Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

As investors’ appetites sour in the midst of a pandemic, a three-and-a-half-year-old Indian firm has secured $10.3 billion in a month from Facebook and four U.S.-headquartered private equity firms.

The major deals for Reliance Jio Platforms have sparked a sudden interest among analysts, executives and readers at a time when many are skeptical of similar big check sizes that some investors wrote to several young startups, many of which are today struggling to make sense of their finances.

Prominent investors across the globe, including in India, have in recent weeks cautioned startups that they should be prepared for the “worst time” as new checks become elusive.

Elsewhere in India, the world’s second-largest internet market and where all startups together raised a record $14.5 billion last year, firms are witnessing down rounds (where their valuations are slashed). Miten Sampat, an angel investor, said last week that startups should expect a 40%-50% haircut in their valuations if they do get an investment offer.

Facebook’s $5.7 billion investment valued the company at $57 billion. But U.S. private equity firms Silver Lake, Vista, General Atlantic, and KKR — all the other deals announced in the past five weeks — are paying a 12.5% premium for their stake in Jio Platforms, valuing it at $65 billion.

How did an Indian firm become so valuable? What exactly does it do? Is it just as unprofitable as Uber? What does its future look like? Why is it raising so much money? And why is it making so many announcements instead of one.

It’s a long story.

Billionaire Mukesh Ambani gave a rundown of his gigantic Indian empire at a gathering in December 2015 packed with 35,000 people including hundreds of Bollywood celebrities and industry titans.

“Reliance Industries has the second-largest polyester business in the world. We produce one and a half million tons of polyester for fabrics a year, which is enough to give every Indian 5 meters of fabric every year, year-on-year,” said Ambani, who is Asia’s richest man.

Powered by WPeMatico

Welcome back to This Week in Apps, the Extra Crunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry is as hot as ever, with a record 204 billion downloads and $120 billion in consumer spending in 2019. People are now spending three hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this Extra Crunch series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week we’re continuing to look at how the coronavirus outbreak is impacting the world of mobile applications. Notably, we saw the launch of the Apple/Google exposure-notification API with the latest version of iOS out this week. The pandemic is also inspiring other new apps and features, including upcoming additions to Apple’s Schoolwork, which focus on distance learning, as well as Facebook’s new Shops feature designed to help small business shift their operations online in the wake of physical retail closures.

Tinder, meanwhile, seems to be toying with the idea of pivoting to a global friend finder and online hangout in the wake of social distancing, with its test of a feature that allows users to match with others worldwide — meaning, with no intention of in-person dating.

Apple this week released the latest version of iOS/iPadOS with two new features related to the pandemic. The first is an update to Face ID which will now be able to tell when the user is wearing a mask. In those cases, Face ID will instead switch to the Passcode field so you can type in your code to unlock your phone, or authenticate with apps like the App Store, Apple Books, Apple Pay, iTunes and others.

Technology can help health officials rapidly tell someone they may have been exposed to COVID-19. Today the Exposure Notification API we created with @Google is available to help public health agencies make their COVID-19 apps effective while protecting user privacy.

— Tim Cook (@tim_cook) May 20, 2020

The other new feature is the launch of the exposure-notification API jointly developed by Apple and Google. The API allows for the development of apps from public health organizations and governments that can help determine if someone has been exposed by COVID-19. The apps that support the API have yet to launch, but some 22 countries have requested API access.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

A cluster of related companies recently caught our eye by raising capital in rapid-fire fashion. TechCrunch covered a few of them, and I read coverage of others. Looking back through my notes and the media cycles that they generated, it feels safe to say that API -based startups are hot right now.

What’s fun about this trend is that the startups we’re considering are all relatively early-stage, so they aren’t limping unicorns staring down a closed IPO window. Instead, we’re taking a peek at startups that mostly haven’t raised material external capital — yet. They have lots of room to grow.

And the group is somewhat easy to understand. Sure, I don’t fully grok their underlying tech — that’s a bit of the point with API startups; they take something complex and offer it in an easy-to-consume fashion — but I do get how they make money. Not only are their business models fairly easy to understand, there are public companies that monetized in similar ways for us to use as a framework as the startups themselves scale.

This morning let’s look at FalconX and Treasury Prime and Spruce and Daily.co and Skyflow and Evervault, all API-focused startups to one degree or another, to see what’s up.

Simply: a high-growth company that delivers its main service via an application programming interface, or API.

APIs help services communicate with other apps, allowing them to execute tasks or request information quickly and easily. These services are sometimes highly valuable because they can offer something complex and difficult, easily and simply.

Powered by WPeMatico

Google has announced a new, welcome and no doubt long-asked-for feature to its Maps app: wheelchair accessibility info. Businesses and points of interest featuring accessible entrances, bathrooms and other features will now be prominently marked as such.

Millions, of course, require such accommodations as ramps or automatic doors, from people with limited mobility to people with strollers or other conveyances. Google has been collecting information on locations’ accessibility for a couple years, and this new setting puts it front and center.

The company showed off the feature in a blog post for Global Accessibility Awareness Day. To turn it on, users can go to the “Settings” section of the Maps app, then “Accessibility settings,” then toggle on “Accessible places.”

This will cause any locations searched for or tapped on to display a small wheelchair icon if they have accessible facilities. Drilling down into the details where you find the address and hours will show exactly what’s available. Unfortunately it doesn’t indicate the location of those resources (helpful if someone is trying to figure out where to get dropped off, for instance), but knowing there’s an accessible entrance or restroom at all is a start.

The information isn’t automatically created or sourced from blueprints or anything — like so much on Google, it comes from you, the user. Any registered user can note the presence of accessible facilities the way they’d note things like in-store pickup or quick service. Just go to “About” in a location’s description and hit the “Describe this place” button at the bottom.

Powered by WPeMatico

Khatabook, a startup that is helping small businesses in India record financial transactions digitally and accept payments online with an app, has raised $60 million in a new financing round as it looks to gain more ground in the world’s second most populous nation.

The new financing round, Series B, was led by Facebook co-founder Eduardo Saverin’s B Capital. A range of other new and existing investors, including Sequoia India, Partners of DST Global, Tencent, GGV Capital, RTP Global, Hummingbird Ventures, Falcon Edge Capital, Rocketship.vc and Unilever Ventures, also participated in the round, as did Facebook’s Kevin Weil, Calm’s Alexander Will, CRED’s Kunal Shah and Snapdeal co-founders Kunal Bahl and Rohit Bansal.

The one-and-a-half-year-old startup, which closed its Series A financing round in October last year and has raised $87 million to date, is now valued between $275 million to $300 million, a person familiar with the matter told TechCrunch.

Hundreds of millions of Indians came online in the last decade, but most merchants — think of neighborhood stores — are still offline in the country. They continue to rely on long notebooks to keep a log of their financial transactions. The process is also time-consuming and prone to errors, which could result in substantial losses.

Khatabook, as well as a handful of young and established players in the country, is attempting to change that by using apps to allow merchants to digitize their bookkeeping and also accept payments.

Today more than 8 million merchants from over 700 districts actively use Khatabook, its co-founder and chief executive Ravish Naresh told TechCrunch in an interview.

“We spent most of last year growing our user base,” said Naresh. And that bet has worked for Khatabook, which today competes with Lightspeed -backed OkCredit, Ribbit Capital-backed BharatPe, Walmart’s PhonePe and Paytm, all of which have raised more money than Khatabook.

The Khatabook team poses for a picture (Khatabook)

According to mobile insight firm AppAnnie, Khatabook had more than 910,000 daily active users as of earlier this month, ahead of Paytm’s merchant app, which is used each day by about 520,000 users, OkCredit with 352,000 users, PhonePe with 231,000 users and BharatPe, with some 120,000 users.

All of these firms have seen a decline in their daily active users base in recent months as India enforced a stay-at-home order for all its citizens and shut most stores and public places. But most of the aforementioned firms have only seen about 10-20% decline in their usage, according to AppAnnie.

Because most of Khatabook’s merchants stay in smaller cities and towns that are away from large cities and operate in grocery stores or work in agritech — areas that are exempted from New Delhi’s stay-at-home orders, they have been less impacted by the coronavirus outbreak, said Naresh.

Naresh declined to comment on AppAnnie’s data, but said merchants on the platform were adding $200 million worth of transactions on the Khatabook app each day.

In a statement, Kabir Narang, a general partner at B Capital who also co-heads the firm’s Asia business, said, “we expect the number of digitally sophisticated MSMEs to double over the next three to five years. Small and medium-sized businesses will drive the Indian economy in the era of COVID-19 and they need digital tools to make their businesses efficient and to grow.”

Khatabook will deploy the new capital to expand the size of its technology team as it looks to build more products. One such product could be online lending for these merchants, Naresh said, with some others exploring to solve other challenges these small businesses face.

Amit Jain, former head of Uber in India and now a partner at Sequoia Capital, said more than 50% of these small businesses are yet to get online. According to government data, there are more than 60 million small and micro-sized businesses in India.

India’s payments market could reach $1 trillion by 2023, according to a report by Credit Suisse .

Powered by WPeMatico

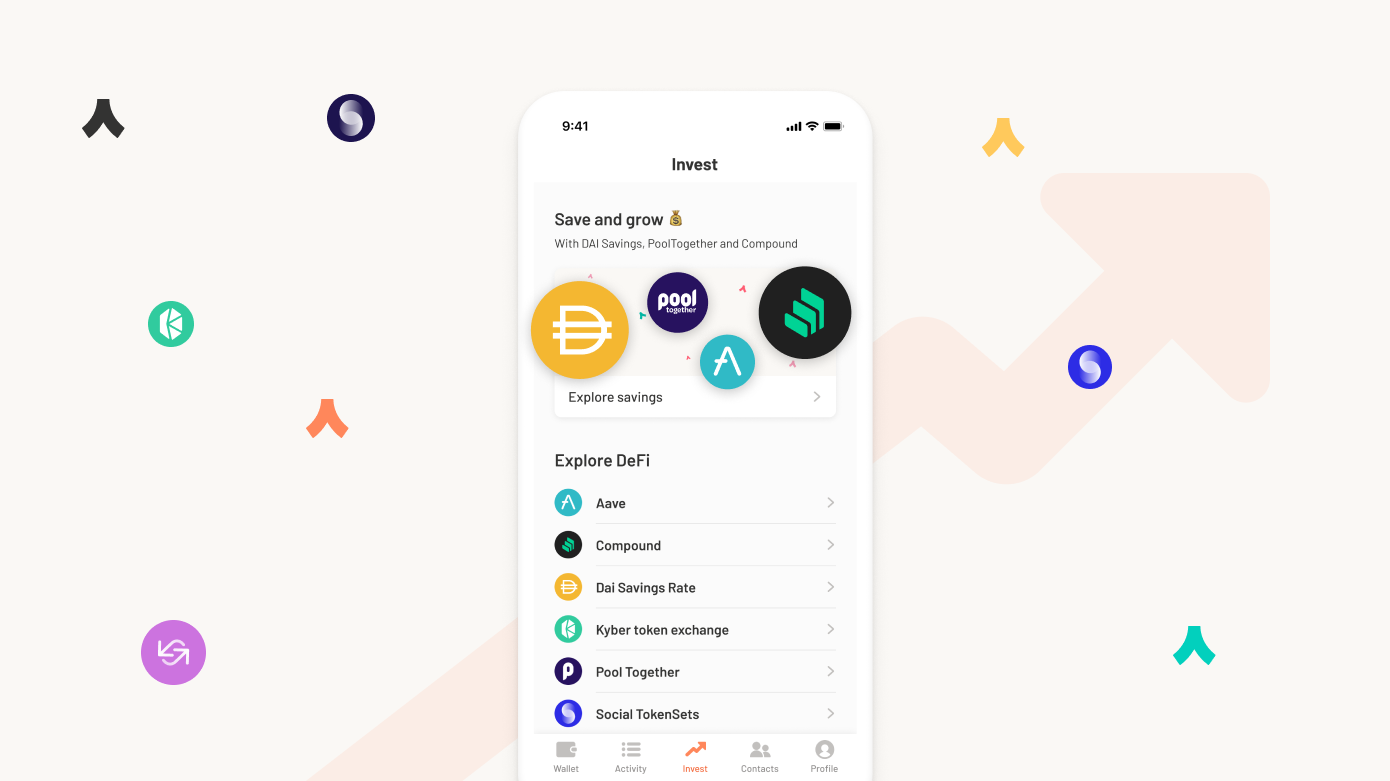

Argent is launching the first public version of its Ethereum wallet for iOS and Android. The company has been available as a limited beta for a few months with a few thousand users. But it has already raised a seed and a Series A round with notable investors, such as Paradigm, Index Ventures, Creandum and Firstminute Capital. Overall, the company has raised $16 million.

I managed to get an invitation to the beta a few months ago and have been playing around with it. It’s a well-designed Ethereum wallet with some innovative security features. It also integrates really well with DeFi projects.

Many people leave their crypto assets on a cryptocurrency exchange, such as Coinbase or Binance. But it’s a centralized model — you don’t own the keys, which means that an exchange could get hacked and you’d lose all your crypto assets. Similarly, if there’s a vulnerability in the exchange API or login system, somebody could transfer all your crypto assets to their own wallets.

At heart, Argent is a non-custodial Ethereum wallet, like Coinbase Wallet or Trust Wallet. You’re in control of the keys. Argent can’t initiate a transaction without your authorization for instance.

But that level of control brings a lot of complexities. Hardware wallets, such as Ledger wallets, ask you to write down a seed phrase so that you can recover your wallet if you lose your device. It requires some discipline and it’s hard to understand if you’re not familiar with the concept of seed phrases.

Even Coinbase Wallet tells you to back up your seed phrase when you first create a wallet. “We see them as advanced tools for developers,” Argent co-founder and CEO Itamar Lesuisse told me.

That’s why a new generation of wallets tries to hide the complexity from the end user, such as ZenGo and Argent. Creating a wallet on Argent is one of the best experiences in the cryptocurrency space. Your wallet is secured by something called ‘guardians’.

A guardian can be someone you know and trust, a hardware wallet (or another phone) or a MetaMask account. Argent also provides a guardian service, which requires you to confirm your identity with a text message and an email. If you lose your phone and you want to recover your wallet on another phone, you need to speak to your guardians and get a majority of confirmations. If they can all confirm that, yes, indeed, your phone doesn’t work anymore and you want to recover your crypto assets, the recovery process starts.

Let’s take an example. Here’s your list of guardians:

In total, there are five different factors involved, you including. If you lose your phone, you can recover your wallet by downloading Argent on another phone (factor #1), asking Argent’s guardian service to send you a text and an email to confirm your identity (factor #2) and confirming your identity with the Ledger Nano S (factor #3).

You have reached a majority and the recovery process starts. You’ll get your funds in 36 hours so that you have enough time to cancel it it’s a hijacking attempt.

But you could also have downloaded the Argent app on another phone (factor #1) and pinged your two friends (factor #2 and #3) directly. If they can confirm the same sequence of characters (emojis in that case), the recovery process would start as well.

“I’m interested in social recovery, multi-key schemes,” Ethereum creator Vitalik Buterin said in a TechCrunch interview in July 2018. It’s not a new concept as social media apps already use social recovery systems. On WeChat, if you lose your password, WeChat asks you to select people in your contact list within a big list of names.

In Argent’s case, social recovery adds an element of virality as well. The experience gets better as more people around you start using Argent.

In addition to wallet recovery, Argent uses guardians to put some limits. Just like you have some limits on your bank account, you can set a daily transaction limit to prevent attackers from grabbing all your crypto assets. You can ask your guardians to waive transactions above your daily limits.

Similarly, you can ask your guardians to lock your account for 5 days in case your phone gets stolen.

Argent is focused on the Ethereum blockchain and plans to support everything that Ethereum offers. Of course, you can send and receive ETH. And the startup wants to hide the complexity on this front as well as it covers transaction fees (gas) for you and gives you usernames. This way, you don’t have to set the transaction fees to make sure that it’ll go through.

The startup plans to integrate DeFi projects directly in the app. DeFi stands for decentralized finance. As the name suggests, DeFi aims to bridge the gap between decentralized blockchains and financial services. It looks like traditional financial services, but everything is coded in smart contracts.

There are dozens of DeFi projects. Some of them let you lend and borrow money — you can earn interest by locking some crypto assets in a lending pool for instance. Some of them let you exchange crypto assets in a decentralized way, with other users directly.

Argent lets you access TokenSets, Compound, Maker DSR, Aave, Uniswap V2 Liquidity, Kyber and Pool Together. And the company already has plans to roll out more DeFi features soon.

Overall, Argent is a polished app that manages to find the right balance between security and simplicity. Many cryptocurrency startups want to build the ‘Revolut of crypto’. And it feels like Argent has a real shot at doing just that with such a promising start.

Powered by WPeMatico

Welcome back to This Week in Apps, the Extra Crunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry is as hot as ever, with a record 204 billion downloads and $120 billion in consumer spending in 2019. People are now spending 3 hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this Extra Crunch series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week we’re continuing to look at how the coronavirus outbreak is impacting the world of mobile applications, including the latest news about COVID-19 apps, Facebook and Houseparty’s battle to dominate the online hangout, the game that everyone’s playing during quarantine, and more. We also look at the new allegations against TikTok, the demise of a popular “Lite” app, new apps offering parental controls, Telegram killing its crypto plans and many other stories, including a hefty load of funding and M&A.

Powered by WPeMatico

Uber announces some COVID-19 related changes, Google’s Chrome browser is giving users a way to organize their tabs and the Senate rejects an amendment that would have raised the bar for law enforcement access to browsing data.

Here’s your Daily Crunch for May 14, 2020.

1. Here’s how your Uber ride will change, starting May 18

The changes — which include an online checklist for all rides, limits on the number of passengers in vehicles and a face mask verification feature for drivers — are designed to stop the spread of COVID-19, the company said Wednesday.

Riders and drivers, as well as delivery workers and even restaurants that use Uber Eats, will have the power to report unsafe COVID-19 behavior and give low ratings. For instance, a delivery worker can give feedback that a restaurant doesn’t have proper protocols in place, such as social distancing.

2. Google Chrome will finally help you organize your tabs

Google announced the launch of “tab groups” for the beta version of its web browser, which will allow you to organize, label and even color-code your tabs for easy access. The feature will make its way to the stable release of Chrome starting next week.

3. Senate narrowly rejects plan to require a warrant for Americans’ browsing data

Senators have narrowly rejected a bipartisan amendment that would have required the government first obtain a warrant before accessing Americans’ web browsing data. The amendment brought by Sens. Ron Wyden (D-OR) and Steve Daines (R-MT) would have forced the government to first establish probable cause (or reasonable suspicion of a crime) to obtain the warrant.

4. Kustomer acquires Reply.ai to enhance chatbots on its CRM platform

Reply.ai is a startup originally founded in Madrid that has built a code-free platform for companies to create customized chatbots to handle customer service inquiries. Its customers include Coca-Cola, Starbucks and Samsung.

5. Why we’re doubling down on cloud investments right now

Three investors at Bessemer Venture Partners argue that COVID-19 is a turning point for the cloud and cloud company founders, and that the cloud model offers businesses a promising future in the age of social distancing and beyond. (Extra Crunch membership required.)

6. Facebook, telcos to build huge subsea cable for Africa and Middle East

The project, called 2Africa, will see the companies lay cables that will stretch to 37,000km (22,990 miles) and interconnect Europe (eastward via Egypt), the Middle East (via Saudi Arabia) and 21 landings in 16 countries in Africa.

7. 7 top mobility VCs discuss COVID-19 strategies and trends

TechCrunch spoke to seven venture capitalists about how COVID-19 affected their portfolio and investment strategy, their current advice for startup founders and where they think the next hot opportunity will be. (Extra Crunch membership required.)

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

Powered by WPeMatico

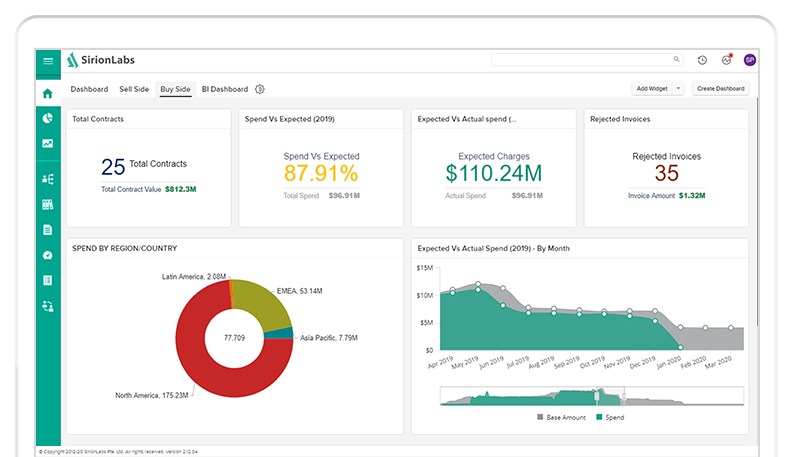

SirionLabs, a startup that provides contract management software to enterprises, has raised $44 million in a new financing round as it looks to expand and handle surge in demand from clients.

Tiger Global and Avatar Growth Capital led the Seattle-headquartered startup’s Series C round. The eight-year-old startup, which was founded in India, has raised $66 million to date. The new round values the startup at about $250 million. Indian VC fund Avatar has long invested in SaaS startups in India, an area that Tiger Global has also made serious bets on in recent quarters.

Enterprises broadly handle two kinds of contracts, one when they are buying things from a supplier for which they use a procurement contract, and the other when they are selling things to customers, when a sales contract comes into play.

A significant number of companies today handle these contracts manually with different teams within an organization often dealing with the same entity, which leads to discrepancies in their promises. Teams work in silos and often don’t know the terms others in the organization have already agreed upon.

That’s where SirionLabs comes into the picture. “We use artificial intelligence and natural language processing to connect the dots between contracts and what happens after the contract has been signed,” explained Ajay Agrawal, cofounder, chairman and chief executive of the startup, in an interview with TechCrunch.

“For us, it’s not just creating a contract, but also realizing the promises that have been made in those contracts,” he said. SirionLabs also audits the invoice of suppliers, which has enabled its customers to save a significant amount of money.

SirionLabs today hosts contracts in over 40 languages for more than 200 of the world’s largest companies including Credit Suisse, Vodafone, EY, Unilever, Abbvie, BP, and Fujitsu.

Agrawal said the startup has seen a 4X growth in the number of customers it has signed up in the last 18 months. Part of the new capital would go into handling their demand. He said the coronavirus crises has resulted in many companies becoming more cautious about what they promise in their contracts.

The startup, which just opened a technology center in Seattle, also plans to open an AI laboratory in the Washington state to fuel technology innovation and grow sales.

It has also hired several industry veterans including the appointment of Amol Joshi as chief revenue officer, Anu Engineer as chief technology officer, Mahesh Unnikrishnan as chief product officer, and Vijay Khera, who will serve as chief customer officer.

Vishal Bakshi, founder and managing partner at Avatar Growth Capital, said he expects SirionLabs, which competes with Apttus and Icertis among other firms, to “capture massive network effects as the platform continues to scale.”

Powered by WPeMatico

Global investment firm KKR is betting on the pizza business — it just led a $43 million Series C investment in Slice.

Formerly known as MyPizza, Slice has created a mobile app and website where diners can order a custom pizza delivery from their local, independent pizzeria.

And for those pizzerias, CEO Ilir Sela said Slice helps to digitize their whole business by also creating a website, improving their SEO and even allowing them to benefit from the “economies of scale” of the larger network, through bulk orders of supplies like pizza boxes.

Sela contrasted his company’s approach with other popular food delivery apps that he characterized as aggregators. For one thing, Slice “anchors” your favorite pizzerias in the app, giving them the top spots and making it easy to place your regular order with just a few taps. And it will be adding more loyalty features soon.

“Our job is to make loyal customers even more loyal,” he said.

In addition, while there’s been services like Grubhub have faced criticism for their steep fees, Sela said Slice’s fee is capped at $2.25 per order, allowing pizzerias to get all the upside from large orders.

Of course, the environment for restaurants has changed dramatically in the last few months, thanks to COVID-19. But most pizzerias are already set up for takeout and delivery, and Sela said that more than 90% of the 12,000-plus pizzerias that work with Slice have stayed open.

He also pointed to the company’s Pizza vs Pandemic initiative, which raises funds for pizzerias to feed healthcare workers. The program has raised more than $470,000 and fed an estimated 140,000 workers.

“Local independent pizzerias have been feeding Americans across communities for decades and we are excited to put our resources behind Slice as they help to move these businesses online,” said KKR Principal Allan Jean-Baptiste in a statement. “Slice charges small business owners a fraction of the fees charged by food delivery apps and offers a suite of vertical specific solutions to solve the challenges faced by independent pizza makers.”

Slice had previously raised $30 million, according to Crunchbase. Sela said he’ll be using the new funding to bring on more pizzerias and continue building a “vertically integrated solution for the small businesses, in order to solve more and more of their challenges.”

Powered by WPeMatico