Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Facebook’s share price fell over 20 percent in after-hours trading today after the company announced its slowest-ever user growth rate and a scary warning that its revenue growth would rapidly decelerate. Before today’s brutal Q2 earnings, Facebook’s share price closed today at $217.50 – a record high — but fell to around $172 after the earnings call. That’s a market cap drop of roughly $123 billion. In two hours, Facebook lost more value than most startups and even public companies are ever worth.

Here’s the full story on Facebook’s disastrous Q2 2018 earnings:

So why did Facebook’s share price sink like a stone? There are five big reasons:

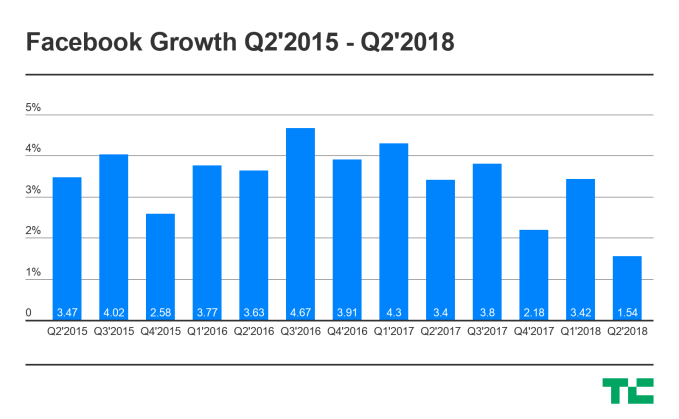

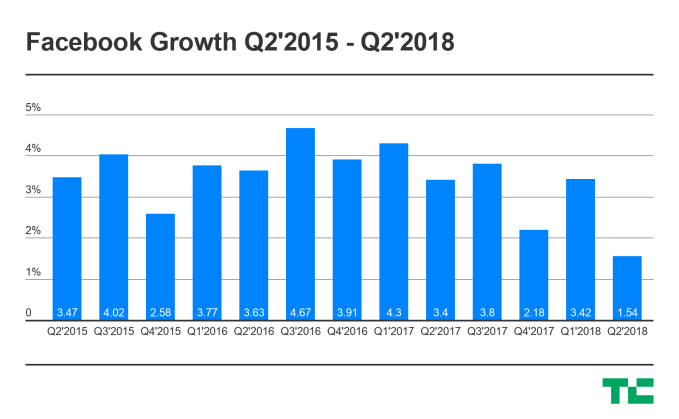

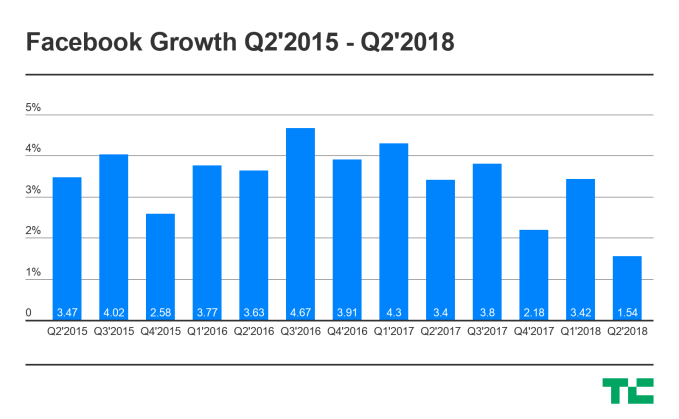

Slowest-Ever User Growth Rate – Facebook’s monthly user count grew just 1.54, compared to 3.14 last quarter. Daily active users grew even slower at 1.44 percent, compared to 3.42 percent last quarter. For reference, 2.18 percent was its previous slowest DAU growth rate back in Q4 2017. Suddenly hitting this wall could limit Facebook’s total user count over the long-run, and its revenue with it. Facebook tried to distract from these facts by announcing a new “family of apps audience” metric of 2.5 billion people using at least one of its apps, which will hide the shift of users from Facebook to Instagram and WhatsApp.

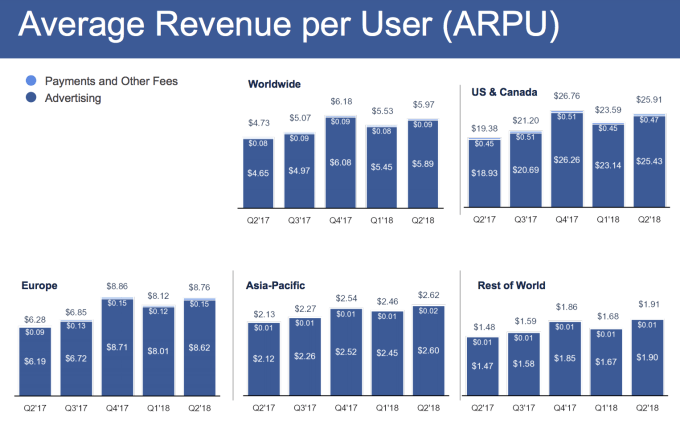

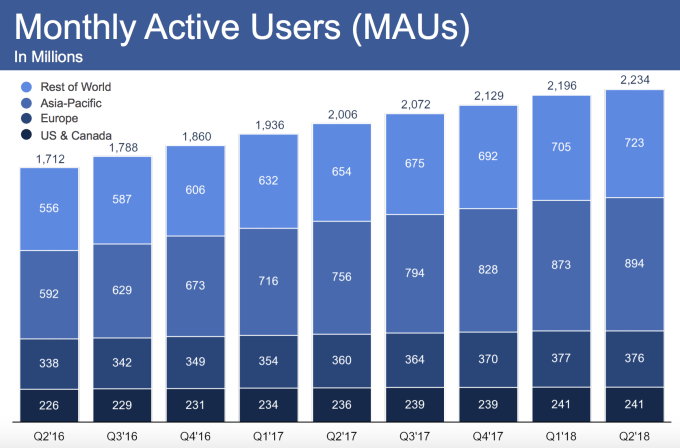

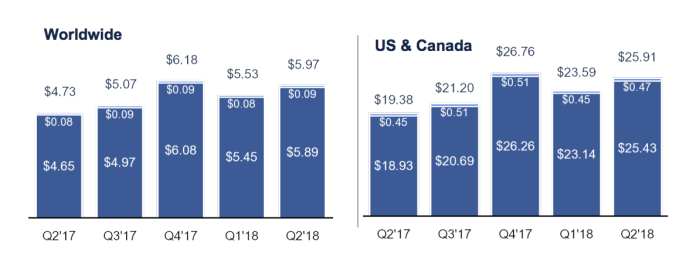

User Count Shrank In Europe, Flat In US & Canada – Facebook saw its first-ever decline in monthly user count in Europe, from 377 million to 376 million. It got stuck at 241 million in the US & Canada after similarly pausing at 239 million in Q4 2017. Those are Facebook’s two most lucrative markets, with it earning $25.91 per user in North America and $8.76 in Europe. If those markets stall, even swift growth in the Rest Of World region where it earns just $1.91 per user won’t save it.

Decelerating Revenue Growth – Facebook’s revenue grew a remarkable 42 percent year-over-year this quarter. But CFO David Wehner warned that metric would decelerate by high single-digit percentage per quarter over the coming quarters. Wehner said a combination of currency headwinds, new privacy controls, and new experiences like Stories will contribute to the deceleration. This news is what caused Facebook’s share price to drop from -7 percent to `-20 percent.

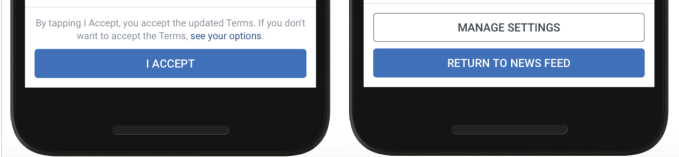

Privacy And Well-Being – Q2 saw the debut of Europe’s GDPR that forced Facebook to change its privacy policies and get users to agree to how it collects data about them. Wehner blamed GDPR for Facebook loss of users in Europe. That law and Facebook’s Cambridge Analytica scandal led the company to have to improve its privacy controls. These could make it tougher for Facebook to target people with ads or show their content to more people.

Meanwhile, Facebook has continued to adopt the “Time Well Spent” philosophy, removing click-bait news and crappy viral videos that lead to passive internet content consumption that studies say is unhealthy. Instead, Facebook is pushing features like Watch Party where users actively interact with each other. Those might not produce as much time on site and subsequent ad views, but CEO Mark Zuckerberg said the changes are “positive and we’re going to continue in this direction.”

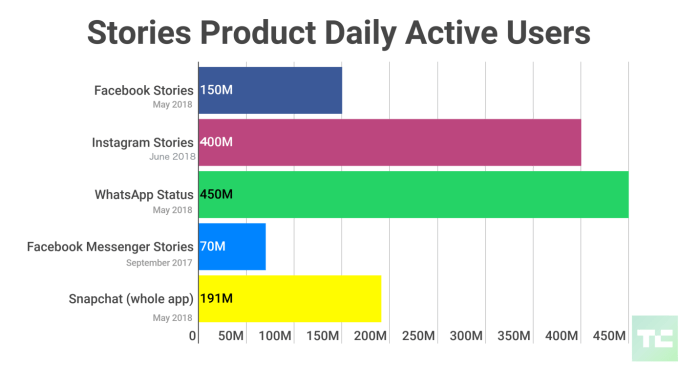

The Shift To Stories – Facebook estimates that by in 2019, sharing via ephemeral vertical Stories slideshows will surpass sharing via feeds. The problem is that advertisers may be slower than users to make that shift. “Will this monetize at the same rate as News Feed? We honestly don’t know” COO Sheryl Sandberg said. Stories ads might be full-screen and more immersive, but they don’t show off links to online stores as well, nor are they as well optimized from decades of banner ad experience by the industry.

Luckily, even though Snapchat invented the Stories format, Facebook has far more people using it each day, with 150 million Stories users on Facebook, 70 million on Messenger, 400 million on Instagram, and 450 million on WhatsApp . If Facebook does manage to figure out Stories ads, it could dominate, but it could take years for its advertiser count and ad prices to rise to offset the shift away from feeds.

Powered by WPeMatico

The pre-social media phenomenon that was early 2000s American Idol might be a weird place to spend a lot of focus when it comes to thinking about the future. But it’s also worth noting how little these types of shows adapted to build themselves into the fabric of live social commentary. Twitter has offered a nice second screen for thirsty users, but what would reality TV look like if it was built for the smartphone?

The team behind FameGame is aiming to answer these very fascinating/worrying questions with their new app which envisions the rebirth of live reality TV on your smartphone. The company’s first offering seems to be a mix of American Idol, Musical.ly and HQ Trivia with young users vying to flex their talents and social media prowess to win cash and glory.

The startup sees live gamified engagement as a social outlet that existing apps and platforms aren’t making much of a dent in. FameGame CEO Alexandra Botez grew interested in the concept after getting into live-streaming herself playing chess on Twitch and seeing the potential of bringing users closer to less gaming-focused verticals.

“We thought that the interactivity of live gaming could also be applied to make conventional TV more entertaining,” Botez tells TechCrunch. “We think Musical.ly and Instagram are pretty big so it’s hard for them to change their infrastructure in such a way that they make the type of immersive experience that we’ve created with FameGame.”

FameGame plays the game of fame by getting users to submit self-shot smartphone videos of their talents. The challenges differ by week but one contest may be focused on dance skills while another may be focused on lip-syncing. After an initial submission period, users can check out what’s been uploaded and vote for their favorites which will be included in a live show that’s hosted at 5:00 PM PT every day.

Cash prizes are at stake, but the real emphasis seems to be on social validation. Winners will also get a shoutout from a Musical.ly “celebrity” user and a big emphasis is put on the host shouting out users and their handles to drive attention their way. The whole design seems to take some pretty clear, erm, inspiration from HQ Trivia but the live voting component adds a more impactful community vibe to it though once users see they aren’t included amongst the finalists, it might be hard to hold onto viewers.

The startup’s efforts are going to start with a focus on the crowd that has helped catapult apps like Instagram and Musical.ly to rabid success. “We decided to go with young teenage girls because they are really obsessed with becoming famous on social media and they spend a lot of time on Musical.ly posting videos and not necessarily getting the gratification that they might want,” CTO Ruben Mayer-Hirshfeld tells me.

There are certainly some unique challenges with catering to such a young user base, especially from a safety standpoint. The company is going to curate the few videos that go into the live show, but there isn’t any screening happening in between user submission and user voting aside from a reporting button so the burden is ultimately put on a young user base to decide what crosses the line.

FameGame is just the start for the company’s ambitions. Botez tells me that there are a number of different TV show formats that seem ripe for the live social mobile elements, but that the main focus is getting excited teens on FameGame right now and seeing whether the format can catch steam and move beyond what’s out there already.

Powered by WPeMatico

Facebook is hiding that users are leaving its main app but sticking with Instagram and WhatsApp by publicizing a new metric. Facebook today for the first time announced that in June, 2.5 billion people used at least one of its apps: Facebook, Instagram, WhatsApp, or Messenger. That’s a helpful number because it counts real people, rather than accounts, since people can have multiple accounts on a single app. 2.5 billion people compares to 2.23 billion monthly users on Facebook, 1 billion users on Instagram, 1.5 billion users on WhatsApp, and 1.3 billion users on Messenger.

Mark Zuckerberg announced the new stat on Facebook’s Q2 2018 earnings call following a tough report that saw its user growth slow to its lowest rate ever. Zuckerberg said the 2.5 billion count “Individual people rather than active accounts” which he says “excludes when people have multiple accounts on a single app. And it reflects that many people use more than one of our services.”

It seems as if Facebook announced the stat in hopes of deflecting attention from the fact that its user count shrank in Europe and was flat in the US & Canada, contributing to extraordinarily low monthly and daily user growth. That growth trouble in turn sent Facebook’s share price down over 20 percent in after-hours trading.

On the 2.5 billion stat, Facebook CFO David Wehner explained that “We believe this number better reflects the size of our community.” He also clarified that Facebook’s monthly active user count of 2.23 billion “does count multiple accounts for a single user, and that accounts for 10 percent of Facebook’s MAU” or 223 million.

By bundling the user counts into a “family of apps audience metric”, Facebook can obscure the fact that its core app is hitting a wall. Instead, it can rely on WhatsApp and Instagram to shore up the number. For example, if teens slip from Facebook to Instagram, they’ll still be counted in the new metric. But that doesn’t change the fact that the company’s main money-maker is losing its edge.

Powered by WPeMatico

Facebook has hit a wall. The social network succumbed to the public backlash over its handling of fake news, privacy, and digital wellbeing to miss some of Wall Street’s estimates, showing mixed results in its Q2 2018 earnings. GDPR, Mark Zuckerberg’s testimony before congress, and more scandals appear to have contributed to Facebook’s weak user growth.

Facebook reached 2.23 billion monthly users, up just 1.54 percent, much slower than Q1’s 3.14 percent around where its growth rate has hovered for years. Facebook earned $13.23 billion in revenue, missing Thomson Reuters consensus estimates of $13.36 billion, but beat with $1.74 EPS compared to an estimated $1.72 EPS.

Daily active users hit 1.47 billion, up an especially low 1.44 percent percent compared to Q1’s 3.42 percent. For comparison, before now Facebook’s slowest quarter-over-quarter daily user growth rate was 2.18 percent in Q4 2017. In an attempt to deflect attention from its weak user growth, Zuckerberg announced on the earnings call that 2.5 billion people use at least one of its apps: Facebook, Instagram, WhatsApp, or Messenger.

The stock market frowned on the slow growth rates, pushing Facebook’s share price down over 21 percent in after-hours trading to around $170 per share. That’s down from $217.50 when the markets closed. Initially the share price dropped 7 percent on news of slow user growth, but then fell much further when Facebook announced revenue growth would slow significantly in upcoming quarters.

The share price descent comes despite Facebook earning $5.106 billion in profit and revenue being up 42 percent year-over-year. Zuckerberg noted in the earnings release that “Our community and business continue to grow quickly”. And while that’s true if you’re looking year-over-year, Q2 could break that trend.

Facebook’s daily and monthly user counts were up 11 percent year-over-year, confirming that the momentum of its business is still overpowering its PR problems when you zoom out. And its DAU to MAU ratio held firm at 66 pecent, indicating that users are still visiting the site often. But the question for today’s earnings call will be whether time spent on the site has decreased significantly, dragging down revenue with it.

One tough spot for Facebook was that it got stuck at 241 million monthly US & Canada users, the same count as last quarter. After failing to grow in that core market in Q4 2017, it appears that Facebook finally has hit saturation at home after 14 years. And in Europe, Facebook lost 1 million users, sinking to 376 million monthlies. That could be sign that GDPR requirements and the annoying terms of service changes it had to get users to agree to deterred some from browsing. In fact, CFO David Wehner said the failure to grow in Europe was “due to the GDPR.”

Facebook still managed to boost its average revenue per user in all markets, growing from $23.59 to $25.91 in the US & Canada, showing its targeting continues to improve and competition for ads is strong. But the fact that it’s stopped growing at home could weigh heavily on its share price. Facebook will have to continue to invent more ways to squeeze dollars out of its existing users.

The earnings call saw a worrying warning from Wehner, who said that after 42 percent year-over-year revenue growth this quarter, Facebook expected high single-digit drops each quarter to that metric over the next few quarters. “In terms of what’s driving the deceleration, it’s a combination of factors. First of all there’s currency that’s going from a tailwind to a modest headwind. Secondly, we’re going to be focusing on growing new experiences like Stories . . . and that’s going to have a negative impact on revenue growth. Andd we’re giving people who use the service more choice in terms of privacy.”

Looking back, the quarter saw Facebook clamp down on APIs for developers in hopes of preventing another Cambridge Analytica style disaster. Its CEO faced tough days of questioning from congress over the privacy problem, alleged bias against conservatives, and its failure to protect the 2016 presidential election. Facebook has faced tough questioning from reporters about its approach to fake news and election interference. Facebook tried to redirect attention away from its troubles during its F8 conference that saw it announce plans for a dating feature.

But all the problems may be taking a toll on user engagement, leading to the revenue miss. Weak daily and monthly user growth should be a big concern, and will put even more pressure on Instagram to prop up the corporation.

This article has been updated to reflect announcements from the earnings call.

For more recent Facebook news:

Powered by WPeMatico

Good news for people who like near-final previews of mobile operating systems. Android just dropped Beta 4 for Android P, marking the last preview milestone before the full version launches. That means the still unnamed OS is just around the corner — promised to arrive at some point later this summer.

As all of the above implies, this build should be pretty close to final, including all of the systems you’ll see in the shipping version. The release is primarily focused on developers, looking to make sure their apps are up to date with Android P when it ships.

That includes a number of the new OS features, which will impact usage across apps, including multi-camera support, display cutout, enhanced notifications and ImageDecoder. More details on all of that can be found here.

Of course, the build is open to anyone who signs up for the Android Beta Program, so long as you also have access to a Pixel device to test it on — there’s a sign up form here. Those who have been testing out earlier builds should be receiving Beta 4 as an automatic update at some point in the near future.

No specific date has been given for the final build — just that it’s “coming soon.” Ditto for the name — though there’s no shortage of dessert foods starting with “P.” These days, I’m leaning toward Pop Rocks. But then, I’m kind of always leaning toward Pop Rocks. Hey, anyone know where a guy can get some Pop Rocks in 2018?

Anyway, more info here.

Powered by WPeMatico

Outvote, a new Y Combinator-backed startup, wants to make grassroots-style campaigning easier and more personal, with the launch of an app that allows people to text their friends with reminders to vote. The idea is to take advantage of people’s willingness to use social sharing to communicate about political issues, while also leveraging the simplicity that comes with tweeting or posting to Facebook and turning that into an actionable reminder that can actually drive people to the polls during critical times.

The startup was founded by Naseem Makiya, a Harvard-educated software engineer with a background in startups, including San Francisco-based Moovweb and Cambridge area’s DataCamp; along with Nadeem Mazen, an MIT grad and interactive designer who once worked with OK GO on one of its viral music videos, and who now owns the Cambridge-based creative agency Nimblebot.

Mazen, who has since moved into an advisory role with Outvote, also has more direct political experience, having run for public office himself. In fact, he learned first-hand how every vote counts, having won his Cambridge City Council position in 2013 by just six votes.

He also attributed his second election win to organizing low propensity, minority and younger voters — plus “really doing a lot of texting and a lot of outreach through my friend networks,” says Mazen.

When Mazen’s time in politics ended, he then helped others get elected using similar means. Later, he and Makiya brought together a group of Harvard and MIT folks to formalize a company around the technology they were using. This became Outvote.

While today there are a lot of tools for voter outreach, many of those operated by well-known organizations, like MoveOn, for example, involve people opting in to receive texts from the group in question. Outvote is different because it’s a tool that helps individual voters reach out to their own personal acquaintances, family and friends.

“The way campaigns are run right now is most of the budget is spent on ads that are really low ROI — they have some effect on persuasion, but less effect on actual voter turnout,” explains Makiya. “With this effort, we’re trying to bring politics back to more of word-of-mouth and conversations between friends,” he says.

The team began working on the technology for Outvote last summer, and officially founded the company early this year.

While individuals are the app’s end users, they’re brought into the app by a campaign.

Users give the app permission to upload their phone’s contacts, which Outvote matches up with registered voter databases. That way, you’ll only be texting those who can actually go vote in your district. When the matching completes, the app has scripts that allow users to just click to text your friends a message from your own phone number.

In other words, it’s no longer a political campaign or organization bugging people to go vote via text — it’s a friend. If your friends have a problem with the unsolicited text, they’ll have to tell you.

In other words, it’s no longer a political campaign or organization bugging people to go vote via text — it’s a friend. If your friends have a problem with the unsolicited text, they’ll have to tell you.

The app also uses some sort of basic modeling to figure out who best to text, based on things like past voter history, whether that person tends to vote in the primaries, if they’re a registered Democrat and so on.

Oh, yes, that’s right — this app is built for Democratic campaigns only.

Outvote makes no apologies about the fact that it is a tool designed to help Democrats win back seats across the U.S., both on local and national levels.

“We think it’s really critical that Democrats begin to invest in and promote technology. The right is doing a much better job of investing in some of the niche technology,” says Mazen. “And, obviously, groups like Cambridge Analytica and folks have been, I would say, underhanded, in their use of technology,” he adds. “We have to work twice as hard to be twice as resolute, as a result.”

The company says it has turned down right-leaning independents and Republican campaigns that wanted to use its technology, and is instead piloting with around 50 Democratic campaigns at present. Campaigns will be charged a low monthly fee for using Outvote that will vary depending on their size. However, many of the pilot customers are using Outvote for free at this time.

The goal is to make Outvote far more affordable than the existing mass-texting services that charge as much as 30 cents per person per month, which can cost campaigns hundreds of thousands of dollars at scale. Outvote aims to be around 2 to 5 cents per text, it says.

For now, its focus is on raising awareness about the candidate and their issues, and getting people to the polls. It’s not offering the sort of “call your congressman”-style outreach efforts you’ll find in some other political apps.

Outvote is also partnered with The Movement Cooperative, Represent.Us, Flippable, the DNC, Vote.org and Swing Left, according to its website.

The startup is already reporting some early successes. When used last November, it found millennials contacted through Outvote were twice as likely to vote, while non-millennials were 50 percent more likely to vote. The company doesn’t have the data yet from how it’s been doing in the primaries, but says it’s been getting good feedback from the participating campaigns.

In addition to the Y Combinator backing, Outvote has raised $300,000 in seed funding from 2enable Partners ahead of Demo Day.

Outvote’s app is available on both iOS and Android.

Powered by WPeMatico

Grubhub announced this morning that it’s agreed to acquire LevelUp for $390 million cash.

Founder and CEO Matt Maloney told me that while previous Grubhub acquisitions like Eat24 were designed to give the company’s delivery business more scale, “This is kind of a different acquisition. It’s a product and strategic positioning acquisition.”

LevelUp is based in Boston, offering a platform to manage digital ordering, payments and loyalty, with customers like KFC, Taco Bell Pret a Manger, Potbelly and Bareburger. Maloney said that buying the company allows Grubhub to deepen its integration with restaurants’ point-of-sale systems. That, in turn, will allow them to handle more deliveries.

At the same time, Maloney said LevelUp can help Grubhub build a restaurant platform that goes beyond delivery, for example by managing their customer interactions across mobile and the web.

“We want to help restaurants actively engage with their diners,” Maloney said. “This is a huge step in that direction.”

Once the regulatory waiting period is over, the entire LevelUp team will be joining Grubhub, with founder and CEO Seth Priebatsch reporting to Maloney — who said that in the short term, he plans to change very little, aside from the POS integrations. Even in the long term, he suggested that LevelUp could continue to operate as its own brand within the larger Grubhub platform.

“They’re doing something really well and we don’t want to screw that up,” he said. “We want to make as little change as possible, until we all understand how we’re better working together.”

The LevelUp platform was launched in 2011, and the company has raised around $108 million in total funding, according to Crunchbase. Investors include Highland Capital, GV, Balderton Capital, Deutsche Telecom Strategic Investments, Continental Advisors, Transmedia Capital and U.S. Boston Capital.

“For the last seven years, we have worked to provide restaurant clients with a complete solution to engage customers, and this agreement is the biggest and most exciting step in achieving that mission,” Priebatsch said in a statement provided by Grubhub. “After close, the entire team will remain in Boston and our office will become Grubhub’s newest center of technology excellence.”

The announcement came as part of Grubhub’s second quarter earnings release, which saw the company grow active diners by 70 percent year-over-year, to 15.6 million, while revenue increased 51 percent, to $240 million.

Powered by WPeMatico

Line, the company best-known for its popular Asian messaging app, is doubling down on games after it acquired a controlling stake in Korean studio NextFloor for an undisclosed amount.

NextFloor, which has produced titles like Dragon Flight and Destiny Child, will be merged with Line’s games division to form the Line Games subsidiary. Dragon Flight has racked up 14 million users since its 2012 launch — it clocked $1 million in daily revenue at peak. Destiny Child, a newer release in 2016, topped the charts in Korea and has been popular in Japan, North America and beyond.

Line’s own games are focused on its messaging app, which gives them access to social features such as friend graphs, and they have helped the company become a revenue generation machine. Alongside income from its booming sticker business, in-app purchases within games made Line Japan’s highest-earning non-game app publisher last year, according to App Annie, and the fourth highest worldwide. For some insight into how prolific it has been over the years, Line is ranked as the sixth highest earning iPhone app of all time.

But, despite revenue success, Line has struggled to become a global messaging giant. The big guns WhatsApp and Facebook Messenger have in excess of one billion monthly users each, while Line has been stuck around the 200 million mark for some time. Most of its numbers are from just four countries: Japan, Taiwan, Thailand and Indonesia. While it has been able to tap those markets with additional services like ride-hailing and payments, it is certainly under pressure from those more internationally successful competitors.

With that in mind, doubling down on games makes sense and Line said it plans to focus on non-mobile platforms, which will include the Nintendo Switch among others consoles, from the second half of this year.

Line went public in 2016 via a dual U.S.-Japan IPO that raised over $1 billion.

Powered by WPeMatico

A group of computer vision researchers from ETH Zurich want to do their bit to enhance AI development on smartphones. To wit: They’ve created a benchmark system for assessing the performance of several major neural network architectures used for common AI tasks.

They’re hoping it will be useful to other AI researchers but also to chipmakers (by helping them get competitive insights); Android developers (to see how fast their AI models will run on different devices); and, well, to phone nerds — such as by showing whether or not a particular device contains the necessary drivers for AI accelerators. (And, therefore, whether or not they should believe a company’s marketing messages.)

The app, called AI Benchmark, is available for download on Google Play and can run on any device with Android 4.1 or higher — generating a score the researchers describe as a “final verdict” of the device’s AI performance.

AI tasks being assessed by their benchmark system include image classification, face recognition, image deblurring, image super-resolution, photo enhancement or segmentation.

They are even testing some algorithms used in autonomous driving systems, though there’s not really any practical purpose for doing that at this point. Not yet anyway. (Looking down the road, the researchers say it’s not clear what hardware platform will be used for autonomous driving — and they suggest it’s “quite possible” mobile processors will, in future, become fast enough to be used for this task. So they’re at least prepped for that possibility.)

The app also includes visualizations of the algorithms’ output to help users assess the results and get a feel for the current state-of-the-art in various AI fields.

The researchers hope their score will become a universally accepted metric — similar to DxOMark that is used for evaluating camera performance — and all algorithms included in the benchmark are open source. The current ranking of different smartphones and mobile processors is available on the project’s webpage.

The benchmark system and app was around three months in development, says AI researcher and developer Andrey Ignatov.

He explains that the score being displayed reflects two main aspects: The SoC’s speed and available RAM.

“Let’s consider two devices: one with a score of 6000 and one with a score of 200. If some AI algorithm will run on the first device for 5 seconds, then this means that on the second device this will take about 30 times longer, i.e. almost 2.5 minutes. And if we are thinking about applications like face recognition this is not just about the speed, but about the applicability of the approach: Nobody will wait 10 seconds till their phone will be trying to recognize them.

“The same is about memory: The larger is the network/input image — the more RAM is needed to process it. If the phone has a small amount of RAM that is e.g. only enough to enhance 0.3MP photo, then this enhancement will be clearly useless, but if it can do the same job for Full HD images — this opens up much wider possibilities. So, basically the higher score — the more complex algorithms can be used / larger images can be processed / it will take less time to do this.”

Discussing the idea for the benchmark, Ignatov says the lab is “tightly bound” to both research and industry — so “at some point we became curious about what are the limitations of running the recent AI algorithms on smartphones”.

“Since there was no information about this (currently, all AI algorithms are running remotely on the servers, not on your device, except for some built-in apps integrated in phone’s firmware), we decided to develop our own tool that will clearly show the performance and capabilities of each device,” he adds.

“We can say that we are quite satisfied with the obtained results — despite all current problems, the industry is clearly moving towards using AI on smartphones, and we also hope that our efforts will help to accelerate this movement and give some useful information for other members participating in this development.”

After building the benchmarking system and collating scores on a bunch of Android devices, Ignatov sums up the current situation of AI on smartphones as “both interesting and absurd”.

For example, the team found that devices running Qualcomm chips weren’t the clear winners they’d imagined — i.e. based on the company’s promotional materials about Snapdragon’s 845 AI capabilities and 8x performance acceleration.

“It turned out that this acceleration is available only for ‘quantized’ networks that currently cannot be deployed on the phones, thus for ‘normal’ networks you won’t get any acceleration at all,” he says. “The saddest thing is that actually they can theoretically provide acceleration for the latter networks too, but they just haven’t implemented the appropriated drivers yet, and the only possible way to get this acceleration now is to use Snapdragon’s proprietary SDK available for their own processors only. As a result — if you are developing an app that is using AI, you won’t get any acceleration on Snapdragon’s SoCs, unless you are developing it for their processors only.”

Whereas the researchers found that Huawei’s Kirin’s 970 CPU — which is technically even slower than Snapdragon 636 — offered a surprisingly strong performance.

“Their integrated NPU gives almost 10x acceleration for Neural Networks, and thus even the most powerful phone CPUs and GPUs can’t compete with it,” says Ignatov. “Additionally, Huawei P20/P20 Pro are the only smartphones on the market running Android 8.1 that are currently providing AI acceleration, all other phones will get this support only in Android 9 or later.”

It’s not all great news for Huawei phone owners, though, as Ignatov says the NPU doesn’t provide acceleration for ‘quantized’ networks (though he notes the company has promised to add this support by the end of this year); and also it uses its own RAM — which is “quite limited” in size, and therefore you “can’t process large images with it”…

“We would say that if they solve these two issues — most likely nobody will be able to compete with them within the following year(s),” he suggests, though he also emphasizes that this assessment only refers to the one SoC, noting that Huawei’s processors don’t have the NPU module.

For Samsung processors, the researchers flag up that all the company’s devices are still running Android 8.0 but AI acceleration is only available starting from Android 8.1 and above. Natch.

They also found CPU performance could “vary quite significantly” — up to 50% on the same Samsung device — because of throttling and power optimization logic. Which would then have a knock on impact on AI performance.

For Mediatek, the researchers found the chipmaker is providing acceleration for both ‘quantized’ and ‘normal’ networks — which means it can reach the performance of “top CPUs”.

But, on the flip side, Ignatov calls out the company’s slogan — that it’s “Leading the Edge-AI Technology Revolution” — dubbing it “nothing more than their dream”, and adding: “Even the aforementioned Samsung’s latest Exynos CPU can slightly outperform it without using any acceleration at all, not to mention Huawei with its Kirin’s 970 NPU.”

“In summary: Snapdragon — can theoretically provide good results, but are lacking the drivers; Huawei — quite outstanding results now and most probably in the nearest future; Samsung — no acceleration support now (most likely this will change soon since they are now developing their own AI Chip), but powerful CPUs; Mediatek — good results for mid-range devices, but definitely no breakthrough.”

It’s also worth noting that some of the results were obtained on prototype samples, rather than shipped smartphones, so haven’t yet been included in the benchmark table on the team’s website.

“We will wait till the devices with final firmware will come to the market since some changes might still be introduced,” he adds.

For more on the pros and cons of AI-powered smartphone features check out our article from earlier this year.

Powered by WPeMatico

PicsArt, the company behind the photo-editing app of the same name, has hired Tammy Nam as its first chief operating officer.

Nam was most recently the CEO of Viki, the Rakuten-acquired video streaming service, and before that served as a marketing executive at Viki, Scribd and Slide.

PicsArt said Nam will report to founder and CEO Hovhannes Avoyan, and that she will oversee all aspects of the business except for product and engineering.

“PicsArt has grown organically so far, but our next big opportunity is in directing this growth through the right market development, community engagement and revenue channels,” Avoyan said in the announcement. “In addition to her proven operational experience in both consumer advertising and subscription-based businesses, Tammy adds deep bench strength in market, brand and community development — areas that will be critical for us moving forward.”

The company announced last year that it’s reaching 100 million monthly active users. Nam told me she was particularly impressed that it achieved that growth without significant marketing spend.

“I understand what it takes to grow quickly, but also thoughtfully,” she said. “Because of my background, the CEO and the board felt like I would be a great match to [help PicsArt] reach the next 200 million, the next 500 million users.”

Asked what thoughtful growth looks like for PicsArt, Nam said it means not just growing at any cost, but also considering things like revenue and the different communities using the app. She said she’s trying to examine the company’s structure to ensure it can “maximize efficiencies towards these big goals.”

“It will continue to grow organically, but the branding, the user development will definitely evolve,” she added. “There’s a sea of companies that play in our space … How do you stand out? And how do you stay relevant?”

Nam also said that she’ll be looking at PicsArt’s opportunities for international growth. Not that the company has been neglecting the world beyond the United States — China is its fastest-growing market and already one of its top countries for revenue. (The company says it recently became profitable following the launch of its PicsArt Gold subscription.)

Nam suggested that PicsArt can move into new markets without competing with the dominant social media platforms, because it’s “agnostic” in terms of where users publish their edited photos.

“It’s completely lowered the barrier,” she said. “It used to be you had to know Photoshop. Now it’s so easy to create professional-looking photos, images and soon animations, videos, etc. Everyone is a creator.”

Powered by WPeMatico