alibaba

Auto Added by WPeMatico

Auto Added by WPeMatico

AutoX, the autonomous vehicle startup backed by Alibaba, has been granted a permit in California to begin driverless testing on public roads in a limited area in San Jose.

The permit will allow AutoX to test its autonomous vehicles without a human safety driver behind the wheel. This is the third company to receive a driverless testing permit. Waymo and Nuro also have driverless testing permits. Unlike the other two companies, AutoX’s permit is limited to one vehicle and restricted to surface streets within a designated part of San Jose near is headquarters, according to the California Department of Motor Vehicles, which regulates AV testing in the state. The vehicle is approved to operate in fair weather conditions and light precipitation on streets with a speed limit of no more than 45 mph, the agency said.

AutoX, which is developing a full self-driving stack, has had a permit to test autonomous vehicles with safety drivers since 2017. Currently, 62 companies have an active permit to test autonomous vehicles with a safety driver on California roads.

To qualify for a driverless testing permit, companies have to show proof of insurance or a bond equal to $5 million, verify the vehicles are capable of operating without a driver, meet federal Motor Vehicle Safety Standards or have an exemption from the National Highway Traffic Safety Administration.

While AutoX has been operating robotaxi pilots in California and China, the company has said its real aim is to license its technology to companies that want to operate robotaxi fleets of their own. It has been particularly active in China, although this driverless permit hints that the company might be ramping up its activity in the U.S. as well.

AutoX opened an 80,000-square-foot Shanghai Robotaxi Operations Center in April, following a 2019 agreement with municipal authorities to deploy 100 autonomous vehicles in the Jiading District. The vehicles in the fleet were assembled at a factory about 93 miles outside of Shanghai.

The company has been operating a fleet of robotaxis in Shenzhen through a pilot program launched in 2019 with BYD. In January, AutoX partnered with Fiat Chrysler to roll out a fleet of robotaxis for China and other countries in Asia.

Powered by WPeMatico

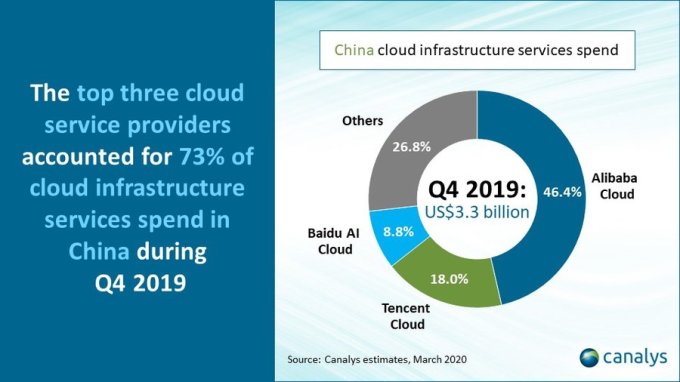

Research firm Canalys reports that the Chinese cloud infrastructure market grew 66.9% to $3.3 billion in the last quarter of 2019, right before the COVID-19 virus hit the country. China is the second largest cloud infrastructure market in the world, with 10.8% share.

The quarter puts the Chinese market on a $13.2 billion run rate. Canalys pegged the U.S. market at $14 billion for the same time period, with a 47% worldwide market share.

Alibaba led the way in China, with more than 46% market share. Like its American e-commerce giant counterpart, Amazon, Alibaba has a cloud arm, and it dominates in its country much the same way AWS does in the U.S.

Tencent was in second, with 18%, roughly the equivalent of Microsoft Azure’s share in the U.S., and Baidu AI Cloud came in third, with 8.8%, roughly the equivalent of Google’s U.S. market share.

Slide: Canalys

Matthew Ball, an analyst at Canalys, says the fourth quarter numbers predate the medical crisis due to the COVID-19 outbreak in China. “In terms of growth drivers for Q4, we have seen the ongoing demand for on-demand compute and storage accelerate throughout 2019, as private and public organizations embark on digital transformation projects and start building platforms and applications to develop new services.”

Ball says gaming was a big cloud customer, as was healthcare, finance, transport and industry. He also pointed to growth in facial recognition technology as part of the smart city sector.

As for next year, Ball says the firm still sees big growth in the market despite the virus impact in Q12020. “In addition to the continuation of digital projects once business returns to normality, we anticipate many businesses new to using cloud services during the crisis will continue use and become paying customers,” he said. The cloud companies have been offering a number of free options to businesses during the crisis.

“The overall outcome of current events around the world will be that companies will assess their business continuity measures and make sure they can continue to operate if events are ever repeated,” he said.

Powered by WPeMatico

Increasingly, the streets of Karachi and Lahore are being flooded with men riding bikes and wearing green T-shirts, a writer friend recently told me. In a sense, these men represent the emergence of Pakistan’s tech startups.

India now has more than 25,000 startups and raised a record $14.5 billion last year, according to government figures. But not all Asian countries are as large as India or have such a thriving startup ecosystem. Long overdue, things are beginning to change in bordering Pakistan.

Bykea, a three-year-old ride-hailing and delivery service, today has more than 500,000 bikes registered on its platform. It operates in some of Pakistan’s most populated cities, such as Karachi, Lahore and Islamabad, Muneeb Maayr, Bykea founder and CEO, told TechCrunch.

Maayr is one of the most recognized startup founders in Pakistan, and previously worked for Rocket Internet, helping the giant run fashion e-commerce platform Daraz in the country. While leading Daraz, he expanded the platform to cater to categories beyond fashion; Daraz was later sold to Alibaba.

Powered by WPeMatico

Sisense, an enterprise startup that has built a business analytics business out of the premise of making big data as accessible as possible to users — whether it be through graphics on mobile or desktop apps, or spoken through Alexa — is announcing a big round of funding today and a large jump in valuation to underscore its traction. The company has picked up $100 million in a growth round of funding that catapults Sisense’s valuation to over $1 billion, funding that it plans to use to continue building out its tech, as well as for sales, marketing and development efforts.

For context, this is a huge jump: The company was valued at only around $325 million in 2016 when it raised a Series E, according to PitchBook. (It did not disclose valuation in 2018, when it raised a venture round of $80 million.) It now has some 2,000 customers, including Tinder, Philips, Nasdaq and the Salvation Army.

This latest round is being led by the high-profile enterprise investor Insight Venture Partners, with Access Industries, Bessemer Venture Partners, Battery Ventures, DFJ Growth and others also participating. The Access investment was made via Claltech in Israel, and it seems that this led to some details of this getting leaked out as rumors in recent days. Insight is in the news today for another big deal: Wearing its private equity hat, the firm acquired Veeam for $5 billion. (And that speaks to a particular kind of trajectory for enterprise companies that the firm backs: Veeam had already been a part of Insight’s venture portfolio.)

Mature enterprise startups have proven their business cases are going to be an ongoing theme in this year’s fundraising stories, and Sisense is part of that theme, with annual recurring revenues of over $100 million speaking to its stability and current strength. The company has also made some key acquisitions to boost its business, such as the acquisition of Periscope Data last year (coincidentally, also for $100 million, I understand).

Its rise also speaks to a different kind of trend in the market: In the wider world of business intelligence, there is an increasing demand for more digestible data in order to better tap advances in data analytics to use it across organizations. This was also one of the big reasons why Salesforce gobbled up Tableau last year for a slightly higher price: $15.7 billion.

Sisense, bringing in both sleek end user products but also a strong theme of harnessing the latest developments in areas like machine learning and AI to crunch the data and order it in the first place, represents a smaller and more fleet of foot alternative for its customers. “We found a way to make accessing data extremely simple, mashing it together in a logical way and embedding it in every logical place,” explained CEO Amir Orad to us in 2018.

“We have enjoyed watching the Sisense momentum in the past 12 months, the traction from its customers as well as from industry leading analysts for the company’s cloud native platform and new AI capabilities. That coupled with seeing more traction and success with leading companies in our portfolio and outside, led us to want to continue and grow our relationship with the company and lead this funding round,” said Jeff Horing, managing director at Insight Venture Partners, in a statement.

To note, Access Industries is an interesting backer which might also potentially shape up to be strategic, given its ownership of Warner Music Group, Alibaba, Facebook, Square, Spotify, Deezer, Snap and Zalando.

“Given our investments in market leading companies across diverse industries, we realize the value in analytics and machine learning and we could not be more excited about Sisense’s trajectory and traction in the market,” added Claltech’s Daniel Shinar in a statement.

Powered by WPeMatico

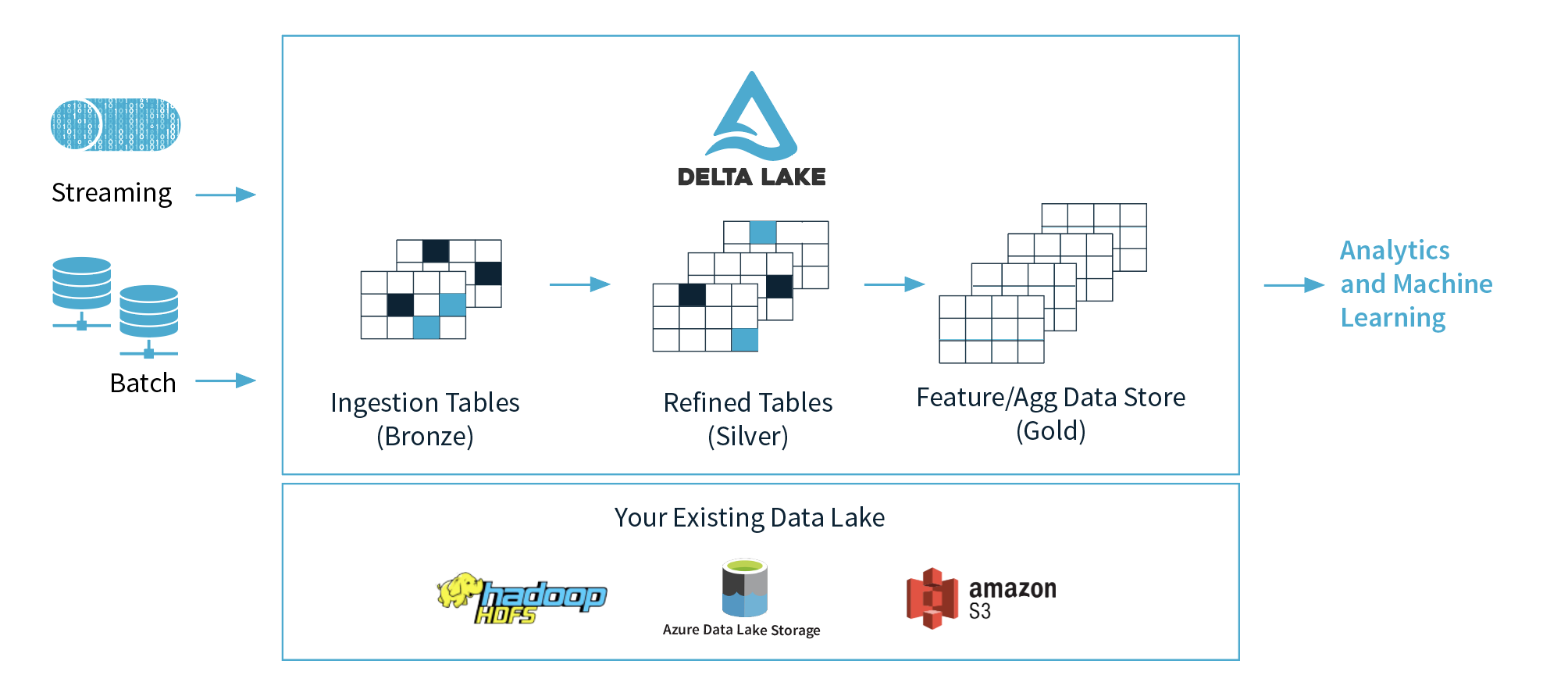

Databricks, the big data analytics service founded by the original developers of Apache Spark, today announced that it is bringing its Delta Lake open-source project for building data lakes to the Linux Foundation under an open governance model. The company announced the launch of Delta Lake earlier this year, and, even though it’s still a relatively new project, it has already been adopted by many organizations and has found backing from companies like Intel, Alibaba and Booz Allen Hamilton.

“In 2013, we had a small project where we added SQL to Spark at Databricks […] and donated it to the Apache Foundation,” Databricks CEO and co-founder Ali Ghodsi told me. “Over the years, slowly people have changed how they actually leverage Spark and only in the last year or so it really started to dawn upon us that there’s a new pattern that’s emerging and Spark is being used in a completely different way than maybe we had planned initially.”

This pattern, he said, is that companies are taking all of their data and putting it into data lakes and then doing a couple of things with this data, machine learning and data science being the obvious ones. But they are also doing things that are more traditionally associated with data warehouses, like business intelligence and reporting. The term Ghodsi uses for this kind of usage is “Lake House.” More and more, Databricks is seeing that Spark is being used for this purpose and not just to replace Hadoop and doing ETL (extract, transform, load). “This kind of Lake House patterns we’ve seen emerge more and more and we wanted to double down on it.”

Spark 3.0, which is launching

Spark 3.0, which is launching today soon, enables more of these use cases and speeds them up significantly, in addition to the launch of a new feature that enables you to add a pluggable data catalog to Spark.

Delta Lake, Ghodsi said, is essentially the data layer of the Lake House pattern. It brings support for ACID transactions to data lakes, scalable metadata handling and data versioning, for example. All the data is stored in the Apache Parquet format and users can enforce schemas (and change them with relative ease if necessary).

It’s interesting to see Databricks choose the Linux Foundation for this project, given that its roots are in the Apache Foundation. “We’re super excited to partner with them,” Ghodsi said about why the company chose the Linux Foundation. “They run the biggest projects on the planet, including the Linux project but also a lot of cloud projects. The cloud-native stuff is all in the Linux Foundation.”

“Bringing Delta Lake under the neutral home of the Linux Foundation will help the open-source community dependent on the project develop the technology addressing how big data is stored and processed, both on-prem and in the cloud,” said Michael Dolan, VP of Strategic Programs at the Linux Foundation. “The Linux Foundation helps open-source communities leverage an open governance model to enable broad industry contribution and consensus building, which will improve the state of the art for data storage and reliability.”

Powered by WPeMatico

Alibaba announced its earnings today, and the Chinese e-commerce giant got a nice lift from its cloud business, which grew 66% to more than $1.1 billion, or a run rate surpassing $4 billion.

It’s not exactly on par with Amazon, which reported cloud revenue of $8.381 billion last quarter, more than double Alibaba’s yearly run rate, but it’s been a steady rise for the company, which really began taking the cloud seriously as a side business in 2015.

At that time, Alibaba Cloud’s president Simon Hu boasted to Reuters that his company would overtake Amazon in four years. It is not even close to doing that, but it has done well to get to more than a billion a quarter in just four years.

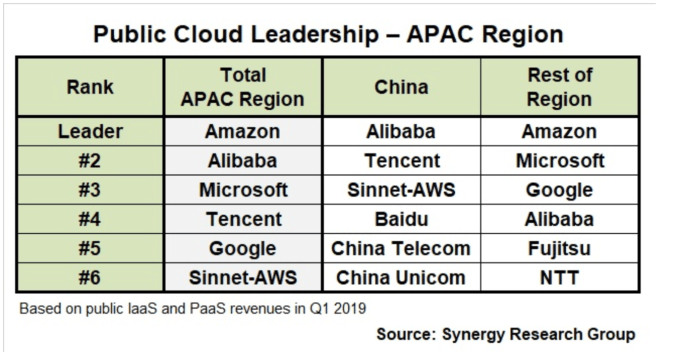

In fact, in its most recent data for the Asia-Pacific region, Synergy Research, a firm that closely tracks the public cloud market, found that Amazon was still number one overall in the region. Alibaba was first in China, but fourth in the region outside of China, with the market’s Big 3 — Amazon, Microsoft and Google — coming in ahead of it. These numbers were based on Q1 data before today’s numbers were known, but they provide a sense of where the market is in the region.

Synergy’s John Dinsdale says the company’s growth has been impressive, outpacing the market growth rate overall. “Alibaba’s share of the worldwide cloud infrastructure services market was 5% in Q2 — up by almost a percentage point from Q2 of last year, which is a big deal in terms of absolute growth, especially in a market that is growing so rapidly,” Dinsdale told TechCrunch.

He added, “The great majority of its revenue does indeed come from China (and Hong Kong), but it is also making inroads in a range of other APAC country markets — Indonesia, Malaysia, Singapore, India, Australia, Japan and South Korea. While numbers are relatively small, it has also got a foothold in EMEA and some operations in the U.S.”

The company was busy last quarter adding more than 300 new products and features in the period ending June 30th (and reported today). That included changes and updates to core cloud offerings, security, data intelligence and AI applications, according to the company.

While the cloud business still isn’t a serious threat to the industry’s Big Three, especially outside its core Asia-Pacific market, it’s still growing steadily and accounted for almost 7% of Alibaba’s total of $16.74 billion in revenue for the quarter — and that’s not bad at all.

Powered by WPeMatico

Aspire, a Singapore-based startup that helps SMEs secure working capital, has raised $32.5 million in a new financing round to expand its presence in several Southeast Asian markets.

The Series A round for the one-and-a-half-year-old startup was funded by MassMutual Ventures Southeast Asia. Arc Labs and existing investors Y Combinator — Aspire graduated from YC last year — Hummingbird and Picus Capital also participated in the round. Aspire has raised about $41.5 million to date.

Aspire operates a neo-banking-like platform to help small and medium-sized enterprises (SMEs) quickly and easily secure working capital of up to about $70,000. AspireAccount, the startup’s flagship product, provides merchants and startups with instant credit limit for daily business expenses, as well as a business-to-business acceptance and other tools to help them manage their cash flow.

Co-founder and CEO Andrea Baronchelli tells TechCrunch that about 1,000 business accounts are opened each month on Aspire and that the company plans to continue focusing on Southeast Asia, where he says there are about 78 million small businesses, leaving plenty of room to scale (applications can be made through Aspire’s mobile app and are reviewed using a proprietary risk assessment engine before getting final approval from a human). Aspire claims it has seen 30% month-over-month growth since it was founded in January 2018 and expects to open more than 100,000 business accounts by next year.

Baronchelli, who served as a CMO for Alibaba’s Lazada platform for four years, says Aspire launched to close the gap left by the traditional banking industry’s focus on consumer services or businesses that make more than $10 million in revenue a year. As a result, smaller businesses in Southeast Asia, including online vendors and startups, often lack access to credit lines, accounts and other financial services tailored to their needs.

Aspire currently operates in Thailand, Indonesia, Singapore and Vietnam. The startup said it will use the fresh capital to scale its footprints in those markets. Additionally, Aspire is building a scalable marketplace banking infrastructure that will use third-party financial service providers to “create a unique digital banking experience for its SME customers.”

Baronchelli adds that “the bank of the future will probably be a marketplace,” so Aspire’s goal is to provide a place where SMEs can not only open accounts and credit cards, but also pick from different services like point of sale systems. It is currently in talks with potential partners. The startup is also working on a business credit card that will be linked to each business account by as early as this year.

Southeast Asia’s digital economy is slated to grow more than six-fold to reach more than $200 billion per year, according to a report co-authored by Google. But for many emerging startups and businesses, getting financial services from a bank and securing working capital have become major pain points.

A growing number of startups are beginning to address these SMEs’ needs. In India, for instance, NiYo Bank and Open have amassed millions of businesses through their neo-banking platforms. Both of these startups have raised tens of millions of dollars in recent months. Drip Capital, which helps businesses in developing markets secure working capital, raised $25 million last week.

Powered by WPeMatico

Salesforce, the 20-year-old leader in customer relationship management (CRM) tools, is making a foray into Asia by working with one of the country’s largest tech firms, Alibaba.

Alibaba will be the exclusive provider of Salesforce to enterprise customers in mainland China, Hong Kong, Macau and Taiwan, and Salesforce will become the exclusive enterprise CRM software suite sold by Alibaba, the companies announced on Thursday.

The Chinese internet has for years been dominated by consumer-facing services such as Tencent’s WeChat messenger and Alibaba’s Taobao marketplace, but enterprise software is starting to garner strong interest from businesses and investors. Workflow automation startup Laiye, for example, recently closed a $35 million funding round led by Cathay Innovation, a growth-stage fund that believes “enterprise software is about to grow rapidly” in China.

The partners have something to gain from each other. Alibaba does not have a Salesforce equivalent serving the raft of small-and-medium businesses selling through its e-commerce marketplaces or using its cloud computing services, so the alliance with the American cloud behemoth will fill that gap.

On the other hand, Salesforce will gain sales avenues in China through Alibaba, whose cloud infrastructure and data platform will help the American firm “offer localized solutions and better serve its multinational customers,” said Ken Shen, vice president of Alibaba Cloud Intelligence, in a statement.

“More and more of our multinational customers are asking us to support them wherever they do business around the world. That’s why today Salesforce announced a strategic partnership with Alibaba,” said Salesforce in a statement.

Overall, only about 10% of Salesforce revenues in the three months ended April 30 originated from Asia, compared to 20% from Europe and 70% from the Americas.

Besides gaining client acquisition channels, the tie-up also enables Salesforce to store its China-based data at Alibaba Cloud. China requires all overseas companies to work with a domestic firm in processing and storing data sourced from Chinese users.

“The partnership ensures that customers of Salesforce that have operations in the Greater China area will have exclusive access to a locally-hosted version of Salesforce from Alibaba Cloud, who understands local business, culture and regulations,” an Alibaba spokesperson told TechCrunch.

Cloud has been an important growth vertical at Alibaba and nabbing a heavyweight ally will only strengthen its foothold as China’s biggest cloud service provider. Salesforce made some headway in Asia last December when it set up a $100 million fund to invest in Japanese enterprise startups and the latest partnership with Alibaba will see the San Francisco-based firm actually go after customers in Asia.

Powered by WPeMatico

China’s war on garbage is as digitally savvy as the country itself. Think QR codes attached to trash bags that allow a municipal government to trace exactly where its trash comes from.

On July 1, the world’s most populated city (Shanghai) began a compulsory garbage-sorting program. Under the new regulations (in Chinese), households and companies must classify their wastes into four categories and dump them in designated places at certain times. Noncompliance can lead to fines. Companies and properties that don’t comply risk having their credit rating lowered.

The strict regime became the talk of the city’s more than 24 million residents, who criticized the program’s inflexibility and confusing waste categorization. Gratefully, China’s tech startups are here to help.

For instance, China’s biggest internet companies responded with new search features that help people identify which wastes are “wet” (compostable), “dry,, “toxic,” or “recyclable.” Not even the most environmentally conscious person can get all the answers right. Like, which bin does the newspaper you just used to pick up dog poop belong to? Simply pull up a mini app on WeChat, Baidu or Alipay and enter the keyword. The tech firms will give you the answer and why.

A WeChat mini program that lets users learn the category of cash

Alipay, Alibaba’s electronics payment affiliate, claims its garbage-sorting mini app added one million users in just three days. The lite app, which is available without download inside the e-wallet with one billion users, has so far indexed more than 4,000 types of rubbish. Its database is still growing, and soon it will save people from typing by using image recognition to classify trash when they snap a photo of it. Alibaba’s answer to Alexa Tmall Genie can already answer (in Chinese) the question “what kind of trash is a wet wipe?” and more.

If people are too busy or lazy to hit the collection schedule, well, startups are offering valet trash service at the doorstep. A third-party developer helped Alipay build a recycling mini app (“垃圾分类回收平台”) and is now collecting garbage from 8,000 apartment complexes across 11 cities. To date, two million people have sold recyclable material through its platform.

Ele.me, Alibaba’s food delivery arm, added trash pickup to its list of valet services its fleets offer on top of “apologize to the girlfriend” and dog walking.

Alibaba’s food delivery & local service platform https://t.co/Yh95Bt0DPG just rolled out a “throw out the trash” service for $2. The delivery guy can also “apologize to the girlfriend” on your behalf among other things #DigitalEconomyinChina $BABA pic.twitter.com/C2ey1ePDvJ

— Krystal Hu (@readkrystalhu) June 24, 2019

Besides helping households, companies are also building software to make property managers’ lives easier. Some residential complexes in Shanghai began using QR codes to trace the origin of garbage, state-owned media outlet Xinhua reported. Each household is asked to attach a unique QR code to their trash bags, which will be scanned for sources and classification when they arrive at the waste management station.

Workers at a waste management station in Shanghai scan codes on trash bags to check their source (Screenshot from Xinhua feature)

This way, regulators in the region know exactly which family has produced the trash — although the city’s current garbage regulations do not require real-name tracking — and those who correctly categorized receive a small reward of 0.1 yuan, or 1.45 cents, per day, according to another report (in Chinese) from Xinhua.

Powered by WPeMatico

Kabbage, the AI-based small business loans platform backed by SoftBank and others, is adding more firepower to its lending machine: the Atlanta-based startup has secured an additional $200 million in the form of a revolving credit facility from an unnamed subsidiary of a large life insurance company, managed and administered by 20 Gates Management, and Atalaya Capital Management.

The money comes on the heels of a $700 million securitization Kabbage secured just three months ago and it is notable not just for its size but its terms: it’s a four-year facility, a length of time that underscores a level of confidence in the company’s performance.

Kabbage, which loans up to $250,000 in a single deal to small and medium businesses, has built a platform that harnesses the long tail of big data from across the web. It uses not just indicators from a company’s own public activities, but also sources comparative information from across a wider group of similar companies, with “2 million live data connections” currently helping to feed its algorithm.

Together, these help Kabbage determine whether to provide the loans, and at what rates. Notably, the whole process takes mere minutes, making Kabbage disruptive to the traditional route of applying for loans from banks, which can come at higher rates, often take longer to close and may never get approved.

The company was last valued at $1.2 billion in its most recent equity round from the Vision Fund in 2017, with about $500 million raised in equity to date from it and other investors, including BlueRun Ventures and Mohr Davidow Ventures. Rob Frohwein, the co-founder and CEO, confirmed to me via email that there are “no plans on the equity side right now.” We’ve asked about IPO plans and will update if we learn anything more on that front.

More importantly, alongside its equity story is the company’s business story: Kabbage has to date loaned out $7 billion in capital — amassed through securitizations and other facilities alongside that — to 185,000 businesses, and the company has seen an acceleration of business activity over the last two years. Nearly $700 million was loaned out in Q2 of this year, passing the record in Q1 of $600 million. This puts Kabbage on track to loan out between $2.4 billion and $3 billion this year.

“This transaction further diversifies Kabbage’s committed sources of funding and prepares us to meet the escalating demand for capital access among small businesses,” said Kabbage head of Capital Markets, Deepesh Jain, in a statement. “2019 has proven to be a tide-shifting year as customers accessed more than $670 million from Kabbage in Q2 2019, well surpassing our previously set record last quarter.”

While a lot of Kabbage’s business has come out of its direct consumer relationships, it’s also been expanding by way of more third-party relationships. It has white-label partnerships with banks to power their own loan offerings for SMBs, and earlier this year it was also tapped by e-commerce giant Alibaba to provide loans to its small business customers of up to $150,000 to help finance purchases, part of the latter company’s redoubled efforts to build out its business in the U.S. by way of its quiet acquisition of OpenSky.

Powered by WPeMatico