This is what a foldable phone case looks like

Foldable phones are having their moments at this year’s Mobile World Congress. A few days after Samsung debuted the Galaxy Fold on stage at an event in San Francisco, Huawei has just shown off its solution, the Mate X.

On the face of it, the device looks like it may well be a step up from the Galaxy device, right down to its three large screens. Of course, all of that display real estate presents some key new challenges, beyond the underlying technology. Namely, how to avoid getting those surfaces scratched to hell.

Huawei’s got a solution for that, too — albeit not quite as elegant as the phone itself. In one of the earliest examples we’ve seen indicating what foldable cases may look like, going forward, the company quickly showed us a slip case.

The accessory opens to accept the folded up phone, snapping shut to protect both sides of the device. That means it doesn’t unfold to protect the eight-inch display — which, to be fair, won’t be exposed when you’re carrying the device around in your pocket.

Of course, this is just an early solution developed in house. No doubt future cases will be every bit as varied — if not more so — than the devices themselves. This, at least, probably won’t run to $2,600.

Powered by WPeMatico

Huawei unveils its 5G consumer solutions built on new 5G chipset

Today at MWC Barcalona Huawei launched its first consumer 5G products. Aside from its 5G Mate 20 X, the company also updated and new products that will bring 5G to people’s homes and devices through routers and connectivity options. Most consumers will first taste 5G not on a dedicated device like a phone, but through broadband-like services and these devices are aimed at that market.

Last year, Huawei announced the 5G CPE Pro but never took it to market. Then, last month, ahead of MWC Barcelona, Huawei announced a new version alongside its new Balong 5000 5G chipset, which is at the heart of its consumer 5G products.

Huawei’s Balong 5000 brings added connectivity options over the company’s previous 5G chipsets. Huawei claims the Balong 5000 is the first chip that supports both standalone (SA) and non-standalone (NSA) network architectures for 5G allowing it connect to existing supercharged 4G networks as well as future 5G networks. It also packs the goods to support vehicle to every communication signaling Huawei’s commitment to infrastructure support.

The company says the Balong 5000 chip can achieve download speeds of 4.6 Gbps and 6.5 Gbps depending on if connected to Sub-6 GHz or high-frequency bands for extended spectrum.

The new 5G CPE Pro packs the Balong 5000 chip along with WiFi 6, which is key to serving 5G’s added speed to devices. With WiFi 6 the CPE Pro can deliver local network speeds of up to 4.8 Gbps.

The 5G CPE Win uses the same Balong 5000 chip and is being positioned as home receiver. It’s weather-proof and can be mounted to a wall, pole, or windowsill and serves network through the house through WiFi or Power Over Ethernet.

The 5G Mobile WiFi is an updated version of a product Huawei announced last year. Like the 5G CPE Pro, the product now features Huawei’s Balong 5000 allowing it connect to existing 4G networks and future 5G networks.

At this time the company did not reveal availability or pricing for any of the above products. Chances are though, giving the company’s legal issues in the States, these products likely will not be available in that market.

Powered by WPeMatico

Huawei is bringing 5G to the Mate 20 X

Today at MWC Barcelona Huawei announced it will bring 5G to its flagship phone, the Mate 20 X. This marks the first 5G phone from the Chinese mobile giant. Huawei joins a growing list of companies introducing their first 5G phone in early 2019.

In the past week, Samsung, Oppo, and Xiaomi announced 5G versions of their flagship phones.

The company failed revealed any more details about the upcoming handset including price and availability. Chances are the Mate 20 X will feature a version of its do-it-all Balong 5000 chipset, the company’s latest 5G chip announced a few weeks ago.

Huawei’s Balong 5000 brings added connectivity options over the company’s previous 5G chipsets. Huawei claims the Balong 5000 is the first chip that supports both standalone (SA) and non-standalone (NSA) network architectures for 5G allowing it connect to existing supercharged 4G networks as well as future 5G networks. This is key as carriers worldwide are looking to sell consumers on the benefits of 5G built on the networks of existing 4G networks.

The Mate 20 X is widely seen as one of the best phones available with an amazing camera, in-screen fingerprint reader, and a large, beautiful screen. Price and market availability

Powered by WPeMatico

Huawei’s 5G foldable costs $2,600

Foldables are expense. And so are 5G phones. But foldable 5G phones? Well, um, get ready for that second mortgage. At the end of Huawei’s MWC press conference, mobile chief Richard Yu dropped a pricing bombshell, noting that the recently announced Mate X will run €2,299 ($2,600).

There’s a pricing premium and then there’s that.

The audience at the event audibly gasped as the price was revealed for the handset, which is set to launch in mid-2019. Yu clearly anticipated the reaction, noting that the company was working with carriers to help bring the price down. The executive took an almost apologetic tone for the price of innovation.

Mass production should help lower the cost as well, but if there was any doubt that this thing is aimed exclusively at early adopters, that should well be put to rest.

Like the Galaxy Fold, the Mate X will feature some beefy specs, including 8GB of RAM, 512GB of storage and a pair of batteries that add up to 4,500mAh. And, well, for $2,600, this thing had better be top of the line.

There’s also the whole problem of Huawei not being able to sell its devices through major channels here in the States. Certainly carriers won’t help subsidize the product in this market, so if that price isn’t enough to make you reconsider, it still may be difficult to come by.

Powered by WPeMatico

The Mate X is Huawei’s 5G foldable

The world’s fastest growing mobile company has long had a chip on its shoulder when it comes to Apple and Samsung. For too long, the company has had to go out of its way to remind the world that it’s capable of being every bit as innovative as those better established brands, a concept very much at the heart of the Mate X.

The device lives right at the cross section of the year’s biggest forward looking trends — foldables and 5G, and unlike some of the concepts we’ve seen to date, the product does so with panache.

It is, of course, a bit of a wild west when it comes to form factors for the burgeoning foldable space. In a quick, behind the scenes briefing ahead of today’s press conference at MWC, we were given the opportunity to see the handset in action. It was, admittedly, a little more rushed than we’d like, involving no actual hands on time with the product — it was more of a stand behind this rope and snap off a couple of photos situation.

No touching, no followup questions. The company promised to shed more light on the product today, as Richard You takes the stage, but for now, it appears to be the kind of cautious presentation one gives involving a device that isn’t quite ready to be put through its paces. Even so, it’s a heck of a lot closer and with much better lighting than we got the first time Samsung showed off its own entry.

And from these early glimpses, I’m mostly impressed with what the Chinese manufacturer was able to do here. Huawei’s brought some clever touches to the product category, and designed what looks to be a pretty slick devices from most angles.

The device is thin, as far as tablets go, at 5.4 mm, unfolded. Closed, it’s nearly double that, at 11 mm. Not thin, exactly, but still a heck of a lot easier to slip into your pants pockets than the 17mm Galaxy Fold.

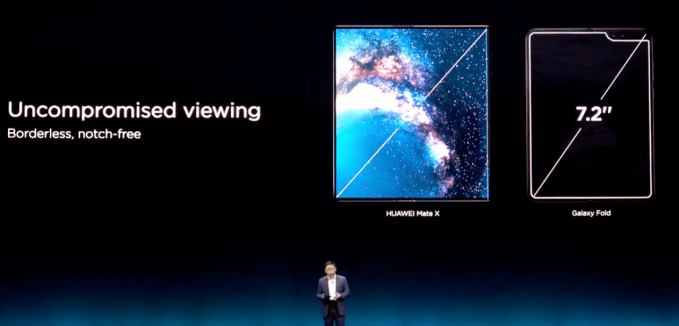

More impressive is what the company’s been able to do with its displays. The screen is very much the thing on these products, and yet the Fold’s outside screen only measures 4.6 inches. The Mate X, meanwhile, sports a pair of outward-facing displays, the larger of which measures 6.6 inches at 2480 x 1148 pixels, with a 19:5 aspect ration.

The flip side is 6.38 inches, allowing for space for the camera bar — a chin that folds over to meet the display. The system features a Leica lens and the design is such that photo subjects can see themselves on the outward-facing display as a shot is taken. On the device’s side is a combo fingerprint reader/power button.

Unfolded using the proprietary “Falcon Wing” hinge (three years in the making, according to mobile CEO Richard Yu), the inside screen is a full eight inches. That’s certainly enough room to have a pair of apps open, side by side. While we didn’t get closer than a few feet away, the vantage point was enough to spot a visible crease in the middle of the phone, detectable when it caught the overhead lights.

The other key part here is, naturally, the 5G. Huawei, of course, manufacturers its own 5G network gear, which means that, unlike most of the competition, it’s been able to speed test. The company calls the Mate X “the world’s fastest 5G phone” — words that admittedly don’t mean a heck of a lot, at the moment. That said, it’s promising download speeds of “up to 4.6 Gbps, which should translate to a 1GB movie download in three seconds.

Inside are a pair of batteries that add up to 4,500mAh – you’re going to need something beefy inside to deal with all of those screens and 5G, which is a notable battery drainer. The company’s Kirin 980 processor is also on board for the device.

Update: The handset will be available mid-year, priced at, get this, $2,600.

Powered by WPeMatico

Accurx raises £8.8M Series A for its messaging app for medical teams and patients

Accurx, the U.K. startup and Entrepreneur First alumni that has developed a messaging service for doctor surgeries, has raised £8.8 million in Series A funding, TechCrunch has learned.

According to multiple sources, London venture capital firm Atomico has led the round, with participation from LocalGlobe and EF. We first heard a term sheet had been put on the table as far back as mid-January, while it is thought the investment only closed last week.

I also understand the round was highly contested, potentially pushing up Accurx’s valuation. One source tells me that Accel was in the running but didn’t end up investing.

Both Atomico and Accurx declined to comment.

Co-founded by Jacob Haddad and Laurence Bargery, who met and subsequently founded the company at Entrepreneur First in 2016, Accurx initially set out to develop a data-set and tools to help tackle the problem of inappropriate use of antibiotics, which is a major contributor to the diminishing effectiveness of antibiotics. Since then the startup has pivoted to focus on creating a broader communication platform to bring medical teams and patients closer together.

(Given Haddad and Bargery’s backgrounds, I dare say that the use of data and machine learning to help improve healthcare delivery is still very much front of mind for the company).

As it exists today, Accurx’s main product is Chain SMS, a messaging app for use by doctor surgeries to communicate with patients. It has been designed to support nurses, administration staff and practice managers etc., as well as GPs. Typical use-cases for Chain SMS includes sending advice to patients, notifying a patient of normal results, and reminding them to book appointments. All communication is saved back to a patient’s medical record to ensure a more joined up approach than might otherwise happen using arcane communication methods such as telephone calls and sending letters in the post.

(Somewhat related: this weekend, British Health Secretary Matt Hancock has called for the use of pagers for communications within the NHS to be phased out by 2021. The outdated technology costs the U.K. taxpayer-funded health service £6.6m per year, apparently).

To that end — and no doubt not gone unnoticed by investors — I gather that Chain SMS is already in use by 20 percent of GP practices in England, from close to zero when it launched in February 2018. The conventional wisdom is that startups find it difficult to penetrate the NHS, when in practice this is starting to change, whilst GP surgeries, although funded through the NHS, are actually run as independent businesses so arguably easier to sell into.

A fun fact: A quick spelunking of Companies House records reveals that prominent Conservative Party politician and former Army officer Tom Tugendhat — who is also the current chairman of the Foreign Affairs Committee and tipped by some to be a possible future PM — is an early investor in Accurx.

Separately, I’m told that Wendy Tan White, the former EF General Partner who recently joined Alphabet’s X (formerly Google X) as Vice President, has also invested as part of this latest round. Meanwhile, I understand that recently recruited Principal Irina Haivas led on behalf of Atomico. Haivas is a former surgeon and former surgical fellow at Harvard Medical School (yes, you read that correctly!) and has previously worked at healthcare investor GHO Capital Partners.

Powered by WPeMatico

Xiaomi announces its first 5G phone, the Mi Mix 3 5G

Xiaomi doesn’t want to miss the 5G bandwagon — the company just unveiled its first smartphone that comes with a 5G modem at a press conference in Barcelona. The Mi Mix 3 5G is a new variant of the Mi Mix 3, a phone that Xiaomi originally released in October 2018.

The company is trying to create a bezel-less phone with the Mi Mix line. Instead of a notch or a punch-hole display, Xiaomi has opted for a sliding front-facing camera. The result is a 93.4 percent screen-to-body ratio. You can find two cameras on the back of the device, which give you the ability to shoot slow-motion videos at 960 frames per second. The handset body is made of ceramic.

There are a few changes in the new device. First, Xiaomi has swapped the Qualcomm Snapdragon 845 system-on-a-chip with a Snapdragon 855 system-on-a-chip — the same chipset you can find on the Samsung Galaxy S10. When it comes to the modem, the company is using Qualcomm’s X50 5G modem.

It’s always hard to grasp the advantages of 5G. That’s why Xiaomi’s Director of Product Management Donovan Sung started a video call with one of its telecom partner, Orange Spain. There was some latency and it wasn’t that convincing.

At launch, Xiaomi is partnering with Orange, 3, Sunrise, Telefonica, Tim and Vodafone. The device will be available in May for €599 ($680) in two colors — Onyx Black and Sapphire Blue. Let’s see if any 5G network will be ready by then.

Chipmaker Qualcomm’s president, Cristiano Amon, stole a little of Xiaomi’s thunder by naming the Mi Mix 3 5G first during a turn on stage at the press conference as a Xiaomi partner.

Amon took the opportunity to give a muscular sales pitch for 5G, claiming the next-gen cellular tech would come faster than the transition from 3G to 4G/LTE and bring transformative benefits for consumers — touting the likes of premium gaming on mobile to replace game consoles. That’s because 5G should greatly lower latency and improve online gaming.

“5G is here. Not in 2020, not in late 2020 – it’s here right now in 2019. 2019 is the year of 5G,” he claimed, suggesting 5G device launches would be fast-followed by commercial 5G services as early as the second half of this year.

On device AI will also get a boost from 5G, Amon suggested, arguing that “every” app will be able to leverage machine learning thanks to reduced latency.

“You can unleash the power of the cloud for every app and service,” he said.

“5G will improve substantially how we think about our phones,” he added. “Everything will get better.”

Xiaomi also used its first MWC new product launch event opportunity to announce the Mi 9 once again. The company has already unveiled its new flagship device earlier this week. It’s a more traditional phone with a waterdrop-shaped notch, a Snapdragon 855 chipset and a triple camera system. You can find a 48-megapixel camera, a 16-megapixel wide-angle camera and a 12-megapixel telephoto camera on the back of the device.

The Mi 9 will be priced at €449 ($510) for 6GB of RAM and 64GB of storage, €499 ($565) for 6GB of RAM and 128GB of storage. Pre-orders start from today in select European markets — devices should ship by February 28.

There are now 224 million monthly active Xiaomi smartphone users globally. While Xiaomi phones aren’t available in the U.S., you can now buy Xiaomi phones in Spain, the U.K., France and Italy in addition to many Asian markets.

Xiaomi also talked up its wider product portfolio, saying it has more than 2,000 Xiaomi-branded products in all, working with more than 200 partners. The company reiterated that it’s committed to having a dual strategy of smartphones plus A-IoT

It singled out electric scooters to say it’s shipped more than 560,000 Mi scooters to date. The Mi scooter was “probably the best selling personal transportation device in the world in 2018”, it added.

At the event it also announced the launch of another new product: The Mi LED Smart Bulb — a connected light bulb that lets users control light color and brightness via their phone. It’s priced at €19.90. The company tried to demo its smart home ecosystem but failed to turn off the air purifier using Google Assistant.

Xiaomi didn’t say a word on its foldable smartphone. It looks like there’s still some more work to do on the device.

Powered by WPeMatico

Airbnb, Automattic and Pinterest top rank of most acquisitive unicorns

Contributor

It takes a lot more than a good idea and the right timing to build a billion-dollar company. Talent, focus, operational effectiveness and a healthy dose of luck are all components of a successful tech startup. Many of the most successful (or, at least, highest-valued) tech unicorns today didn’t get there alone.

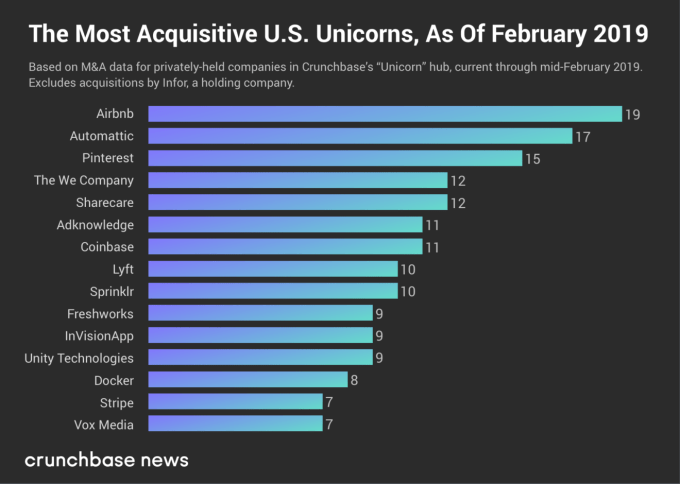

Mergers and acquisitions (M&A) can be a major growth vector for rapidly scaling, highly valued technology companies. It’s a topic that we’ve covered off and on since the very first post on Crunchbase News in March 2017. Nearly two years later, we wanted to revisit that first post because things move quickly, and there is a new crop of companies in the unicorn spotlight these days. Which ones are the most active in the M&A market these days?

The most acquisitive U.S. unicorns today

Before displaying the U.S. unicorns with the most acquisitions to date, we first have to answer the question, “What is a unicorn?” The term is generally applied to venture-backed technology companies that have earned a valuation of $1 billion or more. Crunchbase tracks these companies in its Unicorns hub. The original definition of the term, first applied in a VC setting by Aileen Lee of Cowboy Ventures back in late 2011, specifies that unicorns were founded in or after 2003, following the first tech bubble. That’s the working definition we’ll be using here.

In the chart below, we display the number of known acquisitions made by U.S.-based unicorns that haven’t gone public or gotten acquired (yet). Keep in mind this is based on a snapshot of Crunchbase data, so the numbers and ranking may have changed by the time you read this. To maintain legibility and a reasonable size, we cut off the chart at companies that made seven or more acquisitions.

As one would expect, these rankings are somewhat different from the one we did two years ago. Several companies counted back in early March 2017 have since graduated to public markets or have been acquired.

Who’s gone?

Dropbox, which had acquired 23 companies at the time of our last analysis, went public weeks later and has since acquired two more companies (HelloSign for $230 million in late January 2019 and Verst for an undisclosed sum in November 2017) since doing so. SurveyMonkey, which went public in September 2018, made six known acquisitions before making its exit via IPO.

Who stayed?

Which companies are still in the top ranks? Travel accommodations marketplace giant Airbnb jumped from number four to claim Dropbox’s vacancy as the most acquisitive private U.S. unicorn in the market. Airbnb made six more acquisitions since March 2017, most recently Danish event space and meeting venue marketplace Gaest.com. The still-pending deal was announced in January 2019.

WordPress developer and hosting company Automattic is still ranked number two. Automattic href=”https://www.crunchbase.com/acquisition/automattic-acquires-atavist–912abccd”>acquired one more company — digital publication platform Atavist — since we last profiled unicorn M&A. Open-source software containerization company Docker, photo-sharing and search site Pinterest, enterprise social media management company Sprinklr and venture-backed media company Vox Media remain, as well.

Who’s new?

There are some notable newcomers in these rankings. We’ll focus on the most notable three: The We Company, Coinbase and Lyft. (Honorable mention goes to Stripe and Unity Technologies, which are also new to this list.)

The We Company (the holding entity for WeWork) has made 10 acquisitions over the past two years. Earlier this month, The We Company bought Euclid, a company that analyzes physical space utilization and tracks visitors using Wi-Fi fingerprinting. Other buyouts include Meetup (a story broken by Crunchbase News in November 2017) reportedly for $200 million. Also in late 2017, The We Company acquired coding and design training program Flatiron School, giving the company a permanent tenant in some of its commercial spaces.

In its bid to solidify its position as the dominant consumer cryptocurrency player, Coinbase has been on quite the M&A tear lately. The company recently announced its plans to acquire Neutrino, a blockchain analytics and intelligence platform company based in Italy. As we covered, Coinbase likely made the deal to improve its compliance efforts. In January, Coinbase acquired data analysis company Blockspring, also for an undisclosed sum. The crypto company’s other most notable deal to date was its April 2018 buyout of the bitcoin mining hardware turned cryptocurrency micro-transaction platform Earn.com, which Coinbase acquired for $120 million.

And finally, there’s Lyft, the more exclusively U.S.-focused ride-hailing and transportation service company. Lyft has made 10 known acquisitions since it was founded in 2012. Its latest M&A deal was urban bike service Motivate, which Lyft acquired in June 2018. Lyft’s principal rival, Uber, has acquired six companies at the time of writing. Uber bought a bike company of its own, JUMP Bikes, at a price of $200 million, a couple of months prior to Lyft’s Motivate purchase. Here too, the Lyft-Uber rivalry manifests in structural sameness. Fierce competition drove Uber and Lyft to raise money in lock-step with one another, and drove M&A strategy as well.

What to take away

With long-term business success, it’s often a chicken-and-egg question. Is a company successful because of the startups it bought along the way? Or did it buy companies because it was successful and had an opening to expand? Oftentimes, it’s a little of both.

The unicorn companies that dominate the private funding landscape today (if not in the number of deals, then in dollar volume for sure) continue to raise money in the name of growth. Growth can come the old-fashioned way, by establishing a market position and expanding it. Or, in the name of rapid scaling and ostensibly maximizing investor returns, M&A provides a lateral route into new markets or a way to further entrench the status quo. We’ll see how that strategy pays off when these companies eventually find the exit door .

Powered by WPeMatico

Oppo announces 5G and 10x lossless zoom handsets

Saturday afternoon is a rough time for a press conference — particularly with the official kickoff of Mobile World Congress still a few days away. That said, there are certain advantages to being an early bird. Chief among them is the ability to claim firsts — namely having the first 5G handset of the show.

That might not mean a lot in the grand scheme of things, but in a week that’s expected to be dominated by 5G announcements, it’s a way to stand out from the crowd. Of course, like the rest of the promised 5G handsets we’ve heard about so far — with the noble exception of Samsung’s — details are still pretty scarce

What we do know is that the handset — along with so many others set to be announced this week — will be powered by Qualcomm’s Snapdragon 855. Fitting, given that we can almost certainly expect some 5G news out of the chipmaker this week. Oppo also says the device will be on display on the show floor this week — actually firing it up and experiencing those next generation speeds in person, however, is a different thing entirely.

Another bit of news out of the event is the promise of 10x lossless zoom (16mm-160mm) for the company’s next flagship. If its works as advertised that’s a nice little distinguisher from the competition — though 10x zoom likely isn’t a day to day feature for most smartphone users. That device is due out at some point in Q2.

Powered by WPeMatico

Startups Weekly: Flexport, Clutter and SoftBank’s blood money

The Wall Street Journal published a thought-provoking story this week, highlighting limited partners’ concerns with the SoftBank Vision Fund’s investment strategy. The fund’s “decision-making process is chaotic,” it’s over-paying for equity in top tech startups and it’s encouraging inflated valuations, sources told the WSJ.

The report emerged during a particularly busy time for the Vision Fund, which this week led two notable VC deals in Clutter and Flexport, as well as participated in DoorDash’s $400 million round; more on all those below. So given all this SoftBank news, let us remind you that given its $45 billion commitment, Saudi Arabia’s Public Investment Fund (PIF) is the Vision Fund’s largest investor. Saudi Arabia is responsible for the planned killing of dissident journalist Jamal Khashoggi.

Here’s what I’m wondering this week: Do CEOs of companies like Flexport and Clutter have a responsibility to address the source of their capital? Should they be more transparent to their customers about whose money they are spending to achieve rapid scale? Send me your thoughts. And thanks to those who wrote me last week re: At what point is a Y Combinator cohort too big? The general consensus was this: the size of the cohort is irrelevant, all that matters is the quality. We’ll have more to say on quality soon enough, as YC demo days begin on March 18.

Anyways…

Surprise! Sort of. Not really. Pinterest has joined a growing list of tech unicorns planning to go public in 2019. The visual search engine filed confidentially to go public on Thursday. Reports indicate the business will float at a $12 billion valuation by June. Pinterest’s key backers — which will make lots of money when it goes public — include Bessemer Venture Partners, Andreessen Horowitz, FirstMark Capital, Fidelity and SV Angel.

Ride-hailing company Lyft plans to go public on the Nasdaq in March, likely beating rival Uber to the milestone. Lyft’s S-1 will be made public as soon as next week; its roadshow will begin the week of March 18. The nuts and bolts: JPMorgan Chase has been hired to lead the offering; Lyft was last valued at more than $15 billion, while competitor Uber is valued north of $100 billion.

Despite scrutiny for subsidizing its drivers’ wages with customer tips, venture capitalists plowed another $400 million into food delivery platform DoorDash at a whopping $7.1 billion valuation, up considerably from a previous valuation of $3.75 billion. The round, led by Temasek and Dragoneer Investment Group, with participation from previous investors SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia Capital and Y Combinator, will help DoorDash compete with Uber Eats. The company is currently seeing 325 percent growth, year-over-year.

Here are some more details on those big Vision Fund Deals: Clutter, an LA-based on-demand storage startup, closed a $200 million SoftBank-led round this week at a valuation between $400 million and $500 million, according to TechCrunch’s Ingrid Lunden’s reporting. Meanwhile, Flexport, a five-year-old, San Francisco-based full-service air and ocean freight forwarder, raised $1 billion in fresh funding led by the SoftBank Vision Fund at a $3.2 billion valuation. Earlier backers of the company, including Founders Fund, DST Global, Cherubic Ventures, Susa Ventures and SF Express all participated in the round.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

Menlo Ventures has a new $500 million late-stage fund. Dubbed its “inflection” fund, it will be investing between $20 million and $40 million in companies that are seeing at least $5 million in annual recurring revenue, growth of 100 percent year-over-year, early signs of retention and are operating in areas like cloud infrastructure, fintech, marketplaces, mobility and SaaS. Plus, Allianz X, the venture capital arm attached to German insurance giant Allianz, has increased the size of its fund to $1.1 billion and London’s Entrepreneur First brought in $115 million for what is one of the largest “pre-seed” funds ever raised.

Flipkart co-founder invests $92M in Ola

Redis Labs raises a $60M Series E round

Chinese startup Panda Selected nabs $50M from Tiger Global

Image recognition startup ViSenze raises $20M Series C

Circle raises $20M Series B to help even more parents limit screen time

Showfields announces $9M seed funding for a flexible approach to brick-and-mortar retail

Podcasting startup WaitWhat raises $4.3M

Zoba raises $3M to help mobility companies predict demand

Indian delivery men working with the food delivery apps Uber Eats and Swiggy wait to pick up an order outside a restaurant in Mumbai. ( INDRANIL MUKHERJEE/AFP/Getty Images)

According to Indian media reports, Uber is in the final stages of selling its Indian food delivery business to local player Swiggy, a food delivery service that recently raised $1 billion in venture capital funding. Uber Eats plans to sell its Indian food delivery unit in exchange for a 10 percent share of Swiggy’s business. Swiggy was most recently said to be valued at $3.3 billion following that billion-dollar round, which was led by Naspers and included new backers Tencent and Uber investor Coatue.

Lalamove, a Hong Kong-based on-demand logistics startup, is the latest venture-backed business to enter the unicorn club with the close of a $300 million Series D round this week. The latest round is split into two, with Hillhouse Capital leading the “D1” tranche and Sequoia China heading up the “D2” portion. New backers Eastern Bell Venture Capital and PV Capital and returning investors ShunWei Capital, Xiang He Capital and MindWorks Ventures also participated.

Longtime investor Keith Rabois is joining Founders Fund as a general partner. Here’s more from TechCrunch’s Connie Loizos: “The move is wholly unsurprising in ways, though the timing seems to suggest that another big fund from Founders Fund is around the corner, as the firm is also bringing aboard a new principal at the same time — Delian Asparouhov — and firms tend to bulk up as they’re meeting with investors. It’s also kind of time, as these things go. Founders Fund closed its last flagship fund with $1.3 billion in 2016.”

If you enjoy this newsletter, be sure to check out TechCrunch’s venture capital-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I discuss Pinterest’s IPO, DoorDash’s big round and SoftBank’s upset LPs.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico