Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

The popular news app News Break is announcing that it has raised $115 million in new funding.

The press release claims this round makes News Break “one of the first new unicorns of 2021,” but the startup declined to disclose its actual valuation.

Founder and CEO Jeff Zheng said that when he started the company in 2015, the goal was to differentiate itself from other news aggregation apps by focusing on local news, and to “help or empower these local content creators.”

To be clear, you can find similar stories in News Break that you’d see in other news apps (there’s a whole section for coronavirus news, for example, and this morning you’ll see plenty of headlines about yesterday’s violent takeover of the U.S. Capitol), but you’ll also see plenty of stories that are highlighted specifically based on your location.

“Technology is interweaving with every aspect of the company — in how we empower local publishers and local journalists to generate content more effectively and to reach an online audience more effectively,” Zheng said. “We have AI tools to help provide all these relevant articles … We have location profiles and what you’re most interested in, which we basically match against the content.”

Jeff Zheng. Image Credits: News Break

The local focus may be increasingly valuable given the broader economic challenges facing the local news business — as Zheng put it, there’s “strong user demand” for local news but “weak supply.” And the strategy seems to have paid off for News Break so far, with the app reaching the top spot in the News category of Apple’s U.S. App Store multiple times (it’s currently ranked No. 4), and in Google Play as well. The startup says it’s currently reaching 12 million daily active users.

Zheng said that while News Break already shares ad revenue with publishers, he’s hopeful that the value it provides those publishers will only grow over time: “We want to give as much money back to the creators as possible.”

When I suggested that publishers and journalists may be leery about relying too much on a third-party platform to reach their audience, Zheng argued that News Break’s incentives are very different from the big internet and social media platforms.

“We are local-centric,” he said. “If local publishers are struggling, if the newspapers are diminishing every year, then sooner or later we are out of business.”

And while Zheng previously led Yahoo Labs in Beijing and was also founding CEO at Chinese news startup Yidian Zixun — plus, the startup has team members in Beijing and Shanghai — he emphasized that this is a “U.S. high-tech company incorporated in Delaware, headquartered in Mountain View,” with the majority of its workforce in the United States and a focus on the U.S. market. The distinction could become important if News Break continues to grow, given the U.S. government’s current attempts to ban some Chinese companies.

News Break previously raised $36 million in funding. The new round was led by Francisco Partners, which is taking a seat on the News Break board. IDG Capital also participated.

In a statement, Francisco Partners Principal Alan Ni said:

News Break’s breakout multi-year successes in the local news space is what first brought them to our attention. We are inspired by their mission and extremely impressed by the work they have done to bring local-news distribution into the 21st Century through cutting-edge machine learning and media savvy. We are thrilled to be partnering with News Break’s talented leadership team as they continue to drive local news innovations while also rapidly expanding their business into adjacent local verticals beyond news.

Powered by WPeMatico

Spending on cosmetics has usually weathered economic crises, but that changed during the COVID-19 pandemic, with stay-at-home orders and masks tempering people’s desire to wear makeup. This forced retailers to accelerate their online strategies, finding new ways to capture shoppers’ attention without in-store samples. Virtual beauty try-on technology, like the ones developed by Perfect Corp., will play an important role in this shift to digital. The company announced today it has raised a Series C of $50 million led by Goldman Sachs.

Based in New Taipei City, Taiwan and led by chief executive officer Alice Chang, Perfect Corp . is probably best known to consumers for its beauty app YouCam Makeup, which lets users “try on” virtual samples from more than 300 global brands, including ones owned by beauty conglomerates Estée Lauder and L’Oréal Paris. Launched in 2014, YouCam Makeup now counts about 40 million to 50 million monthly active users and has expanded from augmented selfies to include livestreams and tutorials from beauty influencers, social features and a “Skin Score” feature.

Perfect Corp.’s technology is also used for in-store retail, e-commerce and social media tools. For example, its tech helped create a new augmented reality-powered try-on tool for Google Search that launched last month (its was previously used for YouTube’s makeup try-on features, too). It also worked with Snap to integrate beauty try-on features into Snapchat.

The new funding brings Perfect Corp.’s total raised so far to about $130 million. Its last funding announcement was a $25 million Series A in October 2017. The Series C will be used to further develop Perfect Corp.’s technology for multichannel retail and open more international offices (it currently has operations in 11 cities).

In a press statement, Xinyi Feng, a managing director in the Merchant Banking Division of Goldman Sachs, said, “The integration of technology through artificial intelligence, machine learning and augmented reality into the beauty industry will unlock significant advantages, including amplification of digital sales channels, increased personalization and deeper consumer engagement.”

Perfect Corp. will also be part of the investment firm’s Launch with GS, a $500 million investment initiative to support a diverse, international cohort of entrepreneurs.

The company uses facial landmark tracking technology, which creates a “3D mesh” around users’ faces so beauty try-ons look more realistic. In terms of privacy, chief strategy officer Louis Chen told TechCrunch that no user data, including photos or biometrics, is saved, and all computing is done within the user’s phone.

The vast majority, or about 90%, of Perfect Corp.’s clients are cosmetic or skincare brands, while the rest sell haircare, hair coloring or accessories. Chen said the goal of Perfect Corp.’s technology is to replicate as closely as possible the experience of trying on makeup in a store. When a user virtually applies lipstick, for example, they don’t just see the color on their lips, but also the texture, like matte, glossy, shimmer or metallic (the company currently offers seven lipstick textures, which Chen said is the most in the industry).

While sales of makeup have dropped during the pandemic, interest in skincare has grown. A September 2020 report from the NPD Group found that American women are buying more types of products than they were last year, and using them more frequently. To help brands capitalize on that, Perfect Corp. recently launched a tool called AI Skin Diagnostic solution, which it says is verified by dermatologists and grades facial skin on eight metrics, including moisture, wrinkles and dark circles. The tool can be used on skincare brand websites to recommend products to shoppers.

Before COVID-19, YouCam Makeup and the company’s augmented reality try-on tools appealed to Gen Z shoppers who are comfortable with selfies and filters. But the pandemic is forcing makeup and skincare brands to speed up their adaption of technology for all shoppers. As a McKinsey report about the impact of COVID-19 on the beauty industry put it, “the use of artificial intelligence for testing, discovery and customization will need to accelerate as concerns about safety and hygiene fundamentally disrupt product testing and in-person consultations.”

“Depending on the geography of the brand, in the past probably only 10%, no more than 20%, of their business was direct to consumer, while 80% was going through retail distribution and distribution partnerships, the network they already built over the year,” said Chen. But beauty companies are investing more heavily in e-commerce now, and Perfect Corp. capitalizes on that by offering its technology as a SaaS.

Another way Perfect Corp. has adapted its offerings during the pandemic is offering remote consultation tools, which means beauty and skincare consultants who usually work in salons or a store like Ulta can demonstrate makeup looks on clients through video calls instead.

“Every single thing we are building now is not a siloed technology,” said Chang. “It’s now always combined with video-streaming.” In addition to one-on-one chats, this also means live-cast shopping, which is extremely popular in China and gradually taking off in other countries, and the kind of AR technology that was integrated into YouTube and Snapchat.

Powered by WPeMatico

ShareChat, an Indian social network that added Twitter as an investor in 2019, may soon receive the backing of two more American firms.

The Bangalore-based startup is in advanced stages of talks to raise money from Google and Snap, as well as several existing investors, including Twitter, three sources familiar with the matter told TechCrunch.

The new financing round — a Series E — is slated to be larger than $200 million, with Google alone financing more than $100 million of it, four sources said, requesting anonymity as the talks are private. The round values ShareChat at more than $1 billion, two of the sources said.

ShareChat, Google and Snap did not immediately respond to a request for comment. ShareChat has raised about $264 million to date and was valued at nearly $700 million last year.

The terms of the deal could change and the talks may not materialize into an investment, the sources cautioned. Local TV channel ET Now reported last year that Google was in talks to acquire ShareChat.

ShareChat’s marquee and eponymous app caters to users in 15 Indian languages and has a large following in small Indian cities and towns. Twitter and Snap, on the other hand, are struggling to gain users beyond urban cities in the world’s second-largest internet market. Both Twitter and Snapchat have about 50 million monthly active users in India, according to a popular mobile insight firm.

In an interview with TechCrunch last year, Ankush Sachdeva, co-founder and chief executive of ShareChat, said the app was growing “exponentially” and that users were spending, on average, more than 30 minutes on the app each day.

If the deal goes through, it would be the first investment from Snapchat’s parent company into an Indian startup. Google, on the other hand, has been on a spree of late. The Android-maker last month invested in DailyHunt and InMobi’s Glance, both of which operate short-video apps.

Like the two, ShareChat also operates a short-video app. Its app, called Moj, had amassed more than 80 million monthly active users as of September last year, the startup said at the time. Several of these short videos apps, as well as Times Internet’s MX TakaTak (operated by MX Player), have witnessed an accelerated growth in recent quarters thanks in part to New Delhi banning ByteDance’s TikTok and hundreds of other Chinese apps mid-last year.

Last year, Google announced that it plans to invest $10 billion in India over the course of five to seven years. Days later, the company invested $4.5 billion in Indian telecom giant Jio Platforms. Google and Facebook, which invested $5.7 billion in Jio Platforms last year, reach more than 400 million users in the country.

Google, Facebook, ShareChat, DailyHunt and Glance generate most of their revenue through ads. About 85% of the ad market in India is currently commanded by Facebook and Google, analysts at Bank of America wrote in a report to clients last year. “We estimate this market to be $10 billion by 2024 and see room for Facebook to increase its market-share by 4 percentage points in 4 years led by partnership with Jio. We estimate Facebook may have $4.7 billion revenues by 2024,” they wrote in the equity research report, obtained by TechCrunch.

Powered by WPeMatico

Bangalore-based CRED is kickstarting the new year on a high note.

The two-year-old startup, led by high-profile entrepreneur Kunal Shah, said on Monday it has raised $81 million in a new financing round and bought shares worth $1.2 million (about 90 million Indian rupees) from employees.

The Series C financing round, as first reported by TechCrunch in late November, was led by DST Global. Existing investors Sequoia Capital, Ribbit Capital, Tiger Global and General Catalyst also participated in the round, and so did a few new names, including Satyan Gajwani of Indian conglomerate Times Internet, Sofina and Coatue.

The round gave CRED — which operates an eponymous app to reward customers for paying their credit card bill on time and offers deals from interesting online brands — a post-money valuation of $806 million.

In an interview with TechCrunch, Shah said that about 10% of CRED’s cap table is currently allocated to employees, and those who held vested stocks were eligible to sell up to 50% of their shares back to the startup in its first ESOP liquidity program. “We believe that startups should think about creating wealth for every shareholder, including employees.”

CRED has nearly doubled its customer base to about 5.9 million in the past year, or about 20% of the credit card holder base in India. The startup said that the median credit score of its customer was about 830, and about 30% of its customer base today holds a premium credit card. (On a side note, more than 50% of CRED customers pay their bills using UPI.)

CRED is one of the most talked-about startups in India, in part because of the scale at which its valuation has soared and the amount of capital it has been able to raise in such a short period.

One of the biggest questions surrounding CRED is just how it makes money, given how most fintech startups in the country — and there are many of them — are struggling to find a business model.

Shah said CRED makes money by cross-selling financing products — for which it has a revenue-sharing arrangement with banks and other financial institutions — and levies a similar cut from merchants who are on the platform today. More than 1,300 brands — including big names Starbucks, TAGG, Eat.Fit, Nykaa and emerging premium direct-to-consumer brands such as The Man Company, Sleepy Cat and Crossbeats –have joined the platform in recent years.

Direct-to-consumer market in India is still in its nascent stage, though some estimates say it could be worth $100 billion by 2025.

“I don’t think we were very deliberate to make D2C happen. It just so happened that in the early days when we offered rewards for D2C brands, they started to see huge traction,” he said, adding that CRED drove more than 30% sales for some brands.

“We realized that we were able to solve the discovery problem for customers. We are approaching this with themes — work-from-home and coffee — and it’s working out well. We are now playing matchmaking role between customers and brands that otherwise had to spend a lot of money in marketing.”

One of the biggest propositions of CRED is that it has been able to court some of the most sought-after customers in India. Unlike many other startups and giants such as Google and Facebook, CRED is not going after the next billion users.

“About 20 million customers account for 90% of all online consumption in India. These are the customers we are focusing on,” said Shah, who previously ran financial services firm Freecharge and delivered one of the rare successful exits in the country. The core challenge in chasing customers in smaller cities and towns in India is that very few people have the financial capacity to buy things, Shah said.

For that model to work, the GDP of India — where the average annual income of an individual is about $2,000 — needs to grow. And for that, we need more participation from females, said Shah. Less than 10% of the female population in India are currently part of the workforce, compared to over 90% in China.

An interesting use case for CRED today is that it could potentially license to venture firms data about the traction D2C brands are seeing on its platform, which could use it as a signal to inform their investment decisions.

Shah cautioned that the startup is “extraordinarily sensitive about data” but said the team is thinking about ways to help venture firms discover these firms. “We are planning to create a newsletter to showcase many of these brands to the investor world,” he said.

And finally, will CRED launch a credit card or other banking products? “Can we partner with banks to cross-sell every product that they today offer? The answer is yes,” said Shah, though he cautioned that the startup is in no hurry to supercharge its offerings.

Powered by WPeMatico

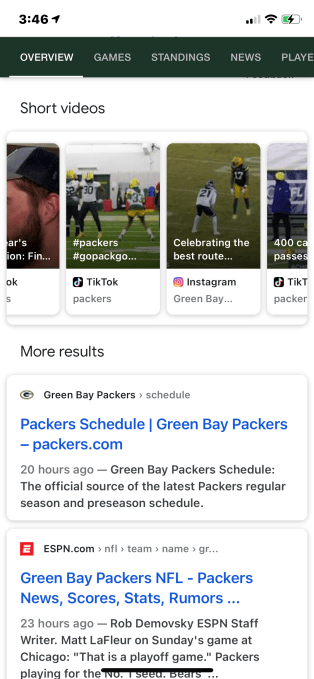

Google is testing a new feature that will surface Instagram and TikTok videos in their own dedicated carousel in the Google app for mobile devices — a move that could help the company retain users in search of social video entertainment from fully leaving Google’s platform. The feature itself expands on a test launched earlier this year, where Google had first introduced a carousel of “Short Videos” within Google Discover — the personalized feed found in the Google mobile app and to the left of the home screen on some Android devices.

To be clear, this “Short Videos” carousel is different from Google’s Stories, which rolled out in October 2020 to the Google Search app for iOS and Android. Those “Stories” — previously known as “AMP Stories” — consist of short-form video content created by Google’s online publishing partners like Forbes, USA Today, Vice, Now This, Bustle, Thrillist and others.

Meanwhile, the “Short Videos” carousel had been focused on aggregating social video from other platforms, including Google’s own short-form video project Tangi, Indian TikTok competitor Trell, as well as Google’s own video platform, YouTube — which has also been experimenting with short-form content as of late.

The expansion to include Instagram and TikTok content in this carousel was first reported by Search Engine Roundtable (via Brian Freiesleben’s tweet). They were able to access the feature by searching for “packers” in the Google app then scrolling down the page.

We were able to replicate this, as well. (See below image.)

Image Credits: screenshot of Google search results

We found the Short Videos carousel appears when you scroll past the Google Knowledge Base box for the Green Bay Packers, followed by the the scores, Top Stories, Twitter results, Top Results, Images, Videos and other content, like a listing of the players, standings and more.

Both Instagram and TikTok videos were available in the Short Videos row. When clicked, you’re taken to the web version of the social platform — not the native mobile app, even if it’s installed on your device. The end result is that Google users are more likely to remain on Google, as all it takes is a tap on the back arrow to return to the search results after watching the video.

Google has been indexing video content for years and partnered with Twitter on 2015 to index search results. It’s not clear to what extent it has any formal relationship with Facebook/Instagram or TikTok, however. (If those companies comment, we’ll update.)

Google declined to formally comment or further detail its plans, but a company spokesperson confirmed to TechCrunch the feature was currently being piloted on mobile devices. They clarified that means it’s a limited, early-stage feature. In other words, you won’t find the video carousel on every search query just yet. But over time, as Google scales the product, it could become an interesting tool for indexing and surfacing top video content from social media — unless, of course, the platforms choose to block Google from doing so.

The feature is currently available in a limited way on the Google app for mobile devices and on the mobile web, the company said.

Powered by WPeMatico

The rivalry between China’s top online learning apps has become even more intense this year because of the COVID-19 pandemic. The latest company to score a significant funding round is Zuoyebang, which announced today (link in Chinese) that it has raised a $1.6 billion Series E+ from investors including Alibaba Group. Other participants included returning investors Tiger Global Management, SoftBank Vision Fund, Sequoia Capital China and FountainVest Partners.

Zuoyebang’s latest announcement comes just six months after it announced a $750 million Series E led by Tiger Global and FountainVest. The latest financing brings Zuoyebang’s total raised so far to $2.93 billion. The company did not disclose its latest worth, but Reuters reported in September that it was raising at a $10 billion valuation.

One of Zuoyebang’s main competitors is Yuanfudao, which announced in October that it had reached a $15.5 billion valuation after closing a $2.2 billion round led by Tencent. This pushed Yuanfudao ahead of Byju as the world’s most valuable edtech company. Another popular online learning app in China is Yiqizuoye, which is backed by Singapore’s Temasek.

Zuoyebang offers online courses, live lessons and homework help for kindergarten to 12th grade students, and claims about 170 million monthly active users, about 50 million of whom use the service each day. In comparison, there were about 200 million K-12 students in 2019 in China, according to the Ministry of Education (link in Chinese).

In fall 2020, the total number of students in Zuoyebang’s paid livestream classes reached more than 10 million, setting an industry record, the company claims. While a lot of the growth was driven by the pandemic, Zuoyebang founder Hou Jianbin said in the company’s funding announcement that it expects online education to continue growing in the longer term, and will invest in K-12 classes and expand its product categories.

Powered by WPeMatico

As the year draws to a close, a few members of our edit staff shared stories that defined the last 12 months for their beat.

Devin Coldewey: Technology played a pivotal role in the coverage of protests against police violence over the summer. Disinformation and discord spread like wildfire on social media, but so did important information and documentation of brutality, often via the newly popular medium of live streaming.

Kirsten Korosec: Uber evolved from a company trying to cover everything in transportation to one focused on ride-hailing and delivery as it aims for profitability in 2021. To get there, Uber offloaded its micromobility unit Jump, its self-driving subsidiary Uber ATG and air taxi moonshot Uber Elevate.

Powered by WPeMatico

As the year draws to a close, a few members of our edit staff shared stories that defined the last 12 months for their beat.

Devin Coldewey: Technology played a pivotal role in the coverage of protests against police violence over the summer. Disinformation and discord spread like wildfire on social media, but so did important information and documentation of brutality, often via the newly popular medium of live streaming.

Kirsten Korosec: Uber evolved from a company trying to cover everything in transportation to one focused on ride-hailing and delivery as it aims for profitability in 2021. To get there, Uber offloaded its micromobility unit Jump, its self-driving subsidiary Uber ATG and air taxi moonshot Uber Elevate.

Powered by WPeMatico

Telegram will introduce ads, TikTok’s parent company is moving into drug discovery and President Trump continues his battle against Section 230. This is your Daily Crunch for December 23, 2020.

The big story: Telegram prepares to monetize

Telegram founder Pavel Durov said the messaging app will introduce advertising next year on public one-to-many channels. Durov wrote on his Telegram channel the ad platform will be “one that is user-friendly, respects privacy and allows us to cover the costs of server and traffic.”

He also pointed to premium stickers as another way that Telegram could monetize, while emphasizing that existing features will remain free and that he does not support showing ads in private chats.

In addition to discussing the company’s monetization plans, Durov said that Telegram is “approaching” 500 million users.

The tech giants

Nikola’s stock crashes after announcing cancelation of contract with Republic Services for 2,500 garbage trucks — This is the latest deal to unravel for Nikola as it tries to patch up following recent devastating reports.

TikTok parent ByteDance hiring for AI drug discovery team — “We are looking for candidates to join our team and conduct cutting-edge research in drug discovery and manufacturing powered by AI algorithms,” the company said in a job posting.

Startups, funding and venture capital

Chinese autonomous driving startup WeRide bags $200M in funding — The new funding will see WeRide joining hands with Yutong, a 57-year-old company, to make autonomous-driving minibuses and city buses.

Voyager Space Holdings to acquire majority stake in commercial space leader Nanoracks — Nanoracks provided the Bishop Airlock that was installed on the International Space Station.

Honk introduces a real-time, ephemeral messaging app aimed at Gen Z — Instead of sending texts off into the void and hoping for a response, friends on Honk communicate via messages that are shown live as you type.

Advice and analysis from Extra Crunch

Dear Sophie: What’s ahead for US immigration in 2021? — Sophie Alcorn weighs in on what’s next for U.S. visas and green cards.

Looking ahead after 2020’s epic M&A spree — This year, four deals involving chip companies totaled over $100 billion on their own.

Heading into 2021: Venture fundraising, liquidity and the everything bubble — Alex Wilhelm’s final column of the year.

(Extra Crunch is our membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

Trump vetoes major defense bill, citing Section 230 — President Trump has vetoed the $740 million National Defense Authorization Act, a major bill that allocates military funds each year.

XRP cryptocurrency crashes following announcement of SEC suit against Ripple — The XRP token’s value has declined more than 42% in the past 24 hours.

TaskRabbit is resetting customer passwords after finding ‘suspicious activity’ on its network — The company later confirmed the activity was a credential stuffing attack, where existing sets of exposed or breached usernames and passwords are matched against different websites to access accounts.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico

As the year draws to a close, a few members of our edit staff shared stories that defined the last 12 months for their beat.

Devin Coldewey: Technology played a pivotal role in the coverage of protests against police violence over the summer. Disinformation and discord spread like wildfire on social media, but so did important information and documentation of brutality, often via the newly popular medium of live streaming.

Kirsten Korosec: Uber evolved from a company trying to cover everything in transportation to one focused on ride-hailing and delivery as it aims for profitability in 2021. To get there, Uber offloads its micromobility unit Jump, its self-driving subsidiary Uber ATG and air taxi moonshot Uber Elevate.

Powered by WPeMatico