Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

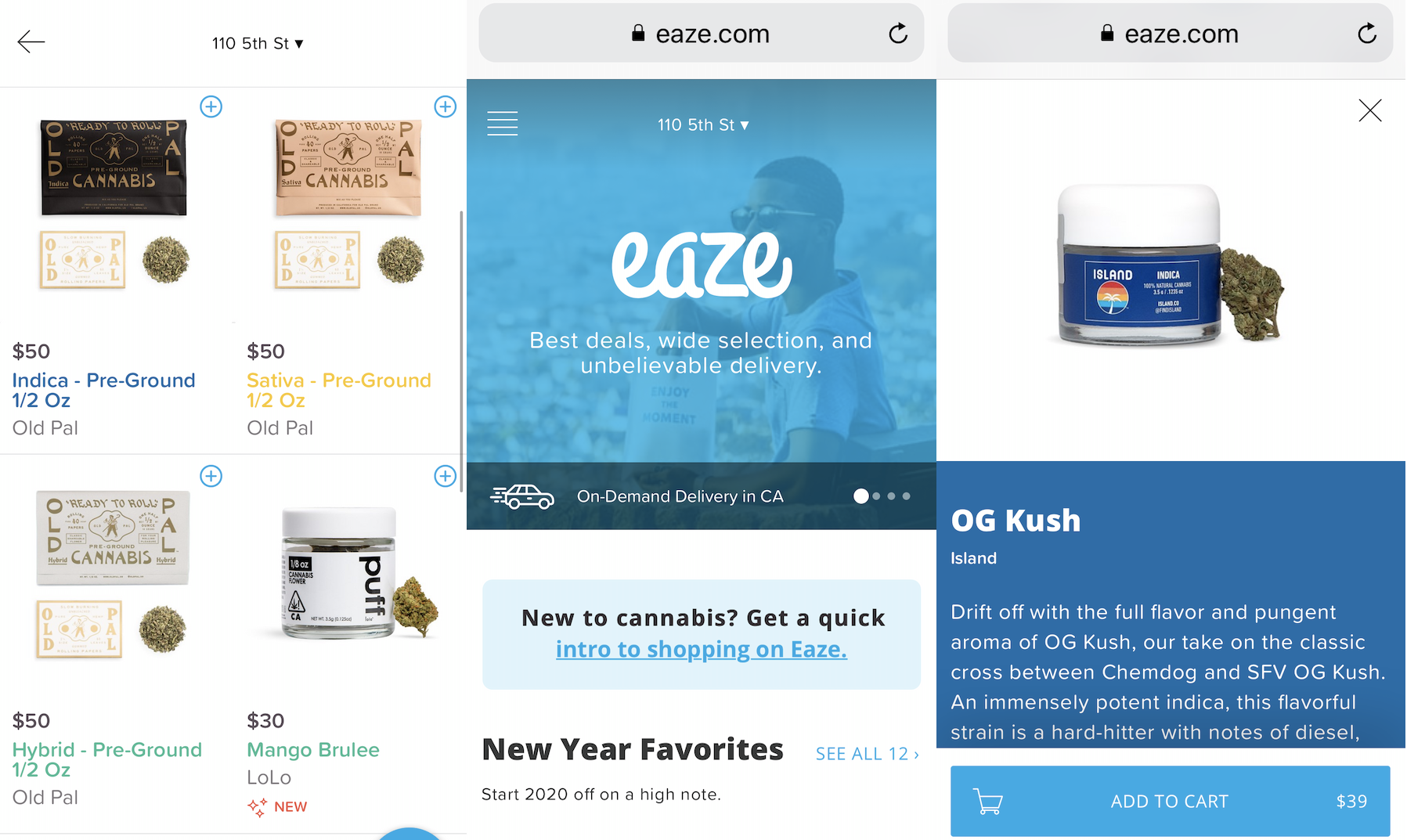

The first cannabis startup to raise big money in Silicon Valley is in danger of burning out. TechCrunch has learned that pot delivery middleman Eaze has seen unannounced layoffs, and its depleted cash reserves threaten its ability to make payroll or settle its AWS bill. Eaze was forced to raise a bridge round to keep the lights on as it prepares to attempt major pivot to ‘touching the plant’ by selling its own marijuana brands through its own depots.

TechCrunch spoke with nine sources with knowledge of Eaze’s struggles to piece together this report. If Eaze fails, it could highlight serious growing pains amid the ‘green rush’ of startups into the marijuana business.

Eaze, the startup backed by some $166 million in funding that once positioned itself as the “Uber of pot” — a marketplace selling pot and other cannabis products from dispensaries and delivering it to customers — has recently closed a $15 million bridge round, according to multiple source. The funding was meant to keep the lights on as Eaze struggles to raise its next round of funding amid problems with making decent margins on its current business model, lawsuits, payment processing issues, and internal disorganization.

An Eaze spokesperson confirmed that the company is low on cash. Sources tell us that the company, which laid off some 30 people last summer, is preparing another round of cuts in the meantime. The spokesperson refused to discuss personnel issues but noted that there have been layoffs at many late stage startups as investors want to see companies cut costs and become more efficient.

From what we understand, Eaze is currently trying to raise a $35 million Series D round according to its pitch deck. The $15 million bridge round came from unnamed current investors. (Previous backers of the company include 500 Startups, DCM Ventures, Slow Ventures, Great Oaks, FJ Labs, the Winklevoss brothers, and a number of others.) Originally, Eaze had tried to raise a $50 million Series D, but the investor that was looking at the deal, Athos Capital, is said to have walked away at the eleventh hour.

Eaze is going into the fundraising with an enterprise value of $388 million, according to company documents reviewed by TechCrunch. It’s not clear what valuation it’s aiming for in the next round.

An Eaze spokesperson declined to discuss fundraising efforts but told TechCrunch, “The company is going through a very important transition right now, moving to becoming a plant-touching company through acquisitions of former retail partners that will hopefully allow us to more efficiently run the business and continue to provide good service to customers.

The news comes as Eaze is hoping to pull off a “verticalization” pivot, moving beyond online storefront and delivery of third-party products (rolled joints, flower, vaping products and edibles) and into sourcing, branding and dispensing the product directly. Instead of just moving other company’s marijuana brands between third-party dispensaries and customers, it wants to sell its own in-house brands through its own delivery depots to earn a higher margin. With a number of other cannabis companies struggling, the hope is that it will be able to acquire brands in areas like marijuana flower, pre-rolled joints, vaporizer cartridges, or edibles at low prices.

An Eaze spokesperson confirmed that the company plans to announce the pivot in the coming days, telling TechCrunch that it’s “a pretty significant change from provider of services to operating in that fashion but also operating a depot directly ourselves.”

The startup is already making moves in this direction, and is in the process of acquiring some of the assets of a bankrupt cannabis business out of Canada called Dionymed — which had initially been a partner of Eaze’s, then became a competitor, and then sued it over payment disputes, before finally selling part of its business. These assets are said to include Oakland dispensary Hometown Heart, which it acquired in an all-share transaction (“Eaze effectively bought the lawsuit,” is how one source described the sale). This will become Eaze’s first owned delivery depot.

In a recent presentation deck that Eaze has been using when pitching to investors — which has been obtained by TechCrunch — the company describes itself as the largest direct-to-consumer cannabis retailer in California. It has completed more than 5 million deliveries, served 600,000 customers and tallied up an average transaction value of $85.

To date, Eaze has only expanded to one other state beyond California, Oregon. Its aim is to add five more states this year, and another three in 2021. But the company appears to have expected more states to legalize recreational marijuana sooner, which would have provided geographic expansion. Eaze seems to have overextended itself too early in hopes of capturing market share as soon as it became available.

An employee at the company tells us that on a good day Eaze can bring in between $800,000 and $1 million in net revenue, which sounds great, except that this is total merchandise value, before any cuts to suppliers and others are made. Eaze makes only a fraction of that amount, one reason why it’s now looking to verticatlize into more of a primary role in the ecosystem. And that’s before considering all of the costs associated with running the business.

Eaze is suffering from a problem rampant in the marijuana industry: a lack of working capital. Since banks often won’t issue working capital loans to weed-related business, deliverers like Eaze can experience delays in paying back vendors. Another source says late payments have pushed some brands to stop selling through Eaze.

Another drain on its finances have been its marketing efforts. A source said out-of-home ads (billboards and the like) allegedly were a significant expense at one point. It has to compete with other pot purchasing options like visiting retail stores in person, using dispensaries’ in-house delivery services, or buying via startups like Meadow that act as aggregated online points of sale for multiple dispensaries.

Indeed, Eaze claims that its pivot into verticalization will bring it $204 million in revenues on gross transactions of $300 million. It notes in the presentation that it makes $9.04 on an average sale of $85, which will go up to $18.31 if it successfully brings in ‘private label’ products and has more depot control.

The poor margins are only one of the problems with Eaze’s current business model, which the company admits in its presentation have led to an inconsistent customer experience and poor customer affinity with its brand — especially in the face of competition from a number of other delivery businesses.

Playing on the on-demand, delivery-of-everything theme, it connected with two customer bases. First, existing cannabis consumers already using some form of delivery service for their supply; and a newer, more mainstream audience with disposable income that had become more interested in cannabis-related products but might feel less comfortable walking into a dispensary, or buying from a black market dealer.

It is not the only startup that has been chasing that audience. Other competitors in the wider market for cannabis discovery, distribution and sales include Weedmaps, Puffy, Blackbird, Chill (a brand from Dionymed that it founded after ending its earlier relationship with Eaze), and Meadow, with the wider industry estimated to be worth some $11.9 billion in 2018 and projected to grow to $63 billion by 2025.

Eaze was founded on the premise that the gradual decriminalisation of pot — first making it legal to buy for medicinal use, and gradually for recreational use — would spread across the US and make the consumption of cannabis-related products much more ubiquitous, presenting a big opportunity for Eaze and other startups like it.

It found a willing audience among consumers, but also tech workers in the Bay Area, a tight market for recruitment.

“I was excited for the opportunity to join the cannabis industry,” one source said. “It has for the most part has gotten a bad rap, and I saw Eaze’s mission as a noble thing, and the team seemed like good people.”

Eaze CEO Ro Choy

That impression was not to last. The company, this employee was told when joining, had plenty of funding with more on the way. The newer funding never materialised, and as Eaze sought to figure out the best way forward, the company cycled through different ideas and leadership: former Yammer executive Keith McCarty, who cofounded the company with Roie Edery (both are now founders at another Cannabis startup, Wayv), left, and the CEO role was given to another ex-Yammer executive, Jim Patterson, who was then replaced by Ro Choy, who is the current CEO.

“I personally lost trust in the ability to execute on some of the vision once I got there,” the ex-employee said. “I thought that on one hand a picture was painted that wasn’t the truth. As we got closer and as I’d been there longer and we had issues with funding, the story around why we were having issues kept changing.” Several sources familiar with its business performance and culture referred to Eaze as a “shitshow”.

The quick shifts in strategy were a recurring pattern that started well before the company got tight financial straits.

One employee recalled an acquisition Eaze made several years ago of a startup called Push for Pizza. Founded by five young friends in Brooklyn, Push for Pizza had gone viral over a simple concept: you set up your favourite pizza order in the app, and when you want it, you pushed a single button to order it. (Does that sound silly? Don’t forget, this was also the era of Yo, which was either a low point for innovation, or a high point for cynicism when it came to average consumer intelligence… maybe both.)

Eaze’s idea, the employee said, was to take the basics of Push for Pizza and turn it into a weed app, Push for Kush. In it, customers could craft their favourite mix and, at the touch of a button, order it, lowering the procurement barrier even more.

The company was very excited about the deal and the prospect of the new app. They planned a big campaign to spread the word, and held an internal event to excite staff about the new app and business line.

“They had even made a movie of some kind that they showed us, featuring a caricature of Jim” — the CEO at a the time — “hanging out of the sunroof of a limo.” (I’ve been able to find the opening segment of this video online, and the Twitter and Instagram accounts that had been created for Push for Kush, but no more than that.)

Then just one week later, the whole plan was scrapped, and the founders of Push for Pizza fired. “It was just brushed under the carpet,” the former employee said. “No one could get anything out of management about what had happened.”

Something had happened, though: the company had been taking payments by card when it made the acquisition, but the process was never stable and by then it had recently gone back to the cash-only model. Push for Kush by cash was less appealing. “They didn’t think it would work,” the person said, adding that this was the normal course of business at the startup. “Big initiatives would just die in favor of pushing out whatever new thing was on the product team’s radar.”

Eaze’s spokesperson confirmed that “we did acquire Push For Pizza . . but ultimately didn’t choose to pursue [launching Push For Kush].”

Payments were a recurring issue for the startup. Eaze started out taking payments only in cash — but as the business grew, that became increasingly problematic. The company found itself kicked off the credit card networks and was stuck with a less traceable, more open to error (and theft) cash-only model at a time when one employee estimated it was bringing in between $800,000 and $1 million per day in sales.

Eventually, it moved to cards, but not smoothly: Visa specifically did not want Eaze on its platform. Eaze found a workaround, employees say, but it was never above board, which became the subject of the lawsuit between Eaze and Dionymed. Currently the company appear to only take payments via debit cards, ACH transfer, and cash, not credit card.

Another incident sheds light on how the company viewed and handled security issues.

At one point, employees allegedly discovered that Eaze was essentially storing all of its customer data — including users’ signatures and other personal information — in an Azure bucket that was not secured, meaning that if anyone was nosing around, it could be easily discovered and exploited.

The vulnerability was brought to the company’s attention. It was something that was up to product to fix, but the job was pushed down the list. It ultimately took seven months to patch this up. “I just kept seeing things with all these huge holes in them, just not ready for prime time,” one ex-employee said of the state of products. “No one was listening to engineers, and no one seemed to be looking for viable products.” Eaze’s spokesperson confirms a vulnerability was discovered but claims it was promptly resolved.

Today, the issue is a more pressing financial one: the company is running out of money. Employees have been told the company may not make its next payroll, and AWS will shut down its servers in two days if it doesn’t pay up.

Eaze’s spokesperson tried to remain optimistic while admitting the dire situation the company faces. “Eaze is going to continue doing everything we can to support customers and the overall legal cannabis industry. We’re excited about the future and acknowledge the challenges that the entire community is facing.”

As medicinal and recreational marijuana access became legal in some states in the latter 2010s, entrepreneurs and investors flocked to the market. They saw an opportunity to capitalize on the end of a major prohibition — a once in a lifetime event. But high government taxes, enduring black markets, intense competition, and a lack of financial infrastructure willing to deal with any legal haziness have caused major setbacks.

While the pot business might sound chill, operations like Eaze depend on coordinating high-stress logistics with thin margins and little room for error. Plenty of food delivery startups from Sprig to Munchery went under after running into similar struggles, and at least banks and payment processors would work with them. With the odds stacked against it, Eaze has a tough road ahead.

Powered by WPeMatico

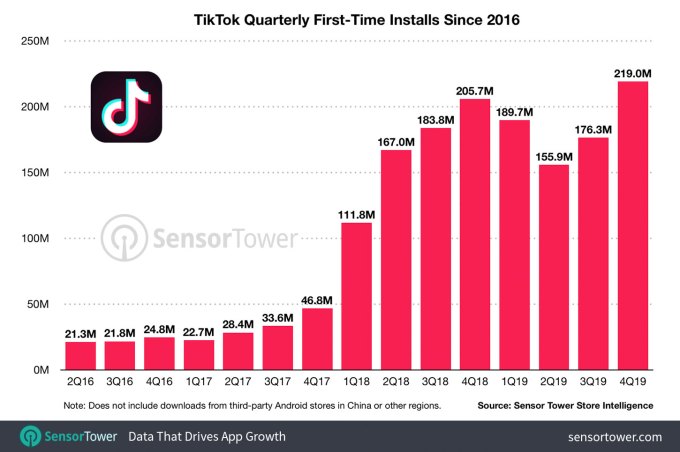

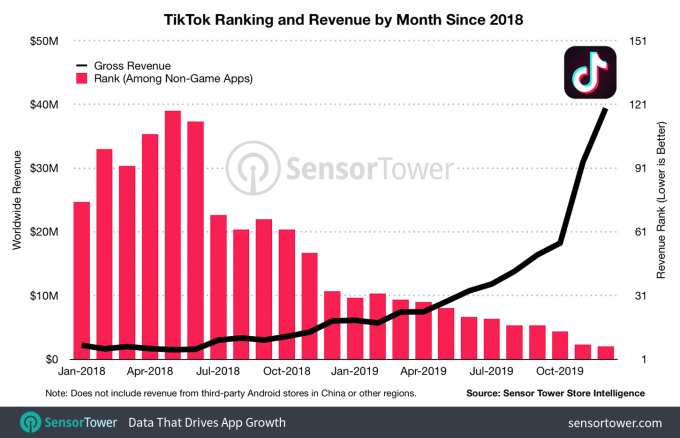

Despite the U.S. government’s concerns over TikTok, which most recently led to the U.S. Navy banning service members’ use of the app, TikTok had a stellar 2019 in terms of both downloads and revenue. According to new data from Sensor Tower, 44% of TikTok’s total 1.65 billion downloads to date, or 738+ million installs, took place in 2019 alone. And though TikTok is still just experimenting with different means of monetization, the app had its best year in terms of revenue, grossing $176.9 million in 2019 — or 71% of its all-time revenue of $247.6 million.

Apptopia had previously reported TikTok was generating $50 million per quarter.

The number of TikTok downloads in 2019 is up 13% from the 655 million installs the app saw in 2018, with the holiday quarter (Q4 2019) being TikTok’s best ever, with 219 million downloads, up 6% from TikTok’s previous best quarter, Q4 2018. TikTok was also the second-most downloaded (non-game) app worldwide across the Apple App Store and Google Play in 2019, according to Sensor Tower data.

However, App Annie’s recent “State of Mobile” report put it in fourth place, behind Messenger, Facebook and WhatsApp — not just behind WhatsApp, as Sensor Tower does.

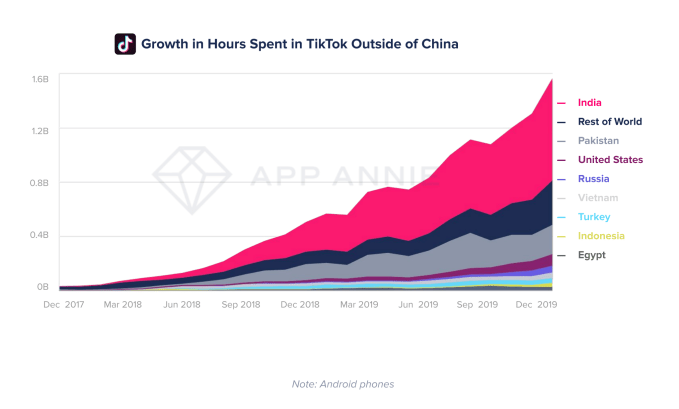

Regardless, the increase in TikTok downloads in 2019 is largely tied to the app’s traction in India. Though the app was briefly banned in the country earlier in the year, that market still accounted for 44% (or 323 million) of 2019’s total downloads. That’s a 27% increase from 2018.

TikTok’s home country, China, is TikTok’s biggest revenue driver, with iOS consumer spend of $122.9 million, or 69% of the total and more than triple what U.S. users spent in the app ($36 million). The U.K. was the third-largest contributor in terms of revenue, with users spending $4.2 million in 2019.

These numbers, however, are minuscule in comparison with the billions upon billions earned by Facebook on an annual basis, or even the low-digit billions earned by smaller social apps like Twitter. To be fair, TikTok remains in an experimental phase with regards to revenue. In 2019, it ran a variety of ad formats, including brand takeovers, in-feed native video, hashtag challenges and lens filters. It even dabbled in social commerce.

Meanwhile, only a handful of creators have been able to earn money in live streams through tipping — another area that deserves to see expansion in the months ahead if TikTok aims to take on YouTube as a home for creator talent.

When it comes to monetization, TikTok is challenged because it doesn’t have as much personal information about its users, compared with a network like Facebook and its rich user profile data. That means advertisers can’t target ads based on user interests and demographics in the same way. Because of this, brands will sometimes forgo working with TikTok itself to deal directly with its influencer stars, instead.

What TikTok lacks in revenue, it makes up for in user engagement. According to App Annie, time spent in the app was up 210% year-over-year in 2019, to reach a total 68 billion hours. TikTok clearly has users’ attention, but now it will need to figure out how to capitalize on those eyeballs and actually make money.

Reached for comment, TikTok confirmed it doesn’t share its own stats on installs or revenue, so third-party estimates are the only way to track the app’s growth for now.

Powered by WPeMatico

French startup Lydia is raising a $45 million Series B round (€40 million). Tencent is leading the round with existing investors CNP Assurances, XAnge and New Alpha also participating.

If you live in France, chances are you already know Lydia quite well. The company has become a ubiquitous mobile payment app, especially for people under 30 years old. Think about it as a sort of Square Cash or Venmo, but for France.

“At first, we wanted to raise less but we ended up raising more,” Lydia co-founder and CEO Cyril Chiche told me in a phone interview.

The company has managed to attract 3 million users in France. More impressive, 25% of French people between 18 and 30 years old have a Lydia account — and 5,000 people sign up every day. Lydia currently has 90 employees.

More recently, the company has expanded beyond peer-to-peer payment. First, the company wants to help you manage your money in many different ways with an important value — everything should happen in real time.

You can create multiple Lydia accounts to put some money aside or use money in that sub-account for a specific purpose. That feature alone turns the app into a versatile money management app.

For instance, you can associate a Lydia payment card with a Lydia account and a virtual card with another Lydia account — that virtual card works with Apple Pay, Google Pay, Samsung Pay and more. You can change those settings in real time.

You can share accounts with other Lydia users. And shared accounts are truly shared — everyone can top up and withdraw money from that account. You can spend directly from that account or withdraw money to another account.

You can also turn any Lydia account into a money pot account. In just a few taps, you can generate a link and share it with your friends so that they can add money using their regular payment card or a Lydia account.

More recently, the company has introduced “the market”, a marketplace of other financial products. From the Lydia app, you can borrow up to €1,000 in just a few seconds. You can also insure your phone and other mobile devices. You can get some free credit when you open a bank account, insure your home with Luko, switch to another electricity and gas provider, compare mobile phone and internet providers and more.

And that strategy is going to be key in the future. “We have an ambitious goal, which is turning Lydia into a mobile financial service app,” Chiche said.

He also pointed out that the company that has been the most successful when it comes to creating a mobile marketplace of financial products is Tencent with WeChat.

“Tencent is also the number one player in the video game industry, and there’s no industry with as much user engagement,” Chiche said. Tencent acquired Supercell, bought 40% of Epic Games, acquired Riot Games (League of Legends), invested in Ubisoft, Activision Blizzard, Discord, etc. Lydia hopes that it can learn from Tencent on the user engagement front.

Compared to many fintech startups, Lydia doesn’t want to replace banks altogether — the company says it wants to build a meta-banking app. Peer-to-peer payments represent the top of the funnel and a great user acquisition strategy thanks to networking effects.

You can then connect your Lydia account with your bank account and your debit card. This way, you can send money back and forth between your Lydia accounts and your bank account. As a user, that strategy slowly pays off over time. After a while, you end up spending money directly from your Lydia account and relying more heavily on Lydia’s native payment features, with your bank account acting as a money back end.

At the bottom of the funnel, Lydia hopes that it can turn active Lydia users into paid customers with a handful of in-house and third-party financial products. In other words, Lydia doesn’t want to become a credit institution like a traditional bank, it wants to become a financial hub. Expanding the marketplace will be a big focus for the company going forward.

While Lydia is available in other European countries, Lydia is still massively used in its home market with other markets lagging behind. With today’s funding round, growth in foreign countries is going to be the second key topic.

Powered by WPeMatico

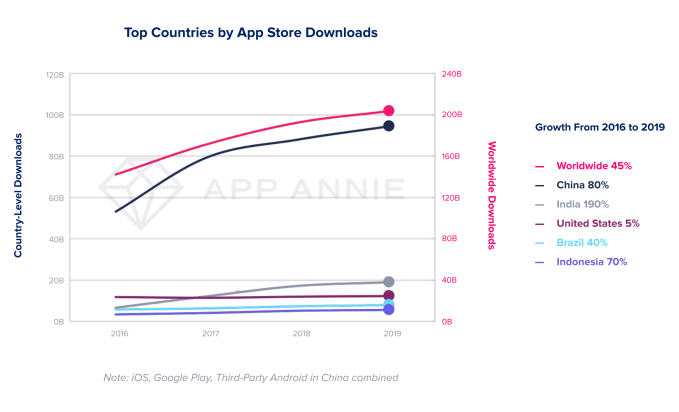

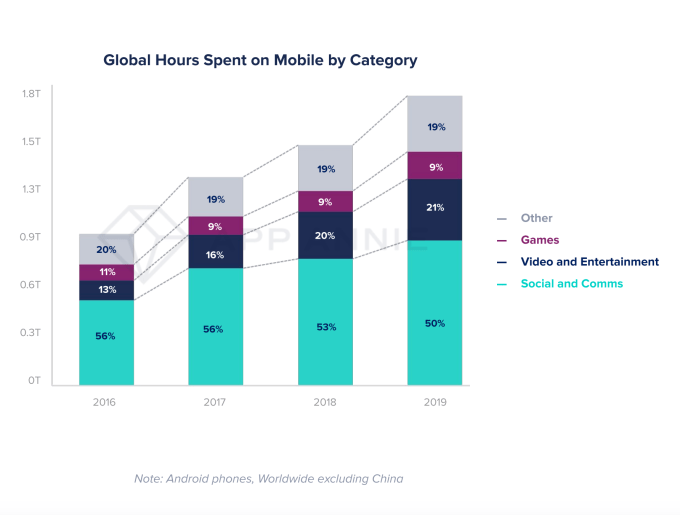

Consumers downloaded a record 204 billion apps in 2019, up 6% from 2018 and up 45% since 2016, and spent $120 billion on apps, subscriptions and other in-app spending in the past year. The average mobile user, meanwhile, is spending 3.7 hours per day using apps. This data and more comes from App Annie’s annual report, “State of Mobile,” which highlights the biggest app trends for the past year, and sets forecasts for the years ahead.

According to App Annie, the record growth in mobile downloads in 2019 can be attributed to the growth taking place in emerging markets like India, Brazil and Indonesia, which have seen downloads soar 190%, 40% and 70%, respectively, since 2016. Meanwhile, download growth in the U.S. has slowed to just 5% during that same time, while China saw 80% growth.

That doesn’t mean users in mature markets aren’t downloading apps, only that the growth in year-over-year download numbers is starting to level off. Still, these more mature markets continue to see large numbers of installs, with more than 12.3 billion downloads in the U.S. in 2019, 2.5 billion in Japan and 2 billion in South Korea.

The record numbers are notable also, given that App Annie’s analysis excludes re-installs and app updates.

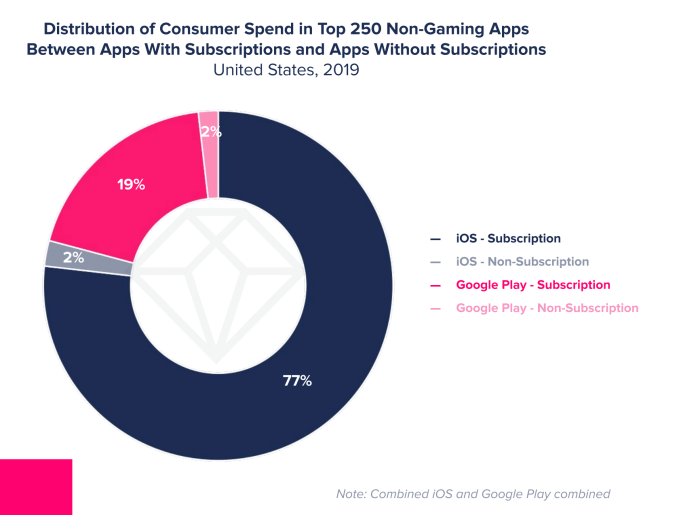

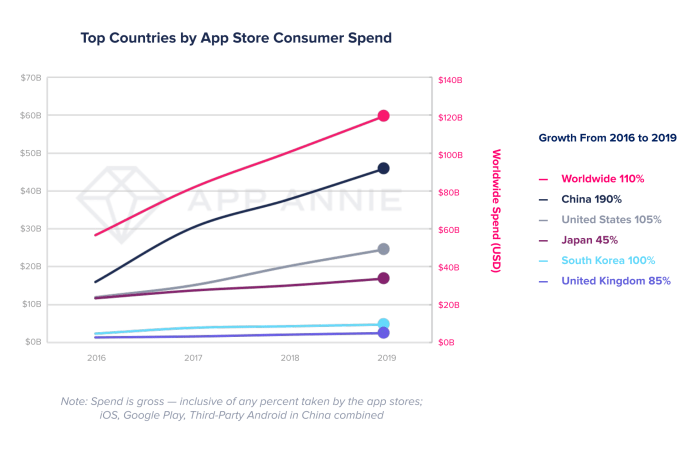

App store consumer spending was on the rise in 2019, as well, with $120 billion spent on apps — a figure that’s up 2.1x from 2016. Games continue to account for the majority (72%) of that spending, but the shift toward subscriptions has played a role, too. Last year, subscriptions in non-gaming apps accounted for 28% of consumer spending, up from 18% in 2016.

Subscriptions are now the primary way many non-gaming apps generate revenue. For example, 97% of consumer spending in the top 250 U.S. iOS apps was driven by subscriptions, and 94% of the apps used subscriptions. On Google Play, 91% of the consumer spending was subscription-based, while 79% of the top 250 apps used subscriptions.

In particular, dating apps like Tinder and video apps like Netflix and Tencent Video topped 2019’s consumer spend charts, thanks to subscription revenue.

Mature markets, including the U.S., Japan, South Korea and the U.K. are helping to fuel consumer spending across both games and subscriptions, App Annie found. But China remains the largest market by far, accounting for 40% of global spend.

App Annie also forecast that the mobile industry will contribute $4.8 trillion to the global GDP by 2023.

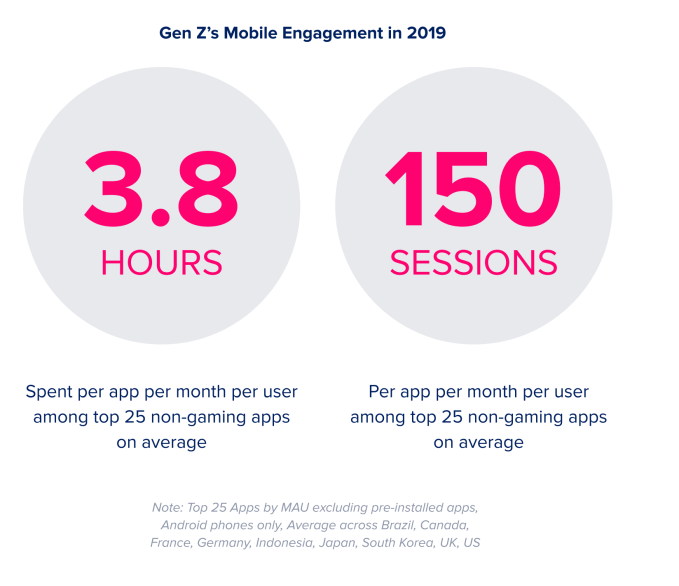

The report additionally identified several mobile trends from 2019, including the mobile app connection to the Internet of Things and smart home devices (106 million downloads for the top 20 IoT apps last year); the huge mobile engagement by Gen Z (3.8 hours per app per month, among the top 25 non-game apps, on avgerage); and mobile ad spend’s growth ($190 billion in 2019 to $240 bilion in 2020).

Ad spending combined with consumer spending is expected to reach $380 billion worldwide by 2020, App Annie forecast.

Gaming was given a big breakout section, given its contribution to consumer spending.

Consumer spending in mobile gaming was 2.4x that of Mac/PC gaming, and 2.9x more than game consoles. In 2019, mobile gaming saw 25% more spending than all other gaming, and is on track to surpass $100 billion across all app stores by next year.

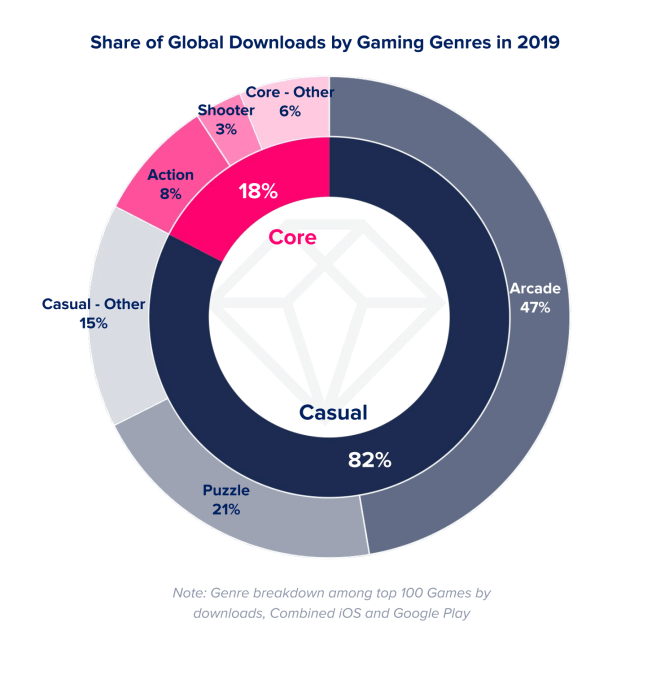

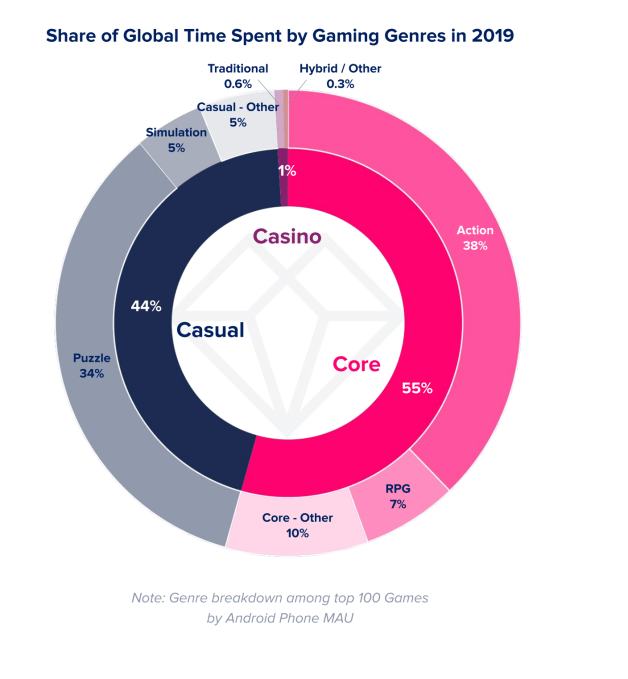

Casual gaming (led by Puzzle and Arcade) was the most downloaded type of games in 2019. Meanwhile, core games (e.g. Action, RPG, etc.) — which were only 18% of downloads — accounted for 55% of time spent in top games. PUBG Mobile was the No. 1 core game (action) on Android in 2019, in terms of time spent, while Anipop (puzzle) was the top casual game.

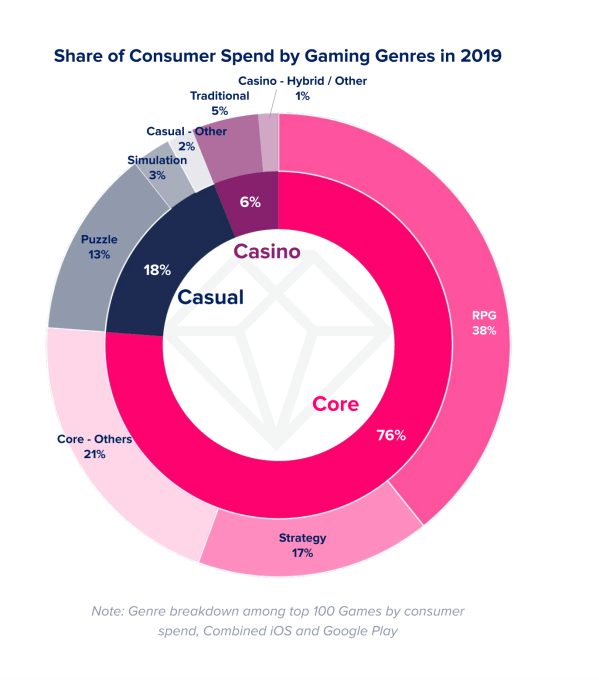

Core games also accounted for the majority (76%) of game spending, followed by casual (18%), then casino (6%).

In 2019, 17% more games surpassed $5 million in consumer spending versus 2017. And the number of games to top $100 million grew 59% compared to two years prior. Despite the sizable growth in revenues, App Annie also pointed to new models in mobile gaming, like Apple Arcade, which is giving other types of games a chance to thrive. Unfortunately, no third-party firm is able to track Arcade revenues, which will become a glaring blind spot for App Annie in the years ahead.

App Annie also examined other sizable segments of the mobile market for trends, including fintech, retail, streaming and social. Some of the more significant findings included: the fintech app user base growth topping that of traditional banking apps; shopping app downloads saw 20% year-over-year growth to reach 5.4 billion downloads; streaming growth that included 50% sessions in 2019 compared to 2017; and 50% of time spent on mobile was spent in social networking and communication apps.

TikTok was given special attention, given its rapid growth last year. Time spent in the short-form video app grew 210% year-over-year in 2019 globally. Even though eight out of every 10 minutes spent in TikTok were by users in China, the app’s usage skyrocketed in other markets as well, App Annie said.

TikTok was given special attention, given its rapid growth last year. Time spent in the short-form video app grew 210% year-over-year in 2019 globally. Even though eight out of every 10 minutes spent in TikTok were by users in China, the app’s usage skyrocketed in other markets as well, App Annie said.

Industries App Annie identified as being transformed by mobile in 2019 included ridesharing, fast food/food delivery, dating, sports streaming, plus health and fitness. The full report offers a few more details and mobile trends for each of these.

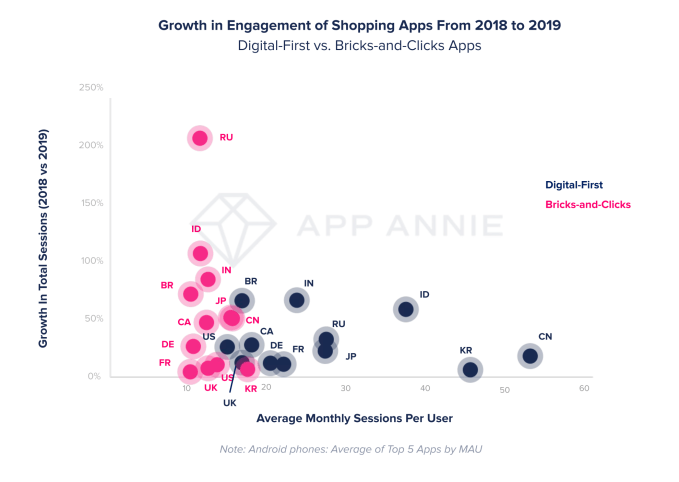

One bigger highlight was that digital-first shopping apps still had 3.2x more average monthly sessions per user compared with apps from traditional brick-and-mortar retailers (dubbed “bricks-and-clicks” apps in the report).

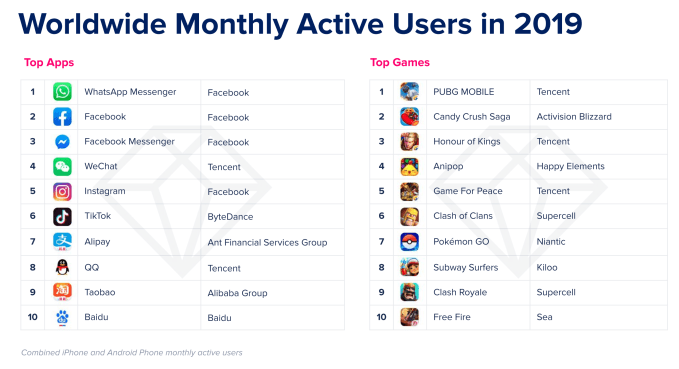

App Annie also compiled its own list of the top apps of 2019 by active users, downloads and revenue. Facebook apps still led by engagement, with WhatsApp, Facebook and Messenger in the top three spots and Instagram as No. 5. And they maintained similar positions by downloads, only swapping places with one another.

Consumer spending was a different story, with Tinder generating the most revenue in 2019, followed by entertainment and streaming apps like Netflix, Tencent Video, iQIYI, YouTube and others.

Powered by WPeMatico

Last week at the Consumer Electronics Show in Las Vegas, Quibi executives — including CEO Meg Whitman and founder/chairman Jeffrey Katzenberg — took the stage in a keynote laying out their vision for the mobile video service.

Katzenberg is a longtime Hollywood executive who led Walt Disney Studios during its animation renaissance in the late ’80s and early ’90s before co-founding Dreamworks Animation. Whitman worked at both Disney and Dreamworks, but she’s best known as the former CEO of eBay and Hewlett Packard Enterprise.

So it’s fitting that they presented Quibi as a company that exists at the intersection of Hollywood and Silicon Valley — as Whitman put it, creating “the very first entertainment technology platform optimized for mobile viewing.”

Powered by WPeMatico

Two co-founders of Google Pay in India are building a neo-banking platform in the country — and they have already secured backing from three top VC funds.

Sujith Narayanan, a veteran payments executive who co-founded Google Pay in India (formerly known as Google Tez), said on Monday that his startup, epiFi, has raised $13.2 million in its Seed financial round led by Sequoia India and Ribbit Capital. The round valued epiFi at about $50 million.

David Velez, the founder of Brazil-based neo-banking giant Nubank, Kunal Shah, who is building his second payments startup CRED in India, and VC fund Hillhouse Capital also participated in the round.

The eight-month-old startup is working on a neo-banking platform that will focus on serving millennials in India, said Narayanan, in an interview with TechCrunch.

“When we were building Google Tez, we realized that a consumer’s financial journey extends beyond digital payments. They want insurance, lending, investment opportunities and multiple products,” he explained.

The idea, in part, is to also help users better understand how they are spending money, and guide them to make better investments and increase their savings, he said.

At this moment, it is unclear what the convergence of all of these features would look like. But Narayanan said epiFi will release an app in a few months.

Working with Narayanan on epiFi is Sumit Gwalani, who serves as the startup’s co-founder and chief product and technology officer. Gwalani previously worked as a director of product management at Google India and helped conceptualize Google Tez. In a joint interview, Gwalani said the startup currently has about two-dozen employees, some of whom have joined from Netflix, Flipkart, and PayPal.

Shailesh Lakhani, Managing Director of Sequoia Capital India, said some of the fundamental consumer banking products such as savings accounts haven’t seen true innovation in many years. “Their vision to reimagine consumer banking, by providing a modern banking product with epiFi, has the potential to bring a step function change in experience for digitally savvy consumers,” he said.

Cash dominates transactions in India today. But New Delhi’s move to invalidate most paper bills in circulation in late 2016 pushed tens of millions of Indians to explore payments app for the first time.

In recent years, scores of startups and Silicon Valley firms have stepped to help Indians pay digitally and secure a range of financial services. And all signs suggest that a significant number of people are now comfortable with mobile payments: More than 100 million users together made over 1 billion digital payments transaction in October last year — a milestone the nation has sustained in the months since.

A handful of startups are also attempting to address some of the challenges that small and medium sized businesses face. Bangalore-based Open, NiYo, and RazorPay provide a range of features such as corporate credit cards, a single dashboard to manage transactions and the ability to automate recurring payouts that traditional banks don’t currently offer. These platforms are also known as neo-bank or challenger banks or alternative banks. Interestingly, most neo-banking platforms in South Asia today serve startups and businesses — not individuals.

Powered by WPeMatico

TikTok has spawned countless memes formats from its creative effects, challenging Instagram for the filtered video crown. Now nearly five years after launching Boomerang, Instagram’s back-and-forth video loop maker is finally getting a big update to its own editing options. Users around the globe can now add SlowMo, “Echo” blurring, and “Duo” rapid rewind special effects to their Boomerangs, as well as trim their length. This is the biggest upgrade yet for one of mobile’s most popular video creation tools.

The effects could help keep Instagram interesting. After so many years of Boomerangs, many viewers simply skip past them in Stories after the first loop since they’re so consistent. The extra visual flare of the new effects could keep people’s attention for a few more seconds and unlock new forms of comedy. That’s critical as Instagram tries to compete with TikTok, which has tons of special effects that have spawned their own meme formats.

“Starting today, people on Instagram will be able to share new SloMo, Echo and Duo Boomerang modes on Instagram” a Facebook company spokesperson tells TechCrunch. “Your Instagram camera gives you ways to express yourself and easily share what you’re doing, thinking or feeling with your friends. Boomerang is one of the most beloved camera formats and we’re excited to expand the creative ways that you can use Boomerang to turn everyday moments into something fun and unexpected.”

The new Boomerang tools can be found by swiping right on Instagram to open the Stories composer, and then swiping left at the bottom of the screen’s shutter selector. After shooting a Boomerang, an infinity symbol button atop the screen reveals the alternate effects and video trimmer. Mobile researcher Jane Manchun Wong spotted Instagram prototyping new Boomerang filters and the trimmer last year.

Typically, Boomerang captures one second of silent video which is then played forward and then in reverse three times to create a six second loop that can be shared or downloaded as a video. Here are the new effects you can add plus how Instagram described them to me in a statement:

The effects aren’t entirely original. Snapchat has offered slow-motion and fast-foward video effects since just days after the original launch of Boomerang back in 2015. TikTok meanwhile provides several motion blur filters and pixelated transitions. But since these are all available with traditional video, unlike on Instagram where they’re confined to Boomerangs, there’s more creative flexibility to use the effects to hide cuts between takes or play with people’s voices.

That’s won TikTok a plethora of ingenius memes that rely on these tools. Users high-five themselves using an Echo-esque feature, highlight action-packed moments or loud sounds with Duo-style glitch cuts, and conjure an army of doppelgangers behind them with infinity clones effect. Instagram Stories has instead focused on augmented reality face filters and classier tools like layout.

TikTok Screenshots

Hopefully we’ll see Instagram’s new editing features brought over to its main Stories and video composers. Video trimming would be especially helpful since a boring start to a Story can quickly lead viewers to skip it.

Instagram has had years of domination in the social video space. But with Snapchat finally growing again and TikTok becoming a global phenomenon, Instagram must once again fight to maintain its superiority. Now approaching 10 years old, it’s at risk of becoming stale if it can’t keep giving people ways to make hastily shot phone content compelling.

Powered by WPeMatico

PayU is acquiring a controlling stake in fintech startup PaySense at a valuation of $185 million and plans to merge it with its credit business LazyPay as the nation’s largest payments processor aggressively expands its financial services offering.

The Prosus-owned payments giant said on Friday that it will pump $200 million — $65 million of which is being immediately invested — into the new enterprise in the form of equity capital over the next two years. PaySense, which employs about 240 people, has served more than 5.5 million consumers to date, a top executive said.

Prior to today’s announcement, PaySense had raised about $25.6 million from Nexus Venture Partners, and Jungle Ventures, among others. PayU became an investor in the five-year-old startup’s Series B financing round in 2018. Regulatory filings show that PaySense was valued at about $48.7 million then.

The merger will help PayU solidify its presence in the credit business and become one of the largest players, said Siddhartha Jajodia, global head of Credit at PayU, in an interview with TechCrunch. “It’s the largest merger of its kind in India,” he said. The combined entity is valued at $300 million, he said.

PaySense enables consumers to secure long-term credit for financing their new vehicle purchases and other expenses. Some of its offerings overlap with those of LazyPay, which primarily focuses on providing short-term credit to consumers to facilitate orders on food delivery platforms, e-commerce websites and other services. Its credit ranges between $210 and $7,030.

Cumulatively, the two services have disbursed more than $280 million in credit to consumers, said Jajodia. He aims to take this to “a couple of billion dollars” in the next five years.

PaySense’s Prashanth Ranganathan and PayU’s Siddhartha Jajodia pose for a picture

As part of the deal, PaySense and LazyPay will build a common and shared technology infrastructure. But at least for the immediate future, LazyPay and PaySense will continue to be offered as separate services to consumers, explained Prashanth Ranganathan, founder and chief executive of PaySense, in an interview with TechCrunch.

“Over time, as the businesses get closer, we will make a call if a consolidation of brands is required. But for now, we will let consumers direct us,” added Ranganathan, who will serve as the chief executive of the combined entity.

There are about a billion debit cards in circulation in India today, but only about 20 million people have a credit card. (The official government figures show that about 50 million credit cards are active in India, but many individuals tend to have more than one card.)

This has meant that most Indians don’t have a traditional credit score, so they can’t secure loans and a range of other financial services from banks. Scores of startups in India today are attempting to address this opportunity by using other signals and alternative data of users — such as the kind of a smartphone a person has — to evaluate whether they are worthy of being granted some credit.

Digital lending is a $1 trillion opportunity (PDF) over the next four and a half years in India, according to estimates from Boston Consulting Group.

PayU’s Jajodia said PaySense and LazyPay will likely explore building new offerings, such as credit for small and medium businesses. He did not rule out the possibility of getting stakes in more fintech startups in the future. PayU has already invested north of half a billion dollars in its India business. Last year, it acquired Wibmo for $70 million.

“At PayU, our ambition is to build financial services using data and technology. Our first two legs have been payments [processing] and credit. We will continue to scale both of these businesses. Even this acquisition was about getting new capabilities and a strong management team. If we find more companies with some unique assets, we may look at them,” he said.

PayU leads the payments processing market in India. It competes with Bangalore-based RazorPay. In recent years, RazorPay has expanded to serve small businesses and enterprises. In November, it launched corporate credit cards and other services to strengthen its neo banking play.

Powered by WPeMatico

Mark Zuckerberg won’t be spending 2020 focused on wearing ties, learning Mandarin or just fixing Facebook. “Rather than having year-to-year challenges, I’ve tried to think about what I hope the world and my life will look in 2030,” he wrote today on Facebook. As you might have guessed, though, Zuckerberg’s vision for an improved planet involves a lot more of Facebook’s family of apps.

His biggest proclamations in today’s notes include that:

These are all reasonable predictions and suggestions. However, Zuckerberg’s post does little to address how the broadening of Facebook’s services in the 2010s also contributed to a lot of the problems he presents:

Noticeably absent from Zuckerberg’s post are explicit mentions of some of Facebook’s more controversial products and initiatives. He writes about “decentralizing opportunity” by giving small businesses commerce tools, but never mentions cryptocurrency, blockchain or Libra directly. Instead he seems to suggest that Instagram store fronts, Messenger customer support and WhatsApp remittance might be sufficient. He also largely leaves out Portal, Facebook’s smart screen that could help distant families stay closer, but that some see as a surveillance and data collection tool.

I’m glad Zuckerberg is taking his role as a public figure and the steward of one of humanity’s fundamental utilities more seriously. His willingness to even think about some of these long-term issues instead of just quarterly profits is important. Optimism is necessary to create what doesn’t exist.

Still, if Zuckerberg wants 2030 to look better for the world, and for the world to look more kindly on Facebook, he may need to hire more skeptics and cynics that see a dystopic future instead — people who understand human impulses toward greed and vanity. Their foresight on where societal problems could arise from Facebook’s products could help temper Zuckerberg’s team of idealists to create a company that balances the potential of the future with the risks to the present.

Every new year of the last decade I set a personal challenge. My goal was to grow in new ways outside my day-to-day work…

Posted by Mark Zuckerberg on Thursday, January 9, 2020

For more on why Facebook can’t succeed on idealism alone, read:

Powered by WPeMatico

At last year’s CES, Twitter introduced its first public prototype app, twttr — dubbed “little T” internally at Twitter. The app allows Twitter to develop and experiment with new features in the public, to see what works and what does not. The app’s main focus, to date, has been on making threaded conversations easier to read. Now, the company is ready to graduate the best of twttr to the main Twitter app.

“We’re taking all the different branches — all the different parts of the conversation — and we’re making it so it’s all in one global view,” explained Suzanne Xie, Twitter’s head of Conversations, speaking to reporters at CES 2020. “This means you can easily understand, and get a pulse of what’s happening in the conversation,” she added.

When the changes roll out, you’ll be able to see when the original tweet’s author is replying within a conversation thread. Twitter will also highlight people you’re following and people who are verified.

This way, Xie continues, “you can understand who is talking to who in a conversation.”

In addition, Twitter will release other features that build on top of threaded conversations to the public, including how the user interface reacts when you tap on a reply.

In addition, Twitter will release other features that build on top of threaded conversations to the public, including how the user interface reacts when you tap on a reply.

On twttr, when you tap into a reply within a conversation, you get more information about the tweet in question. You can also reply in-line to the tweet. And the reply itself is shaded to differentiate it from the surrounding tweets, when selected.

Threaded conversations also hide some of the replies to keep the conversation more readable — but you can click a link to load more of the replies as you scroll down. Twitter says it personalizes which replies are shown and hidden based on things like who you follow, who you interact with and people you’ve interacted with in the past.

“These are pieces of making this global conversation easier to use — so you don’t have to tab to new screens and go back and forth,” Xie explained.

Despite the initial excitement around Twitter’s new app, twttr, some felt the company didn’t take full advantage of having a public experimental playground. Few other new features beyond threaded conversations were tried out on the testing platform.

To some extent, Twitter’s plans could have been impacted by changes in twttr’s leadership. Twitter in August acquired Xie’s startup Lightwell. Meanwhile, Sara Haider, who had been leading the charge on rethinking the design of conversations on Twitter, which included the release of twttr, announced that she would be moving on to a new project at the company after a short break.

With twttr’s threaded conversations feature making its way to Twitter.com, the plan now is to use twttr to experiment with other conversational features.

For example, twttr may be used to try out new features in the incentives space — meaning, how small tweaks to Twitter’s user interface can influence different types of user behavior.

“Going forward, we’re investing and making a concerted effort, as we try new features and as we change different mechanics, to [determine] what we’re incentivizing and what we’re disincentivizing,” said Xie.

For instance, changing the prompts that Twitter displays when a user goes to compose a tweet or a reply could influence how they choose to respond. This is only one example of the sorts of things Twitter aims to test with Little T, as it’s called.

Twitter says the new threaded conversations features will begin to roll out on Twitter for iOS first, followed by web then Android, sometime in Q1.

Powered by WPeMatico