Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Apple is kicking off the Entrepreneur Camp in Cupertino. Eleven female-founded app development companies have been invited to Cupertino for multiple workshops and meetings with Apple employees, and Apple used that opportunity to share a new number when it comes to App Store revenue.

Since the creation of the App Store, Apple has given back $120 billion in revenue to App Store developers. It means that the App Store has generated more revenue than that in total. But if you remove Apple’s cut, $120 billion have been wired to developers.

App Store revenue is still growing rapidly, as more than $30 billion of developer revenue has been generated in the last 12 months alone. Apple reported $100 billion in developer revenue at WWDC back in June 2018.

Apple only counts direct App Store revenue, such as paid downloads, in-app purchases and subscriptions. Developers also could have generated more revenue through ads and subscriptions on a website, for instance.

If you’re curious about the Entrepreneur Camp, Apple has invited the developers of Bites, Camille, CUCO: Lembrete de Medicamentos, Deepr, D’efekt, Hopscotch, LactApp, Pureple, Statues of the La Paz Malecón, WeParent and Seneca Connect. There will be a new session every quarter.

Powered by WPeMatico

Apple is slowly building a lineup of content subscriptions. According to a report from Cheddar, Apple may also be working on a gaming subscription. Alex Heath managed to get five people to talk about the rumored service.

If Apple goes ahead and launches such a service, users could pay a monthly subscription fee to access a library of games. It’s still unclear how much it would cost and what would be included in the subscription.

Given that many iOS games are now free-to-play games, it’s hard to see how it would work. Apple could choose to focus on paid games and provide those games as part of the subscription. The company could also give you free coins and perks when it comes to free-to-play games.

Apple has to talk with potential partners to put together the service — that’s probably how Cheddar learned about Apple’s plans. The company isn’t going to develop a bunch of games overnight (remember Apple’s Texas Hold ‘Em?). But it could act as a sort of game publisher by promoting and distributing new games in a subscription tier.

Games are by far the most popular category on the App Store. They generate a ton of downloads and revenue. And it sounds like Apple thinks it could generate more revenue by switching to a different business model, beyond the usual 30 percent cut on in-app purchases.

Apple has also been signing deals with TV producers in order to put together a streaming service. The company wants to compete with Netflix and other streaming platforms.

Apple has been working on a magazine subscription service, as well. The company acquired Texture back in March 2018 to build the foundation of the service. And that new subscription should launch pretty soon. You can find a landing page for Apple News Magazines in the beta version of iOS 12.2.

And, of course, Apple has attracted 56 million subscribers for Apple Music. Now let’s see if the company can replicate the same success with other services.

Powered by WPeMatico

Apple is sending out a message to app developers: stop tricking users into subscriptions. The company updated its guidelines for mobile developers to more clearly spell out what is and what is not allowed, according to 9to5Mac, which spotted the recent changes. The improved documentation comes at a time when subscriptions are becoming something of a plague on consumers.

Their rapid proliferation is turning everything into a subscription service, which could ultimately see consumers dropping favorite apps because they can’t afford dozens of ongoing payments. But more urgently, Apple’s lax enforcement of its rules around subscriptions had allowed shady app developers to financially benefit.

Subscriptions are a big business on the app stores, as the industry has begun to shift to a recurring revenue model instead of one-time purchases within free apps or paid downloads. For developers who continue to improve apps and roll out new features, subscriptions give them the financial means of continuing that work, instead of constantly hunting for new users.

However, not all developers have been playing fair.

As TechCrunch reported last fall, a number of scammers had begun to take advantage of the subscription model in order to trick consumers into recurring payments, in addition to constantly pestering their free users to upgrade.

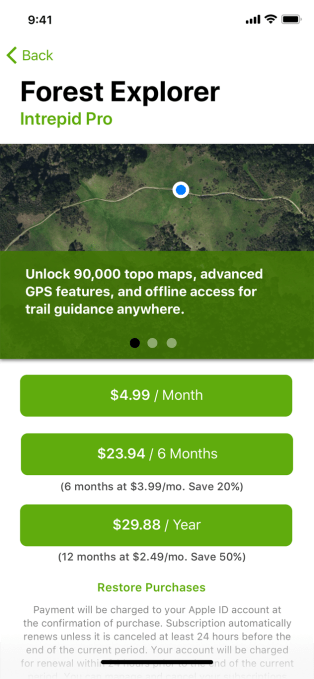

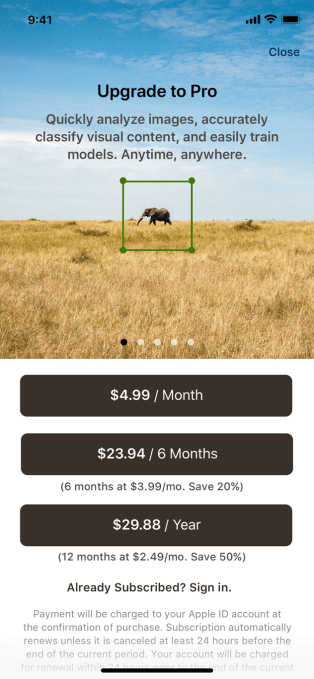

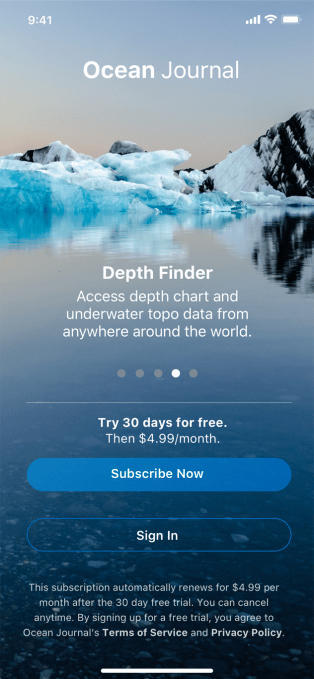

We found apps that constantly popped up upgrade prompts or hid the “x” to close the prompt’s window, as well as apps that promised free trials that actually converted after a very short period — like three days, for example. Others had intentionally confusing designs where subscription opt-in buttons would say things like “Start” or “Continue” in big text, while the text that explains you’re actually agreeing to a paid subscription is tiny, grayed out, difficult to read or hidden in some other way.

Apple’s developer guidelines had clearly prohibited fraudulent behavior related to subscriptions, but Apple has now spelled out the details in black and white.

As 9to5Mac spotted, updates in Apple’s Human Interface Guidelines and App Store documentation now explicitly state that the monthly subscription price has to be clearly displayed, while information about how much people can save if they opt for longer periods of time, like a year, has to be less prominent.

Messages about free trials have to say how long trials last and what will be charged when the trial ends.

The new documentation has also been clearly organized, and includes screenshots of what a proper subscription sign-up flow should look like, as well as sample text developers can modify for use in their own apps. It even suggests that developers allow customers to manage their subscriptions within their app, rather than requiring them to find the subscriptions section in the App Store.

Today, many customers don’t know how to stop their subscriptions once activated — it takes several steps from the iPhone’s Settings to get into subscriptions, and still a few from within the App Store. (It’s also not that obvious. You tap on your profile icon on the top right of the Home page, then your Apple ID, then scroll down to the bottom of the page. By comparison, you can reveal the “Subscriptions” section with just one tap on Google Play’s left-side hamburger menu.)

While the existence of clear documentation that better spells out the dos and don’ts is certainly welcome, the real question now is how well will Apple enforce its rules?

After all, Apple was supposedly not okay with subscription fraud and tricks before, yet its App Store was home to a good handful of bad actors — particularly in the utilities section.

Of course, Apple doesn’t want to develop a reputation for allowing misleading or scammy apps to thrive in its App Store, but it simultaneously benefits when they do.

Although games still account for the majority of App Store spending, non-gaming apps across app stores now account for just over a quarter (26 percent) of total spend, according to App Annie’s “State of Mobile 2019” report. And that number has increased 18 percent since 2016, mainly because of in-app subscriptions.

Getting a handle on the proper way to market subscriptions is key. But there’s also the larger question as to whether subscriptions will be a sustainable model in the long run for the developers. There’s a bit too much of a gold rush mentality around subscriptions in today’s App Store, and it’s hard to resist the near-term benefit of money that rolls in monthly.

But as more developers adopt subscriptions, consumers will ultimately have to decide which have value for them. People are already paying for so many subscriptions — both inside and outside the app stores. Streaming video like Netflix, streaming music like Spotify, streaming TV like YouTube TV, subscription boxes like Ipsy, Prime memberships, grocery delivery like Instacart, smart home subscriptions like Ring or Nest, newspapers and magazines and newsletters, and so on. What’s really going to be left for a selfie editor, to-do list or weather app, in the end?

Many consumers are already starting to hit the point where they don’t have much more to spend, and will have to turn some subscriptions off in order to turn others on. Subscription app user bases could then contract, with only core customers remaining paying subscribers, as casual users return to free products — like Apple’s own built-in apps, for example, or free services offered by well-heeled tech giants, like Google.

Apple would do well to advise developers when subscriptions make sense for an app, not just how to implement and design them. Subscriptions should offer a real benefit, not just continued ability to use an app. And there could be cases where a one-time purchase to retain a customer who continually declines to subscribe makes sense, too.

Powered by WPeMatico

Tinder recently agreed to settle a $23 million class-action age discrimination lawsuit. The lawsuit, filed last April in California, alleged Tinder charged people over 30 years old twice the amount for its subscription services.

The class consists of every person 29 years of age or older at the time who subscribed to Tinder Plus or Tinder Gold between March 2, 2015 and the date of preliminary approval, according to the proposed order granting motion for preliminary approval of the class-action settlement.

“Under the Settlement, Defendants agree to a multifaceted Settlement structure, which includes a universal participation component (automatic benefits to all Class Members);” the settlement states. “An additional cash or cash-equivalent payout to Class Members who submit timely valid claims; and an agreement to substantially halt Defendants’ allegedly discriminatory practices going forward.”

Filed on behalf of about 230,000 class members, each person will be able to receive either $25 in cash, 25 additional Super Likes or a one-month subscription to either Tinder Plus or Tinder Gold. As part of the settlement, Tinder must distribute $11.5 million to all class members, as well as $5.75 million in potential cash or cash-equivalents (e.g. Super Likes) to every class member who submits a claim.

Tinder has also agreed to stop charging people — just those located in California — different prices based on their age. That carries a value of at least $5.75 million, according to the settlement. In total, this amounts to a $23 million settlement.

I’ve reached out to Tinder and will update this story if I hear back. In the meantime, feel free to check out the settlement below.

Powered by WPeMatico

MaaS Global, the company behind the all-in-one mobility app Whim, which offers a subscription service for public transportation, ridesharing, bike rentals, scooter rentals, taxis or car rentals, will be making its U.S. debut later this year.

The company will choose its American launch city from Austin, Boston, Chicago, Dallas and Miami, according to Sampo Hietanen, the company’s chief executive.

The Whim app is currently available in Antwerp, Birmingham, U.K., Helsinki and Vienna, according to Hietanen, and offers a range of subscription options. The top of the line version is a €500 per month all-inclusive package giving users unlimited access to ride hailing, bike and car rentals and public transportation.

“Cars take 70 percent of the market and it’s used 4 percent of the time so you’re paying for the optional capacity,” says Hietanen. Using Whim, which, at the high end costs about as much as a car in Europe, users can get all of the optionality without paying for the unused capacity. It should ideally reduce transportation costs and cut down on emissions, if Hietanen’s claims are accurate.

The Helsinki-based company uses APIs to connect with the back end of a number of service providers. For car rentals, it’s working with businesses like Hertz, Enterprise and EuropeCar; for ridesharing, the company has linked with Gett and local European taxi companies, according to Hietanen.

Users have already booked 3 million trips through the company’s app since its launch and the company is continuing to expand not just in North America, but in Asia as well. There are plans in the works for the company to launch operations in Singapore.

Giving consumers more options for transit through a single gateway could reduce demand for vehicles, but some analysts argue that it won’t do much to alleviate congestion on roads. Consumers, they argue, will choose the convenience of rideshare over mass transit and could actually increase.

As Richard Rowson, a mobility consultant from the U.K., noted in this post:

MaaS doesn’t implicitly mean a net decrease nor increase in the number of road vehicle miles. The changes are complex, but in balance look likely to result in an increase.

Factors such as migration from private car to public transport should cause a reduction, but migration from train and bus, to private hire and smaller demand responsive buses will cause an increase. Other factors such as ‘positioning’ movements as ‘on demand’ vehicles are positioned to exploit demand also create journeys.

Smart journey planning and navigation systems should make better use of available road capacity, such as identifying alternative routes – but at the expense of migrating through traffic to local access roads.

There is the potential that having a single point of access to mobility may actually help cities push riders to favor public transportation by offering a window into the amount of time using each service would take and showing users the fastest route.

Last August the company said it had raised a €9 million round from undisclosed investors. It had previously received capital from Toyota Financial Services and its insurance partner Aioi Nissay Dowa Insurance.

Powered by WPeMatico

What if instead of just accepting Uber rides, gig workers could pick from higher-paying skilled tasks around town like stocking shelves, checking inventory or driving a forklift at a local grocer? When they work quickly and accurately or learn new trades, they get to choose between more complex jobs. That’s the idea that’s racked up $400 million in staffing contracts for Jyve, an on-demand labor platform that’s coming out of stealth today after 3.5 years. It already has 6,000 workers doing tasks for 4,000 stores across the country.

“I believe the skill economy is way bigger than the gig economy,” says Jyve CEO and founder Brad Oberwager. He sees Uber driving as just the low-expertise beginning of a massive new job type where people with specializations or experience are efficiently matched to retail work. Jyve’s secret sauce is the work quality review system built into its app for managers and stores that lets it know who got the job done right and deserves even better opportunities.

Jyve’s potential to become the skilled labor marketplace has quietly attracted $35 million in funding across a seed and Series A round raised over the past few years, led by SignalFire and joined by Crosscut Ventures and Ridge Ventures. “Jyve is one of the fastest-growing companies we’ve seen, having already reached $400 million in bookings in three short years,” writes Chris Farmer, CEO of SignalFire. “They are creating a new economic class.”

It’s all because Safeway hasn’t touched a bag of Doritos in 50 years, Oberwager tells me. Grocery stores have long outsourced the shelving and arrangement of products to the big brands that make them, which is why the retail consumer packaged good industry employs 10 million people in the U.S., or more than 10 percent of the country’s workforce. But instead of relying on one person to drive goods to the store, load them in and shelve them, Jyve can cut costs and divide those tasks and match them to nearby people with sufficient skills.

“Retail isn’t dying, it’s changing, and brands that are thriving are the ones investing in their in-store experience as well as owning their e-commerce initiatives,” observed Oberwager. “The question we must ask then is how do we fill this labor shortage and also enable people to refine special skills that are multi-dimensional and rewarding.”

Oberwager knows the tribulations of grocery shelving well. He built online drugstore More.com before the dot-com boom, then started making his own food products. He created True Fruit Cups, one of the country’s largest importer of grapefruit, and founded and sold his Bare apple chips company. Competing for shelf space with big brands paying workers to set up elaborate displays in grocery stores, he saw a chance to reimagine retail labor.

But it was when his daughter got sick and he realized the surgeon who performed the operation was essentially a high-skilled mercenary that he seized on the opportunity beyond grocers. “He walks in, does the surgery, walks out. He’s a gig worker, but it’s a skill I’m willing to pay a lot for,” says Oberwager.

He created Jyve to aggregate the demand from different stores and the skills from different workers. When someone signs up for Jyve, they start with easier tasks like moving boxes in the backroom. If they do that well, they could unlock higher-paying shelf stocking and display arrangement, then product ordering and brand ambassadorship. At each step, they take photos and leave comments about their work that are reviewed by a combination of store and brand managers, as well as Jyve’s machine vision algorithms and human quality-control team. It can quickly tell if someone puts the Cheerios box on the shelf the wrong way, and won’t give them public-facing tasks if they don’t improve

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

But to fulfill that prophecy, Jyve will have to out-tech old-school staffing firms like Acosta, Advantage and Crossmark. It’s also hoping to ween grocers off of Instacart by bringing shopping for online orders back to stores’ in-house staff — provided by Jyve. A worker could be stocking shelves, then use that knowledge to quickly pick up all the items for an online order and give them to a curbside driver, then return to their task.

Keeping work quality up to snuff will be a challenge, but by dangling higher wages, Jyve aligns its incentives with its workers. The bigger hurdle may be convincing big brands and retail institutions to change the way they’ve done staffing forever. Oberwager professes that it takes a long time to onboard, but also a long time to offboard, so it could build a solid moat if it’s the first to win this market. Jyve is now in more than 1,200 cities across the U.S.., and a real-time map showed a plethora of gigs available around San Francisco during the demo.

Oberwager admits the unskilled gig economy is “a little dehumanizing. It makes people a cog in a machine.” But he hopes each “Jyver,” as he calls them, can become more like a circuit — a complex machine of its own that powers something bigger.

Powered by WPeMatico

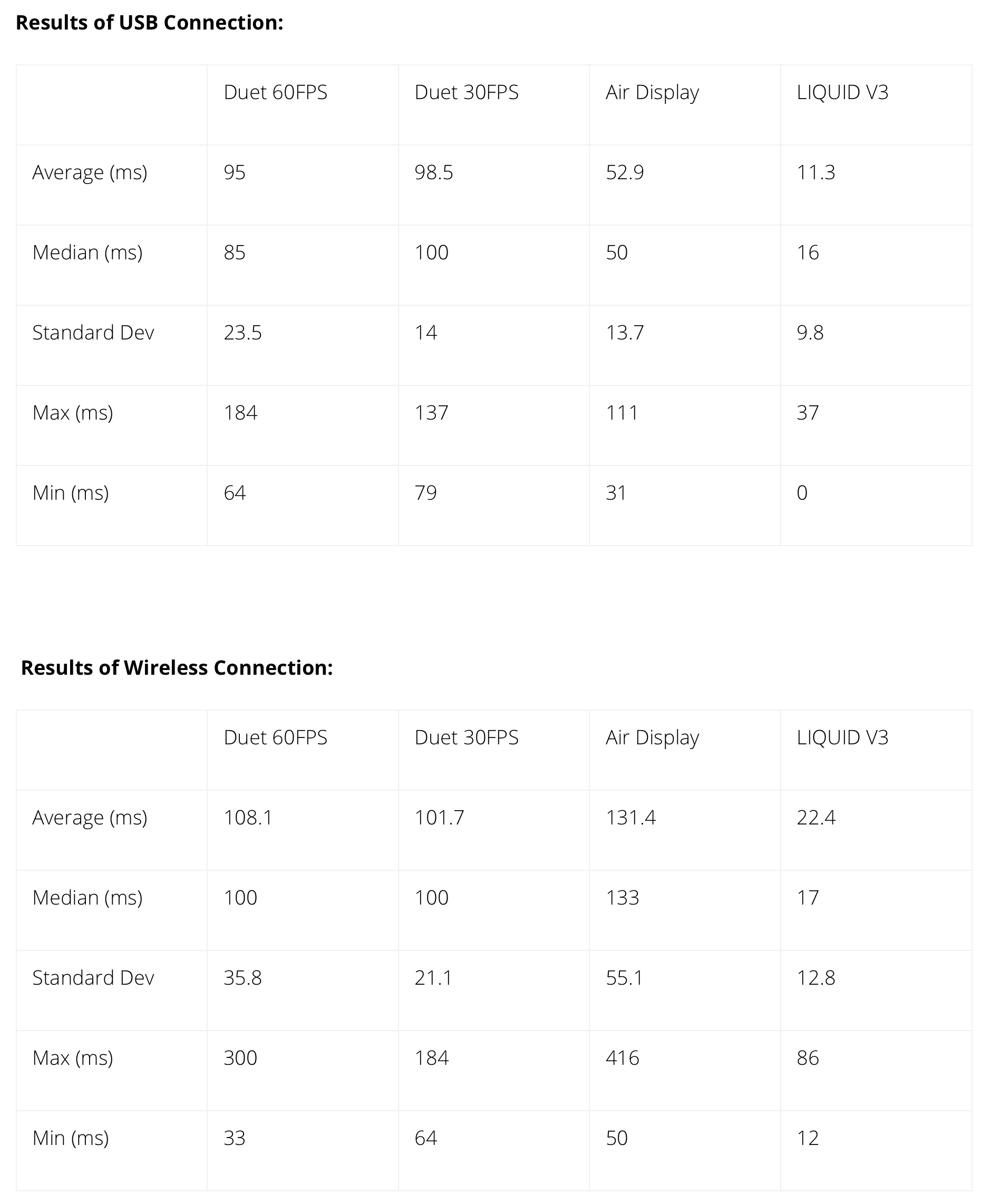

Astro, the company behind Luna Display and Astropad, is releasing a major software update that will drastically improve performance. According to the company’s own testing, you should expect as much as a 100 percent performance increase when it comes to latency and refresh rate.

Luna Display lets you use your iPad as a second monitor for your laptop. For instance, if you’re traveling and you can’t get any work done without an external display, you can use Luna Display to move macOS windows across your laptop display and your iPad.

Some people have also been using it with a home server. For instance, you can use Luna Display to control a Mac Mini using an iPad, a wireless keyboard and a wireless mouse. You’re no longer tied to a desk.

Compared to similar apps, Luna Display relies on a hardware dongle. This tiny USB-C or Mini DisplayPort device emulates a display. In your Mac settings, it looks like you plugged in a standard display even though it’s just a tiny key.

Astropad is a separate app for creative professionals. It lets you mirror your Mac display and use Photoshop with your Apple Pencil. They both rely on the same rendering engine.

And today’s update is all about performance. Thanks to a bunch of optimizations, you get an average latency of 11.3 ms when you use one of those apps with a 13-inch MacBook Pro, an 11-inch iPad Pro and a USB cable. Over Wi-Fi, you get a latency of 22.4 ms.

When it comes to frame rate, it’s a bit harder to quantify. But Astro has compared its products with competing solutions and thinks you have a higher chance of hitting 60 frames per second using Astro’s products.

Astro has compared Luna Display with Duet Display and Air Display. And it’s interesting to see that the company reports better performance than Duet.

Duet recently released an update to take advantage of hardware acceleration. At the time, Duet claimed that its solution was faster and cheaper than Luna Display. It’s clear that this space is moving quickly, and the result is better apps for everyone.

Powered by WPeMatico

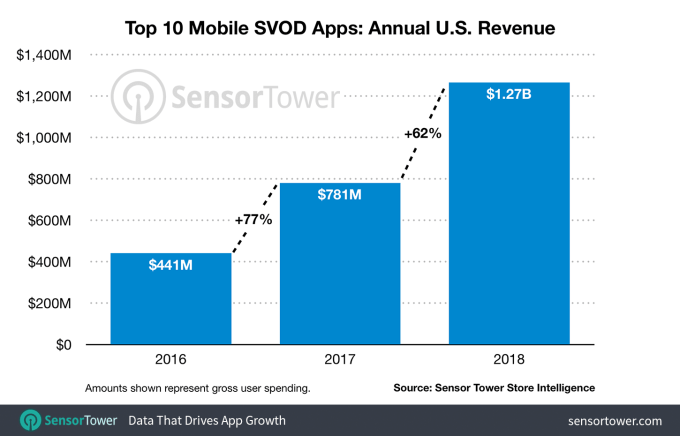

Subscriptions are booming on the app stores, and particularly subscription video apps, thanks to the growing number of cord cutters who are choosing to stream their TV shows and movies instead of paying for cable or satellite. In the U.S., the top 10 subscription video apps by revenue pulled in $1.27 billion in 2018 across both the iOS App Store and Google Play, according to new data from Sensor Tower — that’s a 62 percent increase over the $781 million spent in 2017.

It’s also three times higher than what was spent in these apps back in 2016.

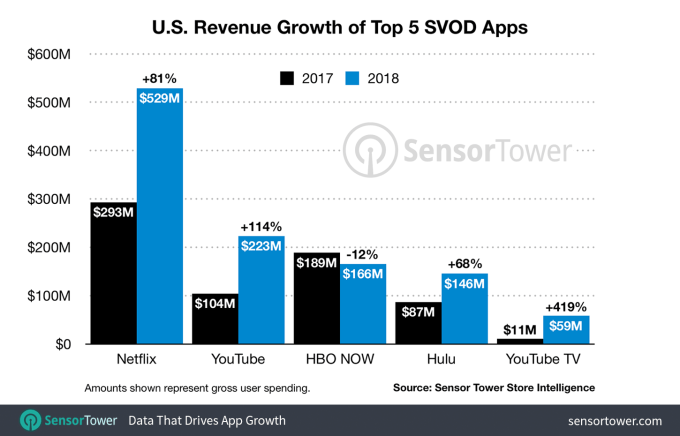

The top app, not surprisingly, was Netflix — which snagged the spot for the second year in a row. It earned an estimated $529 million in the U.S., the report found. However, Netflix won’t maintain the top spot in the rankings in 2019, as the company recently made a decision to keep more of its subscription revenue to itself.

Netflix in 2018 had dropped in-app subscription sign-ups in its Android app on Google Play, then did the same on the iOS App Store in December. That will decrease its in-app subscription revenues this year, though it won’t immediately go to zero because of revenues from existing subscribers.

The No. 2 top grossing app was YouTube, which is maybe more of a surprise to those who don’t realize that the app they use to watch free videos is making quite so much money through in-app purchases. But YouTube offers a couple of different types of in-app purchases, including subscriptions to its ad-free tier, YouTube Premium, as well as virtual currency to be used in Super Chat.

Sensor Tower says YouTube took in less than half as much revenue as Netflix at around $223 million, but it grew substantially in 2018 — up 114 percent from $104 million in 2017.

HBO NOW was the No. 3 top grossing app, even though its subscriber base declined. The app generated 12 percent less in 2018, at $166 million, down from $189 million. The reason, naturally, was that the app was without “Game of Thrones” to attract viewers. That doesn’t bode all that well for HBO’s future without “Thrones,” unless its spin-off becomes a hit.

Hulu and YouTube TV were the No. 4 and No. 5 apps, respectively. Hulu grew by 68 percent while YouTube TV jumped up a whopping 419 percent. CBS’s streaming app is doing decently, too, with 57 percent year-over-year growth in subscriber spending.

Much of that comes from streamers interest in the new “Star Trek” series. In fact, with the Season 2 premiere this month, CBS said its streaming service hit a new milestone across both subscription sign-ups and unique viewers in a weekend. While the network didn’t share exact numbers, it said the January 19 weekend, when the new season of “Star Trek: Discovery” aired, eclipsed 2017’s previous record from the series premiere by more than 72 percent, in terms of sign-ups.

Combined, 2018’s top 10 subscription streaming apps accounted for a sizable chunk — now 22 percent — of non-game app revenue on the app stores in the U.S. Their 62 percent revenue growth was also more than all the other non-game apps combined, which grew 56 percent year-over-year, the new report said.

Subscriptions — and not just for streaming apps — have become the new driver for non-game spending on the app stores, and that isn’t going to change anytime soon.

According to App Annie’s recent forecast for 2019, 10 minutes of every hour spent consuming media across TV and internet will come from streaming video on mobile. It estimates that total time in video streaming apps will increase 110 percent from 2016 to 2019, with consumer spend in entertainment apps rising by 520 percent over that same period. Most of those revenues will come from the growth in in-app subscriptions, the firm had said earlier.

Powered by WPeMatico

In 2019, we still don’t really know what to do about fake news. With nothing to disincentivize viral hyperpartisan headlines and other exercises in confirmation bias, online misinformation seems to run as rampant as ever. It’s a tricky problem, particularly because it’s one that requires the readers most drawn to too outrageous to be true news to challenge their beliefs. In other words, without some kind of technical solution or massive cultural shift, the fake news dilemma won’t be solving itself any time soon.

That being said, Microsoft’s mobile Edge browser is taking a modest swing at it. On Android and iOS, the Microsoft Edge app now installs with a built-in fake news detector called NewsGuard. The partnership is an extension of Microsoft’s Defending Democracy program, and NewsGuard for Edge was first announced earlier this month.

While NewsGuard isn’t on by default, anyone using Edge can enable it with a simple toggle in the settings menu. When I downloaded the app to test it, Edge actually nudged me to the Settings menu and then to an option called News Rating (this enables NewsGuard) with a small blue dot. The dot wasn’t an alarm-red notification but would probably be notable enough to pique my interest and point me to the setting, even if I wasn’t writing this story.

For now, NewsGuard’s ratings concentrate on U.S.-based websites, but major sites abroad are included too. TechCrunch received a healthy green check on NewsGuard, indicating that we maintain “basic standards of accuracy and accountability.” Clicking the green badge next to the address bar presented an option to review TechCrunch’s full “nutrition label” — a rundown of pertinent information like our ownership and financing, content and credibility. The information was pretty nuanced, right down to the insight that “opinion pieces are not always clearly labeled,” which is fair enough. It even included an example of a corrected story and how we handled it. As The Guardian noted, the Daily Mail didn’t fare quite so well.

The editorial deep-dives that influence NewsGuard’s ratings are impressive, though they do exemplify another issue that makes fighting fake news particularly tricky. Even if news sources are evaluated across a matrix of factors, there’s still some degree of subjective assessment necessary to make these decisions. While there are plenty of entities that could be making these calls, how do we reach a consensus on who should be doing it?

NewsGuard is co-led by Gordon Crovitz, former publisher of The Wall Street Journal, and Steven Brill. Like other editorially minded news experiments, NewsGuard relies on a human team instead of algorithms. The company counts former CIA director General Michael Hayden and The Information founder Jessica Lessin among its advisors.

Edge isn’t a very popular browser, but it still makes an interesting case study in the intractable war against low-quality information online. It also illustrates the central Catch 22 of the fake news era: The users who need a fake news detector the most are the least likely to use one. Microsoft’s Edge experiment with NewsGuard isn’t a solution to that issue, but baking some kind of news verification tool right into the browser does feel like a step in a compelling direction.

Powered by WPeMatico

I’m not allowed to tell you exactly how Anchorage keeps rich institutions from being robbed of their cryptocurrency, but the off-the-record demo was damn impressive. Judging by the $17 million Series A this security startup raised last year led by Andreessen Horowitz and joined by Khosla Ventures, #Angels, Max Levchin, Elad Gil, Mark McCombe of Blackrock and AngelList’s Naval Ravikant, I’m not the only one who thinks so. In fact, crypto funds like Andreessen’s a16z crypto, Paradigm and Electric Capital are already using it.

They’re trusting in the guys who engineered Square’s first encrypted card reader and Docker’s security protocols. “It’s less about us choosing this space and more about this space choosing us. If you look at our backgrounds and you look at the problem, it’s like the universe handed us on a silver platter the Venn diagram of our skill set,” co-founder Diogo Monica tells me.

Today, Anchorage is coming out of stealth and launching its cryptocurrency custody service to the public. Anchorage holds and safeguards crypto assets for institutions like hedge funds and venture firms, and only allows transactions verified by an array of biometrics, behavioral analysis and human reviewers. And because it doesn’t use “buried in the backyard” cold storage, asset holders can actually earn rewards and advantages for participating in coin-holder votes without fear of getting their Bitcoin, Ethereum or other coins stolen.

The result is a crypto custody service that could finally lure big-time commercial banks, endowments, pensions, mutual funds and hedgies into the blockchain world. Whether they seek short-term gains off of crypto volatility or want to HODL long-term while participating in coin governance, Anchorage promises to protect them.

Anchorage’s story starts eight years ago when Monica and his co-founder Nathan McCauley met after joining Square the same week. Monica had been getting a PhD in distributed systems while McCauley designed anti-reverse engineering tech to keep U.S. military data from being extracted from abandoned tanks or jets. After four years of building systems that would eventually move more than $80 billion per year in credit card transactions, they packaged themselves as a “pre-product acqui-hire” Monica tells me, and they were snapped up by Docker.

As their reputation grew from work and conference keynotes, cryptocurrency funds started reaching out for help with custody of their private keys. One had lost a passphrase and the $1 million in currency it was protecting in a display of jaw-dropping ignorance. The pair realized there were no true standards in crypto custody, so they got to work on Anchorage.

“You look at the status quo and it was and still is cold storage. It’s the same technology used by pirates in the 1700s,” Monica explains. “You bury your crypto in a treasure chest and then you make a treasure map of where those gold coins are,” except with USB keys, security deposit boxes and checklists. “We started calling it Pirate Custody.” Anchorage set out to develop something better — a replacement for usernames and passwords or even phone numbers and two-factor authentication that could be misplaced or hijacked.

This led them to Andreessen Horowitz partner and a16z crypto leader Chris Dixon, who’s now on their board. “We’ve been buying crypto assets running back to Bitcoin for years now here at a16z crypto. [Once you’re holding crypto,] it’s hard to do it in a way that’s secure, regulatory compliant, and lets you access it. We felt this pain point directly.”

Andreessen Horowitz partner and Anchorage board member Chris Dixon

It’s at this point in the conversation when Monica and McCauley give me their off-the-record demo. While there are no screenshots to share, the enterprise security suite they’ve built has the polish of a consumer app like Robinhood. What I can say is that Anchorage works with clients to whitelist employees’ devices. It then uses multiple types of biometric signals and behavioral analytics about the person and device trying to log in to verify their identity.

But even once they have access, Anchorage is built around quorum-based approvals. Withdrawals, other transactions and even changing employee permissions requires approval from multiple users inside the client company. They could set up Anchorage so it requires five of seven executives’ approval to pull out assets. And finally, outlier detection algorithms and a human review the transaction to make sure it looks legit. A hacker or rogue employee can’t steal the funds even if they’re logged in because they need consensus of approval.

That kind of assurance means institutional investors can confidently start to invest in crypto assets. That swell of capital could help replace the retreating consumer investors who’ve fled the market this year, leading to massive price drops. The liquidity provided by these asset managers could keep the whole blockchain industry moving. “Institutional investing has had centuries to build up a set of market infrastructure. Custody was something that for other asset classes was solved hundreds of years ago, so it’s just now catching up [for crypto],” says McCauley. “We’re creating a bigger market in and of itself,” Monica adds.

With Anchorage steadfastly handling custody, the risk these co-founders admit worries them lies in the smart contracts that govern the cryptocurrencies themselves. “We need to be extremely wide in our level of support and extremely deep because each blockchain has details of implementation. This is inherently a very difficult problem,” McCauley explains. It doesn’t matter if the coins are safe in Anchorage’s custody if a janky smart contract can botch their transfer.

There are plenty of startups vying to offer crypto custody, ranging from Bitgo and Ledger to well-known names like Coinbase and Gemini. Yet Anchorage offers a rare combination of institutional-since-day-one security rigor with the ability to participate in votes and governance of crypto assets that’s impossible if they’re in cold storage. Down the line, Anchorage hints that it might serve clients recommendations for how to vote to maximize their yield and preserve the sanctity of their coin.

They’ll have crypto investment legend Chris Dixon on their board to guide them. “What you’ll see is in the same way that institutional investors want to buy stock in Facebook and Google and Netflix, they’ll want to buy the equivalent in the world 10 years from now and do that safely,” Dixon tells me. “Anchorage will be that layer for them.”

But why do the Anchorage founders care so much about the problem? McCauley concludes that, “When we look at what’s potentially possible with crypto, there a fundamentally more accessible economy. We view ourselves as a key component of bringing that future forward.”

Powered by WPeMatico