Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Clubhouse, a one-year-old social audio app reportedly valued at $1 billion, will now allow users to send money to their favorite creators — or speakers — on the platform. In a blog post, the startup announced the new monetization feature, Clubhouse Payments, as the “the first of many features that allow creators to get paid directly on Clubhouse.”

Clubhouse declined to comment. Paul Davison, the co-founder of Clubhouse, mentioned in the company’s latest town hall that the startup wants to focus on direct monetization on creators, instead of advertisements.

Here’s how it will work: A user can send a payment in Clubhouse by going to the profile of the creator to whom they want to give money. If the creator has the feature enabled, the user will be able to tap “Send Money” and enter an amount. It’s like a virtual tip jar, or a Clubhouse-branded version of Venmo (although the payments feature doesn’t currently let the user send a personalized message along with the money).

“100% of the payment will go to the creator. The person sending the money will also be charged a small card processing fee, which will go directly to our payment processing partner, Stripe,” the post reads. “Clubhouse will take nothing.”

Stripe CEO Patrick Collison tweeted shortly after the blog post went up that “It’s cool to see a new social platform focus first on participant income rather than internalized monetization / advertising.”

When the startup raised a Series B led by Andreessen Horowitz in January, part of the reported $100 million funding was said to go to a creator grant program. The program would be used to “support emerging Clubhouse creators,” according to a blog post. It’s unclear how they define emerging, but cultivating influencers (and rewarding them with money) is one way the startup is promoting high-quality content on its platform.

The synergies here are obvious. A Clubhouse creator can now get tips for a great show, or raise money for a great cause, while also being rewarded by the platform itself for being a recurring host.

The fact that Clubhouse’s first attempt at monetization includes no percentage cut of its own is certainly noteworthy. Monetization, or Clubhouse’s lack thereof, has been a topic of discussion about the buzzy startup since it took off in the early pandemic months. While it currently relies on venture capital to keep the wheels churning, it will need to make money eventually in order to be a self-sustaining business.

Creator monetization, with a cut for the platform, has led to the growth of large businesses. Cameo, a startup that sends personalized messages from creators and celebrities, takes about a 25% cut of each video sold on its platform. The startup reached unicorn status last week with a $100 million raise. OnlyFans, another platform that helps creators directly raise money from fans in exchange for paywalled contact, is projecting $1 billion in revenue for 2021.

Clubhouse’s payments feature will first be tested by a “small test group” starting today, but it is unclear who is in this group. Eventually, the payments feature will be rolled out to other users in waves.

Powered by WPeMatico

Woody Sears has long been interested in storytelling. Following the debut in 2007 of the first iPhone, he founded a storytelling app called Zuuka that built up a library of narrated and illustrated kids’ books for the iPhone and iPad.

Sears later sold that company to a small New York-based outfit. But Sears, who is based in Santa Barbara, California, isn’t done with stories yet. Instead, he just raised $1.6 million in seed funding for his second and newest storytelling startup, HearHere, a subscription-based audio road-trip app that, with users’ permission, pushes information to them as they’re driving, giving them informational tidbits in three- to five-minute segments about their surroundings, including points of interest they might not have been aware of at all.

The idea is to surface the unknown or forgotten history of regions, which makes sense in a world where more people have returned to road trips and parents have grown desperate to pull their kids’ attention away from TikTok. In fact, Sears’s neighbor, Kevin Costner, liked the idea so much that he recently joined its five-person team as a co-founder and narrator and investor, along with Snap Inc., the law firm Cooley, Camping World CEO and reality TV star Marcus Lemonis, AAA and numerous other individual investors, including from NextGen Venture Partners.

Because we, too, like history and road trips (and okay, fine, Kevin Costner), we talked with Sears and Costner earlier today to learn why they think they’ll succeed with HearHere when other content-rich geo-location based apps have fallen short of meaningful adoption.

Excerpts from that chat follow, edited lightly for length.

TC: You’re creating an audio map of the U.S., so how many stories do you have banked as we speak?

WS: We’re up to 5,500 stories across 22 states, and we’ll be nationwide by summer. The mission is to connect people to the places that they’re traveling through, lending people stories about the history, the natural wonders and the colorful characters who’ve lived in that area. We also do stories about sports and music and provide local insights.

TC: That’s a lot of content to gather up, edit down, then record. What does the process look like?

WS: At the end of the day, the content is king, and we take great care with these stories, producing them with a team of 22 researchers, writers, editors and narrators, most whom come from a travel journalism background. We really feel like we get the best end result through that team approach.

Eventually, we’ll open up to third-party content contributors, where we’re hosting both professional content and also user-generated content.

TC: Is there an AI component or will there be?

WS: We more see this as augmented reality in that these stories really do overlay the landscape and give you a different perspective while traveling. But AI and machine learning are things that we’ll incorporate as we start to move into foreign languages and better tailor the content for the end user.

TC: How do you prioritize which stories to tell as you’re building up this content library?

WS: The major historical markers are a big inspiration, but we’re looking for those lesser-known gems, too, and we look at travel patterns — the way that people move when they’re on leisure trips, meaning what interstate highways they’re taking and which scenic routes are most popular.

TC: How does the subscription piece work?

WS: You get five free free stories each month; for unlimited streaming, it’s $35.99 per year.

TC: Kevin, you must be approached a lot with startup ideas and investment opportunities. Why get so involved with this one?

KC: Obviously I’m story-oriented; that doesn’t come as a shock to anybody. But you’re right, a lot of ideas come to me.

HearHere came through my wife, who said that Woody had something he wanted to talk about, and as she explained it to me, I got it, you know? That’s the shiny thing for me, storytelling and having the ability for a good story to come out, especially when it comes to our country.

So we had this meeting and he explained the concept to me, which is kind of equal to what I’d already been doing my whole life, which is stopping at the bronze plaques all over the country and reading about their historical significance — those [moments] that kind of interrupt everybody’s trip except mine. [Laughs.] You know, [it’s] getting out and stretching my legs and reading a little history and dreaming while the rest of the people in the car are kind of moaning because we stopped our progress.

This [product] is an extension of that for me, without getting out of the car, and with stories that can evolve and perhaps get longer. And I can become more involved in what I was driving past and the people in the car can maybe sense what it was that interested me enough to stop.

Image Credits: Hearhere

TC: You love history.

KC: HearHere is a lot more than history, but for me, it was the history [that I found so compelling]. And it’s how the foundation was set for me to become more involved in the company and understand it a lot better and then become somebody who wanted to be a part of the founding of it.

TC: AAA and Camping World are among the company’s strategic investors. How might they promote the app and what other partnerships have you struck to get HearHere in front of people at the right time?

WS: Camping World also owns Good Sam Club, which is the largest organization of RV owners in the world, and AAA is a giant with 57 million members in the U.S., and they all see this as a way to fulfill something they’re aren’t currently doing for their audience; it’s making that bridge to digital, and we’re really excited to get this in front of their members and customers.

We also have partnerships with [the RV marketplaces] Outdoorsy and RVshare [and the RV rental and sales company] Cruise America. It’s a very hot market.

TC: There have been similar ideas. Caterina Fake’s Findery was an early app that aimed to help users discover much more about locations. Detour, a startup that provided walking audio tours of cities that was founded by Groupon co-founder Andrew Mason, seemed interesting but failed to take off with users. What makes you think this startup will click?

WS: I loved Detour. I ate up both of those.

I guess where I think [Detour] missed product-market fit was the number of scenarios where you could use it and also, it was competing for people’s time. We chose to start with road trips because you have a captive audience; there’s only so much you can do when you’re driving in the car, unlike when you’re in a city, where there are all kinds of options to explore its history, including physical books and tour guides. You also had to carve out two hours of your time, and it’s easy to get distracted while you’re walking around.

We want to capture the places that are along the journey and lesser known and more untold and where people have the space to engage in it. Starting as short form helps. It’s also on-demand, so you don’t have to follow a pre-designated route. We’re not taking you on a specific tour, where you have to turn left or turn right. We’re going to surface stories for you no matter what route you take.

Powered by WPeMatico

Apple has announced an expansion for its subscription gaming service Apple Arcade. In addition to exclusive game releases, the company is adding two new categories — Timeless Classics and App Store Greats.

In the “App Store Greats” category, you can find some well-known iPhone games that have been released over the past decade, such as Threes+, Mini Metro+, Monument Valley+, Fruit Ninja Classic+, Cut the Rope Remastered and Badland+.

This is an interesting move, as Apple has focused on exclusive titles so far. Arguably, some Apple Arcade games are sequels of popular App Store games — I’d put Mini Motorways and Rayman Mini in this category, for instance.

But Apple is changing its stance and essentially buying a back catalog of App Store games. Some of them are still available on the App Store, while others have become incompatible with modern iOS versions due to framework and hardware updates. 64-bit processors have rendered many games incompatible for instance.

As always, Apple isn’t just putting free games behind a paywall. These are brand new downloads on the App Store. You get the full game without any ad or in-app purchase.

In addition to old school App Store games, Apple is also adding “Timeless Classics” games. It’s a selection of board games and classic puzzle games that are included in your subscription. Games include Backgammon+, Chess Play & Learn+, Good Sudoku+, Tiny Crossword+, etc.

Those games should definitely help when it comes to reducing churn. Some people just like playing chess over and over again. They might start subscribing to play some chess and pay an Apple Arcade subscription just to keep using the same app.

Overall, Apple is dropping 32 games today, and Apple Arcade has more than 180 games in its catalog. Apple originally launched the service in September 2019. You can download Apple Arcade games for $4.99 per month and there’s no additional in-app purchases. Games are available on the iPhone, the iPad, the Apple TV and macOS. Up to six family members can play with a single Apple Arcade subscription and you can also access Apple Arcade with an Apple One subscription.

Apple has been betting heavily on subscription services, such as Apple Music, Apple TV+, Apple Fitness+ and Apple News+. While some of those services have been very successful, such as Apple Music, the company is still adding more and more content to other services to prove that you should subscribe over the long haul. And today’s Apple Arcade update should definitely help for its game subscription service.

Image Credits: Apple

Powered by WPeMatico

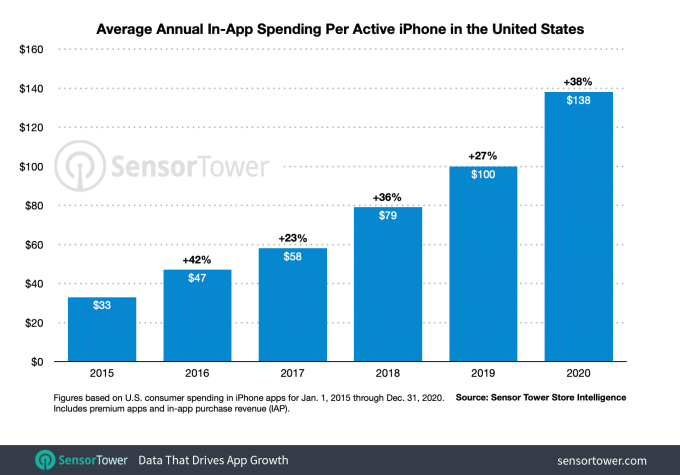

U.S. consumers spent an average of $138 on iPhone apps last year, an increase of 38% year over year, largely driven by the pandemic impacts, according to new data from app store intelligence firm Sensor Tower. Throughout 2020, consumers turned to iPhone apps for work, school, entertainment, shopping and more, driving per-user spending to a new record and the greatest annual growth since 2016, when it had then popped by 42% year over year.

Sensor Tower tells TechCrunch it expects the trend of increased consumer spend to continue in 2021, when it projects consumer spend per active iPhone in the U.S. to reach an average of $180. This will again be tied, at least in part, to the lift caused by the pandemic — and, particularly, the lift in pandemic-fueled spending on mobile games.

Image Credits: Sensor Tower

Last year’s increased spending on iPhone apps in the U.S. mirrored global trends, which saw consumers spend a record $111 billion on both iOS and Android apps, per Sensor Tower, and $143 billion, per App Annie, whose analysis had also included some third-party Android app stores in China.

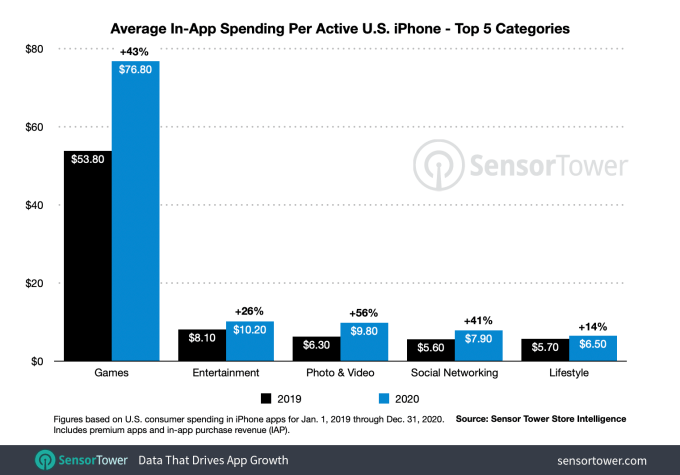

In terms of where U.S. iPhone consumer spending was focused in 2020, the largest category was, of course, gaming.

In the U.S., per-device spending on mobile games grew 43% year over year from $53.80 in 2019 to $76.80 in 2020. That’s more than 20 points higher than the 22% growth seen between 2018 and 2019, when in-game spending grew from $44 to $53.80.

U.S. users spent the most money on puzzle games, like Candy Crush Saga and Gardenscapes, which may have helped to take people’s minds off the pandemic and its related stresses. That category averaged $15.50 per active iPhone, followed by casino games, which averaged $13.10, and was driven by physical casinos closures. Strategy games also saw a surge in spending in 2020, growing to an average of $12.30 per iPhone user spending.

Image Credits: Sensor Tower

Another big category for in-app spending was Entertainment. With theaters and concerts shut down, consumers turned to streaming apps in larger numbers. Disney+ launched in late 2019, just months ahead of the pandemic lockdowns and HBO Max soon followed in May 2020.

Average per-device spending in this category was second-highest, at $10.20, up 26% from the $8.10 spent in 2019. For comparison, per-device spending had only grown by 1% between 2018 and 2019.

Other categories in the top five by per-device spending included Photo & Video (up 56% to $9.80), Social Networking (up 41% to $7.90) and Lifestyle (up 14% to $6.50).

These increases were tied to apps like TikTok, YouTube, and Twitch. Twitch saw 680% year-over-year revenue growth in 2020 on U.S. iPhones, specifically. TikTok, meanwhile, saw 140% growth. In the Lifestyle category, dating apps were driving growth as consumers looked to connect with others virtually during lockdowns, while bars and clubs were closed.

Overall, what made 2020 unique was not necessarily what apps people where using, but how often they were being used and how much was being spent.

App Annie had earlier pointed out that the pandemic accelerated mobile adoption by two to three years’ time. And Sensor Tower today tells us that the industry didn’t see the same sort of “seasonality” around spending in certain types of apps, and particularly games, last year — even though, pre-pandemic, there are typically slower parts of the year for spending. That was not the case in 2020, when any time was a good time to spend on apps.

Powered by WPeMatico

Mmhmm, the software that allows folks to personalize their appearance on video chat, has today announced that it’s introducing usage-based enterprise accounts.

In a conversation with TechCrunch, founder and CEO Phil Libin said this is a natural evolution, remarking that mmhmm has had hundreds of registrations from users all at the same company.

“It was clear that there was a big demand for enterprise accounts,” said Libin. “Not only for central management, to keep it as easy as possible, but also for getting everything on brand. Companies and organizations of all kinds are realizing video is a permanent part of how we’re going to do business and it needs to be on brand.”

The enterprise accounts are priced the same as individual Pro accounts, at $10/month or $100/year. However, when an organization signs up with an enterprise account, they only pay for the number of users who were active on mmhmm each month, rather than worrying about seats.

Enterprise accounts can also share design system assets built specifically for mmhmm to “stay on brand” as Libin said. Folks who opt in to enterprise can also control employee accounts under one umbrella, invite via link, claim an email domain and enjoy a single bill.

Libin also gave us a glimpse into the financials of the business, explaining that while it’s too early to tell, the conversion rate to Pro accounts is outpacing that of Evernote, one of Libin’s earlier ventures.

He said that, with freemium tools like both mmhmm and Evernote, the likelihood of a user upgrading to premium grows with every month they’re on the platform. At Evernote, it was half a percent after the first month, and then 5% by the end of the first year, and after two years it would jump to 12%.

Obviously, mmhmm doesn’t have 24 months’ worth of data. That said, the product is doing 10x better than Evernote did.

But revenue is not the focus, according to Libin. The company is far more concerned with ensuring the onboarding process is easy for casual users and that they really understand what they can do with the platform. In the spirit of that, mmhmm is launching new interactive tutorial videos on the platform to ensure people are fully aware of the features.

Mmhmm first came on the scene in the summer of last year in a closed beta, and eventually opened up to everyone who has a Mac in November 2020. Alongside the launch of enterprise, mmhmm is also launching a Windows version of the app in open beta.

Libin said that mmhmm is in a growth stage, and that after starting five different companies, he knows the biggest challenge is people.

“I’ve been in some startups now that have been through this hyper growth stage,” said Libin. “The toughest thing at this stage is getting people, keeping people from burning out, and doing career development. This is my fifth startup, so I’m trying to demonstrate some learning behavior and apply lessons learned from previous mistakes. We’ll see how it goes.”

Editor’s Note: An earlier version of this article incorrectly stated that mmhmm was introducing Windows in a closed beta. It has been updated for accuracy.

Powered by WPeMatico

Cameo, the celebrity video site you’re probably familiar with if you’ve celebrated a birthday in the last three years, announced this morning that it’s raised a $100M Series C. The round, which was led by Jonathan Turner with e.ventures, puts the site’s value at just north of $1 billion.

Cameo has been building a good deal of steam in recent years, but the service is among those that managed to get a major boost amid the pandemic, as celebrities and normals alike suddenly found themselves with a lot more time on their hands.

“The pandemic put extra stress on the already unstable business models supporting talent across sports and entertainment ecosystems,” CEO Steven Galanis said in a Medium post tied to the news. “It catalyzed a massive shift in awareness and widespread adoption of direct-to-fan models, which has, in turn, created a new foundation for fan engagement. We exist in an entirely different world today — one in which talent actually want to connect more deeply with their fans, and fans expect unprecedented access to the talent they admire most. This funding will help us create the access and connections that will define the future of the ‘connection economy’ on a global scale.”

This latest round more than doubles the service’s total funding, bringing it up to $165 million. Google Ventures, Amazon Alexa Fund, UTA, SoftBank Vision Fund 2, Valor Equity Partners and Counterpoint Global (Morgan Stanley) join existing investors, Lightspeed Venture Partners, Kleiner Perkins, The Chernin Group, Origin Ventures and Spark Capital. There are also some “talent investors” on board, as well, including skateboarding legend Tony Hawk. Because, you know, Cameo.

Cameo says some 80% of its standard video requests are booked as gifts, to celebrate things like birthdays. In total, around two million videos have been created through the offering. But the site is looking to grow into additional categories. Last year it added the ability to book celebrities as guests for Zoom video chats (a very pandemic-focused offering).

Some of the funding will go toward ramping up Cameo for Business (C4B), which brings celebrity videos to events and conferences, as well as ads and sales. Effectively, the service works as a pipeline between businesses and famous people. The company will also be expending its international offering, growing beyond the approximately 20% of videos currently purchased outside the U.S.

Powered by WPeMatico

This morning Bunch announced that it has closed a total of $4.4 million in seed capital, including a new $1 million infusion this week. The company’s product, a mobile app, focuses on teaching leadership skills to the younger generations more accustomed to learning in smaller chunks, often on the go.

Don’t roll your eyes, all ye who attended business school. The concept has traction.

Earlier this month TechCrunch covered Arist, for example, a startup that provides corporate training delivered to end-users via text. That company added $2 million to its prior raise, bringing its round to a total of $3.9 million. To see Bunch pick up some extra cash is therefore not too surprising.

TechCrunch caught up with Bunch CEO and co-founder Darja Gutnick and M13 partner and Bunch-backer Karl Alomar to chat about the round and what the startup is up to.

Bunch claims to be an “AI coach” that provides users with daily, short-form tips and tricks to become a better leader. Given that we have all either worked for a manager who could have used some more training, or been that manager ourselves, the idea isn’t a bad one.

As you would expect, Bunch tailors itself to individual users. Gutnick told TechCrunch that her company has partnered with academics to detail different leadership style “archetypes” as part of its foundation. The Bunch system also molds its out to a user’s style and leadership goals.

Notably when TechCrunch last covered Bunch, it was working on something a bit different. Back in 2017, the company was building what we described as “Google Analytics for company culture.” Since then the startup has shifted its focus to individuals instead of companies.

Bunch’s service launched in November, leading to around 13,000 signups by the start of the year. The startup now claims nearly 20,000. And it has big product plans for the next few months. That’s why the company raised more money, and why Alomar and his firm were willing to put more capital into the startup.

What’s ahead that got M13 sufficiently excited that it put more capital into Bunch? Alomar said that community and peer-review features are coming. It was a good time, he explained, to put more money into Gutnick’s company so that it can build, and then raise more capital later on after it gets some more work done.

The company plans to make money via a freemium offering. Gutnick told TechCrunch that related apps in her category tend to struggle with retention, so they charge up front and then don’t mind limited usage later on. She wants to flip that.

And there’s more to come from Bunch, like other categories of content. But the startup wants to focus and get its first niche done right. It now has another million dollars to prove that its early traction isn’t just that.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

A proposed witness list filed by Apple for its upcoming trial against game-maker Epic reads like a who’s who of executives from the two companies. The drawn out battle could well prove a watershed moment from mobile app payments.

The two sides came to loggerheads when the Fortnite maker was kicked out of the App Store in August of last year after adding an in-game payment system designed to bypass Apple’s – along with Apple’s cut of the profiles.

Epic has accused Apple of monopolist practices pertaining to mobile payment. Apple, meanwhile, has argued that Epic broke the App Store agreement in order to increase its revenue.

Filed late last night by the hardware giant, the document includes top executives from bot sides. For Apple, the list includes CEO Tim Cook, Software Engineering SVP Craig Federighi and Apple Fellow, Phil Schiller. On team Epic, it’s Tim Sweeney and VP Mark Rein. Executives from Microsoft, Facebook and NVIDIA are also included, for good measure.

In a statement provided to TechCrunch, Apple notes,

Our senior executives look forward to sharing with the court the very positive impact the App Store has had on innovation, economies across the world and the customer experience over the last 12 years. We feel confident the case will prove that Epic purposefully breached its agreement solely to increase its revenues, which is what resulted in their removal from the App Store. By doing that, Epic circumvented the security features of the App Store in a way that would lead to reduced competition and put consumers’ privacy and data security at tremendous risk.

The trial is expected to kick off May 3. We’ve reached out to Epic for additional comment.

Powered by WPeMatico

Kosta Eleftheriou, a co-founder of the Fleksy keyboard app later sold to Pinterest in an acqui-hire deal, has been calling attention to Apple App Store issues like fake reviews, ratings and subscription scams, as well as malicious clone apps, after his own app, FlickType, was targeted by scammers. Now, the developer is taking the next step in his App Store crusade: he’s filing a lawsuit against Apple.

The suit, which the developer claims was filed Wednesday in California Superior Court in Santa Clara county, alleges that Apple enticed developers to build applications for its App Store — the only place iOS applications can be legally sold — by claiming it’s a safe and trustworthy place, but doesn’t protect legitimate app developers against scammers profiting from their hard work.

What’s more, the suit says, Apple is disincentivized to do so because scammers are generating revenue for Apple via their use of subscriptions, which involve a revenue share with Apple.

Eleftheriou has been personally impacted by App Store scammers. He left a well-paying job at Pinterest to develop his FlickType app, an alternative swipe keyboard for Apple Watch. After its launch, the app was targeted by copycat app makers who claim their apps offer the same feature set as FlickType but instead lock users into high-priced subscriptions for their poorly designed software. They also flood their apps with fake ratings and reviews to make them appear to be a much better option when users are looking for an app in this space.

Meanwhile, FlickType sports a 3.5-star rating, as it’s often dinged for Apple Watch platform issues that are outside the developer’s control or missing features users want to call attention to. Eleftheriou engages with his app’s users, however — responding to complaints and letting users know when features they’ve requested were added or bugs have been fixed. Scammers simply buy enough 5-star reviews to keep their apps’ overall ratings higher.

In other words, Eleftheriou is doing the hard work of being an App Store developer carving out a category for swipe keyboards for the Watch, but his potential income is being shifted over to scam apps who have a falsified App Store presence.

In years past, Apple took seriously issues of app quality. It worked to clean up shady subscription apps and remove clones and spam from the App Store through regular sweeps. It even once went so far as to ban apps built using templates in an effort to raise the bar on app quality, which angered small businesses that didn’t have the resources or funds to build more professional apps. (Apple later revised its policy to be more equitable.)

But the new lawsuit alleges that Apple is now doing little to police scammers’ apps because it profits from developer misconduct. Eleftheriou also notes he has raised these issues to Apple via his company KPAW, LLC, but Apple did “next to nothing” to resolve the problem.

Eleftheriou’s story is even more complicated, though, because his app was rejected from the App Store numerous times after meeting with Apple special projects manager Randy Marsden over a possible acquisition. He tells TechCrunch numbers were discussed with Apple and his meetings had included a director and a VP, among others. Apple was considering turning FlickType into an Apple Watch feature, the lawsuit notes.

Shortly thereafter, FlickType was pulled from the App Store over App Store Review Guidelines violations, even as a competitor’s app was approved. Eleftheriou appealed for his app through Developer Relations but was given no guidance on how to prevent the same problem in the future, he said.

Over the months that followed, FlickType continued to face rejections from App Store Review. Apple’s App Store Review said that the app offered a “poor user experience,” even though tech journalists at numerous outlets had praised it, and Apple had once considering buying it. App Review also told the developer that “full keyboard apps are not appropriate for Apple Watch,” while it continued to allow competitors to publish their own keyboard apps.

Apple’s App Review team also allowed third-party apps that were running FlickType’s integratable version of the keyboard to be approved without issues. These included Watch apps like Nano for Reddit, Chirp for Twitter, WatchChat for WhatsApp and Lens for Instagram.

After Apple approved FlickType in January 2020, the company claims it had already lost over a year of revenue to competitor keyboards that were not constantly being rejected. Nevertheless, FlickType reached the App Store’s Top 10 Paid app list and generated $130,000 in its first month. As a result of its success, it was quickly targeted by scammers who launched watered-down, barely usable competitors to the app, cutting into FlickType’s revenue. FlickType’s revenue dropped to just $20,000 per month. The competitors were also using fake ratings to get their app boosted and installed by unsuspecting users.

Eleftheriou’s story was not unique, as it turned out. In recent months, he has been documenting the App Store’s multimillion-dollar scams, including those he was facing as well as others brought to his attention by developers with similar struggles. Apple, in some cases, would take action against the scammers he highlighted on social media. In other cases, it would not. And it would sometimes only take down one of the developer’s scam apps, but allow others under the same developer account to continue to operate.

The new lawsuit aims to hold Apple accountable for the issues Eleftheriou faced by asking Apple to restore his lost revenue and pay out any other damages awarded by the court.

Apple has not responded for a request for comment at this time.

A copy of the lawsuit is below. It is not yet appearing in public record searches for verification purposes. We’ll follow up to confirm when the case appears online and update accordingly.

Kpaw, LLC v. Apple, Inc by TechCrunch on Scribd

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

One of the biggest gripes about investing apps is that they are not acting responsibly by not educating users properly and allegedly letting them fend for themselves. This can result in people losing a lot of money, as evidenced by the number of lawsuits against Robinhood.

Today, an eight-year-old company that has been focused on nothing but financial education is now offering trading and banking services in the U.S..

Over the years, London-based Invstr has built out an educational platform with features such as an investing academy. It’s created a Fantasy Finance game, which gives users the ability to manage a virtual $1 million portfolio so they can learn more about the markets before risking their own money for real. Via social gamification, Invstr has set out to make the educational process fun.

It has also built a community around users so they can learn from each other (something another Robinhood competitor Gatsby is also doing).

Over 1 million users have downloaded the platform globally.

Invstr, according to CEO and founder Kerim Derhalli, is taking a different approach from competitors by offering education and learning tools upfront. And in addition to giving users the ability to make commission-free stock trades, it’s also giving them a way to digitally bank and invest using their Invstr+ accounts “without ever needing to move money from one place to another.”

Invstr takes it all a step further for subscribers who have access to an “Invstr Score,” performance stats and behavioral analytics among other things.

Derhalli said moving in this direction with the company was part of his business plan from day one.

“I think the most powerful trend in the U.S. is self-directed investing,” Derhalli told TechCrunch. “Younger generations have grown up in an app world and they expect to be autonomous and do things for themselves. Many distrust the banking system, and they don’t want to follow in their parents’ footsteps when it comes to banking and finance. We think this is a massive opportunity.”

In the unveiling of its new offerings, Invstr also announced Wednesday that it has closed on a $20 million Series A in the form of a convertible offering. This builds upon $20 million it previously raised across two seed rounds from investors such as Ventura Capital, Finberg, European angel investor Jari Ovaskainen and Rick Haythornthwaite, former global chairman of Mastercard.

Derhalli said he felt compelled to found Invstr after seeing firsthand how a lack of knowledge and confidence can prevent individuals from starting to invest. He worked for three decades in senior leadership roles at Deutsche Bank, Lehman Brothers, Merrill Lynch and JPMorgan before founding Invstr “so that anyone, anywhere could learn how to invest.”

Invstr is offering its new investing services in partnership with Apex Clearing, which formerly provided execution and settlement services to Robinhood. Its digital banking services are being offered through a partnership with Vast Bank. To address the security piece, Invstr said its user data is also protected by technology from Okta.

The company, which also has offices in New York and Istanbul, plans to use the new capital to launch new brokerage and analytics tools and a portfolio builder.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico