Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Walmart is giving augmented reality a shot. The retailer today announced the launch of a new AR scanning tool in its iPhone application which will help customers with product comparisons. However, unlike a typical barcode scanner meant only to compare prices on one item at a time, Walmart’s AR scanner can be panned about across store shelves, offering details on pricing and customer ratings beneath the products it sees.

The technology was first developed by a team at an internal Walmart hackathon using Apple’s ARKit technology. At the time, their idea was to create a scanning experience that worked faster and felt faster when used by customers. They also wanted to build a scanner that offered more than just price comparisons.

“Walmart store shoppers love using our mobile app barcode scanner as a price checker. Our team sees the potential of this product as so much more, though,” explains Tim Sears, senior engineering manager at Walmart Labs, in a post announcing the feature’s launch. “When a customer launches the scanner, they get a direct connection between the digital and the physical world that their screen and camera lens creates for them,” he says.

The team won the hackathon, then went on to further redesign the experience to become the one that’s live today in Walmart’s application.

To use the scanner, you launch the feature in the Walmart app, then point it at the products on the shelf you want to compare. As you move the phone between one item and the other, the product tile at the bottom of the screen will update with information, including the product name, price and star rating across however many reviews it has received on Walmart.com. A link to related products is also available.

The AR scanner was designed to anchor dots to what you’ve scanned, but uses smaller dots instead of anchoring the entire content to the product itself to overcome the problems that could occur when multiple items are scanned together in a close space.

Despite the supposed advantages of AR scanning over a simpler barcode scan, it still remains to be seen to what extent consumers will adopt the feature now that it’s live.

Walmart isn’t the only retailer to give AR a go. Others have used it in various ways, including Amazon, Target, Wayfair and many more. But in several cases, AR’s adoption by retailers have been focused on visualizing products in your home, or — in the case of Target’s AR “studio” — makeup on your face.

Walmart’s AR scanner goes after a more practical use.

The AR Scanner is in the latest version of the Walmart iOS app (18.20 and higher), and works on iPhones that run at least iOS 11.3. This latter requirement is due to its use of ARKit 1.5, but will limit the audience largely to those with newer iPhones.

Powered by WPeMatico

Foursquare, the former location-based social network turned enterprise location data platform, has today announced a new partnership with TripAdvisor.

TripAdvisor will be using Foursquare’s Pilgrim SDK, launched in March 2017, to help the platform better serve users with contextually relevant, real-time information based on their location.

Alongside the 13 billion check-ins accumulated on Foursquare’s apps since inception, the company also has analytics based on a consumer panel of more than 70 million people in the U.S. — 10 million of whom have opted into always-on location sharing. This data is the same data that powers Foursquare’s own apps, like, for example, when you get a push notification with a menu tip as you sit down for dinner at a restaurant.

Pilgrim SDK and Foursquare’s other enterprise products give other apps the ability to communicate with users with contextual relevance, and that’s what TripAdvisor is looking to do through this partnership.

TripAdvisor recently launched a new app and website that focuses on social sharing and personalized recommendations. Foursquare’s Pilgrim SDK complements TripAdvisor technology, ensuring that hyper-personalized recommendations are truly accurate.

TripAdvisor reaches more than half a billion users worldwide, which significantly increases the pool of user data Foursquare can potentially access.

This comes on the heels of Foursquare’s Series F financing round, which was announced last month.

Powered by WPeMatico

Twitter is digging one of its most important new features out of its settings and putting it within easy reach. Twitter is now testing with a small number of iOS users a homescreen button that lets you instantly switch from its algorithmic timeline that shows the best tweets first but out of order to the old reverse chronological feed that only shows people you follow — no tweets liked by friends or other randomness.

Sometimes you want to see the latest Tweets, first. We’re testing a way for you to make it easier to switch your timeline between the latest and top Tweets. Starting today, a small number of you will see this test on iOS. pic.twitter.com/7NHLDUjrIv

— Twitter (@Twitter) October 31, 2018

Twitter had previously buried this option in its settings. In mid-September, it fixed the setting so it would only show a raw reverse chronological feed of tweets by people you follow with nothing extra added, and promised a more easily accessible design for the feature in the future. Now we have our first look at it. A little Twitter sparkle icon in the top opens a menu where you can switch between Top Tweets and Latest Tweets, plus a link to your content settings. It would be even better if it was a one-tap toggle.

Twitter’s VP of Product Kayvon Beykpour tweeted that “We want to make it easier to toggle between seeing the latest tweets the top tweets. So we’re experimenting with making this a top-level switch rather than buried in the settings. Feedback welcome.. what do you think?”

Given the backlash back in 2016 when Twitter started shifting to an algorithmically sorted timeline based on what you engaged with, many users will probably think this is great. Whether you’re trying to follow a sports game, a political debate, breaking news, or are just glued to Twitter and want the ordering to make more sense, there are plenty of reasons you might want to switch to reverse chronological.

Still, Twitter’s apprehension to make the setting too accessible makes sense. Hardcore users might prefer reverse chronological, but for most people who only open Twitter a few times per day or week, that’d mean they’d likely miss the tweets from their closest friends that could be drown out by the noise of everyone else. Twitter’s user growth rate perked up after the shift to algorithmic.

We’ve asked whether the setting reverts to the Top Tweets default when you close the app. That might be frustrating to some expert users, but could prevent novice users from accidentally getting stuck in reverse chronological and not knowing how to switch back. The company tells TechCrunch that it’s trying out several different duration options for the setting based on user inactivity to see what works best. For example, one version will revert the setting to the Top Tweets default if they’re gone for a day. That method would make sure people who’ve been inactive long enough to forget changing their timeline setting will get the default back and not end up stuck in a chronological abyss.

If Twitter gets the reversion to default situation figured out, the new button could make the service much more flexible, thereby boosting usage. You could start algorithmic in the morning or after a weekend away to see what you missed, then quickly toggle to reverse chronological if something big happens or you’ll be on it non-stop all day to get the real-time pulse of the world.

Powered by WPeMatico

Bitcoin turned 10 years old, a milestone for a technology that few have used and even fewer understand. Ultimately, the blockchain it wrought could be the biggest change to banking, finance and politics ever — or it could be a dud. The jury is still out, but let’s take a walk down memory lane and see just how the product grew from White Paper to world beater.

Powered by WPeMatico

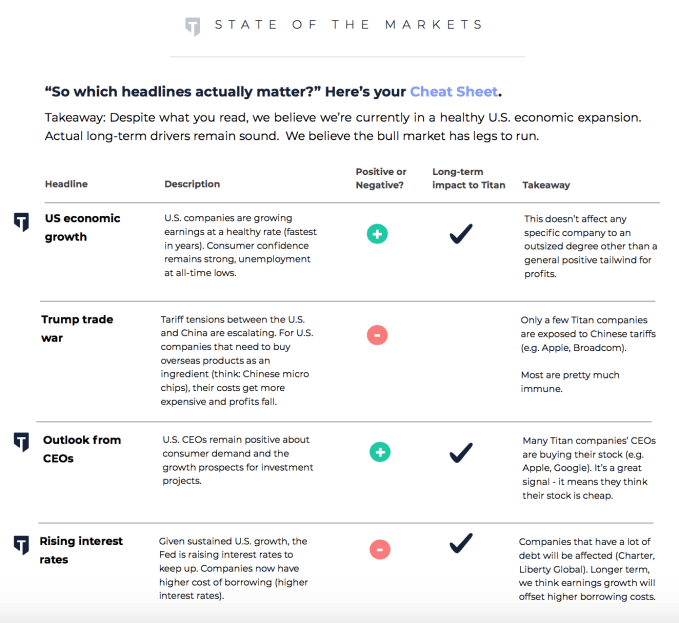

Titan could put an end to stock market FOMO. The app chooses the best 20 stocks by scraping top hedge fund data, adds some shorts based on your personal risk profile and puts your money to work. No worrying about market fluctuations or constantly rebalancing your portfolio. You don’t have to do anything, but can get smarter about stocks thanks to its in-app explanations and research reports. Titan wants to be the easiest way to invest in stocks for a mobile generation that wants an affordable coach to guide them through the market themselves.

“Our goal is to take things that aren’t accessible [in wealth management] and make them accessible, starting with hedge funds,” says Titan co-founder Joe Percoco. That potential to democratize one of the keys to financial mobility has won Titan a $2.5 million seed round from Y Combinator’s co-founder Paul Graham, president Sam Altman and partners including Gmail creator Paul Bucheit. The rest of the capital comes from Maverick Ventures, BoxGroup and Liquid2 Ventures.

“Titan is where investing meets virality,” says Graham. “Those are two very powerful forces.” Since TechCrunch broke the news of Titan’s launch in August, it’s doubled its assets under management to $20 million and hired its first non-founder engineer.

Now it’s launching in-app educational videos so stock market dummies can get up to speed if they want to understand where their money’s going amidst a swirling see of financial news. “There are so many different headlines telling so many different narratives,” Percoco tells me. “Everyone is searching for explanations in a voice they trust. An ‘ETF’ can’t talk back. Sometimes a human face is better than writing. A video can really help people make choices.” Here’s its two-minute video about Facebook’s Q2 earnings a few months ago, explaining why the share price crashed 25 percent:

Percoco and Clayton Gardner met on their first day of Wharton business school, while their third co-founder was earning a hedge fund patent and studying computer science at Stanford. They went on to work at hedge funds and private equity firms like Goldman Sachs, but got fed up just growing the fortunes of the already rich.

So they started Titan to invent a modern, mobile version of BlackRock, the investment giant founded in the 1980s. Titan uses the public disclosures of hedge funds to find consensus around the 20 best performing stocks. With as little as $1,000, users can let Titan robo-manage their investments for a 1 percent fee on assets. Users provide some info on how big they want to gamble, and Titan personalizes their portfolio with more or less conservative shorts to hedge their bets.

Titan’s simplicity combined with the sense of participation could help it grow quickly. It sits between do-it-yourself options like Robinhood or E*Trade, where you’re basically left to fend for yourself, and totally passive options like Wealthfront and Betterment, where you’re so divorced from your portfolio that you’re not learning. Managed hedge funds and fellow active investment vehicles like BlackRock with a human advisor can require a $100,000 minimum investment that’s too steep for millennials.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

Essentially, Titan is a stock trading auto-pilot merged with a flight simulator so you improve your finance skills without having to fear a crash. Percoco tells me the sense of accomplishment that engenders is why clients say they’re telling friends about Titan. “When I invest, I look for companies that are growing quickly and making a huge positive impact on the world. Titan is one of those companies,” investor Altman says. “I think they could improve the financial well-being of an entire generation.”

Powered by WPeMatico

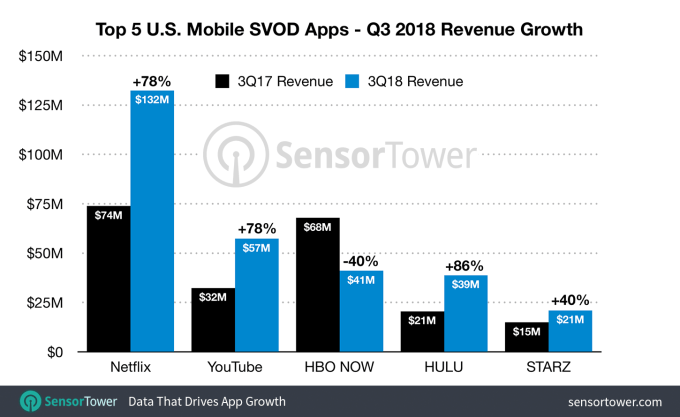

Last year, the top subscription video apps like Netflix and Hulu raked in a combined $781 million, and that trend is showing no sign of slowing down in 2018. In the third quarter of 2018, U.S. consumers spent an estimated $329 million in the top 10 subscription video-on-demand apps across the App Store and Google Play — a figure that’s up 15 percent from the $285 million spent in Q1.

The data is the latest in a new report from app intelligence firm Sensor Tower, which has been following the growth of subscription video apps for some time. Last year, for example, it found that Netflix’s app topped the charts in terms of revenue, when compared with all the other non-game apps on the market.

Netflix hasn’t fallen from its top-ranked position, the new data shows. In fact, it’s continuing to grow.

The app pulled in an estimated $132 million in consumer spending across the app stores in Q3, which is up 78 percent from the $74 million spent in the third quarter of 2017.

However, Hulu is now growing faster, the report found. It saw subscription revenue jump 86 percent to $39 million, up from $21 million a year ago.

It seems some consumers may have made the move to Hulu thanks to the extra cash they had on hand, thanks to dropping their HBO subscription.

The only subscription video app that saw revenue decline in Q3 was HBO NOW, which took in $41 million in the quarter, down 40 percent from the $68 million in Q3 2017. But notably absent this quarter was the network’s biggest draw, “Game of Thrones,” which had been airing at this time last year. A drop was expected.

The top-grossing chart of these subscription video apps for Q3 2018 looks very similar to last year’s in terms of the apps included, and sometimes, even their rankings.

But two services made moves, the report says.

YouTube TV jumped from $3 million in the year-ago quarter to $16 million in Q3 on Apple’s App Store, thanks to its expanded market penetration and consumer adoption. And ESPN Live Sports, which added in-app subscriptions in Q2, grossed $4.6 million in the third quarter, up 119 percent from Q2.

Even CBS is doing well, despite the fact that not everyone loves the new “Star Trek.”

Still, it appears CBS made a good move by betting on fans’ devotion to the franchise, as U.S. consumers spent $6 million in the app in Q3 2018, up 50 percent from the $4 million spent in Q3 2017.

The report’s data includes subscription revenues only, not refunds or in-app advertising revenues, Sensor Tower notes.

The broad increases in consumer spending on these video apps is yet another example of the significant and growing subscription business — much of which is taking place on mobile. Subscriptions accounted for $10.6 billion in consumer spend on the App Store in 2017, and are poised to grow to $75.7 billion by 2022, an earlier report found.

However, the top subscription apps aren’t all video apps. Others that consistently rank highly in the U.S. include Tinder, Spotify and Pandora, for example. Currently, the top-grossing chart for the App Store includes a number of non-games, like Netflix (No. 1), YouTube (No. 2), Tinder (No. 3), Pandora (No. 4), Hulu (No. 7), and Bumble (No. 8).

Powered by WPeMatico

Messaging app firm Line has given up majority control of its Line Games business after it raised outside financing to expand its collection of titles and go after global opportunities.

The Line Games business was formed earlier this year when Line merged its existing gaming division from NextFloor, the Korea-based game publisher that it acquired in 2017. Now the business has taken on capital from Anchor Equity Partners, which has provided 125 billion KRW ($110 million) in financing via its Lungo Entertainment entity, according to a disclosure from Line.

A Line spokesperson clarified that the deal will see Anchor acquire 144,743 newly created shares to take a 27.55 percent stake in Line Games. That increase means Line Corp’s own shareholding is diluted from 57.6 percent to a minority 41.73 percent stake.

Korea-based Anchor is best known for a number of deals in its homeland, including investments in e-commerce giant Ticket Monster, Korean chat giant Kakao’s Podotree content business and fashion retail group E-Land.

Line operates its eponymous chat app, which is the most popular messaging platform in Japan, Thailand and Taiwan, and also significantly used in Indonesia, but gaming is a major source of income. This year to date, Line has made 28.5 billion JPY ($250 million) from its content division, which is primarily virtual goods and in-app purchases from its social games. That division accounts for 19 percent of Line’s total revenue, and it is a figure that is only better by its advertising unit, which has grossed 79.3 billion JPY, or $700 million, in 2018 to date.

The games business is currently focused on Japan, Korea, Thailand and Taiwan, but it said that the new capital will go toward finding new IP for future titles and identifying games with global potential. It is also open to more strategic deals to broaden its focus.

While Line has always been big on games, Line Games isn’t just building for its own service. The company said earlier this year that it plans to focus on non-mobile platforms, which will include the Nintendo Switch among others consoles.

That comes from the addition of NextFloor, which is best known for titles like Dragon Flight and Destiny Child. Dragon Flight has racked up 14 million users since its 2012 launch; at its peak it saw $1 million in daily revenue. Destiny Child, a newer release in 2016, topped the charts in Korea and has been popular in Japan, North America and beyond.

Line went public in 2016 via a dual U.S.-Japan IPO that raised more than $1 billion.

Note: The original version of this article was updated to clarify that Lungo Entertainment is buying newly issued shares.

Powered by WPeMatico

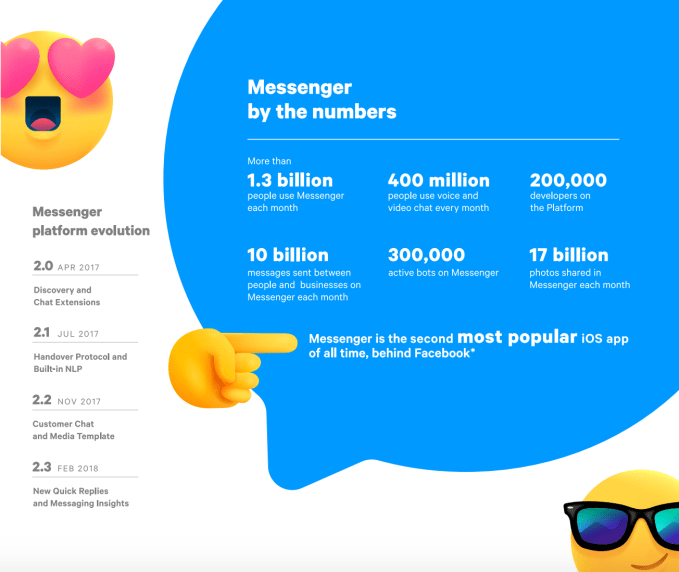

The News Feed won’t sustain Facebook forever, and that’s scaring investors. Today on Facebook’s earnings call, Mark Zuckerberg stressed that sharing is shifting to private chat, where people send 100 billion messages per day on Facebook’s family of apps, and Stories, where he says people share 1 billion of these slideshows per day (though it’s unclear if that includes third-party apps like Snapchat).

But that means Facebook will have to realign its business towards these mediums where monetization is more complex and it has less experience. The result of Zuckerberg’s comments was a reversal of Facebook’s initial 2 percent share price gain after earnings were announced that dragged it down to a 3.5 percent loss. That was only reversed when Zuckerberg said Facebook would reduce limits on video advertising, pushing shares up 3 percent in after-hours trading.

Facebook’s year-over-year revenue growth has already slowed from 59 percent in Q3 2016, to 49 percent a year ago, to 33 percent now as Zuckerberg admits it’s hitting saturation in developed markets, plus it’s running out of News Feed space. Now it will both have to deal with the sharing medium shift, and that the new users it’s adding in the Asia-Pacific and Rest Of World regions earn it 10X less than users in North America.

In messaging, Zuckerberg says “People share more photos, videos, and links on WhatsApp and Messenger than they do on social networks.” He sees Facebook’s position as strong, saying “We’re leading in most countries”, though that’s mostly in the developing world Android market where people choose their own default messaging app. “Our biggest competitor by far is iMessage. In important countries like the US where the iPhone is strong, Apple bundles iMesssage as the default texting app, and it’s still ahead” Zuckerberg notes.

The “bundled” language harkens back to to antitrust lawsuits against Microsoft for bundling computers with Internet Explorer. With Apple CEO Tim Cook constantly harping on the poor privacy practices of ad-supported companies like Facebook, Zuckerberg might be gunning to draw regulator attention to iMessage.

Facebook is starting to more aggressively monetize Messenger through inbox ads, and its now selling enterprise tools to brands on both Facebook and WhatsApp that let them pay to ping users. But Facebook risks its chat apps seeming annoying or intrusive if it packs in too many ads or allows too much Message spam. Users could stray to status quos like iMessage and Android Messages if it puts monetization above the user experience.

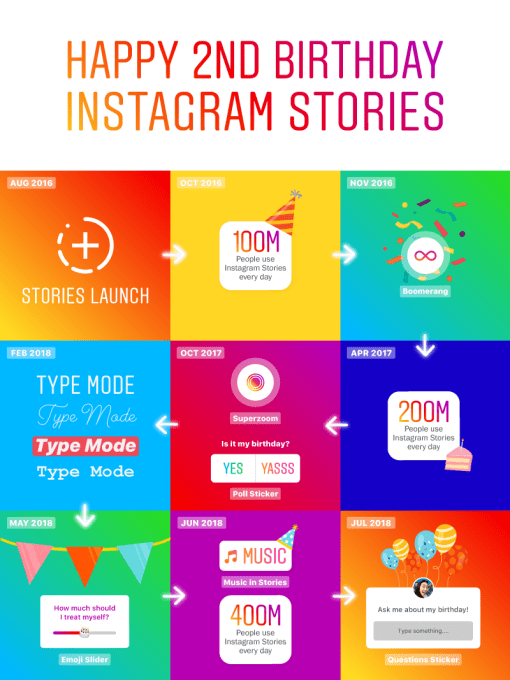

On Stories, Zuckerberg says Facebook is doing even better. Over 1 billion people use its Stories features across Facebook, Messenger, Instagram, and WhatsApp each day, compared to 186 million daily users on Stories inventor Snapchat as a whole. Stories are where the majority of Facebook sharing growth is happening, and Facebook Stories are gaining momentum after a slow and buggy start. That’s why Zuckerberg never mentioned Snapchat, and instead talk about YouTube as its primary competitor in video.

The problem is that creating attractive video ads, especially vertical full-screen ones for Stories, is beyond the capability of the long-tail on small businesses that have fueled Facebook’s News Feed ad revenue. Users often rapidly skip through Stories ads, and Facebook currently doesn’t offer unskippable ones like Snapchat. Many people don’t think to tap or swipe up to visit a link from a Story, or simply don’t want to lose their place in ways that didn’t happen on desktop or even mobile feed ads.

Beyond Stories, Facebook salvaged its after-hours share price by discussing how it plans to show more video, and therefore more of its lucrative video ads. Back in January, Facebook admitted its Q4 user count had declined and revenue might stumble in part because it had decided to show people fewer viral videos that they watch passively. This came as part of its drive for Time Well Spent. But now, Zuckerberg says that Facebook has cracked the code for how to make passive video consumption a positive experience, so Facebook will lift some limits:

“People really want to watch a lot of video. To a large degree we’ve had to rate limit its growth, and we need to do the things so we can stop limiting it. The things that have caused us to limit it are on the one hand, when we see passive consumption of video displacing social interactions . . . We needed to figure out a way that video can grow but people can also keep on interacting and doing what they tell us that they uniquely want from Facebook. And now I think we’re starting to work through what the formula is going to be so we can take some of those rate limits off and let video grow at the rate that it wants to. I feel that that’s a very exciting opportunity ahead.”

Across Facebook’s other products, Zuckerberg noted that 800 million people now use Marketplace, its Jobs feature have helped people find 1 million jobs, and its birthday fundraisers have raised $300 million alone this year. But it will be teaching advertisers how to effectively create sponsored messages and Stories ads that will define whether Facebook’s revenue keeps growing.

Powered by WPeMatico

Last summer, Google introduced its own take on Bitmoji with the launch of “Mini” stickers in its keyboard app, Gboard, which leverage machine learning to create illustrated stickers based on your selfie. Today, Google is expanding the Mini Stickers with the launch of what it calls “Emoji Minis” – meaning, emoji-sized stickers that look like you.

Similar to the initial launch of Mini stickers, the new emoji are also created using machine learning techniques, Google says.

The company said the idea is to give people a way to use emoji they feel better represent who they really are.

“Emoji Minis are designed for those who may have stared into the eyes of emoji and not seen yourself staring back,” explained Google, in a blog post. “These sticker versions of the emoji you use every day are customizable so you can make them look just like you.”

That means your emoji can have differently colored hair – like green or blue or gray, for example – or piercings. It can be wearing a hat, head covering, or glasses.

Google says it uses neural networks to suggest skin tones, hairstyles, and accessories that you can then fine tune. You can choose a color for your hair, facial hair, or select different types of head covering and eyewear. You can also add freckles or wrinkles, if you want.

The result is a not just a single emoji, but a selection of options. For example, you can use your custom emoji as a zombie, mage, heart eyes, crying eyes, shruggie, and all the others.

This the third style of Mini stickers, first introduced last year. Already, these stickers come in two other styles – a more expressive “bold” and a nicer “sweet.”

While it may seem like a minor thing, creative emoji – and specifically, personalized emoji – can be a big draw for messaging apps. Apple advertises its clever Animoji and personalized Memoji as flagship features of its newer Face ID-powered phones. Snapchat bought Bitmoji (Bitstrips) to give its users access to more tools for creative expression. Samsung lets you make your own AR emoji that look like you. And people celebrated when the Unicode Consortium diversified to include more skin tones, and added, at long last, redheads.

Gboard, whose app has been downloaded over a billion times on Google Play, has a similar draw, thanks to its selfie-based stickers.

The company says the new Emoji Minis are available in all Gboard languages and countries, on both iOS and Android, starting today.

Powered by WPeMatico

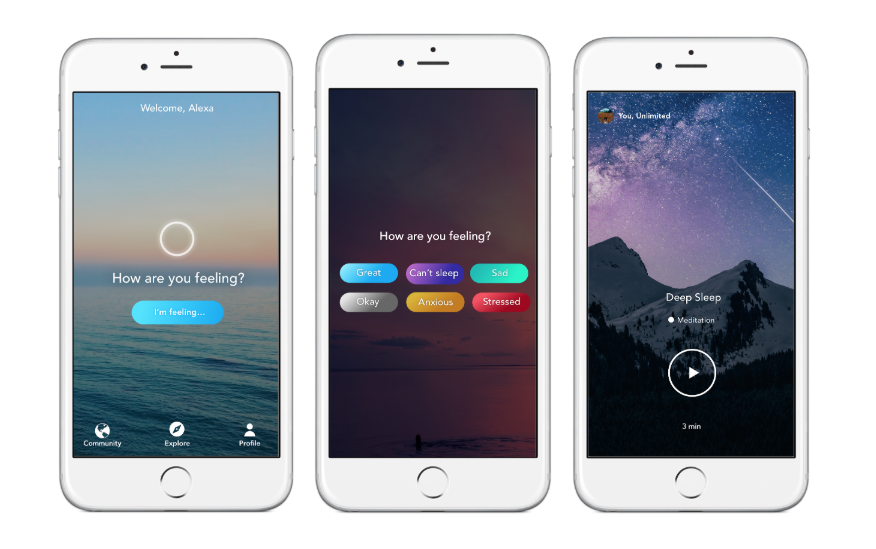

Aura, an app for emotional well-being, has raised a $2.7 million seed round co-led by Cowboy Ventures and Reach Capital, with participation from others.

When Aura first launched a couple of years ago, its bread and butter was short, three-to-seven-minute meditations based on your current mood — be that stressed, anxious, happy or sad. Since then, co-founders Steve and Daniel Lee say the company has grown to a few million users.

“We’ve since grown to become everyone’s emotional wellness assistant,” Steve told me. “We ask how people are feeling right now and then offer content to help them feel better.”

Aura works with therapists, coaches and meditation teachers to offer a variety of content to help people get the type of help they’re looking for. In addition to meditation, Aura offers life coaching, music and inspirational stories.

Premium users, who pay $60 per year, have unlimited access to content, while free users are limited to three minutes of wellness content once every two hours. Aura is not currently sharing how many paid customers it has.

“At Reach, we often ask how we can empower people to achieve at their fullest potential,” Reach Capital Partner Wayee Chu said in a statement. “We are thrilled to be supporting two founders who are not only deeply driven by their own personal narrative in living with a family member with a mental illness, but who have committed themselves in building a world-class technology and tool to empower others in building a regular mental health and wellness practice.”

With the funding in tow, Aura has plans to expand its base of content creators and grow its team — which currently consists just of the Lee brothers. Down the road, Aura envisions integrating the app with wearable devices and their respective sensors to detect mood automatically. That way, Aura would be able to serve up what you need before you know you need it. The company also plans to become more than just a content platform by building additional tools on top of the core service.

Powered by WPeMatico