Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Proxyclick began life by providing an easy way to manage visitors in your building with an iPad-based check-in system. As the pandemic has taken hold, however, customer requirements have changed, and Proxyclick is changing with them. Today the company announced Proxyclick Flow, a new system designed to check in employees during the time of COVID.

“Basically when COVID hit, our customers told us that actually our employees are the new visitors. So what you used to ask your visitors, you are now asking your employees — the usual probing questions, but also when are you coming and so forth. So we evolved the offering into a wider platform,” Proxyclick co-founder and CEO Gregory Blondeau explained.

That means instead of managing a steady flow of visitors — although it can still do that — the company is focusing on the needs of customers who want to open their offices on a limited basis during the pandemic, based on local regulations. To help adapt the platform for this purpose, the company developed the Proovr smartphone app, which employees can use to check in prior to going to the office, complete a health checklist, see who else will be in the office and make sure the building isn’t over capacity.

When the employee arrives at the office, they get a temperature check, and then can use the QR code issued by the Proovr app to enter the building via Proxyclick’s check-in system or whatever system they have in place. Beyond the mobile app, the company has designed the system to work with a number of adjacent building management and security systems so that customers can use it in conjunction with existing tooling.

They also beefed up the workflow engine that companies can adapt based on their own unique entrance and exit requirements. The COVID workflow is simply one of those workflows, but Blondeau recognizes not everyone will want to use the exact one they have provided out of the box, so they designed a flexible system.

“So the challenge was technical on one side to integrate all the systems, and afterwards to group workflows on the employee’s smartphone, so that each organization can define its own workflow and present it on the smartphone,” Blondeau said.

Once in the building, the systems registers your presence and the information remains on the system for two weeks for contact tracing purposes should there be an exposure to COVID. You check out when you leave the building, but if you forget, it automatically checks you out at midnight.

The company was founded in 2010 and has raised $18.5 million. The most recent raise was a $15 million Series B in January.

Powered by WPeMatico

U.S. challenger bank Current, which has doubled its member base in less than six months, announced this morning it raised $131 million in Series C funding, led by Tiger Global Management. The additional financing brings Current to over $180 million in total funding to date, and gives the company a valuation of $750 million.

The round also brought in new investors Sapphire Ventures and Avenir. Existing investors returned for the Series C, as well, including Foundation Capital, Wellington Management Company and QED.

Current began as a teen debit card controlled by parents, but expanded to offer personal checking accounts last year, using the same underlying banking technology. The service today competes with a range of mobile banking apps, offering features like free overdrafts, no minimum balance requirements, faster direct deposits, instant spending notifications, banking insights, check deposits using your phone’s camera and other now-standard baseline features for challenger banks.

In August 2020, Current debuted a points rewards program in an effort to better differentiate its service from the competition, which as of this month now includes Google Pay.

When Current raised its Series B last fall, it had over 500,000 accounts on its service. Today, it touts over 2 million members. Revenue has also grown, increasing by 500% year-over-year, the company noted today.

“We have seen a demonstrated need for access to affordable banking with a best-in-class mobile solution that Current is uniquely suited to provide,” said Current founder and CEO Stuart Sopp, in a statement about the fundraise. “We are committed to building products specifically to improve the financial outcomes of the millions of hard-working Americans who live paycheck to paycheck, and whose needs are not being properly served by traditional banks. With this new round of funding we will continue to expand on our mission, growth and innovation to find more ways to get members their money faster, help them spend it smarter and help close the financial inequality gap,” he added.

The additional funds will be used to further develop and expand Current’s mobile banking offerings, the company says.

Powered by WPeMatico

After raising $215 million from SoftBank to double down on the surge of interest in online learning, Kahoot has made an acquisition to expand the scope of subjects that it covers. The popular startup, which lets people build and share educational games, has picked up Drops, a startup that helps people learn languages by way of short picture and word-based games. The plan is to integrate more Kahoot features into Drops’ apps, and to bring some of Drops’ content into the main Kahoot platform.

Kahoot, which trades a part of its shares through Norway’s alternative exchange the Merkur Market and currently has a market cap of over $3 billion, said in an announcement that it would pay $31 million in cash, plus up to $19 million more in cash and shares, based on Drops meeting certain targets between now and 2022. The deal is expected to close this month, and is the company’s biggest to date.

Drops makes three main apps. First is an eponymous freemium app, with free and paid features, that helps adults learn new languages, currently some 42 in all, with a focus on vocabulary, built around five-minute, “snackable” sessions. A second app, Scripts, is aimed at learning to read, write and sign, and it covers four alphabets and four character-based writing systems. A third, Droplets, is aimed specifically at language learning for learners aged between eight and 17. Altogether Drops has clocked up 25 million users.

Notably, one reason it might be off TechCrunch’s (and the startup world’s) radar is that it was bootstrapped. (It did go through an accelerator, GameFounders.) But it has had some notable accolades, including getting named app of the year by Google in 2018.

The startup was founded in Estonia and has 21 employees, with no “head office” as such, with the team spread across Estonia, U.S., U.K., Spain, Italy, France, Germany, Sweden, the Netherlands, Hungary, Ukraine and Russia. This could be one reason why it’s kept costs low: in 2019 it reported gross revenues of $7.5 million (€6.3 million), with cash conversion of 40%.

For some more context, Kahoot — which is also backed by the likes of Microsoft, Disney and Northzone — says that in the last 12 months, more than 1 billion participating players in over 200 countries attended over 200 million Kahoot sessions. That figure includes both educational users of its free services, as well as enterprises, which pay to build and use games (for example related to professional development or business compliance) on the platform.

“We are thrilled to welcome Drops to the expanding Kahoot! family as we advance towards our vision to become the leading learning platform in the world,” said Eilert Hanoa, the CEO of Kahoot, in a statement. “Drops’ offerings and innovative learning model are a perfect match to Kahoot!’s mission of making learning awesome through a simple, game-based approach. Drops and language learning becomes the latest addition to our growing offering of learning apps for learners of all ages and abilities. We will continue to expand in new areas to make Kahoot! the ultimate learning destination, at home, school or work, and to make learning awesome!”

The COVID-19 pandemic has led to a bonanza for educational apps, which are collectively seeing a huge rush of usage in the last year.

For students, educators and parents, they have become a way of connecting and teaching at a time when physical schools are either closed, or drastically curtailed in what they can do, in order to help limit the spread of the novel coronavirus.

Businesses and other organizations, on the other hand, are leaning on e-learning as a way of keeping connected with staff, engaging them and training them at a time when many are working from home.

It might seem ironic that at a time when travel has been drastically limited, if not completely halted altogether, for many of us, language learning has seen an especially big boom.

Maybe it’s about making hay — that is, using the moment to get yourself ready for a time in the future when you might actually get to use your newly acquired foreign language skills. Or maybe it’s just another option for distracting or occupying ourselves in a more constructive way. Whatever might be the motivation or cause, the effect is that language learning is on the up.

Most recently, Duolingo — which incidentally also uses game-based concepts, where you enter a leaderboard for your learning and your daily sessions become winning streaks — raised $35 million on a $2.4 billion valuation, a huge jump for the company.

Kahoot cites figures that predict that digital language learning will be an $8 billion+ market by 2025 and describes Drops as “one of the fastest-growing language platforms in the world.”

“The entire Drops team has spent the last five years building a new way to learn language, and we’re just getting started,” said Daniel Farkas, co-founder and CEO, Drops, in a statement. “We’ve introduced millions of users across the globe to our playful, dynamic approach to language learning. Kahoot! is doing the same for all types of learning. We’re excited to work with such a mission-aligned company to introduce the Drops platform to game-loving learners everywhere.”

This is Kahoot’s fourth acquisition, and its biggest to date. As with Drops, previous M&A deals were made to bolt on new areas of expertise to the platform, such as maths learning for students and more tools to manage enterprise users.

Powered by WPeMatico

Caura, the U.K. startup that wants to take the hassle out of car ownership, is launching car insurance — unveiling its insurtech ambitions.

Dubbed “Caura Protect,” the new insurance product claims to reduce the cost and time taken to insure a car, building on the app’s existing car management features.

Launched earlier this year by Sai Lakshmi, who previously co-founded medication management service Echo, Caura is a mobile app designed to manage all of the vehicle-related admin that car owners endure.

Drivers are on-boarded by entering their vehicle registration number and can manage parking, tolls, MOT, road tax, congestion charges and now insurance — a “one-stop shop” app in a similar vein to Echo. The idea is that Caura minimises car ownership admin and helps to mitigate associated penalty fines.

Caura is FCA approved to undergo various insurance activities and enables drivers to compare insurers and manage their policy within the app. The startup also says it has redesigned the signup and verification process to significantly reduce the time needed to find the best insurance policy.

“Caura instantly verifies users against official sources like the DVLA, simplifying the experience, and reducing the risk of insurance fraud,” says the company.

The idea is to offer a much more user-friendly insurance search and buying process than is typical of price comparison websites that ask for a multiple-page questionnaire to be filled out before sending you — the “prospect” — to the insurer to complete your purchase. Instead, Caura claims that users can research options, select a quote, pay and be covered to drive in around a minute (if you navigate the app really fast, I’m assuming).

The insurance cover itself is provided by six of the leading U.K. insurers, including Aviva and Markerstudy. In early 2021, Caura users will be able to pay for insurance in monthly installments.

Asked why no one seems to have made shopping around for car insurance quite so straightforward, Lakshmi tells TechCrunch: “Startups in insurtech have been so busy finding niches that they’ve forgotten to innovate for the mainstream consumer”.

Powered by WPeMatico

Cashfree, an Indian startup that offers a wide-range of payments services to businesses, has raised $35.3 million in a new financing round as the profitable firm looks to broaden its offering.

The Bangalore-based startup’s Series B was led by London-headquartered private equity firm Apis Partners (which invested through its Growth Fund II), with participation from existing investors Y Combinator and Smilegate Investments. The new round brings the startup’s to-date raise to $42 million.

Cashfree kickstarted its journey in 2015 as a solution for restaurants in Bangalore that needed an efficient way for their delivery personnel to collect cash from customers.

Akash Sinha and Reeju Datta, the founders of Cashfree, did not have any prior experience with payments. When their merchants asked if they could build a service to accept payments online, the founders quickly realized that Cashfree could serve a wider purpose.

In the early days, Cashfree also struggled to court investors, many of whom did not think a payments processing firm could grow big — and do so fast enough. But the startup’s fate changed after Y Combinator accepted its application, even though the founders had missed the deadline and couldn’t arrive to join the batch on time. Y Combinator later financed Cashfree’s seed round.

Fast-forward five years, Cashfree today offers more than a dozen products and services and helps over 55,000 businesses disburse salary to employees, accept payments online, set up recurring payments and settle marketplace commissions.

Some of its customers include financial services startup Cred, online grocer BigBasket, food delivery platform Zomato, insurers HDFC Ergo and Acko and travel ticketing service provider Ixigo. The startup works with several banks and also offers integrations with platforms such as Shopify, PayPal and Amazon Pay.

Based on its offerings, Cashfree today competes with scores of startups, but it has an edge — if not many. Cashfree has been profitable for the past three years, Sinha, who serves as the startup’s chief executive, told TechCrunch in an interview.

“Cashfree has maintained a leadership position in this space and is now going through a period of rapid growth fuelled by the development of unique and innovative products that serve the needs of its customers,” Udayan Goyal, co-founder and a managing partner at Apis, said in a statement.

The startup processed over $12 billion in payments volumes in the financial year that ended in March. Sinha said part of the fresh fund will be deployed in R&D so that Cashfree can scale its technology stack and build more services, including those that can digitize more offline payments for its clients.

Cashfree is also working on building cross-border payments solutions to explore opportunities in emerging markets, he said.

“We still see payments as an evolving industry with its own challenges and we would be investing in next-gen payments as well as banking tech to make payments processing easier and more reliable. With the solid foundation of in-house technologies, tech-driven processes and in-depth industry knowledge, we are confident of growing Cashfree to be the leader in the payments space in India and internationally,” he said.

Powered by WPeMatico

Snapchat introduces a TikTok-style feed, Amazon Echo Buds add fitness tracking and Vettery acquires Hired. This is your Daily Crunch for November 23, 2020.

The big story: Snapchat adds Spotlight

Snapchat has introduced a dedicated feed where users can watch short, entertaining videos — pretty similar to TikTok. This comes after the app also added TikTok-like music features last month.

Starting today, users will be able to send their Snaps to the new Spotlight feed. Viewers will be able to send direct messages to creators with public profiles (Spotlight will also include anonymous content from private accounts), but there will be no public commentary on these videos.

To encourage creators to post to Spotlight, Snapchat says it will be distributing more than $1 million every day who create the top videos on Spotlight.

The tech giants

Amazon’s Echo Buds get new fitness tracking features — Say “Alexa, start my workout” with the buds in, and they’ll begin logging steps, calories, distance, pace and duration of runs.

Uber refused permission to dismiss 11 staff at its EMEA HQ —The Dutch Employee Insurance Agency has refused to give Uber permission to dismiss 11 people at the company’s EMEA headquarters.

Facebook launches ‘Drives,’ a US-only feature for collecting food, clothing and other necessities for people in need — The feature is being made available through Facebook’s existing Community Help hub.

Startups, funding and venture capital

Relativity Space raises $500M as it sets sights on the industrialization of Mars — LA-based rocket startup Relativity had a big 2020, completing work on a new 120,000-square-foot manufacturing facility in Long Beach.

Resilience raises over $800M to transform pharmaceutical manufacturing in response to COVID-19 — The company will invest heavily in developing new manufacturing technologies across cell and gene therapies, viral vectors, vaccines and proteins.

Video mentoring platform Superpeer raises $8M and launches paid channels — The Superpeer platform allows experts to promote, schedule and charge for one-on-one video calls with anyone who might want to ask for their advice.

Advice and analysis from Extra Crunch

Seven things we just learned about Sequoia’s European expansion plans — Steve O’Hear interviews Luciana Lixandru and Matt Miller about the firm’s plans.

Founders seeking their first check need a fundraising sales funnel — Start digging the well before you’re thirsty.

Will Brazil’s Roaring 20s see the rise of early-stage startups? — In September, homegrown startups raised a record $843 million.

(Extra Crunch is our membership program, which aims to democratize information about startups. And until November 30, you can get 25% off an annual membership.)

Everything else

Vettery acquires Hired to create a ‘unified’ job search platform — Vettery CEO Josh Brenner said the two platforms are largely complementary.

Gift Guide: Which next-gen console is the one your kid wants? — This holiday season, the next generation of gamers will be hoping to receive the next generation of gaming consoles.

Original Content podcast: ‘The Crown’ introduces its Princess Diana — The new season focuses on Queen Elizabeth’s relationship with Prime Minister Margaret Thatcher, and on Prince Charles’ troubled marriage to Diana, Princess of Wales.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico

Friday, an app looking to make remote work more efficient, has announced the close of a $2.1 million seed round led by Bessemer Venture Partners. Active Capital, Underscore, El Cap Holdings, TLC Collective and New York Venture Partners also participated in the round, among others.

Founded by Luke Thomas, Friday sits on top of the tools that teams already use — GitHub, Trello, Asana, Slack, etc. — to surface information that workers need when they need it and keep them on top of what others in the organization are doing.

The platform offers a Daily Planner feature, so users can roadmap their day and share it with others, as well as a Work Routines feature, giving users the ability to customize and even automate routine updates. For example, weekly updates or daily standups done via Slack or Google Hangouts can be done via Friday app, eliminating the time spent by managers, or others, jotting down these updates or copying that info over from Slack.

Friday also lets users set goals across the organization or team so that users’ daily and weekly work aligns with the broader OKRs of the company.

Plus, Friday users can track their time spent in meetings, as well as team morale and productivity, using the Analytics dashboard of the platform.

Friday has a free-forever model, which allows individual users or even organizations to use the app for free for as long as they want. More advanced features like Goals, Analytics and the ability to see past three weeks of history within the app are paywalled for a price of $6/seat/month.

Thomas says that one of the biggest challenges for Friday is that people automatically assume it’s competing with an Asana or Trello, as opposed to being a layer on top of these products that brings all that information into one place.

“The number one problem is that we’re in a noisy space,” said Thomas. “There are a lot of tools that are saying they’re a remote work tool when they’re really just a layer on top of Zoom or a video conferencing tool. There is certainly increased amount of interest in the space in a good and positive way, but it also means that we have to work harder to cut through the noise.”

The Friday team is small for now — four full-time staff members — and Thomas says that he plans to double the size of the team following the seed round. Thomas declined to share any information around the diversity breakdown of the team.

Following a beta launch at the beginning of 2020, Friday says it is used by employees at organizations such as Twitter, LinkedIn, Quizlet, Red Hat and EA, among others.

This latest round brings the company’s total funding to $2.5 million.

Powered by WPeMatico

Snapchat helped pioneer the use of lenses on faces in photos and videos to turn ordinary picture messages into fantastical creations where humans can look like, say, cats, and even cats can wear festival-chic flower crowns. Now it sounds like the company might be turning its attention… to sound.

The company appears to have acquired Voisey, a U.K. startup that features instrumentals that you overlay with your own voice to create short music tracks (and videos), and also lets musicians upload instrumentals that become the basis for those tracks. Users can apply audio filters (like auto-tune, automated harmonies and some funny twists like a Billie-Eilish-ish effect) to their voices; and they can browse and view other people’s Voisey tracks.

The results look something like this or this.

The deal was first reported by Business Insider, which noted Voisey had changed its company address in London to that of Snap’s. In addition to that, we have seen that filings in Companies House indicate that the the four people who co-founded the startup — Dag Langfoss-Håland, Pal Wagtskjold-Myran, Erlend Drevdal Hausken and Oliver Barnes — as well as the startup’s first two investors — Terry Steven Fisher and Jason Lee Brook — all resigned as directors of the company on October 21. At the same time, two employees at Snap — Atul Manilal Porwal on the legal team and international controller Amanda Louise Reid — were assigned directorship roles.

Snap’s London spokesperson Tanya Ridd said Snap declined to comment for this story. Voisey did not respond to our email.

Voisey had raised only $1.88 million to date (per PitchBook data), and it’s ranked at 143 in iOS in Music in the U.S. currently, according to AppAnnie stats. It’s not clear how much Snap would have paid for the startup, but the news comes on the heels of a Snap filing earlier this month that indicated that the U.K. entity, which is still loss-making, is poised to borrow up to $500 million, so there is possibly some cash for acquisitions reserved as part of that.

Voisey has been described in the past as a “TikTok for music creation”. And it does look a little like the popular video app, which like Voisey is also focused around user-generated content. Voisey has a distinctly stronger creator feel to it, and there has even been at least one singer discovered on the platform. The Billie Eilish-esque Olivia Knight, who goes by “poutyface,” signed with Island Records/Warner Chappell earlier this year.

On the other hand, TikTok — at least for now — is less about music creation and more about people creating other kinds of content — dancing, written messages, chitchat — set to music. We write “for now” because TikTok’s parent ByteDance has also quietly acquired assets for music creation, so maybe we should watch this space.

It’s not clear whether Snap would look to integrate some or all of Voisey’s features into its flagship app Snapchat to create new music services, or run Voisey as a separate app (with easy hooks into Snapchat), or a combination of the two. Based on experience it could be any of these.

Snap has been slowly building up its music cred, but up to now that has felt more like work to clone TikTok: last month, it launched Sounds on Snapchat, a feature to let people add tunes to their Stories, to make them, well, more like TikTok videos. That has come with a growing trove of licensing deals with big publishers.

Even before it launched that, Snap hadn’t ignored the power of sound completely. It has been offering voice filters, to give your videos a more comedic twist, for years already. But with music being one of the most engaging of formats on social media, Voisey could potentially give Snap, and Snapchat, a leg up in the feature race with a platform to build original content.

What’s interesting is the timing of this deal.

It was just last week that we revealed another voice-focused acquisition of Snap’s, the Israeli startup Voca.ai, which it acquired for $70 million (although a close source disputed that and said it’s $120 million…).

As with Voisey, no word on where Voca.ai tech will be used, but Voca.ai is an AI-based startup that lets companies create interactive voice-based chatbots for customer service interactions. That could see Snap expanding the kinds of services it provides to businesses, or expanding how people can interact using voice on its existing services, specifically its Spectacles, or both (or, again, something completely different).

Put together with the Voisey deal, it’s a sign of the company doing a lot more than just snapping pictures.

Powered by WPeMatico

South Korea-based PUBG Corporation, which runs sleeper hit gaming title PUBG Mobile, announced last week that it plans to return to India, its largest market by users. But its announcement did not address a key question: Is India, which banned the app in September, on the same page?

The company says it will locally store Indian users’ data, open a local office and release a new game created especially for the world’s second-largest internet market. To sweeten the deal, PUBG Corporation also plans to invest $100 million in India’s gaming, esports and IT ecosystems.

But PUBG’s announcement, which TechCrunch reported as imminent last week, is treading in uncharted territory and it remains unclear if its efforts allay the concerns raised by the government.

Since late June, the Indian government has banned more than 200 apps — including PUBG Mobile, TikTok and UC Browser, all of which identified India as their biggest market by users — with links to China.

New Delhi says it enforced the ban over cybersecurity concerns. The government had received complaints about the apps stealing user data and transmitting it to servers abroad, the nation’s Ministry of Electronics and Information Technology said at the time. The banned apps are “prejudicial to sovereignty and integrity of India,” it added.

KRAFTON, the parent firm of PUBG Corporation, inked a deal with Microsoft to store users’ data of PUBG Mobile and its other properties on Azure servers. Microsoft has three cloud regions in India. Prior to the move, PUBG Mobile data concerning Indian users was stored on Tencent Cloud. In addition, PUBG said it is committed to conducting periodic audits of its Indian users’ data.

In India, PUBG has also cut publishing ties with Chinese giant Tencent, its publisher and distributor in many markets. This has allowed PUBG Corporation to regain the publishing rights of its game in India.

At face value, it appears that PUBG Corporation has resolved the issues that the Indian government had raised. But industry executives say that meeting those concerns is perhaps not all it would take to return to the country.

Here’s where things get complicated.

Not a single app India has blocked in the country has made its comeback yet. Some firms such as TikTok have been engaging with the Indian government for more than four months and have promised to make investments in the country, but they are still not out of the woods.

PUBG Corporation, too, has not revealed when it plans to release the new game in India. “More information about the launch of PUBG Mobile India will be shared at a later day,” it said in a statement last Thursday. According to a popular YouTuber who publishes gameplay videos on PUBG Mobile, the company has privately released the installation file of the new game and has hinted that it plans to release the game in India as soon as Friday. (There’s also a big marketing campaign in the works, which could begin on Friday, people familiar with the matter told TechCrunch.)

Powered by WPeMatico

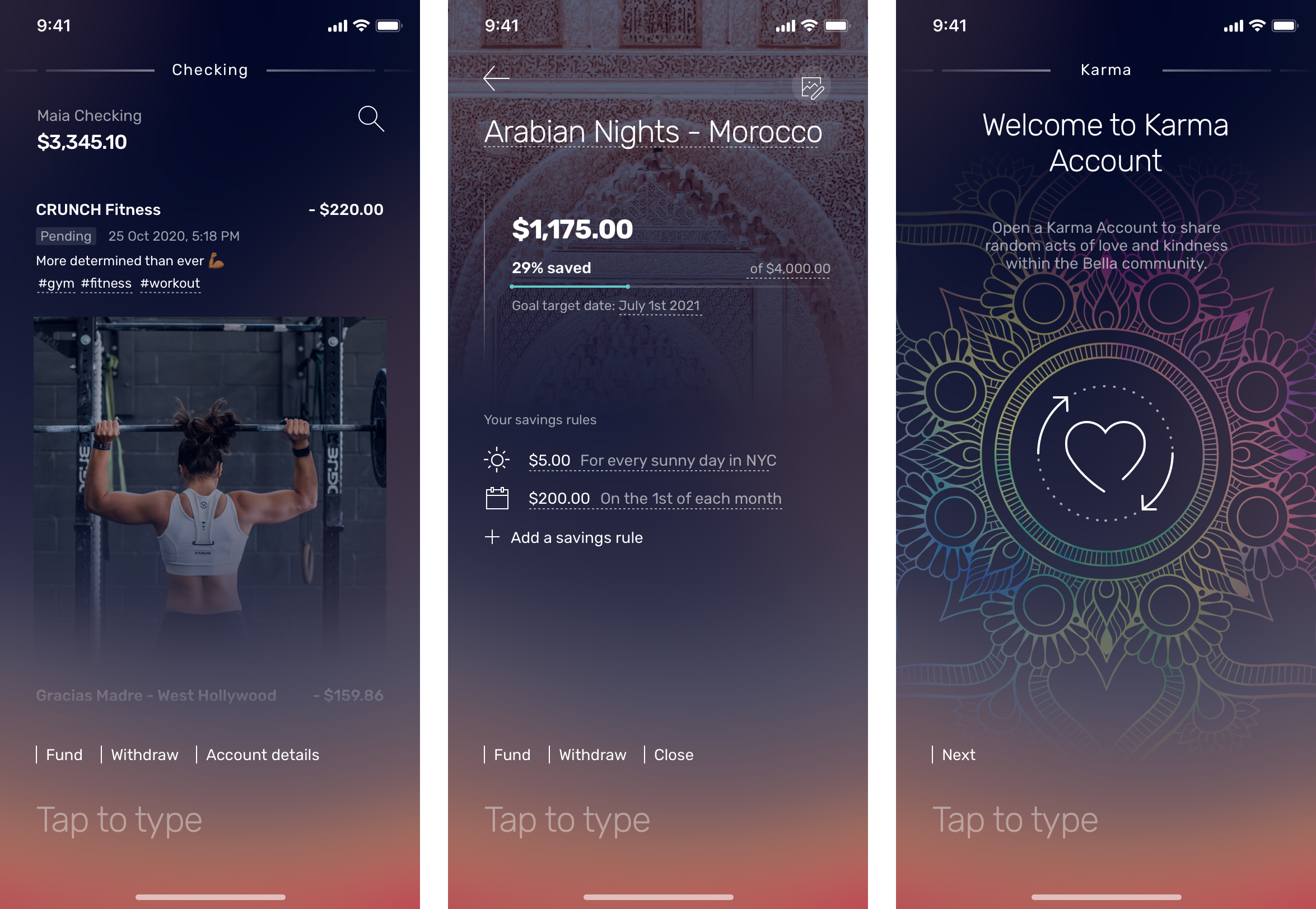

Meet Bella, a new challenger bank launching on November 30th. The company is trying to differentiate itself with two distinctive features. First, you can interact with the app using keywords and text commands. Second, Bella is trying to build a community that helps each other to differentiate its product from soulless monolithic banking services.

Let’s start with the basics. When you open a Bella account, you receive a rainbow debit card that works on the Visa network. You get a checking account as well as the ability to create savings accounts. Behind the scenes, Bella works with nbkc bank for the banking infrastructure. Accounts are FDIC insured up to $5 million.

Your card works with Apple Pay, Google Pay and Samsung Pay. There are no foreign transaction fees and Bella reimburses all ATM fees. There are no account minimums and service fees either.

Image Credits: Bella

But the app doesn’t look like your average banking app. There’s a text field at the bottom of the screen at all times. If you tap that field and enter a keyword, you can do all the interactions you’d expect to do. That feature is called Socratex.

This isn’t a chatbot, it’s more like a command line interface. For instance, if you type “Send”, it’ll suggest “Send money”. You can then enter an amount and hit next. After that, you can type the name of a contact, or add a contact, and then hit send.

You don’t have to find the right menu and hit the right button. The app tries to guide you so that you can construct a full sentence describing your intent. Bella uses LivePerson for that text-based interface. LivePerson is also Bella’s strategic backer.

Image Credits: Bella

And then, there is the Karma account. Over a hundred years ago in Naples, people started ordering two espressos and drinking just one. The second one would be a caffè sospeso. A poor person could ask for a caffè sospeso later that day and get a free coffee.

Bella is basically doing the same thing with its Karma account. Users can deposit up to $20 into a personal Karma account. Another user could use its Bella card and get a notification saying that their purchase is covered by someone else’s Karma account.

Similarly, Bella is introducing a randomized cashback program. The company randomly picks purchases and sends you back 5 to 200% in cashback.

When it comes to savings accounts, you can open as many savings accounts as you want and set some unconventional rules. For instance, you can set up a rule that puts some money aside when it’s sunny, when your sports team is winning, etc.

As you can see, Bella wants to introduce some randomized events so that you get surprised by your own bank account. The company wants to give back $1 million in cashback over the first four weeks on the market. Let’s see if that could turn the financial service into a viral experience.

Powered by WPeMatico