Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

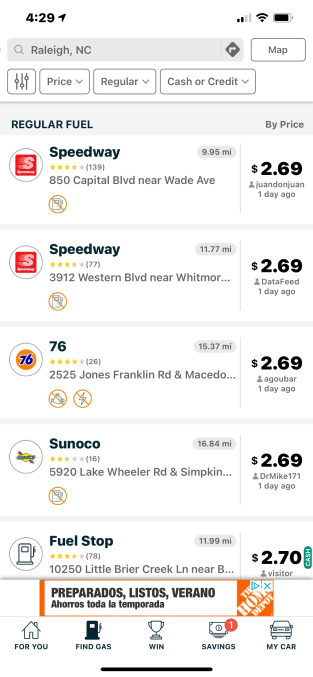

The GasBuddy mobile app, which typically helps consumers find the cheapest gas nearby, has now become the No. 1 app on the U.S. App Store for the first time ever, due to the fuel shortages in the U.S. that followed the cyberattack on the Colonial Pipeline. Americans, fearful that gas would become unavailable, began panic-buying in ways that haven’t been seen since the great toilet paper outage of 2020. As a result, thousands of gas stations ran out of fuel entirely. This dramatic situation has greatly benefitted the GasBuddy app, which includes a crowdsourced feature that helps users locate which local stations still have gas for sale.

As of Wednesday afternoon, GasBuddy says the effects of the Colonial Pipeline shutdown are being felt across 11 U.S. states, largely in the Southeast and Washington, D.C. North Carolina had the highest number of gas stations with fuel outages, with 65% of stations reportedly out of gas as of 2:48 p.m. ET on Wednesday. Kentucky has the lowest at only 2%. Because this data is self-reported by GasBuddy users, it may not represent the most current information, we should note.

Image Credits: GasBuddy app screenshot

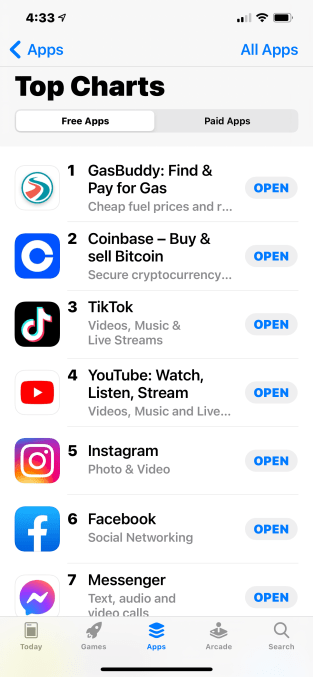

During the week, consumers have been turning to GasBuddy to help them find where they can fill up. Yesterday, the app hit No. 1 in the “Travel” category on the App Store, while it steadily climbed its way up the App Store’s Top Overall charts.

This afternoon, GasBuddy became both the No.1 app in the non-games category as well as the highest-ranked app Overall across the U.S. App Store.

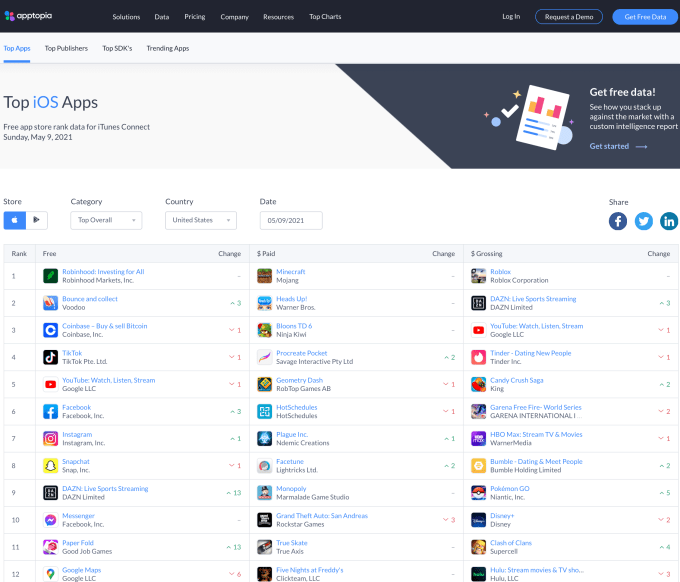

According to data from app store intelligence firm Apptopia, GasBuddy yesterday saw 15,203 new downloads — a 59% increase from its average daily downloads, which were 9,560 for the past 30 days. However, third-party data isn’t always accurate for sudden shots in rank — it catches up a few days after the fact.

Image Credits: Apptopia

Reached for comment, GasBuddy says its downloads were actually far higher than the third-party estimates. Across all platforms, including both iOS and Google Play, it saw 20x more downloads yesterday compared with an average day in 2021. The company told TechCrunch it counted 313,001 total downloads yesterday, compared with average daily downloads for the previous 30 days of 15,339.

Broken down by platform, GasBuddy says it saw 104,735 downloads on Android and 208,266 downloads on iOS on Tuesday, May 11, 2021.

Apptopia also noted that GasBuddy hadn’t been the No. 1 app on the App Store in all the time it’s been recording app store rankings, which goes back to January 1, 2015. However, it noted the app itself launched back in 2010, making it possible (though not likely) that the app had reached No. 1 at some point.

GasBuddy confirmed that’s not the case. Today is the first time it has ever topped the App Store, though it got close once before when it reached No. 2 behind a walkie-talkie app during Hurricane Irma in September 2017.

Image Credits: App Store screenshot on Wed., May 12, 2021

Consumers can continue to track statewide fuel outages here on GasBuddy’s website as well as where highest prices are being found. In the app, they can report whether gas stations have gas or diesel, as well as current prices.

The Colonial Pipeline, which runs 5,500 miles from the Gulf to the Northeast, shut down on Friday due to a ransomware attack from a criminal hacking network known as DarkSide, which is suspected to be based in Russia or Eastern Europe. The pipeline delivers about 45% of fuel used by the Eastern Seaboard. Reports of the shutdown sent Americans to stock up on gas, worsening the situation further. The U.S. Energy Secretary Jennifer Granholm said the Colonial Pipeline intends to restore operations by the end of the week.

Powered by WPeMatico

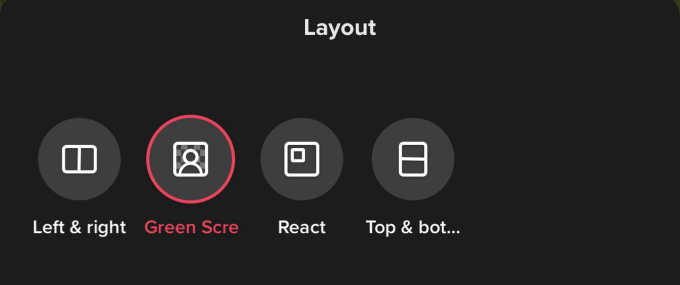

As competition with tech giants heats up, TikTok is rolling out a series of new features to help keep its short-form video app ahead of rivals. The company today announced the launch of a new Green Screen Duet feature, which combines two of TikTok’s most popular editing tools to allow creators to use another video from TikTok as the background in their new video. It also confirmed the test of a new way to discover videos. Called “Topics,” these are dedicated interest-based feeds featuring the top, trending videos in a given category.

Green Screen Duet joins an existing set of Duet tools that let creators lay out two videos side-by-side. Today, Duet layouts include “Left & Right,” “React” and “Top & Bottom.” Creators currently use Duets to sing, dance, joke or act alongside another user’s video, react to a video’s content or even just watch a video from another, sometimes smaller, creator to raise awareness or call attention to its content.

Editing tools like Duet and Stitch are key to what makes TikTok not just a passive video viewing app but, rather, a new type of video-first social network. It’s also proven so popular, it has since been adopted by Facebook’s TikTok clone, Instagram Reels, where it’s known as Remix. Snapchat has been developing a Remix feature of its own, too.

Image Credits: TikTok

TikTok’s new Green Screen Duet will now appear as another option alongside the existing layouts, offering users a way to more easily use another video in the background as they record their own video overlaid on top.

This sort of video experience is something TikTok creators already do in a variety of ways. For example, they may capture images or screen recordings, then use other editing tools to create a green screen effect like this. Or they may react to a video using a Stitch instead, as that can be easier. A built-in Green Screen Duet feature simply offers another way to record new videos that include existing videos.

When the feature is used, the Duetted video plays in the background over the new video being recorded. TikTok believes the launch will inspire new formats for creativity and expression, as a result.

TikTok has been busy upgrading its interface to improve recording and discovering new video content in its app in recent weeks, as Facebook, YouTube and Snapchat have tried to reproduce TikTok’s feature set in their own apps. For instance, TikTok just launched interactive music features last month in an effort to get ahead.

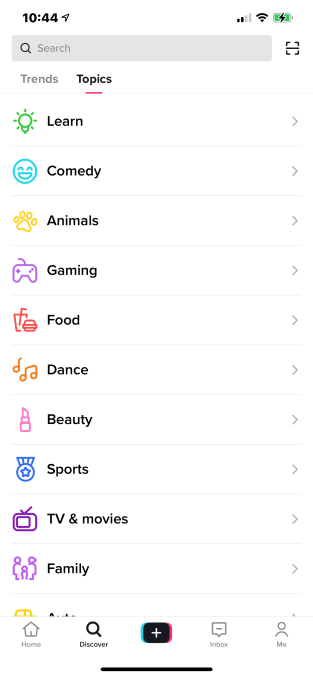

In another leap, TikTok is also now testing a new Discover page in the app, where instead of only featuring the current trends, as before, it now organizes videos into categories.

Image Credits: TikTok

These categories represent the many areas of interest on TikTok, like gaming, beauty, dance, TV & movies, sports, family, learning and much more. When you tap into any given category, you’re taken to a feed that includes the community’s top, trending content. The feeds will be affected by factors like relevance, timeliness and interest, and can help users find new content and creators outside of what their personalized For You page shows.

TikTok confirmed the test has been rolling out in the U.S. over the past few weeks.

The company also is currently testing e-commerce shopping features, where some brands like Hype and Walmart have been given a new “Shopping” tab on their TikTok profile where users can shop items, add to cart and then check out without leaving the app. (Walmart enabled its tab during its livestream event in December, and it’s been there ever since.)

Image Credits: TikTok

The integration is less elegant than Instagram’s Shops, as there’s not a native, universal cart or integrated payment mechanism. Instead, users are visiting the retailer’s website directly.

The advances TikTok is making, however, has been paying off in terms of capturing a large Gen Z user base.

According to eMarketer, more Gen Z users in the U.S. now use TikTok than Instagram, or 37.3 million monthly active users compared with 33.3 million users, respectively. And by 2023, the firm predicts TikTok will surpass Snapchat in terms of total U.S. users, as well.

But TikTok’s global ambitions are impacted not only by its ban in India but also the possibility that creators will find more monetization opportunities on established platforms.

Yesterday, for example, YouTube announced a $100 million fund for top YouTube Shorts creators, and said it will soon be testing ads on Shorts. That could help creators generate revenue from short-form content, while also converting casual viewers to channel subscribers where there are even more opportunities to monetize. Snapchat and Instagram have also been wooing creators with cash, and ultimately, if creators find they can make more money elsewhere they could shift some of their attention away from TikTok, no matter how many creative new features it adds.

Powered by WPeMatico

The digital media industry often talks about how much influence, dominance and power entities like Google and Facebook have. Generally, the focus is on the vast troves of data and audience reach these companies tout. However, there’s more beneath the surface that strengthens the grip these companies have on both app developers and publishers alike.

In reality, software development kit (SDK) integrations are a critical component of why these monolith companies have such a prominent presence. For reference, an SDK is a set of software development tools, libraries, code samples, processes and guides that help developers create or enhance the apps they’re building.

Through a digital marketing lens, SDKs provide in-app analytics, insights on campaign testing, attribution information, location details, monetization capabilities and more.

Through a digital marketing lens, SDKs provide in-app analytics, insights on campaign testing, attribution information, location details, monetization capabilities and more. In the case of companies like Google and Facebook, their ability to provide these insights dovetails with their data and reach.

While that does deliver useful capabilities to developers and publishers alike, it also perpetuates the factors contributing to their perceived monopolistic status — and the detriments a lack of competition fosters.

Almost all (90%) ad-monetized Android apps have Google’s Admob SDK integrated, data from Statista showed. Additionally, the Facebook Audience Network SDK is present in 19% of all global Android apps utilizing mobile ads. It’s worth noting that the large majority of alternative “leading” advertising SDKs outside these two players are used less than 13% of the time in Android apps.

As the app ecosystem rapidly expands beyond the borders of mobile, app developers and publishers would benefit immensely from identifying economical and secure ways of adopting more SDKs.

While there are many SDKs available in the market today, a few key factors contribute to Google and Facebook’s overall dominance. The most basic is around the respective organizations’ reach and industry notoriety. However, a larger component here is the lack of resources and time app developers have.

Powered by WPeMatico

Having a great idea for an app or game is one thing, but scaling it to become a successful business is quite another. A new fintech startup called Sanlo aims to help. The company, which is today announcing an oversubscribed $3.5 million seed round, offers small to medium-sized game and app companies access to tools to manage their finances and capital to fuel their growth.

To be clear, Sanlo is not an investor that’s taking an equity stake in the apps and games it finances. Instead, it’s offering businesses access to technology, tools and insights that will allow them to achieve smart and scalable growth while remaining financially healthy — even if they’re a smaller company without time to sit down and structure their finances. Then, when Sanlo’s proprietary algorithms determine the business could benefit from the smart deployment of capital, it will assist by offering financing.

The idea for Sanlo hails from co-founders Olya Caliujnaia and William Liu, who both have backgrounds in fintech and gaming.

Caliujnaia began her career in venture capital in one of the first mobile-focused funds, before moving to operator roles in gaming, stock photography and fintech at EA, Getty Images and SigFig, respectively. She later joined early-stage fintech and enterprise fund XYZ.vc as an Entrepreneur in Residence.

Liu, meanwhile, worked in gaming at EA, but later switched to fintech, working at startups like Earnest and Branch.

After reconnecting in San Francisco, the co-founders realized they could put their combined experience to work in order to help smaller businesses just starting out recognize when it’s time to scale, what areas of the business to invest in and how much capital they need to grow.

Image Credits: Sanlo’s Olya Caliujnaia and William Liu / Sanlo

Caliujnaia has seen how the app and gaming market has evolved over the years, and she realized the difficulties new developers now face.

“You have this explosion of the app economy that’s growing insanely,” she says. “That’s the exciting part of it. That creativity. That passion and that desire to build — that’s so admirable.”

Today, companies benefit from having access to better development tools, broader access to talent, consumer demand, and other forces, she notes, compared with those in the past. But on the flip side, it’s become incredibly difficult to scale a consumer app or game.

“I think a lot of that comes down to, one, that there are dynamics around the free-to-play model — how you monetize and therefore, what kind of players and users you bring on board,” Caliujnaia says. “And then the second aspect is that it’s just harder to get noticed. So, ultimately, it comes down to marketing.”

Many of the decisions that a company has to make on this front are predictable, however. That means Sanlo doesn’t have to sit down with businesses and consult with them one-on-one, the way a financial advisor working in wealth management would do with their clients.

Instead, Sanlo asks companies for certain types of data to get started. This includes product data about how well the app or game monetizes and customer acquisition and retention, for example, as well as marketing data and a subset of financial data. Its predictive algorithms then continually monitor the company’s growth trajectory to surface insights to identify where and how the business can grow.

This concept alone could have worked as a services business for mobile studios, but Sanlo takes the next step beyond advice to actually provide companies with access to capital. The amount of financing provided will vary based on the life stage of the company and risk profile, but it’s non-dilutive capital. That is, Sanlo takes no ownership stake in the companies it finances.

Image Credits: Sanlo

Caliujnaia said it made more sense to go this route rather than return to the VC world, because of potential to reach a wider group.

“There’s this long tail of developers and it’s more about enabling them, rather than producing more hits,” she says. “It’s very different mindsets, different markets that we’re going for.”

Sanlo doesn’t have a lot of direct competitors beyond perhaps, Silicon Valley Bank and other financial lenders, as well as mobile gaming publishers. But the publisher model often implies some sort of ownership, which is a significant differentiating factor. In some cases, you may see a larger gaming company extending debt financing to a smaller one. That was the case with Finnish mobile games company Metacore, which recently raised another debt round from gaming giant Supercell, for example.

Caliujnaia points out that most smaller companies don’t have that kind of access to financing. Now they could, through Sanlo.

“The idea is to have a healthier layer of companies that are able to survive for the long-term,” she says.

That means more companies that won’t have to stress about their futures, leading them to aggressively monetize their users, and later, scrambling for an exit when their financial runway comes to an end.

Sanlo is currently pilot testing its system with a small group of mobile game studios who will serve as its initial customer base, but plans to later support consumer apps, which have similar struggles with customer acquisition costs and growth.

The San Francisco-headquartered startup itself was founded in 2020 and began raising money. It has now raised a total of $3.5 million in seed funding co-led by Index Ventures and Initial Capital, with participation from LVP, Portag3 Ventures and XYZ Venture Capital. Angel investors include Kristian Segestrale (Super Evil Megacorp CEO), Gokul Rajaram and Charley Ma.

Initial Capital co-founder and partner Ken Lamb became a board director with the fundraise, while Index partner Mark Goldberg and XYZ managing partner Ross Fubini joined as board observers.

“Sanlo cracked the code to help mobile gaming and app companies reach maturity with a new level of speed, scale, and fiscal wellbeing,” said Goldberg, in a statement. “The company is building a very sophisticated fintech offering that will give those companies superpowers.”

Sanlo plans to use the funds to grow its team and product suite ahead of its public launch later this year.

Powered by WPeMatico

Snowman, the small studio behind award-winning iOS games Alto’s Adventure, Alto’s Odyssey, Skate City and others, is spinning out a new company, Pok Pok, that will focus on educational children’s entertainment. Later this month, Pok Pok will debut its first title, Pok Pok Playroom, aimed at inspiring creative thinking through play for the preschool crowd.

The launch takes Snowman back to its roots as an app maker, not a games studio.

In fact, the company’s first iOS app, Checkmark, had been in the productivity space, offering location-based reminders to iPhone users. But Snowman later shifted to making games, tapping into the demand for mobile games with early launches like Circles and Super Squares. But it wasn’t until Alto’s Adventure came out that Snowman really kicked off its foray into gaming.

“We’ve never really considered Snowman to be a video game studio,” explains Snowman co-founder and creative director Ryan Cash. “A lot of people would assume that because it’s really all that we’re known for at the moment. It’s kind of our core business. But we like to think of ourselves more as like a team of tinkerers who like working on creative stuff. And for now, it happens to be video games, but you never know kind of what might be around the corner,” he says.

Image Credits: Snowman

Pok Pok actually emerged from Snowman’s culture of tinkering.

Snowman employees Mathijs Demaeght and Esther Huybreghts, now Pok Pok design director and creative director, respectively, went looking for an app to entertain their young son James when he was a toddler. They soon found that there weren’t many options that fit what they had been hoping to find.

They had wanted something that wouldn’t rile him up, something that wasn’t too technical and something that wasn’t gamified, Esther explains.

When they later had their second son, Jack, they decided to just built the app they wanted for themselves. After showing a rough prototype to Ryan, he saw the potential and told them to run with it.

Ryan’s sister, Melissa Cash, whose background was in developing products at Disney for babies and toddlers, had been helping with the Alto’s Odyssey launch at the time. When she saw what Esther and Mathijs were working on, she was impressed.

Image Credits: Snowman

“I’ve worked in the kid space for five years, and I’ve never seen anything that’s even remotely like this. And then, I just knew this is what I wanted to work on for the next 20 years,” she says. Melissa became involved with the project and is now CEO of the Pok Pok spinout.

Although legally a distinctive entity, Pok Pok remains closely tied to Snowman.

“We’ve been incubating the company within Snowman. We moved desks to a corner and we all work together as mentor, colleagues, and collaborate as a group,” Melissa notes. Ryan is still involved, as well. “Ryan is everything — our advisor, our helper — we haven’t even come up with a title for him,” she adds.

Today, the Pok Pok team is six full-time employees, but works with contractors and educators on its projects. Snowman, meanwhile, is over 20 people, mostly in Toronto. However, some Snowman employees spend 30% to 50% of their time on Pok Pok, Ryan says.

For the time being, Pok Pok is self-funded thanks to Snowman’s success on other fronts, which not only includes the Alto’s series, but also Apple Arcade’s Where Cards Fall and Skate City, both of which are now expanding to PC and console. The company is also working on DISTANT, a collaboration with Slingshot and Satchel.

Pok Pok Playroom, which is aimed at kids ages two to six, will be the first title to go live from Pok Pok, arriving on May 20. The app itself will initially contain six “digital toys,” so to speak, which encourage kids to creatively play. These toys also grow with the child as they age up.

For example, a stacking blocks toy could appeal to toddlers who just want to move the shapes around, but an older child might build a town with them. A drawing toy can encourage scribbles at younger ages or become a real canvas for art when the child is older. There’s also a calming toy called “musical blobs” that’s sort of like a lava lamp with differently shaped blobs that bounce around and respond to touches.

All the toys are designed to be open-ended — there’s no right or wrong way to use them. And Pok Pok Playroom is not a game. There are no levels to beat or objectives to achieve. There’s nothing to buy.

What is different about Pok Pok Playroom, compared with games and “digital toys” from rivals like Toca Boca, for example, is that it’s designed to be more educational and realistic.

“We take a more educational approach, and we still plan to do that for future apps and for whatever Pok Pok Playroom will grow into after launch,” says Esther. “For example, we have no unicorns or no wizards in Pok Pok Playroom. Everything is grounded in reality. I think we want to explore with children what the world looks like and how it works. We have tons of ideas for taking a more education-based approach for all the children, as well, that isn’t necessarily the ABCs, 1,2,3’s pedagogical, so to speak.”

Image Credits: Snowman

Pok Pok also won’t use talking animals or fantasy characters in order to avoid the subject of diversity. Instead, its apps will features all races, all genders, all family constructs, all different sorts of abilities and disabilities, as they’re built.

“I think it’s very important to us to have kids be able to recognize themselves, and family members and friends in the app,” says Esther. “It’s really important to our entire team that everyone feels respected in who they are and what their family looks like, and… I think that’s still really lacking in the kid space right now. We want to be the front-runner there,” she notes.

The new app, which has been in development for nearly three years, will be priced on a subscription basis, with more “digital toys” added over time.

Though Pok Pok will aim more at the preschool crowd, the company envisions a future where it designs creative projects for the next age group up and for other types of learning.

Pok Pok Playroom has been beta tested with around 250 families ahead of its launch.

It will be available on iPhone and iPad starting on May 20 at 9 a.m. ET, with a 14-day free trial. It will then be priced at $3.99 per month or $29.99 per year, and will not feature in-app purchases.

Powered by WPeMatico

Boston-based Apptopia, a company providing competitive intelligence in the mobile app ecosystem, has closed on $20 million in Series C funding aimed at fueling its expansion beyond the world of mobile apps. The new financing was led by ABS Capital Partners, and follows three consecutive years of 50% year-over-year growth for Apptopia’s business, which has been profitable since the beginning of last year, the company says.

Existing investors, including Blossom Street Ventures, also participated in the round. ABS Capital’s Mike Avon, a co-founder of Millennial Media, and Paul Mariani, are joining Apptopia’s board with this round.

The funding follows what Apptopia says has been increased demand from brands to better understand the digital aspects of their businesses.

Today, Apptopia’s customers include hundreds of corporations and financial institutions, including Google, Visa, Coca-Cola, Target, Zoom, NBC, Unity Technologies, Microsoft, Adobe, Glu, Andreessen Horowitz and Facebook.

In the past, Apptopia’s customers were examining digital engagement and interactions from a macro level, but now they’re looking to dive deeper into specific details, requiring more data. For example, a brand may have previously wanted to know how well a competitor’s promotion fared in terms of new users or app sessions. But now they want to know the answers to specific questions — like how many unique users participated, whether those users were existing customers, whether they returned after the promotion ended, and so on.

The majority of Apptopia’s business is now focused on delivering these sorts of answers to enterprise customers who subscribe to Apptopia’s data — and possibly, to the data from its competitors like Sensor Tower and App Annie, with the goal of blending data sets together for a more accurate understanding of the competitive landscape.

Apptopia’s own data, historically, was not always seen as being the most accurate, admits Apptopia CEO Jonathan Kay. But it has improved over the years.

Kay, previously Apptopia COO, is now taking over the top role from co-founder Eliran Sapir, who’s transitioning to chairman of the board as the company enters its next phase of growth.

Apptopia’s rivals like Sensor Tower and App Annie use mobile panels to gather app data, among other methods, Kay explains. These panels involve consumer-facing apps like VPN clients and ad blockers, which users would download not necessarily understanding that they were agreeing to having their app usage data collected. This led to some controversy as the app data industry’s open secret was exposed to consumers, and the companies tweaked their disclosures, as a result.

But the practice continues and has not impacted the companies’ growth. Sensor Tower, for example, raised $45 million last year, as demand for app data continued to grow. And all involved businesses are expanding with new products and services for their data-hungry customer bases.

Image Credits: Apptopia

Apptopia, meanwhile, decided not to grow its business on the back of mobile panels. (Though in its earlier days it did test and then scrap such a plan.)

It gains access to data from its app developer customers — and this data is already aggregated and anonymized from the developers’ Apple and Google Analytics accounts.

Initially, this method put Apptopia at a disadvantage. Rivals had more accurate data from about 2016 through 2018 because of their use of mobile panels, Kay says. But Apptopia made a strategic decision to not take this sort of risk — that is, build a business that Apple or Google could shut off at any time.

“Instead, what we did is we spent years investing into data science and algorithms,” notes Kay. “We figured out how to extract an equal or greater signal from the same data set that [competitors] had access to.”

Using what Kay describes as “huge, huge amounts of historical data,” Apptopia over time learned what sort of signals went into an app’s app store ranking. A lot of people still think an app’s rank is largely determined by downloads, but there are now a variety of signals that inform rank, Kay points out.

“Really, a rank is just an accumulation of analytical data points that Apple and Google give points for,” he explains. This includes things like number of sessions, how many users, how much time is spent in an app, and more. “Because we didn’t have these panels, we had to spend years figuring out how to do reverse engineering better than our competitors. And, eventually, we figured out how to get the same signal that they could get from the panel from rank. That’s what allowed us to have such a fast-growing, successful business over the past several years.”

As Apptopia was already profitable, it didn’t need to fundraise. But the company wanted to accelerate its expansion into new areas, including its planned expansion outside of mobile apps.

Today, consumers use “apps” on their computers, on their smartwatches and on their TVs, in addition to their phones and tablets. And businesses no longer want to know just what’s happening on mobile — they want the full picture of “app” usage.

“We figured out a way to do that that doesn’t rely on any of what our competitors have done in the past,” says Kay. “So, we will not be using any apps to spy on people,” he states.*

[*Sensor Tower, in response to Kay’s statements, said the following: “We have never collected any personally identifying information (PII) on individual users, nor have we received any of the anonymous usage and engagement metrics our panel provides without user consent.”]

Apptopia was not prepared to offer further details around its future product plans at this time. But Kay said they would not rule out partnerships or being acquisitive to accomplish its goals going forward.

The company also sees a broader future in making its app data more accessible. Last year, for instance, it partnered with Bloomberg to bring mobile data to investors via the Bloomberg App Portal on the Bloomberg Terminal. And it now works with Amazon’s AWS Data Exchange and Snowflake to make access to app data available in other channels, as well. Future partnerships of a similar nature could come into play as another means of differentiating Apptopia’s data from its rivals.

The company declined to offer its current revenue run rate or valuation, but notes that it tripled its valuation from its last fundraise at the end of 2019.

In addition to product expansions, the company plans to leverage the funds to grow its team of 55 by another 25 in 2021, including in engineering and analysts. And it will grow its management team, adding a CFO, CPO and CMO this year.

To date, Apptopia has raised $30 million in outside capital.

Powered by WPeMatico

Serialized fiction app Radish has been acquired by Kakao Entertainment in a transaction valued at $440 million. Kakao Entertainment is owned by Kakao, the South Korean internet giant whose services include its eponymous messaging platform. Radish founder Seungyoon Lee will hold onto his role as its chief executive officer, while also becoming Kakao Entertainment’s global strategy officer to lead its growth in international markets.

Radish claims millions of users in North America, and the acquisition will be help Kakao Entertainment expand its own webtoons and web novel business there, and in other English-speaking markets. Radish will retain management autonomy and continue operating as its own brand.

Founded in 2015, Radish originally focused on user-generated content, but now the core of its business is Radish Originals, or serial fiction series designed specifically for the app. The company said the launch of Radish Originals in 2018 helped propel its growth, with revenue increasing more than 10 times in 2020 from the previous year.

Radish monetizes content through its micropayments system, which allows users to read several free episodes before making payments of about 20 to 30 cents to unlock new episodes (users also have the option of waiting an hour to unlock episodes for free). About 90% of its revenue now comes from Radish Originals.

The acquisition means that Radish Originals’ intellectual property will now be adapted by Kakao into webtoons, videos and other content, increasing their reach. Since 2016, Kakao Entertainment has adapted several web novels including “What’s Wrong with Secretary Kim?,” “A Business Proposal” and “Solo Leveling” into webtoons and other media.

Lee told TechCrunch that Radish started exclusively distributing several of Kakao Entertainment’s most popular original series, like “What’s Wrong with Secretary Kim?” last month. It plans to launch more content from Kakao Entertainment’s portfolio and are also “looking at ways in which we can make original localized novel adaptions of Kakao’s popular stories,” he added.

In a press statement, Kakao Entertainment CEO Jinsoo Lee said, “Radish has firmly established itself as a leading web novel platform and yet we see even greater growth potential… With the combination of Kakao’s expertise in the IP business and Radish’s strong North American foothold, we are excited about what we can achieve together.”

The acquisition has been approved by Radish’s board of directors, which includes a representative from SoftBank Ventures Asia, its largest investor, and the majority of its shareholders. Radish’s other backers include Lowercase Capital, K50 Ventures, Nicolas Bergruen, Charlie Songhurst, Duncan Clark and Amy Tan, the best-selling author.

Powered by WPeMatico

The pandemic has just pushed edtech mainstream, but language-learning startup Duolingo had already spent the past decade figuring out how to build a successful edtech app.

In our latest installment of the EC-1 series, Natasha Mascarenhas goes deep with the company to understand how it found product-market fit, then figured out how to grow like a consumer tech startup and monetize like a SaaS startup. After a record 2020, the Pittsburgh-based company also opened up about its plans for the future, including a focus on speaking a new language (in addition to listening, reading and writing).

Here’s more from Natasha about what’s inside:

Want this kind of coverage on a different company or sector. Check out our ever-growing list of EC-1s, which include recent profiles of Klaviyo, StockX, Tonal and more.

Thanks for reading!

Eric Eldon

Managing Editor, Extra Crunch (subbing in for Walter again)

Image Credits: gonin / Wikimedia Commons

If there has ever been a golden age for fintech, it surely must be now.

As of Q1 2021, the number of fintech startups in the U.S. crossed 10,000 for the first time ever — well more than double that if you include EMEA and APAC. There are now three fintech companies worth more than $100 billion (Paypal, Square and Shopify) with another three in the $50 billion-$100 billion club (Stripe, Adyen and Coinbase).

Yet, as fintech companies have begun to go public, there has been a fair amount of uncertainty as to how these companies will be valued on the public markets. This is a result of fintechs being relatively new to the IPO scene compared to their consumer internet or enterprise software counterparts. Furthermore, fintechs employ a wide variety of business models: Some are transactional, while others are recurring or have hybrid business models.

And fintechs now have a multitude of options in terms of how they choose to go public. They can take the traditional IPO route, pursue a direct listing or merge with a SPAC. Given the multitude of variables at play, valuing these companies and then predicting public market performance is anything but straightforward.

Image Credits: princessdlaf (opens in a new window)/ Getty Images

Many fintech startups have tried to become a market-maker between investors and investment opportunities.

However, the challenge with this two-sided market is: How do you get the investors to show up?

It’s hard enough to get retail investors, but family offices and other large check writers are even more challenging to lure.

Image Credits: anyaberkut (opens in a new window) / Getty Images

With an increasing number of enterprise systems, growing teams, a rising proliferation of the web and multiple digital initiatives, companies of all sizes are creating loads of data every day.

This data contains excellent business insights and immense opportunities, but it has become impossible for companies to derive actionable insights from this data consistently due to its sheer volume.

The analytics-as-a-service (AaaS) market is expected to grow to $101.29 billion by 2026. Organizations that have not started on their analytics journey or are spending scarce data engineer resources to resolve issues with analytics implementations are not identifying actionable data insights.

Through AaaS, managed services providers (MSPs) can help organizations get started on their analytics journey immediately without extravagant capital investment.

MSPs can take ownership of the company’s immediate data analytics needs, resolve ongoing challenges, and integrate new data sources to manage dashboard visualizations, reporting and predictive modeling — enabling companies to make data-driven decisions every day.

Image Credits: Nigel Sussman (opens in a new window)

Flywire, a Boston-based magnet for venture capital, filed to go public Monday.

Flywire is a global payments company that attracted more than $300 million as a startup, according to Crunchbase, most recently raising a $60 million Series F last month. We don’t have its most recent valuation, but PitchBook data indicates that the company’s February 2020, $120 million round valued Flywire at $1 billion on a post-money basis.

So what we’re looking at here is a fintech unicorn IPO. A great way to kick off the week, to be honest, though we thought that Robinhood would be the next such debut.

Fintech venture capital activity has been hot lately, which makes the Flywire IPO interesting. Its success or failure could dictate the pace of fintech exits and fintech startup valuations in general, so we have to care about it.

First, what does Flywire do and with whom does it compete? Then, a closer look at its financial results as we hope to get our hands around its revenue quality, aggregate economics and growth prospects.

After that, we’ll discuss valuations and which venture capital groups are set to do well in its flotation.

Image Credits: Nigel Sussman (opens in a new window)

If it feels like IPO news slowed for a few weeks at the start of the second quarter, your gut is correct. Investors previously told The Exchange that the first, third and fourth quarters of 2021 would be hot periods for public debuts, but that Q2 would be slower. Their argument revolved around reporting cadences and how long it takes for certain periods of accounting work to be completed.

So we weren’t surprised when the second quarter’s IPO cycle began to feel a bit soft compared to the rapid-fire first quarter. And, as we’ve all heard in recent days, the great SPAC rush is slowing.

But that hasn’t stopped a number of firms from defying expectations and going public all the same.

Image Credits: SAP

SAP CEO Christian Klein was appointed co-CEO with Jennifer Morgan in October 2019. He became sole CEO just as the pandemic was hitting full force across the world last April.

He was put in charge of a storied company at 39 years old. By October, its stock price was down and revenue projections for the coming years were flat.

That is definitely not the way any CEO wants to start their tenure, but the pandemic forced Klein to make some decisions to move his customers to the cloud faster. That, in turn, had an impact on revenue until the transition was completed. While it makes sense to make this move now, investors weren’t happy with the news.

There was also the decision to spin out Qualtrics, the company his predecessor acquired for $8 billion in 2018. As he looked back on the one-year mark, Klein sat down with TechCrunch to discuss all that has happened and the unique set of challenges he faced.

Image Credits: Forerunner Ventures / Oura

Forerunner General Partner Eurie Kim and Oura CEO Harpreet Rai joined us on Extra Crunch Live to discuss the process of taking Oura to the next level — and beyond — as the product found a second (or third) life during the pandemic through partnerships with sports leagues like the NBA.

And as we’re wont to do, we asked the pair to take a look at a handful of user-submitted pitch decks.

Image Credits: Klaus Vedfelt (opens in a new window) / Getty Images

Domm Holland, co-founder and CEO of e-commerce startup Fast, appears to be living a founder’s dream.

His big idea came from a small moment in his real life. Holland watched as his wife’s grandmother tried to order groceries, but she had forgotten her password and wasn’t able to complete the transaction.

He built a prototype of a passwordless authentication system where users would fill out their information once and would never need to do so again. Within 24 hours, tens of thousands of people had used it.

Shoppers weren’t the only ones on board with this idea. In less than two years, Holland has raised $124 million in three rounds of fundraising, bringing on partners like Index Ventures and Stripe.

Although the success of Fast’s one-click checkout product has been speedy, it hasn’t been effortless.

For one thing, Holland is Australian, which means he started out as a Silicon Valley outsider.

Holland talks about how he built his network, why it’s important — not just for fundraising but for building the entire business — and how to avoid the mistakes he sees new founders make.

Image Credits: Bryce Durbin

It’s only been three years since they hit the streets, but Revel’s blue electric mopeds have already become a common sight in New York, San Francisco and a growing number of U.S. cities.

However, Revel founder and CEO Frank Reig set his sights far beyond building a shared moped service.

In fact, since the beginning of 2021, Revel has launched an e-bike subscription service, an EV charging station venture and an all-electric rideshare service driven by a fleet of 50 Teslas.

We caught up with Reig to talk about what he learned from building the company, how Revel’s business strategy has evolved and what lies ahead.

Image Credits: KTSDESIGN/SCIENCE PHOTO LIBRARY / Getty Images

Divvy, a Utah-based corporate spend unicorn, is considering selling itself to Bill.com for a price that could top $2 billion. For the fintech sector, it’s big news.

Corporate spend startups including Ramp and Brex are raising rapid-fire rounds at ever-higher valuations and growing at venture-ready cadences. Their growth and the resulting private investment were earned by a popular approach to offering corporate cards, and, increasingly, the group’s ability to build software around those cards that took into account a greater portion of the functionality that companies needed to track expenses, manage spend access and, perhaps, save money.

It makes sense to see Bill.com decide to take on the yet-private corporate spend startups that are playing the field; why not absorb a growing customer base and fend off competition in a single move?

To get a better handle on how the startups that compete with Divvy feel about the deal, TechCrunch reached out to both Ramp CEO Eric Glyman, and Brex CEO Henrique Dubugras.

Image Credits: Huber & Starke (opens in a new window) / Getty Images

It’s an entrepreneur’s market in digital health today, with startups raising record-breaking funding at soaring valuations and debuting on public markets to eager investors.

The massive influx of capital to healthcare should not be surprising; the pandemic has made it starkly clear that digital health is the future of healthcare.

To that end, we should anticipate additional healthcare exits worth more than $1 billion in the near term. Which again, is great for entrepreneurs — as long as they understand how hard it is to build a unicorn in healthcare. Today, becoming a unicorn requires founders who are long on vision and operational experience.

During the pandemic, lots of investors jumped in to invest in digital health for the first time. But we’ve been investing for more than a decade.

Here are four instrumental strategies to building a unicorn in digital health that we know work.

Image Credits: Matthias Kulka / Getty Images

There’s no shortage of commentary around the chief marketing officer title these days, and certainly no lack of opinions about the role’s responsibilities and meaning within a company.

There’s a reason for that. CMO is the shortest tenured C-suite role — the average tenure of a CMO is the lowest of all C-suite titles at 3.5 years.

That’s because the chief marketing officer’s role is increasingly complex. Qualifications require broad, strategic thinking while also maintaining tactical acumen across several functions. There’s a big disparity in what companies expect from CMOs. Some want a strategist with an eye for go-to-market planning, while others want a focus on close alignment with sales in addition to brand awareness, content strategy and lead generation.

Other companies want their CMO to emphasize product marketing and management. Ask 10 CMOs how they define their role and you’ll get 10 different answers.

Here, a tenured CMO shares his honest take on what the role actually means, plus the key attributes of today’s modern CMO.

Image Credits: Nigel Sussman (opens in a new window)

People have been discussing the importance of expanding opportunities for women in venture capital and startup entrepreneurship for decades. And for some time it appeared that progress was being made in building a more diverse and equitable environment.

The prospect of more women writing checks was viewed as a positive for female founders, a cohort that has struggled to attract more than a fraction of the funds that their male peers manage. All-female teams have an especially tough time raising capital compared to all-male teams, underscoring the disparity.

Then COVID-19 arrived and scrambled the venture and startup scene, creating a risk-off environment during the end of Q1 and the start of Q2 2020. Following that, the venture world went into overdrive as software sales became a safe harbor in the business world during uncertain economic times. And when it became clear that the vaunted digital transformation of businesses large and small was accelerating, more capital appeared.

But data indicate that the torrent of new capital has not been distributed equally — indeed, some of the progress that female founders made in recent years may have eroded.

Image Credits: wildpixel (opens in a new window) / Getty Images

When it comes to acquiring or merging a business with another, it’s imperative that decision-makers know why they’re pursuing a deal and its potential impact on the company, good and bad.

Mergers and acquisitions (M&A) may indeed be the best route to success, but there’s a lot of room for problems, and many leaders underestimate the role in-house legal teams can play in mitigating these problems and facilitating progress until they’re locked into a deal.

And that’s when issues become much more difficult to resolve and plans unravel.

While a CEO and board might fully appreciate in-house counsel, it’s equally important the team is supported across a company — from marketing to product development — in order to ensure an efficient closing and successful integration. The best way to do that is by bringing in-house counsel into the process early and often.

Image Credits: erhui1979 / Getty Images

The number of SPACs in the deep tech sector was skyrocketing, but a combination of increased SEC scrutiny and market forces over the past few weeks has slowed the pace of new SPAC transactions.

The correction is an inevitable step on the path to mainstreaming SPACs as an alternative to IPOs, but it won’t cause them to go away.

Instead, blank-check vehicles will evolve and will occupy a small and specialized — but important — part of the startup financing landscape.

Image Credits: Matthew Horwood/Getty Images / Getty Images

Uber followed Lyft in reporting its Q1 2021 earnings this week. And like its rival, its results take a little bit of work to understand.

We parsed them as a pair so that we understand what’s going on at the ride-hailing and food-delivery giant.

Let’s start with the big numbers: Uber’s revenue missed sharply, while its profitability beat expectations.

How did investors vet Uber’s performance? The company’s stock is off around 4% in after-hours trading.

Surprised by the revenue miss? Shocked by the profit beat? Startled by the sharp drop in the value of Uber’s stock? Let’s unpack the numbers.

Image Credits: Nigel Sussman (opens in a new window)

Let’s examine the buy now, pay later (BNPL) market, mostly through the lens of PayPal’s first-quarter results.

PayPal’s BNPL results are impressive — and not just to your humble servant, but to other fintech watchers as well — which begs the question: Can the platform effect that the PayPals of the world bring to bear suffocate a growing slice of the startup market?

Image Credits: Richard Drury (opens in a new window) / Getty Images

As the COVID-19 lockdowns cascaded around the world last spring, companies large and small saw demand slow to a halt seemingly overnight. Enterprises weren’t comfortable making big, long-term commitments when they had no clue what the future would hold.

Innovative SaaS companies responded quickly by making their products available for free or at a steep discount to boost demand.

But these free offerings didn’t go away as lockdowns loosened up. SaaS companies instead doubled down on freemium because they realized that doing so had a real and positive impact on their business. In doing so, they busted the outdated myths that have held 82% of SaaS companies back from offering their own free plan.

Image Credits: GIPhotoStock / Getty Images

Shortening the diagnostic odyssey of rare diseases and reducing the associated costs was, until recently, a moonshot challenge, but is now within reach.

About 80% of rare diseases are genetic, and technology and AI advances are combining to make genetic testing widely accessible.

Whole-genome sequencing, an advanced genetic test that allows us to examine the entire human DNA, now costs under $1,000, and market leader Illumina is targeting a $100 genome in the near future.

Image Credits: Bryce Durbin / TechCrunch

As expected, Bill.com is buying Divvy, the Utah-based corporate spend management startup that competes with Brex, Ramp and Airbase. The total purchase price of around $2.5 billion is substantially above the company’s roughly $1.6 billion post-money valuation that Divvy set during its $165 million, January 2021 funding round.

Per Bill.com, the transaction includes $625 million in cash, with the rest of the consideration coming in the form of stock in Divvy’s new parent company.

Bill.com also reported its quarterly results: Its Q1 included revenues of $59.7 million, above expectations of $54.63 million. The company’s adjusted loss per share of $0.02 also exceeded expectations, with the street expecting a sharper $0.07 per share deficit.

The better-than-anticipated results and the acquisition news combined to boost the value of Bill.com by more than 13% in after-hours trading.

Luckily for us, Bill.com released a deck that provides a number of financial metrics relating to its purchase of Divvy. This will not only allow us to better understand the value of the unicorn at exit, but also its competitors, against which we now have a set of metrics to bring to bear.

Let’s unpack the deal to gain a better understanding of the huge exit and the value of Divvy’s richly funded competitors.

Image Credits: NicoElNino / Getty Images

Robotic process automation (RPA) has certainly been getting a lot of attention in the last year, with startups, acquisitions and IPOs all coming together in a flurry of market activity. It all seemed to culminate with UiPath’s IPO last month. The company that appeared to come out of nowhere in 2017 eventually had a final private valuation of $35 billion. It then had the audacity to match that at its IPO. A few weeks later, it still has a market cap of over $38 billion in spite of the stock price fluctuating at points.

Was this some kind of peak for the technology or a flash in the pan? Probably not. While it all seemed to come together in the last year with a big increase in attention to automation in general during the pandemic, it’s a market category that has been around for some time.

RPA allows companies to automate a group of highly mundane tasks and have a machine do the work instead of a human. Think of finding an invoice amount in an email, placing the figure in a spreadsheet and sending a Slack message to Accounts Payable. You could have humans do that, or you could do it more quickly and efficiently with a machine. We’re talking mind-numbing work that is well suited to automation.

Image Credits: Bloomberg (opens in a new window) / Getty Images

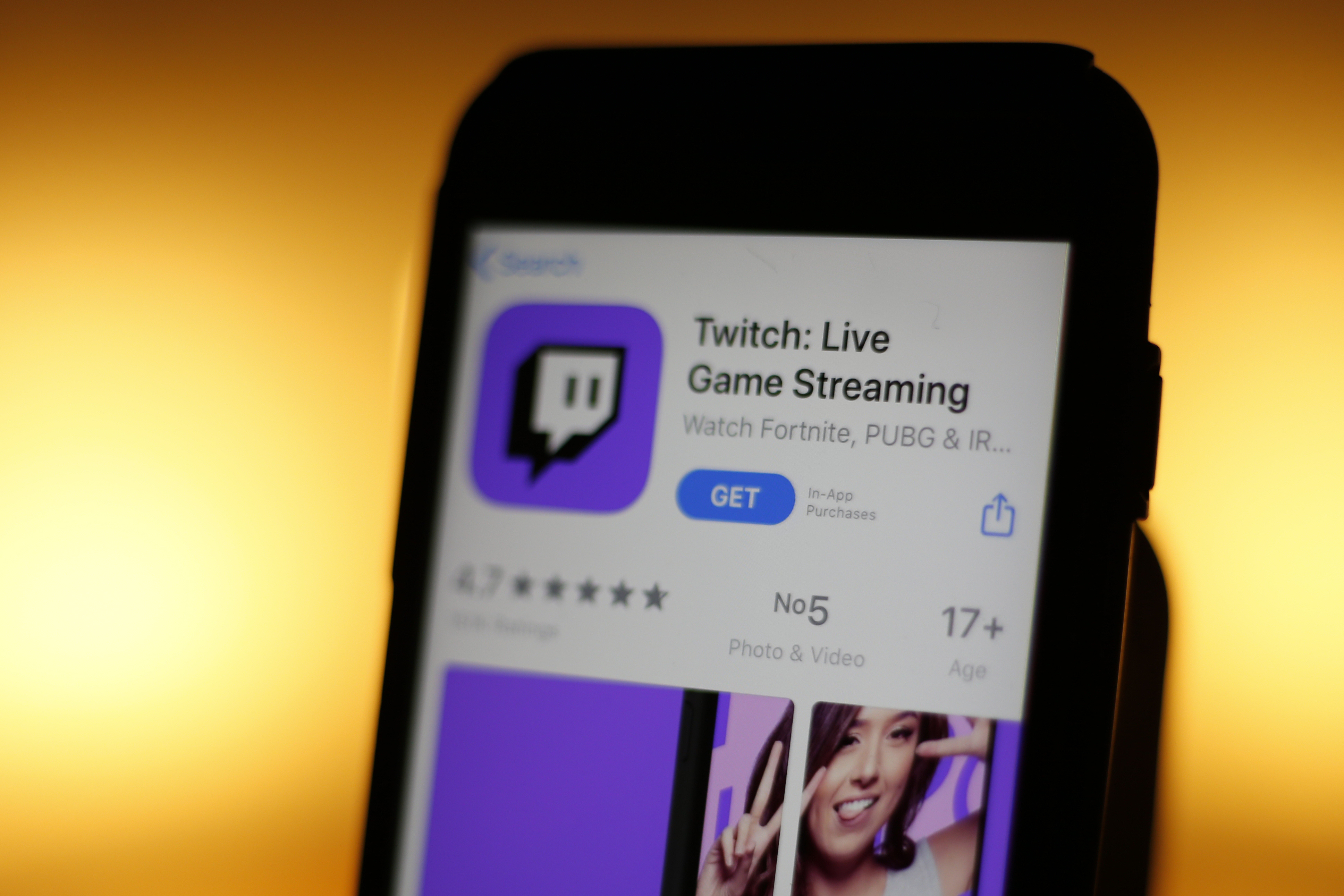

Built for Mars CEO Peter Ramsey tears down Twitch’s UX, asking how Twitch rakes in cash and the psychology used within its app to encourage users to keep spending.

Ramsey describes Twitch’s protocol of asking users if they want to subscribe to a streamer before seeing their stream “unnecessarily boolean,” which would be a great band name.

But that’s neither here nor there. Ramsey notes: “Often it’s at the point of clicking, not the final stage of a process, meaning the user decides to buy the item when they click ‘check out now,’ not when they’ve entered their card details and click ‘complete purchase.’

Ramsey argues Twitch shouldn’t make users choose between doing nothing and subscribing: “Instead, if they changed the text to, say, “learn more,” the user could click it without having to internalize the decision.”

Image Credits: wabeno (opens in a new window) / Getty Images

In non-aerobatic fixed-wing aviation, spins are an emergency. If you don’t have spin recovery training, you can easily make things worse, dramatically increasing your chances of crashing. Despite the life-and-death consequences, licensed amateur pilots in the United States are not required to train for this. Uncontrolled spins don’t happen often enough to warrant the training.

Startups can enter the equivalent of a spin as well. My startup, Kolide, entered a dangerous spin in early 2018, only a year after our Series A fundraise. We had little traction and we were quickly burning through our sizable cash reserves. We were spinning out of control, certain to hit the ground in no time.

All spins start with a stall — a reduction in lift when either the aircraft is flying too slowly or the nose is pointed too high. In Kolide’s case, we were doing both.

Kolide had a lot going for it that enabled me to recover the company, but by far the most important was that we recognized we were in a spin very early, and we had enough cash remaining (and therefore sufficient time) to execute a recovery plan.

Image Credits: Nigel Sussman (opens in a new window)

Shares of Square are up more than 6% after the American fintech company reported a staggering $5.06 billion in revenue in its Q1 2021 earnings report, far ahead of an expected tally of $3.36 billion.

By posting the huge revenue beat, Square grew 266% compared to its year-ago Q1. Because that’s the sort of growth that we generally expect to see from early-stage startups instead of maturing public companies, some exploration is in order. In short, bitcoin revenues from Square, and how they fit into its accounting, are responsible for much of its outsized growth.

And that’s something we need to talk about.

Powered by WPeMatico

Sensor data from smartphones and wearables can meaningfully predict an individual’s ‘biological age’ and resilience to stress, according to Gero AI.

The ‘longevity’ startup — which condenses its mission to the pithy goal of “hacking complex diseases and aging with Gero AI” — has developed an AI model to predict morbidity risk using ‘digital biomarkers’ that are based on identifying patterns in step-counter sensor data which tracks mobile users’ physical activity.

A simple measure of ‘steps’ isn’t nuanced enough on its own to predict individual health, is the contention. Gero’s AI has been trained on large amounts of biological data to spots patterns that can be linked to morbidity risk. It also measures how quickly a personal recovers from a biological stress — another biomarker that’s been linked to lifespan; i.e. the faster the body recovers from stress, the better the individual’s overall health prognosis.

A research paper Gero has had published in the peer-reviewed biomedical journal Aging explains how it trained deep neural networks to predict morbidity risk from mobile device sensor data — and was able to demonstrate that its biological age acceleration model was comparable to models based on blood test results.

Another paper, due to be published in the journal Nature Communications later this month, will go into detail on its device-derived measurement of biological resilience.

The Singapore-based startup, which has research roots in Russia — founded back in 2015 by a Russian scientist with a background in theoretical physics — has raised a total of $5 million in seed funding to date (in two tranches).

Backers come from both the biotech and the AI fields, per co-founder Peter Fedichev. Its investors include Belarus-based AI-focused early stage fund, Bulba Ventures (Yury Melnichek). On the pharma side, it has backing from some (unnamed) private individuals with links to Russian drug development firm, Valenta. (The pharma company itself is not an investor).

Fedichev is a theoretical physicist by training who, after his PhD and some ten years in academia, moved into biotech to work on molecular modelling and machine learning for drug discovery — where he got interested in the problem of ageing and decided to start the company.

As well as conducting its own biological research into longevity (studying mice and nematodes), it’s focused on developing an AI model for predicting the biological age and resilience to stress of humans — via sensor data captured by mobile devices.

“Health of course is much more than one number,” emphasizes Fedichev. “We should not have illusions about that. But if you are going to condense human health to one number then, for a lot of people, the biological age is the best number. It tells you — essentially — how toxic is your lifestyle… The more biological age you have relative to your chronological age years — that’s called biological acceleration — the more are your chances to get chronic disease, to get seasonal infectious diseases or also develop complications from those seasonal diseases.”

Gero has recently launched a (paid, for now) API, called GeroSense, that’s aimed at health and fitness apps so they can tap up its AI modelling to offer their users an individual assessment of biological age and resilience (aka recovery rate from stress back to that individual’s baseline).

Early partners are other longevity-focused companies, AgelessRx and Humanity Inc. But the idea is to get the model widely embedded into fitness apps where it will be able to send a steady stream of longitudinal activity data back to Gero, to further feed its AI’s predictive capabilities and support the wider research mission — where it hopes to progress anti-ageing drug discovery, working in partnerships with pharmaceutical companies.

The carrot for the fitness providers to embed the API is to offer their users a fun and potentially valuable feature: A personalized health measurement so they can track positive (or negative) biological changes — helping them quantify the value of whatever fitness service they’re using.

“Every health and wellness provider — maybe even a gym — can put into their app for example… and this thing can rank all their classes in the gym, all their systems in the gym, for their value for different kinds of users,” explains Fedichev.

“We developed these capabilities because we need to understand how ageing works in humans, not in mice. Once we developed it we’re using it in our sophisticated genetic research in order to find genes — we are testing them in the laboratory — but, this technology, the measurement of ageing from continuous signals like wearable devices, is a good trick on its own. So that’s why we announced this GeroSense project,” he goes on.

“Ageing is this gradual decline of your functional abilities which is bad but you can go to the gym and potentially improve them. But the problem is you’re losing this resilience. Which means that when you’re [biologically] stressed you cannot get back to the norm as quickly as possible. So we report this resilience. So when people start losing this resilience it means that they’re not robust anymore and the same level of stress as in their 20s would get them [knocked off] the rails.

“We believe this loss of resilience is one of the key ageing phenotypes because it tells you that you’re vulnerable for future diseases even before those diseases set in.”

“In-house everything is ageing. We are totally committed to ageing: Measurement and intervention,” adds Fedichev. “We want to building something like an operating system for longevity and wellness.”

Gero is also generating some revenue from two pilots with “top range” insurance companies — which Fedichev says it’s essentially running as a proof of business model at this stage. He also mentions an early pilot with Pepsi Co.

He sketches a link between how it hopes to work with insurance companies in the area of health outcomes with how Elon Musk is offering insurance products to owners of its sensor-laden Teslas, based on what it knows about how they drive — because both are putting sensor data in the driving seat, if you’ll pardon the pun. (“Essentially we are trying to do to humans what Elon Musk is trying to do to cars,” is how he puts it.)

But the nearer term plan is to raise more funding — and potentially switch to offering the API for free to really scale up the data capture potential.

Zooming out for a little context, it’s been almost a decade since Google-backed Calico launched with the moonshot mission of ‘fixing death’. Since then a small but growing field of ‘longevity’ startups has sprung up, conducting research into extending (in the first instance) human lifespan. (Ending death is, clearly, the moonshot atop the moonshot.)

Death is still with us, of course, but the business of identifying possible drugs and therapeutics to stave off the grim reaper’s knock continues picking up pace — attracting a growing volume of investor dollars.

The trend is being fuelled by health and biological data becoming ever more plentiful and accessible, thanks to open research data initiatives and the proliferation of digital devices and services for tracking health, set alongside promising developments in the fast-evolving field of machine learning in areas like predictive healthcare and drug discovery.

Longevity has also seen a bit of an upsurge in interest in recent times as the coronavirus pandemic has concentrated minds on health and wellness, generally — and, well, mortality specifically.

Nonetheless, it remains a complex, multi-disciplinary business. Some of these biotech moonshots are focused on bioengineering and gene-editing — pushing for disease diagnosis and/or drug discovery.

Plenty are also — like Gero — trying to use AI and big data analysis to better understand and counteract biological ageing, bringing together experts in physics, maths and biological science to hunt for biomarkers to further research aimed at combating age-related disease and deterioration.

Another recent example is AI startup Deep Longevity, which came out of stealth last summer — as a spinout from AI drug discovery startup Insilico Medicine — touting an AI ‘longevity as a service’ system which it claims can predict an individual’s biological age “significantly more accurately than conventional methods” (and which it also hopes will help scientists to unpick which “biological culprits drive aging-related diseases”, as it put it).

Gero AI is taking a different tack toward the same overarching goal — by honing in on data generated by activity sensors embedded into the everyday mobile devices people carry with them (or wear) as a proxy signal for studying their biology.

The advantage being that it doesn’t require a person to undergo regular (invasive) blood tests to get an ongoing measure of their own health. Instead our personal device can generate proxy signals for biological study passively — at vast scale and low cost. So the promise of Gero’s ‘digital biomarkers’ is they could democratize access to individual health prediction.

And while billionaires like Peter Thiel can afford to shell out for bespoke medical monitoring and interventions to try to stay one step ahead of death, such high end services simply won’t scale to the rest of us.

If its digital biomarkers live up to Gero’s claims, its approach could, at the least, help steer millions towards healthier lifestyles, while also generating rich data for longevity R&D — and to support the development of drugs that could extend human lifespan (albeit what such life-extending pills might cost is a whole other matter).

The insurance industry is naturally interested — with the potential for such tools to be used to nudge individuals towards healthier lifestyles and thereby reduce payout costs.

For individuals who are motivated to improve their health themselves, Fedichev says the issue now is it’s extremely hard for people to know exactly which lifestyle changes or interventions are best suited to their particular biology.

For example fasting has been shown in some studies to help combat biological ageing. But he notes that the approach may not be effective for everyone. The same may be true of other activities that are accepted to be generally beneficial for health (like exercise or eating or avoiding certain foods).

Again those rules of thumb may have a lot of nuance, depending on an individual’s particular biology. And scientific research is, inevitably, limited by access to funding. (Research can thus tend to focus on certain groups to the exclusion of others — e.g. men rather than women; or the young rather than middle aged.)

This is why Fedichev believes there’s a lot of value in creating a measure than can address health-related knowledge gaps at essentially no individual cost.

Gero has used longitudinal data from the UK’s biobank, one of its research partners, to verify its model’s measurements of biological age and resilience. But of course it hopes to go further — as it ingests more data.

“Technically it’s not properly different what we are doing — it just happens that we can do it now because there are such efforts like UK biobank. Government money and also some industry sponsors money, maybe for the first time in the history of humanity, we have this situation where we have electronic medical records, genetics, wearable devices from hundreds of thousands of people, so it just became possible. It’s the convergence of several developments — technological but also what I would call ‘social technologies’ [like the UK biobank],” he tells TechCrunch.

“Imagine that for every diet, for every training routine, meditation… in order to make sure that we can actually optimize lifestyles — understand which things work, which do not [for each person] or maybe some experimental drugs which are already proved [to] extend lifespan in animals are working, maybe we can do something different.”

“When we will have 1M tracks [half a year’s worth of data on 1M individuals] we will combine that with genetics and solve ageing,” he adds, with entrepreneurial flourish. “The ambitious version of this plan is we’ll get this million tracks by the end of the year.”

Fitness and health apps are an obvious target partner for data-loving longevity researchers — but you can imagine it’ll be a mutual attraction. One side can bring the users, the other a halo of credibility comprised of deep tech and hard science.

“We expect that these [apps] will get lots of people and we will be able to analyze those people for them as a fun feature first, for their users. But in the background we will build the best model of human ageing,” Fedichev continues, predicting that scoring the effect of different fitness and wellness treatments will be “the next frontier” for wellness and health (Or, more pithily: “Wellness and health has to become digital and quantitive.”)

“What we are doing is we are bringing physicists into the analysis of human data. Since recently we have lots of biobanks, we have lots of signals — including from available devices which produce something like a few years’ long windows on the human ageing process. So it’s a dynamical system — like weather prediction or financial market predictions,” he also tells us.

“We cannot own the treatments because we cannot patent them but maybe we can own the personalization — the AI that personalized those treatments for you.”

From a startup perspective, one thing looks crystal clear: Personalization is here for the long haul.

Powered by WPeMatico

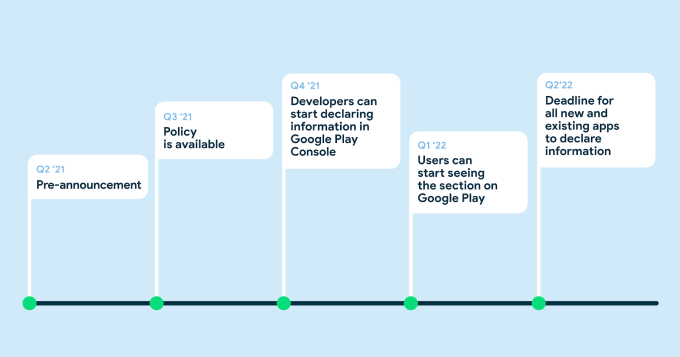

Months after Apple’s App Store introduced privacy labels for apps, Google announced its own mobile app marketplace, Google Play, will follow suit. The company today pre-announced its plans to introduce a new “safety” section in Google Play, rolling out next year, which will require app developers to share what sort of data their apps collect, how it’s stored and how it’s used.

For example, developers will need to share what sort of personal information their apps collect, like users’ names or emails, and whether it collects information from the phone, like the user’s precise location, their media files or contacts. Apps will also need to explain how the app uses that information — for example, for enhancing the app’s functionality or for personalization purposes.

Developers who already adhere to specific security and privacy practices will additionally be able to highlight that in their app listing. On this front, Google says it will add new elements that detail whether the app uses security practices like data encryption; if the app follows Google’s Families policy, related to child safety; if the app’s safety section has been verified by an independent third party; whether the app needs data to function or allows users to choose whether or not to share data; and whether the developer agrees to delete user data when a user uninstalls the app in question.

Apps will also be required to provide their privacy policies.

While clearly inspired by Apple’s privacy labels, there are several key differences. Apple’s labels focus on what data is being collected for tracking purposes and what’s linked to the end user. Google’s additions seem to be more about whether or not you can trust the data being collected is being handled responsibility, by allowing the developer to showcase if they follow best practices around data security, for instance. It also gives the developer a way to make a case for why it’s collecting data right on the listing page itself. (Apple’s “ask to track” pop-ups on iOS now force developers to beg inside their apps for access user data.)

Another interesting addition is that Google will allow the app data labels to be independently verified. Assuming these verifications are handled by trusted names, they could help to convey to users that the disclosures aren’t lies. One early criticism of Apple’s privacy labels was that many were providing inaccurate information — and were getting away with it, too.

Google says the new features will not roll out until Q2 2022, but it wanted to announce now in order to give developers plenty of time to prepare.

Image Credits: Google

There is, of course, a lot of irony to be found in an app privacy announcement from Google.

The company was one of the longest holdouts on issuing privacy labels for its own iOS apps, as it scrambled to review (and re-review, we understand) the labels’ content and disclosures. After initially claiming its labels would roll out “soon,” many of Google’s top apps then entered a lengthy period where they received no updates at all, as they were no longer compliant with App Store policies.

It took Google months after the deadline had passed to provide labels for its top apps. And when it did, it was mocked by critics — like privacy-focused search engine DuckDuckGo — for how much data apps like Chrome and the Google app collect.

Google’s plan to add a safety section of its own to Google Play gives it a chance to shift the narrative a bit.

It’s not a privacy push, necessarily. They’re not even called privacy labels! Instead, the changes seem designed to allow app developers to better explain if you can trust their app with your data, rather than setting the expectation that the app should not be collecting data in the first place.

How well this will resonate with consumers remains to be seen. Apple has made a solid case that it’s a company that cares about user privacy, and is adding features that put users in control of their data. It’s a hard argument to fight back against — especially in an era that’s seen too many data breaches to count, careless handling of private data by tech giants, widespread government spying and a creepy adtech industry that grew to feel entitled to user data collection without disclosure.

Google says when the changes roll out, non-compliant apps will be required to fix their violations or become subject to policy enforcement. It hasn’t yet detailed how that process will be handled, or whether it will pause app updates for apps in violation.

The company noted its own apps would be required to share this same information and a privacy policy, too.

Powered by WPeMatico