Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Welcome back to This Week in Apps, the Extra Crunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry is as hot as ever, with a record 204 billion downloads in 2019 and $120 billion in consumer spending in 2019, according to App Annie’s recently released “State of Mobile” annual report. People are now spending 3 hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this Extra Crunch series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week, we’re looking at the further impact of the coronavirus on the app industry, which is now leading to more major event cancellations — including, as of this week, Google I/O and SXSW. That begs the question, will WWDC be next? And what will that mean for developers who rely on the annual event to make those invaluable face-to-face connections? We’re also looking at the revised App Store review guidelines and what that means for developers, as well as Walmart’s plan to dramatically change its app strategy, Robinhood’s bad week, the launch of a new Spotify competitor from the makers of the world’s most viral app, TikTok and much more.

![]()

Apple this week alerted developers to a new set of App Store review guidelines that detail which apps will be accepted or rejected, and what apps are allowed to do. The changes to the guidelines impact reviews, push notifications, Sign in with Apple, data collection and storage, mobile device management and more, the company says. Some of the more high-profile changes include the ability for apps to now use notifications for ads, stricter rules for dating and fortune-telling apps and a new rule that allows Apple to reject apps that help users evade law enforcement, among other things.

Powered by WPeMatico

Short-form video service Quibi is announcing its full launch lineup today — exactly once month before launch.

True to its name (which stands for “quick bites”), Quibi will focus on short videos that you can watch on your phone. Its content will include “movies in chapters” (longer, scripted stories broken into chapters that are between seven and 10 minutes long), as well as unscripted shows, documentaries and daily hits of news/entertainment/inspiration.

The company, which is astoundingly well-funded and led by longtime Hollywood executive Jeffrey Katzenberg and former eBay CEO Meg Whitman, says there will be 50 shows live at launch, including:

Quibi says it will release a total of 8,500 episodes across 175 shows in its first year.

Using the company’s “Turnstyle” technology, viewers will be able to switch seamlessly between watching videos in portrait and landscape mode. In fact, some shows are designed specifically to offer different-but-complementary viewing experiences in different viewing modes.

The service will cost $4.99 per month with ads or $7.99 per month without ads. Quibi is also announcing today that it’s offering a 90-day free trial — but you’ll need to sign up on the Quibi website before the official launch on April 6.

Powered by WPeMatico

Another afternoon, another round of funding for a mobile banking app. This time, it’s Empower Finance, a San Francisco-based company that’s headed up by former Sequoia Capital partner Warren Hogarth and which just closed on $20 million in Series A funding from Icon Ventures and Defy Ventures.

David Velez, who is the founder and CEO of Nubank, the largest fintech in Latin America, also joined the round.

We’d first written about the company in 2017, when Hogarth was just getting the business off the ground. Fast-forward a bit and Empower now employs 35 people and has attracted more than 600,000 active users to its platform, says Hogarth. What has drawn them in: the company’s promise of combining AI and actual human financial planners to help millennials in particular accrue some wealth, including, more newly, through its own checking account product and through a savings account that’s currently promising 1.60% in annual percentage yield with no minimums, no overdraft fees and unlimited withdrawals.

It’s all part of an overall offering that crunches through account holders’ bank and credit card accounts, and recommends how much they save into which account, how much they should spend given their overall picture, various ways they can cut costs and where and when they’ve surpassed their pre-configured budgets.

Of course, the company has so much competition it’s dizzying, but like the various upstarts against which it’s battling for mindshare, the opportunity that Empower is chasing is enormous, too. Though companies like Chime can seem overpriced given how fast investors have marked up their rounds — Chime’s newest financing, announced in December, was done at a $5.8 billion post-money valuation, which was four times more than the company was worth at the outset of 2019 — digital banks are still tiny fish in an ocean of institutional financial services, representing something like 3% of the market.

They’re gaining more market share by the day, too, including by charging far lower fees for much more.

In Empower’s case, users pay $6 a month, but Hogarth says they also save $300 a year in additional fees they would pay a brick-and-mortar bank. He insists that on average, it also helps them save $1,300 more annually, too.

As for all those other companies — Mint, Acorns, the list goes on — Hogarth sounds surprisingly sanguine. “If you look at it from the outside, it looks crowded. But the consumer financial services in the U.S. is a $2 trillion business, and we haven’t had a fundamental shift since maybe Schwab came along 30 years ago.”

Indeed, says Hogarth, because Empower and its rivals are mobile and branchless and don’t have legacy software to contend with, they’re able to take 60 to 70% of the cost structure out of the business.

What that means on an individual company level is that even if each upstart can attract 2 to 3 million customers, they can get to a multibillion-dollar market cap. At least, that kind of math is “why there’s so much interest in this space,” says Hogarth.

It’s also why people like Nubank’s Velez, who have seen this story play out in Europe and Latin America and who are seeing the early phases of it in the U.S., are apparently keeping the money spigot open for now.

Empower had earlier raised an undisclosed amount of seed funding from Sequoia, followed by a $4.5 million round led by Initialized Capital.

Powered by WPeMatico

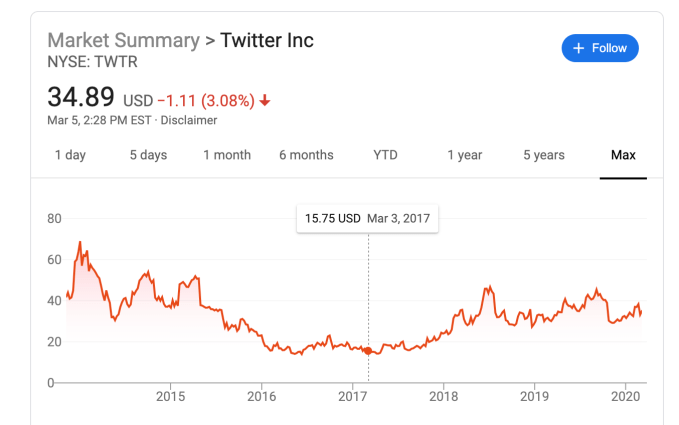

Twitter CEO Jack Dorsey might not spend six months a year in Africa, claims the real product development is under the hood and gives an excuse for deleting Vine before it could become TikTok. Today he tweeted, via Twitter’s investor relations account, a multi-pronged defense of his leadership and the company’s progress.

The proclamations come as notorious activist investor Elliott Management prepares to pressure Twitter into a slew of reforms, potentially including replacing Dorsey with a new CEO, Bloomberg reported last week. Sources confirmed to TechCrunch that Elliott has taken a 4% to 5% stake in Twitter. Elliott has previously bullied eBay, AT&T and other major corporations into making changes and triggered CEO departures.

…Focusing on one job and increasing accountability has made a huge difference for us. One of our core jobs is to keep people informed. We want to be a service that people turn to… to see what’s happening, to be a credible source that people learn from.

— Twitter Investor Relations (@TwitterIR) March 5, 2020

Specifically, Elliott is seeking change because of Twitter’s weak market performance, which as of last month had fallen 6.2% since July 2015, while Facebook had grown 121%. The corporate raider reportedly takes issue with Dorsey also running fintech giant Square, and having planned to spend up to six months a year in Africa. Dorsey tweeted that “Africa will define the future (especially the bitcoin one!),” despite cryptocurrency having little to do with Twitter.

Rapid executive turnover is another sore spot. Finally, Twitter is seen as moving glacially slow on product development, with little about its core service changing in the past five years beyond a move from 140 to 280 characters per tweet. Competing social apps like Facebook and Snapchat have made landmark acquisitions and launched significant new products like Marketplace, Stories and Discover.

Dorsey spoke today at the Morgan Stanley investor conference, though apparently didn’t field questions about Elliott’s incursion. The CEO did take to his platform to lay out an argument for why Twitter is doing better than it looks, though without mentioning the activist investor directly. That type of response, without mentioning to whom it’s directed, is popularly known as a subtweet. Here’s what he outlined:

On democracy: Twitter has prioritized healthy conversation and now “the #1 initiative is the integrity of the conversation around the elections” around the world, which it’s learning from. It’s now using humans and machine learning to weed out misinformation, yet Twitter still hasn’t rolled out labels on false news despite Facebook launching them in late 2016.

On revenue: Twitter expects to complete a rebuild of its core ad server in the first half of 2020, and it’s improving the experience of mobile app install ads so it can court more performance ad dollars. This comes seven years late to Facebook’s big push around app install ads.

On shutting down products: Dorsey claims that “5 years ago we had to do a really hard reset and that takes time to build from… we had been a company that was trying to do too many things…” But was it? Other than Moments, which largely flopped, and the move to the algorithmic feed ranking, Twitter sure didn’t seem to be doing too much and was already being criticized for slow product evolution as it tried to avoid disturbing its most hardcore users.

On stagnation: “Some people talk about the slow pace of development at Twitter. The expectation is to see surface level changes, but the most impactful changes are happening below the surface,” Dorsey claims, citing using machine learning to improve feed and notification relevance.

Yet it seems telling that Twitter suddenly announced yesterday that it was testing Instagram Stories-esque feature Fleets in Brazil. No launch event. No U.S. beta. No indication of when it might roll out elsewhere. It seems like hasty and suspiciously convenient timing for a reveal that might convince investors it is actually building new things.

On talent: Twitter is apparently hiring top engineers “that maybe we couldn’t get 3 years ago.” 2017 was also Twitter’s share price low point of $14 compared to $34 today, so it’s not much of an accomplishment that hiring is easier now. Dorsey claims that “Engineering is my main focus. Everything else follows from that.” Yet it’s been years since fail whales were prevalent, and the core concern now is that there’s not enough to do on Twitter, rather than what it does offer doesn’t function well.

On Jack himself: Dorsey says he should have added more context “about my intention to spend a few months in Africa this year,” including its growing population that’s still getting online. Yet the “Huge opportunity especially for young people to join Twitter” seemed far from his mind as he focused on how crypto trading was driving adoption of Square’s Cash App.

“I need to reevaluate” the plan to work from Africa “in light of COVID-19 and everything else going on.” That makes coronavirus a nice scapegoat for the decision while the phrase “everything else” is doing some very heavy lifting in the face of Elliott’s activist investing.

Photographer: Cole Burston/Bloomberg via Getty Images

On fighting harassment: Nothing. The fact that Twitter’s most severe ongoing problem doesn’t even get a mention should clue you in to how many troubles have stacked up in front of Dorsey.

Running Twitter is a big job. So big it’s seen a slew of leaders ranging from founders like Ev Williams to hired guns like Dick Costolo peel off after mediocre performance. If Dorsey wants to stay CEO, that should be his full-time, work-from-headquarters gig.

This isn’t just another business. Twitter is a crucial communications utility for the world. Its absence of innovation, failure to defend vulnerable users and an inability to deliver financially has massive repercussions for society. It means Twitter hasn’t had the products or kept the users to earn the profits to be able to invest in solving its problems. Making Twitter live up to its potential is no side hustle.

Powered by WPeMatico

Apple this week alerted developers to a new set of App Store Review Guidelines that detail which apps will be accepted or rejected, and what apps are allowed to do. The changes to the guidelines impact reviews, push notifications, Sign in with Apple, data collection and storage, mobile device management and more, the company says. Some of the more high-profile changes include the ability for apps to now use notifications for ads, stricter rules for dating and fortune-telling apps and a new rule that allows Apple to reject apps that help users evade law enforcement, among other things.

This latter change to police-spotting apps, surprisingly, didn’t get as much attention as push ads or changes to dating apps — though it’s among the most notable of the new rules.

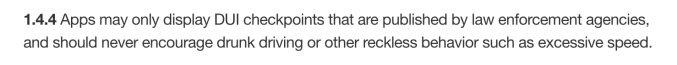

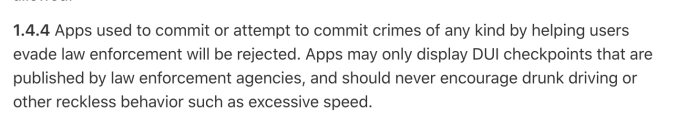

A previous version of the App Store Review Guidelines (seen in a snapshot here from January 2020) stated that apps could only display DUI checkpoints that were published by law enforcement agencies, and noted that apps shouldn’t encourage activities like “drunk driving” or “excessive speed.” These were reasonable concerns.

The revised rule (section 1.4.4.) now says that Apple will reject apps “used to commit or attempt to commit crimes of any kind by helping users evade law enforcement,” in addition to the existing language.

As you may recall, Apple last year got into hot water over its decision to reject a crowdsourced mapping app, HKmap, that was being used by Hong Kong pro-democracy protestors to evade police. Initially, the app had been approved, but was pulled a day after Apple was criticized by Chinese state media who said the app allowed “rioters…to go on violent acts.”

The app had allowed users to crowdsource information like the location of police, the use of tear gas and other details about the protests, which were added to a regularly updated map. In a statement, Apple said it removed the app when it learned it was used to “target and ambush police.”

Above: Section 1.4.4, before and after

The new App Store Review Guidelines now put into writing Apple’s final decision over this sort of app. Effectively, it bans apps that help users evade law enforcement. Arguably, avoiding police isn’t always about wanting to “commit crimes,” as the guidelines state, however. Amnesty International, for example, documented cases of police brutality, including beatings and torture of people in police detention during the Hong Kong protests. The HKmap may have also allowed users to bypass police for their own safety.

Apple’s rule, therefore, is vague enough that it still allows the company itself to make the ultimate call over how an app is being used before deciding to reject or ban it.

Other worthy-of-note changes to the guidelines include an update (section 4.5.4) that allows app developers to send marketing messages (aka ads) in their push notifications. Before, these were banned. This change was immediately hit with user outcry, but it may not be as bad as it first seems.

Clearly, many apps were already spamming their users with ads, despite the prior ban. Now, they’re being required to get customer consent within their app’s user interface and to provide an opt-out mechanism in their app that lets users turn off the push notification ads. This change will at least force reviewers to look for mechanisms and opt-outs in apps offering in-app purchases or that rely on sales to generate revenues.

“Abuse of these services may result in revocation of your privileges,” Apple also warns.

Another change adds “fortune-telling” and “dating” apps to the list of apps that are considered spam if they’re not providing a “unique, high-quality” experience. The relevant section (4.3) warns developers about the app categories that Apple thinks are oversaturated, and where it will be more critical with its reviews.

The guidelines also now include a section (5.6.1) that instruct developers on how to respond to App Store reviews, reminding them to “treat customers with respect when responding to their comments” and not include irrelevant information, personal information, spam, and marketing in their messages. The section also notes that developers must use Apple’s own API to solicit reviews, instead of other mechanisms. This will allow users to toggle off App Store review prompts across all apps from the iOS settings. This language was in the guidelines before, but was moved to 5.6.1 from 1.1.7.

Finally, Apple reminded developers that all apps going forward, including app updates, will need to use the iOS 13 SDK as of April 30, 2020. Apps will need to support the “Sign in with Apple” login/sign-up option as of that date, too.

Correction, 2/5/20, 3:20 PM ET: Clarified that section 5.6.1 is actually a relocated section 1.1.7, instead of a new addition.

Powered by WPeMatico

Bluecrew, a flexible staffing business owned by holding company IAC, is launching a new mobile app called Bluecrew Manager.

Rather than relying on a network of independent contractors, Bluecrew hires its own W-2 employees, who in turn have the option to accept hourly jobs from Bluecrew customers.

The company already offered web-based management tools for those customers, but CEO Adam Roston said the mobile app is designed to help them accomplish “the stuff you need to do right now, while you’re on-the-go.”

For example, he said that a warehouse manager spends most of their day “running around the floor,” so if they’re visiting the pick-and-pack department and need to see who’s on the team that day, they can open the app and see pictures of everyone who’s supposed to be working. And if they see that someone forgot to check in, they can adjust their time clock directly from the app.

Other features include the ability to request more workers and to “favorite” a worker, making it more likely that they’ll be assigned to the same company for future jobs.

Bluecrew says it has been testing out the Manager app (which is available for free to all customers) for the past month. In the launch announcement, Eduardo Medrano, cafe manager at hospitality company Eurest, said the app “is completely changing how I approach staffing” because it allows him “to make adjustments and check who will be there right on my phone.”

The company says that since its acquisition by IAC in 2018, its client base has nearly quadrupled, with growth in industries like logistics and manufacturing, hospitality/culinary and warehousing.

Roston also pointed to California’s new AB-5 law (which limits the ways that companies can classify workers as independent contractors) as a sign that Bluecrew has taken the right approach to combining flexibility and worker protections.

“When [co-founder and CTO Gino Rooney] started the company five years ago, it seemed a little bit crazy to be doing this with W-2 employees,” Roston said. “Over the last year. the landscape has just shifted … The reality, is most companies in the country are already following labor laws and have been at W-2 for years. But we’ve seen some increased momentum from AB-5, and we would expect to see it elsewhere.”

Powered by WPeMatico

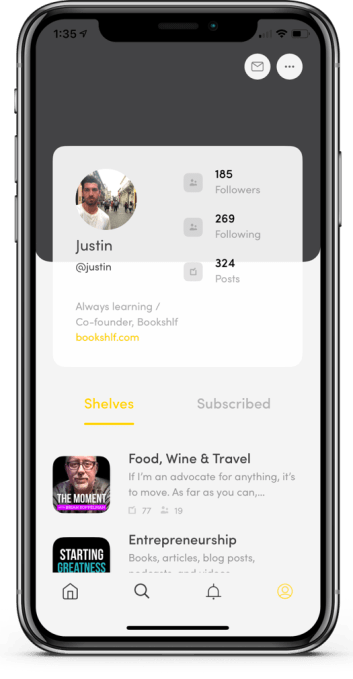

Bookshlf has created a new way for people to recommend media — whether it’s music, videos, articles, podcasts or even tweets — to their friends and to the rest of the world.

The New York-based startup is officially launching its web and iOS app this week and announcing that David A. Steinberg, co-founder and CEO of marketing company Zeta Global, has signed on as both an investor and advisor.

The big emphasis here is curation. It’s a word that comes up a lot in the media industry, but President Andrew Boggs — who previously worked in business development at Zeta, then founded Bookshlf with Mike Abend and Justin Cadelago — argued that the major internet platforms aren’t actually designed for real curation.

“A lot of the legacy platforms have focused on quantity over quality,” Boggs said. “There’s also the nature of things being really fleeting there … For example, if you are sharing stuff about music, I have to sift through your feed to find that information.”

It sounds like this idea resonated with Steinberg, who argued, “The big social media platforms do not make a living by building small groups of very interesting people. They think, ‘How do we get as much volume as possible?’”

In Bookshlf, on the other hand, users can organize their recommendations into different “shelves” based on topic, and then easily add links using the iOS Share menu (or by just adding them directly in the app). You can also share links to your shelves via social media.

Boggs, for example, has shelves tied to topics like electronic music, humor, tech/media news and even the best burgers in New York. Steinberg, meanwhile, said, “I don’t believe people primarily go to Facebook or Instagram to consume business information,” so it’s not surprising his shelves are focused on artificial intelligence, DARPA and Zeta itself.

The paradigm of a shelf of content might seem a little quaint — Boggs compared it to the shelves of DVDs or albums that you might have shown off in the past. But in his view, the model makes sense for these kinds of recommendations, because it allows people to focus on what they’re actually interested in: “Because the shelves are a curated selection, you can jump to your profile, and if you have a music shelf, I can jump right into that.”

While it remains to be seen how people will actually use Bookshlf, Boggs said there’s a likely to be a minority of core users who are doing the most active curation and sharing. These are the kinds of people who are probably already doing a lot of sharing — whether that’s on social media or just over a group chat — and “love to send you interesting articles and interesting podcasts.” At the same time, other users will simply browse the app for interesting recommendations, and they can also use the shelves to save links for themselves.

It sounds like the Bookshlf team isn’t focused on monetization yet, but Boggs suggested that there are a number of interesting opportunities, including targeted advertising, sponsored shelves, micropayments for content and selling data about broader trends in the audience interest.

In addition to Steinberg, Bookshlf has raised an undisclosed amount of funding from CAIVIS Acquisition Corp, Dalton Partners and Cambridge Way Ventures.

Powered by WPeMatico

It wasn’t the leap year, a coding blip, or a hack that caused Robinhood’s massive outages yesterday and today that left customers unable to trade stocks. Instead, the co-CEOs

write that “the cause of the outage was stress on our infrastructure — which struggled with unprecedented load. That in turn led to a “thundering herd” effect — triggering a failure of our DNS system.”

Robinhood was offline from Monday at 6:30am Pacific to 11pm Pacific, then had another outage this morning from 6:30am Pacific until just before 9am Pacific.

The $912 million-funded fintech giant will provide compensation to all customers of its Robinhood Gold premium subscription for borrowing money to trade plus access to Morningstar research reports, Nasdaq data, and bigger instant deposits. It’s offering them three months of service.

A month of Robinhood Gold costs $5 plus 5% yearly interest on borrowing above $1,000, charged daily. Before a pricing change, the flat fee per month could range as high as $200. However, compensated users will only get the $5 off per month, for a total of $15. That could seem woefully insufficient if Robinhood users missed out on buying back into stocks like Apple that went up over 9% on Monday. Robinhood is calling it a “first step”.

Impacted Robinhood users can contact the company here to ask for compensation. Below you can see the email Robinhood sent to custoemrs late last night.

Robinhood’s email to customers late last night

Robinhood is also working to contact impacted customers on a individual basis, and it’s looking into other forms of compensation on a case by case basis, company spokesperson Jack Randall tells me. It’s unclear if that might include cash to offset what traders might have lost by having their money locked in inaccessible Robinhood accounts during the outage.

Compensation could become a significant cost if the startup assesses that many of its 10 million users were impacted. The markets gained a record $1.1 trillion yesterday, but some Robinhood traders may not have been able to buy back in as the rebound occurred following mass selloffs due to fears of coronavirus.

Now the startup, valued at $7.6 billion, will have to try to regain users’ trust. “When it comes to your money, we know how important it is for you to have answers. The outages you have experienced over the last two days are not acceptable and we want to share an update on the current situation . . . We worked as quickly as possible to restore service, but it took us a while. Too long” wrote co-founders and co-CEO Baiju Bhatt and Vlad Tenev [disclosure: who I know from college].

As for exactly what triggered the downtime, the founders write that “Multiple factors contributed to the unprecedented load that ultimately led to the outages. The factors included, among others, highly volatile and historic market conditions; record volume; and record account sign-ups.” There’s been a frenzy of retail trading activity in the wake of coronavirus. There’s also been sudden spikes in stocks like Tesla amidst mainstream media attention.

Going forward, Robinhood promises to “work to improve the resilience of our infrastructure to meet the heightened load we have been experiencing. We’re simultaneously working to reduce the interdependencies in our overall infrastructure. We’re also investing in additional redundancies in our infrastructure.” However, they warn that “we may experience additional brief outages, but we’re now better positioned to more quickly resolve them.”

The outage comes at a vulnerable time for Robinhood as oldschool brokerages like Charles Schwab, Ameritrade, and Etrade all recently moved to eliminate per-trade fees to match Robinhood’s pioneering zero-comission trades. Though some of those brokerages experienced infrastructure troubles recently, Robinhood massive outages could push users towards those incumbents that they might perceive as more stable.

Powered by WPeMatico

It wasn’t the leap year, a coding blip, or a hack that caused Robinhood’s massive outages yesterday and today that left customers unable to trade stocks. Instead, the co-CEOs

write that “the cause of the outage was stress on our infrastructure — which struggled with unprecedented load. That in turn led to a “thundering herd” effect — triggering a failure of our DNS system.”

Robinhood was offline from Monday at 6:30am Pacific to 11pm Pacific, then had another outage this morning from 6:30am Pacific until just before 9am Pacific.

The $912 million-funded fintech giant will provide compensation to all customers of its Robinhood Gold premium subscription for borrowing money to trade, offering them three months of service. A month of Robinhood Gold costs $5 plus 5% yearly interest on borrowing above $1,000, charged daily. However, users will only get the $5 off per month, for a total of $15.

Impacted Robinhood users can contact the company here to ask for compensation. Below you can see the email Robinhood sent to custoemrs late last night.

Robinhood’s email to customers late last night

Robinhood is also working to contact impacted customers on a individual basis, and it’s looking into other forms of compensation on a case by case basis, company spokesperson Jack Randall tells me. It’s unclear if that might include cash to offset what traders might have lost by having their money locked in inaccessible Robinhood accounts during the outage.

Compensation could become a significant cost if the startup assesses that many of its 10 million users were impacted. The markets gained a record $1.1 trillion yesterday, but some Robinhood traders may not have been able to buy back in as the rebound occurred following mass selloffs due to fears of coronavirus.

Now the startup, valued at $7.6 billion, will have to try to regain users’ trust. “When it comes to your money, we know how important it is for you to have answers. The outages you have experienced over the last two days are not acceptable and we want to share an update on the current situation . . . We worked as quickly as possible to restore service, but it took us a while. Too long” wrote co-founders and co-CEO Baiju Bhatt and Vlad Tenev [disclosure: who I know from college].

As for exactly what triggered the downtime, the founders write that “Multiple factors contributed to the unprecedented load that ultimately led to the outages. The factors included, among others, highly volatile and historic market conditions; record volume; and record account sign-ups.” There’s been a frenzy of retail trading activity in the wake of coronavirus. There’s also been sudden spikes in stocks like Tesla amidst mainstream media attention.

Going forward, Robinhood promises to “work to improve the resilience of our infrastructure to meet the heightened load we have been experiencing. We’re simultaneously working to reduce the interdependencies in our overall infrastructure. We’re also investing in additional redundancies in our infrastructure.” However, they warn that “we may experience additional brief outages, but we’re now better positioned to more quickly resolve them.”

The outage comes at a vulnerable time for Robinhood as oldschool brokerages like Charles Schwab, Ameritrade, and Etrade all recently moved to eliminate per-trade fees to match Robinhood’s pioneering zero-comission trades. Though some of those brokerages experienced infrastructure troubles recently, Robinhood massive outages could push users towards those incumbents that they might perceive as more stable.

Powered by WPeMatico

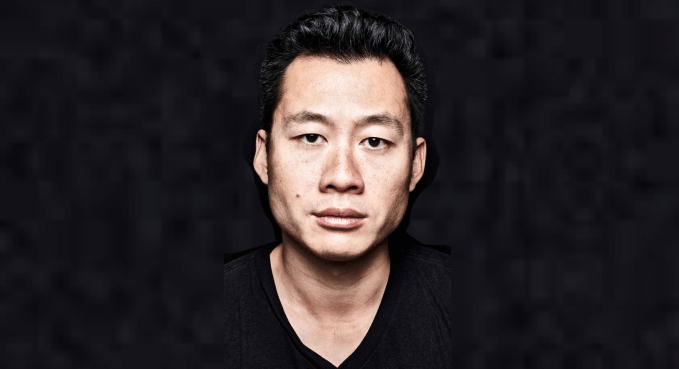

Justin Kan’s hybrid legal software and law firm startup Atrium is shutting down today after failing to figure out how to deliver better efficiency than a traditional law firm, the CEO tells TechCrunch exclusively. The startup has now laid off all its employees, which totaled just over 100. It will return some of its $75.5 million in funding to investors, including Series B lead Andreessen Horowitz. The separate Atrium law firm will continue to operate.

“I’m really grateful to the customers and the team members who came along with me and our investors. It’s unfortunate that this wasn’t the outcome that we wanted but we’re thankful to everyone that came with us on the journey” said Kan. He’d previously founded Justin.tv which pivoted to become Twitch and later sold to Amazon for $970 million. “We decided to call it and wind down the startup operations. There will be some capital returned to investors post wind-down” Kan told me.

Atrium had attempted a pivot back in January, laying off its in-house lawyers to become a more pure software startup with better margins. Some of its lawyers formed a separate standalone legal firm and took on former Atrium clients. But Kan tells me that it was tough to regain momentum coming out of that change, which some Atrium customers tell me felt chaotic and left them unsure of their legal representation.

More layoffs quietly ensued as divisions connected to those lawyers were eliminated. But trying to build software for third-party lawyers, many of which have entrenched processes and older leadership, proved difficult. The streamlined workflows may not have seemed worth the thrash of adopting new technology.

“If you look at our original business model with the veritcalized law firm, a lot of these companies that have this kind of full stack model are not going to survive” Kan explained. “A lot of these companies, Atrium included, did not figure out how to make a dent in operational efficiency.”

Founded in 2017, Atrium built software for startups to navigate fundraising, hiring, acquisition deals, and collaboration with their legal team. Atrium also offered in-house lawyers that could provide counsel and best practices in these matters. The idea was that the collaboration software would make its lawyers more efficient than a traditional law firm so they could get work done faster, translating to savings for clients and Atrium.

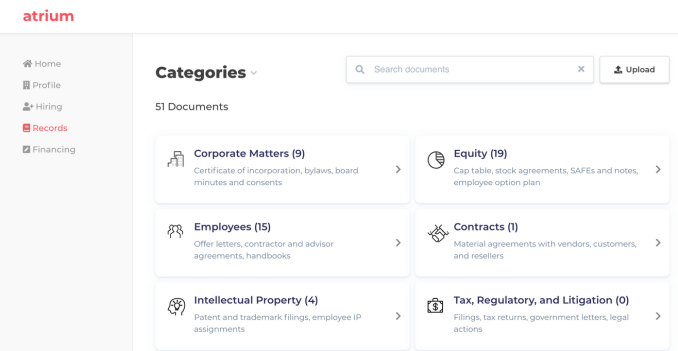

Atrium’s software included Records, a Dropbox-esque system for keeping track of legal documents, and Hiring, which instantly generated employment offer letters based on details punched into a form while keeping track of signatures. The startup hoped it could prevent clients and lawyers from wasting time digging through email chains or missing a sign-off that could put them in legal jeopardy.

The company tried to generate client leads by hosting fundraising workshops for startups, starring Kan and his stories from growing Twitch. A charismatic leader with a near-billion dollar exit under his belt, investors and founders alike were quick to buy into Kan’s vision and advice. Startups saw Atrium as an ally with industry expertise that could help them avoid dirty term sheets or botched hires.

But keeping a large squad of lawyers on staff proved costly. Atrium priced packages of its software and legal assistance under subscriptions, with momentous deals like acquisitions incurring add-on fees. The model relied less on milking clients with steep hourly rates measured down to six-minute increments like most law firms.

Yet eliminating the busy work for lawyers through its software didn’t materialize into bountiful profits. The pivot saught to create a professional services network where Atrium could route clients to attorneys. The layoffs had shaken faith in the startup as clients demanded stability lest they be caught without counsel at a tough time

Rather than trudge on, Kan decided to fold the company. The standalone Atrium law firm will continue to operate under partners Michel Narganes and Matthew Melville, but the startup developing legal software is done.

Atrium’s implosion could send ripples through the legaltech scene, and push other entrepreneurs to start with a more focused software-only approach.

Powered by WPeMatico