Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Netflix is one of the highest-grossing apps on the iOS App Store, but it looks like the video streaming giant is contemplating how it might make an even bigger margin on its iPhone and iPad users.

TechCrunch has learned and confirmed that Netflix, in its own words, is “testing the iTunes payment method” in 33 countries. More specifically, Netflix is testing how to bypass iTunes. Until September 30, new or lapsed subscribers in selected markets across Europe, Latin America and Asia will be unable pay using iTunes. They are instead getting redirected to the mobile web version to log payment details directly with Netflix.

Others like Spotify also have moved users away from using iTunes to pay for subscriptions. It’s notable that both Spotify and Netflix have something else in common: Apple — now the world’s biggest company passing a $1 trillion market cap earlier this month — has made many big moves to encroach on their space, and thus it makes little sense for either company to cut Apple in more than it has to on its direct customer relationships. (You might say the same for Google.)

Netflix’s iOS test was first spotted by NDTV in India last week, with users also flagging changes on Twitter. Journalist Manish Singh (in a tweet he then deleted) subsequently said Netflix was running a two-month experiment. A customer support agent contacted by us earlier today confirmed that the test has actually been running since June, starting first in 10 countries and then expanding to 33 from August 2 until September 30.

“During this time, customers in these countries may experience any of the following when launching the Netflix app on an iOS (mobile or tablet) device: 1. Ability to sign up in app with only iTunes Mode Of Payment. 2. Ability to log into Netflix but not sign up (sign up only via mobile browser),” he wrote. “We are constantly innovating and testing new signup approaches on different platforms to better understand what our members like. Based on what we learn, we work to improve the Netflix experience for members everywhere.”

Asked for more clarification, a spokesperson, provided a statement echoing the same words also used by the customer support agent.

The full list of countries where the billing test is running is as follows: Argentina, Australia, Austria, Belgium, Brazil, Canada, Colombia, Croatia, Czech Republic, Denmark, Ecuador, Finland, France, Germany, Great Britain, Hungary, India, Indonesia, Italy, Japan, Korea, Malaysia, Mexico, Norway, Peru, Philippines, Poland, Slovakia, South Africa, Spain, Sweden, Taiwan and Thailand.

Although Netflix is calling this a test, it’s notable that the company has been gradually shifting its customer relationships on other platforms to develop more direct billing with its users.

As of May 2018, Netflix stopped allowing new or rejoining customers to use Google Play to pay for its service. “If you are currently billed by Google Play, you can continue to use Google Play billing until your account is cancelled,” the company notes on a help page about the change, which is in line with how it appears to be testing billing now on iOS.

Changing the billing to a direct format means that Netflix bypasses giving Google and Apple a cut on those subscriptions. Currently, Apple takes a 30 percent cut on the first year of a subscription, which goes down to 15 percent for subsequent years.

Apple has something of the upper hand especially when it comes to newer apps or those still building up their user bases: it controls the App Store on iOS devices, and with active billing details for a large number of these users, Apple greatly reduces friction for enticing users to sign up and subscribe to a service (the same goes for in-app purchases, too, although that is less relevant to Netflix).

But the math and strategy change for the biggest app publishers, who have their own brands (and even their own memes). These might be more willing to take the chance of creating a little bit more friction in exchange for a bigger return.

Although it’s not elaborating too much about what it is doing, this might be particularly the case for Netflix. In July, the company posted a miss in its quarterly revenues and subscriber additions. Growth may be slowing, so now might be a good time for the company to refocus the margins its making on its 130 million+ users.

The test for payments comes at the same time that Netflix is making other tests and tweaks to its service, including an experiment to see how well video promos between episodes do with users (they seem to universally dislike them), and closing off the option to leave user reviews on videos.

If the billing test grows, or becomes a permanent thing, as it has with Google, it looks like Apple might soon need to update its subscription pages for developers:

En este caso contacta a nuestros amigos de iTunes para que te ayuden con esa cancelación. Te dejo su pagina de soporte: https://t.co/l9Rny3SUZ2

*DR

— Netflix CS (@Netflixhelps) August 20, 2018

iTunes should be available for you. To have iTunes as your biller, you just have to sign up for Netflix on an iOS device. *JR

— Netflix CS (@Netflixhelps) August 2, 2018

We’ll update this post as we learn more.

Additional reporting Jon Russell

Powered by WPeMatico

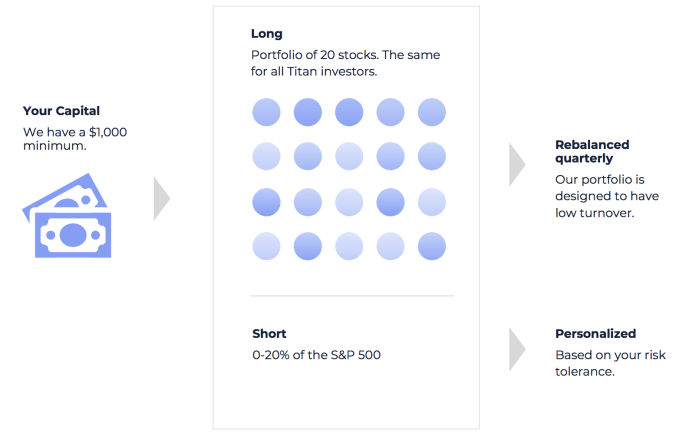

What Robinhood did to democratize buying individual stocks, Titan wants to do for investing in a managed portfolio. Instead of being restricted to rich accredited investors willing to pour $5,000 or even $500,000 into a traditional hedge fund that charges 2 percent fees and 20 percent of profits, Titan lets anyone invest as little as $1,000 for just a 1 percent fee on assets while keeping all the profits. Titan picks the top 20 stocks based on data mined from the most prestigious hedge funds, then invests your money directly in those with personalized shorts based on your risk profile.

Titan has more $10 million under management after quietly spinning up five months ago, and this week the startup graduates from Y Combinator. Now Titan is ready to give upscale millennials a more sophisticated way to play the markets.

This startup is hot. It refused to disclose its funding, likely in hopes of not tipping off competitors and incumbents to the opportunity it’s chasing. But it’s the buzz of YC, with several partners already investing their own money through Titan. When you consider Stanford-educated free stock-trading app Robinhood’s stunning $5.6 billion valuation thanks to its disruption of E*Trade, it’s easy to imagine why investors are eager to back Titan’s attack on other financial vehicles.

“We’re all 28 to 30 years old,” says co-founder Clayton Gardner about his team. “We want to actively invest and participate in the market but most of us who don’t have experience have no idea what we’re doing.” Most younger investors end up turning to family, friends or Reddit for unreliable advice. But Titan lets them instantly buy the most reputable stocks without having to stay glued to market tickers, while using an app to cut out the costs of pricey brokers and Wall Street offices.

Titan co-founders (from left): Max Bernardy, Joe Percoco, Clayton Gardner

“We all came from the world of having worked at hedge funds and private equity firms like Goldman Sachs. We spent five years doing that and ultimately were very frustrated that the experiences and products we were building for wealthy people were completely inaccessible to people who weren’t rich or didn’t have a fancy suit,” Gardner recalls. “Instead of charging high fees, we can use software to bring the products directly to consumers.”

Titan wants to build BlackRock for a new generation, but its origin is much more traditional. Gardner and his co-founder Joe Percoco met on their first day of business school at UPenn’s Wharton (of course). Meanwhile, Titan’s third co-founder, Max Bernardy, was studying computer science at Stanford before earning a patent in hedge fund software and doing engineering at a few startups. The unfortunate fact is the world of finance is dominated by alumni from these schools. Titan will enjoy the classic privilege of industry connections as it tries to carve out a client base for a fresh product.

“We were frustrated that millennials only have two options for investing: buying and selling stocks themselves or investing in a market-weighted index,” says Gardner. “We’re building the third.”

Titan’s first product isn’t technically a hedge fund, but it’s built like one. It piggybacks off the big hedgies that have to report their holdings. Titan uses its software to determine which are the top 20 stocks across these funds based on turnover, concentration and more. All users download the Titan iOS or Android app, fund their account and are automatically invested into fractional shares of the same 20 stocks.

Titan earns a 1 percent annual fee on what you invest. There is a minimum $1,000 investment, so some younger adults may be below the bar. “We’re targeting a more premium millennial for start. A lot of our early users are in the tech field and are already investing,” says Gardner.

For downside protection, Titan collects information about its users to assess their risk tolerance and hedge their investment by shorting the market index 0 to 20 percent so they’ll earn some if everything crashes. Rather than Titan controlling the assets itself, an industry favorite custodian called Apex keeps them secure. The app uses 256-bit encryption and SSL for data transfers, and funds are insured up to $500,000.

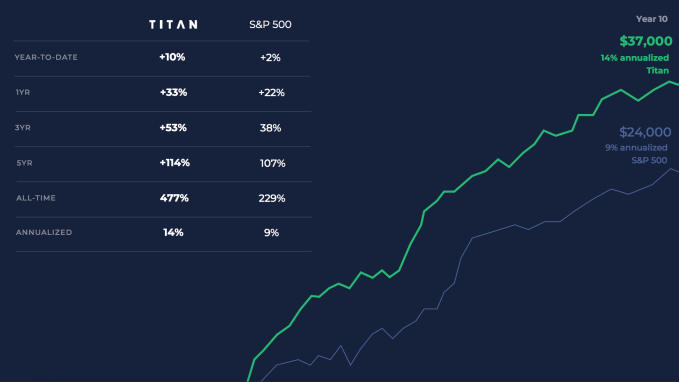

How have its bets and traction been doing? “We’ve been pleasantly surprised so far,” Gardner beams, noting Titan’s thousands of clients. It claims it’s up 10 percent year-to-date and up 33 percent in one year compared to the S&P 500’s 2 percent year-to-date and 22 percent in one year. Since users can pull out their funds in three to four business days, Titan is incentivized to properly manage the portfolio or clients will bail.

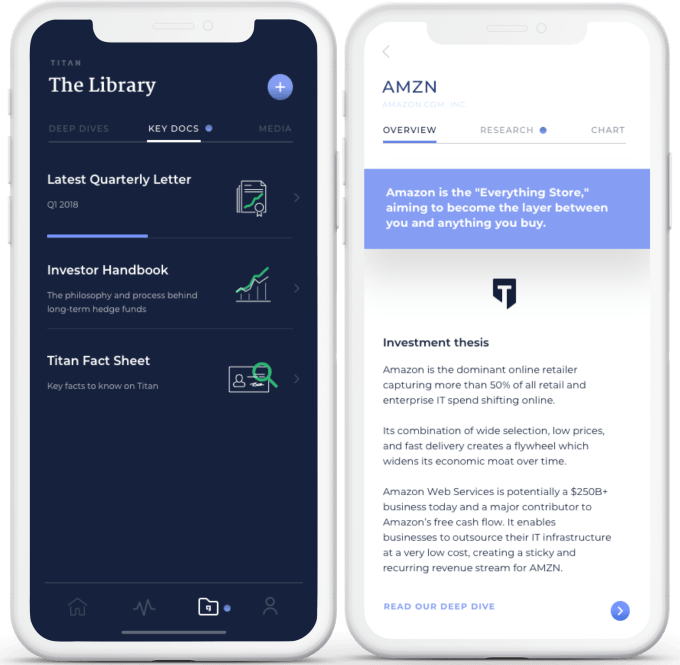

But beyond the demographic and business model, it’s the educational elements that set Titan apart. Users don’t have to hunt online for investment research. Titan compiles it into deep dives into top stocks like Amazon or Comcast, laying out investment theses for why you should want your money in “the everything store” or “a toll road for the Internet.” Through in-app videos, push notifications and reports, Titan tries to make its users smarter, not just richer.

With time and funding, “Eventually we hope to launch other financial products, including crypto, bonds, international equities, etc.,” Percoco tells me. That could put Titan on a collision course with Wealthfront, Coinbase and the recently crypto-equipped Robinhood, as well as direct competitors like asset managers BlackRock and JP Morgan.

“If we fast-forward 10 to 20 years in the future, millennials will have inherited $10 trillion, and at this rate they’re not equipped to handle that money,” says Gardner. “Financial management isn’t something taught in school.”

Worryingly, when I ask what they see as the top threats to Titan, the co-founders exhibited some Ivy League hubris, with Gardner telling me, “Nothing that jumps out…” Back in reality, building software that reliably prints money is no easy feat. A security failure or big drop could crater the app’s brand. And if its education materials are too frothy, they could instill blind confidence in younger investors without the cash to sustain sizable losses. Competitors like Robinhood could try to swoop in an offer managed portfolios.

Hopefully if finance democratization tools like Titan and Robinhood succeed in helping the next generations gather wealth, a new crop of families will be able to afford the pricey tuitions that reared these startups’ teams. While automation might subsume labor’s wages and roll that capital up to corporate oligarchs, software like Titan could boost financial inclusion. To the already savvy, 1 percent might seem like a steep fee, but it buys the convenience to make the stock market more accessible.

Powered by WPeMatico

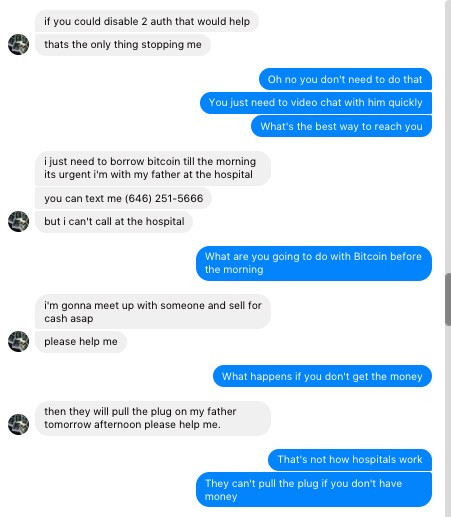

A year ago I felt a panic that still reverberates in me today. Hackers swapped my T-Mobile SIM card without my approval and methodically shut down access to most of my accounts and began reaching out to my Facebook friends asking to borrow crypto. Their social engineering tactics, to be clear, were laughable but they could have been catastrophic if my friends were less savvy.

Flash forward a year and the same thing happened to me again – my LTE coverage winked out at about 9pm and it appeared that my phone was disconnected from the network. Panicked, I rushed to my computer to try to salvage everything I could before more damage occurred. It was a false alarm but my pulse went up and I broke out in a cold sweat. I had dealt with this once before and didn’t want to deal with it again.

Sadly, I probably will. And you will, too. The SIM card swap hack is still alive and well and points to one and only one solution: keeping your crypto (and almost your entire life) offline.

Stories about massive SIM-based hacks are all over. Most recently a crypto PR rep and investor, Michael Terpin, lost $24 million to hackers who swapped his AT&T SIM. Terpin is suing the carrier for $224 million. This move, which could set a frightening precedent for carriers, accuses AT&T of “fraud and gross negligence.”

From Krebs:

Terpin alleges that on January 7, 2018, someone requested an unauthorized SIM swap on his AT&T account, causing his phone to go dead and sending all incoming texts and phone calls to a device the attackers controlled. Armed with that access, the intruders were able to reset credentials tied to his cryptocurrency accounts and siphon nearly $24 million worth of digital currencies.

While we can wonder in disbelief at a crypto investor who keeps his cash in an online wallet secured by text message, how many other services do we use that depend on emails or text messages, two vectors easily hackable by SIM spoofing attacks? How many of us would be resistant to the techniques that nabbed Terpin?

Another crypto owner, Namek Zu’bi, lost access to his Coinbase account after hackers swapped his SIM, logged into his account, and changed his email while attempting direct debits to his bank account.

“When the hackers took over my account they attempted direct debits into the account. But because I blocked my bank accounts before they could it seems there are bank chargebacks on that account. So Coinbase is essentially telling me sorry you can’t recover your account and we can’t help you but if you do want to use the account you owe $3K in bank chargebacks,” he said.

Now Zu’bi is facing a different issue: Coinbase is accusing him of being $3,000 in arrears and will not give him access to his account because he cannot reply from the hacker’s email.

“I tried to work with coinbase hotline who is supposed to help with this but they were clueless even after I told them that the hackerchanged email address on my original account and then created a new account with my email address. Since then I’ve been waiting for a ‘specialist’ to email me (was supposed to be 4 business days it’s been 8 days) and I’m still locked out of my account because Coinbase support can’t verify me,” he said.

It has been a frustrating ride.

“As an avid supporter and investor in crypto it baffles me how one of the market leaders who just supposedly launched institutional grade custody solutions can barely deal with a basic account take-over fraud,” Zu’bi said.

I’ve been using Trezor hardware wallets for a while, storing them in safe places outside of my home and maintaining a separate record of the seeds in another location. I have very little crypto but even for a fraction of a few BTC it just makes sense to practice safe storage. Ultimately, if you own crypto you are now your own bank. That you would trust anyone – including a fiat bank – to keep your digital currency safe is deeply delusional. Heck, I barely trust Trezor and they seem like the only solution for safe storage right now.

When I was first hacked I posted recommendations by crypto exchange Kraken. They are still applicable today:

Call your telco and:

Set a passcode/PIN on your account

- Make sure it applies to ALL account changes

- Make sure it applies to all numbers on the account

- Ask them what happens if you forget the passcode

- Ask them what happens if you lose that too

Institute a port freeze

Institute a SIM lock

Add a high-risk flag

Close your online web-based management account

Block future registration to online management system

Hack yo’ self

See what information they will leak

See what account changes you can make

They also recommend changing your telco email to something wildly inappropriate and using a burner phone or Google Voice number that is completely disconnected from your regular accounts as a sort of blind for your two factor texts and alerts.

Sadly, doing all of these things is quite difficult. Further, carriers don’t make it easy. In May a 27-year-old man named Paul Rosenzweig fell victim to a SIM-swapping hack even though he had SIM lock installed on his account. A rogue T-Mobile employee bypassed the security, resulting in the loss of a unique three character Twitter and Snapchat account.

Ultimately nothing is secure. The bottom line is simple: if you’re in crypto expect to be hacked and expect it to be painful and frustrating. What you do now – setting up real two-factory security, offloading your crypto onto physical hardware, making diligent backups, and protecting your keys – will make things far better for you in the long run. Ultimately, you don’t want to wake up one morning with your phone off and all of your crypto siphoned off into the pocket of a college kid like Joel Ortiz, a hacker who is now facing jail time for “13 counts of identity theft, 13 counts of hacking, and two counts of grand theft.” Sadly, none of the crypto he stole has surfaced after his arrest.

Powered by WPeMatico

Twitter tried to downplay the impact deactivating its legacy APIs would have on its community and the third-party Twitter clients preferred by many power users by saying that “less than 1%” of Twitter developers were using these old APIs. Twitter is correct in its characterization of the size of this developer base, but it’s overlooking millions of third-party app users in the process. According to data from Sensor Tower, six million App Store and Google Play users installed the top five third-party Twitter clients between January 2014 and July 2018.

Over the past year, these top third-party apps were downloaded 500,000 times.

This data is largely free of reinstalls, the firm also said.

The top third-party Twitter apps users installed over the past three-and-a-half years have included: Twitterrific, Echofon, TweetCaster, Tweetbot and Ubersocial.

Of course, some portion of those users may have since switched to Twitter’s native app for iOS or Android, or they may run both a third-party app and Twitter’s own app in parallel.

Even if only some of these six million users remain, they represent a small, vocal and — in some cases, prominent — user base. It’s one that is very upset right now, too. And for a company that just posted a loss of one million users during its last earnings, it seems odd that Twitter would not figure out a way to accommodate this crowd, or even bring them on board its new API platform to make money from them.

Twitter, apparently, was weighing data and facts, not user sentiment and public perception, when it made this decision. But some things have more value than numbers on a spreadsheet. They are part of a company’s history and culture. Of course, Twitter has every right to blow all that up and move on, but that doesn’t make it the right decision.

To be fair, Twitter is not lying when it says this is a small group. The third-party user base is tiny compared with Twitter’s native app user base. During the same time that six million people were downloading third-party apps, the official Twitter app was installed a whopping 560 million times across iOS and Android. That puts the third-party apps’ share of installs at about 1.1 percent of the total.

That user base may have been shrinking over the years, too. During the past year, while the top third-party apps were installed half a million times, Twitter’s app was installed 117 million times. This made third-party apps’ share only about 0.4 percent of downloads, giving the official app a 99 percent market share.

But third-party app developers and the apps’ users are power users. Zealots, even. Evangelists.

Twitter itself credited them with pioneering “product features we all know and love,” like the mute option, pull-to-refresh and more. That means the apps’ continued existence brings more value to Twitter’s service than numbers alone can show.

Image credit: iMore

They are part of Twitter’s history. You can even credit one of the apps for Twitter’s logo! Initially, Twitter only had a typeset version of its name. Then Twitterrific came along and introduced a bird for its logo. Twitter soon followed.

Twitterrific was also the first to use the word “tweet,” which is now standard Twitter lingo. (The company used “twitter-ing.” Can you imagine?)

These third-party apps also play a role in retaining users who struggle with the new user experience Twitter has adopted — its algorithmic timeline. Instead, the apps offer a chronological view of tweets, as some continue to prefer.

Twitter’s decision to cripple these developers’ apps is shameful.

It shows a lack of respect for Twitter’s history, its power user base, its culture of innovation and its very own nature as a platform, not a destination.

P.S.:

twitterrific

Powered by WPeMatico

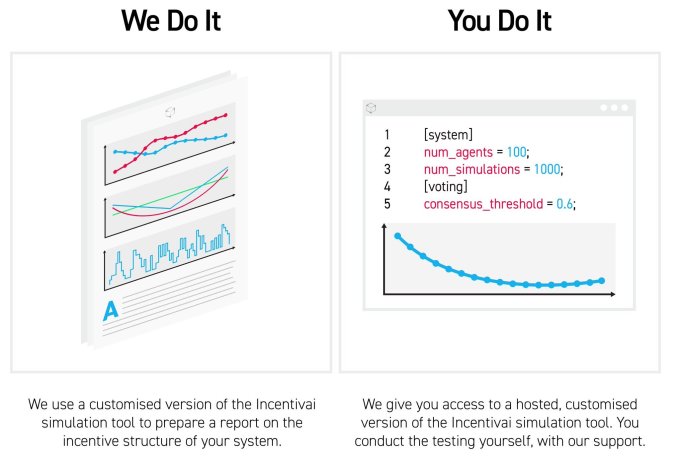

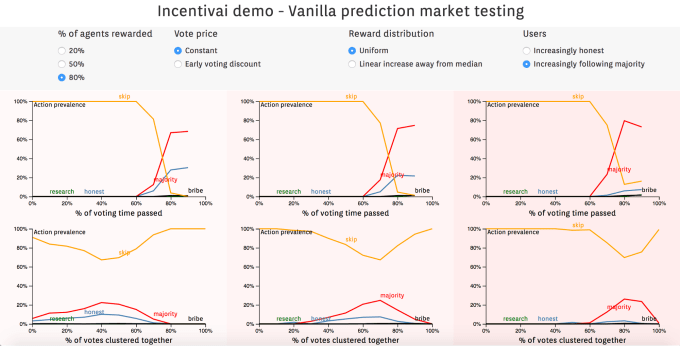

Cryptocurrency projects can crash and burn if developers don’t predict how humans will abuse their blockchains. Once a decentralized digital economy is released into the wild and the coins start to fly, it’s tough to implement fixes to the smart contracts that govern them. That’s why Incentivai is coming out of stealth today with its artificial intelligence simulations that test not just for security holes, but for how greedy or illogical humans can crater a blockchain community. Crypto developers can use Incentivai’s service to fix their systems before they go live.

“There are many ways to check the code of a smart contract, but there’s no way to make sure the economy you’ve created works as expected,” says Incentivai’s solo founder Piotr Grudzień. “I came up with the idea to build a simulation with machine learning agents that behave like humans so you can look into the future and see what your system is likely to behave like.”

Incentivai will graduate from Y Combinator next week and already has a few customers. They can either pay Incentivai to audit their project and produce a report, or they can host the AI simulation tool like a software-as-a-service. The first deployments of blockchains it’s checked will go out in a few months, and the startup has released some case studies to prove its worth.

“People do theoretical work or logic to prove that under certain conditions, this is the optimal strategy for the user. But users are not rational. There’s lots of unpredictable behavior that’s difficult to model,” Grudzień explains. Incentivai explores those illogical trading strategies so developers don’t have to tear out their hair trying to imagine them.

There’s no rewind button in the blockchain world. The immutable and irreversible qualities of this decentralized technology prevent inventors from meddling with it once in use, for better or worse. If developers don’t foresee how users could make false claims and bribe others to approve them, or take other actions to screw over the system, they might not be able to thwart the attack. But given the right open-ended incentives (hence the startup’s name), AI agents will try everything they can to earn the most money, exposing the conceptual flaws in the project’s architecture.

“The strategy is the same as what DeepMind does with AlphaGo, testing different strategies,” Grudzień explains. He developed his AI chops earning a masters at Cambridge before working on natural language processing research for Microsoft.

Here’s how Incentivai works. First a developer writes the smart contracts they want to test for a product like selling insurance on the blockchain. Incentivai tells its AI agents what to optimize for and lays out all the possible actions they could take. The agents can have different identities, like a hacker trying to grab as much money as they can, a faker filing false claims or a speculator that cares about maximizing coin price while ignoring its functionality.

Incentivai then tweaks these agents to make them more or less risk averse, or care more or less about whether they disrupt the blockchain system in its totality. The startup monitors the agents and pulls out insights about how to change the system.

For example, Incentivai might learn that uneven token distribution leads to pump and dump schemes, so the developer should more evenly divide tokens and give fewer to early users. Or it might find that an insurance product where users vote on what claims should be approved needs to increase its bond price that voters pay for verifying a false claim so that it’s not profitable for voters to take bribes from fraudsters.

Grudzień has done some predictions about his own startup too. He thinks that if the use of decentralized apps rises, there will be a lot of startups trying to copy his approach to security services. He says there are already some doing token engineering audits, incentive design and consultancy, but he hasn’t seen anyone else with a functional simulation product that’s produced case studies. “As the industry matures, I think we’ll see more and more complex economic systems that need this.”

Powered by WPeMatico

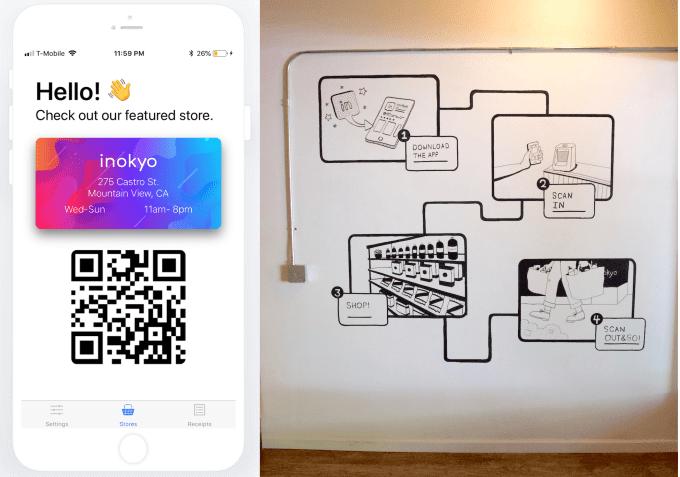

Inokyo wants to be the indie Amazon Go. It’s just launched its prototype cashierless autonomous retail store. Cameras track what you grab from shelves, and with a single QR scan of its app on your way in and out of the store, you’re charged for what you got.

Inokyo‘s first store is now open on Mountain View’s Castro Street selling an array of bougie kombuchas, snacks, protein powders and bath products. It’s sparse and a bit confusing, but offers a glimpse of what might be a commonplace shopping experience five years from now. You can get a glimpse yourself in our demo video below:

“Cashierless stores will have the same level of impact on retail as self-driving cars will have on transportation,” Inokyo co-founder Tony Francis tells me. “This is the future of retail. It’s inevitable that stores will become increasingly autonomous.”

Inokyo (rhymes with Tokyo) is now accepting signups for beta customers who want early access to its Mountain View store. The goal is to collect enough data to dictate the future product array and business model. Inokyo is deciding whether it wants to sell its technology as a service to other retail stores, run its own stores or work with brands to improve their product’s positioning based on in-store sensor data on custom behavior.

“We knew that building this technology in a lab somewhere wouldn’t yield a successful product,” says Francis. “Our hypothesis here is that whoever ships first, learns in the real world and iterates the fastest on this technology will be the ones to make these stores ubiquitous.” Inokyo might never rise into a retail giant ready to compete with Amazon and Whole Foods. But its tech could even the playing field, equipping smaller businesses with the tools to keep tech giants from having a monopoly on autonomous shopping experiences.

“Amazon isn’t as ahead as we assumed,” Francis remarks. He and his co-founder Rameez Remsudeen took a trip to Seattle to see the Amazon Go store that first traded cashiers for cameras in the U.S. Still, they realized, “This experience can be magical.” The two met at Carnegie Mellon through machine learning classes before they went on to apply that knowledge at Instagram and Uber. The two decided that if they jumped into autonomous retail soon enough, they could still have a say in shaping its direction.

N ext week, Inokyo will graduate from Y Combinator’s accelerator that provided its initial seed funding. In six weeks during the program, they found a retail space on Mountain View’s main drag, studied customer behaviors in traditional stores, built an initial product line and developed the technology to track what users are taking off the shelves.

ext week, Inokyo will graduate from Y Combinator’s accelerator that provided its initial seed funding. In six weeks during the program, they found a retail space on Mountain View’s main drag, studied customer behaviors in traditional stores, built an initial product line and developed the technology to track what users are taking off the shelves.

Here’s how the Inokyo store works. You download its app and connect a payment method, and you get a QR code that you wave in front of a little sensor as you stroll into the shop. Overhead cameras will scan your body shape and clothing without facial recognition in order to track you as you move around the store. Meanwhile, on-shelf cameras track when products are picked up or put back. Combined, knowing who’s where and what’s grabbed lets it assign the items to your cart. You scan again on your way out, and later you get a receipt detailing the charges.

Originally, Inokyo actually didn’t make you scan on the way out, but it got the feedback that customers were scared they were actually stealing. The scan-out is more about peace of mind than engineering necessity. There is a subversive pleasure to feeling like, “well, if Inokyo didn’t catch all the stuff I chose, that’s not my problem.” And if you’re overcharged, there’s an in-app support button for getting a refund.

Inokyo co-founders (from left): Tony Francis and Rameez Remsudeen

Inokyo was accurate in what it charged me despite me doing a few switcharoos with products I nabbed. But there were only about three people in the room at the time. The real test for these kinds of systems are when a rush of customers floods in and cameras have to differentiate between multiple similar-looking people. Inokyo will likely need to be more than 99 percent accurate to be more of a help than a headache. An autonomous store that constantly over- or undercharges would be more trouble than it’s worth, and patrons would just go to the nearest classic shop.

Just because autonomous retail stores will be cashier-less doesn’t mean they’ll have no staff. To maximize cost-cutting, they could just trust that people won’t loot it. However, Inokyo plans to have someone minding the shop to make sure people scan in the first place and to answer questions about the process. But there’s also an opportunity in reassigning labor from being cashiers to concierges that can recommend the best products or find what’s the right fit for the customer. These stores will be judged by the convenience of the holistic experience, not just the tech. At the very least, a single employee might be able to handle restocking, customer support and store maintenance once freed from cashier duties.

The Amazon Go autonomous retail store in Seattle is equipped with tons of overhead cameras

While Amazon Go uses cameras in a similar way to Inokyo, it also relies on weight sensors to track items. There are plenty of other companies chasing the cashierless dream. China’s BingoBox has nearly $100 million in funding and has more than 300 stores, though they use less sophisticated RFID tags. Fellow Y Combinator startup Standard Cognition has raised $5 million to equip old-school stores with autonomous camera-tech. AiFi does the same, but touts that its cameras can detect abnormal behavior that might signal someone is a shoplifter.

The store of the future seems like more and more of a sure thing. The race’s winner will be determined by who builds the most accurate tracking software, easy-to-install hardware and pleasant overall shopping flow. If this modular technology can cut costs and lines without alienating customers, we could see our local brick-and-mortars adapt quickly. The bigger question than if or even when this future arrives is what it will mean for the millions of workers who make their living running the checkout lane.

Powered by WPeMatico

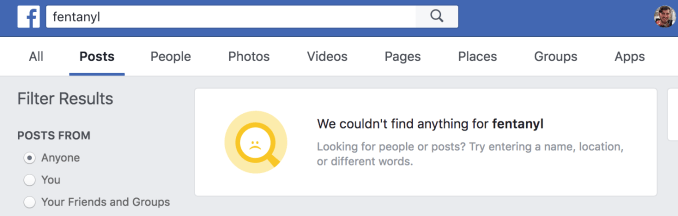

Facebook’s role in the opioid crisis could become another scandal following yesterday’s release of harrowing new statistics from the Center for Disease Control. It estimated there were nearly 30,000 synthetic opioid overdose deaths in the U.S. in 2017, up from roughly 20,000 the year before. When recreational drugs like Xanax and OxyContin are adulterated with the more powerful synthetic opioid Fentanyl, the misdosage can prove fatal. Xanax, OxyContin and other pain killers are often bought online, with dealers promoting themselves on social media including Facebook.

Hours after the new stats were reported by The New York Times and others, a source spotted that Facebook’s internal search engine stopped returning posts, Pages and Groups for searches of “OxyContin,” “Xanax,” “Fentanyl” and other opioids, as well as other drugs like “LSD.” Only videos, often news reports deploring opiate abuse, and user profiles whose names match the searches, are now returned. This makes it significantly harder for potential buyers or addicts to connect with dealers through Facebook.

However, some dealers have taken to putting drug titles into their Facebook profile names, allowing accounts like “Fentanyl Kingpin Kilo” to continue showing up in search results. It’s not exactly clear when the search changes occurred.

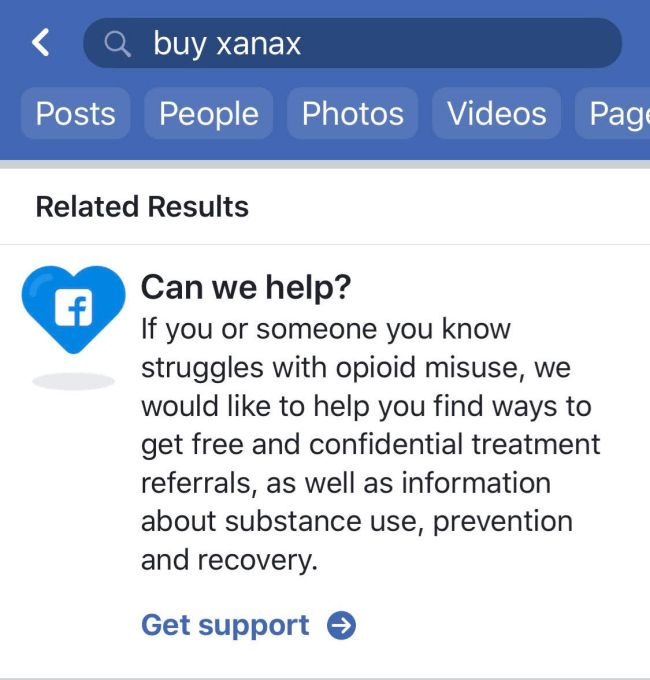

On some search result pages for queries like “buy xanax,” Facebook is now showing a “Can we help?” box that says “If you or someone you know struggles with opioid misuse, we would like to help you find ways to get free and confidential treatment referrals, as well as information about substance use, prevention and recovery.” A “Get support” button opens the site of The Substance Abuse and Mental Health Services Administration, a branch of the U.S. department of health and human services that provides addiction resources. Facebook had promised back in June that this feature was coming.

Facebook search results for many drug names now only surface people and video news reports, and no longer show posts, Pages or Groups, which often offered access to dealers

When asked, Facebook confirmed that it’s recently made it harder to find content that facilitates the sale of opioids on the social network. Facebook tells me it’s constantly updating its approach to thwart bad actors who look for new ways to bypass its safeguards. The company confirms it’s now removing content violating its drug policies, and it’s blocked hundreds of terms associated with drug sales from showing results other than links to news about drug abuse awareness. It’s also removed thousands of terms from being suggested as searches in its typeahead.

Prior to recent changes, buyers could easily search for drugs and find posts from dealers with phone numbers to contact

Regarding the “Can we help?” box, Facebook tells me this resource will be available on Instagram in the coming weeks, and it provided this statement:

We recently launched the “Get Help Feature” in our Facebook search function that directs people looking for help or attempting to purchase illegal substances to the SAMHSA national helpline. When people search for help with opioid misuse or attempt to buy opioids, they will be prompted with content at the top of the search results page that will ask them if they would like help finding free and confidential treatment referrals. This will then direct them to the SAMHSA National Helpline. We’ve partnered with the Substance Abuse & Mental Health Services Administration to identify these search terms and will continue to review and update to ensure we are showing this information at the most relevant times.

Facebook’s new drug abuse resource feature

The new actions follow Facebook shutting down some hashtags like “#Fentanyl” on Instagram back in April that could let buyers connect with dealers. That only came after activists like Glassbreakers’ Eileen Carey aggressively criticized the company, demanding change. In some cases, when users would report Facebook Groups’ or Pages’ posts as violating its policy prohibiting the sale of regulated goods like drugs, the posts would be removed, but Facebook would leave up the Pages. This mirrors some of the problems it’s had with Infowars around determining the threshold of posts inciting violence or harassing other users necessary to trigger a Page or profile suspension or deletion.

Facebook in some cases deleted posts selling drugs, but not the Pages or Groups carrying them

Before all these changes, users could find tons of vendors illegally selling opioids through posts, photos and Pages on Facebook and Instagram. Facebook also introduced a new ads policy last week requiring addiction treatment centers that want to market to potential patients be certified first to ensure they’re not actually dealers preying on addicts.

Much of the recent criticism facing Facebook has focused on it failing to prevent election interference, privacy scandals and the spread of fake news, plus how hours of browsing its feeds can impact well-being. But its negligence regarding illegal opioid sales has likely contributed to some of the 72,000 drug overdose deaths in America last year. It serves as another example of how Facebook’s fixation on the positive benefits of social networking blinded it to the harsh realities of how its service can be misused.

Last November, Facebook CEO Mark Zuckerberg said that learning of the depths of the opioid crisis was the “biggest surprise” from his listening tour visiting states across the U.S, and that it was “really saddening to see.”

Zuckerberg meets with Opioid crisis caregivers and the families of victims in Ohio in April 2017

Five months later, Representative David B. McKinley (R-W.VA) grilled Zuckerberg about Facebook’s responsibility surrounding the crisis. “Your platform is still being used to circumvent the law and allow people to buy highly addictive drugs without a prescription” McKinley said during Zuckerberg’s congressional hearings in April. “With all due respect, Facebook is actually enabling an illegal activity, and in so doing, you are hurting people. Would you agree with that statement?” The CEO admitted “there are a number of areas of content that we need to do a better job policing on our service.”

Yet the fact that he called the crisis a “surprise” but failed to take stronger action when some of the drugs causing the epidemic were changing hands via his website is something Facebook hasn’t fully atoned for, nor done enough to stop. The new changes should be the start of a long road to recovery for Facebook itself.

Powered by WPeMatico

It’s hard to be a fan of Twitter right now. The company is sticking up for conspiracy theorist Alex Jones, when nearly all other platforms have given him the boot, it’s overrun with bots, and now it’s breaking users’ favorite third-party Twitter clients like Tweetbot and Twitterific by shutting off APIs these apps relied on. Worse still, is that Twitter isn’t taking full responsibility for its decisions.

In a company email it shared today, Twitter cited “technical and business constraints” that it can no longer ignore as being the reason behind the APIs’ shutdown.

It said the clients relied on “legacy technology” that was still in a “beta state” after more than 9 years, and had to be killed “out of operational necessity.”

This reads like passing the buck. Big time.

It’s not as if there’s some other mysterious force that maintains Twitter’s API platform, and now poor ol’ Twitter is forced to shut down old technology because there’s simply no other recourse. No.

Twitter, in fact, is the one responsible for its User Streams and Site Streams APIs – the APIs that serve the core functions of these now deprecated third-party Twitter clients. Twitter is the reason these APIs have been stuck in a beta state for nearly a decade. Twitter is the one that decided not to invest in supporting those legacy APIs, or shift them over to its new API platform.

And Twitter is the one that decided to give up on some of its oldest and most avid fans – the power users and the developer community that met their needs – in hopes of shifting everyone over to its own first-party clients instead.

The problem isn’t that the API is old and buggy (which it was), the problem is that the replacement API is unavailable.

— Paul Haddad (@tapbot_paul) August 16, 2018

The company even dismissed how important these users and developers have been to its community over the years, by citing the fact that the APIs it’s terminating – the ones that power Tweetbot, Twitterrific, Tweetings and Talon – are only used by “less than 1%” of Twitter developers. Burn!

Way to kick a guy when he’s already down, Twitter.

But just because a community is small in numbers, does not mean its voice is not powerful or its influence is not felt.

Hence, the #BreakingMyTwitter hashtag, which Twitter claims to be watching “quite often.”

The one where users are reminding Twitter CEO Jack Dorsey about that time he apologized to Twitter developers for not listening to them, and acknowledged the fact they made Twitter what it is today. The time when he promised to do better.

This is…not better:

When I built our push notification server, I added the ability to send a message to every device in case of emergency. Today is the first time I’ve used it. pic.twitter.com/edgkver2Nh

— Craig Hockenberry (@chockenberry) August 15, 2018

The company’s email also says it hopes to eventually learn “why people hire 3rd party clients over our own apps.”

Its own apps?

Oh, you mean like TweetDeck, the app Twitter acquired then shut down on Android, iPhone and Windows? The one it generally acted like it forgot it owned? Or maybe you mean Twitter for Mac (previously Tweetie, before its acquisition), the app it shut down this year, telling Mac users to just use the web instead? Or maybe you mean the nearly full slate of TV apps that Twitter decided no longer needed to exist?

And Twitter wonders why users don’t want to use its own clients?

Perhaps, users want a consistent experience – one that doesn’t involve a million inconsequential product changes like turning stars to hearts or changing the character counter to a circle. Maybe they appreciate the fact that the third parties seem to understand what Twitter is better than Twitter itself does: Twitter has always been about a real-time stream of information. It’s not meant to be another Facebook-style algorithmic News Feed. The third-party clients respect that. Twitter does not.

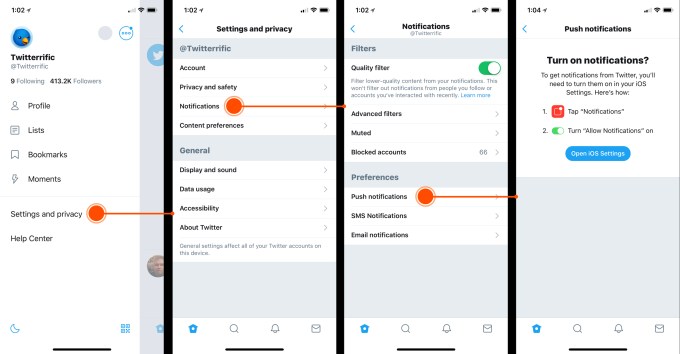

Yesterday, the makers of Twitterific spoke to the API changes, noting that its app would no longer be able to stream tweets, send native push notifications, or be able to update its Today view, and that new tweets and DMs will be delayed.

It recommended users download Twitter’s official mobile app for notifications going forward.

In other words, while Twitterific will hang around in its broken state, its customers will now have to run two Twitter apps on their device – the official one to get their notifications, and the other because they prefer the experience.

A guide to using Twitter’s app for notifications, from Iconfactory

“We understand why Twitter feels the need to update its API endpoints,” explains Iconfactory co-founder Ged Maheux, whose company makes Twitterrific. “The spread of bots, spam and trolls by bad actors that exploit their systems is bad for the entire Twitterverse, we just wish they had offered an affordable way forward for the developers of smaller, third party apps like ours.”

“Apps like the Iconfactory’s Twitterrific helped build Twitter’s brand, feature sets and even its terminology into what it is today. Our contributions were small to be sure, but real nonetheless. To be priced out of the future of Twitter after all of our history together is a tough pill to swallow for all of us,” he added.

The question many users are now facing is what to do next?

Continue to use now broken third-party apps? Move to an open platform like Mastodon? Switch to Twitter’s own clients, as it wants, where it plans to “experiment with showing alternative viewpoints” to pop people’s echo chambers…on a service that refuses to kick out people like Alex Jones?

Or maybe it’s time to admit the open forum for everything that Twitter – and social media, really – has promised is failing? Maybe it’s time to close the apps – third-party and otherwise. Maybe it’s time to go dark. Get off the feeds. Take a break. Move on.

The full email from Twitter is below:

Hi team,

Today, we’re publishing a blog post about our priorities for where we’re investing today in Twitter client experiences. I wanted to share some more with you about how we reached these decisions, and how we’re thinking about 3rd party clients specifically.

First, some history:

3rd party clients have had a notable impact on the Twitter service and the products we build. Independent developers built the first Twitter client for Mac and the first native app for iPhone. These clients pioneered product features we all know and love about Twitter, like mute, the pull-to-refresh gesture, and more.

We love that developers build experiences on our APIs to push our service, technology, and the public conversation forward. We deeply respect the time, energy, and passion they’ve put into building amazing things using Twitter.

But we haven’t always done a good job of being straightforward with developers about the decisions we make regarding 3rd party clients. In 2011, we told developers (in an email) not to build apps that mimic the core Twitter experience. In 2012, we announced changes to our developer policies intended to make these limitations clearer by capping the number of users allowed for a 3rd party client. And, in the years following those announcements, we’ve told developers repeatedly that our roadmap for our APIs does not prioritize client use cases — even as we’ve continued to maintain a couple specific APIs used heavily by these clients and quietly granted user cap exceptions to the clients that needed them.

It is now time to make the hard decision to end support for these legacy APIs — acknowledging that some aspects of these apps would be degraded as a result. Today, we are facing technical and business constraints we can’t ignore. The User Streams and Site Streams APIs that serve core functions of many of these clients have been in a “beta” state for more than 9 years, and are built on a technology stack we no longer support. We’re not changing our rules, or setting out to “kill” 3rd party clients; but we are killing, out of operational necessity, some of the legacy APIs that power some features of those clients. And it has not been a realistic option for us today to invest in building a totally new service to replace these APIs, which are used by less than 1% of Twitter developers.

We’ve heard the feedback from our customers about the pain this causes. We check out #BreakingMyTwitter quite often and have spoken with many of the developers of major 3rd party clients to understand their needs and concerns. We’re committed to understanding why people hire 3rd party clients over our own apps. And we’re going to try to do better with communicating these changes honestly and clearly to developers. We have a lot of work to do. This change is a hard, but important step, towards doing it. Thank you for working with us to get there.

Thanks,

Rob

Powered by WPeMatico

Coinbase wants to be Facebook Connect for crypto. The blockchain giant plans to develop “Login with Coinbase” or a similar identity platform for decentralized app developers to make it much easier for users to sign up and connect their crypto wallets. To fuel that platform, today Coinbase announced it has acquired Distributed Systems, a startup founded in 2015 that was building an identity standard for dApps called the Clear Protocol.

The five-person Distributed Systems team and its technology will join Coinbase. Three of the team members will work with Coinbase’s Toshi decentralized mobile browser team, while CEO Nikhil Srinivasan and his co-founder Alex Kern are forming the new decentralized identity team that will work on the Login with Coinbase product. They’ll be building it atop the “know your customer” anti-money laundering data Coinbase has on its 20 million customers. Srinivasan tells me the goal is to figure out “How can we allow that really rich identity data to enable a new class of applications?”

Distributed Systems had raised a $1.7 million seed round last year led by Floodgate and was considering raising a $4 million to $8 million round this summer. But Srinivasan says, “No one really understood what we’re building,” and it wanted a partner with KYC data. It began talking to Coinbase Ventures about an investment, but after they saw Distributed Systems’ progress and vision, “they quickly tried to move to find a way to acquire us.”

Distributed Systems began to hold acquisition talks with multiple major players in the blockchain space, and the CEO tells me it was deciding between going to “Facebook, or Robinhood, or Binance, or Coinbase,” having been in formal talks with at least one of the first three. Of Coinbase the CEO said, they “were able to convince us they were making big bets, weaving identity across their products.” The financial terms of the deal weren’t disclosed.

Coinbase’s plan to roll out the Login with Coinbase-style platform is an SDK that others apps could integrate, though that won’t necessarily be the feature’s name. That mimics the way Facebook colonized the web with its SDK and login buttons that splashed its brand in front of tons of new and existing users. This turned Facebook into a fundamental identity utility beyond its social network.

Developers eager to improve conversions on their signup flow could turn to Coinbase instead of requiring users to set up whole new accounts and deal with crypto-specific headaches of complicated keys and procedures for connecting their wallet to make payments. One prominent dApp developer told me yesterday that forcing users to set up the MetaMask browser extension for identity was the part of their signup flow where they’re losing the most people.

This morning Coinbase CEO Brian Armstrong confirmed these plans to work on an identity SDK. When Coinbase investor Garry Tan of Initialized Capital wrote that “The main issue preventing dApp adoption is lack of native SDK so you can just download a mobile app and a clean fiat to crypto in one clean UX. Still have to download a browser plugin and transfer Eth to Metamask for now Too much friction,” Armstrong replied “On it :)”

On it 🙂

— Brian Armstrong (@brian_armstrong) August 15, 2018

In effect, Coinbase and Distributed Systems could build a safer version of identity than we get offline. As soon as you give your Social Security number to someone or it gets stolen, it can be used anywhere without your consent, and that leads to identity theft. Coinbase wants to build a vision of identity where you can connect to decentralized apps while retaining control. “Decentralized identity will let you prove that you own an identity, or that you have a relationship with the Social Security Administration, without making a copy of that identity,” writes Coinbase’s PM for identity B. Byrne, who’ll oversee Srinivasan’s new decentralized identity team. “If you stretch your imagination a little further, you can imagine this applying to your photos, social media posts, and maybe one day your passport too.”

Considering Distributed Systems and Coinbase are following the Facebook playbook, they may soon have competition from the social network. It’s spun up its own blockchain team and an identity and single sign-on platform for dApps is one of the products I think Facebook is most likely to build. But given Coinbase’s strong reputation in the blockchain industry and its massive head start in terms of registered crypto users, today’s acquisition well position it to be how we connect our offline identity with the rising decentralized economy.

Powered by WPeMatico

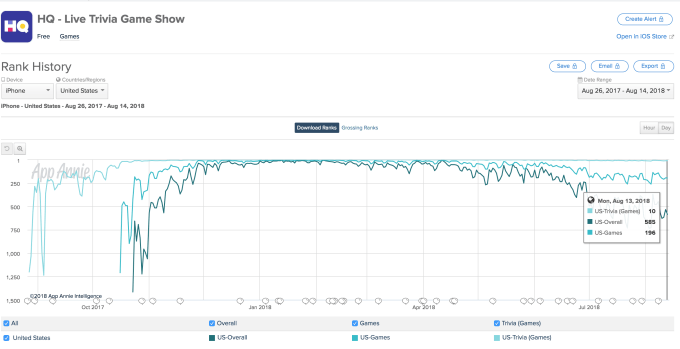

HQ Trivia’s app store ranking has continued to sink the past three months, but it’s hoping a new version on your television could revitalize growth. HQ today launched an Apple TV app that lets users play the twice-daily live quiz game alongside iOS Android players. “Everything about the game is still the same – same questions, same time, same rules,” says a spokesperson, except you’ll play with the Apple TV remote instead of your phone’s screen. But that might not be enough to get HQ’s player count rapidly growing again.

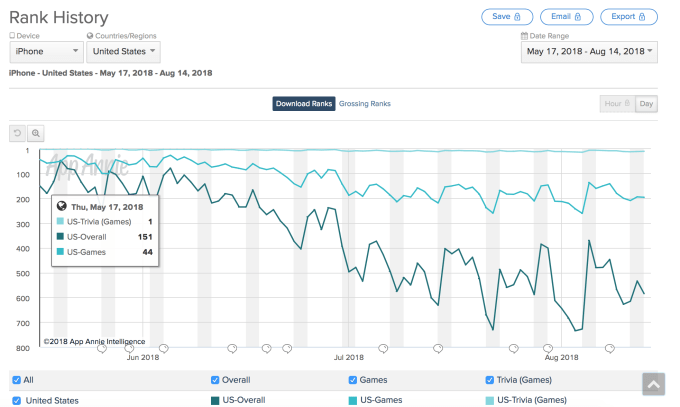

According to App Annie’s app store ranking history, on iOS HQ has fallen from the No. 1 U.S. trivia game to No. 10, from the No. 44 game to No. 196, and from the No. 151 overall app to No. 585. It’s exhibited a similar decline on Android. Analytics firm Sensor Tower estimates HQ has seen 12.5 million lifetime installs by unique users, with about 68 percent on iOS. “Installs have been on the decline. For last month, we estimate them with about 560K, which is down from their height of more than two million per month back in February,” Sensor Tower’s head of mobile insights Randy Nelson tells TechCrunch.

The question is whether this is just a summer lull as people spend time outside and students aren’t locked in the schedule of school, or if HQ is in a downward spiral beyond seasonal fluctuations. But if we zoom out, you can see that HQ has been dropping down the charts through the school year since peaking in January. At one point it climbed as high as the No. 3 game and No. 6 overall app. The app’s record high of concurrent players has also declined from a peak of 2.38 million in late March.

[Update: The CEO of HQ Trivia parent company Intermedia Labs and the former co-founder of Vine, Rus Yusupov, weighed in on the decline in downloads and HQ’s plans. He says, “Games are a hits business and don’t grow exponentially forever,” signalling the drop-off was expected and the team is still optimistic. But he also notes that HQ is “developing new game formats, one of which we think is really special and complements Trivia nicely”, indicating that HQ will branch out beyond its 12-question everyone vs everyone approach.]

Games are a hits business and don’t grow exponentially forever. HQ has massive early traction and still millions playing daily. Also developing new game formats, one of which we think is really special and complements Trivia nicely. More soon! Until then thanks for playing

https://t.co/wnAcztBuJU

— Rus (@rus) August 14, 2018

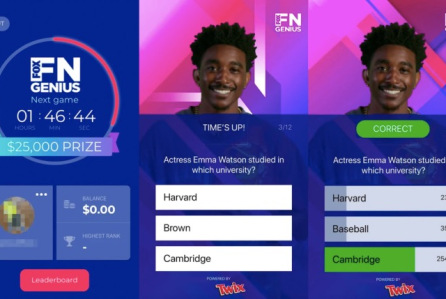

Meanwhile, new clones keep popping up. After the initial wave of Chinese live trivia apps, now U.S. television studios are getting into the mix. This week Fox unveiled FN Genius, which looks and works almost exactly the same as HQ. One of HQ’s long-time rivals, Trivia Crack, where users play asynchronously over the course of days, also declined earlier this year, but has bucked HQ’s trend and started rising on the App Store charts again. There are also new 1-on-1 trivia games like ProveIt that let players bet real money on whether they can outsmart their opponent.

Fox’s FN Genius. Image via Deadline

With themed games, celebrity hosts, big jackpots like a recent $400,000 prize and new features like the ability to see friends’ answers, HQ has tried to keep its app novel. But it’s also encountered cheaters and people playing with multiple phones that make normal players feel like they’ll never win. While the live aspect adds urgency, it also can feel interruptive with time as users aren’t always available for its noon and 6pm Pacific games. HQ may need to launch a second game app, come up with some new viral hooks or find ways to revive lapsed players if it’s going to make good on the $15 million its parent company raised in March.

Powered by WPeMatico