Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

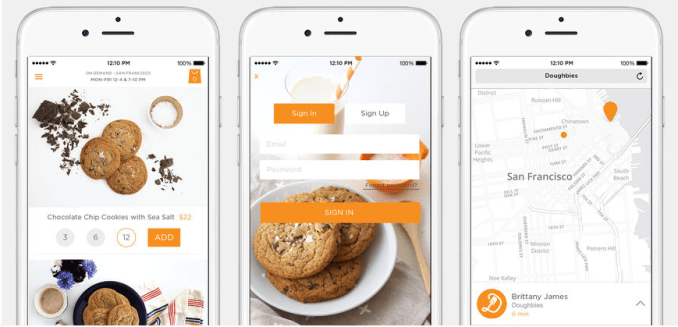

Doughbies should have been a bakery, not a venture-backed startup. Founded in the frothy days of 2013 and funded with $670,000 by investors, including 500 Startups, Doughbies built a same-day cookie delivery service. But it was never destined to be capable of delivering the returns required by the VC model that depends on massive successes to cover the majority of bets that fail. The startup became the butt of jokes about how anything could get funding.

This weekend, Doughbies announced it was shutting down immediately. Surprisingly, it didn’t run out of money. Doughbies was profitable, with 36 percent gross margins and 12 percent net profit, co-founder and CEO Daniel Conway told TechCrunch. “The reason we were able to succeed, at this level and thus far, is because we focused on unit economics and customer feedback (NPS scoring). That’s it.”

Many other startups in the on-demand space missed that memo and vaporized. Shyp mailed stuff for you and Washio dry cleaned your clothes, until they both died sudden deaths. Food delivery has become a particularly crowded cemetery, with Sprig, Maple, Juicero and more biting the dust. Asked his advice for others in the space, Conway said to “Make sure your business makes sense — that you’re making money, and make sure your customers are happy.”

Doughbies certainly did that latter. They made one of the most consistently delicious chocolate chip cookies in the Bay Area. I had them cater our engagement party. At roughly $3 per cookie plus $5 for delivery, it was pricey compared to baking at home, but not outrageous given SF restaurant rates. From its launch at 500 Startups Demo Day with an “Oprah” moment where investors looked beneath their seats to find Doughbies waiting for them, it cared a lot about the experience.

But did it make sense for a bakery to have an app and deliver on-demand? Probably not. There was just no way to maintain a healthy Doughbies habit. You were either gunning for the graveyard yourself by ordering every week, or like most people you just bought a few for special occasions. Startups like Uber succeed by getting people to routinely drop $30 per day, not twice a year. And with the push for nutritious and efficient offices, it was surely hard for enterprise customers to justify keeping cookies stocked.

Flanked by Instacart and Uber Eats, there weren’t many ripe adjacent markets for Doughbies to conquer. It was stuck delivering baked goods to customers who were deterred from growing their cart size by a sense of gluttony.

Without stellar growth or massive sales volumes, there aren’t a lot of exciting challenges to face for people like Conway and his co-founder Mariam Khan. “Ultimately we shut down because our team is ready to move on to something new,” Conway says.

The startup just emailed customers explaining that “We’re currently working on finding a new home for Doughbies, but we can’t make any promises at this time.” Perhaps a grocery store or broader food company will want its logistics technology or customer base. But delivery is a brutal market to break into, dominated by those like Uber who’ve built economies of scale through massive fleets of drivers to maximize routing efficiency.

In the end, Doughbies was a lifestyle business. That’s not a dirty word. A few co-founders with a dream can earn a respectable living doing what they care about. But they have to do it lean, without the advantage of deep-pocketed investors.

As soon as a company takes venture funding, it’s under pressure to deliver adequate returns. Not 2X or 5X, but 10X, 100X, even 1,000X what they raise. That can lead to investors breathing down their neck, encouraging big risks that could tank the business just for a shot at those outcomes. Two years ago we saw a correction hit the ecosystem, writing down the value of many startups, and we continue to see the ripple effect as companies funded before hit the end of their runway.

Desperate for cash, founders can accept dirty funding terms that screw over not just themselves, but their early employees and investors. FanDuel raised more than $416 million at a peak valuation of $1.3 billion. But when it sold for $465 million, the founders and employees received zero as the returns all flowed to the late-stage investors who’d secured non-standard liquidation preferences. After nearly 10 years of hard work, the original team got nothing.

Not every business is a startup. Not every startup is a rocket ship. It takes more than just building a great product to succeed. It can require suddenly cutting costs to become profitable before you run out of funding. Or cutting ambitions and taking less cash at a lower valuation so you can realistically hit milestones. Or accepting a low-ball acquisition offer because it’s better than nothing. Or not raising in the first place, and building up revenues the old-fashioned way so even modest growth is an accomplishment.

Investors are often rightfully blamed for inflating the bubble, pushing up raises and valuations to lure startups to take their money instead of someone else’s. But when it comes to deciding what could be a fast-growing business, sometimes its the founders who need the adjustment.

Powered by WPeMatico

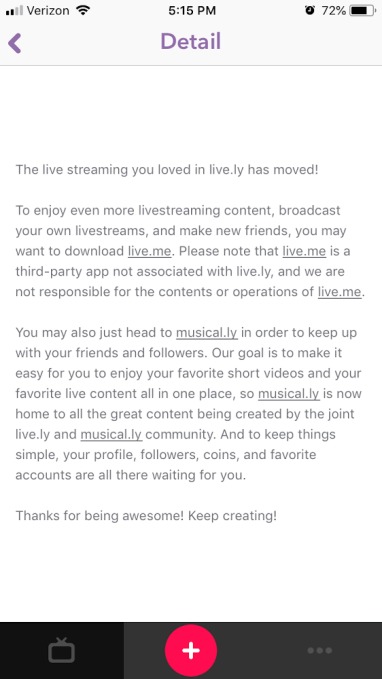

Musical.ly has begun redirecting users of its Live.ly app, which it decided to kill off last month, to a competing app called LiveMe. Existing Live.ly users are being pointed to LiveMe through an in-app message, it says. While it’s a fairly common industry practice for companies to direct users to similar apps or services when a product of theirs is being sunsetted, in this case, Musical.ly’s decision to close down Live.ly and send users to LiveMe was actually a contractually obligated part of Musical.ly’s nearly $1 billion acquisition by Chinese technology company Bytedance last year.

A clause in Bytedance’s agreement to acquire Musical.ly stated that, if the deal went through, Musical.ly would have to close Live.ly within six months, according to a source with knowledge of the deal.

The agreement also said that Live.ly would have to point users to LiveMe for at least 30 days following its closure, we learned, when verifying the information.

The issue at hand was a competing investment – right around the time of the Musical.ly acquisition, Bytedance had also put $50 million into the live-streaming app LiveMe. Apparently, it didn’t want to operate two rival properties.

Clearly, this request was not a deal-breaker for Musical.ly – in fact, it’s integrating Live.ly’s feature set into its own app. That means it will still be something of a competitor to LiveMe, though now no longer a direct one. Musical.ly’s main app, after all, is not known today for its live streaming, but rather for lip syncing videos that are recorded and edited using the app’s included visual effects and editing tools.

In addition, Live.ly had not been able to attract the viewership numbers that Musical.ly had. The company said, when confirming Live.ly’s closure last month, the majority of live stream views were taking place in Musical.ly itself, not in its spinoff.

That said, Live.ly had a fair number of users. Though nowhere near as big as Musical.ly’s 200+ million registered users or 60 million actives, its live stream app had 26 million installs, around 70 percent in the U.S., according to Sensor Tower’s data.

But LiveMe is bigger – it has more than 60 million users and has paid out over $30 million to its broadcasters through its direct virtual gifting program, the company claims.

LiveMe is also not the only app operated by the company. Other LiveMe portfolio apps include the social short video app Cheez, and mobile gaming and esports live streaming app Fluxr. To date, it has raised a total of $110 million.

Live.ly isn’t only redirecting users to LiveMe, however. In its own announcement about the news today, it shows a screenshot that’s pointing Live.ly users to Twitter’s Periscope, for instance. The message also notes that the Live.ly domain name is for sale, and provides an email for sales inquiries.

Musical.ly hasn’t yet responded to a request for comment.

Powered by WPeMatico

Snapcash ended up as a way to pay adult performers for private content over Snapchat, not just a way to split bills with friends. But Snapchat will abandon the peer-to-peer payment space on August 30th. Code buried in Snapchat’s Android app includes a “Snapcash deprecation message” that displays “Snapcash will no longer be available after %s [date]”. Shutting down the feature will bring an end to Snapchat’s four-year partnership with Square to power the feature for sending people money.

Snapcash may have become more of a liability than a utility. With apps like Venmo, PayPal, Zelle, and Square Cash itself, there were plenty of other ways to pay back friends for drinks or Ubers, so Snapcash may have seen low legitimate usage. Meanwhile, a quick Twitter search for “Snapcash” surfaced plenty of offers of erotic content in exchange for payments through the feature. It may have been safer for Snapchat to ditch Snapcash than risk PR problems over its misuse.

TechCrunch tipster Ishan Agarwal provided the below screenshot of Snapchat’s code to TechCrunch. When presented with the code and asked if Snapcash would shut down, a Snapchat spokesperson confirmed to TechCrunch that it would, explaining: “Yes, we’re discontinuing the Snapcash feature as of August 30, 2018. Snapcash was our first product created in partnership with another company – Square. We’re thankful for all the Snapchatters who used Snapcash for the last four years and for Square’s partnership!” The spokesperson noted that users would be notified in-app and through the support site soon.

Snapcash gave Snapchat a way to get users to connect payment methods to the app. That’s increasingly important as the company aims to become a commerce platforms where you can shop without leaving the app. Having payment info on file is what makes buying things through Snapchat easier than the web and draws brands to use Snapchat storefronts.

We’ll see how Snapchat plans evolve its commerce strategy without this driver. Earlier this month, TechCrunch revealed that Snapchat’s code contained mentions of a project codenamed “eagle” that’s a camera search feature. It was designed to allow users to scan an object or barcode with their Snapchat camera and see product results in Amazon. But since our report, mentions of Amazon have disappeared from the code. It’s unclear what will happen in the future, but camera search could give Snapchat new utility and monetization options.

We’ll see how Snapchat plans evolve its commerce strategy without this driver. Earlier this month, TechCrunch revealed that Snapchat’s code contained mentions of a project codenamed “eagle” that’s a camera search feature. It was designed to allow users to scan an object or barcode with their Snapchat camera and see product results in Amazon. But since our report, mentions of Amazon have disappeared from the code. It’s unclear what will happen in the future, but camera search could give Snapchat new utility and monetization options.

Snapcash won’t be a part of that future, though. Given Snapchat’s cost-cutting efforts including layoffs, its desperate need to attract and retain advertisers to hit revenue estimates its missed, and its persistent bad rap as a sexting app, it couldn’t afford to support unnecessary features or another scandal.

Powered by WPeMatico

Meet Wilson, a new iPhone app that plans to change the way you discover and listen to podcasts. The company describes the app as a podcast magazine. It has the same vibe as Longreads, the curated selection of longform articles.

With its minimalistic design and opinionated typography, Wilson looks like no other podcasting app. On an iPhone X, the black background looks perfectly black thanks to the OLED display. It feels like an intimate experience.

Every week, the team selects a handful of podcast episodes all tied together by the same topic. Those topics can be the Supreme Court, the LGBTQ community, loneliness, dads, the World Cup…

Each issue has a cover art and a short description. And the team also tells you why each specific podcast episode is interesting. In other words, Wilson isn’t just an audio experience. You can listen to episodes in the app or open them in Apple Podcasts.

Navigating in the app is all based on swipes. You can scroll through past editions by swiping left and right. You can open an edition by swiping up, and go back to the list by swiping down. This feels much more natural than putting buttons everywhere.

Wilson also feels like tuning in to the radio. Podcasts are great because they let you learn everything there’s to learn about any interest you can have. But it also narrows your interests in a way. Podcast apps are too focused on top lists and “you might also like” recommendations.

Gone are the days when you would switch on the radio and listen to a few people talk about something you didn’t know you cared about. Human editors can change that. That’s why Wilson can be a nice addition to your podcasting routine.

Powered by WPeMatico

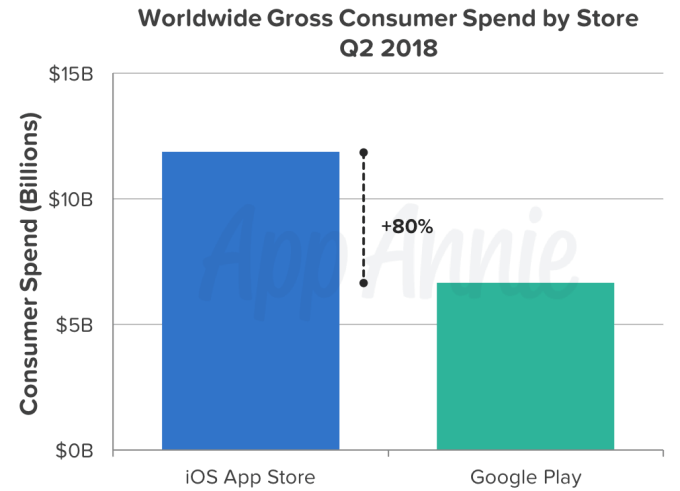

The second quarter of 2018 was another record-breaker for mobile app downloads and revenue. According to a new report this week from App Annie, there were over 28.4 billion app downloads worldwide across both iOS and Google Play in the quarter, up 15 percent year-over-year. That number is even more remarkable because it doesn’t include reinstalls or updates – only new app downloads. In addition, consumer spending in apps was up 20 percent year-over-year to reach $18.5 billion across iOS and Google Play combined.

This is the most money spent in apps compared with any other quarter before, the report notes, topping the prior quarter’s record-breaking $18.4 billion in app revenue, and 27.5 billion downloads.

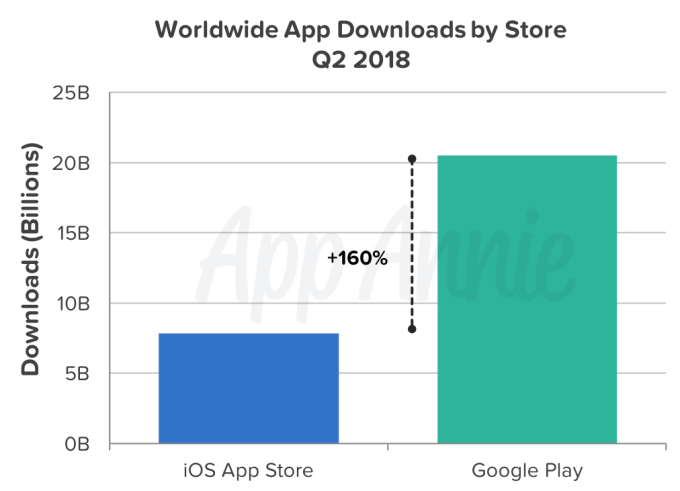

Much of the download activity in Q2 came from Google Play.

On its app marketplace alone, global downloads topped 20 billion, up 20 percent year-over-year and widening the gap between itself and iOS by 25 percent points to 160 percent. (See below).

This massive download growth is attributable largely to India, says App Annie .

The country was the biggest driver of download growth year-over-year in both absolute values and growth in market share. Indonesia also played a big role in Google Play downloads.

Meanwhile, the U.S., Russia and Saudi Arabia saw the largest growth in iOS downloads.

In particular, Google Play app downloads included growth in categories like games, video players and editors, and – not surprisingly, given the World Cup – sports applications. And on iOS, Sports apps were also the largest driver of global iOS downloads, followed by Finance and Travel apps.

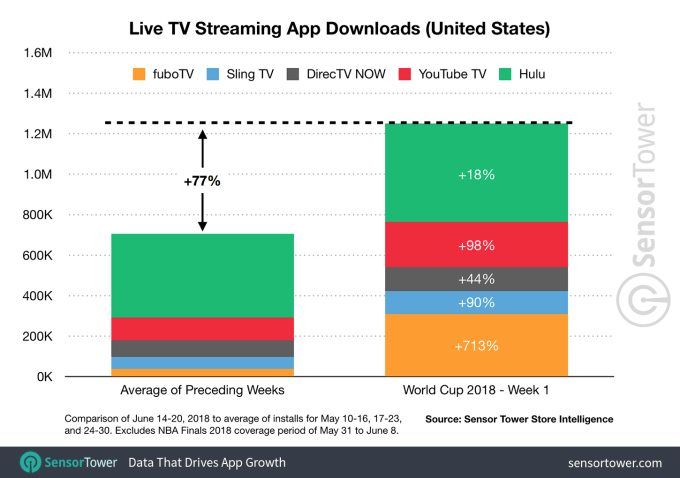

The impact on the 2018 FIFA World Cup on sports app downloads was also highlighted last month by Sensor Tower, whose own analysis found that new installs of the five leading live TV on demand apps offering channels with the World Cup grew 77 percent during the first week of World Cup coverage, compared with the three preceding weeks (excluding the NBA Finals period).

Sports streaming service fuboTV saw the largest impact, growing at a whopping 713 percent and adding 309K new users in the U.S., while Hulu saw the smallest impact at 18 percent growth.

Single network apps grew, too, this earlier report said. FOX Sports downloads increased by 95x for the same period, while Telemundo Deportes En Vivo grew 444x, for example.

App Annie added that the top 3 sports apps in Android in the U.S. during the first three weeks of the tournament were Telemundo Deportes (#1), FOX Sports GO (#2), and FOX Sports (#3), in terms of average megabytes per user – an indication of users’ live-streaming activity. The apps were also new entrants to the top 10 list of apps by total time spent, compared with the three weeks directly prior.

In the U.K., over 6 million hours were spent in the top 10 sports apps on Android during the first 3 weeks of the World Cup, up 65 percent from the 3 weeks prior.

The World Cup also had an impact on consumer spending in apps in the quarter.

Sports apps on iOS were the third largest contributors to absolute growth in consumer spend and in market share in Q2, while Entertainment and Productivity apps were numbers one and two, respectively. In-app subscriptions for both Sports and Entertainment apps drove the consumer spending increases.

On Google Play, Games, Social, and Music & Audio apps saw the largest download growth, quarter-over-quarter.

However, despite the downloads and consumer spending in sports and TV apps, the charts of the top 10 apps by worldwide downloads and consumer spending look a lot like they usually do – with Facebook apps dominating the top 10 by downloads (Messenger, Facebook, WhatsApp and Instagram were the top 4).

And the top 10 apps by spending were still largely those subscription-based entertainment services like Netflix, Tencent Video, iQIYI, Pandora, Youku, and YouTube.

Powered by WPeMatico

The Data Transfer Project is a new team-up between tech giants to let you move your content, contacts, and more across apps. Founded by Facebook, Google, Twitter, and Microsoft, the DTP today revealed its plans for an open source data portability platform any online service can join. While many companies already let you download your information, that’s not very helpful if you can’t easily upload and use it elsewhere — whether you want to evacuate a social network you hate, back up your data somewhere different, or bring your digital identity along when you try a new app. The DTP’s tool isn’t ready for use yet, but the group today laid out a white paper for how it will work.

Creating an industry standard for data portability could force companies to compete on utility instead of being protected by data lock-in that traps users because it’s tough to switch services. The DTP could potentially offer a solution to a major problem with social networks I detailed in April: you can’t find your friends from one app on another. We’ve asked Facebook for details on if and how you’ll be able to transfer your social connections and friends’ contact info which it’s historically hoarded.

From porting playlists in music streaming services to health data from fitness trackers to our reams of photos and videos, the DTP could be a boon for startups. Incumbent tech giants maintain a huge advantage in popularizing new functionality because they instantly interoperate with a user’s existing data rather than making them start from scratch. Even if a social networking startup builds a better location sharing feature, personalized avatar, or payment system, it might be a lot easier to use Facebook’s clone of it because that’s where your profile, friends, and photos live.

From porting playlists in music streaming services to health data from fitness trackers to our reams of photos and videos, the DTP could be a boon for startups. Incumbent tech giants maintain a huge advantage in popularizing new functionality because they instantly interoperate with a user’s existing data rather than making them start from scratch. Even if a social networking startup builds a better location sharing feature, personalized avatar, or payment system, it might be a lot easier to use Facebook’s clone of it because that’s where your profile, friends, and photos live.

If the DTP gains industry-wide momentum and its founding partners cooperate in good faith rather than at some bare minimum level of involvement, it could lower the barrier for people to experiment with new apps. Meanwhile, the tech giants could argue that the government shouldn’t step in to regulate them or break them up because DTP means users are free to choose whichever app best competes for their data and attention.

Powered by WPeMatico

In a bid to cut down on the spread of false information and spam, WhatsApp recently added labels that indicate when a message has been forwarded. Now the company is sharpening that strategy by imposing limits on how many groups a message can be sent on to.

Originally, users could forward messages on to multiple groups, but a new trial will see that forwarding limited to 20 groups worldwide. In India, however, which is WhatsApp’s largest market with 200 million users, the limit will be just five. In addition, a ‘quick forward’ option that allowed users to pass on images and videos to others rapidly is being removed from India.

“We believe that these changes — which we’ll continue to evaluate — will help keep WhatsApp the way it was designed to be: a private messaging app,” the company said in a blog post.

The changes are designed to help reduce the amount of information that goes viral on the service, although clearly this isn’t a move that will end the problem altogether.

The change is in direct response to a series of incidents in India. The BBC recently wrote about an incident which saw one man dead and two others severely beaten after rumors of their efforts to abduct children from a village spread on WhatsApp. Reportedly 17 other people have been killed in the past year under similar circumstances, with police saying false rumors had spread via WhatsApp.

In response, WhatsApp — which is of course owned by Facebook — has bought full-page newspaper ads to warn about false information on its service.

Beyond concern about firing up vigilantes, the saga may also spill into India’s upcoming national general election next year. Times Internet today reports that Facebook and WhatsApp plan to introduce a fake news verification system that it used recently in Mexico to help combat spam messages and the spreading of incorrect news and information. The paper said that the companies have already held talks with India’s Election Commission.

Powered by WPeMatico

Chinese bike-sharing company Ofo is entering a new phase. After a period of aggressive growth, the company is looking back at its international markets and focusing on the most promising ones.

A couple of weeks ago, the company issued a press release highlighting some of the priorities outside of China. As part of this move, Ofo co-founder and CEO Dai Wei is going to be directly in charge of international markets.

“It’s a new strategical phase on the international front,” Ofo France General Manager and Head of EMEA Laurent Kennel told me. “The company wants to focus on the most mature and promising markets.”

So it means that Ofo will stop altogether in some countries, such as Australia, Austria, Czech Republic, Germany, India and Israel.

At the same time, there are some markets that work quite well. In particular, the press release highlights Singapore, the U.S., the U.K., France and Italy. But even if you look at a more granular level, Ofo is going to focus on some specific cities in particular going forward.

As Quartz and Forbes highlighted, Ofo hasn’t been a massive success in smaller American cities. “In the U.S., some markets work better than others, and they’re going to focus on that,” Kennel said. Instead of operating in dozens of American cities, the company is going to scale back and focus on the most important ones.

In France, Ofo has only been available in Paris for instance. Numbers are encouraging as the company handles 5,000 to 10,000 rides a day with 2,500 bikes.

“[In Paris,] We crossed an important milestone to prove that our business model is sustainable,” Kennel said. “Our revenue covers all our operational and maintenance costs.” That doesn’t include occasional investments to purchase new bikes.

Overall, Kennel was quite optimistic about those remaining markets. By focusing on a limited number of cities, the company can invest properly on each of those markets. In Europe, Ofo is going to focus on the U.K., France and Italy.

Just like in the U.S., Ofo is also reducing the number of cities in the U.K. and Italy. The company recently shut down its service in Norwich and Sheffield. In Italy, there was an internal reorganization and the company stopped operating in the mid-sized city of Varese.

Following Mobike’s acquisition by Meituan, Mobike recently announced that it would stop requiring deposits in China. Ofo still asks for a refundable deposit when you sign up in China, but not in Europe.

Mobike’s deep pockets increase the pressure on Ofo. Ofo needs to find a sustainable business model to become a viable independent company in the long term. “It has an impact on international markets, but also on the internal organization in China,” Kennel said.

Ofo doesn’t want to comment on the situation market-by-market. So it’s hard to know for sure where Ofo still operates and where it plans to scale back. On Ofo’s website, you can find a map with all the markets where it claims to operate. I looked at this map, listed the 21 countries and tried to find out what’s happening at a local level.

This isn’t a perfect list, but it gives a good overview of what’s happening at the company.

Still operating normally as far as I know:

Scaling back operations:

Shutting down:

Unclear:

Powered by WPeMatico

The working class of the United States doesn’t get many breaks these days. It’s not just a function of low pay and long hours, but also the incredible uncertainty of income and expenses that makes surviving week-to-week so challenging. One in five Americans have a negative net wealth, even in an economy where the unemployment rate is the lowest in almost two decades. Banks, meanwhile, are actively dissuading the working class from banking with them, creating a permanent class of unbanked and underbanked citizens.

For Jon Schlossberg, CEO and co-founder of Even.com, improving the plight of ordinary Americans and their finances is a deeply personal and professional mission. And now that mission has a huge new bucket of capital behind it, with Keith Rabois of Khosla Ventures leading a $40 million Series B round into the Oakland-based startup. Rabois is a return investor, having previously backed the company in its late 2014 seed round. With this latest round of capital, Even.com has now raised $50.5 million.

When Even.com first launched its eponymous app, the goal was to offer income smoothing for workers, helping them avoid usurious payday loans to make ends meet. Since that first launch several years ago, Schlossberg and his team learned that the only way to improve the finances for the working class is to help them budget better — ending the need for loans in the first place. “To do anything with your life, unless you are just born to the right family, you need to spend your money wisely, but we never teach you how to do that,” Schlossberg explained to me.

Last year, Even.com announced that it had stopped evening through its Pay Protection product. Instead, Schlossberg said that Even.com has evolved and wanted to “build a new kind of financial institution with products that fit your life.” It still has a feature it brands as Instapay, which allows users to request their earned pay in advance of their payday.

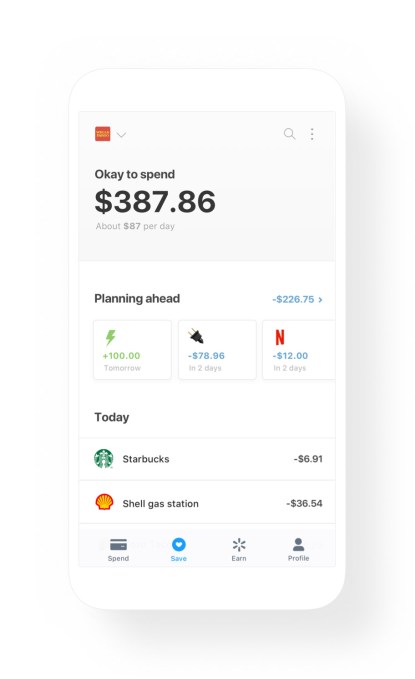

But Even.com is increasingly focused on improving the quality of its intelligent budgeting feature. Using artificial intelligence models honed over the past few years, the company now gives users of its Even app an “Okay to spend” figure that helps them think through their cash flow. By giving a predictive figure rather than a checking account balance, Even can help its users avoid sudden surprise expenses that can trigger the kind of financial death spiral that has become a familiar story in America. The company will also soon launch an automatic savings feature similar to Digit or Acorns that helps people build up regular savings.

Even’s Okay to spend feature gives insight into future cash flows before it is too late

While the company offers an increasingly comprehensive suite of financial tools, it has decided to avoid charging users specific use fees, opting instead for a subscription model. Schlossberg explained that “We are a mission-oriented company, but talk is cheap and where the rubber hits the road, it’s how you make money.” Even is free for users participating through partner employers, or $2.99 a month for individuals without a sponsor.

The company’s highest expense feature is Instapay due to underwriting, and so the company makes higher profits when fewer of its customers need access to payday credit. In other words, the better that its users budget, the fewer loans it will underwrite, and the more money the company makes. We are “directly incentivized to help people with their financial health,” Schlossberg noted.

Even has proven attractive to corporate customers, including Walmart, which partnered with the startup last December to offer its service to all 1.4 million employees at the retailer. Since the launch of that partnership, more than 200,000 Walmart employees regularly use the app, according to Even, and the typical active user checks their Okay to spend balance four times a week. A majority of active users have also taken out an Instapay through Even.

More interestingly, salaried employees at Walmart used the app slightly more than hourly workers, proving that just having a guaranteed income isn’t necessarily a panacea to financial trouble for many American households.

Even.com’s Series B round is all about expansion and growth for the company. Even intends to open an East Coast office this year, and intends to expand its product further into the Fortune 500 with partnerships similar to its Walmart deal. The company currently has 37 employees. In addition to Khosla, the startup raised funding from Valar Ventures, Allen & Company, Harrison Metal, SV Angel, Silicon Valley Bank and others.

Powered by WPeMatico