Amun raises $4M to give stock-like buying options for crypto investors

Crypto represent a “border-less” asset that anyone can own, but actually getting hold of it isn’t easy for everyone. Amun, a company that wants to make buying crypto as easy as stock, has pulled in $4 million in funding to offer more established channels for crypto ownership.

The startup currently offers punters an ETP (exchange-traded product) on the Swiss Stock Exchange that pulls together five of the most popular crypto assets: Bitcoin, Ethereum, Bitcoin Cash, XRP and Litecoin. HODL — as it is called after “holding” crypto rather than selling it (LOL) — can be purchased just like any stock.

That five-crypto basket is just the start for Amun, which is developing ETPs for other crypto assets individually. The first one is for Bitcoin — ABTC — with others planned to come soon; you’d imagine the usual suspects such as Ethereum and co will follow. Indeed, Amun has licenses to the five crypto assets in HODL as well as EOS.

While the products are ETP and not covered by Collective Investment Schemes Act (CISA), they are protected in custody and by insurance. They are collateralized and backed by an identical amount of crypto assets.

Personally, I’ve been able to buy crypto — just base tokens like Bitcoin and Ethereum rather than company-specific ICO tokens — but it certainly is true that it takes some learning. While, speaking for me and likely many others, exchange-based products aren’t easier to me, it does appeal to more institutionally minded individuals or companies for whom holding an account with an exchange or a crypto wallet isn’t feasible. That’s the target that Amun has in mind, as well as outlier cases, too.

Amun CEO and co-founder Hany Rashwan told TechCrunch that growing up in Egypt, he saw the government ban Bitcoin despite the fact that it offered an alternative to the Egyptian pound, which saw its valuation tank massively in 2016. He believes that products like Amun allow anyone to take part in crypto even when they face local restrictions, as was the case in Egypt and other countries.

“We want to make investing in crypto as easy as buying a stock. Institutional investors around the world are looking for a secure, easy and regulated way of accessing the crypto asset class. Amun’s products do that at a low price in one of the most reputable financial hubs in the world,” Rashwan told TechCrunch.

Investors share his optimism and those who took part in this round include Boost VC founder Adam Draper — son of outspoken pro-Bitcoin VC Tim Draper — Graham Tuckwell, founder of ETFS Capital who built ETF products for gold, and Greg Kidd, co-founder of investment firm Hard Yaka. Four undisclosed family offices also took part.

One reason for their optimism is the fact that Amun is developing technology that could, in theory, be licensed out to allow others to develop their own ETFs.

“We invest a ton of resources in both our product development and underlying tech infrastructure. This allows us to come up with innovative but professional and safe ways of accessing the crypto asset class, as well as do all this on a tech platform that can be used by not just us, but any issuer that wishes to do the same as well,” Rashwan said.

“The world needs a company like Amun to make crypto as easy as buying a stock. Now that they were the first to do that, they can now provide the toolset and be the de facto platform for anyone else looking to take their crypto assets/securities to the public markets,” Draper added.

Still, just giving people access doesn’t guarantee returns — that’s on the crypto market itself.

Last year was a dud across the board in terms of pricing, as Bitcoin, for example, plummeted from a record high of nearly $20,000 at the end of 2017 to $3,930-ish at the time of writing. Plenty in the industry are optimistic that will change as genuine value comes out of blockchain technology.

HODL itself debuted at $15.64 last November; today it is at $12.83

Note: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Powered by WPeMatico

Talent Garden raises €44M to expand in cities ignored by the WeWork-style spaces

Finding myself talking at a startup conference in Kosovo three years ago (as one does), I realized how close I was to Albania, a place which held some fascination for me. I managed to grab a lift with a friendly techie to Tirana, where they arranged for me to speak to the local tech community. That meetup was held in a small co-working space called Talent Garden. It gradually transpired that, while WeWork and other such co-working/offices spaces were concentrating on New York and London, Talent Garden had been busily populating southern and eastern Europe with a network of spaces crisscrossing the continent.

That strategy has now paid off with their desire to raise money from investors. Today, it announces that it has raised €44 million ($49.5 million) in a funding round led by Italian private equity firm Tamburi Investment Partners alongside Social Capital, Inadco Ventures and a range of European family offices. Tamburi previously led a €12 million funding round for Talent Garden in 2016.

The company, founded in Brescia, Italy in 2011, now plans to expand its co-working and education to places like Spain, Italy, Denmark, Austria and many more countries around Europe, focusing on second or third-tier cities where tech communities tend to grow fastest because costs are lower than in the major capitals.

Talent Garden’s chief executive and co-founder Davide Dattoli now plans to open 20 new international co-working campuses over the next five years and expand the scope of its “Innovation School” in digital training (as an analogy, think a combination of offices and General Assembly) and generating a “second tech ecosystem” around Europe outside London, Paris and Berlin. It’s also a licensee of the SingularityU Summit brand across Italy, Spain and Switzerland, for instance.

So far, it is now present in eight countries and has 23 active campuses with the Talent Garden Innovation School present in five of those countries.

There will, however, be a particular focus on Spain, with new locations in Madrid and Barcelona; France, with one opening planned in 2019; Italy, where it already has more than 10 campuses; and Austria, where it just recently opened.

In 2018, Talent Garden opened a new campus in Dublin as part of a strategic partnership with Dublin City University and also created a joint venture with Rainmaking Loft in Denmark, and has more than three locations across Copenhagen and is now looking for more locations in the Nordic region. Germany, Israel, Benelux and the CEE region are also within its sights. It won’t be ignoring San Francisco, however, with a kind of the “campus” project planned for next year.

Will things be different as Talent Garden tries to make incursions into bigger cities? For starters, WeWork is building from a very expensive base (major capitals) while TG isn’t. There are fewer revenues in these third-tier cities, sure, but geography has been downgraded for startup teams that are well-used to remote working. So TG could try to lock-in members who only need to “pop in” to the major capitals now and again, where TG has a “landing pad” for them to visit. This potentially creates an incursion into WeWork’s space directly from emerging markets and second/third-tier cities.

Powered by WPeMatico

Starling Bank to open second UK office, creating up to 150 tech and support jobs in Southampton

Starling Bank, the U.K. challenger bank founded by banking veteran Anne Boden, is set to open a second U.K. office this summer, where it plans to recruit up to 50 software engineers and up to 100 customer service team members. The planned location is Southampton, on the south coast of England, and will be Starling’s first office outside of London.

In a call with Boden late on Friday, she told me the majority of its Southampton office will be new hires who will be helping to build out the challenger back’s business-banking product. In just less than a year, Starling has garnered more than 30,000 SME business-account sign-ups, adding to around 500,000 consumer current accounts.

The company plans to invest heavily in its business-banking division over the next few years, partly off the back of being awarded a £100 million grant from the Capability and Innovation Fund (CIF), which was set up by Royal Bank of Scotland to fulfill European state aid conditions arising from the bank’s £45 billion U.K. government bailout during the financial crisis.

Boden says that Southampton was chosen as Starling’s new office for its entrepreneurial spirit and high level of tech talent. She says the city is gaining a reputation as a “burgeoning tech hub” and has a growing skilled jobs market and good transport links, including to and from London.

More broadly, she wants Starling to “spread the fintech love” beyond its traditional base of London. There’s an increasing sense that U.K. tech is too London-centric and that the country’s fast-growing tech sector and the employment opportunities it represents should be more evenly distributed.

To that end, Southampton was recently identified in research conducted by global service company CBRE as a technology “Super Cluster” based on the level, concentration and growth of tech-sector employment in the city.

The city’s tech scene is also supported by the University of Southampton (where Tim Berners-Lee was previously Chair of Computer Science) and home to the Web Science Institute, where Dame Wendy Hall is based. Nearby is also “innovation hub” Southampton Science Park, spanning 72 acres and housing a mixture of commercial offices, laboratories and meeting and conferencing facilities.

Meanwhile, the news of a second Starling office comes a month after the challenger bank announced it had raised £75 million (~$97 million) in further funding. The new capital consisted of a £60 million Series C round led by Merian Global Investors, including Merian Chrysalis, with £15 million in follow-on funding from Starling’s existing backer and major shareholder Harald McPike. It brings total funding to date for the London-based challenger bank to £133 million, not including the more recent £100 million CIF grant.

Further forward, I’m told Starling is also committed to opening a second regional contact centre to support its growing customer base of SME businesses and individual current account holders. There was previously talk that Wales, the country from where Boden hails, could be chosen, although the bank is also eyeing up the North of England and the Midlands.

Powered by WPeMatico

Appen acquires Figure Eight for up to $300M, bringing two data annotation companies together

Appen just announced that it’s acquiring Figure Eight in an all-cash deal that sees Appen paying $175 million upfront, with an additional payment of up to $125 million based on Figure Eight’s performance this year.

Both companies focus on using crowdsourced labor pools to annotate data, which in turn is used to train artificial intelligence and machine learning — for example, Figure Eight (formerly known as CrowdFlower and Dolores Labs) says its technology has been for everything from mapping to stock photography to scanning receipts for expense reports.

Appen, meanwhile, is a publicly-traded company headquartered in Sydney. CEO Mark Brayan described its technology — and its “crowd” of more than 1 million remote workers — as “highly complementary” to Figure Eight, which he praised for its data annotation and self-serve capabilities.

“We know that to compete and to be able to deliver even higher volumes, we need a richer set of technologies,” Brayan said. “That’s where Figure Eight comes in. They are, in our view, the leader in the market of the platform providers.”

As for what this means for the Figure Eight team, he said, “Everybody stays in place,” and that Appen plans to continue investing in the product.

Brayan also noted that Appen previously acquired another data annotation company called Leapforce in 2017, a move that he said provided the company with greater scale.

“The Figure Eight acquisition is the next step of our evolution,” he said. “Step one was to get bigger, step two is to become much more tech forward, which is what we get with Figure Eight.”

San Francisco-based Figure Eight has raised a total of $58 million in funding, according to Crunchbase, from investors including Trinity Ventures, Industry Ventures, Canvas Ventures and Salesforce Ventures. As CrowdFlower, it launched on-stage at the TechCrunch50 conference nearly a decade ago.

“I’m extremely proud of the team,” said Figure Eight co-founder Lukas Biewald in a statement. “This is a genuine validation of everything we’ve achieved and a great platform for our teams to combine and continue to do amazing things in AI.”

Biewald (a college friend of mine), along with his co-founder Chris Van Pelt, has moved on to a new startup called Weights and Biases, but he remains involved in Figure Eight as chairman. You can watch their TC50 presentation here.

Powered by WPeMatico

Josh Wood, hair colorist to the stars, gets $6.5M led by Index in its latest D2C bet

In the age of Amazon, where up to 90 percent of all consumers use it to buy goods and Amazon is accounting for a rapidly-growing percentage of a consumer’s total retail spend (along with other giants like Walmart), direct-to-consumer brands — leveraging social media alongside tech-first apps — are emerging as sometimes surprising, but often effective, competition.

In one of the latest developments, London-based celebrity hair colorist Josh Wood — who has worked with the likes of David Bowie, PJ Harvey, Florence Welch, Saoirse Ronan and Elle Macpherson, as well as with fashion designers Miuccia Prada, Donatella Versace and Marc Jacobs (and, disclaimer, me: I tried out his products before agreeing to write this story) — has raised $6.5 million led by Index Ventures, with JamJar Investments and Venrex also participating, to launch his products into cyberspace with the aim of disrupting the at-home hair color industry.

At-home hair color is a huge market that has largely been untouched in terms of innovation. Some 80 percent of women over 25 color their hair, with 75 percent of those doing it at home, working out to an industry worth $20 billion annually.

As with other direct-to-consumer brands, tech is playing a role on multiple levels at Josh Wood, from how the product is developed through to how it will match with consumers, as well as how it is marketed.

But unlike other direct-to-consumer startups, Josh Wood actually put down roots (heh) first in a very non-tech environment.

If you live in London, you might already recognise the name and logo of Josh Wood. Apart from his star list of clients (and the name check he gets in the media for that work), he has already been running his hair coloring business at some scale.

Wood’s products have been adorning a selection of London buses, in part to promote a partnership he’s had for the last year with Boots, a big UK chain of drugstores, where his coloring kits and other products are sold alongside big names like Revlon and L’Oreal.

That partnership has been a big boost for both Wood and Boots so far. Some 240,000 products were sold in the first year, contributing to the first growth spike that Boots has seen in the hair coloring category for more than a decade. (One reason also that the startup attracted the likes of Index, which has been behind other companies that have straddled the worlds of women’s consumer goods and tech, such as Farfetch and Glossier.)

The range of products — which includes hair coloring kits, root concealer products, and color-specific shampoo and conditioners — has been marketed from the start as a new take on hair coloring.

Wood has been working as a colorist himself for some 30 years, and while he has worked with some of the biggest names in women’s hair care in that time — he’d once been a global ambassador for Wella and he is currently global color creative director for Redken — he believes that there is a lot of room for improvement in home coloring.

“You get thousands of boxes of hair colors, and women are usually terrified of making the wrong choice,” he said in an interview. And that’s before you consider how prolonged dying at home can fry your hair if you don’t know what you’re doing, or using the products incorrectly.

Wood’s focus up to this point has been mainly on the product itself. Using his learnings from being a leading colorist, and knowing some of the pros and cons of working with brands that already sell mass-produced consumer goods, he has worked with chemists and other product designers on developing new ranges of shades an add-in product, called “Shade Shot Plus,” that extend the range even further and bring in highlights that are unique to each person’s hair; as well as aftercare products.

Shade Shot Plus has been a particularly notable development. Wood said that up to now the main endgame for producers of at-home hair coloring products has been to create standardised colors that will always look the same on each woman, so that it can be sold more consistently and predictably (think of those slightly macabre locks of hair that you sometimes see hanging in the aisles at drug stores showing “the color”). But the product developers couldn’t standardise how the highlights product would look. That roadblock, Wood said, turned out “to be a gift.”

In fact, standardised color runs counter to how professionals work, and what those who go to professionals want. “No two colors are the same,” he said of Shade Shot Plus “One of the big barriers at home is that women feel they have obvious ‘box color’, cookie-cutter lego hair, but this unlocks that, because the tones deposit differently on everyone’s hair.”

That product development is set to continue. With an approach reminiscent of Third Love how it has redefined shopping for bras by vastly extending the range of bra sizes, the idea will be to extend that color range even further down the line.

“This is the tip of the iceberg in terms of the ideas I’ve got,” he said. “There is a lot to learn from base color and foundation matching. This is a category that has had no innovation for decades and this is just the first iteration.”

But now, with the funding, the plan is to complement that product development with technology to help people find colors that best suit their own preferences — whether it’s for a new color that will go with a specific complexion, or to find the tint that most closely matches the color their hair used to be before it turned grey. At the same time, the aim is to deliver at-home dying in an experience that is more reminiscent of what you get if you pay much more (and spend more time) going to a trusted, professional hair colorist.

“We are pressing heavy on being able to deliver an amazing consultation online that will deliver a bespoke hair color that is very natural and covers grey,” he said. “But at our heart, I’d like to think of us as a brand that cares for the condition of your hair.”

Wood said that he is currently hiring and working with technologists to develop color-finding tools, akin to the kind you might come across in online makeup storefronts, to explore both how a woman (or man) looks, and what she or he is looking for.

This is in progress but the idea, it sounds like, will not only involve computer vision but also machine learning to tap into a bigger database of what “lookalike” complexions and people choose for colors, as well as a database created by Josh Wood itself to match those colors, based on the tinting choices that many professionals would make for those people were they sitting in a chair in a salon.

Wood said that he wanted to raise this money and expand the product as a direct-to-consumer offering because he didn’t think he’d be able to achieve this with something that is sold on a shelf — although the idea will be to complement that, too.

“The reason we are approaching this growth phase from a digital perspective is because we want to develop our business” — the market for at-home coloring is much bigger than professional, in-salon coloring — “but also have a best-in-class consultation tool. I’ve been coloring for nearly 30 years and this is the moment for me to democratize my learnings, and I couldn’t do that without digital. There is no other way to connect with so many consumers, and it’s very difficult to get that element right in a brick-and-mortar point of sale.”

I asked Wood if he would also explore the idea of subscriptions, a la Dollar Shave Club, as part of the mix as well, and his answer was actually a little refreshing and I think is a good sign for how this might develop over time.

“We are less keen on subscriptions and more keen that women feel we’re in the bathroom with them every time, monitoring how their hair color changes over time. We want something much deeper than just selling the same thing to them once a month.”

Powered by WPeMatico

Funerals are tough. Ever Loved helps you pay for them

Alison Johnston didn’t plan to build a startup around death. An early employee at Q&A app Aardvark that was bought by Google, she’d founded tutoring app InstaEDU and sold it to Chegg. She made mass market consumer products. But then, “I had a family member who was diagnosed with terminal cancer and I thought about how she’d be remembered” she recalls. Inventing the next big social app suddenly felt less consequential.

“I started looking into the funeral industry and discovered that there were very few resources to support and guide families who had recently experienced a death. It was difficult to understand and compare options and prices (which were also much higher than I ever imagined), and there weren’t good tools to share information and memories with others” Johnston tells me. Bombarded by options and steep costs that average $9,000 per funeral in the US, families in crisis become overwhelmed.

Ever Loved co-founder and CEO Alison Johnston

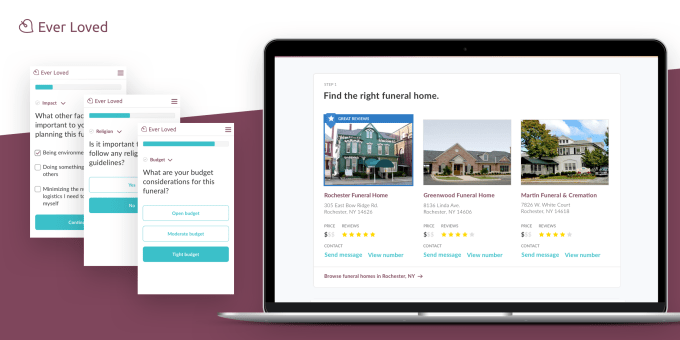

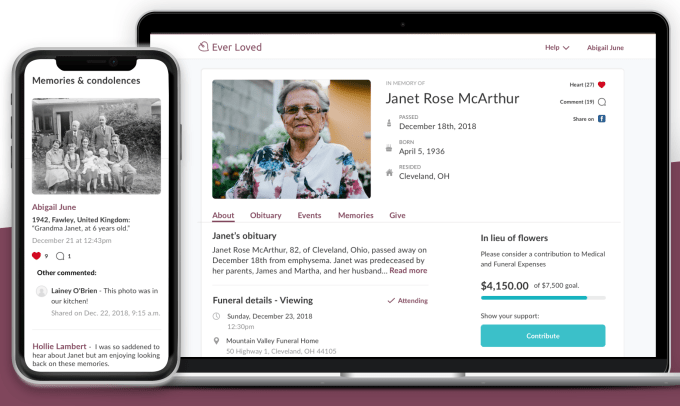

Johnston’s startup Ever Loved wants to provide peace of mind during the rest-in-peace process. It’s a comparison shopping and review site for funeral homes, cemeteries, caskets, urns, and headstones. It offers price guides and recommends top Amazon funeral products and takes a 5 percent affiliate fee that finances Ever Loved’s free memorial site maker for sharing funeral details plus collecting memories and remembrances. And families can even set up fundraisers to cover their costs or support a charity.

The startup took seed funding from Social Capital and a slew of angel investors about a year ago. Now hundreds of thousands of users are visiting Ever Loved shopping and memorial sites each month. Eventually Ever Loved wants to build its own marketplace of funeral services and products that takes a 10 percent cut of purchases, while also selling commerce software to funeral homes.

“People don’t talk about death. It’s taboo in our society and most people don’t plan ahead at all” Johnston tells me. Rushing to arrange end-of-life logistics is enormously painful, and Johnston believes Ever Loved can eliminate some of that stress. “I wanted to explore areas where fewer people in Silicon Valley had experience and that weren’t just for young urban professionals.”

There’s a big opportunity to modernize this aging industry with a sustainable business model and empathy as an imperative. 86 percent of funeral homes are independent, Johnston says, so few have the resources to build tech products. One of the few big companies in the space, the $7 billion market cap public Service Corporation International, has rolled up funeral homes and cemeteries but has done little to improve pricing transparency or the user experience for families in hardship. Rates and reviews often aren’t available, so customers can end up overpaying for underwhelming selection.

On the startup side, there’s direct competitors like FuneralWise, which is focused on education and forums but lacks robust booking features or a memorial site maker. Funeral360 is Ever Loved’s biggest rival, but Ever Loved’s memorial sites looked better and it had much deeper step-by-step pricing estimates and information on funeral homes.

Johnston wants to use revenue from end-of-life commerce to subsidize Ever Loved’s memorial and fundraiser features so they can stay free or cheap while generating leads and awareness for the marketplace side. But no one has hit scale and truly become wedding site The Knot but for funerals.

I’ve known Johnston since college, and she’s always had impressive foresight for what was about to blow up. From an extremely early gig at Box.com to Q&A and on-demand answers with Aardvark to the explosion of online education with InstaEDU, she’s managed to get out in front of the megatrends. And tech’s destiny to overhaul unsexy businesses is one of the biggest right now.

Amazon has made us expect to see prices and reviews up front, so Ever Loved has gathered rate estimates for about two-thirds of US funeral homes and is pulling in testimonials. You can search for 4-star+ funeral homes nearby and instantly get high-quality results. Meanwhile, funeral homes can sign up to claim their page and add information.

Amazon has made us expect to see prices and reviews up front, so Ever Loved has gathered rate estimates for about two-thirds of US funeral homes and is pulling in testimonials. You can search for 4-star+ funeral homes nearby and instantly get high-quality results. Meanwhile, funeral homes can sign up to claim their page and add information.

Facebook popularized online event pages. But its heavy-handed prerogatives, generalist tone, and backlash can make it feel like a disrespectful place to host funeral service details. And with people leaving their hometowns, newspapers can’t spread the info properly. Ever Loved is purpose-built for these serious moments, makes managing invites easy, and also offers a place to collect obituaries, photos, and memories.

Rather than having to click through a link to a GoFundMe page that can be a chore, Ever Loved hosts fundraisers right on its memorial sites to maximize donations. That’s crucial since funerals cost more than most people have saved. Ever Loved only charges a processing fee and allows visitors to add an additional tip, so it’s no more expensive that popular fundraising sites.

Next, “the two big things are truly building out booking through our site and expanding into some of the other end of life logistics” Johnstone tells me. Since the funeral is just the start of the post-death process, Ever Loved is well positioned to move into estate planning. “There are literally dozens of things you have to do after someone passes away — contacting the social security office, closing out bank accounts and Facebook profiles…”

Johnston reveals that 44 percent of families say they had arguments while divvying up assets — a process that takes an average of 560 hours aka 3 months of full-time work. As the baby boomer era ends over the next 30 years, $30 trillion in assets are expected to transfer through estates, she claims. Earning a tiny cut of that by giving mourners tools outlining popular ways to divide estates could alleviate disagreements could make Ever Loved quite lucrative.

“When I first started out, I was pretty awkward about telling people about this. We’re death averse, and that hinders us in a lot of ways” Johnston concludes. My own family struggled with this, as an unwillingness to accept mortality kept my grandparents from planning for after they were gone. “But I quickly learned was this was a huge conversation starter rather than a turn off. This is a topic people want to talk about more and educate themselves more on. Tech too often merely makes life and work easier for those who already have it good. Tech that tempers tragedy is a welcome evolution for Silicon Valley.”

Powered by WPeMatico

The other smartphone business

With the smartphone operating system market sewn up by Google’s Android platform, which has a close to 90% share globally, leaving Apple’s iOS a slender (but lucrative) premium top-slice, a little company called Jolla and its Linux-based Sailfish OS is a rare sight indeed: A self-styled ‘independent alternative’ that’s still somehow in business.

The Finnish startup’s b2b licensing sales pitch is intended to appeal to corporates and governments that want to be able to control their own destiny where device software is concerned.

And in a world increasingly riven with geopolitical tensions that pitch is starting to look rather prescient.

Political uncertainties around trade, high tech espionage risks and data privacy are translating into “opportunities” for the independent platform player — and helping to put wind in Jolla’s sails long after the plucky Sailfish team quit their day jobs for startup life.

Building an alternative to Google Android

Jolla was founded back in 2011 by a band of Nokia staffers who left the company determined to carry on development of mobile Linux as the European tech giant abandoned its own experiments in favor of pivoting to Microsoft’s Windows Phone platform. (Fatally, as it would turn out.)

Nokia exited mobile entirely in 2013, selling the division to Microsoft. It only returned to the smartphone market in 2017, via a brand-licensing arrangement, offering made-in-China handsets running — you guessed it — Google’s Android OS.

If the lesson of the Jolla founders’ former employer is ‘resistance to Google is futile’ they weren’t about to swallow that. The Finns had other ideas.

Indeed, Jolla’s indie vision for Sailfish OS is to support a whole shoal of differently branded, regionally flavored and independently minded (non-Google-led) ecosystems all swimming around in parallel. Though getting there means not just surviving but thriving — and doing so in spite of the market being so thoroughly dominated by the U.S. tech giant.

TechCrunch spoke to Jolla ahead of this year’s Mobile World Congress tradeshow where co-founder and CEO, Sami Pienimäki, was taking meetings on the sidelines. He told us his hope is for Jolla to have a partner booth of its own next year — touting, in truly modest Finnish fashion, an MWC calendar “maybe fuller than ever” with meetings with “all sorts of entities and governmental representatives”.

Jolla co-founder, Sami Pienimaki, showing off a Jolla-branded handset in May 2013, back when the company was trying to attack the consumer smartphone space.

(Photo credit: KIMMO MANTYLA/AFP/Getty Images)

Even a modestly upbeat tone signals major progress here because an alternative smartphone platform licensing business is — to put it equally mildly — an incredibly difficult tech business furrow to plough.

Jolla almost died at the end of 2015 when the company hit a funding crisis. But the plucky Finns kept paddling, jettisoning their early pursuit of consumer hardware (Pienimäki describes attempting to openly compete with Google in the consumer smartphone space as essentially “suicidal” at this point) to narrow their focus to a b2b licensing play.

The early b2b salespitch targeted BRIC markets, with Jolla hitting the road to seek buy in for a platform it said could be moulded to corporate or government needs while still retaining the option of Android app compatibility.

Then in late 2016 signs of a breakthrough: Sailfish gained certification in Russia for government and corporate use.

Its licensing partner in the Russian market was soon touting the ability to go “absolutely Google-free!“.

Buy in from Russia

Since then the platform has gained the backing of Russian telco Rostelecom, which acquired Jolla’s local licensing customer last year (as well as becoming a strategic investor in Jolla itself in March 2018 — “to ensure there is a mutual interest to drive the global Sailfish OS agenda”, as Pienimäki puts it).

Rostelecom is using the brand name ‘Aurora OS‘ for Sailfish in the market which Pienimäki says is “exactly our strategy” — likening it to how Google’s Android has been skinned with different user experiences by major OEMs such as Samsung and Huawei.

“What we offer for our customers is a fully independent, regional licence and a tool chain so that they can develop exactly this kind of solution,” he tells TechCrunch. “We have come to a maturity point together with Rostelecom in the Russia market, and it was natural move plan together, that they will take a local identity and proudly carry forward the Sailfish OS ecosystem development in Russia under their local identity.”

“It’s fully compatible with Sailfish operating system, it’s based on Sailfish OS and it’s our joint interest, of course, to make it fly,” he adds. “So that as we, hopefully, are able to extend this and come out to public with other similar set-ups in different countries those of course — eventually, if they come to such a fruition and maturity — will then likely as well have their own identities but still remain compatible with the global Sailfish OS.”

Jolla says the Russian government plans to switch all circa 8M state officials to the platform by the end of 2021 — under a project expected to cost RUB 160.2 billion (~$2.4BN). (A cut of which will go to Jolla in licensing fees.)

It also says Sailfish-powered smartphones will be “recommended to municipal administrations of various levels,” with the Russian state planning to allocate a further RUB 71.3 billion (~$1.1BN) from the federal budget for that. So there’s scope for deepening the state’s Sailfish uptake.

Russian Post is one early customer for Jolla’s locally licensed Sailfish flavor. Having piloted devices last year, Pienimäki says it’s now moving to a full commercial deployment across the whole organization — which has around 300,000 employees (to give a sense of how many Sailfish powered devices could end up in the hands of state postal workers in Russia).

A rugged Sailfish-powered device piloted by Russian post

Jolla is not yet breaking out end users for Sailfish OS per market but Pienimäki says that overall the company is now “clearly above” 100k (and below 500k) devices globally.

That’s still of course a fantastically tiny number if you compare it to the consumer devices market — top ranked Android smartphone maker Samsung sold around 70M handsets in last year’s holiday quarter, for instance — but Jolla is in the b2b OS licensing business, not the handset making business. So it doesn’t need hundreds of millions of Sailfish devices to ship annually to turn a profit.

Scaling a royalty licensing business to hundreds of thousands of users is sums to “good business”, , says Pienimäki, describing Jolla’s business model for Sailfish as “practically a royalty per device”.

“The success we have had in the Russian market has populated us a lot of interesting new opening elsewhere around the world,” he continues. “This experience and all the technology we have built together with Open Mobile Platform [Jolla’s Sailfish licensing partner in Russia which was acquired by Rostelecom] to enable that case — that enables a number of other cases. The deployment plan that Rostelecom has for this is very big. And this is now really happening and we are happy about it.”

Jolla’s “Russia operation” is now beginning “a mass deployment phase”, he adds, predicting it will “quickly ramp up the volume to very sizeable”. So Sailfish is poised to scale.

Step 3… profit?

While Jolla is still yet to turn a full-year profit Pienimäki says several standalone months of 2018 were profitable, and he’s no longer worried whether the business is sustainable — asserting: “We don’t have any more financial obstacles or threats anymore.”

It’s quite the turnaround of fortunes, given Jolla’s near-death experience a few years ago when it almost ran out of money, after failing to close a $10.6M Series C round, and had to let go of half its staff.

It did manage to claw in a little funding at the end of 2015 to keep going, albeit as much leaner fish. But bagging Russia as an early adopter of its ‘independent’ mobile Linux ecosystem looks to have been the key tipping point for Jolla to be able to deliver on the hard-graft ecosystem-building work it’s been doing all along the way. And Pienimäki now expresses easy confidence that profitability will flow “fairly quickly” from here on in.

“It’s not an easy road. It takes time,” he says of the ecosystem-building company Jolla hard-pivoted to at its point of acute financial distress. “The development of this kind of business — it requires patience and negotiation times, and setting up the ecosystem and ecosystem partners. It really requires patience and takes a lot of time. And now we have come to this point where actually there starts to be an ecosystem which will then extend and start to carry its own identity as well.”

In further signs of Jolla’s growing confidence he says it hired more than ten people last year and moved to new and slightly more spacious offices — a reflection of the business expanding.

“It’s looking very good and nice for us,” Pienimäki continues. “Let’s say we are not taking too much pressure, with our investors and board, that what is the day that we are profitable. It’s not so important anymore… It’s clear that that is soon coming — that very day. But at the same time the most important is that the business case behind is proven and it is under aggressive deployment by our customers.”

The main focus for the moment is on supporting deployments to ramp up in Russia, he says, emphasizing: “That’s where we have to focus.” (Literally he says “not screwing up” — and with so much at stake you can see why nailing the Russia case is Jolla’s top priority.)

While the Russian state has been the entity most keen to embrace an alternative (non-U.S.-led) mobile OS — perhaps unsurprisingly — it’s not the only place in the world where Jolla has irons in the fire.

Another licensing partner, Bolivian IT services company Jalasoft, has co-developed a Sailfish-powered smartphone called Accione.

Jalasoft’s ‘liberty’-touting Accione Sailfish smartphone

It slates the handset on its website as being “designed for Latinos by Latinos”. “The digitalization of the economy is inevitable and, if we do not control the foundation of this digitalization, we have no future,” it adds.

Jalasoft founder and CEO Jorge Lopez says the company’s decision to invest effort in kicking the tyres of Jolla’s alternative mobile ecosystem is about gaining control — or seeking “technological libration” as the website blurb puts it.

“With Sailfish OS we have control of the implementation, while with Android it is the opposite,” Lopez tells TechCrunch. “We are working on developing smart buildings and we need a private OS that is not Android or iOS. This is mainly because our product will allow the end user to control the whole building and doing this with Android or iOS a hackable OS will bring concerns on security.”

Lopez says Jalasoft is using Accione as its development platform — “to gather customer feedback and to further develop our solution” — so the project clearly remains in an early phase, and he says that no more devices are likely to be announced this year.

But Jolla can point to more seeds being sewn with the potential, with work, determination and patience, to sprout into another sizeable crop of Sailfish-powered devices down the line.

Complexity in China

Even more ambitiously Jolla is also targeting China, where investment has been taken in to form a local consortium to develop a Chinese Sailfish ecosystem.

Although Pienimäki cautions there’s still much work to be done to bring Sailfish to market in China.

“We completed a major pilot with our licensing customer, Sailfish China Consortium, in 2017-18,” he says, giving an update on progress to date. “The public in market solution is not there yet. That is something that we are working together with the customer — hopefully we can see it later this year on the market. But these things take time. And let’s say that we’ve been somewhat surprised at how complex this kind of decision-making can be.”

“It wasn’t easy in Russia — it took three years of tight collaboration together with our Russian partners to find a way. But somehow it feels that it’s going to take even more in China. And I’m not necessarily talking about calendar time — but complexity,” he adds.

While there’s no guarantee of success for Jolla in China, the potential win is so big given the size of the market that even if they can only carve out a tiny slice, such as a business or corporate sector, it’s still worth going after. And he points to the existence of a couple of native mobile Linux operating systems he reckons could make “very lucrative partners”.

That said, the get-to-market challenge for Jolla in China is clearly distinctly different vs the rest of the world. This is because Android has developed into an independent (i.e. rather than Google-led) ecosystem in China as a result of state restrictions on the Internet and Internet companies. So the question is what could Sailfish offer that forked Android doesn’t already?

An Oppo Android powered smartphone on show at MWC 2017

Again, Jolla is taking the long view that ultimately there will be appetite — and perhaps also state-led push — for a technology platform bolster against political uncertainty in U.S.-China relations.

“What has happened now, in particular last year, is — because of the open trade war between the nations — many of the technology vendors, and also I would say the Chinese government, has started to gradually tighten their perspective on the fact that ‘hey simply it cannot be a long term strategy to just keep forking Android’. Because in the end of the day it’s somebody else’s asset. So this is something that truly creates us the opportunity,” he suggests.

“Openly competing with the fact that there are very successful Android forks in China, that’s going to be extremely difficult. But — let’s say — tapping into the fact that there are powers in that nation that wish that there would be something else than forking Android, combined with the fact that there is already something homegrown in China which is not forking Android — I think that’s the recipe that can be successful.”

Not all Jolla’s Sailfish bets have paid off, of course. An earlier foray by an Indian licensing partner into the consumer handset market petered out. Albeit, it does reinforce their decision to zero in on government and corporate licensing.

“We got excellent business connections,” says Pienimäki of India, suggesting also that it’s still a ‘watch this space’ for Jolla. The company has a “second move” in train in the market that he’s hopeful to be talking about publicly later this year.

It’s also pitching Sailfish in Africa. And in markets where target customers might not have their own extensive in-house IT capability to plug into Sailfish co-development work Pienimäki says it’s offering a full solution — “a ready made package”, together with partners, including device management, VPN, secure messaging and secure email — which he argues “can be still very lucrative business cases”.

Looking ahead and beyond mobile, Pienimäki suggests the automotive industry could be an interesting target for Sailfish in the future — though not literally plugging the platform into cars; but rather licensing its technologies where appropriate — arguing car makers are also keen to control the tech that’s going into their cars.

“They really want to make sure that they own the cockpit. It’s their property, it’s their brand and they want to own it — and for a reason,” he suggests, pointing to the clutch of major investments from car companies in startups and technologies in recent years.

“This is definitely an interesting area. We are not directly there ourself — and we are not capable to extend ourself there but we are discussing with partners who are in that very business whether they could utilize our technologies there. That would then be more or less like a technology licensing arrangement.”

A trust balancing model

While Jolla looks to be approaching a tipping point as a business, in terms of being able to profit off of licensing an alternative mobile platform, it remains a tiny and some might say inconsequential player on the global mobile stage.

Yet its focus on building and maintaining trusted management and technology architectures also looks timely — again, given how geopolitical spats are intervening to disrupt technology business as usual.

Chinese giant Huawei used an MWC keynote speech last month to reject U.S.-led allegations that its 5G networking technology could be repurposed as a spying tool by the Chinese state. And just this week it opened a cybersecurity transparency center in Brussels, to try to bolster trust in its kit and services — urging industry players to work together on agreeing standards and structures that everyone can trust.

In recent years U.S.-led suspicions attached to Russia have also caused major headaches for security veteran Kaspersky — leading the company to announce its own trust and transparency program and decentralize some of its infrastructure, including by spinning up servers in Europe last year.

Businesses finding ways to maintain and deepen the digital economy in spite of a little — or even a lot — of cross-border mistrust may well prove to be the biggest technology challenge of all moving forward.

Especially as next-gen 5G networks get rolled out — and their touted ‘intelligent connectivity’ reaches out to transform many more types of industries, bringing new risks and regulatory complexity.

The geopolitical problem linked to all this boils down to how to trust increasing complex technologies without any one entity being able to own and control all the pieces. And Jolla’s business looks interesting in light of that because it’s selling the promise of neutral independence to all its customers, wherever they hail from — be it Russia, LatAm, China, Africa or elsewhere — which makes its ability to secure customer trust not just important but vital to its success.

Indeed, you could argue its customers are likely to rank above average on the ‘paranoid’ scale, given their dedicated search for an alternative (non-U.S.-led) mobile OS in the first place.

“It’s one of the number one questions we get,” admits Pienimäki, discussing Jolla’s trust balancing act — aka how it manages and maintains confidence in Sailfish’s independence, even as it takes business backing and code contributions from a state like Russia.

“We tell about our reference case in Russia and people quickly ask ‘hey okay, how can I trust that there is no blackbox inside’,” he continues, adding: “This is exactly the core question and this is exactly the problem we have been able to build a solution for.”

Jolla’s solution sums to one line: “We create a transparent platform and on top of fully transparent platform you can create secure solutions,” as Pienimäki puts it.

“The way it goes is that Jolla with Sailfish OS is always offering the transparent Sailfish operating system core, on source code level, all the time live, available for all the customers. So all the customers constantly, in real-time, have access to our source code. Most of it’s in public open source, and the proprietary parts are also constantly available from our internal infrastructure. For all the customers, at the same time in real-time,” he says, fleshing out how it keeps customers on board with a continually co-developing software platform.

“The contributions we take from these customers are always on source code level only. We don’t take any binary blobs inside our software. We take only source code level contributions which we ourselves authorize, integrate and then we make available for all the customers at the very same moment. So that loopback in a way creates us the transparency.

“So if you want to be suspicion of the contributions of the other guys, so to say, you can always read it on the source code. It’s real-time. Always available for all the customers at the same time. That’s the model we have created.”

“It’s honestly quite a unique model,” he adds. “Nobody is really offering such a co-development model in the operating system business.

“Practically how Android works is that Google, who’s leading the Android development, makes the next release of Android software, then releases it under Android Open Source and then people start to backboard it — so that’s like ‘source, open’ in a way, not ‘open source’.”

Sailfish’s community of users also have real-time access to and visibility of all the contributions — which he dubs “real democracy”.

“People can actually follow it from the code-line all the time,” he argues. “This is really the core of our existence and how we can offer it to Russia and other countries without creating like suspicion elements each side. And that is very important.

“That is the only way we can continue and extend this regional licensing and we can offer it independently from Finland and from our own company.”

With global trade and technology both looking increasingly vulnerable to cross-border mistrust, Jolla’s approach to collaborative transparency may offer something of a model if other businesses and industries find they need to adapt themselves in order for trade and innovation to keep moving forward in uncertain political times.

Antitrust and privacy uplift

Last but not least there’s regulatory intervention to consider.

A European Commission antitrust decision against Google’s Android platform last year caused headlines around the world when the company was slapped with a $5BN fine.

More importantly for Android rivals Google was also ordered to change its practices — leading to amended licensing terms for the platform in Europe last fall. And Pienimäki says Jolla was a “key contributor” to the Commission case against Android.

European competition commissioner Margrethe Vestager, on April 15, 2015 in Brussels, as the Commission said it would open an antitrust investigation into Google’s Android operating system. (Photo credit: JOHN THYS/AFP/Getty Images)

The new Android licensing terms make it (at least theoretically) possible for new types of less-heavily-Google-flavored Android devices to be developed for Europe. Though there have been complaints the licensing tweaks don’t go far enough to reset Google’s competitive Android advantage.

Asked whether Jolla has seen any positive impacts on its business following the Commission’s antitrust decision, Pienimäki responds positively, recounting how — “one or two weeks after the ruling” — Jolla received an inbound enquiry from a company in France that had felt hamstrung by Google requiring its services to be bundled with Android but was now hoping “to realize a project in a special sector”.

The company, which he isn’t disclosing at this stage, is interested in “using Sailfish and then having selected Android applications running in Sailfish but no connection with the Google services”.

“We’ve been there for five years helping the European Union authorities [to build the case] and explain how difficult it is to create competitive solutions in the smartphone market in general,” he continues. “Be it consumer or be it anything else. That’s definitely important for us and I don’t see this at all limited to the consumer sector. The very same thing has been a problem for corporate clients, for companies who provide specialized mobile device solutions for different kind of corporations and even governments.”

While he couches the Android ruling as a “very important” moment for Jolla’s business last year, he also says he hopes the Commission will intervene further to level the smartphone playing field.

“What I’m after here, and what I would really love to see, is that within the European Union we utilize Linux-based, open platform solution which is made in Europe,” he says. “That’s why we’ve been pushing this [antitrust action]. This is part of that. But in bigger scheme this is very good.”

He is also very happy with Europe’s General Data Protection Regulation (GDPR) — which came into force last May, plugging in a long overdue update to the bloc’s privacy rules with a much beefed up enforcement regime.

GDPR has been good for Jolla’s business, according to Pienimäki, who says interest is flowing its way from customers who now perceive a risk to using Android if customer data flows outside Europe and they cannot guarantee adequate privacy protections are in place.

“Already last spring… we have had plenty of different customer discussions with European companies who are really afraid that ‘hey I cannot offer this solution to my government or to my corporate customer in my country because I cannot guarantee if I use Android that this data doesn’t go outside the European Union’,” he says.

“You can’t indemnify in a way that. And that’s been really good for us as well.”

Powered by WPeMatico

Which types of startups are most often profitable?

I co-run an agency that teaches a hundred startups per year how to do growth marketing. This gives me a unique vantage point: I know which types of startups most often reach profitability.

That’s an important metric, because startups that don’t reach this milestone typically fail to raise additional funding — then die.

Here’s what we’ll learn:

- Companies are increasingly living and dying by ads. Because it’s the startup’s approach to customer acquisition — not its business model or market — that most determines its early-stage profitability.

- E-commerce companies lend themselves best to ads, and SMB SaaS the worst. Meanwhile, most startup founders in 2019 are starting SaaS companies. They’d benefit from the data we share in this post.

- In fact, our agency has found that every other type of business reaches profitability quicker than SMB SaaS, including mobile apps, Chrome extensions and enterprise SaaS.

Our sampling of startups isn’t as biased as startup valuation leaderboards, because we also see those that failed. That’s the key.

You can use our experience to de-risk your startup. That’s what this post explores: How to change your product roadmap to pursue a path more likely to reach profitability.

The startups that frequently reach profitability

Here’s the data my agency is referencing for this post:

- We train 12+ venture-backed and bootstrapped startups every month. Half are Y Combinator graduates. This is how we study early-stage product-market fit trends.

- We run ads full-time for between 20 and 30 mature companies per year. On average, each spends $2.5 million annually on paid acquisition. And, on average, each has 30 employees. Our clients include Tovala.com, PerfectKeto.com, SPYSCAPE.com, ImperfectProduce.com, Clearbit.com and Woodpath.com.

- Our students and clients are roughly evenly distributed across D2C e-commerce, B2B, mobile apps and marketplaces.

When we try to control for founder skill and funds raised, the types of startups that first reach profitability do so in this order:

- E-commerce

- Chrome extensions

- Mobile apps

- Enterprise SaaS

- Small-to-medium business SaaS

On average, an e-commerce company is more likely to first reach profitability than an SMB SaaS company.

Before I explain why, let me explain how we’re differentiating startups: I use the word “type” instead of “business model” or “markets” because I’ve learned that business model and market are often not the best predictors of success. Instead, it’s your approach to customer acquisition. That’s what typically determines the likelihood of profitability.

Powered by WPeMatico

Y Combinator president Sam Altman is stepping down amid a series of changes at the accelerator

Sam Altman, the well-known president of the prolific Silicon Valley accelerator Y Combinator, is stepping down, the firm shared in a blog post on Friday.

Altman is transitioning into a chairman role with other YC partners stepping up to take on his day-to-day responsibilities, as first reported by Axios. Sources tell TechCrunch YC has no succession plans. YC’s core program is currently led by chief executive officer Michael Seibel, who joined the firm as a part-time partner in 2013 and assumed the top role in 2016.

The news comes amid a series of shake-ups at the accelerator, which is expected to demo its latest batch of 200-plus companies in San Francisco March 18 and 19. In Friday’s blog post, YC expands on some of those changes, including the firm’s decision to move it’s HQ to San Francisco, which TechCrunch reported earlier this week.

“We are considering moving YC to the city and are currently looking for space,” YC writes. “The center of gravity for new startups has clearly shifted over the past five years, and although we love our space in Mountain View, we are rethinking whether the logistical tradeoff is worth it, especially given how difficult the commute has become. We also want to be closer to our Bay Area alumni, who disproportionately live and work in San Francisco.”

In addition to moving it’s HQ up north, YC has greatly expanded the size of its cohorts — so much so that it’s next demo day will have two stages — and it’s writing larger checks to portfolio companies.

Altman, who joined YC as a partner in 2011 and was named president in 2014, will focus on other efforts, including OpenAI, a research organization in which he co-chairs. Altman was the second-ever YC president, succeeding YC co-founder Paul Graham in 2014. Graham is currently an advisor to YC.

Powered by WPeMatico

‘Fresh Prince’ actor dismisses his Fortnite dance lawsuit

“Fresh Prince” star Alfonso Ribeiro has dropped his lawsuit against Fortnite creator Epic Games for using without his permission his “Carlton” dance as an emote in the popular game.

According to documents filed in an LA court, Ribeiro voluntarily dismissed the suit. He had already dropped a suit against Take-Two Interactive similarly related to his dance. Last month, Ribeiro was denied a copyright for his dance by federal officials, which seemed to put the nail in the coffin for his lawsuit.

The “Carlton” dance seems to be pretty immediately recognizable for its dorky arm-swinging maneuver, but that didn’t cut it for copyright officials. In the U.S. Copyright Office’s statement denying Ribeiro’s copyright claim, their detailed that his copyright was being refused because the work was a “simple dance routine” and thus wasn’t registrable as a choreographic work.

On one hand, original creative expression should always incentivize creators to keep pushing boundaries. On the other hand, singular dance moves are a bit of an annoying thing to copyright, though I still certainly understand the sentiment. Perhaps it’s for the best that future copyright trolls will have one less arena in which to file suit.

Powered by WPeMatico