alibaba

Auto Added by WPeMatico

Auto Added by WPeMatico

Think you’re living in a hyper-connected world? Huawei’s proprietary HarmonyOS wants to eliminate delays and gaps in user experience when you move from one device onto another by adding interoperability to all devices, regardless of the system that powers them.

Two years after Huawei was added to the U.S. entity list that banned the Chinese telecom giant from accessing U.S. technologies, including core chipsets and Android developer services from Google, Huawei’s alternative smartphone operating system was unveiled.

On Wednesday, Huawei officially launched its proprietary operating system HarmonyOS for mobile phones. The firm began building the operating system in 2016 and made it open-source for tablets, electric vehicles and smartwatches last September. Its flagship devices such as Mate 40 could upgrade to HarmonyOS starting Wednesday, with the operating system gradually rolling out on lower-end models in the coming quarters.

HarmonyOS is not meant to replace Android or iOS, Huawei said. Rather, its application is more far-reaching, powering not just phones and tablets but an increasing number of smart devices. To that end, Huawei has been trying to attract hardware and home appliance manufacturers to join its ecosystem.

To date, more than 500,000 developers are building applications based on HarmonyOS. It’s unclear whether Google, Facebook and other mainstream apps in the West are working on HarmonyOS versions.

Some Chinese tech firms have answered Huawei’s call. Smartphone maker Meizu hinted on its Weibo account that its smart devices might adopt HarmonyOS. Oppo, Vivo and Xiaomi, which are much larger players than Meizu, are probably more reluctant to embrace a rival’s operating system.

Huawei’s goal is to collapse all HarmonyOS-powered devices into one single control panel, which can, say, remotely pair the Bluetooth connections of headphones and a TV. A game that is played on a phone can be continued seamlessly on a tablet. A smart soymilk blender can customize a drink based on the health data gleaned from a user’s smartwatch.

Devices that aren’t already on HarmonyOS can also communicate with Huawei devices with a simple plug-in. Photos from a Windows-powered laptop can be saved directly onto a Huawei phone if the computer has the HarmonyOS plug-in installed. That raises the question of whether Android, or even iOS, could, one day, talk to HarmonyOS through a common language.

The HarmonyOS launch arrived days before Apple’s annual developer event scheduled for next week. A recent job posting from Apple mentioned a seemingly new concept, homeOS, which may have to do with Apple’s smart home strategy, as noted by MacRumors.

Huawei denied speculations that HarmonyOS is a derivative of Android and said no single line of code is identical to that of Android. A spokesperson for Huawei declined to say whether the operating system is based on Linux, the kernel that powers Android.

Several tech giants have tried to introduce their own mobile operating systems, to no avail. Alibaba built AliOS based on Linux but has long stopped updating it. Samsung flirted with its own Tizen but the operating system is limited to powering a few Internet of Things, like smart TVs.

Huawei may have a better shot at drumming up developer interest compared to its predecessors. It’s still one of China’s largest smartphone brands despite losing a chunk of its market after the U.S. government cut it off from critical chip suppliers, which could hamper its ability to make cutting-edge phones. HarmonyOS also has a chance to create an alternative for developers who are disgruntled with Android, if Huawei is able to capture their needs.

The U.S. sanctions do not block Huawei from using Android’s open-source software, which major Chinese smartphone makers use to build their third-party Android operating system. But the ban was like a death knell for Huawei’s consumer markets overseas as its phones abroad lost access to Google Play services.

Powered by WPeMatico

Arm today announced the launch of two new platforms, Arm Neoverse V1 and Neoverse N2, as well as a new mesh interconnect for them. As you can tell from the name, V1 is a completely new product and maybe the best example yet of Arm’s ambitions in the data center, high-performance computing and machine learning space. N2 is Arm’s next-generation general compute platform that is meant to span use cases from hyperscale clouds to SmartNICs and running edge workloads. It’s also the first design based on the company’s new Armv9 architecture.

Not too long ago, high-performance computing was dominated by a small number of players, but the Arm ecosystem has scored its fair share of wins here recently, with supercomputers in South Korea, India and France betting on it. The promise of V1 is that it will vastly outperform the older N1 platform, with a 2x gain in floating-point performance, for example, and a 4x gain in machine learning performance.

“The V1 is about how much performance can we bring — and that was the goal,” Chris Bergey, SVP and GM of Arm’s Infrastructure Line of Business, told me. He also noted that the V1 is Arm’s widest architecture yet. He noted that while V1 wasn’t specifically built for the HPC market, it was definitely a target market. And while the current Neoverse V1 platform isn’t based on the new Armv9 architecture yet, the next generation will be.

N2, on the other hand, is all about getting the most performance per watt, Bergey stressed. “This is really about staying in that same performance-per-watt-type envelope that we have within N1 but bringing more performance,” he said. In Arm’s testing, NGINX saw a 1.3x performance increase versus the previous generation, for example.

In many ways, today’s release is also a chance for Arm to highlight its recent customer wins. AWS Graviton2 is obviously doing quite well, but Oracle is also betting on Ampere’s Arm-based Altra CPUs for its cloud infrastructure.

“We believe Arm is going to be everywhere — from edge to the cloud. We are seeing N1-based processors deliver consistent performance, scalability and security that customers want from Cloud infrastructure,” said Bev Crair, senior VP, Oracle Cloud Infrastructure Compute. “Partnering with Ampere Computing and leading ISVs, Oracle is making Arm server-side development a first-class, easy and cost-effective solution.”

Meanwhile, Alibaba Cloud and Tencent are both investing in Arm-based hardware for their cloud services as well, while Marvell will use the Neoverse V2 architecture for its OCTEON networking solutions.

Powered by WPeMatico

Global investors are running from Chinese tech stocks in the wake of the government’s crackdown on Ant Group and Alibaba, two high-flying businesses founded by Ma Yun (Jack Ma) that were once hailed as paragons of China’s new tech elite.

Shares of major technology companies in the country have fallen sharply in recent days, with Bloomberg calculating that Alibaba, Tencent, JD.com and Meituan have lost around $200 billion in value during a handful of trading sessions.

Already reeling from the last-minute halt of the public debut of Ant Group, a major Chinese fintech player with deep ties to Alibaba, the e-commerce giant came under new fire, as China’s markets watchdog opened a probe into its business practices concerning potentially anticompetitive behavior.

Ant Group was itself summoned by the government on December 26, leading to a plan that will force the company to “rectify” its business practices.

Shares of Alibaba are off around 30% from their recent record highs set in late October. Tech shares are also off in the country more broadly, with one Chinese-technology-focused ETC falling around 8% from recent highs, including a 1.5% drop today.

The American Depositary Receipts used by traders to invest in Alibaba fell from around $256 per share at the close of Wednesday trading on the New York Stock Exchange to around $222 last Thursday. The company is down another half point today. It was worth more than $319 per share earlier in the quarter.

It’s clear that the rising tensions between China’s tech giants and the country’s ruling Communist Party have investors spooked. But Jack Ma’s relationship with the Chinese government has always been a bit more fraught than that of his peers. Ma Huateng (Pony Ma), the founder of Tencent, and Xu Yong (Eric Yong) and Li Yanhong (Robin Li), the co-founders of Baidu, have kept lower profiles than the Alibaba founder.

Bloomberg has a good synopsis of the state of the market right now. The companies that are most directly in the crosshairs appear to be Ma Yun’s, but at different times, Tencent has been the focus of Chinese regulators bent on curbing the company’s influence through gaming.

Specifically for Alibaba things have gone from bad to worse, and a boosted share buyback program was not enough to halt the bleeding.

Whether this new round of regulations is a solitary blip on the radar or the signal of an increasing interest in Beijing tying tech companies closer to national interests remains to be seen. As the tit-for-tat tech conflict between the U.S. and China continues, many companies that had seen their growth as apolitical may become caught in the diplomatic crossfire.

Other tech companies are seeing their fortunes rise, boosted by newfound interest from the central government in Beijing.

This is already apparent in the chip industry, where China’s push for self-reliance has brought new riches and capital for new businesses. It’s true for Liu FengFeng, whose company, Tsinghon, was able to raise $5 million for its attempt at building a new semiconductor manufacturer in the country. Intellifusion, a manufacturer of chipsets focused on machine learning applications, was able to raise another $141 million back in April.

Private investors may be less enthused at the prospect of backing Chinese tech upstarts who could face government censure should the regulatory winds shift. Whether other startup markets in the region — India, Japan, among others — will benefit from the Chinese regulatory barrage will be interesting to track in 2021.

Powered by WPeMatico

Residents of Shenzhen will see truly driverless cars on the road starting Thursday. AutoX, a four-year-old startup backed by Alibaba, MediaTek and Shanghai Motors, is deploying a fleet of 25 unmanned vehicles in downtown Shenzhen, marking the first time any autonomous driving car in China tests on public roads without safety drivers or remote operators.

The cars, meant as robotaxis, are not yet open to the public, an AutoX spokesperson told TechCrunch.

The milestone came just five months after AutoX landed a permit from California to start driverless tests, following in the footsteps of Waymo and Nuro.

It also indicates that China wants to bring its smart driving industry on par with the U.S. Cities from Shenzhen to Shanghai are competing to attract autonomous driving upstarts by clearing regulatory hurdles, touting subsidies and putting up 5G infrastructure.

As a result, each city ends up with its own poster child in the space: AutoX and Deeproute.ai in Shenzhen, Pony.ai and WeRide in Guangzhou, Momenta in Suzhou and Baidu’s Apollo fleet in Beijing, to name a few. The autonomous driving companies, in turn, work closely with traditional carmakers to make their vehicles smarter and more suitable for future transportation.

“We have obtained support from the local government. Shenzhen is making a lot of rapid progress on legislation for self-driving cars,” said the AutoX representative.

The decision to remove drivers from the front and operators from a remote center appears a bold move in one of China’s most populated cities. AutoX equips its vehicles with its proprietary vehicle control unit called XCU, which it claims has faster processing speed and more computational capability to handle the complex road scenarios in China’s cities.

“[The XCU] provides multiple layers of redundancy to handle this kind of situation,” said AutoX when asked how its vehicles will respond should the machines ever go rogue.

The company also stressed the experience it learned from “millions of miles” driven in China’s densest city centers through its 100 robotaxis in the past few years. Its rivals are also aggressively accumulating mileage to train their self-driving algorithms while banking sizable investments to fund R&D and pilot tests. AutoX itself, for instance, has raised more than $160 million to date.

Powered by WPeMatico

South Korea-based PUBG Corporation, which runs sleeper hit gaming title PUBG Mobile, announced last week that it plans to return to India, its largest market by users. But its announcement did not address a key question: Is India, which banned the app in September, on the same page?

The company says it will locally store Indian users’ data, open a local office and release a new game created especially for the world’s second-largest internet market. To sweeten the deal, PUBG Corporation also plans to invest $100 million in India’s gaming, esports and IT ecosystems.

But PUBG’s announcement, which TechCrunch reported as imminent last week, is treading in uncharted territory and it remains unclear if its efforts allay the concerns raised by the government.

Since late June, the Indian government has banned more than 200 apps — including PUBG Mobile, TikTok and UC Browser, all of which identified India as their biggest market by users — with links to China.

New Delhi says it enforced the ban over cybersecurity concerns. The government had received complaints about the apps stealing user data and transmitting it to servers abroad, the nation’s Ministry of Electronics and Information Technology said at the time. The banned apps are “prejudicial to sovereignty and integrity of India,” it added.

KRAFTON, the parent firm of PUBG Corporation, inked a deal with Microsoft to store users’ data of PUBG Mobile and its other properties on Azure servers. Microsoft has three cloud regions in India. Prior to the move, PUBG Mobile data concerning Indian users was stored on Tencent Cloud. In addition, PUBG said it is committed to conducting periodic audits of its Indian users’ data.

In India, PUBG has also cut publishing ties with Chinese giant Tencent, its publisher and distributor in many markets. This has allowed PUBG Corporation to regain the publishing rights of its game in India.

At face value, it appears that PUBG Corporation has resolved the issues that the Indian government had raised. But industry executives say that meeting those concerns is perhaps not all it would take to return to the country.

Here’s where things get complicated.

Not a single app India has blocked in the country has made its comeback yet. Some firms such as TikTok have been engaging with the Indian government for more than four months and have promised to make investments in the country, but they are still not out of the woods.

PUBG Corporation, too, has not revealed when it plans to release the new game in India. “More information about the launch of PUBG Mobile India will be shared at a later day,” it said in a statement last Thursday. According to a popular YouTuber who publishes gameplay videos on PUBG Mobile, the company has privately released the installation file of the new game and has hinted that it plans to release the game in India as soon as Friday. (There’s also a big marketing campaign in the works, which could begin on Friday, people familiar with the matter told TechCrunch.)

Powered by WPeMatico

News today that Ant Group’s IPO is suddenly on hold in both Shanghai and Hong Kong caused a sell-off of Alibaba shares. This afternoon, equity in sister-company Alibaba is off around 8% in the wake of the delayed offering and news that Ant had run into regulatory issues with the Chinese government.

Ant was spun out of Alibaba, which owns a one-third stake in the financial technology powerhouse.

Ant’s IPO was on track to be among the largest in history, perhaps raising as much as $34.5 billion in its dual-listing share sale. The company was going to have little trouble filling that book, with retail demand for its shares at IPO reaching nearly $3 trillion in mainland China alone (it’s not uncommon for popular share issues to have massive oversubscription).

That the IPO was called off is financial news on a scale that is hard to comprehend. Ant would have sported a possible market valuation of more than $300 billion at its IPO price. Such a valuation would rank it amongst the most valuable companies in the world.

Alibaba is worth around $772 billion today after the news, off from a value of around $841 billion yesterday. Ant’s delay has cost its former parent company around $60 billion in market capitalization in a single day.

Ant has its roots in Alipay, an online payment service founded in 2004. The company’s Alibaba spin-out came seven years later in 2011, with its former parent company buying 33% of its value in 2018 ahead of its planned IPO. At the time, Ant was valued around $60 billion.

The company’s IPO prospectus details the company’s work in credit, investing, insurance and other fintech-related areas. Ant’s reach has become staggering over time, with Alipay counting over 1 billion annual active users and over 80 million active merchants on the platform.

Ant competes with Tencent’s WePay, amongst other products and services.

As TechCrunch reported this morning, Ant has a history of regulatory issues with the Chinese Communist Party. Precisely what went wrong this time so close to its debut is still not perfectly clear, but news that Alibaba founder and Ant chairman Jack Ma had dinged China’s financial regulation in recent weeks could be part of the issue.

So long as the IPO remains on hold, and a cloud sits atop Mt. Ant, Alibaba shares could remain depressed.

Powered by WPeMatico

The long-anticipated IPO of Alibaba-affiliated Chinese fintech giant Ant Group could raise tens of billions of dollars in a dual-listing on both the Shanghai and Hong Kong exchanges.

Shares for the company formerly known as Ant Financial are expected to price at around HK$80, or roughly 68 to 69 Chinese Yuan. The company is selling around 134 million shares in the Hong Kong portion of its debut, worth around $17.25 billion American dollars at HK$80 apiece.

Given that the share sale is expected to raise a similar amount of money from its Shanghai listing, the company’s IPO could raise as much as $34.5 billion. That tally would make the debut the largest in history, besting the recent Aramco IPO that raised around $29.4 billion.

Alibaba owns a 33% stake in Ant Group. At its currently expected share price, Ant Group would be worth as much as $310 billion, according to The New York Times, or $313 billion per CNBC.

Ant Group’s huge IPO fits its own epic scale. As TechCrunch reported in July, Ant had around 1.3 billion annual active users in March of this year, a number that could have risen in recent quarters. Ant’s Alipay competes with Tencent’s WeChat Pay in the huge and lucrative Chinese market.

The Ant Group IPO could be viewed as a moment in which the United States stock markets showed weakness. When Alibaba went public back in 2014, it did so via the New York Stock Exchange. The Chinese tech giant later dual-listed on the Hong Kong exchange. To see Ant Group dual-list on the Hong Kong and Shanghai indices without a float in New York shows what is possible outside of the United States when it comes to capital financing.

Fintech startups have broadly seen their fortunes rise during 2020 as the global pandemic changed consumer behavior and moved more commerce and payments into the digital realm. And IPOs have generally performed strongly as well, meaning that Ant Group could find a few tailwinds for its equity when it begins to trade.

Ant has not been content to stick to its knitting, keeping itself busy by investing in other startups. The company took a small stake in installment-payment service Klarna earlier this year, for example.

At a valuation of more than $310 billion, Ant Group would be worth about as much as JPMorgan Chase, the most valuable American bank today. It would also best U.S.-based digital payments leader PayPal, which is currently valued at $236 billion, as well as Square, which is valued at $77 billion.

Powered by WPeMatico

This has been a long time coming, but the OpenStack Foundation today announced that it is changing its name to “Open Infrastructure Foundation,” starting in 2021.

The announcement, which the foundation made at its virtual developer conference, doesn’t exactly come as a surprise. Over the course of the last few years, the organization started adding new projects that went well beyond the core OpenStack project, and renamed its conference to the “Open Infrastructure Summit.” The organization actually filed for the “Open Infrastructure Foundation” trademark back in April.

After years of hype, the open-source OpenStack project hit a bit of a wall in 2016, as the market started to consolidate. The project itself, which helps enterprises run their private cloud, found its niche in the telecom space, though, and continues to thrive as one of the world’s most active open-source projects. Indeed, I regularly hear from OpenStack vendors that they are now seeing record sales numbers — despite the lack of hype. With the project being stable, though, the Foundation started casting a wider net and added additional projects like the popular Kata Containers runtime and CI/CD platform Zuul.

“We are officially transitioning and becoming the Open Infrastructure Foundation,” long-term OpenStack Foundation executive president Jonathan Bryce told me. “That is something that I think is an awesome step that’s built on the success that our community has spawned both within projects like OpenStack, but also as a movement […], which is [about] how do you give people choice and control as they build out digital infrastructure? And that is, I think, an awesome mission to have. And that’s what we are recognizing and acknowledging and setting up for another decade of doing that together with our great community.”

In many ways, it’s been more of a surprise that the organization waited as long as it did. As the foundation’s COO Mark Collier told me, the team waited because it wanted to be sure that it did this right.

“We really just wanted to make sure that all the stuff we learned when we were building the OpenStack community and with the community — that started with a simple idea of ‘open source should be part of cloud, for infrastructure.’ That idea has just spawned so much more open source than we could have imagined. Of course, OpenStack itself has gotten bigger and more diverse than we could have imagined,” Collier said.

As part of today’s announcement, the group also announced that its board approved four new members at its Platinum tier, its highest membership level: Ant Group, the Alibaba affiliate behind Alipay, embedded systems specialist Wind River, China’s FiberHome (which was previously a Gold member) and Facebook Connectivity. These companies will join the new foundation in January. To become a Platinum member, companies must contribute $350,000 per year to the foundation and have at least two full-time employees contributing to its projects.

“If you look at those companies that we have as Platinum members, it’s a pretty broad set of organizations,” Bryce noted. “AT&T, the largest carrier in the world. And then you also have a company Ant, who’s the largest payment processor in the world and a massive financial services company overall — over to Ericsson, that does telco, Wind River, that does defense and manufacturing. And I think that speaks to that everybody needs infrastructure. If we build a community — and we successfully structure these communities to write software with a goal of getting all of that software out into production, I think that creates so much value for so many people: for an ecosystem of vendors and for a great group of users and a lot of developers love working in open source because we work with smart people from all over the world.”

The OpenStack Foundation’s existing members are also on board and Bryce and Collier hinted at several new members who will join soon but didn’t quite get everything in place for today’s announcement.

We can probably expect the new foundation to start adding new projects next year, but it’s worth noting that the OpenStack project continues apace. The latest of the project’s bi-annual releases, dubbed “Victoria,” launched last week, with additional Kubernetes integrations, improved support for various accelerators and more. Nothing will really change for the project now that the foundation is changing its name — though it may end up benefitting from a reenergized and more diverse community that will build out projects at its periphery.

Powered by WPeMatico

Flash Express, a two-year-old logistics startup that works with e-commerce firms in Thailand, said on Monday it has raised $200 million in a new financing round as it looks to double down on a rapidly growing market spurred by demand due to the coronavirus pandemic.

The funding, a Series D, was led by PTT Oil and Retail Business Public Company Limited, the marquee oil and retail businesses of Thai conglomerate PTT. Durbell and Krungsri Finnovate, two other top conglomerates in the Southeast Asian country, also participated in the round, which brings Flash Express’ to-date raise to about $400 million.

Flash Express, which operates door-to-door pickup and delivery service, claims to be the second largest private player to operate in this space. The startup, which also counts Alibaba as an investor, entered the market with delivery fees as low as 60 cents per parcel, a move that allowed it to quickly win a significant market share.

The startup has also expanded aggressively in the past year. Flash Express had about 1,100 delivery points during this time last year. Now it has more than 5,000, exceeding those of 138-year-old Thailand Post.

Flash Express currently delivers more than 1 million parcels a day, up from about 50,000 during the same time last year. The startup says it has also invested heavily in technology that has enabled it to handle over 100,000 parcels in a minute by fully automated sorting systems.

Komsan Lee, CEO of Flash Express, said the startup plans to deploy the fresh funds to introduce new services and expand to other Southeast Asian markets (names of which he did not identify). “We are also prepared to create and develop new technologies to achieve even greater delivery and logistics efficiency. More importantly we intend to assist SMEs in lowering their investment costs which we believe will provide long-term benefit for the overall Thai economy in the digital era,” he said.

Retail Business Public Company Limited plans to leverage Flash Express’ logistics network as it looks to meet the rising demand from consumers, said Rajsuda Rangsiyakull, senior executive vice president for Corporate Strategy, Innovation and Sustainability at Retail Business Public Company Limited.

Flash Express competes with Best Express — which, like Flash, is also backed by Alibaba — and Kerry Express, which filed for an initial public offering in late August.

Even as online shopping and delivery has accelerated in recent months, some estimates suggest that the overall logistics market in Thailand will see its first contraction in the history this year. Chumpol Saichuer, president of the Thai Transportation and Logistics Association, said last month Thailand’s logistics business has already been hit hard by the slowing global economy.

Powered by WPeMatico

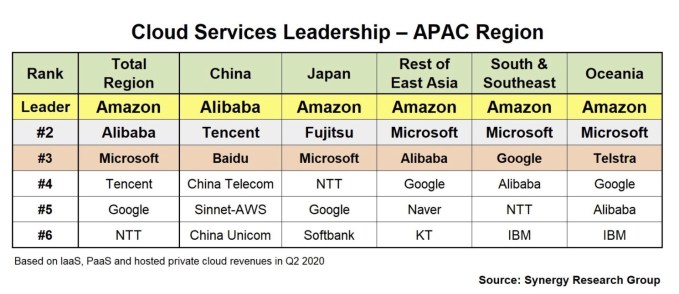

When you look at the Asia-Pacific (APAC) regional cloud infrastructure numbers, it would be easy to think that one of the Chinese cloud giants, particularly Alibaba, would be the leader in that geography, but new numbers from Synergy Research show Amazon leading across the region overall, which generated $9 billion in revenue in Q2.

The only exception to Amazon’s dominance was in China, where Alibaba leads the way with Tencent and Baidu coming in second and third, respectively. As Synergy’s John Dinsdale points out, China has its own unique market dynamics, and while Amazon leads in other APAC sub-regions, it remains competitive.

“China is a unique market and remains dominated by local companies, but beyond China there is strong competition between a range of global and local companies. Amazon is the leader in four of the five sub-regions, but it is not the market leader in every country,” he explained in a statement.

Image Credits: Synergy Research

The $9 billion in revenue across the region in Q2 represents less than a third of the more than $30 billion generated in the worldwide market in the quarter, but the APAC cloud market is still growing at more than 40% per year. It’s also worth pointing out as a means of comparison that Amazon alone generated more than the entire APAC region, with $10.81 billion in cloud infrastructure revenue in Q2.

While Dinsdale sees room for local vendors to grow, he says that the global nature of the cloud market in general makes it difficult for these players to compete with the largest companies, especially as they try to expand outside their markets.

“The challenge for local players is that in most ways cloud is a truly global market, requiring global presence, leading edge technology, strong brand name and credibility, extremely deep pockets and a long-term focus. For any local cloud companies looking to expand significantly beyond their home market, that is an extremely challenging proposition,” Dinsdale said in a statement.

Powered by WPeMatico