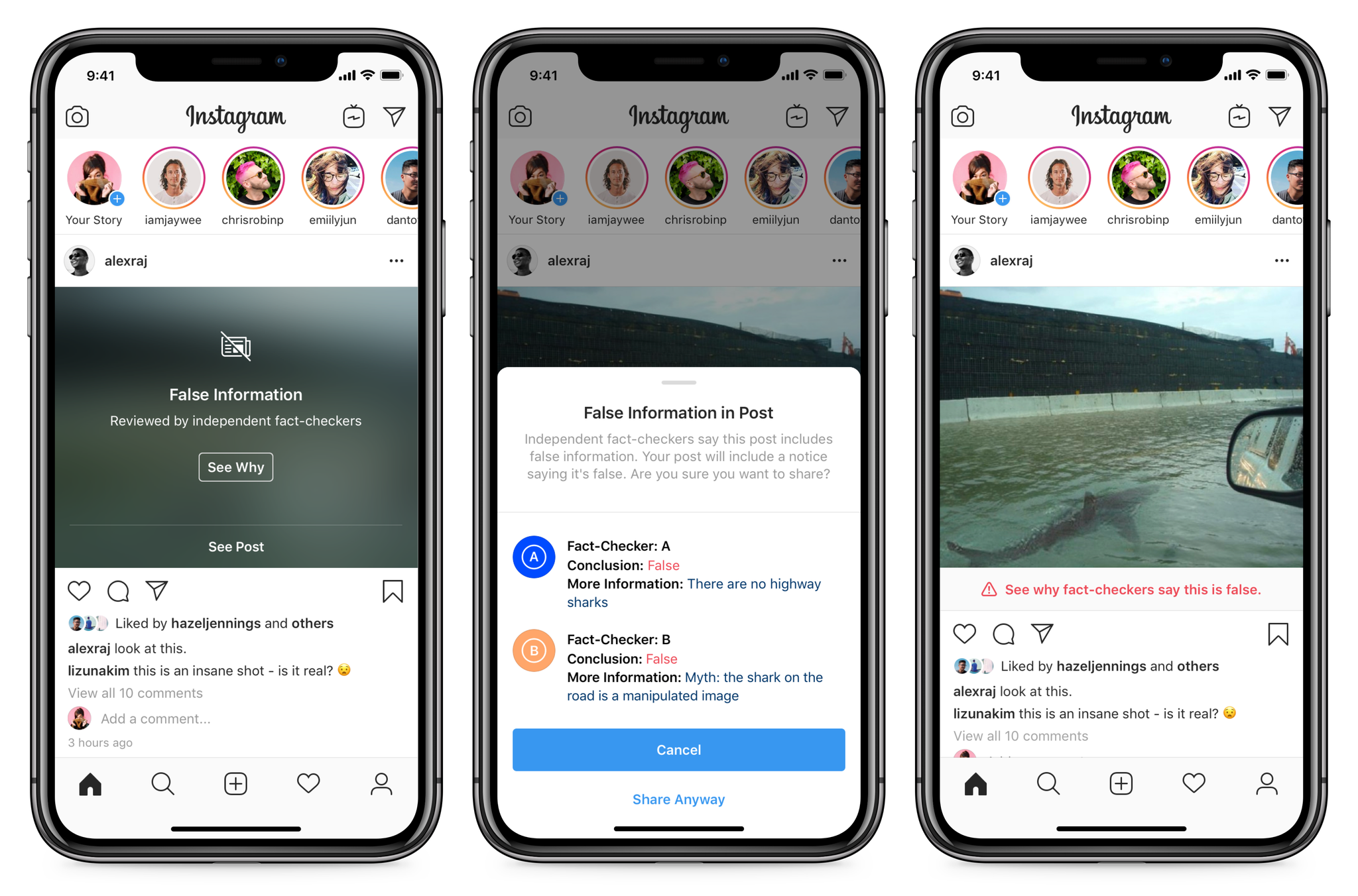

Instagram is giving politicians the same free rein to spread misinformation as its parent company Facebook. Instagram is expanding its limited fact-checking test in the U.S. from May and will now work with 45 third-party organizations to assess the truthfulness of photo and video content on its app. Material rated as false will be hidden from the Explore and hashtag pages, and covered with an interstitial warning blocking the content in the feed or Stories until users tap again to see the post.

This goes an important step further than Facebook’s early attempts to append warnings on links alongside content but that still let users immediately consume the misinformation. In October Facebook announced it would use a similar interstitial warning system.

Instagram will use image matching technology to find additional copies of false content and apply the same label, and do this across Facebook and Instagram content. That could become a talking point for Facebook as it tries to dissuade regulators from breaking up the company and spinning off Instagram. On the other hand, it’s a valuable economy of scale for protecting the internet. Breaking up Facebook, Instagram and WhatsApp might lead to worse enforcement through fragmented resources, though it could lead the apps to compete for the best moderation.

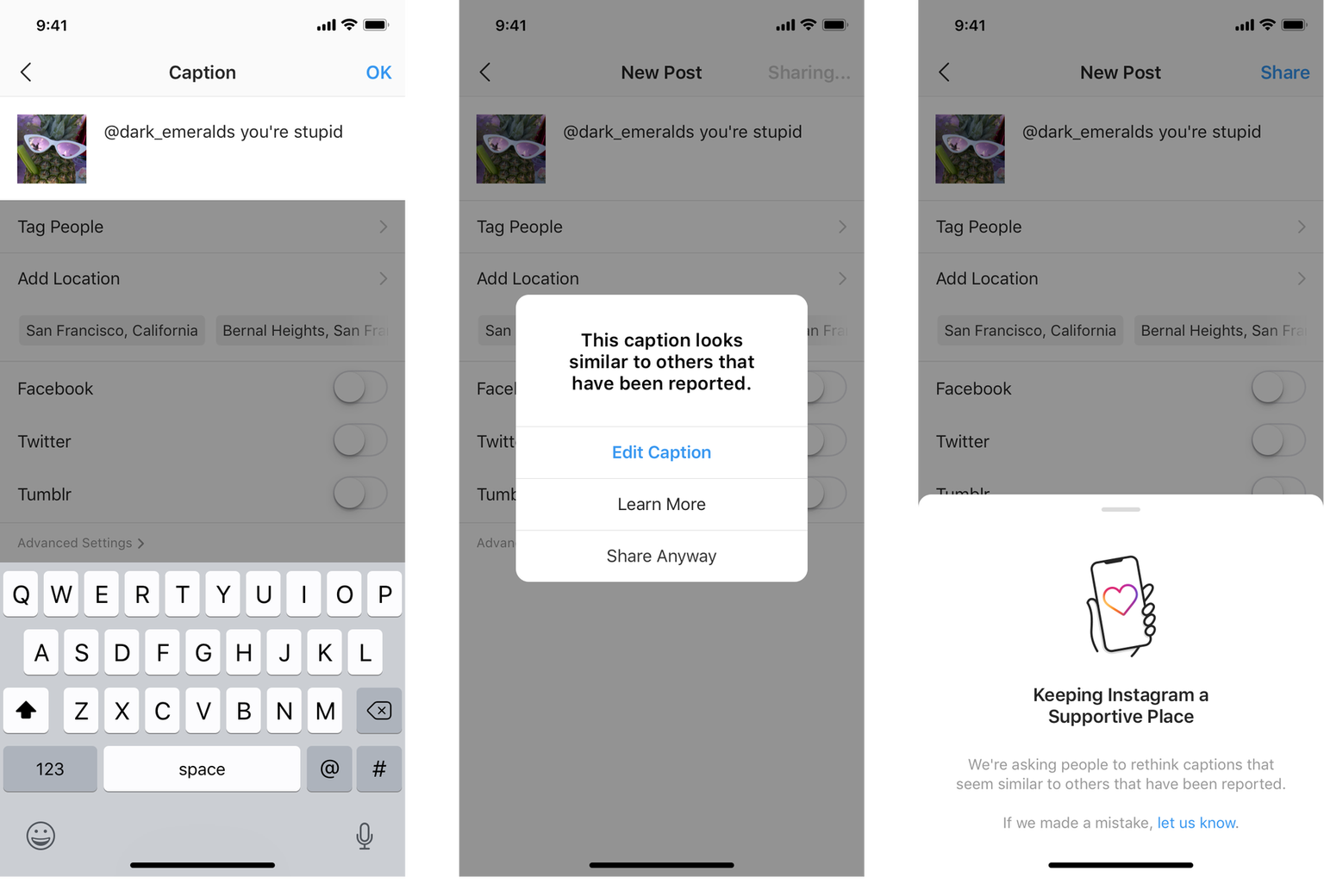

Instagram is trying to beef up its safety practices across the board. Today it began alerting users that the caption they’re about to post on a photo or video could be offensive or seen as bullying, offering them a chance to edit the text before they post it. Instagram started doing the same for comments earlier this year. Instagram is also starting to ask new users their age to make sure they’re 13 or older, which I’d previously written it needed to add since it was otherwise feigning ignorance to dodge Child Online Privacy Protection Act violation fines.

One group that’s exempt from the fact checking, though, is politicians. Their original content on Instagram, including ads, will not be sent for fact checks, even if it’s blatantly inaccurate. This aligns with Facebook’s policy that’s received plenty of backlash from critics, including TechCrunch, who say it could let candidates smear their rivals, stoke polarization and raise money through lies. Instagram CEO Adam Mosseri has maintained that banning political ads could hurt challenger candidates in need of promotion, and that it would be tough to draw the lines between political and issue ads.

Instagram is luckily less dangerous in this respect because feed posts can’t directly link out to websites where politicians could raise money. But verified users can attach links to Stories, and everyone can have one link in the profile. That means false information could still be knowingly weaponized by politicians on the app, furthering their campaigns at the expense of truth… and people’s perception that they can believe what they see on Instagram.

Powered by WPeMatico

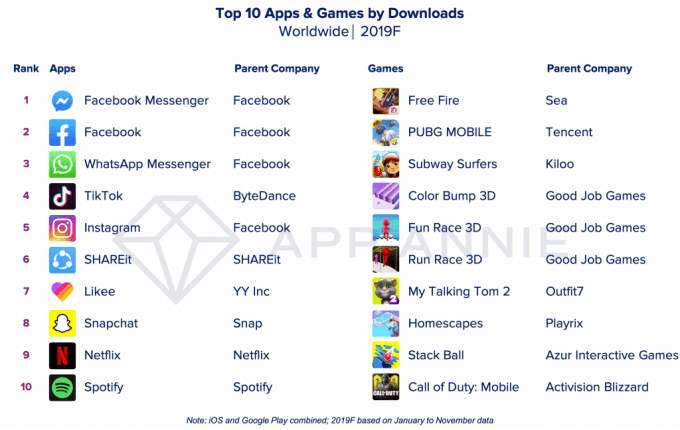

Mobile consumers worldwide will have downloaded a record 120 billion apps from Apple’s App Store and Google Play by the end of 2019, according to App Annie’s year-end report on app trends. This represents a 5% increase from 2018 — a notable achievement given that the number doesn’t include re-installations or app updates. Consumer spending on apps, meanwhile, approached $90 billion in 2019 across both app stores, up 15% from last year. The new report also examined the year’s biggest apps, including the most downloaded apps and games, as well as the most profitable.

Worldwide, the most downloaded non-game apps remained relatively consistent in 2019, with only one new entry on the list of the most downloaded apps — a short-form video creation and sharing app called Likee, which is benefiting from the overall popularity of short-form video. Elsewhere on the chart, TikTok came in at No. 4, beating out Facebook-owned Instagram, plus Snapchat, Netflix and Spotify.

However, Facebook still owned the top of the charts. Its Messenger app was the most downloaded non-game app of 2019, followed by Facebook’s main app, then WhatsApp.

The top 10 games chart showed more volatility in 2019, as seven out of the top 10 games were new to the chart this year. This included the hyper-casual title Fun Race 3D, as well as the anticipated Call of Duty: Mobile, representing the battle royale genre.

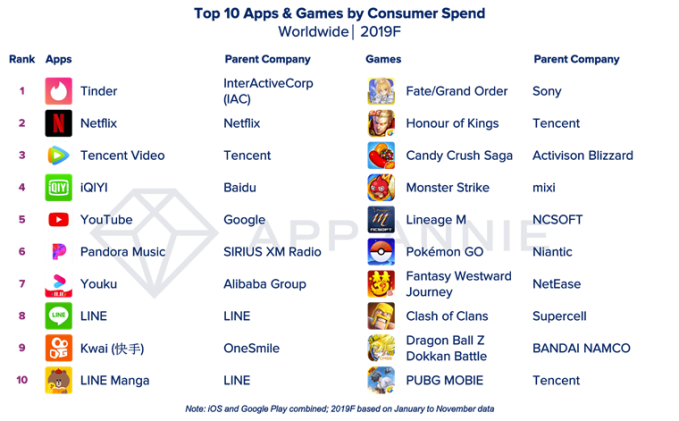

While mobile gaming drives the majority of consumer spending on apps, the subscription economy in 2019 played a big role in increasing app revenues, as well.

Specifically, the non-game apps driving revenue growth this year included those in the Photo & Video and Entertainment categories — a trend App Annie predicts will continue in 2020, as new video services, like Disney+, continue to rise. 2020 will additionally see the launch of several other video services, including HBO Max, NBCU’s Peacock and Jeffrey Katzenberg’s Quibi, which could aid in those increases.

Already, many of the top apps are subscription-based, App Annie had previously noted. During the 12 months ending in September 2019, more than 95% of the top 100 non-gaming apps by consumer spend were offering subscriptions through in-app purchases. Publishers’ growing use of subscription services will continue in 2020 to drive consumer spending even higher, the firm says.

This year, Tinder switched places with Netflix for the No. 1 spot on this chart — last year, it was the other way around. HBO NOW, which saw a surge in spending thanks to “Game of Thrones,” also fell out of the top chart this year, allowing LINE Manga to take its spot. Tencent Video and iQIYI have the same positions as 2018, while YouTube grew from No. 7 to No. 5, and Pandora slipped from No. 5 to No. 6 compared with last year.

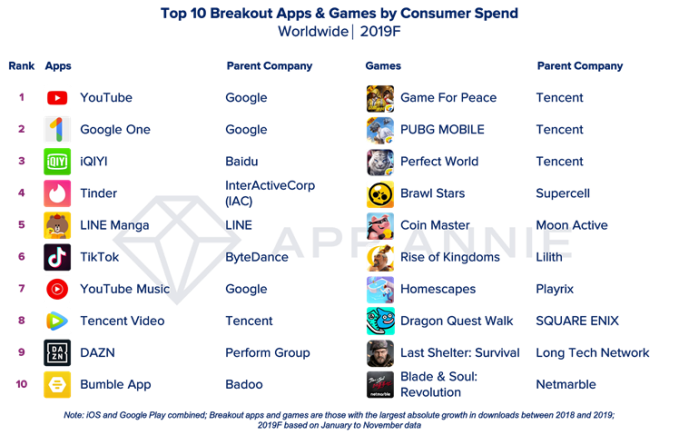

App Annie also took a look at a new category of apps that it’s calling the “breakout” apps of the year. These are those that saw the largest absolute growth in downloads or consumer spending between 2018 and 2019. On this list, the No. 7 most-downloaded app of the year, Likee, from YY Inc., becomes the No. 1 “breakout” app of the year, followed by YY Inc.’s Noizz and Helo. Meanwhile, Indian users drove the adoption of social gaming app Hago at No. 4, which is also popular with Gen Z users in Indonesia.

Breakout apps by consumer spending included YouTube, iQIYI, DAZN and Tencent Video — similar to the top 10 list.

On the gaming side, hyper-casual titles were successful, claiming seven out of 10 slots on the breakout games of the year chart. Hot releases like Mario Kart Tour and Call of Duty: Mobile also appeared. But by consumer spending, core games like No. 1 Game for Peace and No. 2 PUBG Mobile, both published by Tencent, made up the top spots.

Powered by WPeMatico

Here’s a nice little surprise for Android users this weekend. It seems that Google’s pans to roll out Rich Communication Services (RCS) messaging is slightly ahead of schedule. The company announced in November that it would be making the feature available for all Android users in the country by year-end.

A tweet from Android Messages product manager Sanaz Ahari confirms that the SMS-successor has been made available to users in the States as of this week. The new protocol brings with it some key advances over messaging stalwart, SMS.

Hi everyone! RCS is now available to all users in US as of Monday. Make sure to update both Messages and Carrier Services.

— Sanaz (@sanazahari) December 12, 2019

The update brings a lot of features that many have been compared to iMessage, Apple’s standard protocol that’s done a good keeping many users onboard with iOS, for fear of becoming a green bubble. Key features include read receipts, the ability to see another user typing in real-time, larger file transfers and improved group messaging (though, as noted, some features like end to end encryption are still lacking).

Notably back in October, the U.S.’s four primary carriers formed a rare joint effort to accelerate the adoption of RCS. Both the Messages app and carrier services have to be updated to get access. Users in the U.K. and France also have access to the feature as of this summer, with more countries coming soon.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today we’re taking stock of a cohort of special companies: still-private startups that have reached $100 million in annual recurring revenue (ARR). Our goal is to understand which startup companies are actually exceptional. This late in the unicorn era, hundreds of companies around the world have reached a valuation of $1 billion, making the achievement somewhat pedestrian.

Reaching $100 million in ARR, however, still stands out.

We explored the idea earlier this week, citing Asana, Druva and WalkMe as private companies that recently reached $100 million ARR. In addition to that trio, Bill.com and Sprout Social, both of which went public this week, also crossed the nine-figure annual recurring revenue mark in 2019.

After we posted that short list, four other companies either just shy of $100 million ARR, or with a little bit more, reached out to TechCrunch, touting their own successes. Given that our point was that companies which reach the revenue threshold million are neat, it’s worth taking a moment to look at the other companies joining the $100 million ARR club.

For extra fun I got on the phone with a number of their CEOs to chat about their progress. We’ll start with a look at a company that is nearly a member of the club, and then talk about a few that recently punched their membership cards.

To be frank, I did not know that GitLab was as large as it is. Backed by more than $400 million in private capital, GitLab competes with the now-purchased GitHub as a developer resource and service. Its backers include Goldman Sachs, ICONIQ, GV, August Capital and Khosla.

GitLab became a unicorn back in September of 2018, when it raised $100 million at a $1 billion post-money valuation. Its more recent $268 million Series E raised this September pushed that valuation to nearly $2.8 billion.

It’s a good company for us to include, as it provides a good example of how far in advance a $1 billion valuation can precede a $100 million ARR business; in GitLab’s case, provided that it grows as expected, its unicorn valuation came nearly 1.5 years before reaching nine-figure ARR.

To understand more about the company’s growth, we caught up with its CEO Sid Sijbrandij (full discussion here), learning that he views the unicorn tag as a way to help a company brand itself, but something that is outside of his company’s control. Revenue, in his view, is “much more within your control.” According to Sijbrandij, GitLab is aiming for $1 billion in revenue in 2023 and has a November, 2020 IPO targeted.

GitLab is sharing its impending ARR milestone as it runs its whole business very transparently (hence why my chat with its CEO was live-streamed, and archived on YouTube). It will be super interesting to see if the company hits the ARR target on time, and then if it can also stick the landing with a Q4 2020 IPO.

Egnyte, a player in the enterprise productivity, storage and security spaces, has kept growing since its $75 million Series E it raised last October.

The company, backed by Goldman Sachs (again), GV (again) and Kleiner Perkins, has raised just $137.5 million to date. Reaching $100 million ARR on that level of funding means that Egnyte has run efficiently as a business. In fact, as TechCrunch has reported, Egnyte has occasionally made money on its path to the public markets.

TechCrunch has spoken to Egnyte’s CEO Vineet Jain a number of times, but it seemed appropriate to get him back on the phone now that his company is nearly ready to go public (at least in terms of size). According to Jain, in fresh data released to Extra Crunch:

Powered by WPeMatico

Reliance Industries, one of India’s largest industrial houses, has acquired a majority stake in NowFloats, an Indian startup that helps businesses and individuals build online presence without any web developing skills.

In a regulatory filing on Thursday, Reliance Strategic Business Ventures Limited said (PDF) it has acquired an 85% stake in NowFloats for 1.4 billion Indian rupees ($20 million).

Seven-and-a-half-year old, Hyderabad-headquartered NowFloats operates an eponymous platform that allows individuals and businesses to easily build an online presence. Using NowFloats’ services, a mom and pop store, for instance, can build a website, publish their catalog, as well as engage with their customers on WhatsApp.

The startup, which has raised about 12 million in equity financing prior to today’s announcement, claims to have helped over 300,000 participating retail partners. NowFloats counts Blume Ventures, Omidyar Network, Iron Pillar, IIFL Wealth Management, and Hyderabad Angels among its investors.

Last year, NowFloats acquired LookUp, an India-based chat service that connects consumers to local business — and is backed by Vinod Khosla’s personal fund Khosla Impact, Twitter co-founder Biz Stone, Narayana Murthy’s Catamaran Ventures and Global Founders Capital.

Reliance Strategic Business Ventures Limited, a wholly-owned subsidiary of Reliance Industries, said that it would invest up to 750 million Indian rupees ($10.6 million) of additional capital into the startup, and raise its stake to about 89.66%, if NowFloats achieves certain unspecified goals by the end of next year.

In a statement, Reliance Industries said the investment will “further enable the group’s digital and new commerce initiatives.” NowFloats is the latest acquisition Reliance has made in the country this year. In August, the conglomerate said it was buying a majority stake in Google-backed Fynd for $42.3 million. In April, it bought a majority stake in Haptik in a deal worth $100 million.

There are about 60 million small and medium-sized businesses in India. Like hundreds of millions of Indians, many in small towns and cities, who have come online in recent years thanks to world’s cheapest mobile data plans and inexpensive Android smartphones, businesses are increasingly building online presence as well.

But vast majority of them are still offline, a fact that has created immense opportunities for startups — and VCs looking into this space — and major technology giants. New Delhi-based BharatPe, which helps merchants accept online payments and provides them with working capital, raised $50 million in August. Khatabook and OkCredit, two digital bookkeeping apps for merchants, have also raised significant amount of money this year.

In recent years, Google has also looked into the space. It has launched tools — and offered guidance — to help neighborhood stores establish some presence on the web. In September, the company announced that its Google Pay service, which is used by more than 67 million users in India, will now enable businesses to accept digital payments and reach their customers online.

Powered by WPeMatico

Amazon is having another go at expanding its reach to listeners in India. The company, which launched pay-to-use Audible in the country last year, today introduced a new service called Audible Suno that offers free access to “hundreds of hours of audio entertainment, enlightenment and learning.”

And it’s banking on major Indian celebrities to draw the listeners.

Audible Suno, which is exclusively available to users in India, features more than 60 original and exclusive episodes (of 20 to 60 minutes in length) in both Hindi and English languages. Audible, the world’s largest seller and producer of audio content, said Suno is aimed at filling the “idle time” listeners have each day during their commutes and performing other daily chores.

The company says Audible Suno, available to users through a dedicated Android app and via iOS Audible app, is also free of advertisements.

The launch of Audible Suno in India illustrates the commitment the company has in the country, said Audible founder and chief executive Don Katz. Amazon has invested more than $5.5 billion in its business in India to date. The company’s tentacles today reach a number of categories in the country, including e-commerce, payments, online ticketing business, video and audio streaming and VC deals.

“I’ve always been passionate about the transformative power of the spoken word, and I’m delighted to be able to offer this breadth of famous voices and culturally resonant genres with unlimited access, ad-free and free of charge,” said Katz.

Who are these famous voices you ask? Here’s the list: Amitabh Bachchan, Katrina Kaif, Karan Johar, Anil Kapoor, Farhan Akhtar, Mouni Roy, Anurag Kashyap, Neelesh Misra, Tabu, Nawazuddin Siddiqui, Diljit Dosanjh, Vir Das and Vicky Kaushal.

Audible Suno currently offers shows in a range of genres, including horror (Kaali Awaazein), romance and relationships (Matrimonial Anonymous and Piya Milan Chowk), suspense (Thriller Factory) and comedy series (The Unexperts by Abish Mathew). Non-fiction series include interviews with some of the country’s biggest stars, and socially relevant subjects such as mental health, sex education and the rights of the LGBTQI+ community.

Powered by WPeMatico

One share of Amazon stock costs more than $1,700, locking out less-wealthy investors. So to continue its quest to democratize stock trading, Robinhood is launching fractional share trading this week. This lets you buy 0.000001 shares, rounded to the nearest penny, or just $1 of any stock, with zero fee.

The ability to buy by millionth of a share lets Robinhood undercut Square Cash’s recently announced fractional share trading, which sets a $1 minimum for investment. Robinhood users can sign up here for early access to fractional share trading. “One of our core values is participation is power,” says Robinhood co-CEO Vlad Tenev. “Everything we do is rooted in this. We believe that fractional shares have the potential to open up investing for even more people.”

Fractional share trading ensures no one need be turned away, and Robinhood can keep growing its user base of 10 million with its war chest of $910 million in funding. As incumbent brokerages like Charles Schwab and E*Trade move to copy Robinhood’s free stock trading, the startup has to stay ahead in inclusive financial tools. In this case, though, it’s trying to keep up, since Schwab, Square, Stash and SoFi all launched fractional shares this year. Betterment has actually offered this since 2010.

Robinhood has a bunch of other new features aimed at diversifying its offering for the not-yet-rich. Today its Cash Management feature it announced in October is rolling out to its first users on the 800,000-person wait list, offering them 1.8% APY interest on cash in their Robinhood balance plus a Mastercard debit card for spending money or pulling it out of a wide network of ATMs. The feature is effectively a scaled-back relaunch of the botched debut of 3% APY Robinhood Checking a year ago, which was scuttled because the startup failed to secure the proper insurance it now has for Cash Management.

Additionally, Robinhood is launching two more widely requested features early next year. Dividend Reinvestment Plan (DRIP) will automatically reinvest into stocks or ETF cash dividends Robinhood users receive. Recurring Investments will let users schedule daily, weekly, bi-weekly or monthly investments into stocks. With all this, and Crypto trading, Robinhood is evolving into a full financial services suite that will be much harder for competitors to copy.

“We believe that if you want to invest, it shouldn’t matter how much money you have. With fractional shares, we’re opening up a whole universe of stocks and funds, including Amazon, Apple, Disney, Berkshire Hathaway, and thousands of others,” Robinhood product manager Abhishek Fatehpuria tells me.

Users will be able to place real-time fractional share orders in dollar amounts as low as $1 or share amounts as low as 0.000001 shares rounded to the penny during market hours. Stocks worth over $1 per share with a market capitalization above $25 million are eligible, with 4,000 different stocks and ETFs available for commission-free, real-time fractional trading.

“We believe that participation is power. Since day one, we’ve focused on breaking down barriers like trade commissions and account minimums to help people participate in the financial system,” says Fatehpuria. “We have a unique user base — half our customers tell us they’re first-time investors, and the median age of a Robinhood customer is 30. This means we have a unique opportunity to expand access to the markets for this new generation.”

Robinhood is racing to corner the freemium investment tool market before other startups and finance giants can catch up. It opened a waitlist for its U.K. launch next year, which will be its first international market. But in just the past month, Alpaca raised $6 million for an API that lets anyone build a stock brokerage app, and Atom Finance raised $12.5 million for its free investment research tool that could compete with Robinhood’s in-app feature. Meanwhile, Robinhood suffered an embarrassing bug, letting users borrow more money than allowed.

The move fast and break things mentality triggers new dangers when introduced to finance. Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field.

Powered by WPeMatico