Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Google has updated its Lookout app, an AI toolkit for people with impaired vision, with two helpful new capabilities: scanning long documents and reading out food labels. Paper forms and similarly shaped products at the store present a challenge for blind folks and this ought to make things easier.

Food labels, if you think about it, are actually a pretty difficult problem for a computer vision system to solve. They’re designed to be attention-grabbing and distinctive, but not necessarily highly readable or informative. If a sighted person can accidentally buy the wrong kind of peanut butter, what chance does someone who can’t read the label themselves have?

The new food label mode, then, is less about reading text and more about recognizing exactly what product it’s looking at. If the user needs to turn the can or bottle to give the camera a good look, the app will tell them so. It compares what it sees to a database of product images, and when it gets a match it reads off the relevant information: brand, product, flavor, other relevant information. If there’s a problem, the app can always scan the barcode as well.

Document scanning isn’t exactly exciting, but it’s good to have the option built in a straightforward way into a general-purpose artificial vision app. It works as you’d expect: Point your phone at the document (the app will help you get the whole thing in view) and it scans it for your screen reader to read out.

The “quick read” mode that the app debuted with last year, which watches for text in the camera view and reads it out loud, has gotten some speed improvements.

The update brings a few other conveniences to the app, which should run on any Android phone with 2 gigs of RAM and running version 6.0 or higher. It’s also now available in Spanish, German, French and Italian.

Powered by WPeMatico

mmhmm, the latest project from Evernote founder Phil Libin and All Turtles, has today announced the launch of the mmhmm Beta 2. The 100,000-strong waitlist of people who have requested access are getting their invite to the platform today. Also part of the beta 2: a handful of new features for the video presentation software.

Most notable among them is Copilot. Copilot allows two users to “drive” the presentation simultaneously, with one user speaking and visible and the other running the controls of that presentation, switching slides, playing video and/or changing the look and feel.

But let me back up for those of you who’ve (understandably) missed the mmhmm news in the past few weeks.

What is it?

If Twitch got together with the production team for a late night talk show, and their resulting love child was into corporate presentations, that baby would be called mmhmm.

Essentially, users can elevate their on-screen virtual presentations from a head in a box (or sometimes a screen-shared slide deck) to a more elegantly produced affair.

mmhmm users can run their presentation from a PIP (picture-in-picture) window, change the size of themselves on screen, add interesting filters and effects and do it all on the fly.

And as fun as that may be, there is a lot involved in running a live production while also giving a presentation, which is why mmhmm is introducing Copilot. Copilot offers users the chance to have their very own executive producer help them with their call, allowing the presenter to focus on what they’re saying instead of the mmhmm controls.

Because Copilot is multiplayer, beta users can invite one friend per day to the platform starting now.

Alongside Copilot, mmhmm is also launching Dynamic Rooms, which gives users the ability to create a background unique to them, selecting the colors, shapes, etc. to have your own “template.”

The product has raised a total of $4.5 million led by Sequoia, with participation from Human Capital, Biz Stone, Jana Messerschmidt (#ANGELS), Hiroshi Mikitani (Rakuten), Taizo Son (Mistletoe), Brianne Kimmel (worklife.vc), Digital Garage, Precursor Ventures, Kevin Systrom (IG), Mike Krieger (IG), Linda Kozlowski (Blue Apron), Julia and Kevin Hartz (Eventbrite) and Lachy Groom (Stripe).

Powered by WPeMatico

Robinhood’s huge, two-part Series F round came partially in Q2 and partially in Q3. The app-based trading platform announced the first $280 million in early May, valuing the company at around $8.3 billion, up from a prior price tag of around $7.6 billion.

Then in July, Robinhood tacked on $320 million more at the same price, raising its valuation to around $8.6 billion.

While it has long been known that savings and investing apps and services are seeing a boom in 2020, precisely what caused investors to pour $600 million more into this already-wealthy company was less immediately evident. Recent data released by Robinhood concerning one of its revenue sources may help explain the rapid-fire capital events.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Filings from Robinhood covering the April through June period, Q2 2020, indicate that the company’s revenue from payment for order flow, a method by which a broker is paid to route customer orders through a particular group, or party rose during the period. As TechCrunch has covered, Robinhood generates a sizable portion of its revenue from such activities.

The company is hardly alone in doing so. As a new report from The Block, shared with The Exchange ahead of publication notes, Robinhood’s Q2 payment for order flow haul was impressive, but not singularly so; trading houses like E*Trade and Charles Schwab also grew their incomes from order flow routing in the period.

The company is hardly alone in doing so. As a new report from The Block, shared with The Exchange ahead of publication notes, Robinhood’s Q2 payment for order flow haul was impressive, but not singularly so; trading houses like E*Trade and Charles Schwab also grew their incomes from order flow routing in the period.

But Robinhood’s gains come in the wake of the firm’s promise to shake up its options trading setup after a customer took their own life. As we’ve written, there is a tension between Robinhood’s desire to limit who can access options trading, its need to grow and the incomes options-related order flow can drive for the budding fintech giant.

This morning, however, we are focusing on revenue growth over other issues (more to come on those later). Let’s dig into Robinhood’s Q2 order flow revenue numbers and see what we can learn about its run rate and current valuation.

According to The Block’s own calculations, Robinhood saw saw its total payment for order flow revenue roughly double, rising from $90.9 million in Q1 2020 to $183.3 million in Q2 2020, a 102% increase.

Powered by WPeMatico

Data science is the name of the game these days for companies that want to improve their decision making by tapping the information they are already amassing in their apps and other systems. And today, a startup called Mode Analytics, which has built a platform incorporating machine learning, business intelligence and big data analytics to help data scientists fulfill that task, is announcing $33 million in funding to continue making its platform ever more sophisticated.

Most recently, for example, the company has started to introduce tools (including SQL and Python tutorials) for less technical users, specifically those in product teams, so that they can structure queries that data scientists can subsequently execute faster and with more complete responses — important for the many follow-up questions that arise when a business intelligence process has been run. Mode claims that its tools can help produce answers to data queries in minutes.

This Series D is being led by SaaS specialist investor H.I.G. Growth Partners, with previous investors Valor Equity Partners, Foundation Capital, REV Venture Partners and Switch Ventures all participating. Valor led Mode’s Series C in February 2019, while Foundation and REV respectively led its A and B rounds.

Mode is not disclosing its valuation, but co-founder and CEO Derek Steer confirmed in an interview that it was “absolutely” an up-round.

For some context, PitchBook notes that last year its valuation was $106 million. The company now has a customer list that it says covers 52% of the Forbes 500, including Anheuser-Busch, Zillow, Lyft, Bloomberg, Capital One, VMware and Conde Nast. It says that to date it has processed 830 million query runs and 170 million notebook cell runs for 300,000 users. (Pricing is based on a freemium model, with a free “Studio” tier and Business and Enterprise tiers priced based on size and use.)

Mode has been around since 2013, when it was co-founded by Steer, Benn Stancil (Mode’s current president) and Josh Ferguson (initially the CTO and now chief architect).

Steer said the impetus for the startup came out of gaps in the market that the three had found through years of experience at other companies.

Specifically, when all three were working together at Yammer (they were early employees and stayed on after the Microsoft acquisition), they were part of a larger team building custom data analytics tools for Yammer. At the time, Steer said Yammer was paying $1 million per year to subscribe to Vertica (acquired by HP in 2011) to run it.

They saw an opportunity to build a platform that could provide similar kinds of tools — encompassing things like SQL Editors, Notebooks and reporting tools and dashboards — to a wider set of users.

“We and other companies like Facebook and Google were building analytics internally,” Steer recalled, “and we knew that the world wanted to work more like these tech companies. That’s why we started Mode.”

All the same, he added, “people were not clear exactly about what a data scientist even was.”

Indeed, Mode’s growth so far has mirrored that of the rise of data science overall, as the discipline of data science, and the business case for employing data scientists to help figure out what is “going on” beyond the day to day, getting answers by tapping all the data that’s being amassed in the process of just doing business. That means Mode’s addressable market has also been growing.

But even if the trove of potential buyers of Mode’s products has been growing, so has the opportunity overall. There has been a big swing in data science and big data analytics in the last several years, with a number of tech companies building tools to help those who are less technical “become data scientists” by introducing more intuitive interfaces like drag-and-drop features and natural language queries.

They include the likes of Sisense (which has been growing its analytics power with acquisitions like Periscope Data), Eigen (focusing on specific verticals like financial and legal queries), Looker (acquired by Google) and Tableau (acquired by Salesforce).

Mode’s approach up to now has been closer to that of another competitor, Alteryx, focusing on building tools that are still aimed primarily at helping data scientists themselves. You have any number of database tools on the market today, Steer noted, “Snowflake, Redshift, BigQuery, Databricks, take your pick.” The key now is in providing tools to those using those databases to do their work faster and better.

That pitch and the success of how it executes on it is what has given the company success both with customers and investors.

“Mode goes beyond traditional Business Intelligence by making data faster, more flexible and more customized,” said Scott Hilleboe, managing director, H.I.G. Growth Partners, in a statement. “The Mode data platform speeds up answers to complex business problems and makes the process more collaborative, so that everyone can build on the work of data analysts. We believe the company’s innovations in data analytics uniquely position it to take the lead in the Decision Science marketplace.”

Steer said that fundraising was planned long before the coronavirus outbreak to start in February, which meant that it was timed as badly as it could have been. Mode still raised what it wanted to in a couple of months — “a good raise by any standard,” he noted — even if it’s likely that the valuation suffered a bit in the process. “Pitching while the stock market is tanking was terrifying and not something I would repeat,” he added.

Given how many acquisitions there have been in this space, Steer confirmed that Mode too has been approached a number of times, but it’s staying put for now. (And no, he wouldn’t tell me who has been knocking, except to say that it’s large companies for whom analytics is an “adjacency” to bigger businesses, which is to say, the very large tech companies have approached Mode.)

“The reason we haven’t considered any acquisition offers is because there is just so much room,” Steer said. “I feel like this market is just getting started, and I would only consider an exit if I felt like we were handicapped by being on our own. But I think we have a lot more growing to do.”

Powered by WPeMatico

Special is a new startup offering online video creators a way to move beyond advertising for their income.

The service was created by the team behind tech consulting and development firm Triple Tree Software. Special’s co-founder and CEO Sam Lucas told me that the team had already “scrapped our way from nothing to a seven-figure annual revenue,” but when the founders met with Next Frontier Capital (Next Frontier, like Special, is based in Bozeman, Montana) they pitched a bigger idea — an app where creators charge a subscription fee for access to premium content.

While Triple Tree started in the service business, Lucas explained the goal was always to create “a product company that we could sell for $100 million.” Now Special is announcing it has raised $2.26 million in seed funding from Next Frontier and other investors.

It’s also built an initial version of the product that’s being tested by friends, family and a handful of creators, with plans for a broader beta release in October.

With online advertising slowing dramatically during the COVID-19 pandemic, YouTube recently highlighted the fact that 80,000 of its channels are earning money from non-ad sources, and that the number of creators who receive the majority of their income from those sources grew 40% between January and May.

One of the main ways that creators can ask their viewers for money is through Patreon. Lucas acknowledged Patreon as a “very big inspiration” for Special, but he said that conversations with creators pointed to a few key ways that the service falls short.

Image Credits: Special

For one thing, he argued while contributions on Patreon are framed as “donations” or “support,” Special allows creators to emphasize the value of their premium content by putting it behind a subscription paywall. Patreon supports paywalls as well, but that leads to Lucas’ next point — it was built for creators of all kinds, while Special is focused specifically on video, and it has built a high-quality video player into the experience.

In fact, Lucas described Special’s spin on the idea of a white-labeled product as “silver label.” The goal is to create “the perfect balance between a platform and a custom app” — creators get their own customizable channels that emphasize their brand identity (rather than Special’s), while still getting the distribution and exposure benefits of being part of a larger platform, with their content searchable and viewable on web, mobile and smart TVs.

Creators also retain ownership of their content, and they get to decide how much they want to charge subscribers — Lucas said it can be anywhere between “$1 or $999” per month, with Special taking a 10% fee. He added that the team has plans to build a bundling option that would allow creators to team up and offer a joint subscription.

Lucas’ pitch reminded me of startups like Vessel (acquired and shut down by TechCrunch’s parent company Verizon in 2016), which previously hoped to bring online creators together for a subscription offering. In Lucas’ view, Vessel was similar to newer apps like Quibi, in that they directly funded creators to produce exclusive content.

“It’s a billion-dollar arms race, with what used to be a technology play but is now a production studio play,” he said. Special doesn’t have the funding to compete at that level, but Lucas suggested that a studio model also provides the wrong incentives to creators, who say “Hell yeah, keep those checks coming in,” but disappear “the moment the checks stop.”

“I almost think it’s an egotistical play,” Lucas added. “The company thinks they know best what a creator should produce for an audience that doesn’t exist yet. We say: Let them do it on Special. Do whatever you want, as long as you follow our terms of service, and own your creative vision.”

It might also seem like a big challenge to recruit creators while based in Montana, but Lucas replied that Special has more access than you might think, especially since the town has become “such a hotspot for extremely wealthy people to buy their third home.”

More broadly, he suggested that the distance from Hollywood and Silicon Valley “allows us to not follow the trends of every new streaming platform and [instead] truly find those independent creators underneath the woodworks.”

Powered by WPeMatico

Radish is announcing that it has raised $63.2 million in new funding.

Breaking up book-length stories into smaller chapters that are released over days or weeks is an idea that was popularized in the 19th century, and startups have been trying to revive it for at least the past decade. Still, this round represents a major step up in funding, not just for Radish (which only raised around $5 million previously), but also compared to other startups in a relatively nascent market. (Digital fiction startup Wattpad is the notable exception.)

When I first wrote about Radish at the beginning of 2017, the startup was focused on user-generated content. Last year, however, the company launched the Radish Originals program, where Radish is able to produce more content using teams of writers lead by a “showrunner,” and where the startup owns the resulting intellectual property.

“Instead of becoming YouTube or Wattpad for serial fiction, we want to be more like Netflix and create our own originals,” founder and CEO Seungyoon Lee told me. “I got a lot of inspiration from platforms in Korea, China and Japan, where serial fiction is huge and established on mobile.”

One of the ideas Radish took from the Asian markets is rapidly updating its stories. For example, its most popular title, “Torn Between Alphas” (a romance story with werewolves) has released 10 seasons in less than a year, with each season consisting of more than 50 chapters — later seasons have more than 100 chapters — that are released multiple times a day.

“On Netflix, you can binge-watch three seasons of a show at once,” Lee said. “On Radish, you can binge-read a thousand episodes.”

While Radish borrowed the writing room model from TV — and hired Emmy-winning TV writers, particularly those with a background in soap operas — Lee said it’s also taken inspiration from gaming. For one thing, it relies on micro-payments to make money, with users buying coins that allow them to unlock later chapters of a story (chapters usually cost 20 or 30 cents, and more chapters get moved out from behind the paywall over time). In addition, the company can allow reader taste to determine the direction of stories by A/B testing different versions of the same chapter.

Lee pointed to the fall of 2019 as Radish’s “inflection point,” where the model really started to work. Now, the company says its most popular story has made more than $4 million and has received more than 50 million “reads.” Radish stories are mostly in the genres of romance, paranormal/sci-fi, LGBTQ, young adult, horror, mystery and thriller, and Lee said the audience is largely female and based in the United States.

By raising a big round led by SoftBank Ventures Asia (the early-stage investment arm of troubled SoftBank Group) and Kakao Pages (which publishes webtoons, web novels and more, and is part of Korean internet giant Kakao), Lee said he can take advantage of their expertise in the Asian market to grow Radish’s audience in the U.S. That will mean accelerating content production in the hopes of creating more hit titles, and also spending more on performance marketing.

“With its own fast-paced original content production, Radish is best positioned to become a leading player in the global online fiction market,” said SoftBank Ventures Asia CEO JP Lee in a statement. “Radish has proven that its serialized novel platform can change the way people consume online content, and we are excited to support the company’s continued disruption in the mobile fiction space. Leveraging our global SoftBank ecosystem, we hope to support and accelerate Radish’s expansion across different regions worldwide.”

Powered by WPeMatico

“The app that you use the most on your phone and you don’t realize it is your keyboard,” says Christophe Barre, the co-founder and chief executive of OneKey.

A member of Y Combinator’s most recent cohort, OneKey has a plan to make work easier on mobile devices by turning the keyboard into a new way to serve up applications like calendars, to-do lists and, eventually, even Salesforce functionality.

People have keyboards for emojis, other languages and gifs, but there have been few ways to integrate business apps into the keyboard functionality, says Barre. And he’s out to change that.

Right now, the company’s first trick will be getting a Calendly-like scheduling app onto the keyboard interface. Over time, the company will look to create modules they can sell in an app store-style marketplace for the keyboard space on smartphones.

For Barre, the inspiration behind OneKey was the time spent working in Latin America and primarily conducting business through WhatsApp. The tool was great for messaging, but enterprise functionality broke down across scheduling or other enterprise app integrations.

“People are doing more and more stuff on mobile and it’s happening right now in business,” said Barre. “When you switch from a computer-based world to a mobile phone, a lot of the productivity features disappear.”

Barre, originally from the outskirts of Paris, traveled to Bogota with his partner. She was living there and he was working on a sales automation startup called DeepLook. Together with his DeepLook co-founder (and high school friend), Ulysses Pryjiel, Barre set out to see if he could bring over to the mobile environment some of the business tools he needed.

The big realization for Barre was the under-utilized space on the phone where the keyboard inputs reside. He thinks of OneKey as a sort of browser extension for mobile phones, centered in the keyboard real estate.

“The marketplace for apps is the long-term vision,” said Barre. “That’s how you bring more and more value to people. We started with those features like calendars and lists that brought more value quickly without being too specialized.”

The idea isn’t entirely novel. SwiftKey had a marketplace for wallpapers, Barre said, but nothing as robust as the kinds of apps and services that he envisions.

“If you can do it in a regular app, it’s very likely that you can do it through a keyboard,” Barre said.

Powered by WPeMatico

Point, a new challenger bank in the U.S., is launching publicly today with an invite system. While Point is technically providing a bank account, the company focuses on rewards associated with a debit card.

“I started Point as a solution about everything that is frustrating and complicated about credit cards. The incentives between credit card companies and cardholders are misaligned,” Point co-founder and CEO Patrick Mrozowski told me.

When Mrozowski first got a credit card, he was spending a ton of money to reach a certain level of spending and unlock the sign-up bonus. At the end of the month, he ended up with credit card debt for no valid reason.

“What would American Express look like today?” he says to sum up Point’s vision. It comes down to two important principles — being in charge of your budget so that you don’t end up with debt and unlocking rewards from brands that you actually interact with.

Many challenger banks want to provide a simple banking experience for the underbanked. Point doesn’t have the same positioning. Creating a Point account is more like joining a membership program.

When you sign up, you get a debit card with some level of insurance as it’s a Mastercard World Debit card. You can expect some trip cancellation insurance, rental car insurance, purchase insurance, etc.

As the name of the startup suggests, you earn points with each purchase. You get 5x points on subscriptions, such as Spotify and Netflix, 3x points on food, grocery deliveries and ride sharing, and 1x points on everything else. Points can be redeemed for dollars — each point is worth $0.01. In addition to that, Point is going to create a feed of offers with discounts, content, events and more.

Due to its premium positioning, Point isn’t free. You have to pay $6.99 per month or $60 per year to join Point. Point doesn’t charge any foreign transaction fees.

You can connect your Point account with another bank account using Plaid. It lets you top up your account using ACH transfers. Behind the scenes, Point works with Radius Bank for the banking infrastructure, an FDIC-insured bank.

The company announced earlier this month that it has raised a $10.5 million Series A led by Valar Ventures with Y Combinator, Kindred Ventures, Finventure Studio and business angels also participating.

Image Credits: Point

Powered by WPeMatico

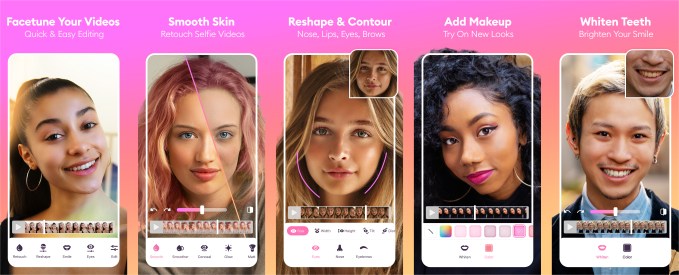

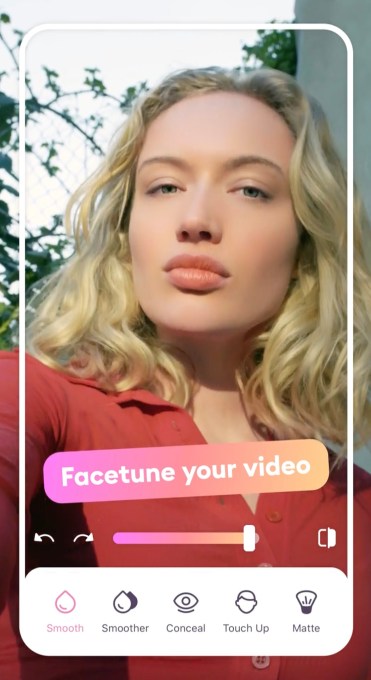

Lightricks, the startup behind a suite of photo and video editing apps — including most notably, selfie editor Facetune 2 — is taking its retouching capabilities to video. Today, the company is launching Facetune Video, a selfie video editing app, that allows users to retouch and edit their selfie and portrait videos using a set of A.I.-powered tools.

While there are other selfie video editors on the market, most today are generally focused on edits involving filters and presets, virtually adding makeup, or using AR or stickers to decorate your video in some way. Facetune Video, meanwhile, is focused on creating a photorealistic video by offering a set of features similar to those found in Lightricks’ flagship app, Facetune .

That means users are able to retouch their face with tools for skin smoothing, teeth whitening, and face reshaping, plus eye color, makeup, conceal, glow, and matte features. In addition, users can tweak tools for general video edits, like adjusting the brightness, contrast, color, and more, like other video editing apps allow for. And these edits can be applied in real-time to see how they look as the video plays, instead of after the fact.

In addition, users can apply the effect to one frame only and Facetune Video’s post-processing technology and neural networks will simultaneously apply an effect to the same area of every frame throughout the entire video, making it easier to quickly retouch a problem area without having to go frame-by-frame to do so.

“In Facetune Video, the 3D face model plays a significant role; users edit only one video frame, but it’s on us, behind-the-scenes, to automatically project the location of their edits to 2D face mesh coordinates derived from the 3D face model, and then apply them consistently on all other frames in the video,” explains Lightricks co-founder and CEO Zeev Farbman. “A Lightricks app needs to be not only powerful, but fun to use, so it’s critical to us that this all happens quickly and seamlessly,” he says.

Users can also save their favorite editing functions as “presets” allowing them to quickly apply their preferred settings to any video automatically.

In a future version of the app, the company plans to introduce a “heal” function which, like Facetune, will allow users to easily remove blemishes.

Image Credits: Lightricks

The technology that makes these selfie video edits work involves Lightricks’ deep neural networks that utilize facial feature detection and geometry analysis for the app’s retouching capabilities. These processes work in real-time without having to transmit data to the cloud first. There’s also no lag or delay while files are rendering.

In addition, Facetune Video uses the facial feature detection along with 3D face modeling A.I. to ensure that every part of the user’s face is captured for editing and retouching, the company says.

“What we’re also doing is taking advantage of lightweight neural networks. Before the user has even begun to retouch their selfie video, A.I.-powered algorithms are already working so that the user experience is quick and interactive,” says Farbman.

The app also does automated segmentation of more complex parts of the face like the interior of the eye, hair, or the lips, which helps it achieve a more accurate end result.

“It’s finding a balance between accuracy in the strength of the face modeling we use, and speed,” Farbman adds.

One challenge here was overcoming the issue of jittering effects, which is when the applied effect shakes as the video plays. The company didn’t want its resulting videos to have this problem, which makes the end result look gimmicky, so it worked to eliminate any shake-like effects and other face tracking issues so videos would look more polished and professional in the end.

The app builds off the company’s existing success and brand recognition with Facetune. With the new app, for example, the retouch algorithms mimic the original Facetune 2 experience, so users familiar with Facetune 2 will be able to quickly get the hang of the retouch tools.

Image Credits: Lightricks

The launch of the new app expands Lightricks further in the direction of video, which has become a more popular way of expressing yourself across social media, thanks to the growing use of apps like TikTok and features like Instagram Stories, for example.

Before, Lightricks’ flagship video product, however, was Videoleap, which focused on more traditional video editing, and not selfie videos where face retouching could be used.

Facetune has become so widely used, its name has become a verb — as in, “she facetunes her photos.” But it has also been criticized at times for its unrealistic results. (Of course, that’s more on the app’s users sliding the smoothing bar all the way to end.)

Across its suite of apps, which includes the original Facetune app (Facetune Classic), Facetune 2, Seen (for Stories), Photofox, Video Leap, Enlight Quickshot, Pixaloop, Boosted, and others, including a newly launched artistic editor, Quickart, the company has generated over 350 million downloads.

Its apps also now reach nearly 200 million users worldwide. And through its subscription model, Lightricks is now seeing what Farbman describes as revenues that are “increasing exponentially year-over-year,” but that are being continually reinvested into new products.

Like its other apps, Facetune Video will monetize by way of subscriptions. The app is free to use by will offer a VIP subscription for more features, at a price point of $8 per month, $36 per year, or a one-time purchase of $70.

Facetune 2 subscribers will get a discount on annual subscriptions, as well. The company will also sell the app in its Social Media Kit bundle on the App Store, which includes Facetune Video, Facetune 2, Seen and soon, an undisclosed fourth app. However, the company isn’t yet offering a single subscription that provides access to all bundled apps.

Powered by WPeMatico

The Berlin-based startup behind Tandem, an app for practicing a second language, has closed a £4.5 million (~$5.7 million) Series A round of financing to capitalize on growth opportunities it’s seeing as the coronavirus crisis continues to accelerate the switch to digital and online learning.

With many higher education institutions going remote as a result of concerns over virus exposure risks of students mixing on physical campuses, there’s a growing need for technology that helps language students find people to practice with, as Tandem tells it. And while language learning apps make for a very crowded space, with giants like Duolingo and Babbel, Tandem focuses on a different niche: native speaker practice.

As the name suggests, its app does pair matching — connecting users with others who’re trying to learn their own language for mutual practice, by (their choice of) text, phone chat or video call.

The platform also incorporates a more formal learning component by providing access to tutors. But the main thrust is to help learners get better by practicing chatting to a native speaker via the app.

Because of the pandemic push to socially distant learners, that’s a growing digital need, according to Tandem co-founder and CEO Arnd Aschentrup. He says the coronavirus crisis spurred a 200% increase in new users — highlighting a “clear appetite” among consumers for digital language learning.

The team has taken another tranche of funding now so it can scale to meeting this growing global opportunity.

The Series A is led by European VC firm Brighteye Ventures, with Trind Ventures, Rubylight Limited and GPS Ventures also participating. It brings the startup’s total raised to date to £6.8 million.

“Given the accelerated user-uptake and clear market opportunity, we felt that 2020 was the right time to partner with the team at Brighteye to bring Tandem into the mainstream,” says Aschentrup, adding: “We anticipate significant growth opportunities for online learning and social learning in the wake of coronavirus.”

He says two “key trends” have emerged over the past few months: “Firstly, schools and universities providing language courses have either temporarily shut down, or moved almost entirely to remote lessons. Students are therefore relying on additional platforms to learn and practice languages, which is precisely what Tandem offers.

“Secondly, we know that lockdown has enormously limited people’s ability to socialise. Friendships have been harder to maintain, and new connections more difficult to spark. We’re excited about Tandem’s ability to connect people all across the globe despite lockdown. Since coronavirus began, engagement on Tandem’s video chat feature has increased three-fold, and new user signups have increased 200%.”

Tandem had been growing usage prior to COVID-19 — increasing membership from around a million back in 2017 (when we last spoke), to more than 10 million members now, spread across 180 countries.

Aschentrup couches the underlying growth as “strong organic demand,” noting the platform has been profitable since 2019 (hence not taking in more outside funding ’til now). But, with the pandemic curve ball accelerating the switch to remote learning, it’s expecting usage of its platform to keep stepping up.

“We’ve successfully increased our community numbers ten-fold in recent years, profitably and organically,” he tells TechCrunch. “More people than ever value digital learning solutions combined with human connection, and so the time is ripe to introduce Tandem to language learners more widely around the globe. With the team at Brighteye on our side we’re excited to further develop Tandem’s reach and voice over the coming period.”

“We expect increased interest in online learning to sustain well after lockdown lifts. In China — where lockdown sanctions were implemented and lifted earlier — user engagement has remained buoyant.”

“Once people experience the value of learning as part of a like-minded global community, it often becomes a lasting part of their lifestyle,” he adds.

Tandem’s best markets for language learners are China (10%), the U.S. (9%) and Japan (9%) — which combined make up close to a third (27%) of its user base.

While the most popular language pairs (in ranked order of popularity) are:

While the vast majority (94%) of Tandem’s user base is making use of the freemium offering, it monetizes via a subscription product, called Tandem Pro, which it introduced in 2018 to cater to members who “preferred taking a community approach to language learning,” as Aschentrup puts it.

“For $9.99 per month, members can access key features such as: translating unlimited messages, finding Tandem partners nearby or in specific locations — for example ahead of international travels or studying abroad — and having enhanced visibility in the community as a featured Pro member,” he explains.

Aschentrup describes the “community aspect” of Tandem as a key differentiator versus other language learning apps — saying it helps users “develop and maintain cross-cultural friendships.”

“Members are often on opposite sides of the world to each other, yet able to enjoy a window into another culture entirely. Now more than ever, we’re pleased to be facilitating members’ healthy curiosity about other languages, countries and styles of living.”

The new funding will go on developing additional features for the app, and expanding the team across marketing and engineering, per Aschentrup. Currently Tandem has 24 full-time employees — it’s planning to double that to a 50-member team globally, post-Series A.

Commenting in a statement, Alex Spiro, managing partner at Brighteye Ventures, lauded the team’s “innovative and effective strategy” in building a community platform that tackles the language gap by connecting learners with fluent speakers.

“The product has not only proven resilient in this global crisis but has seen impressive growth during the period, and the team is now very well equipped to come out of it stronger and to continue to support loyal language learners that now number in the millions and will number many more in the coming years,” he added.

Powered by WPeMatico