Huawei opens a cybersecurity transparency center in the heart of Europe

5G kit maker Huawei opened a Cyber Security Transparency center in Brussels yesterday as the Chinese tech giant continues to try to neutralize suspicion in Western markets that its networking gear could be used for espionage by the Chinese state.

Huawei announced its plan to open a European transparency center last year but giving a speech at an opening ceremony for the center yesterday the company’s rotating CEO, Ken Hu, said: “Looking at the events from the past few months, it’s clear that this facility is now more critical than ever.”

Huawei said the center, which will demonstrate the company’s security solutions in areas including 5G, IoT and cloud, aims to provide a platform to enhance communication and “joint innovation” with all stakeholders, as well as providing a “technical verification and evaluation platform for our

customers”.

“Huawei will work with industry partners to explore and promote the development of security standards and verification mechanisms, to facilitate technological innovation in cyber security across the industry,” it said in a press release.

“To build a trustworthy environment, we need to work together,” Hu also said in his speech. “Both trust and distrust should be based on facts, not feelings, not speculation, and not baseless rumour.

“We believe that facts must be verifiable, and verification must be based on standards. So, to start, we need to work together on unified standards. Based on a common set of standards, technical verification and legal verification can lay the foundation for building trust. This must be a collaborative effort, because no single vendor, government, or telco operator can do it alone.”

The company made a similar plea at Mobile World Congress last week when its rotating chairman, Guo Ping, used a keynote speech to claim its kit is secure and will never contain backdoors. He also pressed the telco industry to work together on creating standards and structures to enable trust.

“Government and the mobile operators should work together to agree what this assurance testing and certification rating for Europe will be,” he urged. “Let experts decide whether networks are safe or not.”

Also speaking at MWC last week the EC’s digital commissioner, Mariya Gabriel, suggested the executive is prepared to take steps to prevent security concerns at the EU Member State level from fragmenting 5G rollouts across the Single Market.

She told delegates at the flagship industry conference that Europe must have “a common approach to this challenge” and “we need to bring it on the table soon”.

Though she did not suggest exactly how the Commission might act.

A spokesman for the Commission confirmed that EC VP Andrus Ansip and Huawei’s Hu met in person yesterday to discuss issues around cybersecurity, 5G and the Digital Single Market — adding that the meeting was held at the request of Hu.

“The Vice-President emphasised that the EU is an open rules based market to all players who fulfil EU rules,” the spokesman told us. “Specific concerns by European citizens should be addressed. We have rules in place which address security issues. We have EU procurement rules in place, and we have the investment screening proposal to protect European interests.”

“The VP also mentioned the need for reciprocity in respective market openness,” he added, further noting: “The College of the European Commission will hold today an orientation debate on China where this issue will come back.”

In a tweet following the meeting Ansip also said: “Agreed that understanding local security concerns, being open and transparent, and cooperating with countries and regulators would be preconditions for increasing trust in the context of 5G security.”

Met with @Huawei rotating CEO Ken Hu to discuss #5G and #cybersecurity.

Agreed that understanding local security concerns, being open and transparent, and cooperating with countries and regulators would be preconditions for increasing trust in the context of 5G security. pic.twitter.com/ltATdnnzvL

— Andrus Ansip (@Ansip_EU) March 4, 2019

Reuters reports Hu saying the pair had discussed the possibility of setting up a cybersecurity standard along the lines of Europe’s updated privacy framework, the General Data Protection Regulation (GDPR).

Although the Commission did not respond when we asked it to confirm that discussion point.

GDPR was multiple years in the making and before European institutions had agreed on a final text that could come into force. So if the Commission is keen to act “soon” — per Gabriel’s comments on 5G security — to fashion supportive guardrails for next-gen network rollouts a full blown regulation seems an unlikely template.

More likely GDPR is being used by Huawei as a byword for creating consensus around rules that work across an ecosystem of many players by providing standards that different businesses can latch on in an effort to keep moving.

Hu referenced GDPR directly in his speech yesterday, lauding it as “a shining example” of Europe’s “strong experience in driving unified standards and regulation” — so the company is clearly well-versed in how to flatter hosts.

“It sets clear standards, defines responsibilities for all parties, and applies equally to all companies operating in Europe,” he went on. “As a result, GDPR has become the golden standard for privacy protection around the world. We believe that European regulators can also lead the way on similar mechanisms for cyber security.”

Hu ended his speech with a further industry-wide plea, saying: “We also commit to working more closely with all stakeholders in Europe to build a system of trust based on objective facts and verification. This is the cornerstone of a secure digital environment for all.”

Huawei’s appetite to do business in Europe is not in doubt, though.

The question is whether Europe’s telcos and governments can be convinced to swallow any doubts they might have about spying risks and commit to working with the Chinese kit giant as they roll out a new generation of critical infrastructure.

Powered by WPeMatico

The Silicon Valley exodus continues

For a long time, it was the norm for founders to haul their hardware to the 3000 block of Sand Hill Road, where the venture capitalists of “Silicon Valley” would be awaiting their pitches. Today, many of the investors that touted the exclusivity of “The Valley” have moved north to San Francisco, where they have better access to top entrepreneurs.

Y Combinator, a Silicon Valley institution and to many the lifeblood of the startups and venture capital ecosystem, is the latest to pack up shop. YC, which invests $150,000 for 7 percent equity in a few hundred startups per year, is currently searching for a space in SF to operate its accelerator program, sources close to YC confirm to TechCrunch, because the majority of YC’s employees and its portfolio founders reside in the city.

Founded in 2005, YC’s roots are in Mountain View, California. In its first four years, YC offered programs in Cambridge, Massachusetts and Mountain View before opting in 2009 to focus exclusively on The Valley. In late 2013, as more and more of its partners and portfolio companies were establishing themselves in SF, YC opened a satellite office in the city in what would be the beginning of its journey northbound.

The small satellite office, used to support SF-based staff and provide portfolio companies resources and workspace, is located in Union Square. The fate of YC’s Mountain View office is unclear.

YC’s move north will be the latest in a series of small changes that, together, point to a new era for the accelerator. Approaching its 15th birthday, YC announced in September it was changing up the way it invests. No longer would it seed startups with $120,000 for 7 percent equity, it would give startups an additional 30,000 to cover the expenses of getting a business off the ground and it would admit a whole lot more companies.

YC began mentoring its largest cohort of companies to date in late 2018. The astonishing 200-plus group in its winter 2019 batch is more than 50 percent larger than the 132-team cohort that graduated in spring 2018. To accommodate the truly gigantic group at YC Demo Days later this month (March 18 and 19), YC has moved to a new venue, SF’s Pier 48. Historically, YC Demo Days were hosted at the Computer History Museum near its home in Mountain View.

YC has also ditched “Investor Day,” which is typically an opportunity for investors to schedule meetings with startups that just completed the accelerator program. YC writes that the decision came “after analyzing its effectiveness.” On top of that, rumors suggest YC is planning to put an end to Demo Days. Other accelerators, AngelPad for example, put a stop to the tradition last year after realizing demo day was more of a stress to startup founders than a resource. Sources close to YC, however, tell TechCrunch these rumors are categorically false.

YC isn’t the first accelerator to ditch its Silicon Valley digs. 500 Startups, a smaller yet still prolific accelerator, opened an SF satellite office the same year as YC, and in 2018, the nine-year-old program made the decision to permanently relocate to SF. Venture capital firms, too, have realized the opportunities are larger in SF than on Sand Hill Road.

The transition from the peninsula to the city began around 2012, when VC heavyweights like Uber and Twitter-backer Benchmark opened an office in SF’s mid-market neighborhood. Months later, 47-year-old Kleiner Perkins, an investor in Stripe and DoorDash, opened the doors to its new workplace in SF’s South Park neighborhood.

Around that same time a whole bunch of firms followed suit: Shasta Ventures, Norwest Venture Partners, Accel, GV, General Catalyst and NEA opened SF shops, to name a few. Many of these firms, Benchmark, Kleiner and Accel, for example, held onto their Silicon Valley locations. Firms like True Ventures and Peter Thiel’s Founders Fund planted stakes in SF years prior. Both firms have operated SF offices since 2005; True Ventures, for its part, has managed a Palo Alto office from the get-go, as well.

“When we first started, it was [expected] that it would be maybe 60-40 Peninsula to the city; it’s actually turned out to be 80-20 SF to The Valley,” True Ventures co-founder Phil Black told TechCrunch. “For us, it was important to be near our customer: the founder. It’s important for us to be in and around where founders are doing their things.”

The transition out of The Valley is ongoing. Other VC funds are still in the process of opening their first SF offices as more partners beg for shorter commutes. Khosla Ventures, for example, is currently searching for an SF headquarters.

Silicon Valley real estate will likely remain a hot — or warm, at least — commodity, however. Why? Because long-time investors have lives established in that part of the bay, where they’ve built homes in well-kept, affluent cities like Woodside, Atherton and Los Altos.

Still, Y Combinator’s move highlights an increasingly adopted mantra: Silicon Valley isn’t the goldmine it used to be. For the best deals and greatest access to entrepreneurs, SF takes the cake — for now, that is. But with rising rents and a changing attitude toward geographically diverse founders, how long SF will remain the destination for top talent is an entirely different question.

Powered by WPeMatico

Wefox Group, the Berlin-based insurance tech startup, raises $125M Series B led by Mubadala

Wefox Group, the Berlin-based insurtech startup behind the consumer-facing insurance app and carrier One and the insurance platform Wefox, has raised $125 million in Series B funding. Notably, the round is led by Abu Dhabi government-owned Mubadala Ventures (which is also an LP in SoftBank’s Vision Fund) and is the first investment from Mubadala’s newly created European Investment Fund. Chinese investor Creditease also participated.

The investment, which Wefox Group says is the first tranche in the Series B round, will be used for expansion into the European broker market. The German company will also grow its product and engineering teams, specifically in relation to applying “advanced data analytics” to realise Wefox’s vision for an all-in-one insurance platform that places personalisation at the heart of how various insurance coverage is sold and delivered.

Wefox’s existing investors include Target Global, Salesforce Ventures, Seedcamp, Idinvest and Hollywood actor Ashton Kutcher’s investment vehicle Sound Ventures. The startup raised $28 million in Series A funding in late 2016.

In a call with Wefox Group co-founder and CEO Julian Teicke, he disclosed that Wefox has grown its revenues to around $40 million since being founded in 2014. The company now serves more than 1,500 brokers and more than 400,000 customers, making it “Europe’s number one insurtech platform.”

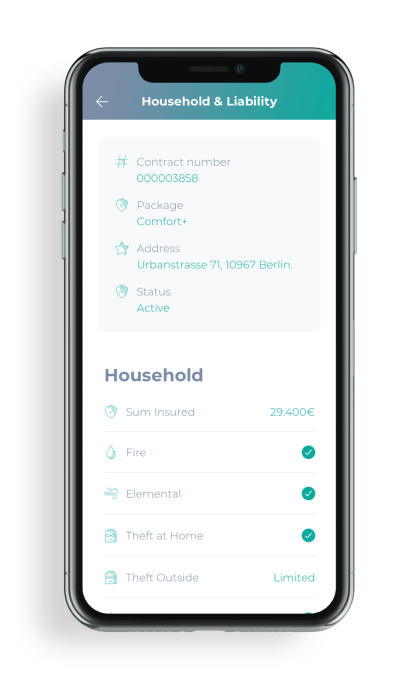

As it exists today, Wefox Group consists of two main products and subsidiaries: Wefox, and One.

Wefox is a platform that connects insurance providers, brokers and customers in an attempt to drag the insurance industry into the digital age. Rather than bypass human brokers entirely, Wefox lets independent brokers on-board their existing customers onto the platform to help deliver a better experience and more easily manage their clients’ coverage.

Efficiencies are achieved through a degree of automation, helping a broker scale the admin side of their business while also ensuring customers get the most appropriate coverage. From a consumer’s perspective, the Wefox app and website also acts as a “digital” wallet, where they can store details of the various insurance coverage to which they have subscribed.

Teicke says that about 80 percent of customers on the Wefox platform come via brokers. The remaining 20 percent sees customers sign-up direct. In this scenario, Wefox effectively acts as a lead generation or matching service for local brokers.

One is a direct-to-consumer fully digital insurance provider, offering various personal insurance coverage — and is only one of multiple insurance providers that reside on the Wefox platform and can be recommended by brokers. Teicke says it is also modular in design, letting customers select areas of coverage and essentially plugging in additional coverage based on their needs and appetite for risk at any given time. This includes pioneering the use of IoT and other data, customer permitting, to make insurance coverage proactive rather than reactive.

One is a direct-to-consumer fully digital insurance provider, offering various personal insurance coverage — and is only one of multiple insurance providers that reside on the Wefox platform and can be recommended by brokers. Teicke says it is also modular in design, letting customers select areas of coverage and essentially plugging in additional coverage based on their needs and appetite for risk at any given time. This includes pioneering the use of IoT and other data, customer permitting, to make insurance coverage proactive rather than reactive.

“The modular, timestamp and IoT triggered product design will be the role model for all insurance incumbents,” says Teicke. Related to this, Wefox Group plans to make the underlying technology of One available to other insurance providers so they too can plug proactive insurance provision into the Wefox platform, based on specific cohorts, scenarios and specialist coverage.

Ultimately, the grand vision and big bet — and no doubt what attracted such large amounts of capital into this Series B round — is that insurance will transition to a platform play, fueled by responsibly harnessing various types of data. The will see a platform exist to deliver the right coverage at the right time from a multitude of providers rather than the outdated and disparate model that exists today.

“Our hypothesis is that insurance will be massively impacted by the IoT data revolution,” says Teicke. “Insurers will have access to an exponentially grown number of real-time variables in order to price insurance products in real time. This trend will change insurance from a pure financial service to a service that offers proactive advice to reduce risk and consists of a financial service component only as an add-on to the core business model.”

Meanwhile, the new round of funding draws a line under a particularly tough period for Wefox Group after it was threatened with a lawsuit by New York-based insurance platform Lemon. The complaint, filed in the U.S. District Court Southern District of NY, alleged that Wefox reverse-engineered Lemonade to create One, and infringed Lemonade’s intellectual property. Ultimately, however, the dispute panned out to be a “much ado about nothing,” with Lemonade quietly dropping the lawsuit a few months later.

Powered by WPeMatico

Gaming clips service Medal has bought Donate Bot for direct donations and payments

The Los Angeles-based video gaming clipping service Medal has made its first acquisition as it rolls out new features to its user base.

The company has acquired the Discord -based donations and payments service Donate Bot to enable direct payments and other types of transactions directly on its site.

Now, the company is rolling out a service to any Medal user with more than 100 followers, allowing them to accept donations, subscriptions and payments directly from their clips on mobile, web, desktop and through embedded clips, according to a blog post from company founder Pim De Witte.

For now, and for at least the next year, the service will be free to Medal users — meaning the company won’t take a dime of any users’ revenue made through payments on the platform.

For users who already have a storefront up with Patreon, Shopify, Paypal.me, Streamlabs or ko-fi, Medal won’t wreck the channel — integrating with those and other payment processing systems.

Through the Donate Bot service any user with a discord server can generate a donation link, which can be customized to become more of a customer acquisition funnel for teams or gamers that sell their own merchandise.

A Webhooks API gives users a way to add donors to various list or subscription services or stream overlays, and the Donate Bot is directly linked with Discord Bot List and Discord Server List as well, so you can accept donations without having to set up a website.

In addition, the company updated its social features, so clips made on Medal can ultimately be shared on social media platforms like Twitter and Discord — and the company is also integrated with Discord, Twitter and Steam in a way to encourage easier signups.

Powered by WPeMatico

Matterport raises $48M to ramp up its 3D imaging platform

The growth of augmented and virtual reality applications and hardware is ushering in a new age of digital media and imaging technologies, and startups that are putting themselves at the center of that are attracting interest.

TechCrunch has learned and confirmed that Matterport — which started out making cameras but has since diversified into a wider platform to capture, create, search and utilise 3D imagery of interior and enclosed spaces in immersive real estate, design, insurance and other B2C and B2B applications — has raised $48 million. Sources tell us the money came at a pre-money valuation of around $325 million, although the company is not commenting on that.

From what we understand, the funding is coming ahead of a larger growth round from existing and new investors, to tap into what they see as a big opportunity for building and providing (as a service) highly accurate 3D images of enclosed spaces.

The company in December appointed a new CEO, RJ Pittman — who had been the chief product officer at eBay, and before that held executive roles at Apple and Google — to help fill out that bigger strategy.

Matterport had raised just under $63 million prior to this and had been valued at around $207 million, according to PitchBook estimates.This current round is coming from existing backers, which include Lux Capital, DCM, Qualcomm Ventures and more.

Matterport’s roots are in high-end cameras built to capture multiple images to create 3D interior imagery for a variety of applications, from interior design and real estate to gaming. Changing tides in the worlds of industry and hardware have somewhat shifted its course.

On the hardware side, we’ve seen a rise in the functionality of smartphone cameras, as well as a proliferation of specialised 3D cameras at lower price points. So while Matterport still sells its own high-end cameras, it is also starting to work with less expensive devices with spherical lenses — such as the Ricoh Theta, which is nearly 10 times less expensive than Matterport’s Pro2 camera — and smartphones.

Using an AI engine — which it has been building for some time — packaged into a service it calls Matterport Cloud 3.0, it converts 2D panoramic and 360-degree images into 3D images. (Matterport Cloud 3.0 is currently in beta and will be launching fully on the 18th of March, initially supporting the Ricoh Theta V, the Theta Z1, the Insta360 ONE X and the Leica Geosystems BLK360 laser scanner.)

Matterport is further using this technology to grow its wider database of images. It already has racked up 1.6 million 3D images and millions of 2D images, and at its current growth rate, the aim is to expand its library to 100 million in the coming years, positioning it as a Getty for 3D enclosed images.

These, in turn, will be used in two ways: to feed Matterport’s machine learning to train it to create better and faster 3D images; and to become part of a wider library, accessible to other businesses by way of a set of APIs.

And, from what I understand, the object will not just be to use images as they are: people would be able to manipulate the images to, for example, remove all the furniture in a room and re-stage it completely without needing to physically do that work ahead of listing a house for sale. Another is adding immersive interior shots into mapping applications like Google’s Street View.

“We are a data company,” Pittman told me when I met him for coffee last month.

The ability to convert 2D into 3D images using artificial intelligence to help automate the process is a potentially big area that Matterport, and its investors, believe will be in increasing demand. That’s not just because people still think there will one day be a bigger market for virtual reality headsets, which will need more interesting content, but because we as consumers already have come to expect more realistic and immersive experiences today, even when viewing things on regular screens — and because B2B and enterprise services (for example design or insurance applications) have also grown in sophistication and now require these kinds of images.

(That demand is driving the creation of other kinds of 3D imaging startups, too. Threedy.ai launched last week with a seed round from a number of angels and VCs to perform a similar kind of 2D-to-3D mapping technique for objects rather than interior spaces. It is already working with a number of e-commerce sites to bypass some of the costs and inefficiencies of more established, manual methods of 3D rendering.)

While Matterport is doubling down on its cloud services strategy, it also has been making some hires to take the business to its next steps. In addition to Pittman, they have added Dave Lippman, formerly design head at eBay, as its chief design officer; and engineering veteran Lou Marzano as its VP of hardware, R&D and manufacturing, with more hires to come.

Powered by WPeMatico

Blueground raises $20 million for flexible apartment rentals

Blueground, the startup providing turnkey flexible rental apartments, has raised $20 million in a round led by Athens-based VentureFriends, with participation from Endeavor Catalyst, Dubai’s Jabbar Internet Group and serial entrepreneur Kevin Ryan. Ryan — who helped found MongoDB, Gilt Groupe, Zola and others — will also join Blueground’s board of directors.

It’s no secret that remote work and frequent business travel are becoming more and more commonplace. As a result, a growing number of people are shying away from lengthy rental or lease commitments and are instead turning to companies like Blueground for more flexible short-term solutions.

Blueground is trying to be the go-to option for individuals moving or traveling to a city for as little as a month, or any duration longer. Similar to flexible office space providers, Blueground partners with major property owners to sign long-term leases for units it then furnishes and rents out with more flexible terms.

Users can rent listings for anywhere between one month to five years, and rates are set on a monthly basis, which can often lead to more favorable prices over medium-to-long-term stays relative to the short-term pricing structures commonly used by hospitality companies.

Filling hospitality gaps and easing rental friction

CEO Alex Chatzieleftheriou is intimately familiar with the value flexible leasing can unlock. Before founding Blueground, Chatzieleftheriou worked as a consultant for McKinsey, where he was frequently sent off to projects in far-off cities for months at a time — living in 15 cities over just seven years.

However, no matter how much time Alex logged in hotels, he constantly felt the frustration and mental strain of not having a stable personal living arrangement.

“I spent so much time in hotels but they never really resembled a home. They didn’t have enough space or enough privacy,” Chatzieleftheriou told TechCrunch. “But renting an apartment can be a huge pain in these cities. They can be hard to find, they usually have a minimum rental term of a year or more, and you usually have to deal with filling out paperwork and buying furniture.”

Knowing there were thousands of people at his company alone dealing with the same frustrations, Alex launched what would become Blueground, beginning with a handful of apartments in his home city of Athens, Greece.

Chatzieleftheriou and his team structured the platform to make the rental process as seamless as possible for the needs of flexible renters like himself. Through a quick plug-and-play checkout flow — more similar to the booking process for a hotel or Airbnb — renters can lock down an apartment without having to deal with the painful, costly and time-consuming traditional rental process. Tenants are also able to switch to any other Blueground listing during their rental period if their preferences change or if they want to explore different locations during their stay.

Every Blueground listing also comes completely furnished by the company’s design team, so renters don’t have to deal with buying, transporting — and eventually selling — furniture. And each apartment comes outfitted with digital and connected infrastructure so that tenants can monitor their apartment and arrange maintenance, housekeeping and other services directly through Blueground’s mobile app.

The value proposition is also fairly straightforward for the landlords Blueground partners with, as they avoid costs related to marketing and coordinating with fragmented brokers to fill open units, while also benefiting from steady rental payments, tenant vetting and free property management.

The offering certainly seems to be compelling for renters — while Chatzieleftheriou initially focused on serving business travelers and those moving for work, he quickly realized the market for flexible leasing was in fact much bigger. Blueground’s sales have tripled over the past three years and after its expansion in the U.S. last year, Blueground now hosts 1,700 listings in 10 cities across three continents.

“The trend of flexible and seamless real estate is bigger and is happening everywhere,” Chatzieleftheriou said. “A lot of people throughout the real estate sector really want this seamless, turnkey, furnished solution.”

To date, Blueground has raised a total of $28 million and plans to use funds from the latest round for additional hiring and to help the company reach its goal of growing its portfolio to 50,000 units over the next five years.

Powered by WPeMatico

France overhauls its special visa for tech talent

The French government has unveiled a complete overhaul of the French Tech Visa for employees working for a tech company. And France is taking a contrarian stance by making it easier to come work in France.

Let’s start with the big number. According to French Tech Mission director Kat Borlongan, there are more than 10,000 startups that meet the requirements to access the French Tech Visa and hire foreign employees more easily. (And if you live in the European Union, you don’t need a visa, of course.)

I asked Borlongan why it was important to overhaul the French Tech Visa. “Because our startups needed it,” she told me. “There are two dimensions to that. There’s the economic supply-demand part — all the high-growth startups we interviewed pretty unanimously said that hiring was their number one priority and that they were looking for profiles that weren’t readily available in France.”

“The second is cultural. As strong an ecosystem as the French Tech is becoming, it’s still perceived as overwhelmingly French. To succeed globally, we need to become global ourselves, in terms of team composition, mindset, markets, etc.”

Unlike many American visas, you don’t need to prove that you’ve been looking for candidates in France. You don’t need to pay crazy-high immigration lawyer fees — the French Tech Visa costs €368 in administrative fees. Future employees don’t need to meet any diploma requirement.

The previous version of the visa was limited to roughly 100 companies that were selected as part of the Pass French Tech program. Employees also had to graduate with a master’s degree. So it’s a huge change.

And it’s a pretty sweet deal for foreign employees as well. Your visa is valid for four years and renewable after that. You don’t have to stay in the same company — you can work for another company and keep your visa. Your family also gets visas so they can come with you.

If your startup has raised money from a VC fund, has been part of an accelerator, has received state funding or has the JEI status, then you’re eligible.

La French Tech and the French government have created various lists of VC funds, accelerators, grants, etc. If you meet one of those conditions, you can apply to the visa program. You’ll find most VC funds and accelerators based in France (but not all of them), as well as a few foreign companies (Y Combinator, 500 Startups, Techstars, Entrepreneur First, Plug and Play, Startupbootcamp). Those lists will be updated multiple times per year.

Startups that want to take advantage of the French Tech Visa need to complete an online form first — the full list of VC funds and accelerators is embedded in the form. Future employees can then get their visa from their home country at the French Consulate.

The French tech ecosystem has been growing rapidly. And many French startups have chosen to work in English and hire foreign talent. Tech talent is becoming a global talent pool, so this visa scheme is essential for the future of the French tech ecosystem.

Powered by WPeMatico

US mobile bank Chime raises $200 million, valuing its business at $1.5 billion

San Francisco-based mobile banking startup Chime announced this morning it has raised an additional $200 million in Series D financing led by DST Global, valuing its business at $1.5 billion. The oversubscribed round also included participation from new investors Coatue, General Atlantic, ICONIQ Capital and Dragoneer Investment Group, along with existing investors Menlo Ventures, Forerunner Ventures, Cathay Innovation and others.

To date, Chime has raised approximately $300 million, including last year’s $70 million Series C, which then saw the company valued at $500 million.

With the new funding, Chime has now raised the most funding and has the highest valuation among other U.S. challenger banks.

The company is now one of several going after a younger, millennial audience who no longer sees the need for banks with physical branches, and who are sick of being nickel-and-dimed by bigger banks’ numerous fees. Like others in this space, Chime offers a “no fees” bank account, which won’t penalize users for things like dropping below a minimum balance or even overdrafts.

On top of this is a modern-day banking app with features that make it look like it was actually built by a technology company — not a traditional bank. That’s because its team’s background is a mix of both tech and finance. Chime’s co-founder and CEO Chris Britt previously worked at Flycast, was an early comScore employee and worked at Visa and Green Dot; co-founder and CTO Ryan King spent time at Plaxo and Comcast before Chime.

Chime also includes a couple of innovative features that help differentiate it from the other mobile banking apps on the market. This includes an automatic savings feature that rounds up purchases to pocket the change; another feature that automatically saves 10 percent of your paycheck into Chime’s savings account; and one that offers a no-fee paycheck advance that makes your money available sooner.

To date, customers have opened more than 3 million FDIC-insured bank accounts on Chime, which makes it the largest brand in its category, the company claims. (This appears to be true. SoFi had 500,000 members as of last year. Simple doesn’t disclose its account base beyond “hundreds of thousands.” Moven and Varo Money are smaller, according to American Banker’s round-up.)

Its size, scale and growth trajectory, perhaps, have aided Chime in poaching a few execs from its other fintech businesses — including rivals. For example, the company recently added Chime VP, Risk Brian Mullins, who was the former head of Risk Ops at Square; and Chime GM, Lending Aaron Plante, who was the former Business Unit leader for Student Loans at SoFi.

The company says it plans to use the new investment to continue to accelerate growth and launch new products, including those in lending and credit. It also plans to double its San Francisco-based team to more than 200 employees and expand its leadership.

“We’re excited to welcome some of the world’s leading growth investors to Chime,” said Britt in a statement about the funding. “Banking should be free, helpful and easy to use but traditional banks are reluctant to embrace this reality. We aim to set a new standard in the industry by using technology to create services that are truly aligned with the best interests of consumers.”

Powered by WPeMatico

London-based Soldo has secured an e-money license from Ireland as a hedge against ‘crazy’ Brexit

Soldo, the London-based fintech startup that offers a multi-user spending account primarily for businesses, has secured an Electronic Money Institution licence from Ireland’s Central Bank, a move the company says is designed to mitigate against the uncertainty of Brexit.

The Accel-backed company is currently licensed by U.K. financial regulator the FCA and benefits from so-called “passporting,” European Union regulation that lets a company regulated in one EU country offer financial services across the whole of the EU and other EAA countries. That arrangement could come to an abrupt end post-Brexit, leaving Soldo unable to service its European customers, which it says represents half of its business.

Explains Soldo: “The E-Money licence enables Soldo to operate its services smoothly during a time of unprecedented turbulence in the business and political sphere and demonstrates the company’s commitment to providing uninterrupted enterprise level financial technology services for businesses of all sizes. With the licence the company will be able to issue payments in Ireland across the European Union under passporting rights.”

Furthermore, in a move that Soldo says will ensure it is Brexit-ready whatever the outcome of ongoing Brexit talks, the company plans to migrate to Ireland the accounts of its EU customers, as well as the team that supports them, from its U.K.-regulated E-Money Institution.

“It’s crazy to think we’ve been forced to work for a year and a half on a hugely complex project, mostly duplicating something that we had already, to prepare our business for something that may or may not happen,” says Soldo co-founder and CEO Carlo Gualandri.

In an email, Gualandri told me he chose Ireland because it was a recognised jurisdiction with a “high reputation,” and has the benefit of being an English language country with a similar legal system to the U.K. and strong ties to the U.K., where Soldo is headquartered.

Asked how much of Soldo’s staff will be moved to Ireland, Gualandri says that after March — the official Brexit deadline — all of the company’s financial services activities related to EU market customers will be managed from Ireland, meaning that the new Irish team will quickly grow to around 10 people, a mixture of relocations and new hires.

“Given that we will continue to serve the U.K. from our FCA-regulated entity initially, all this will just be a duplication, but over time as we expand in Europe most of the personnel growth in our financial services organisation will happen in Dublin,” he adds. “All this would have been based in London but Brexit forced us to change our plans because in a regulated business the people must be located where you are legally established.”

And although Gualandri says he is “delighted” to have passed the robust checks that an Irish license entails, there are a number of other uncertainties related to Brexit that could heavily affect the business. They include issues around data transfer and processing, taxation and, of course, freedom of movement or the ability to hire talent from abroad.

“We have a diverse workforce with a lot of internal mobility and that will become much more difficult if not impossible,” he tells me. “I actually just did the process to obtain settled status myself (and my family) and luckily I have been in the U.K. for quite a long time but some of our younger people are much less confident.”

Given all of the above, does Gualandri have a message for the U.K. government?

“My message to the U.K. government would be this: We just spent a huge amount of time, energy and money (that as a startup is a very very scarce resource) to be ready for Brexit but we don’t know if it will ever happen, or if yes, how and when. So if it happens I’ll be relieved to have done the right thing for the business even though I’ll personally be very sad as a person living in this country. If it doesn’t happen I’ll be personally happy but I’ll have to face the responsibility that I have wasted my company’s time and money by doing the ‘proper’ thing.

“How can we have come to the point where something so big and impactful on the country and the lives of everybody has been managed without any level of planning whatsoever. It is hard to believe this has happened and is still happening today.”

Powered by WPeMatico

Eargo raises $52M for virtually invisible, rechargeable hearing aids

Eargo wants to become the ultimate consumer hearing brand.

The company’s small and virtually invisible direct-to-consumer hearing aids, which come in an AirPods-style chargeable case, are designed to help destigmatize hearing loss. One month after revealing its newest product — the Eargo Neo ($2,550), which can be customized remotely via the case’s Bluetooth connectivity — the startup has closed a $52 million Series D, bringing its total raised to date to $135 million.

The latest round of capital comes from new investor Future Fund (Australia’s sovereign wealth fund) and existing investors NEA, the Charles and Helen Schwab Foundation, Nan Fung Life Sciences and Maveron.

Headquartered in San Jose, Eargo, which counts 20,000 users, will use the cash to continuing crafting and innovating new products targeting baby boomers. The newly launched Eargo Neo is the business’s third line of high-tech hearing aids. The first, Eargo Plus ($1,450), was released in 2017 and the Eargo Max ($2,150) was launched the following year.

“We can see that the product is really making a difference for users,” Eargo chief executive officer Christian Gormsen told TechCrunch. “We have the opportunity to really create a leading brand in the consumer hearing health space.”

Roughly 48 million Americans, or 20 percent of the population, suffer from hearing loss, but, aside from some Medicare Advantage programs, insurance companies provide no reimbursement for hearing aids. Despite high price tags — this is expensive tech — Eargo’s priority is still to make its hearing aids as accessible as possible and to send a message that there’s nothing wrong with admitting to hearing loss.

“Getting a hearing aid feels like admitting a defeat, like there’s something wrong with you, but that’s not true, hearing loss is natural and happens,” Gormsen said. “The number one challenge for the entire industry is awareness. There is so little knowledge about hearing loss out there; it’s such a stigmatized category and how do you change that? The current channel doesn’t do anything to address it, the only way you can address it is through education and communication.”

“I think we’ve come far, but we are looking at 48 million Americans and we are still barely scratching the surface.”

Powered by WPeMatico